Exhibit 99

Group Move Executive Homeowner Policy

MeadWestvaco

2006

April 24, 2006

MeadWestvacoGroup Move Executive Homeowner Relocation Guidebook

Congratulations on your new assignment!

You and your family will encounter many changes as you leave familiar surroundings, find a new place to live, and settle into your new location. To support you as you relocate, we have developed a partnership with GMAC Global Relocation Services (GMAC GRS) to lend support in minimizing disruptions and enabling you to get settled in your new home and job as quickly as possible.

This Relocation Guide outlines the services made available to you to help facilitate your move, including selling your current residence, identifying a new community, purchasing a home and moving your household goods in addition to outlining the expenses MeadWestvaco will pay or reimburse on your behalf.

It is critical to follow the guidelines of the program in order to be eligible for full group move relocation policy benefits.Please note that GMAC GRS must make the initial contact with all real estate agents both with the listing of your current residence and in the purchasing of a new home.

Please take the time to read and familiarize yourself with the policy before you begin planning your relocation. Recognizing that relocating can be a disruptive time, we are prepared to assist you and your family throughout your move.

Our best wishes for continued success in your new location!

April 24, 2006

MeadWestvacoGroup Move Executive Homeowner Relocation Guidebook

TABLE OF CONTENTS

| | |

ASSISTANCE-AT-A-GLANCE | | 1 |

RELOCATION ASSISTANCE | | 3 |

Eligibility | | 3 |

Family | | 3 |

Time Limit | | 3 |

Employee Relocation Reimbursement Agreement | | 3 |

Disclaimer | | 3 |

Relocation Administration | | 4 |

Expenses and Reimbursements | | 5 |

TAX REPORTING PROCESS TO THE IRS | | 6 |

HOME FINDING & TEMPORARY LIVING LUMP SUM ALLOWANCE | | 7 |

HOME SALE ASSISTANCE | | 9 |

Home Eligibility | | 9 |

Overview | | 10 |

Marketing Assistance | | 10 |

Appraised Value Offer | | 14 |

Amended Value Sale | | 16 |

Payment of Equity | | 19 |

Settlement and Equity Distribution | | 19 |

Vacating the Home | | 19 |

INDEPENDENT SALE OF HOME | | 20 |

LOSS ON SALE | | 21 |

Overview | | 21 |

Eligibility | | 21 |

Qualified Capital Improvements | | 21 |

Procedure | | 22 |

Tax Assistance | | 23 |

YOUR NEW LOCATION | | 24 |

Destination Services | | 24 |

Home Purchase Assistance | | 25 |

Duplicate Housing Expenses | | 30 |

Cost of Living Differential Assistance | | 30 |

Miscellaneous Relocation Expense Allowance | | 33 |

Actual Move | | 34 |

SPOUSAL EMPLOYMENT ASSISTANCE | | 37 |

TAX ASSISTANCE | | 38 |

TAX ASSISTANCE | | 38 |

Tax Treatment Table | | 39 |

RELOCATION REIMBURSEMENT AGREEMENT | | 40 |

HOME FINDING & TEMPORARY LIVING LUMP SUM ALLOWANCE FORM | | 41 |

April 24, 2006

MeadWestvacoGroup Move Homeowner Relocation Guidebook

| | |

| ASSISTANCE-AT-A-GLANCE | | 4/24/06 |

Group Move Relocation Assistance for Executive Homeowners

| | |

| |

| Eligibility for Relocation Assistance | | In order to be eligible for executive relocation assistance, you must meetall of the eligibility requirements listed below: • You must be a current full-time, regular, salaried employee • You are a leadership team or operating council member or a company officer • Complete a Relocation Reimbursement Agreement form (described below) • Incur all relocation-related expenses within one year following your effective date of transfer |

| |

| Relocation Reimbursement Agreement | | Prior to incurring any relocation expenses, you will be required to sign an agreement stating that if you leave MeadWestvaco voluntarily within one year of the job move, you will be required to repay 100% of the relocation expenses incurred. |

| |

| Home Sale Assistance | | For your primary residence only which meets eligibility requirements: |

| |

Marketing Assistance And Guaranteed Offer Home Sale Program | | • You select a Listing Broker to work in conjunction with the relocation company • The relocation company must make the initial contact with the real estate firm / agent of your choice • Listing price cap of 10% above listing Broker’s Market Analysis • Mandatory participation in Marketing Assistance Program for minimum of 90 days • Counseling support through the marketing process, assistance with negotiating offers • Appraised value “safety-net” offer provided to you by the relocation company • The listing price cap adjusts to 10% of the appraised value offer after the first 90 days on the market • If no buyer is found within the 120-day “safety-net” offer period, relocation company may acquire the home (at your discretion). Up to two 30-day extensions may be granted for a total of 180 days for the “safety-net” offer period. • Sale and closing of home completed through relocation company • Reasonable and customary closing costs and broker’s fees paid by relocation company on behalf of MeadWestvaco |

| |

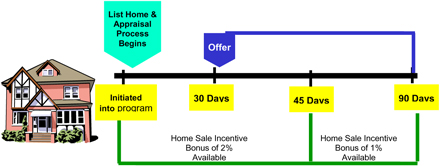

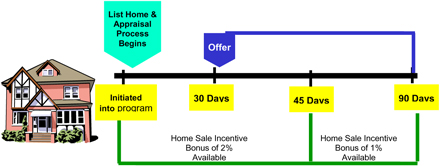

| Home Sale Incentive Bonus | | A bonus of 2% of the final sales price of home (up to maximum of $10,000) is provided if an Amended Value Sale is achieved within 60 days of listing. If the Amended Value Sale is achieved between the 60th and 120th day of listing, a bonus of 1% the final sales price is provided (up to a maximum of $5,000). A bonus is not provided if the Amended Value Sale is achieved after the 121st day of listing. The bonus is not grossed up for taxes. |

| |

| Independent Sale Program | | If your primary residence isnot eligiblefor the relocation company home sale program outlined above, you may receive: • Counseling assistance on selling your home independently • Reimbursement for reasonable and customary home selling expenses • Tax gross-up for the above expenses If your homedoes qualify for the home sale program, and you opt to sell it independently, you willnot be provided with tax gross-up assistance for qualifying home selling expenses. |

| |

| Loss on Sale | | • Company will guarantee the original purchase price and the cost of qualified capital improvements against loss on sale, not to exceed 115% of the appraised value established for your home by the appraisal process or the sales price, whichever is greater to a maximum of $25,000 if you sell your home through the amended value plan. • If you accept the appraised value offer than the payout will be limited to 105% of the appraised value offer or $ 25,000 whichever is less. • Requires participation in the relocation company’s Home Sale Assistance Program |

| |

Home Finding & Temporary Living Lump Sum Allowance | | • A lump sum payment for home finding and temporary living expenses will be made to cover such expenses as transportation, meals, lodging & incidentals. If you spend less than the allowance than that balance is yours. If your expenses exceed the allowance than those additional costs are your responsibility. • Tax gross-up will be provided |

| |

| Return Trips | | • You will be allowed to return home every other weekend for a maximum of 8 trips. |

