As filed with the Securities and Exchange Commission on April 15, 2013

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 20-F

| | ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

or

| | x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2012 |

or

| | ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

or

| | ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report……………………………….

Commission file number 1-15242

Deutsche Bank Aktiengesellschaft

(Exact name of Registrant as specified in its charter)

Deutsche Bank Corporation

(Translation of Registrant’s name into English)

Federal Republic of Germany

(Jurisdiction of incorporation or organization)

Taunusanlage 12, 60325 Frankfurt am Main, Germany

(Address of principal executive offices)

Karin Dohm, +49-69-910-31183, karin.dohm@db.com, Taunusanlage 12, 60325 Frankfurt am Main, Germany

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act

See following page

Securities registered or to be registered pursuant to Section 12(g) of the Act.

NONE

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

NONE

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

| | |

| Ordinary Shares, no par value | | 929,183,898 |

(as of December 31, 2012)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes x No ¨

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act (Check one):

| | | | |

| Large accelerated filer x | | Accelerated filer ¨ | | Non-accelerated filer ¨ |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| | | | |

| U.S. GAAP ¨ | | International Financial Reporting Standards x | | Other ¨ |

| | as issued by the International Accounting Standards Board | | |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow

Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No x

| | | | |

| Deutsche Bank | | | | |

| Annual Report 2012 on Form 20-F | | | | |

| | |

| | | | |

| | |

| | | | |

Securities registered or to be registered pursuant to Section 12(b) of the Act (as of February 28, 2013).

| | |

Title of each class | | Name of each exchange on which

registered |

Ordinary shares, no par value | | New York Stock Exchange |

| | |

6.375 % Noncumulative Trust Preferred Securities of Deutsche Bank Capital Funding Trust VIII | | New York Stock Exchange |

6.375 % Noncumulative Company Preferred Securities of Deutsche Bank Capital Funding LLC VIII* | | |

Subordinated Guarantees of Deutsche Bank AG in connection with Capital Securities* | | |

| | |

6.55 % Trust Preferred Securities of Deutsche Bank Contingent Capital Trust II | | New York Stock Exchange |

6.55 % Company Preferred Securities of Deutsche Bank Contingent Capital LLC II* | | |

Subordinated Guarantees of Deutsche Bank AG in connection with Capital Securities* | | |

| | |

6.625 % Noncumulative Trust Preferred Securities of Deutsche Bank Capital Funding Trust IX | | New York Stock Exchange |

6.625 % Noncumulative Company Preferred Securities of Deutsch Bank Capital Funding LLC IX* | | |

Subordinated Guarantees of Deutsche Bank AG in connection with Capital Securities* | | |

| | |

7.350 % Noncumulative Trust Preferred Securities of Deutsche Bank Capital Funding Trust X | | New York Stock Exchange |

7.350 % Noncumulative Company Preferred Securities of Deutsche Bank Capital Funding LLC X* | | |

Subordinated Guarantees of Deutsche Bank AG in connection with Capital Securities* | | |

| | |

7.60 % Trust Preferred Securities of Deutsche Bank Contingent Capital Trust III | | New York Stock Exchange |

7.60 % Company Preferred Securities of Deutsche Bank Contingent Capital LLC III* | | |

Subordinated Guarantees of Deutsche Bank AG in connection with Capital Securities* | | |

| | |

8.05 % Trust Preferred Securities of Deutsche Bank Contingent Capital Trust V | | New York Stock Exchange |

8.05 % Company Preferred Securities of Deutsche Bank Contingent Capital LLC V* | | |

Subordinated Guarantees of Deutsche Bank AG in connection with Capital Securities* | | |

| | |

DB Agriculture Short Exchange Traded Notes due April 1, 2038 | | NYSE Arca |

| | |

DB Agriculture Long Exchange Traded Notes due April 1, 2038 | | NYSE Arca |

| | |

DB Agriculture Double Short Exchange Traded Notes due April 1, 2038 | | NYSE Arca |

| | |

DB Agriculture Double Long Exchange Traded Notes due April 1, 2038 | | NYSE Arca |

| | |

DB Commodity Short Exchange Traded Notes due April 1, 2038 | | NYSE Arca |

| | |

DB Commodity Long Exchange Traded Notes due April 1, 2038 | | NYSE Arca |

| | |

DB Commodity Double Long Exchange Traded Notes due April 1, 2038 | | NYSE Arca |

| | |

DB Commodity Double Short Exchange Traded Notes due April 1, 2038 | | NYSE Arca |

| | |

DB Gold Double Long Exchange Traded notes due February 15, 2038 | | NYSE Arca |

| | |

DB Gold Double Short Exchange Traded notes due February 15, 2038 | | NYSE Arca |

| | |

DB Gold Short Exchange Traded notes due February 15, 2038 | | NYSE Arca |

| | |

ELEMENTS “Dogs of the Dow” Linked to the Dow Jones High Yield Select 10 Total Return Index due November 14, 2022 | | NYSE Arca |

| | |

ELEMENTS Linked to the Morningstar® Wide Moat Focus(SM) Total Return Index due October 24, 2022 | | NYSE Arca |

| | |

PowerShares DB Base Metals Short Exchange Traded Notes due June 1, 2038 | | NYSE Arca |

| | |

PowerShares DB Base Metals Long Exchange Traded Notes due June 1, 2038 | | NYSE Arca |

| | |

PowerShares DB Base Metals Double Short Exchange Traded Notes due June 1, 2038 | | NYSE Arca |

| | |

PowerShares DB Base Metals Double Long Exchange Traded Notes due June 1, 2038 | | NYSE Arca |

| | |

PowerShares DB Crude Oil Short Exchange Traded Notes due June 1, 2038 | | NYSE Arca |

| | |

PowerShares DB Crude Oil Long Exchange Traded Notes due June 1, 2038 | | NYSE Arca |

| | |

PowerShares DB Crude Oil Double Short Exchange Traded Notes due June 1, 2038 | | NYSE Arca |

| | |

PowerShares DB German Bund Futures Exchange Traded Notes due March 31, 2021 | | NYSE Arca |

| | |

PowerShares DB Italian Treasury Bond Futures Exchange Traded Notes due March 31, 2021 | | NYSE Arca |

| | |

PowerShares DB Japanese Govt Bond Futures Exchange Traded Notes due March 31, 2021 | | NYSE Arca |

| | |

PowerShares DB Inverse Japanese Govt Bond Futures Exchange Traded Notes due November 30, 2021 | | NYSE Arca |

| | |

PowerShares DB US Deflation Exchange Traded Notes due November 30, 2021 | | NYSE Arca |

| | |

PowerShares DB US Inflation Exchange Traded Notes due November 30, 2021 | | NYSE Arca |

| | |

PowerShares DB 3x German Bund Futures Exchange Traded Notes due March 31, 2021 | | NYSE Arca |

| | |

PowerShares DB 3x Italian Treasury Bond Futures Exchange Traded Notes due March 31, 2021 | | NYSE Arca |

| | |

PowerShares DB 3x Japanese Govt Bond Futures Exchange Traded Notes due March 31, 2021 | | NYSE Arca |

| | |

PowerShares DB 3x Inverse Japanese Govt Bond Futures Exchange Traded Notes due November 30, 2021 | | NYSE Arca |

| | |

PowerShares DB 3x Long US Dollar Index Futures Exchange Traded Notes due June 30, 2031 | | NYSE Arca |

| | |

PowerShares DB 3x Short US Dollar Index Futures Exchange Traded Notes due June 30, 2031 | | NYSE Arca |

| | |

PowerShares DB 3x Long 25+ Year Treasury Bond Exchange Traded Notes due May 31, 2040 | | NYSE Arca |

| | |

PowerShares DB 3x Short 25+ Year Treasury Bond Exchange Traded Notes due May 31, 2040 | | NYSE Arca |

| | |

| * | For listing purpose only, not for trading. |

| | | | |

| Deutsche Bank | | | | 1 |

| Annual Report 2012 on Form 20-F | | | | |

| | |

| | | | |

| | |

| | | | |

Table of Contents

| | | | |

| Deutsche Bank | | | | 2 |

| Annual Report 2012 on Form 20-F | | | | |

| | |

| | | | |

| | |

| | | | |

| | | | |

| Deutsche Bank | | | | 3 |

| Annual Report 2012 on Form 20-F | | | | |

| | |

| | | | |

| | |

| | | | |

Deutsche Bank Aktiengesellschaft, which we also call Deutsche Bank AG, is a stock corporation organized under the laws of the Federal Republic of Germany. Unless otherwise specified or required by the context, in this document, references to “we”, “us”, “our”, “the Group” and “Deutsche Bank Group” are to Deutsche Bank Aktiengesellschaft and its consolidated subsidiaries.

