- DB Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Deutsche Bank (DB) 6-KCurrent report (foreign)

Filed: 9 May 19, 12:16pm

Announcement

After convening our Ordinary General Meeting for Thursday, May 23, 2019, in Frankfurt am Main (publication in the Bundesanzeiger on April 11, 2019), Riebeck-Brauerei von 1862 Aktiengesellschaft, Wuppertal, represented by BayerLaw Rechtsanwaltsgesellschaft mbH, Frankfurt am Main, requested in accordance with § 122 (2) and § 124 (1) Stock Corporation Act, that the Agenda of the General Meeting be extended by additional Items and that this Extension of the Agenda be announced without delay.

The following Items are therefore added to the Agenda:

Agenda Item 8: Removal from office of the Supervisory Board member Dr. Paul Achleitner

The shareholder Riebeck-Brauerei von 1862 AG, Vogelsanger Str. 104, 50823 Cologne, (hereinafter: “Riebeck-Brauerei”) proposes that the following resolution be approved:

“The Supervisory Board member Dr. Paul Achleitner is removed from office.”

Reasons for Agenda Item 8:

In the light of Riebeck-Brauerei’s motion for removal from office at the General Meeting 2018, institutional investors and proxy advisors again gave Dr. Achleitner one “last chance” for the year 2018 to guide the bank onto a forward-looking path. Dr. Achleitner failed to use this chance. Despite the replacement of several Management Board members and the appointment of a new Management Board Chairman, the decline of the bank has continued unchecked, without any sign whatsoever being recognizable of where the return on equity of 10 %, i.e. more than 20 times higher than in 2018, which was breezily announced in the Annual Report for some undefined point in the future should come from.

Now, after another year with a share price decline of 50 % again, a further rating downgrade, further regulatory sanction measures and searches of the premises, and with signs of impending further scandals (money laundering, cum-ex, cum-fake), it must have become clear to every shareholder that Deutsche Bank, under the Supervisory Board chairmanship of Dr. Achleitner, remains trapped in an unbroken downward spiral, and this completely independently of whatever the name is of the respective Management Board Chairman sent into the ring by Dr. Achleitner.

Therefore, after another nightmare year in 2018, it must seem to the shareholders as if they were being mocked by the Supervisory Board Chairman, who is obviously suffering from losing touch with reality, when Dr. Achleitner, in his review of 2018 in the Frankfurter Allgemeine Sonntagszeitung newspaper, said he was “satisfied” with the bank’s development over the course of the year and again sought to place the blame for the miserable results on others. This time it was not the U.S. Department of Justice or a tax reform; this time it was the Federal Criminal Police Office and the Public Prosecutor’s Office Frankfurt with their search of the premises. The Supervisory Board Chairman let it be known that neither the justice system nor the press may be criticized in Germany.

This involves the continuation of the Supervisory Board Chairman’s denial of reality, which has been ongoing for years. After all, the decline of Deutsche Bank is inseparably linked with the person of Dr. Achleitner in the last seven years and, due to the now increasingly precarious situation, has even attracted the attention of the Federal Government. The wrong personnel and strategy decisions as well as a completely inadequate supervision of the Compliance system under his leadership are what led to the disastrous state of the bank during these years. This manifests itself in ever new all-time lows of share price and ratings as well as, conversely, steadily increasing financing costs and default premiums. At this bank, one scandal follows the next, and the mantra-like call for “cultural change”, away from a purely bonus-maximizing corporate culture, has now become as credible as the promise of a heroin addict, after the tenth relapse, that he will now really just say no to drugs.

Personnel selection problem Achleitner

The Management Board members Cryan, Hammonds, Schenck and Moreau, who were selected under Dr. Achleit ner’s leadership, left (had to leave) the Management Board again in 2018 after a few years at, in some cases, substantial cost to the bank, without there being any tangible change for the better. Other Management Board members, who have in some cases already demonstrated visible inadequacies for years (see no-confidence proposals under Items 9-11) and have become ballast for the bank, are being retained just the way the bank is upholding its failed Deputy Co-Chairmen (Presidents) model. Previously, the bank had Management Board spokesmen of the caliber of Mr. Abs, Mr. Christiansen and Mr. Herrhausen; after seven years under Dr. Achleitner’s leadership, only Mr. Sewing, Mr. Ritchie and Mr. von Rohr remain, because qualified outsiders have declined. Management Board members such as Mr. Lewis and Mr. Ritchie, with their documented lack of success, are being paid “special allowances” in the millions for obvious Management Board activities as poorly disguised retention awards, so that they do not also go elsewhere. This is the personnel selection problem Achleitner.

