Exhibit 2.1

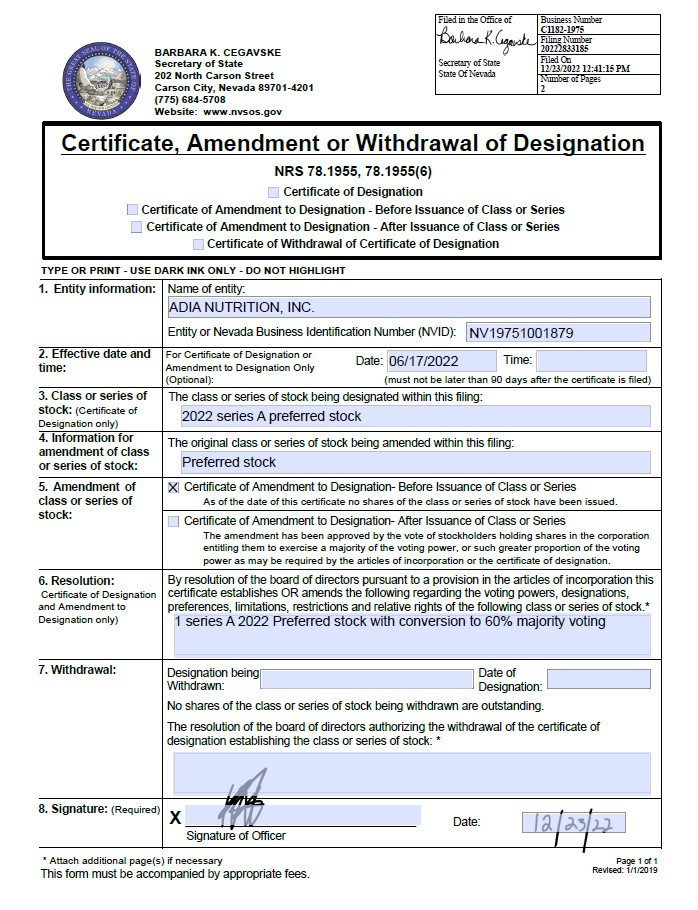

| Filed in the Office of | Business Number |

| C1182-1975 |

| Filing Number |

| 20243938857 |

| Secretary of State | Filed On |

State Of Nevada | 03/26/2024 07:48:24 AM |

| | Number of Pages |

| | 9 |

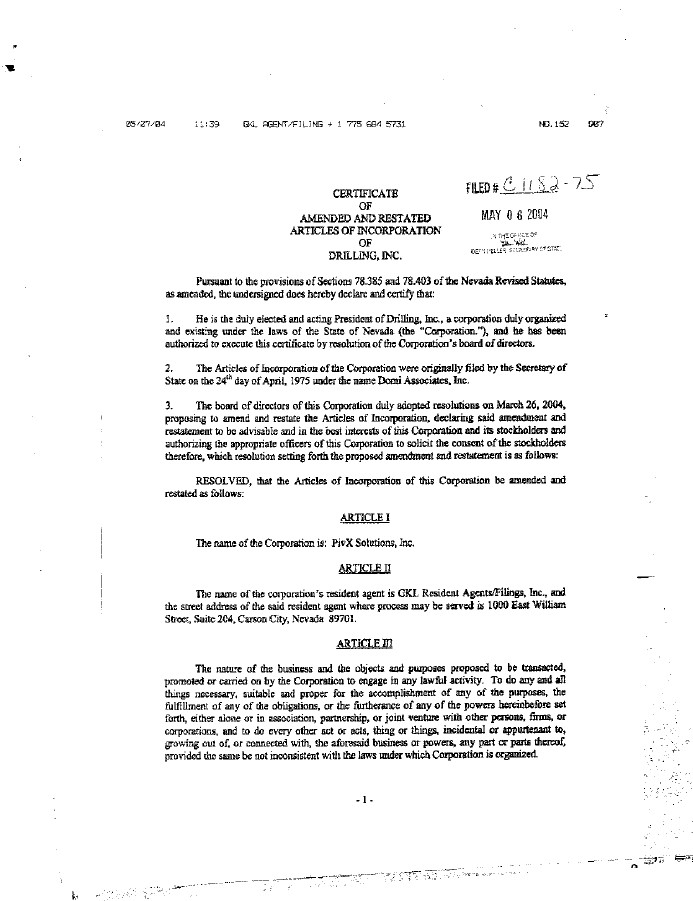

AMENDED AND RESTATED

ARTICLES OF INCORPORATION

OF

ADIA NUTRITION, INC.

(a Nevada corporation)

Adia Nutrition Inc. (the “Corporation”), a corporation incorporated under the laws of the State of Nevada on April 24, 1975, as Domi Associates, Inc., hereby amends and restates its Articles of Incorporation, to embody in one document its original articles and the subsequent amendments and restatements thereto, pursuant to Sections 78.390 and 78.403 of the Nevada Revised Statutes (“NRS”).

Amended and Restated Articles of Incorporation were approved and adopted by the Board of Directors of the Corporation on June 9, 2023. Upon the recommendation of the Board of Directors, the shareholder of the Corporation holding a majority of the voting power approved and adopted these Amended and Restated Articles of Incorporation by an action by written consent in lieu of a meeting of 60% of the eligible votes on June 9, 2023. As a result, these Amended and Restated Articles of Incorporation were authorized and adopted in accordance with the NRS.

These Amended and Restated Articles of Incorporation correctly set forth the text of the Corporation’s Articles of Incorporation as amended up to and by these Amended and Restated Articles of Incorporation.

ARTICLE 1. NAME OF CORPORATION

1.1The name of the corporation is Adia Nutrition, Inc. (the “Corporation”).

ARTICLE 2. DURATION

2.1The Corporation shall continue in existence perpetually, unless sooner dissolved according to law.

ARTICLE 3. REGISTERED AGENT AND REGISTERED OFFICE

3.1The name and address of the Corporation’s registered agent and registered office in the State of Nevada are: Premier Legal Group, 1333 N. Buffalo Drive, Suite 210, Las Vegas, Nevada 89128

ARTICLE 4. PURPOSE

4.1The purpose for which the Corporation is to engage in any lawful activity within or without the State of Nevada.

4.2The Corporation may also maintain offices at such other places within our without the State of Nevada as it may, from time to time, determine. Corporate business of every kind and nature may be conducted, and meetings of directors and shareholders may be held, outside the State of Nevada with the same effect as if in the State of Nevada.

ARTICLE 5. BOARD OF DIRECTORS

5.1Number. The Board of Directors of the Corporation shall consist of such number of persons, not less than one and not to exceed 10, as shall be determined in accordance with the Bylaws of the Corporation from time to time.

ARTICLE 6. CAPITAL STOCK

6.1Authorized Capital Stock. The aggregate number of shares which the Corporation shall have authority to issue is one billion (1,000,000,000) shares, consisting of (a) eight hundred million (800,000,000) shares of common stock, par value $.001 per share (the “Common Stock” or the “Class A Common Stock”), (b) 100,000,000 shares of common stock par value $.001 per share (the “Class B Common Stock”), issuable in one or more series as hereinafter provided, and (c) one hundred million (100,000,000) shares of preferred stock, par value $.001 per share (the “Preferred Stock”), issuable in one or more series as hereinafter provided.

A description of the classes of shares and a statement of the number of shares in each class and the relative rights, voting power and preferences granted to them, and restrictions imposed on them, are as set forth in this Article 6.

6.2Class A Common Stock. Each share of Class A Common Stock shall have, for all purposes, one (1) vote per share. Subject to the preferences applicable to Preferred Stock outstanding at any time, the holders of the shares of Class A Common Stock shall be entitled to receive such dividends and other distributions in cash, property or shares of stock of the Corporation as may be declared thereon by the Board of Directors from time to time out of assets or funds of the Corporation legally available therefrom. The holders of Class A Common Stock issued and outstanding have and possess the right to receive notice of shareholders’ meetings and to vote upon the election of directors or upon any other matter as to which approval of the outstanding shares of Class A Common Stock or approval of the common shareholders is required or requested.

