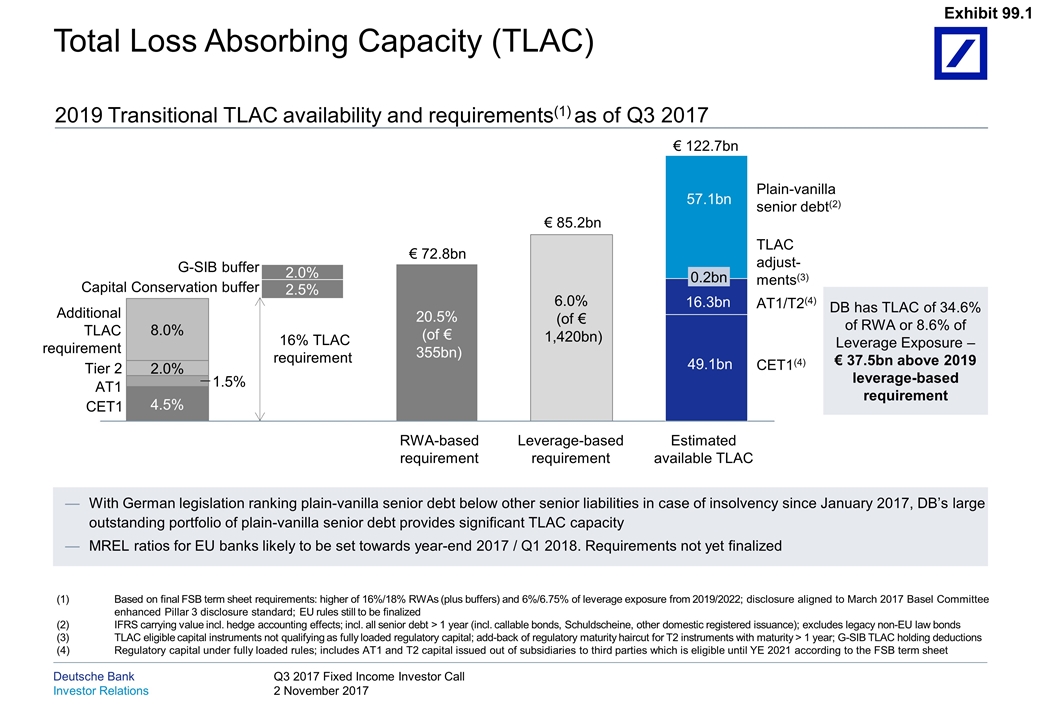

Total Loss Absorbing Capacity (TLAC) 2019 Transitional TLAC availability and requirements(1) as of Q3 2017 RWA-based requirement Leverage-based requirement Estimated available TLAC CET1(4) 16.5bn 54.1bn 50.1bn 0.2bn Plain-vanilla senior debt(2) TLAC adjust- ments(3) € 122.7bn Tier 2 AT1 CET1 Additional TLAC requirement Capital Conservation buffer G-SIB buffer 16% TLAC requirement € 72.8bn € 85.2bn AT1/T2(4) DB has TLAC of 34.6% of RWA or 8.6% of Leverage Exposure – € 37.5bn above 2019 leverage-based requirement With German legislation ranking plain-vanilla senior debt below other senior liabilities in case of insolvency since January 2017, DB’s large outstanding portfolio of plain-vanilla senior debt provides significant TLAC capacity MREL ratios for EU banks likely to be set towards year-end 2017 / Q1 2018. Requirements not yet finalized Based on final FSB term sheet requirements: higher of 16%/18% RWAs (plus buffers) and 6%/6.75% of leverage exposure from 2019/2022; disclosure aligned to March 2017 Basel Committee enhanced Pillar 3 disclosure standard; EU rules still to be finalized IFRS carrying value incl. hedge accounting effects; incl. all senior debt > 1 year (incl. callable bonds, Schuldscheine, other domestic registered issuance); excludes legacy non-EU law bonds TLAC eligible capital instruments not qualifying as fully loaded regulatory capital; add-back of regulatory maturity haircut for T2 instruments with maturity > 1 year; G-SIB TLAC holding deductions Regulatory capital under fully loaded rules; includes AT1 and T2 capital issued out of subsidiaries to third parties which is eligible until YE 2021 according to the FSB term sheet 1.5% 8.0% 2.0% 2.5% 6.0% (of € 1,420bn) 2.0% 4.5% 20.5% (of € 355bn) 0.2bn 57.1bn 16.3bn 49.1bn Exhibit 99.1

