October 9, 2015

BY EDGAR

Carlos Pacho

Senior Assistant Chief Accountant

Division of Corporate Finance

Securities and Exchange Commission

Station Place

100 F Street, N.E.

Washington, D.C. 20549

| Re: | Comment Letter dated September 3, 2015 |

Oi S.A.

Response Dated August 24, 2015

File No. 001-15256

Dear Mr. Pacho:

By letter dated September 3, 2015, the staff of the Securities and Exchange Commission (the “Staff”) provided comments to the annual report on Form 20-F filed on May 7, 2015 (the “2014 Form 20-F”) by Oi S.A. (the “Company”). This letter provides the Company’s responses to the Staff’s comments. For your convenience, we have reproduced below in bold the Staff’s comments and have provided responses immediately below the comments. All page numbers refer to the 2014 Form 20-F.

Form 20-F for Fiscal Year Ended December 31, 2014

Financial Statements

Risk Relating to Our African and Asian Operations, page F-22

30. Reconciliation Between Brazilian GAAP and US GAAP, page F-120

| 1. | We infer from your response to our comments that as of the date of your letter Unitel had not repaid any portion of the US $473.8 million of past due dividends Unitel owes to PT Ventures. Please clarify. As appropriate, please describe for us the timing and amounts of any such dividend payments. |

The Company confirms to the Staff that, as of May 5, 2014 and December 31, 2014 PT Ventures had an account receivable amounting to US$473.8 million representing its share of dividends declared by Unitel but not received. As of the date of our letter of August 24, 2015 and as of the date of this letter, payment of these declared dividends has not been received by PT Ventures.

| 2. | We note from your response to comment 1 that payment of dividends is due under Angolan law 30 days after shareholder approval. Consequently, absent such dividend payments by August 24, 2015, it appears as though these dividends have been past due for approximately 1,000 to 1,700 days. As of the date you finalized your accounting for the May 5, 2014 acquisition of Unitel from Portugal Telecom SGPS, S.A. these dividends appear to have been past due for approximately 700 to 1,500 days. Please expand your response to comment 1 and tell us how you ascertained Unitel’s intended timetable for remitting these past due dividends and why you “believed that these dividends would be received in the short term”. Describe for us any commitments, affirmations or representations received from Unitel or its other shareholders that you relied upon to determine that Unitel would remit these past due dividends to you in full. |

Under the acquisition method prepared in accordance with ASC 805 Business Combination, which was completed as of December 31, 2014, the Company measured the dividends receivable from Unitel in accordance with 805-20-30-1 using the fair value of the dividends. The Company believes that the fair value of the dividends receivable by PT Ventures from Unitel is equal to the face value of the dividends receivable based on the facts and events described below.

During its negotiation of the documentation relating to the acquisition of PT Portugal, SGPS, S.A. (“PT Portugal”), the Company was made aware of ongoing negotiations between Portugal Telecom, SGPS, S.A. (“PT SGPS”) and the other shareholders of Unitel with respect to a potential sale by PT Ventures, SGPS, S.A. (“PT Ventures”), the indirect subsidiary of PT Portugal that directly holds the equity interest in Unitel, of PT Ventures’ interest in Unitel, including its interest in the past due dividends receivable, to one or more of the other shareholders of Unitel. The Company understands that PT SGPS engaged in a negotiation session with Mrs. Isabel dos Santos, the president of the board of Unitel, whom the Company believes to be the indirect sole shareholder of one of the other shareholders of Unitel, on March 24, 2014. Although these negotiations did not lead to the disposal of PT SGPS’s interest in Unitel, the Company believed that the existence of these negotiations confirmed that Unitel acknowledged the dividend payable.

As noted in note 1 to the Company’s financial statements, on March 25, 2014, Unitel issued a statement claiming that PT Ventures was not listed on the shareholders’ register of Unitel, and that the board of directors of Unitel had notified PT SGPS about the existence of an irregularity under Angolan law, which purportedly resulted in Unitel being unable to pay dividends to PT Ventures until the resolution of this irregularity. The Company did not believe that this notice had any impact on the collectability of the dividends, but instead viewed this notice to be an acknowledgement of the obligation to pay the past due dividends.

The Company did not believe that the collectability of the past due dividends was impaired as of the time of the acquisition of PT Portugal, but did believe that it was necessary to inform investors in its capital increase of the many risks relating to the Company’s acquisition of an indirect interest in Unitel, as described in detail on pages S-38 through S-44 of the Company’s Prospectus Supplement, dated April 30, 2014, as filed with the SEC, including the risk that the past due dividends might not be collected.