Due to rounding, numbers presented throughout this document may not add up precisely to the totals we provide and percentages may not precisely reflect the absolute figures.

Our registered address is Taunusanlage 12, 60325 Frankfurt am Main, Germany, and our telephone number is

+49-69-910-00.

Inclusion of Our Financial Report

We have included as an integral part of this Annual Report on Form 20-F our Financial Report 2012, to which we refer for the responses to certain items hereof. Certain portions of the Financial Report have been omitted, as indicated therein. The included Financial Report contains our consolidated financial statements, which we also incorporate by reference into this report, in response to Items 8.A and 18. Such consolidated financial statements differ from those contained in the Financial Report used for other purposes in that, for Notes 42 and 43 thereof, notes addressing non-U.S. requirements have been replaced with notes addressing U.S. requirements. Such consolidated financial statements have been audited by KPMG AG Wirtschaftsprüfungs gesellschaft, as described in their “Report of Independent Registered Public Accounting Firm” included on page 383 of the Financial Report, which report is included only in the version of the Financial Report included in this Annual Report on Form 20-F.

Cautionary Statement Regarding Forward-Looking Statements

We make certain forward-looking statements in this document with respect to our financial condition and results of operations. In this document, forward-looking statements include, among others, statements relating to:

| — | | the potential development and impact on us of economic and business conditions and the legal and regulatory environment to which we are subject; |

| — | | the implementation of our strategic initiatives and other responses there to; |

| — | | the development of aspects of our results of operations; |

| — | | our expectations of the impact of risks that affect our business, including the risks of losses on our trading processes and credit exposures; and |

| — | | other statements relating to our future business development and economic performance. |

In addition, we may from time to time make forward-looking statements in our periodic reports to the United States Securities and Exchange Commission on Form 6-K, annual and interim reports, invitations to Annual General Meetings and other information sent to shareholders, offering circulars and prospectuses, press releases and other written materials. Our Management Board, Supervisory Board, officers and employees may also make oral forward-looking statements to third parties, including financial analysts.

Forward-looking statements are statements that are not historical facts, including statements about our beliefs and expectations. We use words such as “believe”, “anticipate”, “expect”, “intend”, “seek”, “estimate”, “project”, “should”, “potential”, “reasonably possible”, “plan”, “aim” and similar expressions to identify forward-looking statements.

| | | | |

| Deutsche Bank | | | | 4 |

| Annual Report 2012 on Form 20-F | | | | |

| | |

| | | | |

| | |

| | | | |

By their very nature, forward-looking statements involve risks and uncertainties, both general and specific. We base these statements on our current plans, estimates, projections and expectations. You should therefore not place too much reliance on them. Our forward-looking statements speak only as of the date we make them, and we undertake no obligation to update any of them in light of new information or future events.

We caution you that a number of important factors could cause our actual results to differ materially from those we describe in any forward-looking statement. These factors include, among others, the following:

| — | | the potential development and impact on us of economic and business conditions; |

| — | | other changes in general economic and business conditions; |

| — | | changes and volatility in currency exchange rates, interest rates and asset prices; |

| — | | changes in governmental policy and regulation, including measures taken in response to economic, business, political and social conditions; |

| — | | changes in our competitive environment; |

| — | | the success of our acquisitions, divestitures, mergers and strategic alliances; |

| — | | our success in implementing our strategic initiatives and other responses to economic and business conditions and the legal and regulatory environment and realizing the benefits anticipated there from; and |

| — | | other factors, including those we refer to in “Item 3: Key Information – Risk Factors” and elsewhere in this document and others to which we do not refer. |

Use of Non-GAAP Financial Measures

This document and other documents we have published or may publish contain non-GAAP financial measures. Non-GAAP financial measures are measures of our historical or future performance, financial position or cash flows that contain adjustments that exclude or include amounts that are included or excluded, as the case may be, from the most directly comparable measure calculated and presented in accordance with IFRS in our financial statements. Examples of our non-GAAP financial measures, and the most directly comparable IFRS financial measures, are as follows:

| | |

Non-GAAP Financial Measure | | Most Directly Comparable IFRS Financial Measure |

IBIT attributable to Deutsche Bank shareholders | | Income (loss) before income taxes |

| | |

Average active equity | | Average shareholders’ equity |

| | |

Pre-tax return on average active equity | | Pre-tax return on average shareholders’ equity |

| | |

Total assets adjusted | | Total assets |

| | |

Total equity adjusted | | Total equity |

| | |

Leverage ratio (total assets adjusted to total equity adjusted) | | Leverage ratio (total assets to total equity) |

|

While our regulatory risk-weighted assets, capital and ratios thereof are set forth throughout this document under the Basel 2.5 capital rules, we also set forth in several places measures of our regulatory risk-weighted assets, capital and ratios thereof under a pro forma full application of the Basel 3 rules, based on our assumptions as to how such rules will be implemented. Because the Basel 3 rules are not yet implemented, such measures are also non-GAAP financial measures.

For descriptions of these non-GAAP financial measures and the adjustments made to the most directly comparable financial measures under IFRS (or Basel 2.5, as applicable), please refer (i) for the adjusted leverage ratio as well as the total assets adjusted and total equity adjusted figures used in its calculation, to “Management Report: Risk Report: Balance Sheet Management” on pages 183 through 184 of the Financial Report, and (ii) for the other non-GAAP financial measures described above, to pages S-16 through S-18 of the Supplemental Financial Information, which are incorporated by reference herein.

| | | | |

| Deutsche Bank | | | | 5 |

| Annual Report 2012 on Form 20-F | | | | |

| | |

| | | | |

| | |

| | | | |

When used with respect to future periods, our non-GAAP financial measures are also forward-looking statements. We cannot predict or quantify the levels of the most directly comparable financial measures under IFRS or Basel 2.5 (described above) that would correspond to these non-GAAP financial measures for future periods. This is because neither the magnitude of such IFRS or Basel 2.5 financial measures, nor the magnitude of the adjustments to be used to calculate the related non-GAAP financial measures from such IFRS or Basel 2.5 financial measures, can be predicted. Such adjustments, if any, will relate to specific, currently unknown, events and in most cases can be positive or negative, so that it is not possible to predict whether, for a future period, the non-GAAP financial measure will be greater than or less than the related IFRS or Basel 2.5 financial measure.

Use of Internet Addresses

This document contains inactive textual addresses of Internet websites operated by us and third parties. Reference to such websites is made for informational purposes only, and information found at such websites is not incorporated by reference into this document.

| | | | |

| Deutsche Bank | | Item 3: Key Information | | 6 |

| Annual Report 2012 on Form 20-F | | | | |

| | |

| PART I | | | | |

| | |

| | | | |

Item 1: Identity of Directors, Senior Management and Advisers

Not required because this document is filed as an annual report.

Item 2: Offer Statistics and Expected Timetable

Not required because this document is filed as an annual report.

