- DB Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

FWP Filing

Deutsche Bank (DB) FWPFree writing prospectus

Filed: 16 Nov 10, 12:00am

Term Sheet 1011BA To product supplement BA dated September 29, 2009, prospectus supplement dated September 29, 2009 and prospectus dated September 29, 2009 | Registration Statement No. 333-162195 Dated November 16, 2010; Rule 433 |

Deutsche Bank AG  |

Structured Investments | Deutsche Bank $ �� Notes Linked to the Performance of a Basket of Four Currencies Relative to the U.S. Dollar due December 1, 2011 |

| · | The notes are designed for investors who seek a return at maturity linked to the potential appreciation of an equally weighted basket of currencies (the “Basket”) consisting of the Indian rupee, the Indonesian rupiah, the Korean won and the Singapore dollar (the “Basket Currencies”) relative to the U.S. dollar (the “Reference Currency”), as measured by the Basket Return formula set forth herein. Investors should be willing to forgo coupon payments and, if the Basket Return is less than 3.00%, be willing to lose 5.00% of their initial investment. Any payment at maturity is subject to the credit of the Issuer. |

| · | Senior unsecured obligations of Deutsche Bank AG, London Branch maturing December 1, 2011†. |

| · | Minimum purchase of $1,000. Minimum denominations of $1,000 (“Principal Amount”) and integral multiples thereof. |

| · | The notes are expected to price on or about November 19, 2010 (the “Trade Date”) and are expected to settle on or about November 24, 2010 (the “Settlement Date”). |

| Issuer: | Deutsche Bank AG, London Branch |

| Issue Price: | 100% of the Principal Amount |

| Term: | 1 year |

| Basket: | The notes are linked to an equally weighted basket consisting of the Indian rupee, the Indonesian rupiah, the Korean won and the Singapore dollar (each a “Basket Currency,” and together the “Basket Currencies”) relative to the U.S. dollar (the “Reference Currency”). The level of the Basket will increase as the Basket Currencies appreciate relative to the U.S. dollar, and will decrease as the Basket Currencies depreciate relative to the U.S. dollar. |

| Basket Currency | Reference Currency | Fixing Source | Fixing Time | Initial Spot Rate** | Basket Currency Performance Weighting |

Indian rupee (“INR”) | U.S. Dollar | Reuters Page “WMRSPOT40” | 4:00 p.m. London time | 1/4 | |

Indonesian rupiah (“IDR”) | U.S. Dollar | Reuters Page “WMRSPOT40” | 4:00 p.m. London time | 1/4 | |

Korean won (“KRW”) | U.S. Dollar | Reuters Page “WMRSPOT40” | 4:00 p.m. London time | 1/4 | |

Singapore dollar (“SGD”) | U.S. Dollar | Reuters Page “WMRSPOT40” | 4:00 p.m. London time | 1/4 |

** The Initial Spot Rate for each Basket Currency will be determined on the Trade Date. | |

| Currency of the Issue: | United States dollars |

| Payment at Maturity: | At maturity, you will be entitled to receive a cash payment per $1,000 Principal Amount of notes of the Minimum Payment Amount plus the Additional Amount, which may be zero. |

| Any payment at maturity is subject to the credit of the Issuer. | |

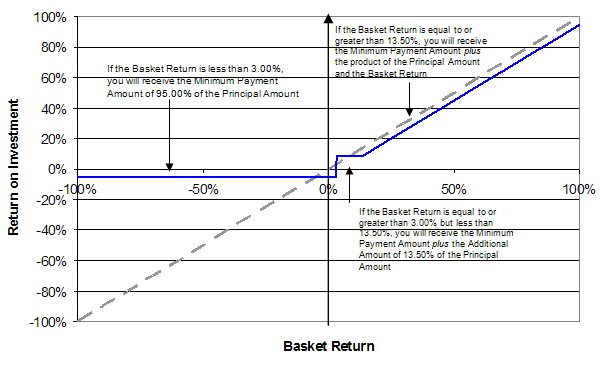

| Minimum Payment Amount: | $950.00, equal to 95.00% of the Principal Amount |

| Additional Amount: | · If the Basket Return is less than 3.00%, the Additional Amount will equal $0.00. · If the Basket Return is greater than or equal to 3.00% but less than 13.50%, the Additional Amount will equal $135.00, calculated as 13.50% of the Principal Amount. · If the Basket Return is greater than or equal to 13.50%, the Additional Amount will be calculated as follows: $1,000 x Basket Return The Additional Amount will not be less than zero. |

