UNITED STATES SECURITIES AND EXCHANGE COMMISSION

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number 001-15244

(Translation of registrant’s name into English)

Paradeplatz 8, 8001 Zurich, Switzerland

(Address of principal executive office)

Commission File Number 001-33434

(Translation of registrant’s name into English)

Paradeplatz 8, 8001 Zurich, Switzerland

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F  Form 40-F

Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

This report includes the media release and the slides for the presentation to investors in connection with the 1Q21 results.

Media Release Zurich, April 22, 2021 | |

First quarter 2021 financial results

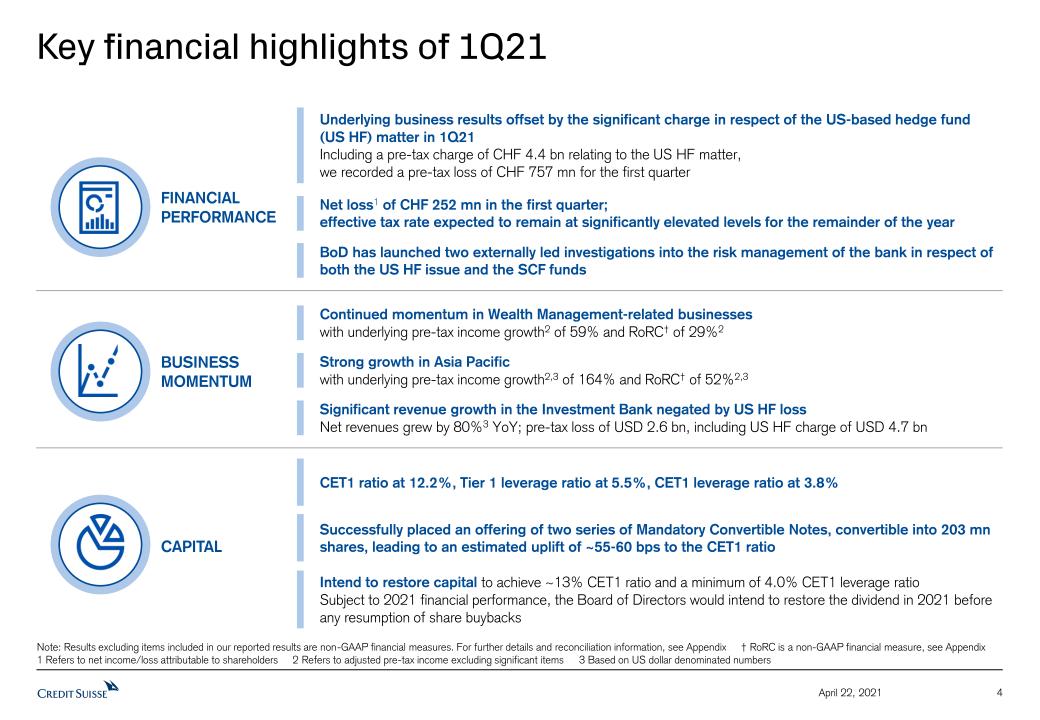

Net loss of CHF 252 mn in 1Q21, reflecting significant charge with respect to the US-based hedge fund matter in 1Q21, offsetting positive performance across wealth management and investment banking; capital position with CET1 ratio of 12.2% to be further strengthened by successful placement of 203 mn shares via two series of Mandatory Convertible Notes

Credit Suisse Group Reported Results (CHF mn, unless otherwise specified) | 1Q21 | 1Q20 | ∆1Q20 |

| Net revenues | 7,574 | 5,776 | 31% |

| o/w Wealth Management-related | 3,882 | 3,766 | 3% |

| o/w Investment Bank in USD mn | 3,888 | 2,155 | 80% |

| Provision for credit losses | 4,394 | 568 | - |

| Total operating expenses | 3,937 | 4,007 | (2)% |

| Pre-tax income / (loss) | (757) | 1,201 | - |

| Net income / (loss) attributable to shareholders | (252) | 1,314 | - |

| Return on tangible equity attributable to shareholders | (2.6)% | 13.1% | - |

| CET1 ratio | 12.2% | 12.1% | - |

Tier 1 leverage ratio1 | 5.5% | 5.3% | - |

| Adjusted excluding significant items and the US-based hedge-fund matter* (CHF mn) | 1Q21 | 1Q20 | ∆1Q20 |

| Net revenues | 7,430 | 5,508 | 35% |

| Pre-tax income | 3,596 | 946 | 280% |

Thomas Gottstein, Chief Executive Officer of Credit Suisse Group AG, commented: “Our results for the first quarter of 2021 have been significantly impacted by a CHF 4.4 bn charge related to a US-based hedge fund. The loss we report this quarter, because of this matter, is unacceptable. Together with the Board of Directors, we have taken significant steps to address this situation as well as the supply chain finance funds matter. Among other decisive actions, we have made changes in our senior business and control functions; we have enhanced our risk review across the bank; we have launched independent investigations into these matters by external advisors, supervised by a special committee of the Board; and we have taken several capital-related actions. We will work to ensure Credit Suisse emerges stronger. However, it is also important to recognize that our underlying 1Q21 financial performance2, across all divisions, was strong, supported by solid results in Switzerland, and strong growth in APAC and investment banking. We expect that our successful MCN placement today will further strengthen our balance sheet and enable us to support the momentum in our core franchises. Our underlying result is a testament to the earnings power of Credit Suisse and to the commitment of our employees. And it makes it all the more important that we quickly and decisively resolve the issues we are currently dealing with.” |

Financial highlights - Strong revenue generation across Wealth Management-related businesses and the Investment Bank; reported net revenues up 31% year on year - Strong 1Q21 Net New Assets (NNA) for the Group of CHF 28.4 bn, of which WM NNA of CHF 14.4 bn, equal to a 7% annualized growth rate with positive contributions across all three WM businesses - CET1 ratio of 12.2% and CET1 leverage ratio of 3.8% at the end of 1Q21, with intention to achieve approx. 13% CET1 ratio and a minimum of 4.0% CET1 leverage ratio - Successfully placed 203 mn shares via two series of MCNs, leading to an estimated uplift of ~55-60 bps to the CET1 ratio3 | Business highlights for 1Q21 - Continued momentum in Wealth Management (WM)-related businesses with pre-tax income growth, on an adjusted basis, excluding significant items*, of 59% year on year and an adjusted RoRC, excluding significant items*, of 29% - Strong growth in Asia Pacific (APAC) with pre-tax income growth, on an adjusted basis and excluding significant items*, of 164% year on year and an adjusted RoRC, excluding significant items*, of 52%, on a USD basis - Investment Bank (IB) results significantly impacted by US-based hedge fund charge of CHF 4.4 bn; net revenues grew by 80% year on year; reported pre-tax loss of USD 2.6 bn - Group-wide AuM of CHF 1.6 trn at end of 1Q21, up 6% vs 4Q20; WM AuM of CHF 841 bn, up 6% vs 4Q20; WM Client Business Volume of CHF 1.3 trn, up 7% vs 4Q20 - Supply Chain Finance (SCF) Funds matter: returning cash to investors in the four supply SCF funds remains CSAM’s priority; to date, total cash distributions to investors of USD 4.8 bn; progress updates to be provided over the coming months |

Media Release Zurich, April 22, 2021 | |

SUMMARY

1Q21 Results

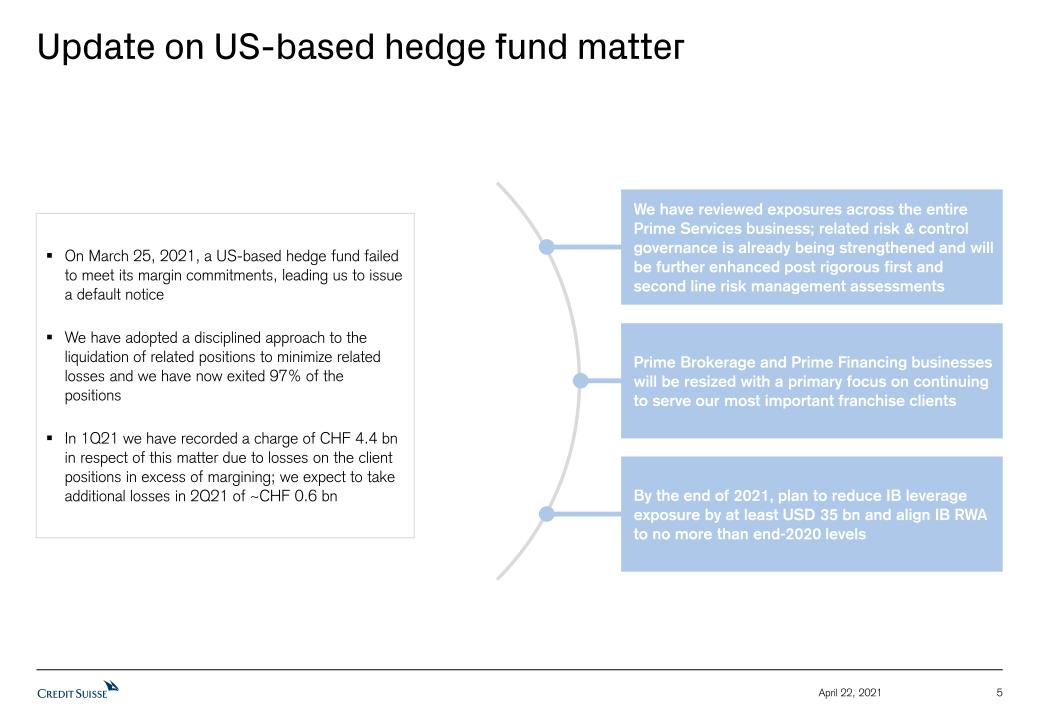

As per our trading updates in March and April, we absorbed several items during the quarter that had a considerable impact on the reported results. We recorded a pre-tax loss of CHF 757 mn in 1Q21 and a net loss attributable to shareholders of CHF 252 mn, including a pre-tax charge of CHF 4.4 bn relating to the US-based hedge fund matter.4 The underlying business results5 have been strong with adjusted net revenues excluding significant items and the US-based hedge-fund matter* were CHF 7.4 bn, up 35% year on year, and higher adjusted pre-tax income, excluding significant items and the US-based hedge-fund matter*, of CHF 3.6 bn, up 280%. As per close of business on April 21, 2021, we have now exited 97% of the related positions and expect to take an additional loss in 2Q21 of approximately CHF 0.6 bn in connection with the US-based hedge fund matter.

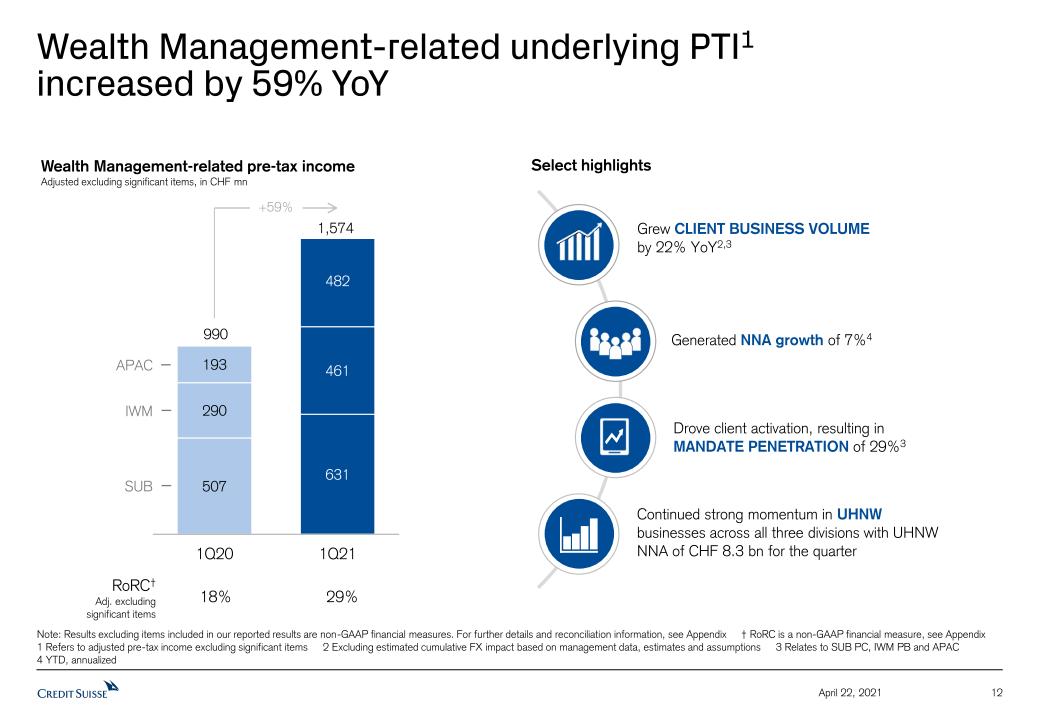

In our Wealth Management-related businesses, we delivered strong growth across our franchise and reported net revenues of CHF 3.9 bn, up 3% year on year, with transaction-based revenues up 18%, recurring commissions & fees up 3% and lower net interest income, down 9%. Adjusted total Wealth-Management-related net revenues, excluding significant items*, of CHF 3.7 bn were up 7% year on year.

Our Investment Bank continued to demonstrate momentum as revenues increased to USD 3.9 bn, up 80% year on year, benefitting from a strong performance across all products: Fixed Income Sales & Trading was up 29% year on year, Equity Sales & Trading was up 23%, and Capital Markets & Advisory6 was up significantly. Global Trading Solutions (GTS), our collaboration between the IB and our wealth management businesses, also recorded increased net revenues, up 10% year on year, underlining the strength of our strategy as we continue to drive collaboration across divisions and business areas.

