Savara Corporate Presentation (NASDAQ: SVRA) January 2021 Exhibit 99.1

Safe Harbor Statement Savara Inc. (“Savara” or the “Company”) cautions you that statements in this presentation that are not a description of historical fact are forward-looking statements which may be identified by the use of words such as “expect,” “intend,” “plan,” “anticipate,” “believe,” and “will,” among others. Such statements include, but are not limited to, statements regarding the timing, design and other matters related to clinical trials of our product candidate; the sufficiency of our resources to fund the advancement of our development program and potential sources of additional capital; the nature, strategy and focus of our organization; the safety, efficacy and projected development timeline and commercial potential of our product candidate; the potential health benefits of our product candidate; our anticipated corporate milestones and the market size or potential for our product. Savara may not actually achieve any of its plans or product development goals in a timely manner, if at all, or otherwise carry out its current intentions or meet the expectations or projections disclosed in its forward-looking statements, and you should not place undue reliance on these forward-looking statements. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. These forward-looking statements are based upon Savara's current expectations and involve assumptions that may never materialize or may prove to be incorrect. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of various risks and uncertainties, which include, without limitation, the risks and uncertainties related to the impact of the COVID-19 pandemic on our business and operations; the outcome of our future interactions with regulatory authorities; risks and uncertainties associated with the ability to project future cash utilization and reserves needed for contingent future liabilities and business operations; the availability of sufficient resources for our operations and to conduct or continue planned clinical development programs; the timing and ability of Savara to raise additional capital as needed to fund continued operations; the ability to successfully conduct clinical trials for our product candidate; the ability to successfully develop our product candidate; and the risks associated with the process of developing, obtaining regulatory approval for and commercializing drug candidates that are safe and effective for use as human therapeutics. The risks and uncertainties facing Savara are described more fully in Savara's filings with the Securities and Exchange Commission including our filings on Form 8-K, our Annual Report on Form 10-K for the fiscal year ended December 31, 2019, and our Quarterly Report on Form 10-Q for the quarter ended September 30, 2020. You are cautioned not to place undue reliance on our forward-looking statements, which speak only as of the date on which they were made. Savara undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made, except as may be required by law. Third-party information included herein has been obtained from sources believed to be reliable, but the accuracy or completeness of such information is not guaranteed by, and should not be construed as a representation by, the Company. The trademarks included herein are the property of the owners thereof and are used for reference purposes only. Such use should not be construed as an endorsement of such products.

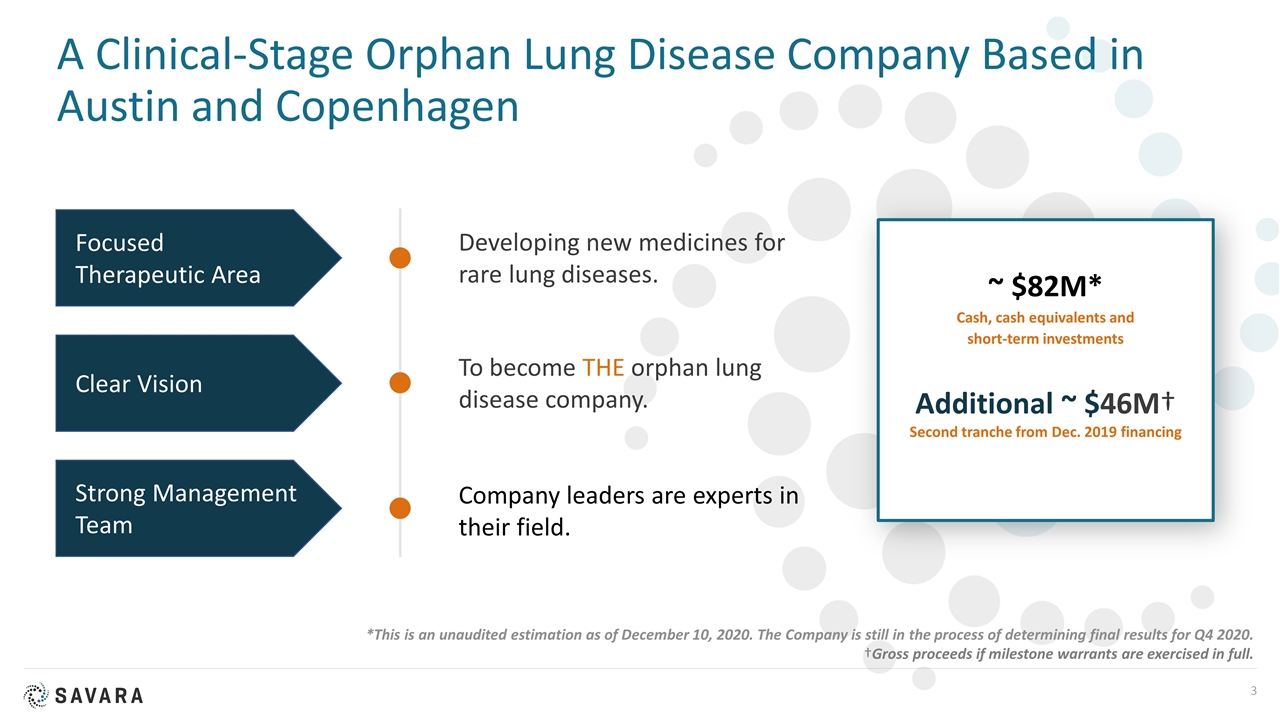

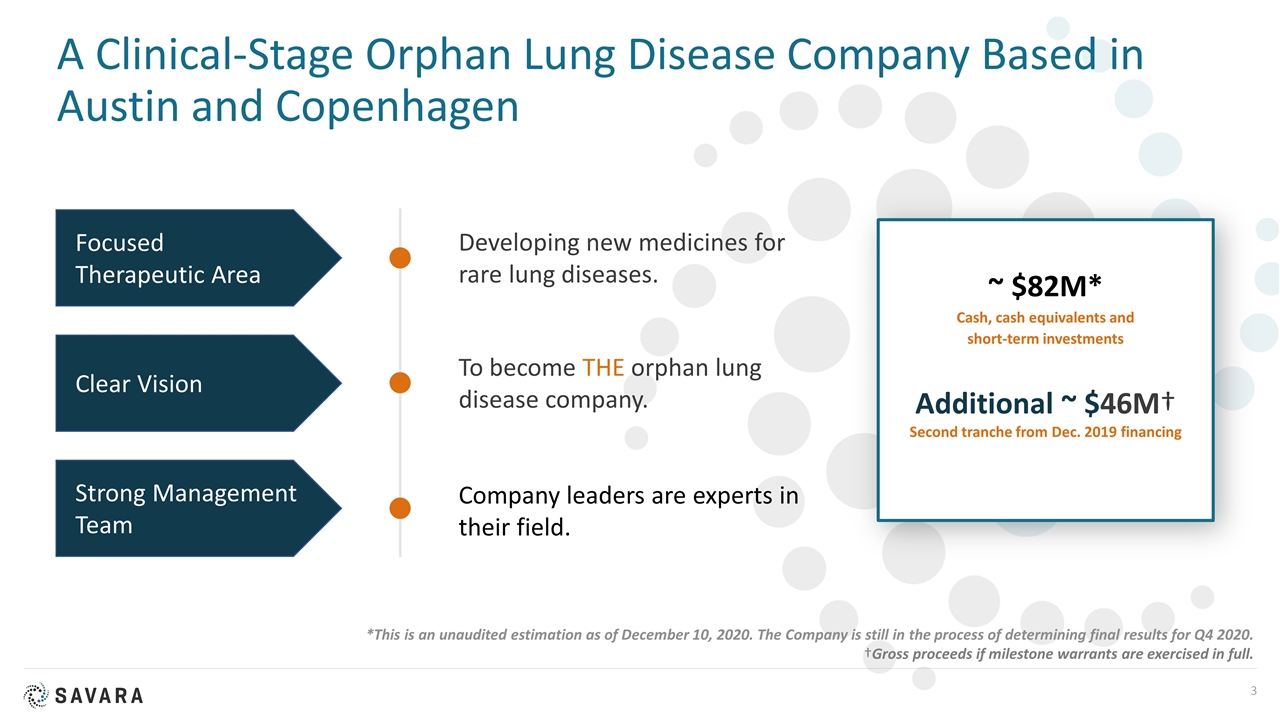

A Clinical-Stage Orphan Lung Disease Company Based in Austin and Copenhagen Developing new medicines for rare lung diseases. To become THE orphan lung disease company. Company leaders are experts in their field. Focused Therapeutic Area Clear Vision Strong Management Team ~ $82M* Cash, cash equivalents and short-term investments Additional ~ $46M† Second tranche from Dec. 2019 financing *This is an unaudited estimation as of December 10, 2020. The Company is still in the process of determining final results for Q4 2020. †Gross proceeds if milestone warrants are exercised in full.

