Financial Data Supplement Q1 2017 Q2 2017 Segmental Structure Front page Exhibit 99.2

Agenda In accordance with our strategy announcement on March 5, 2017, our business operations have been reorganized from the second quarter 2017 onwards under a new divisional structure comprising the divisions: Corporate & Investment Bank (CIB), Private & Commercial Bank (PCB) and Deutsche Asset Management (Deutsche AM). This Financial Data Supplement (FDS) provides historical financial information restated to reflect our new divisional structure for the full years 2015 and 2016 and for the quarters from the first quarter 2016 through the first quarter 2017. The key changes compared to Deutsche Bank’s previously reported divisional information are outlined below: The new corporate division “Corporate & Investment Bank” combines the former segments “Global Markets” and “Corporate & Investment Banking”. It comprises the bank’s Corporate Finance, Global Markets and Global Transaction Banking businesses. The corporate division “Private & Commercial Bank” combines the businesses with private and commercial clients of Deutsche Bank and Postbank, which formerly had been reported separately, and the wealth management activities for wealthy clients, foundations and family offices. The corporate division “Deutsche Asset Management” remains materially unchanged and contains the asset management activities of Deutsche Bank. It focuses on providing investment solutions to individual investors and institutions that serve them. Accordingly total net revenues by division are presented broken down into the following categories: CIB: Global Transaction Banking Origination and Advisory (Equity Origination, Debt Origination, Advisory) Financing (certain financing activities previously reported within “Loan Products and Other” and “Sales & Trading (debt and other products)” ) Sales & Trading (Equity, Fixed Income and Currencies/FIC) Other (will also include revenues associated with assets identified as portfolios not consistent with our new corporate-led CIB strategy) PCB: Private & Commercial Clients (PCC) Postbank Wealth Management HuaXia (which was sold at the end of 2016) In addition, PCB total revenues are presented broken down into Net interest income, Commission and fee income, Remaining income DeAM: Management Fees Performance & Transaction Fees Other Revenues Mark-to-market movements on policyholder positions in Abbey Life (which was sold at the end of 2016) The changes above, and a number of smaller changes as part of the normal course of business, will be reflected in the external reporting for the second quarter 2017 and onwards. Q1 2017 Financial Data Supplement Q2 2017 Segmental Structure

Agenda Q1 2017 Financial Data Supplement Q2 2017 Segmental Structure Due to rounding, numbers presented throughout this document may not add up precisely to the totals we provide and percentages may not precisely reflect the absolute figures.

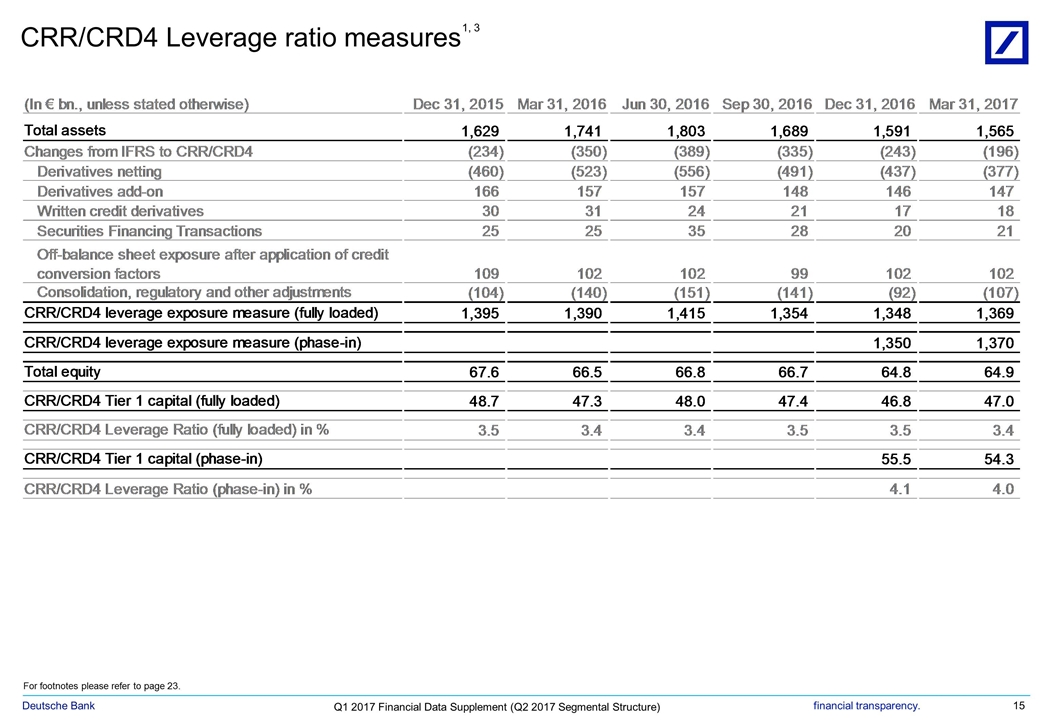

Financial summary FinSum For footnotes please refer to page 23. FY 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 FY 2016 Q1 2017 Key financial information Fully loaded CRR/CRD4 Leverage Ratio in % 1 3.5 % 3.4 % 3.4 % 3.5 % 3.5 % 3.5 % 3.4 % CRR/CRD4 leverage exposure, in € bn. 1 1,395 1,390 1,415 1,354 1,348 1,348 1,369 Common Equity Tier 1 capital ratio (fully loaded) 2,3,4 11.1 % 10.7 % 10.8 % 11.1 % 11.8 % 11.8 % 11.8 % Common Equity Tier 1 capital ratio (phase in) 2,3 13.2 % 12.0 % 12.2 % 12.6 % 13.4 % 13.4 % 12.6 % Risk-weighted assets, in € bn. 3,4 397 401 402 385 358 358 358 Adjusted Costs, in € m. 5 26,451 6,668 6,032 5,852 6,181 24,734 6,336 Post-tax return on average shareholders’ equity 2 (9.8) % 1.4 % 0.1 % 1.6 % (12.3) % (2.3) % 3.8 % Post-tax return on average tangible shareholders' equity 2,6 (12.3) % 1.6 % 0.1 % 2.0 % (14.6) % (2.7) % 4.5 % Cost/income ratio 2 115.3 % 89.0 % 91.0 % 87.4 % 127.2 % 98.1 % 86.2 % Compensation ratio 2 39.7 % 39.6 % 40.1 % 38.6 % 40.0 % 39.6 % 42.8 % Noncompensation ratio 2 75.7 % 49.5 % 50.9 % 48.8 % 87.2 % 58.5 % 43.4 % Total net revenues, in € m. 33,525 8,068 7,386 7,493 7,068 30,014 7,346 Provision for credit losses, in € m. 956 304 259 327 492 1,383 133 Total noninterest expenses, in € m. 38,667 7,184 6,718 6,547 8,992 29,442 6,334 Income (loss) before income taxes, in € m. (6,097) 579 408 619 (2,416) (810) 878 Net income (loss), in € m. (6,772) 236 20 278 (1,891) (1,356) 575 Total assets, in € bn. 3 1,629 1,741 1,803 1,689 1,591 1,591 1,565 Shareholders' equity, in € bn. 3 63 62 62 62 60 60 60 Basic earnings per share 7 € (5.06) € 0.15 € (0.19) € 0.18 € (1.36) € (1.21) € 0.40 Diluted earnings per share 7 € (5.06) € 0.15 € (0.19) € 0.18 € (1.36) € (1.21) € 0.38 Book value per basic share outstanding 2 € 45.16 € 44.44 € 44.54 € 44.42 € 42.74 € 42.74 € 42.24 Tangible book value per basic share outstanding 2 € 37.90 € 37.29 € 37.40 € 37.54 € 36.33 € 36.33 € 35.86 Other Information Branches 3 2,790 2,741 2,721 2,712 2,656 2,656 2,552 thereof: in Germany 1,827 1,824 1,808 1,807 1,776 1,776 1,683 Employees (full-time equivalent) 3 101,104 101,445 101,307 101,115 99,744 99,744 98,177 thereof: in Germany 45,757 46,036 45,744 45,457 44,600 44,600 44,132 Share price at period end 8 € 20.10 € 13.34 € 11.00 € 10.33 € 15.27 € 15.27 € 16.15 Share price high 8 € 29.83 € 19.72 € 15.65 € 12.35 € 16.63 € 19.72 € 17.82 Share price low 8 € 18.46 € 11.63 € 10.75 € 8.83 € 10.22 € 8.83 € 15.12

