SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

FORM 20-F

(Mark One)

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended March 31, 2008 |

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| Date of event requiring this shell company report _____________________ |

| For the transition period from ______ to _____ |

Commission file number 1-15252

Mahanagar Telephone Nigam Limited

(Exact name of Registrant as specified in its charter)

N/A (Translation of Registrant’s name into English) | The Republic of India (Jurisdiction of incorporation or organization) |

12th Floor, Jeevan Bharati Tower-1

124 Connaught Circus

New Delhi 110001

India

(Address of principal executive offices)

Smt Anita Soni, Director Finance, 91-11-2332-1095, dirfinco@bol.net.in

Jeevan Bharati Building, Tower I, 124 Connaught Circus, New Delhi 110001, India

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contract Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

American Depositary Shares, each representing two equity shares. Equity Shares (Not for trading, but only in connection with the registration of the American Depositary Shares) | New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

630,000,000 Equity Shares

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act of 1933, or the Securities Act. YES o NO x

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. YES o NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | x | Accelerated filer | ¨ | Non-accelerated filer | ¨ |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP | x | International Financial Reporting Standards as issued by the International Accounting Standards Board | ¨ | Other | ¨ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

Item 17 o Item 18 o

If this report is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) YES o NO x

TABLE OF CONTENTS

Page

| iii | ||

| iii | ||

| 1 | ||

| 1 | ||

| 1 | ||

| 1 | ||

| 3 | ||

| 4 | ||

| 10 | ||

| 10 | ||

| 20 | ||

| 32 | ||

| 36 | ||

| 36 | ||

| 40 | ||

| 49 | ||

| 49 | ||

| 49 | ||

| 63 | ||

| 65 | ||

| 65 | ||

| 68 | ||

| 68 | ||

| 70 | ||

| 70 | ||

| 70 | ||

| 70 | ||

| 71 | ||

| 72 | ||

| 72 | ||

| 73 | ||

| 73 | ||

| 73 | ||

| 75 | ||

| 81 | ||

| 81 | ||

| 86 | ||

| 86 | ||

| 89 | ||

| 93 | ||

| 93 | ||

| 94 | ||

| 95 | ||

| 95 | ||

| 95 | ||

| 95 | ||

| 99 | ||

| 99 | ||

| 99 | ||

| 99 | ||

| 100 | ||

| 101 | ||

| 101 | ||

| 101 | ||

| 101 | ||

| 102 | ||

PRESENTATION OF FINANCIAL INFORMATION

The financial information in this report has been prepared in accordance with US GAAP with respect to our consolidated statements of operations, shareholders’ equity and cash flow for the fiscal years ended March 31, 2006, 2007 and 2008, and our balance sheets as of March 31, 2007 and 2008. Our fiscal year ends on March 31 of each year, so all references to a particular fiscal year are to the year ended March 31 of that year. The consolidated financial statements, including the notes to those financial statements, are set forth at the end of this report.

Although we have translated in this report certain rupee amounts into dollars for convenience, this does not mean that the rupee amounts referred could have been, or could be, converted into dollars at any particular rate, the rates stated below, or at all. All translations from rupees to dollars with respect to financial data as of March 31, 2008 are based on the noon buying rate in the City of New York for cable transfers in rupees on such date. The Federal Reserve Bank of New York certifies this rate for customs purposes on each date the rate is given. The noon buying rate on March 31, 2008 was Rs. 40.02 per US$1.00.

Information contained in our website, www.mtnl.net.in, is not part of this annual report, and no portion of such information is incorporated herein.

Reference to “we,” “us,” “our,” “MTNL,” and the “Company” refer to Mahanagar Telephone Nigam Limited.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains “forward-looking statements”, as defined in Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended, that are based on our current expectations, assumptions, estimates and projections about our company and our industry. The forward-looking statements are subject to various risks and uncertainties. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as “may,” “will,” “will likely result,” “believe,” “expect,” “will continue,” “anticipate,” “estimate,” “intend,” “plan,” “contemplate,” “seek to,” “future,” “objective,” “goal,” “project,” “should,” and similar expressions or variations of these expressions. We caution you that reliance on any forward-looking statement involves risks and uncertainties, and that although we believe that the assumptions on which our forward-looking statements are based are reasonable, any of those assumptions could prove to be inaccurate, and, as a result, the forward-looking statements based on those assumptions could be incorrect. The uncertainties in this regard include, but are not limited to, those identified in the risk factors discussed elsewhere in this report. See Item 3D. “Key Information—Risk Factors” and Item 5 “Operating and Financial Review and Prospects.” In light of these and other uncertainties, you should not conclude that we will necessarily achieve any plans and objectives or projected financial results referred to in any of the forward-looking statements. We do not undertake to release the results of any revisions of these forward-looking statements to reflect future events or circumstances.

PART I

| Identity of Directors, Senior Management and Advisers |

Not applicable.

| Offer Statistics and Expected Timetable |

Not applicable.

| Key Information |

| 3A. | Selected Financial Data |

SELECTED FINANCIAL AND OPERATING DATA

You should read the following selected financial and operating data in conjunction with our consolidated financial statements and the related notes, and Item 5 “Operating and Financial Review and Prospects” and the other financial information included elsewhere in this report and our other reports filed with the SEC.

Our selected financial and operating data included in this report are presented in Indian rupees and are derived from our consolidated financial statements prepared in accordance with generally accepted accounting principles in the United States of America (US GAAP) for the fiscal years ended March 31, 2004, 2005, 2006, 2007 and 2008.

The selected statement of operations data and cash flow data for the three years ended March 31, 2008, and the selected balance sheet data as of March 31, 2007 and 2008 under US GAAP have been extracted or derived from our consolidated audited US GAAP financial statements which are included elsewhere in this report. The selected statement of operations data and cash flow data for the years ended March 31, 2004 and 2005, and the selected balance sheet data as of March 31, 2004, 2005 and 2006 under US GAAP are derived from our consolidated audited US GAAP financial statements not included in this report. Our historical results do not necessarily indicate our results expected for any future period. You should read the following information in conjunction with “Item 5. Operating and Financial Review and Prospects,” and our consolidated financial statements included elsewhere in this report.

Consolidated financial statements for the year ended March 31, 2008 have been translated for convenience into US dollars (although we have translated certain rupee amounts in this report into US dollars for convenience, this does not mean that the rupee amounts referred to could have been, or could be, converted into US dollars at any particular rate, the rates stated below, or at all). All translations from rupees to dollars with respect to financial data as of March 31, 2008 are based on the noon buying rate in the City of New York for cable transfers in rupees on such date. The Federal Reserve Bank of New York certifies this rate for customs purposes on each date the rate is given. The noon buying rate on March 31, 2008 was Rs. 40.02 per US$1.00.