6.3Class B Common Stock. The shares of Class B Common Stock may be issued from time to time in one or more series. The Board of Directors is authorized, by resolution adopted and filed in accordance with law, to provide for the issue of each series of shares of Class B Common Stock; provided, however, that any issuance of shares of Class B Common Stock shall be made only in connection with a special acquisition transaction, as determined by the Board of Directors. Each series of shares of Class B Common Stock:

(a) may have such voting powers, full or limited or may be without voting powers;

(b) may be subject to redemption at such time or times and at such prices as determined by the Board of Directors;

(c) may be entitled to receive dividends (which may be cumulative or non-cumulative) at such rate or rates, on such conditions and at such times, and payable in preference to, or in relation to, the dividends payable on any other class or classes or series of stock;

(d) may have such rights upon the dissolution of, or upon any distribution of assets of, the Corporation;

(e) may be made convertible into, or exchangeable for, shares of any other class or classes or of any other series of the same or any other class or classes of stock of the Corporation or such other corporation or other entity at such price or prices or at such rates of exchange and with such adjustments;

(f) may be entitled to the benefit of a sinking fund to be applied to the purchase or redemption of shares of such series in such amount or amounts;

(g) may be entitled to the benefit of conditions and restrictions upon the creation of indebtedness of the Corporation or any subsidiary, upon the issue of any additional shares (including additional shares of such series or of any other series) and upon the payment of dividends or the making of other distributions on, and the purchase, redemption or other acquisition by the Corporation or any subsidiary of, any outstanding shares of the Corporation; and

(h)may have such other relative, participating, optional or other special rights, qualifications, limitations or restrictions thereof, in each case as shall be stated in said resolution or resolutions providing for the issue of such shares of Class B Common Stock. Shares of Class B Common Stock of any series that have been redeemed or repurchased by the Corporation (whether through the operation of a sinking fund or otherwise) or that, if convertible or exchangeable, have been converted or exchanged in accordance with their terms shall be retired and have the status of authorized and unissued shares of Class B Common Stock of the same series and may be reissued as a part of the series of which they were originally a part or may, upon the filing of an appropriate certificate with the Secretary of State of the State of Nevada be reissued as part of a new series of shares of Class B Common Stock to be created by resolution or resolutions of the Board of Directors or as part of any other series of shares of Class B Common Stock, all subject to the conditions or restrictions on issuance set forth in the resolution or resolutions adopted by the Board of Directors providing for the issue of any series of shares of Class B Common Stock.

6.4Preferred Stock. The shares of Preferred Stock may be issued from time to time in one or more series. The Board of Directors is authorized, by resolution adopted and filed in accordance with law, to provide for the issue of each series of shares of Preferred Stock. Each series of shares of Preferred Stock:

(a) may have such voting powers, full or limited or may be without voting powers;

(b) may be subject to redemption at such time or times and at such prices as determined by the Board of Directors;

(c) may be entitled to receive dividends (which may be cumulative or non-cumulative) at such rate or rates, on such conditions and at such times, and payable in preference to, or in relation to, the dividends payable on any other class or classes or series of stock;

(d) may have such rights upon the dissolution of, or upon any distribution of assets of, the Corporation;

(e) may be made convertible into, or exchangeable for, shares of any other class or classes or of any other series of the same or any other class or classes of stock of the Corporation or such other corporation or other entity at such price or prices or at such rates of exchange and with such adjustments;

(f) may be entitled to the benefit of a sinking fund to be applied to the purchase or redemption of shares of such series in such amount or amounts;

(g) may be entitled to the benefit of conditions and restrictions upon the creation of indebtedness of the Corporation or any subsidiary, upon the issue of any additional shares (including additional shares of such series or of any other series) and upon the payment of dividends or the making of other distributions on, and the purchase, redemption or other acquisition by the Corporation or any subsidiary of, any outstanding shares of the Corporation; and

(h) may have such other relative, participating, optional or other special rights, qualifications, limitations or restrictions thereof, in each case as shall be stated in said resolution or resolutions providing for the issue of such shares of Preferred Stock. Shares of Preferred Stock of any series that have been redeemed or repurchased by the Corporation (whether through the operation of a sinking fund or otherwise) or that, if convertible or exchangeable, have been converted or exchanged in accordance with their terms shall be retired and have the status of authorized and unissued shares of Preferred Stock of the same series and may be reissued as a part of the series of which they were originally a part or may, upon the filing of an appropriate certificate with the Secretary of State of the State of Nevada be reissued as part of a new series of shares of Preferred Stock to be created by resolution or resolutions of the Board of Directors or as part of any other series of shares of Preferred Stock, all subject to the conditions or restrictions on issuance set forth in the resolution or resolutions adopted by the Board of Directors providing for the issue of any series of shares of Preferred Stock.

6.5Designation of Special 2022 Series A Preferred Stock.

(a) Designation and Amount. The designation of this class of preferred stock shall be “Special 2022 Series A Preferred Stock,” par value $.001 per share (the “Series A 2022 Preferred Stock”). The number of authorized shares of Special 2022 Series A Preferred Stock is one (1).

(b) Voting Rights. Except as otherwise required by law, the holder of the share of Special 2022 Series A Preferred Stock shall have the following rights:

(1) Number of Votes; Voting with Common Stock. Except as provided by Nevada statutes or elsewhere herein, the holder of the Special 2022 Series A Preferred Stock shall vote together with the holders of Preferred Stock (including on an as converted basis), and Common Stock, of the Corporation as a single class. The holder of the share of Special 2022 Series A Preferred Stock is entitled to 60% of all votes (including, but not limited to, Common Stock, and Preferred Stock (including on an as converted basis) entitled to vote at each meeting of shareholders of the Corporation (and written actions of shareholders in lieu of meetings) with respect to any and all matters presented to the shareholders of the Corporation for their action or consideration. The share of Special 2022 Series A Preferred Stock shall not be divided into fractional shares.

(2) Adverse Effects. The Corporation shall not amend, alter, or repeal the preferences, rights, powers or other terms of the Special 2022 Series A Preferred Stock so as to affect adversely the Special 2022 Series A Preferred Stock, or the holder thereof, without the written consent or affirmative vote of the holder of the Special 2022 Series A Preferred Stock given in writing or by vote at a meeting, consenting or voting (as the case may be) separately as a class.

(c)Conversion. The share of the Special 2022 Series A Preferred Stock shall convert into common shares at a conversion rate of 1 preferred to 60,000,000 common shares. The holder of the Special 2022 Series A Preferred Stock can affect the conversion at any time. The conversion into common is a right and conversion is not required.

(d)Dividends; Liquidation. The share of Special 2022 Series A Preferred Stock shall not be entitled to any dividends in respect thereof, and shall not participate in any proceeds available to the Corporation’s shareholders upon the liquidation, dissolution or winding up of the Corporation.

(e)No Impairment. The Corporation shall not intentionally take any action which would impair the rights and privileges of the Special 2022 Series A Preferred Stock set forth herein or the rights of the holder thereof. The Corporation will not, by amendment of its articles of incorporation or through any reorganization, transfer of assets, consolidation, merger, dissolution, issue or sale of securities or any other voluntary action, avoid or seek to avoid the observance or performance of any of the terms to be observed or performed hereunder by the Corporation, but will, at all times, in good faith assist in the carrying out of all the provisions herein and in the taking of all such action as may be necessary or appropriate in order to protect the rights of the holder of the Special 2022 Series A Preferred Stock against impairment.

(f)Replacement Certificate. In the event that the holder of the share of the Special 2022 Series A Preferred Stock notifies the Corporation that the stock certificate evidencing the share of the Special 2022 Series A Preferred Stock has been lost, stolen, destroyed or mutilated, the Corporation shall issue a replacement stock certificate evidencing the shares of the Special 2022 Series A Preferred Stock identical in tenor and date to the original stock certificate evidencing the share of the Special 2022 Series A Preferred Stock, provided that the holder executes and delivers to the Corporation an affidavit of lost stock certificate and an agreement reasonably satisfactory to the Corporation to indemnify the Corporation from any loss incurred by it in connection with such Special 2022 Series A Preferred Stock certificate.

6.6Designation of Series A Preferred Stock.

(a)Designation and Amount. The designation of this class of preferred stock shall be “Series A Preferred Stock,” par value $.001 per share (the “Series A Preferred Stock”). The number of authorized shares of Series A Preferred Stock is ten million (10,000,000).

(b)Voting Rights. Each share of Series A Preferred Stock shall entitle the holder to five (5) votes on any matter submitted to the shareholders of the Corporation for their vote, waiver, release or other action, to be considered in connection with the establishment of a quorum, except as may otherwise be expressly required by law or by the applicable stock exchange rules. The holders of Series A Preferred Stock shall vote together with the shares of Common Stock as one class.

(c)Liquidation Rights. Upon the dissolution, liquidation or winding up of the Corporation, whether voluntary or involuntary, the holders of the then-outstanding shares of Series A Preferred Stock shall be entitled to receive out of the assets of the Corporation the sum of $.001 per share (the “Liquidation Rate”) before any payment or distribution shall be made on any other class of capital stock of the Corporation ranking junior to the Series A Preferred Stock.

(1) The sale, conveyance, exchange or transfer (for cash, shares of stock, securities or other consideration) of all or substantially all the property and assets of the Corporation shall be deemed a dissolution, liquidation or winding up of the Corporation for purposes of this paragraph (c), but the merger, consolidation or other combination of the Corporation into or with any other corporation, or the merger, consolidation or other combination of any other corporation into or with the Corporation, shall not be deemed a dissolution, liquidation or winding up, voluntary or involuntary, for purposes of this paragraph (c). As used herein, the “merger, consolidation or other combination” shall include, without limitation, a forward or reverse triangular merger, or stock exchange of the Corporation and any of its subsidiaries with any other corporation.

