Term sheet No. 1046R To underlying supplement no. 2 dated September 29, 2009, product supplement R dated September 30, 2009, prospectus supplement dated September 29, 2009 and prospectus dated September 29, 2009 | Registration Statement No. 333-162195 Dated December 22, 2010; Rule 433 |

Deutsche Bank AG, London Branch

$ Three-Year Market Contribution Securities Linked to the Deutsche Bank Liquid Commodity Index – Mean Reversion™ Total Return (Non-Principal Protected) due January 24*, 2014

General

| | • | The securities are designed for investors who seek a return linked to the performance of the Deutsche Bank Liquid Commodity Index – Mean Reversion™ Total Return (the “Index”). The Index is composed of futures contracts on six commodities – Heating Oil, Crude Oil, Aluminum, Gold, Wheat and Corn – and systematically adjusts their weighting in the Index to assign higher weights to those commodities trading in a lower price range and lower weights to those commodities trading in a higher price range, in each case, based on the difference between their one-year and five-year moving average prices. The securities will not pay any coupon, and investors should be willing to lose some or all of their initial investment if the Index does not appreciate by 6.01% or more over the term of the securities. |

| | • | Senior unsecured obligations of Deutsche Bank AG due January 24*, 2014. |

| | • | Minimum denominations of $10,000 (the “Face Amount”) and integral multiples of $1,000 in excess thereof. |

| | • | The securities are expected to price on or about January 21*, 2011 and are expected to settle on or about January 26*, 2011. |

| | • | After the Trade Date but prior to the Settlement Date we may accept additional orders for the securities and increase the aggregate Face Amount. |

Key Terms

| Issuer: | | Deutsche Bank AG, London Branch |

Issue Price: | | 100% of the Face Amount |

Index: | | The Deutsche Bank Liquid Commodity Index – Mean Reversion™ Total Return |

Redemption Amount: | | A cash payment, determined on the Final Valuation Date or the Early Redemption Valuation Date, as applicable, that provides you with a return per $10,000 Face Amount, calculated as follows: |

$10,000 + $10,000 x (Index Return – Adjustment Factor)

| | | Your investment will be fully exposed to any decline in the Index. If the Final Level on the Final Valuation Date or the Early Redemption Valuation Date, as applicable, is less than the Initial Level, you will lose 1% of the Face Amount of your securities for every 1% that the Final Level is less than the Initial Level. In addition, the Adjustment Factor will lower your return by approximately 2.00% per annum, regardless of whether the Index appreciates or declines in value. In no event will the Redemption Amount or Early Redemption Amount be less than zero. |

| | | You will lose some or all of your investment at maturity or upon early redemption if the Index does not appreciate in a manner sufficient to offset the effect of the Adjustment Factor. |

| Index Return: | | The performance of the Index from the Initial Level to the Final Level, calculated as follows: |

| Final Level | – 1 |

| Initial Level |

| Adjustment Factor: | | (0.02 x (Days/365)) where “Days” equals the number of calendar days from, and including, the Trade Date to, but excluding, the Final Valuation Date or the Early Redemption Valuation Date, as applicable |

| Payment at Maturity: | | If you hold your securities to maturity, you will receive the Redemption Amount calculated using the Final Level and Adjustment Factor applicable on the Final Valuation Date. |

| Early Redemption Amount: | | You will have the right to cause us to redeem your securities upon fourteen (14) calendar days notice, on February 6, 2012 and February 5, 2013 (each, an “Early Redemption Date”). If an Early Redemption Date is not an Index business day, we shall redeem your securities on the first succeeding Index business day, subject to postponement in the event of a Market Disruption Event. The Early Redemption Amount payable on any Early Redemption Date will be calculated using the Final Level and Adjustment Factor applicable on the relevant Early Redemption Valuation Date. See “Early Redemption” below. |

Initial Level†: | | The Index closing level on the Trade Date |

Final Level†: | | The Index closing level on the Final Valuation Date |

| Trade Date: | | January 21*, 2011 |

| Settlement Date: | | January 26*, 2011 |

| Early Redemption Valuation Date: | | The Early Redemption Valuation Date for an early redemption will be the third Index business day prior to February 6, 2012 or February 5, 2013, as applicable, subject to postponement in the event of a Market Disruption Event. |

| Final Valuation Date: | | January 21*, 2014 |

Maturity Date††: | | January 24*, 2014 |

| Listing: | | The securities will not be listed on any securities exchange. |

| CUSIP: | | 2515A1 2M 2 |

| ISIN: | | US2515A12M20 |

| * | Expected. In the event that we make any change to the expected Trade Date or Settlement Date, the Final Valuation Date and the Maturity Date will be changed so that the stated term of the securities remains the same. |

| † | Subject to adjustment for non-trading days and certain Market Disruption Events. |

| †† | Subject to postponement as described under “Description of Securities – Adjustments to Index Valuation Dates and Payment Dates – Market Disruption Events for Commodity Based Index” and acceleration as described under “Description of Securities – Commodity Hedging Disruption Events for Commodity Based Index” in the accompanying product supplement. |

Investing in the securities involves a number of risks. See “Risk Factors” beginning on page 6 of the accompanying product supplement and “Selected Risk Considerations” beginning on page TS-5 of this term sheet.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities or passed upon the accuracy or the adequacy of this term sheet or the accompanying prospectus supplements and prospectus. Any representation to the contrary is a criminal offense.

| | | | |

| | Price to Public | Max. Discounts and Commissions(1) | Min. Proceeds to Us |

Per Security | $10,000.00 | $0.00 | $10,000.00 |

Total | $ | $ | $ |

| (1) | The securities will not be sold with an up-front commission or fee. However, we expect to pay a portion of the Adjustment Factor as a commission to brokerage firms, which may include Deutsche Bank Securities Inc., and their affiliates, whose clients purchase securities in this offering and who continue to hold their securities. For more detailed information about discounts and commissions, please see “Supplemental Underwriting Information (Conflicts of Interest)” in this term sheet. |

The agent for this offering is our affiliate. For more information see “Supplemental Underwriting Information (Conflicts of Interest)” in this term sheet.

The securities are not bank deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency.