Under US GAAP

| Fiscal Years Ended March 31, | ||||||

| 2004 | 2005 | 2006 | 2007 | 2008 | 2008 | |

| Statement of Income Data | (Rs. in millions except per share data) | Convenience translation into millions of US$ (Unaudited) | ||||

| Revenues | Rs.61,084 | Rs.50,156 | Rs.46,668 | Rs.45,475 | Rs.44,705 | $1,117 |

| Total costs and expense | (55,850) | (47,229) | (47,480) | (48,927) | (47,027) | (1,175) |

| Liability for post retirement medical benefits written back | 0 | 0 | 0 | 5,794 | 0 | 0 |

| Operating income | 5,234 | 2,927 | (812) | 2,342 | (2,323) | (58) |

| Other income / (expense), net | 1,714 | 2,670 | 2,388 | 7,894 | 4,661 | 116 |

| Income before income taxes | 6,948 | 5,597 | 1,576 | 10,236 | 2,338 | 58 |

| Income taxes | (2,570) | (2,124) | (437) | 1,073 | 121 | 3 |

| Equity in (losses) of affiliate | (20) | (67) | (73) | (7) | (1) | (0) |

| Net Income | Rs.4,358 | Rs.3,406 | Rs.1,066 | Rs.11,302 | Rs.2,458 | $ 61 |

| Weighted average equity shares outstanding | 630 | 630 | 630 | 630 | 630 | – |

| EPS – Basic & diluted | Rs.6.92 | Rs.5.41 | Rs.1.69 | Rs.17.94 | Rs.3.90 | $0.10 |

| Basic and diluted earnings per GDR/ADS | Rs.13.84 | Rs.10.82 | Rs.3.38 | Rs.35.88 | Rs.7.80 | $0.20 |

| Dividends paid per equity share | Rs.4.5 | Rs.6.5 | Rs.6.21 | Rs.4.56 | Rs.4.68 | $0.12 |

| Dividends paid per equity share | $0.10 | $0.15 | $0.14 | $0.11 | $0.12 | – |

| Dividends paid per GDR/ADS | Rs.9.0 | Rs.13.0 | Rs.12.42 | Rs.9.12 | Rs.9.37 | $0.23 |

| Dividends paid per GDR/ADS | $0.20 | $0.30 | $0.28 | $0.21 | $0.23 | – |

| As at March 31, | ||||||

| 2004 | 2005 | 2006 | 2007 | 2008 | 2008 | |

| Balance Sheet Data | (Rs. in millions except per share data) | Convenience translation into millions of US$ (Unaudited) | ||||

| Cash and Cash equivalents | Rs.9,891 | Rs.7,561 | Rs.1,641 | Rs.1,660 | Rs.1,346 | $ 34 |

| Investment in bank deposits | 15,654 | 17,732 | 19,020 | 17,102 | 32,444 | 811 |

| Dues from Related Parties | 23,588 | 27,789 | 23,818 | 23,659 | 25,713 | 643 |

| Total Assets | 168,023 | 177,172 | 170,151 | 178,937 | 193,547 | 4,836 |

| Dues to Related Parties | 12,084 | 11,339 | 6,091 | 5,729 | 8,118 | 203 |

| Total Liabilities | 83,466 | 93,839 | 89,703 | 90,060 | 105,160 | 2,628 |

| Total Shareholders equity | 84,557 | 83,333 | 80,448 | 88,877 | 88,387 | 2,209 |

Capital Stock1 | 12,949 | 12,949 | 12,949 | 12,949 | 12,949 | 324 |

| Fiscal Years Ended March 31, | ||||||

| 2004 | 2005 | 2006 | 2007 | 2008 | 2008 | |

| Cash flow data: | (Rs. in millions except per share data) | Convenience translation into millions of US$ (Unaudited) | ||||

| Net cash from operating activities | Rs.19,885 | Rs.15,006 | Rs.6,006 | Rs.9,672 | Rs.27,640 | $ 691 |

| Net cash used in investing activities | Rs.(16,706) | Rs.(12,706) | Rs.(7,976) | Rs.(6,780) | Rs.(25,006) | (625) |

| Net cash from financing activities | Rs. (3,198) | Rs. (4,630) | Rs.(3,951) | Rs.(2,873) | Rs.(2,948) | (74) |

1 Includes capital stock and additional paid-in capital.

EXCHANGE RATES

Fluctuations in the exchange rate between the Indian rupee and the U.S. dollar will affect the U.S. dollar equivalent of the Indian rupee price of our equity shares on the Indian Stock Exchanges and, as a result, will likely affect the market price of the American Depository Shares, or ADSs, in the United States, and vice versa. Such fluctuations will also affect the U.S. dollar conversion by the depositary of any cash dividends paid in Indian rupees on our equity shares represented by the ADSs.

The following table sets forth, for the fiscal years indicated, information concerning the number of Indian rupees for which one US dollar would be exchanged based on the noon buying rate in the City of New York for cable transfers of Indian rupees, as certified for customs purposes by the Federal Reserve Bank of New York.

| Fiscal Year Ended March 31, | At end of period | Average rate (1) | High | Low |

| 2004 | 43.40 | 45.78 | 47.46 | 43.40 |

| 2005 | 43.62 | 44.86 | 46.45 | 43.27 |

| 2006 | 44.48 | 44.21 | 46.26 | 43.05 |

| 2007 | 43.10 | 45.06 | 46.83 | 42.78 |

| 2008 | 40.02 | 40.13 | 43.05 | 38.48 |

| 2009 (through September 22, 2008) | 45.30 | 42.76 | 46.81 | 39.73 |

(1) The average rate is the average of the exchange rates on the last business day of each month during the period.

The following table sets forth the high and low exchange rates for the previous six months and is based on the noon buying rate in the City of New York during the period for cable transfers in Indian rupees as certified for customs purposes by the Federal Reserve Bank of New York:

| Month | High | Low |

| April 2008 | 40.45 | 39.73 |

| May 2008 | 42.93 | 40.45 |

| June 2008 | 42.97 | 42.38 |

| July 2008 | 43.29 | 41.10 |

| August 2008 | 43.74 | 42.01 |

| September 2008 (through September 22, 2008) | 46.81 | 43.95 |

On September 22, 2008, the noon buying rate was Rs. 45.30 = US$1.00.

| 3B. | Capitalization and Indebtedness |

Not applicable.

| 3C. | Reasons for the Offer and Use of Proceeds Not Applicable |

Not applicable.

You should carefully consider all the information contained in this report and the following risk factors that affect us and our industry in evaluating us and our business. The risks below are not the only ones we face. Additional risks not currently known to us or that we presently deem immaterial may also affect our business. This report also contains forward-looking statements that involve risks and uncertainties. The market price of our equity shares or ADSs could decline due to any of these risks or uncertainties.

Risks Relating to Our Business

We expect to continue to encounter increased competition in each of our markets, which could reduce our revenues.

The Indian government is rapidly liberalizing the telecommunications industry in India. The Department of Telecommunications (DOT) may license, at its discretion, multiple additional service providers in any service area, with respect to both basic telecommunications services and cellular services. In November 2003, the Department issued guidelines for Unified Access Licenses, which cover both basic and cellular services within a service area. In the Indian context, “basic telecommunications services” or “basic services” include basic fixed-line access service and a number of other telecommunications services, other than long distance services, cellular service and Internet access. Basic services also include CDMA-based fixed wireless and mobile services (without roaming). Tata Teleservices Limited and Reliance Infocomm Limited are currently competing with us in the market for basic services in both Mumbai and Delhi, and Bharti Tele-Ventures Limited is also competing with us in the basic services market in Delhi and Mumbai. All of these companies already have significant telecommunications infrastructure in Delhi and Mumbai, including, with respect to Tata Teleservices and Reliance Infocom, low-cost CDMA mobile and fixed wireless technology. With approximately 56.08% of our call units having come from approximately 12.86% of our access lines in service, we are particularly vulnerable to losing market share if these or other new operators aggressively target our largest subscribers. Some of our largest customers have already migrated to other basic service operators.

We experience significant and growing competition in the market for GSM cellular and Internet services. Many of these service providers enjoy significant penetration in these markets, have established brand names and have more experience operating a cellular network than we do. Cellular operators also face competition from rapidly growing CDMA-based mobile services, which are priced considerably lower than GSM cellular services.

Increased competition has kept and will likely continue to keep downward pressure on prices and has required and will likely continue to require us to increase our capital investment to improve and expand our services. These developments, in turn, have had and may continue to have a negative impact on our profitability.

Our business is subject to substantial regulation by the Government.

