Exhibit 1

This document is a free translation of the Brazilian judicial administrator’s report referred to March 2019 financial information of Oi S.A. and some of its subsidiaries (“RJ Debtors”) filled within the 7th Business Court of Rio de Janeiro on May 15, 2019. Due to the complexities of language translation, translations are not always precise. The original document was prepared in Portuguese, and in case of any divergence, discrepancy or difference between this version and the Portuguese version, the Portuguese version shall prevail. The Portuguese version is the only valid and complete version and shall prevail for any and all purposes. There is no assurance as to the accuracy, reliability or completeness of the translation. Any person reading this translation and relying on it should do so at his or her own risk.

To Your Honor, JUDGE OF THE 7th BUSINESS COURT OF THE DISTRICT OF THE CAPITAL OF THE STATE OF RIO DE JANEIRO

Case number 0203711-65.2016.8.19.0001

Av. Pres. Juscelino Kubitschek, 510, 8º andar | Postal Cde 04543-906 | São Paulo, SP Phone: +55 11 3074 6000 waldsp@wald.com.br | Franklin Roosevelt Avenue: 115, 4º andar | Postal Code 20021-120 | Rio de Janeiro, RJ Phone: +55 21 2272 9300 waldrj@wald.com.br | SCN, Quadra 04, Nº 100 Bloco B, Petala D, 702 B | Centro Empresarial Varig | Postal Code 70714-900 Brasília, DF | Phon: +55 61 3410 4700 walddf@wald.com.br |

Court-supervised reorganization of Oi S.A and others

TheJUDICIAL ADMINISTRATOR (Arnoldo Wald Law Firm), appointed in the process of Court-supervised reorganization of Oi S.A. and others, respectfully requests that you determine the attachment of the Monthly Activity Report ("RMA") for the month of March 2019.

Rio de Janeiro, May 15, 2019.

Judicial Administrator

Law Office Arnoldo Wald

Av. Pres. Juscelino Kubitschek, 510, 8º andar | Postal Cde 04543-906 | São Paulo, SP Phone: +55 11 3074 6000 waldsp@wald.com.br | Franklin Roosevelt Avenue: 115, 4º andar | Postal Code 20021-120 | Rio de Janeiro, RJ Phone: +55 21 2272 9300 waldrj@wald.com.br | SCN, Quadra 04, Nº 100 Bloco B, Petala D, 702 B | Centro Empresarial Varig | Postal Code 70714-900 Brasília, DF | Phon: +55 61 3410 4700 walddf@wald.com.br |

EXECUTIVE

REPORT

1 | Introduction | 03 |

2 | Organizational Chart of the Oi Group / Companies undergoing Reorganization | 05 |

3 | Relevant Facts & Notices to the Market published | 09 |

4 | Financial Information (Consolidated for the Companies undergoing Reorganization) | 12 |

| 4.1 | Managerial Cash Flow Statement | 13 |

| 4.2 | Balance Sheet of the Companies undergoing Reorganization | 19 |

| 4.3 | Income Statement of the Companies undergoing reorganization | 27 |

5 | Attendance to creditors | 30 |

6 | Demonstrations presented by the Judicial Administrator - AJ | 31 |

7 | Supervision and Compliance with the Court-supervised reorganization Plan - PRJ | 33 |

2

1 - Introduction | EXECUTIVE REPORT | |

INTRODUCTION

To Your Honor JUDGE OF THE 7th BUSINESS COURT OF THE DISTRICT OF THE CAPITAL OF THE STATE OF RIO DE JANEIRO

The Judicial Administrator, Law Firm Arnoldo Wald ("Wald" or "AJ"), appointed in the records of the Court-supervised reorganization of the Oi Group (case number 0203711- 65.2016.8.19.0001), and RC Consultores, subcontracted by the Judicial Administrator - AJ to assist in the preparation of the Monthly Activity Report ("RMA"), come, respectfully, to your presence, under the terms of the decision of pages 91.223 / 91.224, to present the Monthly Activity Report - RMA for the month of March 2019 and the 1st quarter of 2019.

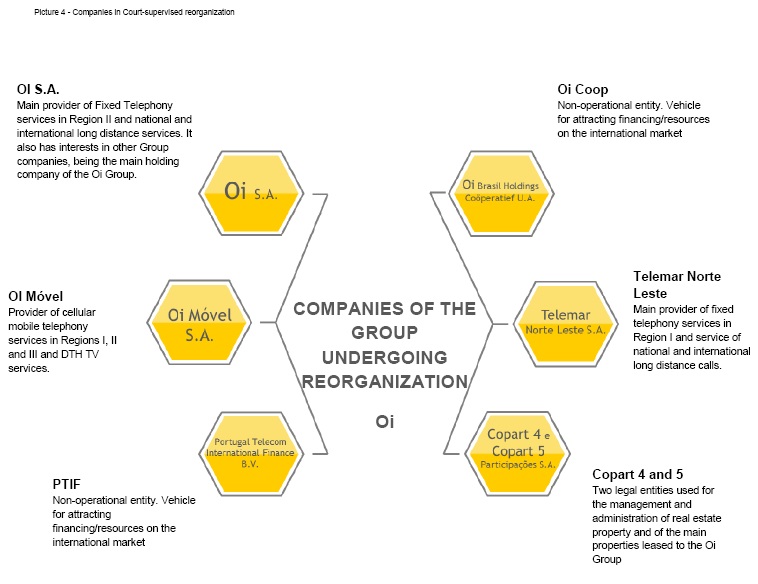

As we know, Court-supervised reorganization involves the following companies:

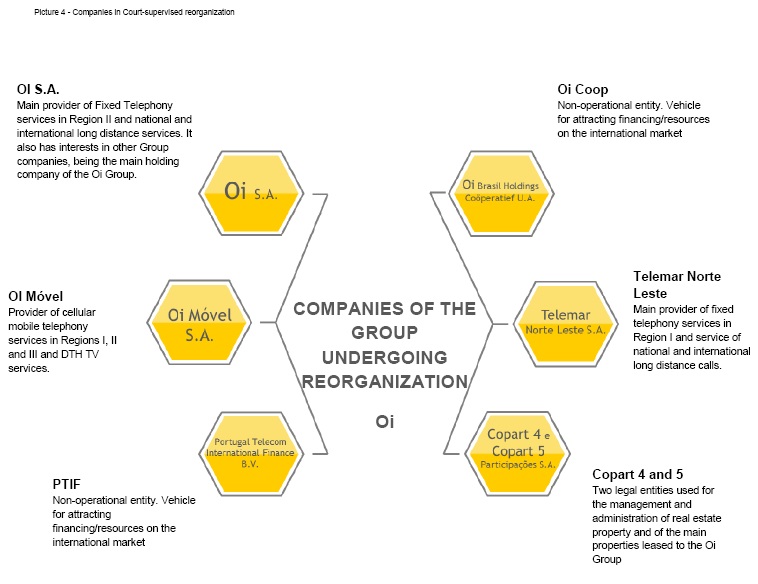

Oi S.A. - under Court-supervised reorganization ("Oi S.A.");

Telemar Norte Leste S.A. – under Judicial Reorgnization ("Telemar Norte Leste");

Oi Móvel S.A. - under Court-supervised reorganization ("Oi Móvel");

Copart4 Participações S.A. - under Court-supervised reorganization ("Copart4");

Copart5 Participações S.A. - under court-supervised reorganization ("Copart5");

Portugal Telecom International Finance B.V. - under Court-supervised reorganization ("PTIF"); and

Oi Brasil Holdings Coöperatief U.A. -under Court-supervised reorganization ("Oi Coop").

This report, which includes financial information based mainly on information provided by the Companies undergoing Reorgnization until May 15, 2019, contains data regarding the month of March 2019, and should be analyzed together with the preliminary report of activities, as well as with the other previously presented Monthly Activity Reports.

The Monthly Activity Report - RMA will have a chapter specifically focused on the consolidated financial information of the Companies undergoing Reorganization, which in this Report will cover the Managerial Cash Flow Statement for that month, presented in the tables in comparison with the immediately preceding month, in addition to the information relating to the Balance Sheet and the Statement of Income of the Companies undergoing Reorganization, with the analysis based on a quarterly comparison between the 1st quarter of 2019 and the 4th quarter of 2018. The report shall highlight the main variations that occurred during the period in question, presenting the clarifications provided by the Management of the Companies undergoing Reorganization.

