UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | |

¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | | Definitive Proxy Statement | | | |

¨ | | Definitive Additional Materials | | | |

¨ | | Soliciting Material under Rule 14a-12 | | | |

MeadWestvaco Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | |

| | | MeadWestvaco Corporation 501 South 5th Street Richmond, Virginia 23219 |

March 21, 2012

Dear Fellow Stockholders:

You are cordially invited to join us at the 2012 Annual Meeting of Stockholders of MeadWestvaco Corporation. The meeting will begin at 11:00 a.m., local time, on Monday, April 23, 2012. The meeting will take place in the Duke of Windsor Room of the Waldorf=Astoria Hotel at 301 Park Avenue, New York, New York.

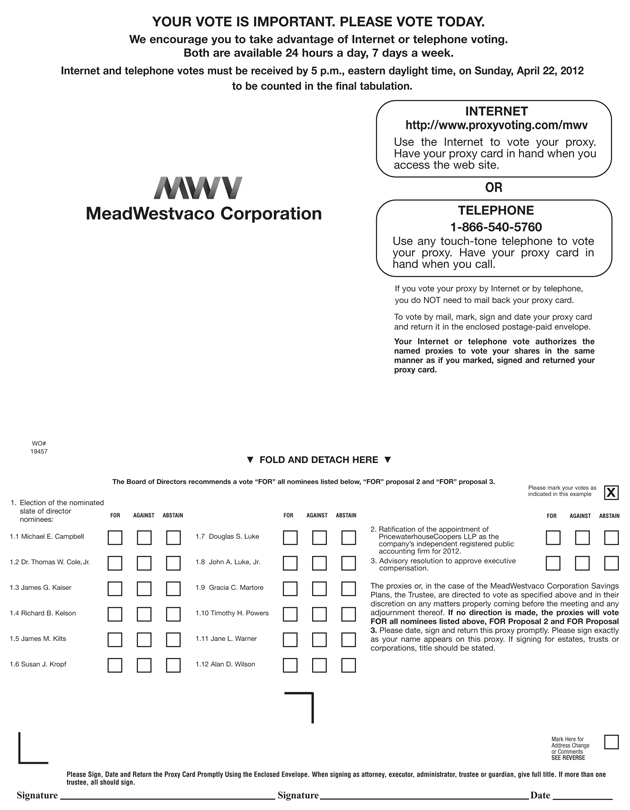

Please vote on all matters listed in the enclosed Notice of 2012 Annual Meeting of Stockholders. This year our proxy materials include three proposals. Your Board of Directors recommends votingFOR Proposal 1, the election of our twelve directors;FOR Proposal 2, the ratification of the appointment of our independent registered public accounting firm;FOR Proposal 3, an advisory resolution to approve executive compensation. Please refer to the proxy statement for detailed information on each of the proposals and the Annual Meeting.

Your interest in your company as demonstrated by the representation of your shares at our Annual Meeting is a great source of strength for your company. Your vote is very important to us and, accordingly, whether or not you expect to attend the meeting, we ask that you sign, date and promptly return the enclosed proxy.

Very truly yours,

John A. Luke, Jr.

Chairman and

Chief Executive Officer

MeadWestvaco Corporation

Notice of 2012 Annual Meeting of Stockholders

The 2012 Annual Meeting of Stockholders of MeadWestvaco Corporation will be held on Monday, April 23, 2012, at 11:00 a.m., local time, at the Waldorf=Astoria Hotel at 301 Park Avenue, New York, New York. Stockholders will be asked to vote on the following matters:

| 1. | | To elect the twelve directors listed in the proxy statement for a term of one year each and until their successors are elected and qualified; |

| 2. | | To consider and vote upon a proposal to ratify the action of the Audit Committee of the Board of Directors in appointing PricewaterhouseCoopers LLP as the company’s independent registered public accounting firm for the year 2012; |

| 3. | | To consider and vote upon an advisory resolution to approve executive compensation; and |

| 4. | | To transact other business that may properly come before the Annual Meeting. |

All holders of common stock of record at the close of business on March 1, 2012 will be entitled to receive notice of and to vote at the Annual Meeting and at any adjournment or postponement thereof. A list of those stockholders will be available for inspection at the executive offices of MeadWestvaco and will also be available for inspection at the Annual Meeting.Whether or not you expect to be at the meeting, please sign, date and promptly return the enclosed proxy or vote by telephone or electronically, as described on the proxy card.

Brokers are not permitted to vote on the election of directors and Proposal 3 without instructions from the beneficial owner. Therefore, if your shares are held in the name of your broker, bank or other nominee, your vote is especially important this year. Unless you vote your shares, your shares will not be voted in the election of directors or Proposal 3.

By Order of the Board of Directors

Wendell L. Willkie, II

Senior Vice President, General Counsel and Secretary

March 21, 2012

Important Notice Regarding the Availability of

Proxy Materials for the Stockholder

Meeting to be Held on April 23, 2012

The proxy statement and annual report to stockholders are available at www.meadwestvaco.com/proxymaterials.

Proxy Statement

MeadWestvaco Corporation

501 South 5th Street

Richmond, Virginia 23219

Your Board of Directors (“Board”) is providing you with this Proxy Statement in connection with the Board’s solicitation of proxies for the 2012 Annual Meeting of Stockholders of MeadWestvaco Corporation (“MeadWestvaco” or the “company”) to be held on April 23, 2012 at 11:00 a.m., local time, at the Waldorf=Astoria Hotel, 301 Park Avenue, New York, New York, and any adjournment or postponement thereof. On or about March 21, 2012, we will mail the Proxy Statement, a proxy card, and the Annual Report of MeadWestvaco for the year 2011 to stockholders of record of MeadWestvaco common stock at the close of business on March 1, 2012. Although the Annual Report and Proxy Statement are being mailed together, the Annual Report should not be deemed to be part of the Proxy Statement.

Who is entitled to vote at the meeting?

Only holders of record of MeadWestvaco’s common stock at the close of business on March 1, 2012 will be entitled to vote.

What are the voting rights of the holders of MeadWestvaco common stock?

Each share of outstanding common stock will be entitled to one vote on each matter considered at the meeting.

Who can attend the meeting?

Attendance at the meeting will be limited to holders of record as of March 1, 2012, or their authorized representatives (not to exceed one per stockholder), management, the Board and guests of management.

What constitutes a quorum?

The presence, in person or by proxy, of the holders of a majority of the votes entitled to be cast at the Annual Meeting is necessary to constitute a quorum. As of the record date, March 1, 2012, 172,348,397 shares of MeadWestvaco common stock, representing the same number of votes, were outstanding. Therefore, the presence of the holders of record of common stock representing at least 86,174,199 votes will be required to establish a quorum. Abstentions and shares represented by “broker non-votes” will be counted in determining whether there is a quorum.

How do I vote?

It is important that your stock be represented at the meeting. Whether or not you plan to attend, please sign, date and return the enclosed proxy promptly in order to be sure that your shares will be voted. If you are a registered stockholder (that is, if you hold your stock in certificate form or if you participate in the MeadWestvaco Savings Plan), and attend the meeting, you may deliver your completed proxy card in person. “Street name” stockholders (that is, those who hold their stock through a broker or other nominee) who wish to vote at the meeting will need to obtain a proxy form from the institution that holds their shares.

Can I vote by telephone or electronically?

If you are a registered stockholder, you may vote by telephone, or electronically through the Internet, by following the instructions included with your proxy card. The deadline for voting by telephone or electronically is 5:00 p.m., Eastern Daylight Time, on April 22, 2012. If your shares are held in “street name,” please check your voting instruction form or contact your broker or nominee to determine whether you will be able to vote by telephone or electronically.

1

Can I revoke my proxy or change my vote after I return my proxy card?

Yes. You may revoke your proxy or change your vote at any time before it is voted at the meeting. Regardless of the way in which you submitted your original proxy, you may revoke or change it by submitting a written revocation or a later-dated proxy to the Secretary of MeadWestvaco, voting by telephone or electronically, or by attending and voting at the Annual Meeting. If your shares are held in “street name” please check your voting instructions form or contact your broker or nominee in order to revoke or change your voting instruction.

What vote is required to approve each item?

