Term sheet No. 687 To prospectus dated October 10, 2006, prospectus supplement dated November 13, 2006 and underlying supplement No. 15/A2 dated September 11, 2008 | Registration Statement No. 333-137902 Dated July 1, 2009; Rule 433 |

Deutsche Bank AG, London Branch

$

Leveraged Securities due July 12, 2012

Linked to the Deutsche Bank Liquid Alpha USD 5 Excess Return and Deutsche Bank Liquid Alpha USD 5 Total Return Indices

General

| • | The securities are designed for investors who seek an enhanced return of2 times the appreciation, if any, of a basket of two versions of the Deutsche Bank Liquid Alpha Index. Investors should be willing to forgo any coupon payments and, if the basket does not appreciate by at least 4.95% over the term of the securities, to lose some or all of their initial investment at a rate of2 times the depreciation of the basket. |

| • | Senior unsecured obligations of Deutsche Bank AG due July 12, 2012. |

| • | Minimum denominations of $1,000 and integral multiples of $1,000 in excess thereof. |

| • | The securities are expected to price on or about July 8, 2009 and are expected to settle three business days later on or about July 13, 2009. |

Key Terms

Issuer: | Deutsche Bank AG, London Branch |

Issue Price: | 100% of the face amount |

Basket: | The Securities are linked to a basket consisting of the Deutsche Bank Liquid Alpha USD 5 Total Return® Index and the Deutsche Bank Liquid Alpha USD 5 Excess Return® Index (each, a “Basket Index” and, collectively, the “Basket Indices”). |

Basket Indices:

| Basket Index | Index Weighting | Initial Index Level† | |||

| Deutsche Bank Liquid Alpha USD 5 Total Return® Index (“Total Return Index”) | 50 | % | |||

| Deutsche Bank Liquid Alpha USD 5 Excess Return® Index (“Excess Return Index”) | 50 | % |

†The initial index levels will be set on the Trade Date.

Participation Rate: | 200% (upside and downside) |

Redemption Amount: | You will receive a cash payment on the Maturity Date or an Early Redemption Date, as applicable, per $1,000 security face amount, calculated as follows: |

[$1,000 + ($1,000 x Basket Return x Participation Rate)] x Adjustment Factor

Your investment will be fully exposed on a leveraged basis to any decline in the Basket. If the Final Basket Level is less than the Initial Basket Level, you will lose 2% of the face amount of your securities for every 1% that the Final Basket Level is less than the Initial Basket Level. In addition, the Adjustment Factor will reduce the payment at maturity or upon early redemption by approximately 3.00% for each year the securities remain outstanding, regardless of whether the Basket appreciates or depreciates. In no event will the Redemption Amount be less than zero. For example, if the Basket Return is -10%, you will lose an amount equal to 20% of your initial investment, and your payment at maturity or upon early redemption will then be further reduced by the Adjustment Factor of approximately 3.00% for each year the securities were outstanding.

You will lose some or all of your investment at maturity or upon early redemption if the Basket does not increase by an amount sufficient to offset the effect of the Adjustment Factor.

Adjustment Factor: | 1 - (0.03 x (Days / 365)), where “Days” equals the number of calendar days from the Trade Date to, but excluding, the Final Averaging Date or the Early Redemption Valuation Date (each, a “Valuation Date”), as applicable. |

Payment at Maturity: | If you hold your securities to maturity, you will receive the Redemption Amount calculated using the Final Basket Level and Adjustment Factor applicable on the Final Averaging Date. |

Basket Return:

Final Basket Level – Initial Basket Level

Initial Basket Level

Initial Basket Level: | 100 |

Final Basket Level: | The Basket closing level will be calculated as follows: |

100 × [1 + (Total Return Index Performance x 50%) + (Excess Return Index Performance x 50%)]

The “Total Return Index Performance” and the “Excess Return Index Performance” are each the performance of the respective Basket Index, expressed as a percentage, from the respective index closing level on the Trade Date to:

(i) the arithmetic average of the respective index closing levels for such Basket Index on the five Averaging Dates, for purposes of calculating the Redemption Amount payable on the Maturity Date; or

(ii) the respective index closing level for such Basket Index on the applicable Early Redemption Valuation Date, for purposes of calculating the Redemption Amount payable on an Early Redemption Date.

The index closing levels on any trading day are subject to adjustment in the event of a Market Disruption Event. See “General Terms of the Securities – Market Disruption Events” herein.

Investing in the securities involves a number of risks. See “Risk Factors” beginning on page TS-6 of this term sheet.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities or passed upon the accuracy or the adequacy of this term sheet or the accompanying underlying supplement, prospectus supplement and prospectus. Any representation to the contrary is a criminal offense.

Price to Public | Discounts and Commissions(1) | Proceeds to Us | ||||

| Per Security | $ | $ | $ | |||

| Total | $ | $ | $ |

| (1) | We expect to pay a portion of the Adjustment Factor as a commission on a quarterly basis to brokerage firms, which may include Deutsche Bank Securities Inc., and their affiliates, whose clients purchase securities in this offering and who continue to hold their securities. For more detailed information about discounts and commissions, please see “Underwriting” in this term sheet. |

The securities are not bank deposits and are not insured by the Federal Deposit Insurance Corporation or any other governmental agency. The securities arenot guaranteed under the Federal Deposit Insurance Corporation’s Temporary Liquidity Guarantee Program.

| Deutsche Bank Securities | Deutsche Bank Trust Company Americas | |

| (cover continued on next page) |

(continued from previous page)

Issuer Early Redemption: | We will have the right, upon fourteen (14) calendar days’ notice, to redeem the securities, in whole, but not in part, for the Redemption Amount, on any Early Redemption Date, subject to postponement if such day is not a business day or in the event of a Market Disruption Event as described under “General Terms of the Securities – Market Disruption Events” herein. If we exercise our early redemption right, the Redemption Amount payable on the applicable Early Redemption Date will be calculated using the Final Basket Level and Adjustment Factor on the corresponding Early Redemption Valuation Date. See “Issuer Early Redemption” herein. |

Investor Early Redemption: | You will have the right to cause us to redeem your securities, in whole, but not in part, for the Redemption Amount, by submitting a notice of your intention to your broker in accordance with your broker’s instructions so that we receive notification of your intention during the applicable Election Period. The Election Period corresponding to each Early Redemption Date is set forth under the heading “Investor Early Redemption” herein. If you exercise your early redemption right, the Redemption Amount payable on the applicable Early Redemption Date will be calculated using the Final Basket Level and Adjustment Factor on the corresponding Early Redemption Valuation Date. See “Investor Early Redemption” herein. |

Averaging Dates: | The five trading days (each, an “Averaging Date”) prior to and including July 9, 2012 (the “Final Averaging Date”), subject to postponement in the event of a Market Disruption Event as described under “General Terms of the Securities – Market Disruption Events” herein. |

Early Redemption Valuation Dates: | July 9, 2010 and July 7, 2011 or, in each case, if such day is not a trading day, the first succeeding trading day, subject to postponement in the event of a Market Disruption Event as described under “General Terms of the Securities – Market Disruption Events” herein. |

Early Redemption Dates: | July 16, 2010 and July 14, 2011, in each case subject to postponement if such day is not a business day or in the event of a Market Disruption Event as described under “General Terms of the Securities – Market Disruption Events” herein. |

Trade Date: | July 8*, 2009 |

Settlement Date: | July 13*, 2009 |

Maturity Date: | July 12*, 2012, subject to postponement if such day is not a business day or in the event of a Market Disruption Event as described under “General Terms of the Securities – Market Disruption Events” herein. |

CUSIP: | 2515A0 L7 6 |

ISIN: | US2515A0L760 |

*Expected.

In the event that we make any change to the expected Trade Date or Settlement Date, the Maturity Date may be changed so that the stated term of the securities remains the same.