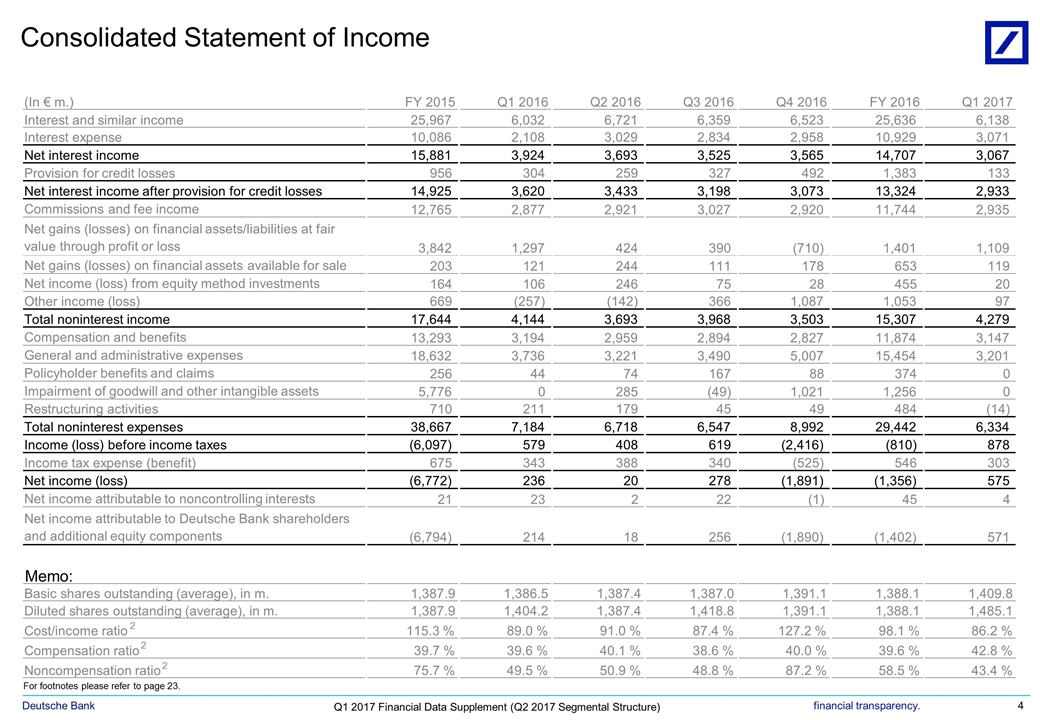

Consolidated Statement of Income Consolidated Statement of Income For footnotes please refer to page 23. (In € m.) FY 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 FY 2016 Q1 2017 Interest and similar income 25,967 6,032 6,721 6,359 6,523 25,636 6,138 Interest expense 10,086 2,108 3,029 2,834 2,958 10,929 3,071 Net interest income 15,881 3,924 3,693 3,525 3,565 14,707 3,067 Provision for credit losses 956 304 259 327 492 1,383 133 Net interest income after provision for credit losses 14,925 3,620 3,433 3,198 3,073 13,324 2,933 Commissions and fee income 12,765 2,877 2,921 3,027 2,920 11,744 2,935 Net gains (losses) on financial assets/liabilities at fair value through profit or loss 3,842 1,297 424 390 (710) 1,401 1,109 Net gains (losses) on financial assets available for sale 203 121 244 111 178 653 119 Net income (loss) from equity method investments 164 106 246 75 28 455 20 Other income (loss) 669 (257) (142) 366 1,087 1,053 97 Total noninterest income 17,644 4,144 3,693 3,968 3,503 15,307 4,279 Compensation and benefits 13,293 3,194 2,959 2,894 2,827 11,874 3,147 General and administrative expenses 18,632 3,736 3,221 3,490 5,007 15,454 3,201 Policyholder benefits and claims 256 44 74 167 88 374 0 Impairment of goodwill and other intangible assets 5,776 0 285 (49) 1,021 1,256 0 Restructuring activities 710 211 179 45 49 484 (14) Total noninterest expenses 38,667 7,184 6,718 6,547 8,992 29,442 6,334 Income (loss) before income taxes (6,097) 579 408 619 (2,416) (810) 878 Income tax expense (benefit) 675 343 388 340 (525) 546 303 Net income (loss) (6,772) 236 20 278 (1,891) (1,356) 575 Net income attributable to noncontrolling interests 21 23 2 22 (1) 45 4 Net income attributable to Deutsche Bank shareholders and additional equity components (6,794) 214 18 256 (1,890) (1,402) 571 Memo: Basic shares outstanding (average), in m. 1,387.9 1,386.5 1,387.4 1,387.0 1,391.1 1,388.1 1,409.8 Diluted shares outstanding (average), in m. 1,387.9 1,404.2 1,387.4 1,418.8 1,391.1 1,388.1 1,485.1 Cost/income ratio 2 115.3 % 89.0 % 91.0 % 87.4 % 127.2 % 98.1 % 86.2 % Compensation ratio 2 39.7 % 39.6 % 40.1 % 38.6 % 40.0 % 39.6 % 42.8 % Noncompensation ratio 2 75.7 % 49.5 % 50.9 % 48.8 % 87.2 % 58.5 % 43.4 %

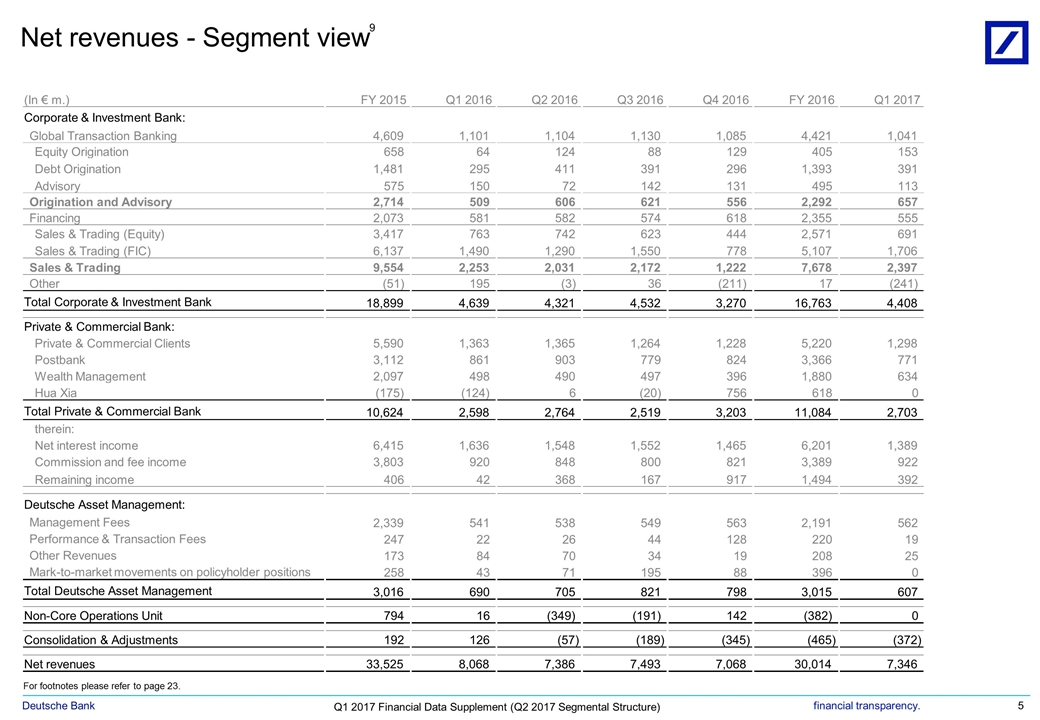

Net revenues - Segment view Net Revenues 9 For footnotes please refer to page 23. (In € m.) FY 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 FY 2016 Q1 2017 Corporate & Investment Bank: Global Transaction Banking 4,609 1,101 1,104 1,130 1,085 4,421 1,041 Equity Origination 658 64 124 88 129 405 153 Debt Origination 1,481 295 411 391 296 1,393 391 Advisory 575 150 72 142 131 495 113 Origination and Advisory 2,714 509 606 621 556 2,292 657 Financing 2,073 581 582 574 618 2,355 555 Sales & Trading (Equity) 3,417 763 742 623 444 2,571 691 Sales & Trading (FIC) 6,137 1,490 1,290 1,550 778 5,107 1,706 Sales & Trading 9,554 2,253 2,031 2,172 1,222 7,678 2,397 Other (51) 195 (3) 36 (211) 17 (241) Total Corporate & Investment Bank 18,899 4,639 4,321 4,532 3,270 16,763 4,408 Private & Commercial Bank: Private & Commercial Clients 5,590 1,363 1,365 1,264 1,228 5,220 1,298 Postbank 3,112 861 903 779 824 3,366 771 Wealth Management 2,097 498 490 497 396 1,880 634 Hua Xia (175) (124) 6 (20) 756 618 0 Total Private & Commercial Bank 10,624 2,598 2,764 2,519 3,203 11,084 2,703 therein: Net interest income 6,415 1,636 1,548 1,552 1,465 6,201 1,389 Commission and fee income 3,803 920 848 800 821 3,389 922 Remaining income 406 42 368 167 917 1,494 392 Deutsche Asset Management: Management Fees 2,339 541 538 549 563 2,191 562 Performance & Transaction Fees 247 22 26 44 128 220 19 Other Revenues 173 84 70 34 19 208 25 Mark-to-market movements on policyholder positions 258 43 71 195 88 396 0 Total Deutsche Asset Management 3,016 690 705 821 798 3,015 607 Non-Core Operations Unit 794 16 (349) (191) 142 (382) 0 Consolidation & Adjustments 192 126 (57) (189) (345) (465) (372) Net revenues 33,525 8,068 7,386 7,493 7,068 30,014 7,346

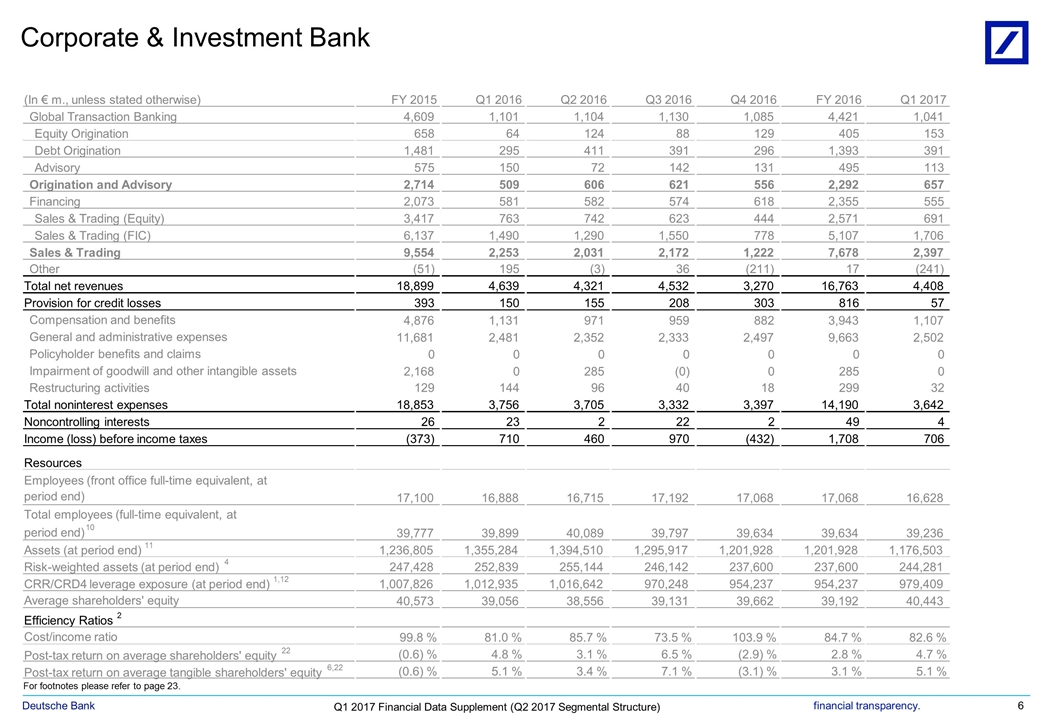

Corporate & Investment Bank Corporate & Investment Bank For footnotes please refer to page 23. (In € m., unless stated otherwise) FY 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 FY 2016 Q1 2017 Global Transaction Banking 4,609 1,101 1,104 1,130 1,085 4,421 1,041 Equity Origination 658 64 124 88 129 405 153 Debt Origination 1,481 295 411 391 296 1,393 391 Advisory 575 150 72 142 131 495 113 Origination and Advisory 2,714 509 606 621 556 2,292 657 Financing 2,073 581 582 574 618 2,355 555 Sales & Trading (Equity) 3,417 763 742 623 444 2,571 691 Sales & Trading (FIC) 6,137 1,490 1,290 1,550 778 5,107 1,706 Sales & Trading 9,554 2,253 2,031 2,172 1,222 7,678 2,397 Other (51) 195 (3) 36 (211) 17 (241) Total net revenues 18,899 4,639 4,321 4,532 3,270 16,763 4,408 Provision for credit losses 393 150 155 208 303 816 57 Compensation and benefits 4,876 1,131 971 959 882 3,943 1,107 General and administrative expenses 11,681 2,481 2,352 2,333 2,497 9,663 2,502 Policyholder benefits and claims 0 0 0 0 0 0 0 Impairment of goodwill and other intangible assets 2,168 0 285 (0) 0 285 0 Restructuring activities 129 144 96 40 18 299 32 Total noninterest expenses 18,853 3,756 3,705 3,332 3,397 14,190 3,642 Noncontrolling interests 26 23 2 22 2 49 4 Income (loss) before income taxes (373) 710 460 970 (432) 1,708 706 Resources Employees (front office full-time equivalent, at period end) 17,100 16,888 16,715 17,192 17,068 17,068 16,628 Total employees (full-time equivalent, at period end) 10 39,777 39,899 40,089 39,797 39,634 39,634 39,236 Assets (at period end) 11 1,236,805 1,355,284 1,394,510 1,295,917 1,201,928 1,201,928 1,176,503 Risk-weighted assets (at period end) 4 247,428 252,839 255,144 246,142 237,600 237,600 244,281 CRR/CRD4 leverage exposure (at period end) 1,12 1,007,826 1,012,935 1,016,642 970,248 954,237 954,237 979,409 Average shareholders' equity 40,573 39,056 38,556 39,131 39,662 39,192 40,443 Efficiency Ratios 2 Cost/income ratio 99.8 % 81.0 % 85.7 % 73.5 % 103.9 % 84.7 % 82.6 % Post-tax return on average shareholders' equity 22 (0.6) % 4.8 % 3.1 % 6.5 % (2.9) % 2.8 % 4.7 % Post-tax return on average tangible shareholders' equity 6,22 (0.6) % 5.1 % 3.4 % 7.1 % (3.1) % 3.1 % 5.1 %

