EXHIBIT 99.1

|  |

MTNL# SECTT/SE/2012 February 10, 2012 |

To,

The Secretary, Stock Exchanges

Delhi/Mumbai/Calcutta/Chennai

National Stock Exchange/NYSE

Sub: | Unaudited Reviewed Financial Results for the Quarter ended on31st December, 2011 |

Dear Sir,

As already informed you, the Meeting of the Board of Directors of the Company was held today i.e. 10.02.2012 at New Delhi to consider the Un-audited Reviewed Financial Results for the quarter ended on 31st December, 2011. A copy of the approved Un-audited Reviewed Financial Results along with the Segment Reporting and Limited Review Report is enclosed for your kind information and record. The same is also being published in the News Papers.

Thanking You,

Yours Faithfully

(S.R.SAYAL)

COMPANY SECRETARY

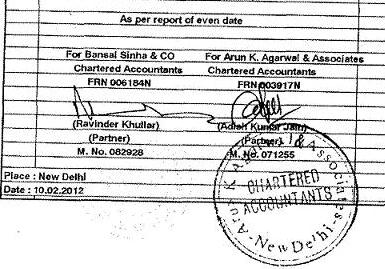

BANSAL SINHA & CO. CO. CHARTERED ACCOUNTANTS 18/19 OLD RAJINDER NAGAR NEW DELHI-110060 PH. 25853424,25722270 FAX: 41046530 | ARUN K AGARWAL & ASSOCIATES CHARTERED ACCOUNTANTS 105, SOUTH EX PLAZA-1, 389, MASJID MOTH, SOUTH EX PART - II. PH:011-26256810,26257400 FAX: 011-46035037 |

LIMITED REVIEW REPORT

To

The Board of Directors

Mahanagar Telephone Nigam Limited

| 1. | We have reviewed the accompanying statement of unaudited financial results of Mahanagar Telephone Nigam Limited for the quarter/period ended December 31, 2011. This statement is the responsibility of the company's management and has been approved by the board of directors. Our responsibility is to issue a report on these financial statements based on our review. |

| 2. | We conducted our review in accordance with the Standard on Review Engagement (SRE) 2410 Engagements to Review Financial Statements issued by the Institute of Chartered Accountants of India. This standard requires that we plan and perform the review to obtain moderate assurance as to whether the financial statements are free of material misstatement. A review is limited primarily to inquiries of company personnel and analytical procedures applied to financial data and thus provide less assurance than an audit. We have not performed an audit and accordingly, we do not express an audit opinion. |

| 3. | We draw attention to the Para No. 2 of the Reviewed quarterly results pertaining to retirement benefits of the employees of the company which has been accounted for on the estimated basis considering the actuarial assumptions of previous year, the issue being technical, we have relied on the estimation provided by the company and managements' perceptions in this regard. |

In view of this we are unable to comment on the adequacy or otherwise of these provisions.

| 4. | Based on our review conducted as above, except the observations/matters mentioned in Annexure-I to this report, no other matter has come to our attention, that causes us to believe that the accompanying statement of unaudited financial results prepared in accordance with applicable accounting standards and other recognized accounting practices and policies has not disclosed the information required to be disclosed in terms of Clause 41 of the Listing Agreement including the manner in which it is to be disclosed, or that it contains any material misstatement. |

BANSAL SINHA & CO. CO. CHARTERED ACCOUNTANTS 18/19 OLD RAJINDER NAGAR NEW DELHI-110060 PH. 25853424,25722270 FAX: 41046530 | ARUN K AGARWAL & ASSOCIATES CHARTERED ACCOUNTANTS 105, SOUTH EX PLAZA-1, 389, MASJID MOTH, SOUTH EX PART - II. PH:011-26256810,26257400 FAX: 011-46035037 |

