- DB Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

FWP Filing

Deutsche Bank (DB) FWPFree writing prospectus

Filed: 14 Dec 10, 12:00am

Term Sheet To underlying supplement No. 1 dated September 29, 2009, product supplement AF dated September 29, 2009, prospectus supplement dated September 29, 2009 and prospectus dated September 29, 2009 | Term Sheet No. 1041AF Registration Statement No. 333-162195 Dated December 14, 2010; Rule 433 |

Structured Investments | Deutsche Bank $ Buffered Return Enhanced Notes Linked to a Weighted Basket Consisting of the Hang Seng China Enterprises Index, the KOSPI 200 Index, the MSCI Taiwan Index, the Hang Seng® Index and the MSCI Singapore Index and Related Asian Currencies due January 6, 2012 |

| • | The notes are designed for investors who seek a return at maturity of two times the appreciation (if any) of a weighted basket of five Asian indices and related Asian currencies up to a Maximum Return on the notes of 14.30%. Investors should be willing to forgo coupon and dividend payments and, if the Basket Return is less than -10.00%, be willing to lose up to 100% of their investment. Any payment at maturity of the securities is subject to the credit of the Issuer. |

| • | Senior unsecured obligations of Deutsche Bank AG, London Branch maturing January 6, 2012† . |

| • | Minimum purchase of $10,000; minimum denominations of $1,000 (the “Face Amount”) and integral multiples thereof. |

| • | The notes are expected to price on or about December 17, 2010 (the “Trade Date”) and are expected to settle on or about December 22, 2010 (the “Settlement Date”). |

| Issuer: | Deutsche Bank AG, London Branch |

| Basket: | The notes are linked to a weighted basket consisting of five indices (each a “Basket Index,” and together, the “Basket Indices”) each as adjusted by the spot exchange rate of its respective related currency (each a “Basket Currency,” and together, the “Basket Currencies”) (the Basket Indices and Basket Currencies together make up the “Basket Components”) as set forth below: |

| Basket Component | |||||

| Basket Index | Ticker | Starting Index Level* | Basket Currency | Initial Spot Rate* | Component Weighting |

| Hang Seng China Enterprises Index | HSCEI | Hong Kong dollar (HKD/USD) | 33.00% | ||

| KOSPI 200 Index | KOSPI2 | Korean won (KRW/USD) | 25.00% | ||

| MSCI Taiwan Index | TAMSCI | Taiwan dollar (TWD/USD) | 19.00% | ||

Hang Seng® Index | HSI | Hong Kong dollar (HKD/USD) | 14.00% | ||

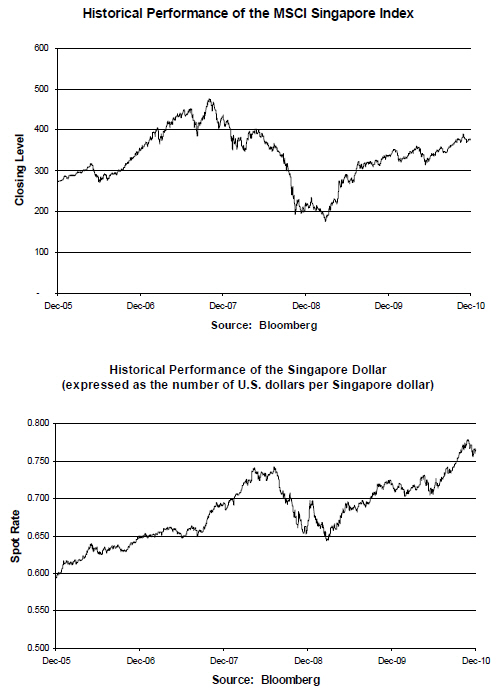

| MSCI Singapore Index | SIMSCI | Singapore dollar (SGD/USD) | 9.00% | ||

| *The Starting Index Levels and Initial Spot Rates will be determined on the Trade Date. | |

| Currency of the Issue: | United States dollar |

| Upside Leverage Factor: | At least 2. The actual Upside Leverage Factor will be set on the Trade Date and will not be less than 2. |