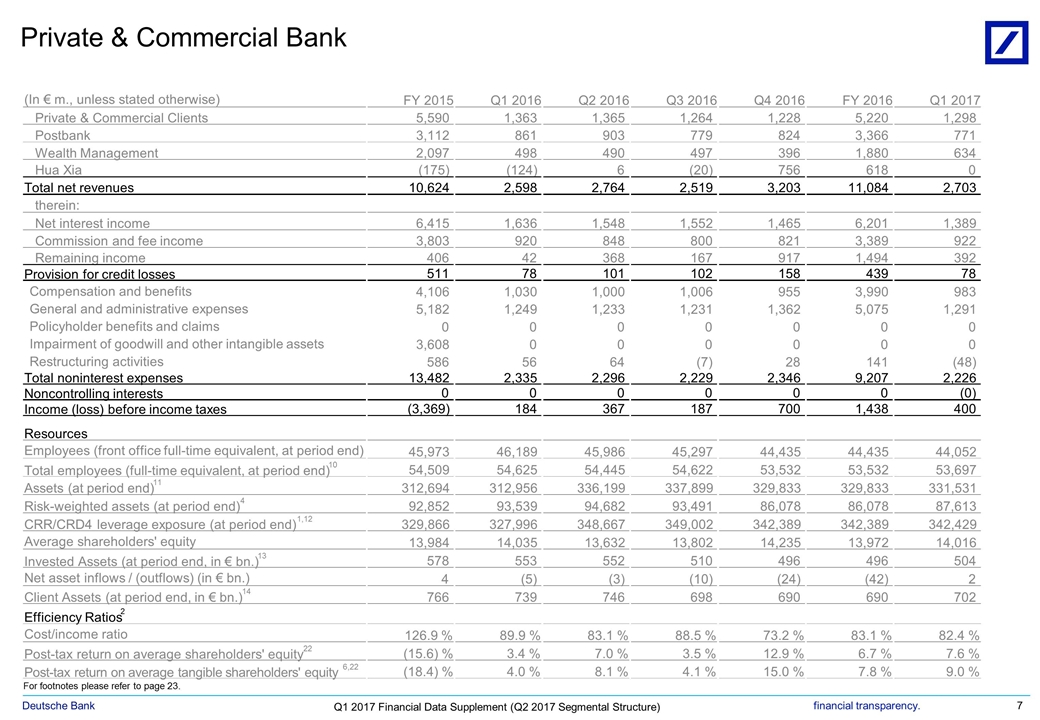

Private & Commercial Bank Private and Commercial Bank For footnotes please refer to page 23. (In € m., unless stated otherwise) FY 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 FY 2016 Q1 2017 Private & Commercial Clients 5,590 1,363 1,365 1,264 1,228 5,220 1,298 Postbank 3,112 861 903 779 824 3,366 771 Wealth Management 2,097 498 490 497 396 1,880 634 Hua Xia (175) (124) 6 (20) 756 618 0 Total net revenues 10,624 2,598 2,764 2,519 3,203 11,084 2,703 therein: Net interest income 6,415 1,636 1,548 1,552 1,465 6,201 1,389 Commission and fee income 3,803 920 848 800 821 3,389 922 Remaining income 406 42 368 167 917 1,494 392 Provision for credit losses 511 78 101 102 158 439 78 Compensation and benefits 4,106 1,030 1,000 1,006 955 3,990 983 General and administrative expenses 5,182 1,249 1,233 1,231 1,362 5,075 1,291 Policyholder benefits and claims 0 0 0 0 0 0 0 Impairment of goodwill and other intangible assets 3,608 0 0 0 0 0 0 Restructuring activities 586 56 64 (7) 28 141 (48) Total noninterest expenses 13,482 2,335 2,296 2,229 2,346 9,207 2,226 Noncontrolling interests 0 0 0 0 0 0 (0) Income (loss) before income taxes (3,369) 184 367 187 700 1,438 400 Resources Employees (front office full-time equivalent, at period end) 45,973 46,189 45,986 45,297 44,435 44,435 44,052 Total employees (full-time equivalent, at period end) 10 54,509 54,625 54,445 54,622 53,532 53,532 53,697 Assets (at period end) 11 312,694 312,956 336,199 337,899 329,833 329,833 331,531 Risk-weighted assets (at period end) 4 92,852 93,539 94,682 93,491 86,078 86,078 87,613 CRR/CRD4 leverage exposure (at period end) 1,12 329,866 327,996 348,667 349,002 342,389 342,389 342,429 Average shareholders' equity 13,984 14,035 13,632 13,802 14,235 13,972 14,016 Invested Assets (at period end, in € bn.) 13 578 553 552 510 496 496 504 Net asset inflows / (outflows) (in € bn.) 4 (5) (3) (10) (24) (42) 2 Client Assets (at period end, in € bn.) 14 766 739 746 698 690 690 702 Efficiency Ratios 2 Cost/income ratio 126.9 % 89.9 % 83.1 % 88.5 % 73.2 % 83.1 % 82.4 % Post-tax return on average shareholders' equity 22 (15.6) % 3.4 % 7.0 % 3.5 % 12.9 % 6.7 % 7.6 % Post-tax return on average tangible shareholders' equity 6,22 (18.4) % 4.0 % 8.1 % 4.1 % 15.0 % 7.8 % 9.0 %

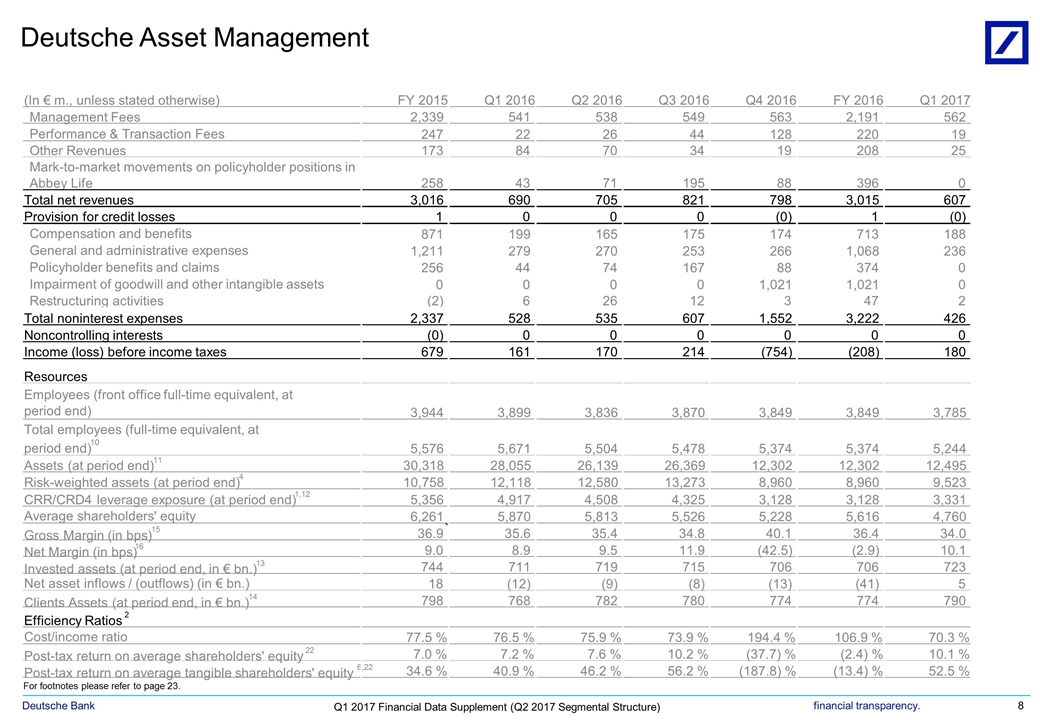

Deutsche Asset Management Asset Management (In € m., unless stated otherwise) FY 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 FY 2016 Q1 2017 Management Fees 2,339 541 538 549 563 2,191 562 Performance & Transaction Fees 247 22 26 44 128 220 19 Other Revenues 173 84 70 34 19 208 25 Mark-to-market movements on policyholder positions in Abbey Life 258 43 71 195 88 396 0 Total net revenues 3,016 690 705 821 798 3,015 607 Provision for credit losses 1 0 0 0 (0) 1 (0) Compensation and benefits 871 199 165 175 174 713 188 General and administrative expenses 1,211 279 270 253 266 1,068 236 Policyholder benefits and claims 256 44 74 167 88 374 0 Impairment of goodwill and other intangible assets 0 0 0 0 1,021 1,021 0 Restructuring activities (2) 6 26 12 3 47 2 Total noninterest expenses 2,337 528 535 607 1,552 3,222 426 Noncontrolling interests (0) 0 0 0 0 0 0 Income (loss) before income taxes 679 161 170 214 (754) (208) 180 Resources Employees (front office full-time equivalent, at period end) 3,944 3,899 3,836 3,870 3,849 3,849 3,785 Total employees (full-time equivalent, at period end) 10 5,576 5,671 5,504 5,478 5,374 5,374 5,244 Assets (at period end) 11 30,318 28,055 26,139 26,369 12,302 12,302 12,495 Risk-weighted assets (at period end) 4 10,758 12,118 12,580 13,273 8,960 8,960 9,523 CRR/CRD4 leverage exposure (at period end) 1,12 5,356 4,917 4,508 4,325 3,128 3,128 3,331 Average shareholders' equity 6,261 5,870 5,813 5,526 5,228 5,616 4,760 Gross Margin (in bps) 15 36.9 35.6 35.4 34.8 40.1 36.4 34.0 Net Margin (in bps) 16 9.0 8.9 9.5 11.9 (42.5) (2.9) 10.1 Invested assets (at period end, in € bn.) 13 744 711 719 715 706 706 723 Net asset inflows / (outflows) (in € bn.) 18 (12) (9) (8) (13) (41) 5 Clients Assets (at period end, in € bn.) 14 798 768 782 780 774 774 790 Efficiency Ratios 2 Cost/income ratio 77.5 % 76.5 % 75.9 % 73.9 % 194.4 % 106.9 % 70.3 % Post-tax return on average shareholders' equity 22 7.0 % 7.2 % 7.6 % 10.2 % (37.7) % (2.4) % 10.1 % Post-tax return on average tangible shareholders' equity 6,22 34.6 % 40.9 % 46.2 % 56.2 % (187.8) % (13.4) % 52.5 % For footnotes please refer to page 23.