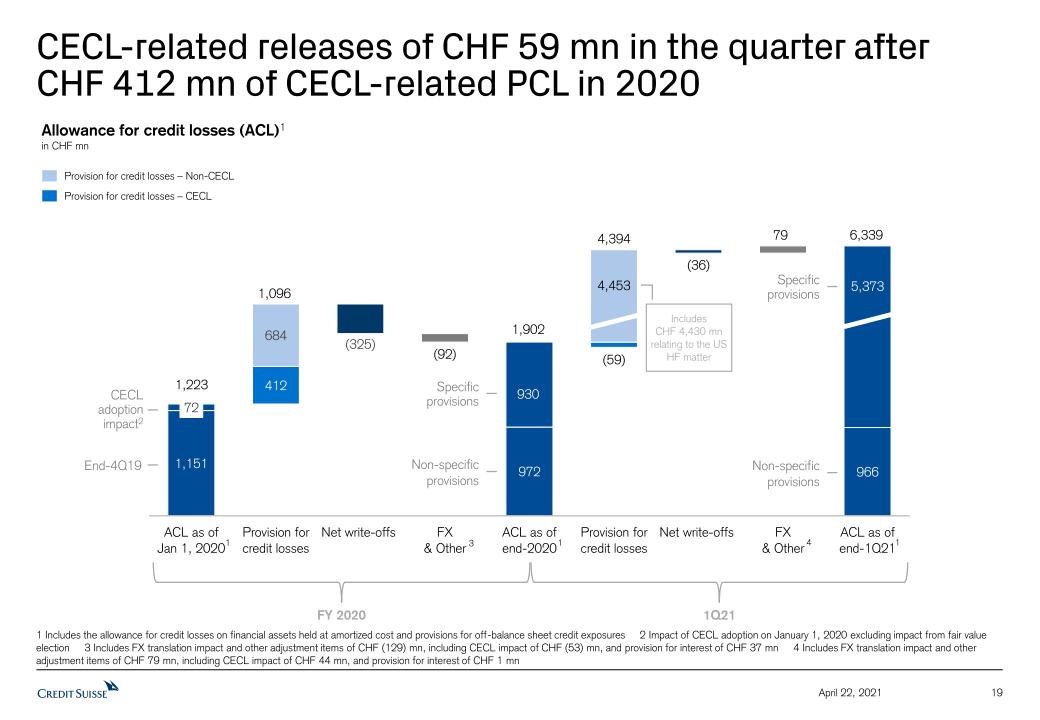

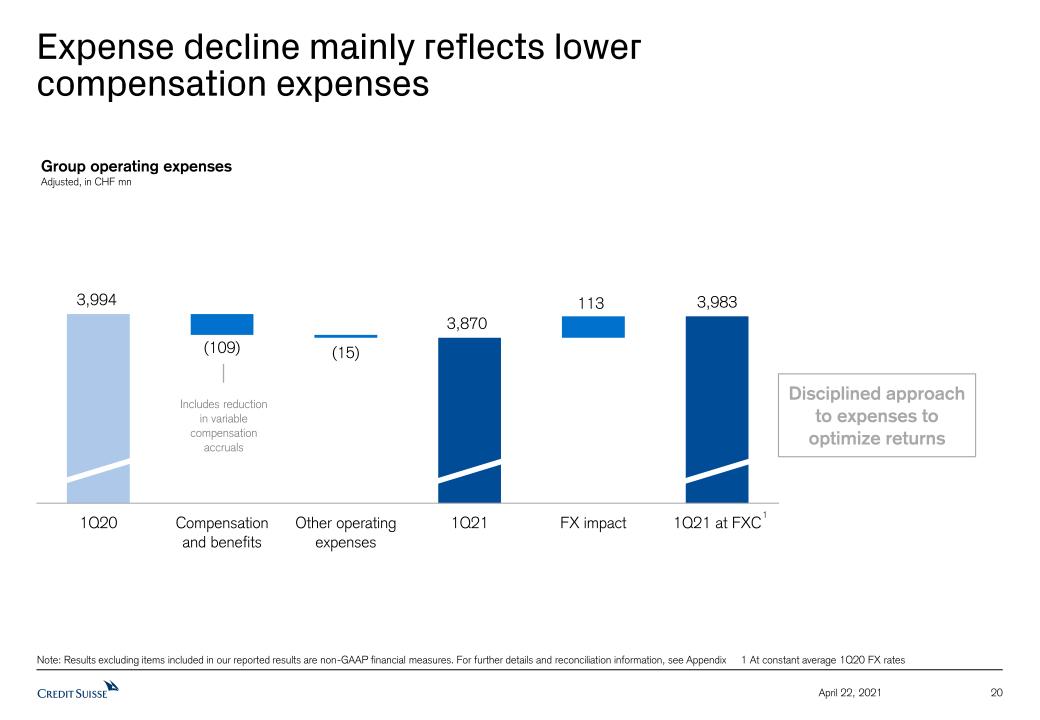

Operating expenses for the Group of CHF 3.9 bn decreased by 2% year on year, mainly reflecting lower compensation expenses; on an adjusted* basis, operating expenses decreased by 3%. Provision for credit losses in 1Q21 increased significantly year on year, and quarter on quarter, due to the US-based hedge fund matter. We recorded CHF 4.4 bn of provision for credit losses, compared to CHF 568 mn in 1Q20 and CHF 138 mn in 4Q20. The vast majority of the quarter’s provisions are reflected in the IB and relate to this specific matter.

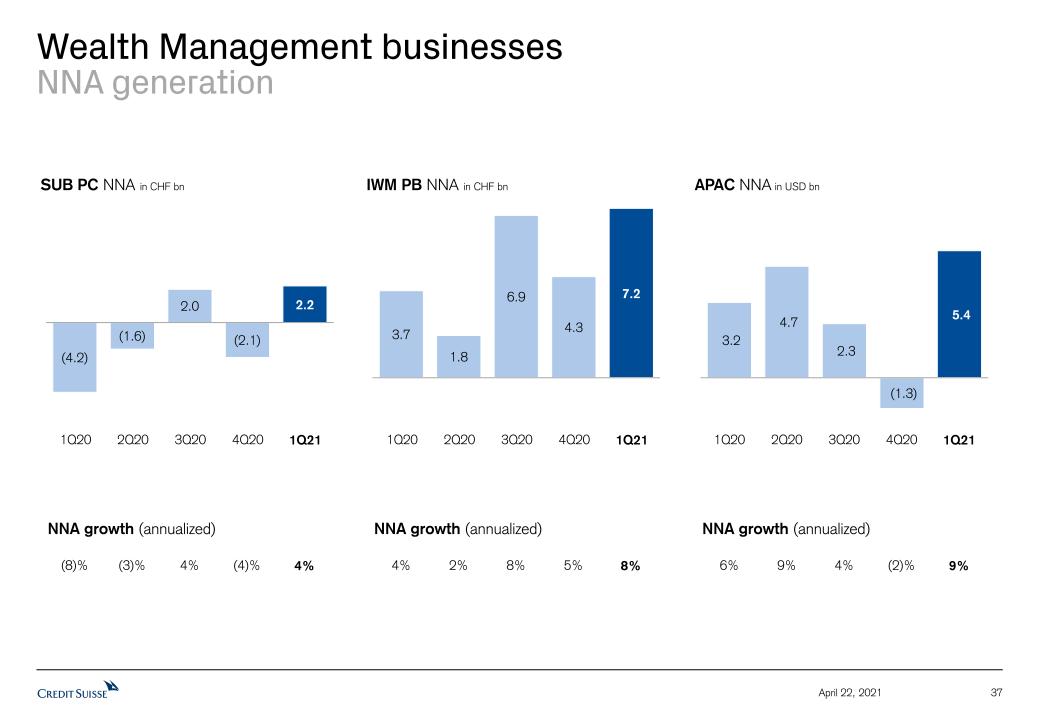

The Group recorded NNA of CHF 28.4 bn in 1Q21, this compares to CHF 5.8 bn in 1Q20 and CHF 8.4 bn in 4Q20. Strong asset gathering across our wealth management businesses with Swiss Universal Bank (SUB) Private Clients recording CHF 2.2 bn, International Wealth Management (IWM) Private Banking recording CHF 7.2 bn and APAC recording USD 5.4 bn. Group Assets under Management (AuM) totaled CHF 1.6 trn at the end of 1Q21, up from CHF 1.5 trn at the end of 4Q20.

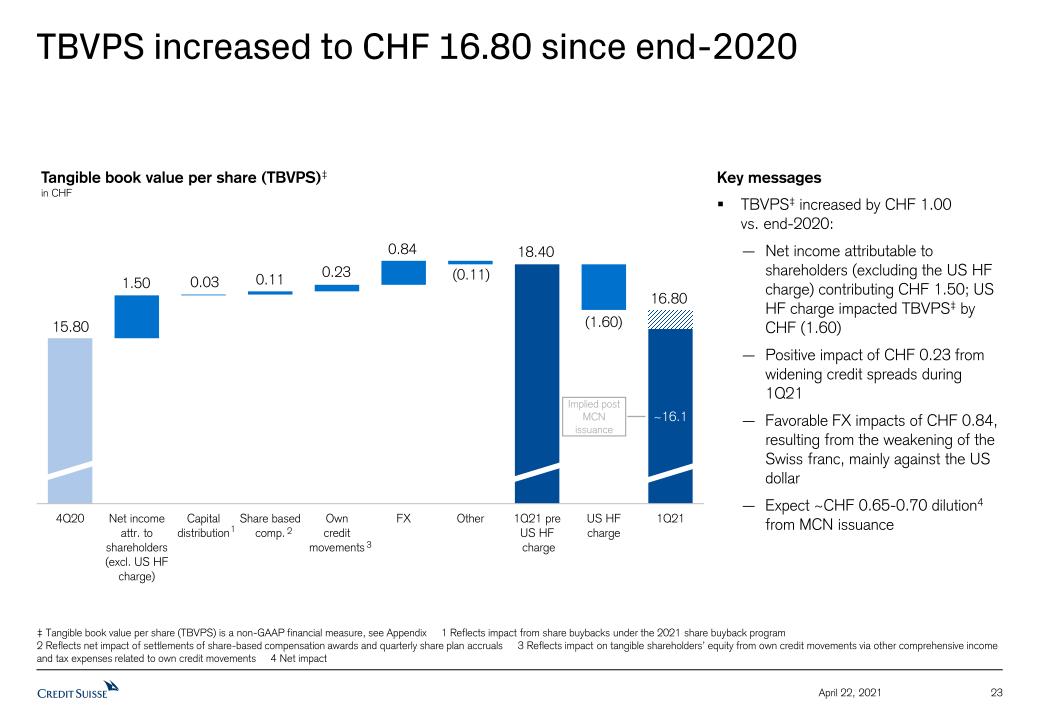

As of the end of 1Q21, our CET1 ratio was 12.2%. For 1Q21, CHF 5.8 bn in risk-weighted assets were related to our remaining exposure in the US-based hedge fund matter, and a Pillar 2 capital add-on of CHF 1.9 bn relating to the supply chain finance funds matter was required by FINMA. During 2Q21, as we exit the hedge fund-related positions, the amount of the associated risk-weighted assets will be reduced accordingly. We would expect the required risk-weighted assets to be reduced to zero during 2Q21.

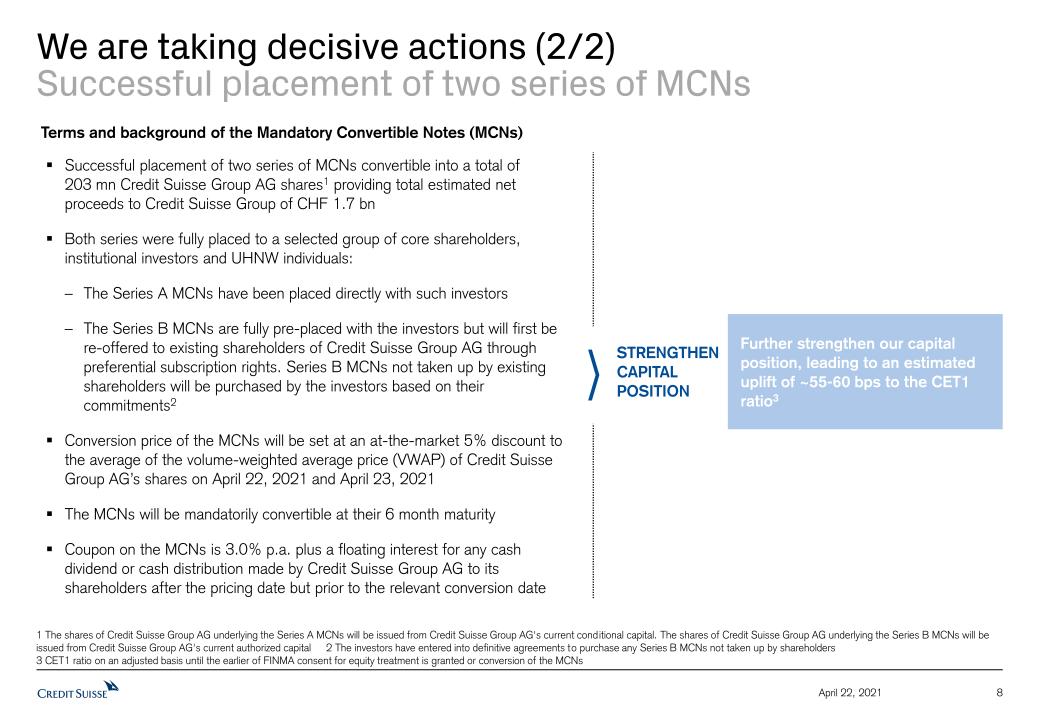

On April 22, 2021, we announced an offering of two series of mandatory convertible notes (MCNs), Series A MCNs and Series B MCNs, which will be convertible into 100 million shares and 103 million shares of Credit Suisse Group AG, respectively. The offering is expected to further strengthen our capital position and to close on or around May 12, 2021.

The shares of Credit Suisse Group AG underlying the Series A MCNs will be issued from Credit Suisse Group AG’s current conditional capital. The shares of Credit Suisse Group AG underlying the Series B MCNs will be issued from Credit Suisse Group AG's current authorized capital. As the full amount of the current authorized capital is expected to be utilized for such issuance, the Board has decided to withdraw, at the Annual General Meeting (AGM) 2021, its proposal for a moderate increase and the extension of the authorized capital.