| Basket Return: | The performance of the Basket from the Initial Basket Level to the Final Basket Level, calculated as follows: |

| Final Basket Level – Initial Basket Level | |

| Initial Basket Level | |

| The Basket Return may be positive, zero or negative. | |

| Initial Basket Level: | Set equal to 100 on the Trade Date. |

| Final Basket Level: | The Final Basket Level will be calculated as follows: |

100 x [1 + (INR Performance x 1/4) + (IDR Performance x 1/4) + (KRW Performance x 1/4) + (SGD Performance x 1/4)] The INR Performance, IDR Performance, KRW Performance and SGD Performance will each equal the Currency Performance of the respective Basket Currency against the U.S. dollar, expressed as a percentage. | |

| Currency Performance: | With respect to each Basket Currency, the performance of the relevant Basket Currency from the Initial Spot Rate to the Final Spot Rate, calculated as follows: |

| Initial Spot Rate – Final Spot Rate | |

| Initial Spot Rate | |

| Initial Spot Rate: | For each Basket Currency, the Spot Rate for such Basket Currency on the Trade Date. |

| Final Spot Rate: | For each Basket Currency, the arithmetic average of the Spot Rates on the Averaging Dates. |

| Spot Rate: | For each Basket Currency, the spot exchange rate for such currency against the U.S. dollar, expressed as units of the respective Basket Currency per U.S. dollar, as determined by the calculation agent by reference to the Spot Rate definitions set forth in this term sheet under “Spot Rates.” The Spot Rates are subject to the provisions set forth under “Market Disruption Events” in this term sheet. |

Averaging Dates†: | November 21, 2011, November 22, 2011, November 23, 2011, November 25, 2011 and November 28, 2011 (the “Final Valuation Date”). |

Maturity Date†: | December 1, 2011 |

| Listing: | The notes will not be listed on any securities exchange. |

| CUSIP / ISIN: | 2515A1 BQ 3 / US2515A1BQ32 |

| † | Subject to postponement as described under "Adjustments to Valuation Dates and Payment Dates" in the accompanying product supplement and "Market Disruption Events" in this term sheet. |

Price to Public(1) | Fees(1)(2) | Proceeds to Issuer | |

| Per note | $1,000.00 | $10.00 | $990.00 |

| Total | $ | $ | $ |

| Final Basket Level | Basket Return | Additional Amount | Payment at Maturity | Return on the Notes |

| 200.00 | 100.00% | $1,000.00 | $1,950.00 | 95.00% |

| 180.00 | 80.00% | $800.00 | $1,750.00 | 75.00% |

| 160.00 | 60.00% | $600.00 | $1,550.00 | 55.00% |

| 140.00 | 40.00% | $400.00 | $1,350.00 | 35.00% |

| 120.00 | 20.00% | $200.00 | $1,150.00 | 15.00% |

| 115.00 | 15.00% | $150.00 | $1,100.00 | 10.00% |

| 113.50 | 13.50% | $135.00 | $1,085.00 | 8.50% |

| 110.00 | 10.00% | $135.00 | $1,085.00 | 8.50% |

| 105.00 | 5.00% | $135.00 | $1,085.00 | 8.50% |

| 103.00 | 3.00% | $135.00 | $1,085.00 | 8.50% |

| 102.50 | 2.50% | $0.00 | $950.00 | -5.00% |

| 100.00 | 0.00% | $0.00 | $950.00 | -5.00% |

| 80.00 | -20.00% | $0.00 | $950.00 | -5.00% |

| 60.00 | -40.00% | $0.00 | $950.00 | -5.00% |

| 40.00 | -60.00% | $0.00 | $950.00 | -5.00% |

| 20.00 | -80.00% | $0.00 | $950.00 | -5.00% |

| 0.00 | -100.00% | $0.00 | $950.00 | -5.00% |

| Basket Currency | Basket Currency Initial Spot Rate | Basket Currency Final Spot Rate | Currency Performance | Basket Currency Weighting |