Item 3: Key Information

Selected Financial Data

We have derived the data we present in the tables below from our audited consolidated financial statements for the years presented. You should read all of the data in the tables below together with the consolidated financial statements and notes included in “Item 18: Financial Statements” and the information we provide in “Item 5: Operating and Financial Review and Prospects.” Except where we have indicated otherwise, we have prepared all of the consolidated financial information in this document in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) and as endorsed by the European Union (“EU”). Our corporate division and segment data comes from our management reporting systems and is not in all cases prepared in accordance with IFRS. For a discussion of the major differences between our management reporting systems and our consolidated financial statements under IFRS, see Note 05 “Business Segments and Related Information”.

| | | | |

| Deutsche Bank | | Item 3: Key Information | | 7 |

| Annual Report 2012 on Form 20-F | | | | |

| | |

| | | | |

| | |

| | | | |

Income Statement Data

| | | | | | | | | | | | | | | | | | | | | | | | |

| | 20121 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | |

| | | in U.S.$ m. | | | in€ m. | | | in€ m. | | | in € m. | | | in € m. | | | in€ m. | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net interest income | | | 20,967 | | | | 15,891 | | | | 17,445 | | | | 15,583 | | | | 12,459 | | | | 12,453 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Provision for credit losses | | | 2,271 | | | | 1,721 | | | | 1,839 | | | | 1,274 | | | | 2,630 | | | | 1,076 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net interest income after provision for credit losses | | | 18,696 | | | | 14,170 | | | | 15,606 | | | | 14,309 | | | | 9,829 | | | | 11,377 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Commissions and fee income | | | 15,187 | | | | 11,510 | | | | 11,544 | | | | 10,669 | | | | 8,911 | | | | 9,741 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Net gains (losses) on financial assets/liabilities at fair value through profit or loss | | | 7,387 | | | | 5,599 | | | | 3,058 | | | | 3,354 | | | | 7,109 | | | | (9,992) | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Other noninterest income (loss) | | | 978 | | | | 741 | | | | 1,181 | | | | (1,039) | | | | (527) | | | | 1,411 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total net revenues | | | 44,518 | | | | 33,741 | | | | 33,228 | | | | 28,567 | | | | 27,952 | | | | 13,613 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Compensation and benefits | | | 17,846 | | | | 13,526 | | | | 13,135 | | | | 12,671 | | | | 11,310 | | | | 9,606 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

General and administrative expenses | | | 19,812 | | | | 15,016 | | | | 12,657 | | | | 10,133 | | | | 8,402 | | | | 8,339 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Policyholder benefits and claims | | | 547 | | | | 414 | | | | 207 | | | | 485 | | | | 542 | | | | (252) | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Impairment of intangible assets | | | 2,488 | | | | 1,886 | | | | – | | | | 29 | | | | (134) | | | | 585 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Restructuring activities | | | 520 | | | | 394 | | | | – | | | | – | | | | – | | | | – | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total noninterest expenses | | | 41,213 | | | | 31,236 | | | | 25,999 | | | | 23,318 | | | | 20,120 | | | | 18,278 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) before income taxes | | | 1,034 | | | | 784 | | | | 5,390 | | | | 3,975 | | | | 5,202 | | | | (5,741) | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Income tax expense (benefit) | | | 651 | | | | 493 | | | | 1,064 | | | | 1,645 | | | | 244 | | | | (1,845) | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net income (loss) | | | 384 | | | | 291 | | | | 4,326 | | | | 2,330 | | | | 4,958 | | | | (3,896) | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net income (loss) attributable to noncontrolling interests | | | 71 | | | | 54 | | | | 194 | | | | 20 | | | | (15) | | | | (61) | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net income (loss) attributable to Deutsche Bank shareholders | | | 312 | | | | 237 | | | | 4,132 | | | | 2,310 | | | | 4,973 | | | | (3,835) | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | in U.S.$ | | | | in€ | | | | in€ | | | | in€ | | | | in€ | | | | in€ | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Basic earnings per share2,3 | | | 0.33 | | | | 0.25 | | | | 4.45 | | | | 3.07 | | | | 7.21 | | | | (6.87) | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Diluted earnings per share2,4 | | | 0.33 | | | | 0.25 | | | | 4.30 | | | | 2.92 | | | | 6.94 | | | | (6.87) | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Dividends paid per share5 | | | 0.99 | | | | 0.75 | | | | 0.75 | | | | 0.75 | | | | 0.50 | | | | 4.50 | |

| |

| 1 | Amounts in this column are unaudited. We have translated the amounts solely for your convenience at a rate of U.S.$ 1.3194 per€, the euro foreign exchange reference rate for U.S. dollars published by the European Central Bank (ECB) for December 31, 2012. |

| 2 | The number of average basic and diluted shares outstanding has been adjusted for all periods before October 6, 2010 to reflect the effect of the bonus element of the subscription rights issue in connection with the capital increase. |

| 3 | We calculate basic earnings per share for each period by dividing our net income (loss) attributable to Deutsche Bank shareholders by the average number of common shares outstanding. |

| 4 | We calculate diluted earnings per share for each period by dividing our net income (loss) attributable to Deutsche Bank shareholders by the average number of common shares outstanding after assumed conversions. |

| 5 | Dividends we declared and paid in the year. |

Balance Sheet Data

| | | | | | | | | | | | | | | | | | | | | | | | |

| | 20121 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | |

| | | in U.S. $ m. | | | in€ m. | | | in€ m. | | | in€ m. | | | in€ m. | | | in€ m. | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total assets | | | 2,655,067 | | | | 2,012,329 | | | | 2,164,103 | | | | 1,905,630 | | | | 1,500,664 | | | | 2,202,423 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Loans | | | 524,170 | | | | 397,279 | | | | 412,514 | | | | 407,729 | | | | 258,105 | | | | 269,281 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Deposits | | | 761,560 | | | | 577,202 | | | | 601,730 | | | | 533,984 | | | | 344,220 | | | | 395,553 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Long-term debt | | | 208,593 | | | | 158,097 | | | | 163,416 | | | | 169,660 | | | | 131,782 | | | | 133,856 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Common shares | | | 3,140 | | | | 2,380 | | | | 2,380 | | | | 2,380 | | | | 1,589 | | | | 1,461 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total shareholders’ equity2 | | | 71,252 | | | | 54,003 | | | | 53,390 | | | | 48,819 | | | | 36,647 | | | | 30,703 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Tier 1 capital3 | | | 66,607 | | | | 50,483 | | | | 49,047 | | | | 42,565 | | | | 34,406 | | | | 31,094 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Regulatory capital3 | | | 75,226 | | | | 57,015 | | | | 55,226 | | | | 48,688 | | | | 37,929 | | | | 37,396 | |

| |

| 1 | Amounts in this column are unaudited. We have translated the amounts solely for your convenience at a rate of U.S.$ 1.3194 per€, the euro foreign exchange reference rate for U.S. dollars published by the European Central Bank (ECB) for December 31, 2012. |

| 2 | The initial acquisition accounting for ABN AMRO, which was finalized at March 31, 2011, resulted in a retrospective adjustment of retained earnings of€ (24) million for December 31, 2010. |

| 3 | Capital amounts for 2012 and 2011 are based on the amended capital requirements for trading book and securitization positions following the Capital Requirements Directive 3, also known as “Basel 2.5”, as implemented in the German Banking Act and the Solvency Regulation (“Solvabilitätsverordnung”). Capital amounts presented for 2010, 2009 and 2008 are pursuant to the revised capital framework presented by the Basel Committee in 2004 (“Basel 2”) as adopted into German law by the German Banking Act and the Solvency Regulation. Excludes transitional items pursuant to Section 64h (3) of the German Banking Act. |

| | | | |

| Deutsche Bank | | Item 3: Key Information | | 8 |

| Annual Report 2012 on Form 20-F | | | | |

| | |

| | | | |

| | |

| | | | |

Certain Key Ratios and Figures

| | | | | | | | | | | | | | | | | | | | |

| | 2012 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | |

Share price at period-end1 | | | € 32.95 | | | | € 29.44 | | | | € 39.10 | | | | € 44.98 | | | € | 25.33 | |

| | | | | | | | | | | | | | | | | | | | |

Share price high1 | | | € 39.51 | | | | € 48.70 | | | | € 55.11 | | | | € 53.05 | | | € | 81.73 | |

| | | | | | | | | | | | | | | | | | | | |

Share price low1 | | | € 22.11 | | | | € 20.79 | | | | € 35.93 | | | | € 14.00 | | | € | 16.92 | |