April 24, 2006

1

MeadWestvacoGroup Move Executive Homeowner Relocation Guidebook

ASSISTANCE-AT-A-GLANCE

Group Move Relocation Assistance for Executive Homeowners

| | |

| |

| Home Purchase Closing Costs | | • Reasonable and customary home purchase expenses will be reimbursed. In addition, reimbursement for loan origination fees and or discount points will be based on a sliding scale table which is tied back to your new first mortgage interest rate. • Current homeowners qualify for home purchase assistance. |

| |

| Equity Advance | | Interest-free advance of up to 95% of available equity when required for deposit or down payment on new home • The advance must be used for the purchase of a new home. • Equity Advance is repaid upon the sale of your current home. If you are ineligible for an equity advance due to Sarbanes Oxley, you may be eligible for a “swing loan” through an outside lender. |

| |

| Duplicate Housing Expenses | | Company will reimburse up to 180 days of qualified duplicate housing expenses on the former home including taxes, insurance, mortgage interest, and homeowner/condominium association fees plus necessary utilities and property maintenance |

| |

| Preferred Lender Mortgage Assistance Program | | MeadWestvaco has contracted with Bank of America, GMAC Mortgage & Wells Fargo. They will provide preferred interest rates, simplified approval process, pre-approval, and direct billing of allowable closing costs. |

| |

| Cost of Living Differential Assistance | | To assist homeowners with the transition to a company location that has substantially higher cost of living than your present area, MeadWestvaco will provide a cost of living subsidy. The subsidy is offered to you as two options: • you may elect to receive a mortgage subsidy paid by MeadWestvaco directly to one of the three company-arranged national lenders named above, or • you may elect to receive your subsidy in monthly payments through payroll. The subsidy is subject to required income tax withholding. Depending on the cost differential, you may be eligible for a 2, 3, 4, or 5 year subsidy. |

| |

| Miscellaneous Relocation Expense Allowance | | To help offset miscellaneous expenses associated with the relocation which are not covered elsewhere in the policy, MeadWestvaco will provide you with an allowance equal to one month’s new base salary up to a maximum of $10,000 to cover incidental expenses associated with your move: • The funds are to be used at your discretion, no receipts are required. • The Miscellaneous Expense Allowance is processed for payment when you have scheduled your household goods shipment to your new permanent residence. |

| |

| Mortgage Interest Differential | | For those employees whose new mortgage interest rate is at least 7% and is more than 1% higher than the old first mortgage interest rate, MeadWestvaco will pay an allowed mortgage interest differential with a graduated annual payment over a three year period. |

| |

| Actual Move | | • Transportation, meal and lodging expenses will be reimbursed for you and your family move from your former location to your new residence. • In addition, lodging and meal expenses while goods are in transit will be reimbursed, as necessary, for up to a maximum of 5 days. |

| |

| Shipment of Personal Property | | • Normal household goods moved including packing, shipping & limited unpacking; replacement value insurance protection; and in-transit storage charges up to a maximum of 30 days, when necessary. • Mileage reimbursed for driving up to two automobiles to the new location. In lieu of driving, the company will pay to ship your second automobile—two automobiles may be shipped if distance exceeds 500 miles |

| |

| Spousal/Partner Assistance | | A Spouse/Partner Employment Assistance Program is available to help ease the career transition for spouses/partners who may need to change jobs as a result of your relocation with MeadWestvaco. |

| |

| Tax Assistance | | Gross-up of specific non-deductible expenses for Federal, State, and FICA. Local tax impact is not covered. Calculated based on MeadWestvaco-derived income only. |

April 24, 2006

2

MeadWestvacoGroup Move Executive Homeowner Relocation Guidebook

RELOCATION ASSISTANCE

Eligibility

The relocation program was developed to facilitate the movement of current, full-time, salaried employees who are requested to relocate by MeadWestvaco as part of the group move. and currently own a home.

To be eligible for the executive homeowner program, you must be a leadership team or operating council member or company officer.

In order to be eligible for relocation as described in this handbook, your relocation must meet the IRS 50-mile distance test. The distance between your former residence and your new job site must be at least 50 miles greater than the distance between your former residence and your former job site.

Family

Your family members eligible for assistance under this policy include your spouse or domestic partner as defined by MeadWestvaco benefits policies and all current permanent household members. In the event an additional member of your household is also asked to relocate as an employee of MeadWestvaco, you are eligible to receive only one set of benefits.

Time Limit

You are eligible for the benefits extended in this handbook for up to 12 months following your effective date of transfer. All expense reports related to your relocation are required to be submitted within 60 days of the date incurred within this 12-month period.

Employee Relocation Reimbursement Agreement

If you voluntarily terminate employment with MeadWestvaco within one year following the date you signed your Relocation Reimbursement Agreement, you will be required to repay the Company in full (100%) for any relocation funds paid to you or on your behalf. Repayment of all relocation reimbursements is required if you begin the relocation process but voluntarily terminate employment prior to one year from the date you signed your Relocation Reimbursement Agreement.

At the back of this policy, you will find the Relocation Reimbursement Agreement for your review and signature. You will need to sign this form and submit it to GMAC GRS. Neither MeadWestvaco nor GMAC GRS will make any relocation related payments or reimbursements to you or on your behalf until your agreement has been properly signed and returned to your GMAC GRS Consultant.

Disclaimer

The Company has the sole right at any time to revise, amend or discontinue this policy. This policy shall not be considered or construed as an employment contract and does not constitute a guarantee of employment for any minimum or specified period of time.

April 24, 2006

3

MeadWestvacoGroup Move Executive Homeowner Relocation Guidebook

RELOCATION ASSISTANCE

Relocation Administration

GMAC GRS is responsible for the successful administration of the MeadWestvaco relocation program and for effectively managing the service providers assigned to assist you. GMAC GRS also works directly with you and the service providers with regard to helping you sell your present home, finding a new residence, shipment of household goods as well as other special services as described in this guide. You should contact GMAC GRS prior to making any other arrangements for your move.

Their address is:

GMAC GRS

465 South Street, 2nd Floor East

Morristown, NJ 07960

973-889-6120 or 1-866-867-6918

Your GMAC GRS Consultant can also be reached by calling their direct dial numbers listed below or sending them an email message at the addresses below.

| | | | |

Consultants | | Phone Numbers | | E-Mail Address |

| | |

| Sandra Breitkopf | | 973-889-6138 or 866-476-6430 | | sandra_breitkopf@gmachs.com |

| | |

| Tara Piergallini | | 973-889-6142 or 866-643-0818 | | tara_piergallini@gmachs.com |

| | |

| Katie Lois | | 973-889-6139 or 888-591-4622 | | katie_lois@gmachs.com |

| | |

| Kathy Murphy | | 973-889-6144 or 866-317-5351 | | kathy_murphy@gmachs.com |

If you wish, you can also call GMAC GRS’ toll free number, 866-867-6918. The receptionist can then direct your call to your Consultant. The toll free number can also be used for assistance beyond GMAC GRS’ normal business hours, and on weekends.Normal business hours are 8:30 AM to 5:00 PM Eastern Time.

Getting Started with Your Move…

Once MeadWestvaco initiates your relocation, a Consultant from GMAC GRS will be assigned to work with you as your main contact for your entire move. You will be provided with personalized relocation services and assistance to help alleviate the time demands associated with relocation. This will include providing you a personalized timeline of items associated with the relocation.

April 24, 2006

4

MeadWestvacoGroup Move Executive Homeowner Relocation Guidebook

RELOCATION ASSISTANCE

Relocation Administration - continued

We encourage you to become fully involved in your move and work closely with your Consultant who will be available to assist you throughout the relocation process.

Expenses and Reimbursements

All relocation expenses must be submitted only after your new manager has approved and signed your relocation expense report. They must be on a Relocation Expense Form that you will receive from GMAC GRS. These forms are included in your relocation packet with instructions for completion. Please call your Consultant should you have any questions regarding form completion. Where relocation-related expenses are specifically reimbursable, the following guidelines apply:

| • | | Your completed expense reports together with your original receipts must be sent and approved by your Consultant. |

| • | | All expenses will be charged to your business unit’s cost center and the expense code assigned for relocation expenses. You are expected to be reasonable and prudent in the expenses you incur. |

| • | | Relocation expenses must not be combined with regular business expenses. In order to determine the federal and state tax liability for reimbursed expenses, relocation expenses must be reported separately. |

All reimbursable moving expenses must be incurred within 12 months from the date you sign your Relocation Reimbursement Agreement and submitted for payment within 60 days from the date the expense is incurred.

| • | | Only expenses specifically outlined in the policy will be reimbursed. |

| • | | You must submit original receipts for reimbursement for any single expense over $25.00. |

April 24, 2006

5

MeadWestvacoGroup Move Executive Homeowner Relocation Guidebook

TAX REPORTING PROCESS TO THE IRS

Many relocation expenses are taxable income to the transferee according to IRS regulations. Therefore corporations are required to report relocation costs and the associated taxes withheld to the IRS on a regular basis. After those calculations have been completed by GMAC GRS, the taxable amounts of the relocation expenses are provided to MeadWestvaco for updates to the employee payroll record. These updates are applied to the employee payroll records in a special run with a check date different from the normal salaried pay date. Employees can review these updates via Employee essentials using the paycheck review function. In most cases, your take home pay will not be impacted by the additional data included in your payroll records.