Election of Directors. The Board of Directors has adopted a majority vote standard in uncontested director elections. Because the company did not receive advance notice under its bylaws of any stockholder nominees for directors, the 2012 election of directors is an uncontested election. To be elected in an uncontested election, a director nominee must receive more “For” votes than “Against” votes. Abstentions and broker non-votes will have no effect on the election of directors since only votes “For” or “Against” a nominee will be counted. A broker non-vote occurs when a bank, broker or other nominee does not have authority to vote on any particular item without instructions from the beneficial owner and has not received instructions.

Effect of an Incumbent Director Not Receiving the Required Vote. MeadWestvaco is a Delaware corporation, and under Delaware law, if an incumbent director does not receive sufficient votes to be elected, that director remains in office until the director’s successor is duly elected and qualified or until the director’s death, resignation or retirement. To address this potential outcome, the Board has also adopted a director resignation policy. Under this policy, any incumbent director who is not elected in accordance with the bylaws will tender his or her resignation to the Chairman of the Board and the Nominating and Governance Committee promptly following certification of the stockholder vote. The Nominating and Governance Committee will promptly consider the resignation tendered by the director, and the Nominating and Governance Committee will recommend to the Board whether to accept the tendered resignation or reject it. In considering whether to accept or reject the tendered resignation, the Nominating and Governance Committee will consider all factors deemed relevant by the members of the Nominating and Governance Committee, including, the reasons why stockholders voted “Against” the election of such director, the length of service and qualifications of the director, the director’s contributions to the company and the MeadWestvaco Corporate Governance Principles. Unless all the directors are affected, no director whose tendered resignation is under consideration will participate in the deliberative process as a member of the Nominating and Governance Committee or the process of the Board described below. The Board will act on the Nominating and Governance Committee’s recommendation within 90 days following certification of the stockholder vote. In considering the Nominating and Governance Committee’s recommendation, the Board will consider the factors considered by the Nominating and Governance Committee and such additional information deemed relevant by the Board. Following the Board’s decision, the company will promptly disclose the Board’s decision whether to accept the director’s resignation as tendered (including an explanation of the process by which the decision was reached and, if applicable, the reasons for rejecting the resignation). To the extent that one or more directors’ resignations are accepted by the Board, the Nominating and Governance Committee will recommend to the Board whether to fill such vacancy or vacancies or to reduce the size of the Board.

Other Items. The affirmative vote of the majority of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the subject matter is required to: ratify the appointment of our independent registered public accounting firm (Proposal 2); and approve an advisory resolution to approve executive compensation (Proposal 3). A properly executed proxy marked “Abstain” with respect to any such matter will not be voted, although it will be counted as entitled to vote on the matter. Accordingly, an abstention will have the effect of a negative vote. Broker non-votes will not have any effect on the outcome of votes for these items.

2

Although the advisory vote on Proposal 3 is non-binding, our Board will review the results of the votes and, consistent with our record of stockholder engagement, will take them into account in making subsequent determinations concerning executive compensation.

Representatives of Computershare, our independent stock transfer agent, will count the votes and act as the inspector of election.

What are the Board’s recommendations?

All shares of MeadWestvaco common stock entitled to vote and represented by properly executed proxies received prior to the Annual Meeting, and not revoked, will be voted as instructed on those proxies. If no instructions are indicated, the shares will be voted as recommended by the Board of Directors. The Board’s recommendation is set forth together with the description of each item in this Proxy Statement. In summary, the Board recommends a vote:

| | • | | FOR election of the nominated slate of twelve directors (see Item 1); |

| | • | | FOR ratification of the appointment of PricewaterhouseCoopers LLP as the company’s independent registered public accounting firm for 2012 (see Item 2); and |

| | • | | FOR the advisory resolution to approve executive compensation (see Item 3). |

If any other matters are properly presented for consideration at the Annual Meeting, or any adjournment or postponement thereof, the persons named in the enclosed form of proxy will have discretion to vote on those matters in accordance with their own judgment to the same extent as the person signing the proxy would be entitled to vote. The company does not currently anticipate that any other matters will be raised at the Annual Meeting.

3

Ownership of Directors and Executive Officers

How much company stock do the company’s directors and executive officers own?

The following table shows the amount of MeadWestvaco common stock beneficially owned, unless otherwise indicated, by our directors, the executive officers named in the Summary Compensation Table and the directors and executive officers as a group. Except as otherwise indicated and subject to applicable community property laws, each owner has sole voting and investment powers with respect to the securities listed.

| | | | | | | | | | | | |

Name | | Total Shares

Beneficially

Owned(1) | | | Options

Exercisable

Within 60 Days | | | Percent of

Class

Beneficially

Owned | |

Directors | | | | | | | | | | | | |

Michael E. Campbell(2) | | | 35,320 | | | | 3,000 | | | | * | |

Dr. Thomas W. Cole, Jr.(2) | | | 34,884 | | | | 3,000 | | | | * | |

James G. Kaiser(2) | | | 40,727 | | | | 3,000 | | | | * | |

Richard B. Kelson(2) | | | 34,762 | | | | 3,000 | | | | * | |

James M. Kilts(2) | | | 21,266 | | | | 0 | | | | * | |

Susan J. Kropf(2) | | | 40,225 | | | | 3,000 | | | | * | |

Douglas S. Luke(2)(3) | | | 72,112 | | | | 3,000 | | | | * | |

John A. Luke, Jr.(4) | | | 2,561,993 | | | | 1,956,174 | | | | 1.5 | % |

Gracia C. Martore(2) | | | 826 | | | | 0 | | | | | |

Robert C. McCormack(2) | | | 36,290 | | | | 3,000 | | | | * | |

Timothy H. Powers(2) | | | 24,225 | | | | 0 | | | | * | |

Jane L. Warner(2) | | | 36,290 | | | | 3,000 | | | | * | |

Alan D. Wilson(2) | | | 2,425 | | | | 0 | | | | * | |

| | | |

Other Named Executive Officers | | | | | | | | | | | | |

James A. Buzzard(5) | | | 662,857 | | | | 529,831 | | | | * | |

E. Mark Rajkowski(5) | | | 565,328 | | | | 418,691 | | | | * | |

Wendell L. Willkie, II(5) | | | 383,725 | | | | 283,280 | | | | * | |

Robert A. Feeser(5) | | | 294,468 | | | | 232,834 | | | | * | |

All Directors and Executive Officers as a Group

(25 persons) | | | 6,319,442 | | | | 4,564,854 | | | | 3.7 | % |

| * | | Less than 1% of MeadWestvaco common stock. |

| (1) | | Information concerning beneficial ownership of shares is as of March 1, 2012, the most recent practicable date. Includes the number of shares that each such person beneficially owns as of March 1, 2012, including shares such person has the right to acquire within 60 days thereafter (shares that can be acquired within 60 days thereafter are also set forth in the column “Options Exercisable Within 60 Days”). |

| (2) | | Each non-employee director holds 31,350 stock units (representing the same number of shares of MeadWestvaco common stock) granted under the MeadWestvaco Corporation Compensation Plan for Non-Employee Directors, with the exception of Mr. Powers, who holds 23,225 stock units, Mr. Kilts, who holds 21,266 stock units, Mr. Wilson who holds 2,425 stock units and Ms. Martore who holds 826 stock units. The rights of each non-employee director in respect of these stock units are vested at all times, and distributions of the stock units are required to be made in MeadWestvaco common stock on the earliest practicable date following the end of the calendar quarter in which the director’s board membership is terminated. |

| (3) | | Includes 2,978 MeadWestvaco shares held in a trust of which Mr. Luke is a co-trustee. Includes 34,784 shares owned by Mr. Luke that serve as collateral security for a line of credit. |

| (4) | | Includes 39,380 MeadWestvaco shares held indirectly through employee benefit plans and 32,304 shares held in trust for or by members of Mr. Luke’s immediate family. |

| (5) | | Includes MeadWestvaco shares held indirectly through employee benefit plans by Messrs. Buzzard, Rajkowski, Willkie and Feeser in the amounts of 14,139 shares, 3,440 shares, 16,724 shares and 7,770 shares, respectively. |

4

Ownership of Certain Beneficial Owners

Who are the largest owners of the company’s stock?