| | | | | | | | | | | | | | | | | | | | |

Book value per basic share outstanding2 | | | € 57.37 | | | | € 58.11 | | | | € 52.38 | | | | € 52.65 | | | € | 47.90 | |

| | | | | | | | | | | | | | | | | | | | |

Return on average shareholders’ equity (post-tax)3 | | | 0.4 % | | | | 8.2 % | | | | 5.5 % | | | | 14.6 % | | | | (11.1) % | |

| | | | | | | | | | | | | | | | | | | | |

Pre-tax return on average shareholders’ equity4 | | | 1.3 % | | | | 10.2 % | | | | 9.5 % | | | | 15.3 % | | | | (16.5) % | |

| | | | | | | | | | | | | | | | | | | | |

Pre-tax return on average active equity5 | | | 1.3 % | | | | 10.3 % | | | | 9.6 % | | | | 15.1 % | | | | (17.7) % | |

| | | | | | | | | | | | | | | | | | | | |

Cost/income ratio6 | | | 92.6 % | | | | 78.2 % | | | | 81.6 % | | | | 72.0 % | | | | 134.3 % | |

| | | | | | | | | | | | | | | | | | | | |

Compensation ratio7 | | | 40.1 % | | | | 39.5 % | | | | 44.4 % | | | | 40.5 % | | | | 70.6 % | |

| | | | | | | | | | | | | | | | | | | | |

Noncompensation ratio8 | | | 52.5 % | | | | 38.7 % | | | | 37.3 % | | | | 31.5 % | | | | 63.7 % | |

| | | | | | | | | | | | | | | | | | | | |

Common Equity Tier 1 capital ratio9 | | | 11.4 % | | | | 9.5 % | | | | 8.7 % | | | | 8.7 % | | | | 7.0 % | |

| | | | | | | | | | | | | | | | | | | | |

Tier 1 capital ratio9 | | | 15.1 % | | | | 12.9 % | | | | 12.3 % | | | | 12.6 % | | | | 10.1 % | |

| | | | | | | | | | | | | | | | | | | | |

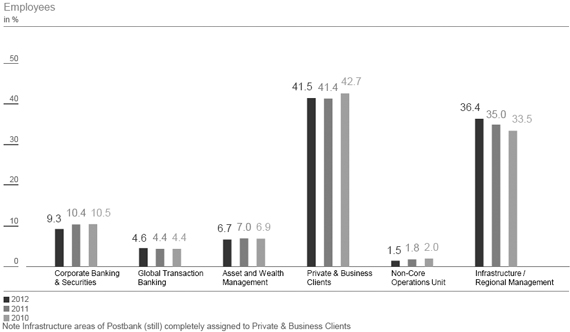

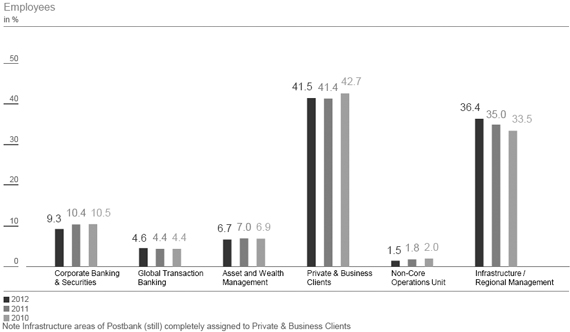

Employees at period-end (full-time equivalent):10 | | | | | | | | | | | | | | | | | | | | |

In Germany | | | 46,308 | | | | 47,323 | | | | 49,265 | | | | 27,321 | | | | 27,942 | |

Outside Germany | | | 51,911 | | | | 53,673 | | | | 52,797 | | | | 49,732 | | | | 52,514 | |

| | | | | | | | | | | | | | | | | | | | |

Branches at period-end: | | | | | | | | | | | | | | | | | | | | |

In Germany | | | 1,944 | | | | 2,039 | | | | 2,087 | | | | 961 | | | | 961 | |

Outside Germany | | | 1,040 | | | | 1,039 | | | | 996 | | | | 1,003 | | | | 989 | |

| |

| 1 | For comparison purposes, the share prices have been adjusted for all periods before October 6, 2010 to reflect the impact of the subscription rights issue in connection with the capital increase. |

| 2 | Shareholders’ equity divided by the number of basic shares outstanding (both at period-end). |

| 3 | Net income (loss) attributable to our shareholders as a percentage of average shareholders’ equity. |

| 4 | Income (loss) before income taxes attributable to our shareholders as a percentage of average shareholders’ equity. |

| 5 | Income (loss) before income taxes attributable to our shareholders as a percentage of average active equity. |

| 6 | Total noninterest expenses as a percentage of net interest income before provision for credit losses, plus noninterest income. |

| 7 | Compensation and benefits as a percentage of total net interest income before provision for credit losses, plus noninterest income. |

| 8 | Noncompensation noninterest expenses, which is defined as total noninterest expenses less compensation and benefits, as a percentage of total net interest income before provision for credit losses, plus noninterest income. |

| 9 | Ratios presented for 2012 and 2011 are based on the amended capital requirements for trading book and securitization positions following the Capital Requirements Directive 3, also known as “Basel 2.5”, as implemented in the German Banking Act and the Solvency Regulation. Ratios presented for 2010, 2009 and 2008 are pursuant to the revised capital framework presented by the Basel Committee in 2004 (“Basel 2”) as adopted into German law by the German Banking Act and the Solvency Regulation (“Solvabilitätsverordnung”). The capital ratios relate the respective capital to risk-weighted assets for credit, market and operational risk. Excludes transitional items pursuant to Section 64h (3) of the German Banking Act. |

| 10 | Deutsche Postbank aligned its FTE definition to that of Deutsche Bank which reduced the Group number as of December 31, 2011 by 260 (prior periods not restated). |

Dividends

The following table shows the dividend per share in euro and in U.S. dollars for the years ended December 31, 2012, 2011, 2010, 2009 and 2008. We declare our dividends at our Annual General Meeting following each year. Our dividends are based on the non-consolidated results of Deutsche Bank AG as prepared in accordance with German accounting principles. Because we declare our dividends in euro, the amount an investor actually receives in any other currency depends on the exchange rate between euro and that currency at the time the euros are converted into that currency.

Effective January 1, 2009, the German withholding tax applicable to dividends increased to 26.375 % (consisting of a 25 % withholding tax and an effective 1.375 % surcharge) compared to 21.1 % applicable for the year 2008. For individual German tax residents, the withholding tax paid after January 1, 2009 represents for private dividends, generally, the full and final income tax applicable to the dividends. Dividend recipients who are tax residents of countries that have entered into a convention for avoiding double taxation may be eligible to receive a refund from the German tax authorities of a portion of the amount withheld and in addition may be entitled to receive a tax credit for the German withholding tax not refunded in accordance with their local tax law.

| | | | |

| Deutsche Bank | | Item 3: Key Information | | 9 |

| Annual Report 2012 on Form 20-F | | | | |

| | |

| | | | |

| | |

| | | | |

U.S. residents will be entitled to receive a refund equal to 11.375 % of the dividends received after January 1, 2009 (compared to an entitlement to a refund of 6.1 % of the dividends received in the year 2008). For U.S. federal income tax purposes, the dividends we pay are not eligible for the dividends received deduction generally allowed for dividends received by U.S. corporations from other U.S. corporations.

Dividends in the table below are presented before German withholding tax.