Media Release Zurich, April 22, 2021 | |

CAPITAL RETURNS TO SHAREHOLDERS

As previously announced on April 6, 2021, the Board of Directors amended its dividend proposal to shareholders at the AGM on April 30, 2021. It is proposing to distribute an ordinary total dividend of CHF 0.10 gross per registered share, half from retained earnings and half out of the capital contribution reserves. This proposal will help to preserve our strong capital positon. Following the completion of share buybacks in 1Q21 of CHF 305 mn of shares, we have suspended the share buyback program. Subject to 2021 financial performance, the Board of Directors would intend to restore the dividend in 2021 before any resumption of share buybacks.

OUTLOOK Overall, we would expect market volumes to return to lower, and more normal, levels in the coming quarters. We expect a residual impact of approximately CHF 0.6 bn from the US-based hedge fund matter in 2Q21, as we have now exited 97% of the related positions. In Wealth Management, we anticipate broadly stable net interest income and improving recurring commissions and fees benefiting from higher levels of AuM. For the Investment Bank, we would expect the second quarter to reflect a slowdown in market activity, as well as the adverse impact from the US-based hedge fund matter, particularly from the resizing of our Prime Services business. Signs of recovery in the global economy could allow us to progressively release part of our allowance for credit losses under the CECL accounting methodology that was built in the early months of the COVID-19 crisis last year. Additionally, we expect the effective tax rate to remain significantly elevated for the remainder of the year. Including the benefit of the MCN-related capital raise as well as other proactive capital actions, we intend to achieve a CET1 ratio of approximately 13% and a minimum 4% CET1 leverage ratio. |

DECISIVE ACTIONS TAKEN FOLLOWING RECENT EVENTS

As previously announced in trading updates in March and April, the Credit Suisse Board of Directors and the Executive Board have taken action to address the supply chain finance funds and US-based hedge fund matters directly. FINMA and other regulators were kept informed. These include:

Senior management changes:

| - | Replacing Brian Chin, CEO Investment Bank, and Lara Warner, Chief Risk and Compliance Officer |

| - | Christian Meissner appointed CEO of the Investment Bank and member of the Executive Board, effective May 1, 2021 |

| - | Joachim Oechslin appointed Chief Risk Officer and member of the Executive Board, in each case on an ad-interim basis, effective April 6, 2021 |

| - | Thomas Grotzer appointed interim Global Head of Compliance, reporting to the Group CEO, effective April 6, 2021 |

| - | Ulrich Körner appointed CEO of Asset Management and member of the Executive Board, effective April 1, 2021 |

| - | And a number of other executive changes in the Investment Bank and the CRCO function |

Enhanced review of risk across the bank:

| - | Extensive review across our Prime Services business focused on underlying risk positions, as well as related counterparties |

| - | Enhanced due diligence across Asset Management following supply chain finance funds matter |

| - | Group-wide review of risk positions and of business and risk processes in close cooperation with Board of Directors and external advisors |

| - | Applying lessons learned from recent matters across the bank |

Launched independent investigations into supply chain finance funds matter and US-based hedge fund matter

| - | The Board of Directors has launched two independent investigations, carried out by external advisors, into the supply chain finance funds matter and the significant US-based hedge fund matter |

Media Release Zurich, April 22, 2021 | |

| - | These investigations are being supervised by a special committee of the Board of Directors and will not only focus on the direct issues arising from those matters, but also reflect on the broader consequences and lessons learned |

Capital related actions:

| - | Suspension of share buyback program |

| - | Reduction of ordinary total dividend proposal to CHF 0.10 gross per registered share |

| - | Successful placement of two series of MCNs |

| - | Close engagement with FINMA and all relevant regulators; FINMA has initiated two enforcement proceedings (with regards to the US-based hedge fund and supply chain finance funds matters) |

UPDATE ON LITIGATION

On April 19, 2021, Credit Suisse entered into a settlement with U.S. Bank as trustee in two legacy legal actions in New York state court relating to residential mortgage-backed securities from 2006 for the aggregate amount of USD 500 mn on claims of over USD 1.3 bn. Credit Suisse is fully reserved and no further charge will be incurred. The settlement remains subject to approval through a separate court proceeding to be brought by the trustee. This resolution also removes two of the largest exposures remaining on Credit Suisse’s legacy RMBS docket.

Media Release Zurich, April 22, 2021 | |

DETAILED DIVISIONAL SUMMARIES

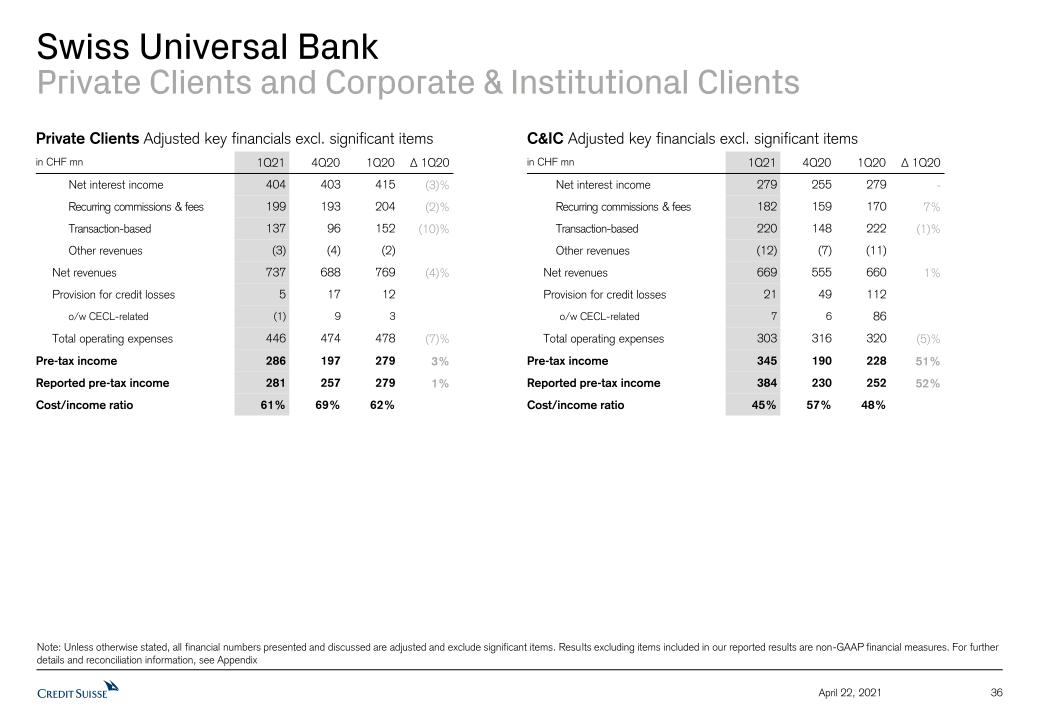

| Swiss Universal Bank (SUB) |

| |

| Reported results (in CHF mn) | 1Q21 | 1Q20 | ∆1Q20 |

| Net revenues | 1,449 | 1,454 | (0)% |

| Provision for credit losses | 26 | 124 | - |

| Total operating expenses | 758 | 799 | (5)% |

| Pre-tax income | 665 | 531 | 25% |

| Cost/income ratio (%) | 52% | 55% | - |

| Net New Assets | 6.1 | 0.6 | - |

| o/w Private Clients | 2.2 | (4.2) | - |

| Adjusted results, excluding significant items* (in CHF mn) | 1Q21 | 1Q20 | ∆1Q20 |

| Net revenues | 1,406 | 1,429 | (2)% |

| Total operating expenses | 749 | 798 | (6)% |

| Pre-tax income | 631 | 507 | 24% |

| Cost/income ratio (%) | 53% | 56% | - |

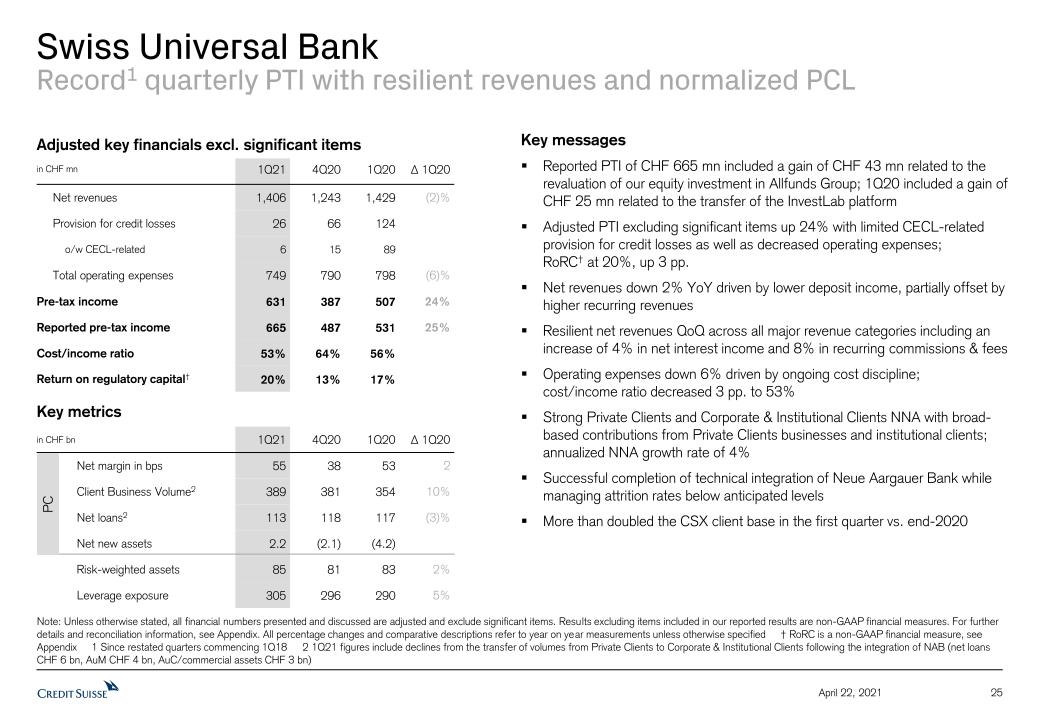

1Q21 Results

| - | Strong pre-tax income for SUB in 1Q21, reflecting stable net revenues; continued positive momentum compared to 4Q20 with resilient performance across all major revenue categories, including net interest income |

| - | Record quarterly adjusted pre-tax income, excluding significant items*, of CHF 631 mn, up 24% year on year, with limited CECL-related provision for credit losses as well as a decreased adjusted* operating expenses, down 6% year on year, driven by ongoing cost discipline |

| - | Resilient adjusted net revenues, excluding significant items*, up 13% compared to 4Q20; down 2% compared to 1Q20, driven by lower deposit income, partially offset by higher recurring commissions & fees |

| - | Strong NNA flows of CHF 6.1 bn with positive contributions from Private Clients and Corporate & Institutional Clients |

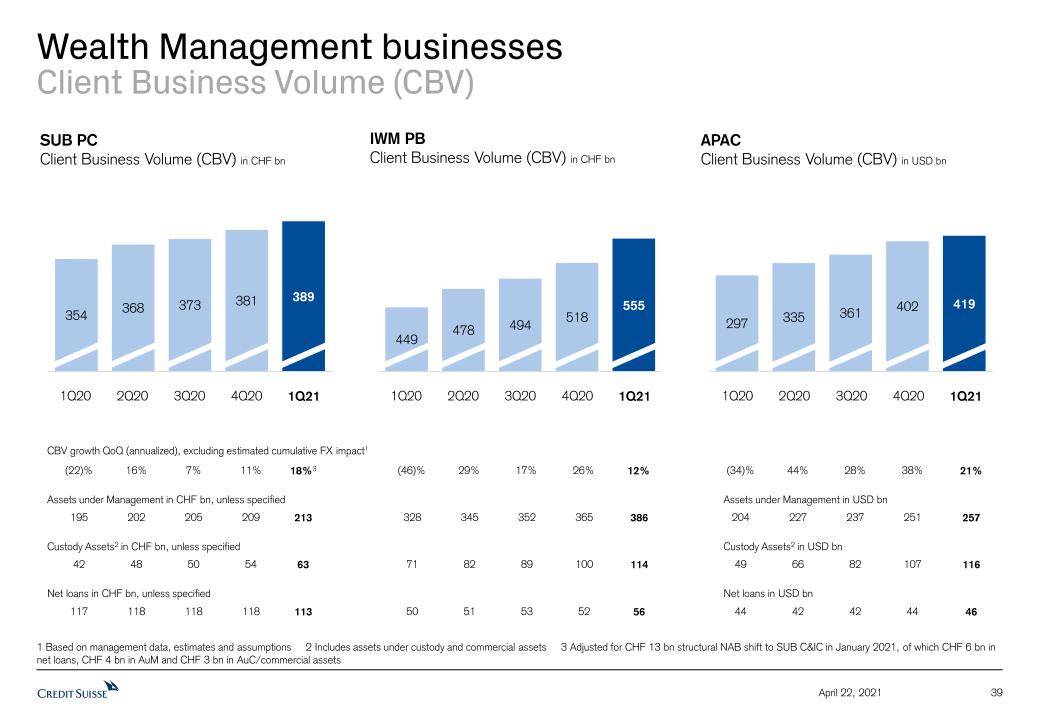

| - | SUB recorded higher client business volumes of CHF 1.0 trn, up 5% compared to 4Q20 |

| - | Private Clients adjusted pre-tax income, excluding significant items*, of CHF 286 mn, up 3% year on year, driven by decreased adjusted* operating expenses, down 7%, and lower provision for credit losses; adjusted net revenues, excluding significant items*, down 4%, driven by lower transaction-based revenues, down 10%, from decreased client activity, decreased net interest income, down 3%, from lower deposit income, and lower recurring commissions & fees, down 2%, mainly from our investment in Swisscard |

| - | Corporate & Institutional Clients adjusted pre-tax income, excluding significant items*, of CHF 345 mn, up 51% year on year, driven by lower provision for credit losses, decreased adjusted* operating expenses, down 5%, as well as increased adjusted net revenues, excluding significant items*, up 1%, driven by higher recurring commissions & fees, up 7%, due to higher fees from lending activities, with stable net interest income and slightly lower transaction-based revenues, down 1%, compared to 1Q20 |

