0001159510 us-gaap:SeniorNotesMember srt:SubsidiariesMember cs:VariableRateMember 2020-12-31 0001159510 us-gaap:InterestRateContractMember us-gaap:NondesignatedMember cs:ForwardsAndForwardRateAgreementsContractsMember 2020-12-31 0001159510 us-gaap:EquityContractMember us-gaap:FairValueInputsLevel2Member us-gaap:FairValueMeasurementsRecurringMember us-gaap:DerivativeMember 2019-12-31 0001159510 us-gaap:CreditRiskContractMember srt:WeightedAverageMember us-gaap:ValuationTechniqueDiscountedCashFlowMember us-gaap:MeasurementInputDefaultRateMember us-gaap:FairValueInputsLevel3Member us-gaap:FairValueMeasurementsRecurringMember us-gaap:DerivativeMember 2019-12-31 0001159510 us-gaap:FederalFundsSoldAndSecuritiesBorrowedOrPurchasedUnderAgreementsToResellMember 2020-01-01 2020-12-31 0001159510 us-gaap:CommercialPortfolioSegmentMember us-gaap:FinancialServicesSectorMember us-gaap:InternalNoninvestmentGradeMember cs:InternalCounterpartyRatingBBToCRatingMember cs:ConsolidatedBankMember 2019-12-31 0001159510 cs:OtherAlternativeInvestmentsMember cs:ConsolidatedBankMember us-gaap:ForeignPlanMember us-gaap:PensionPlansDefinedBenefitMember us-gaap:FairValueInputsLevel1Member 2019-12-31 0001159510 us-gaap:FairValueMeasurementsRecurringMember cs:LongtermDebtHightriggerInstrumentsMember cs:ConsolidatedBankMember us-gaap:FairValueInputsLevel1Member 2020-12-31 0001159510 us-gaap:FederalFundsPurchasedAndSecuritiesSoldUnderAgreementsToRepurchaseMember cs:ConsolidatedBankMember 2018-01-01 2018-12-31

As filed with the Securities and Exchange Commission on March 18, 2021

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2020

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report……………….

For the transition period from __________ to __________

Commission file number: 001-15244

(Exact name of Registrant as specified in its charter)

Canton of Zurich, Switzerland

(Jurisdiction of incorporation or organization)

Paradeplatz 8, 8001Zurich, Switzerland

(Address of principal executive offices)

Paradeplatz 8, 8001Zurich, Switzerland

david.mathers@credit-suisse.com

Telephone: +41 44333 1111

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Commission file number: 001-33434

(Exact name of Registrant as specified in its charter)

Canton of Zurich, Switzerland

(Jurisdiction of incorporation or organization)

Paradeplatz 8, 8001Zurich, Switzerland

(Address of principal executive offices)

Paradeplatz 8, 8001Zurich, Switzerland

david.mathers@credit-suisse.com

Telephone: +41 44333 1111

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

[THIS PAGE INTENTIONALLY LEFT BLANK]

| Securities registered or to be registered pursuant to Section 12(b) of the Act: | | | | | |

| Title of each class of securities | | Trading Symbol(s) | | Name of each exchange on which registered | |

| | | | | | |

| Credit Suisse Group AG | | | | | |

| American Depositary Shares each representing one Share | | CS | | New York Stock Exchange | |

| Shares par value CHF 0.04 * | | CSGN | * | New York Stock Exchange | * |

| | | | | | |

| Credit Suisse AG | | | | | |

| Credit Suisse X-Links® Monthly Pay 2xLeveraged Mortgage REIT ETNs due July 11, 2036 | | REML | | NYSE Arca | |

| Credit Suisse S&P MLP Index ETNs due December 4, 2034 Linked to the S&P MLP Index | | MLPO | | NYSE Arca | |

| Credit Suisse X-Links® Gold Shares Covered Call ETNs due February 2, 2033 | | GLDI | | The Nasdaq Stock Market | |

| Credit Suisse X-Links® Silver Shares Covered Call ETNs due April 21, 2033 | | SLVO | | The Nasdaq Stock Market | |

| Credit Suisse X-Links® Crude Oil Shares Covered Call ETNs due April 24, 2037 | | USOI | | The Nasdaq Stock Market | |

| Credit Suisse FI Large Cap Growth Enhanced ETNs due June 13, 2024 Linked to the Russell 1000® Growth Index Total Return | | FLGE | | NYSE Arca | |

| Credit Suisse FI Enhanced Europe 50 ETNs due May 11, 2028 Linked to the STOXX® Europe 50 USD (Gross Return) Index | | FEUL | | NYSE Arca | |

| | | | | | |

* Not for trading, but only in connection with the registration of the American Depositary Shares |

|

|

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of December 31, 2020: 2,406,144,879 shares of Credit Suisse Group AG

Indicate by check mark if the Registrants are well-known seasoned issuers, as defined in Rule 405 of the Securities Act.

If this report is an annual or transition report, indicate by check mark if the Registrants are not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Indicate by check mark whether the Registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrants were required to file such reports) and (2) have been subject to such filing requirements for the past 90 days.

Indicate by check mark whether Registrants have submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (paragraph 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the Registrants are large accelerated filers, accelerated filers, non-accelerated filers, or emerging growth companies. See definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☒ Accelerated filer ☐ Non-accelerated filer ☐ Emerging growth company ☐

If emerging growth companies that prepare their financial statements in accordance with U.S. GAAP, indicate by check mark if the Registrants have elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark which basis of accounting the Registrants have used to prepare the financial statements included in this filing:

U.S. GAAP ☒ International ☐ Other ☐ Financial Reporting Standards as issued by the International Accounting Standards Board

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

If this is an annual report, indicate by check mark whether the Registrants are shell companies (as defined in Rule 12b-2 of the Exchange Act)

For the purposes of this Form 20-F and the attached Annual Report 2020, unless the context otherwise requires, the terms “Credit Suisse Group,” “Credit Suisse,” the “Group,” “we,” “us” and “our” mean Credit Suisse Group AG and its consolidated subsidiaries. The business of Credit Suisse AG, the direct bank subsidiary of the Group, is substantially similar to the Group, and we use these terms to refer to both when the subject is the same or substantially similar. We use the term the “Bank” when we are referring only to Credit Suisse AG and its consolidated subsidiaries.

Abbreviations and selected terms are explained in the List of abbreviations and the Glossary in the back of the Annual Report 2020.

Throughout this Form 20-F and the attached Annual Report 2020, we describe the position and ranking of our various businesses in certain industry and geographic markets. The sources for such descriptions come from a variety of conventional publications generally accepted as relevant business indicators by members of the financial services industry. These sources include: Standard & Poor’s, Dealogic, Institutional Investor, Lipper, Moody’s Investors Service and Fitch Ratings.

Cautionary statement regarding forward-looking information For Credit Suisse and the Bank, please see the Cautionary statement regarding forward-looking information on the inside page of the back cover of the attached Annual Report 2020.

For the avoidance of doubt, the information appearing on pages 2, 4 to 10, 234 to 237 and A-4 to A-12 as well as the statements “We also aim to grow our Wealth Management-related income before taxes to between CHF 5.0-5.5 billion in 2023.” on page 13 and “Aim to increase Wealth Management-related income before taxes to between CHF 5.0-5.5 billion in 2023;” on page 14 of the attached Annual Report 2020 are not included in Credit Suisse’s and the Bank’s Form 20-F for the fiscal year ended December 31, 2020.

Item 1. Identity of directors, senior management and advisers. Not required because this Form 20-F is filed as an annual report.

Item 2. Offer statistics and expected timetable. Not required because this Form 20-F is filed as an annual report.

A – Selected financial data.

For Credit Suisse and the Bank, please see Appendix – Selected five-year information – Group on page A-2 and – Bank on page A-3 of the attached Annual Report 2020.

B – Capitalization and indebtedness.

Not required because this Form 20-F is filed as an annual report.

C – Reasons for the offer and use of proceeds.

Not required because this Form 20-F is filed as an annual report.

D – Risk factors.

For Credit Suisse and the Bank, please see I – Information on the company – Risk factors on pages 45 to 58 of the attached Annual Report 2020.