| INR | 44.8300 | 38.1055 | 15.0% | 1/4 |

| IDR | 8,928 | 7,589 | 15.0% | 1/4 |

| KRW | 1,127.84 | 958.66 | 15.0% | 1/4 |

| SGD | 1.2929 | 1.0990 | 15.0% | 1/4 |

| Basket Currency | Basket Currency Initial Spot Rate | Basket Currency Final Spot Rate | Currency Performance | Basket Currency Weighting |

| INR | 44.8300 | 22.4150 | 50.0% | 1/4 |

| IDR | 8,928 | 9,821 | -10.0% | 1/4 |

| KRW | 1,127.84 | 1,240.62 | -10.0% | 1/4 |

| SGD | 1.2929 | 1.4222 | -10.0% | 1/4 |

| Basket Currency | Basket Currency Initial Spot Rate | Basket Currency Final Spot Rate | Currency Performance | Basket Currency Weighting |

| INR | 44.8300 | 13.4490 | 70.0% | 1/4 |

| IDR | 8,928 | 10,714 | -20.0% | 1/4 |

| KRW | 1,127.84 | 1,353.41 | -20.0% | 1/4 |

| SGD | 1.2929 | 1.5515 | -20.0% | 1/4 |

| Basket Currency | Basket Currency Initial Spot Rate | Basket Currency Final Spot Rate | Currency Performance | Basket Currency Weighting |

| INR | 44.8300 | 121.0410 | -170.0% | 1/4 |

| IDR | 8,928 | 6,250 | 30.0% | 1/4 |

| KRW | 1,127.84 | 789.49 | 30.0% | 1/4 |

| SGD | 1.2929 | 0.9050 | 30.0% | 1/4 |

| · | APPRECIATION POTENTIAL IF THE BASKET RETURN IS GREATER THAN 13.50% — If the Basket Return is greater than 13.50%, the notes provide the opportunity to receive a return linked to the potential appreciation of the Basket (subject to a maximum possible Basket Return of 100%), which will be added to the Minimum Payment Amount of $950.00 in determining the Payment at Maturity per $1,000 Principal Amount of notes. Because the notes are our senior unsecured obligations, any Payment at Maturity is subject to our ability to pay our obligations as they become due. |

| · | PARTIAL PRESERVATION OF CAPITAL AT MATURITY — You will receive at least 95.00% of the Principal Amount of notes if you hold the notes to maturity, regardless of the performance of the Basket. You should be willing to lose 5% of your initial investment if the Basket Return is less than 3.00%. Additionally, because the Additional Amount will be added to the Minimum Payment Amount of $950.00 in determining the Payment at Maturity per $1,000 Principal Amount of notes, the Basket will need to appreciate by at least 3.00% for you to receive more than your initial investment amount at maturity. Because the notes are our senior unsecured obligations, payment of any amount at maturity is subject to our ability to pay our obligations as they become due. |

| · | DIVERSIFICATION AMONG THE BASKET CURRENCIES — The return on the notes, which may be positive or negative, is linked to the performance of a Basket consisting of the Indian rupee, the Indonesian rupiah, the Korean won and the Singapore dollar, which we refer to as the Basket Currencies, relative to the U.S. dollar, which we refer to as the Reference Currency. Accordingly, the level of the Basket will increase as the Basket Currencies appreciate relative to the U.S. dollar, and will decrease as the Basket Currencies depreciate relative to the U.S. dollar. |

| · | TREATED AS CONTINGENT PAYMENT DEBT INSTRUMENTS — You should review carefully the section of the accompanying product supplement entitled “U.S. Federal Income Tax Consequences,” which contains the opinion of our special tax counsel, Davis Polk & Wardwell LLP, with respect to the tax consequences of an investment in the notes. Based on that opinion, we believe that the notes should be treated for U.S. federal income tax purposes as “contingent payment debt instruments” the denomination currency of which is the U.S. dollar. Under this treatment, regardless of your method of accounting, you will be required to acc rue interest in each year on a constant yield to maturity basis at the “comparable yield,” as determined by us, although we will not make any payment on the notes until maturity. Any income recognized upon a sale, exchange or retirement of the notes generally will be treated as interest income for U.S. federal income tax purposes. |