Strategically unteachable

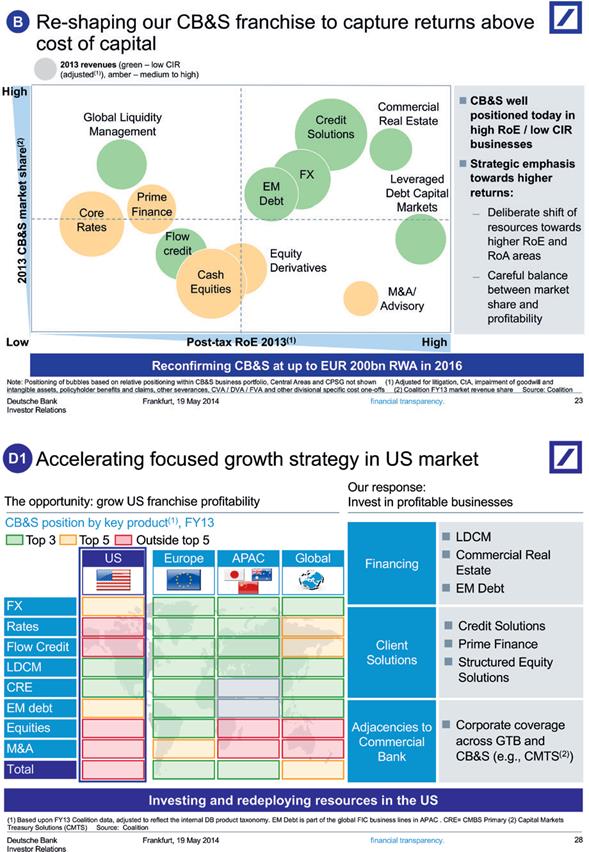

In terms of strategy, Dr. Achleitner has been presiding intransigently, despite a documented lack of success, for five years over a continuing deterioration of the bank’s financial substance. Although analysts, rating agencies, regulatory authorities and several major shareholders have for years been urging a fundamental change of strategy, in particular in investment banking, Dr. Achleitner has been adhering, as already with Mr. Cryan and also after the change to Mr. Sewing, to the strategy devised by him and Anshu Jain for investment banking from the year 2014, with practically no change in terms of content, as it was presented to the

01

investors when Qatar came on board within the framework of the capital increase 2014:

02

After all, there has been – despite grave market share losses and revenue declines in investment banking in the billions and returns on equity in the barely perceptible range – no real shift in strategy whatsoever with regard to investment banking, in particular not in the USA, which the bank also presents as such in the English-language press. In Equities trading, a few poor performers were let go in the USA (U.S. investment banks do this every year), the financing of hedge funds (“prime finance”) was adjusted to weed out small clients and otherwise capital was redirected from unprofitable areas to – allegedly – more profitable high risk areas such as high yield loans and junk bonds (“LDCM”), commercial real estate financing and trading in fixed income securities and derivatives (“redeployment of resources”). This has nothing to do with a change of strategy. Rather, at other banks this is part of day-to-day business. At the same time, billions in salaries and bonuses continue to be pumped into investment banking, most of this in the USA, where the bank has probably never really earned money after deductions for personnel costs, legal risks and legacy balance sheet issues and, given its cost-income ratio, the general opinion is that it will never do so. In denial of all reality, Dr. Achleitner continues to dream of the resurrection of Deutsche Bank’s U.S. investment banking franchise and operating in the same league as its U.S. competitors, and is taking the entire bank hostage in the process. This is Dr. Achleitner’s fundamental strategy problem, and it is responsible for the fact that, under his leadership, the bank can never be successful.

Existence-threatening Compliance and Risk Management problems

It was first discovered by the press in 2018 that the bank’s U.S. operations had already been classified by the New York Federal Reserve Bank as a “Troubled Institution” and by the U.S. Federal Deposit Insurance Corporation as a “Problem Bank” in 2017 and placed under extensive special monitoring. The classification of the U.S. operations as a “Troubled Bank” and “Problem Bank” means that the U.S. regulatory authorities identified problems (here above all in risk management and in the capacity for capital planning) that are a threat to its existence (“weaknesses serious enough to threaten the bank’s survival” and “bank with financial, managerial or operational weaknesses that endanger its financial viability”). This was withheld from the shareholders.

The bank has failed the U.S. stress test for the third time now in four years. The underlying problems have existed for years. The New York Federal Reserve Bank specified the following reasons for this in 2018:

“The Board of Governors objected to the capital plan of DB USA Corporation because of widespread and critical deficiencies across the firm’s capital planning practices. Material weaknesses were identified in data capabilities and controls supporting the firm’s capital planning process; in approaches and assumptions used to forecast revenues and losses arising from many of its key business lines and exposures under stress; and in the firm’s risk management functions, including model risk management and internal audit. Together, these weaknesses raise concerns about DB USA’s ability to effectively determine its capital needs on a forward-looking basis.”

David Hendler, a world-leading risk analyst, subsequently compared Deutsche Bank to a passenger plane that is not safe because its electronic control systems are not working. This is extremely alarming.

The bank’s money laundering problems are taking on con-tinually more dangerous proportions. In the meantime, both U.S. as well as British and German regulators have delegated anti-money laundering monitors or a special representative to the bank because the authorities no longer have trust in the bank’s management bodies to actually address and solve the problems on their own. First, the Management Board had to concede to regulators in spring 2018 that the know-your-customer reviews had been deficiently performed. Also in spring 2018, the anti-money laundering monitor assigned by the U.S. regulators also cited various deficiencies in the prevention of money laundering. Then it turned out that the bank had transferred amounts in the hundreds of billions for Danske Bank Estonia, although according to consistent reports of the news magazine “Der Spiegel” and the news agency Bloomberg, years before the termination of the correspondent bank relationship, there were clear indications of significant irregularities and other correspondent banks had exited years earlier. Last but not least, the nearly annual search of the premises by the Public Prosecutor’s Office became due, this time based on a suspicion of money laundering in connection with the Panama Papers at a subsidiary of the bank on the British Virgin Islands.