See “Item 10: Additional Information – Taxation” for more information on the tax treatment of our dividends.

| | | | | | | | | | | | | | | | |

| | | | | | | | | Payout ratio2,3 | |

| | Dividends

per share1 | | | Dividends

per share | | | Basic earnings

per share | | | Diluted earnings

per share | |

2012 (proposed) | | | $ 0.99 | | | | € 0.75 | | | | N/M | | | | N/M | |

| | | | | | | | | | | | | | | | |

2011 | | | $ 0.97 | | | | € 0.75 | | | | 17 % | | | | 17 % | |

| | | | | | | | | | | | | | | | |

2010 | | | $ 1.00 | | | | € 0.75 | | | | 24 % | | | | 26 % | |

| | | | | | | | | | | | | | | | |

2009 | | | $ 1.08 | | | | € 0.75 | | | | 10 % | | | | 11 % | |

| | | | | | | | | | | | | | | | |

2008 | | | $ 0.70 | | | | € 0.50 | | | | N/M | | | | N/M | |

| | | | | | | | | | | | | | | | |

| 1 | For your convenience, we present dividends in U.S. dollars for each year by translating the euro amounts at the period end rate for the last business day at each year end as described below under “Exchange Rate and Currency Information”. The exchange rates for 2008 are based on the “noon buying rate” announced by the Federal Reserve Bank of New York. The Federal Reserve Bank of New York discontinued the publication of foreign exchange rates on December 31, 2008. |

| 2 | We define our payout ratio as the dividends we paid per share in respect of each year as a percentage of our basic and diluted earnings per share for that year. For 2008, the payout ratio was not calculated due to the net loss. |

| 3 | The number of average basic and diluted shares outstanding has been adjusted for all periods before October 6, 2010 to reflect the effect of the bonus element of the subscription rights issue in connection with the capital increase. |

Exchange Rate and Currency Information

Germany’s currency is the euro. For your convenience, we have translated some amounts denominated in euro appearing in this document into U.S. dollars. Unless otherwise stated, we have made these translations at U.S.$ 1.3194 per euro, the euro foreign exchange reference rate for U.S. dollars published by the European Central Bank (ECB) for December 31, 2012 (the last business day of 2012). ECB euro foreign exchange reference rates are based on a regular daily concertation procedure between central banks across Europe and worldwide, which normally takes place at 2.15 p.m. CET. You should not construe any translations as a representation that the amounts could have been exchanged at the rate used on December 31, 2012 or any other date.

The ECB euro foreign exchange reference rate for U.S. dollars for December 31, 2012 may differ from the actual rates we used in the preparation of the financial information in this document. Accordingly, U.S. dollar amounts appearing in this document may differ from the actual U.S. dollar amounts that we originally translated into euros in the preparation of our financial statements.

Fluctuations in the exchange rate between the euro and the U.S. dollar will affect the U.S. dollar equivalent of the euro price of our shares quoted on the German stock exchanges and, as a result, are likely to affect the market price of our shares on the New York Stock Exchange. These fluctuations will also affect the U.S. dollar value of cash dividends we may pay on our shares in euros. Past fluctuations in foreign exchange rates may not be predictive of future fluctuations.

| | | | |

| Deutsche Bank | | Item 3: Key Information | | 10 |

| Annual Report 2011 on Form 20-F | | | | |

| | |

| | | | |

| | |

| | | | |

Euro foreign exchange reference rates for U.S. dollars as published by the ECB (unless indicated otherwise)

| | | | | | | | | | | | | | | | |

in U.S.$ per€ | | Period-end1 | | | Average2 | | | High | | | Low | |

2013 | | | | | | | | | | | | | | | | |

March (through March 28) | | | 1.2805 | | | | – | | | | 1.3090 | | | | 1.2768 | |

February | | | 1.3129 | | | | – | | | | 1.3644 | | | | 1.3077 | |

January | | | 1.3550 | | | | – | | | | 1.3550 | | | | 1.3012 | |

| | | | | | | | | | | | | | | | |

2012 | | | | | | | | | | | | | | | | |

December | | | 1.3194 | | | | – | | | | 1.3302 | | | | 1.2905 | |

November | | | 1.2986 | | | | – | | | | 1.2994 | | | | 1.2694 | |

October | | | 1.2993 | | | | – | | | | 1.3120 | | | | 1.2877 | |

September | | | 1.2930 | | | | – | | | | 1.3095 | | | | 1.2568 | |

| | | | | | | | | | | | | | | | |

2012 | | | 1.3194 | | | | 1.2932 | | | | 1.3454 | | | | 1.2089 | |

| | | | | | | | | | | | | | | | |

2011 | | | 1.2939 | | | | 1.4000 | | | | 1.4882 | | | | 1.2889 | |

| | | | | | | | | | | | | | | | |

2010 | | | 1.3362 | | | | 1.3207 | | | | 1.4563 | | | | 1.1942 | |

| | | | | | | | | | | | | | | | |

2009 | | | 1.4406 | | | | 1.3963 | | | | 1.5120 | | | | 1.2555 | |

| | | | | | | | | | | | | | | | |

20083 | | | 1.3919 | | | | 1.4695 | | | | 1.6010 | | | | 1.2446 | |

| | | | | | | | | | | | | | | | |

| 1 | Period-end rate is the rate announced for the last business day of the period. |

| 2 | We calculated the average rates for each year using the average of exchange rates on the last business day of each month during the year. We did not calculate average exchange rates within months. |

| 3 | The exchange rates for 2008 are based on the “noon buying rate” announced by the Federal Reserve Bank of New York. The Federal Reserve Bank of New York discontinued the publication of foreign exchange rates on December 31, 2008. |

Capitalization and Indebtedness

Consolidated capitalization in accordance with IFRS as of December 31, 2012

| | | | |

| | in€ m. | |

Debt:1,2 | | | | |

| | | | |

Long-term debt | | | 158,097 | |

| | | | |

Trust preferred securities | | | 12,091 | |

| | | | |

Long-term debt at fair value through profit or loss | | | 12,193 | |

| | | | |

Total debt | | | 182,381 | |

| | | | |

| | | | |

| | | | |

Shareholders’ equity: | | | | |

| | | | |

Common shares (no par value) | | | 2,380 | |

| | | | |

Additional paid-in capital | | | 23,778 | |

| | | | |

Retained earnings | | | 29,198 | |

| | | | |

Common shares in treasury, at cost | | | (60) | |

| | | | |

Accumulated other comprehensive income, net of tax | | | | |

| | | | |

Unrealized net gains (losses) on financial assets available for sale, net of applicable tax and other | | | 465 | |

Unrealized net gains (losses) on derivatives hedging variability of cash flows, net of tax | | | (159) | |

Unrealized net gains (losses) on assets classified as held for sale, net of tax | | | – | |

Foreign currency translation, net of tax | | | (1,589) | |

Unrealized net gains (losses) from equity method investments | | | (10) | |

| | | | |

Total shareholders’ equity | | | 54,003 | |

| | | | |

Noncontrolling interests | | | 407 | |

| | | | |

Total equity | | | 54,410 | |

| | | | |

Total capitalization | | | 236,791 | |

| | | | |

| 1 | € 1,535 million (1 %) of our debt was guaranteed as of December 31, 2012. This consists of debt of a subsidiary of Deutsche Postbank AG which is guaranteed by the German government. |

| 2 | € 56,214 million (31 %) of our debt was secured as of December 31, 2012. |

Reasons for the Offer and Use of Proceeds

Not required because this document is filed as an annual report.

| | | | |

| Deutsche Bank | | Item 3: Key Information | | 11 |

| Annual Report 2012 on Form 20-F | | | | |

| | |

| | | | |

| | |

| | | | |

Risk Factors

An investment in our securities involves a number of risks. You should carefully consider the following information about the risks we face, together with other information in this document, when you make investment decisions involving our securities. If one or more of these risks were to materialize, it could have a material adverse effect on our financial condition, results of operations, cash flows or prices of our securities.

As a global investment bank with a large private client franchise, our businesses are materially affected by global macroeconomic and financial market conditions. Over the last several years, banks, including us, have experienced nearly continuous stress on their business models and prospects. A widespread loss of investor confidence, both in our industry and in the broader markets, has put significant pressure on the financial sector and our businesses.