(2) After payment to the holders of the shares of the Series A Preferred Stock of the full preferential amounts fixed by this paragraph (c) for shares of the Series A Preferred Stock, the holders of the Series A Preferred Stock as such shall have no right to claim to any of the remaining assets of the Corporation.

(3) In the event the assets of the Corporation available for distribution to the holders of the Series A Preferred Stock upon dissolution, liquidation or winding up of the Corporation shall be insufficient to pay in full all amounts to which such holders are entitled pursuant to this paragraph (c), no distribution shall be made on account of any shares of a class or series of capital stock of th Corporation ranking on a parity with the shares of Series A Preferred Stock, if any, upon such dissolution, liquidation or winding up of the Corporation unless proportionate distributive amounts shall be paid on account of the shares of the Series A Preferred Stock, ratably, in proportion to the full distributive amounts for which holders of all such parity shares are respectively entitled upon such dissolution, liquidation or winding up.

(d)Dividends. Except as provided herein, the holders of the Series A Preferred Stock shall be entitled to receive cash, stock or other property, as dividends, when, as and if declared by the Board of Directors of the Corporation. Series A Preferred Stock shall not participate in any dividend declared with respect to the Common Stock.

(e)Preferred Status. The rights of the shares of the Common Stock shall be subject to the preferences and relative rights of the shares of the Series A Preferred Stock. Without the prior written consent of the holders of not less than a majority of the outstanding shares of the Series A Preferred Stock, the Corporation shall not hereafter authorize or issue additional or other capital stock that is of senior or equal rank to the shares of the Series A Preferred Stock in respect of the preferences as to distributions and payments upon the liquidation, dissolution and winding up of the Corporation described in paragraph (c) above.

(f)Vote to Change the Terms of the Series A Preferred Stock. Without the prior written consent of the holders of not less than a majority of the outstanding shares of the Series A Preferred Stock, the Corporation shall not amend, alter, change or repeal any of the powers, designations, preferences and rights of the Series A Preferred Stock.

(g)Lost or Stolen Certificates. Upon receipt by the Corporation of evidence satisfactory to the Corporation of the loss, theft, destruction or mutilation of any Preferred Stock Certificates representing shares of the Series A Preferred Stock, and, in the case of loss, theft or destruction, of any indemnification undertaking or bond, in the Corporation’s discretion, by the holder to the Corporation and, in the case of mutilation, upon surrender and cancellation of the Preferred Stock Certificate(s), the Corporation shall execute and deliver new Series A Preferred Stock Certificate(s) of like tenor and date.

(h)No Re-issuance of Series A Preferred Stock. No share or shares of the Series A Preferred Stock acquired by the Corporation by reason of redemption, purchase or otherwise shall be re-issued, and all such shares of Series A Preferred Stock shall be cancelled, retired and eliminated from the shares of Series A Preferred Stock, as applicable, which the Corporation shall be authorized to issue. Any such shares of Series A Preferred Stock acquired by the Corporation shall have the status of authorized and unissued shares of Preferred Stock issuable in undesignated Series and may be re-designated and re-issued in any Series other than as Series A Preferred Stock.

(i)Registered Holders. A holder of Series A Preferred Stock registered on the Corporation’s stock transfer books as the owner of shares of Series A Preferred Stock, as applicable, shall be treated as the owner of such shares for all purposes. All notices and all payments required to be mailed to a holder of shares of Series A Preferred Stock shall be mailed to such holder’s registered address of the Corporation’s stock transfer books, and all dividends and redemption payments to a holder of Series A Preferred Stock made hereunder shall be deemed to be paid in compliance hereof on the date such payments are deposited into the mail addressed to such holder at such holder’s registered address on the Corporation’s stock transfer books.

(j)Certain Remedies. Any registered holder of shares of Series A Preferred Stock shall be entitled to an injunction or injunctions to prevent breaches of the provisions of this Section 6.6 and to enforce specifically the terms and provisions of this Section 6.6 in any court of the United States or any state thereof having jurisdiction, this being in addition to any other remedy to which such holder may be entitled at law or in equity.

(k)Headings of Subdivisions. The headings of the various subdivisions hereof are for convenience of reference only and shall not affect the interpretation of any of the provisions hereof.

(l)Severability of Provisions. If any right, preference or limitation of the Series A Preferred Stock set forth herein (as may be amended) from time to time is invalid, unlawful or incapable of being enforced by reason of any rule of law or public policy, such right, preference or limitation (including, without limitation, the dividend rate) shall be enforced to the maximum extent permitted by law and all other rights, preferences and limitation set forth herein (as so amended) which can be given effect without the invalid, unlawful or unenforceable right, preference or limitation herein set forth shall not be deemed dependent upon any other such right, preference or limitation unless so expressed herein.

(m)Ranking. The Series A Preferred Stock shall rank, as to rights upon liquidation, dissolution or winding up, pari passu to each other and shall rank senior and prior to (1) the Common Stock and (2) each other class or series of capital stock of the Corporation hereafter created which does not expressly rank pari passu with or senior to the Series A Preferred Stock, as applicable.

ARTICLE 7. NO FURTHER ASSESSMENTS

7.1The capital stock, after the amount of the subscription price determined by the board of directors has been paid in money, property, or services, as the Directors shall determine, shall be subject to no further assessment to pay the debts of the Corporation, and no stock issued as fully paid up shall ever be assessable or assessed, and these Articles of Incorporation shall not and cannot be amended, regardless of the vote therefore, so as to amend, modify or rescind this Article 7.

ARTICLE 8. NO PREEMPTIVE RIGHTS

8.1Except as otherwise set forth herein, none of the shares of the Corporation shall carry with them any preemptive right to acquire additional or other shares of the Corporation and no holder of any stock of the Corporation shall be entitled, as of right, to purchase or subscribe for any part of any unissued shares of stock of the Corporation or for any additional shares of stock, of any class or series, which may at any time be issued, whether now or hereafter authorized, or for any rights, options, or warrants to purchase or receive shares of stock or for any bonds, certificates of indebtedness, debentures, or other securities.

ARTICLE 9. NO CUMULATIVE VOTING

9.1There shall be no cumulative voting of shares.

ARTICLE 10. ELECTION NOT TO BE

GOVERNED BY PROVISIONS OF NRS 78.411 TO 78.444

10.1 The Corporation, pursuant to NRS 78.434, hereby elects not to be governed by the provisions of NRS 78.411 to 78.444, inclusive.

ARTICLE 11. INDEMNIFICATION OF OFFICERS AND DIRECTORS

11.1The Corporation shall indemnify its directors, officers, employees, fiduciaries and agents to the fullest extent permitted under the Nevada Revised Statutes.

11.2Every person who was or is a party or is threatened to be made a party to or is involved in any action, suit or proceedings, whether civil, criminal, administrative or investigative, by reason of the fact that he or a person for whom he is the legal representative is or was a director or officer of the Corporation or is or was serving at the request of the Corporation as a director or officer of another corporation, or as its representative in a partnership, joint venture, trust or other enterprise, shall be indemnified and held harmless to the fullest extent legally permissible under the law of the State of Nevada from time to time against all expenses, liability and loss (including attorney's fees, judgments, fines and amounts paid or to be paid in settlement) reasonably incurred or suffered by him in connection therewith. Such right of indemnification shall be a contract right that may be enforced in any manner desired by such person. Such right of indemnification shall not be exclusive of any other right which such directors, officers or representatives may have or hereafter acquire and, without limiting the generality of such statement, they shall be entitled to their respective rights of indemnification under any Bylaw, agreement, vote of stockholders, provision of law or otherwise, as well as their rights under this Article.

11.3Without limiting the application of the foregoing, the Board of Directors may adopt Bylaws from time to time with respect to indemnification to provide at all times the fullest indemnification permitted by the law of the State of Nevada and may cause the Corporation to purchase and maintain insurance on behalf of any person who is or was a director or officer of the Corporation as a director of officer of another corporation, or as its representative in a partnership, joint venture, trust or other enterprise against any liability asserted against such person and incurred in any such capacity or arising out of such status, whether or not the Corporation would have the power to indemnify such person.

11.4The private property of the Stockholders, Directors and Officers shall not be subject to the payment of corporate debts to any extent whatsoever.