The DOT retains the right to revoke our licenses after giving one month’s notice to us. The DOT also retains the right, after giving notice to us, to modify the terms and conditions of our licenses at any time if in their opinion it is necessary or expedient to do so in the interest of the general public or for the proper operation of the telecommunications sector. A revocation of any license or a change in significant terms of any license, such as its duration, the amount of license fee payable, the range of services permitted and the scope of exclusivity could limit our ability to operate particular lines of our business or result in increased costs in the form of increased license fees or costs associated with applying for new licenses, or contesting limitations on our licenses.

Regulations applicable to public sector enterprises in India governing certain personnel matters, procurement, capital expenditure and the issuance of securities may affect our ability to compete effectively.

As long as the Indian government’s shareholding in us equals or exceeds 51%, we are deemed to be an Indian government company. As such, we are subject to laws and regulations generally applicable to public sector enterprises in India. These laws and regulations govern, among other things, personnel matters, procurement, budgeting and capital expenditures and the generation of funds through the issuance of securities.

Under our articles of association, the President of India, on behalf of the Indian government, may also issue directives with respect to the conduct of our business and affairs, and certain matters with respect to our business, including the appointment and remuneration of our Chairman and Managing Director and the declaration of dividends. None of our shareholders, management or board of directors may take action in respect of any matter reserved for the President of India without his approval. If the President of India does not allow us to make capital expenditures pursuant to our business plan, we may be unable to compete effectively or maintain profitability. Government formalities, including requirements that many of our purchases be made through a competitive bidding process, often cause delays in our equipment and product procurement; these delays can place us at a disadvantage relative to private sector competitors.

The Indian government, our controlling shareholder, when considering matters pertaining to us, often also considers the interests of the largest government-owned telecommunications company, Bharat Sanchar Nigam Limited (BSNL). The Indian government is evaluating the possibility of a merger of us with BSNL.

The Indian government, through the DOT, holds 56.25% of our outstanding equity shares and 100% of BSNL’s equity shares. Consequently, the DOT controls both of us. The DOT has the power to determine the outcome of most actions requiring approval of our board of directors or shareholders, including proposed expansion of our basic and cellular services into new areas in which we may compete with BSNL, transactions with BSNL or the assertion of claims against BSNL. When considering many of these matters, the DOT may also take into account the interests of BSNL. Failure by the DOT to resolve conflicts involving us and BSNL in an equitable manner could have a material adverse effect on our business prospects.

India’s Ministry of Communications has appointed private sector banks to act as consultants to advise on restructuring BSNL and us. We understand that these consultants have submitted their reports. There have been media reports about consideration of a merger of our companies or the transfer by the DOT of their shares in us to BSNL or to a holding company that would control both us and BSNL. There are no further announcements on this. We cannot assess the likelihood of such a transaction, or the impact of such a transaction on our business or the value of our shares or ADSs.

We have significant related party transactions.

The Indian Government is our controlling shareholder and hence we are deemed to be an Indian government company. As such, we are subject to laws and regulations generally applicable to public sector enterprises in India. These laws and regulations govern, among other things, personnel matters, procurement, budgeting and capital expenditures and the generation of funds through the issuance of securities. We have extensive commercial and regulatory relationships with the DOT and BSNL, most of which were established at the time when there was no corporate separation between the DOT, BSNL and us. Also the Indian Government when considering matters pertaining to us, often also considers the interests of the largest government-owned telecommunications company, Bharat Sanchar Nigam Limited (BSNL). We have significant amounts due from related party and our inability to collect them or change in the terms of our arrangements with our related parties could adversely affect our revenues and profitability. See Notes 3, 4, 19 and 25 to our consolidated financial statements and Item 7B. Related Party Transactions in this report.

We do not have title to property, and we cannot sell our properties without payment of stamp duties and registering properties in our name.

In 1987, the assets and properties of the DOT located in Delhi and Mumbai were transferred to us by an order of the Government of India (the “Government”) and a deed of sale was executed by the Government in our favor representing an irrevocable transfer. Indian law generally requires that to perfect the transfer or lease of real property, the transfer should be evidenced by a formal, duly stamped deed of transfer and registered with the Central Land Registrar within a specified period after the execution of the deed of transfer or lease. A formal transfer deed for real property of the DOT, transferred by the Government to us has been executed but has not been registered with the appropriate municipal authorities. The formal transfer deed and physical delivery of possession of the DOT’s non-real estate assets has resulted in the transfer of such non-real estate assets of the DOT to us in Delhi and Mumbai.

Indian law also requires payment of stamp duty (at rates which vary among states) on instruments, which effect transfer of title to real estate or in respect of leases of real estate. We have not paid stamp duty in respect of any of the acquired or leased properties. Accordingly, we may be liable for stamp duty and penalties thereon if a deed is registered by us in the future (other than with respect to the DOT properties acquired from the Government as at March 30, 1987). All liabilities for stamp duties in respect of the DOT properties acquired by us from the Government as at March 30, 1987 are to be borne by the Government. We have been advised by our counsel that although we have valid possession including the risks and rewards of ownership and title to all of our property to enable us to perfect and thereby acquire marketable title to real property in our possession, we would need to have relevant documents relating to transfer or lease of real property duly registered and stamped. Accordingly, we cannot sell our properties without payment of stamp duties and registering the properties in our name.

Compliance with new and changing corporate governance and public disclosure requirements adds uncertainty to our compliance policies and increases our costs of compliance. In certain areas management had concluded there were material weaknesses in our internal controls.

We are incorporated in India and investors should be aware that there are differences in the governance standards and shareholder rights for a U.S. company and those applicable to a foreign isser as us. Changing laws, regulations and standards relating to accounting, corporate governance and public disclosure, including the Sarbanes-Oxley Act of 2002, new U.S. Securities and Exchange Commission, or SEC, regulations, the NYSE, rules, Securities and Exchange Board of India, or SEBI, rules, and Indian stock market listing regulations are creating uncertainty for companies like ours. These new or changed laws, regulations and standards may lack specificity and are subject to varying interpretations. Their application in practice may evolve over time, as new guidance is provided by regulatory and governing bodies. This could result in continuing uncertainty regarding compliance matters and higher costs of compliance as a result of ongoing revisions to such corporate governance standards.

In particular, our efforts to comply with Section 404 of the Sarbanes-Oxley Act of 2002 and the related regulations regarding our required assessment of our internal controls over financial reporting and our external auditors’ audit of that assessment requires the commitment of significant financial and managerial resources. We consistently assess the adequacy of our internal controls over financial reporting, remediate any control deficiencies that may be identified, and validate through testing that our controls are functioning as documented.

As of March 31, 2008, management had concluded that our internal controls over periodical reporting were not effective by reason of certain material weaknesses, particularly as to updating of our fixed assets register, reconciliation of subscriber deposits, accounting for related party transactions and information technology controls. These deficiencies could result in misstatements in reporting in those areas. We had undertaken certain initiatives and remedial action in those areas during the 2008 fiscal year and have undertaken additional remedial action and expect to complete the remedial action in the 2009 fiscal year. See Item 15. Controls and Procedures.

We have received a demand to pay sales tax in respect of certain historical telecommunications revenues, mainly telephone rental charges. We are not yet able to estimate our potential aggregate liability, but it could be large and have a material adverse effect on our results of operations, financial condition and cash flow.

We have received a demand from the state government of Maharashtra, of which Mumbai is a part, for payment of Rs.1.9 billion in sales tax for fiscal 1989-2000 on certain telecommunications revenues, mainly telephone rental charges.

