Exhibit 99.1

| |

NEWS - FOR IMMEDIATE RELEASE | NYSE American: GORO |

October 26, 2023 | |

GOLD RESOURCE CORPORATION

REPORTS THE FILING OF A SK1300 INITIAL ASSESSMENT FOR THE BACK FORTY PROJECT

DENVER – October 26, 2023 – Gold Resource Corporation (NYSE American: GORO) (the “Company”, “we”, “our” or “GRC”) is pleased to announce the results of a SK1300 compliant Technical Report Summary for an Initial Assessment (“IA” or the “Technical Report”) which comprises an updated Mineral Resource Estimate (“MRE”) and a financial analysis for the Company’s 100% owned Back Forty Project (“Back Forty” or the “Project”), located in the Upper Peninsula of Michigan.

Allen Palmiere, the Company’s CEO stated: “We are very happy with the results of the study. It confirms our belief that the Back Forty Project represents an opportunity to create substantial value for our shareholders. This study is the result of veery strong technical work and represents a compete revision to the mine plan, process flow, project footprint and the elimination of any wetlands impact. It has been designed to minimize the environmental impact by reducing the footprint and adopting dry-stack tailings management thus eliminating the need for a tailings dam. We are very pleased with the results and are looking forward to advancing the project.”

The IA integrates the work done by InnovExplo Inc. (“InnovExplo”), Foth Infrastructure & Environment (“Foth”), and GRC since the 2020 NI43-101 Preliminary Economic Assessment (“PEA”) to improve the Project while at the same time reducing its environmental impact. The results suggest a very robust Project with a moderate capital investment and a 9-year mine life during which 504 koz of gold, 6,150 koz of silver, 61.6 Mlbs of copper and 778 Mlbs of zinc would be produced.