December 22, 2010

ADDITIONAL TERMS SPECIFIC TO THE SECURITIES

| | • | You should read this term sheet together with underlying supplement no. 2 dated September 29, 2009, product supplement R dated September 30, 2009, the prospectus supplement dated September 29, 2009 relating to our Series A global notes of which these securities are a part and the prospectus dated September 29, 2009. You may access these documents on the SEC website at www.sec.gov as follows (or if such address has changed, by reviewing our filings for the relevant date on the SEC website): |

| | • | Underlying supplement no. 2 dated September 29, 2009: |

| | • | Product supplement R dated September 30, 2009: |

| | • | Prospectus supplement dated September 29, 2009: |

| | • | Prospectus dated September 29, 2009: |

| | • | Our Central Index Key, or CIK, on the SEC website is 0001159508. As used in this term sheet, “we,” “us” or “our” refers to Deutsche Bank AG, including, as the context requires, acting through one of its branches. |

| | • | This term sheet, together with the documents listed above, contains the terms of the securities and supersedes all other prior or contemporaneous oral statements as well as any other written materials including preliminary or indicative pricing terms, correspondence, trade ideas, structures for implementation, sample structures, brochures or other educational materials of ours. You should carefully consider, among other things, the matters set forth in “Risk Factors” in the accompanying product supplement, as the securities involve risks not associated with conventional debt securities. We urge you to consult your investment, legal, tax, accounting and other advisers before deciding to invest in the securities. |

| | • | Deutsche Bank AG has filed a registration statement (including a prospectus) with the Securities and Exchange Commission, or SEC, for the offering to which this term sheet relates. Before you invest, you should read the prospectus in that registration statement and the other documents relating to this offering that Deutsche Bank AG has filed with the SEC for more complete information about Deutsche Bank AG and this offering. You may obtain these documents without cost by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, Deutsche Bank AG, any agent or any dealer participating in this offering will arrange to send you the prospectus, prospectus supplement, product supplement and this term sheet if you so request by calling toll-free 1-800-311-4409. |

| | • | You may revoke your offer to purchase the securities at any time prior to the time at which we accept such offer by notifying the applicable agent. We reserve the right to change the terms of, or reject any offer to purchase, the securities prior to their issuance. We will notify you in the event of any changes to the terms of the securities, and you will be asked to accept such changes in connection with your purchase of any securities. You may also choose to reject such changes, in which case we may reject your offer to purchase the securities. |

What Is the Redemption Amount on the Securities Assuming a Range of Performance for the Index?

The following table illustrates the hypothetical Redemption Amount per $10,000 Face Amount, for a hypothetical range of performance for the Index from -100% to +100%. The hypothetical Redemption Amounts set forth below assume an Initial Level of 1,670.00 and a period of 1,096 calendar days from the Trade Date to the Final Valuation Date and that the holder of the securities does not exercise the early redemption right. The actual Initial Level will be determined on the Trade Date. The hypothetical Redemption Amounts set forth below are for illustrative purposes only and may not be the actual Redemption Amounts applicable to a purchaser of the securities. The numbers appearing in the following table and examples have been rounded for ease of analysis.

| Final Index Level | Percent Change in Index | Adjustment Factor | Redemption Amount | Return on Securities |

| 3,340.00 | 100.00% | 6.01% | $19,399.45 | 93.99% |

| 3,173.00 | 90.00% | 6.01% | $18,399.45 | 83.99% |

| 3,006.00 | 80.00% | 6.01% | $17,399.45 | 73.99% |

| 2,839.00 | 70.00% | 6.01% | $16,399.45 | 63.99% |

| 2,672.00 | 60.00% | 6.01% | $15,399.45 | 53.99% |

| 2,505.00 | 50.00% | 6.01% | $14,399.45 | 43.99% |

| 2,338.00 | 40.00% | 6.01% | $13,399.45 | 33.99% |

| 2,171.00 | 30.00% | 6.01% | $12,399.45 | 23.99% |

| 2,004.00 | 20.00% | 6.01% | $11,399.45 | 13.99% |

| 1,837.00 | 10.00% | 6.01% | $10,399.45 | 3.99% |

| 1,670.00 | 0.00% | 6.01% | $9,399.45 | -6.01% |

| 1,503.00 | -10.00% | 6.01% | $8,399.45 | -16.01% |

| 1,336.00 | -20.00% | 6.01% | $7,399.45 | -26.01% |

| 1,169.00 | -30.00% | 6.01% | $6,399.45 | -36.01% |

| 1,002.00 | -40.00% | 6.01% | $5,399.45 | -46.01% |

| 835.00 | -50.00% | 6.01% | $4,399.45 | -56.01% |

| 668.00 | -60.00% | 6.01% | $3,399.45 | -66.01% |

| 501.00 | -70.00% | 6.01% | $2,399.45 | -76.01% |

| 334.00 | -80.00% | 6.01% | $1,399.45 | -86.01% |

| 167.00 | -90.00% | 6.01% | $399.45 | -96.01% |

| 0.00 | -100.00% | 6.01% | $0.00 | -100.00% |

Hypothetical Examples of Redemption Amounts

The following examples illustrate how the Redemption Amounts set forth in the table above is calculated.

Example 1: The level of the Index increases 50.00% from the Initial Level of 1,670.00 to a Final Level of 2,505.00. Assuming a period of 1,096 calendar days from the Trade Date to the Final Valuation Date and no early redemption, the holder receives a Redemption Amount of $14,399.45 per $10,000 Face Amount, calculated as follows:

$10,000 + $10,000 x ((2,505.00 / 1,670.00 - 1) - (0.02 x (1,096/365))) = $14,399.45

Example 2: The Initial Level and the Final Level of the Index are both 1,670.00 such that the Index Return is 0%. If the Index Return is 0%, the investor will receive a Redemption Amount that is less than $10,000 per $10,000 Face Amount due to the Adjustment Factor. Assuming a period of 1,096 calendar days from the Trade Date to the Final Valuation Date and no early redemption, the holder receives a Redemption Amount of $9,399.45 per $10,000 Face Amount, calculated as follows:

$10,000 + $10,000 x ((1,670.00 / 1,670.00 - 1) - (0.02 x (1,096/365))) = $9,399.45

Example 3: The level of the Index decreases 30.00% from the Initial Level of 1,670.00 to a Final Level of 1,169.00. Assuming a period of 1,096 calendar days from the Trade Date to the Final Valuation Date and no early redemption, the holder receives a Redemption Amount of $6,399.45 per $10,000 Face Amount, calculated as follows:

$10,000 + $10,000 x ((1,169.00 / 1,670.00 - 1) - (0.02 x (1,096/365))) = $6,399.45

Selected Purchase Considerations

| | • | THE ADJUSTMENT FACTOR REDUCES THE PAYMENT AT MATURITY OR UPON EARLY REDEMPTION — The payment at maturity or upon early redemption will be reduced by approximately 2.00% for each year the securities remain outstanding. Because the Adjustment Factor is applied to the value of the Index Return on the Final Valuation Date or an Early Redemption Valuation Date, as applicable, the Adjustment Factor will reduce the return on the securities regardless of whether the Final Level on the Final Valuation Date or on an Early Redemption Valuation Date, as applicable, is greater than the Initial Level. Because the securities are our senior unsecured obligations, payment of any amount at maturity or upon an early redemption is subject to our ability to pay our obligations as they become due. |

| | • | RETURN LINKED TO THE PERFORMANCE OF THE DEUTSCHE BANK LIQUID COMMODITY INDEX – MEAN REVERSION™ TOTAL RETURN — The return on the securities is linked to the Deutsche Bank Liquid Commodity Index – Mean Reversion™ Total Return (the “Index”). The Index is composed of futures contracts on six commodities – Heating Oil, Crude Oil, Aluminum, Gold, Wheat and Corn (the “Index Constituents”). The Index’s closing level is calculated on a “total return” basis. |

On December 20, 2010, the Instrument Amounts for the exchange traded instruments relating to the respective Index Constituents were as follows:

| Index Constituent | Exchange | Instrument Amount |

| Heating Oil | NYMEX | 23.74% |

| Crude Oil | NYMEX | 30.88% |

| Aluminum | LME | 20.37% |

| Gold | COMEX | 1.46% |

| Corn | CBOT | 10.01% |

| Wheat | CBOT | 13.54% |

For more information on the Index, including its calculation methodology, see “The Deutsche Bank Liquid Commodity Index – Mean Reversion™” in underlying supplement no. 2. Terms relating to the Index used but not defined in this term sheet are defined in underlying supplement no. 2.

| | • | A COMMODITY HEDGING DISRUPTION EVENT MAY RESULT IN ACCELERATION OF THE SECURITIES — If a Commodity Hedging Disruption Event (as defined under “Description of Securities – Adjustments to Index Valuation Dates and Payment Dates – Commodity Hedging Disruption Events for Commodity Based Index” in the accompanying product supplement) occurs, we will have the right, but not the obligation, to accelerate the payment on the securities. The amount due and payable per $10,000 Face Amount of securities upon such early acceleration will be determined by the calculation agent in good faith in a commercially reasonable manner on the date on which we deliver notice of such acceleration and will be payable on the fifth business day following the day on which the calculation agent delivers notice of such acceleration. |

| | Please see the risk factor entitled “Commodity Futures Contracts are Subject to Uncertain Legal and Regulatory Regimes, Which May Result in a Hedging Disruption Event and a Loss on Your Investment” in this term sheet for more information. |

| | • | TAX CONSEQUENCES — You should review carefully the section of the accompanying product supplement entitled “U.S. Federal Income Tax Consequences,” bearing in mind that the coupon rate on your securities is zero. Although the tax consequences of an investment in the securities are uncertain, we believe it is reasonable to treat the securities as prepaid financial contracts for U.S. federal income tax purposes. Under this treatment, (i) you should not recognize taxable income or loss prior to the maturity of your securities, other than pursuant to a sale or exchange (including upon early redemption), and (ii) your gain or loss on the securities should be capital gain or loss and should be long-term capital gain or loss if you have held the securities for more than one year. If, however, the Internal Revenue Service (the “IRS”) were successful in asserting an alternative treatment for the securities, the tax consequences of ownership and disposition of the securities might be affected materially and adversely. We do not plan to request a ruling from the IRS, and the IRS or a court might not agree with the tax treatment described in this term sheet and the accompanying product supplement. |

| | In 2007, Treasury and the IRS released a notice requesting comments on various issues regarding the U.S. federal income tax treatment of “prepaid forward contracts” and similar instruments, which may include the securities. The notice focuses in particular on whether to require holders of these instruments to accrue income over the term of their investment. It also asks for comments on a number of related topics, including the character of income or loss with respect to these instruments; the relevance of factors such as the nature of the underlying property to which the instruments are linked; the degree, if any, to which income (including any mandated accruals) realized by non-U.S. persons should be subject to withholding tax; and whether these instruments are or should be subject to the “constructive ownership” regime, which very generally can operate to |

recharacterize certain long-term capital gain as ordinary income and impose an interest charge. While the notice requests comments on appropriate transition rules and effective dates, any Treasury regulations or other guidance promulgated after consideration of these issues could materially and adversely affect the tax consequences of an investment in the securities, possibly with retroactive effect.

| | Recently enacted legislation requires certain individuals who hold “debt or equity interests” in any “foreign financial institution” that are not “regularly traded on an established securities market” to report information about such holdings on their U.S. federal income tax returns, generally for tax years beginning in 2011, unless a regulatory exemption is provided. Individuals who purchase the securities should consult their tax advisers regarding this legislation. |

| | Under current law, the United Kingdom will not impose withholding tax on payments made with respect to the securities. |

| | For a discussion of certain German tax considerations relating to the securities, you should refer to the section in the accompanying prospectus supplement entitled “Taxation by Germany of Non-Resident Holders.” |

| | We do not provide any advice on tax matters. Prospective investors should consult their tax advisers regarding the U.S. federal tax consequences of an investment in the securities (including possible alternative treatments and the issues presented by the 2007 notice), as well as tax consequences arising under the laws of any state, local or non-U.S. taxing jurisdiction. |

Selected Risk Considerations

An investment in the securities involves significant risks. Investing in the securities is not equivalent to investing directly in the Index or any of the components of the Index. These risks are explained in more detail in the “Risk Factors” section of the accompanying product supplement.