ADDITIONAL TERMS SPECIFIC TO THE SECURITIES

| • | You should read this term sheet together with the prospectus dated October 10, 2006, as supplemented by the prospectus supplement dated November 13, 2006 relating to our Series A global notes of which these securities are a part, and the more detailed information regarding the Basket Indices contained in underlying supplement no. 15/A2 dated September 11, 2008. You may access these documents on the SEC website atwww.sec.gov as follows (or if such address has changed, by reviewing our filings for the relevant date on the SEC website): |

| • | Underlying Supplement No. 15/A2 dated September 11, 2008: |

http://www.sec.gov/Archives/edgar/data/1159508/000119312508194800/d424b21.pdf

| • | Prospectus supplement dated November 13, 2006: |

http://www.sec.gov/Archives/edgar/data/1159508/000119312506233129/d424b3.htm

| • | Prospectus dated October 10, 2006: |

http://www.sec.gov/Archives/edgar/data/1159508/000095012306012432/u50845fv3asr.htm

| • | Our Central Index Key, or CIK, on the SEC website is 0001159508. As used in this term sheet, “we,” “us“ or “our“ refers to Deutsche Bank AG, including, as the context requires, acting through one of its branches. |

| • | This term sheet, together with the documents listed above, contains the terms of the securities and supersedes all other prior or contemporaneous oral statements as well as any other written materials including preliminary or indicative pricing terms, correspondence, trade ideas, structures for implementation, sample structures, brochures or other educational materials of ours. You should carefully consider, among other things, the matters set forth under the heading “Risk Factors” herein, as the securities involve risks not associated with conventional debt securities. We urge you to consult your investment, legal, tax, accounting and other advisers before deciding to invest in the securities. |

| • | Deutsche Bank AG has filed a registration statement (including a prospectus) with the Securities and Exchange Commission, or SEC, for the offering to which this term sheet relates. Before you invest, you should read the prospectus in that registration statement and the other documents relating to this offering that Deutsche Bank AG has filed with the SEC for more complete information about Deutsche Bank AG and this offering. You may obtain these documents without cost by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, Deutsche Bank AG, any agent or any dealer participating in this offering will arrange to send you the prospectus, underlying supplement, and this term sheet if you so request by calling toll-free 1-800-311-4409. |

| • | You may revoke your offer to purchase the securities at any time prior to the time at which we accept such offer by notifying the applicable agent. We reserve the right to change the terms of, or reject any offer to purchase, the securities prior to their issuance. We will notify you in the event of any changes to the terms of the securities, and you will be asked to accept such changes in connection with your purchase of any securities. You may also choose to reject such changes, in which case we may reject your offer to purchase the securities. |

TS-1

HYPOTHETICAL EXAMPLES

What is the Redemption Amount on the Securities at Maturity Assuming a Range of Performance for the Basket?

The following table illustrates the hypothetical Redemption Amount at maturity per $1,000 security face amount, for a hypothetical range of performance for the Basket from -100% to +100%. The hypothetical Redemption Amounts set forth below assume a period of 1,096 calendar days from the Trade Date to the Final Averaging Date, that we do not exercise our early redemption right and that you do not exercise your early redemption right. The hypothetical Redemption Amounts set forth below are for illustrative purposes only and may not be the actual Redemption Amounts applicable to a purchaser of the securities. The numbers appearing in the following table and examples have been rounded for ease of analysis.

| Final Basket Level | Basket Return | Adjustment Factor | Redemption Amount | Return on Securities | ||||

| 200.00 | 100.00% | 0.909918 | $2,729.75 | 172.98% | ||||

| 190.00 | 90.00% | 0.909918 | $2,547.77 | 154.78% | ||||

| 180.00 | 80.00% | 0.909918 | $2,365.79 | 136.58% | ||||

| 170.00 | 70.00% | 0.909918 | $2,183.80 | 118.38% | ||||

| 160.00 | 60.00% | 0.909918 | $2,001.82 | 100.18% | ||||

| 150.00 | �� 50.00% | 0.909918 | $1,819.84 | 81.98% | ||||

| 140.00 | 40.00% | 0.909918 | $1,637.85 | 63.79% | ||||

| 130.00 | 30.00% | 0.909918 | $1,455.87 | 45.59% | ||||

| 120.00 | 20.00% | 0.909918 | $1,273.88 | 27.39% | ||||

| 110.00 | 10.00% | 0.909918 | $1,091.90 | 9.19% | ||||

| 104.95 | 4.95% | 0.909918 | $1,000.00 | 0.00% | ||||

| 103.00 | 3.00% | 0.909918 | $964.51 | -3.55% | ||||

| 100.00 | 0.00% | 0.909918 | $909.92 | -9.01% | ||||

| 90.00 | -10.00% | 0.909918 | $727.93 | -27.21% | ||||

| 80.00 | -20.00% | 0.909918 | $545.95 | -45.40% | ||||

| 70.00 | -30.00% | 0.909918 | $363.97 | -63.60% | ||||

| 60.00 | -40.00% | 0.909918 | $181.98 | -81.80% | ||||

| 50.00 | -50.00% | 0.909918 | $0.00 | -100.00% | ||||

| 40.00 | -60.00% | 0.909918 | $0.00 | -100.00% | ||||

| 30.00 | -70.00% | 0.909918 | $0.00 | -100.00% | ||||

| 20.00 | -80.00% | 0.909918 | $0.00 | -100.00% | ||||

| 10.00 | -90.00% | 0.909918 | $0.00 | -100.00% | ||||

| 0.00 | -100.00% | 0.909918 | $0.00 | -100.00% |

Hypothetical Examples of Amounts Payable at Maturity

The following examples illustrate how the Redemption Amounts set forth in the table above are calculated.

Example 1: The level of the Basket increases from the Initial Basket Level of 100 to a Final Basket Level of 200.Assuming a period of 1,096 calendar days from the Trade Date to the Final Averaging Date, you would receive a payment at maturity of $2,729.75 per $1,000.00 security face amount, calculated as follows:

[$1,000 + ($1,000 x ((200 – 100) / 100)) x 200%)] x [1 – 0.03 x (1,096 / 365)] = $2,729.75

TS-2

Example 2: The level of the Basket increases from the Initial Basket Level of 100 to a Final Basket Level of 150. Assuming a period of 1,096 calendar days from the Trade Date to the Final Averaging Date, you would receive a payment at maturity of $1,819.84 per $1,000.00 security face amount, calculated as follows:

[$1,000 + ($1,000 x ((150 – 100) / 100)) x 200%)] x [1 – 0.03 x (1,096 / 365)] = $1,819.84

Example 3: The level of the Basket increases from the Initial Basket Level of 100 to a Final Basket Level of 104.95.Assuming a period of 1,096 calendar days from the Trade Date to the Final Averaging Date, you would receive a payment at maturity of $1,000.00 per $1,000.00 security face amount, calculated as follows:

[$1,000 + ($1,000 x ((104.95 – 100) / 100)) x 200%)] x [1 – 0.03 x (1,096 / 365)] = $1,000.00

Example 4: The level of the Basket increases from the Initial Basket Level of 100 to a Final Basket Level of 103.In this case, even though the Final Basket Level is greater than the Initial Basket Level, you would receive a payment at maturity that isless than $1,000.00 per $1,000.00 security face amount because the increase in the level of the Basket is not sufficient to offset the effect of the Adjustment Factor. Assuming a period of 1,096 calendar days from the Trade Date to the Final Averaging Date, you would receive a payment at maturity of $964.51 per $1,000.00 security face amount, calculated as follows:

[$1,000 + ($1,000 x ((103 – 100) / 100)) x 200%)] x [1 – 0.03 x (1,096 / 365)] = $964.51

Example 5: The Initial Basket Level and the Final Basket Level are both 100. In this case, you would receive a payment at maturity that isless than $1,000.00 per $1,000.00 security face amount. Assuming a period of 1,096 calendar days from the Trade Date to the Final Averaging Date, you would receive a payment at maturity of $909.92 per $1,000.00 security face amount, calculated as follows:

[$1,000 + ($1,000 x ((100 – 100) / 100)) x 200%)] x [1 – 0.03 x (1,096 / 365)] = $909.92

Example 6: The level of the Basket decreases from the Initial Basket Level of 100 to a Final Basket Level of 70.Assuming a period of 1,096 calendar days from the Trade Date to the Final Averaging Date, you would participate in the depreciation of the Basket on a leveraged basis and receive a payment at maturity that reflects the leveraged downside exposure and the Adjustment Factor. Your payment at maturity would equal to $363.97 per $1,000.00 security face amount, calculated as follows:

[$1,000 + ($1,000 x ((70 – 100) / 100)) x 200%)] x [1 – 0.03 x (1,096 / 365)] = $363.97

Example 7: The level of the Basket decreases from the Initial Basket Level of 100 to a Final Basket Level of 50.In this case, even though the Final Basket Level is greater than 0, you wouldnot receive any payment at maturitybecause for each 1% decline in the Basket Level from the Initial Basket Level, you will lose 2% of your initial investment, subject also to the impact of the Adjustment Factor. Your payment at maturity reflects participation in the decrease in the level of the Basket on a leveraged basis and the Adjustment Factor. Assuming a period of 1,096 calendar days from the Trade Date to the Final Averaging Date, you would receive a payment at maturity of $0.00 per $1,000.00 security face amount, calculated as follows:

[$1,000 + ($1,000 x ((50 – 100) / 100)) x 200%)] x [1 – 0.03 x (1,096 / 365)] = $0.00

