- DB Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

FWP Filing

Deutsche Bank (DB) FWPFree writing prospectus

Filed: 5 Jan 11, 12:00am

|

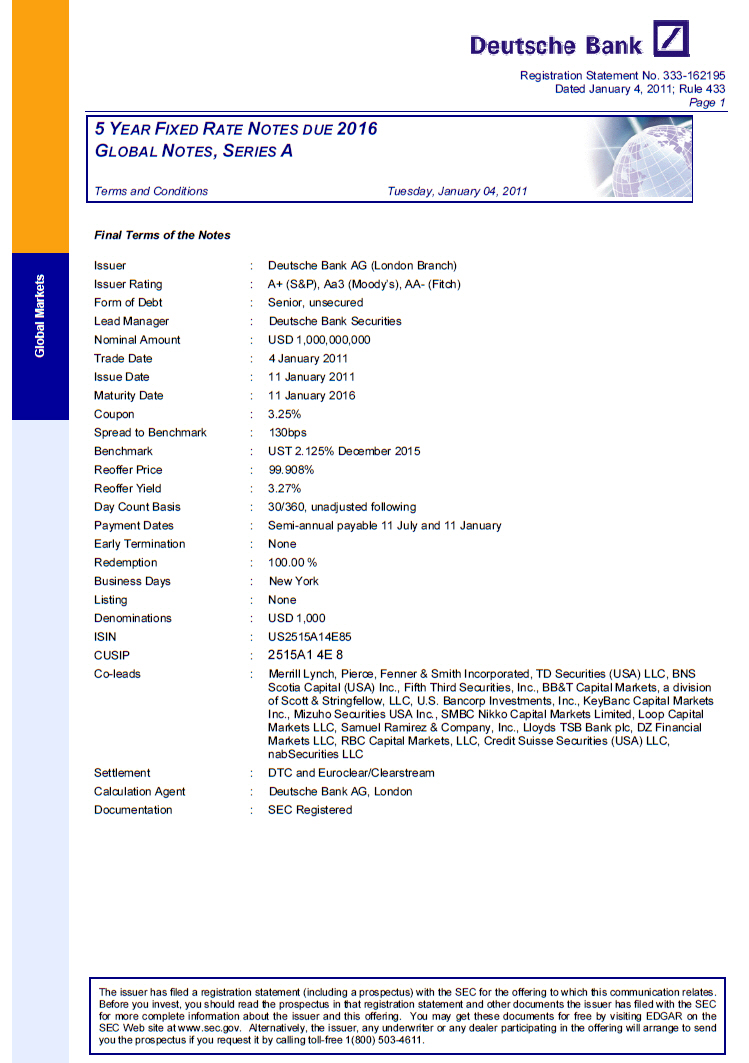

Registration Statement No. 333-162195

Dated January 4, 2011; Rule 433

Page 1

5 YEAR FIXED RATE NOTES DUE 2016

GLOBAL NOTES, SERIES A

Terms and Conditions Tuesday, January 04, 2011

Final Terms of the Notes

Issuer : Deutsche Bank AG (London Branch)

Issuer Rating : A+ (S and P), Aa3 (Moody's), AA- (Fitch)

Form of Debt : Senior, unsecured

Lead Manager : Deutsche Bank Securities

Nominal Amount : USD 1,000,000,000

Trade Date : 4 January 2011

Issue Date : 11 January 2011

Maturity Date : 11 January 2016

Coupon : 3.25%

Spread to Benchmark : 130bps

Benchmark : UST 2.125% December 2015

Reoffer Price : 99.908%

Reoffer Yield : 3.27%

Day Count Basis : 30/360, unadjusted following

Payment Dates : Semi-annual payable 11 July and 11 January

Early Termination : None

Redemption : 100.00 %

Business Days : New York

Listing : None

Denominations : USD 1,000

ISIN : US2515A14E85

CUSIP : 2515A1 4E 8

Co-leads : Merrill Lynch, Pierce, Fenner and Smith Incorporated, TD Securities (USA) LLC, BNS

Scotia Capital (USA) Inc., Fifth Third Securities, Inc., BB and T Capital Markets, a division

of Scott and Stringfellow, LLC, U.S. Bancorp Investments, Inc., KeyBanc Capital Markets

Inc., Mizuho Securities USA Inc., SMBC Nikko Capital Markets Limited, Loop Capital

Markets LLC, Samuel Ramirez and Company, Inc., Lloyds TSB Bank plc, DZ Financial

Markets LLC, RBC Capital Markets, LLC, Credit Suisse Securities (USA) LLC,

nabSecurities LLC

Settlement : DTC and Euroclear/Clearstream

Calculation Agent : Deutsche Bank AG, London

Documentation : SEC Registered

The issuer has filed a registration statement (including a prospectus) with the

SEC for the offering to which this communication relates. Before you invest,

you should read the prospectus in that registration statement and other

documents the issuer has filed with the SEC for more complete information about

the issuer and this offering. You may get these documents for free by visiting

EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any

underwriter or any dealer participating in the offering will arrange to send

you the prospectus if you request it by calling toll-free 1(800) 503-4611.

|

|

Registration Statement No. 333-162195

Dated January 4, 2011; Rule 433

Page 2

5 YEAR FIXED RATE NOTES DUE 2016

GLOBAL NOTES, SERIES A

Terms and Conditions Tuesday, January 04, 2011

[] Prospectus supplement dated September 29, 2009:

http://www.sec.gov/Archives/edgar/data/1159508/000119312509200021/d424b31.pdf

[] Prospectus dated September 29, 2009:

http://www.sec.gov/Archives/edgar/data/1159508/000095012309047023/f03158be424b2

xpdfy.pdf

SMBC Nikko Capital Markets Limited is not a U.S. registered broker-dealer and,

therefore, intends to participate in the Global offering outside of the United

States and, to the extent that the offering is within the United States, as

facilitated by an affiliated U.S. registered broker-dealer, SMBC Nikko

Securities America, Inc. ("SMBC Nikko-SI"), as permitted under applicable law.

To that end, SMBC Nikko Capital Markets Limited and SMBC Nikko-SI have entered

into an agreement pursuant to which SMBC Nikko-SI provides certain advisory

and/or other services with respect to this offering. In return for the

provision of such services by SMBC Nikko-SI, SMBC Nikko Capital Markets Limited

will pay to SMBC Nikko-SI a mutually agreed-fee.

The issuer has filed a registration statement (including a prospectus) with the

SEC for the offering to which this communication relates. Before you invest,

you should read the prospectus in that registration statement and other

documents the issuer has filed with the SEC for more complete information about

the issuer and this offering. You may get these documents for free by visiting

EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any

underwriter or any dealer participating in the offering will arrange to send

you the prospectus if you request it by calling toll-free 1(800) 503-4611.

|