| Downside Factor: | 1.1111 |

| Buffer Amount: | 10.00% |

| Payment at Maturity: | If the Basket Return is greater than zero, you will receive a cash payment per $1,000 Face Amount of notes calculated as follows, subject to the Maximum Return on the notes of 14.30%: $1,000 + [$1,000 × (Basket Return × Upside Leverage Factor)] If the Basket Return is less than or equal to zero but greater than or equal to -10.00%, you will receive a cash payment of $1,000 per $1,000 Face Amount of notes. If the Basket Return is less than -10.00%, you will lose 1.1111% of the Face Amount of your notes for every 1.00% by which the Basket Return is less than -10.00%, and you will receive a cash payment per $1,000 Face Amount of notes calculated as follows: $1,000 + [1,000 × (Basket Return + 10.00%) x Downside Factor] You will lose some or all of your investment at maturity if the Basket Return is less than -10.00%. Any payment at maturity of the securities is subject to the credit of the Issuer. |

| Maximum Return: | At least 14.30%. The actual Maximum Return on the notes will be set on the Trade Date and will not be less than 14.30%. |

| Basket Return: | Ending Basket Level - Starting Basket Level Starting Basket Level |

| Starting Basket Level: | Set equal to 100 on the Trade Date |

| Ending Basket Level: | The arithmetic average of the Basket Levels on the Averaging Dates |

| Basket Level: | The Basket Level on each Averaging Date will be calculated as follows: 100 × [(HSCEI Index Multiplier × 33.00% × HKD/USD Currency Multiplier) + (KOSPI2 Index Multiplier × 25.00% × KRW/USD Currency Multiplier) + (TAMSCI Index Multiplier × 19.00% × TWD/USD Currency Multiplier) + (HSI Index Multiplier × 14.00% × HKD/USD Currency Multiplier) + (SIMSCI Index Multiplier × 9.00% × SGD/USD Currency Multiplier)] The Multipliers set forth in the formula above reflect the performance of the respective Basket Index or Basket Currency as of the applicable Averaging Date. |

| Index Multiplier: | On the applicable Averaging Date, with respect to each Basket Index, the performance of such Basket Index from its Starting Index Level to its Ending Index Level, calculated as follows: |

| Ending Index Level | |

| Starting Index Level | |

| Starting Index Level: | With respect to each Basket Index, the index closing level on the Trade Date. |

| Ending Index Level: | With respect to each Basket Index, the index closing level on the applicable Averaging Date. |

| Currency Multiplier: | On the applicable Averaging Date, for each Basket Currency, the performance of such Basket Currency from its Initial Spot Rate to its Final Spot Rate, calculated as follows: Final Spot Rate Initial Spot Rate |

| Initial Spot Rate: | For each Basket Currency, the Spot Rate on the Trade Date. |

| Final Spot Rate: | For each Basket Currency, the Spot Rate on the applicable Averaging Date. |

| Spot Rate: | For each Basket Currency, the official MID WM Reuters fixing at 4 pm London Time, expressed as the number of U.S. dollars per one unit of such Basket Currency. |

Averaging Dates†: | December 27, 2011, December 28, 2011, December 29, 2011, December 30, 2011 and January 3, 2012 (the “Final Valuation Date”) |

Maturity Date†: | January 6, 2012 |

| Listing: | The notes will not be listed on any securities exchange. |

| CUSIP/ISIN: | 2515A1 2H 3 / US2515A12H35 |

Price to Public(1) | Fees(2) | Proceeds to Issuer | |

| Per note | $1,000.00 | $10.00 | $990.00 |

| Total | $ | $ | $ |

Hypothetical Ending Basket Level | Hypothetical Basket Return | Hypothetical Return | Payment at Maturity |

