EXECUTION COPY

ASSET PURCHASE AGREEMENT

THIS ASSET PURCHASE AGREEMENT (the “Agreement”) effective as of this 16th day of June, 2005, by and among NURSES PRN ACQUISITION CORP., a Nevada corporation (the “Purchaser”), MEDICAL STAFFING SOLUTIONS, INC., a Nevada corporation (“MSSI”), NURSES PRN, LLC, a Florida limited liability company (the “Company”), and the individuals listed on Exhibit “A” attached hereto (individually, a “Member” and collectively, the “Members”).

RECITALS:

A. The Company specializes in temporary and contract placement of nurses primarily in acute care facilities (the “Business”).

B. The Company desires to sell to the Purchaser, which is 100% owned by MSSI, and the Purchaser desires to purchase from the Company, substantially all of the assets of the Company upon the terms and conditions set forth herein.

AGREEMENT:

NOW, THEREFORE, in consideration of the mutual premises herein set forth and certain other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties hereto agree as follows:

| 1. | SALE OF ASSETS AND RELATED TRANSACTIONS. |

1.1. Sale and Purchase of Assets.

The Company shall sell, convey, assign, transfer and deliver to Purchaser at the Closing (as hereinafter defined), and Purchaser will purchase and accept at the Closing, all assets, properties, privileges, rights, interests, business and goodwill belonging to the Company, of every kind and description, real, personal and mixed, tangible and intangible and wherever located (such assets, properties, privileges, rights, interests, business and goodwill being transferred hereunder are hereinafter referred to collectively as the “Purchased Assets”). Without limiting the generality of the foregoing, the Purchased Assets shall include all of the Company’s right, title and interest in and to the following:

(a) Fixed Assets. All machinery, equipment, computers, vehicles, furniture, tools and other fixed assets and goods and other items of tangible personal property owned or leased by the Company from an independent third party as of the date of this Agreement and used by the Company.

(b) Accounts Receivable. All notes receivables, accounts receivable and other receivables of Company of any kind arising out of the Business of the Company as of the Closing Date (as defined below).

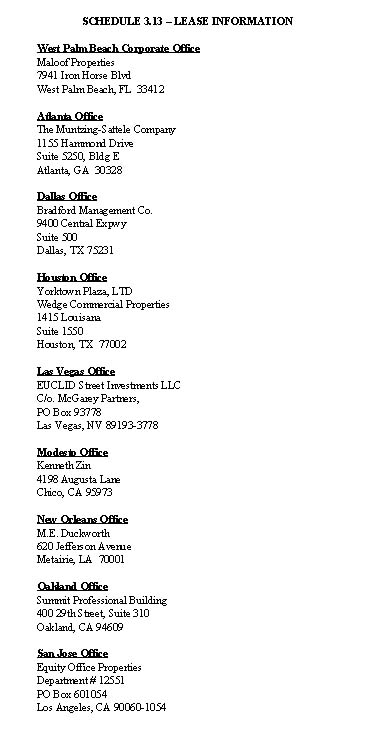

(c) Real Property Leases. All leases pursuant to which the Company is a lessee of any real property (the “Leases”), all of which are listed in Schedule 3.13;

(d) Intellectual Property. All intellectual property rights listed on Schedule 3.15, including but not limited to, all rights that the Company has to use of the name “Nurses PRN;”

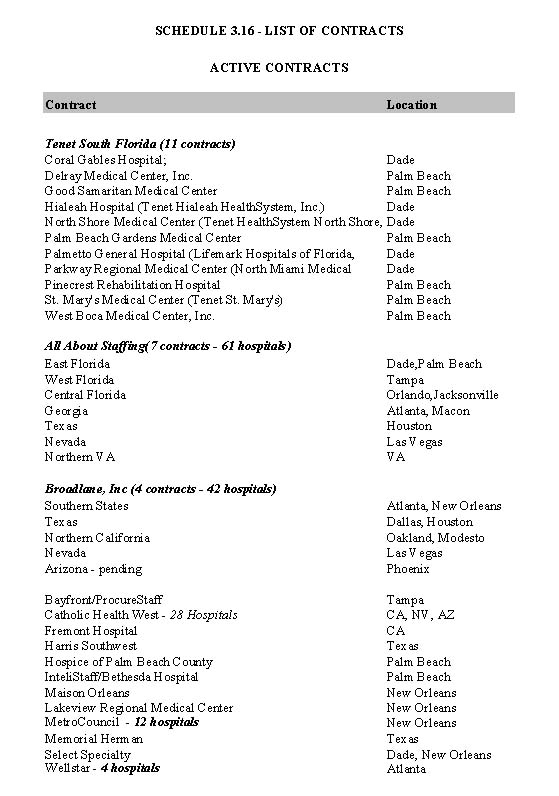

(e) Material Contracts. The Material Contracts (as defined in Section 3.16 below) listed on Schedule 3.16;

(f) Files and Records. All files and records of the Company related to the conduct of the Business, including, without limitation, all of the Company’s books, records, manuals, documents, books of account, correspondence, sales and credit reports, customer lists, literature, brochures, advertising material and the like, provided that Purchaser shall be provided with only a copy of the Company’s books of account and the Company shall retain the original books of account and such other records as Company requires for income tax and other reporting purposes;

(g) Goodwill. All of the Company’s goodwill related to the Business, and the going concern value of the the Company; and

(h) All cash items, securities and financial instruments of the Company, as of the Closing Date;

1.2. Passage of Title. Title to all of the Purchased Assets shall pass from the Company to Purchaser at Closing.

1.3. Transfer Taxes. The Company shall be responsible for the payment of all transfer, sales, use and bulk sales taxes, ad valorem and property taxes, and similar assessments which arise from the consummation of the transactions contemplated herein.

1.4. Liabilities.

(a) Assumed Liabilities. The Purchaser, after the Closing, shall assume the following debts and liabilities (collectively, the “Assumed Liabilities”) (it being expressly understood by the parties to this Agreement that the Purchaser will not assume any other debts or liabilities except for those debts or liabilities set forth below and MSSI shall not assume any debts whatsoever of the Company): (a) a Three Hundred Sixty Five Thousand Four Hundred Eighty Seven and 50/100 Dollar ($365,487.50) note payable (“Dowling Note”) issued to Jeff Dowling (“Dowling”) by the Purchaser, which shall be payable solely out of the Purchaser’s cash flows and which shall be secured by Robert Murphy (“Murphy”) and Linda Romano’s (“Romano”) interest in 3,166,666 MSSI Shares (as defined below) (“Dowling Security Shares”), and guaranteed by MSSI to the extent the total value of the Dowling Security Shares at the Closing is less than the principal and accrued interest on the Dowling Note, in exchange for Dowling releasing the guaranty of Aftabe Adamjee (“Adamjee”) with respect to the Dowling Note; (b) a Two Hundred Fifty Thousand Dollar ($250,000) note payable to Adamjee (“Adamjee”) by the Company (the “Adamjee Note”), guaranteed by MSSI, which shall be issued to Adamjee in exchange for Adamjee releasing the Company and the Purchaser from any obligations due to him under a One Million Dollar ($1,000,000) note payable issued by the Company to Adamjee (the “Note Payable”);and (c) the general payables specifically set forth in Schedule 1.4 hereto.

Without the prior, written consent of Murphy and Romano, the Purchaser shall not make any changes to the terms and conditions of the Dowling Note to the extent such changes will have any adverse affect on Murphy and/or Romano.

The Adamjee Note will have a one-year term with semi-annual payments of One Hundred Twenty Five Thousand Dollars ($125,000). A form of the Adamjee Note is attached hereto as Exhibit “B”.

Except for the Assumed Liabilities, the Purchaser is not assuming any liability or obligation of the Company (or any predecessor owner of all or part of the Purchased Assets) and will not pay, discharge, perform or otherwise be liable for any liabilities, indebtedness or obligations which relate to the Company or the Purchased Assets existing on the Closing Date or arising out of any transactions entered into, or any state of facts existing, on or prior to the Closing Date (collectively, the “Excluded Liabilities”). All such Excluded Liabilities and obligations shall be retained by and remain obligations and liabilities of the Company or the Members, as the case may be.