| | • | YOUR INVESTMENT IN THE SECURITIES MAY RESULT IN A LOSS — The securities do not guarantee any return of your initial investment. The return on the securities at maturity or upon an early redemption is linked to the performance of the Index and will depend on whether, and the extent to which, the Index Return is positive or negative. Your investment will be fully exposed to any decline in the Final Level determined on the Final Valuation Date or the Early Redemption Valuation Date, as applicable, as compared to the Initial Level. Accordingly, you could lose up to $10,000 for each $10,000 that you invest. Payment of any amount at maturity or upon early redemption is subject to our ability to meet our obligations as they become due. |

| | • | THE INCLUSION OF AN ADJUSTMENT FACTOR REDUCES THE PAYMENT AT MATURITY OR UPON EARLY REDEMPTION — The payment at maturity or upon early redemption will be reduced by approximately 2.00% for each year the securities remain outstanding. Since the Adjustment Factor is applied to the value of the Index Return on the Final Valuation Date or the Early Redemption Valuation Date, as applicable, the Adjustment Factor will reduce the return on the securities regardless of whether the Final Level on the Final Valuation Date or on the Early Redemption Valuation Date, as applicable, is greater than the Initial Level. The securities have a term from the Trade Date to the Final Valuation Date of approximately three years, so the total return at maturity will be reduced by approximately 6.01% compared to the total return if the Adjustment Factor had not been applied. Consequently, at maturity, you will receive less than your original investment unless the Final Level determined on the Final Valuation Date is approximately 6.01% or more greater than the Initial Level. |

| | • | THE VALUE OF THE SECURITIES IS SUBJECT TO OUR CREDITWORTHINESS — An actual or anticipated downgrade in our credit rating will likely have an adverse effect on the market value of the securities. The payment at maturity or upon early redemption of the securities is subject to our creditworthiness. |

| | • | TRADING BY US OR OUR AFFILIATES IN THE COMMODITIES MARKETS MAY IMPAIR THE VALUE OF THE SECURITIES — We and our affiliates are active participants in the commodities markets as dealers, proprietary traders and agents for our customers, and therefore at any given time we may be a party to one or more commodities transactions. In addition, we or one or more of our affiliates may hedge our commodity exposure from the securities by entering into various transactions, such as over-the-counter options or futures. We may adjust these hedges at any time and from time to time. Our trading and hedging activities may have a material adverse effect on the commodities prices and have a potentially negative impact on the performance of the Index. It is possible that we or our affiliates could receive significant returns from these hedging activities while the value of or amou nts payable under the securities declines. We or our affiliates may also issue or underwrite other securities or financial or derivative instruments with returns linked or related to changes in commodity prices. By introducing competing products into the marketplace in this manner, we or our affiliates could adversely affect the value of the securities. Any of the foregoing activities described in this paragraph may reflect trading strategies that differ from, or are in direct opposition to, the trading strategy of investors in the securities. |

| | • | ADJUSTMENTS TO THE WEIGHTS OF THE EXCHANGE TRADED INSTRUMENTS INCLUDED IN THE INDEX MAY LIMIT THE INDEX RETURN AND, CONSEQUENTLY, THE RETURN ON THE SECURITIES — During the term of the securities, the methodology of the Index may require adjustments to the weights of the futures contracts included in the Index. In particular, the weight of a futures contract may be increased when its price is historically low or decreased when its price is historically high. These adjustments may limit potential increases to the value of the Index during certain periods and could adversely affect the Index Return. See “The Deutsche Bank Liquid Commodity Index – Mean Reversion™ – Determining the Instrument Amount on a DBLCI Rebalancing Day” in underlying supplement no. 2. |

| | • | THE YIELD ON THE SECURITIES MAY BE LOWER THAN THE YIELD ON DEBT SECURITIES OF COMPARABLE MATURITY AND MAY BE ZERO OR NEGATIVE — The yield to the Maturity Date on the securities may be lower than the yield on our conventional debt securities of a comparable maturity and credit rating. At maturity, you will receive a positive return on your investment only if the Final Level on the Final Valuation Date exceeds the Initial Level by approximately 6.01% or more. If you choose to exercise your early redemption right, you will receive a positive return on your investment only if the Final Level on the Early Redemption Valuation Date exceeds the Initial Level by an amount sufficient to entirely offset the effect of the Adjustment Factor. If the Final Level on the Final Valuation Date or the Early Redemption Valuation Date, as applicable, is equal to the Initial Level , you will receive a negative return on your investment due to the Adjustment Factor. Even if the applicable Final Level is greater than the Initial Level by an amount sufficient to |

entirely offset the Adjustment Factor, the yield to the Maturity Date may not fully compensate you for any opportunity cost, taking into account inflation and other factors relating to the time value of money.

| | • | CERTAIN BUILT-IN COSTS ARE LIKELY TO ADVERSELY AFFECT THE VALUE OF THE SECURITIES PRIOR TO MATURITY — While the Payment at Maturity described in this term sheet is based on the full Face Amount of your securities, the original Issue Price of the securities includes the commissions, discounts and fees, if any, and the expected cost of hedging our obligations under the securities through one or more of our affiliates. As a result, the price, if any, at which Deutsche Bank AG or its affiliates, will be willing to purchase securities from you in secondary market transactions will likely be lower than the original Issue Price, and any sale prior to the Maturity Date could result in a substantial loss to you. The securities are not designed to be short-term trading instruments. Accordingly, you should be willing and able to hold your securities to maturity. |

| | • | DEUTSCHE BANK LIQUID COMMODITY INDEX – MEAN REVERSION™ TOTAL RETURN HAS LIMITED PERFORMANCE HISTORY — Publication of the Index began in February 2003. Therefore, the Index has limited performance history, and no actual investment which allowed a tracking of the performance of the Index was possible before that date. |

| | • | NO COUPON PAYMENTS — As a holder of the securities, you will not receive coupon payments. |

| | • | THE SECURITIES WILL NOT BE LISTED AND THERE WILL LIKELY BE LIMITED LIQUIDITY — The securities will not be listed on any securities exchange. Deutsche Bank AG or its affiliates may offer to purchase the securities in the secondary market but are not required to do so and may cease such market-making activities at any time. Even if there is a secondary market, it may not provide enough liquidity to allow you to trade or sell the securities easily. Because other dealers are not likely to make a secondary market for the securities, the price at which you may be able to trade your securities is likely to depend on the price, if any, at which Deutsche Bank AG or its affiliates are willing to buy the securities. |