Based upon Schedule 13D and 13G filings with the Securities and Exchange Commission, the following investment advisers are believed to have beneficial ownership (as defined for certain purposes by the Securities and Exchange Commission) as of December 31, 2011 of more than 5% of the company’s common stock by virtue of having investment authority and, to some extent, voting authority over the number of shares indicated.

| | | | | | | | |

| | | Shares | | | Percent

of Class* | |

BlackRock, Inc.(1) 40 East 52nd Street New York, New York 10022 | | | 19,824,715 | | | | 11.6 | % |

| | |

Capital World Investors(2) 333 South Hope Street Los Angeles, CA 90071 | | | 17,204,800 | | | | 10.1 | % |

| | |

The Vanguard Group, Inc.(3) 100 Vangurd Blvd. Malvern, PA 19355 | | | 9,015,159 | | | | 5.3 | % |

| * | | As of December 31, 2011, based on 170,861,250 shares outstanding as of that date. |

| (1) | | Based on Schedule 13G/A filed by BlackRock, Inc. on January 10, 2012. The reporting person has sole voting power with respect to 19,824,715 shares, shared voting power with respect to no shares, sole dispositive power with respect to 19,824,715 shares and shared dispositive power with respect to no shares. |

| (2) | | Based on Schedule 13G/A filed by Capital World Investors on February 10, 2012. The reporting person has sole voting power with respect to 11,659,800 shares, shared voting power with respect to no shares, sole dispositive power with respect to 17,204,800 shares, and shared dispositive power with respect to no shares. |

| (3) | | Based on Schedule 13G filed by the Vanguard Group, Inc. on February 6, 2012. The reporting person has sole voting power with respect to 236,433 shares, shared voting power with respect to no shares, sole dispositive power with respect to 8,778,726 shares, and shared dispositive power with respect to 236,433 shares. |

The MeadWestvaco stock ownership plans for salaried and hourly employees held, as of March 1, 2012, an aggregate amount of 9,597,247 MeadWestvaco shares, or approximately 5.6% of the total outstanding shares as of that date, for which full voting rights are exercisable by members of the plans. As of that date, there were approximately 11,941 participants in these plans.

5

Corporate Governance

1. Election of Directors

The Board of Directors of the company, pursuant to the company’s bylaws, has determined that the number of directors of the company will be twelve. Pursuant to the company’s bylaws, each director is elected annually. Directors in this uncontested election will be elected if the director nominee receives more “For” votes than “Against” votes. There is no provision for cumulative voting in the election of directors. At the meeting, the Corporate Secretary or Assistant Secretary named in the enclosed proxy (or a substitute) will, if authorized, vote the shares covered by such proxy for election of the twelve nominees for directors.

The present nominees, Michael E. Campbell, Dr. Thomas W. Cole, Jr., James G. Kaiser, Richard B. Kelson, James M. Kilts, Susan J. Kropf, Douglas S. Luke, John A. Luke, Jr., Gracia C. Martore, Timothy H. Powers, Jane L. Warner and Alan D. Wilson, if elected, will be elected for terms expiring at the 2013 Annual Meeting of Stockholders and until their successors are elected and qualified.The Board of Directors unanimously recommends a vote FOR the named nominees. Should any of these nominees become unavailable for election for any reason presently unknown, the Corporate Secretary or Assistant Secretary named in the enclosed proxy (or a substitute) will vote for the election of such other person or persons, if any, as the Board of Directors may recommend, or the Board may decrease the size of the Board. Pursuant to the company’s bylaws, Mr. Robert C. McCormack will retire from the Board on April 23, 2012.

All of the preceding twelve persons currently serve as directors of MeadWestvaco and have done so since the combination of The Mead Corporation and Westvaco Corporation was completed in January 2002 with the exception of Timothy H. Powers who became a director in January 2006, James M. Kilts who became a director in October 2006, Alan D. Wilson who became a director in June 2011 and Gracia C. Martore who became a director in February 2012. Set forth on the following pages is the principal occupation of, and certain other information regarding the director nominees.

6

Nominees for Election as Directors

| | | | | | | | |

Name | | Age* | | | Director of

MeadWestvaco

Since | |

MICHAEL E. CAMPBELL | | | 64 | | | | 2002 | |

| Chairman, President and Chief Executive Officer, Arch Chemicals, Inc., a global biocides company, 1999-2011. Director: National Association of Manufacturers, Milliken & Company. Former director and chairman: American Chemistry Council and Society of Chemical Industry. | | | | | | | | |

| | |

DR. THOMAS W. COLE, JR. | | | 71 | | | | 2002 | |

| Interim President of the Interdenominational Theological Center, an educational group, 2009-2010. Interim Chancellor, University of Massachusetts at Amherst, 2007-2008. President and Chief Executive Officer, Great Schools Atlanta, an educational organization, 2004-2006. President Emeritus since 2002 and President, 1989-2002, Clark Atlanta University. Chairman, The Quality Education for Minorities Network. | | | | | | | | |

| | |

JAMES G. KAISER | | | 69 | | | | 2002 | |

| Chairman and Chief Executive Officer, Avenir Partners, Inc., an automotive business, since 1998. President, Kaiser Services, LLC, a business development company, since 1997. Manager, Kaiser Ridgeway, a real estate development company, LLC, since 2002. President and Chief Executive Officer, Quanterra Incorporated 1994-1996. Quanterra succeeded to businesses of the environmental analytical services division of International Technology Corporation and Enseco (a unit of Corning Incorporated) for which Mr. Kaiser had been President and Chief Executive Officer since June 1992 after serving in various management positions at Corning since 1982. Director, Sunoco, Inc. | | | | | | | | |

| | |

RICHARD B. KELSON | | | 65 | | | | 2002 | |

| Private equity investor and advisor to middle-market companies. Chairman, President and Chief Executive Officer, Servco, LLC, a strategic sourcing and supply chain management company, since 2009. Operating Advisor, Pegasus Capital Advisors, L.P., a private equity fund manager, 2006-2009. Chairman’s Counsel, Alcoa, Inc., a global manufacturer of aluminum and aluminum based products, 2006; Executive Vice President and Chief Financial Officer, 1997-2005. Director: PNC Financial Services, Commercial Metals Company, Ecovative Design, LLC, KaBOOM!, Inc. Former director, Lighting Science Group Corporation, 2007-2010. Member, University of Pittsburgh School of Law Board of Visitors. | | | | | | | | |

| | |

JAMES M. KILTS | | | 64 | | | | 2006 | |

| Founding Partner, Centerview Capital, a private equity firm, since 2006. Vice Chairman, The Procter & Gamble Company, a global consumer products company, 2005-2006. Chairman, President and Chief Executive Officer, The Gillette Company, a global consumer products company, 2001-2005. President and Chief Executive Officer, Nabisco Holdings Corporation, 1998-2000. Director: Metropolitan Life Insurance Company, Nielsen Holdings, N.V. (non-executive Chairman), Pfizer, Inc. Former director, The New York Times Company, 2005-2008. Former Chairman of Supervisory Board, The Nielsen Company, B.V., 2007-2011. Member: Board of Trustees, Knox College, Board of Trustees, University of Chicago, Board of Overseers of Weill Cornell Medical College. | | | | | | | | |

*Ages of directors are as of March 1, 2012.