2

In June 2014, PT Ventures (formerly known as Portugal Telecom Internacional, SGPS, S.A.) resolved the alleged irregularity with respect to its registration as a shareholder of Unitel with the Angolan Foreign Investment Institute, and on June 3, 2014, PT Ventures was issued a Foreign Investment Certificate endorsing its current name. In light of the fact that the authorization for the payment of US$190 million to PT Ventures relating to the dividend for fiscal year 2011 had been issued by the National Bank of Angola on February 13, 2014 and endorsed by Banco BIC, S.A. on February 18, 2014, the Company believed that this past due dividends would be paid in due course.

By September 2014, the Company had become aware of additional information on the discordant relations between PT SGPS, PT Ventures and the other shareholders of Unitel through its review of records of Unitel and Africatel Holdings B.V. (the sole shareholder of PT Ventures). Based on a review of these documents, it became clear that the other shareholders of Unitel had issues with PT SGPS and certain of its officials based on the transfer of a minority interest in Africatel to an unrelated investment fund.

The Company’s management believed that the discord among the shareholders was related to actions and perceived actions of PT SGPS and that the Company would be able to present itself as a new controlling shareholder of Africatel and to negotiate a solution to the issues with the other shareholders of Unitel. The Company believed that although the negotiations held in March 2014 between PT SGPS and Mrs. dos Santos had not led to a definitive agreement to sell PT Ventures’ interest in Unitel, the Company’s management would be able to reopen these negotiations.

PT Ventures received a letter dated November 4, 2014 in which the other shareholders of Unitel requested that PT Ventures appoint a representative to resume the negotiations of the sale of its interest in Unitel to them.

In a letter dated November 24, 2014, PT Ventures responded to the request that it appoint a representative to resume the negotiations of the sale of its shares of Unitel to the other shareholders of Unitel asking that any proposals relating to this matter be sent to Mr. Schroeder.

In a letter dated November 28, 2014 to Mrs. Isabel dos Santos, the chairman of the board of Unitel, PT Ventures made a demand for payment of its share of the dividends with respect to the 2010 and 2011 fiscal years.

Based on the status of the relationship between Unitel and its other shareholders as of December 31, 2014, including the renewed interest of the other shareholders in purchasing PT Ventures’ equity interest in Unitel, the management of the Company determined that it was probable that it would be able to complete the disposal of its interest in Unitel to the other shareholders during 2015 and, consequently, as part of the disposal transaction, the Company would be able to receive the past due dividends. However, in light of the continuing non-payment of these dividends, the inability of PT Ventures to seat any member of the board of directors or Unitel, its inability to examine the books and records of Unitel, and the contentious nature of the relationship between PT Ventures and the other shareholders of Unitel, the Company believed that it was necessary to inform its investors of the risks inherent in this investment as detailed under the caption “Item 3. Key Information—Risk Factors— Risks Relating to Our African and Asian Operations” on pages 23 through 28 in the Form 20-F and under the caption “Risks Relating to Our African and Asian Operations” in note 1 to its financial statements on pages F-22 through F-29.

3

By letter dated January 28, 2015, PT Ventures reiterated its demand for payment of the past due dividends.

By letter dated February 23, 2015, PT Ventures requested a meeting with the other shareholders of Unitel separate from the General Shareholders Meeting scheduled to be held on March 9, 2015 to discuss outstanding issues among them and the terms under which the PT Ventures would sell its interest in Unitel to the other shareholders.

By letter dated March 5, 2015, Unitel informed PT Ventures that the re-convening of the General Shareholders Meeting had been postponed until April 9, 2015 and that arrangements could be made to hold the requested meeting with the other shareholders on that date (this meeting was not held as a result of the subsequent cancellation of this General Shareholders Meeting).

By letter dated April 14, 2015, PT Ventures requested that a meeting of the shareholders of Unitel be held at least 10 days prior to the General Shareholders Meeting scheduled to be held on May 13, 2015 to discuss resolution of the outstanding issues among the shareholders, and by separate letter of the same date the Company reiterated this request, noting communications made by the Brazilian Embassy in Angola to the Angolan Ministry of Foreign Affairs regarding the disputes among the shareholders at the Company’s request.

In May 2015, PT Ventures was contacted by a representative of Unitel’s other shareholders, who stated that the other shareholders had agreed to commence negotiations.