| | • | COMMODITY FUTURES CONTRACTS ARE SUBJECT TO UNCERTAIN LEGAL AND REGULATORY REGIMES, WHICH MAY RESULT IN A HEDGING DISRUPTION EVENT AND A LOSS ON YOUR INVESTMENT — The commodity futures contracts that comprise the components of the Index are subject to legal and regulatory regimes in the United States and, in some cases, in other countries that may change in ways that could adversely affect our ability to hedge our obligations under the securities. The effect on the value of the securities of any future regulatory change, including but not limited to changes resulting from the Dodd-Frank Wall Street Reform and Consumer Protection Act, which was enacted on July 21, 2010, is impossible to predict, but could be substantial and adverse to your interest. For example, we may become subject to position limits on certain commodities (s uch as energy commodities) and the manner in which current exemptions for bona fide hedging transactions or positions are implemented. Such restrictions may cause us or our affiliates to be unable to effect transactions necessary to hedge our obligations under the securities, in which case we may, in our sole and absolute discretion, accelerate the payment on the securities early and pay you an amount determined in good faith and in a commercially reasonable manner by the calculation agent. If the payment on the securities is accelerated, your investment may result in a loss and you may not be able to reinvest your money in a comparable investment. Please see “Description of Securities — Adjustments to Index Valuation Dates and Payment Dates — Commodity Hedging Disruption Events for Commodity Based Index” in the accompanying product supplement. |

| | • | WE AND OUR AFFILIATES AND AGENTS MAY PUBLISH RESEARCH, EXPRESS OPINIONS OR PROVIDE RECOMMENDATIONS THAT ARE INCONSISTENT WITH INVESTING IN OR HOLDING THE SECURITIES. ANY SUCH RESEARCH, OPINIONS OR RECOMMENDATIONS COULD AFFECT THE LEVEL OF THE INDEX TO WHICH THE SECURITIES ARE LINKED OR THE MARKET VALUE OF THE SECURITIES — Deutsche Bank AG, its affiliates and agents publish research from time to time on financial markets and other matters that may influence the value of the securities, or express opinions or provide recommendations that are inconsistent with purchasing or holding the securities. Deutsche Bank AG, its affiliates and agents may have published research or other opinions that are inconsistent with the investment view implicit in the securities. Any research, opinions or recommendations expressed by Deutsche Bank AG, its affiliates or agents may not be consistent with each other and may be modified from time to time without notice. Investors should make their own independent investigation of the merits of investing in the securities and the Index to which the securities are linked. |

| | • | NO RIGHTS IN EXCHANGE-TRADED FUTURES CONTRACTS ON THE INDEX CONSTITUENTS — As an owner of the securities, you will not have any rights that holders of exchange-traded futures contracts on the commodities included in the Index may have. |

| | • | THE BROKERAGE FIRM THROUGH WHICH YOU HOLD YOUR SECURITIES AND YOUR BROKER MAY HAVE ECONOMIC INTERESTS THAT ARE DIFFERENT FROM YOURS — We expect to pay a portion of the Adjustment Factor as a commission on a quarterly basis to brokerage firms, which may include Deutsche Bank Securities Inc. (“DBSI”), and their affiliates, whose clients purchase securities in this offering and who continue |

to hold their securities. We expect that the brokerage firm through which you hold your securities will pay a portion of these commissions to your broker. As a result of these arrangements, the brokerage firm through which you hold your securities and your broker may have economic interests that are different than yours. As with any security or investment for which the commission is paid over time, your brokerage firm and your broker may have an incentive to encourage you to continue to hold the securities because they will no longer receive these quarterly commissions if you sell or redeem your securities. You should take the above arrangements and the potentially different economic interests they create into account when considering an investment in the securities. For more information about the payment of these commissions, see “ ;Supplemental Underwriting Information (Conflicts of Interest)” in this term sheet.

| | • | POTENTIAL CONFLICTS OF INTEREST EXIST BECAUSE WE, THE CALCULATION AGENT FOR THE SECURITIES, THE SPONSOR OF THE INDEX AND THE CALCULATION AGENT FOR THE INDEX ARE THE SAME LEGAL ENTITY — Deutsche Bank AG, London Branch is the Issuer of the securities, the calculation agent for the securities, the sponsor of the Index (the “Sponsor”) and the calculation agent for the Index. We, as calculation agent for the securities, will determine whether there has been a Market Disruption Event with respect to the Index or exchange traded instruments relating to the respective Index Constituents or a Hedging Disruption Event with respect to the securities. In such event, we may use an alternate method to calculate the Index closing level, including the Initial Level and the Final Level, and the payment due on the securities. As the Sponsor, we carry out calculations necessary to promulgate the Index, and we maintain some discretion as to how such calculations are made. In particular, the Sponsor has discretion in selecting among methods of how to calculate the Index in the event the regular means of determining the Index is unavailable at the time such determination is scheduled to take place, and the Sponsor has even more discretion in the case of a Force Majeure Event relating to the Index. While Deutsche Bank AG, London Branch will act in good faith and in a commercially reasonable manner in making all determinations with respect to the securities and the Index, there can be no assurance that any determinations made by Deutsche Bank AG, London Branch in these various capacities will not affect the value of the securities or the Index. Because determinations made by Deutsche Bank AG, London Branch as the calculation agent for the securities, Sponsor of the Index and the calculation agent for the Index may affect the Payment at Maturity, potential conflicts of interest may exist between Deutsche Bank AG, London Branch and you, as a holder of the securities. |

Furthermore, Deutsche Bank AG, London Branch or one or more of its affiliates may have published, and may in the future publish, research reports on the Index Constituents (or various contracts or products related to the Index Constituents) or related indices. This research is modified from time to time without notice and may express opinions or provide recommendations that are inconsistent with purchasing or holding the securities. Any of these activities may affect the value of the Index and, therefore, the value of the securities or the potential payout on the securities.

