EXHIBIT 2

Oi S.A.

CNPJ/MF Nº 76.535.764/0001-43

Identification Number of Companies Registration (NIRE) 3330029520-8

CVM Code no. 11312

Publicly-Held Corporation

Management's Proposal to be submitted for approval at the Extraordinary General Meeting to be held on March 19, 2019, pursuant to Brazilian Securities Commission (CVM) Ruling No. 480/09 and CVM Ruling 481/09.

Dear Shareholders:

Oi S.A.’s management (“Oi” or “Company”) sends this Management’s Proposal related to the Extraordinary General Meeting to be held on March 19, 2019, at 10 AM, at the Company’s headquarters, in compliance with CVM Ruling 481 and Law 6,404/76, as per the Notice of Meeting published on this date (“Meeting”):

(i)To ratify the appointment and engagement of Valore Consultoria e Avaliações Ltda. (“Meden”), as the firm responsible for the appraisal report of the book value of the shareholders’ equity of Copart 5 Participações S.A. (“Copart 5”),a wholly-owned subsidiary of the Company,to be merged into the shareholders’ equity of the Company (“Appraisal Report”):

The Company’s management proposes the ratification of the appointment and hiring, by Oi’s management, of the specialized companyValore Consultoria e Avaliações Ltda., CNPJ No. 28.104.680/0001-02 (“Meden”)to prepare an appraisal report on the carrying value of the shareholders’ equity of Copart 5 Participações S.A. (“Copart 5”), to be merged into the Company’s equity (“Appraisal Report”).

The information on the appraisers, as required by Exhibit 21 of CVM Ruling 481/09, is available onExhibit II of this Proposal.

(ii) Review, discuss, and vote on the Appraisal Report prepared by Meden:

The management proposes the approval, for the purpose of merging Copart 5 into the Company, of the Appraisal Report, whose base-date is November 30, 2018, which is theExhibit IV Of this Proposal.

(iii) Review, discuss, and vote on the Protocol of Merger and Instrument of Justification (Protocolo e Justificação de Incorporação) of Copart 5 into Company (“Protocol of Merger and Instrument of Justification”), and all exhibits thereto, which set forth the terms and conditions of the merger of Copart 5 into the Company, accompanied by the relevant documents:

The Company’s management proposes the approval of the Protocol and Justification of Merger of Copart 5 Participações S.A. into Oi S.A., as well as its exhibits and relevant documents, which reflect the terms and conditions of the merger of Copart 5 into the Company (“Protocol and Justification”), as perExhibit V.

(iv) Vote on the proposal of merger of Copart 5 into the Company,without change in the capital stock or issuance of new shares of the Company:

The Company’s management submits to the approval of its shareholders the proposal of merger of Copart 5 into Oi, in accordance with the terms and conditions of the Protocol and Justification. Due to said merger, Copart 5 will no longer exist and Oi will succeed it universally, in relation to all its assets, rights and obligations.

The management informs that the merger of Copart 5 into Oi will not result in an increase to the shareholders’ equity of Oi, since all shares of Copart 5 are directly held by Oi, which already has the consolidated registration of the Absorbed Company, under the equity method, in its consolidated financial statements. Therefore, Oi’s capital stock will not be changed because of the Merger, and no new shares will be issued, so no the current shareholders of Oi will suffer no dilution.

The main terms and conditions, as required by article 20-A of CVM Ruling 481 are described inExhibit VI of this proposal.

(v)To approve the amendment of the of article 5 of the Bylaws to reflect the Capital Increases approved by the Board of Directors within the authorized capital limit, under the terms of the Judicial Reorganization Plan and the Backstop Agreement:

The Company’s management submits to the Company’s shareholders approval a proposal to amend thehead provision of article 5 of the Articles of Incorporation, as indicated inExhibit VIII of this proposal, which containing the origin and justification for the amendment and the comparison with the current wording of the Articles of Incorporation, in order to reflect (i) the issuance of one hundred and sixteen million, one hundred and eighty-nine thousand, three hundred and forty (116,189,340) common shares, nominatives and with no par value, due to the use of the subscription warrants issued by the Company in the scope of the capital increase carried out with the Capitalization of QualifiedBondholders' Unsecured Credits and approved andratified by the Board of Directors in the meetings held on March 5, and July 20, 2018 as per clauses 4.3.3.5 and 4.3.3.6 of the Judicial Reorganization Plan, (ii) the completion and ratification of the Capital Increase - New Resources, as per Clause 6.1 of the Company’s Judicial Reorganization Plan, upon issuance of three billion, two hundred and twenty-five million, eight hundred and six thousand, four hundred and fifty-one (3,225,806,451) new common shares, nominatives and with no par value, for the issuance price of one Real and twenty-four centavos (BRL 1.24), totaling four billion Reais (BRL 4,000,000,000.00), as well as (iii) the issuance of two hundred and seventy-two million, one hundred and forty-eight thousand, seven hundred and five (272,148,705) new common shares, nominatives and with no par value, for the issuance price of one Real and twenty-four centavos (BRL 1.24) per share, regarding the commitment premium set forth in clause 6.1.1.3 of the Judicial Reorganization Plan and in theBackstop Agreement.

(iv) Ratify the election of member nominated in the Board of Directors Meeting held on October 04, 2018 to the Board of Director, in the form provided for in Article 150 of Law 6,404/76 and pursuant to Clauses 9.3 and 9.6 of the Judicial Reorganization Plan, according to the Notice to the Market disclosed on such date:

As per article 30, sole paragraph, of the Company’s Articles of Incorporation and article 150 of the Corporation Law, and the clauses 9.3 and 9.6 of the Judicial Reorganization Plan, the Company’s Board of Directors, due to the vacancy in one of the positions of the Board of Directors, approved the appointment of Mr. Roger Solé Rafols as member of the Board of Directors, in a meeting held on October 4, 2018, which became effective on December 5, 2018, upon approval by the Brazilian Telecommunications Agency (Anatel) of the request for prior consent made by the Company, as disclosed in the Market Communication.

Therefore, the Company’s management proposes the election of Mr. Roger Solé Rafols as member of the Board of Directors be confirmed, to complement the ongoing term.

Once elected, the Company's Board of Directors shall have the following composition:

EFFECTIVE |

Eleazar de Carvalho Filho (Chairman) |

Marcos Grodetzky (Vice-Chairman) |

Henrique José Fernandes Luz |

José Mauro Mettrau Carneiro da Cunha |

Marcos Bastos Rocha |

Maria Helena dos Santos Fernandes de Santana |

Paulino do Rego Barros Jr |

Ricardo Reisen de Pinho |

Rodrigo Modesto de Abreu |

Wallim Cruz de Vasconcellos Junior |

Roger Solé Rafols |

The information related to the professional experience of the candidate is available inExhibit IX of this Proposal, pursuant to items 12.5 to 12.10 of the Reference Form and pursuant to CVM Ruling No. 481/09.

Chairman of the Board of Directors

Oi S.A. – Under Judicial Reorganization

EXHIBIT I

(CALL NOTICE)

EXHIBIT II

INFORMATION ON APPRAISERS

(as per Exhibit 21 of CVM Ruling 481)

| Information on appraisers | 11 |

EXHIBIT III

Commercial Proposal

EXHIBIT IV

Appraisal Report

EXHIBIT V

PROTOCOL AND JUSTIFICATION OF MERGER OF COPART 5

| Protocol and Justification of Merger of Copart 5 | 15 |

5

EXHIBIT VI

INFORMATION ON THE MERGER

(as per Exhibit 20-A ofCVM Ruling 481)

| Information on the merger | 21 |

EXHIBIT VII

Copy of the minutes of the Board of Directors and FISCAL COUNCIL’s Meeting

| Minutes of the Board of Directors | 35 |

| Minutes of the Fiscal Council | 37 |

EXHIBIT VIII

(ARTICLES OF INCORPORATION)

| Origin and Justification of the Proposal of Amendment | 40 |

| Copy of the Company’s Articles of Incorporation containing the proposed amendments | 42 |

EXHIBIT IX

(ITEM 12.5 TO 12.10 OF THE REFERENCE FORM)

| Indicate in a chart the information of item 12.5 of the Reference Form | 62 |

| Meeting attendance percentage (members of the Board of Directors and Fiscal Council) | 63 |

Information of item 12.5 in relation to the members of committees created by the articles of incorporation, audit, financial risk and compensation | 63 |

| Meeting attendance percentage (members of the committees) | 64 |

| Kinship | 64 |

Relationships of subordination, provision of services or control between managers and controlled companies, controlling companies and others | 65 |

EXHIBIT I

Oi S.A. – In Judicial Reorganization

CNPJ/MF No. 76.535.764/0001-43

NIRE 3330029520-8

Publicly held Company

CALL NOTICE FOR THE

EXTRAORDINARY GENERAL SHAREHOLDERS MEETING

The Board of Directors of Oi S.A. – In Judicial Reorganization (“Company”) hereby calls the Shareholders to an Extraordinary General Shareholders Meeting, to be held on March 19, 2019, at 10 a.m., at the Company’s headquarters located at Rua do Lavradio No. 71, Centro, City and State of Rio de Janeiro, to discuss the following agenda:

(1) To ratify the appointment and engagement of Valore Consultoria e Avaliações Ltda. (“Meden”), as the firm responsible for the appraisal report of the book value of the shareholders’ equity of Copart 5 Participações S.A. (“Copart 5”),a wholly-owned subsidiary of the Company,to be merged into the shareholders’ equity of the Company (“Appraisal Report”);

(2) Review, discuss, and vote on the Appraisal Report prepared by Meden;

(3) Review, discuss, and vote on the Protocol of Merger and Instrument of Justification (Protocolo e Justificação de Incorporação) of Copart 5 into Company (“Protocol of Merger and Instrument of Justification”), and all exhibits thereto, which set forth the terms and conditions of the merger of Copart 5 into the Company, accompanied by the relevant documents;

(4) Vote on the proposal of merger of Copart 5 into the Company,without change in the capital stock or issuance of new shares of the Company;

(5) To approve the amendment of the of article 5 of the Bylaws to reflect the Capital Increases approved by the Board of Directors within the authorized capital limit, under the terms of the Judicial Reorganization Plan and the Backstop Agreement; and

(6) Ratify the election of member nominated in the Board of Directors Meeting held on October 04, 2018 to the Board of Director, in the form provided for in Article 150 of Law 6,404/76 and pursuant to Clauses 9.3 and 9.6 of the Judicial Reorganization Plan,according to the Notice to the Market disclosed on such date.