| 200.00 | 100.00% | 14.30% | $1,143.00 |

| 180.00 | 80.00% | 14.30% | $1,143.00 |

| 165.00 | 65.00% | 14.30% | $1,143.00 |

| 150.00 | 50.00% | 14.30% | $1,143.00 |

| 140.00 | 40.00% | 14.30% | $1,143.00 |

| 130.00 | 30.00% | 14.30% | $1,143.00 |

| 120.00 | 20.00% | 14.30% | $1,143.00 |

| 110.00 | 10.00% | 14.30% | $1,143.00 |

| 107.15 | 7.15% | 14.30% | $1,143.00 |

| 105.00 | 5.00% | 10.00% | $1,100.00 |

| 102.50 | 2.50% | 5.00% | $1,050.00 |

| 101.00 | 1.00% | 2.00% | $1,020.00 |

| 100.00 | 0.00% | 0.00% | $1,000.00 |

| 99.00 | -1.00% | 0.00% | $1,000.00 |

| 95.00 | -5.00% | 0.00% | $1,000.00 |

| 90.00 | -10.00% | 0.00% | $1,000.00 |

| 80.00 | -20.00% | -11.11% | $888.89 |

| 70.00 | -30.00% | -22.22% | $777.78 |

| 60.00 | -40.00% | -33.33% | $666.67 |

| 50.00 | -50.00% | -44.44% | $555.56 |

| 40.00 | -60.00% | -55.56% | $444.44 |

| 30.00 | -70.00% | -66.67% | $333.33 |

| 20.00 | -80.00% | -77.78% | $222.22 |

| 10.00 | -90.00% | -88.89% | $111.11 |

| 0.00 | -100.00% | -100.00% | $0.00 |

| Ticker | HSCEI | KOSPI2 | TAMSCI | HSI | SIMSCI |

| Basket Currency | Hong Kong dollar | Korean won | Taiwan dollar | Hong Kong dollar | Singapore dollar |

| Weighting | 33.00% | 25.00% | 19.00% | 14.00% | 9.00% |

| Hypothetical Starting Index Level | 12,660.00 | 260.00 | 310.00 | 22,160.00 | 380.00 |

| Hypothetical Ending Index Level | 12,660.00 | 260.00 | 310.00 | 22,160.00 | 380.00 |

| Index Multiplier | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Hypothetical Initial Spot Rate | 0.12863 | 0.0008764 | 0.03325 | 0.12863 | 0.7648 |

| Hypothetical Final Spot Rate | 0.12863 | 0.00096404 | 0.036575 | 0.1286300 | 0.84128 |

| Currency Multiplier | 1.00 | 1.10 | 1.10 | 1.00 | 1.10 |

Basket Level on Applicable Averaging Date† | 105.30 | ||||

Basket Level on Applicable Averaging Date† | = 100 × [(HSCEI Index Multiplier × 33.00% × HKD/USD Currency Multiplier) + (KOSPI2 Index Multiplier × 25.00% × KRW/USD Currency Multiplier) + (TAMSCI Index Multiplier × 19.00% × TWD/USD Currency Multiplier) + (HSI Index Multiplier × 14.00% × HKD/USD Currency Multiplier) + (SIMSCI Index Multiplier × 9.00% × SGD/USD Currency Multiplier)] = 100 × [(100.00% × 33.00% × 1.00) + (100.00% × 25.00% × 1.10) + (100.00% × 19.00% × 1.10) + (100.00% × 14.00% × 1.00) + (100.00% × 9.00% × 1.10)] = 105.30 |

| Ticker | HSCEI | KOSPI2 | TAMSCI | HSI | SIMSCI |

| Basket Currency | Hong Kong dollar | Korean won | Taiwan dollar | Hong Kong dollar | Singapore dollar |

| Weighting | 33.00% | 25.00% | 19.00% | 14.00% | 9.00% |

| Hypothetical Starting Index Level | 12,660.00 | 260.00 | 310.00 | 22,160.00 | 380.00 |

| Hypothetical Ending Index Level | 15,192.00 | 312.00 | 372.00 | 26,592.00 | 456.00 |

| Index Multiplier | 120.00% | 120.00% | 120.00% | 120.00% | 120.00% |

| Hypothetical Initial Spot Rate | 0.12863 | 0.0008764 | 0.03325 | 0.12863 | 0.7648 |

| Hypothetical Final Spot Rate | 0.12863 | 0.00096404 | 0.036575 | 0.12863 | 0.84128 |

| Currency Multiplier | 1.00 | 1.10 | 1.10 | 1.00 | 1.10 |

Basket Level on Applicable Averaging Date† | 126.36 | ||||

Basket Level on Applicable Averaging Date† | = 100 × [(HSCEI Index Multiplier × 33.00% × HKD/USD Currency Multiplier) + (KOSPI2 Index Multiplier × 25.00% × KRW/USD Currency Multiplier) + (TAMSCI Index Multiplier × 19.00% × TWD/USD Currency Multiplier) + (HSI Index Multiplier × 14.00% × HKD/USD Currency Multiplier) + (SIMSCI Index Multiplier × 9.00% × SGD/USD Currency Multiplier)] = 100 × [(120.00% × 33.00% × 1.00) + (120.00% × 24.00% × 1.10) + (120.00% × 21.00% × 1.10) + (120.00% × 14.00% × 1.00) + (120.00% × 8.00% × 1.10)] = 126.36 |

| Ticker | HSCEI | KOSPI2 | TAMSCI | HSI | SIMSCI |

| Basket Currency | Hong Kong dollar | Korean won | Taiwan dollar | Hong Kong dollar | Singapore dollar |

