- DB Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

FWP Filing

Deutsche Bank (DB) FWPFree writing prospectus

Filed: 5 Jan 11, 12:00am

|

Deutsche Bank [logo]

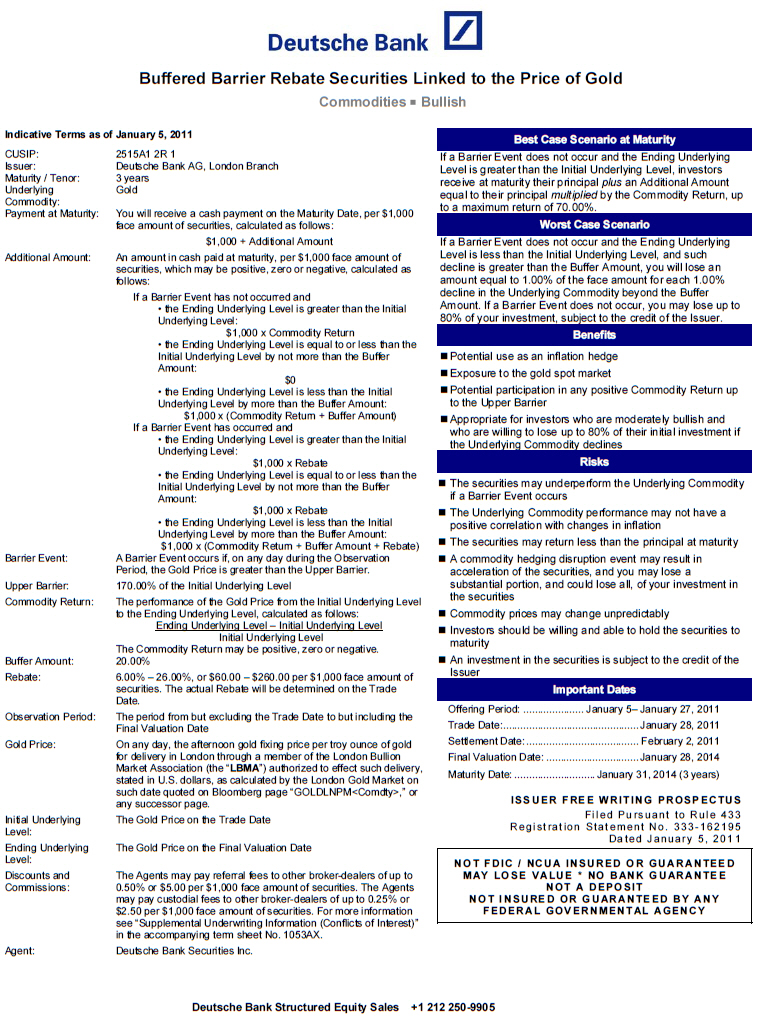

Buffered Barrier Rebate Securities Linked to the Price of Gold

Commodities [] Bullish

Indicative Terms as of January 5, 2011

CUSIP: 2515A1 2R 1

Issuer: Deutsche Bank AG, London Branch

Maturity / Tenor: 3 years

Underlying Commodity: Gold

Payment at Maturity: You will receive a cash payment on the Maturity

Date, per $1,000 face amount of securities,

calculated as follows:

$1,000 + Additional Amount

Additional Amount: An amount in cash paid at maturity, per $1,000

face amount of securities, which may be

positive, zero or negative, calculated as follows:

If a Barrier Event has not occurred and

o the Ending Underlying Level is greater

than the Initial Underlying Level:

$1,000 x Commodity Return

o the Ending Underlying Level is equal to or

less than the Initial Underlying Level by

not more than the Buffer Amount:

$0

o the Ending Underlying Level is less than the

Initial Underlying Level by more than the

Buffer Amount:

$1,000 x (Commodity Return + Buffer Amount)

If a Barrier Event has occurred and

o the Ending Underlying Level is greater than

the Initial Underlying Level:

$1,000 x Rebate

o the Ending Underlying Level is equal to or

less than the Initial Underlying Level by

not more than the Buffer Amount:

$1,000 x Rebate

o the Ending Underlying Level is less than the

Initial Underlying Level by more than th

Buffer Amount:

$1,000 x (Commodity Return + Buffer Amount

+ Rebate)

Barrier Event: A Barrier Event occurs if, on any day during the

Observation Period, the Gold Price is greater

than the Upper Barrier.

Upper Barrier: 170.00% of the Initial Underlying Level

Commodity Return: The performance of the Gold Price from the

Initial Underlying Level to the Ending Underlying

Level, calculated as follows:

Ending Underlying Level - Initial Underlying Level

--------------------------------------------------

Initial Underlying Level The

Commodity Return may be positive, zero or

negative.