Executive Leadership We are a team with deep expertise in orphan lung diseases and pulmonary medicine and a proven track record that spans from early clinical development through commercialization. Matthew Pauls Chairman and CEO Dave Lowrance CFO Badrul Chowdhury CMO

Molgradex Molgramostim Inhalation Solution for Autoimmune Pulmonary Alveolar Proteinosis (aPAP)

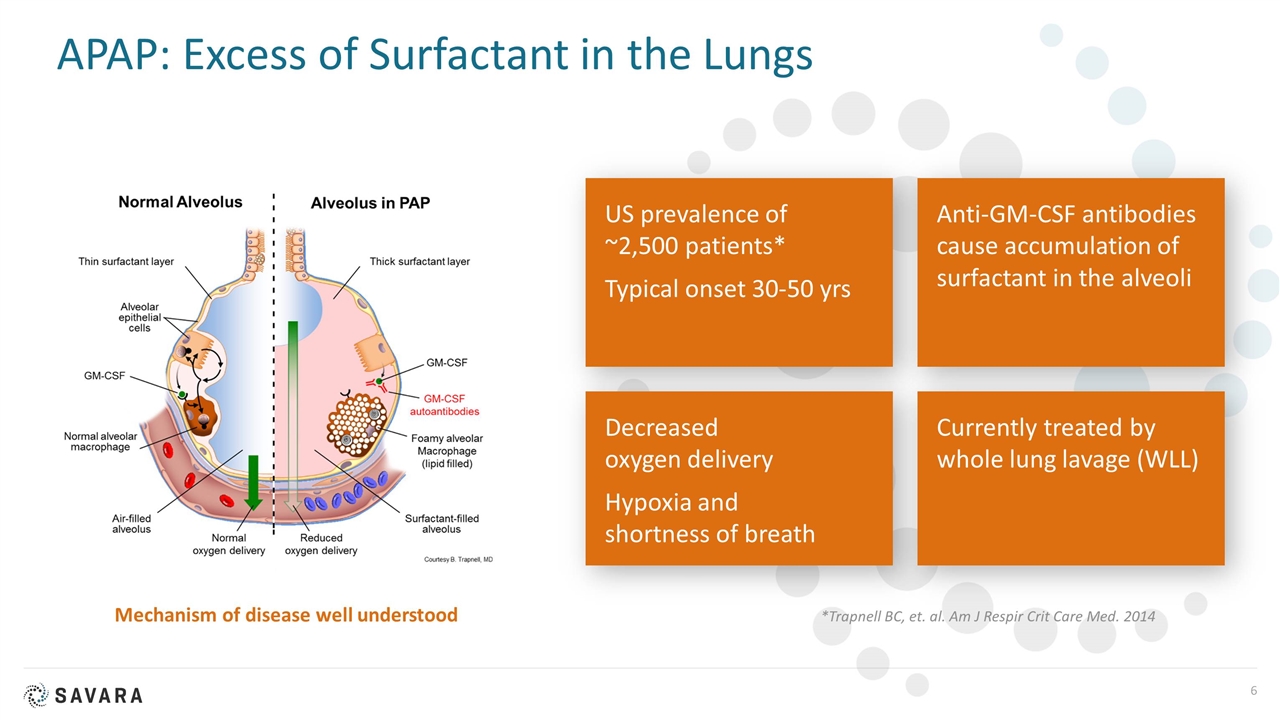

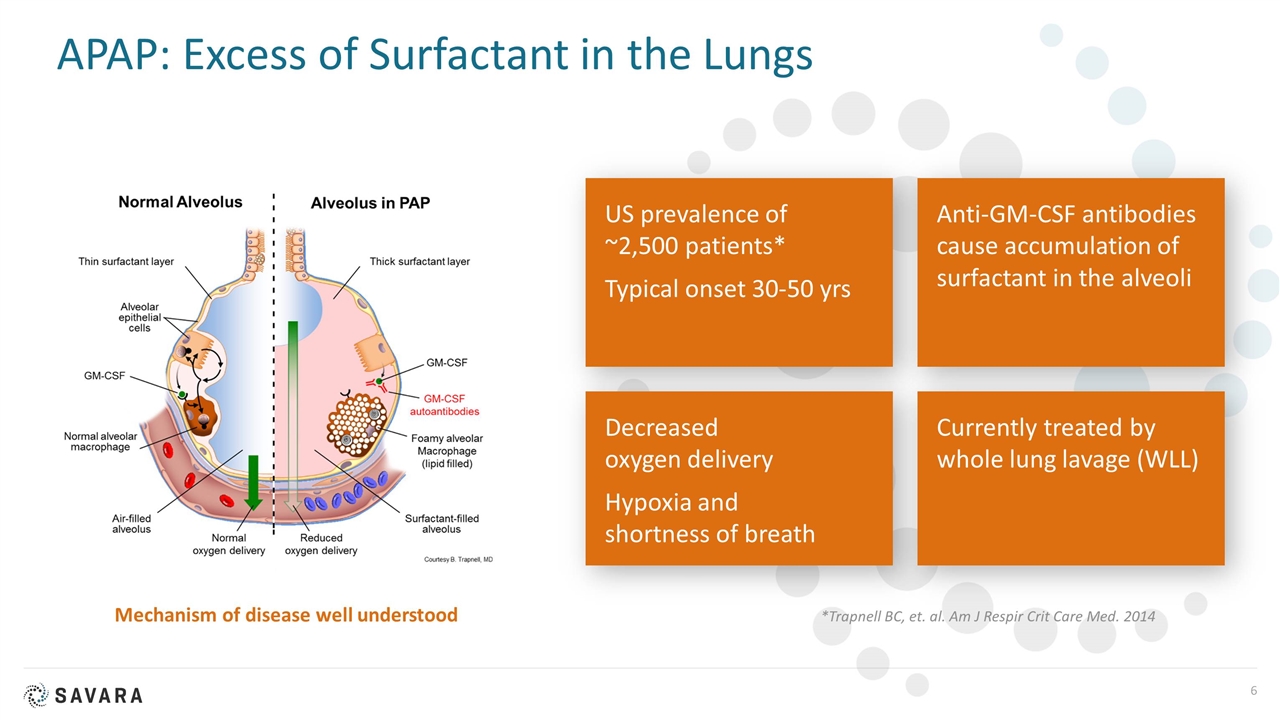

APAP: Excess of Surfactant in the Lungs Mechanism of disease well understood *Trapnell BC, et. al. Am J Respir Crit Care Med. 2014 US prevalence of ~2,500 patients* Typical onset 30-50 yrs Anti-GM-CSF antibodies cause accumulation of surfactant in the alveoli Decreased oxygen delivery Hypoxia and shortness of breath Currently treated by whole lung lavage (WLL)