TS-3

Selected Purchase Considerations

| • | APPRECIATION POTENTIAL— The securities provide the opportunity to leverage returns by multiplying the Basket Return by a Participation Rate of 200%. Because the securities are our senior obligations, payment of any amount at maturity is subject to our ability to pay our obligations as they become due. |

| • | ACCELERATED LOSS AND NO PROTECTION AGAINST LOSS — The securities provide for a downside Participation Rate of 200%. If the Final Basket Level is less than the Initial Basket Level, for every 1% decline of the Final Basket Level below the Initial Basket Level, you will lose an amount equal to 2% of the face amount of your securities. Your payment at maturity or upon early redemption will be further reduced by the Adjustment Factor. |

| • | RETURN LINKED TO THE PERFORMANCE OF A BASKET OF INDICES — The return on the securities, which may be positive or negative, is linked to a basket consisting of the Total Return Index and the Excess Return Index. |

Deutsche Bank Liquid Alpha USD 5 Total Return® Index

The Total Return Index is intended to reflect the combined total return performance of a number of indices referred to as Index Constituents selected from among a pool of available indices referred to as Selection Pool Indices. The Selection Pool Indices are proprietary indices of Deutsche Bank or Standard & Poor’s and are categorized into one of five asset classes: equity, rates, commodities, FX and cash. The Index Constituents comprising the Total Return Index and their weights are selected by a process involving Deutsche Bank AG, London Branch or any duly appointed successor as Index Sponsor (the “Index Sponsor“) using a computer-based model (the “Model“), designed, owned and controlled by Deutsche Bank AG, London Branch. The Model is intended, on each Index Selection Date (as defined in the accompanying underlying supplement), to identify a notional portfolio of the Selection Pool Indices that, if the Total Return Index had comprised such notional portfolio over the period of 60 business days immediately preceding the relevant Index Selection Date, would have generated the highest level of annualized return for the Total Return Index during such period at a predetermined level of volatility. Certain of the Selection Pool Indices involve a dynamic allocation to underlying reference assets reflecting an alpha investment strategy. “Alpha” refers to the difference in the performance of an asset relative to a benchmark asset and an alpha investment strategy is a strategy that aims to generate returns without regard to the direction of the benchmark asset. For additional information about the Total Return Index, see the information set forth under “The Deutsche Bank Liquid Alpha Indices” in this term sheet and “The Deutsche Bank Liquid Alpha USD 5 Total Return® Index and the Deutsche Bank Liquid Alpha USD 5 Excess Return® Index” in the accompanying underlying supplement.

Deutsche Bank Liquid Alpha USD 5 Excess Return® Index

The Excess Return Index is intended to reflect the performance of the Total Return Index relative to the performance of the Deutsche Bank Fed Funds Total Return Index (the “Fed Funds Index”). For additional information about the Excess Return Index, see the information set forth under “The Deutsche Bank Liquid Alpha Indices“ in this term sheet and “The Deutsche Bank Liquid Alpha USD 5 Total Return® Index and the Deutsche Bank Liquid Alpha USD 5 Excess Return® Index” in the accompanying underlying supplement.

| • | THE ADJUSTMENT FACTOR REDUCES THE PAYMENT AT MATURITY OR UPON EARLY REDEMPTION — The payment at maturity or upon early redemption will be reduced by approximately 3.00% for each year the securities remain outstanding. |

TS-4

The Adjustment Factor is applied on the applicable Valuation Date and will reduce the return on the securities regardless of whether the Final Basket Level on the applicable Valuation Date is greater than, less than or equal to the Initial Basket Level. Because the securities are our senior unsecured obligations, payment of any amount at maturity or upon an early redemption is subject to our ability to pay our obligations as they become due. |

| • | TAX CONSIDERATIONS— You should review carefully the section in this term sheet entitled “Certain U.S. Federal Income Tax Consequences.” |

Under current law, the United Kingdom will not impose withholding tax on payments made with respect to the securities.

For a discussion of certain German tax considerations relating to the securities, you should refer to the section in the accompanying prospectus supplement entitled “Taxation by Germany of Non-Resident Holders.”

We do not provide any advice on tax matters. Both U.S. and non-U.S. holders should consult their tax advisers regarding all aspects of the U.S. federal tax consequences of investing in the securities, as well as any tax consequences arising under the laws of any state, local or non-U.S. taxing jurisdiction.

TS-5

RISK FACTORS

An investment in the securities involves significant risks. Investing in the securities is not equivalent to investing directly in the Basket Indices, the Index Constituents or any of the components underlying the Index Constituents.You should consider carefully the following discussion of risks together with the risk information contained in the accompanying prospectus supplement and prospectus before you decide that an investment in the securities is suitable for you.

| • | YOUR INVESTMENT IN THE SECURITIES MAY RESULT IN A LOSS ON AN ACCELERATED BASIS — The securities do not guarantee any return of your initial investment. The return on the securities at maturity or upon an early redemption is linked to the performance of the Basket and will depend on whether, and the extent to which, the Final Basket Level is greater than the Initial Basket Level. Your investment will be fully exposed to any decline in the Final Basket Level, determined on the applicable Valuation Date, as compared to the Initial Basket Level, magnified by a Participation Rate of 200%. You could lose all of your initial investment if the Final Basket Level is less than the Initial Basket Level. Specifically, for every 1% that the Final Basket Level is less than the Initial Basket Level, you will lose 2% of the face amount of your securities,provided that your payment at maturity or upon early redemption will not be less than $0. Accordingly, you will lose your entire investment at maturity or upon early redemption if the Final Basket Level is less than the Initial Basket Level by 50% or more. You will lose some of your initial investment if the Final Basket Level is greater than the Initial Basket Level but the Final Basket Level is not sufficiently greater than the Initial Basket Level to offset the effect of the Adjustment Factor. |

| • | THE INCLUSION OF AN ADJUSTMENT FACTOR REDUCES THE PAYMENT AT MATURITY OR UPON EARLY REDEMPTION — The payment at maturity or upon early redemption will be reduced by approximately 3.00% for each year the securities remain outstanding. The Adjustment Factor is applied on the applicable Valuation Date and will reduce the return on the securities regardless of whether or not the Final Basket Level is greater than the Initial Basket Level. The securities have a term of three years, so the total return at maturity will be reduced by approximately 9.00% compared to the total return if the Adjustment Factor had not been applied. Consequently, at maturity, you will receive less than your original investment unless the Final Basket Level, determined on the Final Averaging Date, is approximately 4.95% or more greater than the Initial Basket Level. |

| • | THE SECURITIES ARE SUBJECT TO THE ISSUER’S CREDITWORTHINESS— An actual or anticipated downgrade in the Issuer’s credit rating will likely have an adverse effect on the market value of the securities. The payment at maturity on the securities is subject to the creditworthiness of the Issuer. |

| • | LIQUID ALPHA INDICES STRATEGY RISK — The Total Return Index is intended to reflect the combined total return performance of a number of indices referred to as Index Constituents while the Excess Return Index is intended to reflect the performance of the Total Return Index relative to the performance of the Fed Funds Index. The Index Constituents and their weights are selected by a process involving the Index Sponsor using a computer-based model, the Model, designed, owned and controlled by the Index Sponsor. The Model is intended, on each Index Selection Date (as defined in the accompanying underlying supplement), to identify a notional portfolio of the Selection Pool Indices that, if the Total Return Index had comprised such notional portfolio over the period of 60 business days immediately preceding the relevant Index Selection Date, would have generated the highest level of annualized return for the Total Return Index |

TS-6

during such period at a predetermined level of annualized volatility of 5.00%. The selection by the Model of the Index Constituents and their weights is based on a retrospective calculation, and there is no assurance that the Index Constituents and weights selected by the Model will cause the level of the Total Return Index or that of the Excess Return Index to increase. |

| • | THE YIELD ON THE SECURITIES MAY BE LOWER THAN THE YIELD ON DEBT SECURITIES OF COMPARABLE MATURITY AND MAY BE ZERO OR NEGATIVE — The yield to the Maturity Date on the securities may be lower than the yield on our conventional debt securities of a comparable maturity and credit rating. If your securities have not been redeemed prior to maturity, at maturity, you will receive a positive return on your investment only if the Final Basket Level on the Final Averaging Date exceeds the Initial Basket Level by approximately 4.95% or more. If we choose to exercise our early redemption right, you will receive a positive return on your investment only if the Final Basket Level on the applicable Early Redemption Valuation Date exceeds the Initial Basket Level by an amount sufficient to entirely offset the effect of the Adjustment Factor. Similarly, if you choose to exercise your early redemption right, you will receive a positive return on your investment only if the Final Basket Level on the applicable Early Redemption Valuation Date exceeds the Initial Basket Level by an amount sufficient to entirely offset the effect of the Adjustment Factor. If the Final Basket Level on the applicable Valuation Date is equal to the Initial Basket Level, you will receive a negative return on your investment due to the Adjustment Factor. Even if the Final Basket Level on the applicable Valuation Date is greater than the Initial Basket Level by an amount sufficient to entirely offset the Adjustment Factor, the yield to the Maturity Date may not fully compensate you for any opportunity cost, taking into account inflation and other factors relating to the time value of money. |