| Weighting | 33.00% | 25.00% | 19.00% | 14.00% | 9.00% |

| Hypothetical Starting Index Level | 12,660.00 | 260.00 | 310.00 | 22,160.00 | 380.00 |

| Hypothetical Ending Index Level | 11,394.00 | 234.00 | 279.00 | 19,944.00 | 342.00 |

| Index Multiplier | 90.00% | 90.00% | 90.00% | 90.00% | 90.00% |

| Hypothetical Initial Spot Rate | 0.12863 | 0.0008764 | 0.03325 | 0.12863 | 0.7648 |

| Hypothetical Final Spot Rate | 0.12863 | 0.0008764 | 0.0399 | 0.12863 | 0.956 |

| Currency Multiplier | 1.00 | 1.00 | 1.20 | 1.00 | 1.25 |

Basket Level on Applicable Averaging Date† | 95.58 | ||||

Basket Level on Applicable Averaging Date† | = 100 × [(HSCEI Index Multiplier × 33.00% × HKD/USD Currency Multiplier) + (KOSPI2 Index Multiplier × 25.00% × KRW/USD Currency Multiplier) + (TAMSCI Index Multiplier × 19.00% × TWD/USD Currency Multiplier) + (HSI Index Multiplier × 14.00% × HKD/USD Currency Multiplier) + (SIMSCI Index Multiplier × 9.00% × SGD/USD Currency Multiplier)] = 100 × [(90.00% × 33.00% × 1.00) + (90.00% × 24.00% × 1.00) + (90.00% × 21.00% × 1.20) + (90.00% × 14.00% × 1.00) + (90.00% × 8.00% × 1.25)] = 95.58 |

| Ticker | HSCEI | KOSPI2 | TAMSCI | HSI | SIMSCI |

| Basket Currency | Hong Kong dollar | Korean won | Taiwan dollar | Hong Kong dollar | Singapore dollar |

| Weighting | 33.00% | 25.00% | 19.00% | 14.00% | 9.00% |

| Hypothetical Starting Index Level | 12,660.00 | 260.00 | 310.00 | 22,160.00 | 380.00 |

| Hypothetical Ending Index Level | 10,761.00 | 182.00 | 232.50 | 17,728.00 | 342.00 |

| Index Multiplier | 85.00% | 70.00% | 75.00% | 80.00% | 90.00% |

| Hypothetical Initial Spot Rate | 0.12863 | 0.0008764 | 0.03325 | 0.12863 | 0.7648 |

| Hypothetical Final Spot Rate | 0.12863 | 0.0008764 | 0.0399 | 0.12863 | 0.956 |

| Currency Multiplier | 1.00 | 1.00 | 1.20 | 1.00 | 1.25 |

Basket Level on Applicable Averaging Date† | 83.95 | ||||

Basket Level on Applicable Averaging Date† | = 100 × [(HSCEI Index Multiplier × 33.00% × HKD/USD Currency Multiplier) + (KOSPI2 Index Multiplier × 25.00% × KRW/USD Currency Multiplier) + (TAMSCI Index Multiplier × 19.00% × TWD/USD Currency Multiplier) + (HSI Index Multiplier × 14.00% × HKD/USD Currency Multiplier) + (SIMSCI Index Multiplier × 9.00% × SGD/USD Currency Multiplier)] = 100 × [(85.00% × 33.00% × 1.00) + (70.00% × 24.00% × 1.00) + (75.00% × 21.00% × 1.20) + (80.00% × 14.00% × 1.00) + (90.00% × 8.00% × 1.25)] = 83.95 |

| • | APPRECIATION POTENTIAL — The notes provide the opportunity to enhance equity returns by multiplying any positive Basket Return by an Upside Leverage Factor, up to the Maximum Return on the notes. The Upside Leverage Factor and Maximum Return will be set on the Trade Date and will not be less than 2 and 14.30%, respectively. Accordingly, the maximum Payment at Maturity is expected to be $1,143.00 for every $1,000 Face Amount of notes. Because the notes are our senior unsecured debt obligations, payment of any amount at maturity is subject to our ability to pay our obligations as they become due. |

| • | LIMITED PROTECTION AGAINST LOSS — Payment at Maturity of the notes is protected against a decline in the Ending Basket Level, as compared to the Starting Basket Level, of up to the Buffer Amount of 10.00%. If the Basket Return is less than -10.00%, you will lose 1.1111% of the Face Amount for every 1.00% by which the Basket Return is less than -10.00%, and you may lose up to your entire investment as a result. |