* Copart4 Participações S.A. was merged into Telemar Norte Leste S.A. in January 2019, as set forth in clause 7, annex 7.1, of the Court Supervised Reorganization Plan - PRJ; Copart5 Participações S.A. was merged into Oi S.A. in March 2019, as set forth in clause 7, annex 7.1, of the Court Supervised Reorganization Plan - PRJ.

3

1 - Introduction | EXECUTIVE REPORT | |

This report, prepared through analytical procedures and discussions with the Company's management, aims to provide the Court and interested parties with information on the financial situation of the Companies undergoing Reorganization and the relevant operations carried out by them, as well as a summary of the activities carried out by the Judicial Administrator - AJ up to the closing of this report.

The information presented below is based mainly on data and elements submitted by the Companies undergoing Reorganization. The individual financial statements of all Companies undergoing Reorganization, as well as the consolidated financial statements of the Oi Group (which include but are not limited to Companies undergoing Reorganization) are audited annually by independent auditors. Limited review procedures are applied by the auditors for the filing with the Securities and Exchange Commission - CVM of consolidated Quarterly Financial Information ("ITRs") Of the Oi Group. With respect to the individual financial information of each Company undergoing Reorganization, prepared in monthly periods other than those that comprise the Quarterly Financial Information ITR delivered to the Securities and Exchange Commission -CVM, these are not subject to independent audit, either by the auditors hired by the Oi Group or by the Judicial Administrator - AJ.

The Judicial Administrator - AJ, honored with the task assignedto himm, is available for further clarification on the information contained in this report or other additional information.

Yours sincerely,

| |

|

Arnoldo Wald Filho awf@wald.com.br Samantha Mendes Long samantha@wald.com.br Partners Telephone: +55 (11) 3074-6000 | | Marcel Augusto Caparoz Chief Economist marcel@rcconsultores.com.br Telephone: +55 (11) 3053-0003 |

4

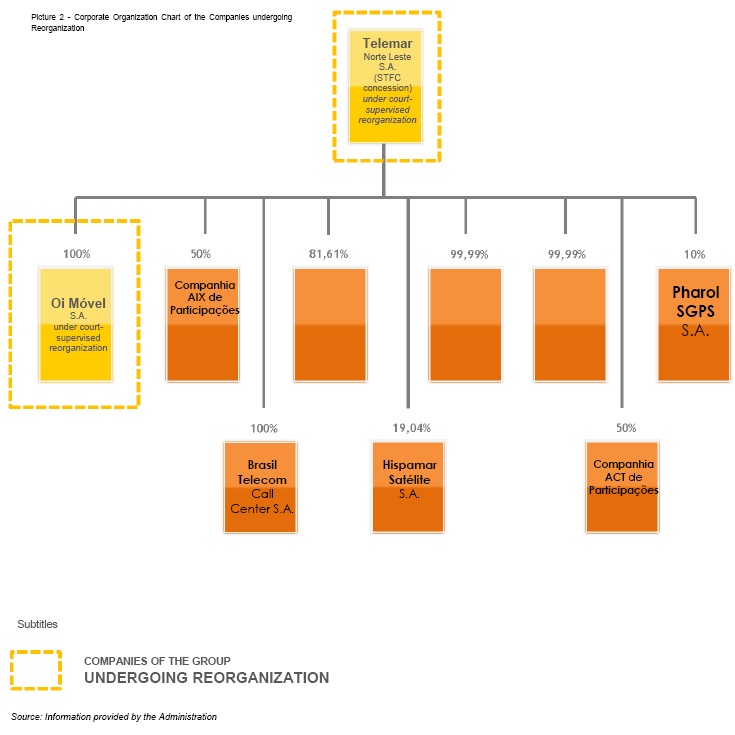

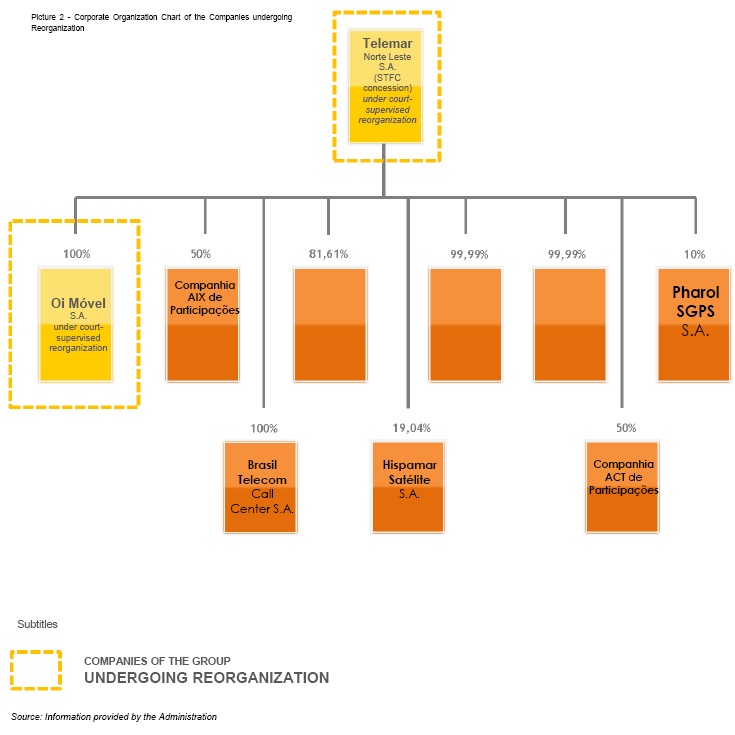

2 Corporate Organization Chart of the Companies undergoing Reorganization | EXECUTIVE REPORT | |

CORPORATE ORGANIZATION CHART OF THE COMPANIES UNDERGOING REORGANIZATION

* Chart previously presented in the Preliminary Activity Report.

Information presented again to facilitate the understanding of the structure of the Companies undergoing Reorganization

5

2 Corporate Organization Chart of the Companies undergoing Reorganization | EXECUTIVE REPORT | |

CORPORATE ORGANIZATION CHART OF THE COMPANIES UNDERGOING REORGANIZATION

* Chart previously presented in the Preliminary Activity Report.

Information presented again to facilitate the understanding of the structure of the Companies undergoing Reorganizaiton

6

2 Corporate Organization Chart of the Companies undergoing Reorganization | EXECUTIVE REPORT | |

CORPORATE ORGANIZATION CHART OF THE COMPANIES UNDERGOING REORGANIZATION

* Chart previously presented in the Preliminary Activity Report.

Information presented again to facilitate the understanding of the structure of the Companies undergoing Reorganization

7

2 Brief description of the Companies undergoing Reorganization | EXECUTIVE REPORT | |

COMPANIES UNDER COURT-SUPERVISED REORGANIZATION

8

Relevant Facts & Announcements to the Market published | EXECUTIVE REPORT | |

RELEVANT FACTS & ANNOUNCEMENTS TO THE MARKET

The following are some of the relevant facts and announcements to the market disclosed by the Oi Group that are directly related to the Companies undergoing Reorganization:

Material Facts and Announcements to the Market in the month ofMARCH/19

March 19th - New Board of Directors Unitel

Oi S.A. - Oi S.A. -under Court-supervised reorganization ("Oi"), informed its shareholders and the market in general that a General Meeting of the Angolan telecommunications company Unitel S.A. ("Unitel") was held on that date, in which a new Board of Directors was elected, composed of five members, two of whom were appointed by PT Ventures SGPS S.A. ("PT Ventures"), an indirect subsidiary of Oi.

It informed further that, among the two members appointed by PT Ventures, one of them will hold the position of Chief Executive of Unitel, a position that had been held until this date by Mr. Antony Dolton.

In this way, the Board of Directors of Unitel will be able to count on Mr. António Miguel Ferreira Geraldes (Chief Executive Officer) and on Mr. Luiz Henrique Soares Rosa, both nominated by PT Ventures. In addition to them, the following were also elected to the Board of Directors of Unitel.Mr. João Boa Francisco Quipa, Ms. Isabel José dos Santos and Mr. Amílcar Frederico Safeca.