| • | WE MAY REDEEM THE SECURITIES PRIOR TO THE MATURITY DATE — We will have the right, in our sole discretion, to redeem the securities, in whole, but not in part, for the Redemption Amount, upon fourteen (14) calendar days’ notice, on any Early Redemption Date. If we choose to exercise our early redemption right, the Redemption Amount payable on the Early Redemption Date will be calculated using the Final Basket Level and Adjustment Factor on the corresponding Early Redemption Valuation Date. Such Redemption Amount could be less, and potentially substantially less, than your initial investment in the securities. In addition, you will not benefit from any appreciation of the Basket that may occur after the Early Redemption Valuation Date and you will not be able to hold your securities to maturity. We have no obligation to consider your interests in determining whether to redeem the securities prior to the maturity date. |

| • | CERTAIN BUILT-IN COSTS ARE LIKELY TO ADVERSELY AFFECT THE VALUE OF THE SECURITIES PRIOR TO MATURITY — While the payment at maturity described in this term sheet is based on the full face amount of your securities, the issue price of the securities includes the commissions, discounts and fees, if any, and the expected cost of hedging our obligations under the securities through one or more of our affiliates. The hedging costs also include the projected profit that the Issuer or its affiliates may realize in consideration for assuming the risks inherent in managing the hedging transactions. The fact that the issue price of the securities includes these commissions and hedging costs may adversely affect the price at which the Issuer or its affiliates may be willing to purchase the securities in the secondary market, if any. In addition, the hedging activity of the Issuer or its affiliates may result in the Issuer or its affiliates receiving a profit from hedging, even if the market value of the securities declines. |

TS-7

| • | NO COUPON PAYMENTS — As a holder of the securities, you will not receive coupon payments. |

| • | LACK OF LIQUIDITY — The securities will not be listed on any securities exchange. Deutsche Bank Securities Inc. (“DBSI“) may offer to purchase the securities in the secondary market but is not required to do so. Because other dealers are not likely to make a secondary market for the securities, the price at which you may be able to sell your securities is likely to depend on the price, if any, at which DBSI is willing to buy the securities. |

| • | POTENTIAL CONFLICTS OF INTEREST EXIST BECAUSE WE, THE CALCULATION AGENT AND THE SPONSOR OF THE BASKET INDICES AND CERTAIN OF THE CONSTITUENT INDICES ARE THE SAME LEGAL ENTITY— Deutsche Bank AG, London Branch is the Issuer of the securities, the Calculation Agent for the securities, the sponsor of the Basket Indices and the sponsor of certain of the Index Constituents. We, as Index Sponsor, will determine whether there has been a Market Disruption Event with respect to a Basket Index or any Index Constituent. In the event of any such Market Disruption Event, we may use an alternate method to calculate the closing level of the applicable Basket Index. As the Index Sponsor, we carry out calculations necessary to promulgate the Basket Indices and certain of the Index Constituents, and we maintain some discretion as to how such calculations are made. In particular, we have discretion in selecting among methods of how to calculate a Basket Index or any Index Constituent in the event the regular means of determining a Basket Index or any Index Constituent is unavailable at the time such determination is scheduled to take place. While we will act in good faith and in a commercially reasonable manner in making all determinations with respect to the securities, the Basket Indices and the Index Constituents, there can be no assurance that any determinations made by Deutsche Bank AG, London Branch in these various capacities will not affect the value of the securities, the Index or the Index Constituents. Because determinations made by Deutsche Bank AG, London Branch as the Calculation Agent for the securities, the sponsor of the Basket Indices and the sponsor of certain of the Index Constituents may affect the Redemption Amount you receive at maturity or upon early redemption, potential conflicts of interest may exist between Deutsche Bank AG, London Branch and you, as a holder of the securities. |

Furthermore, Deutsche Bank AG, London Branch or one or more of its affiliates may have published, and may in the future publish, research reports on the Index Constituents, investment strategies reflected by the Index Constituents or any components of the Index Constituents (or various contracts or products related to the Index Constituents or any components thereof). This research is modified from time to time without notice and may express opinions or provide recommendations that are inconsistent with purchasing or holding the securities. Any of these activities may affect the value of the Basket Indices and, therefore, the value of the securities or the potential payout on the securities.

| • | THE BROKERAGE FIRM THROUGH WHICH YOU HOLD YOUR SECURITIES AND YOUR BROKER MAY HAVE ECONOMIC INTERESTS THAT ARE DIFFERENT FROM YOURS — We expect to pay a portion of the Adjustment Factor as a commission on a quarterly basis to brokerage firms, which may include DBSI, and their affiliates, whose clients purchase securities in this offering and who continue to hold their securities. We expect that the brokerage firm through which you hold your securities will pay a portion of these commissions to your broker. |

TS-8

As a result of these arrangements, the brokerage firm through which you hold your securities and your broker may have economic interests that are different than yours. As with any security or investment for which the commission is paid over time, your brokerage firm and your broker may have an incentive to encourage you to continue to hold the securities because they will no longer receive these quarterly commissions if you sell or redeem your securities. You should take the above arrangements and the potentially different economic interests they create into account when considering an investment in the securities. For more information about the payment of these commissions, see “Underwriting” in this term sheet.

| • | THE VALUE OF THE SECURITIES WILL BE AFFECTED BY A NUMBER OF UNPREDICTABLE FACTORS — We expect that, generally, the levels of the Basket Indices on any day will affect the value of the securities more than any other single factor. While the value of the securities in the secondary market should vary in proportion to changes in the levels of the Basket Indices, the value of the securities will be affected by a number of other factors that may either offset or magnify each other, including: the volatility of the Basket Indices and the Index Constituents; the closing levels of the Index Constituents; the currency markets generally and any currency exchange rates reflected in any of the Index Constituents; the value of Treasury Bills; interest and yield rates generally; monetary policies of the Federal Reserve Board and other central banks of various countries; inflation and expectations concerning inflation; the equity markets generally and any stock prices and dividend rates reflected in any of the Index Constituents; the financial condition and results of operations of any companies whose shares comprise any of the Index Constituents and conditions generally in the industries in which such companies operate; the commodity markets (including markets for commodity futures contracts) generally and the prices of commodities or commodity futures contracts reflected in any of the Index Constituents; supply and demand for the securities; a variety of economic, financial, political, regulatory or judicial events including wars, acts of terrorism; and natural disasters; and our creditworthiness, including actual or anticipated downgrades in our credit ratings. |

| • | THE CORRELATION AMONG THE INDEX CONSTITUENTS COULD CHANGE UNPREDICTABLY— Correlation is the extent to which the values of the Index Constituents increase or decrease to the same degree at the same time. The value of the securities may be adversely affected by increased correlation among the Index Constituents, in particular in a down market. The value of the securities may also be adversely affected by decreased correlation between the Basket Indices, meaning the positive performance of one Basket Index could be entirely offset by the negative performance of the other. |

| • | THE RETURN ON YOUR INVESTMENT COULD BE SIGNIFICANTLY LESS THAN THE PERFORMANCE OF ANY INDIVIDUAL ELEMENT INCLUDED IN THE BASKET INDICES — The return on your investment in the securities could be less than the return on an alternative investment with similar risk characteristics, even if some of the Index Constituents have generated significant returns. The levels of the Index Constituents may move in different directions at different times compared to each other, and underperformance by one or more of the Index Constituents may reduce the performance of the Total Return Index and the Excess Return Index. |

| • | THE BASKET INDICES HAVE LIMITED PERFORMANCE HISTORY — Calculation of the Basket Indices began on April 17, 2008. Therefore, they have very limited performance history and no actual investment which allowed tracking of the performance of the Basket Indices was possible before that date. |

TS-9

| • | THE U.S. FEDERAL INCOME TAX CONSEQUENCES OF AN INVESTMENT IN THE SECURITIES ARE UNCLEAR — There is no direct legal authority regarding the proper U.S. federal income tax treatment of the securities, and we do not plan to request a ruling from the Internal Revenue Service (the “IRS“). Consequently, significant aspects of the tax treatment of the securities are uncertain and no assurance can be given that the IRS or a court will agree with the treatment of the securities as prepaid financial contracts, as described in the section of this term sheet entitled “Certain U.S. Federal Income Tax Consequences.” If the IRS were successful in asserting an alternative treatment, the tax consequences of ownership and disposition of the securities might be affected materially and adversely. As described in “Certain U.S. Federal Income Tax Consequences,” in December 2007, the Department of the Treasury (“Treasury“) and the IRS released a notice requesting comments on various issues regarding the U.S. federal income tax treatment of “prepaid forward contracts” and similar instruments, such as the securities. Any Treasury regulations or other guidance promulgated after consideration of these issues could materially and adversely affect the tax consequences of an investment in the securities, possibly with retroactive effect. |