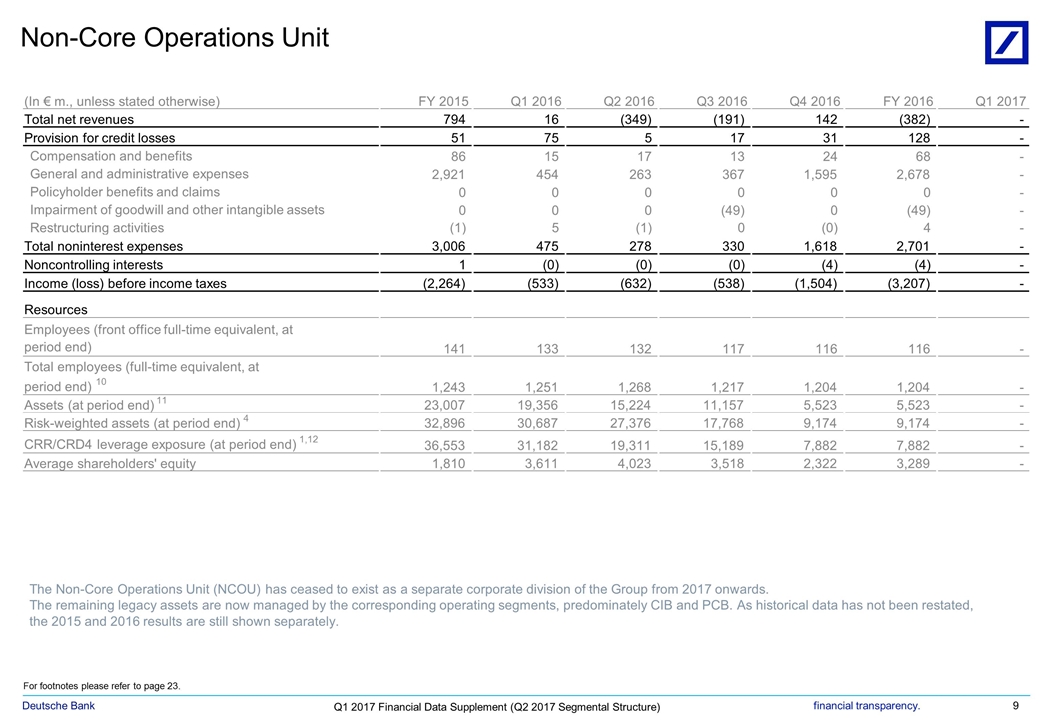

Non-Core Operations Unit Non Core Ops For footnotes please refer to page 23. The Non-Core Operations Unit (NCOU) has ceased to exist as a separate corporate division of the Group from 2017 onwards. The remaining legacy assets are now managed by the corresponding operating segments, predominately CIB and PCB. As historical data has not been restated, the 2015 and 2016 results are still shown separately. (In € m., unless stated otherwise) FY 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 FY 2016 Q1 2017 Total net revenues 794 16 (349) (191) 142 (382) - Provision for credit losses 51 75 5 17 31 128 - Compensation and benefits 86 15 17 13 24 68 - General and administrative expenses 2,921 454 263 367 1,595 2,678 - Policyholder benefits and claims 0 0 0 0 0 0 - Impairment of goodwill and other intangible assets 0 0 0 (49) 0 (49) - Restructuring activities (1) 5 (1) 0 (0) 4 - Total noninterest expenses 3,006 475 278 330 1,618 2,701 - Noncontrolling interests 1 (0) (0) (0) (4) (4) - Income (loss) before income taxes (2,264) (533) (632) (538) (1,504) (3,207) - Resources Employees (front office full-time equivalent, at period end) 141 133 132 117 116 116 - Total employees (full-time equivalent, at period end) 10 1,243 1,251 1,268 1,217 1,204 1,204 - Assets (at period end) 11 23,007 19,356 15,224 11,157 5,523 5,523 - Risk-weighted assets (at period end) 4 32,896 30,687 27,376 17,768 9,174 9,174 - CRR/CRD4 leverage exposure (at period end) 1,12 36,553 31,182 19,311 15,189 7,882 7,882 - Average shareholders' equity 1,810 3,611 4,023 3,518 2,322 3,289 -

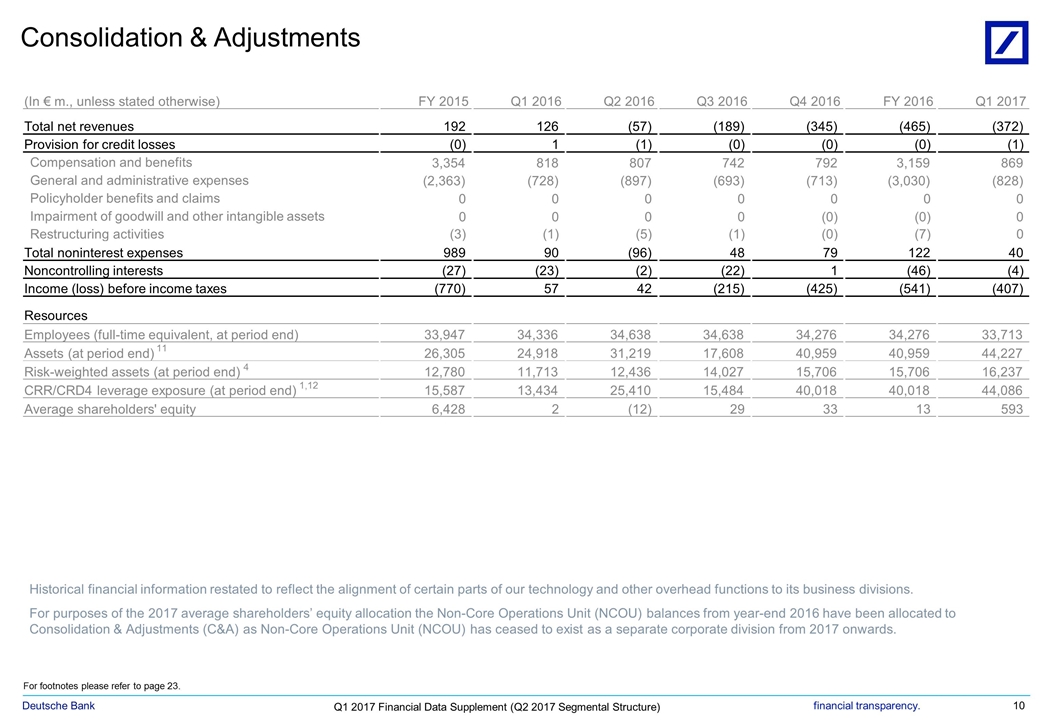

Consolidation & Adjustments C&A For footnotes please refer to page 23. Historical financial information restated to reflect the alignment of certain parts of our technology and other overhead functions to its business divisions. For purposes of the 2017 average shareholders’ equity allocation the Non-Core Operations Unit (NCOU) balances from year-end 2016 have been allocated to Consolidation & Adjustments (C&A) as Non-Core Operations Unit (NCOU) has ceased to exist as a separate corporate division from 2017 onwards. (In € m., unless stated otherwise) FY 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 FY 2016 Q1 2017 Total net revenues 192 126 (57) (189) (345) (465) (372) Provision for credit losses (0) 1 (1) (0) (0) (0) (1) Compensation and benefits 3,354 818 807 742 792 3,159 869 General and administrative expenses (2,363) (728) (897) (693) (713) (3,030) (828) Policyholder benefits and claims 0 0 0 0 0 0 0 Impairment of goodwill and other intangible assets 0 0 0 0 (0) (0) 0 Restructuring activities (3) (1) (5) (1) (0) (7) 0 Total noninterest expenses 989 90 (96) 48 79 122 40 Noncontrolling interests (27) (23) (2) (22) 1 (46) (4) Income (loss) before income taxes (770) 57 42 (215) (425) (541) (407) Resources Employees (full-time equivalent, at period end) 33,947 34,336 34,638 34,638 34,276 34,276 33,713 Assets (at period end) 11 26,305 24,918 31,219 17,608 40,959 40,959 44,227 Risk-weighted assets (at period end) 4 12,780 11,713 12,436 14,027 15,706 15,706 16,237 CRR/CRD4 leverage exposure (at period end) 1,12 15,587 13,434 25,410 15,484 40,018 40,018 44,086 Average shareholders' equity 6,428 2 (12) 29 33 13 593

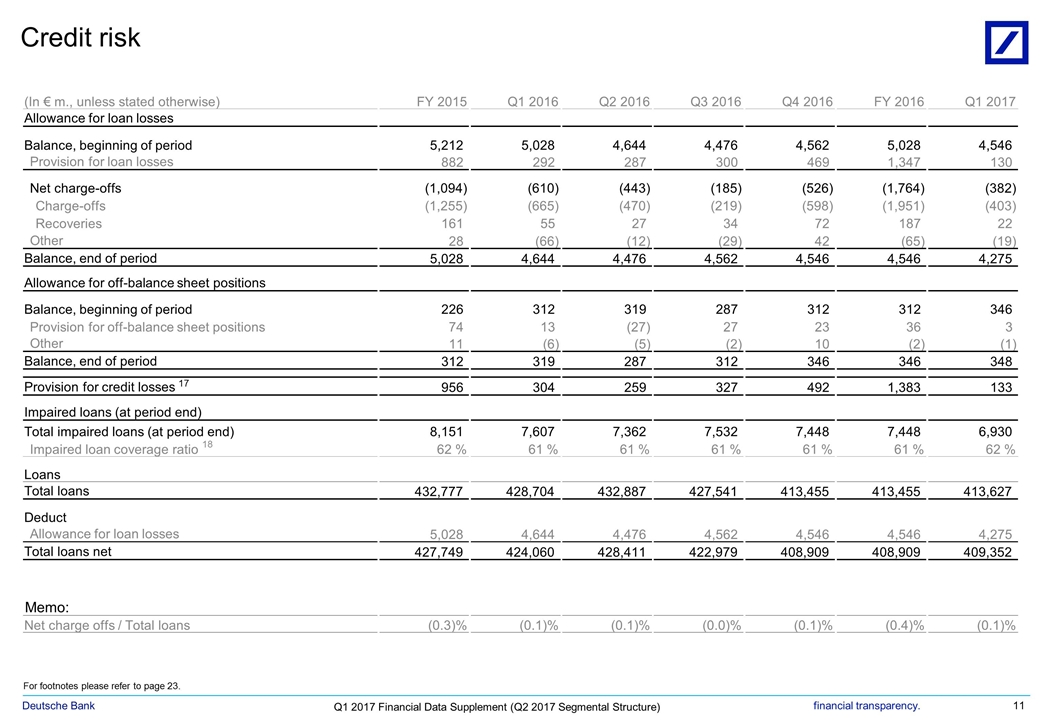

Credit risk Credit Risk For footnotes please refer to page 23. (In € m., unless stated otherwise) FY 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 FY 2016 Q1 2017 Allowance for loan losses Balance, beginning of period 5,212 5,028 4,644 4,476 4,562 5,028 4,546 Provision for loan losses 882 292 287 300 469 1,347 130 Net charge-offs (1,094) (610) (443) (185) (526) (1,764) (382) Charge-offs (1,255) (665) (470) (219) (598) (1,951) (403) Recoveries 161 55 27 34 72 187 22 Other 28 (66) (12) (29) 42 (65) (19) Balance, end of period 5,028 4,644 4,476 4,562 4,546 4,546 4,275 Allowance for off-balance sheet positions Balance, beginning of period 226 312 319 287 312 312 346 Provision for off-balance sheet positions 74 13 (27) 27 23 36 3 Other 11 (6) (5) (2) 10 (2) (1) Balance, end of period 312 319 287 312 346 346 348 Provision for credit losses 17 956 304 259 327 492 1,383 133 Impaired loans (at period end) Total impaired loans (at period end) 8,151 7,607 7,362 7,532 7,448 7,448 6,930 Impaired loan coverage ratio 18 62 % 61 % 61 % 61 % 61 % 61 % 62 % Loans Total loans 432,777 428,704 432,887 427,541 413,455 413,455 413,627 Deduct Allowance for loan losses 5,028 4,644 4,476 4,562 4,546 4,546 4,275 Total loans net 427,749 424,060 428,411 422,979 408,909 408,909 409,352 Memo: Net charge offs / Total loans (0.3)% (0.1)% (0.1)% (0.0)% (0.1)% (0.4)% (0.1)%