All relocation expenses should be submitted by October 31st if possible, as this is the year-end cut-off for relocation expenses. Subsequent expenses will be included in the next year’s income. The assistance provided by MeadWestvaco is based only on income earned by the employee at MeadWestvaco. Spouse/Partner or other employee income will not be used in the calculation.

Employees should seek the advice of a tax accountant or financial advisor for assistance or advice on tax returns or the impact of the relocation on their financial position. This assistance is not reimbursable, however the employee may use funds from their Miscellaneous Relocation Expense Allowance for this expense.

Should you have any further questions on this process, please contact your Consultant for more details.

April 24, 2006

6

MeadWestvacoGroup Move Executive Homeowner Relocation Guidebook

HOME FINDING & TEMPORARY LIVING LUMP SUM ALLOWANCE

MeadWestvaco will provide a lump sum payment intended to cover most expenses incurred in locating both temporary and permanent housing at the new work location. This one time allowance is in place of submitting individual expense reports for typically receipted house hunting and temporary living expenses. The purpose of this lump sum allowance is for you to tailor this allowance and its monies around your personal plans and needs in the house hunting and temporary living areas.

It is important to note that if your overall relocation costs in these two areas are less than your allowance from MeadWestvaco, the savings are yours. Conversely, if your total relocation costs in these areas exceed your allowance those additional expenses must be borne by you.

GMAC GRS will be coordinating the payment of this lump sum allowance and they should also be used in the planning and scheduling of your house hunting trip, the selection of the best real estate agent or agents in the new work location, and to identify the preferred facilities to be utilized for temporary living. Should you have any questions on the lump sum calculation / formula found below, please direct that inquiry to your Consultant.

This allowance will be paid according to the following table:

For Existing Homeowner With Family // Policy A

| | | | | | | | | |

Distance of Move | | Area One | | Area Two | | Area Three |

| 50 to 1,000 Miles | | $ | 8,250 | | $ | 10,600 | | $ | 14,450 |

| 1001 Miles and above | | $ | 8,850 | | $ | 11,200 | | $ | 15,050 |

For Single Homeowner // Policy A

| | | | | | | | | |

Distance of Move | | Area One | | Area Two | | Area Three |

50 to 1,000 Miles | | $ | 5,750 | | $ | 7,300 | | $ | 9,850 |

1001 Miles and above | | $ | 6,150 | | $ | 7,700 | | $ | 10,250 |

To receive this lump sum allowance, you must sign and submit / fax the Home Finding & Temporary Living Lump Sum Allowance Form found at the back of this guide to your GMAC GRS Consultant who will review and approve it for payment.

This non-receipted lump sum payment is intended to cover but not be limited to the following expenses:

| | • | | Home finding travel costs, i.e. auto, airfare or train. |

| | • | | Home finding meals, lodging and rental car. |

| | • | | Child care, elder care or pet care during both home finding and temporary living periods. |

| | • | | 60 days of temporary living lodging, transportation and meals for employee and family. |

April 24, 2006

7

MeadWestvacoGroup Move Executive Homeowner Relocation Guidebook

Please contact your GMAC GRS Consultant for a list of the company approved temporary living facilities. Should you need additional time in temporary housing and have already paid for 60 days lodging out of your lump sum, an additional 60 days of lodging expense may be approved and direct-billed to GMAC GRS. To be eligible for this extension, you must be staying in an approved facility and must provide documentation of the length of your stay to your Consultant.

Tax Treatment:

Home Finding & Temporary Living Lump Sum Allowance will be grossed up.

Note: We would strongly encourage you not to purchase a home in the new location which may be considered ineligible under a future move. In particular, homes with Synthetic Stucco or similar issues may experience buyer resistance to this product as well as potentially high costs associated with either litigation, repairs and or both. Please consult with your Consultant for further information.

A referral fee will be collected from the home finding real estate agent by GMAC GRS as this helps offset the overall relocation costs to MeadWestvaco.

April 24, 2006

8

MeadWestvacoGroup Move Executive Homeowner Relocation Guidebook

HOME SALE ASSISTANCE

Home Eligibility

A home eligible for the Home Sale Program is any completed single-family or two-family residence, including a condominium, that is used as your principal residence and that is owned by you, your spouse/partner, any of your dependents residing in the same household, or any combination of those persons at the time you are asked to relocate. This also includes land customarily considered part of a residential lot and all personal property normally sold with a residence according to local custom.

Homes consideredineligible for home sale assistance include, but are not limited to, the following:

| | • | | a home in which part is used for nonresidential purposes, |

| | • | | homes in which you do not have clear title, |

| | • | | properties with acreage beyond what is normal or in excess of five acres, |

| | • | | homes partially completed or under substantial renovation, |

| | • | | farms, businesses, investment or commercial properties, etc., |

| | • | | multifamily homes of more than two units, |

| | • | | cooperative apartments, |

| | • | | vacation/secondary homes, |

| | • | | mobile homes and house boats, homes without a permanent foundation, |

| | • | | homes with undeveloped lots |

| | • | | homes with non-contiguous land parcels |

| | • | | homes deemed ineligible through building inspections |

| | • | | homes uninhabitable or unmarketable due to physical condition, and |

| | • | | tenant-occupied homes that cannot be vacated within 30 days of the offer date. |

| | • | | homes with toxic substances and/or potential defects that may put MeadWestvaco at legal risk (e.g. toxic mold, synthetic stucco, etc.) |

Homes considered ineligible for Home Sale Assistance, as noted above, will not be eligible for the Appraised Value Sale coverage nor will you qualify for either an Equity Advance or the Home Marketing Incentive Bonus.

Any defects, which affect your home’s marketability, insurability, and ability to secure a mortgage, will also disqualify it from the program. The following issues must be disclosed, resolved and/or remediatedbefore you can participate in the Home Sale Program:

| | • | | major structural deficiencies, |

| | • | | environmental toxins in excess of the recommended level by the Federal Environmental Protection Agency (EPA), |

| | • | | plumbing that includes polybutylene piping will need to be replaced in its entirety prior to closing with a new buyer or accepting GMAC GRS’ offer. |

| | • | | systems defects (including but not limited to: plumbing, electrical, roofing and heating) |

| | • | | deficiencies in septic tank and drain fields, |

| | • | | pest infestation and/or subsequent damage, |

| | • | | water related issues; e.g., potability/availability, |

April 24, 2006

9

MeadWestvacoGroup Move Executive Homeowner Relocation Guidebook

HOME SALE ASSISTANCE

Home Eligibility - continued

| | • | | existence of asbestos, pyretic shale, urea formaldehyde foam insulation (UFFI), or excessive levels of radon gas, lead paint, non toxic mold, or other such substances; or any hardboard sidings found to be defective according to a structural inspection. |

Should MeadWestvaco determine through professional consultation that a serious problem exists, MeadWestvaco reserves the right to exclude your home from the Home Sale Program. Properties with defects may qualify for the Independent Sale provision described on page 20. If an approval is granted by your Consultant and MeadWestvaco, you may qualify for the Home Marketing Incentive Bonus and tax gross up, but will not be eligible for an Equity Advance.

Overview

The Home Sale Program is designed to help you sell your home at the best market price and complete your move within a reasonable timeframe. It consists of specialized assistance in marketing your home, and once you receive a bona fide offer, closing the sale of your home. The Home Sale Program is also provided so that you may obtain the equity from your current home before it is sold in order to purchase a home in the new area.

Please keep in mind that you must follow the guidelines of the program below in order to be eligible for full relocation benefits. One of those guidelines is that GMAC GRS must make the initial contact with all real estate agents both in the listing of your current residence and in the purchasing of a new home.