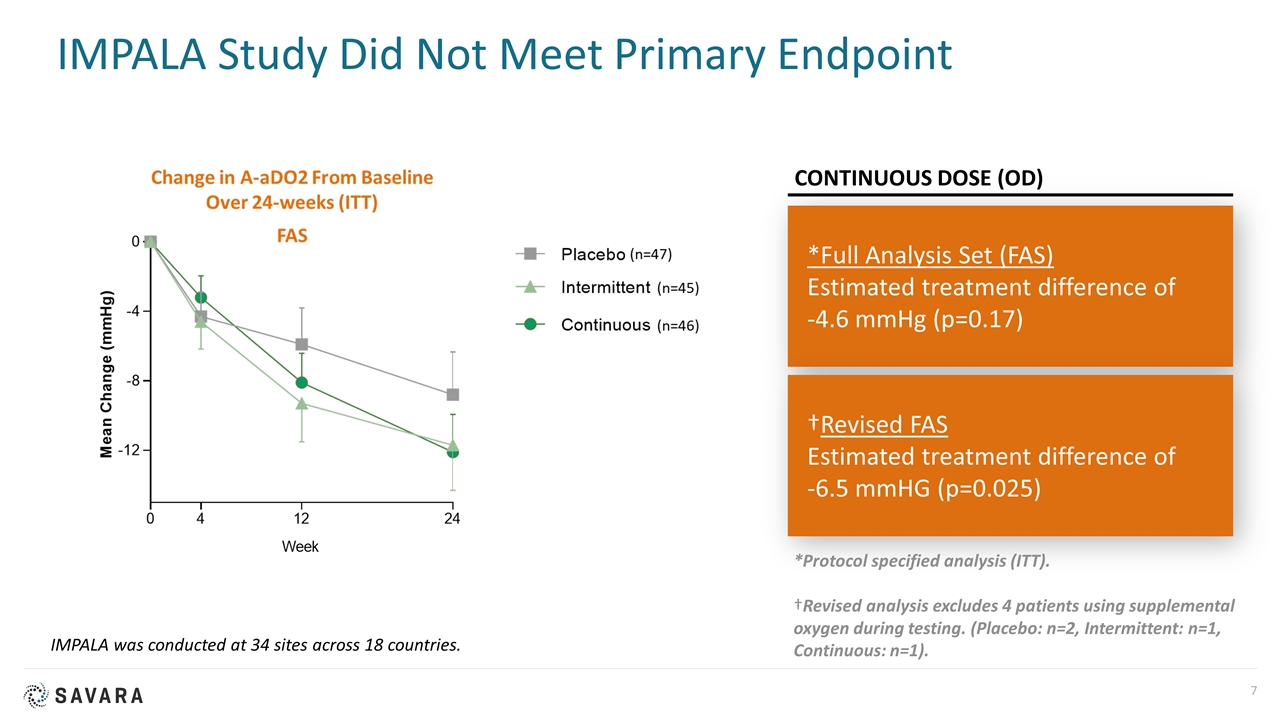

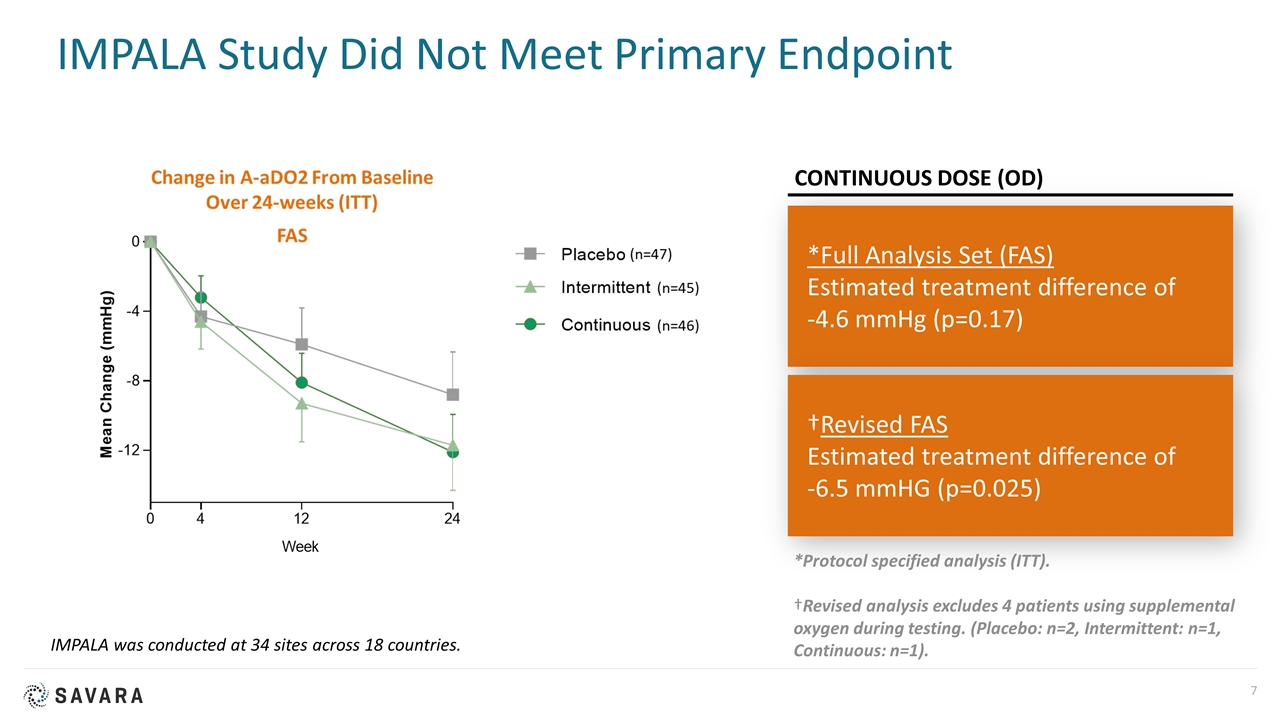

IMPALA Study Did Not Meet Primary Endpoint *Full Analysis Set (FAS) Estimated treatment difference of -4.6 mmHg (p=0.17) †Revised FAS Estimated treatment difference of -6.5 mmHG (p=0.025) CONTINUOUS DOSE (OD) IMPALA was conducted at 34 sites across 18 countries. *Protocol specified analysis (ITT). †Revised analysis excludes 4 patients using supplemental oxygen during testing. (Placebo: n=2, Intermittent: n=1, Continuous: n=1).