General Instructions:

1. The documentation and information relating to matters that are going to be deliberated at the Meeting are available at the Company’s headquarters, in the Shareholders’ Participation Manual, on the Company’s Investors Relations page (www.oi.com.br/ri), as well as on the website of the Brazilian Securities Commission (www.cvm.gov.br) pursuant to CVM Instruction 481/09, and at B3 (http://www.bmfbovespa.com.br/), with the purpose of examination by the Shareholders.

2. The Shareholder who wishes to personally attend the Meeting or to be represented by an attorney-in-fact, is requested to deposit the following documents at Rua Humberto de Campos No. 425, 5th Floor, Leblon, in the City of Rio de Janeiro- RJ, from 9 a.m to 12 p.m. or from 2 p.m. to 6 p.m., within a period of up to two (2) business days prior to the Meeting, under the care of the Corporate and M&A Management: (i) In the case of a Legal Entity: certified copies of the Articles of Incorporation or Bylaws or Articles of Association, minutes of the election of the Board of Directors (when applicable) and of the election of the Board of Directors that contains the election of the legal representative(s) present at the Meeting; (ii) In the case of an Individual Taxpayer Person: certified copies of the Shareholder’s Identification Document and the Individual Taxpayer Registration Number (CPF); and (iii) In the case of an Investment Fund: certifiedcopies of the Fund’s Bylaws and Instruments of Incorporation or the Fund’s manager Bylaws or Articles of Association, as well as the minutes of the election of the legal representative(s) present at the Meeting. In addition to this, the documents indicated in (i), (ii) and (iii) are also required, as the case may be, when the Shareholder is represented by an attorney-in-fact, he or she shall forward with such documents the respective mandate, and with special powers and recognized signatures, as well as certified copies of the Attorney-in-fact’s Identification Document and Individual Taxpayer Registration Number (CPF).The measure is intended to grant speed to the Shareholders present at the Meeting. The holders of preferred shares shall on have the right to vote in all matters subject to deliberation and included in the Agenda of the Extraordinary General Shareholders Meeting convened, pursuant to paragraph 3 of article 13 of the Company’s Bylaws and paragraph 1 of article 111 of Law 6,404 / 76, and shall vote jointly with the common shares.

3. The Shareholders participating in the Fungible Custody of Registered Shares of the Stock Exchange who wish to participate in the Meeting must submit statement issued up to two (2) business days prior to its realization, containing a respective equity interest, provided by the custodian body.

4. Finally, in order to facilitate and encourage the participation of its shareholders in the Extraordinary General Shareholders Meeting and, in accordance with the rules of the Brazilian Securities and Exchange Commission (“CVM”), in particular CVM Instruction 481/09, amended by CVM Instructions 561/15 and 570/15, the Company will allow the participation and exercise of remote voting, allowing its shareholders to send, through their respective custody agents or directly to the Company, a Distance Voting Bulletin, which is provided by the Company on its Investor Relations website, as well as on the website of the CVM and B3, together with the other documents that are to be discussed at the Extraordinary General Shareholders Meeting, subject to the guidelines contained in the Distance Voting Bulletin.

Rio de Janeiro, February 15, 2019.

Eleazar de Carvalho Filho

Chairman of the Board of Directors

EXHIBIT II

INFORMATION ON APPRAISERS

(as per Exhibit 21 of CVM Ruling 481)

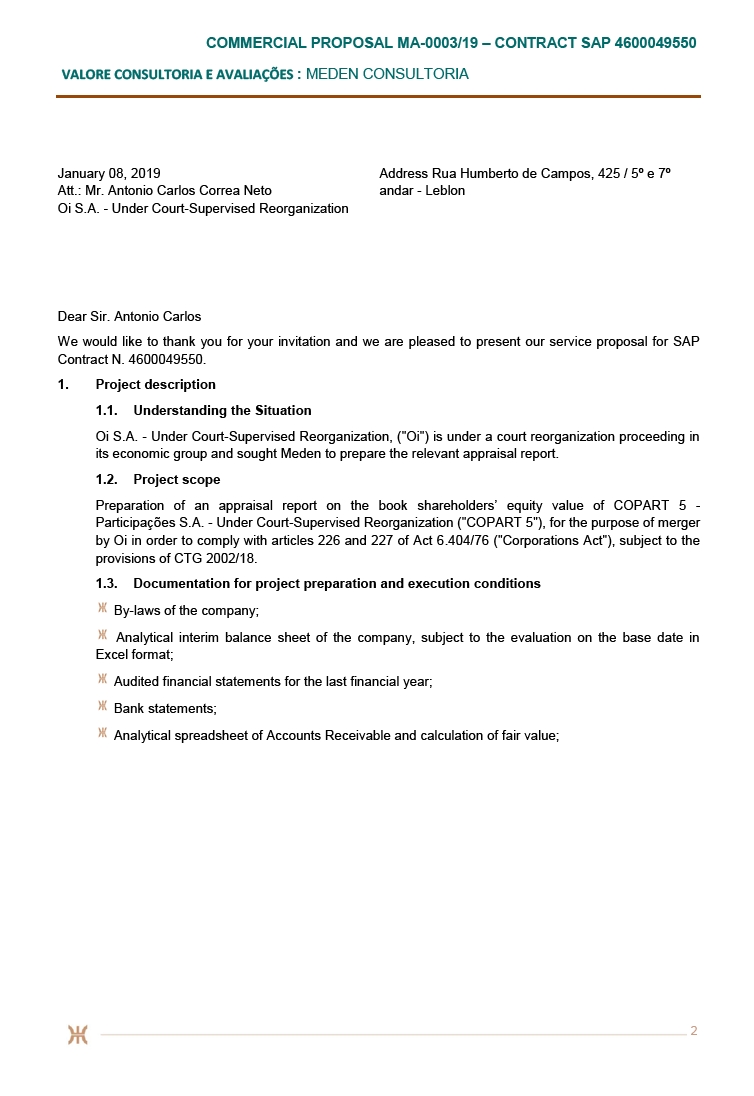

1. List the evaluators recommended by the management

Valore Consultoria e Avaliações Ltda.(“Meden”) was hired to assess the member’s equity of Copart 5 Participações S.A. – In Judicial Reorganization (“Copart 5”), at book value, to be incorporated to the equity of Oi S.A. – In Judicial Reorganization (“Company”), based on the financial statements of Copart 5 assessed on the reference date of November 30, 2018 (“Reference Date”).

2. Describe the qualification of the recommended evaluators

Meden is a limited company organized since July 2017, acting in the market since its organization, providing consulting in the preparation of evaluation reports on member’s equity at book and market value.

Valore Consultoria Empresarial Ltda. is also part of Meden Consultoria group which is focused on the preparation of economic reports, management of fixed assets, valuation of personal and real property, evaluation of intangibles, and other related services.

3. Provide copy of work proposals and compensation of the recommended evaluators

A copy of the work proposal and compensation of the evaluator was made available to the Company’s shareholders, through IPE System, and can be verified at CVM’s (www.cvm.gov.br), BM&FBOVESPA’s (www.bovespa.com.br) and the Company’s website.

4. Describe any relevant relation in the last 3 (three) years between the recommended evaluators and the parties related to the company, as defined by the accounting rules that deal with this subject.

In the last three years, Meden has prepared the accounting reports of the Net Equity of Rede Conecta Serviço de Rede S.A. and Copart 4participações SA - In Judicial Reorganization, for the mergers of detailed companies into SEREDE - Serviços de Rede SA and Telemar Norte Leste SA - In Judicial Reorganization, respectively, within the scope of the restructuring process of the Oi Companies provided in the Judicial Reorganization Plan of the Company and its subsidiaries under judicial reorganization.

In addition, Valore Consultoria Empresarial Ltda. also prepared a review report on the economic useful life of the movable assets of the Oi Companies, as well as two reports to meet the demands arising from the Company's judicial recovery.

EXHIBIT III

Commercial Proposal

EXHIBIT IV

Appraisal Report

EXHIBIT V

PROTOCOL AND JUSTIFICATION OF THE MERGER OF COPART 5 PARTICIPAÇÕES S.A. – IN JUDICIAL REORGANIZATION INTO AND WITH OI S.A. – IN JUDICIAL REORGANIZATION

COPART 5 PARTICIPAÇÕES S.A. - IN JUDICIAL REORGANIZATION, a closely-held company, with head office located at Rua General Polidoro, nº 99, 5º andar - parte, Botafogo, Rio de Janeiro/RJ, Taxpayer Identification (CNPJ/MF) Number 12.278.083/0001-64, with its corporate documents filed with the Commercial Registry of the State of Rio de Janeiro ("JUCERJA") under NIRE 3330029428-7, herein represented under its By-laws ("Copart 5"); and

OI S.A. – IN JUDICIALREORGANIZATION, a publicly-held company with head office at Rua do Lavradio, 71, 2º andar - Centro, in the City and State of Rio de Janeiro, Postal Code (CEP) 20230-070, Taxpayer Identification (CNPJ/MF) Number 76.535.764/0001-43, with its corporate documents filed with JUCERJA under NIRE 33.3.0029520-8, herein represented under its By-laws (referred to individually as "Oi" and, jointly and indistinctly with Copart 5, as the "Parties"),

WHEREAS:

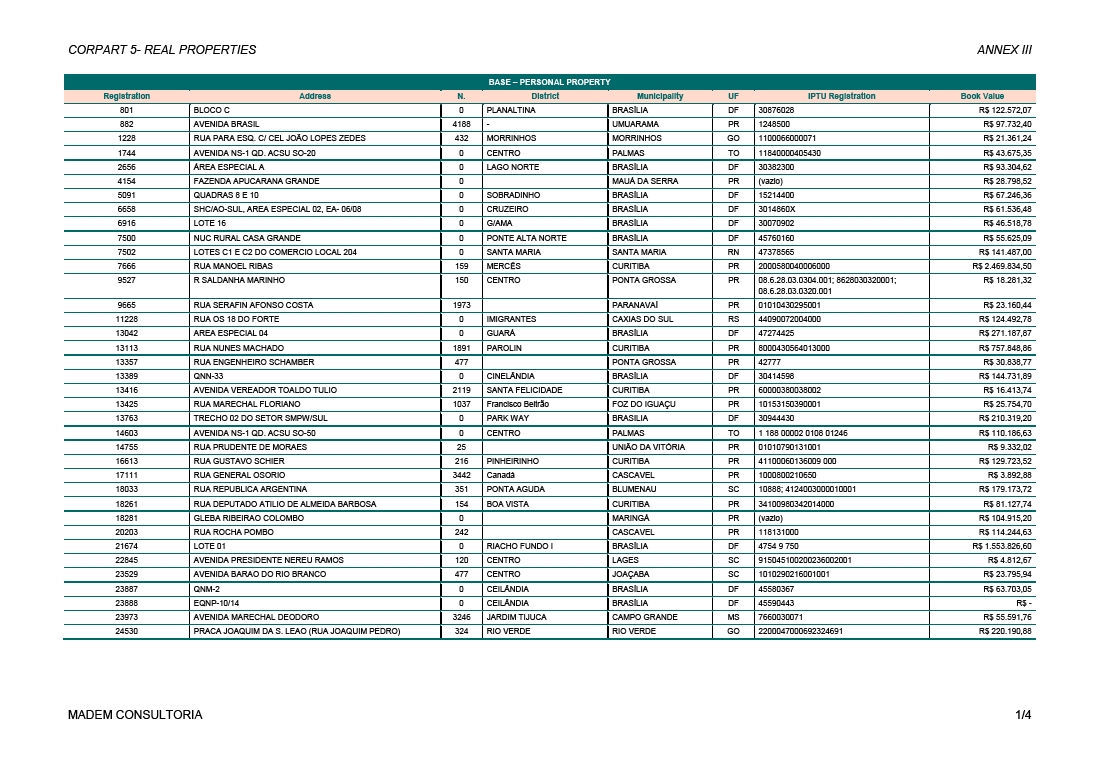

(i) Copart 5 is a joint-stock company whose sole shareholder is Oi, holding 100% (one hundred percent) of its capital stock. Copart 5’s corporate purpose is the management and leasing of real property, as well as the assignment of rights of any nature, including over real estate, being able to lease, give in usufruct, in whole or in part, and, finally, perform all acts required for the best use of such assets, including performing maintenance, repair and improvement thereof;

(ii) Oi is a publicly-held company whose corporate purpose is the offer of telecommunications services and all activities required or useful for the delivery of such services, in accordance with the concessions, authorizations and permits granted to it, Oi being entitled, for achieving its purpose, to include the assets and rights of third parties in its assets, hold equity interests in the capital of other companies, incorporate wholly-owned subsidiaries to perform activities included in its corporate purpose and which are recommended to be decentralized, promote the import of goods and services required for the performance of activities included in its corporate purpose, provide technical assistance services to telecommunications companies, performing activities of common interest, carry out studies and research aimed at the development of the telecommunications sector, enter into contracts and agreements with other companies operating telecommunications services or any persons or entities, aiming to ensure operation of the services, without prejudice to its duties and responsibilities, and perform other activities related or correlated to its corporate purpose;

(iii) the Parties are undergoing a judicial reorganization process, together with other companies directly or indirectly controlled by Oi (all, jointly, the "Companies under Reorganization"), and their Restated Judicial Reorganization Plan was approved by the General Meeting of Creditors on December 20, 2017 and confirmed by the 7th Corporate Court of the Capital District of the State of Rio de Janeiro on January 8, 2018, according to the decision published on February 5, 2018 (the "JRP");

(iv) the JRP established the adoption of a series of measures by the Companies under Reorganization with a view to overcoming its momentary economic and financial crisis, among which are the implementation of corporate reorganization operations with a view to optimizing operations and increasing the results of the Companies under Reorganization and other direct and indirect subsidiaries of Oi (all, together with the Companies under Reorganization, the "Oi Companies"), as well as obtaining a more efficient and adequate structure to implement the proposals provided in the JRP and continuing the activities of the Oi Companies;

(v) the merger of Copart 5 with and into Oi is expressly mentioned in Annex 7.1 of the JRP as one of the corporate reorganization operations that may be carried out by the Companies under Reorganization and will contribute to achieve the goals mentioned in the previous item; and

(vi) the unification of the operations of the Parties, through the consolidation of the activities developed, will bring considerable administrative and economic benefits, with reduction of costs and generation of synergy gains for greater efficiency in the offer of services, contributing to the achievement by the Oi Companies of the objectives mentioned in item (iv).

The Parties resolve, in compliance with the provisions of articles 224, 225 and 227 of Law No. 6,404/76 (the "BrazilianCorporations Law"), to enter into this Protocol and Justification of the Merger of Copart 5 Participações S.A. - In Judicial Reorganization into and with Oi S.A. - In Judicial Reorganization (the "Protocol and Justification"), aiming to regulate the terms and conditions applicable to the merger of Copart 5 into and with Oi (the "Merger"):

CLAUSE ONE - PROPOSED TRANSACTION AND JUSTIFICATION

1.1.Proposed Transaction. The transaction consists of the merger of Copart 5 by Oi, with the transfer of all shareholders’ equity of Copart 5 to Oi, which shall succeed the former universally, in all its assets, rights and obligations, so that Copart 5 will be terminated, pursuant to articles 227et seq. of the Brazilian Corporations Law.

1.2.Justification of the Merger. The purpose of the Merger is to consolidate the activities conducted by the Parties in a single company, which will bring considerable administrative and economic benefits, with rationalization of costs and gains in synergy, for greater efficiency in the offer of services, contributing to the achievement by the Oi Companies of the goals mentioned in item (iv) of the Recitals.

1.3.Copart 5’s account balances. The balances of Copart 5's creditor and debtor accounts shall be transferred to the corresponding accounts in Oi's accounting books, with the necessary adjustments. Thus, Copart 5's assets and liabilities shall be transferred to Oi's equity, and Copart 5 shall be terminated.