1.5. Share Consideration Paid by Purchaser. The Purchaser shall cause MSSI to issue, and deliver to the Company, which shall deliver same to the Members in the denominations set forth opposite each Member’s name on Exhibit “A” attached hereto, newly issued restricted shares of common stock, par value $0.001 per share of MSSI (the “MSSI Common Stock”). The total number of shares of MSSI Common Stock to be issued to the Company shall be equal to Nine Million Five Hundred Thousand (9,500,000) shares. The restricted shares of MSSI Common Stock to be issued as part of the Agreement are referred to herein as the “MSSI Shares,” also sometimes referred to hereinafter as the “Share Consideration.” The MSSI Shares shall be delivered to the Company at Closing and the Company shall then distribute the MSSI Shares to the existing Members at the Closing.

1.6. Cash Consideration.

(a) In addition to the Share Consideration, the Purchaser shall pay the Company One Million Six Hundred Thousand Dollars ($1,600,000) in cash (the “Cash Consideration”), which shall be used to pay or satisfy its outstanding Tax Liabilities (as defined below) and, at the direction of the Members, shall be paid directly to the Internal Revenue Service (the “IRS”). Murphy agrees to return to the Purchaser a pro rata portion of the Cash Consideration in the event that Murphy resigns as an employee of the Purchaser or is terminated for good cause (as such term is defined in Section 4(a) (except for subsection (iv) therein) of the Murphy Employment Agreement (as defined below)) by the Purchaser within Thirty Six (36) months of the Closing Date. Romano agrees to return to the Purchaser a pro rata portion of the Cash Consideration in the event that Romano resigns as an employee of the Purchaser or is terminated for good cause (as such term is defined in Section 4(a) (except for subsection (iv) therein) of the Romano Employment Agreement (as defined below)) by the Purchaser within Thirty Six (36) months of the Closing Date. For purposes of this Agreement, “Tax Liabilities” shall mean unsatisfied federal employment taxes for purposes of Form 941, and all interest and penalties related thereto for periods prior to June 16, 2005.

1.7. Contingent Consideration. In addition to the Share Consideration and the Cash Consideration, the Purchaser shall pay a contingent payment (collectively, the “Contingent Consideration”) to the Company. The Contingent Consideration may not modified without the consent of Adamjee. The Contingent Consideration shall be based on the Purchaser’s achievement of financial targets based on Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA Target”), if such EBITDA Targets are achieved by the Company for the fiscal year beginning June 16, 2005 through June 15, 2006 (the “Contingent Consideration Period”), as follows:

(a) the Contingent Consideration is an amount equal to Forty Percent (40%) of the EBITDA Target.

(b) The payment owned under this Section 1.7 shall not exceed Five Hundred Thousand Dollars ($500,000). The Contingent Consideration earned under this Section 1.7 shall be calculated at the end of each calendar month following the Closing (subject to adjustment at the end of MSSI’s fiscal year) and shall be payable as follows: One Hundred Percent (100%) to the Company in Ten Thousand Dollar ($10,000) monthly installments (the “Monthly Installments”), with the first Monthly Installment to be made on July 31, 2005 (for the period from June 16, 2005 to July 15, 2005) and on the last day of each month thereafter, if applicable. It is expressly understood that the Monthly Installments are advance payments of the Contingent Consideration, which will be paid monthly, in arrears, based on the Contingent Consideration calculations made on a rolling basis commencing on June 16, 2005. In the event the estimated Contingent Consideration amount for any monthly measurement period is less than $10,000, then the payment for such month shall only be the estimated amount of the Contingent Consideration earned for such month, unless the Contingent Consideration amounts for previous months exceeded $10,000 for such previous month. For purposes of clarification, if the estimated Contingent Consideration for the period from June 16, 2005 through July 15, 2005 is $15,000, then $10,000 would be paid on July 31, 2005 and the excess ($5,000) would be carried forward to the next monthly measurement period in which the Contingent Consideration is less than $10,000. If the estimated Contingent Consideration for the period from August 16 through September 15, 2005 is only $5,000, then the payment for September 30, 2005 would nonetheless be $10,000 ($5,000 carry-over for July 2005 and $5,000 for August 2005). The Monthly Payments shall be directed to a bank account to be specified by the Company from time to time. The final payment of the balance of the Contingent Consideration, if any, shall be made on September 16, 2006.

(c) All computations of EBITDA with respect to the Contingent Consideration Period and the amount of bonus hereunder (the “Calculated Amounts”) shall be undertaken by MSSI’s regular independent accounting firm (the “MSSI Accountants”) in accordance with GAAP consistently applied, and reported to the Members by a written notice. MSSI shall supply the Members at least quarterly (or more frequently if calculated by MSSI) with calculations of the Contingent Consideration for each calendar quarter. Within ninety (90) days after the end of the Contingent Consideration Period, MSSI shall deliver to the Company and Adamjee a copy of the MSSI Financial Statements and a statement setting forth in reasonable detail its computation of the Calculated Amounts. If, within thirty (30) days after delivery by MSSI to the Company of such statements, or if the Company gives written notice to MSSI disputing the computation of the Calculated Amounts or otherwise disputing such statements (a “Dispute Notice”), the MSSI Accountants and the independent certified public accountants retained by the Company (the “Company’s Accountants”) to dispute the statement at the Company’s expense, shall undertake to reach an agreement as to the Calculated Amounts and shall notify the Company and MSSI in writing as to such agreement. Any such agreement by such accountants shall be conclusive and binding on the parties hereto. If within ten (10) days after the matter is referred to them, the Company’s Accountants and the MSSI Accountants are unable to agree as to the Calculated Amounts, such accountants jointly shall promptly select a third independent certified public accounting firm (the “Third Accountant”). The Third Accountant shall, within thirty (30) days after the matter is referred to it, notify the Company and MSSI in writing of its determination of the Calculated Amounts. Any such determination by the Third Accountant shall be conclusive and binding on the parties hereto. If the Company does not deliver a Dispute Notice to MSSI within the prescribed timeframe, the Calculated Amounts for the Contingent Consideration Period shall be conclusive and binding on the parties hereto. The fees and expenses of the Third Accountant, and all other costs associated with any dispute in which a Third Accountant is appointed, shall be paid by the non-prevailing party (as determined by the Third Accountant), except that each of MSSI, on the one hand, and the Company, on the other hand, shall be responsible for its own attorneys' fees, accountants' fees and other expenses incurred in connection with the dispute. For purposes of this Agreement, the non-prevailing party shall be considered to be the party whose proposed Calculated Amount is not substantially adopted by the Third Accountant.

1.8. Closing. The parties to this Agreement shall cause this Agreement to become effective as of date first written above and consummate the other transactions contemplated by this Agreement (the “Closing”) no later than June 16, 2005 or such other date as mutually agreed to by the parties to this Agreement; provided, in no event shall the Closing occur prior to the satisfaction of the conditions precedent set forth in Sections 6, 7 and 8 hereof. The date of the Closing is referred to herein as the “Closing Date.” The Closing shall take place at the offices of counsel to the Purchaser, or at such other place as may be mutually agreed upon by the Purchaser, the Company and the Members. At the Closing, (i) the Purchaser shall cause MSSI to deliver to Murphy and Romano the stock certificates representing the MSSI Shares; (iii) the Purchaser shall deliver to the Company the Cash Consideration; (iii) the Company shall execute to the extent the execution by the company is necessary and deliver to, or cause to be delivered to, the Purchaser bills of sale, deeds, certificates of title and general instruments of assignment and transfer to transfer ownership of the Purchased Assets from the Company to Purchaser in a form reasonably acceptable to the parties and duly executed by the Company (the “Bills of Sale”); (iv) the Purchaser shall execute an assignment and assumption agreement transferring to the Purchaser from the Company all responsibility for the Assumed Liabilities in a form reasonably acceptable to the Parties and duly executed by the Company (the “Assignment and Assumption Agreement”); (v) the Company shall execute and deliver to the Company the Assignment and Assumption Agreement; and (vi) the Company shall have paid $1,600,000 towards its Tax Liabilities.

1.9. Approval of Asset Sale and Purchase. By his or her execution of this Agreement, each Member in their capacity as a Member of the Company and in their capacity as a member of the Board of Managers of the Company hereby ratifies, approves and adopts this Agreement, all documents to be executed hereunder, and the transactions contemplated hereby and thereby. On or before the execution of this Agreement, the Board of Directors of the Purchaser and MSSI shall have approved this Agreement, all documents to be executed hereunder, and the transactions contemplated hereby and thereby.