11.5No director, officer or shareholder shall have any personal liability to the Corporation or its stockholders for damages for breach of fiduciary duty as a director or officer, except that this provision does not eliminate nor limit in any way the liability of a director or officer for:

| (a) | Acts or omissions which involve intentional misconduct, fraud or a knowing violation of law; or |

| | | |

| (b) | The payment of dividends in violation of Nevada Revised Statutes (N.R.S.) 78.300. |

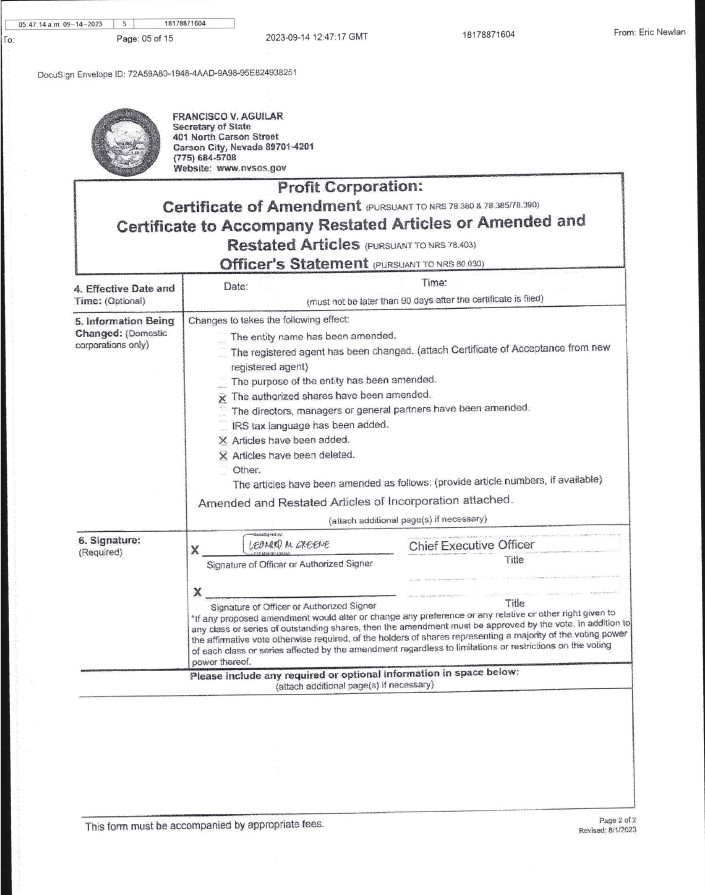

I, the undersigned, being the Chief Executive Officer of Adia Nutrition, Inc., hereby declares and certifies, under penalties of perjury, that this is my act and deed and the facts herein stated are true, and, accordingly, have hereunto set my hand this 19th day of September, 2023.

/s/ Lenny M. Greene

Lenny M. Greene

Chief Executive Officer

Adia Nutrition, Inc.

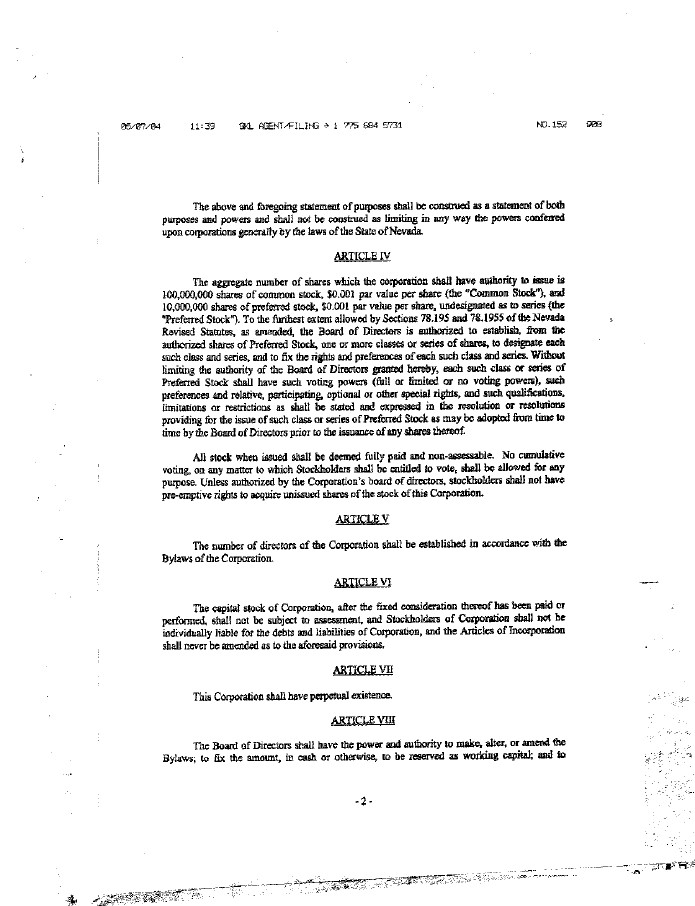

AMENDED AND RESTATED

ARTICLES OF INCORPORATION

OF

ADIA NUTRITION, INC.

(a Nevada corporation)

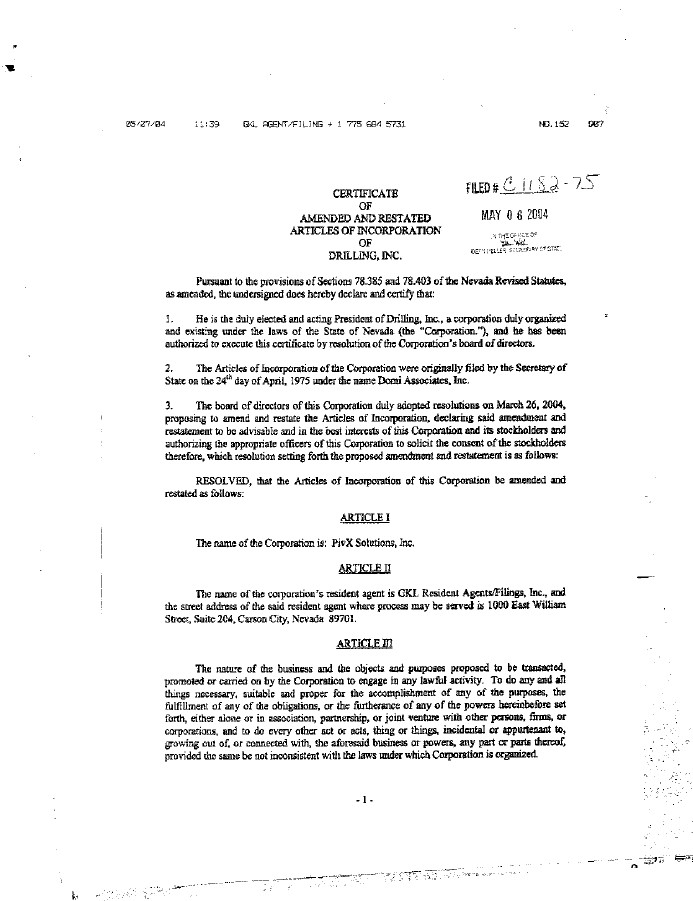

Adia Nutrition Inc. (the “Corporation”), a corporation incorporated under the laws of the State of Nevada on April 24, 1975, as Dorni Associates, Inc., hereby amends and restates its Articles of Incorporation, to embody in one document its original articles and the subsequent amendments and restatements thereto, pursuant to Sections 78.390 and 78.403 of the Nevada Revised Statutes (“NRS”).

Amended and Restated Articles of Incorporation were approved and adopted by the Board of Directors of the Corporation on June 9, 2023. Upon the recommendation of the Board of Directors, the shareholder of the Corporation holding a majority of the voting power approved and adopted these Amended and Restated Articles of Incorporation by an action by written con .sent in lieu of a meeting of 60% of the eligible votes on June 9, 2023, AS a result, these Amended and Restated Articles of Incorporation were authorized and adopted in accordance with the NRS.

These Amended and Restated Articles of Incorporation correctly set forth the text of the Corporation's Articles of Incorporation as amended up to and by these Amended and Restated Articles of Incorporation.

ARTICLE I. NAME OF CORPORATION

1.1 The name of the corporation is Adia Nutrition, Inc. (the “Corporation”).

ARTICLE 2, DURATION

2.1 The Corporation shall continue in existence perpetually, unless sooner dissolved according to law.

ARTICLE 3. REGISTERED AGENT AND REGISTERED OFFICE

3.1 The name and address of the Corporation's registered agent and registered office in the State of Nevada are:

Premier Legal Group, 1333 N. Buffalo Drive, Suite 210, Las Vegas, Nevada 89128

ARTICLE 4, PURPOSE

4.1The purpose for which the Corporation is to engage in any lawful activity within or without the State of Nevada.

4.2The Corporation may also maintain offices at such other places within our without the State of Nevada as it may, from time to time, determine. Corporate business of every kind and nature may be conducted, and meetings of directors and shareholders may be held, outside the State of Nevada with the same effect as if in the State of Nevada.

ARTICLE 5. BOARD OF DIRECTORS

5.1Number. The Board of Directors of the Corporation shall consist of such number of persons, not less than one and not to exceed 10, as shall be determined in accordance with the Bylaws of the Corporation from time to time.