Media Release Zurich, April 22, 2021 | |

| International Wealth Management (IWM) – Private Banking |

| |

| Reported results (in CHF mn) | 1Q21 | 1Q20 | ∆1Q20 |

| Net revenues | 987 | 1,032 | (4)% |

| Provision for credit losses | 0 | 39 | - |

| Total operating expenses | 579 | 648 | (11)% |

| Pre-tax income | 408 | 345 | 18% |

| Cost/income ratio (%) | 59% | 63% | - |

| Net New Assets | 7.2 | 3.7 | - |

| Adjusted results, excluding significant items* (in CHF mn) | 1Q21 | 1Q20 | ∆1Q20 |

| Net revenues | 929 | 1,017 | (9)% |

| Total operating expenses | 585 | 649 | (10)% |

| Pre-tax income | 344 | 329 | 5% |

| Cost/income ratio (%) | 63% | 64% | - |

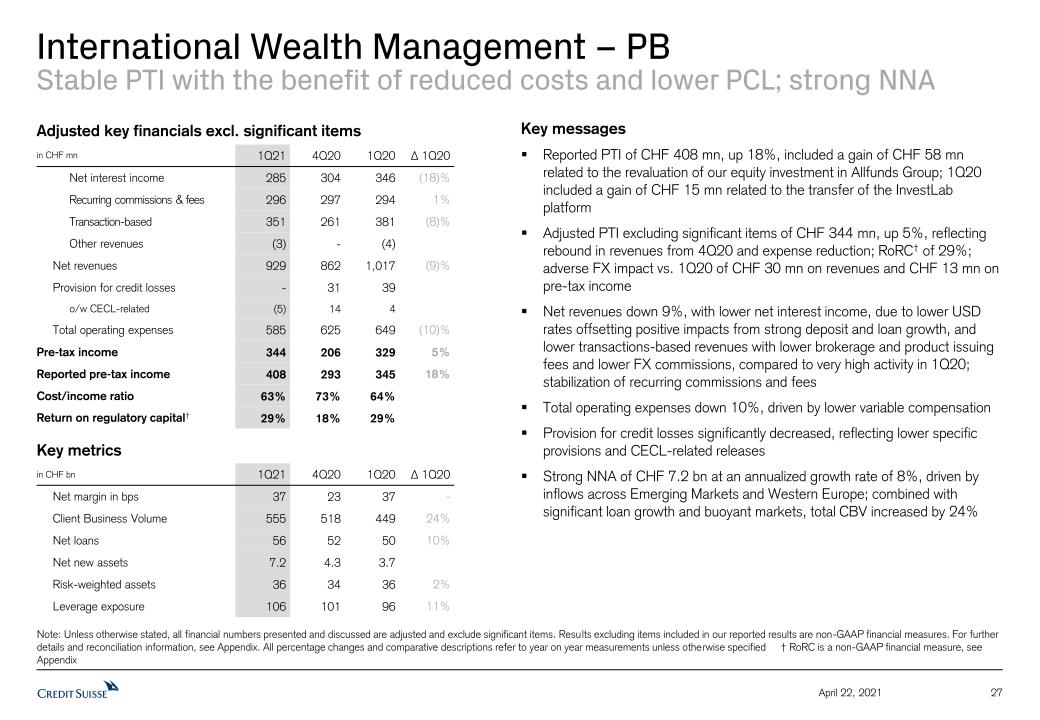

1Q21 Results

| - | Adjusted pre-tax income, excluding significant items*, was CHF 344 mn, up 5% year on year, driven by lower costs, with adjusted* operating expenses down 10% and lower provision for credit losses, offset in part by lower net revenues |

| - | Adjusted net revenues, excluding significant items*, down 9% year on year, with 18% lower net interest income primarily due to lower USD interest rates, offsetting positive impacts from strong deposit and loan growth; recurring commissions & fees, up 1%, and lower transaction-based revenues, down 8% with lower brokerage and product issuing fees and lower FX commissions, compared to high activity in 1Q20. Compared to 4Q20, there was a rebound in net revenues |

| - | Adverse FX impact compared to 1Q20 of CHF 30 mn on revenues and CHF 13 mn on adjusted pre-tax income, excluding significant items* |

| - | Strong NNA of CHF 7.2 bn from across Emerging Markets and Western Europe |

| - | IWM recorded higher client business volumes of CHF 555 bn, up 7% compared to 4Q20 |

Media Release Zurich, April 22, 2021 | |

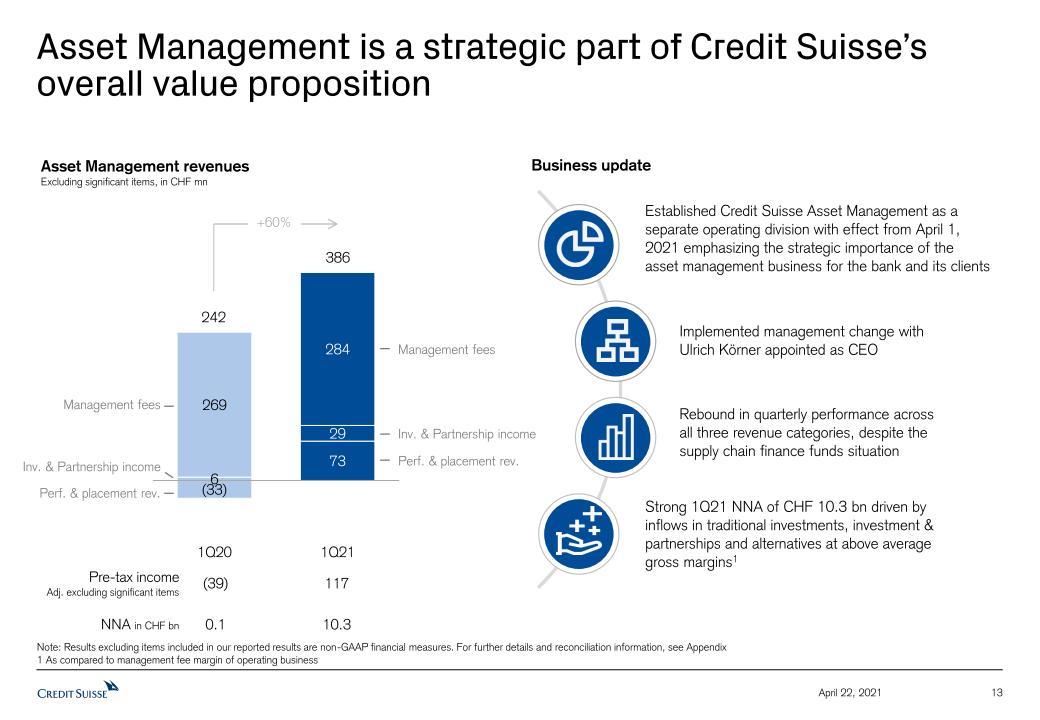

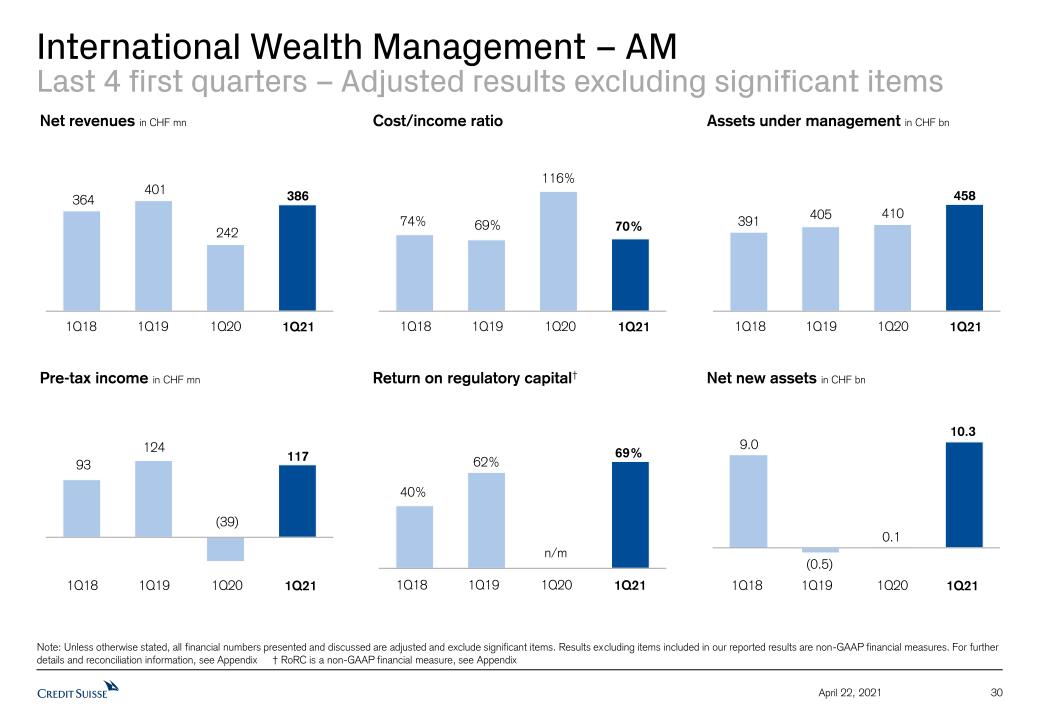

| International Wealth Management (IWM) – Asset Management |

| |

| Reported results (in CHF m) | 1Q21 | 1Q20 | ∆1Q20 |

| Net revenues | 386 | 445 | (13)% |

| Provision for credit losses | 0 | 0 | - |

| Total operating expenses | 271 | 281 | (4)% |

| Pre-tax income | 115 | 164 | (30)% |

| Cost/income ratio (%) | 70% | 63% | - |

| Net New Assets | 10.3 | 0.1 | - |

| Adjusted results, excluding significant items* (in CHF m) | 1Q21 | 1Q20 | ∆1Q20 |

| Net revenues | 386 | 242 | 60% |

| Total operating expenses | 269 | 281 | (4)% |

| Pre-tax income / (loss) | 117 | (39) | - |

| Cost/income ratio (%) | 70% | 116% | - |

1Q21 Results

| - | It remains Credit Suisse Asset Management’s priority to return cash to investors in the supply chain finance funds; as of April 9, 2021, redemption payments totaling USD 4.8 bn have been made; intend to provide a further update on the progress made by the end of April 2021 |

| - | Adjusted pre-tax income, excluding significant items*, was CHF 117 mn, up significantly year on year, driven by higher adjusted net revenues, excluding significant items*, and lower adjusted* operating expenses, down 4% |

| - | Adjusted net revenues, excluding significant items*, were CHF 386 mn, up 60% year on year, driven by significantly higher investment-related gains, and higher management fees, up 6%, on higher AuM and strong NNA inflows |

| - | Strong NNA of CHF 10.3 bn driven by Equities and Index Solutions |

Media Release Zurich, April 22, 2021 | |

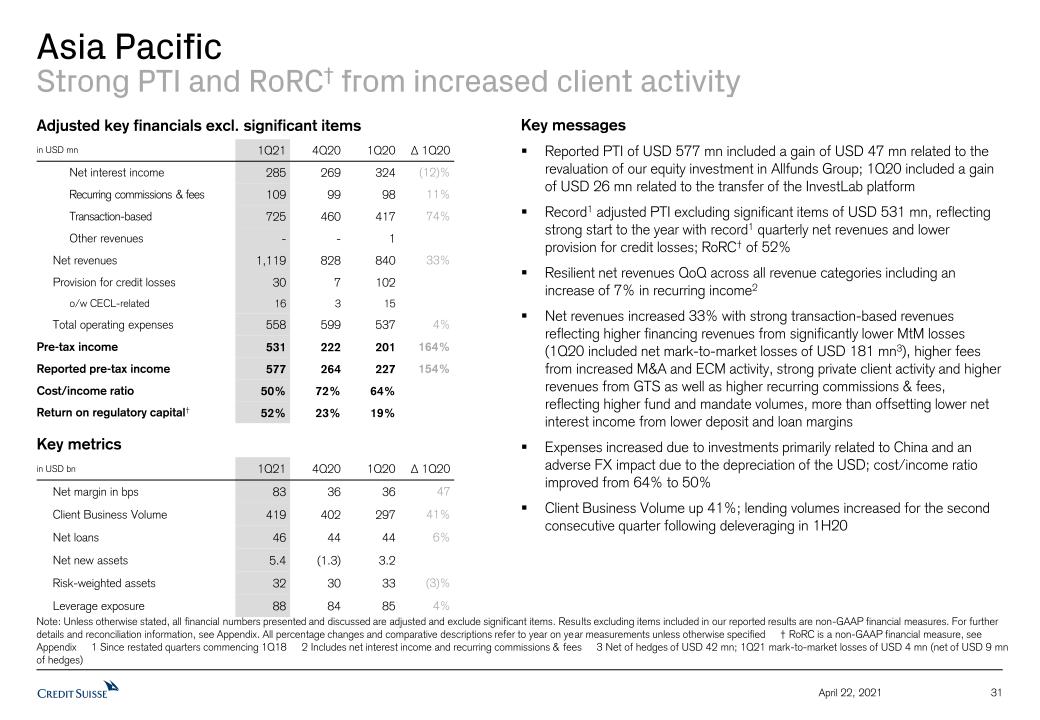

| Asia Pacific (APAC) |

| |

| Reported results (in USD mn) | 1Q21 | 1Q20 | ∆1Q20 |

| Net revenues | 1,166 | 866 | 35% |

| Provision for credit losses | 30 | 102 | - |

| Total operating expenses | 559 | 537 | 4% |

| Pre-tax income | 577 | 227 | 154% |

| Cost/income ratio (%) | 48% | 62% | - |

| Net New Assets | 5.4 | 3.2 | - |

| Adjusted results, excluding significant items* (in USD mn) | 1Q21 | 1Q20 | ∆1Q20 |

| Net revenues | 1,119 | 840 | 33% |

| Total operating expenses | 558 | 537 | 4% |

| Pre-tax income | 531 | 201 | 164% |

| Cost/income ratio (%) | 50% | 64% | - |

1Q21 Results

| - | Adjusted pre-tax income, excluding significant items*, was USD 531 mn, up significantly year on year, driven by higher adjusted net revenues, excluding significant items*, offset partly by adjusted* operating expenses up 4%, due in part to China-related investments; provision for credit losses was significantly lower |