7

Nominees for Election as Directors

| | | | | | | | |

Name | | Age* | | | Director of

MeadWestvaco

Since | |

SUSAN J. KROPF | | | 63 | | | | 2002 | |

| President and Chief Operating Officer, Avon Products, Inc., a global manufacturer and marketer of beauty and related products, 2001-2006; Director, 1998-2006. Director: Coach, Inc., The Kroger Company, The Sherwin-Williams Company, Wallace Foundation. | | | | | | | | |

| | |

DOUGLAS S. LUKE | | | 70 | | | | 2002 | |

| President and Chief Executive Officer, HL Capital, Inc., a private investment company with diversified interests in marketable securities and private equities, since 1999. Director, Regency Centers Inc. Trustee, The Adirondack Nature Conservancy/Adirondack Land Trust. | | | | | | | | |

| | |

JOHN A. LUKE, JR. | | | 63 | | | | 2002 | |

| Chairman and Chief Executive Officer, MeadWestvaco Corporation, since 2002. Chairman, President and Chief Executive Officer, MeadWestvaco, 2002-2003. Chairman, President and Chief Executive Officer, Westvaco Corporation, 1996-2002. Director: American Forest and Paper Association, The Bank of New York Mellon, The Timken Company, Factory Mutual Insurance Company, National Association of Manufacturers. Trustee: American Enterprise Institute for Public Policy Research, Richmond Performing Arts Center, Virginia Museum of Fine Arts. | | | | | | | | |

| | |

GRACIA C. MARTORE | | | 60 | | | | 2012 | |

| President and Chief Executive Officer, Gannett Co., Inc., a media and marketing solutions company, since 2011; President and Chief Operating Officer, 2010-2011; Executive Vice President and Chief Financial Officer, 2006-2010; Senior Vice President and Chief Financial Officer, 2003-2006; Senior Vice President of Finance and Treasurer, 2001-2003. Director: Factory Mutual Insurance Company, Gannett Co., Inc., Gannett Foundation. | | | | | | | | |

| | |

TIMOTHY H. POWERS | | | 63 | | | | 2006 | |

| Chairman, President and Chief Executive Officer, Hubbell Incorporated, a manufacturer of electrical products, since September 2004; President and Chief Executive Officer, 2001-2004; Senior Vice President and Chief Financial Officer, 1998-2001. Director, National Electrical Manufacturers Association. Board of Trustees, Manufacturers Alliance/MAPI. | | | | | | | | |

| | |

JANE L. WARNER | | | 65 | | | | 2002 | |

| Executive Vice President, since 2007, Group Vice President, 2005-2007, Worldwide Finishing Systems, Illinois Tool Works, Inc., a global industrial products company. President, Plexus Systems, 2004-2005. Vice President, EDS and President, Global Manufacturing and Communications Industries, 2002-2004, Managing Director, Automotive Industry Group, 2000-2002. Director: Tenneco Corporation, John G. Shedd Aquarium. | | | | | | | | |

| | |

ALAN D. WILSON | | | 54 | | | | 2011 | |

| Chairman, since 2009, President, since 2007, and Chief Executive Officer, since 2008, McCormick & Company, Inc., a global spice and specialty foods company; President, North American Consumer Products, 2005-2006; President, U.S. Consumer Foods Group, 2003-2005; Vice President-Sales and Marketing, McCormick U.S. Consumer Foods Group, 2001-2003. Director: Grocery Manufacturers Association, Greater Baltimore Committee, Maryland Economic Development Commission. Former Director, Williams Scotsman, Inc. 2006-2007. | | | | | | | | |

*Ages of directors are as of March 1, 2012.

8

Director Compensation

How are directors compensated?

Each non-employee director of the company receives $75,000 as an annual cash retainer for service as a director. Board members may elect to defer all or a portion of the annual cash retainer under the MeadWestvaco Corporation Compensation Plan for Non-Employee Directors. Directors who are also employees of the company receive no additional compensation for service as a director.

Each year, non-employee directors also receive a grant of MeadWestvaco stock units equivalent to $100,000 at the time of grant. Distributions of stock units are made in MeadWestvaco common stock upon termination of a director’s board membership.

In addition to the compensation described above, the Audit Committee Chair receives a $20,000 annual retainer, the Compensation and Organization Development Committee Chair receives a $15,000 annual retainer and the Chair of each of the other standing Committees receives an annual retainer of $10,000. Each of the members of the Audit Committee, other than the Chair, receives an annual retainer of $10,000. The lead director receives an annual retainer of $25,000.

How often did the Board meet during 2011?

During 2011, the Board of Directors met six times, and no incumbent director attended less than 75 percent of the aggregate of: (1) the total number of meetings of the Board of Directors held in 2011 while he or she was a director and (2) the total number of meetings held in 2011 by all committees of the Board of Directors on which he or she served while he or she was a director.

Non-Employee Director Compensation Table

| | | | | | | | | | | | | | | | |

Name | | Fees Earned or

Paid in Cash $(1) | | | Stock

Awards $(2) | | | All Other

Compensation $(3) | | | Total

Compensation $ | |

Michael E. Campbell | | $ | 110,000 | | | $ | 100,000 | | | $ | 2,500 | | | $ | 212,500 | |

Dr. Thomas W. Cole, Jr. | | $ | 75,000 | | | $ | 100,000 | | | $ | 0 | | | $ | 175,000 | |

James G. Kaiser | | $ | 85,000 | | | $ | 100,000 | | | $ | 0 | | | $ | 185,000 | |

Richard B. Kelson | | $ | 95,000 | | | $ | 100,000 | | | $ | 5,000 | | | $ | 200,000 | |

James M. Kilts | | $ | 75,000 | | | $ | 100,000 | | | $ | 5,000 | | | $ | 180,000 | |

Susan J. Kropf | | $ | 75,000 | | | $ | 100,000 | | | $ | 0 | | | $ | 175,000 | |

Douglas S. Luke | | $ | 75,000 | | | $ | 100,000 | | | $ | 5,000 | | | $ | 180,000 | |

Robert C. McCormack* | | $ | 85,000 | | | $ | 100,000 | | | $ | 2,500 | | | $ | 187,500 | |

Timothy H. Powers | | $ | 100,000 | | | $ | 100,000 | | | $ | 0 | | | $ | 200,000 | |

Jane L. Warner | | $ | 95,000 | | | $ | 100,000 | | | $ | 0 | | | $ | 195,000 | |

Alan D. Wilson | | $ | 75,000 | | | $ | 100,000 | | | $ | 0 | | | $ | 175,000 | |

| * | | Mr. McCormack will retire from MeadWestvaco’s Board of Directors on April 23, 2012. |

| (1) | | This column includes fees earned or paid in cash, representing the annual retainer, and where applicable the lead director retainer, the committee chair retainers and the audit committee member retainer. |

| (2) | | The amounts shown in this column represent the aggregate grant date fair market value of stock units granted in 2011 to non-employee directors computed in accordance with FASB ASC Topic 718. Assumptions used in the calculation of these amounts are included in Note K to the company’s audited financial statements for the year ended December 31, 2011 included in the company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on February 27, 2012. |

| (3) | | The amounts included in this column represent matching contributions by the MeadWestvaco Foundation with respect to charitable contributions made by the director. The MeadWestvaco |

9

| | Foundation provides for a maximum annual dollar amount for matching funds of $2,500 per calendar year for two designated programs (for an annual total amount of $5,000). |

| (4) | | The table below reflects for each director, the aggregate number of outstanding stock and option awards at December 31, 2011. In January 2004 the Board of Directors discontinued the practice of providing an automatic annual grant of stock options to each director. |

| | | | | | | | | | | | |

| | | Stock

Options | | | Vested Stock

Grants | | | Total Shares Subject to

Outstanding Awards as of

December 31, 2011 | |

Michael E. Campbell | | | 3,000 | | | | 31,094 | | | | 34,094 | |

Dr. Thomas W. Cole, Jr. | | | 3,000 | | | | 31,094 | | | | 34,094 | |

James G. Kaiser | | | 3,736 | | | | 31,094 | | | | 34,830 | |

Richard B. Kelson | | | 3,000 | | | | 31,094 | | | | 34,094 | |

James M. Kilts | | | 0 | | | | 21,093 | | | | 21,093 | |

Susan J. Kropf | | | 3,736 | | | | 31,094 | | | | 34,830 | |

Douglas S. Luke | | | 3,000 | | | | 31,094 | | | | 34,094 | |

Robert C. McCormack* | | | 3,000 | | | | 31,094 | | | | 34,094 | |

Timothy H. Powers | | | 0 | | | | 23,075 | | | | 23,075 | |

Jane L. Warner | | | 3,000 | | | | 31,094 | | | | 34,094 | |

Alan D. Wilson | | | 0 | | | | 2,405 | | | | 2,405 | |

| | * | | Mr. McCormack will retire from MeadWestvaco’s Board of Directors on April 23, 2012. |

10

Board Committees

What committees has the Board established?