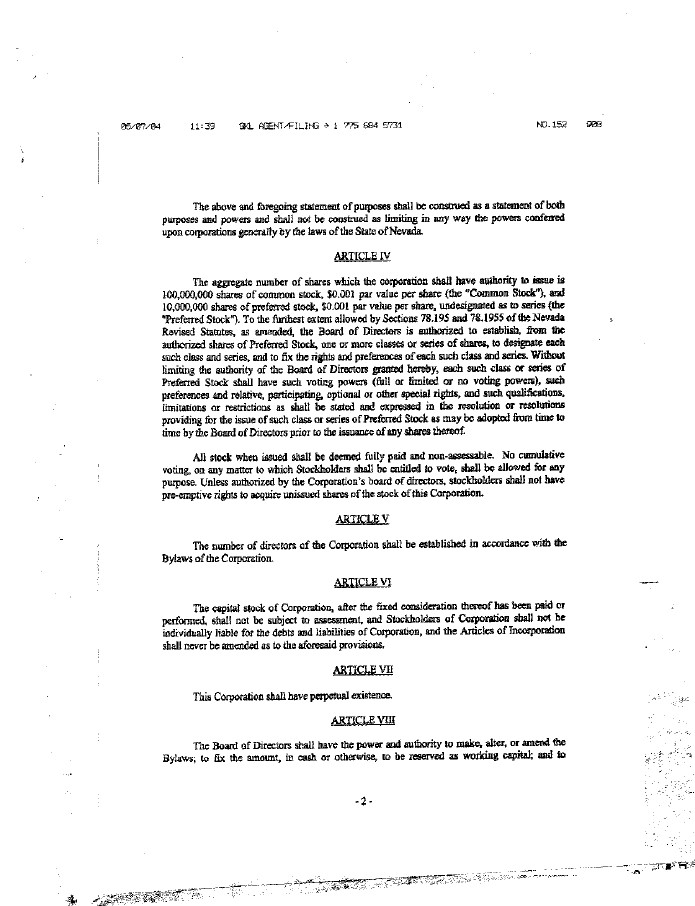

ARTICLE 6. CAPITAL STOCK

6.1Authorized Capital Stock. The aggregate number of shares which the Corporation shall have authority to issue is one billion (1,000,000,000) shares, consisting of (a) eight hundred million (800,000,000) shares of common stock, par value $.001 per share (the “Common Stock” or the “Class A Common Stock”), (b) 100,000,000 shares of common stock par value $.001 per share (the “Class B Common Stock”), issuable in one or more series as hereinafter provided, and (c) one hundred million (100,000,000) shares of preferred stock, par value $.001 per share (the "Preferred Stock"), issuable in one or more series as hereinafter provided.

A description of the classes of shares and a statement of the number of shares In each class and the relative tights, voting power and preferences wanted to them, and restrictions imposed on them, are as set forth in this Article 6.

6.2Class A Common Stock. Each share of Class A Common Stock shall have, for all purposes, one (1) vote per share. Subject to the preferences applicable to Preferred Stock outstanding at any time., the holders of the shares of Class A Common Stock shall be entitled to receive such dividends and other distributions in cash, property or shares of stock of the Corporation as may be declared thereon by the Board of Directors from time to time out of assets or funds of the. Corporation legally available therefrom. The holders of Class A Common Stock issued and outstanding have and possess the right to receive notice of shareholders' meetings and to vote upon the election of directors or upon any other matter as to which approval of the outstanding shares of Class A Common Stock or approval of the common shareholders is required:or requested.

6.3Class B Common Stock. The shares of Class 13 Common Stock may be issued from time to time in one more series. The Board of Directors is authorized, by resolution adopted and filed in accordance with law, to provide for the issue of each series of shares of Class 13 Common Stock; provided, however, that any issuance of shares of Class B Common Stock shall be made only in connection with a special acquisition transaction, as determined by the Board of Directors. Each series of shares of Class B Common Stock:

(a)may have such voting powers, full or limited or may be without voting powers;

(b)may be subject to redemption at such time or times and at such prices as determined by the Board of Directors;

(c) may be entitled to receive dividends (which may be cumulative or noncumulative) at such rate or rates, on such conditions and at such times, and payable in preference to, or in relation to, the dividends payable on any other class or classes or series of stock;

(d) may have such rights upon, the dissolution of, or upon any distribution of assets of, the Corporation;

(e) maybe made convertible into, or exchangeable for; shares of any other class or classes or of any other series of the same or any other class or classes of stock of the Corporation or such other corporation or other entity at such price or prices or at such rates of exchange and with such adjustments;

(f) may be entitled to the benefit of a sinking fund to be applied to the purchase or redemption of shares of such series in such amount or amounts;

(g) may be entitled to the benefit of conditions and restrictions upon the creation of indebtedness of the Corporation or any subsidiary, upon the issue of any additional shares (including additional shares of such series or of any other series) and won the payment of dividends or the making of other distributions on, and the purchase, redemption or other acquisition by the Corporation or any subsidiary of, any outstanding shares of the Corporation; and

(h) may have such other relative, participating, optional or other special rights, qualifications, limitations or restrictions thereof, in each case as shall be stated in said resolution or resolutions providing for the issue of such shares of Class B Common Stock. Shares of Class B Common Stock of any series that have been redeemed or repurchased by the Corporation (whether through the operation of a sinking fund or otherwise) or that, if convertible or exchangeable, have been converted or exchanged in accordance with their terms shall be retired and have the status of authorized and unissued shares of Class 13 Common Stock of the same series and may be reissued as a part of the series of which they were originally a part or may, upon the filing of art appropriate certificate with the Secretary of State of the State of Nevada he;reissued as part of a new series of shares of Class B Common Stock to be created by resolution or resolutions of the Board of Directors or as part of any other series of shares of Class B Common Stock, all subject to the conditions or restrictions on issuance set forth in the resolution or resolutions adopted. by the Board of Directors providing for the issue of any series of shares of Class B Common Stock.

6.4Preferred Stock. The shares of Preferred Stock may be issued from time to time in one or more series. The Board of Directors is authorized, by resolution adopted and filed in accordance with law, to provide for the issue of each series of shares of Preferred Stock. Each series of shares of Preferred Stock:

(a) may have such voting powers, hall or limited or may be without voting powers;

(b) may be subject to redemption at such time or times and at such prices as determined by the Board of Directors;

(c) may be entitled to receive dividends (which may he cumulative or non. cumulative) at such rate or rates, on such conditions and at such times, and payable in preference to, or in relation to, the dividends payable on any other class or classes or series of stock;

(d) may have such rights upon the dissolution of, or upon any distribution of assets of, the Corporation;

(e) maybe made convertible into, or exchangeable for, shares of any other class or classes or of any:other series of the same or any other class or classes of stock of the Corporation or such other corporation or;other entity at such price or prices or at such rates of exchange and with such adjustments;

(f)may be entitled to the benefit of a sinking bind to be applied to the purchase or redemption of shares of such series in such amount or amounts;

(g) may be entitled to the benefit of conditions and restrictions upon the creation of indebtedness of the Corporation or any subsidiary, upon the issue of any additional shares (including additional shares of such series or of any other series) and upon the payment of dividends or the making of other distributions on, and the purchase, redemption or other acquisition by the Corporation or any;subsidiary of, any outstanding shares of the Corporation; and

(h) may have such other relative, participating, optional or other special rights, qualifications, limitations or restrictions thereof, in each case as shall be stated in said resolution or resolutions providing for the issue of such shares of Preferred Stock. Shares of Preferred Stock of any series that have been redeemed or repurchased by the Corporation (whether through the operation of a sinking fund or otherwise) or that, if convertible or exchangeable, have been converted or exchanged in accordance with their terms shall be retired and have the status of authorized and unissued shares of Preferred Stock of the same series and may be reissued as a part of the series of which they were originally a part or may, upon the filing of an appropriate certificate with the Secretary of State of the State of Nevada be reissued as part of a new series of shares of Preferred Stock to be created by resolution or resolutions of the Board of Directors or as part of any other series of shares of Preferred Stock, all subject to the conditions or restrictions on issuance set forth in the resolution or resolutions adopted by the Board of Directors providing;for the issue of any series of shares of Preferred Stock.

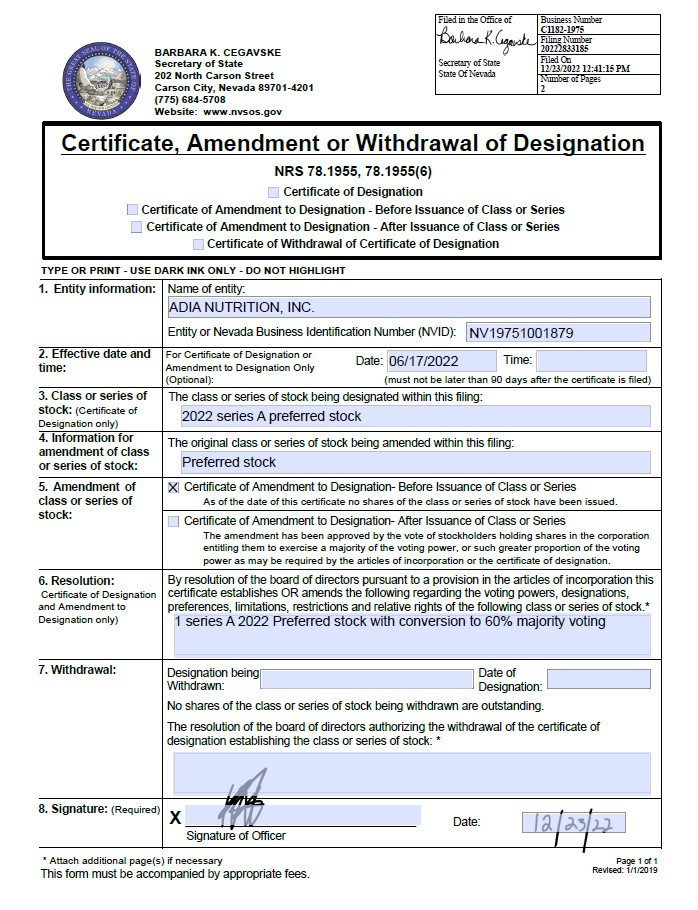

6.5Designation of Series A 2022 Preferred Stock.