The relevant fact can be accessed at:

https://www.oi.com.br/ri/conteudo_en.asp?language=0&type=43089&conta=28&id=256681

9

Relevant Facts & Announcements to the Market published | EXECUTIVE REPORT | |

RELEVANT FACTS & ANNOUNCEMENTS TO THE MARKET

Relevant Facts and Announcements to the Market during the month ofAPRIL/19

April 3rd- Approval of the Agreement between Oi and Pharol

Oi S.A. - In Court-supervised reorganization ("Oi" or "Company") comes, in addition to the Relevant Fact disclosed by Oi and to the Announcement disclosed by its indirect shareholder Pharol SGPS S.A. ("Pharol"), both on January 9, 2019, to inform the market that the Approval of the Instrument became effective, pursuant to the Agreement entered into on January 8, 2019 between Oi, its direct shareholder Bratel S.à.r.l. ("Bratel") and Pharol (together, "Parties"), because fifteen (15) business days passed after the publication of the judicial decision that granted it.

Thus, as determined in the Agreement, the period for the fulfilment of the second part of the obligations of both Parties to the Agreement begins on this date, including (a) the request for termination of all disputes involving the Parties indicated in the instrument of the Agreement ("Disputes") and (b) the delivery to Bratel of 33.8 million shares of Oi that are in its Treasury, being 32 million common shares and 1.8 million preferred shares.

In addition, several obligations and rights of the Parties described in the Material Fact disclosed by Oi and in the Announcement disclosed by Pharol both on January 9, 2019, which, under the terms of the Agreement, could be resolved in case of non-validation by the Court-supervised reorganization Court, are fully improved.

The announcement to the market can be accessed at:

https://www.oi.com.br/ri/conteudo_en.asp?type=43700&id=0&language=0&account=28&idsecao=43852&ano=2019&mes=04

10

3Relevant Facts & Announcements to the Market published | EXECUTIVE REPORT | |

RELEVANT FACTS & ANNOUNCEMENTS TO THE MARKET

Relevant Facts and Announcements to the Market in the month ofMAY/19

May 8th - ANATEL Decision

Oi S.A. – under Court-supervised reorganization ("Oi" or "Company") informed its shareholders and the market in general that it became aware, as of the publication in the Official Gazette of the Union (DOU)Of the Ruling No. 226, issued by the Board of Directors of the National Telecommunications Agency - ANATEL on May 3rd, 2019 ("Decision"), by which the Board of Directors decided, among other points, to maintain the special monitoring of the provision of telecommunications services by the companies that are part of the Oi Group for the year 2019, by imposing the following requirements on its telecommunications service providers and holding companies:

a) to maintain the timely notice to Anatel of the call for meetings of its Board of Directors, with a view to the participation of representatives of this autarchy;

b) that they also give noticce to the Agency of their participation in meetings of the various administrative advisory committees, such as the Court-supervised reorganization Plan Implementation Committee, the Audit, Risks and Controls Committee, among others, when the issues to be addressed are related to the actions outlined in the court-supervised reorganization plan, in particular, issues related to: (b.1) the disposal of assets, as provided for in item 5.1 of the Court-supervised reorganization Plan; (b.2) additional forms of financing, either through the public issue of common shares or new debt instruments, or through the contracting of new lines of credit for importing equipment, pursuant to item 5.3 of the Court-supervised reorganization Plan; and, (b.3) corporate reorganization, pursuant to item 7 of the Court-supervised reorganization Plan;

c) that they submit to Anatel, by means of a detailed report, within 60 days of being informed of such decision: (c.1) its consolidated cash flow, divided between operating cash flow, cash flow from investment activities and cash flow from financing activities, carried out in 2018, as well as a comparison with the provisions of Annex 2.6 of the Court-supervised reorganization Plan, and justification for the differences between the realized and the foreseen; and (c.2) the adjusted forecast of its discounted consolidated cash flow, divided into operating cash flow, cash flow from investment activities and cash flow from financing activities, for the period until the end of the concessions of the Fixed Commuted Telephone Service (STFC). Such a forecast shall be accompanied by the economic and financial hypotheses and assumptions on which it is based, especially the expected profitability of the main planned investments, as well as the cost of borrowing and contracting loans and financing and their compatibility with the planned investments. In this forecast, the sources of funds shall be highlighted, particularly those arising (c.2.1) from the realization of divestments in the capital of other companies, whether they are telecommunications providers or not, (c.2.2) from the realization and approval of transactions with related parties, constitution of liens or encumbrances of any nature on the permanent assets, and provision of guarantees linked to the assets and rights of the concessionaires of the group, and (c.2.3) the realization of permanent assets that have a direct or indirect relationship with the delegated telecommunications services;

d) that they should provide access to documents, accounting, legal, economic-financial and operational information that have served as a basis for the decisions taken on the themes listed above;

e) that they forward the minutes and other records of the meetings of the aforementioned forums, signed by all members who participated in them by videoconference, or telephone, within up to two business days, counted from the signature of the last member attending the meeting;

f) that they should submit to the prior consent of this Agency, with the presentation of updated information related to its control, in fact and in law, the changes of the members of the Board of Directors, including with respect to alternates, and any agreements that directly or indirectly interfere with the exercise of their control; e,

g) communicate to the Superintendence of Competition the negotiations of relevant participations of its capital stock, higher than 5% of the voting capital, at the stock exchange, in the shortest possible time compatible with the closing of trades in the spot market of B3 S.A. - Brasil, Bolsa, Balcão.

Oi has indicated that it has not yet had access to the documents justifying this decision. Besides, the Company also became aware of Anatel's Board or Directors’ Ordinance nº 819, of May 3, 2019, by which a Working Group was established to monitor the operational and economic-financial situation of the companies comprising the Oi Group. The full text of the Ruling and Ordinance is attached to this Announcement to the Market. A translation of these documents into English will be sent as soon as possible to the US Securities and Exchange Commissionby means of Form 6-K.

The announcement to the market can be accessed at:

https://www.oi.com.br/ri/conteudo_en.asp?language=0&conta=28&type=43700

11

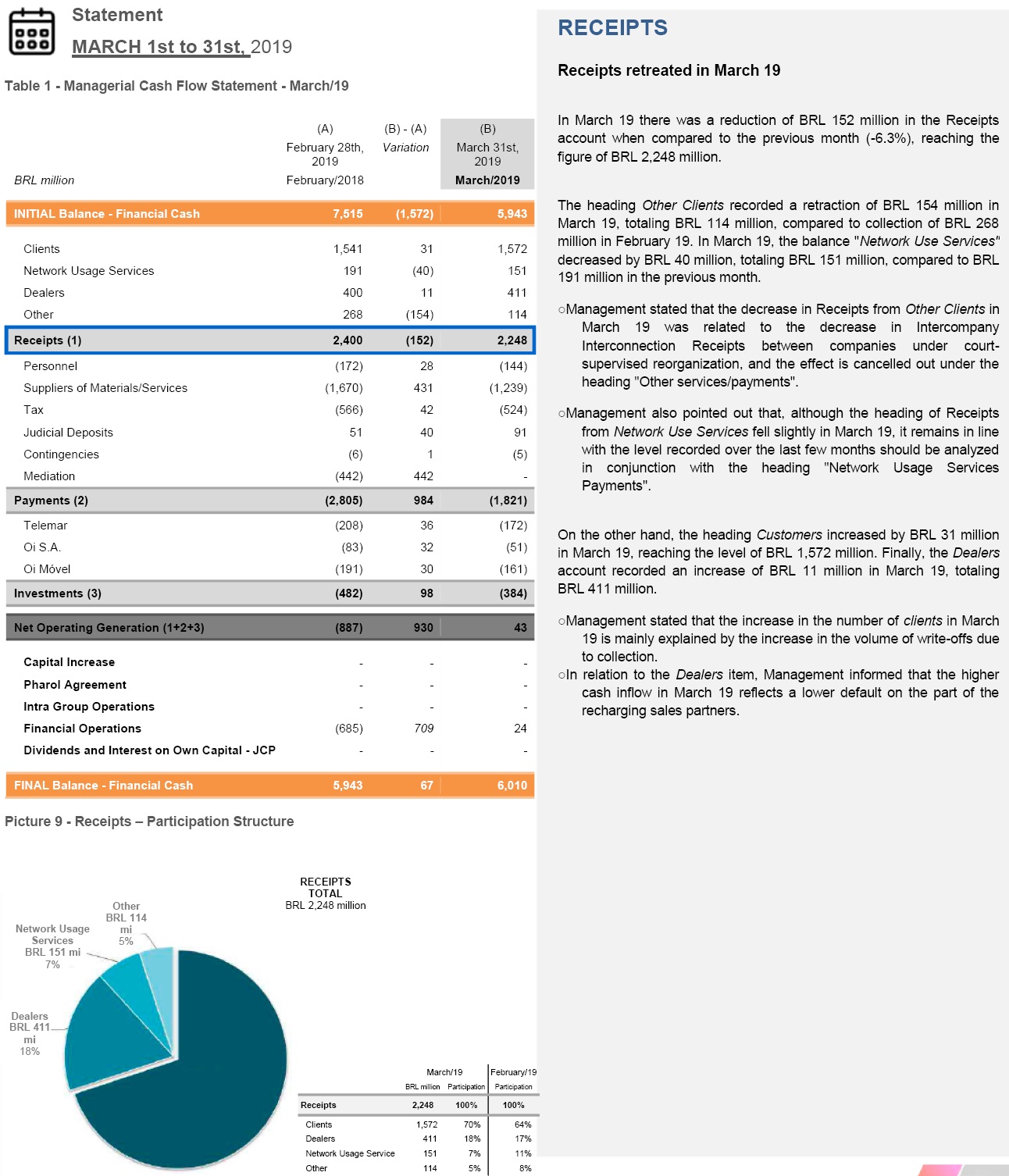

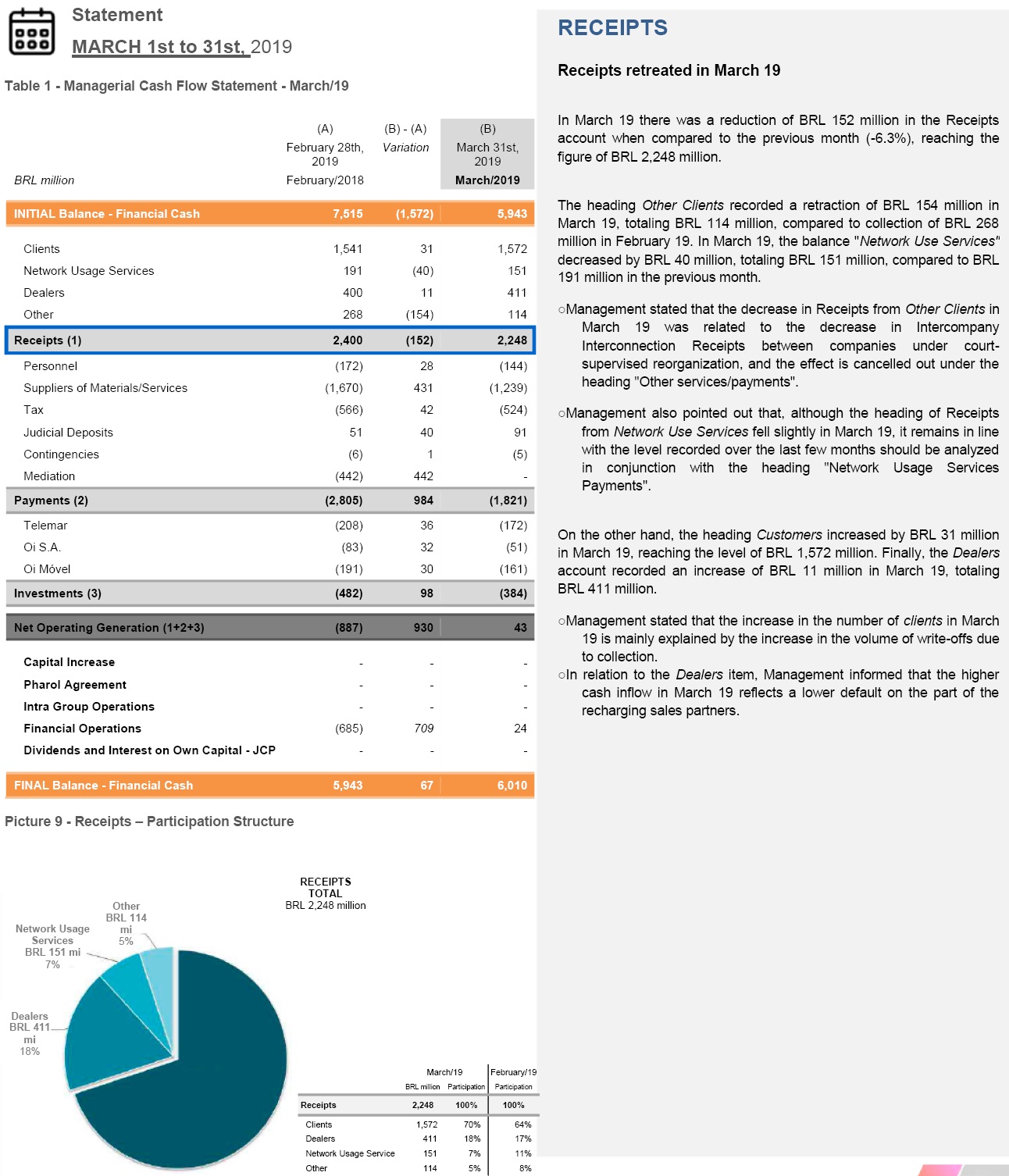

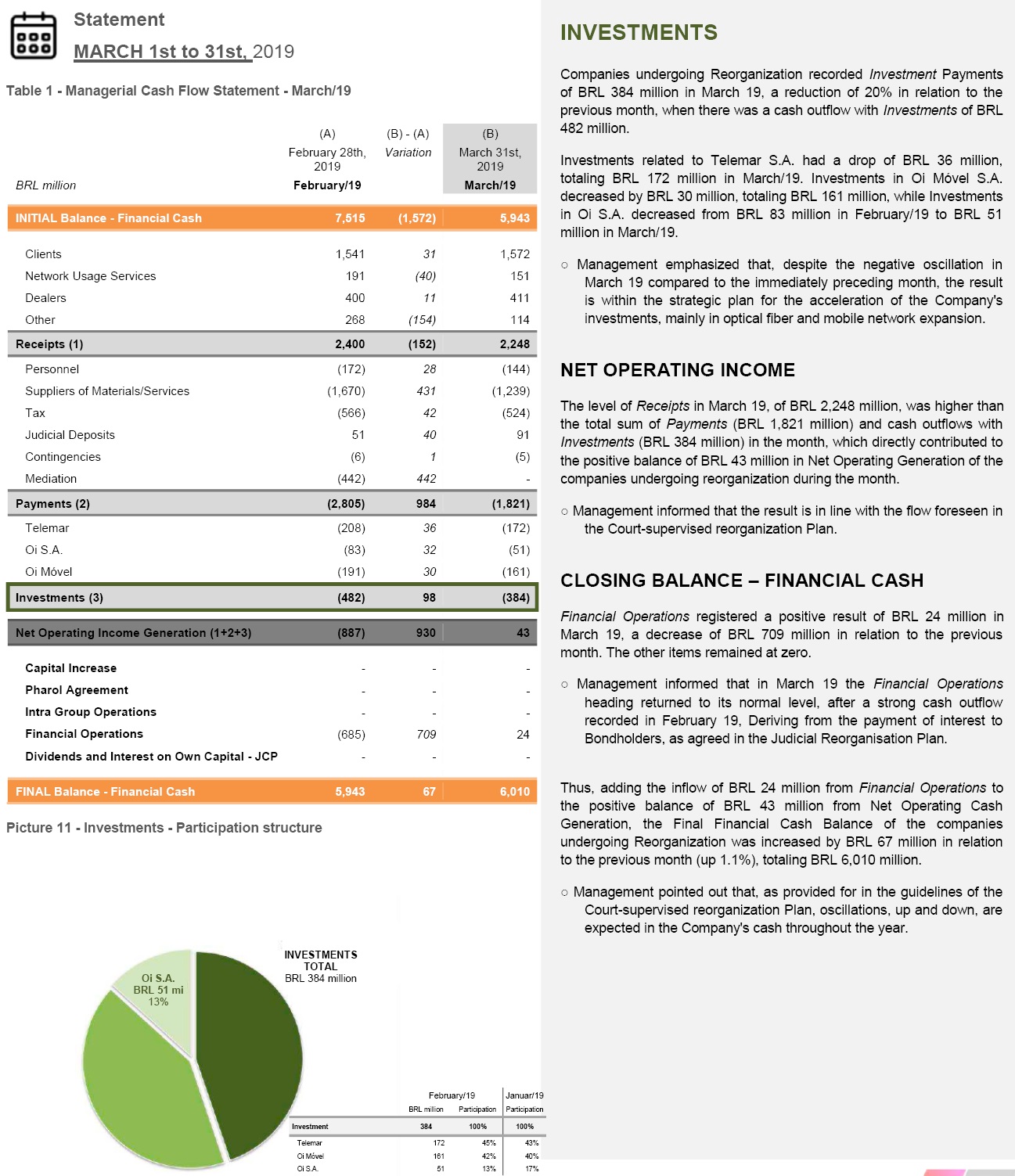

4.1 MANAGERIAL CASH FLOW STATEMENT Consolidated Monthly for the Companies undergoing Reorganization (unaudited) | EXECUTIVE REPORT | |