The Company’s chief executive officer met with General Leopoldino Nascimento, the President of the Unitel General Shareholders Meeting on June 23, 2015 to discuss the outstanding issues and the proposed sale of PT Ventures’ interest in Unitel to the other shareholders. At this meeting, General Nascimento acknowledged the past due dividends owing to PT Ventures.

Subsequent to the June 23, 2015 meeting, the Company has attempted on numerous occasions to schedule a further meeting and/or to obtain the definitive written proposal to purchase the shares of Unitel owned by PT Ventures that the Company understood was to be forthcoming.

On September 1, 2015, the Company’s shareholders elected new members to its board of directors for terms expiring at the General Shareholders’ Meeting of the Company that approves its financial statements for the year ending December 31, 2017. The Company’s new board of directors held their first meeting on September 18, 2015. At this meeting, the Company’s board of directors authorized the commencement of several legal actions against Unitel and its other shareholders, including the actions with respect to the past due dividends described in the response to comment 3.

4

| 3. | We note your representation made in response to comment 2 that “(a)s of December 31, 2014, (Oi S.A.) had undertaken all efforts it deemed appropriate to preserve and guarantee PT Ventures’ right to receive the dividends”. We further note that the only legal impediment to payment of these dividends was cured in June 2014. Given the serious past due nature of these receivables, describe for us the recourse available to you under Angolan law to compel payment of the dividends due PT Ventures. Describe for us the actions you pursued to obtain actual payment of these dividends from Unitel and why you believe those actions are sufficient to realize the collection of these dividends. |

In November 2014, the Company engaged Portuguese and Angolan counsel to advise it with respect to its rights under Angolan corporate and commercial law with respect to a variety of issues relating to its investment in Unitel, including the collection of the past due dividends. The Company advises the Staff that advice from Portuguese counsel was sought because in matters of corporate and commercial law, Angolan law and precedent closely follow the laws of Portugal.

The Company has been advised that pursuant to Angolan law:

| | (a) | The dividends are due within 30 days after the general meeting of shareholders has resolved on the distribution, unless the shareholders agree to extend such deadline; and |

| | (b) | the statute of limitations for suits to collect dividends is five years from the date when the right to receive dividends due can be exercised. |

Accordingly:

| | • | | the past due dividends of US$93.8 million relating to a special dividend that was declared on November 16, 2010 was due on December 16, 2010 and the statute of limitations for a suit to collect this dividend expires on December 16, 2015; |

| | • | | the past due dividends of US$190 million relating to a dividend that was declared on June 18, 2012 was due on July 18, 2012 and the statute of limitations for a suit to collect this dividend expires on July 18, 2017; and |

| | • | | the past due dividends of US$190 million relating to a dividend that was declared on November 4, 2013 was due on December 4, 2013 and the statute of limitations for a suit to collect this dividend expires on December 4, 2018. |

The Company has been advised that in order to bring an action in an Angolan court to collect the past due dividends through, among other remedies, the seizure of assets of Unitel, PT Ventures must present specific documents (títulos executivos) which, as a general rule, are the formal documents expressly listed in the applicable Angolan law, such as, but not limited to, a judgment of enforcement and private documents certified by a notary public.

5

Because the minutes of general shareholders meetings of Unitel at which the past due dividends were declared, as well as the financial reports of Unitel and PT Ventures’ private claims on the right to receive the dividends do not fall into the legal category oftítulos executivos, before bringing an action to collect the past due dividends, PT Ventures must bring a lawsuit against Unitel in order to obtain a declaratory judgment attesting to the legitimacy and existence of the right to receive dividends, which declaratory judgment would fall into the legal category oftítulos executivos. The statute of limitations period for suits to collect dividends described above is tolled upon service of a summons on the defendant following the filing of the lawsuit seeking such a declaratory judgment.

In September 2014, the Company’s management increased its focus on the issues relating to the investment in Unitel that it had acquired, including the status of the past due dividends and remedies available to the Company.

Following the Company’s engagement of Portuguese and Angolan counsel in November 2014, the Company was advised by its Portuguese and Angolan counsel that following the resolution of the alleged irregularity with respect to PT Ventures’ registration as a shareholder of Unitel with the Angolan Foreign Investment Institute in June 2014, no further action was required by it to perfect its right to receive the past due dividends.