(a)Designation and Amount. The designation of this class of preferred stock shall be “Series A 2022 Preferred Stock,” par value $.001 per share (the “Series A 2022 Preferred Stock”). The number of authorized shares of Special 2021 Series A Preferred Stock is one (1).

(b)Voting Rights. Except as otherwise required by law, the holder of the share of Series A 2022 Preferred Stock shall have the following rights:

(1)Number of Votes; Voting with Common Stock. Except as provided by Nevada statutes or elsewhere herein, the bolder of the Series A 2022 Preferred Stock shall vote together with the holders of Preferred Stuck (including on an as converted basis), and Common Stock, of the Corporation as a single class, the holder of the share of Series A 2022 Preferred Stock is entitled to 60% of all votes (including, but not limited to, Common Stock, and Preferred Stock (including on an as converted basis)) entitled to vote, at each meeting of shareholders of the Corporation (and written actions of shareholders in lieu of meetings) with respect to any and all matters presented to the shareholders of the Corporation for their action or consideration. The share of Series A 2022 Preferred Stock- shall not be divided into fractional shares.

(2)Adverse Effects. The Corporation shall not amend, alter, or repeal the preferences, rights, powers or other terms of the Series A 2022 Preferred Stock so as to affect adversely the Series A 2022 Preferred Stock, or the holder thereof, without the written consent or affirmative vote of the holder of the Series A 2022 Preferred Stock given in writing or by vote at a meeting, consenting or voting (as the case may be) separately as a class.

(c)Conversion. The Share of the Series A 2022 Preferred Stock shall have not rights of conversion.

(d)Dividends: Liquidation. The share of Series A 2022 Preferred Stock shall not be entitled to any dividends in respect thereof, and shall not participate in any proceeds available to the Corporation's shareholders upon the liquidation, dissolution or winding up of the Corporation.

(e)No Impairment. The Corporation shall not intentionally take any action which would impair the rights and privileges of the. Series A 2022 Preferred Stock set forth herein or the rights of the holder thereof. The Corporation will not, by amendment of its articles of incorporation or through any reorganization, transfer of assets, consolidation, merger, dissolution, issue or sale of securities or any other voluntary action, avoid or seek to avoid the observance or performance of any of the terms to be observed or.performed hereunder by the Corporation, but will, at all times, in good faith assist in the carrying out of all the provisions herein and in the taking of all such action as may be necessary or appropriate in order to protect the, rights of the holder of the Series A 2022 Preferred Stock against impairment.

(f)Replacement Certificate. In the event that the holder of the share of the Series A 2022 Preferred Stock notifies the Corporation that the stock certificate evidencing the share of the Series A 2022 Preferred. Stock has been lost, stolen, destroyed or mutilated, the Corporation shall issue a replacement stock certificate evidencing the shares of the Series A 2022 Preferred Stock identical in tenor and date to the original stock certificate evidencing the share of the Series A 2022 Preferred Stock, provided that the holder executes and delivers to the Corporation an affidavit of lost stock certificate and an agreement reasonably satisfactory to the Corporation to indemnify the Corporation from any loss incurred by it in connection with such Series A 2022 Preferred Stock certificate.

6.6Designation of Series A Preferred Stock.

(a)Designation and Amount. The designation of this class of preferred stock shall be “Series A Preferred Stock,” par Value $.001 per share (the “Series A Preferred Stock”). The number of authorized shares of Series A Preferred Stock is ten million (10,000,000).

(b)Voting Rights. Each share of Series A Preferred Stock shall entitle the holder to five (5) votes on any matter submitted to the shareholders of the Corporation for their vote, waiver, release or other action, to be considered in connection with the establishment of a quorum. except as may otherwise be expressly required by law or by the applicable stock exchange rules. The holders of Series A Preferred Stock shall vote together with the shares of Common Stock as one class.

(c)Liquidation Rights. Upon the dissolution, liquidation or winding up of the Corporation, whether voluntary or involuntary, the holders of the then-outstanding shares of Series A Preferred Stock shall be entitled to receive out of the assets of the Corporation the stun of $.001 per share (the “Liquidation Rate”) before any payment or distribution shall be made on any other class of capital stock of the Corporation ranking junior to the Series A Preferred Stock.

(1) The sale, conveyance, exchange or transfer (fir cash, shares of stock, securities or other consideration) of all or substantially all the property and assets of the Corporation shall be deemed a dissolution, liquidation or winding up of the Corporation for purposes of this paragraph (e), but the merger, consolidation or other combination of the Corporation into or with any other corporation, or the merger, consolidation or other combination of any other corporation into or with the Corporation, shall not be deemed a dissolution, liquidation or winding up, voluntary or involuntary, for purposes of this paragraph (c). As used herein, the "merger, consolidation or other combination" shall include, without limitation, a forward or reverse triangular merger, or stock exchange of the Corporation and any of its subsidiaries with any other corporation.

(2) After payment to the holders of the shares of the Series A Preferred Stock of the full preferential amounts fixed by this paragraph (c) for shies of the Series A Preferred Stock, the holders of the Series A Preferred Stock as such shall have no right to claim to any of the remaining assets of the Corporation.

(3)In the event the assets of the Corporation available for distribution to the holders of the Series A Preferred Stock upon dissolution, liquidation or winding up of the Corporation shall be insufficient to pay in full all amounts to which such holders are entitled pursuant to this paragraph (c), no distribution shall be made on account of any shares of a class or series of capital stock of the Corporation ranking on a parity with the shares of Series. A Preferred Stock, if any, upon such dissolution, liquidation or winding up of the Corporation unless proportionate distributive amounts shall be paid on account of the shares of the Series A Preferred Stock, ratably, in proportion to the full distributive amounts for which holders of all such parity shares are respectively entitled upon such dissolution, liquidation or winding up.

(d) Dividends. Except as provided herein, the holders of the Series A Preferred. Stock shall be entitled to receive cash, stock or other property, as dividends, when, as and if declared by the 'Board of Directors of the Corporation. Series A Preferred Stock shall not participate in any dividend declared with respect to the Common Stock.

(e) Preferred Status. The rights of the shares of the Common Stock shall be subject to the preferences and relative rights of the shares of the Series A Preferred Stock. Without the prior written consent of the holders of not less than a majority of the outstanding shares of the Series A Preferred Stock, the Corporation shall not hereafter authorize or issue additional or other capital stock that is of senior or equal rank to the shares of the Series A Preferred Stock in. respect of the preferences as to distributions and payments:upon the liquidation, dissolution and winding up of the Corporation described in paragraph (c) above.

(f) Vote to Change the Terms of the Series A Preferred Stock Without the prior written consent of the holders of not less than a majority of the outstanding shams of the Series A Preferred Stock, the Corporation shall not amend, alter, change or repeal any of the powers, designations, preferences and rights of the Series A Preferred. Stock.

(g) Lost or Stolen Certificates., Upon receipt by the Corporation of evidence satisfactory to the Corporation of the loss, theft, destruction or mutilation of any Preferred Stock Certificates representing shares of the Series A Preferred Stock, and, in the case of loss, theft or destruction, of any indemnification undertaking or bond, in the Corporation's discretion, by the holder to the Corporation and, in the ease of mutilation, upon surrender and cancellation of the Preferred Stock Certificate(s), the Corporation shall execute and deliver new Series A Preferred Stock. Certificate(s) of like tenor and date.

(h) No Re-issuance of Series A Preferred Stock. No share or shares of the Series A Preferred Stock acquired by the Corporation by reason of redemption, purchase or otherwise shall be re-issued, and all such shares of Series A Preferred Stock shall be cancelled, retired and eliminated from the shares of Series A Preferred Stock, as applicable, which the Corporation shall be authorized to issue. Any such shares of Series A Preferred Stock acquired by the Corporation shall have the status of authorized and unissued shares of Preferred Stock issuable in undesignated Series and may be re-designated and re-issued in any Series other than as Series A Preferred Stock.