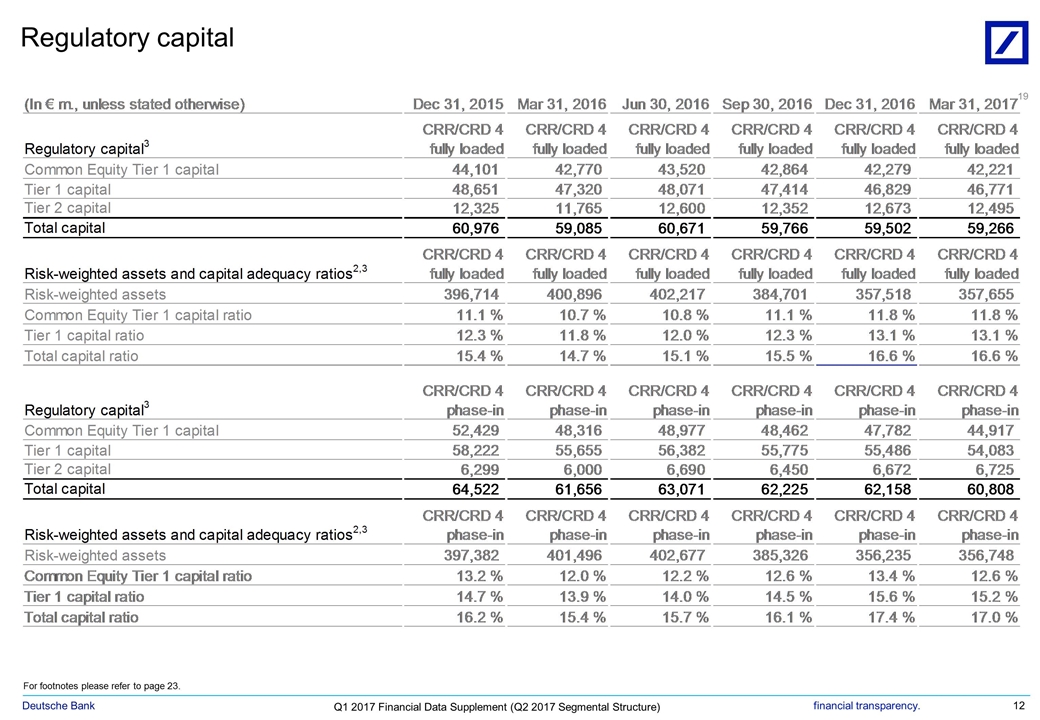

Regulatory capital Capital and Market Risk For footnotes please refer to page 23. 19

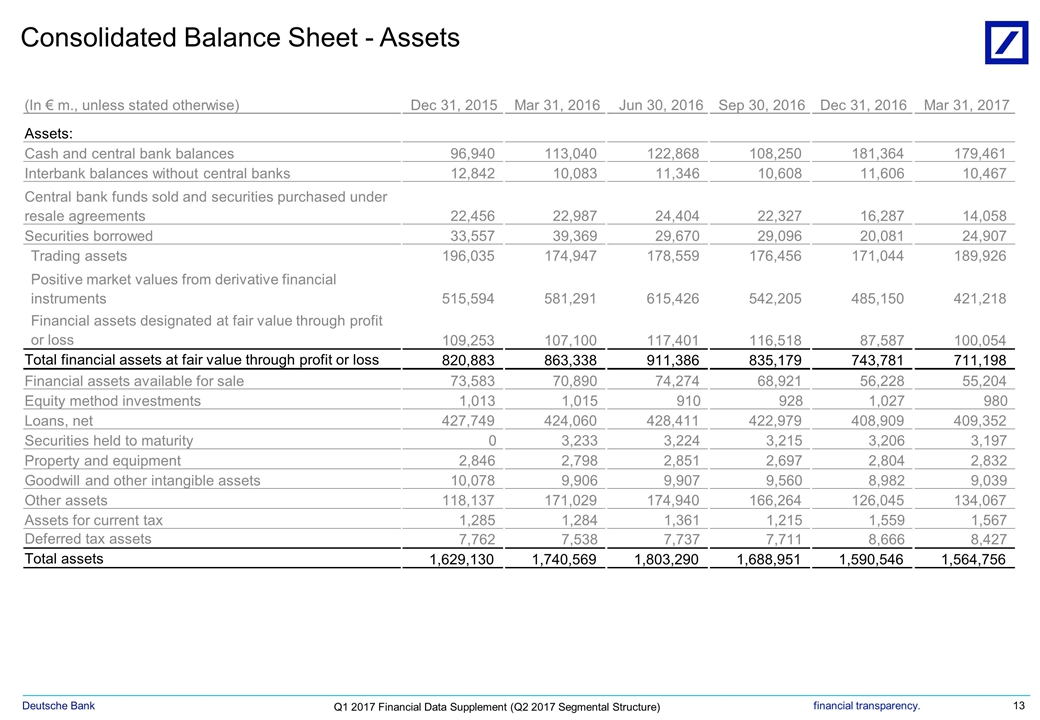

Consolidated Balance Sheet - Assets Assets (In € m., unless stated otherwise) Dec 31, 2015 Mar 31, 2016 Jun 30, 2016 Sep 30, 2016 Dec 31, 2016 Mar 31, 2017 Assets: Cash and central bank balances 96,940 113,040 122,868 108,250 181,364 179,461 Interbank balances without central banks 12,842 10,083 11,346 10,608 11,606 10,467 Central bank funds sold and securities purchased under resale agreements 22,456 22,987 24,404 22,327 16,287 14,058 Securities borrowed 33,557 39,369 29,670 29,096 20,081 24,907 Trading assets 196,035 174,947 178,559 176,456 171,044 189,926 Positive market values from derivative financial instruments 515,594 581,291 615,426 542,205 485,150 421,218 Financial assets designated at fair value through profit or loss 109,253 107,100 117,401 116,518 87,587 100,054 Total financial assets at fair value through profit or loss 820,883 863,338 911,386 835,179 743,781 711,198 Financial assets available for sale 73,583 70,890 74,274 68,921 56,228 55,204 Equity method investments 1,013 1,015 910 928 1,027 980 Loans, net 427,749 424,060 428,411 422,979 408,909 409,352 Securities held to maturity 0 3,233 3,224 3,215 3,206 3,197 Property and equipment 2,846 2,798 2,851 2,697 2,804 2,832 Goodwill and other intangible assets 10,078 9,906 9,907 9,560 8,982 9,039 Other assets 118,137 171,029 174,940 166,264 126,045 134,067 Assets for current tax 1,285 1,284 1,361 1,215 1,559 1,567 Deferred tax assets 7,762 7,538 7,737 7,711 8,666 8,427 Total assets 1,629,130 1,740,569 1,803,290 1,688,951 1,590,546 1,564,756

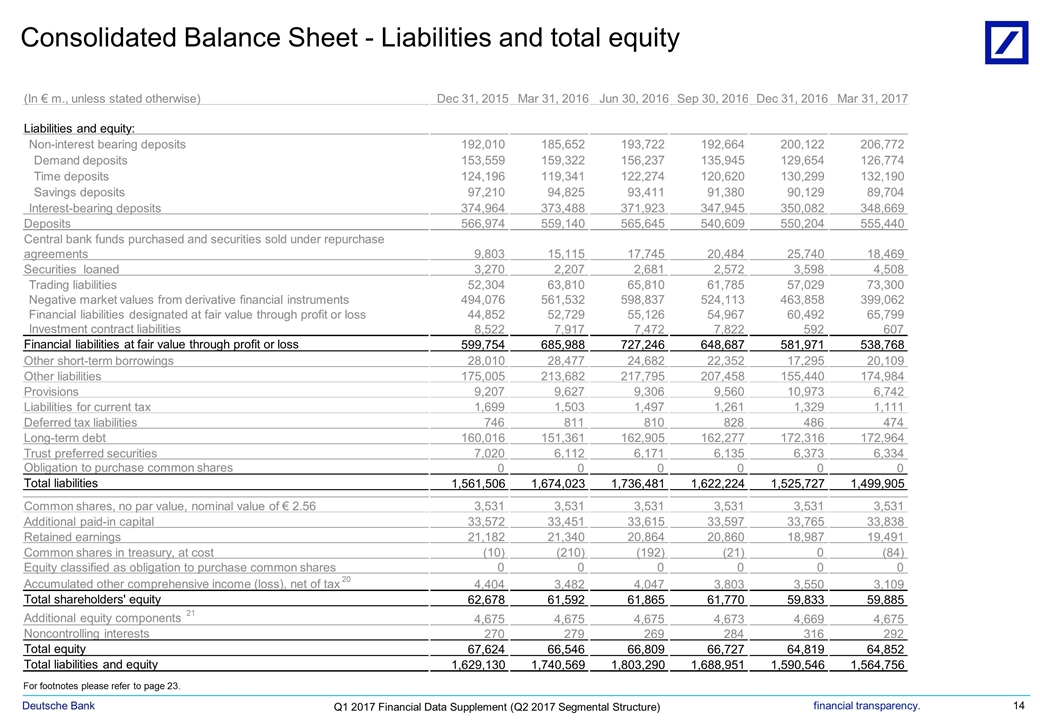

Consolidated Balance Sheet - Liabilities and total equity Liabilities For footnotes please refer to page 23. (In € m., unless stated otherwise) Dec 31, 2015 Mar 31, 2016 Jun 30, 2016 Sep 30, 2016 Dec 31, 2016 Mar 31, 2017 Liabilities and equity: Non-interest bearing deposits 192,010 185,652 193,722 192,664 200,122 206,772 Demand deposits 153,559 159,322 156,237 135,945 129,654 126,774 Time deposits 124,196 119,341 122,274 120,620 130,299 132,190 Savings deposits 97,210 94,825 93,411 91,380 90,129 89,704 Interest-bearing deposits 374,964 373,488 371,923 347,945 350,082 348,669 Deposits 566,974 559,140 565,645 540,609 550,204 555,440 Central bank funds purchased and securities sold under repurchase agreements 9,803 15,115 17,745 20,484 25,740 18,469 Securities loaned 3,270 2,207 2,681 2,572 3,598 4,508 Trading liabilities 52,304 63,810 65,810 61,785 57,029 73,300 Negative market values from derivative financial instruments 494,076 561,532 598,837 524,113 463,858 399,062 Financial liabilities designated at fair value through profit or loss 44,852 52,729 55,126 54,967 60,492 65,799 Investment contract liabilities 8,522 7,917 7,472 7,822 592 607 Financial liabilities at fair value through profit or loss 599,754 685,988 727,246 648,687 581,971 538,768 Other short-term borrowings 28,010 28,477 24,682 22,352 17,295 20,109 Other liabilities 175,005 213,682 217,795 207,458 155,440 174,984 Provisions 9,207 9,627 9,306 9,560 10,973 6,742 Liabilities for current tax 1,699 1,503 1,497 1,261 1,329 1,111 Deferred tax liabilities 746 811 810 828 486 474 Long-term debt 160,016 151,361 162,905 162,277 172,316 172,964 Trust preferred securities 7,020 6,112 6,171 6,135 6,373 6,334 Obligation to purchase common shares 0 0 0 0 0 0 Total liabilities 1,561,506 1,674,023 1,736,481 1,622,224 1,525,727 1,499,905 Common shares, no par value, nominal value of € 2.56 3,531 3,531 3,531 3,531 3,531 3,531 Additional paid-in capital 33,572 33,451 33,615 33,597 33,765 33,838 Retained earnings 21,182 21,340 20,864 20,860 18,987 19,491 Common shares in treasury, at cost (10) (210) (192) (21) 0 (84) Equity classified as obligation to purchase common shares 0 0 0 0 0 0 Accumulated other comprehensive income (loss), net of tax 20 4,404 3,482 4,047 3,803 3,550 3,109 Total shareholders' equity 62,678 61,592 61,865 61,770 59,833 59,885 Additional equity components 21 4,675 4,675 4,675 4,673 4,669 4,675 Noncontrolling interests 270 279 269 284 316 292 Total equity 67,624 66,546 66,809 66,727 64,819 64,852 Total liabilities and equity 1,629,130 1,740,569 1,803,290 1,688,951 1,590,546 1,564,756