MeadWestvaco currently has five principal standing committees of the Board of Directors: Audit; Compensation and Organization Development; Finance; Nominating and Governance; and The Committee on Safety, Health and the Environment. Each of these committees operates under a written charter adopted by the Board of Directors and included on the company’s website atwww.meadwestvaco.com under the “Investors” tab at the top of the page and then under the “Corporate Governance” tab. Printed copies are available to any stockholder upon request by calling 1-800-432-9874. MeadWestvaco also has an Executive Committee that may be convened under certain circumstances when a special meeting of the Board of Directors is not practical or is not warranted.

The current members of the Board committees are as follows:

| | |

Audit | | Finance |

Richard B. Kelson, Chairman | | Robert C. McCormack, Chairman* |

James G. Kaiser | | Michael E. Campbell |

Gracia C. Martore | | James M. Kilts |

Timothy H. Powers | | Susan J. Kropf |

Jane L. Warner | | Douglas S. Luke |

(all independent directors) | | Gracia C. Martore |

| | (all independent directors) |

| |

Compensation and Organization Development | | Nominating and Governance |

Timothy H. Powers, Chairman | | Michael E. Campbell, Chairman |

Dr. Thomas W. Cole, Jr. | | James M. Kilts |

Richard B. Kelson | | Susan J. Kropf |

James M. Kilts | | Robert C. McCormack* |

Alan D. Wilson | | Timothy H. Powers |

(all independent directors) | | (all independent directors) |

| |

Executive | | Safety, Health and the Environment |

John A. Luke, Jr., Chairman | | Jane L. Warner, Chairman |

Michael E. Campbell | | Dr. Thomas W. Cole, Jr. |

Richard B. Kelson | | James G. Kaiser |

Robert C. McCormack* | | Douglas S. Luke |

Timothy H. Powers | | Alan D. Wilson |

Jane L. Warner | | (all independent directors) |

| * | | Mr. McCormack will retire from MeadWestvaco’s Board of Directors on April 23, 2012. |

The functions of the current Board committees are as follows:

Audit Committee

Assists the Board of Directors in fulfilling its responsibilities to stockholders, potential stockholders and the investment community relating to corporate accounting, reporting practices of the company and the quality and integrity of the financial reports of the company. The Committee assists the Board of Directors in reviewing and monitoring (1) the integrity of the financial statements of the company and internal control over financial reporting, (2) the compliance by the company with legal and regulatory requirements, (3) the independence and qualifications of the company’s independent registered public accounting firm and (4) the performance of the company’s internal audit function and independent registered public accounting firm. Included within the scope of its responsibilities, the Committee meets periodically with management to review the company’s risk assessment and risk management policies. The Audit Committee also has sole authority to appoint and replace the independent registered public accounting firm, subject to stockholder ratification. None of the members serve on more than three audit committees. All members are “financially literate” under New York Stock Exchange listing

11

standards, and at least one member has such accounting or related financial management expertise as to be considered a “financial expert” under Securities and Exchange Commission rules. The Board has designated the Audit Committee Chair, Richard B. Kelson and Committee members Gracia C. Martore and Timothy H. Powers as “audit committee financial experts” as a result of their experience in senior corporate executive positions with financial oversight responsibilities. The Audit Committee met six times in 2011.

Compensation and Organization Development Committee

Reviews and approves the company’s compensation philosophy. It is charged with the responsibility for assuring that officers and key management personnel are effectively compensated in terms that are motivating, internally equitable and externally competitive. The Committee approves compensation of the company’s executive officers including the Leadership Team (the Chairman and Chief Executive Officer and his direct reports), reviews compensation for remaining senior management, sets the criteria for awards under incentive compensation plans and determines whether such criteria have been met. The Committee seeks to ensure that the company’s compensation policies and plans are appropriately aligned with the company’s strategic objectives to protect and enhance shareholder value. The Committee generally oversees policies and practices of the company that advance its organization development, including succession planning as well as those designed to achieve the most productive engagement of the company’s workforce and the attainment of greater diversity. The Compensation and Organization Development Committee met five times in 2011. The details of the process and procedures followed by the Committee are disclosed in the Compensation Discussion and Analysis and report of the Compensation and Organization Development Committee at page 21.

Executive Committee

Provides for the exercise of certain powers of the Board between meetings of the Board when a special meeting of the Board is not practical or is not warranted. The Executive Committee did not meet in 2011.

Finance Committee

Oversees the company’s financial affairs and recommends those financial actions and policies that are most appropriate to accommodate the company’s operating strategies while maintaining a sound financial condition. The Committee reviews the company’s capital structure, financial plans, policies and requirements as well as strategic actions proposed by the company’s management. Included within the scope of its responsibilities the Committee oversees the company’s risk management programs and activities, and meets periodically with management to review the company’s strategic and financial risk exposures and the steps management has taken to monitor and control such exposures. The Committee also reviews funding recommendations concerning the company’s pension plans together with the investment performance of such plans and the company’s risk management policies and practices. The Finance Committee met three times in 2011.

Nominating and Governance Committee

Studies and makes recommendations concerning the qualifications of all directors, and selects and recommends candidates for election and re-election to the Board and persons to fill vacancies on the Board, as well as the compensation paid to non-employee directors. The Committee also reviews and considers other matters of corporate governance, including trends and emerging expectations, as well as best practices. In advising the Board and management, the Committee may consider a range of governance matters, including Board structure, Board composition, committees and criteria for committee appointment, Board meeting policies, and the ongoing relationship between the Board and management. The Nominating and Governance Committee met four times in 2011.

The Committee on Safety, Health and the Environment

Reviews implementation of the company’s workplace safety and health program. The Committee also reviews the stewardship of the company with respect to conservation of natural resources and its ability

12

to protect the natural environment. The Committee receives regular reports from management, reviews safety, health and environmental matters with management, including the company’s compliance record and programs, and makes recommendations as needed. Included within the scope of its responsibilities the Committee meets periodically with management to review the company’s property risk exposures, as well as operational risk exposures impacting safety, health and the environment, and the steps management has taken to monitor and control such exposures. The Committee on Safety, Health and the Environment met two times in 2011.

Corporate Governance Principles

MeadWestvaco’sCorporate Governance Principles, adopted by the Board of Directors in January 2003 and subsequently amended, address, among other things, standards for evaluating the independence of the company’s directors. The full text of thePrinciples,which contain the Board’s independence standards, is available on the company’s website atwww.meadwestvaco.com under the “Investors” tab at the top of the page and then under the “Corporate Governance” tab. Printed copies are available to any stockholder upon request by calling 1-800-432-9874.

Pursuant to thePrinciples, the Board, with the support of the Nominating and Governance Committee, reviewed the independence of directors in February 2012. Transactions and relationships, if any, between each director or any member of his or her immediate family and the company and its subsidiaries were considered. As provided in thePrinciples, the purpose of this review was to determine whether any such relationships or transactions were inconsistent with a determination that the director is independent. The Committee reviewed whether there were commercial, banking, consulting, legal, accounting, charitable and familial relationships between the company and individual directors or their immediate family members. The Committee identified one director, Ms. Jane L. Warner, who currently serves as an executive officer of a company that in the last three fiscal years transacted business with MeadWestvaco on a routine basis under standard commercial terms. In the case of Ms. Warner, who became an executive officer of Illinois Tool Works, Inc. in 2007, MeadWestvaco sales of product to such company in 2009 and 2011 were approximately a fifteenth of one percent of the annual consolidated revenues of such company (there were no sales in 2010), which is well under the independence thresholds established by the Board. Mr. Campbell, Mr. Kaiser, Mr. Kelson, Mr. Kilts and Ms. Kropf are directors of companies with which MeadWestvaco does business. The amount that MeadWestvaco paid to or received from each of these companies in each of the last three fiscal years for goods and services is well below one percent of the annual consolidated gross revenues of these companies.

As a result of this review, the Board affirmatively determined that, with the exception of John A. Luke, Jr., the Chairman and Chief Executive Officer of the company, all of the directors, including each of the members of the Audit, Compensation and Organization Development, and Nominating and Governance Committees, are independent of the company under the standards set forth in theCorporate Governance Principles and the New York Stock Exchange listing standards: Mr. Campbell, Dr. Cole, Mr. Kaiser, Mr. Kelson, Mr. Kilts, Ms. Kropf, Mr. Douglas Luke, Ms. Martore, Mr. Powers, Ms. Warner and Mr. Wilson. The Board determined in 2011 that Mr. McCormack (who will retire from the Board on April 23, 2012) was an independent director.