1.10. Shares to Creditor. In exchange for Phil Dodge (the “Creditor”) releasing the Company from any obligations due to him and providing a general release to each of the Members, the Purchaser shall cause MSSI to issue and deliver to the Company Two Million Five Hundred Thousand (2,500,000) shares of the MSSI Common Stock (the “Creditor Shares”). The Company shall deliver to the Creditor the Creditor Shares at Closing.

1.11. Factoring Agreement. Any interest refund which is due the Company from Rockland Credit Finance, LLC (also known as, Webbank, Inc.) for period prior to Closing (the “Accrued Interest”) shall be assigned by the Company to Adamjee.

1.12. Name Change. Within two (2) days following the Closing Date, the Company shall change its current name, “Nurses PRN LLC” to a different company name, which does not contain the phrase “Nurses PRN.”

2.1. Access and Inspection, Etc. The Company and the Members have allowed and shall allow the Purchaser and its authorized representatives full access during normal business hours from and after the date hereof and prior to the Closing Date to all of the properties, books, contracts, commitments and records of the Company for the purpose of making such investigations as the Purchaser may reasonably request in connection with the transactions contemplated hereby, and the Members shall cause the Company to furnish the Purchaser such information concerning its affairs as the Purchaser may reasonably request. The Company and the Members have caused and the Company shall cause the personnel of the Company to assist the Purchaser in making such investigation and shall use their best efforts to cause the counsel, accountants, and other non-employee representatives of the Company to be reasonably available to the Purchaser for such purposes.

2.2. Confidential Treatment of Information. From and after the date hereof, the parties hereto shall and shall cause their representatives to hold in confidence, and not use except for purposes of evaluating and effecting the transactions contemplated herby, this Agreement (including the Exhibits and Schedules hereto), all matters relating hereto and all data and information obtained with respect to the other parties or their business, except such data or information as is published or is a matter of public record, or as compelled by legal process. In the event this Agreement is terminated pursuant to Section 10 hereof, each party shall promptly return to the other(s) any statements, documents, schedules, exhibits or other written information obtained from them in connection with this Agreement, and shall not retain any copies thereof.

2.3. Public Announcements. After the date hereof and prior to the Closing, none of the parties hereto shall make any press release, statement to employees or other disclosure of this Agreement or the transactions contemplated hereby without the prior written consent of the other parties, except as may be required by law or advised by their respective counsel. Neither party shall make any such disclosure unless the other parties shall have received prior notice of the contemplated disclosure and has had adequate time and opportunity to comment on such disclosure, which shall be satisfactory in form and content to the other parties and their respective counsel.

2.4. Securities Law Compliance. The issuance of the MSSI Shares to the Company hereunder shall not be registered under the Securities Act of 1933, as amended, by reason of the exemption provided by Section 4(2) thereof, and such shares may not be further transferred unless such transfer is registered under applicable securities laws or, in the opinion of MSSI’s counsel, such transfer complies with an exemption from such registration. All certificates evidencing the MSSI Shares to be issued to the Company shall be legended as follows.

The shares(s) represented by this Certificate has not been registered under the Securities Act of 1933, as amended, or the securities laws of any state. This Share has been acquired for investment and may not be sold, transferred, pledged or hypothecated in the absence of any effective registration statement for such Share under the Securities Act of 1933, as amended, and any applicable state securities laws or an opinion of counsel acceptable to counsel for the Company that registration is not required under such laws.

2.5. Employment Agreements. Prior to the Closing, the Purchaser shall enter into employment agreements with the following individuals: (a) Murphy, in the form attached hereof as Exhibit “C” (the “Murphy Employment Agreement”), and (b) Romano, in the form attached hereof as Exhibit “D” (the “Romano Employment Agreement”) The Murphy Employment Agreement and the Romano Employment Agreement are collectively referred to as the “Employment Agreements”. At or prior to the Closing, Murphy and Romano shall, at the Purchaser’s expense, each obtain a life insurance policy of One Million Dollars ($1,000,000) naming the Purchaser as the beneficiary.

2.6. Best Efforts. Subject to the terms and conditions provided in this Agreement, each of the parties shall use its best efforts in good faith to take or cause to be taken as promptly as practicable all reasonable actions that are within its power to cause to be fulfilled those conditions precedent to its obligations or the obligations of the other parties to consummate the transactions contemplated by this Agreement that are dependent upon its actions.

2.7. Further Assurances. The parties shall deliver any and all other instruments or documents required to be delivered pursuant to, or necessary or proper in order to give effect to, the provisions of this Agreement, including, without limitation, all necessary instruments of transfer as may be necessary or desirable to transfer ownership of the Purchased Assets and to consummate the transactions contemplated by this Agreement.

2.8. Noncompetition.

2.8.1. Competitive Business. From and after the Closing Date and for a period five (5) years thereafter (the “Restricted Period”) and except for employment by MSSI and/or the Purchaser, (i) Romano, Murphy and the Company shall not directly nor indirectly compete with MSSI and/or the Purchaser by owning, managing, controlling or participating in the ownership, management or control of or be employed by or engaged in any Competitive Business (as defined herein) of MSSI and/or the Purchaser in the continental United States, and (ii) Adamjee shall not directly or indirectly compete with the Purchaser by owning, managing, controlling or participating in the ownership, management or control of or be employed by or engaged in any nurse staffing business in the continental United States . As used herein, a “Competitive Business” is any other corporation, partnership, proprietorship, firm or other business entity which is engaged in a “core business of MSSI and/or the Purchaser, as applicable.” A “core business of MSSI and/or the Purchaser, as applicable” is providing (i) long-term medical personnel, homeland security and technology services to federal, state and local governments and/or (ii) nurse staffing to the healthcare industry, as applicable.

2.8.2. Non-Interference. From and after the date hereof and during the Restricted Period, no Member or the Company shall directly or indirectly induce or solicit any employee of MSSI and/or the Purchaser or any person doing business with MSSI and/or the Purchaser to terminate his or her employment or business relationship with MSSI and/or the Purchaser or otherwise interfere with any such relationship.

2.8.3. Confidentiality. The Members and the Company agree and acknowledge that, by reason of the nature of the Members’ ownership interest in MSSI and/or the Purchaser, each Member and the Company will have or may have access to and become informed of confidential and secret information which is a competitive asset of MSSI and/or the Purchaser (“Confidential Information”), including, without limitation, technology, any lists of customers, financial statistics, research data or any other statistics and plans contained in profit plans, capital plans, critical issue plans, strategic plans or marketing or operation plans or other trade secrets of MSSI and/or the Purchaser and any of the foregoing which belong to any person or company but to which the Members and the Company have had access by reason of their relationship with MSSI and/or the Purchaser. The Members and the Company agree faithfully to keep in strict confidence, and not, either directly or indirectly, to make known, divulge, reveal, furnish, make available or use any such Confidential Information. The Members and the Company acknowledge that all manuals, instruction books, price lists, information and records and other information and aids relating to MSSI and/or the Purchaser’s business, and any and all other documents containing Confidential Information furnished to the Members and the Company by MSSI and/or the Purchaser or otherwise acquired or developed by the Members or the Company, shall at all times be the property of MSSI and/or the Purchaser. Upon the termination of each Members’ or Company’s status as a shareholder of MSSI or as a shareholder of the Purchaser, as applicable, each Member and the Company shall return to MSSI and/or the Purchaser, as appropriate, any such property or documents of the respective company which are in their possession, custody or control, but the Members’ and the Company’s obligation of confidentiality shall survive such termination. The obligations of the Members and the Company under this subsection are in addition to, and not in limitation or preemption of, all other obligations of confidentiality which each Member and the Company may have to MSSI and/or the Purchaser, as appropriate, under general legal or equitable principles. Notwithstanding the above, however, MSSI and/or the Purchaser acknowledges that each Member and the Company may have extensive experience in the general industry in which MSSI and/or the Purchaser operate, and these restrictions are not intended to prevent a Member from using his knowledge of the industry. These restrictions only apply to Confidential Information which is owned by MSSI and/or the Purchaser, or was learned by a Member or the Company as a shareholder of MSSI or a shareholder of the Purchaser.