While slow economic growth largely continued in 2011 and 2012 in our key North American and Asian markets, the eurozone has fallen back into recession for the second time since 2009, and even our home market Germany is likely to have contracted in the last quarter 2012. Continued concerns about the European sovereign debt crisis have persisted through 2012, fuelled by increasing public debt loads, economic contraction or weak growth and surging unemployment rates in several European countries. The continued high degree of uncertainty in Europe has been further exacerbated by headwinds in the global economy, with declining rates of growth in emerging economies including China, and a recovery in the United States that has remained tepid at best. The negative sentiment has particularly affected banks, such as us, given their sensitivity to macroeconomic conditions. In addition, the economic outlook remains uncertain and many European banks are finding themselves positioned between the threat posed by the European sovereign debt crisis and uncertain or reduced revenue streams, on the one hand, and new and more rigorous regulatory capital requirements and proposals for further regulatory tightening, coupled with market expectations that they phase in the new capital requirements quickly, on the other hand. In response, some banks have tightened the availability of credit in the real economy, placing further pressure on the prospects for early economic recovery.

These conditions have adversely impacted many of our businesses, even as we have been recalibrating our business model in response to the effects of the global financial crisis that began in 2008 and the ongoing European sovereign debt crisis. In particular, during 2008 and 2009, we wrote down the carrying values of some of our portfolios of assets, including leveraged loans and loan commitments, and more recently we wrote down the carrying value of our Greek sovereign debt portfolio. Despite initiatives to reduce our exposure to affected asset classes or activities, reductions of exposures have not always been possible due to illiquid trading markets for many assets. As a result, we have substantial remaining exposures in some asset classes and thus continue to be exposed to any future deterioration in prices for the remaining positions. In addition, levels of activity in a number of our businesses that are dependent on robust levels of client activity, such as our credit and equity trading businesses and our asset management business, have seen lower levels of customer-driven transaction flow, leading to lower revenues. If uncertainty about the macroeconomic environment persists or worsens, this trend may also be difficult for us to counter. More generally, if economic conditions in the eurozone fail to improve, or continue to worsen, or if economic growth stagnates elsewhere, our results of operations may be materially and adversely affected. In particular, we may in the future be unable to offset the potential negative effects on our profitability of the current macroeconomic and market conditions through performance in our other businesses.

We have been and may continue to be directly affected by the ongoing European sovereign debt crisis, and we may be required to take impairments on our exposures to the sovereign debt of European or other countries. The credit default swaps into which we have entered to manage sovereign credit risk may not be available to offset these losses.

Starting in late 2009, the sovereign debt markets of the eurozone began to undergo substantial stress as the markets began to perceive the credit risk of a number of countries as having increased. Despite a number of measures taken by European governments and regulators to stem the negative effects of the crisis, in particular the loosening of central bank funding and participation in the restructuring of Greece’s sovereign indebtedness,

| | | | |

| Deutsche Bank | | Item 3: Key Information | | 12 |

| Annual Report 2012 on Form 20-F | | | | |

| | |

| | | | |

| | |

| | | | |

the uncertainty surrounding the sovereign debt crisis and European Union efforts to resolve the crisis have continued largely unabated. During 2012, concern increased that financial contagion would spread to the core of the eurozone, as investors demanded increasingly high returns for the sovereign debt of Italy and Spain.

The effects of the sovereign debt crisis have been especially evident in the financial sector, as a large portion of the sovereign debt of eurozone countries is held by European financial institutions, including us. As of December 31, 2012, we had a direct sovereign credit risk exposure of€ 847 million to Italy,€ 1.5 billion to Spain,€ 355 million to Ireland,€ 258 million to Portugal and€ 39 million to Greece. In February 2012 the Greek government invited private sector holders of bonds issued or guaranteed by the Greek government to participate in a debt exchange offer and consent solicitations. As a consequence of the exchange, we and other financial institutions recognized further impairments in March 2012 in addition to prior impairments voluntarily agreed in 2011. However, it remains uncertain whether Greece will be able to manage its reduced debt levels after these efforts. In addition, concerns over the ability of other eurozone sovereigns, especially Spain, Italy and Cyprus, to manage their debt levels have intensified, and similar negotiations or exchanges could take place with respect to the sovereign debt of these or other affected countries. The outcome of any negotiations regarding changed terms (including reduced principal amounts or extended maturities) of sovereign debt may result in additional impairments of assets on our balance sheet. Any negotiations are highly likely to be subject to political and economic pressures that we cannot control, and we are unable to predict their effects on the financial markets, on the greater economy or on ourselves.

In addition, any restructuring of outstanding sovereign debt may result in potential losses for us and other market participants that are not covered by payouts on hedging instruments that we have entered into to protect against the risk of default. These instruments largely consist of credit default swaps, generally referred to as CDSs, pursuant to which one party agrees to make a payment to another party if a credit event (such as a default) occurs on the identified underlying debt obligation. A sovereign restructuring that avoids a credit event through voluntary write-downs of value may not trigger the provisions in CDSs we have entered into, meaning that our exposures in the event of a write-down could exceed the exposures we previously viewed as our net exposure after hedging. Additionally, even if the CDS provisions are triggered, the amounts ultimately paid under the CDSs may not correspond to the full amount of any loss we incur. We also face the risk that our hedging counterparties have not effectively hedged their own exposures and may be unable to provide the necessary liquidity if payments under the instruments they have written are triggered. This may result in systemic risk for the European banking sector as a whole and may negatively affect our business and financial position.

Regulatory and political actions by European governments in response to the sovereign debt crisis may not be sufficient to prevent the crisis from spreading or to prevent departure of one or more member countries from the common currency. The default or departure of any one or more countries from the euro could have unpredictable consequences on the financial system and the greater economy, potentially leading to declines in business levels, write-downs of assets and losses across our businesses. Our ability to protect ourselves against these risks is limited.

The deterioration of the sovereign debt market in the eurozone and Eastern Europe, particularly the increasing costs of borrowing affecting many eurozone states during the course of 2012 and downgrades in the credit ratings of most eurozone countries in 2011 and 2012, indicate that the sovereign debt crisis can affect even the financially more stable countries in the eurozone, including Germany. Substantial doubt remains whether actions taken by European policymakers will be sufficient to contain the crisis over the longer term. In particular, there are doubts about the effectiveness of the European Stability Mechanism, generally referred to as the ESM, the special purpose vehicle created by the European Union to combat the sovereign debt crisis. In addition, the austerity programs introduced by a number of countries across the eurozone in response to the sovereign debt crisis appear to be dampening economic growth, and may continue to do so over the medium and longer terms. As the eurozone has fallen back into recession, questions about the long-term growth prospects

| | | | |

| Deutsche Bank | | Item 3: Key Information | | 13 |

| Annual Report 2012 on Form 20-F | | | | |

| | |

| | | | |

| | |

| | | | |

of the eurozone countries could exacerbate their difficulties in refinancing their sovereign debt as it comes due, further increasing pressure on other eurozone governments.

In addition, the possibility exists that one or more members of the eurozone may default on their debt obligations or leave the common currency, resulting in the reintroduction of one or more national currencies. Should a eurozone country conclude it must exit the common currency, the resulting need to reintroduce a national currency and restate existing contractual obligations could have unpredictable financial, legal, political and social consequences, leading not only to significant losses on sovereign debt but also on private debt in that country. Given the highly interconnected nature of the financial system within the eurozone, and the high levels of exposure we have to public and private counterparties around Europe, our ability to plan for such a contingency in a manner that would reduce our exposure to non-material levels is likely to be limited. If the overall economic climate deteriorates as a result of one or more departures from the eurozone, our business could be adversely affected, and, if overall business levels decline or we are forced to write down significant exposures among our various businesses, we could incur substantial losses.

We have a continuous demand for liquidity to fund our business activities, and our ability to access the capital markets for liquidity and to fund assets in the current market environment may be limited. In addition, we may suffer during periods of market-wide or firm-specific liquidity constraints, and liquidity may not be available to us even if our underlying business remains strong.