We have challenged the demands raised before the respective high courts and we have been granted interim stays against enforcement of the demands. However this stay order is subject to the outcome of the Supreme Court judgment on the issue. During the year ended March 31, 2006, the Supreme Court of India has concluded in the BSNL Vs Union of India case that rendering basic services does not amount to a “transfer of right to use the telephone system”. Hence the imposition of the sales tax on any facility of the telecommunication services is untenable in law. Based on opinion received from legal counsel and drawing reference to the judgment of the Supreme Court of India in the abovementioned case, management believes that the sales tax departments would have to withdraw their demands of sales tax on basic telephony and that an adverse outcome in respect of the above is remote. The legal case filed in the Sales Tax Tribunal Maharashtra has been remanded to the Commissioner to reconsider the issue in light of the above Supreme Court judgment.

If we were required to pay sales tax in respect of certain historical revenues, including telephone rentals, such payments could have a material adverse effect upon our results of operations, financial condition and cash flow. At this time, we cannot estimate potential aggregate actual liability associated with sales tax.

We have and may continue to implement Voluntary Retirement Schemes that will affect our profitability.

We have and continue to offer voluntary retirement to certain of our employees with a view to reducing our workforce. While we believe the long-term effect to our financial performance will be beneficial, the cost of such programs will affect our profitability over the next few years.

Risks Relating to Investments in Indian Companies

There are risks of political uncertainty in India that could affect our business.

During the past decade, the government of India has pursued policies of economic liberalization, including significantly relaxing restrictions on the private sector. Nevertheless, the role of the Indian central and state governments in the Indian economy as producers, consumers and regulators has remained significant. A coalition government is in power. We cannot assure that these liberalization policies will continue in the future. The rate of economic liberalization could change, and specific laws and policies affecting foreign investment, currency exchange rates and other matters affecting investment in our securities could change as well. A significant change in India’s economic liberalization and deregulation policies could disrupt business and economic conditions in India generally and could adversely affect the telecommunications licensing and regulatory framework in which we operate our business.

A slowdown in economic growth in India may adversely affect our business and results of operations.

Our performance and the quality and growth of our business are necessarily dependent on the health of the overall Indian economy. The Indian economy has grown significantly over the past few years. Any future slowdown in the Indian economy could harm us, our customers and other contractual counterparties. In addition, the Indian economy is in a state of transition. The share of the services sector of the economy is rising while that of the industrial, manufacturing and agricultural sector is declining. It is difficult to gauge the impact of these fundamental economic changes on our business.

Financial instability in other countries, particularly emerging market countries in Asia, could adversely affect the Indian economy and cause our business and the market for our equity shares and ADSs to suffer.

Financial turmoil in Asia, Russia and elsewhere in the world in the late 1990s affected different sectors of the Indian economy in varying degrees. Although economic conditions are different in each country, investors’ reactions to developments in one country can have adverse effects on the securities of companies in other countries, including India. A loss of investor confidence in the financial systems of other emerging markets may cause increased volatility in Indian financial markets and, indirectly, in the Indian economy in general. Any worldwide financial instability could influence the Indian economy and could have a material adverse effect on the market for securities of Indian companies, including our equity shares and ADSs.

Social conflict, terrorism and related military activity may adversely affect the Indian economy or world economic activity, either of which could adversely affect our business and the prices of our equity shares and ADSs.

India and other parts of the world have recently experienced significant social conflict and/or terrorist acts. In India, social conflict, including religious and regional/separatist conflicts, has been an ongoing problem, which occasionally includes significant acts of terrorism. To the extent that the Indian economy is adversely affected by such conflict, terrorism or military activity, our business may also be adversely affected, resulting in a decline in revenue, and the prices of our equity shares and ADSs may decline.

Risks Relating to the ADSs and Equity Shares

Ability to withdraw equity shares from the depositary facility is uncertain and may be subject to delays.

India’s restrictions on foreign ownership of Indian companies limit the number of shares that may be owned by foreign investors and generally require government approval for foreign ownership. The maximum foreign ownership permitted in us without prior governmental approval is 49% under the sectoral caps currently provided for by the government of India and the Reserve Bank of India. Investors who withdraw equity shares from the depositary facility will be subject to Indian regulatory restrictions on foreign ownership of equity shares upon withdrawal. It is possible that this withdrawal process may be subject to delays.

Ability to sell in India any equity shares withdrawn from the depositary facility may be subject to delays.

Persons seeking to sell in India any equity shares withdrawn upon surrender of an ADS will require Reserve Bank of India approval for each such transaction. Because of possible delays in obtaining necessary approvals, holders of equity shares may be prevented from realizing gains during periods of price increases or limiting losses during periods of price declines.

Ability to withdraw and redeposit shares in the depositary facility is limited, which may cause our equity shares to trade at a discount or premium to the market price of our ADSs.

Because of Indian legal restrictions, despite recent relaxations, the supply of ADSs may be limited. Under procedures recently adopted by the Reserve Bank of India, the depositary will be permitted to accept deposits of our outstanding equity shares and deliver ADSs representing the deposited equity shares to the extent, and limited to the number, of ADSs that have previously been converted into underlying equity shares. Under these new procedures, if you elect to surrender your ADSs and receive equity shares, you may be unable to re-deposit those outstanding equity shares with our depositary and receive ADSs because the number of new ADSs that can be issued cannot, at any time, exceed the number of ADSs converted into underlying equity shares or result in foreign equity in us exceeding 49%. This may restrict your ability to re-convert the equity shares obtained by you to ADSs. Also, investors who exchange ADSs for the underlying equity shares and are not holders of record will be required to declare to us details of the holder of record. Any investor who fails to comply may be liable for a fine of up to Rs.1,000 for each day such failure continues. See Item 10. “Additional Information—Indian Foreign Exchange Controls and Securities Regulations.”

The restrictions described above may cause our equity shares to trade at a discount or premium to our ADSs.

Conditions in the Indian securities market may affect the price or liquidity of the equity shares and the ADSs.

The Indian securities markets are generally smaller and more volatile than securities markets in the world’s major financial centers. Indian stock exchanges have also experienced problems that have affected the market price and liquidity of the securities of Indian companies. These problems have included temporary exchange closures, the suspension of stock exchange administration, broker defaults, settlement delays and strikes by brokers. In addition, the governing bodies of the Indian stock exchanges have from time to time imposed restrictions on trading in certain securities, limitations on price movements and margin requirements. Further, from time to time, disputes have occurred between listed companies and stock exchanges and other regulatory bodies, which, in some cases, may have had a negative effect on market sentiment. Similar problems could happen in the future and, if they do, they could affect the market price and liquidity of our equity shares and our ADSs.

Because there may be less company information available in Indian securities markets than securities markets in more developed countries, the price of our equity shares could fluctuate unexpectedly.

There is a difference between the level of regulation and monitoring of the Indian securities market and the activities of investors, brokers and other participants and that of markets in the United States and other developed

economies. The Securities and Exchange Board of India is responsible for improving disclosure and other regulatory standards for the Indian securities markets. The Securities and Exchange Board of India has issued regulations and guidelines on disclosure requirements, insider trading and other matters. There may, however, be less publicly available information about Indian companies than is regularly made available by public companies in developed economies. As a result, shareholders could act on incomplete information and cause the price of our equity shares to fluctuate unexpectedly.

ADS holders may be unable to exercise preemptive rights available to shareholders and therefore may suffer future dilution of their ownership position.