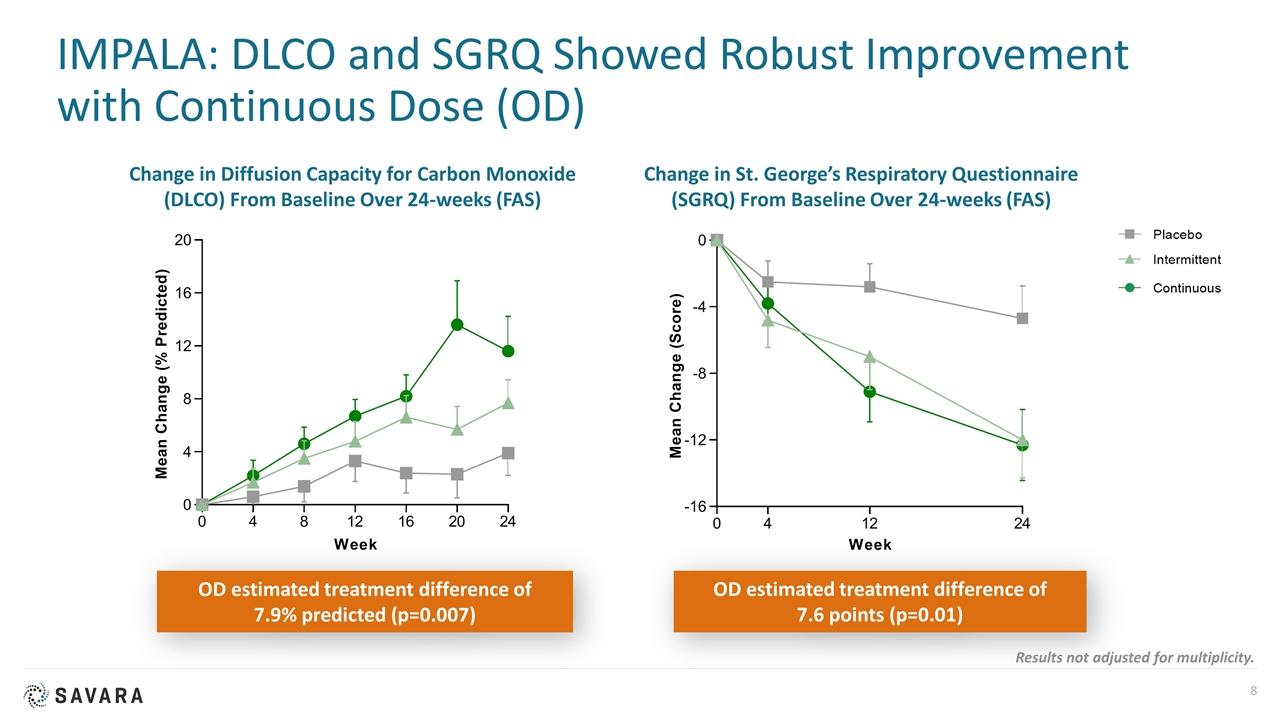

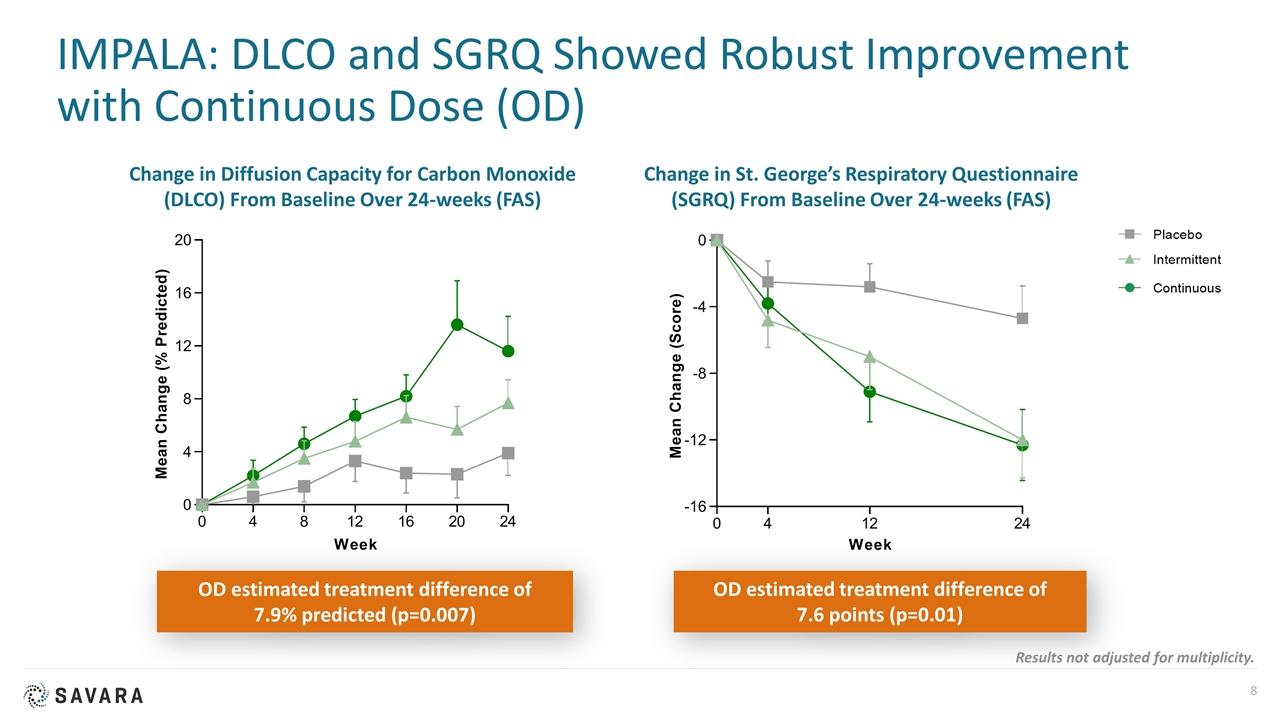

IMPALA: DLCO and SGRQ Showed Robust Improvement with Continuous Dose (OD) OD estimated treatment difference of 7.9% predicted (p=0.007) Change in Diffusion Capacity for Carbon Monoxide (DLCO) From Baseline Over 24-weeks (FAS) Change in St. George’s Respiratory Questionnaire (SGRQ) From Baseline Over 24-weeks (FAS) OD estimated treatment difference of 7.6 points (p=0.01) Results not adjusted for multiplicity.