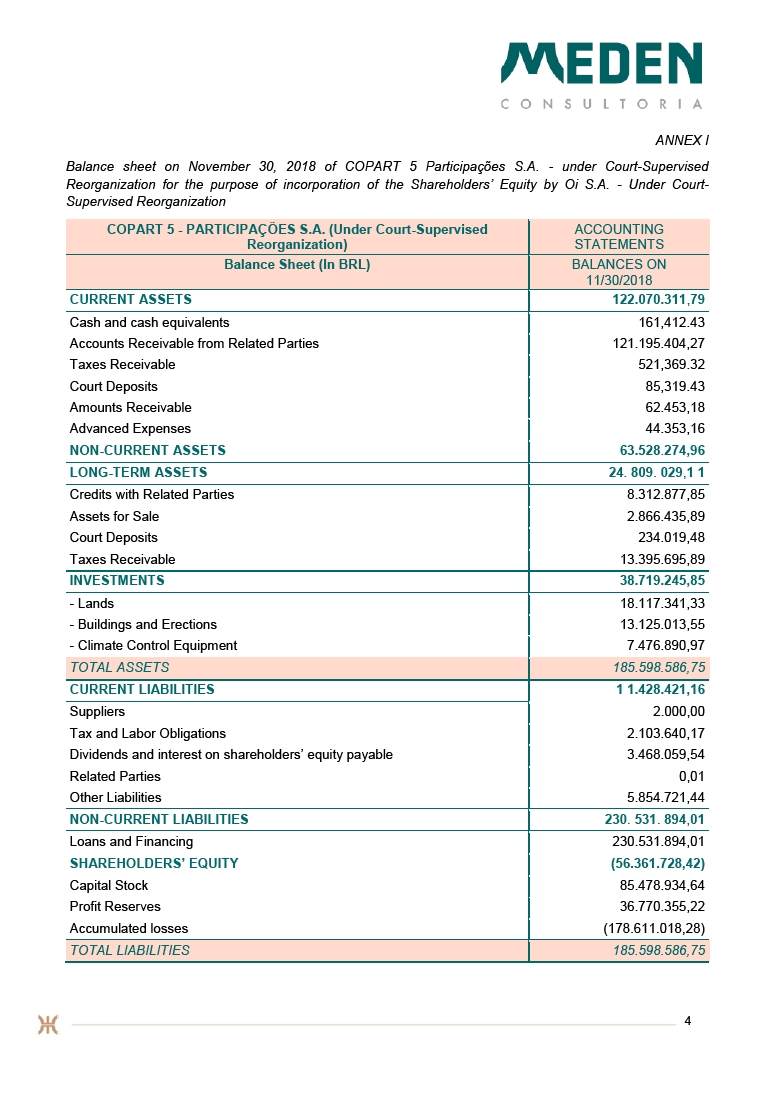

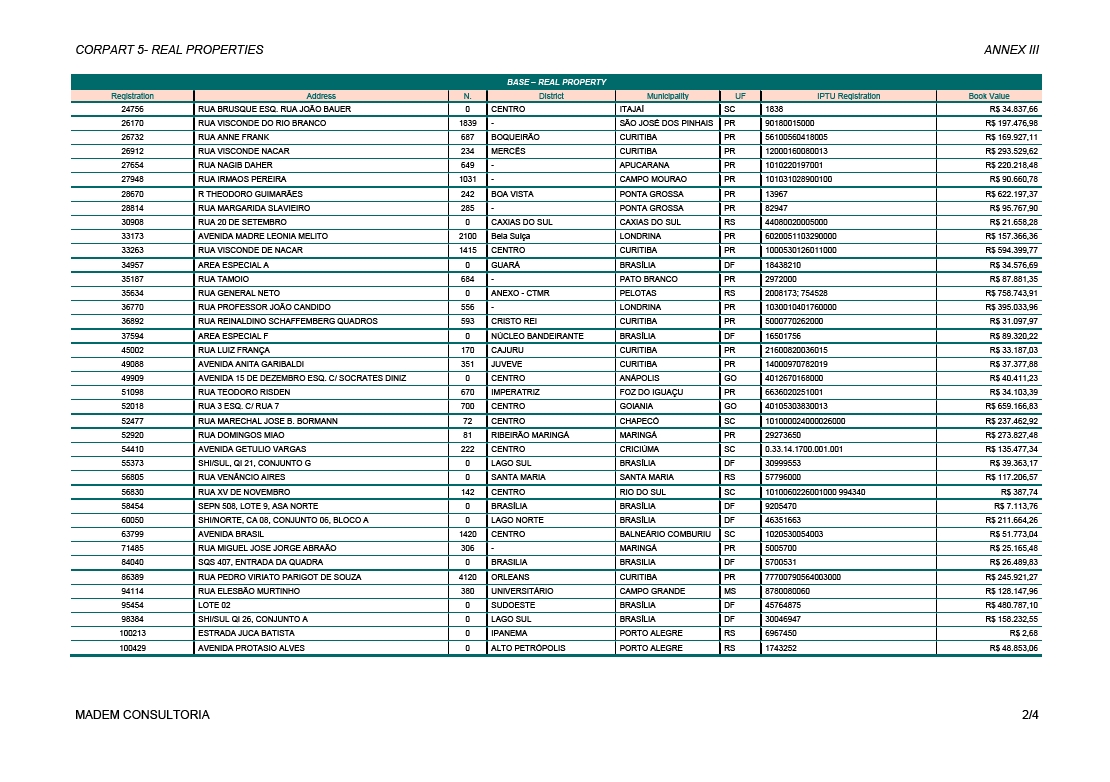

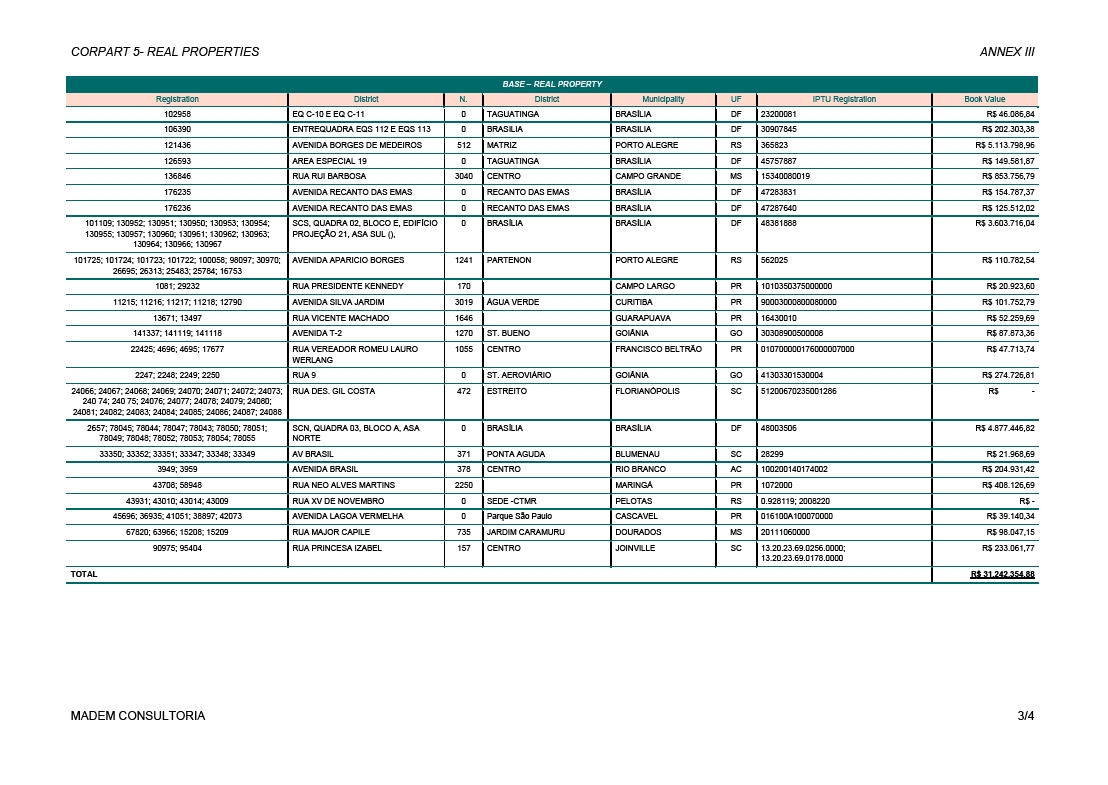

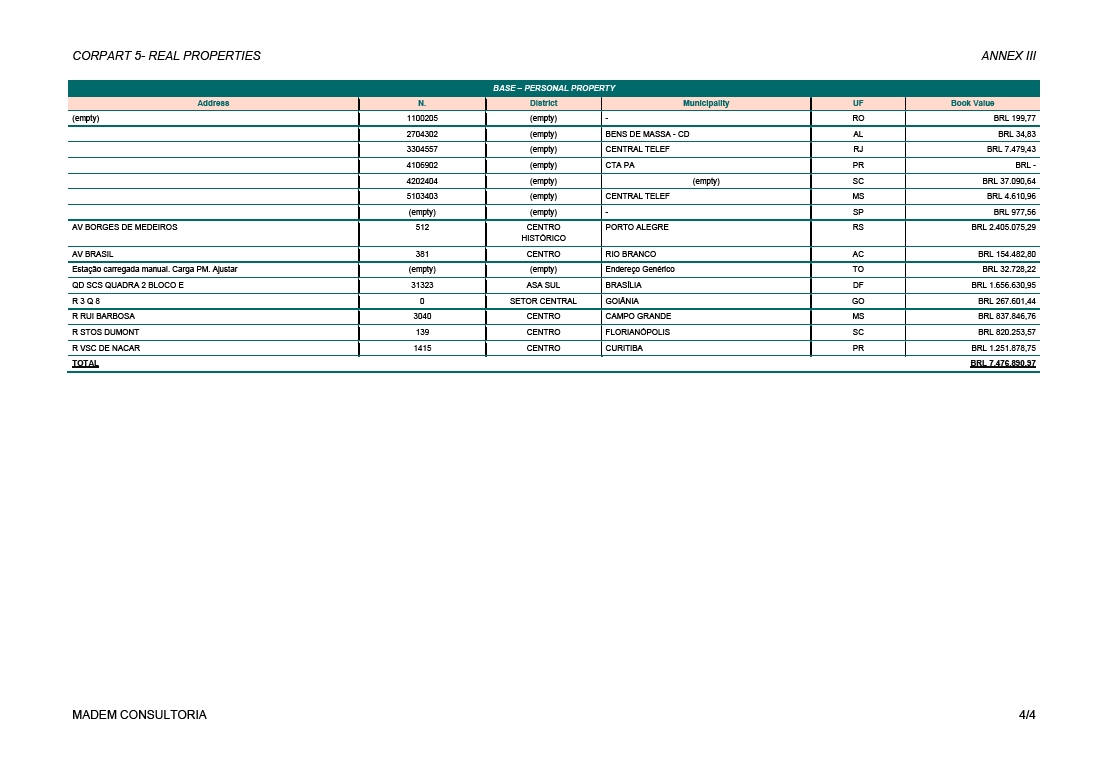

CLAUSE TWO - CRITERIA FOR THE APPRAISAL OF THE SHAREHOLDERS’ EQUITY OF COPART 5

2.1.Appraisal of the shareholders’ equity of Copart 5. Copart 5's shareholders' equity was appraised based on its book value, according to the analytical interim balance sheet of the Parties prepared on the base date of November 30, 2018 ("Base Date"), as well as on the analytical opening of the most relevant equity items, among other documents. In compliance with the provisions of articles 226 and 227 of the Brazilian Corporations Law, the specialized company Valore Consultoria e Avaliações Ltda. ("Meden") was selected to undertake the appraisal of the net equity of Copart 5, which shall be absorbed by Oi. The selection and engagement of Meden shall be ratified and approved by Oi, as the sole shareholder of Copart 5, and by Oi's shareholders. As provided in the appraisal report included in Exhibit I (the "Appraisal Report"), the book value of Copart 5's shareholders' equity, on the Base Date, is negative in the amount of R$ 56,361,728.42 (fifty-six million, three hundred and sixty-one thousand, seven hundred and twenty-eight reais and forty-two cents).

2.2.Appraisal at Market Value. Given that 100% (one hundred percent) of the shares issued by Copart 5 are held by Oi, and that Copart 5 does not, therefore, have other shareholders, the preparation and submission of an appraisal report on the net worth of Copart 5 and Oi at market value, as established in article 264 of the Brazilian Corporations Law, as well as the assembly of an independent special committee, provided for in CVM Guiding Opinion No. 35/08, are not required.

2.3.Treatment of Equity Variations. The equity variations occurring in Copart 5 as from the Base Date shall be appropriated in Oi in the accumulated profits or loss account.

CLAUSE THREE - SHARES ISSUED BY ONE COMPANY AND HELD BY ANOTHER AND TREASURY SHARES

3.1.Treatment of Shares issued by one Company and held by the Other. Upon the approval of the Merger and the consequent termination of Copart 5, all shares issued by Copart 5 and held by Oi shall be cancelled. There are no shares issued by Oi held by Copart 5.

3.2.Treatment of treasury shares. Copart 5 has no treasury shares. The Merger shall have no impact on the shares held in treasury by Oi.

CLAUSE FOUR - INCREASE IN THE CAPITAL STOCK OF OI AND NUMBER, TYPE AND CLASS OF SHARES TO BE ALLOCATED

4.1.Copart 5's Net Equity. The book value of the net equity of Copart 5 to be incorporated by Oi is negative in the amount of R$ 56,361,728.42 (fifty-six million, three hundred and sixty-one thousand, seven hundred and twenty-eight reais and forty-two cents).

4.2.Number, Type and Class of Shares to be Allocated. Given that all shares issued by Copart 5 are held by Oi, Copart 5's unsecured liabilities shall not have any effect on Oi's capital stock, as the acquiring company, and there shall be no increase or reduction in its capital stock, nor issuance of new shares of Oi as a result of the Merger and, therefore, the provisions of articles 224, items I and V, of the Brazilian Corporations Law do not apply.

CLAUSE FIVE - APPROVAL BY THE GENERAL MEETINGS OF SHAREHOLDERS OF COPART 5 AND OI

5.1.General Meetings. Extraordinary General Meetings of Shareholders of Copart 5 and Oi shall be held for approval of the Merger, which shall resolve on the Merger.

CLAUSE SIX - MISCELLANEOUS

6.1.No incidence of ITBI. On the Merger, theInter Vivos Real Estate Transfer Tax (Imposto sobre a Transmissão de Bens Imóveis Inter Vivos) ("ITBI") is not levied, as expressly provided for in article 156, paragraph 2, item I, of the Constitution of the Federative Republic of Brazil, since Oi, as the acquiring company and, consequently, as the acquirer of the real estate properties held by Copart 5, has as its main activity the offer of telecommunications services, as highlighted in item (ii) of the Recitals of this Protocol and Justification.

6.2.Right of Withdrawal. Pursuant to the provisions of article 137 of the Brazilian Corporations Law, the right of withdrawal is ensured to shareholders of the mergee that dissent from the resolution approving the Merger. Given that Oi is the sole shareholder of Copart 5 and the acquiring company, there shall be no exercise of the withdrawal right as a result of the Merger.