In the context of problems in the prevention of money laundering in the correspondent banking system, Danske Bank Estonia is merely the tip of the iceberg (see Item 11 below on the “Russian Laundromat”). Until only recently, Deutsche Bank was a correspondent bank for various banks in the Baltic States, on Cyprus and in Eastern Europe that were closed by, or in response to pressure from, the U.S. authorities due to money laundering, financing of terrorism and/or violations of sanctions. In the meantime, according to press reports, the central bank and the Department of Justice in the USA are investigating, the U.S. Congress – across party lines – has announced investigations into the inadequate prevention of money laundering, and even the German authorities have now ordered, along with a review once again of all of the bank’s clients, an audit of the Danske Bank case matters and the correspondent banking system by a special representative appointed by official order for the first time ever in German banking history. To date, the bank has already had to allocate an amount to pay for penalties in “money laundering” matters and costs related to investigations and monitors that could be coming close to a billion U.S. dollars based only on the recent past. The potential consequences of these

03

investigations could multiply this amount in the near future and are so severe (see also Item 9) that the bank has to state for the first time in its Annual Report on page 41:

“Compliance and Anti-Financial Crime risks

We are also subject to regulatory reviews and investigations, the outcome of which is difficult to estimate and which may substantially and adversely affect our planned results of operations, financial condition and reputation. For example, on September 21, 2018, the German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht, “BaFin”) issued an order requiring us to implement measures on specified timelines over the coming months and years to improve our control and compliance infrastructure relating to anti-money laundering and, in particular, the know-your-client ( KYC ) processes in CIB , and appointed KPMG as special representative, reporting to BaFin on a quarterly basis on certain aspects of our compliance and progress with implementation of these measures. In addition, the BaFin extended the special representative’s mandate to cover the bank’s internal controls in the correspondent banking business on February 15, 2019. Our anti-money laundering and KYC processes, as well as our other internal processes that are aimed at preventing use of our products and services for the purpose of committing or concealing financial crime and our personnel responsible for our efforts in these areas, continue to be the subject of scrutiny by authorities in a number of jurisdictions. If these authorities determine that the processes of the bank have significant deficiencies or if we are unable to significantly improve our infrastructure and control environment in a timely manner, our results of operation, financial condition and reputation could be materially and adversely affected .” [Emphasis added]

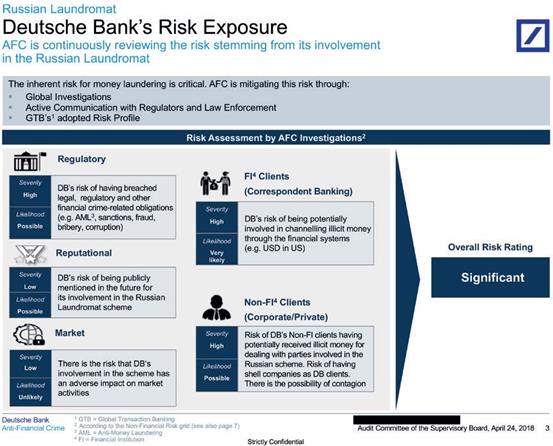

Already existing material risks for the bank from money laundering were already reported to the Audit Committee on April 24, 2018 (see Item 9). These risks were withheld from shareholders and creditors of the company.

The money laundering problems and in particular their non-remediation are the result of inadequate supervision on the part of Dr. Achleitner and/or the members of the Supervisory Board he has chaired over the last seven years.

Last exit Commerzbank

All of the fundamental problems now posing an existential risk to the bank would not be solved through a merger with Commerzbank, which Dr. Achleitner favorably supports; on the contrary, at best they would be concealed. A Commerzbank merger has no added value for shareholders, as it would ultimately only serve to secure Management Board members and investment bankers in their positions and to enable them to continue, with the acquired Commerzbank deposits, without severe cuts in investment banking and at the expense of the company and its shareholders, to uninhibitedly redirect billions for their own personal wealth optimization. Nevertheless, the bank, with Dr. Achleitner’s active assistance and at the expense of its shareholders, has been saddled with a de facto merger coercion to engage in a prospectively highly dilutive transaction with the highest execution risks and with the ostensible motivations of an alleged “economic benefit” to “reshape the German banking landscape” and to create a “national champion” in order to “leverage economies of scale,” which the Management Board can hardly withdraw from now without significant damages for the bank and its shareholders.

This is because, after seven years of Dr. Achleitner, there is no longer a credible “Plan B” for the bank and, in the event of a break-off of the negotiations, the bank is at risk of a further downgrade by the rating agencies and thus a further increase in funding costs and client attrition. The fact that – of all people – a Minister of Finance from the social democratic party has drummed up such a transaction, which would cost thousands of jobs in Germany upon implementation, can therefore only be seen as an urgent sign of the precarious state the bank is in, which Dr. Achleitner decisively contributed to causing.