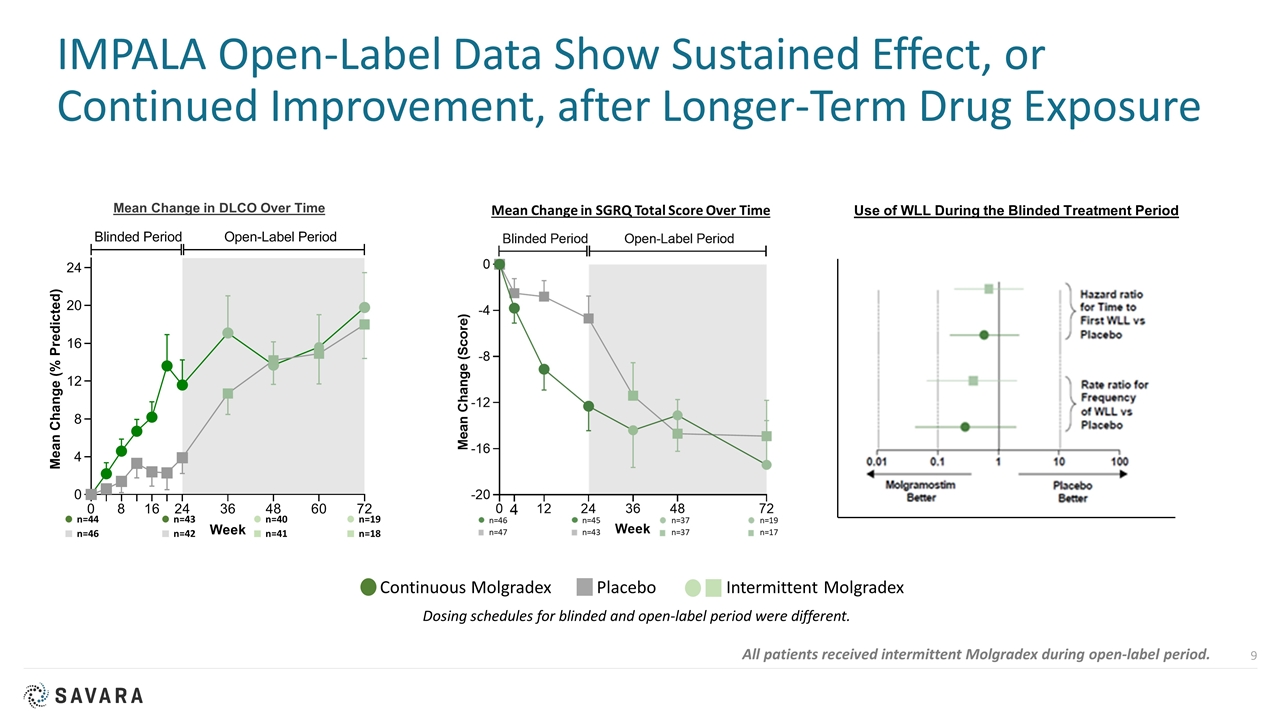

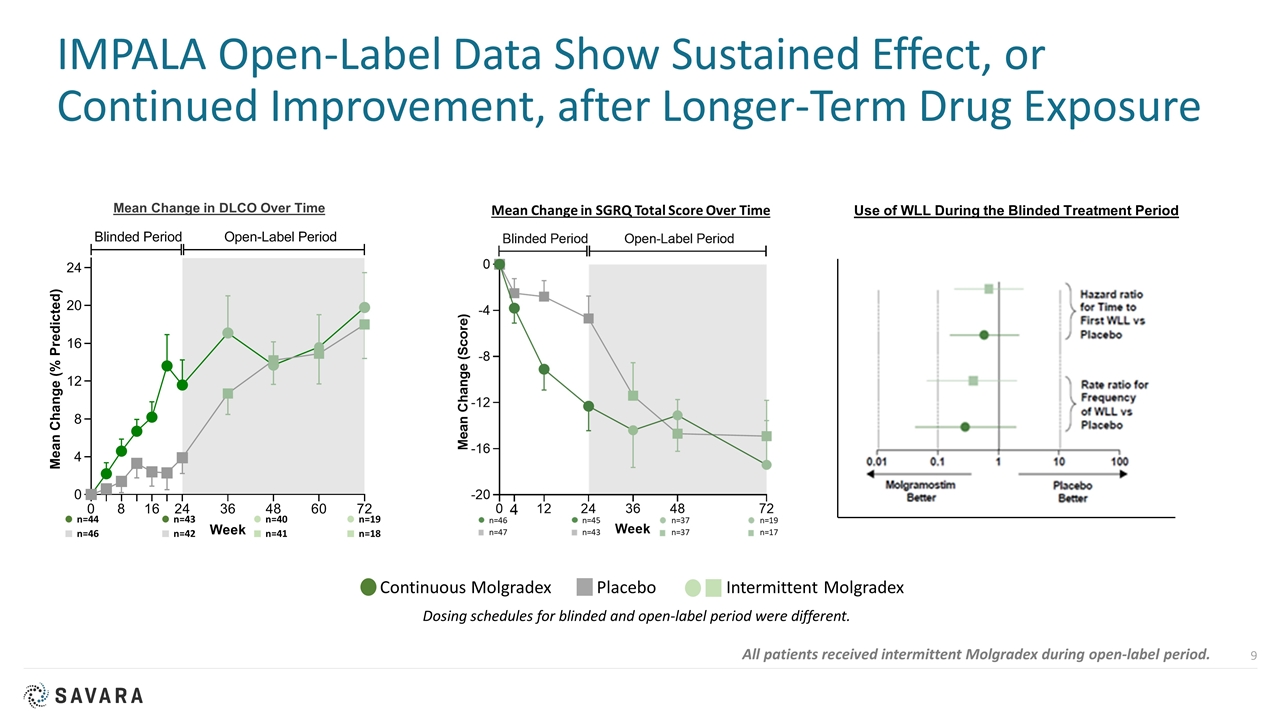

IMPALA Open-Label Data Show Sustained Effect, or Continued Improvement, after Longer-Term Drug Exposure Continuous Molgradex Placebo Intermittent Molgradex Dosing schedules for blinded and open-label period were different. Mean Change in DLCO Over Time n=44 n=46 n=43 n=42 n=40 n=41 n=19 n=18 All patients received intermittent Molgradex during open-label period. Use of WLL During the Blinded Treatment Period

Published online on 9/2/2020. IMPALA Study Results Published in NEJM in September 2020 IMPALA Study Results Published in NEJM in Sept. 2020