| • | DIVERSIFICATION AMONG THE BASKET COMPONENTS –– The return on the notes is linked to a basket consisting of the Hang Seng China Enterprises Index, the KOSPI 200 Index, the MSCI Taiwan Index, the Hang Seng® Index, the MSCI Singapore Index and the exchange rates of the Hong Kong dollar, the Korean won, the Taiwan dollar and the Singapore dollar, each with respect to the U.S. dollar. The Hang Seng China Enterprises Index is a market-capitalization weighted index consisting of all the Hong Kong listed H-shares of Chinese enterprises one year after the first H-share company was listed on the HKSE. H-shares are Hong Kong listed shares, traded in Hong Kong dollars, of Chinese state-owned enterprises. The KOSPI 200 Index is a capitalization-weighted index of 200 Korean stoc ks which make up a large majority of the total market value of the KRX Stock Market (‘‘KRX’’). The constituent stocks are selected on the basis of the market value of the individual stocks, liquidity and their relative positions in their respective industry groups. The MSCI Taiwan Index is a free float-adjusted market capitalization index of securities listed on the Taiwan Stock Exchange. The Hang Seng® Index is a free-float adjusted market capitalization weighted stock market index of The Stock Exchange of Hong Kong Ltd. (“HKSE”) and purports to be an indicator of the performance of the Hong Kong stock market. The MSCI Singapore Index is a free float-adjusted market capitalization index that is calculated by MSCI Inc. (“MSCI”) and designed to measure equity market performance in Singapore. For additional information about each Basket Index, see the information set forth under & #8220;The Hang Seng Indices,” “The KOSPI 200 Index” and “The MSCI Indices” in the accompanying underlying supplement. |

| • | TAX CONSEQUENCES — You should review carefully the section of the accompanying product supplement entitled “U.S. Federal Income Tax Consequences,” which contains the opinion of our special tax counsel, Davis Polk & Wardwell LLP, with respect to the tax consequences of an investment in the notes. Although the tax consequences of an investment in the notes are uncertain, based on that opinion we believe it is reasonable to treat the notes as prepaid financial contracts for U.S. federal income tax purposes. Under this treatment, you should not recognize taxable income or loss prior to the maturity of your notes, other than pursuant to a sale or exchange. Your gain or loss on the notes should be capital gain or loss and should be long-term capital gain or loss if you have held the notes for more than one year. If, however, the Internal Revenue Service (the “IRS”) were successful in asserting an alternative treatment for the notes, the tax consequences of ownership and disposition of the notes might be affected materially and adversely. We do not plan to request a ruling from the IRS, and the IRS or a court might not agree with the tax treatment described in this term sheet and the accompanying product supplement. |

In 2007, Treasury and the IRS released a notice requesting comments on various issues regarding the U.S. federal income tax treatment of “prepaid forward contracts” and similar instruments, such as the notes. The notice focuses in particular on whether to require holders of these instruments to accrue income over the term of their investment. It also asks for comments on a number of related topics, including the character of income or loss with respect to |

| Recently enacted legislation requires certain individuals who hold “debt or equity interests” in any “foreign financial institution” that are not “regularly traded on an established securities market” to report information about such holdings on their U.S. federal income tax returns, generally for tax years beginning in 2011, unless a regulatory exemption is provided. Individuals who purchase the notes should consult their tax advisers regarding this legislation. |

| Under current law, the United Kingdom will not impose withholding tax on payments made with respect to the notes. |

| For a discussion of certain German tax considerations relating to the notes, you should refer to the section in the accompanying prospectus supplement entitled “Taxation by Germany of Non-Resident Holders.” |

| We do not provide any advice on tax matters. Prospective investors should consult their tax advisers regarding the U.S. federal tax consequences of an investment in the notes (including possible alternative treatments and the issues presented by the 2007 notice), as well as tax consequences arising under the laws of any state, local or non-U.S. taxing jurisdiction. |

| • | YOUR INVESTMENT IN THE NOTES MAY RESULT IN A LOSS — The notes do not guarantee any return of your investment. The return on the notes at maturity is linked to the performance of the Basket and will depend on whether, and the extent to which, the Basket Return is positive or negative. The Basket Return will be determined based on the Ending Basket Level, which will in turn depend on the performance of the Basket Indices and the Basket Currencies. If any Basket Index declines from its Starting Index Level to its Ending Index Level or if the U.S. dollar appreciates in value against any of the Hong Kong dollar, the Korean won, the Taiwan dollar or the Singapore dollar, it will result in a lower Basket Return and your Payment at Maturity may be adversel y affected. If the Basket Return is less than -10.00%, your investment will be exposed on a leveraged basis of 1.1111% to each 1.00% by which the Basket Return is less than -10.00%, and you could lose some or all of your investment. |