Marketing Assistance

As soon as MeadWestvaco authorizes your relocation, your Consultant will contact you to explain the required listing and marketing procedures for your home. It is your Consultant’s main objective to assist you in placing your home on the market as advantageously as possible.It is important and required that GMAC GRS make the initial contact with any real estate firms. Throughout the home sale process, your Consultant will continuously track your agent’s efforts to market your home. The goal of these efforts is to help you obtain the best offer for your home.

Your Consultant’s objectives are to:

| | |

| | • identify a qualified and active agent to assist you in listing and marketing your home in a highly effective manner, • develop a strategic marketing plan to sell your home at the best possible market value, • suggest any minor repairs and/or improvements that will increase the marketability of your home, • help you to find a buyer willing to purchase your home at an agreed upon price, • assist you during your home sale negotiations, and • work with you and your real estate agent throughout the marketing process to ensure maximum exposure for your home, provide feedback on the marketing process, and recommend strategy modifications, if needed |

April 24, 2006

10

MeadWestvacoGroup Move Executive Homeowner Relocation Guidebook

HOME SALE ASSISTANCE

Marketing Assistance - continued

How the Marketing Process Works…

The following is a step-by-step process of marketing assistance services provided by your Consultant.

Agent Selection and Referrals

Your Consultant will arrange for two experienced local real estate agents to advise you about selling and pricing strategies that work best in your location. If you have personal preferences about an agent, your Consultant should make the initial contact and referral with the agent. As a requirement of the MeadWestvaco program, it is not permissible to select and use a listing agent who is an employee of MeadWestvaco, a spouse/partner of a MeadWestvaco employee, or a relative of a MeadWestvaco employee.A referral fee is charged to the listing agent and is designed to help offset the costs of the entire program for MeadWestvaco.

Market Analysis

The two selected real estate agents will be asked by your Consultant to complete a market analysis on your home that will be used to prepare a marketing strategy. The market analysis will describe the current marketplace along with the agent’s opinion of the most probable sales price for your home. The analysis also contains a suggested sales action plan with recommendations for preparing your home for optimum market exposure.

Inspections

Inspections as called for by suppliers, local custom and or GMAC GRS may be ordered on your property at the same time you are going through the agent selection process. The inspections that can be ordered by your Consultant may include but are not limited to the following: pest, general home, radon, well, septic, synthetic stucco, structural, asbestos, mold, roof, pool, etc. The inspectors will call to set up appointments.Please be sure to schedule these inspections as soon as possible in order to eliminate any possible delays in receiving your appraised value offer.

Listing Your Home

Your Consultant will ask you to select one real estate agent from the two you have interviewed. He or she will then work with you and your selected agent to develop a marketing strategy and establish a list price that is both attractive and realistic in the local market. During the first 90-day marketing period, it is a requirement of this program that your list price be no higher than 10% above the listing broker’s sales price analysis. By marketing your home at the suggested list price, your home is more likely to sell quickly. The best offers are usually received within the first 30 days of listing your home.

Disclosure Statement

You will be provided with a property disclosure statement or statements by GMAC GRS and or the listing agent. These statements must be accurately completed and returned to GMAC GRS before your appraisal value / home sale offer can be officially released to you.

April 24, 2006

11

MeadWestvacoGroup Move Executive Homeowner Relocation Guidebook

HOME SALE ASSISTANCE

Marketing Assistance – continued

Listing Exclusion Clause

When you first speak with your Consultant, he or she will discuss the necessity of including the following language in the listing agreement with your agent. The reason for this clause is to allow for cancellation of the listing agreement if you decide to accept the “Appraised Value” offer from the relocation company. This clause is considered “standard operating procedure” among agents who work with Consultants and those who list homes for corporate transferees.

The following Exclusion Clause should be signed by you and your real estate agent and attached as an addendum to the Listing Agreement.

“In the event of any conflict or inconsistency between this Addendum and the Listing Agreement, the terms of this Addendum shall control.

It is understood and agreed that regardless of whether or not an offer is presented by a ready, willing and able buyer:

| | 1. | No commission or compensation shall be earned by, or be due and payable to agent until the sale of the property has been consummated between seller and buyer, the deed delivered to the buyer and the purchase price delivered to the seller; and |

| | 2. | The seller reserves the right to sell the property to the relocation company or to: (individually and collectively a “Named Prospective Purchaser”) at any time. Upon the execution by a Named Prospective Purchaser and me (us) of an Agreement of Sale with respect to the property, this listing agreement shall immediately terminate without obligation on my (our) part or on the part of any Named Prospective Purchaser to either pay a commission or to continue this listing.” |

| | | | | | |

| | | | | | |

| Real Estate Agent | | | | Date | | |

| | | | | | |

| Seller | | | | Date | | |

| | | | | | |

| Seller | | | | Date | | |

Monitoring the Marketing Process

Your Consultant will work with you and your real estate agent throughout the marketing process to ensure maximum exposure for your home, provide feedback on the marketing process, and recommend strategy modifications, if needed.

Home Marketing Incentive Bonus

The Home Marketing Incentive Bonus provides you with an additional incentive to sell your home during the allowed home marketing period. The bonus is being offered because securing a buyer is advantageous both for you and for MeadWestvaco.You receive the best possible market price, and MeadWestvaco avoids the significant expense of purchasing, maintaining, and reselling your home through the relocation company.

If you have participated fully in the Marketing Assistance Program, and you obtain a bona fide purchase offer from an outside buyer during the first 60 days of your marketing period, you will be eligible to receive a bonus equal to 2% of the final net sales price of your home, up to a maximum of $10,000 when the sale is closed with the outside or third party buyer. If the offer is received between the 61st and 120th day of marketing, a bonus of 1% will be provided up to a maximum of $5,000. If the offer is received after the 121st day, no bonus is provided.

April 24, 2006

12

MeadWestvacoGroup Move Executive Homeowner Relocation Guidebook

To qualify for the bonus you are required to:

| | • | | Remain actively involved in the marketing of your home during the required ninety (90) day marketing period (or until a bona fide offer is obtained) |

| | • | | Discuss the selection of your listing broker with your Consultant |

| | • | | Commence marketing your home while waiting for completion of the appraisal process |

| | • | | Collaborate with your real estate broker and Consultant on marketing strategy to attract a buyer |

| | • | | List your home with a real estate broker for no more than 110% of listing broker’s price analysis prior to the appraisal process. After the first 90 days, you must list your home for no more than 110% of the Appraised Value. |

| | • | | Submit all offers to your Consultant beforethe offer is accepted or rejected |

The Incentive Bonus will be considered taxable income to you and is not grossed up for tax impact.

Buyer Incentive

To give your home an edge over the competition and to help it sell faster, MeadWestvaco will give an allowance of up to 2% of the negotiated sale price capped at $3,000 to be used as a credit to the buyer at closing. The incentive may be given as a credit in the form of closing costs, mortgage buy-down, repairs, homeowner’s warranty or decorating allowance. The credit must always appear on the HUD-1 Settlement Statement. Please consult with your Consultant for more details.

Please make sure you communicate this very attractive resale incentive to your listing agent. The agent should actively promote this unique selling feature through a flyer in your home to the real estate community and most importantly to potential buyers.

If you have agreed to concessions in excess of the Buyer Incentive, those additional costs will be at your expense and normally deducted from your equity unless your equity has already been paid.

April 24, 2006

13

MeadWestvacoGroup Move Executive Homeowner Relocation Guidebook

HOME SALE ASSISTANCE

Home Sale Program Timeline

Appraised Value Offer

Your decision to relocate should not be hampered by concerns about selling your home. GMAC GRS will assist you by making an offer to purchase your home at a value established by independent fee appraisers.

Appraisal Process

When your Consultant introduces you to the home sale services, he or she will fully explain the appraisal process. You will be given a list of independent appraisers in your area and asked to select two (2) appraisers from this list. You may not select or request appraisers be used that are not on GMAC GRS’ initial appraiser list or that are family members. You are encouraged to interview the appraisers to assist in making your decision. If you do not feel qualified to make the selection, ask your real estate agent for guidance or your Consultant can help you make the selection.