CRR/CRD4 Leverage ratio measures Leverage For footnotes please refer to page 23. 1, 3

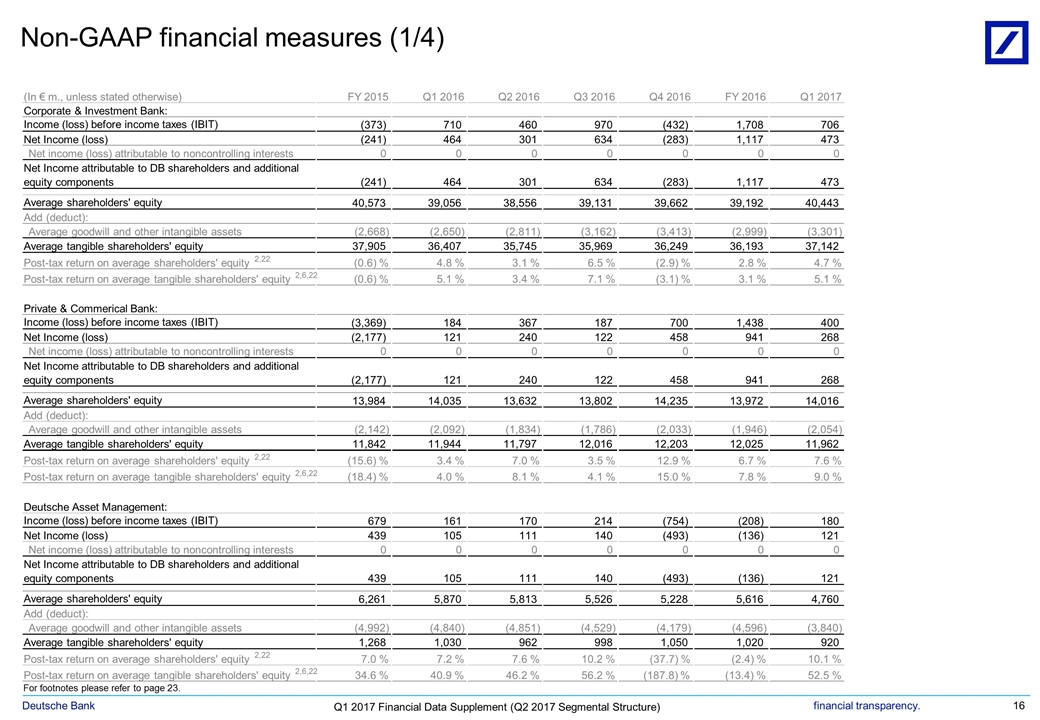

Non-GAAP financial measures (1/4) NGFM 1 For footnotes please refer to page 23. (In € m., unless stated otherwise) FY 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 FY 2016 Q1 2017 Corporate & Investment Bank: Income (loss) before income taxes (IBIT) (373) 710 460 970 (432) 1,708 706 Net Income (loss) (241) 464 301 634 (283) 1,117 473 Net income (loss) attributable to noncontrolling interests 0 0 0 0 0 0 0 Net Income attributable to DB shareholders and additional equity components (241) 464 301 634 (283) 1,117 473 Average shareholders' equity 40,573 39,056 38,556 39,131 39,662 39,192 40,443 Add (deduct): Average goodwill and other intangible assets (2,668) (2,650) (2,811) (3,162) (3,413) (2,999) (3,301) Average tangible shareholders' equity 37,905 36,407 35,745 35,969 36,249 36,193 37,142 Post-tax return on average shareholders' equity 2,22 (0.6) % 4.8 % 3.1 % 6.5 % (2.9) % 2.8 % 4.7 % Post-tax return on average tangible shareholders' equity 2,6,22 (0.6) % 5.1 % 3.4 % 7.1 % (3.1) % 3.1 % 5.1 % Private & Commerical Bank: Income (loss) before income taxes (IBIT) (3,369) 184 367 187 700 1,438 400 Net Income (loss) (2,177) 121 240 122 458 941 268 Net income (loss) attributable to noncontrolling interests 0 0 0 0 0 0 0 Net Income attributable to DB shareholders and additional equity components (2,177) 121 240 122 458 941 268 Average shareholders' equity 13,984 14,035 13,632 13,802 14,235 13,972 14,016 Add (deduct): Average goodwill and other intangible assets (2,142) (2,092) (1,834) (1,786) (2,033) (1,946) (2,054) Average tangible shareholders' equity 11,842 11,944 11,797 12,016 12,203 12,025 11,962 Post-tax return on average shareholders' equity 2,22 (15.6) % 3.4 % 7.0 % 3.5 % 12.9 % 6.7 % 7.6 % Post-tax return on average tangible shareholders' equity 2,6,22 (18.4) % 4.0 % 8.1 % 4.1 % 15.0 % 7.8 % 9.0 % Deutsche Asset Management: Income (loss) before income taxes (IBIT) 679 161 170 214 (754) (208) 180 Net Income (loss) 439 105 111 140 (493) (136) 121 Net income (loss) attributable to noncontrolling interests 0 0 0 0 0 0 0 Net Income attributable to DB shareholders and additional equity components 439 105 111 140 (493) (136) 121 Average shareholders' equity 6,261 5,870 5,813 5,526 5,228 5,616 4,760 Add (deduct): Average goodwill and other intangible assets (4,992) (4,840) (4,851) (4,529) (4,179) (4,596) (3,840) Average tangible shareholders' equity 1,268 1,030 962 998 1,050 1,020 920 Post-tax return on average shareholders' equity 2,22 7.0 % 7.2 % 7.6 % 10.2 % (37.7) % (2.4) % 10.1 % Post-tax return on average tangible shareholders' equity 2,6,22 34.6 % 40.9 % 46.2 % 56.2 % (187.8) % (13.4) % 52.5 %

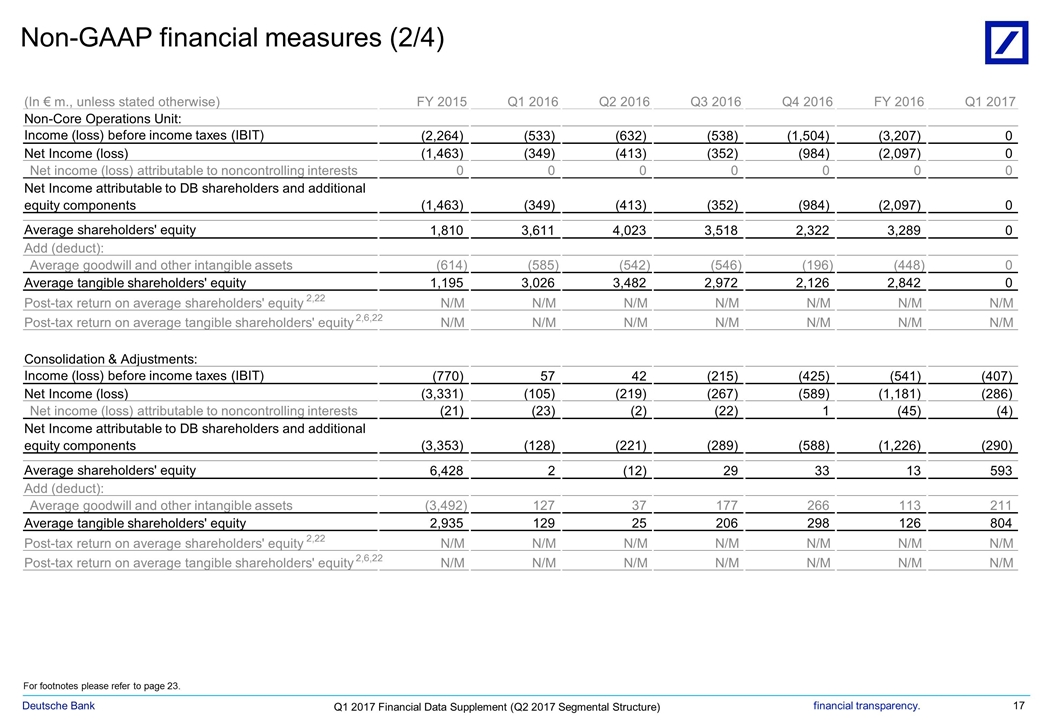

Non-GAAP financial measures (2/4) NGFM 2 For footnotes please refer to page 23. (In € m., unless stated otherwise) FY 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 FY 2016 Q1 2017 Non-Core Operations Unit: Income (loss) before income taxes (IBIT) (2,264) (533) (632) (538) (1,504) (3,207) 0 Net Income (loss) (1,463) (349) (413) (352) (984) (2,097) 0 Net income (loss) attributable to noncontrolling interests 0 0 0 0 0 0 0 Net Income attributable to DB shareholders and additional equity components (1,463) (349) (413) (352) (984) (2,097) 0 Average shareholders' equity 1,810 3,611 4,023 3,518 2,322 3,289 0 Add (deduct): Average goodwill and other intangible assets (614) (585) (542) (546) (196) (448) 0 Average tangible shareholders' equity 1,195 3,026 3,482 2,972 2,126 2,842 0 Post-tax return on average shareholders' equity 2,22 N/M N/M N/M N/M N/M N/M N/M Post-tax return on average tangible shareholders' equity 2,6,22 N/M N/M N/M N/M N/M N/M N/M Consolidation & Adjustments: Income (loss) before income taxes (IBIT) (770) 57 42 (215) (425) (541) (407) Net Income (loss) (3,331) (105) (219) (267) (589) (1,181) (286) Net income (loss) attributable to noncontrolling interests (21) (23) (2) (22) 1 (45) (4) Net Income attributable to DB shareholders and additional equity components (3,353) (128) (221) (289) (588) (1,226) (290) Average shareholders' equity 6,428 2 (12) 29 33 13 593 Add (deduct): Average goodwill and other intangible assets (3,492) 127 37 177 266 113 211 Average tangible shareholders' equity 2,935 129 25 206 298 126 804 Post-tax return on average shareholders' equity 2,22 N/M N/M N/M N/M N/M N/M N/M Post-tax return on average tangible shareholders' equity 2,6,22 N/M N/M N/M N/M N/M N/M N/M