| • | YOUR MAXIMUM GAIN ON THE NOTES IS LIMITED TO THE MAXIMUM RETURN — If the Ending Basket Level is greater than the Starting Basket Level, for each $1,000 Face Amount of notes, you will receive at maturity $1,000 plus an additional amount that will not exceed a predetermined percentage of the Face Amount, regardless of the appreciation in the Basket, which may be significant. We refer to this percentage as the Maximum Return, which will be set on the Trade Date and will not be less than 14.30%. Accordingly, the maximum Payment at Maturity is expected to be $1,143.00 for every $1,000 Face Amount of notes. |

| • | CREDIT OF THE ISSUER — The notes are senior unsecured obligations of the Issuer, Deutsche Bank AG, and are not, either directly or indirectly, an obligation of any third party. Any payment to be made on the notes, including any Payment at Maturity, depends on the ability of Deutsche Bank AG to satisfy its obligations as they come due. As a result, the actual and perceived creditworthiness of Deutsche Bank AG will affect the value of the notes and in the event Deutsche Bank AG were to default on its obligations you may not receive the Payment at Maturity owed to you under the terms of the notes. |

| • | TRADING AND OTHER TRANSACTIONS BY US OR OUR AFFILIATES MAY IMPAIR THE VALUE OF THE NOTES — We or one or more of our affiliates may hedge our exposure from the notes by entering into equity, equity derivative, foreign exchange and currency derivative transactions, such as over-the-counter options or exchange-traded instruments. Such trading and hedging activities may affect the levels of the Basket Components and make it less likely that you will receive a positive return on your investment in the notes. It is possible that we or our affiliates could receive substantial returns from these hedging activities while the value of the notes declines. We or our affiliates may also engage in trading in instruments linked to the Basket Indices or the Basket Currencies on a regular basis as part of our general broker-dealer and other businesses, for proprietary accounts, fo r other accounts under management or to facilitate transactions for customers, including block transactions. We or our affiliates may also issue or underwrite other securities or financial or derivative instruments with returns linked or related to changes in the Basket Indices or the Basket Currencies. By introducing competing products into the marketplace in this manner, we or our affiliates could adversely affect the value of the notes. Any of the foregoing activities described in this paragraph may reflect trading strategies that differ from, or are in direct opposition to, the trading strategy of investors in the notes. |

| • | CHANGES IN THE LEVELS OF THE BASKET INDICES AND THE EXCHANGE RATES OF THE BASKET CURRENCIES MAY OFFSET EACH OTHER — Movements in the Basket Indices and movements in the exchange rates of the Basket Currencies may not correlate with each other. At a time when the level of one or more of the Basket Indices increases and/or one or more of the Basket Currencies appreciates against the U.S. dollar, the level of the other Basket Indices may not increase as much or may decline and/or one or more of the Basket Currencies may not appreciate as much or may weaken against the U.S. dollar. Therefore, in calculating the Basket Return, increases in the value of one or more of the Basket Indices and/or increases in the value of one or more of the Basket Currencies against the U.S. dollar may be moderated, offset or more than offset by lesser increases or declines in the value of the other Basket Indices and/or the value of the other Basket Currencies against the U.S. dollar. |

| • | THE NOTES ARE SUBJECT TO CURRENCY EXCHANGE RISK — Foreign currency exchange rates vary over time, and may vary considerably during the term of the notes. If the U.S. dollar strengthens against any of the Basket Currencies during the term of the notes, your return will be adversely affected. The relative values of the U.S. dollar and each of the Basket Currencies are at any moment a result of the supply and demand for such currencies. Changes in foreign currency exchange rates result over time from the interaction of many factors directly or indirectly affecting economic and political conditions in the country or countries in which such currency is used, and economic and political developments in other relevant countries. Of particular importance to currency exchange risk are: |

| · | existing and expected rates of inflation; |

| · | existing and expected interest rate levels; |

| · | the balance of payments in the United States, China, Taiwan, Singapore and Korea between each country and its major trading partners; and |

| · | the extent of governmental surplus or deficit in the United States, China, Taiwan, Singapore and Korea. |

| All of these factors are, in turn, sensitive to the monetary, fiscal and trade policies pursued by the United States, China, Taiwan, Singapore and Korea and other countries important to international trade and finance. |