Item 4. Information on the company. A – History and development of the company.

For Credit Suisse and the Bank, please see I – Information on the company – Credit Suisse at a glance on page 12 and – Strategy on pages 13 to 18 and IV – Corporate Governance – Overview – Corporate governance framework – Company details on page 187 of the attached Annual Report 2020. In addition, for Credit Suisse, please see Note 3 – Business developments, significant shareholders and subsequent events and Note 4 – Segment information in VI – Consolidated financial statements – Credit Suisse Group on pages 290 to 294 of the attached Annual Report 2020 and, for the Bank, please see Note 3 – Business developments, significant shareholders and subsequent events and Note 4 – Segment information in VIII – Consolidated financial statements – Credit Suisse (Bank) on pages 456 to 457 of the attached Annual Report 2020. For additional information on Credit Suisse and the Bank, please see Item 10.H of this Form 20-F regarding documents on display.

B – Business overview.

For Credit Suisse and the Bank, please see I – Information on the company – Divisions on pages 19 to 25 of the attached Annual Report 2020. In addition, for Credit Suisse, please see Note 4 – Segment information in VI – Consolidated financial statements – Credit Suisse Group on pages 293 to 294 of the attached Annual Report 2020 and, for the Bank, please see Note 4 – Segment information in VIII – Consolidated financial statements – Credit Suisse (Bank) on page 457 of the attached Annual Report 2020.

C – Organizational structure.

For Credit Suisse and the Bank, please see I – Information on the company – Credit Suisse at a glance on page 12, – Strategy on pages 13 to 18 and II – Operating and financial review – Credit Suisse – Group and Bank differences on page 75 of the attached Annual Report 2020. For a list of Credit Suisse’s significant subsidiaries, please see Note 41 – Significant subsidiaries and equity method investments in VI – Consolidated financial statements – Credit Suisse Group on pages 411 to 414 of the attached Annual Report 2020 and, for a list of the Bank’s significant subsidiaries, please see Note 40 – Significant subsidiaries and equity method investments in VIII – Consolidated financial statements – Credit Suisse (Bank) on pages 517 to 519 of the attached Annual Report 2020.

D – Property, plant and equipment.

For Credit Suisse and the Bank, please see X – Additional information – Other information – Property and equipment on page 576 of the attached Annual Report 2020.

Information Required by Industry Guide 3.

For Credit Suisse and the Bank, please see X – Additional information – Statistical information on pages 560 to 571 of the attached Annual Report 2020. In addition, for both Credit Suisse and the Bank, please see III – Treasury, Risk, Balance sheet and Off-balance sheet – Risk management – Risk portfolio analysis – Credit risk – Loans and irrevocable loan commitments on page 165 of the attached Annual Report 2020. For Credit Suisse, please see Appendix – Selected five-year information – Selected information – Group on page A-2 of the attached Annual Report 2020.

Disclosure pursuant to Section 13(r) of the Securities Exchange Act of 1934

During 2020, Credit Suisse AG processed a small number of de minimis payments related to the operation of Iranian diplomatic missions in Switzerland and related to fees for ministerial government functions such as issuing passports and visas. Processing these payments is permitted under Swiss law, and Credit Suisse AG intends to continue processing such payments. Revenues and profits from these activities are not calculated but would be negligible.

Item 4A. Unresolved staff comments. None.

Item 5. Operating and financial review and prospects. A – Operating results.

For Credit Suisse and the Bank, please see II – Operating and financial review on pages 59 to 112 of the attached Annual Report 2020. In addition, for both Credit Suisse and the Bank, please see I– Information on the company – Regulation and supervision on pages 26 to 44 of the attached Annual Report 2020, III – Treasury, Risk, Balance sheet and Off-balance sheet – Liquidity and funding management – Funding management – Interest rate management on page 120 and – Capital management – Shareholders’ equity – Foreign exchange exposure on page 136 of the attached Annual Report 2020.

B – Liquidity and capital resources.

For Credit Suisse and the Bank, please see III – Treasury, Risk, Balance sheet and Off-balance sheet – Liquidity and funding management and – Capital management on pages 114 to 138 of the attached Annual Report 2020. In addition, for Credit Suisse, please see Note 26 – Long-term debt in VI – Consolidated financial statements – Credit Suisse Group on pages 322 to 323 and Note 38 – Capital adequacy in VI – Consolidated financial statements – Credit Suisse Group on pages 397 to 398 of the attached Annual Report 2020 and, for the Bank, please see Note 25 – Long-term debt in VIII – Consolidated financial statements – Credit Suisse (Bank) on page 476 and Note 37 – Capital adequacy in VIII – Consolidated financial statements – Credit Suisse (Bank) on pages 515 to 516 of the attached Annual Report 2020.

C – Research and development, patents and licenses, etc.

Not applicable.

D – Trend information.

For Credit Suisse and the Bank, please see Item 5.A of this Form 20-F. In addition, for Credit Suisse and the Bank, please see I – Information on the company – Divisions on pages 19 to 25 of the attached Annual Report 2020.

E – Off-balance sheet arrangements.

For Credit Suisse and the Bank, please see III – Treasury, Risk, Balance sheet and Off-balance sheet – Balance sheet and off-balance sheet on pages 179 to 182 of the attached Annual Report 2020. In addition, for Credit Suisse, please see Note 33 – Derivatives and hedging activities, Note 34 – Guarantees and commitments and Note 35 – Transfers of financial assets and variable interest entities in VI – Consolidated financial statements – Credit Suisse Group on pages 351 to 370 of the attached Annual Report 2020 and, for the Bank, please see Note 32 – Derivatives and hedging activities, Note 33 – Guarantees and commitments, Note 34 – Transfers of financial assets and variable interest entities in VIII – Consolidated financial statements – Credit Suisse (Bank) on pages 493 to 503, and Note 13 – Derivative financial instruments in IX – Parent company financial statements – Credit Suisse (Bank) on pages 545 to 548 of the attached Annual Report 2020.

F – Tabular disclosure of contractual obligations.

For Credit Suisse and the Bank, please see III – Treasury, Risk, Balance sheet and Off-balance sheet – Balance sheet and off-balance sheet – Contractual obligations and other commercial commitments on page 181 of the attached Annual Report 2020.

Item 6. Directors, senior management and employees. A – Directors and senior management.

For Credit Suisse and the Bank, please see IV – Corporate Governance – Board of Directors, – Board Committees, – Biographies of the Board members, – Executive Board and – Biographies of the Executive Board members on pages 196 to 228 of the attached Annual Report 2020.

B – Compensation.

For Credit Suisse and the Bank, please see V – Compensation on pages 238 to 268 of the attached Annual Report 2020. In addition, for Credit Suisse, please see Note 10 – Compensation and benefits in VI – Consolidated financial statements – Credit Suisse Group on page 296, Note 30 – Employee deferred compensation in VI – Consolidated financial statements – Credit Suisse Group on pages 335 to 339, Note 32 – Pension and other post-retirement benefits in VI – Consolidated financial statements – Credit Suisse Group on pages 341 to 350, Note 6 – Personnel expenses in VII – Parent company financial statements – Credit Suisse Group on page 434 and Note 23 – Shareholdings in VII – Parent company financial statements – Credit Suisse Group on pages 442 to 443 of the attached Annual Report 2020. For the Bank, please see Note 10 – Compensation and benefits in VIII – Consolidated financial statements – Credit Suisse (Bank) on page 458, Note 29 – Employee deferred compensation in VIII – Consolidated financial statements – Credit Suisse (Bank) on pages 483 to 485, Note 31 – Pension and other post-retirement benefits in VIII – Consolidated financial statements – Credit Suisse (Bank) on pages 487 to 492, Note 6 – Personnel expenses in IX – Parent company financial statements – Credit Suisse (Bank) on page 541, Note 17 – Pension plans in IX – Parent company financial statements – Credit Suisse (Bank) on pages 549 to 550 and Note 23 – Shareholdings of the Board of Directors, Executive Board and employees and information on compensation plans in IX – Parent company financial statements – Credit Suisse (Bank) on pages 553 to 555 of the attached Annual Report 2020.

C – Board practices.

For Credit Suisse and the Bank, please see IV – Corporate Governance on pages 183 to 232 of the attached Annual Report 2020.