(i) Registered Holders_ A. holder of Series A Preferred Stock registered on the Corporation's stock transfer books as the owner of shares of Series A Preferred Stock, as applicable, shall be treated as the owner of such shares for all purposes. All notices and all payments required to be mailed to a holder of shares of Series A Preferred Stock shall be mailed to such holder's registered address of the Corporation's stock transfer 'peaks, and all dividends and redemption payments to a holder of Series A Preferred Stock made hereunder shall be deemed to be paid in compliance hereof on the date such payments are deposited into the mail addressed to such holder at such holder's registered address on the Corporation's stock transfer books.

(j) Certain Remedies. Any registered holder of shares of Series A Preferred Stock shall be entitled to an injunction or injunctions to prevent breaches of the provisions of this Section 6.6 and to enforce specifically the terms and provisions of this Section 6.6 in any court of the United States or any state thereof having jurisdiction, this being in addition to any other remedy to which such holder maybe entitled at law or in equity.

(k) Headings of Subdivisions, The headings of the various subdivisions hereof are for convenience of reference only and shall not affect the interpretation of any of the provisions hereof.

(l)Severability of Provisions. If any right, preference or limitation of the Series A Preferred Stock set forth herein (as may be amended) from time to time is invalid, unlawful or incapable of being enforced by reason of any rule of law or public policy, with right, preference or limitation (including, without limitation, the dividend rate) shall be enforced to the maximum extent permitted by law and all other rights, preferences and limitation set forth herein (as so amended) which can be given effect without the invalid, unlawful or unenforceable right, preference or limitation herein set forth shall not be deemed dependent upon any other such right, preference or limitation unless so expressed herein.

(m) Ranking. The Series A Preferred Stock shall rank, as to rights upon liquidation, dissolution or winding up, pari passu to each other and shall rank senior and prior to (1) the Common Stock and (2) each other class or series of capital stock of the Corporation hereafter created which does not expressly rank pari passu with or senior to the Series A Preferred Stock, as applicable.

ARTICLE 7. NO FURTHER ASSESSMENTS

7.1The capital stock, after the amount of the subscription;price determined by the board of directors has been paid in money, property, or services, as the Directors shall determine, shall be subject to no further assessment to pay the debts of the Corporation, and no stock issued as fully paid up shall ever be assessable or assessed, and these Articles of Incorporation shall not and cannot be amended, regardless of the vote therefore, so as to amend, modify or rescind this Article 7.

ARTICLE 8. NO PREEMPTIVE RIGHTS

8.1Except as otherwise set forth herein, none of the shares of the Corporation shaft carry with them any preemptive right to acquire additional or other shares of the Corporation and no holder of any stock of the Corporation shall be entitled, as of right, to purchase or subscribe for any part of any unissued shares of stock of the Corporation or for any additional shares of stock, deny class or series, which may at any time be issued, whether now or hereafter authorized, or for any rights, options, or warrants to purchase or receive shares of stock or for any bonds, certificates of indebtedness, debentures, or other securities.

ARTICLE 9. NO CUMULATIVE VOTING

9.1There shall be no cumulative voting of shares.

ARTICLE 10. ELECTION NOT TO BE GOVERNED BY PROVISIONS OF NRS 78.411 TO 78.444

10.1The Corporation, pursuant to NRS 78.434, hereby elects not to be governed by the provisions of NRS 78.411 to 78.444, inclusive.

ARTICLE; IL INDEMNIFICATION OF OFFICERS AND DIRECTORS

11.1The Corporation shall indemnify its directors, officers, employees; fiduciaries and agents to the fullest extent permitted under the Nevada Revised Statutes.

11.2Every person who was or is a party or is threatened to be made a party to or' is involved in any action, suit or proceedings, whether civil; criminal, administrative or investigative, by reason of the:fact that he or a person for whom he is the legal representative is or was a director or officer of the Corporation or is or was serving at the request of the Corporation as director or officer of another corporation, or as its representative in a partnership, joint venture, trust Dr other enterprise, shall be indemnified awl held harmless to the fullest extent legally permissible under the law of the State of Nevada from time to time against all expenses, liability and loss (including attorney's fees, judgments, fines and amounts paid or to be paid in settlement) reasonably incurred or suffered by him in connection therewith. Such right of indemnification shall be a contract right that maybe enforced in any manner desired by such person. Such right of indemnification shall not be exclusive of any other right which such directors, officers or representatives may have or hereafter acquire and, without limiting the generality of such statement, they shall be entitled to their respective rights of indemnification under any Bylaw, agreement, vote of stockholders, provision of law or otherwise, as well as their rights under this Article.

11.3Without limiting the application of the foregoing, the Board of Directors may adopt Bylaws from time to time with respect to indemnification to provide at all times the fullest indemnification permitted by the law of the State of Nevada and may cause the Corporation to purchase and maintain insurance on behalf of any person who is or was a director or officer of the Corporation as a director of officer of another corporation, or as its representative in a partnership, joint venture, trust or other enterprise against any liability asserted against such person and incurred it any such capacity or arising out of such status, whether or not the Corporation would have the power to indemnify such person.

11.4The private property of the Stockholders, Directors and Officers shall not be subject to the payment of corporate debts to any extent whatsoever.

11.5No director, officer or shareholder shall have any personal liability to the Corporation or its stockholders for damages for breach of fiduciary duty as a director or officer, except that this provision does not eliminate nor limit in any way the liability of a director or officer for:

(a)Acts or omissions which involve intentional misconduct, fraud or a knowing violation of law or

(b)The payment of dividends in violation of Nevada Revised Statutes (N.R.S.) 78.300.

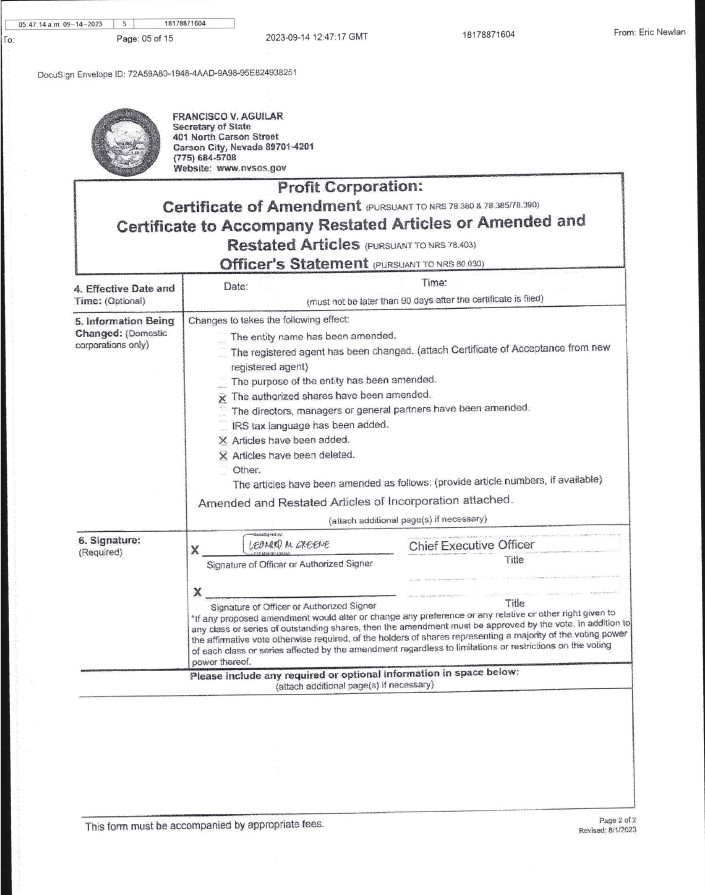

I, the undersigned, being the Chief Executive Officer of Adia Nutrition, Inc., hereby declares and certifies, under penalties of perjury, that this is my act and deed and the facts herein stated are true, and, accordingly, have hereunto set my hand this 12th day of September, 2023.

/s/ Lenny M. Greene

Lenny M. Greene

Chief Executive Officer

Adia Nutrition, Inc.