Dr. Achleitner was not elected to the Supervisory Board to implement macroeconomic considerations and to further pursue unrealistic investment bank fantasies. Dr. Achleitner was elected in 2012 to restore the economic success of the bank and to finally take steps to ensure that the bank conducts its business in a manner that is in full conformity with the law. For seven years, Dr. Achleitner has failed miserably at this in every respect, apparently without the lack of success of his work since he took office having changed anything in the self-awareness of his severe impact for the bank. There is hardly any other way to explain that the post-merger jobs for Dr. Achleitner, Mr. Sewing and Mr. Zielke were already finalized first, according to a report of the news magazine “Der Spiegel” on April 13, 2019, long before the clarification of material aspects of a Commerzbank merger.

Act now, before it is too late!

Shareholders voted to approve the proposal for Dr. Achleitner’s removal from office last year without obtaining the required majority. The reasons for this that proxy advisors, in particular, gave to their clients were above all the wish for continuity on the Supervisory Board following the highly unprofessional course of the Management Board reshuffling and the lack of a suitable candidate who could have replaced Dr. Achleitner at the head of the Supervisory Board.

This continuity, unfortunately, was achieved by the institutional investors and proxy advisors. The bank’s decline continued and is continuing, unchecked, despite a revamped Management Board, which the results of the first quarter of 2019 will probably demonstrate once again. A renewed rejection of the proposal would therefore mean that either the shareholders have confidence that Dr. Achleitner can deliver in years eight to ten of his term of office what he was not capable of doing during years one to seven, or they accept, with eyes wide open, the continued decline of Deutsche Bank and the investment in their shares.

Unlike in 2018, there has been a leader on the shareholders’side of the Supervisory Board for one year now, John A. Thain,

04

who could guarantee a smooth handover of the chairing of the Supervisory Board and could initiate a new beginning, thanks to his long-term operational experience in both investment and private banking. The shareholder Riebeck-Brauerei cannot foresee if this would lead to a prompt improvement in the bank’s situation or if it is already too late for such a change. However, Riebeck-Brauerei sees a continuation of Dr. Achleitner’s term of office to be a guarantee that the bank’s decline under the Achleitner system will continue the same way it has over the last seven years.

In any event, with a view to limiting the damages, Riebeck-Brauerei therefore calls upon the other shareholders and proxy advisors to now support the proposal for Dr. Achleitner’s removal from office.

Agenda Item 9: Proposal of no confidence in the Management Board member Ms. Silvie Matherat

Riebeck-Brauerei proposes the following resolution:

“Confidence is withdrawn in the member of the Management Board Ms. Silvie Matherat.”

Reasons

Ms. Matherat has been responsible for the bank’s regulatory matters as the Global Head of Government & Regulatory Affairs since 2014 and as a member of the Management Board since the end of 2015.

During this time, Ms. Matherat has not managed to transform the bank’s anti-money laundering system into a legally compliant state. According to the Compensation Report, she is among the underperformers with Mr. Ritchie and did not meet her targets. For example:

During Ms. Matherat’s term of office, there has been a downright exceptional fluctuation in anti-money laundering officers in Europe and the USA. In addition, there is an irreconcilable discrepancy between, on the one hand, the presentation of Anti-Money Laundering and Compliance in general to the public and shareholders, and on the other hand, the actual situation based on authorities’ findings and measures and press analyses.

Back in 2017, Ms. Matherat bragged about alleged “electroshocks” the staff members had been given to make it clear that the new management takes the so-called “cultural change” seriously. In Danske Bank matters, as Ms. Matherat let it recently be known, it is not the bank’s duty to review the clients; the bank has nothing to reproach itself for. This self-defense claim falls much too short. The requirements for the prevention of money laundering in the USA go much further, in particular, for correspondent banking business with conspicuous, non-resident banks in countries known to be high risk for many years for money laundering, such as Danske Bank Estonia in the Baltic States (see the bank-internal assessment below of the “Russian Laundromat” matters). In addition, according to consistent press reports, the clearest warning signals from the bank’s American anti-money laundering center regarding payments of Danske Bank Estonia were not only insufficiently observed, but were also actually suppressed for years. In the Annual Financial Statements 2017, page 107, the report to shareholders on the anti-money laundering systems is in diametric contradiction to the actual state of affairs:

“Clients are assessed as part of due diligence and are regularly screened against internal and external criteria. [...] In cases of suspicious activity, regulatory and government bodies are informed according to existing legal and regulatory requirements. [...] The New Client Adoption process deals with the on-boarding of potential clients. No funds or assets may be accepted or transacted, nor any legal commitment entered into (including the operation of an account, sale of a product, or rendering of a service) prior to fully completed adoption of the client.”