As discussed in the Company’s response to comment 2, the Company believed that it could establish a more constructive relationship with Unitel and its other shareholders than the relationship that had existed between PT SGPS and these entities and pursued a normalization of this relationship and sought to reinitiate discussions with respect to a sale of PT Ventures’ interest in Unitel, with the understanding that the past due dividends would be paid in connection with that transaction.

In light of the advice that the Company had received regarding the remedies available to it and the statute of limitations relating to legal actions to collect the past due dividends, the Company determined that it would forbear the commencement of legal proceedings to collect the past due dividends for so long as the Company believed that a consensual solution to the disputes with the other shareholders was likely, bearing in mind the necessity of bringing legal action prior to the expiration of the statute of limitations.

As discussed in the Company’s response to comment 2, following the persistent delays of the other shareholders of Unitel in presenting a definitive proposal with respect to the purchase of PT Ventures’ interest in Unitel and the resolution of the past due dividends, on September 18, 2015 the Company’s board of directors authorized the commencement of a declaratory actions before the Angolan courts to begin the process of collection of the past due dividends. The Company’s Angolan counsel is preparing the filing necessary to commence these declaratory actions and the Company expects to commence these actions in the near future.

6

| 4. | We note from your response to comment 3 that “the cash flows from (your) model were discounted for an additional 18-month period, in order to reflect management’s expectation regarding the risk associated with the realization of the cash flows associated with this investment”. We note from page 25 of Form 20-F that “the other shareholders of Unitel stated to PT Ventures that its rights as a shareholder of Unitel had been suspended in October 2012”. Subsequently, on December 15, 2014, the other shareholders of Unitel denied PT Ventures its voting and other rights at the general Unitel shareholders’ meeting. Tell us why management believes such a limited discount is appropriate given the long past due status of the US $473.8 million dividends Unitel owes to PT Ventures. Tell us your consideration of how other market participants would assess these risks in light of the ongoing abrogation of PT Ventures’ shareholder rights and the historic conflict between minority owner, PT Ventures, and the controlling shareholder interest in Unitel and the past due status of these dividends. |

Regarding the recognition of its 25% indirect interest in Unitel, the Company used the Income Approach valuation technique to determine the fair value of the investment and measured it in the fair value hierarchy at Level 3, as described on our response to comment 3 of our letter as of August 24, 2015.

In order to prepare the model to be used in the Income Approach to determine the fair value of Unitel, the Company developed unobservable inputs using the best information available in the circumstance as of December 31, 2014 and the requirements ofASC 820-10-35-2B.

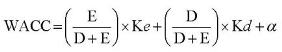

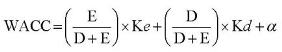

The Company advises the Staff that the Company calculated the weighted average cost of capital (“WACC”) of 15.9% as of May 5, 2014 and of 14.8% as of December 31, 2014 in accordance with ASC 820-10-55-5 through 9 as described below.

The WACC was determined as the weighted average of a company’s costs of equity and debt. Such costs are weighted by the respective proportion of equity and debt in the company’s capital structure, according to the following formula. The Company estimated the WACC of the Company by geography, reflecting the country risk, the cost of debt and borrowing capacity in order to determine an optimal capital structure.

D : Net Debt Amount

E : Equity Amount

Ke : Cost of Equity

Kd : Cost of Debt

a: Shareholders Structure

Our calculations of cost of equity were derived from the CAPM formula below:

Ke = Rf + ß × (Rm - RF) + Z

Ke : Cost of Equity

Rf : Risk Free Rate

Rm – Rf : Market Risk Premium

ß:Estimated beta for the non-diversifiable risk of a company measured by the correlation of its return versus market return

Z : Country Risk

7

The Company considered the yield of the German government bond as the best estimation for the risk-free rate of return in Euros. The Company used the 10-year German Treasury Bond of 1.591% (24 months average) because:

| | • | | It is a fixed income security whose long-term yield reflects investors’ expectations about future expected returns; and |

| | • | | The 10-year Bond, unlike short-term rates, it is not used as an instrument of monetary policy. |

The Market Risk Premium refers to the additional return required by investors to compensate for the higher risk involved in equities vis-à-vis investments in U.S. Treasury bonds (risk-free investment). An estimate of the Market Risk Premium is the historical average of the spread between the return of the Standard & Poors – 500 index (S&P-500) and the return on long-term bonds of the U.S. government during the period between 1926 and 2012. The Company prefers a historical approach rather than predictions of future behavior, since the Company does not believe that the Market Risk Premium is predictable beyond a period of three to four years. As the Market Risk Premium presents a random behavior, historical information was considered the best estimate of the future.