Both U.S. and non-U.S. holders should consult their tax advisers regarding the U.S. federal income tax consequences of an investment in the securities (including possible alternative treatments and the issues presented by the December 2007 notice), as well as any tax consequences arising under the laws of any state, local or non-U.S. taxing jurisdiction.

| • | AN INVESTMENT IN THE SECURITIES IS NOT THE SAME AS AN INVESTMENT IN THE INDEX CONSTITUENTS — The closing levels of the Basket Indices on any trading day will depend on the performance of the Index Constituents. The weighting of each Index Constituent is determined by the Model, which seeks to maximize returns for a given level of volatility.You should carefully consider the composition and calculation of each Index Constituent before deciding that an investment in the securities is suitable for you. |

| • | THE INDEX CONSTITUENTS ARE NOT EQUALLY WEIGHTED AND MAY OFFSET EACH OTHER — The Index Constituents are assigned different weightings by the Model and such weightings are periodically adjusted in accordance with the Model. The same return generated by two Index Constituents, whether positive or negative, may have a different effect on the performance of the Total Return Index and the Excess Return Index. Additionally, positive returns generated by one or more of the Index Constituents may be moderated or more than offset by smaller positive returns or negative returns generated by the other Index Constituents, particularly if the Index Constituents that generate positive returns are assigned relatively low weightings. |

| • | THE ACTUAL EXPERIENCED VOLATILITY OF EACH INDEX CONSTITUENT AND INDEX MAY NOT EQUAL THE TARGET VOLATILITY, WHICH MAY HAVE A NEGATIVE IMPACT ON THE PERFORMANCE OF THE BASKET INDICES — The weighting of each Index Constituent is adjusted to target a volatility level of 5.00%. Because this adjustment is based on the volatility of the previous 60 business days, the actual volatility realized on the Index Constituents and the Total Return Index will not necessarily equal the volatility target, which could have an adverse effect on the Basket Indices and consequently the value of your securities. |

| • | THE CALCULATION OF THE CLOSING LEVELS OF THE BASKET INDICES WILL INCLUDE A DEDUCTION OF COSTS FROM THE CONSTITUENT INDICES — On each trading day, the calculation of the closing levels of the Basket Indices will include a deduction of costs from the Index Constituents, currently ranging between a minimum |

TS-10

of 21 basis points per annum and a maximum of 63 basis points per annum, depending on the individual weightings of the Index Constituents. |

Risks Relating to the Index Constituents

| • | THE S&P X-ALPHA USD TOTAL RETURN STRATEGY INDEX HAS LIMITED PERFORMANCE HISTORY — Publication of the S&P X-Alpha USD Total Return Strategy Index (the “X-Alpha Index“) began on October 31, 2007. Therefore, the X-Alpha Index has very limited performance history, and no actual investment which allowed a tracking of the performance of the X-Alpha Index was possible before that date. |

| • | THE X-ALPHA INDEX CONSTITUENT PAIRS ARE NOT EQUALLY WEIGHTED IN THE X-ALPHA MODEL AND MAY OFFSET EACH OTHER— The X-Alpha Index uses a rules-based, mathematical model (the “X-Alpha Model“) that reflects the performance of eight Deutsche Bank proprietary equity indices (collectively, the “DB Regional Style Indices“) relative to the performance of four well known regional equity benchmark indices maintained by third-party sponsors (collectively, the “Benchmark Indices“ and, together with the DB Regional Style Indices, the “X-Alpha Index Constituents“). The closing level of the X-Alpha Index on any trading day will depend on the performance, in relation to each pair of X-Alpha Index Constituents which consists of a DB Regional Style Index and a Benchmark Index (each, an “X-Alpha Index Constituent Pair“), of each DB Regional Style Index compared to the Benchmark Index with which it is paired. The X-Alpha Index Constituent Pairs are assigned different weightings in the X-Alpha Index. Positive returns generated by one or more X-Alpha Index Constituent Pairs may be moderated or more than offset by smaller positive returns or negative returns generated by the other X-Alpha Index Constituent Pairs, particularly if the X-Alpha Index Constituent Pairs that generate positive returns are assigned relatively low weightings in the X-Alpha Model. |

| • | THE RETURNS OF THE X-ALPHA INDEX CONSTITUENT PAIRS WILL BE EXPOSED TO FLUCTUATIONS IN EXCHANGE RATES — For the purposes of determining the returns of the X-Alpha Index Constituent Pairs (each consisting of a DB Regional Style Index together with a Benchmark Index), the currency in which any DB Regional Style Index or Benchmark Index (if such currency is not U.S. dollars) will be converted into U.S. dollars at the relevant spot exchange rate. Any positive or negative return that is generated as a result of the performance of a DB Regional Style Index compared to that of a Benchmark Index with which it is paired is exposed to fluctuations in the exchange rate between the U.S. dollar and the currency in which such DB Regional Style Index and such Benchmark Index are publicly quoted. |

| • | THE ACTUAL EXPERIENCED VOLATILITY OF EACH X-ALPHA INDEX CONSTITUENT PAIR AND THE X-ALPHA MODEL MAY NOT EQUAL TARGET VOLATILITY, WHICH MAY HAVE A NEGATIVE IMPACT ON THE PERFORMANCE OF THE X-ALPHA INDEX — The weighting of each X-Alpha Index Constituent Pair in the X-Alpha Model and the X-Alpha Model are adjusted to target a volatility level of 8%. Because this adjustment is based on recently experienced volatility and is subject to a minimum of 50% and a maximum of 150%, the actual volatility realized on the X-Alpha Index Constituent Pairs and the X-Alpha Model will not necessarily equal the volatility target, which could have an adverse effect on the value of the X-Alpha Index. |

| • | THE CALCULATION OF THE CLOSING LEVEL OF THE X-ALPHA INDEX WILL INCLUDE THE DEDUCTION OF A BORROW FEE— On each trading day, the |

TS-11

calculation of the closing level of the X-Alpha Index will include the deduction of a borrow fee to defray transaction costs incurred in relation to the X-Alpha Index on such day. |

| • | THE DEUTSCHE BANK COMMODITY HARVEST USD TOTAL RETURN INDEX HAS LIMITED PERFORMANCE HISTORY — Publication of the Deutsche Bank Commodity Harvest USD Total Return Index (the “Commodity Harvest Index”) began on December 17, 2007. Therefore, the Commodity Harvest Index has very limited performance history, and no actual investment which allowed a tracking of the performance of the Commodity Harvest Index was possible before that date. |

| • | COMMODITY HARVEST INDEX STRATEGY RISK — The Commodity Harvest Index reflects a strategy that takes a long position in the Deutsche Bank Commodity Booster Index (the “Booster Index”) and a short position in the S&P GSCI™ Light Energy Index (the “S&P Light Energy Index”). With respect to certain of its constituent commodity futures contracts, the Booster Index employs a rule-based approach when it replaces constituent futures contracts approaching expiration with futures contracts having a later expiration (a process referred to as “rolling”). Rather than select new futures contracts for certain constituent commodities based on a predefined schedule (e.g.,monthly), as does the S&P Light Energy Index, the Booster Index rolls to those futures contracts (from the list of tradable futures which expire in the next thirteen months), that seek to generate the maximum implied roll yield. The Booster Index aims to maximize the potential roll benefits in backwardated markets (where futures contracts prices are less than spot prices) and minimize losses in contango markets (where futures contracts prices are greater than spot prices). This strategy may not be successful. The value of the Commodity Harvest Index will be adversely affected if the Booster Index does not outperform the benchmark S&P Light Energy Index. |

| • | COMMODITY MARKETS MAY BE HIGHLY VOLATILE — Commodity markets may be highly volatile and prices of commodities and commodity futures contracts can fluctuate rapidly based on numerous factors, including: changes in supply and demand relationships (whether actual, perceived, anticipated, unanticipated or unrealized); weather; agriculture; trade; fiscal, monetary and exchange control programs; domestic and foreign political and economic events and policies; disease; pestilence; technological developments; changes in interest rates, whether through governmental action or market movements; and monetary and other governmental policies, action and inaction. In addition, certain commodities may be produced in a limited number of countries and may be controlled by a small number of producers. Political, economic and supply related events in such countries could have a disproportionate impact on the prices of such commodities. Any of these factors could have an adverse effect on the performance of the Commodity Harvest Index. |

| • | THE DEUTSCHE BANK BALANCED CURRENCY HARVEST (USD-FUNDED) INDEX HAS LIMITED PERFORMANCE HISTORY — Publication of the Deutsche Bank Balanced Currency Harvest (USD-Funded) Index (the “Currency Harvest Index”) began on October 19, 2005. Therefore, the Currency Harvest Index has limited performance history, and no actual investment which allowed a tracking of the performance of the Currency Harvest Index was possible before that date. |

| • | CURRENCY HARVEST INDEX STRATEGY RISK — The strategy reflected in the Currency Harvest Index takes the view that by taking long positions in high yielding currencies and short positions in low yielding currencies, an investor’s gain from interest rate differentials in the high yielding jurisdictions will exceed any potential losses from exchange rate risk. This strategy may not be successful and there is no |