| · | MARKET RISK — The notes do not guarantee the full return of your investment. The return on the notes at maturity is linked to the performance of the Basket Currencies relative to the U.S. dollar and will depend on the Basket Return. Because the Minimum Payment Amount of $950.00 is less than the Principal Amount per note, you will receive less than your initial investment at maturity if the Basket Return is less than 3.00%. Accordingly, if the Basket does not appreciate sufficiently, you will lose some of your initial investment. Payment of any amount at maturity is subject to our ability to meet our obligations as they become due. |

| · | YOU MAY RECEIVE A NEGATIVE RETURN ON THE NOTES EVEN IF THE BASKET RETURN IS POSITIVE — The Additional Amount will be added to the Minimum Payment Amount of $950.00 in determining the Payment at Maturity per $1,000 Principal Amount of notes. The Additional Amount is equal to $0.00 if the Basket Return is less than 3.00%. Therefore, even if the Basket Return is positive, you will lose some of your initial investment in the notes if the Basket Return is less than 3.00%. |

| · | CREDIT OF THE ISSUER — The notes are senior unsecured obligations of the Issuer, Deutsche Bank AG, and are not, either directly or indirectly, an obligation of any third party. Any payment to be made on the notes, including any Payment at Maturity, depends on the ability of Deutsche Bank AG to satisfy its obligations as they come due. As a result, the actual and perceived creditworthiness of Deutsche Bank AG will affect the value of the notes and in the event Deutsche Bank AG were to default on its obligations you may not receive the Payment at Maturity owed to you under the terms of the notes. |

| · | TRADING AND OTHER TRANSACTIONS BY US OR OUR AFFILIATES IN THE FOREIGN EXCHANGE AND CURRENCY DERIVATIVE MARKET MAY IMPAIR THE VALUE OF THE NOTES — We or one or more of our affiliates may hedge our foreign currency exposure from the notes by entering into foreign exchange and currency derivative transactions, such as over-the-counter options. Such trading and hedging activities may affect the Spot Rates and make it less likely that you will receive a positive return on your investment in the notes. It is possible that we or our affiliates could receive substantial returns from these hedging activities while the value of the notes declines. We or our affiliates may also engage in trading in instruments linked to the Spot Rates on a regular basis as part of our general broker-dealer and other businesse s, for proprietary accounts, for other accounts under management or to facilitate transactions for customers, including block transactions. We or our affiliates may also issue or underwrite other securities or financial or derivative instruments with returns linked or related to changes in the Spot Rates. By introducing competing products into the marketplace in this manner, we or our affiliates could adversely affect the value of the notes. Any of the foregoing activities described in this paragraph may reflect trading strategies that differ from, or are in direct opposition to, the trading strategy of investors in the notes. |

| · | THE NOTES ARE NOT BANK DEPOSITS AND ARE NOT INSURED OR GUARANTEED BY THE FEDERAL DEPOSIT INSURANCE CORPORATION OR ANY OTHER GOVERNMENTAL AGENCY. |

| · | THE NOTES ARE NOT DESIGNED TO BE SHORT-TERM TRADING INSTRUMENTS — The notes are not designed to be short-term trading instruments. Accordingly, you should be willing and able to hold your notes to maturity. |

| · | THE NOTES DO NOT PAY COUPONS – Unlike ordinary debt securities, the notes do not pay coupons and do not guarantee any return of the initial investment at maturity. |

| · | INVESTING IN THE NOTES IS NOT EQUIVALENT TO INVESTING DIRECTLY IN THE BASKET CURRENCIES – You may receive a lower Payment at Maturity than you would have received if you had invested directly in the Basket Currencies. The Basket Return is based on the Currency Performance for each of the Basket Currencies, which is in turn based upon the formula set forth above. The Currency Performances are dependent solely on such stated formula and not on any other formula that could be used for calculating currency performances. |