MANAGERIAL CASH FLOW STATEMENT

HIGHLIGHTS

| Statement |

MARCH 1st to 31st,2019 |

○Generation of Net Operating Cash by the Companies undergoing Reorganizationwas positive by BRL 43 million in March/19

○Investments reached the level of BRL 384 million in March/19

○Receipts were reduced by BRL 152 million in March 19, totaling BRL 2,248 million

○Payments fell by BRL 984 million in March 19, reaching a level of BRL 1,821 million

○TheFinal Financial Cash Balance of the Companies undergoing Reorganization increased by BRL 67 million in March 19, totaling BRL 6,010 million

12

4.1 MANAGERIAL CASH FLOW STATEMENT Consolidated Monthly for the Companies undergoing Reorganization (unaudited) | EXECUTIVE REPORT | |

13

4.1 MANAGERIAL CASH FLOW STATEMENT Consolidated Monthly for the Companies undergoing Reorganization (unaudited) | EXECUTIVE REPORT | |

14

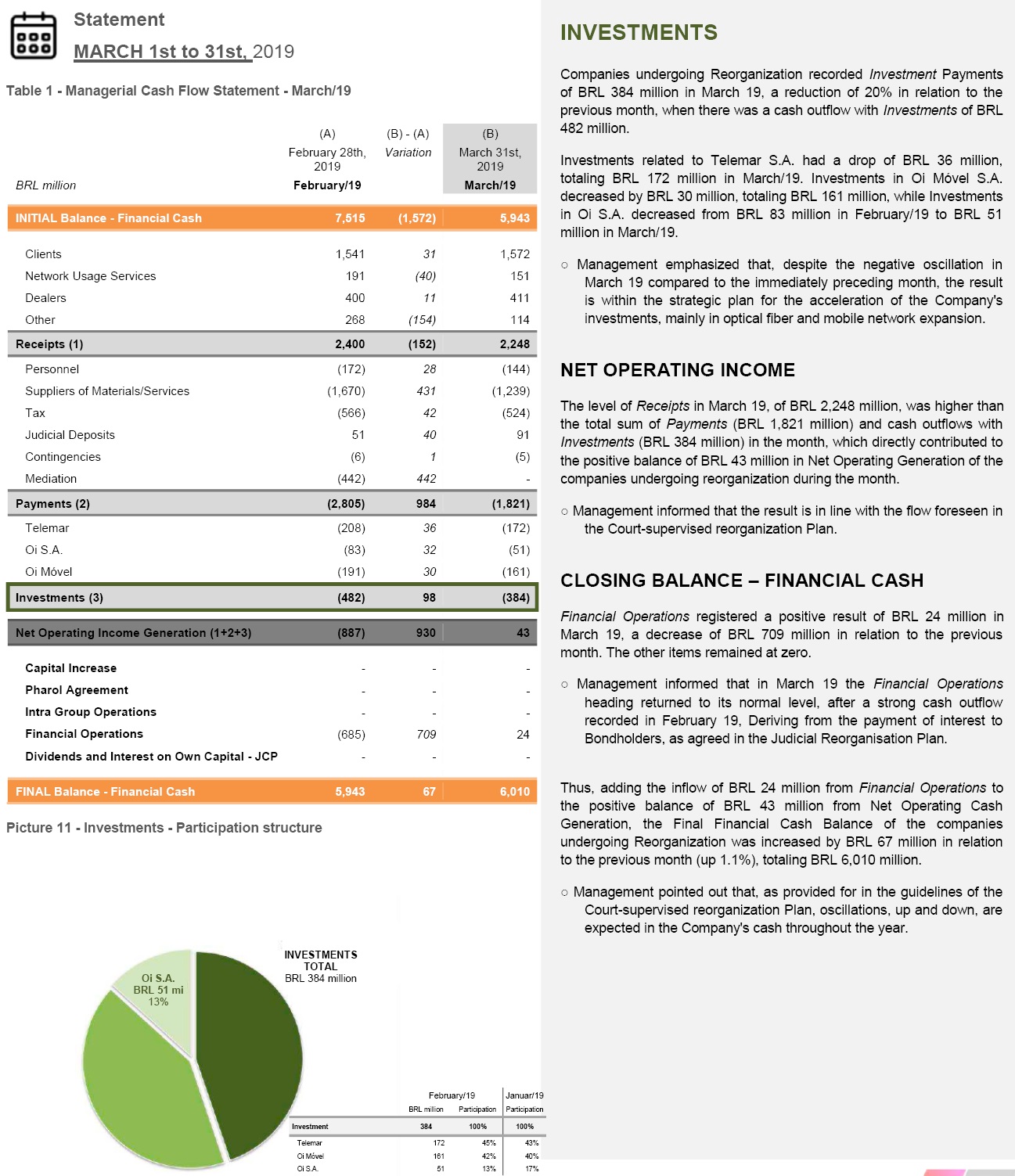

4.1 MANAGERIAL CASH FLOW STATEMENT Consolidated Monthly for the Companies undergoing Reorganization (unaudited) | EXECUTIVE REPORT | |

15

4.1 MANAGERIAL CASH FLOW STATEMENT Consolidated Monthly for the Companies undergoing Reorganization (unaudited) | EXECUTIVE REPORT | |

16

4.1 MANAGERIAL CASH FLOW STATEMENT Consolidated Monthly for the Companies undergoing Reorganization (unaudited) | EXECUTIVE REPORT | |

| Statement |

MARCH 1st to 31st,2019 |

Table 2 - Direct Cash Flow

BRL million

CONSOLIDATED FOR THE COMPANIES UNDERGOING REORGANIZATION | OCTOBER/2017 | NOVEMBER/17 | DECEMBER/17 | JANUARY/18 | FEBRUARY/18 | MARCH/18 | APRIL/18 | MAY/18 | JUNE/18 | JULY/18 | AUGUST/18 | SEPTEMBER/18 | OCTOBER/18 | NOVEMBER/18 | DECEMBER/18 | JANUARY/19 | FEBRUARY/19 | MARCH/19 |

Opening Balance - Financial Cash | 7,524 | 7,324 | 6,877 | 6,881 | 6,128 | 5,909 | 5,831 | 4,820 | 4,602 | 4,819 | 4,677 | 4,721 | 4,815 | 4,379 | 4,362 | 4,469 | 7,515 | 5,943 |

Receipts | 2,893 | 2,689 | 2,716 | 2,816 | 2,758 | 2,646 | 2,619 | 2,386 | 2,736 | 2,589 | 2,659 | 2,694 | 2,898 | 2,815 | 2,645 | 2,463 | 2,400 | 2,248 |

Clients | 1,946 | 1,873 | 1,905 | 1,825 | 1,691 | 1,855 | 1,780 | 1,799 | 1,734 | 1,836 | 1,731 | 1,681 | 1,756 | 1,807 | 1,697 | 1,628 | 1,541 | 1,572 |

Network Usage Services | 144 | 190 | 197 | 201 | 209 | 212 | 234 | 3 | 467 | 228 | 210 | 205 | 204 | 192 | 192 | 177 | 191 | 151 |