TS-12

assurance that this expectation is or will remain valid. Various market factors and circumstances at any time and over any period could cause and have in the past caused investors to become more risk averse to high yielding currencies. Such risk aversion is greater with respect to the non-G10 currencies, which may be volatile and subject to large fluctuations, devaluations, exchange controls and inconvertibility. |

| • | GAINS IN COMPONENTS OF THE CURRENCY HARVEST INDEX MAY BE OFFSET BY LOSSES IN OTHER INDEX COMPONENTS — The Currency Harvest Index is composed of multiple currency positions. Any gain in one position may be offset by a loss in another position. |

| • | CURRENCY MARKETS MAY BE HIGHLY VOLATILE — Currency markets may be highly volatile, particularly in relation to emerging or developing nations’ currencies and, in certain market conditions, also in relation to developed nations’ currencies. The Currency Harvest Index components may include emerging market countries that are more exposed to the risk of swift political change and economic downturns than their industrialized counterparts. Political or economic instability is likely to have an adverse effect on the performance of the Currency Harvest Index. |

| • | THE DEUTSCHE BANK SMART USD INDEX HAS LIMITED PERFORMANCE HISTORY — Publication of the Deutsche Bank SMART USD Index (the “SMART Index”) began on July 15, 2007. Therefore, the SMART Index has very limited actual performance history, and no actual investment which allowed a tracking of the performance of the SMART Index was possible before that date. |

| • | SMART INDEX STRATEGY RISK — The SMART Index reflects an investment strategy that systematically selects steepening or flattening positions with respect to the USD yield curve. In order to capture returns generated by changes in the slope of the USD yield curve, the positions reflected in the SMART Index are determined on the basis of signals that indicate a rate cutting or rate hiking cycle, or, if such signals are inconclusive, on the basis of the yield of holding two forward starting interest rate swaps, receiving fixed payments of a 2-year maturity and making fixed payments of a 10-year maturity for one month’s time. This strategy may not be successful. If the slope of the USD yield curve does not behave in the manner indicated by the signals or remains flat or nearly flat for extended periods, the value of the SMART Index could be adversely affected. |

| • | LEVERAGED EXPOSURE TO THE SMART USD INDEX — Positive or negative returns generated by the SMART Index are five times leveraged before being assigned a weighting in the Index by the Model. If the investment strategy reflected by the SMART Index does not generate positive results, the contribution of the SMART Index to Index will be the weighted, leveraged negative performance of the SMART USD Index. |

TS-13

ISSUER EARLY REDEMPTION

We will have the right, upon fourteen (14) calendar days’ notice, to redeem the securities, in whole, but not in part, for the Redemption Amount, on any Early Redemption Date, subject to postponement if such day is not a business day or in the event of a Market Disruption Event as described under “General Terms of the Securities – Market Disruption Events” herein. If we exercise our early redemption right, the Redemption Amount payable on the applicable Early Redemption Date will be calculated using the Final Basket Level and Adjustment Factor on the corresponding Early Redemption Valuation Date.

Because the securities are represented by a global security, the Depository Trust Company (the “Depositary”) or the Depositary’s nominee will be the holder of the securities. We will notify only the Depositary or the Depositary’s nominee at least fourteen (14) calendar days prior to the Early Redemption Date of our intention to exercise our early redemption right. We expect that the Depositary or the Depositary’s nominee will notify the broker or other direct or indirect participant through which you hold your securities and that your broker will notify you of our intention to exercise our early redemption right. Different firms have different policies for transmitting notices to their customers and, accordingly, you should consult the broker or other direct or indirect participant through which you hold your securities in order to ascertain how and when you will receive a notice of early redemption if we issue such a notice to the Depositary or its nominee. You may receive such notice less than fourteen (14) calendar days prior to the Early Redemption Date and we take no responsibility for any failure by the Depositary or the Depositary’s nominee to transmit such notice to your broker or by your broker to transmit such notice to you in a timely manner or at all.

INVESTOR EARLY REDEMPTION

You will have the right to cause us to redeem your securities, in whole, but not in part, for the Redemption Amount, by submitting a notice of your intention to your broker in accordance with your broker’s instructions so that we receive notification of your intention during the applicable Election Period. The Election Period corresponding to each Early Redemption Date is set forth in the table below and includes the specified Election Start Date and Election End Date:

Election Start Date | Election End Date | Early Redemption Date | ||

June 17, 2010 | July 1, 2010 | July 16, 2010 | ||

June 15, 2011 | June 29, 2011 | July 14, 2011 |

Any Election End Date that is not a business day will be postponed to the next following business day. If you exercise your early redemption right, the Redemption Amount payable on the applicable Early Redemption Date will be calculated using the Final Basket Level and Adjustment Factor on the corresponding Early Redemption Valuation Date.

Because the securities are represented by a global security, the Depositary or the Depositary’s nominee will be the holder of the securities and therefore will be the only entity that can exercise the investor early redemption right. In order to ensure that the Depositary’s nominee will timely exercise the investor early redemption right, you must instruct the broker through which you hold your securities to notify the Depositary of your intention to exercise the investor early redemption right so we are notified of your intention during the applicable Election Period. Different

TS-14

firms have different cut-off times for accepting instructions from their customers and, accordingly, you should consult the broker or other direct or indirect participant through which you hold your securities in order to ascertain the cut-off time by which an instruction must be given in order for timely notice to be delivered to the Depositary, which will in turn notify us of the exercise of your early redemption right. We take no responsibility for any failure by your broker to transmit such notice to the Depositary in a timely manner or at all.

TS-15

THE DEUTSCHE BANK LIQUID ALPHA INDICES

This section is a summary only of the Basket Indices. You should carefully read and consider the full descriptions of the Basket Indices that appears in Underlying Supplement No. 15/A2 before deciding that an investment in the securities is suitable for you. The Basket Indices have been calculated on an actual basis from April 17, 2008 and, for the period prior to that date, has been retrospectively calculated from January 21, 1999 (the “Index Commencement Date“).

The Total Return Index is intended to reflect the combined total return performance of a number of indices referred to as Index Constituents selected from among a pool of available indices referred to as Selection Pool Indices. The Excess Return Index is intended to reflect the performance of the Total Return Index relative to the performance of the Fed Funds Index.

The Index Constituents comprising the Total Return Index and their weights are selected by a process involving Deutsche Bank AG, London Branch or any duly appointed successor as Index Sponsor using a computer-based model, referred to as the Model, designed, owned and controlled by Deutsche Bank AG, London Branch. The Model is intended, on each Index Selection Date (as defined in the accompanying underlying supplement), to identify a notional portfolio of the Selection Pool Indices that, if the Total Return Index had comprised such notional portfolio over the period of 60 business days immediately preceding the relevant Index Selection Date, would have generated the highest level of annualized return for the Total Return Index during such period at a predetermined level of volatility.

The Selection Pool Indices are proprietary indices of Deutsche Bank or Standard & Poor’s and are categorized into one of five asset classes: equity, rates, commodities, FX and cash. The current Index Constituents, together with details of their Selection Pool Index Type, are set out below.

Index Constituents | Selection Pool Index Type | Bloomberg Code | ||

S&P X-Alpha USD Total Return Strategy Index | Equity | SPXADT | ||

Deutsche Bank Commodity Harvest USD Total Return Index | Commodity | DBCMHLTU | ||

Deutsche Bank Balanced Currency Harvest (USD-Funded) Index | FX | DBHVBUSF | ||

Deutsche Bank SMART USD Index | Rates | DBSMARTD | ||

Fed Funds Total Return Index | Cash | DBMMFED1 |

Certain of the Selection Pool Indices involve a dynamic allocation to underlying reference assets reflecting an alpha investment strategy. “Alpha” refers to the difference in the performance of an asset relative to a benchmark asset, and an alpha investment strategy is a strategy that aims to generate returns without regard to the direction of the benchmark asset.