6.3.Termination of Copart 5. Upon implementation of the Merger, Copart 5 will be terminated and all its assets, rights, properties, obligations and responsibilities shall be merged into Oi, which shall succeed Copart 5.

6.4.Authorization to the Parties’ Management. Once the Merger is approved by the General Shareholders' Meetings of the Parties, the Parties’ managers shall be authorized to perform any and all acts necessary for implementation and formalization of the Merger, including the transfer of Copart 5's equity, whether assets or liabilities, to Oi.

6.5.Survival of Valid Articles. If any clause, provision, term or condition of this Protocol and Justification is found to be invalid, the other clauses, provisions, terms and conditions not affected by such invalidation shall remain valid.

6.6.Jurisdiction. The Courts of the Central Judiciary District of the Capital of the State of Rio de Janeiro are hereby elected to settle all matters arising from this Protocol and Justification, waiving any other, however privileged it may be or may come to be.

In witness whereof, the parties execute this Protocol and Justification in four (4) counterparts of equal content and form and for one only purpose, together with two witnesses identified below.

Rio de Janeiro, January 23, 2019.

COPART 5 PARTICIPAÇÕES S.A. – IN JUDICIAL REORGANIZATION

____________________________________Name: Title: | ____________________________________ Name: Title: |

OI S.A. – IN JUDICIAL REORGANIZATION

____________________________________Name: Title: | ____________________________________ Name: Title: |

Witnesses:

____________________________________ Name: Taxpayer Id. N. (CPF): | ____________________________________ Name: Taxpayer Id. N. (CPF): |

Exhibit I

Accounting appraisal report of the Shareholders’ Equity of

COPART 5 PARTICIPAÇÕES S.A. – IN JUDICIAL REORGANIZATION

EXHIBIT VI

INFORMATION ON THE MERGER

(as per ANNEX 20-A of CVM Ruling 481)

.

1. Protocol and justification of the operation, under arts. 224 and 225 of Act no. 6.404, of 1976 Protocol and Justification of merger of Copart 5 Participações S.A. – In Judicial Reorganization (“Copart 5”) by Oi S.A. – In Judicial Reorganization (“Merger”) shall be available in Annex V of this Proposal It is also available on the Company's website (www.ri.oi.com.br) and into the Sistemas Empresas NET from CVM (www.cvm.gov.br), in addition to the B3 SA website - Brasil, Bolsa,Balcão (www.b3.com.br). |

2. Other agreements, contracts and pre-contracts governing the exercise of the voting right or the transfer of the shares of companies subsisting or resulting from the operation, filed in the headquarters of the company or to which the company controller is a party There are no other agreements, contracts and pre-contracts regulating the exercise of voting rights or the transfer of shares issued by companies subsisting or resulting from the transaction. |

3. Operation description, including: |

a. Terms and conditions The transaction consists of the merger of Copart 5, wholly-owned subsidiary of Oi, with the full transfer of Copart 5's assets, valued at its book value, to Oi, which will succeed the former universally, in all its assets, rights and obligations, so that Copart 5 will be extinguished, pursuant to articles 227 and following of the Corporations Act. . (“Lei das S.A”) (“Merger”) Upon the Merger, all the shares representing Copart 5’s capital stock, which are directly held by Oi, as provided for in article 226, paragraph 1, of the Corporations Act, shall be cancelled. Since it is a merger of company whose shares are fully held by Oi, the merger shall not result in increase of Oi’s equity. Therefore, since Oi has a consolidated registration of Copart 5 in its consolidated financial statements, by equity method, it shall not have its capital stock changed due to the Merger, and there shall be no issuance of new shares or dilution in shares held by Oi’s current shareholders. The unification of the operations of the Parties, through consolidation of the developed activities, will bring considerable administrative and economic benefits, with reduction of costs and generation of synergy gains for greater efficiency in the offer of services, contributing to achievement by Oi Companies of the objectives mentioned above. |

b. Obligations to indemnify: |

i. The managers of any involved company There is no obligation to indemnify. ii. If the operation does not occur There is no obligation to indemnify. |

c. Comparative table of the rights, advantages and restrictions of the shares of the companies involved or resulting before and after the operation Since Oi is the single shareholder, there shall be no issuance of new shares of Oi due to the Merger and all of Oi’s shares shall remain with the same rights and advantages. All Copart 5’s shares shall be cancelled upon Merger. |

d. Eventual need of approval by debenturists or other creditors None. |

e. Assets and liabilities elements which shall constitute each part of the equity, in the event of spin-off Not applicable, since it is a merger. |

f. Intention of the companies resulting from the registration of issuer of securities Not applicable. |

4. Plans for corporate business, notably regarding to specific corporate events intended to be promoted OI is currently focused on - and shall so remain after the Merger - the operation of telecommunications services and activities necessary or useful for the performance of such services, in accordance with the concessions, authorizations and permissions granted to it, through the activities included in its corporate purpose, maintaining its publicly-held corporation registration. |

5. Analysis of the following aspects of the operation: |

a. Description of main expected benefits1, including: i. Synergies; ii. Tax benefits and iii. Strategic advantages The Parties are in a court-supervised reorganization together with other companies directly or indirectly controlled by Oi (all, jointly, "Reorganizing Companies"), and their Restated Court-Supervised Reorganization Plan was approved by the General Meeting of Creditors on December 20, 2017 and homologated by the 7th Business Court of the Judiciary District of the State of Rio de Janeiro on January 8, 2018, according to the decision published on February 5, 2018 ("PRJ"); PRJ established the adoption of a series of measures by the Reorganizing Companies with a view to overcoming its current economic and financial crisis, among which are the implementation of corporate reorganization operations with a view to optimizing operations and increasing the results of Reorganizing Companies and other direct and indirect subsidiaries of Oi (all, together with Reorganizing Companies, "Oi Companies"), as well as obtaining a more efficient and adequate structure to implement the proposals provided in the PRJ and to continue the activities of Oi Companies. The merger of Copart 5 by Oi is expressly mentioned in Annex 7.1 of PRJ as one of the corporate reorganization operations that may be carried out by the Reorganizing Companies and will contribute to achieve the goals mentioned in the previous item. The unification of the operations of the Parties, through consolidation of the activities developed, will bring considerable administrative and economic benefits, with reduction of costs and generation of synergy gains for greater efficiency in the offer of services, contributing to achievement by Oi Companies of the objectives with a view to optimizing operations and increasing the results of Reorganizing Companies and other direct and indirect subsidiaries of Oi, as well as obtaining a more efficient and adequate structure to implement the proposals provided in PRJ and to continue the activities of Oi Companies. |

b. Costs The managers of the Company and Acquired Company estimate that the costs of realizing the Merger will be approximately R$ 143.321,82, including publications and evaluations expenses. |

c. Risk factors Oi may face unforeseen difficulties of an operational nature, delaying and impairing the returns that are expected with the Merger. The Company understands that the Merger does not increase the exposure to risks and does not impact the risk factors already disclosed in its Reference Form. |

d. In the case of a transaction with related party possible alternatives that could have been used to achieve the same objectives, indicating the reasons why these alternatives were discarded2 The Managers of the Companies evaluated other possible corporate operations, but they decided on the corporate merger as it was the most appropriate one to be implemented in order to achieve the proposed objectives, considering the costs involved and the gains and synergies expected from the operation (item 3, (a)), as well as the fact that Copart 5 is a wholly owned subsidiary of Oi. |

e. Relation of replacement Not applicable. Considering that the Acquired Company has its shares wholly owned by Oi, and its equity is already reflected in Oi's financial statements, the Merger will not result in a change in Oi's shareholders' equity, nor an increase in its capital stock, no shares shall be issued replacing the Acquired Company's shares, which shall be canceled as a result of the Merger, as provided for in article 226, paragraph 1, of Brazilian Corporate Act. |

f. In operations involving controlling companies, controlled companies or companies under common control i. Stock replacement ratio calculated in accordance with art. 264 of Act No. 6,404 of 1976 ii. Detailed description of the process of trading the replacement ratio and other terms and conditions of the operation iii. If the transaction has been preceded, in the last 12 (twelve) months, by an acquisition of control or acquisition of a control block: · Comparative analysis of the replacement ratio and price paid on the acquisition of control · Reasons for possible differences in assessment in the different operations iv. Justification of why the replacement ratio is commutative, with a description of the procedures and criteria adopted to guarantee the commutativity of the operation or, if the substitution ratio is not commutative, payment detail or equivalent measures adopted to ensure adequate compensation Not applicable, since it is a merger of the company whose shares are wholly owned by Oi, which is why no new shares shall be issued in substitution for the shares of the Acquired Company, which shall be canceled as a result of the Merger, according to item "e" above. Therefore, there shall be no dilution for Oi's shareholders as a result of the Merger. |

6. Copy of minutes of all meetings of the board of directors, fiscal council and special committees in which the operation was discussed, including any dissident votes The Copies of the minutes of the meetings of the Board of Directors, in which the operation was discussed, and of the Fiscal Council, which gave a favorable opinion on the proposed Merger are in the Annex VII of this Proposal and available on the Company's website (http://ri.oi.com.br) and e CVM. |

7. Copy of studies, presentations, reports, opinions or appraisal reports of the companies involved in the operation made available to the controlling shareholder at any stage of the operation Valore Consultoria e Avaliações Ltda.(“Meden”) was hired to prepare the appraisal report at the book value of Copart 5's shareholders' equity, that shall be used on the Copart 5 Merger by the Company. The appraisal report constitutes Annex IV of this Management Proposal. |

7.1. Identification of possible conflicts of interest between financial institutions, companies and professionals who have prepared the documents mentioned in item 7 and the companies involved in the operation

Meden stated that it does not have any conflict of interests that undermines the independence of its work.

|

8. Statutory draft or statutory changes of the companies resulting from the operation Oi's Bylaws shall not be altered as a result of the Merger. |

9. Financial statements used for the purpose of the transaction, in accordance with specific rule Copart's financial statements used for operations were those corresponding to the period ended on November 30, 2018. |

10.Pro forma financial statements prepared for the purpose of the operation, pursuant to the specific rule Not applicable. Under article 10 of IN CVM 565, since the Merger does not represent a dilution higher than 5% (five percent), since there shall be no issuance of OI shares as a result of the Merger. |

11. Document containing information on directly involved companies that are not publicly-held companies, including3: |

a. Risk factors, under the terms of items 4.1 and 4.24 of the reference form The Merger's risk factors are included and mentioned in items 4.1 and 4.2 of the reference form, except for the withdrawal of Copart 5 from the list of Oi Group companies in court-supervised reorganization, since, according to art. 227 of the Brazilian Corporation Act, the acquiring company shall succeed the acquired company in all rights and obligations. |

b. Description of the main changes in the risk factors occurred in the previous year and expectations regarding the reduction or increase in the exposure to risks as a result of the operation, pursuant to item 5.4 of the reference form5 After the Merger, the Acquired Company shall be extinguished. There will be no reduction or increase in the exposure to risks as a result of the Merger. |

c. Description of activities, under items 7.1, 7.2, 7.3 and 7.4 of the reference form. Copart 5 is a wholly-owned subsidiary of the Company and was incorporated to manage and lease real estate, as well as assignment of rights of any nature, including real estate, and it may lease, usufruct, in whole or in part, practice all the necessary acts for the best use of said goods including maintenance, repair and improvement thereof. |

3It is unnecessary to provide the information referred to in this item with respect to companies that meet the following conditions:

(i) have no liabilities of any kind; and (ii) have as sole assets shares of other companies involved in the operation.