05

The actual money laundering risks from the correspondent banking system are illustrated based on an example in a presentation to the Audit Committee using the bank’s involvement in the so-called “Russian Laundromat” dated April 24, 2018, in which the bank, in particular through its correspondent bank relationships, was involved with Latvian and Moldavian banks that authorities have closed in the meantime:

06

07

The internal assessment by anti-money laundering specialists indicates that there is the possibility of highly severe breaches of legal, regulatory and other obligations, for example, relating to anti-money laundering, compliance with sanctions and the prevention of fraud, bribery and corruption; that illicit money may possibly have been channeled through the U.S. dollar system; and that overall a high risk has to be assumed for the bank. The Audit Committee was also informed that there is a significant risk for regulatory sanctions, fines, significant share price impacts and even legal action or criminal prosecution aimed at members of the senior management team. In January 2019, the Federal Criminal Police Office seized assets throughout Germany that were transferred under this scheme. The internal assessment given to the Audit Committee comes to the conclusion that solely due to the involvement in the “Russian Laundromat” the loss of a license, for example, in the USA is not a risk. Whether or not this assessment can be maintained without any reservations when looking overall at the bank’s recently discovered involvements in money laundering (mirror trades, Danske Bank, Russian Laundromat, Troika Laundromat (cf. Süddeutsche Zeitung, March 4, 2019), Panama Papers, etc.) is uncertain from the perspective of Riebeck-Brauerei.

Ms. Matherat is not solely responsible for the now emergent substantial risks of the bank from the handling of anti-money laundering in non-conformity with the law. But with leading responsibility for this area since 2014/15, she has not been able to demonstrate in any way that she is professionally and personally capable of implementing a legally conform and actually functioning anti-money laundering system at the bank. No confidence in her is therefore to be declared.

Agenda Item 10: Proposal of no confidence in the Management Board member Mr. Stuart Lewis

Riebeck-Brauerei proposes the following resolution:

“Confidence is withdrawn in the member of the Management Board Mr. Stuart Lewis.”

Reasons

Mr. Lewis has been the Deputy Chief Risk Officer and Chief Risk Officer of the company’s Corporate & Investment Bank since 2010. He was appointed to the Management Board in 2012 as the so-to-speak second choice Chief Risk Officer, after BaFin rejected the originally intended candidate Broeksmith.

Already in 2015, Mr. Lewis came into regulatory authorities’ sights in connection with the LIBOR affairs. Mr. Lewis was and has also been, during practically his entire term of office, exposed to ongoing criticism of the risk management systems, in particular in the division he comes from, investment banking, and in the USA. The continual findings and Mr. Lewis’s incapacity or unwillingness to remediate the severe deficiencies in the risk management systems led to the result that the bank failed all three stress tests it was required to take in the USA and was classified as a “Troubled Bank” and “Problem Bank” (see Item 8 above) in 2017. These shortcomings have had extensive financial impacts on the bank. For years, it has not been allowed to pay dividends from the USA, must maintain significantly higher capital buffers and has in the meantime no longer been able to conduct its U.S. operations fully on its own without the U.S. authorities having a say in the matter. According to the Financial Times, the London Branch of the bank has already been under the “Enhanced Supervision” of the British regulator, the Financial Conduct Authority, since January 2015 due to significant deficiencies in its internal systems.

Although in its most recent stress test the Federal Reserve Bank of New York found precisely the opposite (see Item 8 above), the bank reported in its Annual Financial Statements 2017, in the middle of page 31, on the core area of Mr. Lewis’s responsibility:

“The Strategic and Capital Planning process allows us to:

In addition, there are, for example, nearly regular occurrences of mistaken transfers in the billions, enormous losses in individual trading transactions or in hedging portfolios, and a breach of risk limits, in some cases many times over (see Item 11 directly below), which overall indicate that an actually functioning risk management system does not exist in the bank under the leadership of Mr. Lewis. Under these circumstances, it is absolutely absurd that Mr. Lewis received, for the “further [sic!] improvement of relationships with U.S. regulators”, in addition to his salary and bonus entitlements, a special allowance of EUR 150,000 a month between December 2017 and August 2018.

Pursuant to § 91 (2) Stock Corporation Act and numbers 4.1.3 and 4.1.4 of the German Corporate Governance Code, establishing a functioning risk management system is the responsibility of the entire Management Board, and conformity with these regulations was and is assured pursuant to § 161 Stock Corporation Act.

Nevertheless, as the Chief Risk Officer on the Management Board, Mr. Lewis holds central responsibility for this. Since 2012, however, Mr. Lewis has not managed to establish a risk management system that conforms to the legal and regulatory requirements. No confidence in him is therefore to be declared.

08

Agenda Item 11: Proposal of no confidence in the Management Board member Mr. Garth Ritchie

Riebeck-Brauerei proposes the following resolution:

“Confidence is withdrawn in the member of the Management Board Mr. Garth Ritchie.”

Reasons

Mr. Garth Ritchie became a member of the Management Board on January 1, 2016. According to his resume, he is an equities and derivatives trader and has been Co-Head of Equities in the Corporate Banking & Securities division since 2009 and sole Head since 2010. Although, according to consistent press reports, he had already initiated his departure from the bank in spring 2018, the Supervisory Board not only endowed Mr. Ritchie with a new five-year contract, sole responsibility for investment banking and a title as Co-Chairman of the Management Board, but also granted him, in addition to his salary and bonus, a special allowance of EUR 250,000 a month in light of the alleged handling of “Brexit tasks”, which makes him the highest paid member of the Management Board. This took place although Mr. Ritchie did not fulfil his targets, as the Compensation Report documents, and is among the underperformers with Ms. Matherat.