2.8.4. Remedies. It is expressly agreed by the Members, MSSI, the Company and the Purchaser that the provisions in this Section 2.8 are reasonable for purposes of preserving for MSSI and/or the Purchaser its business, goodwill and Confidential Information. It is also agreed that if any provision is found by a court having jurisdiction to be unreasonable because of scope, area or time, then that provision shall be amended to correspond in scope, area and time to that considered reasonable by a court and as amended shall be enforced and the remaining provisions shall remain effective. In the event any threatened or actual breach of these provisions by any Member or the Company, the parties recognize and acknowledge that a remedy at law will be inadequate and MSSI and/or the Purchaser may suffer irreparable injury. The Members and the Company consent to injunctive and other appropriate equitable relief without the posting of a bond upon the institution of proceedings therefor by MSSI and/or the Purchaser in order to protect MSSI and/or the Purchaser’s rights. Such relief shall be in addition to any other relief to which MSSI and/or the Purchaser may be entitled at law, in equity, or under any other agreement between each Member and the Company and MSSI and/or the Purchaser. The provisions of this Section 2.8 (including the subsections) shall survive the termination of this Agreement.

2.9. Intentionally Omitted.

2.10. No-Shop. From the date hereof until the termination of this Agreement, neither the Company nor any Member shall, directly or indirectly, make, solicit, initiate or encourage submission of proposals or offers from any persons (including any of their employees or officers) relating to an Acquisition Proposal (as defined below). As used herein, “Acquisition Proposal” means any proposal or offer involving a liquidation, dissolution, recapitalization, merger, consolidation or acquisition or purchase of all or substantially all of the assets of, or equity interest in, the Company or other similar transaction or business combination involving the Company. Each of the Company and each Member shall immediately cease and cause to be terminated all discussions or negotiations with third parties with respect to any Acquisition Proposal, if any, exiting on the date hereof.

2.11. Allocation of Consideration Paid by Purchaser. The Share Consideration, the Cash Consideration, the Contingent Consideration and the assumption of the Assumed Liabilities (collectively, the “Consideration”) shall be allocated in accordance with Code Section 1060 and the allocation statement (the “Allocation Statement”) prepared by the parties within One Hundred Sixty-Five (165) days after the Closing Date. The parties agree to prepare and file on a timely basis any necessary tax forms setting forth an allocation set forth in the Allocation Statement. The parties further agree to report this transaction for income tax purposes in accordance with the Allocation Statement and each party agrees to act in accordance with such Allocation Statement in the course of any tax audit, tax review or tax litigation concerning such party and relating thereto (except as otherwise required by law). The parties will not assert that the allocation set forth in the Allocation Statement was not separately bargained for at arm’s length and in good faith.

| 3. | REPRESENTATIONS, COVENANTS AND WARRANTIES OF THE MEMBERS AND THE COMPANY. |

To induce the Purchaser and MSSI to enter into this Agreement and to consummate the transactions contemplated hereby, the Company and each of the Members, other than Adamjee except as specifically set forth herein (collectively the “Representing Members”) (it being expressly understood by the parties that Adamjee is not a Representing Member), jointly and severally, except as specifically set forth below, represent and warrant to and covenant with the Purchaser and MSSI, as of the date hereof and as of the Closing date, as follows:

3.1. Organization; Compliance. The Company is a limited liability company duly organized, validly existing and in good standing under the laws of Florida. The Company is: (a) entitled to own or lease its properties and to carry on its business as and in the places where such business is now conducted, and (b) except in Texas, duly licensed and qualified in all jurisdictions where the character of the property owned by it or the nature of the business transacted by it makes such license or qualification necessary, except where the failure to do so would not result in a material adverse effect on the Company. Schedule 3.1 lists all locations where the Company has an office or place of business and the nature of the ownership interest in such property (fee, lease, or other).

3.2. Capitalization. On the date of Closing, no Member shall be subject to any agreement, understanding or arrangement, direct or indirect, which shall cause any of the Purchased Assets or any of such Members’ Membership Interests to contain any encumbrances, liens, or charges of any kind or character except the lien of the IRS for unpaid employment taxes and penalties and interest relating thereto in the amount of $64,000 (the “Tax Lien”).

3.3. Intentionally Omitted.

3.4. Execution; No Inconsistent Agreements; Etc.

(a) Each Member including Adamjee and the Company represent and warrant that, this Agreement is a valid and binding agreement of such Member and the Company, enforceable in accordance with its terms, except as such enforcement may be limited by bankruptcy or similar laws affecting the enforcement of creditors’ rights generally, and the availability of equitable remedies. Each Member including Adamjee and the Company represent and warrant that, such Member and the Company have the absolute and unrestricted right, power, authority, and capacity to execute and deliver this Agreement and the documents to be delivered by such Member and the Company in connection with the Closing and to perform his or her obligations under this Agreement.

(b) The execution and delivery of this Agreement by the Representing Members and the Company does not, and the consummation of the transactions contemplated hereby will not, constitute a breach or violation of the charter of the Company, or a default under any of the terms, conditions or provisions of (or an act or omission that would give rise to any right of termination, cancellation or acceleration under) any note, bond, mortgage, lease, indenture, agreement or obligation to which the Company or any Representing Member is a party, pursuant to which the Company or any Representing Member otherwise receives benefits, or to which any of the properties of the Company or any Representing Member is subject, or violate any judgment, order, decree, statute or regulation applicable to the Company or any Representing Member or by which any of them may be subject.

3.5. Corporate Records. To the knowledge of the Representing Members and the Company, the books of account, minute books, unit record, books, and other records of the Company, all of which have been made available to the Purchaser ad MSSI, are complete and correct and have been maintained in accordance with sound business practices. The minute books of the Company contain accurate and complete records of all meetings held of, and corporate action taken by, the Members, the Board of Managers, and committees of the Boards of Managers of the Company, and no meeting of any such Members, Board of Managers, or committee has been held for which minutes have not been prepared and are not contained in such minute books.

3.6. Financial Statements.

(a) The Company and the Representing Members have delivered to the Purchaser the balance sheet of the Company as of December 31, 2004 (the balance sheet as of December 31, 2004 is hereinafter referred to as the “Balance Sheet’), and the related statements of income, members’ equity and cash flows of the Company for the fiscal year ended December 31, 2004 and the independent auditors’ report thereon. The Representing Members and the Company represent that the December 31, 2004 financial statements have been reviewed by the Company’s certified public accountants. All the foregoing financial statements are referred to herein collectively as the “Company Financial Statements.”

(b) The Company Financial Statements have been and will be prepared in accordance with applicable GAAP throughout the periods involved, subject, in the case of interim financial statements, to normal recurring year-end adjustments (the effect of which will not, individually or in the aggregate, be materially adverse) and the absence of notes (that, if presented, would not differ materially from those included in the Balance Sheet), applied on a consistent basis, and fairly reflect and will reflect in all material respects the financial condition of the Company as at the dates thereof and the results of the operations of the Company for the periods then ended, and are true and complete and are consistent with the books and records of the Company.

3.7. Liabilities. Except as set forth on Schedule 3.7 hereto and the Assumed Liabilities, to the knowledge of the members of the Board of Managers of the Company, the Company has no debts, liabilities or other obligations which are material to the business of the Company.

3.8. Absence of Changes. From December 31, 2004 to the date of this Agreement:

(a) there has not been any adverse change in the business, assets, liabilities, results of operations or financial condition of the Company or in its relationships with suppliers, customers, employees, lessors or others, other than changes in the ordinary course of business, none of which, singularly or in the aggregate, have had or will have a material adverse effect on the business, properties or financial condition of the Company;

(b) there has not been any: (i) change in the Company’s authorized or issued Membership Interests, retirement, or other acquisition by the Company of any Membership Interests; (ii) a declaration or payment of any dividend or other distribution or payment in respect of units of Membership Interests; (iii) amendment to the Articles of Organization or Operating Agreement; (iv) increase by the Company of any bonuses, salaries, or other compensation to any member, manager, officer, or (except in the ordinary course of business) employee or entry into any employment, severance, or similar agreement with any manager, officer, or employee; (v) adoption of, or increase in the payments to or benefits under, any profit sharing, bonus, deferred compensation, savings, insurance, pension, retirement, or other employee benefit plan for or with any employees of the Company; (vi) sale, lease, or other disposition of any asset or property of the Company in excess of Ten Thousand Dollars ($10,000), individually, or mortgage, pledge, or imposition of any lien or other encumbrance on any material asset or property of the Company; (vii) cancellation or waiver of any claims or rights with a value to the Company in excess of Five Thousand Dollars ($5,000); (viii) material change in the accounting methods used by the Company; or (ix) except pursuant to this Agreement and the contemplated transactions herein, agreement, whether oral or written, by the Company to do any of the foregoing; and

3.9. Title to Properties. The Company has good and marketable title to all of its properties and assets, real and personal owned by it, including, but not limited to, those reflected in the Balance Sheet (except as since sold or otherwise disposed of in the ordinary course of business, or as expressly provided for in this Agreement), free and clear of all encumbrances, liens or charges of any kind or character except: (a) the Tax Lien; (b) those securing liabilities of the Company incurred in the ordinary course (with respect to which no default exists); (c) liens of 2004 real estate and personal property taxes; and (d) imperfections of title and encumbrances, if any, which, in the aggregate (i) are not substantial in amount; (ii) do not detract from the value of the property subject thereto or impair the operations of the Company; and (iii) do not have a material adverse effect on the business, properties or assets of the Company.