| - | Adjusted net revenues, excluding significant items*, up 33% year on year, reflected significantly higher transaction-based revenues, up 74%, mainly from significantly lower mark-to-market losses, elevated private client activity levels, higher M&A and ECM activities and higher revenues from GTS, as well as higher recurring commissions & fees up 11%, reflecting strong fund and mandates volumes. These were offset in part by lower net interest income down 12%, driven by lower deposit and lower loan margins |

| - | Asia Pacific regional net revenues7, excluding significant items*8, were up 30% year on year and represented 19% of the bank’s net revenues, on a CHF basis |

| - | Strong NNA inflows of USD 5.4 bn, mainly driven by inflows from Greater China |

| - | Higher client business volumes of USD 419 bn, up 4% compared to 4Q20 |

Media Release Zurich, April 22, 2021 | |

| Investment Bank (IB) |

| |

| Reported results (in USD mn) | 1Q21 | 1Q20 | ∆1Q20 |

| Net revenues | 3,888 | 2,155 | 80% |

| Provision for credit losses | 4,618 | 315 | - |

| Total operating expenses | 1,830 | 1,754 | 4% |

| Pre-tax income/loss | (2,560) | 86 | - |

| Cost/income ratio (%) | 47% | 81% | - |

| Return on Regulatory Capital | (70)% | 2% | - |

| Adjusted results, excluding the US-based hedge fund matter* (in USD mn) | 1Q21 | 1Q20 | ∆1Q20 |

| Net revenues | 3,888 | 2,155 | 80% |

| Total operating expenses | 1,778 | 1,758 | 1% |

| Pre-tax income | 2,199 | 82 | - |

| Cost/income ratio (%) | 46% | 82% | - |

| Return on Regulatory Capital | 60% | 2% | - |

1Q21 Results

| - | Provision for credit losses of USD 4.6 bn includes the charge related to the US-based hedge fund matter, as announced on April 6, 2021; this led to a reported pre-tax loss of USD 2.6 bn |

| - | Strategic review underway focused on resizing and de-risking Prime Brokerage and Prime Financing businesses, with a primary focus on continuing to serve our most important franchise clients. By the end of 2021, we plan to reduce IB leverage exposure by at least USD 35 bn and align IB RWA to no more than end-2020 levels |

| - | Adjusted pre-tax income, excluding the US-based hedge fund matter*, of USD 2.2 bn, up significantly year on year, driven by strong revenue performance across the diversified franchise with net revenues up 80% |

| - | Fixed Income Sales and Trading revenues of USD 1.6 bn, up 29% year on year, reflecting continued strength in our leading9 credit franchise with particular strength in Securitized Products and higher Emerging Markets Trading and Financing revenues |

| - | Equity Sales and Trading revenues of USD 988 mn, up 23% year on year, reflected strength in Equity Derivatives and higher Cash Equities Trading activity, partially offset by lower Prime Services revenues |

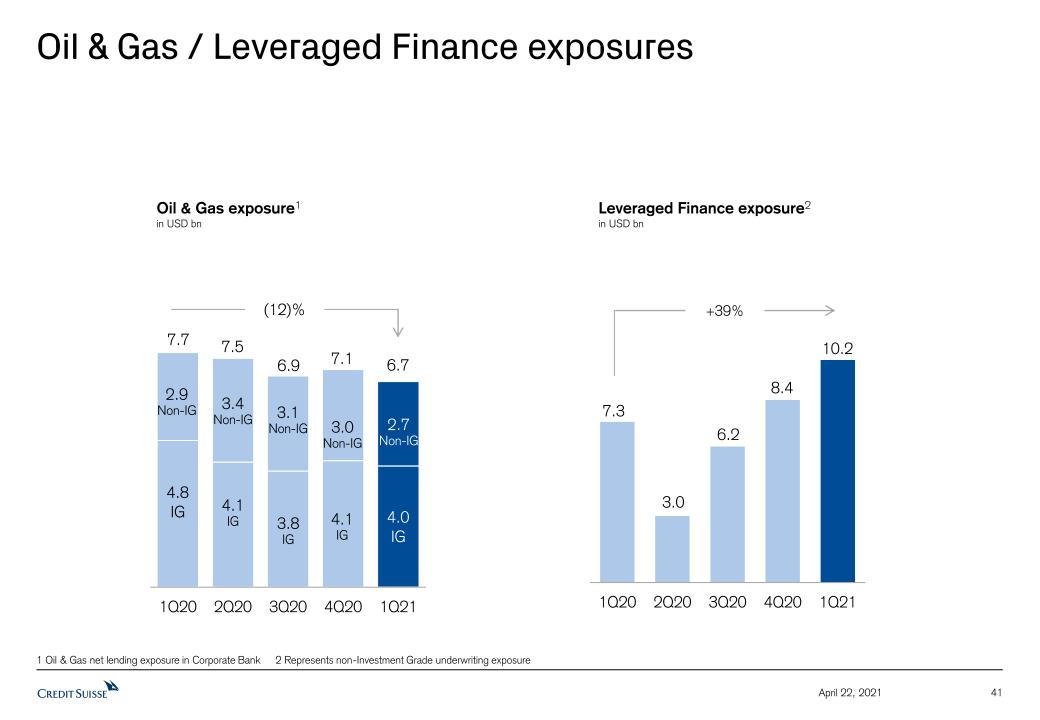

| - | Capital Markets revenues of USD 1.2 bn, up significantly year on year, driven by outperformance in equity capital markets resulting in market share gains10 and rebound in leveraged finance issuance |

| - | Advisory revenues of USD 214 mn, up 49% year on year, driven by increased M&A deal completions |

| - | Global investment banking Capital Markets and Advisory share of wallet11 of 4.9% increased 110 basis points year on year to the highest level since 4Q17 |

| - | We continue to see strong momentum in Global Trading Solutions reflecting increased collaboration and continued momentum with our wealth management, institutional and corporate clients |

Media Release Zurich, April 22, 2021 | |

ONGOING COMMITMENT TO SUSTAINABILITY AND PROGRESS UPDATE ON SRI

Credit Suisse continued to work on its ambition to become a leading provider of sustainable solutions in financial services and our dedicated Sustainability, Research & Investment Solutions (SRI) function continued to sharpen its value proposition in 1Q21:

| - | As of end of 1Q21, Credit Suisse’s assets managed according to sustainability criteria (Sustainable AuM) were CHF 118 bn, up from CHF 108 bn at the end of 4Q20 |

| - | Credit Suisse enhanced its scope of reporting and launched its Sustainability Report in March 2021, as part of the 2020 annual reporting suite. The Sustainability Report includes new disclosures pursuant to the Sustainability Accounting Standards Board (SASB) standards, for the first time, as well as enhanced Task Force on Climate-related Financial Disclosures (TCFD) disclosures |

| - | Published a number of key publications such as ‘The Decarbonizing Portfolio’ report and the ‘Double Delta of Impact Investing’ report; we also sponsored the ‘Little Book of Investing in Nature’, a guide to taking action on biodiversity |

| - | SRI additionally drives Credit Suisse’s commitment to Diversity & Inclusion; in January 2021, we announced further steps toward our commitment in this area by joining ‘The Valuable 500’, a global movement to put disability on the business agenda |

| - | Credit Suisse has been included in the Bloomberg Gender-Equality Index (GEI) for the second consecutive year in 2021, underscoring our commitment to transparency in gender-data reporting |

| - | In January 2021, we also celebrated our 16th consecutive year of achieving a score of 100% on the Human Rights Campaign Corporate Equality Index, which highlights our ongoing efforts to promote LGBT+ equality in the workplace |

Media Release Zurich, April 22, 2021 | |

CONTACT DETAILS

Kinner Lakhani, Investor Relations, Credit Suisse Tel: +41 44 333 71 49 Email: investor.relations@credit-suisse.com |

Katrin Schaad, Corporate Communications, Credit Suisse Tel: +41 844 33 88 44 Email: media.relations@credit-suisse.com |

The Earnings Release and Presentation Slides for 1Q21 are available to download from 06:45 CEST today at: https://www.credit-suisse.com/results |

PRESENTATION OF 1Q21 RESULTS – THURSDAY, APRIL 22, 2021

| Event | Analyst Call | Media Call |

| Time | 08:15 Zurich 07:15 London 02:15 New York | 10:30 Zurich 09:30 London 04:30 New York |

| Language | English | English |

| Access | Switzerland: +41 44 580 48 67 Europe: +44 203 057 6528 US: +1 866 276 8933 Reference: Credit Suisse Analysts and Investors Call Conference ID: 8485515 Please dial in 10 minutes before the start of the call Webcast link here. | Switzerland: +41 44 580 48 67 Europe: +44 203 057 6528 US: +1 866 276 8933 Reference: Credit Suisse Media Call Conference ID: 6849056 Please dial in 10 minutes before the start of the call Webcast link here. |

| Q&A Session | Following the presentation, you will have the opportunity to ask the speakers questions | Following the presentation, you will have the opportunity to ask the speakers questions |

| Playback | Replay available approximately two hours after the event Switzerland: +41 44 580 40 26 Europe: +44 333 300 9785 US: +1 917 677 7532 Conference ID: 8485515 | Replay available approximately two hours after the event Switzerland: +41 44 580 40 26 Europe: +44 333 300 9785 US: +1 917 677 7532 Conference ID: 6849056 |

Media Release Zurich, April 22, 2021 | |

* Refers to adjusted results, adjusted results excluding significant items, and adjusted results excluding significant items and the US-based hedge fund matter, as applicable. Results excluding items included in our reported results are non-GAAP financial measures. For a reconciliation to the most directly comparable US GAAP measures, see the Appendix of this Media Release. Significant items include the gain related to the transfer of the InvestLab fund platform to Allfunds Group in 1Q20, the gain related to the equity investment revaluation of Allfunds Group in 4Q20, the gain related to the equity investment revaluation of SIX in 4Q20, the impairment to the valuation of our non-controlling interest in York Capital Management in 4Q20 and the gain related to the equity investment revaluation of Allfunds Group in 1Q21. Reported results in 1Q21 include a charge of CHF 4,430 million in respect of the failure by a US-based hedge fund to meet its margin commitments.

Footnotes

Abbreviations

AGM – Annual General Meeting; APAC – Asia Pacific; AuM – assets under management; BCBS – Basel Committee on Banking Supervision; BIS – Bank for International Settlements; bn – billion; CECL – US GAAP accounting standard for current expected credit losses; CET1 – common equity tier 1; CHF – Swiss francs; C&IC – Corporate & Institutional Clients; CRCO – Chief Risk and Compliance Officer; CSAM – Credit Suisse Asset Management; DCM – Debt Capital Markets; ECM – Equity Capital Markets; EMEA – Europe, Middle East, Africa; ExB – Executive Board; FINMA – Swiss Financial Market Supervisory Authority FINMA; FX – Foreign Exchange; FXC – Foreign Exchange Constant; GAAP – Generally accepted accounting principles; GTS – Global Trading Solutions; IB – Investment Bank; IPO – Initial Public Offering; ITS – International Trading Solutions; IWM – International Wealth Management; NAB– Neue Aargauer Bank; mn – million; M&A – Mergers & Acquisitions; NNA – net new assets; PB – Private Banking; PC – Private Clients; PTI – Pre-Tax Income; RM – Relationship Manager; RMBS – Residential Mortgage Backed Securities; RoRC – Return on Regulatory Capital; RoTE – Return on Tangible Equity; RWA – risk weighted assets; SEC – U.S. Securities and Exchange Commission; SME – Small and Medium Enterprises; SRI – Sustainability, Research & Investment Solutions; SUB – Swiss Universal Bank; SCF – Supply Chain Finance; trn – trillion; US – United States; USD – US dollar; WM – Wealth Management.

Mandatory Convertible Notes

These materials are not for release, publication or distribution (directly or indirectly) in or to Australia, Canada, Hong Kong, Japan or any other jurisdiction in which such distribution would be prohibited by applicable law.

These materials are not an offer of securities for sale in the United States or to U.S. persons (“U.S. persons”) as defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act”). The mandatory convertible notes described in these materials and the shares of Credit Suisse Group AG issuable on their conversion have not been and will not be registered under the U.S. Securities Act and may not be offered or sold in the United States or to, or for the account or benefit of, U.S. persons, absent registration or an applicable exemption from registration under the U.S. Securities Act.

Important information

This document contains select information from the full 1Q21 Earnings Release and 1Q21 Results Presentation slides that Credit Suisse believes is of particular interest to media professionals. The complete 1Q21 Earnings Release and 1Q21 Results

Media Release Zurich, April 22, 2021 | |

Presentation slides, which have been distributed simultaneously, contain more comprehensive information about our results and operations for the reporting quarter, as well as important information about our reporting methodology and some of the terms used in these documents. The complete 1Q21 Earnings Release and 1Q21 Results Presentation slides are not incorporated by reference into this document.

Credit Suisse has not finalized its 1Q21 Financial Report and Credit Suisse’s independent registered public accounting firm has not completed its review of the condensed consolidated financial statements (unaudited) for the period. Accordingly, the financial information contained in this document is subject to completion of quarter-end procedures, which may result in changes to that information.

We may not achieve all of the expected benefits of our strategic initiatives. Factors beyond our control, including but not limited to the market and economic conditions (including macroeconomic and other challenges and uncertainties, for example, resulting from the COVID-19 pandemic), changes in laws, rules or regulations and other challenges discussed in our public filings, could limit our ability to achieve some or all of the expected benefits of these initiatives.

In particular, the terms “Estimate”, “Illustrative”, “Ambition”, “Objective”, “Outlook” and “Goal” are not intended to be viewed as targets or projections, nor are they considered to be Key Performance Indicators. All such estimates, illustrations, ambitions, objectives, outlooks and goals are subject to a large number of inherent risks, assumptions and uncertainties, many of which are completely outside of our control. These risks, assumptions and uncertainties include, but are not limited to, general market conditions, market volatility, interest rate volatility and levels, global and regional economic conditions, challenges and uncertainties resulting from the COVID-19 pandemic, political uncertainty, changes in tax policies, regulatory changes, changes in levels of client activity as a result of any of the foregoing and other factors. Accordingly, this information should not be relied on for any purpose. We do not intend to update these estimates, illustrations, ambitions, objectives, outlooks or goals.