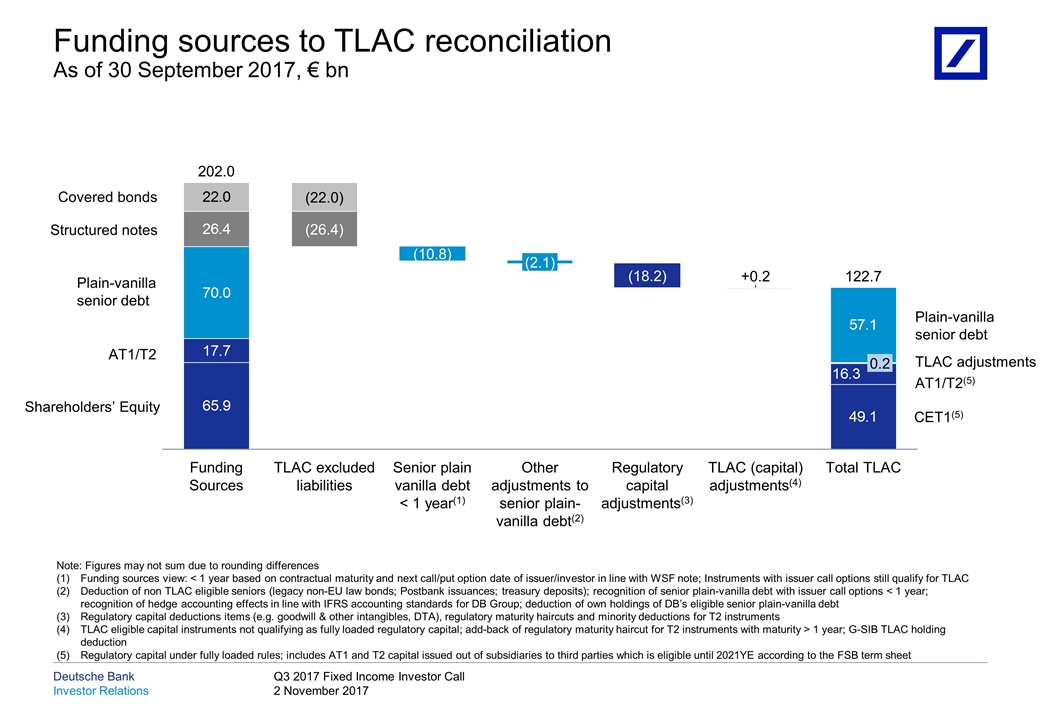

Funding sources to TLAC reconciliation As of 30 September 2017, € bn Covered bonds Structured notes Plain-vanilla senior debt AT1/T2 Shareholders’ Equity TLAC adjustments Plain-vanilla senior debt AT1/T2(5) CET1(5) Note: Figures may not sum due to rounding differences Funding sources view: < 1 year based on contractual maturity and next call/put option date of issuer/investor in line with WSF note; Instruments with issuer call options still qualify for TLAC Deduction of non TLAC eligible seniors (legacy non-EU law bonds; Postbank issuances; treasury deposits); recognition of senior plain-vanilla debt with issuer call options < 1 year; recognition of hedge accounting effects in line with IFRS accounting standards for DB Group; deduction of own holdings of DB’s eligible senior plain-vanilla debt Regulatory capital deductions items (e.g. goodwill & other intangibles, DTA), regulatory maturity haircuts and minority deductions for T2 instruments TLAC eligible capital instruments not qualifying as fully loaded regulatory capital; add-back of regulatory maturity haircut for T2 instruments with maturity > 1 year; G-SIB TLAC holding deduction Regulatory capital under fully loaded rules; includes AT1 and T2 capital issued out of subsidiaries to third parties which is eligible until 2021YE according to the FSB term sheet (3) () () () (1) (2) () () + (4)