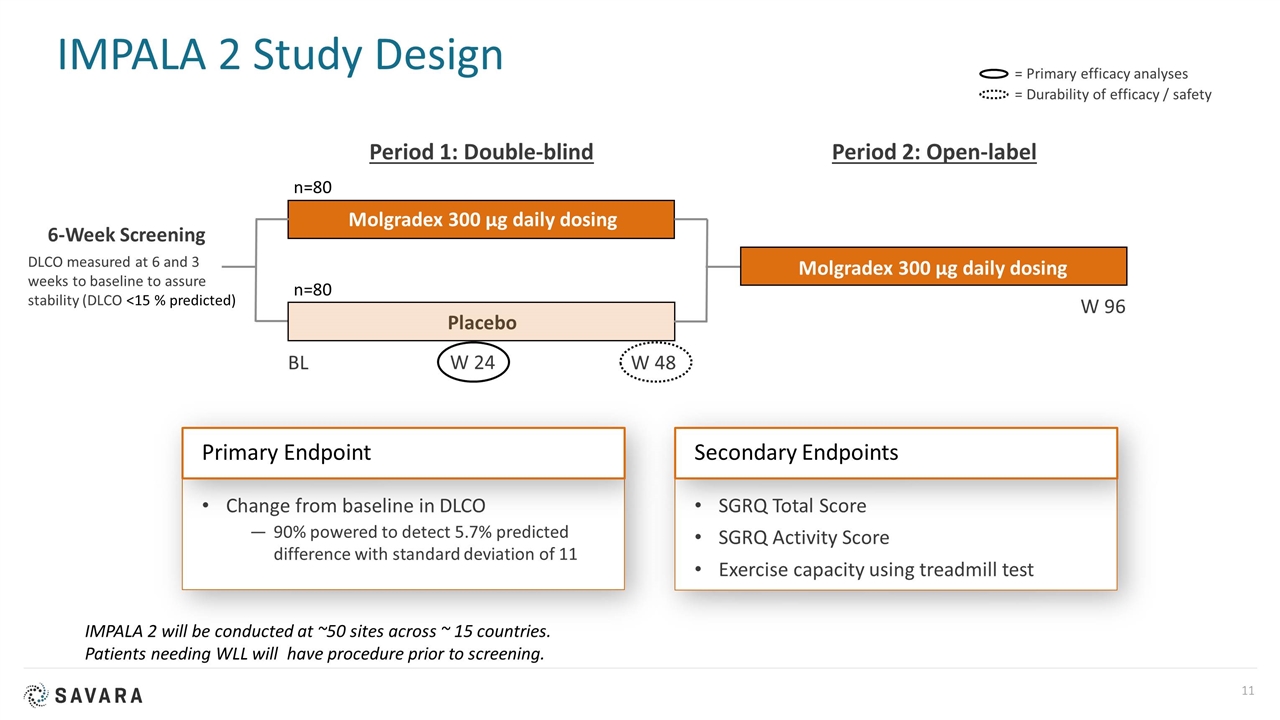

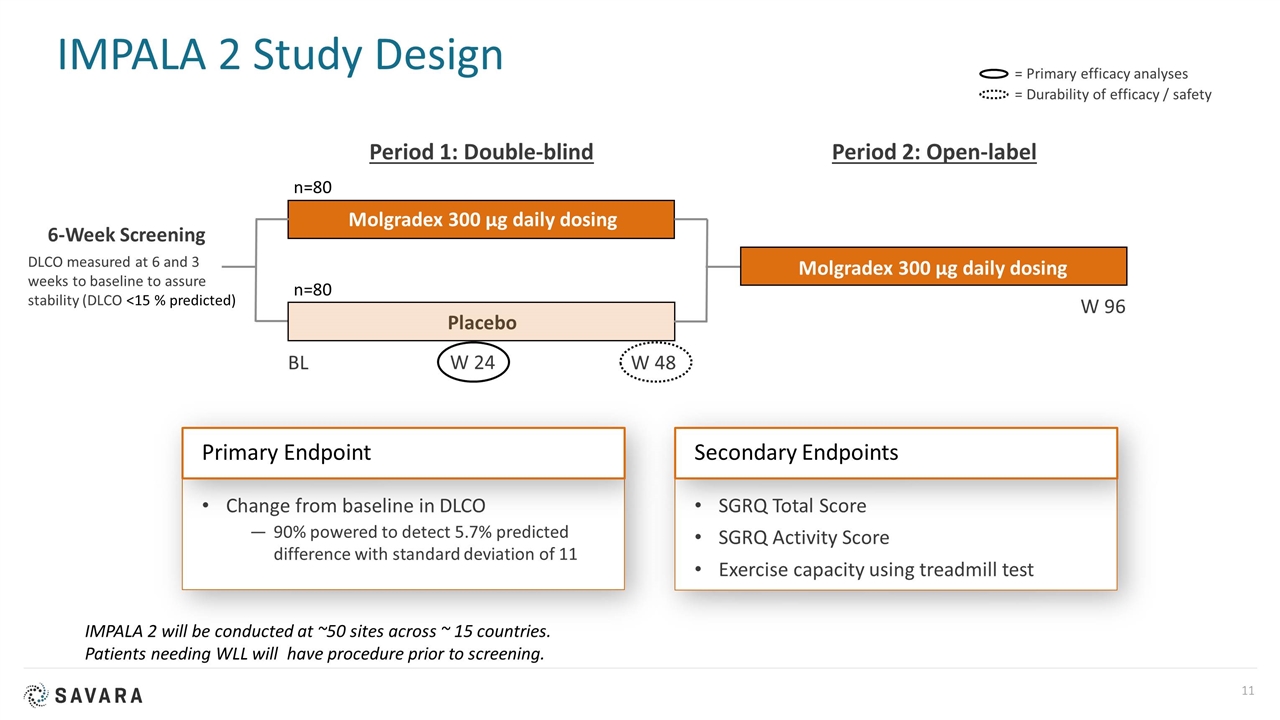

IMPALA 2 Study Design SGRQ Total Score SGRQ Activity Score Exercise capacity using treadmill test Change from baseline in DLCO 90% powered to detect 5.7% predicted difference with standard deviation of 11 = Primary efficacy analyses = Durability of efficacy / safety Secondary Endpoints Primary Endpoint 6-Week Screening BL Molgradex 300 µg daily dosing Period 1: Double-blind W 24 W 48 Period 2: Open-label W 96 Placebo Molgradex 300 µg daily dosing n=80 n=80 IMPALA 2 will be conducted at ~50 sites across ~ 15 countries. Patients needing WLL will have procedure prior to screening. DLCO measured at 6 and 3 weeks to baseline to assure stability (DLCO <15 % predicted)