| · | CERTAIN BUILT-IN COSTS ARE LIKELY TO ADVERSELY AFFECT THE VALUE OF THE NOTES PRIOR TO MATURITY – While the Payment at Maturity described in this term sheet is based on the full Principal Amount of your notes, the original Issue Price of the notes includes the agent’s commission and the cost of hedging our obligations under the notes through one or more of our affiliates. Such cost includes our or our affiliates’ expected cost of providing such hedge, as well as the profit we or our affiliates expect to realize in consideration for assuming the risks inherent in providing such hedge. As a result, the price, if any, at which Deutsche Bank AG (or its affiliates) will be willing to purchase notes from you, prior to maturity, in secondary market transactions, if at all, will likel y be lower than the original Issue Price, and any sale prior to the Maturity Date could result in a substantial loss to you. The notes are not designed to be short-term trading instruments. Accordingly, you should be able and willing to hold your notes to maturity. |

| · | GAINS IN THE CURRENCY PERFORMANCE OF ONE OR MORE BASKET CURRENCIES MAY BE OFFSET BY LOSSES IN THE CURRENCY PERFORMANCE OF ONE OR MORE OTHER BASKET CURRENCIES – The notes are linked to the performance of the Basket, which is composed of four currencies with equal weightings. The Basket Return will be based on the appreciation or depreciation of the Basket as a whole, as measured by the Basket Return formula set forth herein. Therefore, positive Currency Performance of one or more Basket Currencies may be offset, in |

| · | CURRENCY MARKETS MAY BE VOLATILE – Currency markets may be highly volatile, particularly in relation to emerging or developing nations’ currencies, and, in certain market conditions, also in relation to developed nations’ currencies. Significant changes, including changes in liquidity and prices, can occur in such markets within very short periods of time. Foreign currency rate risks include, but are not limited to, convertibility risk and market volatility and potential interference by foreign governments through regulation of local markets, foreign investment or particular transactions in foreign currency. These factors may affect the values of the Basket Currencies and the value of your notes in varying ways, and different factors may cause the values of the Basket Currencies and the volatility of their prices to move in inconsistent directions at inconsistent rates. |

| · | LEGAL AND REGULATORY RISKS – Legal and regulatory changes could adversely affect currency rates. In addition, many governmental agencies and regulatory organizations are authorized to take extraordinary actions in the event of market emergencies. It is not possible to predict the effect of any future legal or regulatory action relating to currency rates, but any such action could cause unexpected volatility and instability in currency markets with a substantial and adverse effect on the performance of the Basket Currencies and, consequently, the value of the notes. |

| · | THE NOTES ARE SUBJECT TO EMERGING MARKETS’ POLITICAL AND ECONOMIC RISKS — The Basket Currencies are currencies of emerging market countries. Emerging market countries are more exposed to the risk of swift political change and economic downturns than their industrialized counterparts. In recent years, emerging markets have undergone significant political, economic and social change. Such far-reaching political changes have resulted in constitutional and social tensions, and, in some cases, instability and reaction against market reforms have occurred. With respect to any emerging or developing nation, there is the possibility of nationalization, expropriation or confiscation, political changes, government regulation and social instability . There can be no assurance that future political changes will not adversely affect the economic conditions of an emerging or developing-market nation. Political or economic instability is likely to have an adverse effect on the performance of the Basket Currencies, and, consequently, the return on the notes. |

| · | IF THE LIQUIDITY OF THE BASKET CURRENCIES IS LIMITED, THE VALUE OF THE NOTES WOULD LIKELY BE IMPAIRED – Currencies and derivatives contracts on currencies may be difficult to buy or sell, particularly during adverse market conditions. Reduced liquidity on the Averaging Dates would likely have an adverse effect on the Final Spot Rate for each Basket Currency, and therefore, on the return on your notes. Limited liquidity relating to any Basket Currency may also result in Deutsche Bank AG, London Branch, as calculation agent, being unable to determine the Basket Return using its normal means. The resulting discretion by the calculation agent in determining the Basket Return could, in turn, result in potential conflicts of interest. |

| · | POTENTIAL CONFLICTS OF INTEREST EXIST BECAUSE THE ISSUER AND THE CALCULATION AGENT FOR THE NOTES ARE THE SAME LEGAL ENTITY – Deutsche Bank AG, London Branch is the Issuer of the notes and the calculation agent for the notes. Deutsche Bank AG, London Branch carries out calculations necessary to calculate the Basket Return and maintains some discretion as to how such calculations are made, in particular if the Spot Rate for any Basket Currency is not available on any Averaging Date. In addition, the Issuer may hedge its obligations under the notes. There can be no assurance that any determinations made by Deutsche Bank AG, London Branch in these various capacities will not affect the value of the notes or the performance of the Basket Currencies. |