The re-appointment of Mr. Ritchie contradicts everything the bank has communicated to shareholders with regard to its alleged realignment, “cultural change” and cost-cutting drive. Mr. Ritchie represents an area (trading in equities and equity derivatives) that is to be partially cut back, and regulatory authorities, according to press reports, have been urging its rapid downsizing for two years now. He has neither experience nor valuable client relationships in the investment banking areas in Germany and Europe where the bank wants to expand, i.e., in particular in the commercial banking business. Mr. Ritchie is a holdover from the era Mitchell/Jain, i.e., a representative of precisely the business model and practices of the “super-bonus bankers” the bank actually wanted to free itself from.

Since taking on his leadership responsibility for investment banking, this division has experienced an unprecedented decline; earnings, for example, in equities sales and trading have fallen from one quarter to the next. Since the end of 2015, investment banking revenues have declined by 30%, the cost ratio has remained at around 95%, and the return on equity has been below 1%. The number of employees, in contrast, has only gone down by 7 to 8%; while the capital demand has practically remained the same. Analysts’ estimates project that a decline in revenues of 4% can be expected, which means that revenues are continuing to drop much faster than costs are sinking.

In addition to this, various recent incidents in investment banking show that an effective supervision of this division is not taking place under Mr. Ritchie:

Shareholders can assume from this that the incidents discovered are only the tip of the iceberg.

Despite allegedly focusing on its home market, the bank, under Mr. Ritchie’s leadership, essentially makes headlines with business deals that are either unimportant or damaging to the German business economy. Large bets against the Turkish lira, a loan in the billions to Tesla shortly before the company had to repay its convertible bonds, a loan in the billions to Softbank to handle the IPO of a subsidiary, which was an embarrassment to the bank around the world due to the 20% share price drop on the day of the IPO, the financing of the squeeze out in Arsenal London for more than a half-billion pounds, the IPO of U.S. gas tax-optimization models and loans in the billions to the bank’s large shareholder Cerberus (see Item 12 below).

Many high performers have left the bank since Mr. Ritchie took office, while the bank is bloated with unproductive and expensive senior executives, many of them with guaranteed bonuses. There has been a bunch of strange personnel decisions: The bank is increasingly relying on inexpensive career starters, who need around seven years to become full-fledged traders. The so-called “gardening leave” of departing employees is often dispensed with for cost reasons, which makes it possible for them to take their customers with them to the competition immediately; in other cases, due to costs reasons, terminated employees, contrary to all customary practices, are retained until their period of notice comes to an end, which significantly increases the risk of sabotage, breaches of secrecy and the poaching of customers. Recently, the bank has increasingly

09

hired investment bankers who have been out of the market, in some cases, for years and who have, at best, cold client contacts.

To put it briefly, there is no clear guideline that could in any way indicate that the investment banking division under Mr. Ritchie’s leadership will ever get bank on its feet again.

Riebeck-Brauerei assumes, for the reasons specified above, that Mr. Ritchie is professionally incapable of making the investment banking division successful again. Confidence in him is therefore to be withdrawn.

Agenda Item 12: Resolution on the appointment of a Special Representative to assert claims to compensation for damages of the company against current and former members of the Management Board and Supervisory Board pursuant to § 93, § 116 and § 147 (1) Stock Corporation Act as well as against influential shareholders and joint and severally liable persons within the meaning of § 117 Stock Corporation Act pursuant to § 147 (1) and § 117 (1) to (3) Stock Corporation Act

Riebeck-Brauerei proposes the following resolution:

“Pursuant to § 147 (2) Stock Corporation Act, a Special Representative is appointed to assert claims to compensation for damages against the responsible current and former members of the company’s Management Board and Supervisory Board pursuant to § 93, § 116 and § 147 (1) Stock Corporation Act as well as against influential shareholders and joint and severally liable debtors within the meaning of § 117 Stock Corporation Act pursuant to § 147 (1) and § 117 (1) to (3) Stock Corporation Act. The Special Representative shall assert the following claims to compensation for damages:

Attorney

Mr. Christopher Rother

Eislebener Straße 6

10789 Berlin

is elected as the Special Representative.

In the event that Mr. Rother cannot accept such office,

10

Attorney

Mr. Clemens Hüber

c/o TRICON - FREUNDL WOLLSTADT & PARTNER

Rechtsanwälte Steuerberater mbB Bräuhausstrasse 4

80331 Munich

is elected as the Special Representative.

Besides the assertion of the claims to compensation for damages specified above, the authorization of the General Meeting to the Special Representative also expressly covers the ancillary claims to the issuing of information, accounting and potentially identifying the obligation to provide compensation for damages, to the extent that the damages cannot yet be conclusively assessed. The Special Representative is authorized to draw on the services of suitable agents for the assertion of the claims to compensation for damages. The Special Representative also receives the authorization to perform a legal and/or factual examination of the claims to compensation for damages.”