Once you have selected two appraisers, notify your Consultant. He or she will call the appraisers and ask them to contact you directly to arrange a convenient time for an inspection of the property. The appraisers’ appointments should be scheduled at least two to three hours apart.

When the appraisers arrive to inspect your property, you should be prepared to discuss any facts that may be important in determining the value of your property such as:

| | • | | A confirmation of precisely which personal property is to be included in the appraisals |

| | • | | Any improvement you have made to the property that may or may not be visible to the appraisers |

The appraisers may ask for a copy of the land survey and a copy of the title policy that you received when you closed on the property. They will need these items to obtain the correct legal description.

We also encourage you to provide the appraisers with any information on similar homes that have recently sold in your area on the Pre-Appraisal Worksheet.

April 24, 2006

14

MeadWestvacoGroup Move Executive Homeowner Relocation Guidebook

HOME SALE ASSISTANCE

Appraised Value Offer - continued

The Appraisal

An appraisal is an estimate or opinion of value. Appraisers estimate value primarily by comparing your home to the sales of similar properties, making detailed adjustments for the differences between those properties and yours. Along with other factors, the appraisers consider location, size, condition and marketability. Other considerations include financing and supply and demand for your neighborhood.

Your home will be appraised in “as is” condition. Therefore, it is important that your home shows favorably to maximize the appraised value and resale efforts.

Title Search

In addition to arranging for the appraisals and inspections, a title search will be initiated in order to prepare for closing. Please inform your real estate agent that GMAC GRS is bringing the title up-to-date. This can avoid a duplicate title search. Often an agent will arrange for a title search upon notification from a lender of a buyer’s loan approval.

Determining the Appraised Value Offer

Your offer will equal the average of the two independent appraisals. However, if the variance between the two appraisals is greater than 5% of the higher amount, a third appraisal will be ordered. In this case, your offer will be determined by averaging the two closest appraisals.

Example:

| | | |

Appraisal 1 | | $ | 150,000 |

Appraisal 2 | | $ | 145,000 |

| | | |

Difference | | $ | 5,000 |

| |

5% of highest appraisal | | $ | 7,500 |

| |

Lower appraisal is within 5% ($7,500) of higher appraisal | | | |

| |

Appraised Offer (average) | | $ | 147,500 |

Your Consultant will calculate your offer only after the appraisers’ reports and all required inspection reports have been received and reviewed.

April 24, 2006

15

MeadWestvacoGroup Move Executive Homeowner Relocation Guidebook

HOME SALE ASSISTANCE

Appraised Value Offer - continued

The Offer Period

Your Consultant will call you with the Appraised Value Offer approximately 14 to 21 days from the time the last appraiser and inspector visited your home. Your 120-day acceptance period begins when your Consultant contacts you with the offer. Up to two 30-day extensions may be granted for a total of 180-day offer period. After a total of 90 days on the market, it is required that you amend your list price to be no higher than 110% of the Appraised Value Offer in order to maximize your opportunities for a sale.

The Appraised Value Offer should be considered a “safety net” offer in the event you are unable to sell your home.

Accepting the Appraised Value Offer

If you are unable to sell your home during the 120-day offer period and accept the Appraised Value Offer, you and your spouse/partner (all title holders) will need to sign GMAC GRS’ Contract of Sale and return both copies to your Consultant along with the other supporting documents. Your execution of the Contract of Sale is a legal transaction.

The signed Contract of Sale and related documents must be received by your Consultant on or prior to the expiration date of your offer. The contract will be dated on the day all necessary documents are complete and signed by your Consultant.

After you and GMAC GRS has signed the Contract of Sale, you will continue to be responsible for the costs including but not limited to maintenance of your home, payments for utilities, mortgage, taxes, premiums for insurance, and any necessary homeowner association dues until you actually vacate. Prior to vacating, you will be expected to cooperate fully with all attempts by GMAC GRS to market the home by allowing prospective purchasers to view the premises by appointment during reasonable hours.

Amended Value Sale

Achieving an Amended Sale is of benefit to you and MeadWestvaco. The Company avoids the significant expense of purchasing, maintaining and reselling the home; and you receive the highest possible price for your home.

If at any time during your initial marketing period or 120-day acceptance period you receive an offer through the efforts of your Realtor, regardless of the offer amount, you must submit the offer to your Consultant for review.

Your Consultant will be able to assist you in negotiating the offer for the highest possible price as well as reviewing the offer with you to determine items that may not be covered under the relocation plan. Once the final offer has been approved, your Consultant will amend your Contract of Sale to reflect the buyer’s offer.

April 24, 2006

16

MeadWestvacoGroup Move Executive Homeowner Relocation Guidebook

HOME SALE ASSISTANCE

Amended Value Sale - continued

There are many advantages in participating in the Amended Value Sale program

| | • | | You may receive a greater cash return than the appraised value offer. |

| | • | | You will be relieved of the responsibilities of property ownership upon vacate or contract date, whichever is later. |

| | • | | You will be relieved of the necessity of attending the closing, as all documents will be pre-signed. Your Consultant will handle all closing details, and reasonable and customary closing costs will be paid by MeadWestvaco. |

| | • | | After GMAC GRS has signed the Contract of Sale, you will be assured of receiving the net proceeds based upon the amended value price even if the sale falls through and does not close. |

| | • | | You may be authorized to accept an offer down to 97% of the Appraised Value, and still receive the appraised value offer price and the 2% Incentive Bonus. |

Example:

MeadWestvaco allows you to accept an offer from a buyer down to 97% of the Appraised Value. You will receive the Appraised Value Offer plus the Incentive Bonus.

| | |

Appraised Value | | $150,000 |

Sales price from buyer | | $148,000 |

You will receive your equity based on the $150,000 Appraised Offer plus an Incentive Bonus of $2,960 based on the sales price of $148,000.

Receiving Offers and Negotiating the Sale

When you receive a written offer for your home, you must immediately call your Consultantbefore accepting it — even verbally. DO NOT SIGN a contract (or any other document) with the buyers or take any money as a deposit from the Realtor or prospective buyer. Remember, your Consultant is available to assist you in the negotiation process and to objectively review the offer with you once a buyer is found.

If the offer is “Bona Fide”, GMAC GRS will sign the documents and close the transaction with your buyers.

Determining a “Bona Fide” Offer

Once you give your Consultant the details of the outside offer, he or she will determine if it is “bona fide”. A bona fide offer is not subject to the sale of the buyer’s property, does not contain any unusual or unreasonable terms and is not subject to interim financing, or other contingencies.

April 24, 2006

17

MeadWestvacoGroup Move Executive Homeowner Relocation Guidebook

HOME SALE ASSISTANCE

Amended Value Sale - continued

Finalizing a Sale

Your Consultant will handle the details of the real estate transaction once the terms of the sales agreement have been finalized.

Closing the Sale

GMAC GRS will acquire your home, according to the terms of their Contract of Sale with you. They will also fully honor the terms of the Purchase Agreement with the buyers, by closing the transaction with your buyer and paying normal and customary home sale expenses on behalf of MeadWestvaco. Reasonable and customary expenses relative to the sale of your home can include:

| | • | | Realtor’s commission at the prevailing rate in your current location not to exceed 7% |

| | • | | Real estate recording fees and transfer taxes |

| | • | | Mortgage prepayment penalties |

GMAC GRS will make every effort to close the transaction with your buyer. However, if the sale is not eventually consummated, your Contract of Sale with the relocation company remains intact. Your equity payment will be based upon the Contract Sale Price.

Responsibility for your property remains with you until the possession date, which is the date GMAC GRS signs the Contract of Sale or you vacate, whichever is later. You will be responsible through the possession date for such expenses as but not limited to, internal and external maintenance of your home, payments for utilities, mortgage, taxes, insurance premiums, homeowner association dues, etc.

April 24, 2006

18

MeadWestvacoGroup Move Executive Homeowner Relocation Guidebook

HOME SALE ASSISTANCE

Payment of Equity

Your equity is the Appraised Value or Amended Value for which you sold your home less any existing liens or encumbrances, and less home ownership expenses prorated as of the date GMAC GRS takes possession of the property or your vacate date, whichever is later. This normally includes, but is not limited to:

| | • | | existing mortgage balance(s), |

| | • | | prorated mortgage interest, |

| | • | | liens, special assessments, homeowner association dues or outstanding repairs. |

Your equity advance, if applicable and as discussed on page 25, will be deducted from your final equity payment.