| · | SUSPENSION OR DISRUPTIONS OF MARKET TRADING IN THE BASKET CURRENCIES MAY ADVERSELY AFFECT THE VALUE OF THE NOTES – The currency markets are subject to temporary distortions and disruptions due to various factors, including government regulation and intervention, the lack of liquidity in the markets and the participation of speculators. These circumstances could adversely affect the exchange rates of the Basket Currencies and, therefore, the value of the notes. |

| · | LACK OF LIQUIDITY – The notes will not be listed on any securities exchange. Deutsche Bank AG or its affiliates may offer to purchase the notes in the secondary market but is not required to do so and may cease such market-making activities at any time. Even if there is a secondary market, it may not provide enough liquidity to allow you to trade or sell your notes easily. Because other dealers are not likely to make a secondary market for the notes, the price at which you may be able to trade your notes is likely to depend on the price, if any, at which Deutsche Bank AG or its affiliates are willing to buy the notes. |

| · | THE PAYMENT FORMULA FOR THE NOTES WILL NOT TAKE INTO ACCOUNT ALL DEVELOPMENTS IN THE BASKET CURRENCIES – Changes in the Basket Currencies during the term of the notes before the Averaging Dates may not be reflected in the calculation of the Payment at Maturity. Generally, the calculation agent will calculate the Basket Return by multiplying the Currency Performance for each Basket Currency by its respective weighting and then taking the sum of the weighted Currency Performances, as described above. The Currency Performances will be calculated only as of the Final Valuation Date, and will be based on the arithmetic average of the Spot Rates for each Basket Currency on the Averaging Dates. As a result, the Basket Return may be less than zero even if the Basket Currencies had moved favorably at certai n times during the term of the notes before moving to unfavorable levels on the Averaging Dates. |

| · | WE AND OUR AFFILIATES AND AGENTS, OR J.P. MORGAN CHASE & CO. AND ITS AFFILIATES, MAY PUBLISH RESEARCH, EXPRESS OPINIONS OR PROVIDE RECOMMENDATIONS THAT ARE INCONSISTENT WITH INVESTING IN OR HOLDING THE NOTES. ANY SUCH RESEARCH, OPINIONS OR RECOMMENDATIONS COULD AFFECT THE VALUE OF THE BASKET CURRENCIES TO WHICH THE NOTES ARE LINKED OR THE VALUE OF THE NOTES – We, our affiliates and agents, and J.P. Morgan Chase & Co. and its affiliates, publish research from time to time on financial markets and other matters that may influence the value of the notes, or express opinions or provide recommendations that may be inconsistent with purchasing or holding the notes. We, our affiliates and agents, or J.P. Morgan Chase & Co. and its affiliates, may publish research or other opinions that are inconsistent with the investment view implicit in the notes. Any research, opinions or recommendations expressed by us, our affiliates or agents, or J.P. Morgan Chase & Co. or its affiliates, may not be consistent with each other and may be modified from time to time without notice. Investors should make their own independent investigation of the merits of investing in the notes and the Basket Currencies to which the notes are linked. |

| · | ECONOMIC AND MARKET FACTORS WILL IMPACT THE VALUE OF THE NOTES – We expect that, generally, the Spot Rates for the Basket Currencies on any day will affect the value of the notes more than any other single factor. However, you should not expect the value of the notes in the secondary market to vary in proportion to the appreciation or depreciation of the Basket Currencies relative to the U.S. dollar. The value of the notes will be affected by a number of other factors that may either offset or magnify each other, including: |

| · | the expected volatility of the Basket Currencies and the U.S. dollar, as reference currency; |

| · | the time to maturity of the notes; |

| · | the exchange rates and the volatility of the exchange rate between each Basket Currency and the U.S. dollar; |

| · | interest and yield rates in the market generally and in the markets of the Basket Currencies and the U.S. dollar; |

| · | a variety of economic, financial, political, regulatory or judicial events; |

| · | supply and demand for the notes; and |

| · | our creditworthiness, including actual or anticipated downgrades in our credit ratings. |