In preparing this document, management has made estimates and assumptions that affect the numbers presented. Actual results may differ. Annualized numbers do not take into account variations in operating results, seasonality and other factors and may not be indicative of actual, full-year results. Figures throughout this document may also be subject to rounding adjustments. All opinions and views constitute judgments as of the date of writing without regard to the date on which the reader may receive or access the information. This information is subject to change at any time without notice and we do not intend to update this information.

Return on tangible equity, a non-GAAP financial measure, is calculated as annualized net income attributable to shareholders divided by average tangible shareholders’ equity. Tangible shareholders’ equity, a non-GAAP financial measure, is calculated by deducting goodwill and other intangible assets from total shareholders’ equity as presented in our balance sheet. Management believes that return on tangible equity is meaningful as it is a measure used and relied upon by industry analysts and investors to assess valuations and capital adequacy. For end-1Q21, tangible shareholders’ equity excluded goodwill of CHF 4,644 mn and other intangible assets of CHF 239 mn from total shareholders’ equity of CHF 44,590 mn as presented in our balance sheet. For end-1Q20, tangible shareholders’ equity excluded goodwill of CHF 4,604 mn and other intangible assets of CHF 279 mn from total shareholders’ equity of CHF 48,675 mn as presented in our balance sheet.

Prior to 3Q20, regulatory capital was calculated as the worst of 10% of RWA and 3.5% of leverage exposure, and return on regulatory capital (a non-GAAP financial measure) was calculated using income / (loss) after tax and assumed a tax rate of 30%. In 3Q20, we updated our calculation approach, following which regulatory capital is calculated as the average of 10% of RWA and 3.5% of leverage exposure, and return on regulatory capital (a non-GAAP financial measure) is calculated using income / (loss) after tax and assumes a tax rate of 30% for periods prior to 2020 and 25% from 2020 onward. For periods in 2020, for purposes of calculating Group return on regulatory capital, leverage exposure excludes cash held at central banks, after adjusting for the dividend paid in 2020. For the Investment Bank division, return on regulatory capital is based on US dollar denominated numbers. Adjusted return on regulatory capital is calculated using adjusted results, applying the same methodology to calculate return on regulatory capital.

Foreign exchange impact is calculated by converting the CHF amount of net revenues, provision for credit losses and operating expenses for 2021 back to the original currency on a monthly basis at the respective spot foreign exchange rate. The respective amounts are then converted back to CHF applying the average 2020 foreign exchange rate from the period against which the foreign exchange impact is measured. Average foreign exchange rates apply a straight line average of monthly foreign exchange rates for major currencies.

Client business volume includes assets under management, custody assets and net loans.

Credit Suisse is subject to the Basel III framework, as implemented in Switzerland, as well as Swiss legislation and regulations for systemically important banks, which include capital, liquidity, leverage and large exposure requirements and rules for emergency plans designed to maintain systemically relevant functions in the event of threatened insolvency. Credit Suisse has adopted the Bank for International Settlements (BIS) leverage ratio framework, as issued by the Basel Committee on Banking Supervision (BCBS) and implemented in Switzerland by the Swiss Financial Market Supervisory Authority FINMA (FINMA).

Media Release Zurich, April 22, 2021 | |

Unless otherwise noted, all CET1 capital, CET1 ratio, Tier-1 leverage ratio, risk-weighted assets and leverage exposure figures in this document are as of the end of the respective period and, for periods prior to 2019, on a “look-through” basis.

Unless otherwise noted, leverage exposure is based on the BIS leverage ratio framework and consists of period-end balance sheet assets and prescribed regulatory adjustments. The tier 1 leverage ratio and CET1 leverage ratio are calculated as BIS tier 1 capital and CET1 capital, respectively, divided by period end leverage exposure. Swiss leverage ratios are measured on the same period-end basis as the leverage exposure for the BIS leverage ratio. Unless otherwise noted, for periods in 2020, leverage exposure excludes cash held at central banks, after adjusting for the dividend paid in 2020.

References to Wealth Management-related mean SUB, IWM and APAC or their combined results. References to global investment banking mean the Investment Bank, APAC advisory and underwriting as well as M&A, DCM and ECM in SUB C&IC. References to Global Trading Solutions, prior to 3Q20, mean the combination of ITS and APAC Solutions.

Investors and others should note that we announce important company information (including quarterly earnings releases and financial reports as well as our annual sustainability report) to the investing public using press releases, SEC and Swiss ad hoc filings, our website and public conference calls and webcasts. We also routinely use our Twitter account @creditsuisse (https://twitter.com/creditsuisse), our LinkedIn account (https://www.linkedin.com/company/credit-suisse/), our Instagram accounts (https://www.instagram.com/creditsuisse_careers/ and https://www.instagram.com/creditsuisse_ch/), our Facebook account (https://www.facebook.com/creditsuisse/) and other social media channels as additional means to disclose public information, including to excerpt key messages from our public disclosures. We may share or retweet such messages through certain of our regional accounts, including through Twitter at @csschweiz (https://twitter.com/csschweiz) and @csapac (https://twitter.com/csapac). Investors and others should take care to consider such abbreviated messages in the context of the disclosures from which they are excerpted. The information we post on these social media accounts is not a part of this document.

Information referenced in this document, whether via website links or otherwise, is not incorporated into this document.

Certain material in this document has been prepared by Credit Suisse on the basis of publicly available information, internally developed data and other third-party sources believed to be reliable. Credit Suisse has not sought to independently verify information obtained from public and third-party sources and makes no representations or warranties as to accuracy, completeness or reliability of such information.

In various tables, use of “–” indicates not meaningful or not applicable.

The English language version of this document is the controlling version.

| Key metrics |

| | in / end of | | % change | |

| | 1Q21 | | 4Q20 | | 1Q20 | | QoQ | | YoY | |

| Credit Suisse Group results (CHF million) |

| Net revenues | | 7,574 | | 5,221 | | 5,776 | | 45 | | 31 | |

| Provision for credit losses | | 4,394 | | 138 | | 568 | | – | | �� | |

| Compensation and benefits | | 2,207 | | 2,539 | | 2,316 | | (13) | | (5) | |

| General and administrative expenses | | 1,376 | | 2,279 | | 1,346 | | (40) | | 2 | |

| Commission expenses | | 329 | | 303 | | 345 | | 9 | | (5) | |

| Restructuring expenses | | 25 | | 50 | | – | | (50) | | – | |

| Total other operating expenses | | 1,730 | | 2,632 | | 1,691 | | (34) | | 2 | |

| Total operating expenses | | 3,937 | | 5,171 | | 4,007 | | (24) | | (2) | |

| Income/(loss) before taxes | | (757) | | (88) | | 1,201 | | – | | – | |

| Net income/(loss) attributable to shareholders | | (252) | | (353) | | 1,314 | | (29) | | – | |

| Statement of operations metrics (%) |

| Return on regulatory capital | | (7.6) | | (0.9) | | 11.9 | | – | | – | |

| Balance sheet statistics (CHF million) |

| Total assets | | 851,395 | | 805,822 | | 832,166 | | 6 | | 2 | |

| Risk-weighted assets | | 302,869 | | 275,084 | | 300,580 | | 10 | | 1 | |

| Leverage exposure | | 967,798 | | 799,853 | | 869,706 | | 21 | | 11 | |

| Assets under management and net new assets (CHF billion) |

| Assets under management | | 1,596.0 | | 1,511.9 | | 1,370.5 | | 5.6 | | 16.5 | |

| Net new assets | | 28.4 | | 8.4 | | 5.8 | | 238.1 | | 389.7 | |

| Basel III regulatory capital and leverage statistics (%) |

| CET1 ratio | | 12.2 | | 12.9 | | 12.1 | | – | | – | |

| CET1 leverage ratio | | 3.8 | | 4.4 | | 4.2 | | – | | – | |

| Tier 1 leverage ratio | | 5.5 | | 6.4 | | 5.8 | | – | | – | |

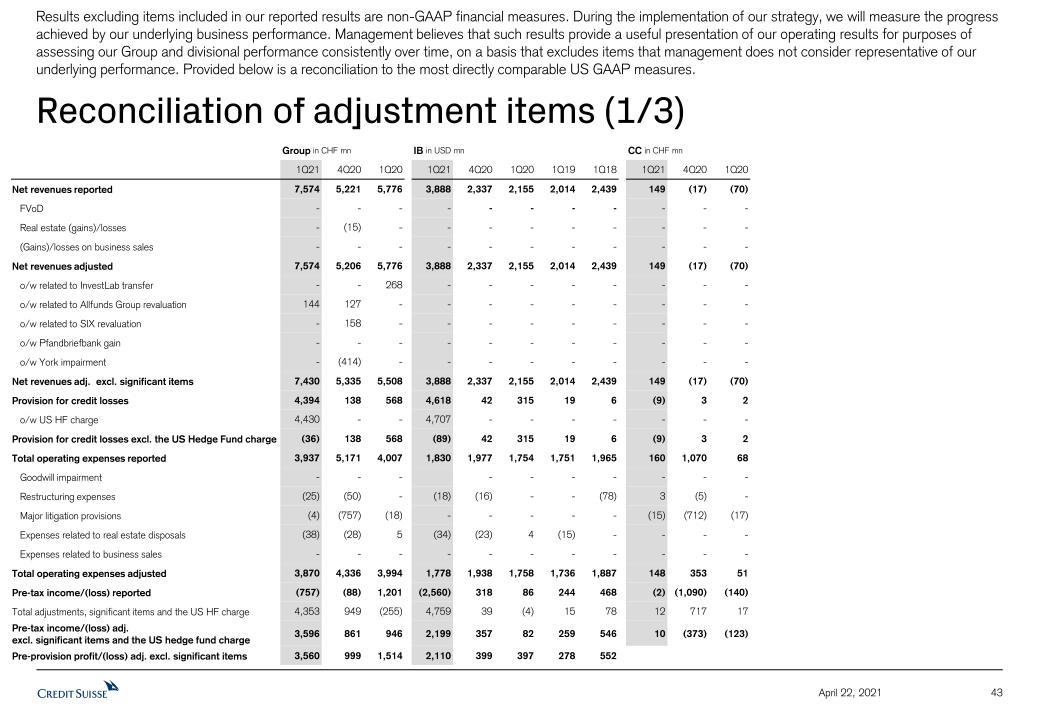

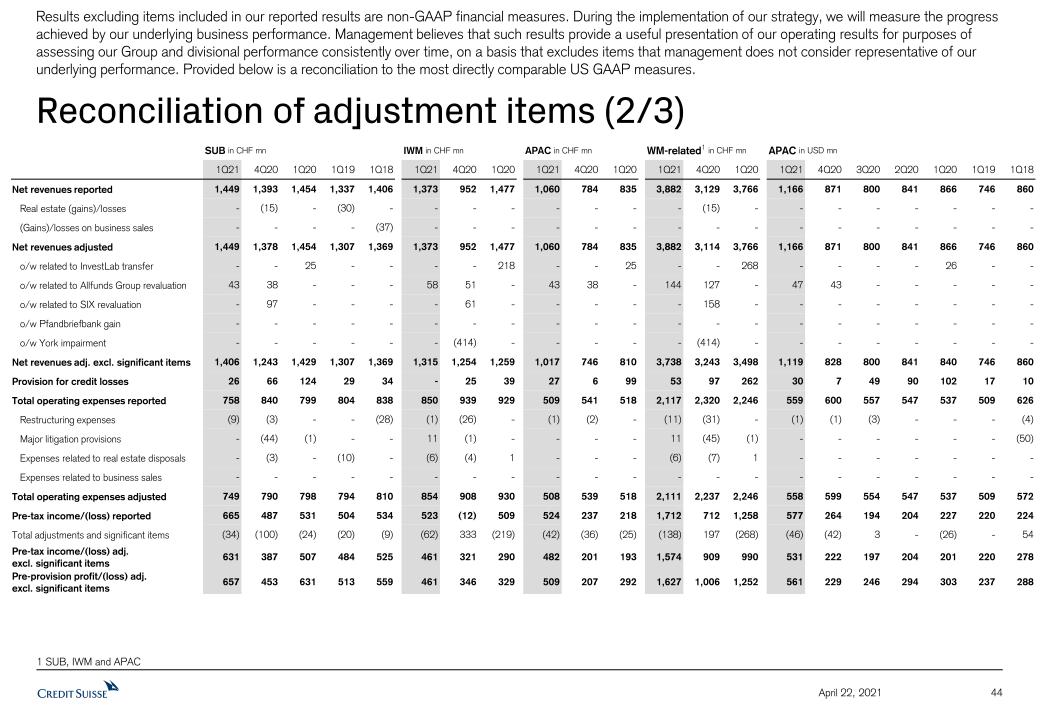

Results excluding certain items included in our reported results are non-GAAP financial measures. Management believes that such results provide a useful presentation of our operating results for purposes of assessing our Group and divisional performance consistently over time, on a basis that excludes items that management does not consider representative of our underlying performance. Provided below is a reconciliation of our adjusted results, our adjusted results excluding significant items and our adjusted results excluding significant items and the US-based hedge fund matter to the most directly comparable US GAAP measures.

