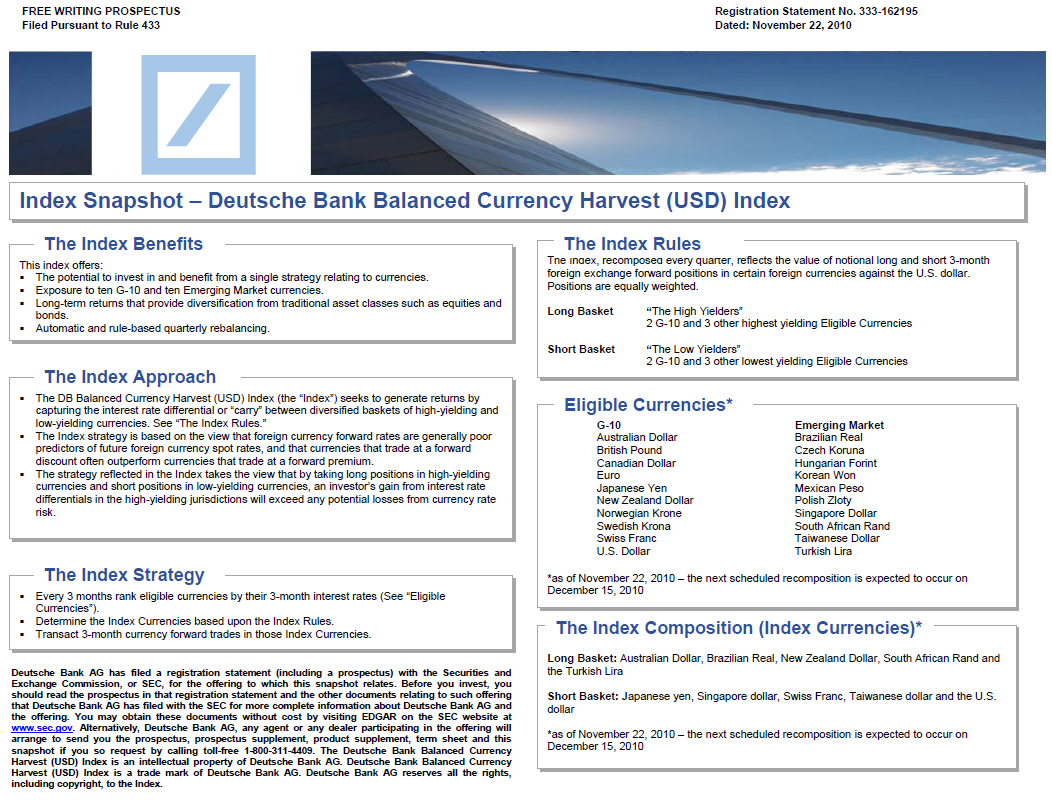

Index Snapshot -- Deutsche Bank Balanced Currency Harvest (USD) Index

The above charts are for illustrative purposes only and do not purport to

predict future performance of the Index or securities relating to the Index.

The Index was launched on December 19, 2005. The currencies comprising the

Index at particular dates in the above graphs are extremely likely to be

different from the currencies comprising the Index on or after the date of this

snapshot.

Past performance -- including any performance based on retrospective

calculations -- is not necessarily indicative of future results.

Risk Considerations

* THE RISK OF INVESTING IN CURRENCIES CAN BE SUBSTANTIAL -- The prices of the

currencies which comprise the Index may be affected by numerous market factors,

including events in the equity markets, the bond market and the foreign

exchange market, fluctuations in interest rates, and world economic, political

and regulatory events. A rise in the value of one currency may be offset by a

fall in the value of one or more of the other currencies comprising the Index.

* STRATEGY RISK -- The strategy reflected in the Index takes the view that by

taking long positions in high-yielding currencies and short positions in

low-yielding currencies, an investor's gain from interest rate differentials in

the high-yielding jurisdictions will exceed any potential losses from currency

rate risk. The Index Sponsor provides no assurance that this expectation is or

will remain valid. Various market factors and circumstances at any time and

over any period could cause and have in the past caused investors to become

more risk averse to high-yielding currencies. Such risk aversion is greater

with respect to the non-G10 currencies, which may be volatile and subject to

large fluctuations, devaluations, exchange controls and inconvertibility, which

would negatively affect the value of the Index and securities relating to this

snapshot.

* GAINS IN COMPONENTS OF THE INDEX MAY BE OFFSET BY LOSSES IN OTHER INDEX

COMPONENTS -- The Index is composed of multiple currency positions and

therefore a positive return in one position may be offset, in whole or in part,

by a negative return of a lesser, equal or greater magnitude in another

position, resulting in an aggregate Index return equal to or less than zero.

* CURRENCY MARKETS MAY BE HIGHLY VOLATILE -- Currency markets may be highly

volatile, particularly in relation to emerging or developing nations'

currencies and, in certain market conditions, also in relation to developed

nations' currencies. Significant changes, including changes in liquidity and

prices, can occur in such markets within very short periods of time. Foreign

currency rate risks include, but are not limited to, convertibility risk and

market volatility and potential interference by foreign governments through

regulation of local markets, foreign investment or particular transactions in

foreign currency. These factors may affect the values of the components

reflected in the Index and the value of securities relating to this snapshot in

varying ways, and different factors may cause the values of the Index

components and the volatility of their prices to move in inconsistent

directions at inconsistent rates.

* LEGAL AND REGULATORY RISKS -- Legal and regulatory changes could adversely

affect currency rates. In addition, many governmental agencies and regulatory

organizations are authorized to take extraordinary actions in the event of

market emergencies. It is not possible to predict the effect of any future

legal or regulatory action relating to currency rates, but any such action

could cause unexpected volatility and instability in currency markets with a

substantial and adverse effect on the performance of the Index and,

consequently, the value of securities relating to this snapshot.

* THE CURRENCY PRICES REFLECTED IN THE INDEX ARE SUBJECT TO EMERGING MARKETS'

POLITICAL AND ECONOMIC RISKS -- The Index components include currencies of

emerging market countries, which are more exposed to the risk of swift

political change and economic downturns than their industrialized counterparts.

Indeed, in recent years, many emerging market countries have undergone

significant political, economic and social change. In many cases, far- reaching

political changes have resulted in constitutional and social tensions and, in

some cases, instability and reactions against market reforms. With respect to

any emerging or developing nation, there is the possibility of nationalization,

expropriation or confiscation, political changes, government regulation and

social instability. There can be no assurance that future political changes

will not adversely affect the economic conditions of an emerging or developing

market nation. Political or economic instability is likely to have an adverse

effect on the performance of the Index, and, consequently, the return on

securities relating to this snapshot.

| | |