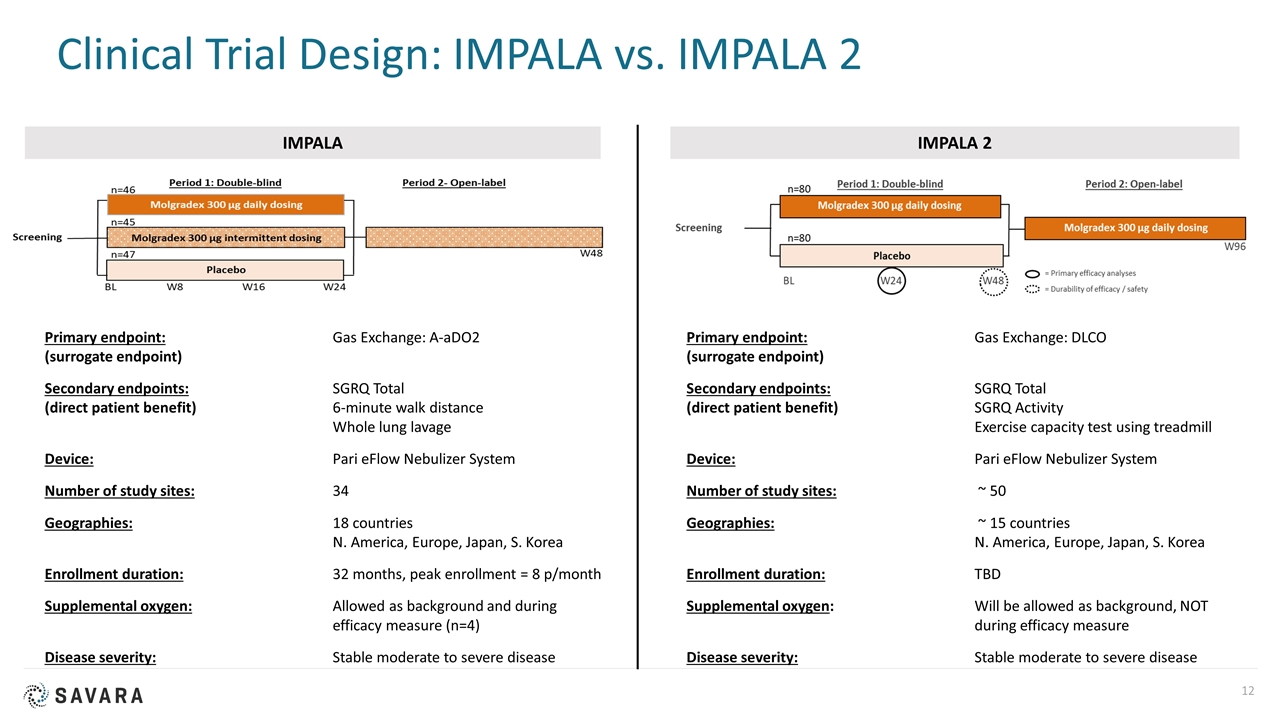

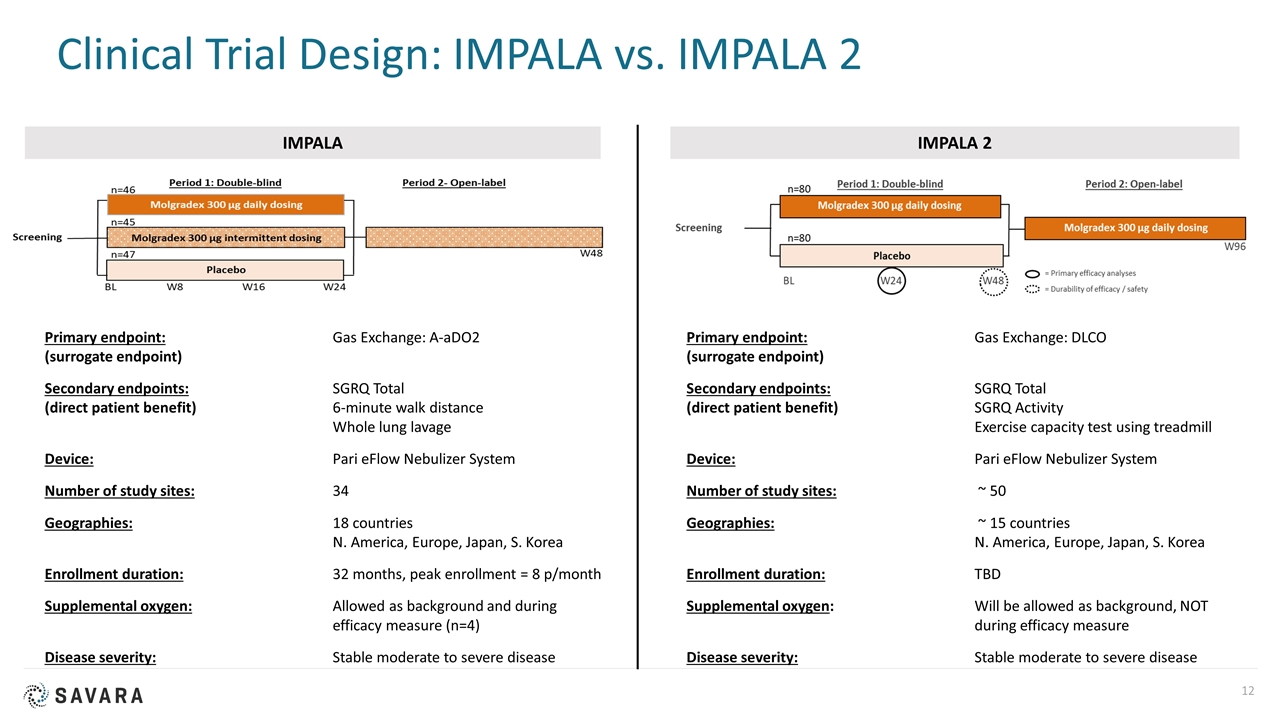

Clinical Trial Design: IMPALA vs. IMPALA 2 IMPALA IMPALA 2 Primary endpoint: Gas Exchange: A-aDO2 (surrogate endpoint) Secondary endpoints: SGRQ Total (direct patient benefit)6-minute walk distance Whole lung lavage Device: Pari eFlow Nebulizer System Number of study sites: 34 Geographies: 18 countries N. America, Europe, Japan, S. Korea Enrollment duration: 32 months, peak enrollment = 8 p/month Supplemental oxygen: Allowed as background and during efficacy measure (n=4) Disease severity:Stable moderate to severe disease Primary endpoint: Gas Exchange: DLCO (surrogate endpoint) Secondary endpoints: SGRQ Total (direct patient benefit)SGRQ Activity Exercise capacity test using treadmill Device: Pari eFlow Nebulizer System Number of study sites: ~ 50 Geographies: ~ 15 countries N. America, Europe, Japan, S. Korea Enrollment duration: TBD Supplemental oxygen:Will be allowed as background, NOT during efficacy measure Disease severity:Stable moderate to severe disease