ANNEXURE I TO LIMITED REVIEW REPORT

ANNEXED TO AND FORMING PART OF THE LIMITED REVIEW REPORT (Referred to in Para 4 of our report dated February 10, 2012

| 1. | The company in its unaudited results for the quarter/period under review, has neither disclosed how the qualification made by the auditors in respect of previous accounting years/periods have been addressed and if the qualifications have not been resolved, the reasons therefore and the steps the company intends to take in such matters, nor it has given the impact of these qualifications on the unaudited results for the quarter/period under review, as required under the provisions of clause 41(iv)(c) of the Listing Agreement. |

| 2. | The License Fee to the DOT is being worked out on accrual basis as against the terms of License Agreements according to which the expenditure/deductions from the Gross Revenue are allowed on actual payment basis in respect of the Public Switching Telecom Network (PSTN) related call charges and roaming charges payable to BSNL and other service providers. |

| 3. | The balances appearing in Advance Tax, Provisions for Income Tax and Interest on income Tax Refund are subject to confirmation of the Income Tax Department. |

| 4. | The company has not made payments of service tax on billings to BSNL after the Point of Taxation Rules 2011, which requires the payment of service tax on accrual basis with effect from July 1, 2011.Besides, the company has also not made payments of service tax payable on receipt basis in respect of sundry debtors as on 30.6.2011 in Delhi Unit, after the Point of Taxation Rules 2011 with effect from July 1, 2011. |

| 5. | The company has allocated the establishment overheads towards capital works on estimation basis. In view of the large amount getting allocated on capital projects vis a vis actual amount spent on these projects, the basis needs to be made more realistic and scientific and the same should avoid capitalizing the loss due to idle time of labour and machines. Moreover, in the absence of confirmation of the status / completion of WIP (work in progress), we cannot examine authenticity and accuracy of amounts outstanding and shown as WIP for extraordinary time period. |

| 6. | All the receivables and payables including amount receivable/payable to BSNL/DOT/ITI, Inter Unit Accounts and bank balances are subject to confirmation, reconciliation and consequent adjustments. In the case of BSNL, the bills raised for the use of infrastructure services are not accepted by them, hence we cannot comment on the recoverability of the said amount. The company is not making any provision for old outstanding balances from BSNL, DOT, Govt, agencies and other operators. |

| 7. | The breakup of staff cost as made in reviewed financial results has been made by the management and relied upon by us. |

| 8. | The accounting policy for making provisions for bad and doubtful debts pertaining to CDMA unit has not been revised from three years outstanding to six months' outstanding despite of the same being transferred from Basic to Cellular services. |

BANSAL SINHA & CO. CO. CHARTERED ACCOUNTANTS 18/19 OLD RAJINDER NAGAR NEW DELHI-110060 PH. 25853424,25722270 FAX: 41046530 | ARUN K AGARWAL & ASSOCIATES CHARTERED ACCOUNTANTS 105, SOUTH EX PLAZA-1, 389, MASJID MOTH, SOUTH EX PART - II. PH:011-26256810,26257400 FAX: 011-46035037 |

9. | The loss on account of subscriber's instruments for WLL closed connections within last three years has not been ascertained and provided for. |

| 10. | The company has sent material worth Rs.95.35 million to BSNL on barter basis for which corresponding material of Rs.2.45 Millions is only received from BSNL. As the transfer is in the nature of sales yet the same has not been shown as such and no sales tax has been charged by the company on such transfers. |

11. | Based on the expert opinions, the company has not been deducting Tax at source on services received from BSNL. Also, the expenditure on account of Pension liability on the basis of actuarial valuation is considered as an allowable expense for the purpose of tax calculation. |

| 12. | The provision for employee's benefits as per Accounting Standard 15 (Revised) and depreciation has been made on estimated basis. Pending actual determination of the liability/asset in this regard. The impact of the same on the results of the quarter is not ascertainable. Further, the liability on account of medical facilities to the retired employees has not been accounted for on actuarial basis rather the annual insurance premium paid for the policy for the purpose has been accounted for on year to year basis. |

| 13. | The reconciliation of Subscribers' deposits, Sundry Debtors, Income from Recharge Coupons, ITC Cards, prepaid calling cards and stock of recharge coupons and leased circuits is under progress. |

| 14. | The Company had accounted for Rs.3014.80 million during the previous year 2010-11, towards wet lease for infrastructure and other services provided in respect of Commonwealth Games of which Rs.430 million is subject to acceptance and final settlement. Besides, a claim of Rs.410 million has not been booked subject to final acceptance and settlement. |