Buffer Amount: 20.00%

Rebate: 6.00% - 26.00%, or $60.00 - $260.00 per $1,000

face amount of securities. The actual Rebate

will be determined on the Trade Date.

Observation Period: The period from but excluding the Trade Date to

but including the Final Valuation Date

Gold Price: On any day, the afternoon gold fixing price per

troy ounce of gold for delivery in London

through a member of the London Bullion Market

Association (the "LBMA") authorized to effect

such delivery, stated in U.S. dollars, as

calculated by the London Gold Market on such

date quoted on Bloomberg page

"GOLDLNPM[Comdty]," or any successor page.

Initial Underlying Level: The Gold Price on the Trade Date

Ending Underlying Level: The Gold Price on the Final Valuation Date

Discounts and Commissions: The Agents may pay referral fees to other

broker-dealers of up to 0.50% or $5.00 per

$1,000 face amount of securities. The Agents

may pay custodial fees to other broker-dealers

of up to 0.25% or $2.50 per $1,000 face amount

of securities. For more information see

"Supplemental Underwriting Information

(Conflicts of Interest)" in the accompanying

term sheet No. 1053AX.

Agent: Deutsche Bank Securities Inc.

Deutsche Bank Structured Equity Sales +1 212 250-9905

- --------------------------------------------------------------------------------

Best Case Scenario at Maturity

- --------------------------------------------------------------------------------

If a Barrier Event does not occur and the Ending Underlying Level is greater

than the Initial Underlying Level, investors receive at maturity their principal

plus an Additional Amount equal to their principal multiplied by the Commodity

Return, up to a maximum return of 70.00%.

- --------------------------------------------------------------------------------

Worst Case S6cenario

- --------------------------------------------------------------------------------

If a Barrier Event does not occur and the Ending Underlying Level is less than

the Initial Underlying Level, and such decline is greater than the Buffer

Amount, you will lose an amount equal to 1.00% of the face amount for each 1.00%

decline in the Underlying Commodity beyond the Buffer Amount. If a Barrier Event

does not occur, you may lose up to 80% of your investment, subject to the credit

of the Issuer.

- --------------------------------------------------------------------------------

Benefits

- --------------------------------------------------------------------------------

[] Potential use as an inflation hedge

[] Exposure to the gold spot market

[] Potential participation in any positive Commodity Return up to the Upper

Barrier

[] Appropriate for investors who are moderately bullish and who are willing to

lose up to 80% of their initial investment if the Underlying Commodity

declines

- --------------------------------------------------------------------------------

Risks

- --------------------------------------------------------------------------------

[] The securities may underperform the Underlying Commodity if a Barrier Event

occurs

[] The Underlying Commodity performance may not have a positive correlation

with changes in inflation

[] The securities may return less than the principal at maturity

[] A commodity hedging disruption event may result in acceleration of the

securities, and you may lose a substantial portion, and could lose all, of

your investment in the securities

[] Commodity prices may change unpredictably

[] Investors should be willing and able to hold the securities to maturity

[] An investment in the securities is subject to the credit of the Issuer

- --------------------------------------------------------------------------------

Important Dates

- --------------------------------------------------------------------------------

Offering Period: ..................... January 5- January 27, 2011

Trade Date:........................... January 28, 2011

Settlement Date: ..................... February 2, 2011 Final

Valuation Date: ...................... January 28, 2014

Maturity Date: ....................... January 31, 2014 (3 years)

ISSUER FREE WRITING PROSPECTUS

Filed Pursuant to Rule 433

Registration Statement No. 333-162195

Dated January 5, 2011

-------------------------------------

NOT FDIC / NCUA INSURED OR GUARANTEED

MAY LOSE VALUE * NO BANK GUARANTEE

NOT A DEPOSIT

NOT INSURED OR GUARANTEED BY ANY

FEDERAL GOVERNMENTAL AGENCY

-------------------------------------

Deutsche Bank Structured Equity Sales +1 212 250-9905

|

| Return Scenarios at Maturity (Assumes an Upper Barrier of 170.00%, a Buffer of 20.00% and a Rebate of 16.00% | ||||

| If a Barrier Event Does Not Occur | If a Barrier Event Does Occur | |||

| Underlying Commodity Return | Payment at Maturity (per $1,000 invested) | Payment Return (%) | Payment at Maturity (per $1,000 invested) | Payment Return (%) |