MeadWestvaco Nominating and Governance Committee

Charter

The Board of Directors of MeadWestvaco adopted a Nominating and Governance Committee charter on January 30, 2002 that was subsequently amended. The Nominating and Governance Committee Charter is included on the company’s website atwww.meadwestvaco.com under the “Investors” tab at the top of the page and then under the “Corporate Governance” tab. Printed copies are available to any stockholder upon request by calling 1-800-432-9874. The charter sets forth the purposes, goals and responsibilities of the Committee. The charter also provides that the Committee annually evaluates its performance. In accordance with the company’sCorporate Governance Principles, the members of the

13

Nominating and Governance Committee are required to be independent directors under the criteria established by the Board, consistent with the requirements of the New York Stock Exchange.

Director Candidates

In accordance with theCorporate Governance Principles, the Nominating and Governance Committee is responsible for recommending qualified individuals for membership on the Board of Directors. The Committee is dedicated to periodically reviewing with the Board the requisite qualifications of Board members as well as the composition of the Board as a whole. This assessment addresses independence of Board members, as well as the consideration of professional expertise, educational background, experience, judgment, knowledge and other factors that promote diversity of views and experience in the context of the needs of the Board. General criteria for the nomination of all director candidates include:

| | • | | the highest integrity and ethical standards; |

| | • | | the ability to provide wise and informed guidance to management; |

| | • | | a willingness to pursue thoughtful, objective inquiry on important issues before the company; |

| | • | | a commitment to enhancing stockholder value; and |

| | • | | a range of experience and knowledge commensurate with the company’s needs as well as the expectations of knowledgeable investors. |

The Board succession plan states that the Committee seeks the following additional attributes:

| | • | | a demonstrated track record of success; |

| | • | | independence, objectivity, perspective and judgment; |

| | • | | willingness to challenge prevailing opinion; |

| | • | | capacity for teamwork and compatibility with other Board members; |

| | • | | specific knowledge in significant areas; and |

| | • | | consistent availability. |

In addition, the background and specific competencies of candidates are considered. These include business management, financial expertise, manufacturing background, marketing experience, knowledge of the packaging industry, global business experience, innovation, service in government, academia or other public sector professions and independence under the standards of the New York Stock Exchange. The Committee assesses the effectiveness of this objective when evaluating new director candidates and when assessing the composition of the Board. In 2011 and 2012, the Nominating and Governance Committee recommended and the Board approved the addition of two new members, Alan D. Wilson and Gracia C. Martore. The Committee works with an executive search firm to assist in the identification of qualified director candidates. Mr. Wilson and Ms. Martore were initially recommended by other Board members based on their qualifications and experience.

The Committee has recommended to the Board, and the Board has approved the nomination of twelve of the current thirteen Board members (Mr. McCormack will retire from the Board on April 23, 2012) for election as director for a term of one year and until their successors are elected and qualified. Nominees were identified and proposed as candidates for service on the company’s Board based on their record of service and individual contributions to the overall mission and responsibilities of the Board under MeadWestvaco’sCorporate Governance Principles.In addition, the Committee and the Board considered a number of additional factors in the selection of the nominees including but not limited to the following:

| | (1) | | for Michael E. Campbell, his background, experience and judgment as chief executive officer of a major publicly traded manufacturing company which provides him with leadership, business and governance skills that benefit our Board; |

14

| | (2) | | for Dr. Thomas W. Cole, Jr., his professional and scientific experience and background and judgment as executive for institutions of higher education which provides him with leadership and governance skills that benefit our Board; |

| | (3) | | for James G. Kaiser, his background, experience and judgment as an executive officer for companies in the manufacturing and service sectors which provides him with leadership, business perspective and operating skills that benefit our Board; |

| | (4) | | for Richard B. Kelson, his background, experience and judgment as an executive officer for a major publicly traded global company in the areas of finance, safety and environment and law which provides him with leadership, governance and financial expertise that benefit our Board; |

| | (5) | | for James M. Kilts, his background, experience and judgment as chief executive officer of major publicly traded global consumer products companies which provides valuable leadership, business perspective, market expertise and governance skills that benefit our Board; |

| | (6) | | for Susan J. Kropf, her background, experience and judgment as an executive officer of a major publicly traded global consumer products company which provides valuable leadership, business perspective, market expertise and governance skills that benefits our Board; |

| | (7) | | for Douglas S. Luke, his background, experience and judgment as chief executive officer of a financial investment company which provides valuable leadership and financial expertise that benefits our Board; |

| | (8) | | for John A. Luke, Jr., his background, experience and judgment, and his unique knowledge and understanding of MeadWestvaco’s operations as chief executive officer of the company which provides him with valuable leadership, business and governance skills that benefit our Board; |

| | (9) | | for Gracia C. Martore, her background, experience and judgment as chief executive officer and chief financial officer of a major publicly traded media company which provides her with leadership, business, financial and governance skills that benefit our Board; |

| | (10) | | for Timothy H. Powers, his background, experience and judgment as chief executive officer and chief financial officer of a major publicly traded manufacturing company which provides him with broad leadership, management and governance skills that benefit our Board; |

| | (11) | | for Jane L. Warner, her background, experience and judgment as an executive officer for major publicly traded manufacturing companies which provides valuable leadership, operational and business expertise that benefit the Board; and |

| | (12) | | for Alan D. Wilson, his background, experience and judgment as chief executive officer of a major publicly traded multinational consumer foods company which provides him with leadership, market expertise, and business and governance skills that benefit our Board. |

As indicated above, the substantial business and professional background and experience, as well as the considerable knowledge and judgment of each member of the MeadWestvaco Board is directly relevant to and supportive of the Board’s ongoing deliberations regarding the important matters before it, including the oversight of the company’s business and its management, as well as the execution of the company’s strategy.

Stockholder Recommendations for Director Candidates

The Nominating and Governance Committee will consider stockholder recommendations for nominees to the Board of Directors. Stockholders’ recommendations for director nominees should also provide to the Nominating and Governance Committee the information as set forth in the company’s bylaws with respect to any individual they wish to recommend and such recommendations are treated in the same manner as other recommendations for nominees for director. In addition, any stockholder entitled to vote for the election of directors at a meeting may nominate persons for election as directors in accordance with the requirements, including timing information, set forth in the company’s bylaws.

15

Code of Conduct

The MeadWestvaco Code of Conduct applies to all MeadWestvaco directors and employees worldwide, including the Chief Executive Officer and the Chief Financial Officer. These policies and principles support the company’s core values of integrity, respect for the individual, commitment to excellence and teamwork. TheCode of Conduct can be found on the company’s website atwww.meadwestvaco.com under the “Investors” tab at the top of the page and then under the “Corporate Governance” tab. Printed copies are available to any stockholder upon request by calling 1-800-432-9874. Any future changes or amendments to our Code of Conduct and any waiver of our Code of Conduct that applies to our Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer, or member of the Board of Directors, will be posted on the company’s website atwww.meadwestvaco.com under the “Investors” tab at the top of the page and then under the “Corporate Governance” tab.

Contact MeadWestvaco Board

Anyone who wants specifically to raise a concern to the Board of Directors, the non-management members of the Board of Directors, or the lead director, including concerns about the company’s accounting, internal accounting controls or auditing matters, may contact the Chair of the Audit Committee directly. Such communications will also be received and reviewed by the General Counsel and treated as confidentially as possible, consistent with ensuring appropriate and careful review of the matter. Communications may be anonymous. The Chair of the Audit Committee will report as appropriate to the Board of Directors regarding such concerns. The company’sCode of Conduct prohibits any employee from taking any adverse action against anyone who in good faith provides information concerning suspected violations of law or company policy.

To convey a concern to the Chair of the Audit Committee, you may call 1-888-536-1502, or write to: Audit Committee Chair, MeadWestvaco Corporation, Attention: General Counsel, 501 South 5th Street, Richmond, Virginia 23219-0501. If preferred, concerns may be emailed using the form set forth at the following address:http://www.meadwestvaco.com/InvestorRelations/CorporateGovernance/MWV001063. Inclusion of your name and email address is optional.