Dealers | 488 | 467 | 420 | 524 | 411 | 456 | 461 | 491 | 471 | 431 | 518 | 420 | 466 | 478 | 412 | 498 | 400 | 411 |

Other | 315 | 159 | 194 | 266 | 447 | 123 | 144 | 93 | 64 | 94 | 200 | 388 | 472 | 338 | 344 | 160 | 268 | 114 |

Payments | (2,721) | (2,752) | (2,560) | (3,239) | (2,578) | (2,231) | (3,109) | (2,213) | (2,223) | (2,383) | (2,279) | (2,276) | (2,751) | (2,432) | (2,285) | (2,733) | (2,805) | (1,821) |

Personnel | (135) | (142) | (236) | (234) | (177) | (140) | (303) | (179) | (147) | (186) | (170) | (140) | (137) | (133) | (244) | (200) | (172) | (144) |

Suppliers of Materials and Services | (1,796) | (1,839) | (1,422) | (2,421) | (1,789) | (1,488) | (1,641) | (1,332) | (1,568) | (1,698) | (1,604) | (1,640) | (2,048) | (1,775) | (1,508) | (1,829) | (1,670) | (1,239) |

Materials/Services | (1,651) | (1,645) | (1,222) | (2,215) | (1,575) | (1,277) | (1,401) | (1,325) | (1,101) | (1,470) | (1,393) | (1,433) | (1,842) | (1,581) | (1,315) | (1,649) | (1,478) | (1,087) |

Plant Maintenance | (88) | (324) | (345) | (341) | (309) | (331) | (375) | (302) | (283) | (312) | (297) | (299) | (332) | (347) | (425) | (406) | (344) | (305) |

Rentals | (191) | (213) | (139) | (386) | (210) | (259) | (248) | (245) | (260) | (322) | (349) | (329) | (336) | (338) | (297) | (401) | (438) | (273) |

Data Processing/Printshops | (116) | (129) | (113) | (127) | (122) | (140) | (122) | (111) | (108) | (132) | (122) | (103) | (134) | (129) | (97) | (134) | (122) | (108) |

Call Center Customer Service/Billing | (123) | (228) | (157) | (147) | (126) | (188) | (143) | (128) | (104) | (140) | (138) | (104) | (138) | (147) | (163) | (129) | (155) | (113) |

Dealers | (98) | (102) | (105) | (103) | (105) | (104) | (101) | (105) | (99) | (111) | (108) | (109) | (112) | (116) | (110) | (115) | (115) | (105) |

Consultancy / Audits / Fees | (62) | (78) | (31) | (55) | (67) | (50) | (56) | (50) | (35) | (75) | (71) | (45) | (96) | (74) | (52) | (124) | (50) | (34) |

Other Services/Payments | (973) | (571) | (332) | (1,056) | (636) | (205) | (356) | (384) | (212) | (378) | (308) | (444) | (694) | (430) | (171) | (340) | (254) | (149) |

Network Usage Services | (145) | (194) | (200) | (206) | (214) | (211) | (240) | (7) | (467) | (228) | (211) | (207) | (206) | (194) | (193) | (180) | (192) | (152) |

Taxes | (688) | (652) | (633) | (621) | (628) | (527) | (1,172) | (698) | (518) | (531) | (507) | (516) | (551) | (543) | (576) | (683) | (566) | (524) |

Judicial Deposits | 29 | 20 | (224) | 43 | 53 | (11) | 8 | (4) | 11 | 50 | 46 | 40 | 41 | 55 | 75 | 34 | 51 | 91 |

Contingencies | (5) | - | 1 | (1) | - | (12) | - | - | (1) | (8) | - | (4) | (2) | (1) | (12) | (5) | (6) | (5) |

Mediation | (126) | (139) | (46) | (5) | (37) | (53) | (1) | - | - | (10) | (44) | (16) | (54) | (35) | (20) | (50) | (442) | - |

Investment | (410) | (391) | (190) | (554) | (430) | (519) | (536) | (434) | (377) | (370) | (363) | (339) | (582) | (421) | (344) | (603) | (482) | (384) |

Telemar | (188) | (184) | (89) | (272) | (200) | (215) | (278) | (182) | (170) | (154) | (178) | (147) | (222) | (193) | (174) | (234) | (208) | (172) |

Oi S.A. | (63) | (45) | (25) | (70) | (63) | (81) | (70) | (66) | (63) | (52) | (47) | (64) | (76) | (58) | (46) | (103) | (83) | (51) |

Oi Móvel | (159) | (162) | (76) | (212) | (167) | (223) | (188) | (186) | (144) | (164) | (138) | (128) | (284) | (170) | (124) | (266) | (191) | (161) |

Operational Generation | (238) | (454) | (34) | (977) | (250) | (104) | (1,026) | (261) | 136 | (164) | 17 | 79 | (435) | (38) | 16 | (873) | (887) | 43 |

Capital Increase | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | 4,007 | - | - |

Pharol Agreement | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | (106) | - | - |

Intra Group Operations | - | - | - | - | - | - | - | 28 | 55 | 3 | (1) | - | - | - | 14 | - | - | - |

Financial Operations | 38 | 7 | 38 | 32 | 24 | 26 | 15 | 15 | 26 | 19 | 28 | 15 | (1) | 21 | 23 | 18 | (685) | 24 |

Dividends and Interest on Own Capital - JCP | - | - | - | 192 | 7 | - | - | - | - | - | -- | - | - | - | 54 | - | - | - |

Closing Balance - Financial Cash | 7,324 | 6,877 | 6,881 | 6,128 | 5,909 | 5,831 | 4,820 | 4,602 | 4,819 | 4,677 | 4,721 | 4,815 | 4,379 | 4,362 | 4,469 | 7,515 | 5,943 | 6,010 |

17

4.2 BALANCE SHEET FOR COMPANIES UNDERGOING REORGANIZATION Consolidated Quarterly for the Companies undergoing Reorganization (unaudited) | EXECUTIVE REPORT | |