| • | IF THE LIQUIDITY OF THE BASKET CURRENCIES IS LIMITED, THE VALUE OF THE NOTES WOULD LIKELY BE IMPAIRED — Currencies and derivatives contracts on currencies may be difficult to buy or sell, particularly during adverse market conditions. Reduced liquidity on the Averaging Dates would likely have an adverse effect on the Final Spot Rate for each Basket Currency, and therefore, on the return on your notes. Limited liquidity relating to any Basket Currency may also result in Deutsche Bank AG, London Branch, as calculation agent, being unable to determine the Basket Return using its normal means. The resulting discretion by the calculation agent in determining the Basket Return could, in turn, result in potential conflicts of interest. |

| • | THE HONG KONG DOLLAR DOES NOT FLOAT FREELY — Exchange rates of many developed and major emerging economies, including the United States, are currently “floating,” meaning that they are permitted to fluctuate in value relative to other currencies. However, the Hong Kong dollar does not float freely. The exchange rate of the Hong Kong dollar relative to the U.S. dollar is fixed within a narrow range by the Hong Kong Monetary Authority. For as long as the Hong Kong Monetary Authority restricts the Hong Kong dollar from floating relative to the U.S. dollar, the exchange rate between the Hong Kong dollar and the U.S. dollar will not fluctuate by any appreciable amount. If at any time the Hong Kong Monetary Authority permits the Hong Kong dollar to float, the exchange rate between the Hong Kong dollar and the U.S. dollar is likely to move significantly in a very short period of time, which would affect the Basket Return, and, consequently, the value of your notes. |

| • | THE NOTES DO NOT PAY COUPONS — Unlike ordinary debt securities, the notes do not pay coupons and do not guarantee any return of your investment at maturity. |

| • | NO DIVIDEND PAYMENTS OR VOTING RIGHTS — As a holder of the notes, you will not have voting rights or rights to receive cash dividends or other distributions or other rights that holders of stocks comprising any Basket Index would have. |

| • | CERTAIN BUILT-IN COSTS ARE LIKELY TO ADVERSELY AFFECT THE VALUE OF THE NOTES PRIOR TO MATURITY — While the Payment at Maturity described in this term sheet is based on the full Face Amount of your notes, the original issue price of the notes includes the agent’s commission and the projected profit included in the cost of hedging our obligations under the notes through one or more of our affiliates. Such cost includes our or our affiliates’ expected cost of providing such hedge, as well as the profit we or our affiliates expect to realize in consideration for assuming the risks inherent in providing such hedge. As a result, the price, if any, at which Deutsche Bank (or its affiliates) will be willing to purchase notes from you in secondary market transactions, if at all, will likely be lower than the original issue price, and any sale prior to the Matur ity Date could result in a substantial loss to you. The notes are not designed to be short-term trading instruments. Accordingly, you should be able and willing to hold your notes to maturity. |

| • | RISKS ASSOCIATED WITH INVESTMENTS IN SECURITIES INDEXED TO THE VALUE OF FOREIGN EQUITY SECURITIES — Investments in securities indexed to the value of foreign equity securities, such as the securities composing the Hang Seng China Enterprises Index, the KOSPI 200 Index, the MSCI Taiwan Index, the Hang Seng® |

| • | EMERGING MARKETS COUNTRIES OFTEN SUFFER FROM POLITICAL AND ECONOMIC INSTABILITY — The value of the notes is subject to the political and economic risks of emerging market countries. Some Basket Indices may include companies that are located in emerging market countries and whose securities trade on the exchanges of emerging market countries. In recent years, some emerging markets have undergone significant political, economic and social upheaval. Such far-reaching changes have resulted in constitutional and social tensions and, in some cases, instability and reaction against market reforms have occurred. With respect to any emerging market country, there is the possibility of nationalization, expropriation or confiscation, political changes, government regulation and social instability. There can be no assurance that future political changes will not adversely aff ect the economic conditions of an emerging market country. Political or economic instability could have an adverse effect on the value of, and Payment at Maturity on, your notes. |

| • | LACK OF LIQUIDITY — The notes will not be listed on any securities exchange. Deutsche Bank (or its affiliates) may offer to purchase the notes in the secondary market but is not required to do so. Even if there is a secondary market, it may not provide enough liquidity to allow you to trade or sell the notes easily. Because other dealers are not likely to make a secondary market for the notes, the price at which you may be able to trade your notes is likely to depend on the price, if any, at which Deutsche Bank (or its affiliates) is willing to buy the notes. If you have to sell your notes prior to maturity, you may not be able to do so or you may have to sell them at a substantial loss. |