D – Employees.

For Credit Suisse and the Bank, please see IV – Corporate Governance – Overview – Corporate Governance framework – Employee relations on page 190 of the attached Annual Report 2020. In addition, for both Credit Suisse and the Bank, please see II – Operating and financial review – Credit Suisse – Employees and other headcount on page 68 of the attached Annual Report 2020.

E – Share ownership.

For Credit Suisse and the Bank, please see V – Compensation on pages 238 to 268 of the attached Annual Report 2020. In addition, for Credit Suisse, please see Note 30 – Employee deferred compensation in VI – Consolidated financial statements – Credit Suisse Group on pages 335 to 339, and Note 23 –Shareholdings in VII – Parent company financial statements – Credit Suisse Group on pages 442 to 443 of the attached Annual Report 2020. For the Bank, please see Note 29 – Employee deferred compensation in VIII – Consolidated financial statements – Credit Suisse (Bank) on pages 483 to 485, and Note 23 – Shareholdings of the Board of Directors, Executive Board and employees and information on compensation plans in IX – Parent company financial statements – Credit Suisse (Bank) on pages 553 to 555 of the attached Annual Report 2020.

Item 7. Major shareholders and related party transactions. A – Major shareholders.

For Credit Suisse, please see IV – Corporate Governance – Shareholders on pages 190 to 195 of the attached Annual Report 2020. In addition, for Credit Suisse, please see Note 3 – Business developments, significant shareholders and subsequent events in VI – Consolidated financial statements – Credit Suisse Group on pages 290 to 292, Note 16 – Credit Suisse Group shares held by subsidiaries in VII – Parent company financial statements – Credit Suisse Group on page 439, Note 17– Purchases and sales of treasury shares in VII – Parent company financial statements – Credit Suisse Group on page 439 and Note 18 – Significant shareholders in VII – Parent company financial statements – Credit Suisse Group on page 439 of the attached Annual Report 2020. Credit Suisse’s major shareholders do not have different voting rights. The Bank has 4,399,680,200 shares outstanding and is a wholly owned subsidiary of Credit Suisse. See Note 22 – Significant shareholders and groups of shareholders in IX – Parent company financial statements – Credit Suisse (Bank) on pages 552 to 553 of the attached Annual Report 2020.

B – Related party transactions.

For Credit Suisse and the Bank, please see V – Compensation on pages 238 to 268 and IV – Corporate Governance – Additional information – Banking relationships with Board and Executive Board members and related party transactions on page 229 of the attached Annual Report 2020. In addition, for Credit Suisse, please see Note 31 – Related parties in VI – Consolidated financial

statements – Credit Suisse Group on pages 339 to 340 and Note 21 – Assets and liabilities with related parties in VII – Parent company financial statements – Credit Suisse Group on page 441 of the attached Annual Report 2020. For the Bank, please see Note 30 – Related parties in VIII – Consolidated financial statements – Credit Suisse (Bank) on page 486 and Note 24 – Amounts receivable from and amounts payable to related parties in IX – Parent company financial statements – Credit Suisse (Bank) on page 555 of the attached Annual Report 2020.

C – Interests of experts and counsel.

Not applicable because this Form 20-F is filed as an annual report.

Item 8. Financial information. A – Consolidated statements and other financial information.

Please see Item 18 of this Form 20-F.

For a description of Credit Suisse’s legal and arbitration proceedings, please see Note 40 – Litigation in VI – Consolidated financial statements – Credit Suisse Group on pages 400 to 411 of the attached Annual Report 2020. For a description of the Bank’s legal and arbitration proceedings, please see Note 39 – Litigation in VIII – Consolidated financial statements – Credit Suisse (Bank) on page 516 of the attached Annual Report 2020.

For a description of Credit Suisse’s policy on dividend distributions, please see III – Treasury, Risk, Balance sheet and Off-balance sheet – Capital management – Dividends and dividend policy on pages 137 to 138 of the attached Annual Report 2020.

B – Significant changes.

None.

Item 9. The offer and listing. A – Offer and listing details, C – Markets.

For information regarding the price history of Credit Suisse Group shares and the stock exchanges and other regulated markets on which they are listed or traded, please see X – Additional information – Other information – Listing details on page 576 of the attached Annual Report 2020. Shares of the Bank are not listed.

B – Plan of distribution, D – Selling shareholders, E – Dilution, F – Expenses of the issue.

Not required because this Form 20-F is filed as an annual report.

Item 10. Additional information. A – Share capital.

Not required because this Form 20-F is filed as an annual report.

B – Memorandum and Articles of Association.

For Credit Suisse, please see IV – Corporate Governance – Overview – Corporate Governance framework, – Shareholders and – Board of Directors on pages 190 to 220 of the attached Annual Report 2020. In addition, for Credit Suisse, please see X – Additional information – Other information – Exchange controls and – American Depositary Shares on page 572 of the attached Annual Report 2020. Shares of the Bank are not listed.

C – Material contracts.

Neither Credit Suisse nor the Bank has any contract that would constitute a material contract for the two years immediately preceding the date of this Form 20-F.

D – Exchange controls.

For Credit Suisse and the Bank, please see X – Additional information – Other information – Exchange controls on page 572 of the attached Annual Report 2020.

E – Taxation.

For Credit Suisse, please see X – Additional information – Other information – Taxation on pages 572 to 575 of the attached Annual Report 2020. The Bank does not have any public shareholders.

F – Dividends and paying agents.

Not required because this Form 20-F is filed as an annual report.

G – Statement by experts.

Not required because this Form 20-F is filed as an annual report.

H – Documents on display.

Credit Suisse and the Bank file annual reports on Form 20-F and furnish or file quarterly and other reports on Form 6-K and other information with the SEC pursuant to the requirements of the Securities Exchange Act of 1934, as amended. These materials are available to the public over the Internet at the SEC’s website at www.sec.gov, which contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. Further, our reports on Form 20-F, Form 6-K and certain other materials are available on the Credit Suisse website at www.credit-suisse.com. Information contained on our website and apps is not incorporated by reference into this Form 20-F.

In addition, Credit Suisse’s parent company financial statements, together with the notes thereto, are set forth on pages 427 to 444 of the attached Annual Report 2020 and incorporated by reference herein. The Bank’s parent company financial statements, together with the notes thereto, are set forth on pages 521 to 558 of the attached Annual Report 2020 and incorporated by reference herein.

I – Subsidiary information.

Not applicable.

Item 11. Quantitative and qualitative disclosures about market risk. For Credit Suisse and the Bank, please see I – Information on the company – Risk factors on pages 45 to 58 and III – Treasury, Risk, Balance sheet and Off-balance sheet – Risk management on pages 139 to 178 of the attached Annual Report 2020.

Item 12. Description of securities other than equity securities. A – Debt Securities, B – Warrants and Rights, C – Other Securities.

Not applicable.

D – American Depositary Shares.

For Credit Suisse, please see IV – Corporate Governance – Additional information – Other information – Fees and charges for holders of ADS on page 231 of the attached Annual Report 2020. Shares of the Bank are not listed.

Item 13. Defaults, dividend arrearages and delinquencies. None.

Item 14. Material modifications to the rights of security holders and use of proceeds. None.

Item 15. Controls and procedures. For Credit Suisse’s management report, please see Controls and procedures in VI – Consolidated financial statements – Credit Suisse Group on page 426 and for the related report of the Group’s independent auditors, please see Report of the Independent Registered Public Accounting Firm on pages 271 to 271-III of the attached Annual Report 2020. For the Bank’s management report please see Controls and procedures in VIII – Consolidated financial statements – Credit Suisse (Bank) on page 520 and for the related report of the Group’s independent auditors, please see Report of the Independent Registered Public Accounting Firm on pages 447 to 447-III of the attached Annual Report 2020.

Item 16A. Audit committee financial expert. For Credit Suisse and the Bank, please see IV – Corporate Governance – Board of Directors – Board committees – Audit Committee on pages 206 to 207 of the attached Annual Report 2020.

Item 16B. Code of ethics. For Credit Suisse and the Bank, please see IV – Corporate Governance – Overview – Corporate governance framework on pages 186 to 190 of the attached Annual Report 2020.

