- DB Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Deutsche Bank (DB) 6-KCurrent report (foreign)

Filed: 14 Feb 20, 12:09pm

Exhibit 5.4

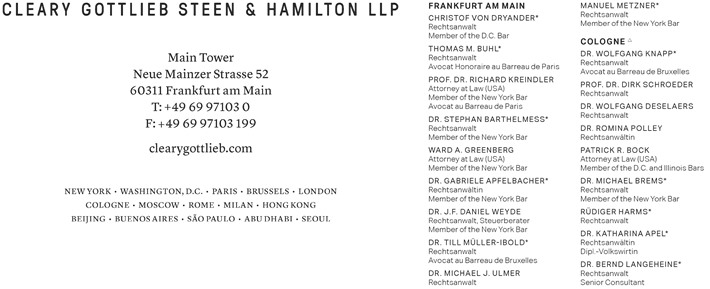

Writer’s Direct Dial: +49 69 97 10 30

E-Mail: wgreenberg@cgsh.com

| EXHIBIT 5.4 | ||

Deutsche Bank Aktiengesellschaft Taunusanlage 12 | February 14, 2020 | |

| 60325 Frankfurt am Main | ||

| Germany |

Ladies and Gentlemen:

We have acted as special United States counsel to Deutsche Bank Aktiengesellschaft, a stock corporation (Aktiengesellschaft) organized under the laws of the Federal Republic of Germany (the “Bank”), in connection with the Bank’s offering pursuant to a registration statement on Form F-3 (No. 333 226421) of $1,250,000,000 aggregate principal amount of the Undated Non-cumulative Fixed to Reset Rate Additional Tier 1 Notes of 2020 (the “Notes”) to be issued under a capital securities indenture dated as of November 6, 2014 (the “Base Indenture”), as supplemented by the second supplemental capital securities indenture dated July 25, 2019 (the “Second Supplemental Indenture”), as further supplemented by the fourth supplemental capital securities indenture dated February 14, 2020 (the “Fourth Supplemental Indenture”) and as additionally supplemented by the fifth supplemental capital securities indenture dated February 14, 2020 (the “Fifth Supplemental Indenture” and, together with the Base Indenture, the Second Supplemental Indenture and the Fourth Supplemental Indenture, the “Indenture”), in each case among the Bank, The Bank of New York Mellon, as trustee (the “Trustee”), and Deutsche Bank Trust Company Americas, as paying agent, calculation agent, transfer agent and registrar and authenticating agent (the “Agent”). Such registration statement, as amended as of its most recent effective date (February 10, 2020), insofar as it relates to the Notes (as determined for purposes of Rule 430B(f)(2) under the Securities Act of 1933, as amended (the “Securities Act”)), including the

documents incorporated by reference therein but excluding any related Form T-1 filing, is herein called the “Registration Statement;” the related prospectus dated August 18, 2020, included in the Registration Statement filed with the Securities and Exchange Commission (the “Commission”) under the Securities Act, including the documents incorporated by reference therein, is herein called the “Base Prospectus;” the preliminary prospectus supplement dated February 10, 2020, as filed with the Commission pursuant to Rule 424(b) under the Securities Act, including the documents incorporated by reference therein, is herein called the “Preliminary Prospectus Supplement;” and the related prospectus supplement dated February 11, 2020, as filed with the Commission pursuant to Rule 424(b) under the Securities Act, including the documents incorporated by reference therein, is herein called the “Final Prospectus Supplement.” The Base Prospectus and the Preliminary Prospectus Supplement together are herein called the “Pricing Prospectus,” and the Base Prospectus and the Final Prospectus Supplement together are herein called the “Final Prospectus.”

In arriving at the opinion expressed below, we have reviewed the following documents:

| (a) | the Registration Statement; |

| (b) | copies of the Notes in global form as executed by the Bank and authenticated by the Agent; and |

| (c) | an executed copy of the Indenture. |

In addition, we have made such investigations of law as we have deemed appropriate as a basis for the opinion expressed below.

In rendering the opinion expressed below, we have assumed the authenticity of all documents submitted to us as originals and the conformity to the originals of all documents submitted to us as copies. In addition, we have assumed and have not verified the accuracy as to factual matters of each document we have reviewed.

2

Based on the foregoing, and subject to the further assumptions and qualifications set forth below, it is our opinion that the Notes have been duly executed and delivered by the Bank under the law of the State of New York and are the valid, binding and enforceable obligations of the Bank, entitled to the benefits of the Indenture (except that we express no opinion with respect to the validity, binding effect or enforceability of (i) the provisions of § 2 (2) of the terms of the Notes relating to the ranking of the Notes and their status, which provisions are expressed to be governed by German law, including, in relation to such provisions, any determination of whether a Resolution Measure (as defined in the Notes) has been imposed on the Bank, or (ii) Section 1.02(l) of the Second Supplemental Indenture and Section 2.03(i) of the Fifth Supplemental Indenture (and the corresponding provisions in the Notes) providing for the survival of the Bank’s obligations to indemnify the Trustee in accordance with Sections 6.02 and 6.06 of the Base Indenture after the imposition of a Resolution Measure by the competent resolution authority (each as defined in the Second Supplemental Indenture) with respect to the Notes).

Insofar as the foregoing opinion relates to the validity, binding effect or enforceability of any agreement or obligation of the Bank, (a) we have assumed that the Bank and each other party to such agreement or obligation has satisfied those legal requirements that are applicable to it to the extent necessary to make such agreement or obligation enforceable against it (except that no such assumption is made as to the Bank regarding matters of the federal law of the United States of America or the law of the State of New York that in our experience normally would be applicable to general business entities with respect to such agreement or obligation), (b) such opinion is subject to applicable bankruptcy, insolvency and similar laws affecting creditors’ rights generally and to general principles of equity, (c) we express no opinion with respect to the effect of any mandatory choice of law rules and (d) such opinion is subject to the effect of judicial application of foreign laws or foreign governmental actions affecting creditors’ rights.

The foregoing opinion is limited to the federal law of the United States of America and the law of the State of New York.

With respect to the first sentence of Section 11.12 of the Base Indenture and Section 14.02 of the Fifth Supplemental Indenture, we express no opinion as to the subject matter jurisdiction of any United States Federal court to adjudicate any action relating to the Notes where jurisdiction based on diversity of citizenship under 28 U.S.C. § 1332 does not exist. We express no opinion as to the enforceability of Section 11.13 of the Base Indenture relating to currency indemnity.

3

We hereby consent to the use of our name in each of the Pricing Prospectus and the Final Prospectus under the heading “Legal Matters,” as counsel for the Bank who has passed on the validity of the Notes and to the filing of this opinion with the Commission as Exhibit 5.4 to the Bank’s Current Report on Form 6-K dated February 14, 2020. In giving such consent, we do not thereby admit that we are within the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Commission promulgated thereunder. We assume no obligation to advise you or any other person, or to make any investigations, as to any legal developments or factual matters arising subsequent to the date hereof that might affect the opinion expressed herein.

| Very truly yours, | ||

| CLEARY GOTTLIEB STEEN & HAMILTON LLP | ||

| By: | /s/ Ward A. Greenberg | |

| Ward A. Greenberg, a Partner | ||

4