A company incorporated in India must offer its holders of equity shares preemptive rights to subscribe and pay for a proportionate number of shares to maintain their existing ownership percentages prior to the issuance of any new equity shares, unless these rights have been waived by at least 75% of the company’s shareholders present and voting at a shareholders’ general meeting. Holders of our ADSs as well as our shareholders located in the United States may be unable to exercise preemptive rights for our equity shares underlying our ADSs unless a registration statement under the Securities Act is effective with respect to those rights or an exemption from the registration requirements of the Securities Act is available. Our decision to file a registration statement will depend on the costs and potential liabilities associated with any such registration statement, as well as the perceived benefits of enabling investors in our ADSs to exercise their preemptive rights and any other factors we consider appropriate at the time. We do not commit that we would file a registration statement under these circumstances. If we issue any such rights in the future, the rights would be issued to the depositary, which may sell the rights in the securities markets in India for the benefit of the holders of our ADSs. There can be no assurance as to the value, if any, the depositary would receive upon the sale of the rights. To the extent that holders of our ADSs as well as our shareholders located in the United States are unable to exercise preemptive rights, their proportional interests in us would be reduced.

ADS holders may be subject to potential losses arising out of exchange rate risk on the Indian rupee and risks associated with the conversion of rupee proceeds into foreign currency.

Holders of ADSs as well as our shareholders located outside India will be subject to currency fluctuation risks and convertibility risks, since our equity shares are quoted in rupees on the Indian stock exchanges on which they are listed. Dividends on our equity shares will also be paid in rupees, and then converted into US dollars for distribution to ADS holders. Holders that seek to convert the rupee proceeds of a sale of equity shares withdrawn upon surrender of ADSs into foreign currency and export the foreign currency will need to obtain the approval of the Reserve Bank of India for each transaction. In addition, holders that seek to sell equity shares withdrawn from the depositary facility will have to obtain approval from the Reserve Bank of India, unless the sale is made on a stock exchange or in connection with an offer made under the regulations regarding takeovers. Holders of rupees in India may also generally not purchase foreign currency without general or special approval from the Reserve Bank of India.

ADS holders may be subject to Indian taxes arising out of capital gains.

Generally, capital gains, whether short-term or long-term, arising on the sale of the underlying equity shares in India are subject to Indian capital gains tax. For the purpose of computing the amount of capital gains subject to tax, Indian law specifies that the cost of acquisition of the equity shares will be deemed to be the share price prevailing on The Stock Exchange, Mumbai or the National Stock Exchange on the date the depositary advises the custodian to deliver equity shares upon surrender of ADSs. The period of holding of equity shares, for determining whether the gain is long-term or short-term, commences on the date of the giving of such notice by the depositary to the custodian.

Investors are advised to consult their own tax advisers and to consider carefully the potential tax consequences of an investment in our ADSs.

ADS holders may not be able to enforce a judgment of a foreign court against us.

We are a limited liability company incorporated under the laws of India. All our directors and executive officers are residents of India and almost all of our assets and the assets of such persons are located in India. India is not a party to any international treaty in relation to the recognition or enforcement of foreign judgments. We have been advised by counsel that recognition and enforcement of foreign judgments is provided for on a statutory basis and that foreign judgments shall be conclusive regarding any matter directly adjudicated upon except where:

| · | the judgment has not been pronounced by a court of competent jurisdiction; |

| · | the judgment has not been given on the merits of the case; |

| · | it appears on the face of the proceedings that the judgment is founded on an incorrect view of international law or a refusal to recognize the law of India in cases in which Indian law is applicable; |

| · | the proceedings in which the judgment was obtained were opposed to natural justice; |

| · | the judgment has been obtained by fraud; or |

| · | the judgment sustains a claim founded on a breach of any law in force in India. |

It may not be possible for holders of our ADSs or our shareholders to effect service of process upon us or our directors and executive officers and experts named in the report that are residents of India outside India or to enforce judgments obtained against us or them in foreign courts predicated upon the liability provisions of foreign countries, including the civil liability provisions of the federal securities laws of the United States.

Moreover, it is unlikely that a court in India would award damages on the same basis as a foreign court if an action is brought in India. Furthermore, it is unlikely that an Indian court would enforce foreign judgments if it viewed the amount of damages as excessive or inconsistent with Indian practice. An Indian court may not enforce a foreign judgment involving more than actual and quantifiable damages.

Although announced policy indicates there is no intention to do so, possible sales of our equity shares by the government of India could affect the value of our ADSs.

The government of India holds approximately 56.25% of our outstanding equity shares. There have been no indications that the current government of India plans to further reduce its shareholding in us through a sale of equity. As a result, this ownership affects the voting by shareholders and the ability to influence any third party transactions, such as mergers or other business combinations.

Any future disposal of equity shares by the Indian government could adversely affect the trading price of our equity shares and ADSs.

Item 4. | Information on the Company |

| 4A. | History and Development of the Company |

HISTORY AND DEVELOPMENT OF THE INDIAN TELECOMMUNICATIONS INDUSTRY

Until the mid-1980s, the telecommunications sector in India was a monopoly controlled by the government of India through the Department of Posts and Telegraphs of the Ministry of Communications, providing all telecommunications services, both domestic and international. The Indian Telegraph Act of 1885 established the government of India’s monopoly in the sector and, together with the Indian Wireless Telegraphy Act of 1933, provided the legal framework for the regulation of the Indian telecommunications industry.

Development of the telecommunications sector historically was seen as a relatively low priority and received limited budgetary support from the government of India. As a result, the telecommunications infrastructure in India grew relatively slowly. In the mid-1980s, faced with rapidly increasing demand for telecommunications

services and equipment, the government of India commenced a reorganization of the sector designed to facilitate the rapid introduction of new technology, stimulate the growth of the telecommunications industry and tap the resources of the private sector in facilitating such technological innovation and growth. The reorganization included the division of the Department of Posts and Telegraphs into the DOT and the Department of Posts.

As part of the reorganization, we were incorporated on February 28, 1986 under the Companies Act as a wholly-owned government of India company and, on April 1, 1986, assumed responsibility for the control, management and operation of the telecommunications networks in Delhi and Mumbai, two of the largest metropolitan areas in India. Videsh Sanchar Nigam Limited (VSNL) (now Tata Communications Ltd) was established at the same time to provide international telecommunications services and the DOT retained responsibility for providing all other telecommunications services throughout India. The DOT also assumed regulatory authority over the Indian telecommunications industry. Simultaneously, the Telecom Commission was established in 1986 as an executive body under the Ministry of Communications to make policy decisions and to accelerate the development of all aspects of the telecommunications sector and the implementation of new telecommunications policies.

In December 1991, with a view to fulfilling its objective of facilitating the rapid introduction of new services and technology, the DOT invited bids from Indian companies with a maximum of 49% foreign ownership for two non-exclusive GSM cellular licenses in each of the cities of Kolkata (formerly called Calcutta), Chennai (formerly called Madras), Delhi and Mumbai. The private operators commenced cellular services in late 1995. In October 1997 we were permitted to provide GSM cellular service in Mumbai and Delhi. Beginning in 1995, the DOT also invited tenders and awarded cellular licenses for the regional “circles” established for the purpose of licensing cellular services in the rest of India. We believe that as of May 31, 2008, there were approximately 278 million cellular subscribers in India.

Since 1992, as part of its general policy of gradually reducing its holdings in public sector enterprises, the Indian government sold a portion of its equity holdings in us and VSNL (now Tata Communications Ltd) to certain mutual funds, banks and financial institutions controlled by the government of India. In our 1997 global depositary receipt offering, the Indian government sold 40 million of our equity shares represented by 20 million global depositary receipts, constituting 6.3% of our then outstanding equity shares. Additionally, in 1997 and 1999, the Indian government sold additional equity shares of VSNL in the form of global depositary receipts, thereby reducing its equity interest in the company to 51%. In February 2002, the government of India divested an additional 25% interest in VSNL to the Tata Group through a competitive bidding process.

In May 1994, the government of India announced its National Telecom Policy, which was aimed at achieving accelerated telecommunications growth and network expansion. The broad objectives of this policy were higher national telephone penetration, reduction of waiting lists, improvement in the quality of networks, improved rural access to telecommunications services, introduction of value-added services and private sector participation in the provision of basic and cellular services.

