“Paying Agent” means DBTCA, with respect to payments to be made in U.S. Dollars (or such other currency as to which DBTCA or its agent has agreed to make payments hereunder), or any person authorized by the Issuer in accordance with Section 3.04.

“Periodic Offering” means an offering of Securities of a series from time to time, the specific terms of which Securities, including, without limitation, the rate or rates of interest, if any, thereon, the stated maturity or maturities thereof and the redemption provisions, if any, with respect thereto, are to be determined by the Issuer or its agents upon the issuance of such Securities.

“Person” means any individual, corporation, partnership, joint venture, association, joint stock company, trust, unincorporated organization or government or any agency or political subdivision thereof.

“principal” whenever used with reference to the Securities or any Security or any portion thereof, shall be deemed to include “and premium, if any”.

“record date” shall have the meaning set forth in Section 2.07.

“Redemption Notice Period” shall have the meaning set forth in Section 13.02.

“Registered Global Security” means a Security evidencing all or a part of a series of Registered Securities, issued to the Depositary for such series in accordance with Section 2.04, and bearing the legend prescribed in Section 2.04.

“Registered Security” means any Security registered on the Security register of the Issuer.

“Registrar” shall have the meaning set forth in Section 2.08.

“Required Currency” shall have the meaning set forth in Section 12.13.

“Resolution Measure” shall have the meaning set forth in Section 6.01(a).

“Responsible Officer” when used with respect to any Person means the chairman of the board of directors, any vice chairman of the board of directors, the chairman of the trust committee, the chairman of the executive committee, any vice chairman of the executive committee, the president, any vice president (whether or not designated by numbers or words added before or after the title “vice president”), the cashier, the secretary, the treasurer, any trust officer, any assistant trust officer, any assistant vice president, any assistant cashier, any assistant secretary, any assistant treasurer, or any other officer or assistant officer of the Person customarily performing functions similar to those performed by the persons who at the time shall be such officers, respectively, or to whom any corporate trust matter is referred because of such Person’s knowledge of and familiarity with the particular subject.

“Securities Act” means the U.S. Securities Act of 1933, as amended.

“Security” or “Securities” has the meaning stated in the first recital of this Indenture, or, as the case may be, Securities that have been authenticated and delivered under this Indenture.

“Trust Indenture Act” means the Trust Indenture Act of 1939, as amended.

“Trustee” means the Person identified as “Trustee” in the first paragraph hereof and, subject to the provisions of Article 7, shall also include any successor trustee. “Trustee” shall also mean or include each Person who is then a trustee hereunder and if at any time there is more than one such Person, “Trustee” as used with respect to the Securities of any series shall mean the trustee with respect to the Securities of such series.

“U.S. Dollar” means the coin or currency of the United States of America as at the time of payment is legal tender for the payment of public and private debts.

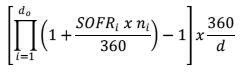

“Yield to Maturity” means the yield to maturity on a series of Securities, calculated at the time of issuance of such series, or, if applicable, at the most recent redetermination of interest on such series, and calculated in accordance with accepted financial practice.

Section 1.02. Securities of a Prior Series. The Original Senior Debt Funding Indenture shall not be amended by this Amended and Restated Senior Debt Funding Indenture with respect to any Securities of any series created prior to the date of this Amended and Restated Senior Debt Funding Indenture, and any Securities of any series created prior to the date of this Amended and Restated Senior Debt Funding Indenture shall continue to be governed by such Original Senior Debt Funding Indenture and not by this Amended and Restated Senior Debt Funding Indenture.

ARTICLE 2

SECURITIES

Section 2.01. Forms Generally. The Securities of each series and the Coupons, if any, to be attached thereto shall be substantially in such form (not inconsistent with this Indenture) as shall be established by one or more Board Resolutions (as set forth in a Board Resolution) or one or more Officers’ Certificates detailing such establishment or in one or more indentures supplemental hereto, in each case with such appropriate insertions,

9