- DB Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

FWP Filing

Deutsche Bank (DB) FWPFree writing prospectus

Filed: 22 Dec 10, 12:00am

|

Issuer Free Writing Prospectus

Filed pursuant to Rule 433

Registration Statement No. 333-162195

Dated: December 22, 2010

Structured Solutions Snapshot

3-Year Market Contribution Securities (MCS) linked to the Deutsche Bank Liquid

Commodity Index --

Mean Reversion(TM) Total Return

Investment Rationale and Positioning

- --------------------------------------------------------------------------------

[] Commodities is not a homogenous asset class and comprises four distinct

sectors that have their unique fundamentals and follow their own business

cycles that are uncorrelated to other commodity sectors.

[] The Index employs a relative value trading strategy that seeks to extract

superior returns from the commodities markets.

[] The strategy allocates weight to 6 commodities using a non-discretionary,

rule-based formula aimed at assigning higher weight to cheap commodities

and lower weight to expensive commodities.

Description and Return Profile

- --------------------------------------------------------------------------------

The Market Contribution Securities linked to the Deutsche Bank Liquid Commodity

Index -- Mean Reversion(TM) (DBLCI-MR) Total Return (the "Index") offer clients:

[] A vehicle for expressing a moderately bullish view on the commodity

markets, specifically the Index, over the next 3 years.

[] Full participation in the upside and downside performance of the Index,

reduced by an Adjustment Factor of 2.00% each year the securities remain

outstanding (applied at Maturity or upon Early Redemption).

[] Best-Case Scenario: Participation in any positive index return, net of the

Adjustment Factor. The redemption amount of the securities is uncapped if

the Index increases in value.

[] Worst-Case Scenario: Full downside risk; if the Index falls below its

initial closing level, investors will participate dollar-for-dollar on the

downside, in addition to the deduction of the Adjustment Factor.

Key Terms

- --------------------------------------------------------------------------------

Issuer Deutsche Bank AG, London Branch

Underlying Deutsche Bank Liquid Commodity Index -- Mean

Reversion(TM) Total Return (Bloomberg: DBLCMMVL

Index (GO))

Subscription Period Closes 9:00 AM New York Time January 21, 2011

Maturity 3 Years, subject to Early Redemption

Investment Currency USD

Principal Protection None

Participation 100% in appreciation/depreciation of the Underlying

less an Adjustment Factor

Investment Amount $10,000 minimum with $1,000 increments thereafter

Early Redemption Redemption prior to Maturity at the option of the

investor, upon fourteen (14) calendar days notice, on

February 6, 2012 and February 5, 2013

Adjustment Factor 2.00% annually; applied at Maturity or upon any Early

Redemption.

Eligible Purchasers N.A.

IRA, ERISA eligible? No

Listing The securities will not be listed on any securities

exchange. Deutsche Bank Securities Inc. ("DBSI")

intends to offer to purchase the securities in the

secondary market but is not required to do so.

Purchases made by DBSI in the secondary market will

be subject to an additional 0.35% fee.

Fees The securities will not be sold with an up-front

commission or fee. However, we expect to pay a

portion of the Adjustment Factor as a commission to

brokerage firms, which may include Deutsche Bank

Securities Inc., and their affiliates, whose clients

purchase securities in this offering and who continue

to hold their securities. For more detailed

information about discounts and commissions, please

see "Supplemental Underwriting Information (Conflicts

of Interest)" in the accompanying term sheet no.

1046R.

- --------------------------------------------------------------------------------

Deutsche Bank AG has filed a registration statement (including a prospectus)

with the Securities and Exchange Commission, or SEC, for the offering to which

this document relates. Before you invest, you should read the prospectus in that

registration statement and the other documents relating to this offering that

Deutsche Bank AG has filed with the SEC for more complete information about

Deutsche Bank AG and this offering. You may obtain these documents without cost

by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, Deutsche

Bank AG, any agent or any dealer participating in this offering will arrange to

send you the prospectus, prospectus supplement, product supplement, underlying

supplement, term sheet and this document if you so request by calling toll-free

1-800-311-4409.

|

|

Benefits / Considerations

- --------------------------------------------------------------------------------