Reasons

The bank’s regulatory authorities in the USA and in the United Kingdom and Germany have repeatedly found over the past ten years that the bank’s risk management and anti-money laundering systems do not satisfy the legal requirements, and corresponding requirements and fines have been issued and/or regulatory actions have been taken, triggering significant costs for the bank, for example, the appointment of independent monitors. This demonstrates that the Management Board and Supervisory Board have culpably not fulfilled their legal duties to establish and maintain functioning risk and anti-money laundering systems and thus have caused and continue to cause damage to the company.

HNA Group Co. Ltd. should have corrected its incorrect voting rights notification as of the dividend record date 2017 in 2018. The correction comprised around 200,000 shares that were held outside of the C-Quadrat chain; it is not known if there were further unreported shares or voting rights. The correction did not take place until after BaFin received third-party information of the reporting of these shares in the USA. It has to be assumed that the non-reporting of these shares was knowingly withheld due to the importance of remaining below the 10% threshold for HNA Group to avoid an extensive ownership control procedure by the ECB as well as overlapping directorships in the reported and unreported lines. In addition, according to analyses of the Financial Times, GAR Holding, which was reported as a subsidiary of the HNA Group as of the dividend record date 2017, did not yet belong to the HNA Group, but rather it was held by a third party. This fact of the matter has not been corrected to date. A reclaiming of the dividends did not take place, although the company was notified of the actual circumstances at the General Meeting 2018 and through litigation. This is due to either the influence exerted by representatives of HNA Group on the Supervisory Board or it took place in any event culpably.

Paramount Services Holdings Ltd. and Supreme Universal Holdings Ltd. report their voting rights as if this involves the private investment vehicles of two distantly related members of the Qatari ruling family. The voting rights situation reported is obviously incorrect. Both the incumbent Emir of Qatar as well as the Qatari Foreign Minister and head of the Qatari state-owned fund QIA made it clear at the press conference of the German Federal Government and/or in a press interview that participations of the companies specified above in Deutsche Bank are handled exactly the same as, for example, the state-owned participations of the State of Qatar in Volkswagen AG. It is reported in the press that active Qatari state officials have participations in Paramount and/or Supreme and that governmental concessions in trade issues vis-à-vis Qatar will be demanded for an increase, if any, in Qatar’s shareholding or the approval of a merger, if any, with Commerzbank. A reclaiming of the dividends did not take place, although the company was notified of the actual circumstances at the General Meeting 2018 and through litigation. This is due to either the influence exerted by representatives of the Qatari shareholdings on the Supervisory Board or it took place in any event culpably.

Riebeck-Brauerei is convinced that the advisory contract concluded with Cerberus Group and the loan constitute illegal repayments of capital contributions, which were instructed by Cerberus Group in exerting its influence on the company at conditions unusual for the market.

According to press reports, an advisory contract was previously demanded by Cerberus also from Commerzbank and from Deutsche Bank already vis-à-vis Mr. Cryan; these requests, however, were pointedly rejected for good reasons. It was Mr. Sewing who first agreed to this advisory contract, without obtaining the consent of the Supervisory Board, which did not address this contract until afterwards. The advisory services or advisory results actually provided are not visible; according to press reports, it is said that Mr. Zames only has a telephone call with Mr. Sewing every two weeks. The investment of the bank’s liquidity reserves apparently initiated by Cerberus in asset-backed securities and portfolios of government bonds is exceptionally questionable in the bank’s current situation; in any event, as this should be among the better skills of a chief financial officer, an advisory contract is not needed for this. With regard to potential savings, the Management Board considered itself compelled, despite the advisory contract, to launch a contest for ideas from employees. The result: savings on travel expenses; no advisory contract is needed for this either.

In addition, there are the most significant conflicts of interest in the information imbalance between Cerberus and the other shareholders, which an advisory contract at customary market terms already precludes. Contrary to the bank’s statements in the press, there are also no effective Chinese Walls.

11

Although the advisory contract was concluded with Cerberus Advisory Group, which is formally separate from Cerberus Capital Management Group, the “advisory team” is led by Mr. Matthew E. Zames, who holds overall investment responsibility for all bank participations at Cerberus Capital Management Group. When the contract was concluded, Mr. Zames did not even work for Cerberus Operations Advisory Group as documented by its internet website. Therefore, there are no admissible Chinese Walls. The commitment from Cerberus not to trade in any Deutsche Bank shares over the duration of the advisory contract does not change anything in this regard. This is because, on the one hand, Cerberus can easily establish corresponding derivative positions, and on the other hand – and especially in the current situation – there are no obligations pursuant to the advisory contact for the positioning vis-à-vis Commerzbank, of which Cerberus is also a large shareholder.

The timing to and the background of the advisory contract closing (the Group spokesperson of the bank, Mr. Eigendorf, twittered enthusiastically that Cerberus could not engage in shareholder activism during the term of the contract) show that this involves an additional source of revenues for Cerberus from its shareholding in the bank, with no legally admissible performance in exchange. This probably simply involves a form of so-called “ greenmail ”, with which Mr. Sewing obtained peace after taking office from a proactive investor known for its robust manners in handling non-performing management board members.