Item 16C. Principal accountant fees and services. For Credit Suisse and the Bank, please see IV – Corporate Governance – Additional information – External audit on pages 229 to 230 of the attached Annual Report 2020.

Item 16D. Exemptions from the listing standards for audit committee. None.

Item 16E. Purchases of equity securities by the issuer and affiliated purchasers. For Credit Suisse, please see III – Treasury, Risk, Balance sheet and Off-balance sheet – Capital management – Share purchases on page 137 of the attached Annual Report 2020. The Bank does not have any class of equity securities registered pursuant to Section 12 of the Exchange Act.

Item 16F. Change in registrants’ certifying accountant. Following a tender of the audit mandate and structured evaluation and selection process in 2018, the Board of Directors (Board) proposed PricewaterhouseCoopers AG (PwC) as Credit Suisse’s new statutory auditor to succeed KPMG AG (KPMG) at the Annual General Meeting (AGM) on April 30, 2020. At the AGM on April 30, 2020, the proposal was approved by shareholders and PwC’s appointment became effective for the fiscal year ending December 31, 2020. Although Credit Suisse is not subject to mandatory external audit firm rotation requirements, the Audit Committee’s decision to pursue a rotation in auditors was made in view of the EU rules with respect to mandatory auditor rotation for certain of Credit Suisse’s significant subsidiaries. KPMG was engaged as our independent auditor for the fiscal years ended December 31, 2018 and December 31, 2019 until the filing of Credit Suisse’s and the Bank’s 2019 Annual Report on Form 20-F (2019 Form 20-F), which was filed with the SEC on March 30, 2020.

The disclosure called for by paragraph (a) of this Item 16F was previously reported, as that term is defined in Rule 12b-2 under the Exchange Act, in Credit Suisse’s and the Bank’s 2019 Form 20-F.

For further information regarding the external auditor’s appointment, please see IV – Corporate Governance – Additional information – External Audit on page 229 of the attached Annual Report 2020.

Item 16G. Corporate governance. For Credit Suisse, please see IV – Corporate Governance – Additional Information – Other information – Complying with rules and regulations on pages 230 to 231 of the attached Annual Report 2020. Shares of the Bank are not listed.

Item 16H. Mine Safety Disclosure. None.

Item 17. Financial statements. Not applicable.

Item 18. Financial statements. Credit Suisse’s consolidated financial statements, together with the notes thereto and the Report of the Independent Registered Public Accounting Firm thereon, are set forth on pages 269 to 426 of the attached Annual Report 2020 and incorporated by reference herein. The Bank’s consolidated financial statements, together with the notes thereto (and any notes or portions thereof in the consolidated financial statements of Credit Suisse Group referred to therein) and the Report of the Independent Registered Public Accounting Firm thereon, are set forth on pages 445 to 520 of the attached Annual Report 2020 and incorporated by reference herein.

2.1 Pursuant to the requirement of this item, we agree to furnish to the SEC upon request a copy of any instrument defining the rights of holders of long-term debt of us or of our subsidiaries for which consolidated or unconsolidated financial statements are required to be filed.

101 Interactive Data Files (XBRL-Related Documents).

104 Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101).

Each of the registrants hereby certifies that it meets all of the requirements for filing on Form 20-F and that it has duly caused and authorized the undersigned to sign this annual report on its behalf.

CREDIT SUISSE GROUP AG

(Registrant)

Date: March 18, 2021

/s/ Thomas Gottstein /s/ David R. Mathers

Name: Thomas Gottstein Name: David R. Mathers

Title: Chief Executive Officer Title: Chief Financial Officer

CREDIT SUISSE AG

(Registrant)

Date: March 18, 2021

/s/ Thomas Gottstein /s/ David R. Mathers

Name: Thomas Gottstein Name: David R. Mathers

Title: Chief Executive Officer Title: Chief Financial Officer

[this page intentionally left blank]

| Key metrics |

| | in / end of | | % change | |

| | 2020 | | 2019 | | 2018 | | 20 / 19 | | 19 / 18 | |

| Credit Suisse (CHF million) |

| Net revenues | | 22,389 | | 22,484 | | 20,920 | | 0 | | 7 | |

| Provision for credit losses | | 1,096 | | 324 | | 245 | | 238 | | 32 | |

| Total operating expenses | | 17,826 | | 17,440 | | 17,303 | | 2 | | 1 | |

| Income before taxes | | 3,467 | | 4,720 | | 3,372 | | (27) | | 40 | |

| Net income attributable to shareholders | | 2,669 | | 3,419 | | 2,024 | | (22) | | 69 | |

| Cost/income ratio (%) | | 79.6 | | 77.6 | | 82.7 | | – | | – | |

| Effective tax rate (%) | | 23.1 | | 27.4 | | 40.4 | | – | | – | |

| Basic earnings per share (CHF) | | 1.09 | | 1.35 | | 0.79 | | (19) | | 71 | |

| Diluted earnings per share (CHF) | | 1.06 | | 1.32 | | 0.77 | | (20) | | 71 | |

| Return on equity (%) | | 5.9 | | 7.7 | | 4.7 | | – | | – | |

| Return on tangible equity (%) | | 6.6 | | 8.7 | | 5.4 | | – | | – | |

| Assets under management and net new assets (CHF billion) |

| Assets under management | | 1,511.9 | | 1,507.2 | | 1,344.9 | | 0.3 | | 12.1 | |

| Net new assets | | 42.0 | | 79.3 | | 53.7 | | (47.0) | | 47.7 | |

| Balance sheet statistics (CHF million) |

| Total assets | | 805,822 | | 787,295 | | 768,916 | | 2 | | 2 | |

| Net loans | | 291,908 | | 296,779 | | 287,581 | | (2) | | 3 | |

| Total shareholders' equity | | 42,677 | | 43,644 | | 43,922 | | (2) | | (1) | |

| Tangible shareholders' equity | | 38,014 | | 38,690 | | 38,937 | | (2) | | (1) | |

| Basel III regulatory capital and leverage statistics (%) |

| CET1 ratio | | 12.9 | | 12.7 | | 12.6 | | – | | – | |

| CET1 leverage ratio | | 4.4 | | 4.0 | | 4.1 | | – | | – | |

| Tier 1 leverage ratio | | 6.4 | | 5.5 | | 5.2 | | – | | – | |

| Share information |

| Shares outstanding (million) | | 2,406.1 | | 2,436.2 | | 2,550.6 | | (1) | | (4) | |

| of which common shares issued | | 2,447.7 | | 2,556.0 | | 2,556.0 | | (4) | | 0 | |

| of which treasury shares | | (41.6) | | (119.8) | | (5.4) | | (65) | | – | |

| Book value per share (CHF) | | 17.74 | | 17.91 | | 17.22 | | (1) | | 4 | |

| Tangible book value per share (CHF) | | 15.80 | | 15.88 | | 15.27 | | (1) | | 4 | |

| Market capitalization (CHF million) | | 27,904 | | 32,451 | | 27,605 | | (14) | | 18 | |

| Dividend per share (CHF) | | 0.2926 | | 0.2776 | | 0.2625 | | 5 | | 6 | |

| Number of employees (full-time equivalents) |

| Number of employees | | 48,770 | | 47,860 | | 45,680 | | 2 | | 5 | |

| See relevant tables for additional information on these metrics. |

Credit Suisse Group AG

Credit Suisse AG

For the purposes of this report, unless the context otherwise requires, the terms “Credit Suisse Group”, “Credit Suisse”, the “Group”, “we”, “us” and “our” mean Credit Suisse Group AG and its consolidated subsidiaries. The business of Credit Suisse AG, the direct bank subsidiary of the Group, is substantially similar to the Group, and we use these terms to refer to both when the subject is the same or substantially similar. We use the term the “Bank” when we are referring only to Credit Suisse AG and its consolidated subsidiaries. Abbreviations and selected terms are explained in the List of abbreviations and the Glossary in the back of this report. Publications referenced in this report, whether via website links or otherwise, are not incorporated into this report. The English language version of this report is the controlling version. In various tables, use of “–” indicates not meaningful or not applicable.