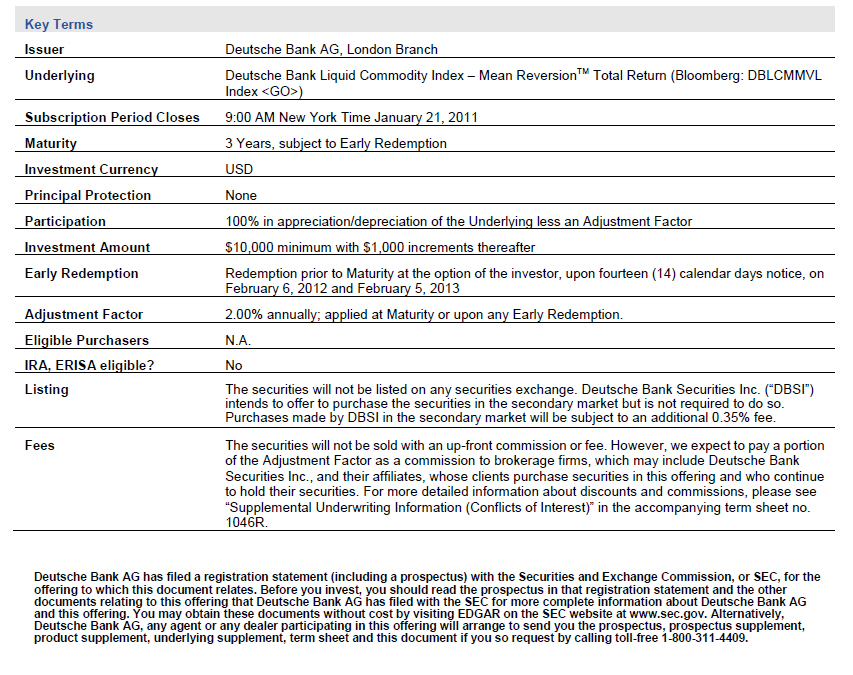

[] The DBLCI-MR (TM) Total Return Index became an investable index in

February, 2003. Annualized returns from January 2000 through February 2003

were retrospectively calculated. Hypothetical and past performance is not

indicative of future results.

[] Index levels are available daily on Bloomberg (DBLCMMVL Index (GO))

[] Annual Adjustment Factor of 2.00%. A fee of 0.35% will be applied to

purchases, if any, made by DBSI in the secondary market.

[] Tax Treatment: We believe it is reasonable to treat the securities as

prepaid financial contracts for U. S. federal income tax purposes. Assuming

this treatment is respected, gain or loss recognized upon a sale, exchange

or retirement (including an early redemption) generally should be treated

as capital gain or loss. You should review carefully the section of the

accompanying term sheet no. 1046R entitled "Tax Consequences. " Deutsche

Bank does not provide legal, tax or accounting advice.

Retrospective and Historical Performance of the

DBLCI-MR(TM) Total Return

- --------------------------------------------------------------------------------

[GRAPHIC OMITTED]

Underlying

- --------------------------------------------------------------------------------

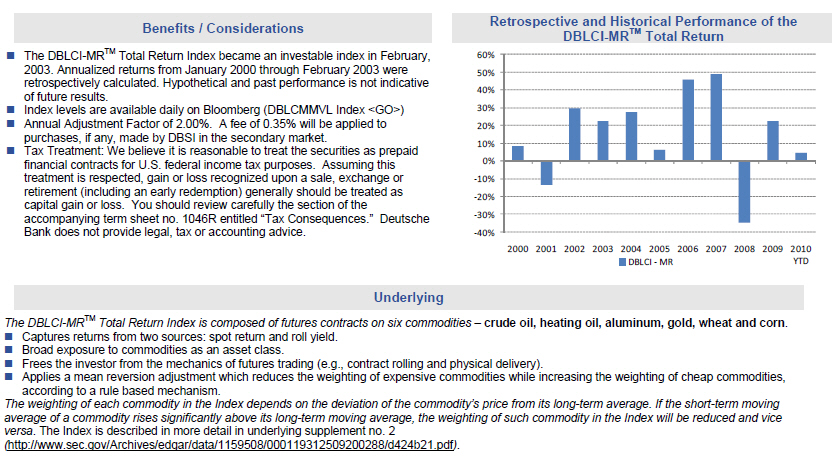

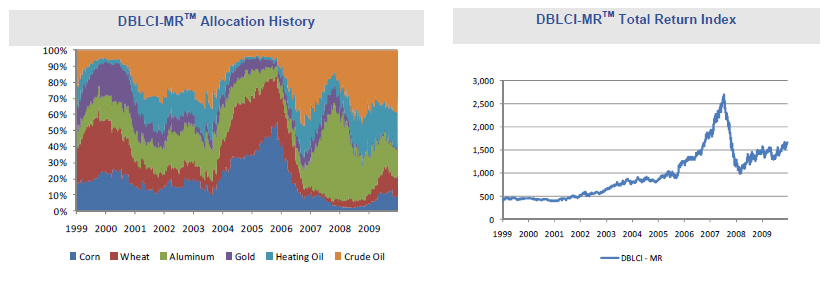

The DBLCI-MR(TM) Total Return Index is composed of futures contracts on six

commodities -- crude oil, heating oil, aluminum, gold, wheat and corn.

[] Captures returns from two sources: spot return and roll yield.

[] Broad exposure to commodities as an asset class.

[] Frees the investor from the mechanics of futures trading (e. g. , contract

rolling and physical delivery).

[] Applies a mean reversion adjustment which reduces the weighting of

expensive commodities while increasing the weighting of cheap commodities,

according to a rule based mechanism.

The weighting of each commodity in the Index depends on the deviation of the

commodity's price from its long-term average. If the short-term moving average

of a commodity rises significantly above its long-term moving average, the

weighting of such commodity in the Index will be reduced and vice versa. The

Index is described in more detail in underlying supplement no. 2

(http://www.sec.gov/Archives/edgar/data/1159508/000119312509200288/d424b21.pdf).