The same applies to the loan amounting to USD 5.7 billion that was issued in close temporal connection with the advisory contract. As documented, the sums specified above involve financings with practically 100% debt capital, which are probably structured without recourse to collateral from Cerberus (non-recourse), which leaves only the acquired (impaired) assets as recoverable assets for the bank. This does stand up to a third-party comparison. In total, according to press reports, the bank’s exposure to Cerberus Group doubled in 2018, probably reflecting a questionable cluster risk in total of USD 10 to 12 billion. This circumstance as well as the close temporal connection with the appointment of Mr. Sewing and the conclusion of the advisory contract indicate that this involves one entire transaction for the same set of motives.

The election of a Special Representative to assert the resolved claims to compensation for damages is called for because otherwise it is to be feared that the claims will not be asserted by the management on behalf of the company. Riebeck-Brauerei reminds its co-shareholders of the fully insufficient settlement reached with Mr. Breuer in light of his financial situation as well as the partial waiver, at best of a symbolic nature, by former Management Board members of their bonuses. Riebeck-Brauerei also calls to mind the public demolition of former Supervisory Board member Dr. Thoma, which was probably closely connected to the clarification and pursuit of precisely the failings raised here of the management bodies in risk management and in the prevention of money laundering. And Riebeck-Brauerei points out the sudden demission of Mr. Cryan in apparently direct temporal connection with his call for a retroactive restatement of the accounts in light of losses concealed for years by the bank with total sum of USD 1.6 billion (cf. Wall Street Journal, February 21, 2019, “Deutsche Bank Lost $1.6 Billion on a Bond Bet”) as well as, according to the article, the bank’s internal investigations terminated directly following the article.

Therefore, the shareholders who hold the view that it is not the company and shareholders alone who should bleed for the bank’s losses in the billions, but also that those responsible for them have to be held accountable financially, are called upon by Riebeck-Brauerei to support the application for the appointment of a Special Representative.

12

Statement of the Management Board of Deutsche Bank regarding Agenda Items 8 to 12

We refrain for legal reasons from responding to the proposals made under Items 8 to 12 as the Management Board may not propose on Supervisory Board composition (Item 8) and could be perceived as biased with regard to motions of no confidence against the members of the Management Board, Ms. Sylvie Matherat, Mr. Stuart Lewis and Mr. Garth Ritchie (Agenda Items 9 to 11) as well as the appointment of a special representative, which also concerns the assertion of claims for damages against members of the Management Board (Agenda Item 12).

Frankfurt am Main, April 2019

The Management Board

Deutsche Bank’s Supervisory Board’s Comments regarding Agenda Item 8

The Supervisory Board issues the following statement regarding the request for the addition of Item 8 to the Agenda of the Ordinary General Meeting 2019 from Riebeck-Brauerei von 1862 Aktiengesellschaft and the resolution proposal it contains as follows:

Already for the Ordinary General Meeting 2018, Riebeck-Brauerei von 1862 Aktiengesellschaft proposed that Dr. Achleitner be removed from office as member of the Supervisory Board. This resolution proposal was rejected by the General Meeting 2018 with a majority of 90.95% of the votes cast. At its meeting on May 24, 2018, following the General Meeting 2018, the Supervisory Board again unanimously elected Dr. Achleitner as its Chairman – with Dr. Achleitner abstaining. The entire Supervisory Board has never had, and still does not have, any doubts concerning Dr. Achleitner’s comprehensive personal and professional skills and integrity. The Supervisory Board considers the allegations raised by Riebeck-Brauerei von 1862 Aktiengesellschaft against Dr. Achleitner to be groundless and has full confidence in his performance of office.

The Supervisory Board therefore proposes voting against revoking Dr. Achleitner’s appointment to the Supervisory Board.

Deutsche Bank’s Supervisory Board’s 1 Comments regarding Agenda Items 9, 10 and 11

The Supervisory Board issues the following statement regarding the request for the additions of Items 9, 10 and 11 to the Agenda of the Ordinary General Meeting 2019 from Riebeck-Brauerei von 1862 Aktiengesellschaft and the resolution proposals they contain as follows:

The Supervisory Board acknowledges that the General Meeting may withdraw its confidence in individual Management Board members. However, the Supervisory Board believes that the appointment, assessment and replacement of Management Board members of a globally regulated company with global operations constitute a complex task, requiring the consideration and detailed assessment of multifaceted economic, regulatory and organizational aspects as well as the effects on the risk profile. The Supervisory Board holds the view that it is not possible to perform such multilayered considerations in each individual case in the appropriate detail at a General Meeting held in public; these tasks should rather remain, also to preclude precedent-setting cases, in the hands of the Supervisory Board.

The Supervisory Board therefore proposes voting against withdrawing confidence in Ms. Sylvie Matherat, Mr. Stuart Lewis and Mr. Garth Ritchie.

Frankfurt am Main, April 2019

The Supervisory Board

(1) As Dr. Achleitner is personally affected by Riebeck-Brauerei’s resolution proposal, Dr. Achleitner stated that, in order to prevent any conflicts of interest, he will not participate in the taking of any potential resolutions in this matter.

13