| 15. | The Fixed Assets redeployed out of the Commonwealth Games Project to Delhi and Mumbai units are yet to be made fully operational in both the units, therefore, we are unable to comment on the impairment or further liability that would accrue for making the same fully operational. |

| 16. | The overall impact of matters referred to in above paras on the results of the company is not determinable. |

| Annexure A | |||||||

MAHANAGAR TELEPHONE NIGAM LIMITED ( A Govt, of India Enterprise) Regd. Office : Jeevan Bharti Building, Tower-1, 12th Floor, 124, Connaught Circus, New Delhi-110001 REVIEWED FINANCIAL RESULTS FOR THE THREE MONTHS EHOED 31/12/2011 | |||||||

(Rs. in Million) | |||||||

| S. No. | Particulars | 3 Months ended 31/12/2011 | Previous 3 Months ended 30/09/2011 | Corresponding 3 Months ended 31/12/2010 In the previous year | Year to date figures for Current period ended 31/12/2011 | Year to date figures for previous year ended 31/12/2010 | Previous accounting year ended 31/03/2011 |

| UNAUDITED | UNAUDITED | UNAUDITED | UNAUDITED | UNAUDITED | AUDITED | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 1 | (a) Net Income from Operations | 8,520.97 | 8,606.47 | 9,225.22 | 25,259.26 | 29,290.95 | 36,739.52 |

| (b) Other Operating Income | 226.72 | 353.93 | 287.06 | 878.99 | 571.04 | 1,230.74 | |

| Total Income | 8,747.68 | 8,960.40 | 9,512.28 | 26,138.24 | 29,861,99 | 37,970,26 | |

| 2 | Expenditure | ||||||

(a1) Staff Cost other than retirement benefits | 4,437.42 | 4,234.08 | 4,781.88 | 13,078.21 | 12,790.52 | 17,103.38 | |

(a2) Staff Cost for retirement benefits (Actual Payouts) | 1,029.30 | 1,236.19 | 750.96 | 3,347.05 | 2,440.61 | 3,477.84 | |

(a3) Staff Cost for retirement benefits (Provisions) | 2,765.90 | 2,541.38 | 2,595.67 | 8,297.75 | 7,907.00 | 12,004.26 | |

| (b) Revenue Sharing. | 1,056.41 | 1,290.05 | 1,186.43 | 3,419.22 | 3,392.17 | 4,432.46 | |

| (c) Licence Fees and Spectrum Charges | 715.93 | 722.23 | 908.41 | 2,134.01 | 2,648.81 | 3,211.22 | |

| (d) Admn./0perative Expenditure | 2,102.13 | 1,769.04 | 2,240.93 | 5,379.80 | 6,541.36 | 8,817.38 | |

| Total Expenditure | 12,107.08 | 11,792.97 | 12,464.29 | 35,656.03 | 35,720.48 | 49,046.55 | |

| 3 | Earnings from Operations before Other Income, Interest, Depreciation & Amortisation & Exceptional Items (1-2) | (3,359.40) | (2,832.57) | (2,952.00) | (9,517.79) | (5,858.48) | (11,076.29) |

| 4 | Depreciation & Amortisation | 3,681.60 | 3,586.61 | 3,606.31 | 10,832.33 | 10,479.89 | 14,101.48 |

| 5 | Profit / (Loss) from Operations after Depreciation & Amortisation but before Other Income, Interest & Exceptional Items (3-4) | (7,040.99) | (6,419.18) | (6,558.31) | (20,350,11) | (16,338.37) | (25,177.77) |

| 6 | Other income | 195.93 | 130.17 | 1,167.94 | 575.11 | 2,109.55 | 1,949.70 |

| 7 | Profit / (Loss) before Interest & Exceptional Items (5+6) | (6,845.06) | (6.289.02) | (5,390.37) | (19,775.00) | (14,228,82) | (23,228.07) |

| 8 | Interest | 2,593.77 | 2,350.38 | 1,359.83 | 6,803.11 | 3,076.37 | 4,519.46 |