3.10. Compliance With Law. The business and activities of the Company has at all times been conducted in accordance with its Articles of Organization and the Operating Agreement and any applicable law, regulation, ordinance, order, License (as defined below), permit, rule, injunction or other restriction or ruling of any court or administrative or governmental agency, ministry, or body, except where the failure to do so would not result in a material adverse effect on the Company.

3.11. Taxes. Except as set forth on Schedule 3.11 hereto, the Company has duly filed all federal, provincial, and material local and foreign tax returns and reports, and all returns and reports of all other governmental units having jurisdiction with respect to taxes imposed on it or on its income, properties, sales, franchises, operations or employee benefit plans or trusts, all such returns were complete and accurate when filed, and all taxes and assessments payable by the Company have been paid to the extent that such taxes have become due. Except as set forth on Schedule 3.11 hereto, all taxes accrued or payable by the Company for all periods through the Closing have been accrued or paid in full, whether or not due and payable and whether or not disputed. Except as set forth on Schedule 3.11 hereto, the Company has withheld proper and accurate amounts from its employees for all periods in full compliance with the tax withholding provisions of applicable foreign, federal, state and local tax laws. There are no waivers or agreements by the Company for the extension of time for the assessment of any taxes. There are no examinations of the income tax returns of the Company pending, or any proposed deficiencies or assessments against the Company of additional taxes of any kind.

3.12. Real Property. The Company does not have an interest in any real property, except for the Leases (as defined below).

3.13. Leases of Real Property. The Leases are listed in Schedule 3.13 and are valid and enforceable in accordance with their terms. There is not under any of such Leases any material default or any claimed material default by the Company or any event of default or event which with notice or lapse of time, or both, would constitute a material default by the Company and in respect to which the Company has not taken adequate steps to prevent a default on its part from occurring. The copies of the Leases heretofore furnished to the Purchaser are true, correct and complete, and such Leases have not been modified in any respect since the date they were so furnished, and are in full force and effect in accordance with their terms. The Company is lawfully in possession of all real properties of which they are a lessee (the “Leased Properties”).

3.14. Contingencies. Except as set forth on Schedule 3.14, there are no actions, suits, claims or proceedings pending, or to the knowledge of the Company and the Representing Members threatened against, by or affecting, the Company in any court or before any arbitrator or governmental agency that may have a material adverse effect on the Company or which could materially and adversely affect the right or ability of any Representing Member or the Company to consummate the transactions contemplated hereby. To the knowledge of the Representing Members and the Company, there is no valid basis upon which any such action, suit, claim, or proceeding may be commenced or asserted against the Company. There are no unsatisfied judgments against the Company and no consent decrees or similar agreements to which the Company is subject and which could have a material adverse effect on the Company.

3.15. Intellectual Property Rights. The Company has: (a) the exclusive right to use the name(s) identified on Schedule 3.15 and the use of such name(s) does not conflict with or infringe upon the rights of any other person, and (b) made all material filings and publications required to register and perfect such exclusive right. The Company is not, and will not be, subject to any liability, direct or indirect, for infringement damages, royalties, or otherwise, by reason of (a) the use of any name(s) in or outside the United States or (b) the business operations of the Company, at any time prior to the Closing Date. The Company has good and marketable title to its trade secrets, free and clear of all encumbrances, liens, or charges of any kind or character.

3.16. Material Contracts. Schedule 3.16 contains a complete list of all contracts of the Company which involve consideration in excess of the equivalent of five thousand ($5,000) Dollars or have a term of ninety (90) days or more (the “Material Contracts”). The Company has delivered to MSSI a true, correct and complete copy of each of the written contracts, and a summary of each oral contract, listed on Schedule 3.16. Except as disclosed in Schedule 3.16: (a) the Company has performed all material obligations to be performed by it under all such contracts, and is not in material default thereof, and (b) no condition exists or has occurred which with the giving of notice or the lapse of time, or both, would constitute a material default by the Company or accelerate the maturity of, or otherwise modify, any such contract, and (c) all such contracts are in full force and effect. No material default by any other party to any of such contracts is known or claimed by the Company or any Representing Member to exist. The Representing Members and the Company represent and warrant to the Purchaser and MSSI that, except as set forth in Schedule 3.16, each of the Material Contracts, including, but not limited to, any Material Contracts with any hospitals will be assigned to the Purchaser and will be valid and binding after the Closing Date and will not result in any Liability to MSSI or the Purchaser after the Closing Date due to issues related to assignability.

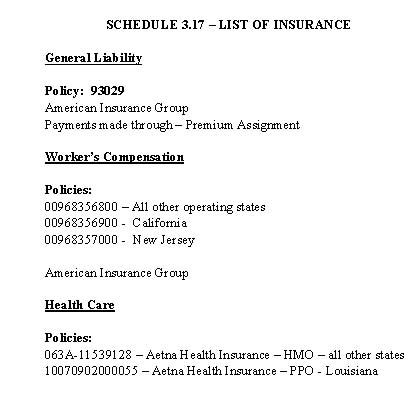

3.17. Insurance. Schedule 3.17 contains a complete list of all policies of insurance presently maintained by the Company all of which are, and will be maintained through the Closing Date, in full force and effect; and all premiums due thereon have been paid and the Company has not received any notice of cancellation with respect thereto. The Company has heretofore delivered to the Purchaser or its representatives a true, correct and complete copy of each such insurance policy.

3.18. Employment and Labor Matters. Schedule 3.18 sets forth the name, position, employment date, and 2005 compensation (base and bonus) of each employee of the Company who earned Ten Thousand Dollars ($10,000) or more in 2004 or is anticipated to earn Ten Thousand Dollars ($10,000) or more in 2005. The Company is not a party to any collective bargaining agreement (whether industry wide or on a company level) or agreement of any kind with any union or labor organization. There has not been any attempt by any union or other labor organization to organize the employees of the Company at any time in the past five (5) years. Except as disclosed in Schedule 3.18, the Company is not a party to or bound by any employment contract, consulting agreement, deferred compensation agreement, bonus plan, incentive plan, profit sharing plan, retirement agreement, or other employee compensation agreement. The Representing Members and the Company are not aware that any officer or key employee, or that any group of key employees, intends to terminate their employment with the Company, nor that the Company has any present intention to terminate the employment of any of the foregoing.

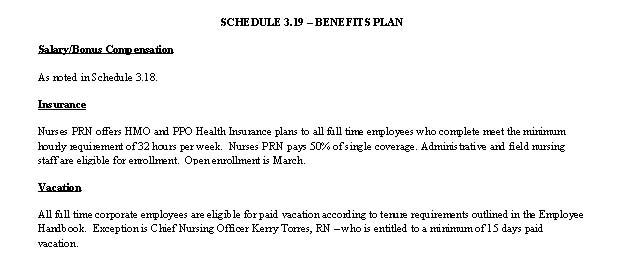

3.19. Employee Benefit Matters.

(a) Except as disclosed in Schedule 3.19, the Company does not provide, nor is it obligated to provide, directly or indirectly, any benefits for employees other than salaries, sales commissions and bonuses, including, but not limited to, any pension, profit sharing, unit option, retirement, bonus, hospitalization, insurance, severance, vacation or other employee benefits (including any housing or social fund contributions) under any practice, agreement or understanding.