| | • | OUR ACTIONS AS CALCULATION AGENT AND OUR HEDGING ACTIVITY MAY ADVERSELY AFFECT THE VALUE OF THE SECURITIES — We and our affiliates play a variety of roles in connection with the issuance of the securities, including acting as calculation agent and hedging our obligations under the securities. In performing these duties, the economic interests of the calculation agent and other affiliates of ours are potentially adverse to your interests as an investor in the securities. |

| | • | LEGAL AND REGULATORY CHANGES COULD IMPAIR THE VALUES OF THE INDEX CONSTITUENTS — Legal and regulatory changes could adversely affect commodity prices. In addition, many governmental agencies and regulatory organizations are authorized to take extraordinary actions in the event of market emergencies. It is not possible to predict the effect of any future legal or regulatory action relating to commodities, but any such action could cause unexpected volatility and instability in commodity markets, with a substantial and adverse effect on the performance of the Index and, consequently, the value of the securities. |

| | • | THE VALUE OF THE SECURITIES WILL BE AFFECTED BY A NUMBER OF UNPREDICTABLE FACTORS — The value of the securities will be affected by the supply of and demand for the securities and other factors, many of which are independent of our financial condition and results of operations, including: |

| | • | the levels of the Index; |

| | • | trends of supply and demand for the Index Constituents; |

| | • | geopolitical conditions and economic, financial, political, regulatory and judicial events that affect the Index Constituents or commodities markets generally; |

| | • | the interest rates then prevailing in the market; |

| | • | the time remaining to maturity of the securities; |

| | • | the volatility of, and correlation among, the prices of the Index Constituents; |

| | • | the expected volatility of the Index; and |

| | • | our creditworthiness, including actual or anticipated downgrades in our credit ratings. |

| | • | THE CORRELATION AMONG THE INDEX CONSTITUENTS COULD CHANGE UNPREDICTABLY — Correlation is the extent to which the values of the Index Constituents increase or decrease to the same degree at the same time. If the correlation among the Index Constituents changes, the value of the securities may be adversely affected. |

| | • | THE RETURN ON YOUR INVESTMENT COULD BE SIGNIFICANTLY LESS THAN THE PERFORMANCE OF THE INDEX OR CERTAIN COMPONENTS OF THE INDEX — The return on your investment in the securities could be significantly less than the return on an alternative investment with similar risk characteristics, even if some of the futures contracts reflected in the Index, or the commodities underlying such futures contracts, have generated significant returns. The levels of such futures contracts and such commodities may move in different directions at different times compared to each other, and underperformance by one or more of the futures contracts included in the Index may reduce the performance of the Index as a whole. |

| | • | COMMODITY PRICES MAY CHANGE UNPREDICTABLY — Market prices of the Index Constituents may fluctuate rapidly based on numerous factors, including changes in supply and demand relationships, weather, trends in agriculture and trade, fiscal, monetary and exchange control programs, domestic and foreign political and economic events and policies, disease, pestilence, technological developments and changes in interest rates. These factors may affect the values of the related contracts reflected in the Index and the value of your securities in varying ways, and different factors may cause the values of the Index Constituents and the volatility of their prices to move in inconsistent directions at inconsistent rates. |

| | • | THE MARKETS FOR THE UNDERLYING COMMODITIES SUFFER FROM SYSTEMIC RISKS — Changes in supply and demand can have significant adverse effects on the prices of commodities. In addition, commodities tend to be exposed to the risk of fluctuations in currency exchange rates, volatility from speculative activities and the risk that substitutes for the commodities in their common uses will become more widely available or comparatively less expensive. Corn and wheat prices are often heavily affected by weather, crop yields, natural disasters, pestilence and technological developments, as well as government policies regarding agriculture, energy, trade, fiscal and monetary issues, particularly with regard to subsidies and tariffs. In addition, there are many risks specific to the individual underlying commodities. |

| | • | Corn: Corn is primarily used as a livestock feed but is also processed into food and industrial products, including starches, sweeteners, corn oil, beverage and industrial alcohol, and fuel ethanol. Demand for corn is influenced by a variety of factors including the level of global livestock production, the level of human consumption of corn and corn-derived products and, in the case of demand for production into ethanol, demand for corn as the basis for ethanol. The supply of corn is dominated by the United States, China, Central and South America and the European Union. |

| | • | Wheat: Global supply of, and demand for, wheat are generally driven by global grain production, population growth and economic activity. Alternative uses for grains such as energy sources or in manufacturing also drive the prices for grains. |

| | • | Aluminum: Changes in the levels of global industrial activity and adjustments to inventory in response to changes in economic activity and/or pricing levels can cause a great deal of volatility in the demand for the aluminum. The automobile, packaging and construction sectors are particularly important to the demand for aluminum. The supply of aluminum is widely spread around the world, and the principal factor dictating the smelting of such aluminum is the ready availability of inexpensive power. The supply of aluminum is also affected by current and previous price levels, which will influence investment decisions in new smelters. Other factors influencing supply include droughts, transportation problems and shortages of power and raw materials. |

| | • | Crude Oil: Demand for refined petroleum products by consumers, as well as the agricultural, manufacturing and transportation industries, affects the price of crude oil. Crude oil’s end-use as a refined product is often as transport fuel, industrial fuel and in-home heating fuel. Because the precursors of demand for petroleum products are linked to economic activity, demand will tend to reflect economic conditions. Demand is also influenced by government regulations, such as environmental or consumption policies. In addition to general economic activity and demand, prices for crude oil are affected by political events, labor activity and, in particular, direct government intervention (such as embargos) or supply disruptions in major oil producing regions of the world. Such events tend to affect oil prices worldwide, regardless of the location of the event. Supply for crude oil may increase or decrease depending on ma ny factors. These include production decisions by the Organization of Oil and Petroleum Exporting Countries and other crude oil producers. In the event of sudden disruptions in the supplies of oil, such as those caused by war, natural events, accidents or acts of terrorism, prices of oil futures contracts could become extremely volatile and unpredictable. Also, sudden and dramatic changes in the futures market may occur, for example, upon a cessation of hostilities that may exist in countries producing oil, the introduction of new or previously |

withheld supplies into the market or the introduction of substitute products or commodities. West Texas Intermediate light sweet crude oil is also subject to the risk that it has demonstrated a lack of correlation with world crude oil prices due to structural differences between the U.S. market for crude oil and the international market for crude oil. We can give no assurance that the settlement price will not be more volatile than world crude oil prices generally.