4Information on market risks should be provided in accordance with item 5.1 of the reference form until the amendments made by CVM Instruction 552 of October 9, 2014, in Annex 24 of CVM Instruction No. 480, of December 7, 2009, come into force on January 1, 2016.

5Information on market risks should be provided in accordance with point 4.2 of the reference form until the amendments made by CVM Instruction 552 of October 9, 2014, in Annex 24 of CVM Instruction No. 480, of December 7, 2009, come into force on January 1, 2016.

d. Description of the economic group, under the terms of item 15 of the reference form Copart 5 is directly controlled by Oi, which holds a 100% interest in its capital stock, and is part of the same "Economic Group" of the Company. |

e. Description of the capital stock, pursuant to item 17.1 of the reference form Copart 5 is a closely held corporation that has as its sole shareholder Oi, holder of 100% (one hundred percent) of its capital stock. |

12. Description of the capital and control structure after the operation, pursuant to item 15 of the reference form There shall be no change in the structure of the capital stock and ownership structure of OI after the Merger, since it is a merger of a company whose shares are wholly owned by Oi, with no new shares issued by Oi. |

13. Number, class, type and type of the securities of each company involved in the operation held by any other companies involved in the operation, or by persons related to those companies, as defined by the rules dealing with the public offering for the acquisition of shares OI is the direct holder of all of the shares of the Acquired Company, whose fully subscribed and paid-in capital stock, in the amount of eighty-five million, four hundred and seventy-nine thousand, nine hundred and thirty-three (R$ 85,479,933.24) reais and twenty-four centavos), divided into 1,000 (one thousand) common shares without par value. |

14. Exposure of any of the companies involved in the operation, or persons related thereto, as defined by the rules dealing with the public offering for the acquisition of shares, in derivatives referenced in securities issued by the other companies involved in the operation Not applicable. |

15. Report covering all business conducted in the last six (6) months by the persons indicated below with securities issued by the companies involved in the operation: |

a. Companies involved in operation |

i. Private purchase operations · average price · number of involved shares · involved securities · percentage in relation to the class and type of securities · other relevant conditions |

ii. Private sale operations · average price · number of involved shares · involved securities · percentage in relation to the class and type of securities · other relevant conditions iii. Purchase operations on regulated markets · average price 1,4280 · number of involved shares 1.800.000 · involved securities R$ 2.570.333,00 · percentage in relation to the class and type of securities It represents 1.14% of the PN · other relevant conditions · Not applicable iv. Sales operations on regulated markets · average price · number of involved shares · involved securities · percentage in relation to the class and type of securities · other relevant conditions |

b. Parties related to companies involved in the operation |

i. Private purchase operations · average price · number of involved shares · involved securities · percentage in relation to the class and type of securities · other relevant conditions ii. Private sales operations · average price · number of involved shares · involved securities · percentage in relation to the class and type of securities · other relevant conditions |

iii. Purchase operations on regulated markets · average price · number of involved shares · involved securities · percentage in relation to the class and type of securities · other relevant conditions iv. Sales operations on regulated markets · average price · number of involved shares · involved securities · percentage in relation to the class and type of securities · other relevant conditions None |

16. Document through which the Independent Special Committee submitted its recommendations to the Board of Directors, in case the operation was negotiated pursuant to CVM Guidance Opinion No. 35 of 2008. Not applicable, since the Merger is not subject to Article 264 of Act 6,404/76 and there shall be no exchange relation, since Oi holds all the shares of the Acquired Company. |

Annex 20-A included by CVM Instruction 565, of June 15, 2015.

EXHIBIT VII

Copy of the minutes of the Board of Directors and FISCL COUNCIL’s Meeting

Oi S.A. – In Judicial Reorganization

Corporate Taxpayers’ Registry (CNPJ/MF) No. 76.535.764/0001-43

Board of Trade (NIRE) No. 33.30029520-8

Publicly-Held Company

EXCERPT OF ITEMS (1.II), (6), (7) AND (8) OF THE MINUTES OF THE 217th MEETING OF THE BOARD OF DIRECTORS HELD ON JANUARY 23, 2019.

As Secretary of the Meeting of the Board of Directors, I hereby CERTIFY that items 1.ii “Board’s Secretariat”, 6 “Incorporation of Copart 5,” 7 “PGMC (General Plan of Competition Goals): Wholesale Office” and 8 “Arrangement Matrix” of the minute of the 217th Meeting of the Board of Directors of Oi S.A.- In Judicial Reorganization held on January 23, 2019, at 9:30h, Praia de Botafogo 300, 11th floor, cj. 1101, Botafogo - Rio de Janeiro, contains the following:

“Regardingsub item (1.ii)of the Order of the day, the Chairman of the Board informed of the termination of the Secretary of the Board, Mrs. Luciene Sherique Antaki’s maternity leave, recording her return as of the present date, and the Board’s acknowledgment of Mr. José Augusto da Gama Figueira’s dedication during the time he replaced Mrs. Luciene .”

“Turning toitem (6) of the Order of the Day, Mr. David Tavares presented the incorporation proposal, by the Company, of its wholly-owned subsidiary Copart 5 Participações S.A – In Judicial Reorganization (“Incorporation”), explaining that such corporate restructuring operation is expressly set forth in the Judicial Reorganization Plan (Clause and Annex 7.1 of the Judicial Reorganization Plan) approved and ratified by the Judicial Reorganization Court. As a result of the Incorporation, the net equity of Copart 5 Participações S.A – In Judicial Reorganization (“Copart 5“), currently negative in R$ 56,361,728.42 (fifty six million, three hundred and sixty one thousand, seven hundred and twenty eight reais and forty two cents), shall be incorporated to the Company’s net worth, without alteration to the share capital and to the number of shares issued by the Company and also without dilution of the current assets of the Company. The Board of Directors unanimously: (i) ratified the choice of hiring Valore Consultoria e Avaliações Ltda., to prepare the valuation of the book equity value of Copart 5; (ii) approved the Protocol and Justification of Copart 5 by the Company, which was previously sent to the members of the Board and filed in the Company; (iii) approved the convocation of the Company’s General Shareholders Meeting for March 19, 2019 in order to deliberate the Incorporation and the applicable documents; and (iv)authorize the Company’s Board of Officers to adopt the necessary measures in order to implement the incorporation. In addition, the members of the Board approved the inclusion in the General Meeting’s agenda the amendment of article 5 of the share capital, so that it reflects the capial increases undertaken, and the ratification of the appointment, on October 4, 2018, of Mr. Roger Solé Rafols to become part of the Board of Directors of the Company”.

“Regardingitem (7)of the Order of the Day, considering the regulatory requirement imposed to Oi Group (as a holder of PMS) to formalize, by means of deliberation of the Board of Directors, the existence of a department with the status of an Office, exclusively responsible for all processes of service, commercialization and delivery of the products connected with the Product Reference Offer in the Wholesale Market, Mrs. Adriana Cunha da Costa proposed the ratification of the existence of the Wholesale Office, in compliance with the provision set forth in article 14, paragraph 2 of PGMC’s Annex II. The Board members unanimously approved the proposal. (...).”

“Regardingitem (8)of the Order of the Day, the Company proposed that the current Wholesale Matrix be kept for 35 additional days, until the Board of Directors Meeting to take place on February 27, 2019, considering that a proposal was already sent to the Audit, Risks and Control Committee and that the topic will be discussed at the meeting of February 6th. The Board members unanimously approved the proposal.”

The majority members of the Board were present and affixed their signatures: Mr. Marcos Grodetzky (Chairman of the Board), Maria Helena dos Santos F. Santana,Marcos Bastos Rocha, Rodrigo Modesto de Abreu, Paulino do Rego Barros Jr., José Mauro M. Carneiro da Cunha, Roger Solé Rafols, Henrique José Fernandes Luz and Wallim C. de Vasconcellos Junior.

Rio de Janeiro, January 23, 2019.

Luciene Sherique Antaki

Secretary

Oi S.A. – IN JUDICIAL REORGANIZATION

CNPJ/MF 76.535.764/0001-43

NIRE 33.30029520-8

Publicy-Held Company

MINUTES OF THE MEETING OF THE FISCAL COUNCIL

HELD ON JANUARY 21st, 2019

I. DATE, TIME AND PLACE OF THE MEETING:On the 21st day of January 2019, at 11:00 am, bytelephone contact and the materials were previously presented by the Company.

II. CALL NOTICE: Made by individual messages sent to the Fiscal Council.

III. QUORUM AND ATTENDANCE: All members of the Fiscal Council.

IV. BOARD:Chairman of the Meeting: Mr. Pedro Wagner Pereira Coelho.

V. AGENDA:(1) Opine about the new issuance of common shares to be subscribed by Backstop Investors, in accordance with Clause 6.1.1.3 of the reorganization plan approved by the Creditors’ General Meeting and ratified by the Judicial Reorganization Court (“Plan”) (“Capital Increase - New Funds”) and the Subscription and Commitment Agreement attached to the Plan (“Commitment Agreement”); and(2) Incorporation of the Copart 5 Participações S.A. – In Judicial Reorganization by Oi.