Message from the Chairman and the Chief Executive Officer In 2020, we recorded strong operating performance in Wealth Management-related and Investment Bank divisions. We confirmed our strategy of being a leading Wealth Manager with strong global Investment Banking capabilities by launching a number of strategic initiatives to support our growth ambitions. In a year dominated by the global COVID-19 pandemic, we generated net income attributable to shareholders of CHF 2.7 billion. Group net new assets were CHF 42 billion.

Dear shareholders, clients and colleagues

In our previous Annual Report, we noted that the COVID-19 pandemic, still in its early stages at the time, would have a significant impact on the global economy. Like others, we are devastated by the enormous human and economic toll that this crisis inflicted, and continues to inflict. Even as we work hard to achieve our business goals, we cannot lose sight of what is happening around us in our communities and societies. We must keep events in their proper perspective. Nonetheless, we are proud of what our roughly 49,000 employees in all markets have achieved for our clients, the bank and its shareholders over the last 12 months.

Solid result in a difficult operating environment

The outstanding commitment and loyalty of our employees made it possible for us to deliver a solid result even in the difficult year of 2020. After equity markets – and not least financial stocks – came under great pressure in March and April, the global economy contracted with extraordinary severity at the start of the second quarter of 2020 as a result of the measures taken to combat the pandemic. Central banks and governments reacted with monetary and fiscal stimulus of an unprecedented magnitude. The period from May to August was then characterized by a sharp recovery as volatility declined and stock markets bounced back impressively. The resurgence of new case numbers in the US, Europe and a number of Asian countries from the fall onward then led to new restrictions on public life, together with commercial restrictions in certain sectors. While expectations of a return to normality have risen against a backdrop of vaccine program rollouts since December, the situation remains challenging in view of the emergence of new virus mutations.

In this environment, net revenues in the Wealth Management-related businesses across our divisions declined by 8% in total to CHF 13.6 billion in 2020. Global investment banking revenues of USD 10.2 billion in 2020, increased 19% year on year. With overall net revenues for the Group remaining stable at CHF 22.4 billion and a 2% increase in total operating expenses to CHF 17.8 billion, the Group recorded income before taxes of CHF 3.5 billion, 27% lower than in the previous year. Net income attributable to shareholders amounted to CHF 2.7 billion for 2020. This was a decline of 22% year on year including primarily the effects of higher provision for credit losses and major litigation provisions, as well as the impairment to the valuation of our minority shareholding in York Capital Management. Across the Group, we attracted net new assets of CHF 42 billion in 2020, and recorded assets under management in excess of CHF 1.5 trillion at year end.

Operating performance supporting our growth agenda

The repercussions of the COVID-19 pandemic brought macroeconomic challenges in their wake, along with very unfavorable exchange rate movements. As only around a quarter of our business is generated in our reporting currency, the Swiss franc, a depreciation of the dollar – precisely the scenario that unfolded in the reporting year – feeds through into the final numbers. However, our strategy of being a leading wealth manager with strong global investment banking capabilities proved robust in this environment. We recorded a strong underlying performance that would have seen adjusted income before taxes, excluding significant items* rise by 6% and adjusted pre-provision profit, excluding significant items* rise by 22%.

In keeping with our strategy, we launched four key strategic initiatives in the reporting year. First, we created a global Investment Bank (IB), including our Global Trading Solutions (GTS) business and a globally integrated equities platform. Second, we affirmed our commitment to play a leading role as a provider of sustainable financial services with the establishment of a new Sustainability, Research & Investment Solutions (SRI) function at the Executive Board level. Third, we are on track in integrating Neue Aargauer Bank into the Swiss Universal Bank (SUB) and have successfully launched a digital banking offering – CSX – for Swiss retail clients. Fourth, we are ensuring alignment across our control functions in respect of risk and compliance business practices through the new, integrated Chief Risk and Compliance Officer (CRCO) function, which will be retained at Executive Board level. We anticipate gross savings of approximately CHF 400 to 450 million annually from these initiatives, which should feed through into our results fully from 2022 onward. Assuming favorable commercial market and economic conditions, we will be able to reinvest this entire amount in our business.

Divisional results

The SUB division recorded income before taxes of CHF 2.1 billion for the full year 2020, a decline of 18% compared to 2019. Net revenues declined 5% year on year to CHF 5.6 billion, or on

Urs Rohner, Chairman of the Board of Directors (left) and Thomas Gottstein, Chief Executive Officer.

an adjusted* basis were almost precisely the amount that we were able to generate the previous year. Net new assets for the division as a whole amounted to CHF 7.8 billion. Total operating expenses remained stable compared to the previous year at CHF 3.2 billion, despite litigation expenses of CHF 45 million and restructuring costs of CHF 44 million, primarily incurred in connection with the integration of Neue Aargauer Bank. The Private Clients area recorded a 16% decline in income before taxes to CHF 1.1 billion year on year. Net revenues amounted to CHF 3.1 billion, or 4% lower than in the previous year. Corporate & Institutional Clients generated income before taxes of CHF 1.0 billion, down 21% on the prior year due to a 6% decline in net revenues to CHF 2.6 billion.

The International Wealth Management (IWM) division recorded income before taxes of CHF 1.1 billion in 2020, 49% lower than in the previous year, with net revenues recording a decline of 17% year on year to CHF 4.8 billion. The result was impacted by significant items that resulted in a net negative effect of CHF 84 million – compared to a positive effect of CHF 323 million in 2019 – and by restructuring costs of CHF 55 million. The division attracted high net new assets of CHF 32.2 billion in 2020. In Private Banking, income before taxes for 2020 totaled CHF 1.1 billion, a decline of 31% year on year. Net revenues for 2020 declined by 10% to CHF 3.7 billion. Private Banking recorded record-high net new assets of CHF 16.7 billion, a rise of 5% year on year, with notable inflows from emerging markets and Western Europe. Asset Management generated a loss before taxes of CHF 39 million for 2020, which mainly reflected the impairment loss from York in the final quarter. At CHF 1.1 billion, net revenues were down 33% compared to 2019.

The Asia Pacific (APAC) division increased net revenues to CHF 3.2 billion in 2020, 4% up from the previous year. Income before taxes for 2020 totaled CHF 828 million, a decline of 10% year on year. The rise in transaction-based revenues only partially compensated for higher provision for credit losses. Total operating expenses rose by 2% to CHF 2.1 billion compared to 2019. The division attracted net new assets of CHF 8.6 billion in 2020, an impressive result. APAC had assets under management of CHF 221.3 billion at the end of the year.

The IB division recorded income before taxes of CHF 1.7 billion in 2020, an increase of 61% year on year. Net revenues rose by 11% to CHF 9.1 billion compared to the previous year, with all business lines contributing to this result. Total operating expenses for 2020 declined by 1% year on year. Return on regulatory capital** was 12.2% for 2020, compared to just 7.1% for the prior year. The IB achieved this outstanding result in an environment characterized by the repercussions of the COVID-19 pandemic and high volatility, which was also impacted by geopolitical and macroeconomic uncertainties such as the UK’s exit from the EU and the US presidential elections. The weakening of the US dollar impacted our reported result in Swiss francs as it had a negative effect on revenues while at the same time reducing operating expenses.

Creating value for shareholders

In keeping with our intention to increase the ordinary dividend per share by at least 5% per annum, the Board of Directors will propose a cash distribution of CHF 0.2926 per share for the 2020 financial year to shareholders at the Annual General Meeting on April 30, 2021. Half of the distribution will be paid out of capital contribution reserves, free of withholding tax and not subject to income tax for Swiss resident individuals who hold the shares as a private investment; the remaining half will be paid out of retained earnings, net of 35% Swiss withholding tax.

In December, we completed our share buyback program for 2020 that we had started on January 6, 2020 and then had to suspend in March as a result of the COVID-19 pandemic. As part of this program, we bought back approximately 28.5 million shares for a total of CHF 325 million, which were then cancelled in line with the capital reduction approved by shareholders at the 2020 Annual General Meeting.

Our share buyback program for 2021, through which we intend to buy back shares amounting to at least CHF 1.0 billion with an upper limit of CHF 1.5 billion, subject to market and economic conditions, kicked off in January. The shares bought back in 2021 are expected to be cancelled via a capital reduction, in line with a resolution expected to be passed at a later Annual General Meeting.