DBLCI-MR(TM) Allocation History

- --------------------------------------------------------------------------------

[GRAPHIC OMITTED]

DBLCI-MR(TM) Total Return Index

- --------------------------------------------------------------------------------

[GRAPHIC OMITTED]

|

|

Risks

- --------------------------------------------------------------------------------

[] The securities are not principal protected, and therefore, investors may

lose part or all of their initial investment.

[] The inclusion of an Adjustment Factor reduces the payment at Maturity or

upon Early Redemption.

[] The DBLCI-MR (TM) Total Return Index has limited performance history.

Publication of the DBLCI-MR (TM) Total Return Index began in February 2003

and historical or retrospectively-calculated performance of the DBLCI-MR

(TM) Total Return Index should not be relied on to predict future

performance.

[] Market prices of the commodities comprising the Index may fluctuate rapidly

based on numerous factors, including but not limited to, changes in supply

and demand relationships, weather, trends in agriculture and trade, fiscal,

monetary and exchange control programs, domestic and foreign political and

economic events and policies, disease, pestilence, technological

developments and changes in interest rates. These factors may affect the

values of the related contracts reflected in the Index and therefore the

value of your securities in varying ways.

[] A commodity hedging disruption event could result in the early acceleration

of the securities. We have the right (but not the obligation) to repurchase

the securities prior to maturity if legal or regulatory restrictions

prevent us from hedging our obligations under the securities.

[] An investment in the securities is subject to the credit of the Issuer.

Risks (continued)

- --------------------------------------------------------------------------------

[] The payout on the securities is linked to the value of the DBLCI-MR (TM)

Total Return Index on a specific valuation date. Therefore, a temporary

decline in value around the date of Maturity or Early Redemption could

greatly affect the holder's return.

[] A liquid secondary market for the securities is not guaranteed and may be

limited. The Issuer may, but is not obligated to, purchase securities in

the open market by tender offer or private agreement.

[] Potential conflicts of interest exist because the Issuer, the calculation

agent for the securities and the sponsor of the DBLCI-MR (TM) Total Return

Index and some of its components are the same legal entity.

[] For further risk considerations, please refer to accompanying term sheet

no. 1046R, underlying supplement no. 2, product supplement R (including the

section entitled "Risk Factors"), the prospectus supplement, and the

prospectus.

[] Significant aspects of the U. S. federal income tax treatment of the

securities are uncertain, and the Internal Revenue Service, or a court

might not accept the tax consequences described in the accompanying term

sheet no. 1046R.

[] We expect to pay a portion of the Adjustment Factor as a commission on a

quarterly basis to brokerage firms, which may include DBSI, and their

affiliates, whose clients purchase securities in this offering and who

continue to hold their securities. We expect that the brokerage firm

through which you hold your securities will pay a portion of these

commissions to your broker. As a result of these arrangements, the

brokerage firm through which you hold your securities and your broker may

have economic interests that are different than yours. For more information

about the payment of these commissions, see "Supplemental Underwriting

Information (Conflicts of Interest)" in the accompanying term sheet no.

1046R.

Important Information and Disclosures

- --------------------------------------------------------------------------------

[] This snapshot does not contain all the terms and conditions relevant to the

securities. This snapshot must be read in conjunction with the accompanying

term sheet no. 1046R, prospectus supplement, prospectus, underlying

supplement no. 2 and product supplement R. This snapshot does not purport

to summarize all of the conditions, representations, warranties, and other

provisions relevant to the securities.

[] We have sent you this document in our capacity as a potential counterparty

acting at arm's length. We are not acting as your financial adviser or in a

fiduciary capacity in respect of this proposed transaction or any other

transaction with you unless otherwise expressly agreed by us in writing.

Prospective investors should understand and discuss with their professional

tax, legal, accounting and other advisors the effect of a transaction they

may enter into.

[] Before entering into any transaction, you should take steps to ensure that

you understand and have made an independent assessment of the

appropriateness of the transaction in light of your own objectives and

circumstances, including the possible risks and benefits of entering into

such transaction. You should also consider making such independent

investigations as you consider necessary or appropriate for such purposes.

[] The past performance of securities, indices or other instruments referred

to herein does not guarantee or predict future performance.

[] The securities involve risk, which may include interest rate, commodity,

currency, credit, political, liquidity, time value, and market risk and are

not suitable for all investors. For further risk considerations, please

refer to the accompanying term sheet no. 1046R, prospectus supplement,

prospectus, underlying supplement no. 2 and product supplement R, including

the section entitled "Risk Factors".

[] The securities are not insured or guaranteed by the Federal Deposit

Insurance Corporation (FDIC) or any other U. S. governmental agency.

[] We or our affiliates, or persons associated with us or such affiliates,

may: maintain a long or short position in securities referred to herein, or

in related futures or options, purchase or sell, make a market in, or

engage in any other transaction involving such securities, and earn

brokerage or other compensation.

[] "Deutsche Bank" means Deutsche Bank AG and its affiliated companies, as the

context requires. Deutsche Bank Private Wealth Management refers to

Deutsche Bank's wealth management activities for high-net-worth clients

around the world. Deutsche Bank Alex. Brown is a division of Deutsche Bank

Securities Inc.

|