(b) Each employee benefit plan maintained by or on behalf of the Company or any other party (including any terminated pension plans) which covers or covered any employees or former employees of the Company (collectively, the “Employee Benefit Plan”) is listed in Schedule 3.19. The Company has delivered to the Purchaser true and complete copies of all such plans and any related documents. With respect to each such plan: (i) no litigation, administrative or other proceeding or claim is pending, or to the knowledge of the Representing Members and the Company, threatened or anticipated involving such plan; (ii) there are no outstanding requests for information by participants or beneficiaries of such plan; and (iii) such plan has been administered in compliance in all material respects with all applicable laws and regulations.

(c) The Company has timely made payment in full of all contributions to all of the Employee Benefit Plans which the Company was obligated to make prior to the date hereof; and there are no contributions declared or payable by the Company to any Employee Benefit Plan which, as of the date hereof, has not been paid in full.

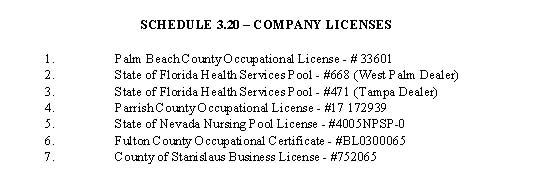

3.20. Possession of Franchises, Licenses, Etc. Except for certificates of authority to conduct business as a foreign entity in Nevada, Texas and Louisiana, the Company: (a) possesses all franchises, certificates, licenses, permits and other authorizations (collectively, the “Licenses”) from governmental authorities, political subdivisions or regulatory authorities that are necessary for the ownership, maintenance and operation of its business in the manner presently conducted; (b) is not in violation of any provisions thereof; and (c) has maintained and amended, as necessary, all Licenses and duly completed all filings and notifications in connection therewith. Schedule 3.20 sets forth a list of all of the Company’s Licenses, which it currently possesses and will possess on the Closing Date.

3.21. Environmental Matters. Except as disclosed in Schedule 3.21: (i) the Company is not in violation, in any material respect, of any Environmental Law (as defined below); (ii) the Company has received all permits and approvals with respect to emissions into the environment and the proper collection, storage, transport, distribution or disposal of Wastes (as defined below) and other materials required for the operation of its business at present operating levels; and (iii) the Company is not liable or responsible for any material clean up, fines, liability or expense arising under any Environmental Law, as a result of the disposal of Wastes or other materials in or on the property of the Company (whether owned or leased) by the Company, or in or on any other property, including property no longer owned, leased or used by the Company. As used herein, (a) “Environmental Laws” means, collectively, any federal, or applicable provincial or local statute, law, ordinance, code, rule, regulation, order or decree (foreign or domestic) regulating, relating to, or imposing liability or standards of conduct concerning, Wastes, or the environment; and (b) “Wastes” means and includes any hazardous, toxic or dangerous waste, liquid, substance or material (including petroleum products and derivatives), the generation, handling, storage, disposal, treatment or emission of which is subject to any Environmental Law.

3.22. Accounts Receivable. On the Closing Date, the Company will deliver to the Purchaser a complete and accurate list, as of a date not more than five (5) business days prior to the Closing Date, of the accounts and notes receivable due to the Company (including, without limitation, receivables from advances to employees and the Members), which includes an aging of all accounts and notes receivable showing amounts due in thirty (30) day aging categories (collectively, the “Accounts Receivable”). As of the Closing Date, the Accounts Receivable (a) will represent valid obligations arising from sales actually made or services actually performed in the ordinary course of business; (b) will be current and collectible net of any applicable reserves shown on the Company’s books and records (which reserves are adequate and calculated consistently with past practice); (c) subject to such reserves, will be collected in full, without any set-off, within sixty (60) days after the Closing Date; and (d) are not and will not be subject to any contest, claim, defense or right of set-off, other than rebates and returns in the ordinary course of business.

3.23. Agreements and Transactions with Related Parties. Except as disclosed on Schedule 3.23, and except as disclosed in the Company Financial Statements, the Company is not a party to any contract, agreement, lease or transaction with, or any other commitment to, (a) any Member, (b) any person related by blood, adoption or marriage to any Member, (c) any manager or officer of the Company, (d) any corporation or other entity in which any of the foregoing parties has, directly or indirectly, at least five percent (5%) beneficial interest in the capital stock or other type of equity interest in such corporation or other entity, or (e) any partnership in which any such party is a general partner or a limited partner having a five percent (5%) or more interest therein (any or all of the foregoing being herein referred to as a “Related Party” and, collectively, as the “Related Parties”). Without limiting the generality of the foregoing, except as set forth in Schedule 3.23, and except as disclosed in the Company Financial Statements no Related Party, directly or indirectly, owns or controls any assets or properties which are used in the business of the Company.

3.24. Business Practices. The Company has not, at any time, directly or indirectly, made any contributions or payment, or provided any compensation or benefit of any kind, to any municipal, county, state, federal or foreign governmental officer or official, or any other person charged with similar public or quasi-public duties, or any candidate for political office. The Company’s books, accounts and records (including, without limitation, customer files and invoices) accurately describe and reflect, in all material respects, the nature and amount of the Company’s purchases, sales and other transactions. Without limiting the generality of the foregoing, the Company has not engaged, directly or indirectly, in: (a) the practice known as “double-invoicing;” or (b) the incorrect or misleading labeling or marketing of goods as or services.

3.25. Condition and Sufficiency of Assets. The buildings and equipment leased or owned by the Company are generally in good operating condition and repair, and are adequate for the uses to which they are being put. The buildings and equipment of the Company are sufficient for the continued conduct of the Company’s business after the Closing in substantially the same manner as conducted prior to the Closing.

3.26. Accounting System. The Company’s accounting software is owned or licensed by the Company, free and clear of all claims, liens and encumbrances, and the transactions contemplated hereby will not result in a breach of any license or other agreement with respect to the accounting software. The Company’s accounting software is in good working order and condition, free from defects (latent and patent), has been maintained in accordance with the manufacturer’s recommended maintenance program, if any, and is suitable for maintaining the books and records of the Company and all other purposes for which it is intended.

3.27. Employment. In consideration for the Cash Consideration, the Share Consideration, the assumption of the Assumed Liabilities and the Contingent Consideration, the Representing Members expressly represent and warrant to and covenant with the Purchaser that they each intend to remain employed by the Purchaser for a minimum of three (3) years from the Closing Date.

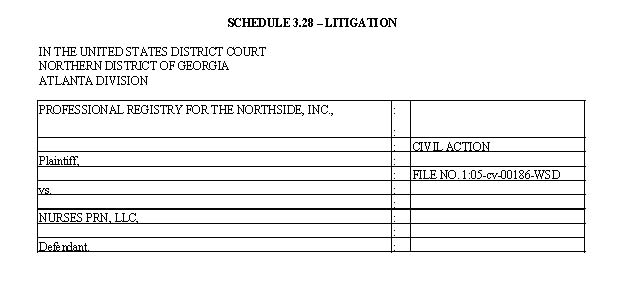

3.28. Litigation. Except as set forth on Schedule 3.28, there is no suit, action or proceeding pending, and no person has overtly-threatened in a writing delivered to the Company or the Representing Members to commence any suit, action or proceeding, against or affecting the Company, nor is there any judgment, decree, injunction, or order of any governmental entity or arbitrator outstanding against, or, to the knowledge of the Representing Members and the Company, pending investigation by any governmental entity involving, the Company or any Representing Members, except with respect to amounts owed to the IRS.

3.29. Full Disclosure. No representation or warranty of the Members or the Company contained in this Agreement, and none of the statements or information concerning the Company contained in this Agreement and the Schedules, contains or will contain as of the date hereof and as of the Closing Date any untrue statement of a material fact nor will such representations, warranties, covenants or statements taken as a whole omit a material fact required to be stated therein or necessary in order to make the statements therein, in light of the circumstances under which they were made, not misleading.

3.30. Broker. Neither the Company nor the Representing Members have agreed or will become obligated to pay, or has taken any action that might result in any person claiming to be entitled to receive, any brokerage commission, finder’s fee or similar commission or fee in connection with this Agreement or the transactions related to this Agreement.