The Bloomberg pages relating to the Total Return Index and the Excess Return Index are DBLAUT5J and DBLAUE5J, respectively, or any successors to such pages or services as selected by the Index Sponsor from time to time. Certain details as to levels of the Basket Indices and adjustments made in respect of the Basket Indices may be made available on such pages.

TS-16

Historical Information

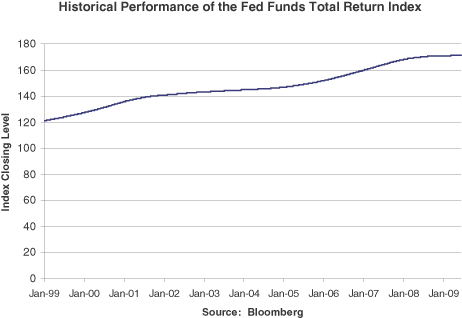

The Deutsche Bank Fed Funds Total Return Index

The “Fed Funds Index” has existed only since October 8, 2007. The historical performance data below from October 8, 2007 through June 30, 2009 represent the actual performance of such index. The historical performance data prior to October 8, 2007 reflect a retrospective calculation of the levels of the Fed Funds Index using archived data and the current methodology for the calculation of the Fed Funds Index. The closing level of the Fed Funds Index on June 30, 2009 was 171.174.All prospective investors should be aware that no actual investment which allowed a tracking of the performance of the Fed Funds Index was possible at any time prior to October 8, 2007.

TS-17

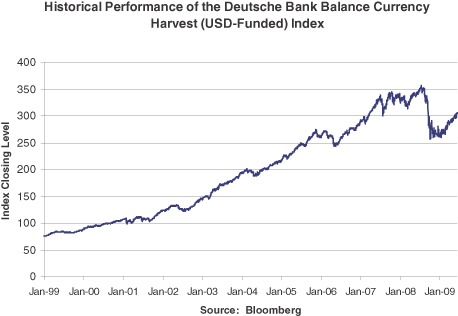

The Deutsche Bank Balanced Currency Harvest (USD-Funded) Index

The Currency Harvest Index has existed only since October 19, 2005. The historical performance data below from October 19, 2005 through June 30, 2009 represent the actual performance of such index. The historical performance data prior to October 19, 2005 reflect a retrospective calculation of the levels of the Currency Harvest Index using archived data and the current methodology for the calculation of the Currency Harvest Index. The closing level of the Currency Harvest Index on June 30, 2009 was 305.75.All prospective investors should be aware that no actual investment which allowed a tracking of the performance of the Currency Harvest Index was possible at any time prior to October 19, 2005.

TS-18

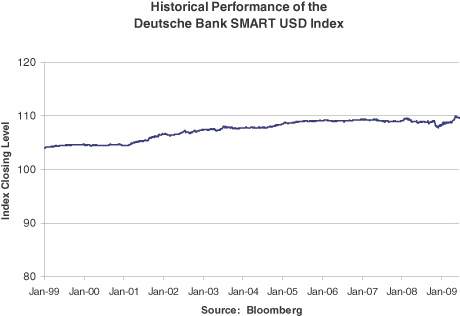

The Deutsche Bank SMART USD Index

The SMART Index has existed only since July 15, 2007. The historical performance data below from July 15, 2007 through June 30, 2009 represent the actual performance of such index. The historical performance data prior to July 15, 2007 reflect a retrospective calculation of the levels of the SMART Index using archived data and the current methodology for the calculation of the SMART Index. The closing level of the SMART Index on June 30, 2009 was 109.6322.All prospective investors should be aware that no actual investment which allowed a tracking of the performance of the SMART Index was possible at any time prior to July 15, 2007.

TS-19

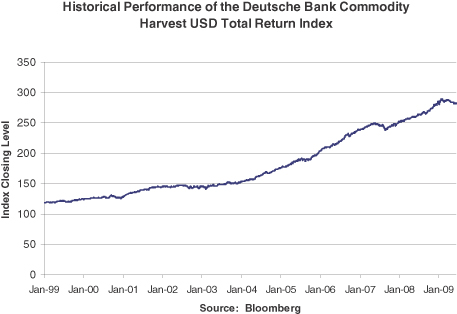

The Deutsche Bank Commodity Harvest USD Total Return Index

The Commodity Harvest Index has existed only since December 17, 2007. The historical performance data below from December 17, 2007 through June 30, 2009 represent the actual performance of such index. The historical performance data prior to December 17, 2007 reflect a retrospective calculation of the levels of the Commodity Harvest Index using archived data and the current methodology for the calculation of the Commodity Harvest Index. The closing level of the Commodity Harvest Index on June 30, 2009 was 282.76.All prospective investors should be aware that no actual investment which allowed a tracking of the performance of the Commodity Harvest Index was possible at any time prior to December 17, 2007.

TS-20

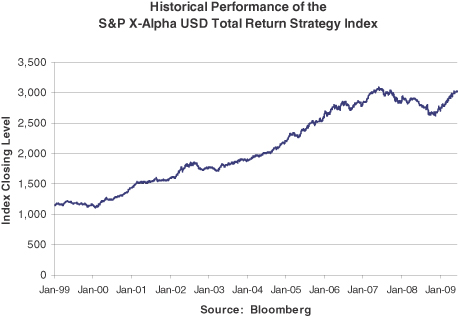

The Standard and Poor’s X-Alpha USD Total Return Strategy Index

The X-Alpha Index has existed only since October 31, 2007. The historical performance data below from October 31, 2007 through June 30, 2009 represent the actual performance of such index. The historical performance data prior to October 31, 2007 reflect a retrospective calculation of the levels of the X-Alpha Index using archived data and the current methodology for the calculation of the X-Alpha Index. The closing level of the X-Alpha Index on June 30, 2009 was 3,022.86.All prospective investors should be aware that no actual investment which allowed a tracking of the performance of the X-Alpha Index was possible at any time prior to October 31, 2007.

TS-21

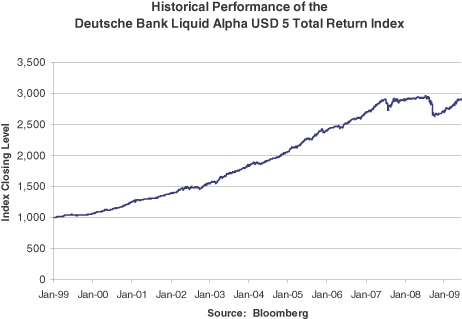

The Deutsche Bank Liquid Alpha USD 5 Total Return® Index

The Total Return Index has existed only since April 17, 2008 and publication of the Total Return Index began on April 23, 2008. The historical performance data below from April 17, 2008 through June 30, 2009 represent the actual performance of the Total Return Index. The historical performance data prior to April 17, 2008 reflect a retrospective calculation of the levels of the Total Return Index using archived data and the current methodology for the calculation of the Total Return Index. The closing level of the Total Return Index on June 30, 2009 was 2,901.765.All prospective investors should be aware that no actual investment which allowed a tracking of the performance of the Total Return Index was possible at any time prior to April 17, 2008.

TS-22

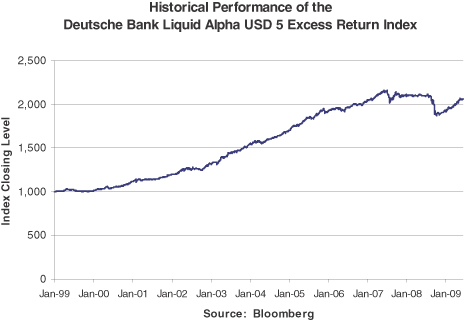

The Deutsche Bank Liquid Alpha USD 5 Excess Return® Index

The Excess Return Index has existed only since April 17, 2008 and publication of the Excess Return Index began on April 23, 2008. The historical performance data below from April 17, 2008 through June 30, 2009 represent the actual performance of the Excess Return Index. The historical performance data prior to April 17, 2008 reflect a retrospective calculation of the levels of the Excess Return Index using archived data and the current methodology for the calculation of the Excess Return Index. The closing level of the Excess Return Index on June 30, 2009 was 2,061.455.All prospective investors should be aware that no actual investment which allowed a tracking of the performance of the Total Return Index was possible at any time prior to April 17, 2008.

TS-23

GENERAL TERMS OF THE SECURITIES

Market Disruption Events

In this term sheet, we refer to any Market Disruption Event or Additional Disruption Event, each as defined in the accompanying underlying supplement, as a “Market Disruption Event.”

If a closing level for a Basket Index is not available on any Averaging Date or Early Redemption Valuation Date due to the occurrence or continuation of a Market Disruption Event, then such Averaging Date or Early Redemption Valuation Date will be postponed to the next trading day upon which a closing level for the applicable Basket Index is available.