| Reconciliation of adjustment items |

| | Group | |

| in | | 1Q21 | | 1Q20 | |

| Credit Suisse (CHF million) |

| Net revenues | | 7,574 | | 5,776 | |

| Significant items | | | | | |

| Gain related to InvestLab transfer | | 0 | | (268) | |

| Gain on equity investment in Allfunds Group | | (144) | | 0 | |

| Adjusted net revenues excluding significant items | | 7,430 | | 5,508 | |

| Provision for credit losses | | 4,394 | | 568 | |

| US-based hedge fund matter | | (4,430) | | 0 | |

| Provision for credit losses excluding the US-based hedge fund matter | | (36) | | 568 | |

| Total operating expenses | | 3,937 | | 4,007 | |

| Restructuring expenses | | (25) | | – | |

| Major litigation provisions | | (4) | | (18) | |

| Expenses related to real estate disposals | | (38) | | 5 | |

| Adjusted total operating expenses | | 3,870 | | 3,994 | |

| Income before taxes | | (757) | | 1,201 | |

| Adjusted income/(loss) before taxes | | (690) | | 1,214 | |

| Adjusted income before taxes excluding significant items | | (834) | | 946 | |

| Adjusted income before taxes excluding significant items and the US-based hedge fund matter | | 3,596 | | 946 | |

| Reconciliation of adjustment items excluding FX impact |

| | Group | |

| in | | 1Q21 | | 1Q20 | |

| Adjusted results excluding significant items and FX impact (CHF million) |

| Adjusted net revenues | | 7,574 | | 5,776 | |

| Significant items | | | | | |

| Gain related to InvestLab transfer | | 0 | | (268) | |

| Gain on equity investment in Allfunds Group | | (144) | | 0 | |

| Adjusted net revenues excluding significant items | | 7,430 | | 6,044 | |

| FX impact | | 243 | | – | |

| Adjusted net revenues excluding FX impact | | 7,673 | | 6,044 | |

| Provision for credit losses | | 4,394 | | 568 | |

| US-based hedge fund matter | | (4,430) | | – | |

| Provision for credit losses excluding the US-based hedge fund matter | | (36) | | 568 | |

| FX impact | | (5) | | – | |

| Provision for credit losses excluding the US-based hedge fund matter and excluding FX impact | | (41) | | 568 | |

| Adjusted operating expenses | | 3,870 | | 3,994 | |

| FX impact | | 113 | | – | |

| Adjusted operating expenses excluding FX impact | | 3,983 | | 3,994 | |

| Adjusted income before taxes | | 3,596 | | 946 | |

| FX impact | | 135 | | – | |

| Adjusted income before taxes excluding significant items, the US-based hedge fund matter and FX impact | | 3,731 | | 946 | |

| Swiss Universal Bank |

| | in / end of | | % change | |

| | 1Q21 | | 4Q20 | | 1Q20 | | QoQ | | YoY | |

| Results (CHF million) |

| Net revenues | | 1,449 | | 1,393 | | 1,454 | | 4 | | 0 | |

| of which Private Clients | | 737 | | 750 | | 769 | | (2) | | (4) | |

| of which Corporate & Institutional Clients | | 712 | | 643 | | 685 | | 11 | | 4 | |

| Provision for credit losses | | 26 | | 66 | | 124 | | (61) | | (79) | |

| Total operating expenses | | 758 | | 840 | | 799 | | (10) | | (5) | |

| Income before taxes | | 665 | | 487 | | 531 | | 37 | | 25 | |

| of which Private Clients | | 281 | | 257 | | 279 | | 9 | | 1 | |

| of which Corporate & Institutional Clients | | 384 | | 230 | | 252 | | 67 | | 52 | |

| Metrics (%) |

| Return on regulatory capital | | 21.2 | | 15.8 | | 17.5 | | – | | – | |

| Cost/income ratio | | 52.3 | | 60.3 | | 55.0 | | – | | – | |

| Private Clients |

| Assets under management (CHF billion) | | 213.1 | | 208.6 | | 194.8 | | 2.2 | | 9.4 | |

| Net new assets (CHF billion) | | 2.2 | | (2.1) | | (4.2) | | – | | – | |

| Gross margin (annualized) (bp) | | 142 | | 146 | | 146 | | – | | – | |

| Net margin (annualized) (bp) | | 54 | | 50 | | 53 | | – | | – | |

| Corporate & Institutional Clients |

| Assets under management (CHF billion) | | 487.0 | | 462.6 | | 405.3 | | 5.3 | | 20.2 | |

| Net new assets (CHF billion) | | 3.9 | | 3.8 | | 4.8 | | – | | – | |

| Reconciliation of adjustment items |

| | Swiss Universal Bank | |

| in | | 1Q21 | | 1Q20 | |

| Adjusted results excluding significant items (CHF million) |

| Net revenues | | 1,449 | | 1,454 | |

| Significant items | | | | | |

| Gain related to InvestLab transfer | | 0 | | (25) | |

| Gain on equity investment in Allfunds Group | | (43) | | 0 | |

| Adjusted net revenues excluding significant items | | 1,406 | | 1,429 | |

| Provision for credit losses | | 26 | | 124 | |

| Total operating expenses | | 758 | | 799 | |

| Restructuring expenses | | (9) | | – | |

| Major litigation provisions | | 0 | | (1) | |

| Adjusted total operating expenses | | 749 | | 798 | |

| Income before taxes | | 665 | | 531 | |

| Adjusted income before taxes | | 674 | | 532 | |

| Adjusted income before taxes excluding significant items | | 631 | | 507 | |

| Reconciliation of adjustment items |

| | Swiss Universal Bank –

Private Clients | |

| in | | 1Q21 | | 1Q20 | |

| Adjusted results excluding significant items (CHF million) |

| Net revenues | | 737 | | 769 | |

| Provision for credit losses | | 5 | | 12 | |

| Total operating expenses | | 451 | | 478 | |

| Restructuring expenses | | (5) | | – | |

| Adjusted total operating expenses | | 446 | | 478 | |

| Income before taxes | | 281 | | 279 | |

| Adjusted income before taxes | | 286 | | 279 | |

| Adjusted income before taxes excluding significant items | | 286 | | 279 | |

| Reconciliation of adjustment items |

| | Swiss Universal Bank –

Corporate &

Institutional Clients | |

| in | | 1Q21 | | 1Q20 | |

| Adjusted results excluding significant items (CHF million) |

| Net revenues | | 712 | | 685 | |

| Significant items | | | | | |

| Gain related to InvestLab transfer | | 0 | | (25) | |

| Gain on equity investment in Allfunds Group | | (43) | | 0 | |

| Adjusted net revenues excluding significant items | | 669 | | 660 | |

| Provision for credit losses | | 21 | | 112 | |

| Total operating expenses | | 307 | | 321 | |

| Restructuring expenses | | (4) | | – | |

| Major litigation provisions | | 0 | | (1) | |

| Adjusted total operating expenses | | 303 | | 320 | |

| Income before taxes | | 384 | | 252 | |

| Adjusted income before taxes | | 388 | | 253 | |

| Adjusted income before taxes excluding significant items | | 345 | | 228 | |

| International Wealth Management |

| | in / end of | | % change | |

| | 1Q21 | | 4Q20 | | 1Q20 | | QoQ | | YoY | |

| Results (CHF million) |

| Net revenues | | 1,373 | | 952 | | 1,477 | | 44 | | (7) | |

| of which Private Banking | | 987 | | 974 | | 1,032 | | 1 | | (4) | |

| of which Asset Management | | 386 | | (22) | | 445 | | – | | (13) | |

| Provision for credit losses | | 0 | | 25 | | 39 | | (100) | | (100) | |

| Total operating expenses | | 850 | | 939 | | 929 | | (9) | | (9) | |

| Income/(loss) before taxes | | 523 | | (12) | | 509 | | – | | 3 | |

| of which Private Banking | | 408 | | 293 | | 345 | | 39 | | 18 | |

| of which Asset Management | | 115 | | (305) | | 164 | | – | | (30) | |

| Metrics (%) |

| Return on regulatory capital | | 38.6 | | (0.9) | | 38.7 | | – | | – | |

| Cost/income ratio | | 61.9 | | 98.6 | | 62.9 | | – | | – | |

| Private Banking |

| Assets under management (CHF billion) | | 386.2 | | 365.4 | | 327.7 | | 5.7 | | 17.9 | |

| Net new assets (CHF billion) | | 7.2 | | 4.3 | | 3.7 | | – | | – | |

| Gross margin (annualized) (bp) | | 105 | | 109 | | 115 | | – | | – | |

| Net margin (annualized) (bp) | | 44 | | 33 | | 39 | | – | | – | |

| Asset Management |

| Assets under management (CHF billion) | | 458.0 | | 440.3 | | 409.6 | | 4.0 | | 11.8 | |

| Net new assets (CHF billion) | | 10.3 | | 6.3 | | 0.1 | | – | | – | |

| Reconciliation of adjustment items |

| | International

Wealth

Management | |

| in | | 1Q21 | | 1Q20 | |

| Adjusted results excluding significant items (CHF million) |

| Net revenues | | 1,373 | | 1,477 | |

| Significant items | | | | | |

| Gain related to InvestLab transfer | | 0 | | (218) | |

| Gain on equity investment in Allfunds Group | | (58) | | 0 | |

| Adjusted net revenues excluding significant items | | 1,315 | | 1,259 | |

| Provision for credit losses | | 0 | | 39 | |

| Total operating expenses | | 850 | | 929 | |

| Restructuring expenses | | (1) | | – | |

| Major litigation provisions | | 11 | | 0 | |

| Expenses related to real estate disposals | | (6) | | 1 | |

| Adjusted total operating expenses | | 854 | | 930 | |

| Income/(loss) before taxes | | 523 | | 509 | |

| Adjusted income before taxes | | 519 | | 508 | |

| Adjusted income before taxes income excluding significant items | | 461 | | 290 | |

| Reconciliation of adjustment items |

| | International

Wealth Management –

Private Banking | |

| in | | 1Q21 | | 1Q20 | |

| Adjusted results excluding significant items (CHF million) |

| Net revenues | | 987 | | 1,032 | |

| Significant items | | | | | |

| Gain related to InvestLab transfer | | 0 | | (15) | |

| Gain on equity investment in Allfunds Group | | (58) | | 0 | |

| Adjusted net revenues excluding significant items | | 929 | | 1,017 | |

| Provision for credit losses | | 0 | | 39 | |

| Total operating expenses | | 579 | | 648 | |

| Major litigation provisions | | 11 | | 0 | |

| Expenses related to real estate disposals | | (5) | | 1 | |

| Adjusted total operating expenses | | 585 | | 649 | |

| Income before taxes | | 408 | | 345 | |

| Adjusted income before taxes | | 402 | | 344 | |

| Adjusted income before taxes income excluding significant items | | 344 | | 329 | |

| Reconciliation of adjustment items |

| | International

Wealth Management –

Asset Management | |

| in | | 1Q21 | | 1Q20 | |

| Adjusted results excluding significant items (CHF million) |

| Net revenues | | 386 | | 445 | |

| Significant items | | | | | |

| Gain related to InvestLab transfer | | 0 | | (203) | |

| Adjusted net revenues excluding significant items | | 386 | | 242 | |

| Provision for credit losses | | 0 | | 0 | |

| Total operating expenses | | 271 | | 281 | |

| Restructuring expenses | | (1) | | – | |

| Expenses related to real estate disposals | | (1) | | 0 | |

| Adjusted total operating expenses | | 269 | | 281 | |

| Income/(loss) before taxes | | 115 | | 164 | |

| Adjusted income before taxes | | 117 | | 164 | |

| Adjusted income/(loss) before taxes income excluding significant items | | 117 | | (39) | |

| Asia Pacific |

| | in / end of | | % change | |

| | 1Q21 | | 4Q20 | | 1Q20 | | QoQ | | YoY | |

| Results (CHF million) |

| Net revenues | | 1,060 | | 784 | | 835 | | 35 | | 27 | |

| Provision for credit losses | | 27 | | 6 | | 99 | | 350 | | (73) | |

| Total operating expenses | | 509 | | 541 | | 518 | | (6) | | (2) | |

| Income before taxes | | 524 | | 237 | | 218 | | 121 | | 140 | |

| Metrics (%) |

| Return on regulatory capital | | 56.3 | | 27.0 | | 21.7 | | – | | – | |

| Cost/income ratio | | 48.0 | | 69.0 | | 62.0 | | – | | – | |

| Assets under management (CHF billion) | | 241.9 | | 221.3 | | 197.0 | | 9.3 | | 22.8 | |

| Net new assets (CHF billion) | | 5.0 | | (1.1) | | 3.0 | | – | | – | |

| Gross margin (annualized) (bp) | | 184 | | 141 | | 156 | | – | | – | |

| Net margin (annualized) (bp) | | 91 | | 43 | | 41 | | – | | – | |

| Asia Pacific |

| | in / end of | | % change | |

| | 1Q21 | | 4Q20 | | 1Q20 | | QoQ | | YoY | |

| Results (USD million) |

| Net revenues | | 1,166 | | 871 | | 866 | | 34 | | 35 | |

| Provision for credit losses | | 30 | | 7 | | 102 | | 329 | | (71) | |

| Total operating expenses | | 559 | | 600 | | 537 | | (7) | | 4 | |

| Income before taxes | | 577 | | 264 | | 227 | | 119 | | 154 | |

| Reconciliation of adjustment items |

| | Asia Pacific | |

| in | | 1Q21 | | 1Q20 | |

| Adjusted results excluding significant items (USD million) |

| Net revenues | | 1,166 | | 866 | |

| Significant items | | | | | |

| Gain related to InvestLab transfer | | 0 | | (26) | |

| Gain on equity investment in Allfunds Groups | | (47) | | 0 | |

| Adjusted net revenues excluding significant items | | 1,119 | | 840 | |

| Provision for credit losses | | 30 | | 102 | |

| Total operating expenses | | 559 | | 537 | |

| Restructuring expenses | | (1) | | – | |

| Adjusted total operating expenses | | 558 | | 537 | |

| Income before taxes | | 577 | | 227 | |

| Adjusted income before taxes | | 578 | | 227 | |

| Adjusted income before taxes excluding significant items | | 531 | | 201 | |

| Reconciliation of adjustment items |

| | Wealth

Management-

related | |

| in | | 1Q21 | | 1Q20 | |

| Adjusted results excluding significant items (CHF million) |

| Net revenues | | 3,882 | | 3,766 | |

| Significant items | | | | | |

| Gain related to InvestLab transfer | | 0 | | (268) | |

| Gain on equity investment in Allfunds Group | | (144) | | 0 | |

| Adjusted net revenues excluding significant items | | 3,738 | | 3,498 | |

| Provision for credit losses | | 53 | | 262 | |

| Total operating expenses | | 2,117 | | 2,246 | |

| Restructuring expenses | | (11) | | – | |

| Major litigation provisions | | 11 | | (1) | |

| Expenses related to real estate disposals | | (6) | | 1 | |

| Adjusted total operating expenses | | 2,111 | | 2,246 | |

| Income before taxes | | 1,712 | | 1,258 | |

| Adjusted income before taxes | | 1,718 | | 1,258 | |

| Adjusted income before taxes excluding significant items | | 1,574 | | 990 | |

| Investment Bank |

| | in / end of | | % change | |

| | 1Q21 | | 4Q20 | | 1Q20 | | QoQ | | YoY | |

| Results (CHF million) |

| Net revenues | | 3,543 | | 2,109 | | 2,080 | | 68 | | 70 | |

| Provision for credit losses | | 4,350 | | 38 | | 304 | | – | | – | |

| Total operating expenses | | 1,660 | | 1,781 | | 1,693 | | (7) | | (2) | |

| Income/(loss) before taxes | | (2,467) | | 290 | | 83 | | – | | – | |

| Metrics (%) |

| Return on regulatory capital | | (69.2) | | 8.8 | | 2.3 | | – | | – | |

| Cost/income ratio | | 46.9 | | 84.4 | | 81.4 | | – | | – | |

| Results (USD million) |

| Net revenues | | 3,888 | | 2,337 | | 2,155 | | 66 | | 80 | |

| Provision for credit losses | | 4,618 | | 42 | | 315 | | – | | – | |

| Total operating expenses | | 1,830 | | 1,977 | | 1,754 | | (7) | | 4 | |

| Income/(loss) before taxes | | (2,560) | | 318 | | 86 | | – | | – | |

| Reconciliation of adjustment items |

| | Investment Bank | |

| in | | 1Q21 | | 1Q20 | |

| Adjusted results (USD million) |

| Net revenues | | 3,888 | | 2,155 | |

| Provision for credit losses | | 4,618 | | 315 | |

| US-based hedge fund matter | | (4,707) | | 0 | |

| Provision for credit losses excluding the US-based hedge fund matter | | (89) | | 315 | |