AEROVANC Inhaled Vancomycin for MRSA in Cystic Fibrosis

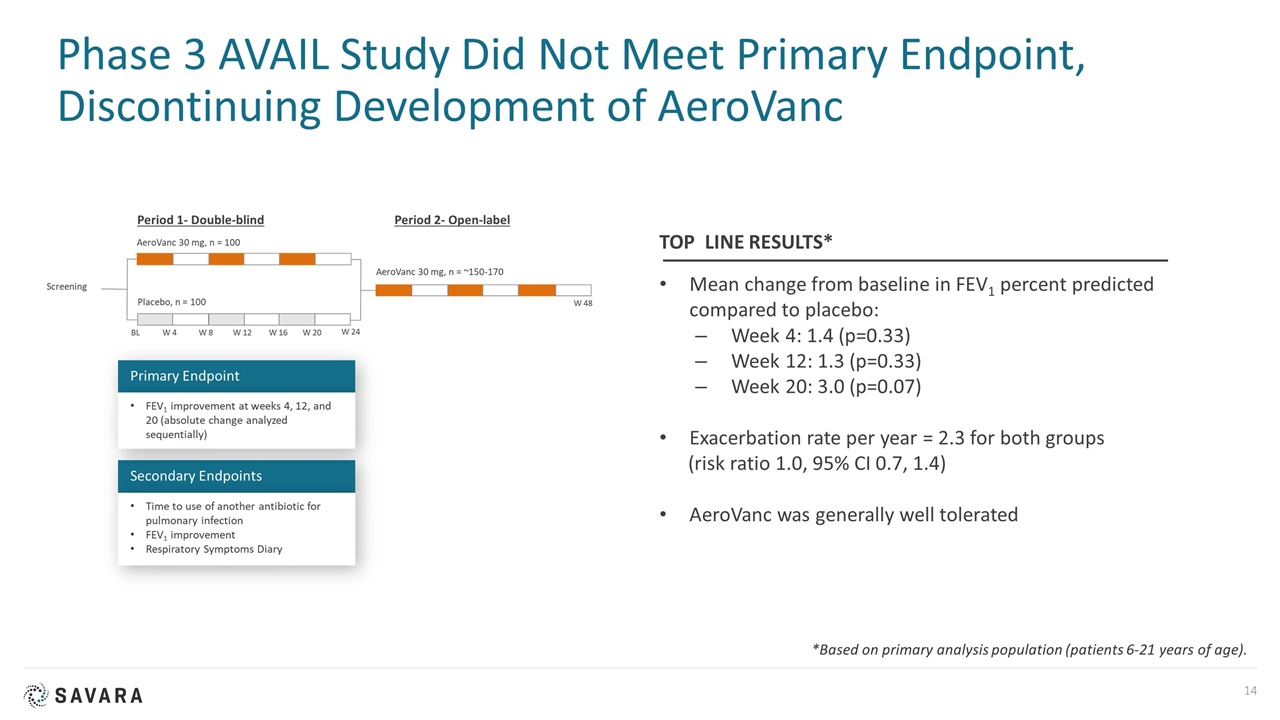

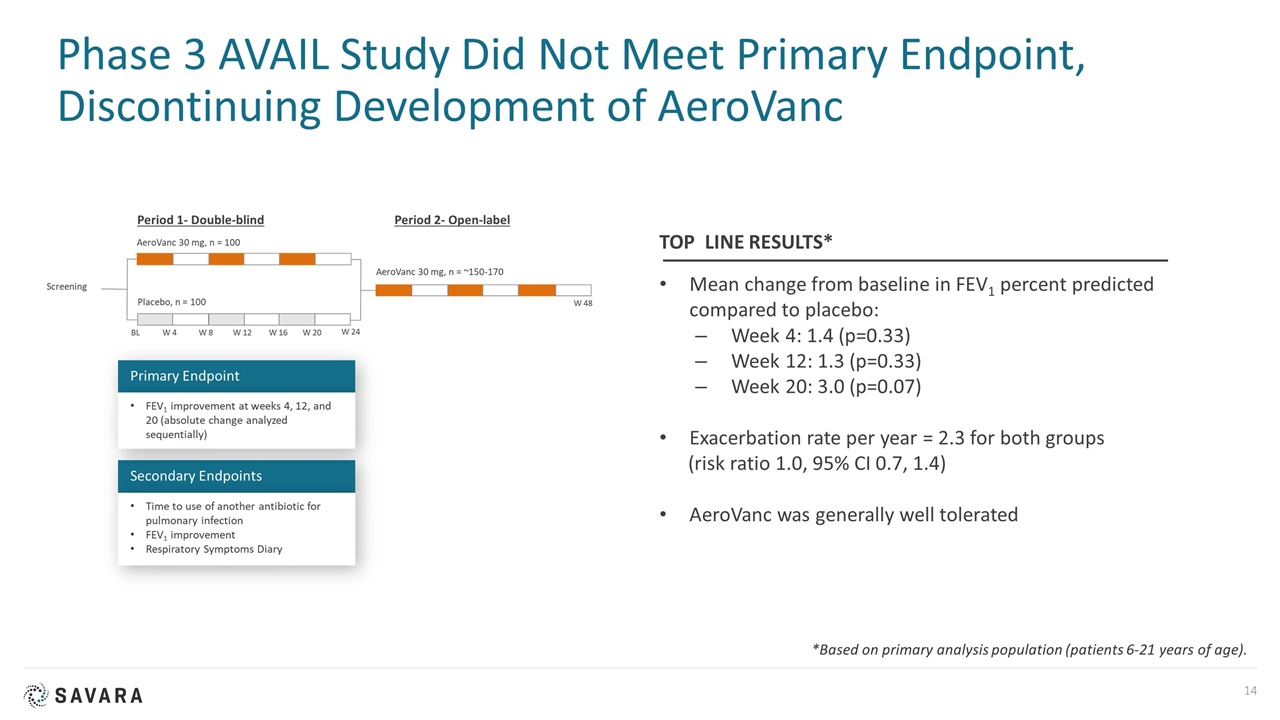

Phase 3 AVAIL Study Did Not Meet Primary Endpoint, Discontinuing Development of AeroVanc Mean change from baseline in FEV1 percent predicted compared to placebo: Week 4: 1.4 (p=0.33) Week 12: 1.3 (p=0.33) Week 20: 3.0 (p=0.07) Exacerbation rate per year = 2.3 for both groups (risk ratio 1.0, 95% CI 0.7, 1.4) AeroVanc was generally well tolerated TOP LINE RESULTS* *Based on primary analysis population (patients 6-21 years of age).

Financials and Milestones

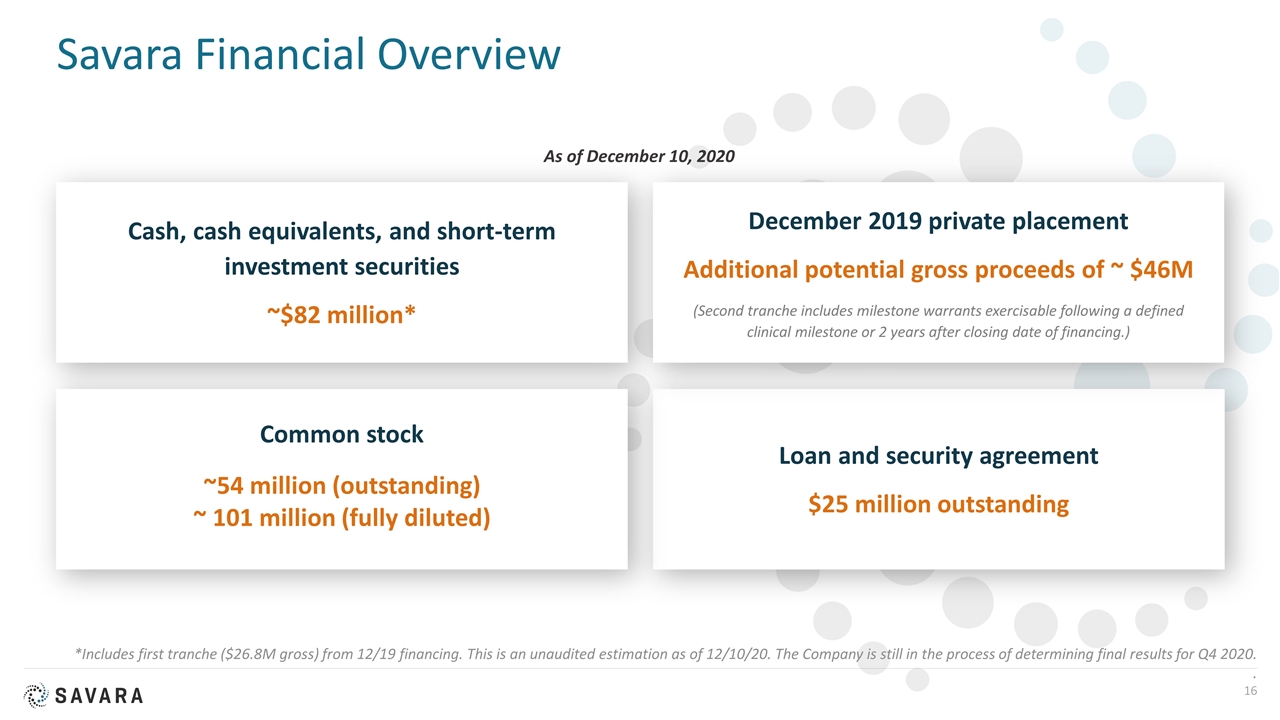

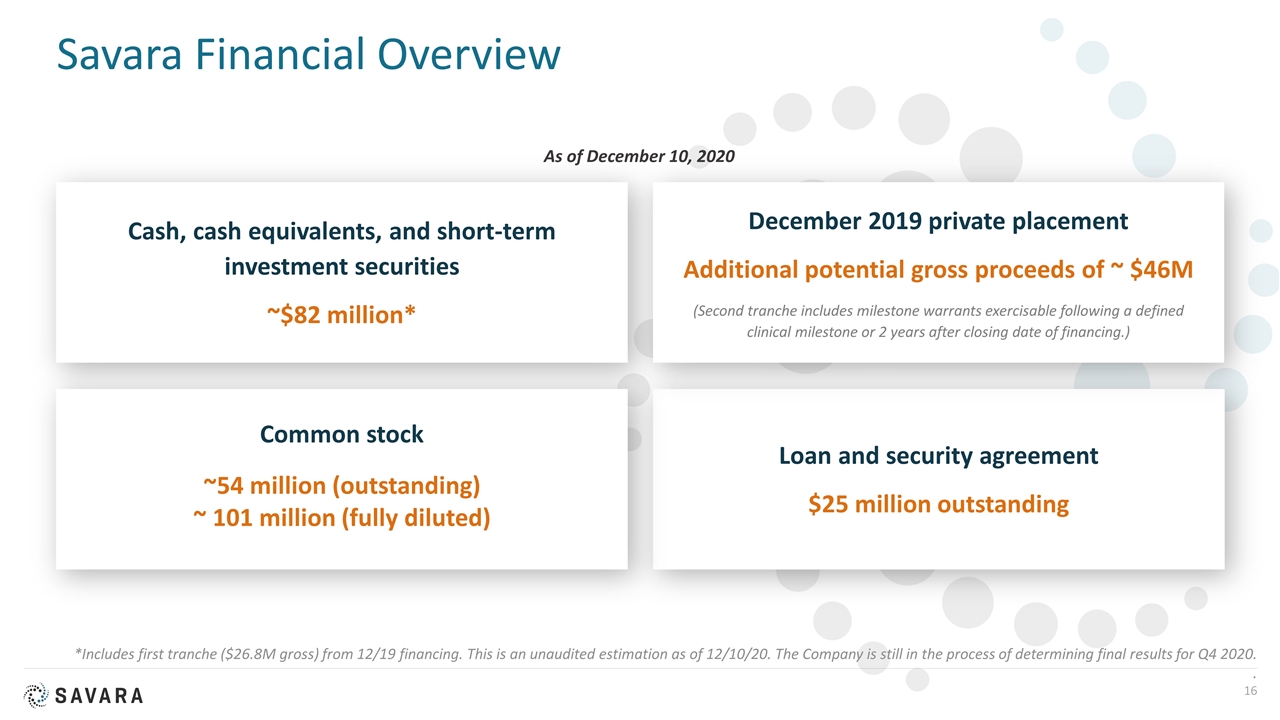

Savara Financial Overview *Includes first tranche ($26.8M gross) from 12/19 financing. This is an unaudited estimation as of 12/10/20. The Company is still in the process of determining final results for Q4 2020. . Cash, cash equivalents, and short-term investment securities ~$82 million* Loan and security agreement $25 million outstanding Common stock ~54 million (outstanding) ~ 101 million (fully diluted) December 2019 private placement Additional potential gross proceeds of ~ $46M (Second tranche includes milestone warrants exercisable following a defined clinical milestone or 2 years after closing date of financing.) As of December 10, 2020