BALANCE SHEET FOR COMPANIES UNDERGOING REORGANIZATION

HIGHLIGHTS

| Statement |

1stQUARTER 2019 |

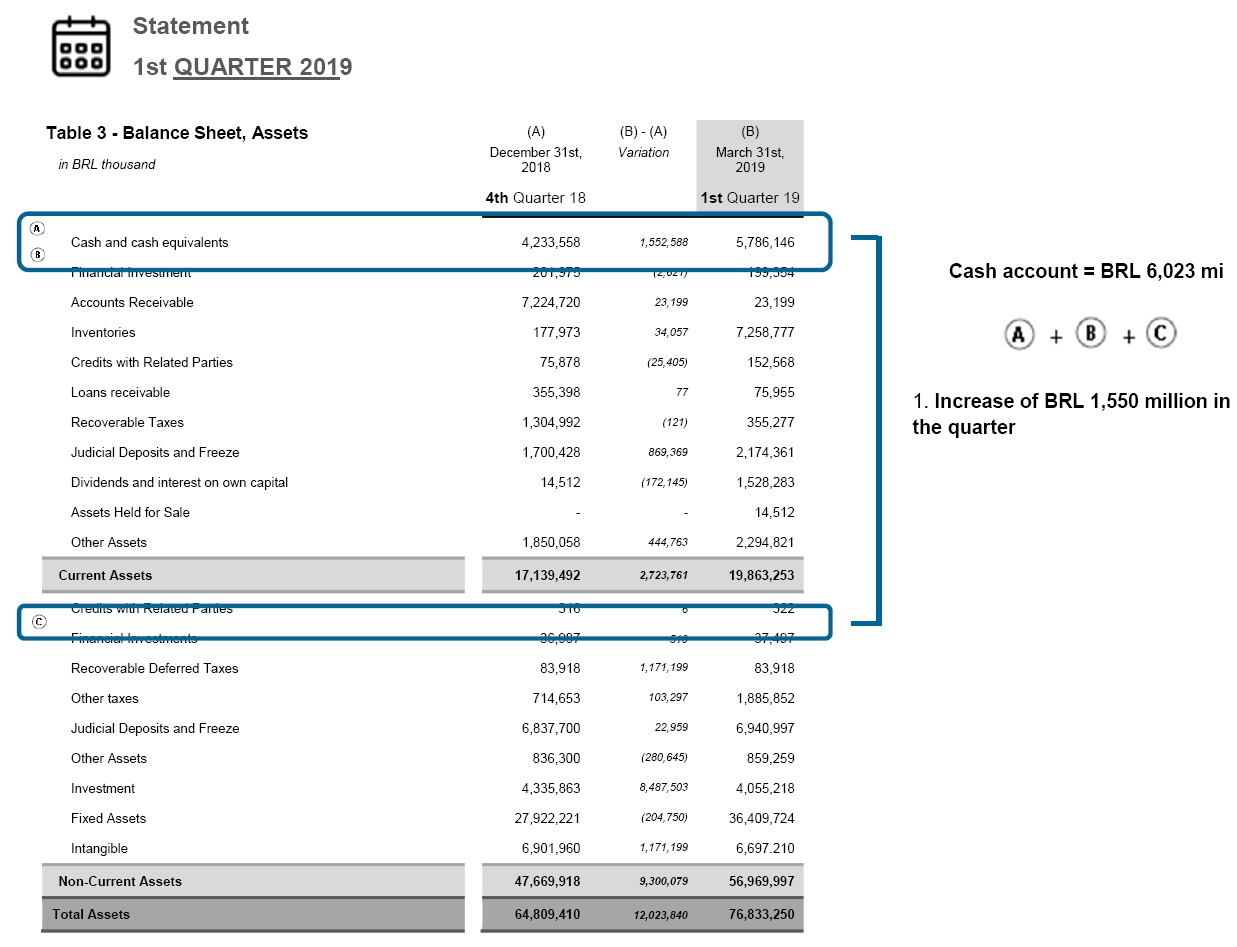

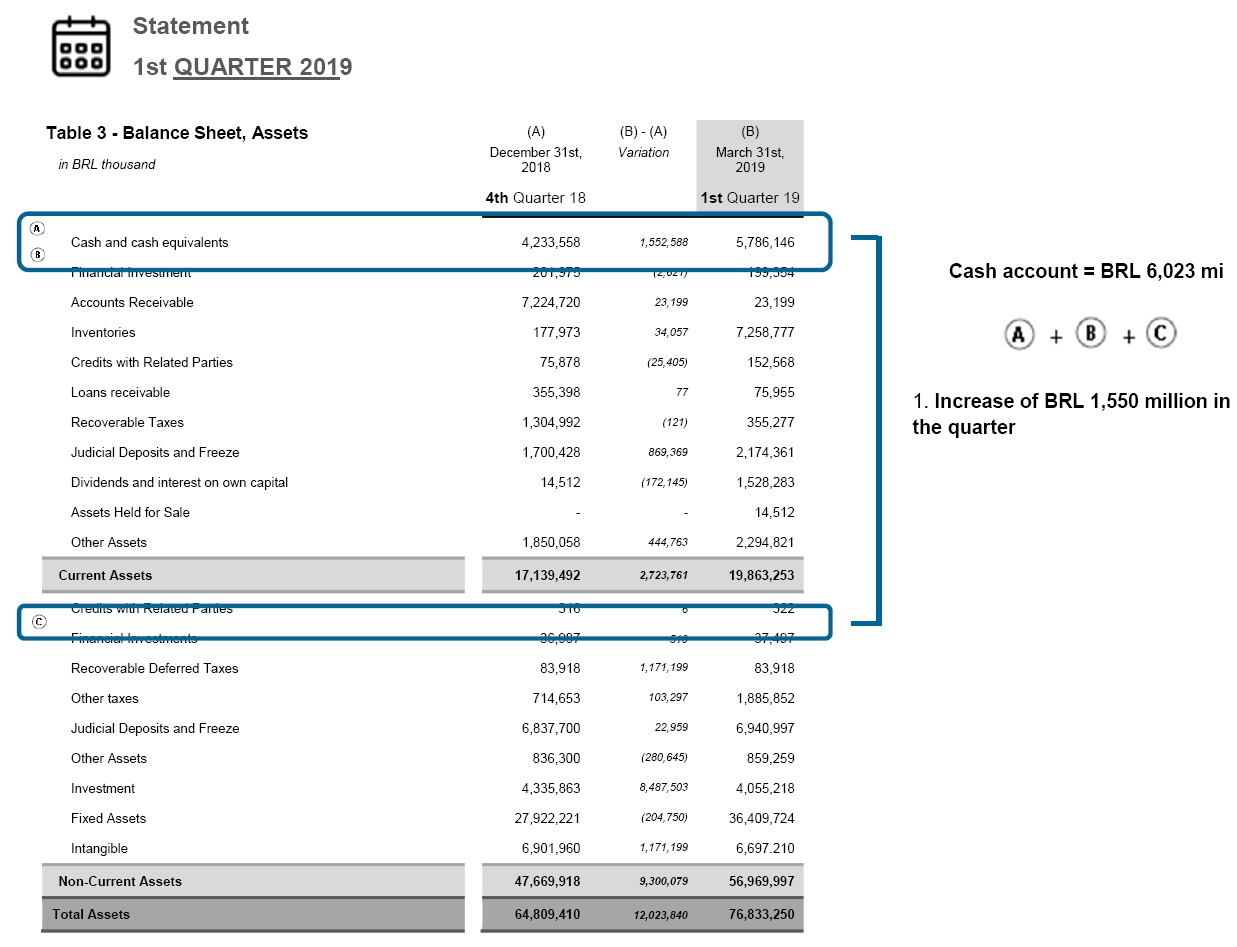

○Cash recorded in the Booksof the Companies undergoing Reorganization registered an increase of BRL 1,550 million in the quarter, reaching BRL 6,023 million

○ Short-term recoverable taxesincreased by BRL 869.4 million in the quarter, totaling BRL 2,174 million

○Leases payableon current liabilities for Companies undergoing Reorganization reached BRL 1,326 million in the first quarter of 2019.Leases payable from non-current liabilities for Companies undergoing Reorganization totaled BRL 6,548 million in the same period

○Consolidated Profit from the Companies undergoing Reorganization was BRL 568.4 million in the first quarter of 2019

18

4.2 BALANCE SHEET FOR COMPANIES UNDERGOING REORGANIZATION Consolidated Quarterly for the Companies undergoing Reorganization (unaudited) | EXECUTIVE REPORT | |

Current Assets(page 1 of 2)

Cash Recorded in the Books of the Companies undergoing Reorganization had an increase of BRL1,550 million in the 1st Quarter of 2019

Total Assets for Recovered presented an increase of BRL 12,024 million in the first quarter of 2019 compared to the previous quarter, due to the increase of BRL 2,724 million in Current Assets and the increase of BRL 9,300 million in Non-Current Assets. The increase of BRL 2,724 million in theCurrent Assetswas influenced by:

○ 1. Cash and cashequivalents (resulting from the sum ofcash and cash equivalents, current financial investments and non-current financial investments)presented an increase of BRL 1,550 million in the first quarter of 2019 (up 34.7%), totaling BRL 6,023 million. According to Management, the increase in cash in this quarter is related to the conclusion of the Company's capital increase, which was partially offset by cash outflows, such as the payment of the first installment of qualified bond interest and the payment of the first installment of partner suppliers, as provided for in the Court-supervised reorganization Plan.

