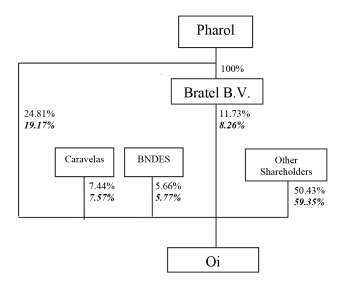

Transfer of Shares from Bratel B.V. to Bratel S.à r.l.

In September 2017, Oi received letters from Bratel B.V. informing it that Bratel B.V. had transferred its shareholding interests in Oi to its wholly-owned subsidiary Bratel S.à r.l.

Changes in JGP Shareholding Interest

In February 2018, Oi received a letter from JGP Gestão de Recursos Ltda. and its affiliate JGP Gestão Patrimonial Ltda., or collectively JGP, informing it that JGP held an aggregate 34,502,800 Common Shares, which was equivalent to 6.64% of Oi’s outstanding common stock.

Also in February 2018, Oi received a letter from JGP informing it that JGP held an aggregate 31,231,200 Common Shares, which was equivalent to 6.01% of Oi’s outstanding common stock.

Also in February 2018, Oi received a letter from JGP informing it that JGP held an aggregate 34,640,300 Common Shares, which was equivalent to 6.67% of Oi’s outstanding common stock.

Also in February 2018, Oi received a letter from JGP informing it that JGP held an aggregate 32,918,900 Common Shares, which was equivalent to 6.33% of Oi’s outstanding common stock.

Also in February 2018, Oi received a letter from JGP informing it that JGP held an aggregate 35,263,200 Common Shares, which was equivalent to 6.78% of Oi’s outstanding common stock.

In March 2018, Oi received a letter from JGP informing it that JGP held an aggregate 32,683,762 Common Shares, which was equivalent to 6.29% of Oi’s outstanding common stock.

Also in March 2018, Oi received a letter from JGP informing it that JGP held an aggregate 28,990,362 Common Shares, which was equivalent to 5.58% of Oi’s outstanding common stock.

In April 2018, Oi received a letter from JGP informing it that JGP held an aggregate 39,027,862 Common Shares, which was equivalent to 7.51% of Oi’s outstanding common stock.

In June 2018, Oi received a letter from JGP informing it that JGP held an aggregate 26,243,562 Common Shares, which was equivalent to 3.93% of Oi’s outstanding common stock. As a result, JGP no longer holds a material shareholding interest in Oi.

Changes in Solus Shareholding Interest

In February 2018, Solus Alternative Asset Management LP, a Delaware limited partnership that serves as the investment manager to the Solus Funds with respect to the Preferred Shares held by the Solus Funds, Solus GP LLC, a Delaware limited liability company that serves as the general partner to Solus Alternative Asset Management LP, and Mr. Christopher Pucillo, a United States citizen, who serves as the managing member to Solus GP LLC, jointly filed a Schedule 13G with the SEC disclosing the Solus Funds’ ownership of 15,109,224 Preferred Shares as of December 31, 2017, which was equivalent to 9.69% of Oi’s outstanding preferred stock.

In August 2018, Solus Alternative Asset Management LP, Solus GP LLC and Mr. Christopher Pucillo jointly filed a Schedule 13D with the SEC disclosing the Solus Funds’ ownership of 171,284,560 Common Shares (in the form of 34,256,912 Common ADSs), which was equivalent to 7.97% of Oi’s outstanding common stock, and 14,145,359 Preferred Shares (in the form of 14,145,359 Preferred ADSs), which was equivalent to 9.07% of Oi’s outstanding preferred stock, in each case as of July 31, 2018. Of these, the Solus Funds acquired 171,284,560 Common Shares (in the form of 34,256,912 Common ADSs) through their participation in the Capitalization of Credits Capital Increase. In addition, the Solus Funds received 2,447,203 ADWs in the Capitalization of Credits Capital Increase, which they had the right to exercise to acquire 12,236,015 Common Shares ADSs (in the form of 2,447,203 ADSs).

In October 2018, Solus Alternative Asset Management LP, Solus GP LLC and Mr. Christopher Pucillo jointly filed a Schedule 13G with the SEC disclosing the Solus Funds’ ownership of 192,520,575 Common Shares (in the form of 36,056,912 Common ADSs and 2,447,203 ADWs), which was equivalent to 8.90% of Oi’s outstanding common stock, and 14,145,359 Preferred Shares (in the form of 14,145,359 Preferred ADSs), which was equivalent to 9.07% of Oi’s outstanding preferred stock, in each case as of October 4, 2018.

As of January 28, 2019, according to Oi’s shareholder records, the Solus Funds owned 447,873,325 Common Shares, or 7.77% of Oi’s outstanding common stock, including Common Shares (in the form of Common ADSs) that the Solus Funds acquired through their participation in the preemptive rights offering and pursuant to their commitments under the Commitment Agreement, and 14,145,359 Preferred Shares, or 9.07% of Oi’s outstanding preferred stock.

251