In order to achieve these objectives, the Indian government decided to permit private sector involvement in basic telecommunications services, which, in the Indian context, includes basic fixed-line access service and a number of other telecommunications services (including CDMA-based fixed wireless and mobile services (without roaming)), other than long distance services, cellular service and Internet access. Accordingly, in September 1994 the Indian government announced its “Guidelines for Private Sector Entry into Basic Telecom Services,” and beginning in 1995 began to invite tenders from companies with no more than 49% foreign ownership for basic service licenses for the regional “circles” established for licensing basic telecommunications services. After a period of consolidation, the most prominent private-sector providers of basic telecommunications services currently include Bharti Tele-Ventures Limited, Tata Teleservices and Reliance Infocomm, each of which operates in multiple circles. Tata Teleservices and Reliance Infocomm both operate in the circles that include Mumbai and Delhi, and hence now compete with us in those areas. Bharti Tele-Ventures Limited also provides basic services in Delhi.

In February 1997, a multilateral agreement on basic telecommunications services was agreed to among member governments of the World Trade Organization. As part of this agreement, the Indian government has reaffirmed its commitment to further liberalize the Indian telecommunications sector through the licensing of new basic and cellular service providers.

In March 1997, the government established the Telecom Regulatory Authority of India (TRAI), an independent regulatory authority with broad regulatory powers over the telecommunications industry in India, including the power to set rates on domestic and international telecommunications services and determine the terms and conditions of interconnect arrangements between service providers. These regulatory powers had previously been vested in the DOT, which controls us and is part of the Ministry of Communications. However, the power to grant, renew or revoke licenses remains with the DOT.

In November 1998, the government of India announced its Internet policy, which aims to increase Internet usage by, among other things, allowing up to 49% foreign ownership of Internet service providers (ISPs) and declaring a license fee moratorium for five years. (Currently the foreign ownership limit for ISPs is up to 74% in most cases.)

In March 1999, the government of India announced its New Telecom Policy 1999 which sets forth as one of its central goals the fostering of increased competition in the Indian telecommunications industry and the liberalization of government telecommunications regulation.

Additionally, effective May 1, 1999, the TRAI implemented the 1999 tariff order pursuant to which the TRAI seeks to align tariffs charged by service providers with the corresponding costs associated with such services so as to limit cross-subsidization of services by a provider while allowing providers to set tariffs at any level below certain maximum levels. The TRAI has since adjusted tariffs several times under the tariff order.

In October 1999, the DOT, which had both performed the role of licensor and policy maker for the Ministry of Communications and operated as India’s domestic long distance service provider and basic service provider (except for the areas of Delhi and Mumbai, which are covered by us), was bifurcated into two departments. The DOT/Telecom Commission, or the DOT, now performs the role of licensor and policy maker, and the Department of Telecom Services, functions as the government of India’s local and long distance network service provider. In October 2000, the Department of Telecom Services’ local and long distance business was corporatized into a new company named BSNL. The Indian government has also recently established an independent Information Technology Department within the Ministry of Communications (now formally known as the Ministry of Communications and Information Technology). The IT department will, among other things, promote the Internet, e-commerce and knowledge based industries. Internet licensing functions will remain with the DOT. The DOT controls the equity shares in us that are held by the Indian government and appoints all of the directors on our 12-seat board. Two of our board seats are for DOT officers.

ILD and NLD Licenses Simplified

The Government has constantly endeavored to usher in policy decisions that could facilitate affordable public telecom facilities, in accordance with the New Telecom Policy, 1999. In line with this strategy, in December 2005, the Government made a major decision to remove various to further liberalise the NLD (national long distance) and ILD (international long distance) licenses in order to facilitate the growth of the IT and IT-enabled services in India. Some of the changes brought about by such decisions are as follows:

| (a) | NLD Service License |

| (i) | The entry fee for new NLD licenses was reduced from Rs. 100 crore to Rs. 2.5 crore. Likewise, the annual license fee for NLD licenses was reduced from 15% to 6% of AGR effective January 2006. |

| (ii) | The NLD licenses had stipulated a mandatory provision of setting up of a point of presence in each long distance charging area. Mandatory roll out obligations were no longer required for future NLD license and existing licenses. |

| (iii) | The net worth requirement and paid up capital requirement of the applicant company for NLD licenses was reduced to the level of Rs. 2.5 crore from Rs. 250 crore. |

| (iv) | To facilitate promotion of the BPO/KPO industry, NLD service providers were permitted to access the subscribers directly for provision of leased circuits/closed user groups i.e. they can provide last mile connectivity. |

| (b) | ILD Service License |

| (i) | The entry fee for new ILD licenses was reduced from RS. 25 crore to Rs. 2.5 crore. |

| (ii) | The annual license fee for ILD licenses was reduced from 15% to 6% of AGR, effective January 2006. |

| (iii) | There is no further need to have mandatory roll out obligation for ILD service licenses except for having at least one switch in India. |

| (iv) | ILD service providers can access the subscriber directly only for provision of leased circuits/closed user groups. |

| (v) | The net worth and paid up capital of the applicant company for ILD service license was reduced to Rs. 2.5 crore. |

| (c) | Requirement of experience in telecom sector grant of licenses |

Prior experience in telecom sector is no longer a prerequisite for being granted telecom service licenses.

| (d) | Provision of Internet telephony, Internet Services and Broadband services by Access Providers |

Access service provider can provide Internet telephony, Internet services and Broadband services. If required, access service provider can use the network of NLD/ILD service licensee.

| (e) | IP-II & ISPs with IP-VPN Licenses |

| (i) | The Government has decided to do away with IP II and IPVPN licenses. Existing IP-II/IP-VPN licenses are allowed to migrate to NLD/ILD service license. |

| (ii) | Provisional entry fee of IP-VPN on migration to NLD/ILD to be adjusted in entry fee and dues to the Government by way of license fee and spectrum charges/or refunded as per TDSAT order. |

| (iii) | ISP with Internet telephony (restricted) are charged a license fee at 6% of AGR effective January 2006. |

| (iv) | The access providers can provide broadband services including triple play i.e. voice, video and data. ISPs can provide Internet Access/Internet Content Services where Internet has been defined as a global information system that is logically linked by a globally unique address based on IP or its subsequent enhancement/upgradation. ISPs cannot provide content services on a managed network (virtual/real) not derived from Internet. |

| (v) | IP-II licensees which are not interested in migrating to NLD/ILD are not permitted to provide National/International leased line/bandwidth to individual subscribers as per existing IP-II license guidelines. |

| (vi) | IP-VPN licensees which are not interested in migrating to NLD/ILD are not permitted to carry voice traffic over VPN network. |

| (f) | VSAT commercial |

| (i) | Annual license fee charged at 6% of AGR effective January 2006. |

Approximate number of licenses for providing telecom services issued as of March 31, 2008 are:

| SUMMARY OF LICENSES | |

| LICENSEES | No. of LICENSEES |

| BASIC LICENSEES | 2 |

| CMTS LICENSEES | 53 |

| UAS LICENSEES | 224 |

| NLD LICENSEES | 21 |

| ILD LICENSEES | 14 |

| TOTAL LICENSEES | 314 |

The table clearly indicates that the competition among the telecom service providers has increased many folds in recent years are we are making efforts to keep the pace with the industry.