| 80.00% | N/A | N/A | $1,160.00 | 16.00% |

| 60.00% | $1,600.00 | 60.00% | $1,160.00 | 16.00% |

| 40.00% | $1,400.00 | 40.00% | $1,160.00 | 16.00% |

| 20.00% | $1,200.00 | 20.00% | $1,160.00 | 16.00% |

| 0.00% | $1,000.00 | 0.00% | $1,160.00 | 16.00% |

| -20.00% | $1,000.00 | 0.00% | $1,160.00 | 16.00% |

| -40.00% | $800.00 | -20.00% | $960.00 | -4.00% |

| -60.00% | $600.00 | -40.00% | $760.00 | -24.00% |

| -80.00% | $400.00 | -60.00% | $560.00 | -44.00% |

This hypothetical scenario analysis does not reflect advisory fees, brokerage or other commissions, or any other expenses that an investor may incur in connection with the securities. No representation is made that any trading strategy or account will, or is likely to, achieve similar returns to those shown above. Hypothetical results are neither an indicator nor guarantee of future returns. Actual results will vary, perhaps materially, from this analysis. The numbers appearing in the above table have been rounded for ease of analysis. Selected Risk Factors An investment in the securities involves significant risks. You should read “Risk Factors” in the accompanying term sheet No. 1053AX for detailed information about the risks listed below. |

YOUR INVESTMENT IN THE SECURITIES MAY RESULT IN A LOSS — The securities do not guarantee any return of your investment. The return on the securities at maturity is based on whether or not a Barrier Event occurs and whether, and the extent to which, the Commodity Return is positive or negative. If a Barrier Event does not occur, and the Ending Underlying Level is less than the Initial Underlying Level by more than the Buffer Amount of 20.00%, your investment will lose 1.00% for every 1.00% decline in the Ending Underlying Level, and you could lose up to 80.00% of your investment in the securities. If a Barrier Event does occur, the Ending Underlying Level is less than the Initial Underlying Level by more than the Buffer Amount of 20.00%, you could lose up to between 74.00% and 54.00% (to be determined on the Trade Date). The payment of any amount at maturity is subject to our ability to meet our obligations as they become due. IF A BARRIER EVENT OCCURS, YOUR ADDITIONAL AMOUNT WILL BE LIMITED TO THE REBATE — If a Barrier Event occurs, your Additional Amount will be limited to the Rebate of between 6.00% and 26.00% (to be determined on the Trade Date), regardless of any positive performance of the Gold Price above the Upper Barrier. You will not benefit from any appreciation of the Gold Price beyond the Rebate. CREDIT RISK — The payment of amounts owed to you under the securities is subject to the Issuer’s ability to pay. Consequently, you are subject to risks relating to the creditworthiness of Deutsche Bank AG. TRADING BY US OR OUR AFFILIATES IN THE COMMODITIES MARKETS MAY IMPAIR THE VALUE OF THE SECURITIES — We and our affiliates are active participants in the commodities markets as dealers, proprietary traders and agents for our customers, and therefore at any given time we may be a party to one or more commodities transactions. In addition, we or one or more of our affiliates may hedge our commodity exposure from the securities by entering into commodity derivative transactions, such as over-the-counter options or futures. Such trading and hedging activities may affect commodity prices and make it less likely that you will receive a positive return on your investment in the securities. It is possible that we or our affiliates could receive substantial returns from these hedging and trading activities while the value of the securities declines. We or our affiliates may also engage in trading in instruments linked to gold on a regular basis as part of our general broker-dealer and other businesses, for proprietary accounts, for other accounts under management or to facilitate transactions for customers, including block transactions. We or our affiliates may also issue or underwrite other securities or financial or derivative instruments with returns linked or related to changes in commodity prices. By introducing competing products into the marketplace in this manner, we or our affiliates could adversely affect the value of the securities. Any of the foregoing activities described in this paragraph may reflect trading strategies that differ from, or are in direct opposition to, the trading strategy of investors in the securities. | RETURN LINKED TO THE PERFORMANCE OF A SINGLE COMMODITY, AND THE PRICE OF GOLD MAY CHANGE UNPREDICTABLY – Investments linked to the prices of commodities, such as gold, are considered speculative and the prices for commodities such as gold may fluctuate significantly over short periods due to a variety of factors, including changes in supply and demand relationships; wars; political and civil upheavals; acts of terrorism; agriculture, trade, fiscal, monetary, and exchange control programs; domestic and foreign political and economic events and policies; technological developments; changes in interest and exchange rates; trading activities in gold and substitute commodities and related contracts; weather; climatic events; and the occurrence of natural disasters. These factors may affect the price of gold and the value of your securities in varying and potentially inconsistent ways. Specific factors affecting the price of gold include economic factors, including, among other things, the structure of and confidence in the global monetary system, expectations of the future rate of inflation, the relative strength of, and confidence in, the U.S. dollar (the currency in which the price of gold is generally quoted), interest rates and gold borrowing and lending rates, and global or regional economic, financial, political, regulatory, judicial or other events. Gold prices may also be affected by industry factors such as industrial and jewelry demand, lending, sales and purchases of gold by the official sector, including central banks and other governmental agencies and multilateral institutions which hold gold, levels of gold production and production costs in major gold producing nations such as South Africa, the United States and Australia, non-concurrent trading hours of gold market s and short-term changes in supply and demand because of trading activities in the gold market. It is not possible to predict the aggregate effect of all or any combination of these factors. COMMODITY PRICE MAY CHANGE UNPREDICTABLY — The Gold Price is determined by the LBMA. The LBMA is a self-regulatory association of bullion market participants. Although all market-making members of the LBMA are supervised by the Bank of England and are required to satisfy a capital adequacy test, the LBMA itself is not a regulated entity. If the LBMA should cease operations, or if bullion trading should become subject to a value added tax or other tax or any other form of regulation currently not in place, the role of LBMA price fixings as a global benchmark for the value of gold may be adversely affected. The LBMA is a principals’ market which operates in a manner more closely analogous to over-the-counter physical commodity markets than regulated futures markets, and certain features of U.S. futures contracts are not present in the context of LBMA trading. For example, there are no daily price limits on the LBMA, which would otherwise restrict fluctuations in the prices at which commodities trade on the LBMA. In a declining market, it is possible that prices would continue to decline without limitation within a trading day or over a period of trading days. |