The Company used historical data since 1926 because:

| | • | | This period reflects events that impacted the economic environment, such as wars, depressions and “booms”, which would not be reflected if the Company used shorter periods; and |

| | • | | Variations in the risk premium are random. |

Thus, using historical long-term data is considered the best way to estimate the future behavior.

The Company used a Market Risk Premium of 6.70% (arithmetic average of the period 1926-2012, source: Ibbotson).

The Beta measures the market risk / systematic risk / non-diversifiable risk. It is a coefficient that attempts to indicate to what extent the volatility of a company’s share price may be explained by the volatility in the market portfolio. It was calculated through a linear regression between the series of variations in the share price and the series of variations in the market portfolio (Index). Beta is composed of operational and financial risk. In order to factor the operational risk of the business, the “full” beta (ßL) is unlevered based on the selected companies debt/equity structure and income tax. The average unlevered beta (ßU) of the set of comparable companies is then levered according to the estimated target capital structure and income tax of the assessed company. We used the unlevered beta (ßU) of 0.98.

8

To determine the Country Risk Premium, the Company used as a base the rating assigned by independent agencies (Moody’s and S&P) to sovereign bonds issued by each of the countries. Based on these ratings, the incremental return required by investors compared to sovereign bonds issued by countries with “risk free” profiles (AAA rating) was determined. In case of emerging market countries, a volatility index is applied over the spread of sovereign risk. This volatility index is calculated from the ratio of Standard Deviation of the Equities Market / Standard Deviation of Sovereign Bonds. This index in emerging market countries is approximately 1.5x. This spread is the best representation of the perceived risk of the international investor community on any given date. This assumption is aligned with the fact that the cost of capital of a company should reflect, at any time, the opportunity cost of the investor to invest in assets with similar risk.

Country Risk Premium (%)

| | | | | | | | |

Angola | | May 2014 | | | December 2014 | |

Moody’s Sovereign Ratings | | | Ba3 | | | | Ba2 | |

S&P Sovereign Rating | | | BB- | | | | BB- | |

Country Default Spread (%) | | | 3.6% | | | | 3.0% | |

Volatility Index for Equity Markets in emerging market countries | | | 1.5x | | | | 1.5x | |

Country Risk Premium (%) | | | 5.4% | | | | 4.5% | |

Thea factor considered by the Company in the computation of WACC reflects the specific context of the investment in Unitel and the relationship among shareholders, as described in more detail in the 2014 Form 20-F. In order to determine this factor, the Company has considered that an additional 18 month discount should be used. As mentioned in comment 2 above, until May 2015 the relationship with the other shareholders of Unitel experienced some deterioration, but some positive developments had also occurred. Market participants other than the Company could have a different assessment of this factor, but the Company believes that another market participant would need to include in its valuation the effect of the shareholders’ structure of Unitel, namely the need to obtain the approval by the other shareholders to acquire the Company’s interest in Unitel, and the need to settle a shareholders’ agreement to exercise any significant influence over Unitel and establish a governance that would include rights and duties of the shareholders and Unitel.

9

Discount rate (WACC)

| | | | | | | | | | |

WACC Unitel |

Item | | May

2014 | | | December

2014 | | | Description of premises |

| | | |

Cost of Equity (Ke) | | | | | | | | | | |

Risk free rate | | | 1.6% | | | | 1.6% | | | Average return (last 24 months) of the 10-year German Bond |

Market risk premium | | | 6.7% | | | | 6.7% | | | Spread between the return on the S&P 500 and the return of long-term bonds of the U.S. government (1926 to 2012) |

Unlevered Beta | | | 0.98 | | | | 0.98 | | | Average of the unlevered betas of comparable companies |

Leverage (D/E) | | | 5.2% | | | | 5.2% | | | Average leverage of comparable companies |

Leverage (D/D+E) | | | 5.0% | | | | 5.0% | | | |

Taxes | | | 35.0% | | | | 35.0% | | | Local income tax rate for legal entities |

Leverage Beta | | | 1.02% | | | | 1.02% | | | |

Country risk premium | | | 5.4% | | | | 4.5% | | | Average spread based on sovereign bonds and adjusted by the volatility of equity markets in emerging countries |

Ke | | | 13.80% | | | | 12.9% | | | |

| | | |

Cost of Debt (Kd) | | | | | | | | | | |

EuroSwap 10-year | | | 1.9% | | | | 1.9% | | | Average return (last 24 months) of the 10-year EuroSwap |