It is important to note that certain items are not covered under the program and will be deducted from your final equity if you have agreed to any of these additional seller’s expenses such as but not limited to:

| | • | | repairs and improvements requested by the buyer or identified in inspections, |

| | • | | buyer’s closing costs, and/or |

| | • | | Realtor’s commission above the standard rate for your area. |

If you vacate before your stated vacate date, you will receive an adjustment from your Consultant and if you remain in the home beyond the stated vacate date, expenses will be billed to you.

Settlement and Equity Distribution

GMAC GRS will handle the final settlement transaction for your home. Once you have signed and returned the Contract of Sale, GMAC GRS will complete an equity statement, which calculates any net proceeds payable to you, and mail the statement to you along with the balance of your equity. Your Consultant will explain the calculation to you in detail.

Vacating the Home

You have 60 days from the date GMAC GRS signs the Contract of Sale in which to vacate the property. Responsibility for your property remains with you until the later of the vacate date or the date GMAC GRS signs the Contract of Sale. This responsibility may include, but is not limited to, maintenance of your home, payments for utilities, mortgage, taxes, premiums for insurance, and any necessary homeowner association dues including snow removal and lawn maintenance.

All essential utilities (electricity, fuel and water) should be left on when you move and in working condition. Please cancel your phone and any cable services. Contact your Consultant for instructions on changing the billing address for your utilities.

To prevent any lapse in your homeowner’s insurance coverage, contact your Consultant to insure that you follow the proper procedure for cancellation.You must carry homeowners insurance on your property until GMAC GRS’ possession date

April 24, 2006

19

MeadWestvacoGroup Move Executive Homeowner Relocation Guidebook

INDEPENDENT SALE OF HOME

If your primary residence which you must own and occupy is not eligible for the Home Sale Assistance Program, you may qualify for assistance on selling your home independently. Your Consultant at GMAC GRS will provide counseling on how to sell your home independently. GMAC GRS may reimburse you for qualifying home selling expenses. Reimbursements for normal and customary expenses relative to the sale of your home can be grossed up for taxes, and can include:

| | • | | Realtor’s commissions at the prevailing rate in your current location not to exceed 7% |

| | • | | Real estate transfer taxes |

| | • | | Cooperative apartment “flip taxes” |

| | • | | Mortgage prepayment penalties |

Please be aware that if you are reimbursed for the reasonable and customary closing costs of a home you sell on your own without approval of both MeadWestvaco & GMAC GRS, there is a significant tax liability and MeadWestvaco will not gross up this taxable income. In addition, you will not qualify to receive an Equity Advance nor will you be eligible for the Home Marketing Incentive Bonus.

April 24, 2006

20

MeadWestvacoGroup Move Executive Homeowner Relocation Guidebook

LOSS ON SALE

Overview

During periods of downturn in the real estate market, you may find that the appraised value for your home is less than what you have invested in your home. To minimize your concern about a substantial loss on your home, MeadWestvaco will guarantee the original purchase price and the cost of qualified capital improvements against loss on sale if you sell your home under the Marketing Assistance / Amended Value program. The loss and qualified capital improvements would be covered up to 115% of the appraised value established for your home by the appraisal process or the sales price, whichever is greater to a maximum of $25,000 (provided an Amended Value Sale is achieved). If your home is not sold and you accept GMAC GRS’ appraised value offer then your loss and qualified capital improvements will be covered up to 105% of GMAC GRS’ appraised value offer or $ 25,000 whichever is less (see examples found on page 23).

This guideline is intended to provide reasonable protection to you as a transferring homeowner employee. It is not a guarantee, however, that you will be kept whole for all that has been invested in improving and fixing up the property; nor does it protect costs determined to be associated with excess land, extremes of design, complexity, or elaborateness in which you have invested.

Eligibility

This guarantee is subject to the following provisions and must be approved by the Head of Human Resources for your business unit or corporate department.

| | • | | The home is your principal residence. |

| | • | | The home was purchased within the past five (5) years. |

| | • | | You agree to aggressively market your home with a realtor up until the vacate date. |

| | • | | You list the home with a Realtor for an asking price not to exceed the average of the original purchase price and the appraised value established for your home by the appraisal process. |

| | • | | You sell the home to the third party provider (GMAC GRS) within the 60-day offer period for the appraised value offer or an approved amended value offer. |

| | • | | You can provide satisfactory documentation of the original purchase price and cost of qualified capital improvements. |

Qualified Capital Improvements

Qualified capital improvements are those major improvements which are fixed additions to the property, prolong its useful life, or adapt it to new uses. Qualified capital improvements do not include repairs or upkeep to maintain the home in good condition nor do they include changes, such as interior decorating, done to reflect the owner’s taste. Only capital improvements which cost $500 or more will be taken into account. Some examples of qualified capital improvements are:

| | • | | Constructing a finished recreation room in an unfinished basement |

| | • | | Adding a bedroom or bathroom |

| | • | | Adding a patio. deck or garage |

| | • | | Updating wiring or plumbing |

| | • | | Extensive restoration or remodeling that was needed – such as the replacement of a kitchen, installation of a new roof, replacement of heating/air conditioning system. |

April 24, 2006

21

MeadWestvacoGroup Move Executive Homeowner Relocation Guidebook

LOSS ON SALE

Qualified Capital Improvements - continued

Items not considered to be qualified capital improvements and not covered under the provisions of this guideline, include:

| | • | | Repairs or additions of gutters and downspouts |

| | • | | Window treatments (such as, mini blinds) |

| | • | | Decorative items (such as, ceiling fans, light fixtures, wallpaper, drapes) |

Procedure

It is your responsibility to notify your Consultant when the appraised value offer is less than the original purchase price and cost of qualified capital improvements. Notification must be made in the form of a memorandum and include the following details:

| | • | | The appraised value offer |

| | • | | The recorded purchase price of the home and date purchased |

| | • | | An orderly list of all qualified capital improvements made to the home |

Attached to this memorandum, in a legible and chronological list, must be all receipts and other records to satisfactorily document the expenditures listed. Also, attached must be a copy of the closing statement. Your Consultant will obtain approval from your Division Manager or Corporate Department Head to reimburse you the loss on original purchase price and qualified capital improvements consistent with the policy.

The amount guaranteed by MeadWestvaco will not change the appraised value offer to you. However, the Company will pay you the difference between the price at which GMAC GRS acquires the home and the amount guaranteed. MeadWestvaco will pay this difference when you have signed and returned the Contract of Sale to GMAC GRS. The original purchase price is considered the recorded amount which you paid for the home. It does not include settlement fees or closing costs which you may have paid.

This benefit can be altered or rescinded at any time subject to changes in real estate market conditions.

April 24, 2006

22

MeadWestvacoGroup Move Executive Homeowner Relocation Guidebook

LOSS ON SALE

Procedure - continued

Loss on Sale Examples

| | | | | | | | | | |

Amended Value Sale | | | Accepting GMAC GRS’ Offer | |

Sales Price | | $ | 205,000 | | | GMAC GRS’ Offer | | $ | 195,000 | |

Times | | | 115 | % | | Times | | | 105 | % |

Sub Total | | $ | 23,575 | | | Sub Total | | $ | 20,475 | |

Plus Cap | | $ | 3,000 | | | Plus Cap | | $ | 3,000 | |

| | | | | | Improve | | | Improve | |

Total | | $ | 26,575 | (A) | | Total | | $ | 23,475 | (B) |

| | • | | (A) The 115% cap includes qualified capital improvements. This reimbursement is capped at $25,000 |

| | • | | (B) If you accept GMAC GRS’ offer the $ 25,000 cap includes qualified capital improvements. |

Tax Assistance

Tax gross-up will be provided for loss on sale reimbursements.