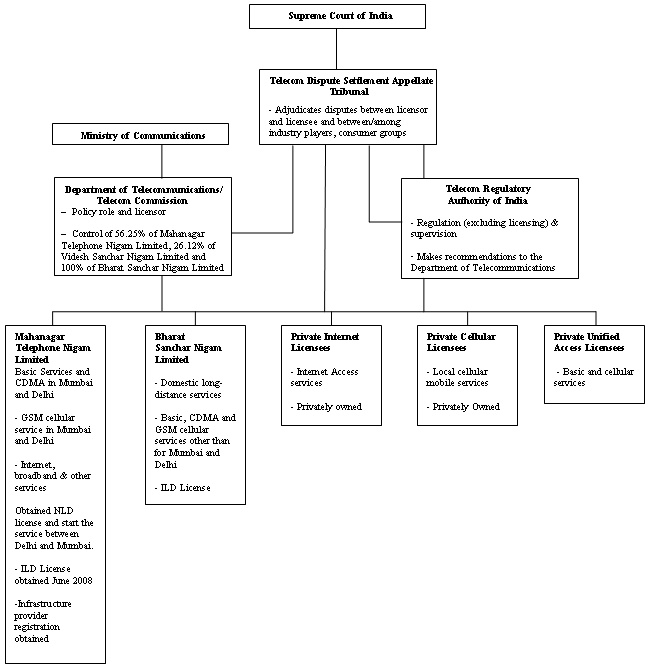

The following chart illustrates the current operational and regulatory structure of India’s telecommunications services industry:

In November 2003, the DOT issued guidelines for Unified Access License which cover within a service area both basic telecommunications services and cellular services. In the Indian context, “basic telecommunications services” or “basic services” include basic fixed-lined access service and a number of other telecommunications services, other than long distance services, cellular service and Internet access. Basic services also include CDMA-based fixed wireless and mobile services (without roaming). We have submitted a request to the DOT to migrate to UAS Licenses for our service area under mobile licenses for Delhi and Mumbai to be able to provide services at par with other operators in these areas. In September 2006, our request for migration of our CMTS Licenses to UAS Licenses as our operating cellular service in the licensed area was not accepted by the DOT. In October 2006, we sought reconsideration and grant of permission for migration to UAS Licenses.

In April 2008, we received in-principal approval to use CDMA technology under the existing Cellular Mobile Telephone Service (CMTS) License for Delhi and Mumbai service areas. We will use CDMA technology (in addition to GSM technology being used by us) under the existing Cellular Mobile Telephone Service (CMTS) License for Delhi and Mumbai service areas.

On November 22, 2006, the DOT issued the instructions that “The licensee shall ensure adequate verification of each and every customer before enrolling him as a subscriber. Instructions issued by the licensor in this regard from time to time shall be scrupulously followed.”

For ensuring that the complete subscriber information is available with all the service providers and the same is duly verified, the DOT also decided that each licensee shall take up re-verification of the existing subscribers on priority and ensure that the re-verification of the existing subscribers is completed by March 31, 2007. By re-verification, it is meant that there shall be 100% check of CAF/SAF documentary proof of identity and documentary proof of address and it would be ensured that the subscriber information available in service provider’s database matches with that in CAF/SAF and associated documents. Further the licensee company would cross-verify the information from the actual user by calling the respective subscriber. There shall not be any connection working after March 31, 2007 in licensee’s network without having the subscriber information duly verified.

After March 31, 2007, if any subscriber number is found working without proper verification, a minimum penalty of Rs. 1000 per violation of subscriber number verification would be levied on the licensee apart from immediate disconnection of the subscriber number by the licensee.

In response of the above DOT instructions, our GSM subscriber base reduced from approximately 2.7 million to 2.5 million during the period March 2007 to April 2007. As of May 31, 2008, our GSM subscriber base grew to 3.35 million.

We have implemented the procedure for ‘Do not call’ for Telecom Unsolicited Commercial Communication in the service areas of Delhi and Mumbai, in accordance with a March 2008 amendment by Telecom Regulatory Authority of India, the Telecom Unsolicited Commercial Communications Regulations, 2007 (4 of 2007).

Mahanagar Telephone Nigam Limited

Mahanagar Telephone Nigam Limited is the principal provider of fixed-line and other basic telecommunications services in Delhi and Mumbai. Delhi and Mumbai are two of the largest, most densely populated and wealthiest metropolitan areas in India. At the end of fiscal 2008 our fixed-line telecommunications networks in Delhi and Mumbai had an aggregate of approximately 3.81 million fixed lines in service. In February 2001, we launched our cellular services using global system for mobile communications, or GSM, technology in Delhi and Mumbai and had approximately 3.24 million subscribers as of March 31, 2008. GSM is the European and Asian standard for digital mobile telephone networks. We launched CDMA-based services in 1997, and at the end of fiscal 2008 had approximately 1.61 lakh limited mobile subscribers in Mumbai and Delhi. CDMA is a digital wireless technology that increases network capacity by allowing more than one user to simultaneously occupy a single radio frequency band with reduced interference. We began providing Internet service in both Delhi and Mumbai in February 1999 and had approximately 1.36 million Internet access subscribers at the end of fiscal 2008.

We obtained a national long distance license in May 2006 and began to carry our own traffic between Mumbai and Delhi.

We believe that the size of the markets in Delhi and Mumbai, the economic environment, the Indian government’s ongoing liberalization of the telecommunications industry and the still low level of penetration of fixed-line, mobile and cellular services in these two areas and the low level of penetration of Internet services in India provide opportunities for future industry growth.

The number of our access lines in service grew at a compound annual growth rate of 7.55% from March 31, 2000 to March 31, 2008. In fiscal 2008, these lines increased by 8.14%, due to cellular services. In fiscal 2008, our network had approximately 3.18 million access lines in service in Delhi and approximately 4.03 million access lines in service in Mumbai. In addition, our access lines in service per employee increased from 66 at March 31, 2000 to 151 at March 31, 2008.

We derive our revenue primarily from local, domestic long distance and international calls that originate from our network. In fiscal 2008, approximately 27% of our revenue was derived from call charges, 57% from rentals of telephones, access lines and other telecommunications equipment and use of our value-added services and 8% from public call offices. Interconnect revenue, which is revenue derived from other telecommunications service providers for calls made into our network, accounted for 8% of our revenues in fiscal 2008. Local calls are carried on our network, unless the termination point is in the network of one of the cellular operators or one of the new private-sector basic service providers in the locality. We have been carrying our own traffic between Delhi and Mumbai since May 2006. Other domestic long distance calls continue to be passed from our network to the domestic telecommunications network operated by BSNL, although we have entered into interconnect agreements with the new private-sector domestic long distance service providers and intend to pass such domestic long distance calls also through such other providers. In addition, currently all international outgoing calls continue to be passed from our network to international gateways operated by VSNL, India’s former government-controlled international long distance carrier, although we have entered into interconnect agreements with other private-sector international long distance carriers and have plans for joint development with BSNL of submarine cable to connect the east and west coasts of India with Malaysia and the Middle East (and ultimately Europe and the USA).

We expect competition to continue to increase in all major sectors of the Indian telecommunications industry, as both government and private-sector companies continue to invest in capacity expansion and seize opportunities to enter new geographical areas and lines of business. See “— Business Overview—Competition” below.

Our principal executive office is located at 12th floor, Jeevan Bharati Tower—1, 124 Connaught Circus, New Delhi—110001, India, and our telephone number is +91-11-2374-2212.

Licenses/License Areas

We provide all of our telecommunications services, other than Internet, under a single, general, non-exclusive license. The license initially granted to us in 1986 was effective for a five-year period that ended on March 31, 1991. The term of the license has been extended for a 25-year period ending March 31, 2013 for basic services.