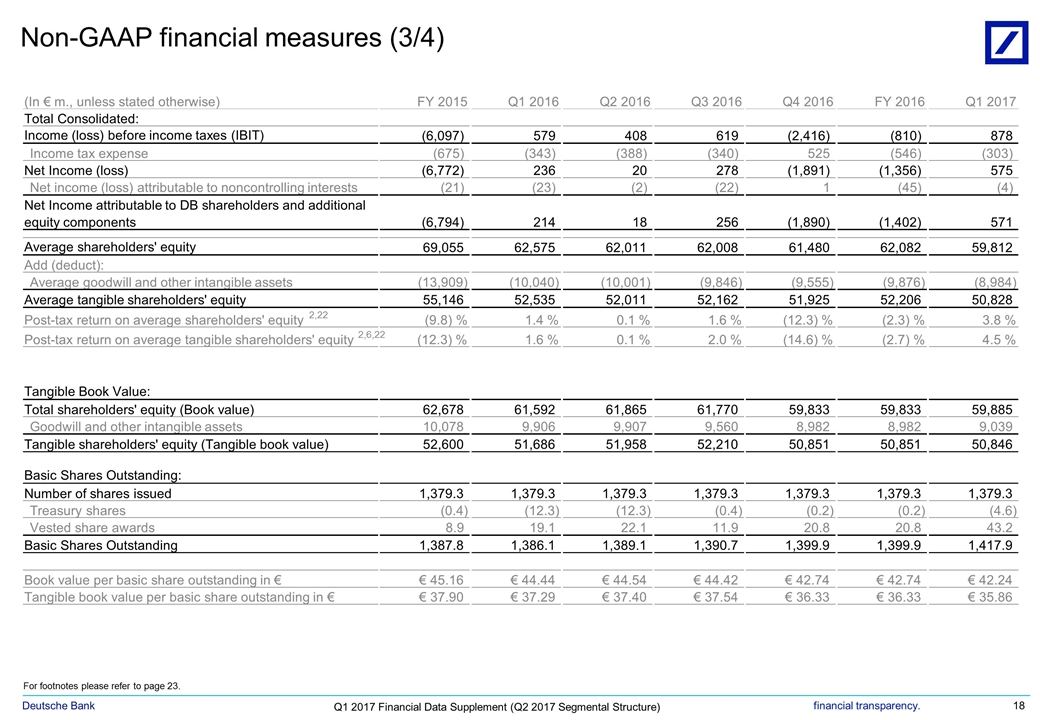

Non-GAAP financial measures (3/4) NGFM 3 For footnotes please refer to page 23. (In € m., unless stated otherwise) FY 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 FY 2016 Q1 2017 Total Consolidated: Income (loss) before income taxes (IBIT) (6,097) 579 408 619 (2,416) (810) 878 Income tax expense (675) (343) (388) (340) 525 (546) (303) Net Income (loss) (6,772) 236 20 278 (1,891) (1,356) 575 Net income (loss) attributable to noncontrolling interests (21) (23) (2) (22) 1 (45) (4) Net Income attributable to DB shareholders and additional equity components (6,794) 214 18 256 (1,890) (1,402) 571 Average shareholders' equity 69,055 62,575 62,011 62,008 61,480 62,082 59,812 Add (deduct): Average goodwill and other intangible assets (13,909) (10,040) (10,001) (9,846) (9,555) (9,876) (8,984) Average tangible shareholders' equity 55,146 52,535 52,011 52,162 51,925 52,206 50,828 Post-tax return on average shareholders' equity 2,22 (9.8) % 1.4 % 0.1 % 1.6 % (12.3) % (2.3) % 3.8 % Post-tax return on average tangible shareholders' equity 2,6,22 (12.3) % 1.6 % 0.1 % 2.0 % (14.6) % (2.7) % 4.5 % Tangible Book Value: Total shareholders' equity (Book value) 62,678 61,592 61,865 61,770 59,833 59,833 59,885 Goodwill and other intangible assets 10,078 9,906 9,907 9,560 8,982 8,982 9,039 Tangible shareholders' equity (Tangible book value) 52,600 51,686 51,958 52,210 50,851 50,851 50,846 Basic Shares Outstanding: Number of shares issued 1,379.3 1,379.3 1,379.3 1,379.3 1,379.3 1,379.3 1,379.3 Treasury shares (0.4) (12.3) (12.3) (0.4) (0.2) (0.2) (4.6) Vested share awards 8.9 19.1 22.1 11.9 20.8 20.8 43.2 Basic Shares Outstanding 1,387.8 1,386.1 1,389.1 1,390.7 1,399.9 1,399.9 1,417.9 Book value per basic share outstanding in € € 45.16 € 44.44 € 44.54 € 44.42 € 42.74 € 42.74 € 42.24 Tangible book value per basic share outstanding in € € 37.90 € 37.29 € 37.40 € 37.54 € 36.33 € 36.33 € 35.86

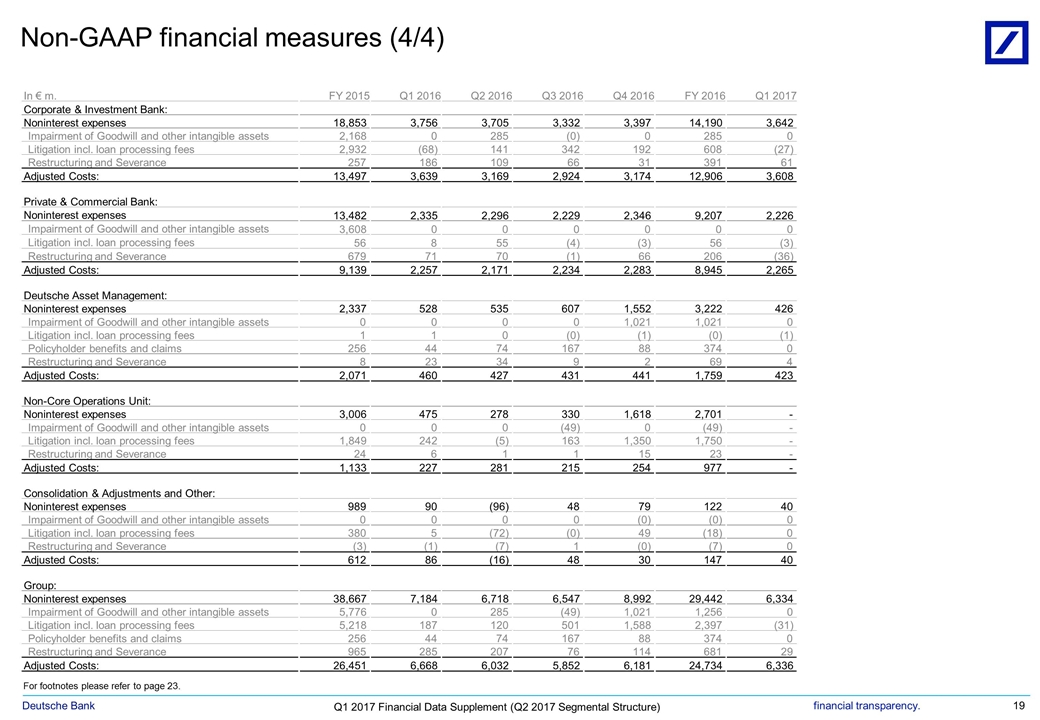

Non-GAAP financial measures (4/4) NGFM 4 For footnotes please refer to page 23. In € m. FY 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 FY 2016 Q1 2017 Corporate & Investment Bank: Noninterest expenses 18,853 3,756 3,705 3,332 3,397 14,190 3,642 Impairment of Goodwill and other intangible assets 2,168 0 285 (0) 0 285 0 Litigation incl. loan processing fees 2,932 (68) 141 342 192 608 (27) Restructuring and Severance 257 186 109 66 31 391 61 Adjusted Costs: 13,497 3,639 3,169 2,924 3,174 12,906 3,608 Private & Commercial Bank: Noninterest expenses 13,482 2,335 2,296 2,229 2,346 9,207 2,226 Impairment of Goodwill and other intangible assets 3,608 0 0 0 0 0 0 Litigation incl. loan processing fees 56 8 55 (4) (3) 56 (3) Restructuring and Severance 679 71 70 (1) 66 206 (36) Adjusted Costs: 9,139 2,257 2,171 2,234 2,283 8,945 2,265 Deutsche Asset Management: Noninterest expenses 2,337 528 535 607 1,552 3,222 426 Impairment of Goodwill and other intangible assets 0 0 0 0 1,021 1,021 0 Litigation incl. loan processing fees 1 1 0 (0) (1) (0) (1) Policyholder benefits and claims 256 44 74 167 88 374 0 Restructuring and Severance 8 23 34 9 2 69 4 Adjusted Costs: 2,071 460 427 431 441 1,759 423 Non-Core Operations Unit: Noninterest expenses 3,006 475 278 330 1,618 2,701 - Impairment of Goodwill and other intangible assets 0 0 0 (49) 0 (49) - Litigation incl. loan processing fees 1,849 242 (5) 163 1,350 1,750 - Restructuring and Severance 24 6 1 1 15 23 - Adjusted Costs: 1,133 227 281 215 254 977 - Consolidation & Adjustments and Other: Noninterest expenses 989 90 (96) 48 79 122 40 Impairment of Goodwill and other intangible assets 0 0 0 0 (0) (0) 0 Litigation incl. loan processing fees 380 5 (72) (0) 49 (18) 0 Restructuring and Severance (3) (1) (7) 1 (0) (7) 0 Adjusted Costs: 612 86 (16) 48 30 147 40 Group: Noninterest expenses 38,667 7,184 6,718 6,547 8,992 29,442 6,334 Impairment of Goodwill and other intangible assets 5,776 0 285 (49) 1,021 1,256 0 Litigation incl. loan processing fees 5,218 187 120 501 1,588 2,397 (31) Policyholder benefits and claims 256 44 74 167 88 374 0 Restructuring and Severance 965 285 207 76 114 681 29 Adjusted Costs: 26,451 6,668 6,032 5,852 6,181 24,734 6,336