| | • | Heating Oil: Demand for heating oil depends heavily on the level of global industrial activity and the seasonal temperatures in countries throughout the world. Heating oil is derived from crude oil and as such, any factors that influence the supply of crude oil may also influence the supply of heating oil. |

| | • | Gold: Gold prices are affected by numerous factors, including the relative strength of the U.S. dollar (in which gold prices are generally quoted) to other currencies, industrial and jewelry demand, expectations with regard to the rate of inflation, interest rates and transactions by central banks and other governmental or multinational agencies that hold gold. The market for gold bullion is global, and gold prices are affected by macroeconomic factors such as the structure of and confidence in the global monetary system and gold borrowing and lending rates. |

| | • | THE ABSENCE OF BACKWARDATION OR PRESENCE OF CONTANGO IN THE MARKETS FOR FUTURES CONTRACTS INCLUDED IN THE INDEX WILL ADVERSELY AFFECT THE LEVEL OF THE INDEX — As the futures contracts that underlie the Index near expiration, they are replaced by contracts that have a later expiration. Thus, for example, a contract purchased and held in December 2010 may specify a January 2011 expiration. As that contract nears expiration, it may be replaced by selling the January 2011 contract and purchasing the contract expiring in March 2011. This process is referred to as “rolling.” Historically, the prices of some futures contracts have frequently been higher for contracts with shorter-term expirations than for contracts with longer-term expirations, which is referred to as “backwardation.” In t hese circumstances, absent other factors, the sale of the January 2011 contract would take place at a price that is higher than the price at which the March 2011 contract is purchased, thereby creating a gain in connection with rolling. While certain futures contracts included in the Index have historically exhibited consistent periods of backwardation, backwardation will likely not exist in these markets at all times. The absence of backwardation in the markets for these futures contracts will adversely affect the levels of the Index and, accordingly, decrease the value of your securities. Conversely, some futures contracts included in the Index have historically exhibited “contango” markets rather than backwardation. Contango markets are those in which the prices of contracts are higher in the distant delivery months than in the nearer delivery months due to the costs of long-term storage of a physical commodity prior to delivery or other factors. The presence of contango in the markets for the se futures contracts will adversely affect the levels of the Index and, accordingly, decrease the value of your securities. |

| | • | THE LONDON METAL EXCHANGE DOES NOT HAVE DAILY PRICE LIMITS — The official cash offer prices of aluminum are determined by reference to the per unit U.S. dollar cash offer prices of contracts traded on The London Metal Exchange, which we refer to as the LME. The LME is a principals’ market that operates in a manner more closely analogous to the over-the-counter physical commodity markets than regulated futures markets. For example, there are no daily price limits on the LME, which would otherwise restrict the extent of daily fluctuations in the prices of LME contracts. In a declining market, therefore, it is possible that prices would continue to decline without limitation within a trading day or over a period of trading days. In addition, a contract may be entered into on the LME calling for delivery on any day from one day to three months following the d ate of such contract and for monthly delivery in any of the next 16 to 24 months (depending on the commodity) following such third month, in contrast to trading on futures exchanges, which call for delivery in stated delivery months. As a result, there may be a greater risk of a concentration of positions in LME contracts on particular delivery dates, which in turn could cause temporary aberrations in the prices of LME contracts for certain delivery dates. If such aberrations occur on the Final Valuation Date, the per unit U.S. dollar cash offer prices used to determine the official cash offer price of aluminum and, consequently, the payment to you at maturity, could be adversely affected. |

| | • | THE COMMODITY PRICES REFLECTED IN THE INDEX ARE SUBJECT TO EMERGING MARKETS’ POLITICAL AND ECONOMIC RISKS — The Index Constituents may be produced in emerging market countries that are more exposed to the risk of swift political change and economic downturns than their industrialized counterparts. Indeed, in recent years, many emerging market countries have undergone significant political, economic and social change. In many cases, far-reaching political changes have resulted in constitutional and social tensions and in some cases, instability and reaction against market reforms has occurred. There can be no assurance that future political changes will not adversely affect the economic conditions of an emerging market country. Political or economic instability is likely to adversely impact the level of the Index and, potentially, the return on your invest ment. |

| | • | IF THE LIQUIDITY OF THE INDEX CONSTITUENTS IS LIMITED, THE VALUE OF THE SECURITIES WOULD LIKELY BE IMPAIRED, AND THIS COULD RESULT IN POTENTIAL CONFLICTS OF INTEREST — Commodities and derivatives contracts on commodities may be difficult to buy or sell, particularly during adverse |

market conditions. Reduced liquidity on the Final Valuation Date or an Early Redemption Valuation Date, as applicable, would likely have an adverse effect on the level of the Index and, therefore, on the return on your securities. Limited liquidity relating to the Index Constituents may also result in the Sponsor being unable to determine the level of the Index using its normal means. The resulting discretion by the Sponsor in determining the Final Level could, in turn, result in potential conflicts of interest.

| | • | SUSPENSION OR DISRUPTIONS OF MARKET TRADING IN THE COMMODITY AND RELATED FUTURES MARKETS MAY ADVERSELY AFFECT THE VALUE OF THE SECURITIES — The commodity markets are subject to temporary distortions or other disruptions due to various factors, including the lack of liquidity in the markets, the participation of speculators and government regulation and intervention. In addition, U.S. futures exchanges and some foreign exchanges have regulations that limit the amount of fluctuation in futures contract prices that may occur during a single business day. These limits are generally referred to as “daily price fluctuation limits” and the maximum or minimum price of a contract on any given day as a result of these limits is referred to as a “limit price.” Once the limit price has been reached in a particular contract, no trades may be made at a different price. Limit prices have the effect of precluding trading in a particular contract or forcing the liquidation of contracts at disadvantageous times or prices. These circumstances could adversely affect the level of the Index and, therefore, the value of your securities. |

| | • | RISKS ASSOCIATED WITH THE INDEX MAY ADVERSELY AFFECT THE MARKET PRICE OF THE SECURITIES — Because the securities are linked to the Index, which reflects the return on futures contracts on six different exchange-traded physical commodities, it will be less diversified than other funds or investment portfolios investing in a broader range of products and, therefore, could experience greater volatility. |