VI. RESOLUTIONS: The meeting having started, the members of the Fiscal Council decided to elect Ms. Daniella Geszikter Ventura to assist with the draft of the minutes. Following toitem (1) of the Agenda, having been clarified by the Company to the members of the Fiscal Council that, in accordance with Clause 6.1.1.3 of the Plan and in the Commitment Agreement, in light of the guarantee commitment of the CapitalIncrease – New Funds undertaken by the Backstop Investors and (i) compliance with the conditions in the plan and in the Commitment Agreement, and (ii) The Backstop Investors representing84,4% of the total guarantee commitment of the Capital Increase – New Funds, they chose to receive the premium of the commitment in new common shares, in accordance with Clause 6.1.1.3 of the Plan and Clause 5 of the Commitment Agreement, strictly under the plan and the Commitment Agreement that was legally ratified, 272,148,705 new common shares nominative and no par value shall be issued, at the issuance price of one real and twenty four cents (R$ 1,24) per share, determined on the basis of independent negotiation undertaken by Oi’s management and its creditors, which shall be subscribed by Backstop Investors entitled to receive in new common shares the credit related to the premium of the guarantee commitment of the Capital Increase – New Funds owed by the Company to the Backstop Investors. In accordance with the Plan and the Commitment Agreement, the shares shall be issued directly and immediately to Backstop Investors that chose to receive the premium of the commitment in shares, which will be delivered to Itaú Unibanco S.A., as the custody agent of the ADS of the The Bank of New York, CNPJ/MF nº 05.523.773/0001-76, depositary institution of the Company’s Deposit Programs, to be issued to the corresponding ADSs and subsequently assigned to the Backstop Investors, as the case may be. The shares and fractions of ADSs that cannot be delivered to Backstoppers Investors will be sold and proceeds from the sale will be delivered to Backstop Investors. Thus, the Fiscal Council issued opinions on the issuance of the shares, since it follows the provisions of the Judicial Reorganization Plan approved by the creditors and approved by the Judicial Recovery Court that such opinion does not represent a manifestation of the Fiscal Council on the merits of the adopted structure.Item (2) of the Agenda, the Company presented a proposal for incorporating it’s integral subsidiary, Copart 5 Participações S.A – in Judicial Reorganization (“Copart 5”). This corporate reorganization is expressly set forth in the Judicial Reorganization Plan (Clause and annex 7.1 of the Plan) approved and ratified by Judicial Recovery Court. As a result of the Merger, the net assets of Copart 5, which is negative in fifty-six million, three hundred and sixty-one thousand, seven hundred and twenty-eightreais and forty-two cents (R$ 56,361,728.42) will be incorporated to the Company’s assets, without changing the Company’s share capital and the amount of shares issued by the Company and also without the Company’s shareholders dilution. The Fiscal Council issued its favorable opinion on the proposed Incorporation, based on the synergy gains of reduction of costs and tax reduction benefits presented by management, and approved the Protocol and Justification of Copart 5 Merger by Oi, including all the annexes, which stablish the general conditions of the Incorporation. One Protocol and Justification copy is annex in this Minute of the Meeting (Annex 1). The Fiscal Council also agreed unanimously on electing Daniela Maluf Pfeiffer to represent the Fiscal Council in the Extraordinary General Meeting of the Company to be summoned to deliberate the subject.

VII. CLOSING: With nothing further to discuss, the Chairman adjourned the Meeting, and these minutes were drafted, read and approved, and signed by all members of the Fiscal Council and by the Secretary.(/s/) Mr(s). Pedro Wagner Pereira Coelho, Alvaro Bandeira, Daniela Maluf Pfeiffer and Domenica Eisenstein Noronha.

These minutes are a true copy of the original registered in the Company’s books.

Rio de Janeiro, January 21, 2019.

Pedro Wagner Pereira Coelho

(Chairman of the Fiscal Council)

EXHIBIT VIII

Article 11 of CVM Ruling No. 481/09

Origin and Justification of the Proposal of Amendment to the Articles of Incorporation

The chart below summarizes the proposed amendment to the Company’s Articles of Incorporation:

Report on the proposed amendment to

OI S.A.’s Articles of Incorporation.

Below is the report, in a chart, detailing the origin and justification of the proposal of amendment to the Company’s Articles of Incorporation and analyzing its occasional legal and economic effects, as per article 11 of CVM Ruling 481/09:

Current wording of the Articles of Incorporation | Text suggested for the Articles of Incorporation | Justification |

Article 5- The capital stock, fully subscribed and paid is of thirty-two billion, thirty-eight million, four hundred and seventy-one thousand, three hundred and seventy-five Reais (BRL 32,038,471,375.00), represented by two billion, three hundred and forty million, sixty thousand, five hundred and five (2,340,060,505) shares, of which two billion, one hundred and eighty-two million, three hundred and thirty-three thousand, two hundred and sixty-four (2,182,333,264) are common shares and one hundred and fifty-seven million, seven hundred and twenty-seven thousand, two hundred and forty-one (157,727,241) are preferred shares, all of them registered and with no par value. | Article 5- The capital stock, fully subscribed and paid is ofthirty-two billion, five hundred and thirty-eight million, nine hundred and thirty-seven thousand, three hundred and seventy Reais (BRL 32,538,937,370.00),represented by five billion, nine hundred and fifty-four million, two hundred and five thousand and one (5,954,205,001) shares, of which five billion, seven hundred and ninety-six million, four hundred andseventy-seven thousand, seven hundred and sixty (5,796,477,760)are common shares and one hundred and fifty-seven million, seven hundred and twenty-seven thousand, two hundred and forty-one (157,727,241) are preferred shares, all of them nominatives and with no par value. | The amendment intends to reflect the value and number of shares of the capital stock after completion of the Capital Increases approved by the Board of Directors, within the authorized capital’s limit, in strict compliance with the Judicial Reorganization Plan and the Commitment Agreement, such Capital Increase – Capitalization of Crédits, including the shares related to the subscription warrants issued to the subscribers of the increase, the Capital Increase - New resources, and the increase resulting from the issuance of new shares because of the commitment premium, as set forth in Clause 6.1.1.3 of the Plan and in the Commitment Agreement. |

OI S.A.

Corporate Taxpayer’s Registry (CNPJ/MF) No. 76.535.764/0001-43

Board of Trade (NIRE) No. 33.3.0029520-8

Publicly Held Company

Bylaws

CHAPTER I

LEGAL SYSTEM

Article 1- Oi S.A. (“Company”) is a publicly held company, which is governed by the present Bylaws and applicable legislation.

1st Paragraph -Once the Company is admitted to the special listing segment known as Level 1 Corporate Governance of theB3 S.A. – Brasil, Bolsa, Balcão (“B3”), the Company, its shareholders, management and members of its Audit Committee, shall be subject to the provisions of the Listing Regulations of the Level 1 Corporate Governance of B3 (“Level 1 Listing Regulations”).

2nd Paragraph- The Company, its management and shareholders shall comply with the provisions of the regulations for listed issuers and admission for securities trading, including rules regarding delisting and exclusion from trading securities admitted for trading on organized markets administered by B3.

3rd Paragraph- Capitalized terms, when not defined in these Bylaws, shall have the meaning given to them in the Level 1 Listing Regulations.

Article 2- The object of the Company is to offer telecommunications services and all activities required or useful for the delivery of these services, in accordance with concessions, authorizations and permits granted thereto.

Sole Paragraph -In connection with achieving of its object, the Company may include goods and rights of third parties in its assets, as well as:

I. hold equity interests in the capital of other companies;

II. organize fully-owned subsidiaries for the performance of activities comprising its object, which are recommended to be decentralized;

III. perform or procure the importation of goods and services that are necessary for the execution of the activities comprised in its object;

IV. render technical assistance services to other telecommunications companies, performing activities of common interest;

V. perform research and development activities seeking to develop the telecommunications sector;

VI. enter into contracts and agreements with other telecommunications service companies or any person or entity, seeking to ensure the operation of its services, without prejudicing its activities and responsibilities; and

VII. perform other activities related or correlated to the Company’s corporate object.

Article 3- The Company is headquartered in the City of Rio de Janeiro, State of Rio de Janeiro, and may, by decision of its Board of Executive Officers, in compliance with Article 39, create, change the address and close branches and offices of the Company.

Article 4- The duration of the Company is indefinite.

CHAPTER II

CAPITAL STOCK

Article 5- The capital stock, fully subscribed and paid is of thirty-two billion, five hundred and thirty-eight million, nine hundred and thirty-seven thousand, three hundred and seventy Reais (BRL 32,538,937,370.00), represented by five billion, nine hundred and fifty-four million, two hundred and five thousand and one (5,954,205,001) shares, of which five billion, seven hundred and ninety-six million, four hundred and seventy-seven thousand, seven hundred and sixty (5,796,477,760) are common shares and one hundred and fifty-seven million, seven hundred and twenty-seven thousand, two hundred and forty-one (157,727,241) are preferred shares, all of them nominatives and with no par value.

1st Paragraph- The issuance of participation certificates and new preferred shares by the Company is prohibited.

2nd Paragraph- The preferred shares may be converted into common shares, at the time and under the conditions approved by the Board of Directors of the Company.

3rd Paragraph- All of the shares of the Company are book-entry shares, and are held in a deposit account with a financial institution authorized by the Brazilian Securities Commission(Comissão de Valores Mobiliários - “CVM”), on behalf of their holders, and are not available in certificated form.

4th Paragraph- Transfer and registration costs, as well as the cost of service on the book-entry shares may be charged directly to the shareholder by the depositary institution as provided in Article 35, 3rd Paragraph of Law No. 6,404 of December 15, 1976 (“Corporate Law”).

Article 6- The Company is authorized to increase its capital stock by resolution of the Board of Directors, in common shares, until its capital stock reaches R$38,038,701,741.49, it being understood that the Company may no longer issue preferred shares in capital increases by public or private subscription.

Sole Paragraph- Within the authorized capital limit, the Board of Directors may:

i. deliberate on the issuance of bonds and debentures convertible into shares; and

ii. according to a plan approved at a Shareholders’ Meeting, grant an option to purchase stock to its management, employees of the Company or of its subsidiaries and/or individuals who render services to them, without the shareholders having preemptive rights to the subscription of such stock.

Article 7- Through a resolution of the Shareholders’ Meeting or of the Board of Directors, as the case may be, the Company’s capital stock may be increased by capitalizing profit or reserves.

Sole Paragraph- Any such capitalization shall be made with no alteration to the number of shares issued by the Company.

Article 8- The capital stock is represented by common and preferred shares, with no par value, and there is no requirement that the shares maintain their current proportions in future capital increases.

Article 9- Through resolution of a Shareholders’ Meeting or the Board of Directors, as the case may be, the period for exercising the preemptive right for the subscription of shares, subscription of bonds or debentures convertible into shares in the cases provided in Article 172 of the Corporate Law, may be excluded or reduced.