| Total operating expenses | | 1,830 | | 1,754 | |

| Restructuring expenses | | (18) | | – | |

| Expenses related to real estate disposals | | (34) | | 4 | |

| Adjusted total operating expenses | | 1,778 | | 1,758 | |

| Income before taxes | | (2,560) | | 86 | |

| Adjusted income before taxes | | (2,508) | | 82 | |

| Adjusted income before taxes excluding the US-based hedge fund matter | | 2,199 | | 82 | |

| Net revenue detail |

| in | | 1Q21 | | 1Q20 | |

| Net revenue detail (USD million) |

| Fixed income sales and trading | | 1,569 | | 1,220 | |

| Equity sales and trading | | 988 | | 805 | |

| Capital markets | | 1,189 | | 63 | |

| Advisory and other fees | | 214 | | 144 | |

| Other revenues | | (72) | | (77) | |

| Net revenues | | 3,888 | | 2,155 | |

| Global investment banking revenues |

| in | | 1Q21 | | 1Q20 | |

| Global investment banking revenues (USD million) |

| Fixed income sales and trading | | 1,569 | | 1,220 | |

| Equity sales and trading | | 988 | | 805 | |

| Capital markets | | 1,295 | | 127 | |

| Advisory and other fees | | 267 | | 177 | |

| Other revenues | | (72) | | (77) | |

| Global investment banking revenues | | 4,047 | | 2,252 | |

Cautionary statement regarding forward-looking information

This document contains statements that constitute forward-looking statements. In addition, in the future we, and others on our behalf, may make statements that constitute forward-looking statements. Such forward-looking statements may include, without limitation, statements relating to the following:

■ our plans, targets or goals;

■ our future economic performance or prospects;

■ the potential effect on our future performance of certain contingencies; and

■ assumptions underlying any such statements.

Words such as “believes,” “anticipates,” “expects,” “intends” and “plans” and similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. We do not intend to update these forward-looking statements.

By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific, and risks exist that predictions, forecasts, projections and other outcomes described or implied in forward-looking statements will not be achieved. We caution you that a number of important factors could cause results to differ materially from the plans, targets, goals, expectations, estimates and intentions expressed in such forward-looking statements and that the COVID-19 pandemic creates significantly greater uncertainty about forward-looking statements in addition to the factors that generally affect our business. These factors include:

■ the ability to maintain sufficient liquidity and access capital markets;

■ market volatility and interest rate fluctuations and developments affecting interest rate levels, including the persistence of a low or negative interest rate environment;

■ the strength of the global economy in general and the strength of the economies of the countries in which we conduct our operations, in particular the risk of negative impacts of COVID-19 on the global economy and financial markets and the risk of continued slow economic recovery or downturn in the EU, the US or other developed countries or in emerging markets in 2021 and beyond;

■ the emergence of widespread health emergencies, infectious diseases or pandemics, such as COVID-19, and the actions that may be taken by governmental authorities to contain the outbreak or to counter its impact;

■ potential risks and uncertainties relating to the severity of impacts from COVID-19 and the duration of the pandemic, including potential material adverse effects on our business, financial condition and results of operations;

■ the direct and indirect impacts of deterioration or slow recovery in residential and commercial real estate markets;

■ adverse rating actions by credit rating agencies in respect of us, sovereign issuers, structured credit products or other credit-related exposures;

■ the ability to achieve our strategic goals, including those related to our targets, ambitions and financial goals;

■ the ability of counterparties to meet their obligations to us and the adequacy of our allowance for credit losses;

■ the effects of, and changes in, fiscal, monetary, exchange rate, trade and tax policies;

■ the effects of currency fluctuations, including the related impact on our business, financial condition and results of operations due to moves in foreign exchange rates;

■ political, social and environmental developments, including war, civil unrest or terrorist activity and climate change;

■ the ability to appropriately address social, environmental and sustainability concerns that may arise from our business activities;

■ the effects of, and the uncertainty arising from, the UK’s withdrawal from the EU;

■ the possibility of foreign exchange controls, expropriation, nationalization or confiscation of assets in countries in which we conduct our operations;

■ operational factors such as systems failure, human error, or the failure to implement procedures properly;

■ the risk of cyber attacks, information or security breaches or technology failures on our reputation, business or operations, the risk of which is increased while large portions of our employees work remotely;

■ the adverse resolution of litigation, regulatory proceedings and other contingencies;

■ actions taken by regulators with respect to our business and practices and possible resulting changes to our business organization, practices and policies in countries in which we conduct our operations;

■ the effects of changes in laws, regulations or accounting or tax standards, policies or practices in countries in which we conduct our operations;

■ the expected discontinuation of LIBOR and other interbank offered rates and the transition to alternative reference rates;

■ the potential effects of changes in our legal entity structure;

■ competition or changes in our competitive position in geographic and business areas in which we conduct our operations;

■ the ability to retain and recruit qualified personnel;

■ the ability to maintain our reputation and promote our brand;

■ the ability to increase market share and control expenses;

■ technological changes instituted by us, our counterparties or competitors;

■ the timely development and acceptance of our new products and services and the perceived overall value of these products and services by users;

■ acquisitions, including the ability to integrate acquired businesses successfully, and divestitures, including the ability to sell non-core assets; and

■ other unforeseen or unexpected events and our success at managing these and the risks involved in the foregoing.

We caution you that the foregoing list of important factors is not exclusive. When evaluating forward-looking statements, you should carefully consider the foregoing factors and other uncertainties and events, including the information set forth in “Risk factors” in I – Information on the company in our Annual Report 2020 and in “Risk factor” in Credit Suisse in our 1Q21 Earnings Release.

Thomas Gottstein, Chief Executive OfficerDavid Mathers, Chief Financial OfficerApril 22, 2021 Credit SuisseFirst Quarter 2021 ResultsAnalyst and Investor Call

Disclaimer (1/2) 2 April 22, 2021 Credit Suisse has not finalized its 1Q21 Financial Report and Credit Suisse's independent registered public accounting firm has not completed its review of the condensed consolidated financial statements for the period. Accordingly, the financial information contained in this presentation is subject to completion of quarter-end procedures, which may result in changes to that information.This material does not purport to contain all of the information that you may wish to consider. This material is not to be relied upon as such or used in substitution for the exercise of independent judgment. Cautionary statement regarding forward-looking statements This presentation contains forward-looking statements that involve inherent risks and uncertainties, and we might not be able to achieve the predictions, forecasts, projections and other outcomes we describe or imply in forward-looking statements. A number of important factors could cause results to differ materially from the plans, targets, goals, expectations, estimates and intentions we express in these forward-looking statements, including those we identify in "Risk factors” in our Annual Report on Form 20-F for the fiscal year ended December 31, 2020 and “Credit Suisse – Risk factor” and the “Cautionary statement regarding forward-looking information" in our 1Q21 Earnings Release published on April 22, 2021 and filed with the US Securities and Exchange Commission, and in other public filings and press releases. We do not intend to update these forward-looking statements. In particular, the terms “Estimate”, “Illustrative”, “Ambition”, “Objective”, “Outlook” and “Goal” are not intended to be viewed as targets or projections, nor are they considered to be Key Performance Indicators. All such estimates, illustrations, ambitions, objectives, outlooks and goals are subject to a large number of inherent risks, assumptions and uncertainties, many of which are completely outside of our control. These risks, assumptions and uncertainties include, but are not limited to, general market conditions, market volatility, interest rate volatility and levels, global and regional economic conditions, challenges and uncertainties resulting from the COVID-19 pandemic, political uncertainty, changes in tax policies, regulatory changes, changes in levels of client activity as a result of any of the foregoing and other factors. Accordingly, this information should not be relied on for any purpose. We do not intend to update these estimates, illustrations, ambitions, objectives, outlooks or goals. We may not achieve the benefits of our strategic initiativesWe may not achieve all of the expected benefits of our strategic initiatives. Factors beyond our control, including but not limited to the market and economic conditions (including macroeconomic and other challenges and uncertainties, for example, resulting from the COVID-19 pandemic), changes in laws, rules or regulations and other challenges discussed in our public filings, could limit our ability to achieve some or all of the expected benefits of these initiatives. Estimates and assumptionsIn preparing this presentation, management has made estimates and assumptions that affect the numbers presented. Actual results may differ. Annualized numbers do not take into account variations in operating results, seasonality and other factors and may not be indicative of actual, full-year results. Figures throughout this presentation may also be subject to rounding adjustments. All opinions and views constitute judgments as of the date of writing without regard to the date on which the reader may receive or access the information. This information is subject to change at any time without notice and we do not intend to update this information.RestatementAs of 3Q20, financial information reflects the new divisional reporting structure and management responsibilities announced on July 30, 2020 and updates to certain calculations and allocations. Prior periods have been restated to conform to the current presentation. In light of the restructuring announced on July 30, 2020 and several significant items impacting results in prior periods, we intend to focus on adjusted numbers, excluding significant items in our discussion of results until the restructuring is completed.

Disclaimer (2/2) 3 April 22, 2021 Statement regarding non-GAAP financial measuresThis presentation contains non-GAAP financial measures, including results excluding certain items included in our reported results as well as return on regulatory capital and return on tangible equity and tangible book value per share (which are both based on tangible shareholders’ equity). Further details and information needed to reconcile such non-GAAP financial measures to the most directly comparable measures under US GAAP can be found in this presentation in the Appendix, which is available on our website at www.credit-suisse.com.Our estimates, ambitions, objectives and targets often include metrics that are non-GAAP financial measures and are unaudited. A reconciliation of the estimates, ambitions, objectives and targets to the nearest GAAP measures is unavailable without unreasonable efforts. Results excluding certain items included in our reported results do not include items such as goodwill impairment, major litigation provisions, real estate gains, impacts from foreign exchange and other revenue and expense items included in our reported results, all of which are unavailable on a prospective basis. Return on tangible equity is based on tangible shareholders’ equity, a non-GAAP financial measure also known as tangible book value, which is calculated by deducting goodwill and other intangible assets from total shareholders’ equity as presented in our balance sheet, both of which are unavailable on a prospective basis. Return on regulatory capital (a non-GAAP financial measure) is calculated using income / (loss) after tax and assumes a tax rate of 25% and capital allocated based on the average of 10% of RWA and 3.5% of leverage exposure; the essential components of this calculation are unavailable on a prospective basis. Such estimates, ambitions, objectives and targets are calculated in a manner that is consistent with the accounting policies applied by us in preparing our financial statements.Statement regarding capital, liquidity and leverageCredit Suisse is subject to the Basel III framework, as implemented in Switzerland, as well as Swiss legislation and regulations for systemically important banks, which include capital, liquidity, leverage and large exposure requirements and rules for emergency plans designed to maintain systemically relevant functions in the event of threatened insolvency. Credit Suisse has adopted the Bank for International Settlements (BIS) leverage ratio framework, as issued by the Basel Committee on Banking Supervision (BCBS) and implemented in Switzerland by the Swiss Financial Market Supervisory Authority FINMA.Unless otherwise noted, leverage exposure is based on the BIS leverage ratio framework and consists of period-end balance sheet assets and prescribed regulatory adjustments. The tier 1 leverage ratio and CET1 leverage ratio are calculated as BIS tier 1 capital and CET1 capital, respectively, divided by period-end leverage exposure. Swiss leverage ratios are measured on the same period-end basis as the leverage exposure for the BIS leverage ratio.SourcesCertain material in this presentation has been prepared by Credit Suisse on the basis of publicly available information, internally developed data and other third-party sources believed to be reliable. Credit Suisse has not sought to independently verify information obtained from public and third-party sources and makes no representations or warranties as to accuracy, completeness or reliability of such information.Mandatory Convertible NotesThese materials are not an offer to sell securities or the solicitation of any offer to buy securities, nor shall there be any offer of securities, in any jurisdiction in which such offer or sale would be unlawful.These materials are not an offer of securities for sale in the United States or to U.S. persons (“U.S. persons”) as defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act”). The mandatory convertible notes described in these materials and the shares of Credit Suisse Group AG issuable on their conversion have not been and will not be registered under the U.S. Securities Act and may not be offered or sold in the United States or to, or for the account or benefit of, U.S. persons, absent registration or an applicable exemption from registration under the U.S. Securities Act.