Upon postponement of any Valuation Date, the Maturity Date or Early Redemption Date, as applicable, will be postponed in order to maintain the same number of business days that originally had been scheduled between such Valuation Date and the Maturity Date or Early Redemption Date, as applicable.

“Business day” and “trading day” each have the meaning given to that term in the underlying supplement.

Calculation Agent

Deutsche Bank AG, London Branch will act as the “Calculation Agent“ for the securities. The Calculation Agent will determine all values and levels required for the purposes of the securities, whether there has been a Market Disruption Event or a discontinuation of a Basket Index and whether there has been a material change in the method of calculating a Basket Index. All determinations made by the Calculation Agent will be at the sole discretion of the Calculation Agent and will, in the absence of manifest error, be conclusive for all purposes and binding on you and on us. We may appoint a different Calculation Agent from time to time after the Trade Date without your consent and without notifying you.

The Calculation Agent will provide written notice to the trustee at its New York office, on which notice the trustee may conclusively rely, of the amount to be paid at maturity or upon early redemption on or prior to 11:00 a.m. on the business day preceding the Maturity Date or the Early Redemption Date, as applicable.

All calculations with respect to the levels of the Basket Indices will be rounded to the nearest one hundred-thousandth, with five one-millionths rounded upward (e.g., 0.876545 would be rounded to 0.87655); all dollar amounts related to determination of the payment per security, if any, at maturity or upon early redemption will be rounded to the nearest ten-thousandth, with five one hundred-thousandths rounded upward (e.g., 0.76545 would be rounded up to 0.7655); and all dollar amounts paid on the aggregate initial investment amount of securities per holder will be rounded to the nearest cent, with one-half cent rounded upward.

Events of Default

Under the heading “Description of Debt Securities – Events of Default” in the accompanying prospectus is a description of events of default relating to debt securities including the securities.

Payment Upon an Event of Default

In case an event of default with respect to the securities will have occurred and be continuing, the amount declared due and payable per security upon any acceleration of the

TS-24

securities will be determined by the Calculation Agent and will be an amount in cash equal to the amount payable at maturity per security as described herein, calculated as if the five trading days prior to and including the date of acceleration were the Averaging Dates.

If the maturity of the securities is accelerated because of an event of default as described above, we will, or will cause the Calculation Agent to, provide written notice to the trustee at its New York office, on which notice the trustee may conclusively rely, and to DTC of the cash amount due with respect to the securities as promptly as possible and in no event later than two business days after the date of acceleration.

Modification

Under the heading “Description of Debt Securities – Modification of the Indenture” in the accompanying prospectus is a description of when the consent of each affected holder of debt securities is required to modify the indenture.

Defeasance

The provisions described in the accompanying prospectus under the heading “Description of Debt Securities – Discharge and Defeasance” are not applicable to the securities.

Listing

The securities will not be listed on any securities exchange.

DBSI intends to offer to purchase the securities in the secondary market, although it is not required to do so and may discontinue such activity at any time.

Book-Entry Only Issuance – The Depository Trust Company

The Depository Trust Company, or DTC, will act as securities depositary for the securities. The securities will be issued only as fully-registered securities registered in the name of Cede & Co. (DTC’s nominee). One or more fully-registered global securities certificates, representing the total aggregate initial investment amount of the securities, will be issued and will be deposited with DTC. See the descriptions contained in the accompanying prospectus supplement under the headings “Description of Notes — Form, Legal Ownership and Denomination of Notes.”

Registrar, Transfer Agent and Paying Agent

Payment of amounts due at maturity on the securities will be payable and the transfer of the securities will be registrable at the office of Deutsche Bank Trust Company Americas (“DBTCA“) in The City of New York.

DBTCA or one of its affiliates will act as registrar and transfer agent for the securities. DBTCA will also act as paying agent and may designate additional paying agents.

Registration of transfers of the securities will be effected without charge by or on behalf of DBTCA, but upon payment (with the giving of such indemnity as DBTCA may require) in respect of any tax or other governmental charges that may be imposed in relation to it.

Governing Law

The securities will be governed by and interpreted in accordance with the laws of the State of New York.

TS-25

CERTAIN U.S. FEDERAL INCOME TAX CONSEQUENCES

The following is a summary of certain material U.S. federal income tax consequences of ownership and disposition of the securities.

The following discussion only applies to an investor who holds the securities as capital assets within the meaning of Section 1221 of the Internal Revenue Code of 1986, as amended to the date hereof (the “Code“). This discussion is based on the Code, administrative pronouncements, judicial decisions and currently effective and proposed Treasury regulations, changes to any of which subsequent to the date of this term sheet may affect the tax consequences described below, possibly retroactively. This summary does not address all aspects of U.S. federal income taxation that may be relevant to an investor in light of the investor’s particular circumstances or to certain types of investors subject to special treatment under the U.S. federal income tax laws, such as certain former citizens or residents of the United States, certain financial institutions, real estate investment trusts, regulated investment companies, tax-exempt entities, dealers and certain traders in securities, partnerships or other entities classified as partnerships for U.S. federal income tax purposes, persons who hold the securities as a part of a hedging transaction, straddle, conversion or integrated transaction, U.S. holders (as defined below) who have a “functional currency” other than the U.S. dollar, or any individual non-U.S. investor who is present in the United States for 183 days or more in a taxable year in which the investor’s securities are sold or retired.

Tax Treatment of the Securities

We believe it is reasonable to treat the securities as prepaid financial contracts for U.S. federal income tax purposes, with the consequences described below. Due to the absence of authorities that directly address instruments that are similar to the securities, significant aspects of the U.S. federal income tax consequences of an investment in the securities are uncertain. We do not plan to request a ruling from the IRS, and no assurance can be given that the IRS or a court will agree with the treatment described herein. Accordingly, you should consult your tax adviser regarding the U.S. federal income tax consequences of an investment in the securities (including possible alternative treatments, some of which are discussed below) and with respect to any tax consequences arising under the laws of any state, local or non-U.S. taxing jurisdiction. Unless otherwise stated, the following discussion assumes that the above treatment of the securities will be respected.

Tax Consequences to U.S. Holders

You are a “U.S. holder” if, for U.S. federal income tax purposes, you are a beneficial owner of the securities who is: (i) a citizen or resident of the United States; (ii) a corporation created or organized under the laws of the United States or any political subdivision thereof; or (iii) an estate or trust the income of which is subject to U.S. federal income taxation regardless of its source.

Assuming the treatment of the securities described above is respected, the following are certain material U.S. federal income tax consequences of the ownership and disposition of the securities under current law.

Tax Treatment Prior to Maturity. You should not recognize taxable income or loss over the term of the securities prior to maturity, other than pursuant to a sale or exchange, as described below.

TS-26

Sale, Exchange or Retirement of the Securities. Upon a sale, exchange or retirement of the securities, you will recognize taxable gain or loss equal to the difference between the amount realized on such sale, exchange or retirement and your tax basis in the securities. Your tax basis in the securities generally should equal the amount you paid to acquire them. This gain or loss generally should be capital gain or loss and should be long-term capital gain or loss if you have held the securities for more than one year. The deductibility of capital losses is subject to certain limitations.

Possible Alternative Tax Treatments of an Investment in the Securities. Due to the absence of authorities that directly address the proper tax treatment of the securities, no assurance can be given that the IRS will accept, or that a court will uphold, the treatment described above. Alternative U.S. federal income tax treatments of the securities are possible that, if applied, could materially and adversely affect the timing and/or character of income or loss with respect to the securities. It is possible, for example, that the securities could be treated as debt instruments issued by us. Under this treatment, the securities would be governed by Treasury regulations relating to the taxation of contingent payment debt instruments. In that event, even if you are a cash-method taxpayer, in each year that you held the securities you would be required to accrue into income “original issue discount” based on our comparable yield for similar non-contingent debt, determined as of the time of issuance of the securities, even though no cash will be received on the securities other than the redemption amount. In addition, any gain on the sale, exchange or retirement of the securities would generally be treated as ordinary in character. Moreover, if you were to recognize a loss above certain thresholds, you could be required to file a disclosure statement with the IRS.

Other alternative U.S. federal income tax characterizations of the securities might also require you to include amounts in income during the term of the securities and/or might treat all or a portion of the gain or loss on the sale or settlement of the securities as ordinary income or loss or as short-term capital gain or loss, without regard to how long you held the securities. For instance, it is possible that any reconstitution, rebalancing, recomposition, change in methodology of or substitution of a successor to a Basket Index, Index Constituents or indices underlying the Index Constituents could be treated as a “deemed” taxable exchange that could cause you to recognize gain or loss (subject, in the case of loss, to possible application of the “wash sale” rules) as if you had sold or exchanged the securities.