SINGLE COMMODITY PRICES TEND TO BE MORE VOLATILE AND MAY NOT CORRELATE WITH THE PRICES OF COMMODITIES GENERALLY — The Payment at Maturity on the securities is linked exclusively to the price of gold and not to a diverse basket of commodities or a broad-based commodity index. The price of gold may not correlate to the price of commodities generally and may diverge significantly from the prices of commodities generally. Because the securities are linked to the price of a single commodity, they carry greater risk and may be more volatile than a security linked to the prices of multiple commodities or a broad-based commodity index. CERTAIN BUILT-IN COSTS ARE LIKELY TO ADVERSELY AFFECT THE VALUE OF THE SECURITIES PRIOR TO MATURITY — Certain built-in costs, such as our estimated cost of hedging, are likely to adversely affect the value of the securities prior to maturity and may adversely affect the price, if any, at which the Issuer or its affiliates may be willing to purchase the securities from you in the secondary market. You should be willing and able to hold your securities to maturity. OUR RESEARCH, OPINIONS OR RECOMMENDATIONS COULD AFFECT THE PRICES OF GOLD OR THE MARKET VALUE OF THE SECURITIES — We and our affiliates and agents may publish research, express opinions or provide recommendations that are inconsistent with investing in or holding the securities, which could affect the Gold Price or the value of the securities. POTENTIAL CONFLICTS — We and our affiliates play a variety of roles in connection with the issuance of the securities, including acting as calculation agent and hedging our obligations under the securities. In performing these roles, the economic interests of the calculation agent and other affiliates of ours are potentially adverse to your interests as an investor in the securities. LACK OF LIQUIDITY — There may be little or no secondary market for the securities. The securities will not be listed on any securities exchange and the Issuer and its affiliates, although they may do so, will have no obligation to offer to purchase the securities in the secondary market. | MANY ECONOMIC AND MARKET FACTORS WILL AFFECT THE VALUE OF THE SECURITIES — In addition to the Gold Price on any day, the value of the securities will be affected by a number of complex and interrelated economic and market factors that may either offset or magnify each other. THE U.S. TAX CONSEQUENCES OF AN INVESTMENT IN THE SECURITIES ARE UNCLEAR — Significant aspects of the U.S. federal income tax treatment of the securities are uncertain, and the Internal Revenue Service or a court might not agree with the tax consequences described in the accompanying term sheet. See “Risk Factors” in the accompanying term sheet for more information. Deutsche Bank AG has filed a registration statement (including a prospectus) with the Securities and Exchange Commission, or SEC, for the offering to which this fact sheet relates. Before you invest, you should read the prospectus in that registration statement and the other documents including term sheet No. 1053AX relating to this offering that Deutsche Bank AG has filed with the SEC for more complete information about Deutsche Bank AG and this offering. You may obtain these documents without cost by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, Deutsche Bank AG, any agent or any dealer participating in this offering will arrange to send you the prospectus, prospectus supplement, term sheet No. 1053AX and this fact sheet if you so request by calling toll-free 1-800-311-4409. You may revoke your offer to purchase the securities at any time prior to the time at which we accept such offer by notifying the applicable agent. We reserve the right to change the terms of, or reject any offer to purchase, the securities prior to their issuance. We will notify you in the event of any changes to the terms of the securities, and you will be asked to accept such changes in connection with your purchase of any securities. You may also choose to reject such changes, in which case we may reject your offer to purchase the securities. |