| 9 | Profit / (Loss) after Interest but before Exceptional Items (7-8) | (9,438.83) | (8,639.39) | (6,750.20) | (26,578.11) | (17,305.19) | (27,747.53) |

| 10 | Exceptional Items | - | - | - | - | - | - |

| 11 | Profit/ (Loss) from ordinary activities before tax (9-10) | (9,438.83) | (8,639.39) | (6,750.20) | (26,578.11) | (17,305.19) | (27,747.53) |

| 12 | Tax expense | ||||||

| (a) Provision for Current Tax | 0.48 | 0.47 | 0.46 | 1.43 | 1.37 | 1.91 | |

| (b) Taxes for earlier period written back/paid | - | - | - | - | - | 285.38 | |

| (c) Provision for Deferred Tax | - | - | - | - | - | - | |

| 13 | Net Profit/(Loss) from ordinary activities after tax (11-12) | (9,439.31) | (8,639.87) | (6,750.66) | (26,579.54) | (17,306.56) | (28,034.82) |

| 14 | Extraordinary items/ Prior Period Adjustments (net of tax) | (141.58) | 1.98 | (40.20) | (139.54) | (32.84) | (15.67) |

| 15 | Net Profit (Loss) for the period (13-14) | (9,297.73) | (8,641.85) | (6,710.46) | (26,440.00) | (17,273.72) | (28,019.15) |

| 16 | Paid up equity share capital (Face value of Rs.10/-eaeh) | 6,300.00 | 6,300.00 | 6,300.00 | 6,300.00 | 6,300.00 | 6,300.00 |

| 17 | Reserves excluding Revaluation Reserves as per balance sheet of previous accounting year | 60,164.81 | |||||

| 18 | Earning Per Share (EPS) | ||||||

| (a) Basic and Diluted EPS before Extraordinary items for the period | (14.98) | (13.71) | (10.72) | (42.19) | (27.47) | (44.50) | |

| (b) Basic and Diluted EPS after Extraordinary items for the period | (14.76) | (13.72) | (10.65) | (41.97) | (27.42) | (44.47) | |

| 19 | Public Shareholding | ||||||

| a) Number of shares | 275,627,260 | 275,627,260 | 275,627,260 | 275,627,260 | 215,627,260 | 275,627,260 | |

| b) Percentage of shareholding | 43.75% | 43.75% | 43.75% | 43.75% | 43.75% | 43.75% | |

| 20 | Promoter and promoter group Shareholding | ||||||

| a) Pledged/Encumbered | |||||||

| - Number of shares | 0 | 0 | 0 | 0 | 0 | 0 | |

| - Percentage of shares (as a % of the total shareholding of promoter and promoter group) | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | |

| - Percentage of shares (as a % of the total share capital of the company) | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | |

| b) Non encumbered | |||||||

| - Number of shares | 354,372,740 | 354,372,740 | 354,372,740 | 354,372,740 | 354,372,740 | 354,372,740 | |

| - Percentage of shares (as a % of the total shareholding of promoter and promoter group) | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | |

| - Percentage of shares (as a % of the total share capital of the company) | 56.25% | 56.25% | 56.25% | 56.25% | 56.25% | 56.25% | |

| Notes: | |||||||

| 1 | The above results have been reviewed and recommended for adoption by the Audit Committee in their meeting held on 10.02.2012 and approved by the Board of Directors of the Company at their meeting held on 10.02.2012. The Statutory Auditors have carried out a Limited Review of the financial results as required under Clause-41 of the Listing Agreement. | ||||||

| 2 | The above results have been finalised by providing for retirement benefits discounting factor @8.50% in accordance with the yield of central government securities, 4% increase in dearness relief of pension, 3.50% on salary escalation & 0.50% on attrition rates as per projected liability estimated by the actuary on the salary increase assumption of 31.03.2011. | ||||||

| 3 | Previous period/year figures have been regrouped/rearranged wherever necessary. | ||||||

| 4 | The status of investor complaints received and disposed off during this quarter ended on 31.12.2011 is as under: | ||||||