Spread – Portugal Telecom | | | 6.5% | | | | 6.5% | | | Estimated spread for long-term securities issued by PT in Europe and by subsidiaries in Africa |

Gross cost of debt | | | 8.4% | | | | 8.4% | | | |

Taxes | | | 35.0% | | | | 35.0% | | | Local income tax rate for legal entities |

Kd | | | 5.5% | | | | 5.5% | | | |

a | | | 2.6% | | | | 2.3% | | | Qualitative assessment on the effect of Shareholders’ structure and shareholders’ relationship |

| | | |

Capital Structure | | | | | | | | | | |

Leverage (D/E) | | | 5.2% | | | | 5.2% | | | Average leverage of comparable companies |

E/(D+E) | | | 95.0% | | | | 95.0% | | | |

D/(D+E) | | | 5.0% | | | | 5.0% | | | |

WACC | | | 15.9% | | | | 14.8% | | | |

As explained above the Company believes it has reflected in the computation of WACC risks and uncertainties in line with those considered by other market participants as required by ASC 820-10-55-7 through 9.

The Company also observed as indicated in ASC 820-10-35-54F that other telecommunication companies in Africa like MTN Group, Zain Group, Vodacom Group and Global Telecom, had an average of EV/Ebitda of 5.2x quite similar to Unitel EV/Ebitda of 4.6x as of December, 2014.

The Company advises the Staff that in accordance with latest financial information received from Unitel, its balance sheet as of May 31, 2014 included a net cash position of US$1,955 million and an account payable to PT Ventures regarding past due dividends was recognized. Revenues and operating income for the five-month period ended May 31, 2014 were in line with the budget used by the Company to compute the fair value, and key performance indicators were presenting a positive evolution. The Company advises the Staff that Unitel is the major mobile telecommunication operator in Angola and has a dominant market position.

10

| 5. | Moreover, we note you do not control Unitel nor do you exercise significant influence over it, but instead own a restricted minority equity interest in an entity controlled by others. In the absence of an active trading market in the shares of Unitel tell us management’s consideration of the use of discounts for lack of control and lack marketability in your estimation of the market value of PT Ventures’ interest in Unitel, for US GAAP purposes, upon acquisition in May 2014 and as of December 31, 2014. Explain how such considerations contemplated a market participant’s likely evaluation of the facts and circumstances of the PT Ventures’ adverse and deteriorating relationships with Unitel’s other shareholders, Unitel’s current management and its Board of Directors. |

The Company advises the Staff that its response to comment 5 should be read in connection with the response to comment 4 above.

As of May 5, 2014, the Company already had knowledge of some adverse relationship between shareholders of Unitel based on information provided by PT Ventures and had considered that in its assessment on how to recognize its 25% indirect interest in Unitel. The Company considered that it did not acquire significant influence over Unitel and therefore did not account for Unitel under the equity method.

After May 5, 2014, the relationship with the other shareholders of Unitel deteriorated in some specific formal matters, namely the fact that PT Ventures was not capable to elect any representative to the Board of Directors of Unitel. On the other hand PT Ventures/Oi was able to discuss with the other shareholders a potential transaction that envisaged the sale of its interest in Unitel.

Market participants, other than Unitel or Unitel’ shareholders, if engaged in a transaction to acquire the Company’s interest in Unitel could value in a different manner the fair value of Unitel. The Company acknowledges that any potential transaction to sell its interest in Unitel to a third party would require the approval of other shareholders of Unitel and would require the acquirer to negotiate a shareholders’ agreement in order to exercise any significant influence over Unitel.

* * *

The Company hereby acknowledges that:

| | • | | it is responsible for the adequacy and accuracy of the disclosure in its filings; |

| | • | | Staff comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the filings; and |

| | • | | the Company may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

11

We appreciate in advance your time and attention to our comments. Should you have any additional questions or concerns, please contact Bayard De Paoli Gontijo, our Chief Executive Officer, at +55-21-3131-2972.

|

| Very truly yours, |

|

| /s/ Flavio Nicolay Guimarães |

Flavio Nicolay Guimarães Chief Financial Officer and Investor Relations Officer Oi S.A. |

| cc: | Robert S. Littlepage, Jr., Accounting Branch Chief |

Joseph M. Kempf, Senior Staff Accountant

Dean Suehiro, Senior Staff Accountant

Securities and Exchange Commission

12