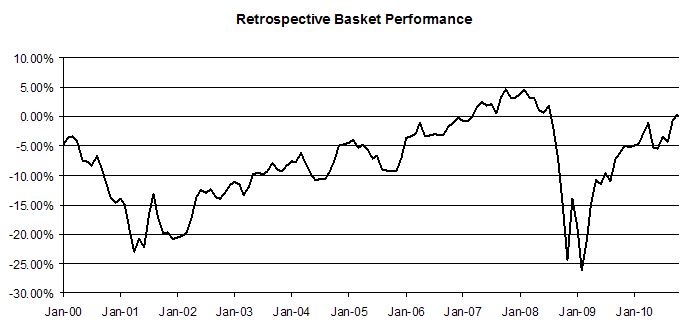

| · | HISTORICAL PERFORMANCE OF THE BASKET CURRENCIES SHOULD NOT BE TAKEN AS AN INDICATION OF THE FUTURE PERFORMANCE OF THE BASKET CURRENCIES DURING THE TERM OF THE NOTES – It is impossible to predict whether the Spot Rates of any of the Basket Currencies will rise or fall. The Spot Rates of the Basket Currencies will be influenced by complex and interrelated political, economic, financial and other factors. |

| · | MARKET DISRUPTIONS MAY ADVERSELY AFFECT YOUR RETURN – The calculation agent may, in its sole discretion, determine that the markets have been affected in a manner that prevents it from determining the Basket Return in the manner described herein, and calculating the amount that we are required to pay you upon maturity, or from properly hedging its obligations under the notes. These events may include disruptions or suspensions of trading in the markets as a whole or general inconvertibility or non-transferability of one or more currencies. If the calculation agent, in its sole discretion, determines that any of these events prevents us or any of our affiliates from properly hedging our obligations under the notes or prevents the calculation ag ent from determining the Basket Return or Payment at Maturity in the ordinary manner, the calculation agent will determine the Basket Return or Payment at Maturity in good faith and in a commercially reasonable manner, and it is possible that the Averaging Dates, the Final Valuation Date and the Maturity Date will be postponed, which may adversely affect the return on your notes. For example, if the source for the Spot Rate of a Basket Currency is not available on an Averaging Date, the calculation agent may determine the exchange rate for such date, and such determination may adversely affect the return on your notes. |