We are exposed to liquidity risk, which is the risk arising from our potential inability to meet all payment obligations when they become due or only being able to meet them at excessive cost. Our liquidity may become impaired due to a reluctance of our counterparties or the market to finance our operations due to actual or perceived weaknesses in our businesses. Such impairments can also arise from circumstances unrelated to our businesses and outside our control, such as, but not limited to, disruptions in the financial markets. As a result of the ongoing European sovereign debt crisis, we have, in recent periods, experienced declines in the price of our shares and increases in the premium investors must pay when purchasing CDSs on our debt. In addition, negative developments concerning other financial institutions perceived to be comparable to us and negative views about the financial services industry in general have also recently affected us. These perceptions have affected the prices at which we have accessed the capital markets to obtain the necessary funding to support our business activities; should these perceptions worsen, our ability to obtain this financing on acceptable terms may be adversely affected. Among other things, an inability to refinance assets on our balance sheet or maintain appropriate levels of capital to protect against deteriorations in their value could force us to liquidate assets we hold at depressed prices or on unfavorable terms, and could also force us to curtail business, such as the extension of new credit. This could have an adverse effect on our business, financial condition and results of operations.

As a result of funding pressures arising from the European sovereign debt crisis, there has been increased intervention by a number of central banks, in particular the European Central Bank, generally referred to as the ECB, and the U.S. Federal Reserve. In September 2012, the ECB announced a new unlimited sovereign bond buying program aimed at keeping the borrowing costs of affected eurozone countries low through the purchase of their debt instruments. In addition, the ECB agreed in December 2011 and February 2012 to provide low-interest secured loans to European financial institutions for up to three years. The U.S. Federal Reserve has expanded its provision of U.S. dollar liquidity to the ECB, which the ECB has then made available to European banks. To date a number of financial institutions have drawn on these funding sources to maintain or enhance their liquidity. To the extent these incremental measures are curtailed or halted, this could adversely impact funding markets for all European institutions, including us, leading to an increase in funding costs, or reduced funding supply, which could result in a reduction in business activity. In addition, negative perceptions concerning our business and prospects could develop as a result of large losses, changes of our credit ratings, a general decline in the level of business activity in the financial services sector, regulatory action, serious employee misconduct or illegal activity, as well as many other reasons outside our control and that we cannot foresee.

| | | | |

| Deutsche Bank | | Item 3: Key Information | | 14 |

| Annual Report 2012 on Form 20-F | | | | |

| | |

| | | | |

| | |

| | | | |

Since the start of the global financial crisis the major credit rating agencies have lowered our credit ratings or placed them on review or watch on multiple occasions. This trend has continued during the ongoing European sovereign debt crisis. On November 29, 2011, Standard & Poor’s, while affirming our long-term credit rating at A+, revised our outlook to “negative”, on December 15, 2011, Fitch Ratings announced that it was downgrading our long-term issuer default rating to A+ from AA-, and on June 21, 2012, Moody’s Investor Services announced it was downgrading our long-term senior debt rating from A2 to Aa3. Most recently, on March 26, 2013, Standard & Poor’s placed our long-term credit rating on credit watch with negative implications. Recent credit rating downgrades have not materially affected our borrowing costs. However, any future downgrade could materially affect our funding costs, although we are unable to predict whether this would be the case or the extent of any such effect. The effect would depend on a number of factors including whether a downgrade affects financial institutions across the industry or on a regional basis, or is intended to reflect circumstances specific to us; any actions our senior management may take in advance of or in response to the downgrade; the willingness of counterparties to continue to do business with us; any impact of other market events and the state of the macroeconomic environment more generally.

Additionally, under many of the contracts governing derivative instruments to which we are a party, a downgrade could require us to post additional collateral, lead to terminations of contracts with accompanying payment obligations for us or give counterparties additional remedies. We take these effects into account in our liquidity stress testing analysis, as further described in “Management Report: Risk Report: Liquidity Risk: Stress Testing and Scenario Analysis” on pages 164 through 165 of the Financial Report.

Regulatory reforms enacted and proposed in response to the persistent weaknesses in the financial sector, together with increased regulatory scrutiny more generally, will require us to maintain increased capital and may significantly affect our business model and the competitive environment. Any perceptions in the market that we may be unable to meet our capital requirements with an adequate buffer, or that we should maintain capital in excess of the requirements, could intensify the effect of these factors on our business and results.

In response to the global financial crisis and the European sovereign debt crisis, governments, regulatory authorities and others have made and continue to make proposals to reform the regulatory framework for the financial services industry to enhance its resilience against future crises. Legislation has already been enacted and regulations issued in response to some of these proposals. The regulatory framework for financial institutions is likely to undergo further significant change. This creates significant uncertainty for us and the financial industry in general. The wide range of recent actions or current proposals includes, among others, provisions for more stringent regulatory capital and liquidity standards, restrictions on compensation practices, charging special levies to fund governmental intervention in response to crises, expansion of the resolution powers of regulators, separation of certain businesses from deposit taking, breaking up financial institutions that are perceived to be too large for regulators to assume the risk of their failure, and reforming derivatives and other market infrastructures. In addition, regulatory scrutiny under existing laws and regulations has become more intense. The specific effects of a number of new laws and regulations remain uncertain because the drafting and implementation of these laws and regulations are still on-going. In December 2010, the Basel Committee on Banking Supervision published a set of comprehensive changes to the capital adequacy framework, known as Basel 3, which will be implemented into European Union law by a legislative package referred to as “CRD 4”. Following political agreement on CRD 4, the Council of the European Union published a revised draft of the legislative package on March 26, 2013. CRD 4 will contain, among others, detailed rules on regulatory banking capital, increased capital requirements and the introduction of additional capital buffers, tightened liquidity standards and the introduction of a non-risk based leverage ratio. CRD 4 will also provide for executive compensation reforms which could put us at a disadvantage to our competitors in attracting and retaining talented employees, especially compared to those outside the European Union. Most of the new rules are expected to apply from January 1, 2014, with capital requirements and buffers increasing from year to year.

| | | | |

| Deutsche Bank | | Item 3: Key Information | | 15 |

| Annual Report 2012 on Form 20-F | | | | |

| | |

| | | | |

| | |

| | | | |

We may not have sufficient capital to meet increasing regulatory requirements. This could occur due to regulatory and other changes, such as the gradual phase out of our hybrid capital instruments, and due to any substantial losses we were to incur, which would reduce our retained earnings, a component of Core Tier 1 capital (which will be replaced by Common Equity Tier 1 capital when the CRD 4 proposals become law), or due to a combination of these factors. If we are unable to increase our capital ratios to the regulatory minimum in any such case, by raising new capital through the capital markets, through the reduction of risk-weighted assets or through other means, we could be forced to accept capital injections from the German government or the European Union. These capital injections could lead to significant dilution of our shareholders, and regulators may impose additional operational and other limitations or obligations on our business as conditions to public funding. If we are unable to build up capital buffers as required by Basel 3 and CRD 4, we may become subject to restrictions on the pay-out of dividends, share buybacks and discretionary compensation payments. In addition, any requirement to increase capital ratios could lead us to adopt a strategy focusing on capital preservation and creation over revenue generation and profit growth, in particular involving the reduction in higher margin risk-weighted assets.

Any increased capital requirements, including those described above, could have adverse effects on our business, financial condition and results of operations, as well as on perceptions in the market of our stability, particularly if any such proposal becomes effective and results in our having to raise capital at a time when financial markets are distressed. If these regulatory requirements must be implemented very quickly, we may decide that the quickest and most reliable path to compliance is to reduce the level of assets on our balance sheet, dispose of divisions or separate out certain activities or reduce or close down certain business lines. The effects on our capital raising efforts in such a case could be amplified due to the expectation that our competitors, at least those subject to the same or similar capital requirements, would likely also be required to raise capital at the same time. Moreover, some of our competitors, particularly those outside the European Union, may not face the same or similar regulations, which could put us at a competitive disadvantage.

In addition to these regulatory initiatives, market sentiment may encourage financial institutions such as us to maintain even more capital beyond regulatory-mandated minima, which could exacerbate the effects on us described above or, if we do not increase our capital to the encouraged levels, could lead to the perception in the market that we are undercapitalized relative to our peers generally.