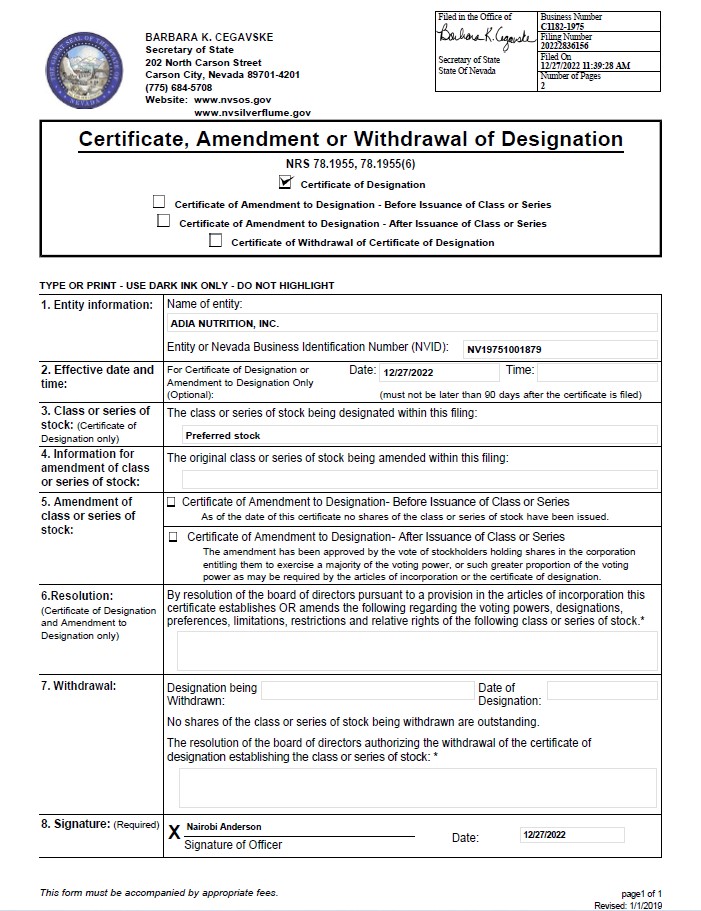

“Attachment for Series A”

CERTIFICATE OF DESIGNATION, PREFERENCES AND RIGHTS

OF

SERIES A PREFERRED STOCK

PIVX SOLUTIONS, INC.

(Pursuant to Section 78.1955 of the

Nevada Revised Statutes)

PivX Solutions. Inc., a corporation organized and existing under the laws of the State of Nevada (the “Company”), hereby certifies that, pursuant to the authority vested in the Board of Directors of the Company (the “Board”) by the Certificate of Incorporation of the Company (the “Certificate of Incorporation”), as amended, the following resolution was adopted as of June 23. 2006 by the Board:

RESOLVED, that pursuant to the authority granted to and vested in the Board in accordance with the provisions of the Certificate of Incorporation, as amended and restated, there shall be created a series of Preferred Stock, $0001 par value, which series shall have the following designations and number thereof, powers, preferences, rights, qualifications. limitations and restrictions:

1. Designation and Number of Shares. There shall hereby be created and established a series of Preferred Stock designated as “Series A Preferred Stock” (the “Series A Preferred Stock”). The authorized number of shares of Series A Preferred Stock shall be 10,000,000.

2. Dividends. Except as provided herein, the holders of the Series A Preferred Stock shall be entitled to receive cash, stock or other property, as dividends, when, as, and if declared by the Board of Directors of the Company. Series A Preferred Stock shall not participate in any dividend declared with respect to the Common Stock.

3. Liquidation Rights. Upon the dissolution, liquidation or winding up of the Company, whether voluntary or involuntary, the holders of the then outstanding shares of Series A Preferred Stock shall be entitled to receive out of the assets of the Company the sum of $0.001 per share (the “Liquidation Rate”) before any payment or distribution shall be made on any other class of capital stock of the Company ranking junior to the Series A Preferred Stock.

(a) The sale, conveyance, exchange or transfer (for cash, shares of stock, securities or other consideration) of all or substantially all the property and assets of the Company shall be deemed a dissolution, liquidation or winding up of the Company for purposes of this Paragraph 3, but the merger, consolidation, or other combination of the Company into or with any other corporation, or the merger, consolidation, or other combination of any other corporation into or with the Company, shall not be deemed a dissolution, liquidation or winding up, voluntary or involuntary, for purposes of this Paragraph 3. As use herein, the "merger, consolidation, or other combination" shall include, without limitation, a forward or reverse triangular merger, or stock exchange of the Company and any of its subsidiaries with any other corporation.

(b) After the payment to the holders of shares of the Series A Preferred Stock of the full preferential amounts fixed by this Paragraph 3 for shares of the Series A Preferred Stock, the holders of the Series A Preferred Stock as such shall have no right to claim to any of the remaining assets of the Company.

(c) In the event the assets of the Company available for distribution to the holders of the Series A Preferred Stock upon dissolution, liquidation or winding up of the Company shall be insufficient to pay in full all amounts to which such holders are entitled pursuant to this Paragraph 3, no distribution shall he made on account of any shares of a class or series of capital stock of the Company ranking on a parity with the shares of Series A Preferred Stock, if any, upon such dissolution, liquidation or winding up unless proportionate distributive amounts shall be paid on account of the shares of the Series A Preferred Stock. ratably, in proportion to the full distributive amounts for which holders of all such parity shares are respectively entitled upon such dissolution, liquidation or winding up.

4. Preferred Status. The rights of the shares of the Common Stock shall be subject to the preferences and relative rights of the shares of the Series A Preferred Stock. Without the prior written consent of the holders of not less than a majority of the outstanding shares of the Series A Preferred Stock, the Company shall not hereafter authorize or issue additional or other capital stock that is of senior or equal rank to the shares of the Series A Preferred Stock in respect of the preferences as to distributions and payments upon the Liquidation, dissolution and winding up of the Company described in Paragraph 3 above.

5. Vote to Change the Terms of the Series A Preferred Stock. Without the prior written consent of the holders of not less than a majority of the outstanding shares of the Series A Preferred Stock, the Company shall not amend, alter. change or repeal any of the powers. designations. preferences and rights of the Series A Preferred Stock.

6. Lost or Stolen Certificates. Upon receipt by the Company of evidence satisfactory to the Company of the loss, theft, destruction or mutilation of any Preferred Stock Certificates representing shares of the Series A Preferred Stock, and, in the case of loss, theft or destruction. of any indemnification undertaking or bond, in the Company's discretion, by the holder to the Company and, in the case of mutilation, upon surrender and cancellation of the Preferred Stock Certificate(s), the Company shall execute and deliver new Series A Preferred Stock Certificate(s) of like tenor and date.

7. Voting. Each share of Series A Preferred Stock shall entitle the holder to five (5) votes on any matter submitted to the shareholders of the Company for their vote, waiver, release or other action, to be considered in connection with the establishment of a quorum, except as may otherwise be expressly required by law or by the applicable stock exchange rules. The holders of Series A Preferred Stock shall vote together with the shares of Common Stock as one class.

8. No Reissuance of Series A Preferred Stock. No share or shares of Series A Preferred Stock acquired by the Company by reason of redemption, purchase or otherwise shall be reissued, and all such shares of Series A Preferred Stock shall be cancelled, retired and eliminated from the shares of Series A Preferred Stock, as applicable, which the Company shall be authorized to issue. Any such shares of Series A Preferred Stock acquired by the Company shall have the status of authorized and unissued shares of Preferred Stock issuable in undesignated Series and may be redesignated and reissued in any series other than as Series A Preferred Stock.

9. Registered Holders. A holder of Series A Preferred Stock registered on the Company's stock transfer books as the owner of shares of Series A Preferred Stock, as applicable, shall be treated as the owner of such shares of all purposes. All notices and all payments required to be mailed to a holder of shares of Series A Preferred Stock shall be mailed to such holder's registered address on the Company's stock transfer books, and all dividends and redemption payments to a holder of Series A Preferred Stock made hereunder shall be deemed to be paid in compliance hereof on the date such payments are deposited into the mail addressed to such holder at such holder's registered address on the Company's stock transfer hooks.

10. Certain Remedies. Any registered holder of shares of Series A Preferred Stock shall he entitled to an injunction or injunctions to prevent breaches of the provisions of this Certificate of Designations and to enforce specifically the terms and provisions of this Certificate of designations in any court of the United States or any state thereof having jurisdiction, this being in addition to any other remedy to which such holder may be entitled at law or in equity.

11. Headings of Subdivisions. The headings of various subdivisions hereof are for convenience of reference only and shall not affect the interpretation of any of the provisions hereof.

12. Severability of Provisions. If any right, preference or limitation of the Series A Preferred Stock set forth herein (as may be amended) from time to time is invalid, unlawful or incapable of being enforced by reason of any rule of law or public policy, such right, preference or limitation (including, without limitation, the dividend rate) shall be enforced to the maximum extent permitted by law and all other rights, preferences and limitations set forth herein (as so amended) which can be given effect without the invalid, unlawful or unenforceable right, preference or limitation herein set forth shall not be deemed dependent upon any other such right, preference or limitation unless so expressed herein.

13. Ranking. The Series A Preferred Stock shall rank, as to rights upon liquidation, dissolution or winding up, pari passu to each other and shall rank senior and prior to (i) the Common Stock and (ii) each other class or series of capital stock of the Company hereafter created which does not expressly rank pari passu with or senior to the Series A Preferred Stock, as applicable.

IN WITNESS WHEREOF, the undersigned, being the Chief Executive Officer of the Company, has executed this Certificate of Designation. Preferences and Rights of Series A Preferred Stock effective as of June 23, 2006.

PIVX SOLUTIONS. INC.

By: /s/ Tydus Richards

Name: Tydus Richards

Title: Chief Executive Officer