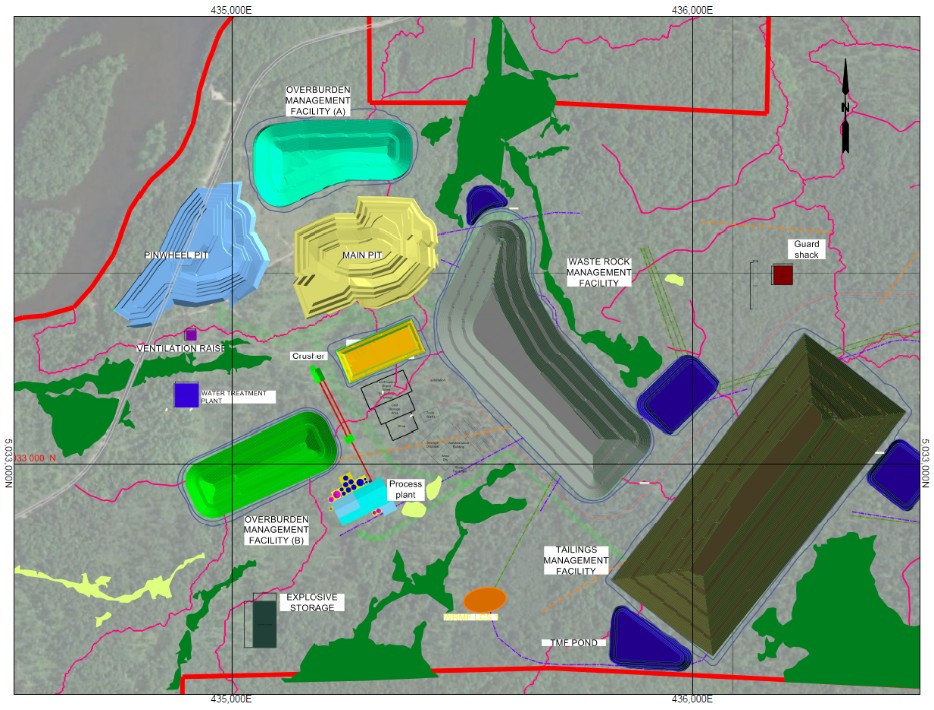

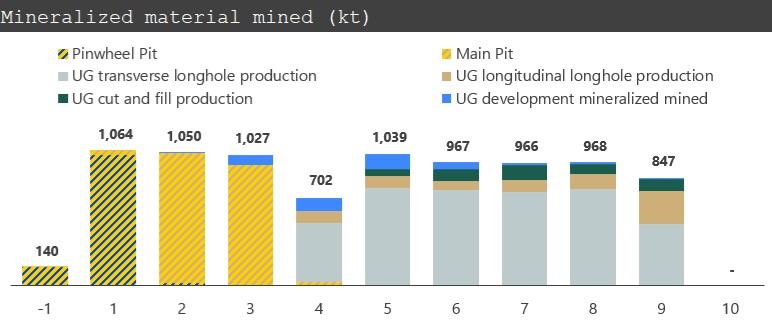

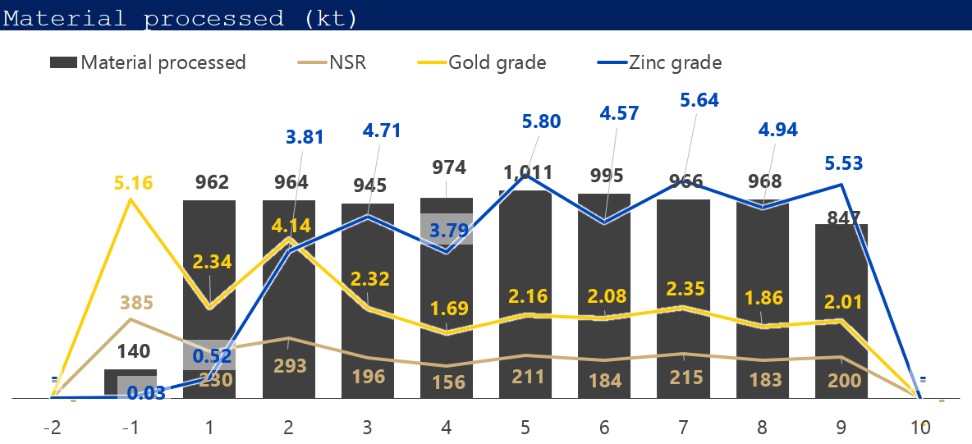

The Project consists in two open pit mines, an underground mine, a nominal 2,500 metric tonnes per day (“tpd”) processing plant and the supporting infrastructures (Figure 1). A 21-month construction period would be followed by open pit mining in the Pinwheel Pit and then in the Main Pit for the first 3 years. Development for the underground mine would start in Year 2 from inside the Main Pit to support the processing plant starting in Year 4.

STUDY HIGHLIGHTS:

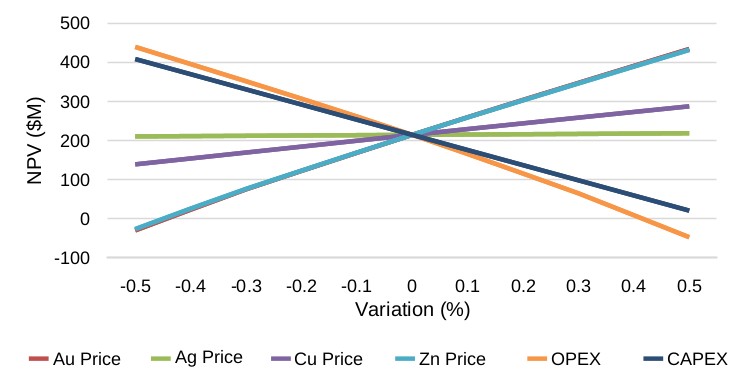

| ● | $214.4 million after-tax net present value at a 6% discount rate (“NPV6”) (pre-tax $291.5 million) at a base case metal prices of $1,800 per ounce (“/oz”) for gold, $23.30/oz for silver, $3.90 per pound (“/lb”) for copper, and $1.25/lb for zinc; |

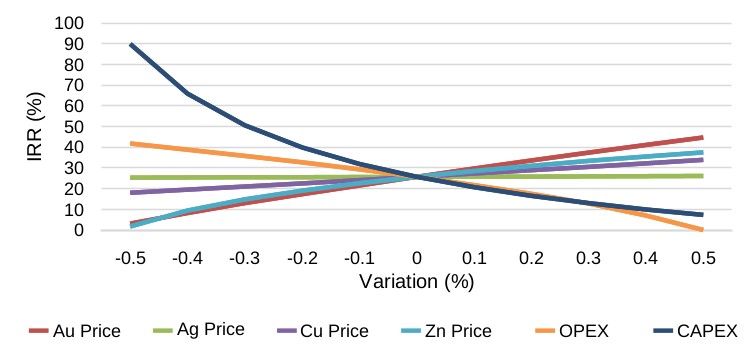

| ● | 25.7% after-tax internal rate of return (“IRR”); |

| ● | $25.8million average annual after-tax free cash flow (“FCF”); |

| ● | $361.2 million cumulative after-tax life-of-mine (“LOM”) FCF; |

| ● | 56,000 ounces (“oz”) of gold, 683,300 oz of silver, 6.8 Mlbs of copper, and 86.4 Mlbs of zinc LOM average annual production |

| ● | 504 koz of gold, 6,150 koz of silver, 61.6 Mlbs of copper and 778 Mlbs of zinc LOM total cumulative metal production; |

| ● | 2.37 grams per tonne (“g/t”) gold, 26.2 g/t silver, 0.39% copper, and 4.29% zinc for $210 per tonne (“$/t”) net smelter return (“NSR”) average LOM diluted head grade; |

| ● | Average overall LOM recovery rates 77.8% for gold, 86.8% for silver, 86.4% for copper, and 95.7% for zinc; |

| ● | 84.81 $/t milled LOM total unit operating costs; |

| ● | $325.1 million initial capital expenditures (including $28.9 million in contingency costs); |

| ● | $102.8 million sustaining capital expenditures (including $8.7 million in contingency costs). |