On February 6, 2013, the German government published a Draft Bill on the Separation of Risks and Recovery and Resolution Planning for Credit Institutions and Banking Groups (the “Draft Bill”). The Draft Bill contains, among other provisions, rules on the preparation of recovery and resolutions plans for banks, such as us, which are deemed systemically important to the German economy. The Draft Bill also grants additional powers to the German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht, “BaFin”) to eliminate impediments to a bank’s resolution, which could affect our business activities or our legal or operational structure. The Draft Bill preempts in part the implementation into German law of the European directive establishing a framework for the recovery and resolution of credit institutions and investment firms (“RRD”), a draft of which was published by the European Commission on June 6, 2012. The RRD, in addition to the rules and requirements set forth in the Draft Bill, provides for the power of the resolution authority to write down debt, or to convert debt into equity (so-called “bail-in”). In order to facilitate such bail-in powers, which are expected to become effective from January 1, 2018 onwards, banks may be required to include in their debt instruments conditions that recognize the powers to write down or convert debt. The bail-in powers and such conditions could result in increased refinancing costs. Furthermore, we may not be able to issue debt instruments subject to bail-in in sufficient amounts to meet regulatory requirements, for example because there is no liquid market for such debt instruments. This could adversely affect our business, financial condition and results of operations.

In the United States, the Dodd-Frank Wall Street Reform and Consumer Protection Act, or the Dodd-Frank Act, enacted in July 2010, has numerous provisions that may affect our operations. Under the Dodd-Frank Act, we and certain of our affiliates and subsidiaries registered as swap dealers and became subject to extensive oversight by the U.S. Commodity Futures Trading Commission. Regulation of swap dealers by the U.S. Commodity

| | | | |

| Deutsche Bank | | Item 3: Key Information | | 16 |

| Annual Report 2012 on Form 20-F | | | | |

| | |

| | | | |

| | |

| | | | |

Futures Trading Commission will impose numerous corporate governance, business conduct, capital, margin, reporting, clearing, execution and other regulatory requirements on us, which may adversely affect our derivatives business and make us less competitive, especially as compared to competitors not subject to such regulation. However, although many significant regulations applicable to swap dealers are already in effect, we are unable at this time to determine the full impact of these requirements because some of the most important rules, such as margin requirements, have not yet been implemented.

Proposals in the United States designed to prohibit proprietary trading (Volcker Rule) and in the European Union and Germany, targeting structural separation of trading from deposit taking activities (based upon the Liikanen group recommendations), could have significant implications for future bank strategy. In Germany, these proposals form part of the Draft Bill. While none of the proposals are settled yet, and the ultimately agreed rules may have limited implications for market-making activity, each of the proposals has the potential to disrupt markets and materially increase operational costs. If the proposals in the Draft Bill were implemented as drafted, we would be required to separate our proprietary trading (as defined in the rulemaking, which could include trading we view as customer related) and certain other activities associated with higher risks from our deposit-taking business. Such separation could result in higher operational financing costs for the separated activities that could adversely affect our business, financial condition and results of operations.

Regulatory authorities also have substantial discretion in how to regulate banks, and this discretion, and the means available to the regulators, have been steadily increasing during the recent years of crisis. Regulation may be imposed on an ad hoc basis by governments and regulators in response to the ongoing or future crises, and these may especially affect financial institutions such as us that are deemed to be systemically important. For example, future stress tests or exceptional and temporary capital ratios, such as the one mandated by the European Council in October 2011, may be imposed very quickly. In addition, the regulators having jurisdiction over us have discretion to impose capital deductions on financial institutions for operational risks that are not otherwise recognized in risk-weighted assets or other surcharges depending on the individual situation of the bank. Furthermore, any prospective changes in accounting standards, such as those imposing stricter or more extensive requirements to carry assets at fair value, could also have uncertain impacts on our capital needs.

In December 2012, the U.S. Federal Reserve proposed a rule that would impose enhanced prudential standards on our U.S. operations and would require us to organize all of our U.S. bank and nonbank subsidiaries under a U.S. intermediate holding company that would be subject to U.S. capital requirements and enhanced prudential standards applicable to top-tier U.S. bank holding companies of its size. Such proposed rule, which is open for public comment until April 30, 2013, would become effective in July 2015. This rule, if adopted in its current form, could require us to reduce assets held in the U.S., inject capital or otherwise change the structure of our U.S. operations. To the extent that we are required to reduce operations in the U.S. or deploy capital in the U.S. that could be deployed more profitably elsewhere, the rule could have an adverse effect on our business, financial condition and results of operations.

In addition, bank levies have been introduced in some countries including Germany and the United Kingdom and are still under discussion in a number of other countries. We accrued€ 247 million for the German and U.K. bank levies in 2011 and€ 222 million in 2012, primarily recognized in Consolidation & Adjustments. Furthermore, the European Union contemplates the introduction of a bank-funded European resolution fund, which will likely replace national resolution funds such as the German restructuring fund. The impact of future levies cannot currently be quantified and they may have a material adverse effect on our business, results of operations and financial condition in future periods.

Separately, on January 22, 2013, the Council of the European Union adopted a decision authorizing eleven member states (Austria, Belgium, Estonia, France, Germany, Greece, Italy, Portugal, Slovakia, Slovenia and Spain) to proceed with the introduction of a financial transaction tax under the European Union’s “enhanced cooperation procedure”. The European Commission adopted a draft directive for the implementation of the financial transaction tax on February 14, 2013. Since the directive is only in draft form, the scope of the proposed tax is still uncertain. Depending on the final details, the proposed financial transaction tax could have a

| | | | |

| Deutsche Bank | | Item 3: Key Information | | 17 |

| Annual Report 2012 on Form 20-F | | | | |

| | |

| | | | |

| | |

| | | | |

materially negative effect on our profits and business. National financial transaction taxes have already been proposed or implemented in a number of European jurisdictions, including France (starting in August 2012) and Italy (starting from March/July 2013). Though these national regimes include intermediary exemptions, there will be implementation costs as well as market consequences which may affect our revenues.

Adverse market conditions, historically low prices and volatility have affected and may in the future materially and adversely affect our revenues and profits, particularly in our investment banking, brokerage and other commission- and fee-based businesses. As a result, we have incurred and may in the future incur significant losses from our trading and investment activities.

As a global investment bank, we have significant exposure to the financial markets and are more at risk from adverse developments in the financial markets than are institutions engaged predominantly in traditional banking activities. Sustained market declines have caused and can in the future cause our revenues to decline, and, if we are unable to reduce our expenses at the same pace, can cause our profitability to erode or cause us to show material losses. Volatility can also adversely affect us, by causing the value of financial assets we hold to decline or the expense of hedging our risks to rise.

Specifically, our investment banking revenues, in the form of financial advisory and underwriting fees, directly relate to the number and size of the transactions in which we participate and are susceptible to adverse effects from sustained market downturns. These fees and other income are generally linked to the value of the underlying transactions and therefore can decline with asset values, as they have during the recent downturn. In addition, periods of market decline and uncertainty, such as that currently being experienced in light of the ongoing European sovereign debt crisis, tend to dampen client appetite for market and credit risk, a critical driver of transaction volumes and investment banking revenues, especially transactions with higher margins. In the recent past, decreased client appetite for risk has led to lower results in our Corporate Banking & Securities Corporate Division. Our revenues and profitability could sustain material adverse effects from a significant reduction in the number or size of debt and equity offerings and merger and acquisition transactions.

Market downturns also have led and may in the future lead to declines in the volume of transactions that we execute for our clients and, therefore, to declines in our noninterest income. In addition, because the fees that we charge for managing our clients’ portfolios are in many cases based on the value or performance of those portfolios, a market downturn that reduces the value of our clients’ portfolios or increases the amount of withdrawals reduces the revenues we receive from our asset management and private banking businesses. Even in the absence of a market downturn, below-market or negative performance by our investment funds may result in increased withdrawals and reduced inflows, which would reduce the revenue we receive from our asset management business. While our clients would be responsible for losses we incur in taking positions for their accounts, we may be exposed to additional credit risk as a result of their need to cover the losses where we do not hold adequate collateral or cannot realize it. Our business may also suffer if our clients lose money and we lose the confidence of clients in our products and services.