Director Attendance at Annual Meetings

Directors are invited and encouraged to attend the company’s Annual Meeting of Stockholders. All directors attended the 2011 meeting.

Board Leadership Structure

MeadWestvaco’s business is conducted by its officers and employees under the direction of the chief executive officer (“CEO”) and the oversight of the Board of Directors. Currently, Mr. John A. Luke, Jr. serves as Chairman of the Board and CEO. The Board believes that a single person, acting in the capacities of Chairman and CEO, serves as the most effective bridge between the Board and management and provides critical leadership for carrying out the company’s strategic initiatives and confronting its challenges. The Board believes that the company can most effectively execute its strategy and business plans to maximize stockholder value if the Chairman of the Board is also a member of the management team. Notwithstanding the foregoing, the company has adopted various policies to provide for a strong and independent board. All directors, with the exception of the Chairman, are independent as defined under NYSE regulations, and all Committees of the Board (with the exception of the Executive Committee) are made up entirely of independent directors. In addition, the Board and Nominating and Governance Committee have assembled a Board comprised of capable and experienced directors who are currently or have recently been leaders of major companies or institutions, are independent thinkers and have a wide range of expertise and skills.

In addition, in 2007 the independent directors of the Board established the position of an independent lead director. The lead director chairs executive session meetings of non-management directors. Mr. Michael E. Campbell was designated as lead director to serve for an initial term of three years, which was extended by the Board for an additional three year term in 2010. The lead director’s duties

16

and responsibilities include: (i) presiding at all meetings of the Board at which the Chairman and CEO is not present, including executive sessions of the independent directors; (ii) orchestrating dialogue among the independent directors to enhance productivity of conversations with management; (iii) serving as liaison between the Chairman and CEO and the independent directors; (iv) working with the Chairman and CEO in developing the Board’s agenda, including the review of the form of information sent to the Board, and proposed meeting schedules to assure that there is sufficient time for discussion of all agenda items; and (v) in extraordinary circumstances (for example, the incapacity of the Chairman and CEO) serving as the Board’s representative for consultation with management, shareholders and other interested parties. Based on these duties and responsibilities, the Board believes that the lead director provides an effective balance to the combined role of CEO and Chairman.

Additionally, the Board regularly meets in executive session without the presence of management. The lead director presides at these meetings and provides the Board’s guidance and feedback to the Chairman and the company’s management team. Further, the Board has full access to the company’s leadership team.

Executive Sessions

The non-management directors met in executive session at each of the six regularly scheduled Board meetings in 2011. The lead director chairs the executive sessions and reports back as appropriate to the Chief Executive Officer.

Board’s Role in the Oversight of Risk

Under the MeadWestvacoCorporate Governance Principles, it is the duty of the Board to oversee the management of MeadWestvaco’s business, including the oversight of risk. The company’s Leadership Team is responsible for the comprehensive management of all material risks to the company’s businesses. The Board and its Committees, in their oversight role, periodically reviews the company’s risk management policies and programs to provide that risk management is consistent with the company’s corporate strategy and effective in fostering a culture of risk-aware and risk-adjusted decision-making throughout the organization. The company’s risk management program functions to bring to the Board’s attention the company’s most material risks for evaluation, including strategic, operational, financial and legal risks.

The Board and its Committees work with the company’s Leadership Team to promote and cultivate a corporate culture and environment that incorporates enterprise-wide risk management into corporate strategy and business operations. The Board has delegated to its Committees responsibility to evaluate elements of the company’s risk management program based on each Committee’s expertise and applicable regulatory requirements. Each Committee coordinates and reports on its risk assessment review with other Committees and the full Board. In evaluating risk, the Board and its Committees consider whether the company’s risk programs adequately identify material risks the company faces in a timely manner; implement appropriate risk management strategies that are responsive to such material risk; and adequately transmit necessary information with respect to material risks within the organization.

Director Stock Ownership

In February 2005, the Board approved stock ownership guidelines for non-employee directors pursuant to which non-employee directors are encouraged to own, at a minimum, MeadWestvaco stock or stock units equal to three times their annual cash retainer within three years of joining the Board. Discretion may be applied in periods of volatile markets.

Prohibition Against Hedging

The company has a policy that prohibits our directors and officers from hedging their ownership of the company’s stock, including trading in options, puts, calls or other derivative instruments related to company stock or debt.

17

Certain Relationships and Related Transactions

The Board recognizes that Related Person Transactions (as defined below) can present potential or actual conflicts of interest and create the appearance that company decisions are based on considerations other than the best interests of the company and its stockholders. In January 2007, the Board delegated authority to the Nominating and Governance Committee (the “N&G Committee”) to review and approve Related Person Transactions, and the Committee has adopted a written policy and procedures set forth below for the review, approval, or ratification of Related Person Transactions. A “Related Person Transaction” is any transaction, arrangement or relationship (including any indebtedness or guarantee of indebtedness), or any series of similar transactions, arrangements or relationships, in which (a) the aggregate amount involved will or may be expected to exceed $120,000 in any fiscal year, (b) the company is a participant, and (c) any Related Person has or will have a direct or indirect interest (other than solely as a result of being a director or trustee (or any similar position) or a less than 10 percent beneficial owner of another entity). A “Related Person” is any (a) person who is an executive officer, director or nominee for election as a director of the company, (b) greater than 5 percent beneficial owner of the company’s outstanding common stock, or (c) Immediate Family Member of any of the foregoing. An “Immediate Family Member” is any child, stepchild, parent, stepparent, spouse, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law or sister-in-law and any person (other than a tenant or employee) sharing the household of a person. The N&G Committee shall review all of the relevant facts and circumstances of all Related Person Transactions that require the N&G Committee’s approval and either approve or disapprove of the entry into the Related Person Transaction, subject to the following exceptions:

| | • | | employment of an executive officer, who is not an immediate family member of another executive officer or director of the company (provided compensation approved by the Compensation and Organization Development Committee of the Board); |

| | • | | compensation paid to a director approved by the Board; |

| | • | | any transaction with another company for which a Related Person’s only relationship is as (i) an employee (other than an executive officer) or director, (ii) a beneficial owner of less than 10 percent of that company’s outstanding equity, if the aggregate amount involved does not exceed the greater of $1,000,000 or 2 percent of that company’s total annual revenue; |

| | • | | any charitable contribution, grant or endowment by MeadWestvaco to a charitable organization, foundation or university where a Related Person’s only relationship is as an employee (other than an executive officer) or director, if the aggregate amount involved does not exceed the lesser of $1,000,000 or 2 percent of the charitable organization’s total annual receipts; |

| | • | | transactions where all stockholders received proportional benefits. |

In determining whether to approve or ratify a Related Person Transaction, the N&G Committee will take into account, among other factors it deems appropriate, whether the Related Person Transaction is on terms that are or would be generally available to an unaffiliated third-party under the same or similar circumstances and the extent of the Related Person’s interest in the transaction.

18

Report of the Audit Committee of the Board of Directors

Membership and Role of the Audit Committee

The Audit Committee consists of five members of the company’s Board of Directors. Each member of the Audit Committee is required to meet heightened independence standards and possesses other qualifications as required by the New York Stock Exchange. All of the members of the Audit Committee, moreover, are independent of the company under the standards set forth in theCorporate Governance Principles. The Audit Committee operates under a written charter adopted by the Board of Directors. The full text of the Audit Committee Charter is included on the company’s website atwww.meadwestvaco.com under the “Investors” tab at the top of the page and then under the “Corporate Governance” tab. Printed copies are available to any stockholder upon request by calling 1-800-432-9874.

The primary function of the Audit Committee is to assist the Board of Directors in reviewing and monitoring (1) the integrity of the financial statements of the company and internal control over financial reporting, (2) the compliance by the company with legal and regulatory requirements, (3) the independence and qualifications of the company’s independent registered public accounting firm and (4) the performance of the company’s internal audit function and independent registered public accounting firm.