In October 1997, our license was amended to explicitly include cellular services and radio paging, and our license for such additional services currently extends to October 2017. The license is not specific as to the type of cellular technology that we may use. The license covers areas within the territorial jurisdiction of the State of Delhi and the areas covered by the municipalities of Mumbai, Navi Mumbai and Thane. The DOT has extended the scope of our license to allow us to provide cellular services in certain surrounding areas of Delhi and Mumbai covered by other cellular operators in those cities. The license specifies that we may provide local, domestic long distance access (through interconnection with domestic long distance operators) and international long distance access (through interconnection with networks of international long distance operators), as well as telex and leased line services. Specifically, our license permits us to originate, terminate and transit domestic and international long distance calls. However, we believe that our license would need to be amended if we wanted to enter the market for

domestic long distance utilizing our network. We expect to be licensed to provide for full international long distance service in the near future.

The DOT retains the right to revoke our license after giving one month’s notice to us. The DOT also retains the right, after giving notice to us, to modify the terms and conditions of our license at any time if in their opinion it is necessary or expedient to do so in the interest of the general public or for the proper operation of the telecommunications sector. A revocation of the license or a change in significant terms of the license, such as its duration, the amount of license fee payable, the range of services permitted and the scope of exclusivity could limit our ability to operate particular lines of our business or result in increased costs in the form of increased license fees or costs associated with applying for new licenses, or contesting limitations on our licenses.

We provide our Internet services in Delhi and Mumbai under separate non-exclusive license agreements. These licenses were granted in November 1998, and currently extend to September 7, 2017. In addition, our wholly owned subsidiary, Millennium Telecom Limited, provides Internet access services throughout India under a license granted in 2000 for an initial period of 15 years.

Delhi. According to the government of India’s provisional 2001 population census data, Delhi had a total population of approximately 12.8 million. In addition to being India’s political capital, Delhi has the highest per capita income of all the states in India. Delhi has a high concentration of service and manufacturing industries and houses the central government, the head offices for many major public sector enterprises, embassies, high commissions and various government missions and development agencies.

Mumbai. The city of Mumbai, the financial capital of India and the capital of the State of Maharashtra, is India’s most populous city, with a population of approximately 16.4 million according to the 2001 census data. Mumbai accounted for 36% of India’s income tax contributions in fiscal 2000.

Strategy

Key elements of our strategy include the following:

| · | Expand GSM Cellular and CDMA Mobile Services in Delhi and Mumbai. We launched our cellular services using GSM technology in Delhi and Mumbai in February 2001, and currently have an installed capacity of 17.75 lakh lines in Delhi and 13.25 lakh lines in Mumbai. We believe that current penetration rates in Mumbai and Delhi remain attractive for continued high growth in subscriber base. GSM capacity in Delhi and Mumbai was planned to be further expanded by 2 million each (1.5 million 3G including). Purchase Order (PO) for the procurement of 750K 2G lines each for Delhi and Mumbai has already been placed. PO for the balance 1250K each for Delhi and Mumbai is being placed in next phase based on spectrum for 3G of 5 mhz in each city which stands alotted. The price for this spectrum shall be determined by the Government after the auction process of 3G spectrum is over. In addition, we have launched lower-cost CDMA-based limited mobility mobile services in each of Mumbai and Delhi, and currently have 160,916 subscribers with an installed capacity of 1,098,230 CDMA connections (most of which are to employ the more advanced CDMA 2000 1X technology) in each city. We believe that this new limited mobile service will enable us to target a wider customer base that is more price sensitive than GSM customers and that does not require India-wide and international roaming facilities. We intend to compete effectively in these growing markets by providing high quality service at affordable rates. |

| · | Focus on Customer Service. In order to strengthen the loyalty of our customers, attract cellular subscribers and improve our competitive position, we have a program to improve customer service and become more responsive to the needs of our subscribers. We have introduced improved bill collection and payment procedures (including bill payment over the Internet and via credit card), opened Tele-marts at which most subscriber services are available, introduced telephone directories on the Internet and on CD-ROM and implemented a customer service management system. Our customer service management system enables our staff to provide customers with access to a range of “on-line” services, including registration for new telephone lines, changes of address and issuances of bills, and allows us to monitor complaints from a single point of contact. We have identified high usage |

| “commercially important persons” and are making all efforts to strengthen our relationship with these subscribers. |

| · | Further Develop and Modernize our Network. We intend to continue to invest in expanding and upgrading our network to improve the quality of service. We have placed a PO to add 24K tandem capacity based on NGN – next generation network, in Delhi and Mumbai. We have commissioned a state of art IP/MPLS core network in Delhi and Mumbai to provide a converged IP network for all services. This network is currently carrying our Broadband, IPTV and GSM traffic. Layer 2 and Layer 3 VPN services are also being provided by us through this network. We are working on the expansion of our IP/MPS network so as to further extend the IP reach of our network. Further, we are replacing our old PDH transmission network with synchronous digital hierarchy technology. We have placed a PO for the supply of 42 terminals (20 Delhi and 20 Mumbai) of 40 channel 10 GB/channel DWDM equipment to strengthen our transmission network. The testing of the equipment is going on and the installation is expected to start after completion of testing. We are continuing to implement fiber-in-local-loop and wireless-in-local-loop technologies where appropriate. We have introduced broadband technology based on ADSL2+, capable of providing triple play services (video, voice and data), in a significant way. Through expansion and modernization of our network, we seek to improve the capacity of our network, reduce network failure rates, improve call completion rates and decrease average waiting time for new lines as well as support our Internet and value-added services. |

| · | Selectively Target International Opportunities. We plan to selectively target expansion opportunities outside India where we can leverage our expertise and relationships. Our Nepal joint venture, United Telecom Limited, in which we hold a 26.7% equity interest, has commenced wireless in local loop services as the first private-sector telecommunications operator in that country and had a subscriber base of 111,000 as of March 31, 2008. We have also been awarded licenses to provide basic, mobile and international long distance service in Mauritius. We launched international long distance services in Mauritius in the current fiscal year. We have also launched a fixed wireless service in Mauritius. As of February 29, 2008, we had approximately 26,500 fixed mobile customers. On December 15, 2006, mobile services were launched under the brand name “MOKOZEE,” and as of February 29, 2008, we had a total of 8,884 prepaid mobile customers. We are also examining other international opportunities. |

| · | Enter the Market for International Long Distance Services. We intend to lay submarine cable jointly with BSNL from both the east and west coasts of India to the far East and the Middle East, respectively, to carry voice and data traffic, and with an intent to further extend to the US and Europe. |

| · | Expand Internet Services. We commenced our Internet service provider operations in February 1999 with an initial network capacity to support up to 5,000 subscribers in each of Delhi and Mumbai. As of March 31, 2008, we had approximately 1.36 million Internet access users. We have also started providing high speed internet services on broadband. |

| · | Enhance Value-added Services. We provide our subscribers with value-added services such as call-waiting, call-forwarding, wake-up calls, absent subscriber service and caller identification at no charge or for a nominal fee. We also provide our Intelligent Network services to subscribers, which include our calling card services, a toll-free calling service, a premium rate “0900” number service, universal access service and a televoting service. We also provide high speed data transmission services using integrated services digital network technology, which allows simultaneous high speed transmission of voice, data and images. We expect that our value-added service offerings will increase use of our network, enhance overall customer satisfaction and provide new sources of revenue. |

| 4B. | Business Overview |

Services

Our primary business is providing basic telecommunications services in Delhi and Mumbai, which include:

| 1. | Basic fixed-line access (including phone plus facilities) in Delhi and Mumbai: We provide basic fixed-line access, which consists of installation and provision of basic voice telephony services. Rental charges include maintenance of connections between a subscriber’s premises and our network, 60 pulses of calls per month as well as the use of a basic handset (although subscribers may elect to buy their own handset and have their installation charges reduced accordingly). Phone plus facilities in basic fixed-line include such services as abbreviated dialing, call transfer, hotline facility, three party conferencing, absentee facility, CLIP facility, call hunting, call alert and morning alarm. |