Resilient business model generates capital

Our resilient diversified business model allows us to continue to generate capital. Already at the end of 2019, our capital and leverage ratios met the Swiss regulatory requirements that took effect in 2020. We strengthened our capital base once again last year. This is reflected in our common equity tier 1 (CET1) ratio, which rose from 12.7% at the end of 2019 to 12.9% at the end of 2020.

Reflecting the fourth quarter results, the Group’s Return on Tangible Equity (RoTE)** declined to 6.6% for the full year 2020. For the first nine months of 2020, this figure stood at 9.8%, higher than the 8.7% reported for the full year 2019. We are maintaining our medium-term RoTE** target of 10-12%, in a normalized environment and subject to market and economic conditions. Diluted earnings per share for 2020 amounted to CHF 1.06, compared to CHF 1.32 for 2019, while the tangible book value per share** remained stable at CHF 15.80 at the end of 2020, compared to CHF 15.88 at the end of 2019.

Cooperative dialogue with regulators

As reported in last year’s Annual Report, the Swiss Financial Market Supervisory Authority FINMA (FINMA) regarded our emergency plan for Credit Suisse (Schweiz) AG in February 2020 as effective. In September 2020, FINMA announced that it was opening enforcement proceedings against Credit Suisse in the context of the “observation activities.” We are cooperating fully in these proceedings, and working with our Swiss regulator to ensure a comprehensive and brisk resolution of this matter.

Changes to the Board of Directors and Executive Board

After serving on the Board of Directors for 12 years and chairing this body for 10 of them, Urs Rohner will step down from the Board at this year’s Annual General Meeting, in keeping with the maximum term of 12 years introduced during his time in office. The Board of Directors is pleased to be able to propose António Horta-Osório for election as the new Chairman of the Board of Directors at the Annual General Meeting on April 30, 2021. António Horta-Osório has been Group Chief Executive Officer of Lloyds Banking Group, the largest retail and commercial bank in the UK, since 2011. With this proposed appointment, the Board of Directors is looking forward to gaining as its new Chairman a profoundly experienced figure in the international banking industry with a proven track record.

In addition to Urs Rohner, two other current members of the Board of Directors will not be standing for re-election at the 2021 Annual General Meeting: Joaquin J. Ribeiro and John Tiner. As already communicated at the end of October last year, the Board of Directors of Credit Suisse Group AG will be proposing the election of two new, non-executive members of the Board of Directors at the Annual General Meeting on April 30, 2021, namely Clare Brady and Blythe Masters. Clare Brady, a British citizen, was previously director of Internal Audit at the International Monetary Fund. She is currently a member of the Audit and Risk Commission of the International Federation of Red Cross and Red Crescent Societies in Switzerland, and a non-executive member of the Board of Directors of Fidelity Asian Values, PLC in the UK. Blythe Masters, likewise a British citizen, held a number of leading functions at J.P. Morgan Chase over a period of 27 years. She then moved to Digital Asset Holdings, an enterprise blockchain company for which she acted as CEO until 2018. She is currently a member of the Board of Directors of A.P. Møller-Maersk, as well as Chair of the Board of Directors and Audit Committee of Phunware, an enterprise mobile platform.

In keeping with the launch of the above-mentioned strategic initiatives, there have also been changes to the Executive Board. We transferred management responsibility for the global Investment Bank to Brian Chin, who previously headed up our former Global Markets division. David Miller, previously CEO of the former Investment Banking & Capital Markets division, has stepped down from the Executive Board and taken over management of the capital markets and advisory business within IB. With the aim

of bringing greater effectiveness and efficiency to our controlling environment given changing regulatory parameters, we have now combined Risk and Compliance into the single function of Chief Risk and Compliance Officer (CRCO), which is held by Lara Warner. The new Sustainability, Research & Investment Solutions (SRI) function is headed by Lydie Hudson as CEO.

Ongoing commitment to sustainability

The new Executive Board-level function for sustainability underscores our commitment to this topic, which formed an important aspect of Group strategy in 2020. While the challenge of climate change received rather less public attention last year due to the pandemic, we are in no doubt that the Earth’s climate and other sustainability questions will rightfully remain in the spotlight over the coming decade. We want to be a leading provider of sustainability solutions in the financial industry, across our Wealth Management and the Investment Bank. We are underlining this ambition by assigning the mandate of a Board of Directors Sustainability Leader to our board member Iris Bohnet.

In 2020, we made significant progress in this area. Specifically, we introduced the Client Energy Transition Frameworks for the key industries of oil and gas, mining, and utilities/power generation, which we believe will form an important part of our strategic program of evaluating the energy transition readiness of corporate clients in these sectors. Our progress in this area is attracting recognition. For example, as part of the annual review of the S&P Dow Jones Indices in November 2020, we were once again selected as an index component of both the Dow Jones Sustainability World Index and the Dow Jones Sustainability Europe Index. Meanwhile, Credit Suisse’s rating by the Carbon Disclosure Project in respect of climate-related disclosure improved to “A-,” while the MSCI ESG rating improved to “A.”

Outlook and recent events

At our 4Q20 results announcement on February 18, 2021, we noted in our outlook statement that Credit Suisse has seen a strong start to 2021. This has continued over the last month, with the Group achieving the highest level of income before taxes in both January and February in a decade. Our Investment Bank division is benefitting from a particularly strong performance in capital markets issuance activity and from a continued good performance across sales & trading, with overall Investment Bank year-to-date revenues up over 50% compared to the same period last year. Increased YoY client activity is also benefitting all three of our Wealth Management-related businesses, led by growth in GTS, and with particular strength in the Asia Pacific division, while sequentially net interest income is stabilizing and recurring commissions and fees continue to trend up. Notwithstanding the continued COVID-19 pandemic, our credit loss experience remains benign, with signs of improvement in the global economy beginning to benefit allowance for credit losses under the current expected credit loss (CECL) accounting methodology.

With regard to the suspension and liquidation of the supply chain finance funds (with an aggregate net asset value of approximately USD 10 billion as published in late February 2021) managed by Credit Suisse Asset Management (CSAM) with assets originated and structured by Greensill Capital, Credit Suisse’s priority remains the recovery of funds for CSAM’s investors. CSAM is working closely with the administrators of Greensill Capital, Grant Thornton, and with other parties to facilitate this process. Initial redemption repayments totalling USD 3.1 billion across the four funds have been made beginning on March 8, 2021. The funds’ management companies intend to announce further cash distributions over the coming months, and we will update fund investors accordingly. With respect to the collateralized USD 140 million bridge loan made by Credit Suisse to Greensill Capital last year, USD 50 million has been recently repaid by the administrators of Greensill Capital, reducing the outstanding loan to USD 90 million. While these issues are still at an early stage, we would note that it is reasonably possible that Credit Suisse will incur a charge in respect of these matters.

On March 17, 2021, and subsequent to the recent reports and announcements regarding the CSAM managed supply chain finance funds, the Board of Directors of the Group decided to appoint Ulrich Körner as CEO of Asset Management and a member of the Group Executive Board, effective April 1, 2021. From that date, the Asset Management business will be separated from the International Wealth Management division and managed as a new separate division. As a member of the Executive Board, Ulrich Körner will report directly to the Group CEO, Thomas Gottstein.

As a final point, we would like to thank our roughly 49,000 employees around the world for their terrific work and dedication in 2020. The repercussions of the coronavirus pandemic have posed major challenges to our clients, our company and the everyday working lives of our employees. What we achieved in 2020 for our clients under difficult circumstances makes us proud, and strengthens confidence that our bank will prove successful in tackling the challenges that lie ahead – whether that be tackling the ongoing pandemic, the demands posed by the ongoing digitalization of financial services or the greatest social and macroeconomic challenge of our era – climate change.

Best regards

Urs Rohner Thomas Gottstein

Chairman of the Chief Executive Officer

Board of Directors

March 2021

> Refer to “Important Information” on page 10 for a reconciliation of adjusted results and further information.

Interview with the Chairman and the Chief Executive Officer After three very good quarters despite a difficult operating environment, you closed the fourth quarter of 2020 with a loss due to several items, which had an adverse impact on your results. Does that frustrate you?