Review of the Company’s Audited Financial Statements for the Year Ended December 31, 2011 and Internal Control over Financial Reporting as of December 31, 2011

Management is responsible for the financial reporting process, including the system of internal controls, and for the preparation of consolidated financial statements in accordance with accounting principles generally accepted in the United States of America. PricewaterhouseCoopers LLP, the company’s independent registered public accounting firm for 2011, is responsible for auditing those financial statements and the company’s internal control over financial reporting. The Audit Committee discussed with PricewaterhouseCoopers LLP the matters that are required to be discussed under Public Company Accounting Oversight Board (“PCAOB”) Standards. The Audit Committee also received the written disclosures and letter from PricewaterhouseCoopers LLP required by applicable requirements of the PCAOB regarding the independent accountant’s communications with the Audit Committee concerning independence (Independence Discussion with Audit Committees), and has discussed with PricewaterhouseCoopers LLP the independence of PricewaterhouseCoopers LLP from MeadWestvaco and its management. The Audit Committee has reviewed and discussed the audited financial statements and management’s assessment of the effectiveness of internal control over financial reporting with management.

The Audit Committee of MeadWestvaco reviewed and discussed the foregoing as reflected in the minutes of the Audit Committee, and on the basis of that review and the discussions referred to above, recommended to the Board of Directors that the audited financial statements of MeadWestvaco for the year ended December 31, 2011 be included in the Annual Report on Form 10-K for the year ended December 31, 2011 for filing by MeadWestvaco with the United States Securities and Exchange Commission.

The Audit Committee met six times in 2011. After each meeting, the Audit Committee met in executive sessions with the independent registered public accounting firm and the director of internal audit to review, among other things, staffing, the audit plan and reports on effectiveness of internal control over financial reporting.

The Audit Committee approved 100% of the audit, audit-related, tax and other services for the company performed by the independent registered public accounting firm in 2011 and 2010.

The Audit Committee concluded that the provision of non-audit services in 2011 and 2010 by PricewaterhouseCoopers LLP was compatible with their independence.

Submitted by:

| | |

Richard B. Kelson, Chairman | | Timothy H. Powers |

James G. Kaiser | | Jane L. Warner |

Gracia C. Martore | | |

19

The following fees were billed to MeadWestvaco for services rendered by PricewaterhouseCoopers LLP for the years ended December 31, 2011 and 2010:

| | | | | | | | |

| | | Year ended

December 31,

2011 | | | Year ended

December 31,

2010 | |

Audit fees | | $ | 6,601,000 | | | $ | 5,674,000 | |

| | | | | | | | |

Audit-related fees(1) | | | | | | | | |

Other attest services | | | 20,000 | | | | 20,000 | |

Other audit-related | | | 265,000 | | | | 125,000 | |

| | | | | | | | |

Total audit-related fees | | $ | 285,000 | | | $ | 145,000 | |

| | | | | | | | |

Tax fees | | | | | | | | |

Tax compliance and other matters(2) | | $ | 108,000 | | | $ | 95,000 | |

| | | | | | | | |

Other fees(3) | | $ | 25,000 | | | $ | 49,000 | |

| | | | | | | | |

| (1) | | Audit-related fees in 2011 and 2010 are comprised of agreed-upon procedures and accounting advisory services. Fees in 2011 also include $150,000 for the review of an S-4 registration statement related to the spin-off and merger of the company’s Consumer & Office Products business with ACCO Brands Corporation. |

| (2) | | Tax fees reflect fees for professional services performed by PricewaterhouseCoopers LLP (“PwC”) for tax advice, international tax compliance and tax technology. PwC has not provided any services related to tax shelter transactions, nor has PwC provided any services under contingent fee arrangements. |

| (3) | | Other fees are comprised of license fees for access to the PwC accounting and reporting database and other advisory services. |

Policy for Approval of Audit and Permitted Non-Audit Services

All audit, audit-related, tax and other services were pre-approved by the Audit Committee, which concluded that the provision of such services by PricewaterhouseCoopers LLP was compatible with the maintenance of that firm’s independence in the conduct of its auditing functions. The Audit Committee’s Pre-Approval Policy provides for pre-approval of specifically described audit, audit-related and tax services by the Committee on an annual basis as long as the Audit Committee is informed of each service, but an individual service engagement anticipated to exceed pre-established thresholds must be separately approved. The policy authorizes the Audit Committee to delegate to one or more of its members pre-approval authority with respect to permitted non-audit services.

2. Proposal to Ratify Appointment of the Independent Registered Public Accounting Firm

The Audit Committee of the Board of Directors has appointed PricewaterhouseCoopers LLP to serve as the company’s independent registered public accounting firm for 2012. Pursuant to the company’s bylaws and as a matter of good corporate governance, the Board is submitting this selection for ratification by the stockholders at the 2012 Annual Meeting. PricewaterhouseCoopers LLP currently serves as the company’s independent registered public accounting firm, and received $7,019,000 in fees and expenses during the year ended December 31, 2011. The Audit Committee has been advised by PricewaterhouseCoopers LLP that neither the firm, nor any of its partners or staff, has any direct financial interest or material indirect financial interest in the company or any of its subsidiaries. Representatives of PricewaterhouseCoopers LLP who plan to attend the Annual Meeting, will have an opportunity to make a statement if they desire and will be available to respond to appropriate questions. If the stockholders do not ratify this appointment, the Audit Committee will consider the appointment of another independent registered public accounting firm.

20

The Board of Directors unanimously recommends a vote FOR the ratification of the appointment of PricewaterhouseCoopers LLP as the company’s independent registered public accounting firm.

Executive Compensation

Compensation and Organization Development Committee

The Compensation and Organization Development Committee, a Board committee, consists of five members of the company’s Board of Directors, none of whom is or has been at any time an employee of the company or its subsidiaries, and none of whom is receiving any compensation from the company or its subsidiaries other than as a director. All of the members of the Compensation and Organization Development Committee, moreover, are independent of the company under the standards set forth in theCorporate Governance Principlesand the rules of the New York Stock Exchange. The Committee is charged with assuring that the company’s executive officers are effectively compensated in terms that are motivating, externally competitive and internally equitable. The Committee considers and approves all compensation and benefits for the company’s executive officers. The Committee also reviews compensation of the company’s business unit presidents, key personnel and corporate officers. With regard to compensation, the Committee approves awards for cash and equity compensation and sets criteria for awards under incentive compensation plans for the company’s executive officers and determines whether such criteria have been met. In addition, the Committee reviews and recommends for approval by the Board of Directors the company’s various employee benefit plans, as appropriate. The Committee also oversees the development of the company’s leadership succession plan and employee relations strategies. The Compensation and Organization Development Committee Charter is included on the company’s website atwww.meadwestvaco.com under the “Investors” tab at the top of the page and then under the “Corporate Governance” tab. Printed copies are available to any stockholder upon request by calling 1-800-432-9874.

Compensation Discussion and Analysis

Business Overview

In 2011, MWV continued its transformation into a global packaging company. Guided by its maximizing value discipline, which at its core is about generating higher levels of profitable growth through an economic profit lens, the company:

| | • | | Achieved record segment operating results for the year |

| | • | | Earnings of $258 million from continuing operations, or $1.49 per share |

| | • | | Pre-tax earnings from the company’s business segments (before Corporate and Other) of $838 million, a 15% increase from $731 million in 2010 |

| | • | | Exceeded productivity savings targets by $69 million resulting in 2011 annual incentive plan payout; see page 30 |

| | • | | Generated solid cash flow from operations of $565 million |

| | • | | Delivered strong return to shareholders—paid a regular quarterly dividend of $.25 cents per common share each quarter |

| | • | | Achieved change in economic profit (as measured by the company ) of $119 million resulting in 2010 long-term awards vesting; see page 31 |

| | • | | Delivered annual total shareholder return of 18% representing top quartile performance relative to Peer Group |

21

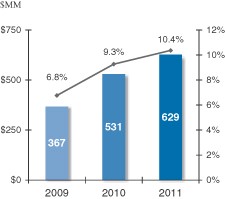

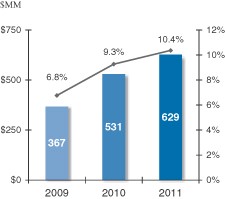

MWV has demonstrated year over year improvement in operating income, as measured by Earnings Before Interest and Taxes (EBIT), as well as a higher operating profitability, as measured by EBIT Margin, reflecting a strong and sustainable business model as follows:

EBIT* / EBIT Margin