Article 10- Non-payment by the subscriber of the issuance price as provided in the list or call shall cause it to be legally in default, for the purposes of Articles 106 and 107 of the Corporate Law, being subject to payment of the overdue amount adjusted for inflation in accordance with the fluctuation of the Market Price Index - IGP-M in the shortest period permitted by law, in addition to interest of 12% (twelve percent) per year,“pro rata temporis” and a fine of 10% (ten percent) of the amount overdue, duly adjusted for inflation.

CHAPTER III

SHARES

Article 11- Each common share is entitled to the right to one vote at the deliberations of the Shareholders’ Meetings.

Sole Paragraph- Ordinary shares entitle their holders to the right to be included in a public offering of shares resulting from the sale of control of the Company at the same price and under the same terms offered to the seller, pursuant to Article 46 of these Bylaws.

Article 12- The preferred shares have no right to vote and are assured priority in the payment of the minimum and non-cumulative dividend of 6% (six percent) per year calculated as a percentage of the amount resulting from dividing the capital stock by the total number of shares of the Company, or 3% (three percent) per year calculated as a percentage of the book value of shareholders’ equity divided by the total number of shares of the Company, whichever is higher.

1st Paragraph- The preferred shares of the Company, in compliance with the terms of the first paragraph of this Article, shall be granted the right to vote, through separate voting, in the decisions related to the hiring of foreign entities related to the controlling shareholders, in the specific cases of management service agreements, including technical assistance.

2nd Paragraph- The preferred shares of the Company, in compliance with the terms of the first paragraph of this Article, shall be granted the right to vote in the decisions related to employment of foreign entities related to the controlling shareholders, in terms of management services, including technical assistance, and the amounts of which shall not exceed in any given year, until the termination of the concession, 0.1% (zero point one percent) of annual sales for the Fixed Switched Telephone Service of the Telecommunication Transport Network.

3rd Paragraph- The preferred shares shall acquire the right to vote if the Company fails to pay the minimum dividends to which they are entitled for 3 (three) consecutive years, in accordance with the terms of this article.

CHAPTER IV

SHAREHOLDERS’ MEETING

Article 13- The Shareholders’ Meeting shall be held ordinarily once a year and extraordinarily when convened pursuant to law or to these Bylaws.

Article 14- The Shareholders’ Meeting shall be convened by the Board of Directors, or the manner in sole paragraph of Article 123 of the Corporate Law.

Article 15-The Shareholders’ Meeting shall be convened and presided over by the Chairman of the Board of Directors or the individual appointed, either at the time of the Meeting, or in advance, by means of a power of attorney with specific powers. In the absence of the Chairman of the Board of Directors or at the election of the Chairman of the Board of Directors, the Shareholders’ Meeting shall be convened and presided over by the Vice-Chairman of the Board of Directors or whomsoever appointed, or by means of a proxy previously granted with specific powers. In the event of the absence of the Vice-Chairman of the Board or his or her appointment, it shall be incumbent upon any Statutory Officer present to convene and preside over the General Meeting. The Chairman of the meeting, in turn, shall choose the corresponding secretary.

Article 16- Before convening the Shareholders’ Meeting, the duly identified shareholders shall sign the Shareholders’ Attendance Book.

Sole Paragraph -The signing of the shareholders’ attendance list shall be ended by the Chairman of the Meeting at the time the Shareholders’ Meeting is convened.

Article 17 -The following formal requirements for attendance at the Shareholders’ Meeting will be required to be complied with by the Company and the Board, in addition to the procedures and requirements provided for by law:

(i) Up to 2 (two) business days prior to the Shareholders’ Meeting, each shareholder shall have sent to the Company, at the address indicated in the Call Notice, proof of or a statement issued by the depositary institution or the custodian, containing its respective equity interest, and issued by the competent body within 3 (three) business days prior to the Shareholders’ Meeting; and (i) if the shareholder is a Legal Entity, certified copies of its Certificate of Incorporation, Bylaws or Articles of Association, the minutes of the meeting electing its Board of Directors (if any) and minutes of the election of the Board of Executive Officers that contains the election of the legal representative(s) attending the Shareholders’ Meeting; or (ii) if the shareholder is an Individual, certified copies of its identity documents and tax identification number; and (iii) if the shareholder is a Fund, certified copies of the regulations of the Fund and the Bylaws or Articles of Association of the manager of the Fund, as well as minutes of the meeting of the election of the legal representative(s) attending the Meeting. In addition to the documents listed in (i), (ii) and (iii), as the case may be, when the shareholder is represented by a proxy, it shall submit along with such documents the respective proxy, with special powers and notarized signature, as well as certified copies of the identity documents and minutes of the meeting of the election of the legal representative who signed the proxy to confirm its powers of representation, in addition to the identity documents and tax identification numbers of the attorney in fact in attendance.

(ii)A copy of the documents referred to in the previous paragraph may be submitted, and the original documents referred to in the subsection above shall be presented to the Company prior to convening the Shareholders’ Meeting.

Article 18- The resolutions of the Meeting, except as otherwise provided by law or by these Bylaws, shall be taken by a majority vote of those present or represented, not counting abstentions.

Article 19- The discussions and deliberations of the Shareholders’ Meeting shall be written in the book of minutes, signed by the members of the board and by the shareholders present, which represent, at least, the majority required for the deliberations made.

1st Paragraph- The minutes may be drafted in summarized form, including dissent and objections.

2nd Paragraph- Except for resolutions to the contrary by the Shareholders’ Meeting, the minutes shall be published without signatures of the shareholders.

Article 20- In addition to the other duties provided by law and by these Bylaws, the Shareholders’ Meeting shall be solely responsible for the following:

(i) elect and remove members from the Board of Directors and the Audit Committee;

(ii) establish the aggregate remuneration of members of the Board of Directors and members of the Audit Committee;

(iii) approve plans to grant stock options to purchase shares to officers and employees of the Company or companies under its direct or indirect control and/or individuals who provide services to the Company;

(iv) deliberate on the allocation of annual net income and the distribution of dividends;

(v) authorize management to file for bankruptcy, request bankruptcy protection or file for bankruptcy protection;

(vi) deliberate on a proposed delisting of the Company from the special listing segment of Level 1 Corporate Governance of B3; and

(vii) choose the institution or specialized companies to evaluate the Company in the cases provided for in the Corporate Law and in these Bylaws.

CHAPTER V

COMPANY’S MANAGEMENT

Section I

General Rules

Article 21- Management of the Company shall be overseen by the Board of Directors and by the Board of Executive Officers.

1st Paragraph- The appointment of members of management will not require a guarantee and will be accomplished through execution of the instrument of appointment in the Minutes Book of the Meetings of the Board of Directors or the Board of Executive Officers, as appropriate. The appointment of members of management shall be subject to the prior subscription of the Term of Consent of Management(Termo de Anuência dosAdministratores) in accordance with the Level 1 Listing Regulations and the Statement of Consent to the Code of Ethics and the Disclosure and Securities Trading Policies adopted by the Company, and compliance with applicable legal requirements.

2nd Paragraph- The positions of Chairman of the Board of Directors and Chief Executive Officer or principal executive of the Company may not be held by the same person.

Section II

Board of Directors

Article 22 -The Board of Directors is comprised of 11 (eleven) members, all elected and dismissible through the Shareholders’ Meeting, with a combined term of 2 (two) years; reelection permitted.

1st Paragraph- Only the individuals who meet the following, in addition to legal and regulatory requirements, can be elected to serve on the Board of Directors: (i) do not hold positions in companies that may be considered competitors of the Company or its subsidiaries in the marketplace, in particular, on advisory, management and/or audit committees; and (ii) have no conflict of interest with the Company or with its subsidiaries.

2nd Paragraph- Holders of preferred shares shall be entitled to elect, by separate vote, a member of the Board of Directors.

3rd Paragraph- Amendments of the terms set forth in the 2nd Paragraph of this Article shall require separate approval by the holders of preferred shares.

4th Paragraph- The members the Board of Directors shall remain in office after the end of the term until appointment of their replacements.

Article 23- The Chairman and the Vice-Chairman of the Board of Directors shall be appointed by the Board Members, in the first meeting of the Board of Directors to be held after the General Shareholders’ Meeting that elects the Board Members, in compliance with the provisions of Paragraph 2 of Article 21

1st Paragraph- The Chairman of the Board of Directors shall be responsible for convening the meeting of the Board of Directors and arranging for convening the Shareholders’ Meetings, when approved by the Board of Directors.

2nd Paragraph– In the event of an disability or temporary absence, the Chairman shall be replaced by the Vice-Chairman or, in his absence, by another Director appointed by the Chairman of the Board and, if there is no indication, by other members of the Board.

3rd Paragraph - In the event of a permanent vacancy in the position of Chairman or Vice-Chairman of the Board of Directors, the new chairman will be appointed by the Board of Directors from among its members, at a meeting specially convened for this purpose.

Article 24- At least 20% (twenty percent) of the members of the Board of Directors shall be Independent Members of the Board of Directors, in the manner prescribed in the Novo Mercado Listing Rules, and expressly declared as such in the minutes of the Shareholders’ Meeting electing them, andshall be considered as independent members of the Board of Directors elected pursuant to the provisions under Article 141, §§ 4 and 5 of the Corporate Law.

Sole Paragraph- When, in connection with the calculation of the percentage referred to in the first paragraph of this Article, the result is a fractional number of members of the Board of Directors, the Company shall round the number to the nearest whole number immediately higher.

Article 25- Except as provided in Article 26 hereof, the election of members of the Board of Directors will be done through a slate system.

1st Paragraph- In the election covered by this Article, only the following may compete as part of the slates: (a) those nominated by the Board of Directors; or (b) those that are nominated, pursuant to the 3rd Paragraph of this Article, by any shareholder or group of shareholders.

2nd Paragraph- The Board of Directors shall, before or on the day of convening the Shareholders’ Meeting to elect the members of the Board of Directors, disclose the management’s proposal, indicating the members of the proposed slate and post a statement signed by each member of the slate nominated thereby, at the Company, including: (a) his or her complete qualifications; (b) a complete description of his or her professional experience, mentioning professional activities previously performed, as well as professional and academic qualifications; and (c) information about disciplinary and judicial proceedings in which he or she has been convicted in a final and unappealable decision, as well as information, if applicable, on the existence of cases of being barred or conflict of interest, pursuant to Article 147, 3rd Paragraph of the Corporate Law.