CEO: The write-downs and costs from litigation issues we booked in the fourth quarter – with the underlying matters dating back several years – do frustrate me, yes. This is natural. On the other hand, it was important for us to find a resolution as rapidly as possible and keep these matters from holding us back in the future.

In connection with the presentation of the results for the full year 2020, you talked about a basis for growth. What do you mean by that?

CEO: Not only did we have to absorb the repercussions of the pandemic in 2020, we also had to confront other macroeconomic challenges, along with highly unfavorable exchange rate movements. In my view, we did a good job in rising to those challenges. It became clear last year that our strategy of being a leading wealth manager with strong global investment banking capabilities could withstand the kind of pandemic not seen for generations.

So aren’t any corrections to the strategy needed?

CEO: We launched a number of strategic initiatives last year to position ourselves for growth. We created a global Investment Bank and aligned our Risk and Compliance control functions in a newly integrated Risk and Compliance area at the Executive Board level. In addition, we established an entirely new function at the Executive Board level – Sustainability, Research & Investment Solutions – with the ambition to put sustainability at the core of our offering to private, corporate and institutional clients. We want to lead the way with our research-based advisory activity. At the same time, we are underscoring our commitment to achieving the objectives set out in the Paris Agreement. The strategy is the right one, and we are making it future-oriented by aligning it with the key themes of the coming years.

Urs Rohner, after 10 years as Chairman, 12 years on the Board of Directors, and a full 17 years at Credit Suisse, you are not standing for re-election at this year’s AGM. Is now the right time?

Chairman: Well, I suppose I’m at fault myself when it comes to the timing, as the term restriction of 12 years for a board member was after all introduced during my tenure as Chairman. I am convinced that in these kinds of functions, change is necessary at appropriate intervals. So in that sense, it’s time for a change in my case too. The outstanding qualities my designated successor, António Horta-Osório, brings to the table only strengthen me in that belief.

You have joined the Executive Board in 2004. How does the Credit Suisse of 2021 differ from the Credit Suisse of 2004?

Chairman: To be honest, a comprehensive answer to that question would go beyond the scope of this interview. On the one hand, the DNA of Credit Suisse is very much the same: an entrepreneur’s bank that shapes its business in accordance with the social and economic challenges of the era. But when you compare operating and strategic business models, no stone has been left unturned. And don’t forget that as an industry we are operating in a very different environment compared to 17 years ago.

By that you mean what specifically?

Chairman: It took years to repair the damage of the financial crisis of 2007-2008 and the subsequent eurozone debt crisis. Also, for a global, systemically important big bank operating from Switzerland, the introduction of the automatic exchange of information fundamentally redefined the rules of the cross-border wealth management business.

And how did these changes impact Credit Suisse?

Chairman: Looking back at my time as Chairman, the years from 2011 to 2015 were challenging, as we still had to deal with the repercussions of 2008. In addition to legal disputes and regulatory investigations, we were above all grappling with a need for reform that was apparent throughout the financial industry. And all this came against the backdrop of a eurozone debt crisis, the new Basel III framework, and the “Too Big to Fail” legislation in Switzerland. Specifically, we needed to be more resilient, build up more capital, ensure more stable financing and adjust the bank’s business model, as well as exit certain business areas. With regard to the build-up of capital and the reduction of risks, we had met our planned objectives by the end of 2013. In 2014, we resolved significant legacy issues relating to the cross-border business with the US authorities, while in the very same year the G20 confirmed the automatic exchange of information as a global standard. These – combined with the so-called “Swiss finish” – were the key parameters for the world of banking following the great financial crisis, together with the Financial Stability Board’s proposal in respect of the loss-absorbing capacity of global systemically important banks, of which Credit Suisse is one.

Did you ever ask yourselves whether growth was even possible against such a backdrop?

Chairman: The strategic question of how a company or indeed an industry can grow sustainably will always arise, irrespective of the prevailing environment. For instance, in mid-January 2015, we saw the decision by the Swiss National Bank to abandon the minimum level it had set for the euro-Swiss franc exchange rate, along with the introduction of negative

interest rates – which at that point was supposed to be for just a short period of time. The year 2015 turned out to be a transitional one, in which the Board of Directors and the executive management team embarked on a restructuring led by a new CEO. This strategy was to be a leading Wealth Manager with strong Investment Banking capabilities. The consistent implementation of this strategy led to losses in 2015 and 2016. We also closed 2017 with a loss due to the revaluation of our tax assets in connection with the US tax reform, even though we would have returned to profitability on a pre-tax basis adjusting for this effect. And by 2018, over the course of which we were able to complete our restructuring, we reported a net profit once again of more than CHF 2 billion. So to give a simple answer to your question: Yes, we have shown that growth is possible.

How are you dealing with the risks that arise in an era of pandemic?

CEO: With the above-mentioned combination of Risk and Compliance into a single Executive Board-level function, we have once again strengthened risk management. If you look at credit provisions, you will see that we are quite prudent. Our current provisions are significantly higher than our long-term average. So while it is a huge rise in relative terms, we believe it is appropriate for us in the current environment.

Following a major slump in the stock price in the spring of 2020, the valuation of CS has now recovered along with those of other financial stocks. But you presumably cannot be satisfied with where you are now?

CEO: No, we are not yet satisfied with our share price. But I also have confidence in our fundamental development going forward. Our performance last year clearly demonstrates our potential on the operating side. We also continued to build up our capital base in this difficult environment. This shows that our strategy is the right one, as well as being the right fit for the parameters in which we are operating.

Last year, the debate over the merger of banking institutions in Europe was very prominent in the media. What is your assessment of the situation?

Chairman: The business models of banks nowadays presuppose ongoing cost management, and size can make a difference in this respect because it allows for certain scale effects. For this reason, consolidation in the European banking environment is rightly a topic of discussion at the moment. As Chairman, I can hardly cover my ears to this topic, because I believe that would not be doing justice to my mandate, which includes observing the environment on an ongoing basis.

Credit Suisse wanted to achieve a return on tangible equity of around 10% in 2020, but missed this ambition due to the loss-making fourth quarter. Have you nonetheless reaffirmed your commitment to this ambition going forward?

CEO: We were at 9.8% for the first nine months of the year and, as previously mentioned, confronted a lot of special items in the fourth quarter. In view of our robust operating performance in this challenging environment, we remain committed to the ambitions we set out at our Investor Update last December. With our strategic initiatives, we believe that we are in an excellent position to further invest in growth.

How has the COVID-19 pandemic changed the nature of the bank’s relationship with its clients?

CEO: The crisis has given us the opportunity to do the very best we can for clients and employees. We co-initiated Switzerland’s bridge-loan program and also provided the best possible support to our clients in other markets too. This required a Herculean effort on the part of our employees, whom we fully supported. Digitalization has progressed to a remarkable degree over a very short time, both internally and in our contacts with clients. Our home working capacity now amounts to some 90%, while our online banking service in Switzerland recorded 47% growth over the last two years. Things will continue to move in this direction, and I think that is good: I am a fan of offering our clients both, “high-tech” and “high-touch”, depending on their needs and preferences.

Alongside the pandemic and the various economic challenges, a number of developments last year showed that societies are becoming increasingly aware of social and environmental issues. How is Credit Suisse responding?

Chairman: We continuously assess our operations, our environmental footprint and our role in a changing society. At the start of the year, we published a revised Code of Conduct, addressing above all the need for increased awareness of diversity and inclusion. And we have made significant progress over the last 10 years, as underlined by the number of female members of both the Board of Directors and Executive Board today. However, we still have a long way to go, and we have to continue to infuse this priority throughout our organization and functions.

Your term as Chairman of the Board will end at the upcoming AGM. What are your hopes for your successor after he is approved at the AGM?

Chairman: Above all, I would like to wish António Horta-Osório a great start. He will remain with Lloyds Banking Group until April, and only then start with us. I have no doubt that together with the Board of Directors, the Executive Board and our employees, he will carry on the tradition and purpose of our unique bank, which we express as follows: We build lasting value by serving our clients with care and entrepreneurial spirit. This is ultimately what will benefit our shareholders and society as a whole.