| | • | THE U.S. FEDERAL INCOME TAX CONSEQUENCES OF AN INVESTMENT IN THE SECURITIES ARE UNCLEAR — There is no direct legal authority regarding the proper U.S. federal income tax treatment of the securities, and we do not plan to request a ruling from the IRS. Consequently, significant aspects of the tax treatment of the securities are uncertain, and the IRS or a court might not agree with the treatment of the securities as prepaid financial contracts. If the IRS were successful in asserting an alternative treatment for the securities, the tax consequences of ownership and disposition of the securities might be affected materially and adversely. In addition, as described above under “Tax Consequences,” in 2007 Treasury and the IRS released a notice requesting comments on various issues regarding the U.S. federal income tax treatment of “prepaid forward contracts” and similar instruments, which may include the securities. Any Treasury regulations or other guidance promulgated after consideration of these issues could materially and adversely affect the tax consequences of an investment in the securities, possibly with retroactive effect. Prospective investors should review carefully the section of the accompanying product supplement entitled “U.S. Federal Income Tax Consequences,” and consult their tax advisers regarding the U.S. federal income tax consequences of an investment in the securities (including possible alternative treatments and the issues presented by the 2007 notice), as well as tax consequences arising under the laws of any state, local or non-U.S. taxing jurisdiction. |

Historical Information

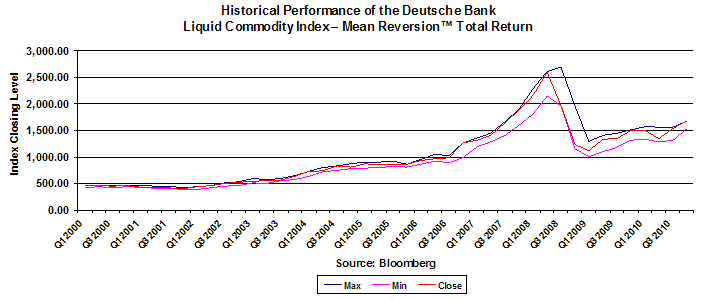

The following graph shows the historical high, low and period end closing levels of the Index for each calendar quarter from January 3, 2000 through December 20, 2010. Because the Index was launched in February 2003, data for the periods prior to the Index launch date are hypothetical and have been calculated using the same methodologies used to calculate the Index on an actual basis. The closing level of the Deutsche Bank Liquid Commodity Index – Mean Reversion™ Total Return on December 20, 2010 was 1,669.661.

Because the Index was launched in February 2003, the Sponsor has retrospectively calculated the levels of the Index based on actual historical commodity forward rates using the same methodology as described above. Although the Sponsor believes that these retrospective calculations represent accurately and fairly how the Index would have performed before February 2003, the Index and did not, in fact, exist before February 2003. All prospective investors should be aware that no actual investment that allowed a tracking of the performance of the Index was possible at anytime prior to February 2003. Past performance of the Index is no guarantee of future results.

The historical levels of the Index should not be taken as an indication of future performance, and no assurance can be given as to the closing level of the Index on any Early Redemption Valuation Date or the Final Valuation Date. We cannot give you assurance that the performance of the Index will result in the return of your initial investment.

Additional Terms of the Securities

Early Redemption

You will have the right to cause us to redeem your securities upon fourteen calendar days’ notice on February 6, 2012 and February 5, 2013 (each an “Early Redemption Date”). If any Early Redemption Date is not an Index business day, we shall redeem your securities on the first succeeding Index business day, subject to postponement in the event of a Market Disruption Event as described under “Description of Securities – Adjustments to Index Valuation Dates and Payment Dates – Market Disruption Events for Commodity Based Index” in the accompanying product supplement.

The Early Redemption Amount will be calculated using the Final Level and the Adjustment Factor applicable on the Early Redemption Valuation Date.

The Early Redemption Valuation Date for an early redemption will be the third Index business day prior to February 6, 2012 or February 5, 2013, as applicable, subject to postponement in the event of a Market Disruption Event as described under “Description of Securities – Adjustments to Index Valuation Dates and Payment Dates – Market Disruption Events for Commodity Based Index” in the accompanying product supplement.

Because the securities are represented by a global security, the Depository Trust Company (the “Depositary”) or the Depositary’s nominee will be the holder of the securities and therefore will be the only entity that can exercise the early redemption right. In order to ensure that the Depositary’s nominee will timely exercise the early redemption right, you must instruct your broker through which you hold your securities to notify the Depositary of your desire to exercise the early redemption right so that notice of redemption is received fourteen (14) calendar days prior to the applicable Early Redemption Date. Different firms have different cut-off times for accepting instructions from their customers and, accordingly, you should consult the broker or other direct or indirect par ticipant through which you hold your securities in order to ascertain the cut-off time by which an instruction must be given in order for timely notice to be delivered to the Depositary, which will in turn notify us of the exercise of the early redemption right.

In addition, DBSI intends to offer to purchase the securities in the secondary market, although it is not required to do so. In the event DBSI offers to purchase securities in the secondary market, DBSI anticipates that its purchase price will be based on the Redemption Amount calculated as if the date of repurchase was the Final Valuation Date, less a fee equal to 0.35% times the Face Amount, subject to adjustments deemed appropriate by DBSI in its sole discretion to reflect, among other things, then current market conditions and liquidity.

Supplemental Underwriting Information (Conflicts of Interest)

DBSI, acting as agent for Deutsche Bank AG, will not receive an up-front commission or fee in connection with the sale of the securities. However, we expect to pay a portion of the Adjustment Factor as a commission on a quarterly basis to brokerage firms, which may include DBSI, and their affiliates, whose clients purchased securities in this offering and who continue to hold their securities. See “Underwriting (Conflicts of Interest)” in the accompanying product supplement. After the Trade Date but prior to the Settlement Date, we may accept additional orders for the securities and increase the aggregate Face Amount.

The agent for this offering, DBSI, is our affiliate. In accordance with Rule 5121 of the Financial Industry Regulatory Authority Inc. (FINRA), DBSI may not make sales in this offering to any discretionary account without the prior written approval of the customer.

Settlement

We expect to deliver the securities against payment for the securities on the Settlement Date indicated above, which may be a date that is greater than three business days following the Trade Date. Under Rule 15c6-1 of the Securities Exchange Act of 1934, as amended, trades in the secondary market generally are required to settle in three business days, unless the parties to a trade expressly agree otherwise. Accordingly, purchasers who wish to transact in securities that are to be issued more than three business days after the Trade Date will be required to specify alternative settlement arrangements to prevent a failed settlement.