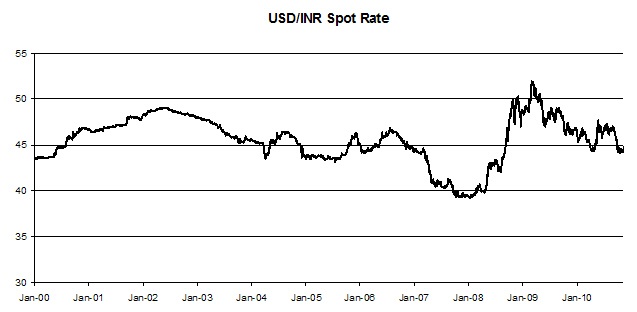

| Indian Rupee | High | Low | Period End |

2000 | 46.9150 | 43.4750 | 46.6750 |

2001 | 48.3700 | 46.3412 | 48.2450 |

2002 | 49.0713 | 47.9235 | 47.9750 |

2003 | 48.0500 | 45.2100 | 45.6250 |

2004 | 46.5150 | 43.2800 | 43.4600 |

2005 | 46.3900 | 43.1300 | 45.0500 |

2006 | 47.0450 | 44.0200 | 44.2700 |

2007 | 44.7040 | 39.1737 | 39.4125 |

2008 | 50.6050 | 39.2057 | 48.8025 |

2009 | 52.1800 | 45.8050 | 46.5250 |

2010 (through November 12, 2010) | 47.7450 | 43.9750 | 44.8300 |

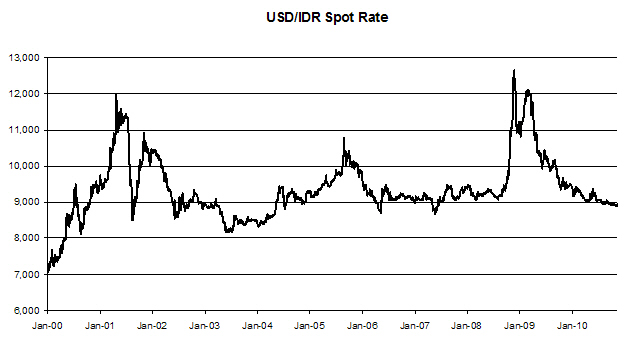

| Indonesian Rupiah | High | Low | Period End |

2000 | 9,675 | 6,950 | 9,675 |

2001 | 12,200 | 8,280 | 10,400 |

2002 | 10,550 | 8,427 | 8,950 |

2003 | 9,160 | 8,095 | 8,420 |

2004 | 9,595 | 8,299 | 9,270 |

2005 | 10,875 | 9,115 | 9,830 |

2006 | 9,846 | 8,694 | 8,995 |

2007 | 9,482 | 8,650 | 9,393 |

2008 | 13,000 | 9,045 | 11,120 |

2009 | 12,160 | 9,280 | 9,404 |

2010 (through November 12, 2010) | 9,440 | 8,881 | 8,928 |

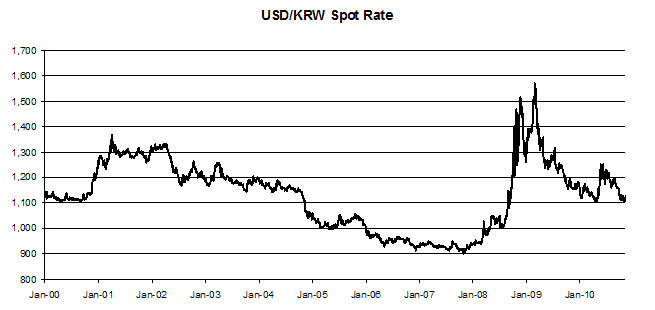

| Korean Won | High | Low | Period End |

2000 | 1,274.50 | 1,100.97 | 1,265.00 |

2001 | 1,368.00 | 1,233.00 | 1,313.50 |

2002 | 1,335.20 | 1,157.50 | 1,185.70 |

2003 | 1,263.50 | 1,144.85 | 1,192.10 |

2004 | 1,198.00 | 1,034.95 | 1,035.10 |

2005 | 1,062.30 | 989.22 | 1,010.00 |

2006 | 1,010.50 | 912.90 | 929.70 |

2007 | 953.55 | 899.69 | 935.37 |

2008 | 1,524.57 | 931.90 | 1,259.55 |

2009 | 1,597.45 | 1,149.40 | 1,164.00 |

2010 (through November 12, 2010) | 1,277.85 | 1,102.85 | 1,127.84 |

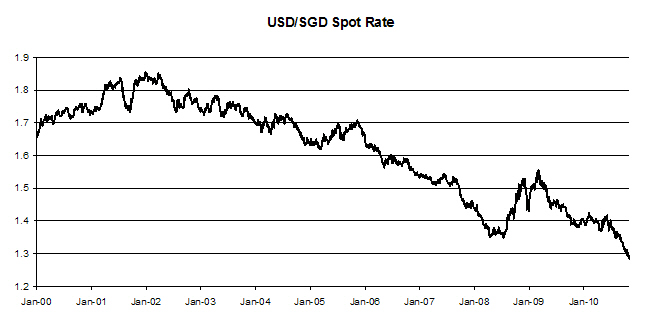

| Singapore Dollar | High | Low | Period End |

2000 | 1.7617 | 1.6470 | 1.7345 |

2001 | 1.8556 | 1.7266 | 1.8455 |

2002 | 1.8539 | 1.7280 | 1.7346 |

2003 | 1.7890 | 1.6980 | 1.6995 |

2004 | 1.7306 | 1.6288 | 1.6318 |

2005 | 1.7065 | 1.6163 | 1.6630 |

2006 | 1.6635 | 1.5320 | 1.5378 |

2007 | 1.5479 | 1.4356 | 1.4401 |

2008 | 1.5349 | 1.3451 | 1.4301 |

2009 | 1.5581 | 1.3780 | 1.4049 |

2010 (through November 12, 2010) | 1.4274 | 1.2817 | 1.2929 |