Important Information

* Refers to adjusted results or adjusted results excluding significant items as applicable. Results excluding items included in our reported results are non-GAAP financial measures.

| in | | 2020 | | 2019 | | % change | |

| Results (CHF million) |

| Income/(loss) before taxes | | 3,467 | | 4,720 | | (27) | |

| Total adjustments | | 1,181 | | 248 | | 376 | |

| Adjusted income before taxes | | 4,648 | | 4,968 | | (6) | |

| Significant items | | | | | | | |

| gain related to InvestLab transfer | | 268 | | 327 | | (18) | |

| gain on equity investment in Allfunds Group | | 127 | | 0 | | – | |

| gain on equity investment in SIX Group AG | | 158 | | 498 | | (68) | |

| gain on equity investment in Pfandbriefbank | | 134 | | 0 | | – | |

| impairment on York Capital Management | | (414) | | 0 | | – | |

| Adjusted income before taxes excluding significant items | | 4,375 | | 4,143 | | 6 | |

| Adjusted results are non-GAAP financial measures which exclude certain items included in our reported results. Refer to “Reconciliation of adjusted results” in II – Operating and financial review – Credit Suisse for further information. |

** Return on tangible equity, return on regulatory capital and tangible book value per share are non-GAAP financial measures. Refer to II – Operating and financial review – Credit Suisse for information on how these measures are calculated and to “Financial goals” in I- Information on the company – Strategy for further information on ambitions that are non-GAAP financial measures. For further details on capital-related information, see “Capital Management-Regulatory Capital Framework” in III-Treasury, Risk, Balance sheet and Offbalance sheet.

References to Wealth Management mean SUB Private Clients, IWM Private Banking and APAC or their combined results. References to Wealth Management-related mean SUB, IWM and APAC or their combined results. References to global investment banking mean the Investment Bank, APAC advisory and underwriting as well as M&A, DCM and ECM in SUB Corporate & Institutional Clients. References to pre-provision profit mean pre-tax income excluding provision for credit losses.

We may not achieve all of the expected benefits of our strategic initiatives. Factors beyond our control, including but not limited to the market and economic conditions (including macroeconomic and other challenges and uncertainties, for example, resulting from the COVID-19 pandemic), changes in laws, rules or regulations and other challenges discussed in our public filings, could limit our ability to achieve some or all of the expected benefits of these initiatives.

This document contains forward-looking statements that involve inherent risks and uncertainties, and we might not be able to achieve the predictions, forecasts, projections and other outcomes we describe or imply in forward-looking statements. A number of important factors could cause results to differ materially from the plans, objectives, expectations, estimates and intentions we express in these forward-looking statements, including those we identify in I – Information on the company – Risk factors and in the “Cautionary statement regarding forward-looking information” in our Annual Report 2020 on Form 20-F for the fiscal year ended December 31, 2020 and other public filings and press releases. We do not intend to update these forward-looking statements.

This document contains certain unaudited interim financial information for the first quarter of 2021. This information has been derived from management accounts, is preliminary in nature, does not reflect the complete results of the first quarter of 2021 and is subject to change, including as a result of any normal quarterly adjustments in relation to the financial statements for the first quarter of 2021. This information has not been subject to any review by our independent registered public accounting firm. There can be no assurance that the final results for these periods will not differ from these preliminary results, and any such differences could be material. Quarterly financial results for the first quarter of 2021 will be included in our 1Q21 Financial Report. These interim results of operations are not necessarily indicative of the results to be achieved for the remainder of the full first quarter of 2021.

In preparing this document, management has made estimates and assumptions that affect the numbers presented. Actual results may differ. Annualized numbers do not take into account variations in operating results, seasonality and other factors and may not be indicative of actual, full-year results. Figures throughout this document may also be subject to rounding adjustments. All opinions and views constitute judgments as of the date of writing without regard to the date on which the reader may receive or access the information. This information is subject to change at any time without notice and we do not intend to update this information.

Credit Suisse at a glance Our strategy builds on Credit Suisse’s core strengths: its position as a leading global wealth manager, its specialist investment banking capabilities and its strong presence in our home market of Switzerland. We seek to follow a balanced approach with our wealth management activities, aiming to capitalize on both the large pool of wealth within mature markets as well as the significant growth in wealth in Asia Pacific and other emerging markets. Founded in 1856, we today have a global reach with operations in about 50 countries and 48,770 employees from over 150 different nations. Our broad footprint helps us to generate a more geographically balanced stream of revenues and net new assets and allows us to capture growth opportunities around the world. We serve our clients through three regionally focused divisions: Swiss Universal Bank, International Wealth Management and Asia Pacific. These regional businesses are supported by our Investment Bank division. Our business divisions cooperate closely to provide holistic financial solutions, including innovative products and specially tailored advice.

The Swiss Universal Bank division offers comprehensive advice and a wide range of financial solutions to private, corporate and institutional clients primarily domiciled in our home market of Switzerland, which offers attractive growth opportunities and where we can build on a strong market position across our key businesses. Our Private Clients business has a leading franchise in our Swiss home market and serves ultra-high-net-worth individual, high-net-worth individual, affluent and retail clients. Our Corporate & Institutional Clients business serves large corporate clients, small and medium-sized enterprises, institutional clients, external asset managers, financial institutions and commodity traders.

International Wealth Management The International Wealth Management division through its Private Banking business offers comprehensive advisory services and tailored investment and financing solutions to wealthy private clients and external asset managers in Europe, the Middle East, Africa and Latin America, utilizing comprehensive access to the broad spectrum of Credit Suisse’s global resources and capabilities as well as a wide range of proprietary and third-party products and services. Our Asset Management business offers investment solutions and services globally to a broad range of clients, including pension funds, governments, foundations and endowments, corporations and individuals.

The Asia Pacific division delivers an integrated wealth management, financing, underwriting and advisory offering to our target ultra-high-net-worth, entrepreneur and corporate clients. We provide a comprehensive suite of wealth management products and services to our clients in Asia Pacific and provide a broad range of advisory services related to debt and equity underwriting of public offerings and private placements as well as mergers and acquisitions. Our close collaboration with the Investment Bank supports and enables our wealth management activities in the region through the delivery of holistic, innovative products and tailored advice.

The Investment Bank division delivers client-centric sales and trading products, services and solutions across all asset classes and regions as well as advisory, underwriting and financing services. Our range of products and services includes global securities sales, trading and execution, prime brokerage, capital raising and comprehensive corporate advisory services. Additionally, our Global Trading Solutions platform provides centralized trading and sales services to the Group’s other business divisions. Our clients include financial institutions and sponsors, corporations, governments, ultra-high-net-worth individuals, sovereigns and institutional investors.

Our strategy is to be a leading Wealth Manager with strong global Investment Banking capabilities.

Our strategy has driven our operational success as we have transformed Credit Suisse since 2015. During our restructuring phase between 2015 and 2018, we lowered our break-even point through a significant reduction in our cost base, successfully de-risked our investment banking activities and strengthened our capital base. Since then, we have implemented a series of structural refinements intended to improve effectiveness, drive efficiencies and capture future growth opportunities.

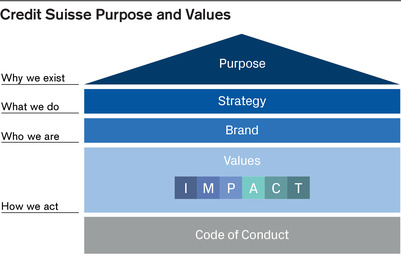

Our organizational structure now consists of three regionally focused Wealth Management-related divisions: Swiss Universal Bank, International Wealth Management and Asia Pacific, supported by the global Investment Bank. We launched a new Sustainability, Research & Investment Solutions (SRI) function at the Executive Board level, underlining the sharpened focus on sustainability. We combined our former Risk Management and Compliance functions into a single integrated Chief Risk and Compliance Officer function to unlock potential global synergies. Our operating businesses are supported by focused corporate functions at the Group Executive Board level, consisting of: Chief Financial Officer, Chief Operating Officer, Chief Risk and Compliance Officer, Sustainability, Research & Investment Solutions, General Counsel and Human Resources.