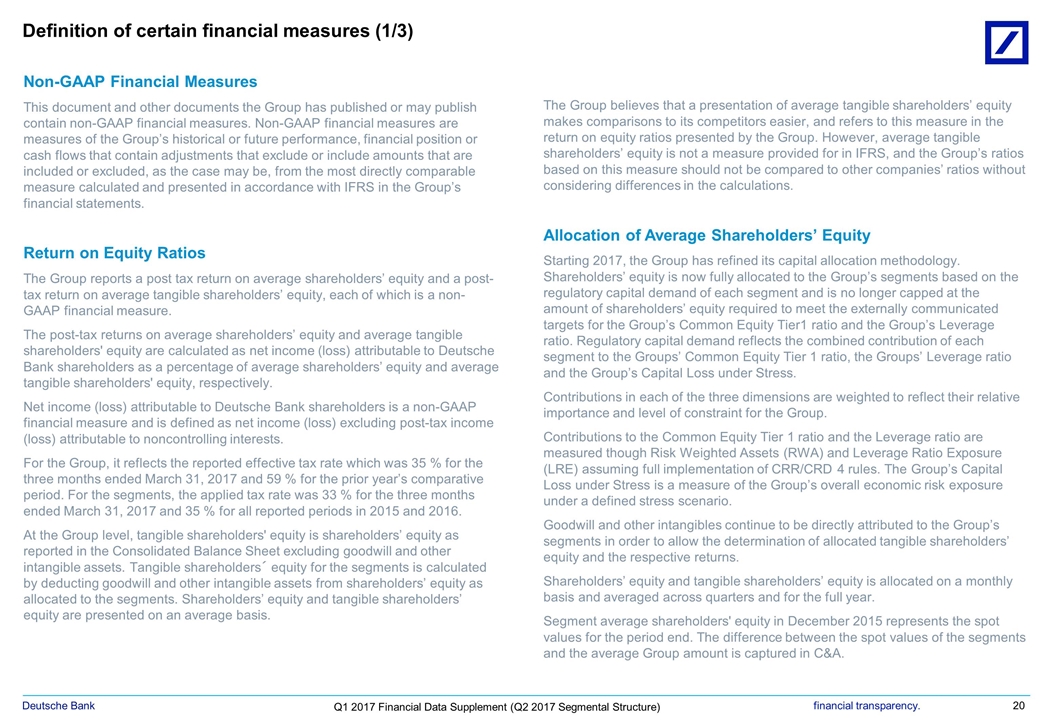

Definition of certain financial measures (1/3) Non-GAAP Financial Measures This document and other documents the Group has published or may publish contain non-GAAP financial measures. Non-GAAP financial measures are measures of the Group’s historical or future performance, financial position or cash flows that contain adjustments that exclude or include amounts that are included or excluded, as the case may be, from the most directly comparable measure calculated and presented in accordance with IFRS in the Group’s financial statements. Return on Equity Ratios The Group reports a post tax return on average shareholders’ equity and a post-tax return on average tangible shareholders’ equity, each of which is a non-GAAP financial measure. The post-tax returns on average shareholders’ equity and average tangible shareholders' equity are calculated as net income (loss) attributable to Deutsche Bank shareholders as a percentage of average shareholders’ equity and average tangible shareholders' equity, respectively. Net income (loss) attributable to Deutsche Bank shareholders is a non-GAAP financial measure and is defined as net income (loss) excluding post-tax income (loss) attributable to noncontrolling interests. For the Group, it reflects the reported effective tax rate which was 35 % for the three months ended March 31, 2017 and 59 % for the prior year’s comparative period. For the segments, the applied tax rate was 33 % for the three months ended March 31, 2017 and 35 % for all reported periods in 2015 and 2016. At the Group level, tangible shareholders' equity is shareholders’ equity as reported in the Consolidated Balance Sheet excluding goodwill and other intangible assets. Tangible shareholders´ equity for the segments is calculated by deducting goodwill and other intangible assets from shareholders’ equity as allocated to the segments. Shareholders’ equity and tangible shareholders’ equity are presented on an average basis. The Group believes that a presentation of average tangible shareholders’ equity makes comparisons to its competitors easier, and refers to this measure in the return on equity ratios presented by the Group. However, average tangible shareholders’ equity is not a measure provided for in IFRS, and the Group’s ratios based on this measure should not be compared to other companies’ ratios without considering differences in the calculations. Allocation of Average Shareholders’ Equity Starting 2017, the Group has refined its capital allocation methodology. Shareholders’ equity is now fully allocated to the Group’s segments based on the regulatory capital demand of each segment and is no longer capped at the amount of shareholders’ equity required to meet the externally communicated targets for the Group’s Common Equity Tier1 ratio and the Group’s Leverage ratio. Regulatory capital demand reflects the combined contribution of each segment to the Groups’ Common Equity Tier 1 ratio, the Groups’ Leverage ratio and the Group’s Capital Loss under Stress. Contributions in each of the three dimensions are weighted to reflect their relative importance and level of constraint for the Group. Contributions to the Common Equity Tier 1 ratio and the Leverage ratio are measured though Risk Weighted Assets (RWA) and Leverage Ratio Exposure (LRE) assuming full implementation of CRR/CRD 4 rules. The Group’s Capital Loss under Stress is a measure of the Group’s overall economic risk exposure under a defined stress scenario. Goodwill and other intangibles continue to be directly attributed to the Group’s segments in order to allow the determination of allocated tangible shareholders’ equity and the respective returns. Shareholders’ equity and tangible shareholders’ equity is allocated on a monthly basis and averaged across quarters and for the full year. Segment average shareholders' equity in December 2015 represents the spot values for the period end. The difference between the spot values of the segments and the average Group amount is captured in C&A.

Definition of certain financial measures (2/3) We also set forth in this and other documents such CRR/CRD 4 measures on a “fully loaded” basis, reflecting full application of the rules without consideration of the transitional provisions under CRR/CRD 4. With respect to risk-weighting, we assume in our CRR/CRD 4 “fully loaded” methodology for a limited subset of equity positions that the impact of the expiration of these transitional rules will be mitigated through sales of the underlying assets or other measures prior to the expiration of the grandfathering provisions by end of 2017. Such fully loaded metrics are described in (i) “Management Report: Risk Report: Risk and Capital Performance: Capital and Leverage Ratio” on pages 136 to 152 of our Annual Report 2016 and “Supplementary Information: Non-GAAP Financial Measures: Fully Loaded CRR/CRD 4 Measures” on pages 471 to 472 of our Annual Report 2016 and in (ii) the subsections “Management Report: Risk Report: Risk and Capital Performance: Regulatory Capital”, “Management Report: Risk Report: Leverage Ratio” and “Other Information (unaudited): Fully loaded CRR/CRD 4 Measures” of our Q1 Interim Report. Such sections also provide reconciliation to the respective CRR/CRD 4 transitional or IFRS values. As the final implementation of CRR/CRD 4 may differ from our expectations, and our competitors’ assumptions and estimates regarding such implementation may vary, our fully loaded CRR/CRD 4 measures may not be comparable with similarly labeled measures used by our competitors. Allocation of Average Shareholders’ Equity (cont’d) For purposes of the 2017 average shareholders’ equity allocation the Non-Core Operations Unit (NCOU) balances from year-end 2016 have been allocated to Consolidation & Adjustments (C&A) as Non-Core Operations Unit (NCOU) has ceased to exist as a separate corporate division from 2017 onwards. Adjusted Costs Adjusted costs is one of the key performance indicators outlined in our strategy. It is a non-GAAP financial measure for which the most directly comparable IFRS financial measure is noninterest expenses. Adjusted costs is calculated by deducting from noninterest expenses under IFRS (i) impairment of goodwill and other intangible assets, (ii) litigation, (iii) policyholder benefits and claims and (iv) restructuring and severances. Policyholder benefits and claims arose from the Abbey Life Assurance business which was sold in late 2016 and so will not occur in future periods. The Group believes that a presentation of noninterest expenses excluding the impact of these items provides a more meaningful depiction of the costs associated with our operating businesses. Fully loaded CRR/CRD 4 Measures Since January 1, 2014, our regulatory assets, exposures, risk-weighted assets, capital and ratios thereof are calculated for regulatory purposes under CRR/CRD4. CRR/CRD 4 provides for “transitional” (or “phase-in”) rules, under which capital instruments that are no longer eligible under the new rules are permitted to be phased out as the new rules on regulatory adjustments are phased in, as well as regarding the risk weighting of certain categories of assets. In some cases, CRR/CRD 4 maintains transitional rules that had been adopted in earlier capital adequacy frameworks through Basel 2 or Basel 2.5. These relate e.g. to the risk weighting of certain categories of assets and include rules permitting the grandfathering of equity investments at a risk-weight of 100 %.

Definition of certain financial measures (3/3) Book Value and Tangible Book Value per Basic Share Outstanding Book value per basic share outstanding and tangible book value per basic share outstanding are non-GAAP financial measures that are used and relied upon by investors and industry analysts as capital adequacy metrics. Book value per basic share outstanding represents the Bank’s total shareholders’ equity divided by the number of basic shares outstanding at period-end. Tangible book value represents the Bank’s total shareholders’ equity less goodwill and other intangible assets. Tangible book value per basic share outstanding is computed by dividing tangible book value by period-end basic shares outstanding. Cost ratios Cost/income ratio: Noninterest expenses as a percentage of total net revenues, which are defined as net interest income before provision for credit losses plus noninterest income. Compensation ratio: Compensation and benefits as a percentage of total net revenues, which are defined as net interest income before provision for credit losses plus noninterest income. Noncompensation ratio: Noncompensation noninterest expenses, which are defined as total noninterest expenses less compensation and benefits, as a percentage of total net revenues, which are defined as net interest income before provision for credit losses plus noninterest income. Other key ratios Diluted earnings per share: Net income (loss) attributable to Deutsche Bank shareholders, which is defined as net income (loss) excluding noncontrolling interests, divided by the weighted-average number of diluted shares outstanding. Diluted earnings per share assume the conversion into common shares of outstanding securities or other contracts to issue common stock, such as share options, convertible debt, unvested deferred share awards and forward contracts. Other key ratios (cont’d) Book value per basic share outstanding: Book value per basic share outstanding is defined as shareholders’ equity divided by the number of basic shares outstanding (both at period end). Tangible book value per basic share outstanding: Tangible book value per basic share outstanding is defined as shareholders’ equity less goodwill and other intangible assets, divided by the number of basic shares outstanding (both at period-end). Tier 1 capital ratio: Tier 1 capital, as a percentage of the risk-weighted assets for credit, market and operational risk. Common Equity Tier 1 capital ratio: Common Equity Tier 1 capital, as a percentage of the risk-weighted assets for credit, market and operational risk. Fully loaded CRR/CRD4 Leverage Ratio: Tier 1 capital (CRR/CRD4 fully loaded), as a percentage of the CRR/CRD4 leverage ratio exposure measure (fully loaded). Phase-in CRR/CRD4 Leverage Ratio: Tier 1 capital (CRR/CRD4 phase-in), as a percentage of the phase-in CRR/CRD4 leverage ratio exposure measure (phase-in).

We calculate our leverage ratio exposure on a fully loaded basis in accordance with Article 429 of the CRR as per Delegated Regulation (EU) 2015/62 of October 10, 2014 published in the Official Journal of the European Union on January 17, 2015 amending Regulation (EU) No 575/2013. Definitions of ratios are provided on pages 19, 20 and 21 of this document. At period end. Regulatory capital amounts, risk weighted assets and capital ratios are based upon CRR/CRD 4 fully-loaded. The reconciliation of adjusted costs is provided on page 19 of this document. The reconciliation of average tangible shareholders‘ equity is provided on pages 16-18 of this document. Earnings were adjusted by € 276 million and € 238 million net of tax for the coupons paid on Additional Tier 1 Notes in April 2016 and April 2015, respectively. In accordance with IAS 33 the coupons paid on Additional Tier 1 Notes are not attributable to Deutsche Bank shareholders and therefore need to be deducted in the calculation. This adjustment created a net loss for Earnings per Common Share for the three and six months ended June 30, 2016. Diluted Earnings per Common Share include the numerator effect of assumed conversions. In case of a net loss potentially dilutive shares are not considered for the earnings per share calculation, because to do so would decrease the net loss per share. Source for share price information: Bloomberg, based on XETRA; high and low based on intraday prices. To reflect the capital increase in 2017, the historical share prices up to and including March 20, 2017 (last trading day cum rights) have been adjusted with retroactive effect by multiplication with the correcting factor of 0.8925 (R-Factor). Includes net interest income and net gains (losses) on financial assets/liabilities at fair value through profit or loss, net fee and commission income and remaining revenues. Reflects front office employees and related Infrastructure employees (allocated on a pro forma basis). Segment assets represent consolidated view, i.e. the amounts do not include intersegment balances (except for Central Liquidity Reserves implemented 3Q 15, Shorts Coverage, Liquidity Portfolio and Repack reallocations from CIB to PCB and NCOU, regarding assets consumed by other segments but managed by CIB). Contains Group-neutral reallocation of Central Liquidity Reserves to business divisions, majority re-allocated from CIB to PCB. Invested Assets include assets held on behalf of customers for investment purposes and/or assets that are managed by DB. Invested assets are managed on a discretionary or advisory basis, or these assets are deposited with DB. Please note: In the first quarter 2016 a stricter definition for Invested Assets became effective and Client Assets were introduced as additional metric. Prior periods have been restated accordingly. Client Assets include Invested Assets plus Assets under Administration; Assets under Administration include assets over which DB provides non investment services such as custody, risk management, administration and reporting (including execution only brokerage) as well as current accounts / non-investment deposits. Total net revenues excluding the revenue impact from mark-to-market movements on policyholder benefits and claims (annualized) as a percentage of average invested assets. Income (loss) before income taxes attributable to Deutsche Bank shareholders (annualized), which is defined as IBIT excluding pre-tax noncontrolling interests, as a percentage of average invested assets. Includes provision for loan losses and provision for off-balance sheet positions. Impaired loan coverage ratio: balance of the allowance for loan losses as a percentage of impaired loans (both at period end). Based on recent ECB guidance, CET1 capital for the first quarter 2017 has been revised down to not include any interim profits for the period, lowering first quarter capital by € (215) million and the CET 1 ratio by 7 bps. Excluding actuarial gains (losses) related to defined benefit plans, net of tax. Includes Additional Tier 1 Notes, which constitute unsecured and subordinated notes of Deutsche Bank and are classified as equity in accordance with IFRS. Based on Net income (loss) attributable to Deutsche Bank shareholders (Post-tax), definitions of ratios are provided on page 19, 20 and 21 of this document. Footnotes