3.31. MSSI Shares.

(a) The Members and the Company and their attorneys, investment advisors, business advisors, tax advisors and accountants have had access to MSSI’s reports, schedules, forms, statements and other documents filed by it with the United States Securities and Exchange Commission under the Securities Exchange Act of 1934, as amended (all of the foregoing filed prior to the date hereof and all exhibits included therein, and financial statements and schedules thereto, and documents incorporated by reference therein, being hereinafter referred to as the “SEC Documents”), and, prior to the execution of this Agreement by the Members and the Company, have carefully reviewed the SEC Documents. The Members and the Company have relied solely on the information contained in the SEC Documents in making their investment decision, and, in making such investment decision, has disregarded any other written or oral statements or information, if any, concerning MSSI or the MSSI Shares made by any party, including, without limitation, the officers, directors, and employees of MSSI. The Members and the Company understand the business in which MSSI is engaged and have such knowledge and experience in financial and business matters that they are capable of evaluating the merits and risks of an investment in MSSI and making an informed investment decision with respect thereto. The Members and the Company have obtained sufficient information to evaluate the merits and risks of the investment and to make such a decision;

(b) The Company and the Members and their attorneys, investment advisors, business advisors, tax advisors and accountants have had sufficient access to all documents and records pertaining to MSSI and the MSSI Shares. Additionally, the Members and the Company and all of their advisors have had the opportunity to ask questions and receive answers concerning the terms and conditions of the offering and other matters pertaining to this investment, and all such questions have been answered to the satisfaction of the Members and the Company. The Members and the Company and all of their advisors have had an opportunity to obtain any additional information which MSSI possesses, or can acquire without unreasonable effort or expense, necessary to verify the accuracy of the information furnished in the SEC Documents;

(c) The Members and the Company (i) have adequate means of providing for their current needs and possible personal contingencies and those of their families, if applicable, in the same manner as they would have been able to provide prior to making the investment in the MSSI Shares, (ii) have no need for liquidity in this investment, (iii) are aware of and able to bear the risks of this investment for an indefinite period of time and (iv) are presently able to afford a complete loss of such investment;

(d) The Members and the Company recognize that an investment in the MSSI Shares involves significant risks, including, without limitation, those set forth in the SEC Documents;

(e) The Members and the Company understand that none of the MSSI Shares have been registered under the Shares Act of 1933, as amended (the “Securities Act”) or the securities laws of any state in reliance upon exemptions therefrom for private offerings. The Members and the Company understand that the MSSI Shares must be held indefinitely unless the sale thereof is subsequently registered under the Securities Act and applicable state securities laws or exemptions from such registration are available. The Members and the Company further understand that MSSI has no obligation to repurchase any of the MSSI Shares. All certificates evidencing the Company’s and subsequently the Members’ ownership of the Shares will bear the legend set forth in Section 2.4 of this Agreement.

(f) The MSSI Shares are being acquired solely for the Company’s account and subsequently for the Members’ account for investment and not for the account of any other person, except for the distribution to the Members, and not with a view to or for distribution, assignment or resale in connection with any distribution within the meaning of the Securities Act, and no other person has a direct or indirect beneficial interest in such MSSI Shares. The Members represent that, except for the distribution of the MSSI Shares by the Company to the Members, they have no agreement, understanding, commitment or other arrangement with any person and no present intention to sell, transfer or assign any MSSI Shares;

(g) The Members and the Company realize that they may not be able to sell or dispose of any of the MSSI Shares and that no market of any kind (public or private) may be available for any of the Shares. In addition, the Members and the Company understand that their right to transfer the MSSI Shares will be subject to restrictions contained in applicable United States Federal and state securities laws;

(h) The Members and the Company understand that no financial projections are included in the SEC Documents, and neither the Members or the Company nor any of their advisors are relying on any financial projections in connection with determining the merits of an investment in the MSSI Shares. The Members and the Company understand and acknowledge that no representations concerning the accuracy of information or financial projections, if any, not included in the SEC Documents are being made and he and all of his advisors have completely disregarded such information or financial projections, if any, not included in the SEC Documents in determining whether to invest in the MSSI Shares; and

(i) The Members and the Company understand that MSSI may at any time, in its sole discretion, arrange for the offer and sale of additional shares of its capital stock to current or additional shareholders, at such prices and in such amounts as it, in its sole discretion, may determine to be in the best interests of MSSI.

3.32. Regulatory Matters.

(a) To the knowledge of the Representing Members and the Company, neither the Company nor any individual employed or retained by the Company, has engaged in any activities which are prohibited under any applicable provisions 42 U.S.C. §§ 1320 et seq. or 42 U.S.C. § 1395 et seq. (subject to the exceptions set forth in such legislation), or the regulations promulgated thereunder, or which are prohibited by similar state and or applicable local statutes or regulations, or which are prohibited by rules of professional conduct, including but not limited to the following:

(i) knowingly and willfully making or causing to be made a false, statement or representation of a fact in any application for any health care benefit or payment or of a fact for use in determining rights to any health care benefit or payment;

(ii) failing to disclose knowledge by any governmental program claimant of the occurrence of any event affecting the initial or continued right to any health care benefit or payment on the claimant's behalf or on behalf of another, with intent to secure fraudulently such health care benefit or payment;

(iii) (knowingly and willfully offering, paying, soliciting or receiving any remuneration (including any kickback, bribe or rebate), directly or indirectly, in cash or in kind (1) in return for referring an individual to a person for the furnishing or arranging for the furnishing of any item or service for which payment may be made in whole or in part by Medicare or Medicaid or another federal or state health care program, or (2) in return for purchasing, leasing, or ordering or arranging for or recommending purchasing, leasing, or ordering any good, facility, service or item for which payment may be made in whole or in part by Medicare or Medicaid or another federal or state health care program; and

(iv) referring a patient for designated health services (as defined in 42 U.S.C. §1395nn) or providing designated health services to a patient upon a referral from an entity or person with which the Company or an immediate family member has a financial relationship and to which no exception under 42 U.S.C. §1395nn applies.

(b) Neither the Company nor any individual employed or retained by either Company, has received any notice from the Medicare, Medicaid, CHAMPUS or other federal or state health care program of any pending or threatened audits or investigations, or has any reason to believe that any such audits or investigations or surveys are pending, threatened or imminent.

(c) Neither the Company, nor its employees, have been charged with or convicted of an offense related to healthcare or listed by a federal agency as being debarred, excluded, or otherwise ineligible for federal program participation as of the Closing.

(d) The Representing Members and the Company have maintained the confidentiality of all medical records as required by and in conformance with all applicable federal, state and local laws (including but not limited to the Health Insurance Portability and Accountability Act of 1996, and regulations promulgated thereto), and with generally accepted standards of practice. Neither the Representing Members nor the Company has transferred any medical records to any persons against the request of any patient or client of the Representing Member or the Company, except as permitted or required by law.

(e) Each of the Representing Members and the Company has complied with all applicable laws, regulations and rules of Medicare, Medicaid, CHAMPUS, and other federal and state health insurance programs, including but not limited to the Medicare prohibition on reassignment codified at 42 U.S.C. § 1395u(b)(6) and any similar federal or state prohibitions applying to Medicaid, CHAMPUS and/or other government funded programs.

| 4. | REPRESENTATIONS AND WARRANTIES OF MSSI. |

To induce the Members and the Company to enter into this Agreement and to consummate the transactions contemplated hereby, the Purchaser and MSSI represent and warrant to and covenants with the Members and the Company as follows:

4.1. Organization. MSSI and the Purchaser are corporations duly organized, validly existing and in good standing under the laws of the State of Nevada. MSSI and each of its subsidiaries, including the Purchaser, is entitled to own or lease its properties and to carry on its business as and in the places where such business is now conducted, and MSSI and each of its subsidiaries, including the Purchaser, is duly licensed and qualified in all jurisdictions where the character of the property owned by it or the nature of the business transacted by it makes such license or qualification necessary, except where such failure would not result in a material adverse effect on MSSI or its subsidiaries, including the Purchaser.

4.2. Capitalization and Related Matters.

(a) MSSI has authorized capital stock consisting of 300,000,000 shares of common stock, par value $0.001 per share, and 30,000,000 shares of preferred stock, par value $0.001, of which 159,658,089 shares of common stock and no shares of preferred stock are outstanding the date hereof. The MSSI Shares will be, when issued, duly and validly authorized and fully paid and non-assessable, and will be issued to the Members free of all encumbrances, claims and liens whatsoever.