April 24, 2006

23

MeadWestvacoGroup Move Executive Homeowner Relocation Guidebook

YOUR NEW LOCATION

Destination Services

Selecting a house can be an exciting process. It can also be time-consuming and stressful, particularly when you and your family are relocating to a new area. GMAC GRS provides home finding counseling at no cost to you. It is intended to assist you in locating the right home quickly and easily.

Please make note that GMAC GRS must make the initial contact with all real estate agents both in the listing of your current residence and in the purchasing of a new home.

Your Consultant will contact you to discuss your family’s specific needs, preferences, and lifestyle. After review of your family’s requirements, your Consultant will work with the real estate community in the new area to select and assign a real estate professional who is experienced in the areas of importance to you. By planning in advance, the realtor will be prepared to take you on an area tour and discuss items of interest to you and your family.

Your Consultant and real estate agent will work together so that your visits are convenient and productive. Throughout the home finding period your Consultant will continue to work with you and your agent to ensure your satisfaction.

As a requirement of the MeadWestvaco program, it is not permissible to select and use a home finding agent who is an employee of MeadWestvaco, a spouse/partner of a MeadWestvaco employee, or a relative of a MeadWestvaco employee.A referral fee is charged to the home finding agent and is designed to help offset the costs of the entire program for MeadWestvaco.

Note: We would strongly encourage you not to purchase a home in the new location with Synthetic Stucco due to growing buyer resistance to this product as well as potential high costs associated with either litigation, repairs and or both. Please consult with your Consultant for further information.

April 24, 2006

24

MeadWestvacoGroup Move Executive Homeowner Relocation Guidebook

YOUR NEW LOCATION

Home Purchase Assistance

Equity Advance

If you are a current homeowner who will be closing through GMAC GRS and need a partial advance of your equity to purchase a new home, your Consultant will provide you with an interest-free equity advance of up to 95% of the substantiated equity in your home. Equity is calculated based on the Appraised Value Offer amount. The loan amount required will be determined based upon receipt of a fully executed contract of purchase for the new home and execution of a promissory note. Obtaining an equity advance obligates you to either sell your property directly to GMAC GRS through the Appraised Value Offer or obtain a sale, using the Amended Value Sale Program. Your equity advance will be deducted from your final equity payment once you contract with GMAC GRS.

Please remember the following when requesting an equity advance:

| | • | | The equity advance must be used as earnest money and/or down payment for the purchase of your new primary residence in the new area. |

| | • | | You and your spouse/partner (all title holders) must sign a promissory note prior to the loan being issued. |

| | • | | You will need to provide your Consultant with a copy of the purchase agreement for your new home before the equity advance can be processed. |

Sarbanes-Oxley Act

Due to the recently enacted Sarbanes-Oxley Act, MeadWestvaco and GMAC GRS are forbidden by law to advance an equity advance to any officer of MeadWestvaco.

If you are in this category within MeadWestvaco and are ineligible for an equity advance and need funds prior to the full execution by both parties of the Contract of Sale, you may be eligible to obtain a “swing loan” through an external lender. The company will provide monthly payments or a lump sum payment to you equivalent to the interest charged by the external lender. The “swing loan” may not exceed 95% of the equity in your home and the payments from the company as noted above will be made to you as long as the relocation benefits apply (up to one year by policy, unless an exception is granted). Please contact your consultant for further information.

Closing Costs

As a current homeowner, if you purchase a primary residence in the new location within one year from your effective date of transfer you will be reimbursed for certain reasonable and customary closing costs incurred on the purchase of your home. (In order to qualify for reimbursement of new home closing costs, you must have owned a home in the former work location.)

Reasonable and customary home purchase expenses include:

| | |

• Normal attorney’s fees/escrow fees • Appraisal fee for mortgage • Credit report • Recording and transfer fees (including revenue stamps) | |  |

April 24, 2006

25

MeadWestvacoGroup Move Executive Homeowner Relocation Guidebook

| | • | | Title insurance (lender’s coverage, only), |

| | • | | General home inspection ($500 maximum) |

| | • | | Inspections which are customary or are required by the lender or law |

April 24, 2006

26

MeadWestvacoGroup Move Executive Homeowner Relocation Guidebook

YOUR NEW LOCATION

Home Purchase Assistance - continued

The reimbursement of either discount points or loan origination fees will be based upon your new first mortgage interest rate and will be paid as outlined below

| | |

New Interest Rate | | Discount Points (DP) or Loan Origination Fees (LOF) Paid |

| 7% or Below | | No reimbursement for either expense |

| |

| 7.01% to 9% | | A total of 1% reimbursed for DP or LOF |

| |

| 9.01% + Above | | A total of 2% reimbursed for DP & LOF |

You must submit a relocation expense report noting all allowable closing expenses to be reimbursed along with a copy of your closing statement (HUD-1 Form) to your Consultant.

Reasonable and customary closing costs which arenot excludable from your income taxes will be grossed-up. Mortgage origination fees, for example, are deductible and are therefore not grossed-up for tax impact.

If you decide to build a home…

If you choose to build a home rather than buy an existing one, separate closings may be required to obtain a construction loan and then convert the construction loan to a permanent mortgage. The Company will not reimburse you for duplicate closing costs that may result from two closings.

In addition, since building a residence often takes longer, you should be aware that temporary living and storage of household goods are not extended for those choosing to build.

April 24, 2006

27

MeadWestvacoGroup Move Executive Homeowner Relocation Guidebook

YOUR NEW LOCATION

Home Purchase Assistance - continued

Mortgage Assistance

MeadWestvaco has established agreements with Bank of America, GMAC Mortgage and Wells Fargo to assist you if you are purchasing a home in your new location. Your use of these lenders is optional, but as a relocating employee there are several benefits that you may want to consider:

| | • | | Direct billing to MeadWestvaco of reasonable and customary closing costs and processing fees (eliminating your need to receive a cash advance for out-of-pocket expenses that you outlay) |

| | • | | Competitive mortgage interest rates |

| | • | | Pre-approval assistance |

| | • | | Simplified application process |

| | • | | Variety of mortgage financing options |

You can contact these three mortgage companies by calling them directly at the number below or you can look up their information on MyGMACRelocation.com. If you call, please identify yourself as a MeadWestvaco transferee and let them know which Consultant at GMAC GRS that you are working with.

Bank of America 800-809-0228

GMAC Mortgage 800-462-2684

Wells Fargo 800-525-3902

The decision of which mortgage lender to use is your own.However, if you choose a lender other than one of these three, please be aware that the direct bill service will not be available.

Mortgage Interest Differential

You should make every effort to obtain the lowest mortgage interest rate possible on your new residence. If your new interest rate is 1% or higher than your old mortgage interest rate, then the Company will pay, based upon further criteria, the allowed difference above a 1% threshold / differential over a three year period. The differential formula is the interest rate differential between the old and new interest rates less one percent, times the new first mortgage balance.

To qualify for this benefit, you must reinvest at least 90% of the equity in your former home as a down payment and utilize an identical mortgage product as you had in old residence. In addition, your new first mortgage interest rate must be in excess of 7%.

April 24, 2006

28

MeadWestvacoGroup Move Executive Homeowner Relocation Guidebook

YOUR NEW LOCATION

Home Purchase Assistance - continued

The payout will be for a three-year period on a graduated scale. The first annual amount is 100%. It will be paid shortly after you have closed on your new home. The second payment will be at 66% of the initial differential amount and third year will be set at 33%. These annual payments will be made by GMAC GRS after you have submitted the necessary documentation. An adjustable rate mortgage, a refinance or another transfer during this three year time frame may cancel or amend your payment amount. The purpose of this provision is not to cover the total difference in interest rates but to help you adjust to higher mortgage interest payments.

Example:

Factors

Old Interest Rate 6% / New Interest Rate 8.5%

New Mortgage Balance $ 200,000

| | | | |

Formula | | | | |

| |

New Mortgage Balance | | $ | 200,000 | |

Times Interest Differential Less | | | | |

One Percent | | | 1.5 | % |

First Year Interest Differential Payment | | $ | 3,000 | |

Second Year Interest Differential Payment | | $ | 2,000 | |

Third Year Interest Differential Payment | | $ | 1,000 | |

Your Consultant can provide additional information and/or calculations should you need further clarification on this benefit.