| Complaints pending at the beginning of the quarter | 0 | ||||||

| Complaints received during this quarter | 4 | ||||||

| Complaints disposed off during this quarter | 4 | ||||||

| Complaints lying unresolved at the end of the quarter | 0 | ||||||

MTNL's REVIEWED SEGMENT WISE REVENUE, RESULTS AND CAPITAL EMPLOYED FOR THE THREE MONTHS ENDED ON 31/12/2011 | |||||||

| (Rs. In Million) | |||||||

| S. No. | Particulars | 3 Months ended 31/12/2011 | Previous 3 Months ended 30/09/2011 | Corresponding 3 Months ended 31/12/2010 in the previous year | Year to date figures for Current period ended 31/12/2011 | Year to date figures for previous year ended 31/12/2010 | Previous accounting year ended 31/3/2011 |

| UNAUDITED | UNAUDITED | UNAUDITED | UNAUDITED | UNAUDITED | AUDITED | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 1. | Segment Revenue | ||||||

a. Basic Services | 6,782.76 | 6,796.62 | 7,624.41 | 20,077.66 | 24,620.42 | 30,899.69 | |

b. Cellular | 1,809.46 | 1,877.59 | 1,630.73 | 5,401.07 | 4,907.06 | 6,450.74 | |

| c. Unallocated | - | - | - | - | - | (164.18) | |

| Total | 8,592.22 | 8,674.20 | 9,255.15 | 25,478.73 | 29,527.49 | 37,186.25 | |

| Less: Inter Segment Revenue | 71.26 | 67.73 | 29.92 | 219.47 | 236.53 | 446.73 | |

| Net Income from Operations | 8,520.97 | 8,606.47 | 9,225.22 | 25,259.26 | 29,290.95 | 36,739.52 | |

| 2. | Segment Results (Profit/(Loss) before tax and Interest from each segment) | ||||||

a. Basic Services | (5,137.15) | (4,884.12) | (5,531.40) | (15,426.37) | (13,766.33) | (17,894.14) | |

b. Cellular | (887.70) | (746.81) | (1,117.96) | (2,329.05) | (2,460.94) | (3,858.31) | |

| c. Unallocated | (820.21) | (658.10) | 1,258.99 | (2,019.59) | 1,998.45 | (1,475.63) | |

| Total | (6,845.06) | (6,289.02) | (5,390.37) | (19,775.00) | (14,228.82) | (23,228.07) | |

| Less: (i) Interest | 2,593.77 | 2,350.38 | 1,359.83 | 6,803.11 | 3,076.37 | 4,519.46 | |

Less: (ii) Prior Period Items | (141.58) | 1.98 | (40.20) | (139.54) | (32.84) | (15.67) | |

Total Profit / (Loss) before tax | (9,297.25) | (8,641.37) | (6,710.00) | (26,438.57) | (17,272.35) | (27,731.86) | |

| Less: (i) Provision for Current Tax | 0.48 | 0.47 | 0.46 | 1.43 | 1.37 | 1.91 | |

| Less: (ii) Provision for Deferred Tax | - | - | - | - | - | - | |

Less: (iii) Taxes for earlier period written back/paid | - | - | - | - | - | 285.38 | |

| Total Profit/(Loss) after tax | (9,297.73) | (8,641.85) | (6,710.46) | (26,440.00) | (17,273.72) | (28,019.15) | |

| 3. | Capital Employed | ||||||

| (Segment Assets - Segment Liabilities) | |||||||

a. Basic Services | (7,040.92) | (4,873.69) | 41,408.89 | (7,040.92) | 41,408.89 | 31.26 | |

b. Cellular | 66,838.46 | 67,488.35 | 68,891.02 | 66,838.46 | 68,891.02 | 68,652.67 | |

c. Unallocated | (20,321.00) | (13,719.62) | (33,146.35) | (20,321.00) | (33,146.35) | (2,219.11) | |

| Total | 39,476.54 | 48,895.04 | 77,153.55 | 39,476.54 | 77,153.55 | 66,464.81 | |

| Place: New Delhi | |||||||

| Date: 10.02.2012 | |||||||