(b) Except as disclosed in the SEC Documents, and except for employee stock options to purchase shares of the MSSI’s Common Stock, MSSI does not have outstanding any securities convertible into capital stock, nor any rights to subscribe for or to purchase, or any options for the purchase of, or any agreements providing for the issuance (contingent or otherwise) of, or any calls, commitments or claims of any character relating to, its capital stock or securities convertible into its capital stock.

4.3. Execution; No Inconsistent Agreements; Etc.

(a) The execution and delivery of this Agreement and the performance of the transactions contemplated hereby have been duly and validly authorized and approved by MSSI and the Purchaser and this Agreement is a valid and binding agreement of MSSI and the Purchaser enforceable against MSSI and the Purchaser in accordance with its terms, except as such enforcement may be limited by bankruptcy or similar laws affecting the enforcement of creditors’ rights generally, and the availability of equitable remedies.

(b) The execution and delivery of this Agreement by MSSI and Purchaser does not, and the consummation of the transactions contemplated hereby will not, constitute a breach or violation of the charter or bylaws of MSSI or the Purchaser or a default under any of the terms, conditions or provisions of (or an act or omission that would give rise to any right of termination, cancellation or acceleration under) any material note, bond, mortgage, lease, indenture, agreement or obligation to which MSSI or any of its subsidiaries, including the Purchase, is a party, pursuant to which any of them otherwise receive benefits, or by which any of their properties may be bound.

4.4. Employees. Immediately after the Closing Date, the Purchaser intends to hire Murphy and Romano, pursuant to the Employment Agreements.

4.5. Broker. MSSI and the Purchaser have not agreed or will become obligated to pay, or has taken any action that might result in any person claiming to be entitled to receive, any brokerage commission, finder’s fee or similar commission or fee in connection with this Agreement or the transactions related to this Agreement.

4.6. Full Disclosure. No representation or warranty of MSSI or the Purchaser contained in this Agreement, and none of the statements or information concerning MSSI and the Purchaser contained in this Agreement, contains or will contain as of the date hereof and as of the Closing Date any untrue statement of a material fact nor will such representations, warranties, covenants or statements taken as a whole omit a material fact required to be stated therein or necessary in order to make the statements therein, in light of the circumstances under which they were made, not misleading.

| 6. | CONDITIONS TO OBLIGATIONS OF ALL PARTIES. |

The obligation of the Members, the Company, the Purchaser and MSSI to consummate the transactions contemplated by this Agreement are subject to the satisfaction, on or before the Closing, of each of the following conditions; any or all of which may be waived in whole or in part by the joint agreement of the Members, the Company, the Purchaser and MSSI:

6.1. Absence of Actions. No action or proceeding shall have been brought or threatened before any court or administrative agency to prevent the consummation or to seek damages in a material amount by reason of the transactions contemplated hereby, and no governmental authority shall have asserted that the within transactions (or any other pending transaction involving MSSI, any of its subsidiaries, including the Purchaser, the Members or the Company when considered in light of the effect of the within transactions) shall constitute a violation of law or give rise to material liability on the part of the Members, the Company or MSSI or its subsidiaries, including the Purchaser.

6.2. Consents. The parties shall have received from any customers, suppliers, lessors, lenders, lien holders or governmental authorities, bodies or agencies having jurisdiction over the transactions contemplated by this Agreement, or any part hereof, such consents, authorizations and approvals as are necessary for the consummation hereof, including, without limitation, the consents listed on Schedule 6.2(a), except for such consents, authorizations and approvals listed on Schedule 6.2(b), which shall have not been received as of Closing; provided however, the Purchaser may waive this condition precedent at any time and at its sole discretion.

| 7. | CONDITIONS TO OBLIGATIONS OF MSSI. |

All obligations of MSSI and the Purchaser to consummate the transactions contemplated by this Agreement are subject to the fulfillment and satisfaction of each and every of the following conditions on or prior to the Closing, any or all of which may be waived in whole or in part by MSSI or the Purchaser:

7.1. Representations and Warranties. The representations and warranties contained in Section 3 of this Agreement and in any certificate, instrument, schedule, agreement or other writing delivered by or on behalf of the Members or the Representing Members, as applicable, and the Company in connection with the transactions contemplated by this Agreement shall be true, correct and complete in all material respects (except for representations and warranties which are by their terms qualified by materiality, which shall be true, correct and complete in all respects) as of the date when made and shall be deemed to be made again at and as of the Closing Date and shall be true, correct and complete at and as of such time in all material respects (except for representations and warranties which are by their terms qualified by materiality, which shall be true, correct and complete in all respects).

7.2. Compliance with Agreements and Conditions. The Members and the Company shall have performed and complied with all agreements and conditions required by this Agreement to be performed or complied with by each of them and/or by the Company prior to or on the Closing Date.

7.3. Absence of Material Adverse Changes. No material adverse change in the business, assets, financial condition, or prospects of the Company shall have occurred, no substantial part of the assets of the Company not substantially covered by insurance shall have been destroyed due to fire or other casualty, and no event shall have occurred which has had or will have a material adverse effect on the business, assets, financial condition or prospects of the Company.

7.4. Certificate of the Members and the Company. The Members or the Representing Members, as applicable, and the Company shall have executed and delivered, or caused to be executed and delivered, to the Purchaser one or more certificates, dated the Closing Date, certifying in such detail as the Purchaser may reasonably request to the fulfillment and satisfaction of the conditions specified in Sections 7.1 through 7.3 above.

7.5. Board Approval. This Agreement and the transactions contemplated hereby shall have been approved by the approval of the Purchaser’s Board of Directors and MSSI’s Board of Directors.

7.6. Satisfactory Results of Inspection. The results of the inspection referred to in section 2.1 hereof shall be satisfactory to the Purchaser in its sole discretion.

7.7. Intentionally Omitted.

7.8. Note Payable. The Company shall have received a release from Adamjee, a form of which is attached hereto as Exhibit “E”.

7.9. Employment Agreements. The Purchaser shall have received executed Employment Agreements from Murphy and Romano.

7.10. Life Insurance. Murphy and Romano shall, at the Purchaser’s expense, each have obtained a life insurance policy of One Million Dollars ($1,000,000) naming MSSI as the beneficiary.

7.11. Mutual Member Releases. Each Member shall have executed and delivered to each other Member and the Company, a general release, dated the Closing Date, in form and substance reasonably acceptable to all of the Members and the Purchaser, pursuant to which each Member releases each other Member and the Company from any and all liabilities, claims and obligations that such Member has, had, or may have against each other Member and the Company in such person’s capacity as a Member and/or as a manager of the Company prior to the Closing Date (other than any such obligations or liability that arise or may arise as a result of this Agreement and the transactions contemplated hereunder). A form of the mutual general release is attached hereto as Exhibit “G”.

7.12. Dowling Note. Dowling shall have provided Adamjee with a release of his guaranty of the Dowling Note. Murphy and Romano shall have issued and delivered to Dowling a pledge and security agreement with respect to Dowling Note, guaranteed by MSSI to the extent the total value of the Dowling Security Shares at the Closing is less than the principal and accrued interest on the Dowling Note.

7.13. Creditor Release. The Creditor shall have provided a general release to the Company and shall have provided a general release to each of the Members, a form of which is attached hereto as Exhibit “F”.

7.14. Bills of Sale. The Purchaser shall have received all necessary Bills of Sale executed by the Company.

7.15. Assignment and Assumption Agreement. The Purchaser shall have received the Assignment and Assumption Agreement executed by the Company.

7.16. Consents. The Purchaser shall have consented to the assignment of all Material Contracts by the Company to the Purchaser.

| 8. | CONDITIONS TO OBLIGATIONS OF THE MEMBERS. |

All of the obligations of the Members and the Company to consummate the transactions contemplated by this Agreement are subject to the fulfillment and satisfaction of each and every of the following conditions on or prior to the Closing, any or all of which may be waived in whole or in part by the Members or the Company:

8.1. Representations and Warranties. The representations and warranties contained in Section 4 of this Agreement and in any certificate, instrument, schedule, agreement or other writing delivered by or on behalf of MSSI and the Purchaser in connection with the transactions contemplated by this Agreement shall be true and correct in all material respects (except for representations and warranties which are by their terms qualified by materiality, which shall be true, correct and complete in all respects) when made and shall be deemed to be made again at and as of the Closing Date and shall be true at and as of such time in all material respects (except for representations and warranties which are by their terms qualified by materiality, which shall be true, correct and complete in all respects).