Tax Treatment:

Since these expenses are interest related and deductible from your W-2, they will not be tax assisted.

April 24, 2006

29

MeadWestvacoGroup Move Executive Homeowner Relocation Guidebook

YOUR NEW LOCATION

Duplicate Housing Expenses

If you close on your new home before you complete the sale of your former home, you may be faced with the expense of temporarily maintaining two homes. You will be reimbursed for qualified duplicate housing expenses on your former home for a period not to exceed 180 days.

You must fully participate in the Home Sale Program in order to be eligible for reimbursement of qualified duplicate housing expenses. Reimbursements will apply to your former home only.

Qualified expenses include:

| | • | | dwelling insurance, and |

Tax gross-up will be provided for non-deductible duplicate housing expenses.The Company will not provide tax assistance for property taxes and mortgage interest, as these expenses are tax deductible.

Cost of Living Differential Assistance

MeadWestvaco recognizes that the cost of living may vary significantly among different company locations. To assist with the transition to a company location that has substantially higher cost of living than your present area, MeadWestvaco will provide a cost of living subsidy. The subsidy is offered to you as two options: (1) you may elect to receive a mortgage subsidy paid by MeadWestvaco directly to a company-arranged national lender or (2) you may elect to receive your subsidy as monthly payments through payroll. The subsidy is subject to required income tax withholding. Depending on the cost differential, you may be eligible for a 2, 3, 4, or 5 year subsidy.

The benefit to you of a mortgage subsidy is the ability to qualify for a greater mortgage amount than your income might otherwise permit. The mortgage subsidy allows you to qualify for a higher mortgage by reducing the initial interest rate. The result is more purchasing power to assist with the affordability of the new destination area.

For example if the current mortgage interest rate is 7.25% and the first year subsidy results in a 3% reduction in rate, you are qualified by the lender as though the market interest rate were 4.25%. A further benefit is that, at tax time, you may be able to deduct mortgage interest at the note rate of 7.25%. The mortgage interest you pay will increase each year as the subsidy paid to the lender is reduced each year by 1% until you are paying the full note rate in the year that the subsidy ceases.

April 24, 2006

30

MeadWestvacoGroup Move Executive Homeowner Relocation Guidebook

YOUR NEW LOCATION

Cost of Living Differential Assistance - continued

Eligibility

| | • | | You must be a current homeowner who purchases a home at the new location. |

| | • | | The cost of living differential must be at least 5.1% higher in the new location than in the old location, as established by GMAC GRS. |

| | • | | You will be required to reinvest 90% of the equity from the sale of your previous home. |

| | • | | You must use one of the three national pre-qualified lenders, Bank of America, GMAC Mortgage and Wells Fargo. |

Subsidy Calculation

GMAC GRS will use an overall cost-of-living index developed by a mobility consulting firm. This index will be calculated on your present and final permanent housing locations. A Cost of Living Differential will be provided when the index is at least 5.1% higher in the new location than in the old location. The subsidy calculation will be based upon a fully amortized loan, including principal and interest payments, regardless of the specific loan product you select. For instance, if you selected an interest only loan, your subsidy calculation will be based as if your mortgage loan is fully amortized having both principal and interest payments versus an interest only payment.”

Index

| | • | | If the overall index is less than 5%, you are not eligible for a subsidy. |

| | • | | If the overall index is at least 5.1% and less than 10%, a two-year subsidy is provided. |

| | • | | If the overall index is at least 10.1% and less than 15%, a three-year subsidy is provided. |

| | • | | If the overall index is at least 15.1% and less than 20%, a four-year subsidy will be provided. |

| | • | | If the overall index is above 20.1%, a five year subsidy is provided |

Examples

A 2-year subsidy reduces the interest rate on the mortgage 2% the first year and 1% the second year. The payment and interest rate during the third and all succeeding years will be at the note rate. If the note rate is 7.25%, the subsidy will reduce the rate to 5.25% for the first year and 6.25% the second year. In the third year, the note rate of 7.25% would apply.

A 3-year subsidy reduces the interest rate on your mortgage 3% the first year, 2% the second year, and 1% the third year. The payment and interest rate during the fourth and all succeeding years will be at the note rate. If the note rate is 7.25%, the subsidy will reduce the rate to 4.25% for the first year, 5.25% the second year and 6.25% the third year. In the fourth year, the note rate of 7.25% would apply.

A 4-year subsidy reduces the interest rate on your mortgage 4% the first year, 3% the second year, 2% the third year, and 1% in the fourth year. The payment and interest rate during the fifth and all succeeding years will be at the note rate. If the note rate is 7.25%, the subsidy will reduce the rate to 3.25% for the first year, 4.25% the second year, 5.25% the third year, and 6.25% the fifth year. In the fifth year, the note rate of 7.25% would apply.

April 24, 2006

31

MeadWestvacoGroup Move Executive Homeowner Relocation Guidebook

YOUR NEW LOCATION

Cost of Living Differential Assistance - continued

A 5-year subsidy reduces the interest rate on your mortgage 5% the first year, 4% the second year, 3% the third year, and 2% in the fourth year, and 1% in the fifth year. The payment and interest rate during the sixth and all succeeding years will be at the note rate. If the note rate is 7.25%, the subsidy will reduce the rate to 2.25% for the first year, 3.25% the second year, 4.25% the third year, and 5.25% the fourth year, and 6.25% in the fifth year. In the sixth year, the note rate of 7.25% would apply.

Monthly Payment

If you are eligible, you will receive a monthly mortgage subsidy payment through payroll. Required income taxes will be withheld each month.

To determine your eligibility and how the cost of living differential assistance will apply to your specific situation, please contact your Consultant.

Termination and Subsequent Transfer

Subsidy payments will cease upon termination of employment, except in cases of involuntary termination, (not for cause), in which case the mortgage subsidy would continue for the period of benefits continuation, as outlined in the Severance Pay Plan.

If you are transferred while receiving a subsidy, the subsidy will continue while you are responsible for your current home until it is sold or acquired under the company’s Employee Relocation Policy as part of your transfer. If you should elect to keep your home at the old location, the subsidy will cease upon the effective date of your transfer to the new location. If you purchase a home at the new location, a new cost of living index will be calculated.

April 24, 2006

32

MeadWestvacoGroup Move Executive Homeowner Relocation Guidebook

YOUR NEW LOCATION

Miscellaneous Relocation Expense Allowance

The Company recognizes that you may incur various miscellaneous expenses during the relocation process that are not covered elsewhere in this policy. Therefore, the Company will provide you with a lump sum allowance equal to one month’s new base salary, up to a maximum of $10,000. The Miscellaneous Expense Allowance is subject to required federal, state and local tax withholding and will not be tax assisted by the company.

This allowance will be approved by GMAC GRS and sent to the MeadWestvaco payroll department for payment when you have scheduled your household goods shipment to your new permanent residence.

Use of the allowance is at your discretion and no receipts are required; however, it is typically used for:

| | |

• Automobile registration, title, sales and transfer tax • Utility deposits • House cleaning (new or old location) • Non-refundable tuition, memberships, club dues or subscriptions • Piano tuning • Driver’s license fees • Telephone installation • Cable and utility hookups • Carpet and drapery refitting or purchase • Trash removal • Change of locks • Gratuities to movers and service people • Tax consulting | |  |

This list is not meant to be all-inclusive, but an example of the various items that the allowance is typically used for.Even though you do not need to account for the funds used, it is recommended that you retain all receipts for tax purposes.

Return Trips

You will be reimbursed for transportation expenses for return visits home every other weekend during the length of your approved temporary living up to a maximum of 8 trips. You may return home or your spouse/partner may use these return trips to visit the new location for additional house hunting or related activities. No lodging and meal expenses will be reimbursed for this type of expense.

April 24, 2006

33

MeadWestvacoGroup Move Executive Homeowner Relocation Guidebook

YOUR NEW LOCATION

Actual Move

Travel at Time of Move