| • | POTENTIAL CONFLICTS — We and our affiliates play a variety of roles in connection with the issuance of the notes, including acting as calculation agent and hedging our obligations under the notes. In performing these roles, the economic interests of the calculation agent and other affiliates of ours are potentially adverse to your interests as an investor in the notes. |

| • | WE AND OUR AFFILIATES AND AGENTS, OR JPMORGAN CHASE & CO. AND ITS AFFILIATES, MAY PUBLISH RESEARCH, EXPRESS OPINIONS OR PROVIDE RECOMMENDATIONS THAT ARE INCONSISTENT WITH INVESTING IN OR HOLDING THE NOTES. ANY SUCH RESEARCH, OPINIONS OR RECOMMENDATIONS COULD AFFECT THE VALUE OF THE BASKET COMPONENTS TO WHICH THE NOTES ARE LINKED OR THE VALUE OF THE NOTES — We, our affiliates and agents, and J.P. Morgan Chase & Co. and its affiliates, publish research from time to time on financial markets and other matters that may influence the value of the notes, or express opinions or provide recommendations that may be inconsistent with purchasing or holding the notes. We, our affiliates and agents, or J.P. Morgan Chase & Co. and its affiliates, may publish research or other opinions that are inconsistent with the investment view implicit in the notes. Any research , opinions or recommendations expressed by us, our affiliates or agents, or J.P. Morgan Chase & Co. or its affiliates, may not be consistent with each other and may be modified from time to time without notice. Investors should make their own independent investigation of the merits of investing in the notes and the Basket Indices and Basket Currencies to which the notes are linked. |

| • | MANY ECONOMIC AND MARKET FACTORS WILL IMPACT THE VALUE OF THE NOTES — In addition to the levels of the Basket Indices and the exchange rates of the Basket Currencies relative to the U.S. dollar on any day, the value of the notes will be affected by a number of economic and market factors that may either offset or magnify each other, including: |

| • | the expected volatility of the Basket Indices; |

| • | the time to maturity of the notes; |

| • | the dividend rates on the stocks comprising the Basket Indices; |

| • | interest and yield rates in the market generally; |

| • | the volatility of the exchange rates between the U.S. dollar, the Hong Kong dollar, the Korean won, the Taiwan dollar and the Singapore dollar; |

| • | geopolitical conditions and a variety of economic, financial, political, regulatory or judicial events that affect the stocks comprising the Basket Indices or stock markets generally and which may affect the levels of the Basket Indices; and |

| • | our creditworthiness, including actual or anticipated downgrades in our credit ratings. |

| Some or all of these factors may influence the price that you will receive if you choose to sell your notes prior to maturity. The impact of any of the factors set forth above may enhance or offset some or all of any change resulting from another factor or factors. |

| • | THE U.S. FEDERAL INCOME TAX CONSEQUENCES OF AN INVESTMENT IN THE NOTES ARE UNCLEAR — There is no direct legal authority regarding the proper U.S. federal income tax treatment of the notes, and we do not plan to request a ruling from the IRS. Consequently, significant aspects of the tax treatment of the notes are uncertain, and the IRS or a court might not agree with the treatment of the notes as prepaid financial contracts. If the IRS were successful in asserting an alternative treatment for the notes, the tax consequences of ownership and disposition of the notes might be affected materially and adversely. In addition, as described above under “Tax |

| Prospective investors should review carefully the section of the accompanying product supplement entitled “U.S. Federal Income Tax Consequences,” and consult their tax advisers regarding the U.S. federal income tax consequences of an investment in the notes (including possible alternative treatments and the issues presented by the 2007 notice), as well as tax consequences arising under the laws of any state, local or non-U.S. taxing jurisdiction. |

| Basket Index | Closing Level (December 10, 2010) | Basket Currency | Exchange Rate (December 10, 2010) |

| Hang Seng China Enterprises Index | 12,661.01 | Hong Kong dollar (HKD/USD) | 0.12863 |

| KOSPI 200 Index | 261.74 | Korean won (KRW/USD) | 0.0008764 |

| MSCI Taiwan Index | 310.53 | Taiwan dollar (TWD/USD) | 0.03325 |

Hang Seng® Index | 23,162.91 | Hong Kong dollar (HKD/USD) | 0.12863 |

| MSCI Singapore Index | 375.96 | Singapore dollar (SGD/USD) | 0.7648 |