19

4.2 BALANCE SHEET FOR COMPANIES UNDERGOING REORGANIZATION Consolidated Quarterly for the Companies undergoing Reorganization (unaudited) | EXECUTIVE REPORT | |

Current Assets(page 2 of 2)

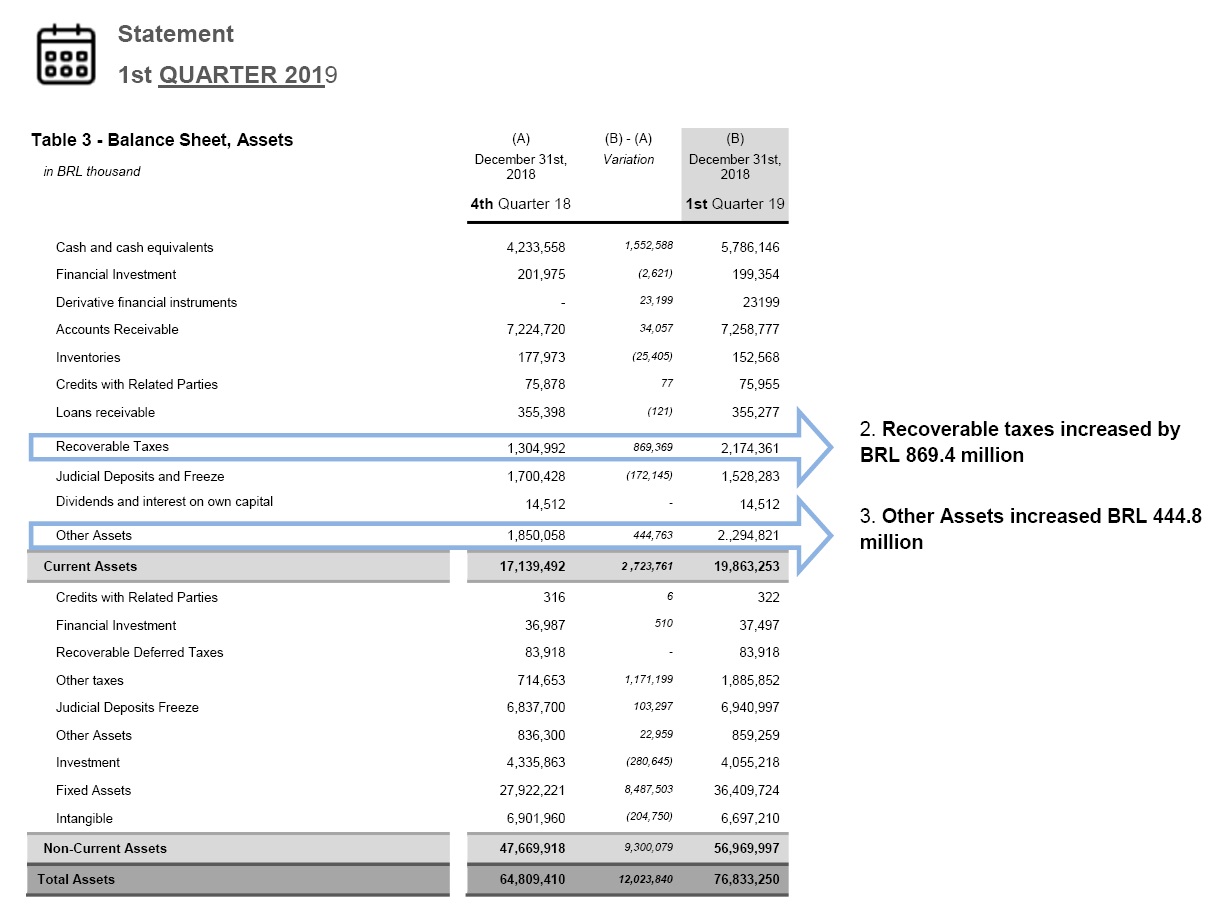

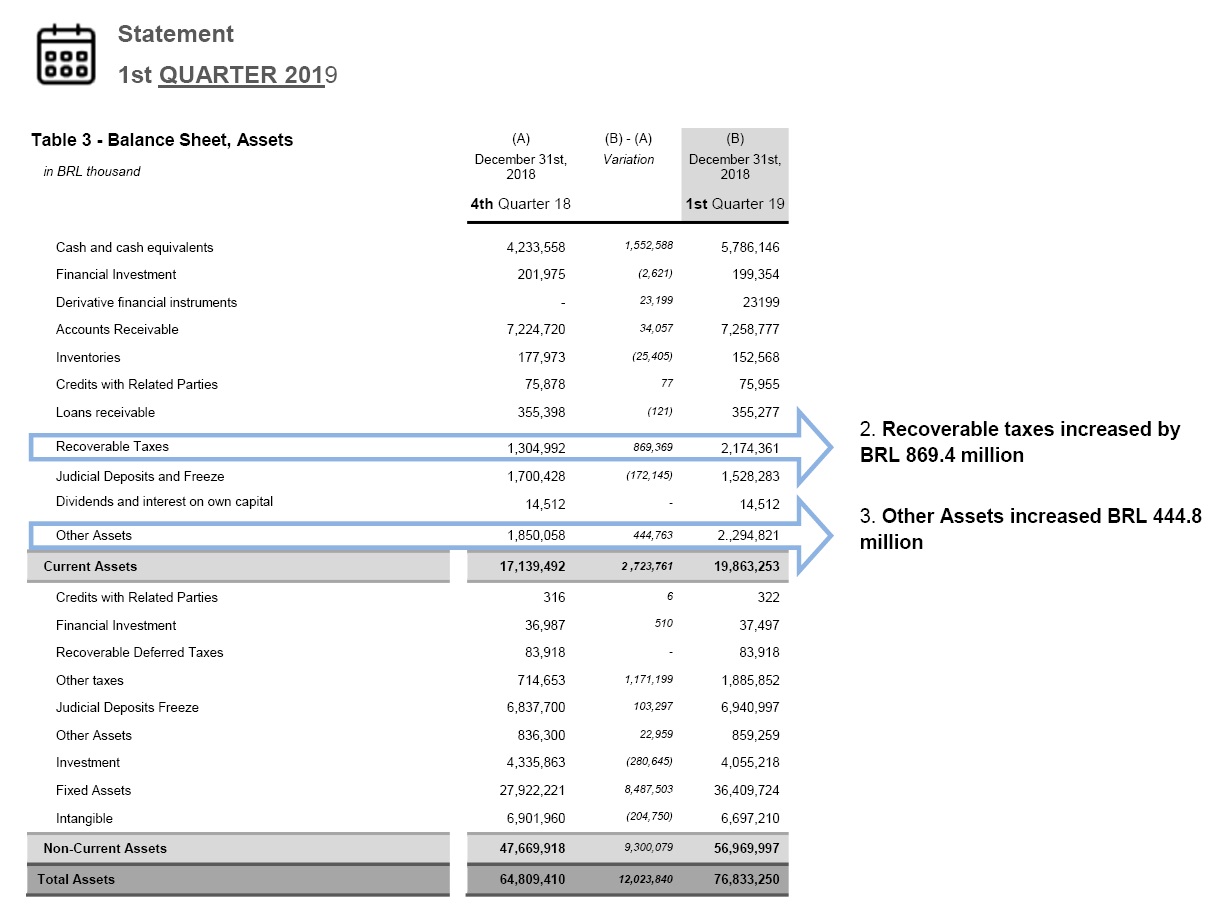

Recoverable taxes increased by BRL 869.4 million in the 1st Quarter of 2019

Total Assets of the Companies undergoing Reorganization presented an increase of BRL 12,024 million in the first quarter of 2019 compared to the previous quarter, due to the increase of BRL 2,724 million in Current Assets and the increase of BRL 9,300 million in Non-Current Assets. The increase of BRL 2,724 million inCurrent Assetswas influenced by:

○ 2.Taxes recoverablefrom Companies undergoing Reorganization increased by BRL 869.4 million (66.6% increase), totaling BRL 2,174 million. Management informed that the increase observed concerns the registration of Social Integration Program - PIS and Contribution to the Financing of Social Security - COFINS credits deriving from a final and unappealable court decision, in which the Company discussed the non-levy of PIS and COFINS on the Tax on Circulation of Merchandises and Services - ICMS tax basis.

○ 3. The itemOtherRecoverableAssetsincreased by BRL 444.8 million (24.0% increase), totaling BRL 2,295 million. According to the Company, the observed variation is related to the annual payment of the Fistel Fee, which will be appropriated monthly to the result until December 2019.

20

4.2 BALANCE SHEET FOR COMPANIES UNDERGOING REORGANIZATION Consolidated Quarterly for the Companies undergoing Reorganization (unaudited) | EXECUTIVE REPORT | |

Non-Current Assets(page 1 of 1)

Intangible assets increased BRL 7,585 million in the first quarter of 2019

Total Assets of the Companies undergoing Reorganization presented an increase of BRL 12,024 million in the first quarter of 2019 compared to the previous quarter, due to the increase of BRL 2,724 million in Current Assets and the increase of BRL 9,300 million in Non-Current Assets. The increase of BRL 9,300 million in theNon-Current Assetswas influenced by:

○ 1.Other long-term taxesincreased by BRL 1,171 million in the quarter, totaling BRL 1,886 million. According to Management, the increase that may be noticed is a reflection of the registration of Social Integration Program - PIS and Contribution to the Financing of Social Security - COFINS credits deriving from a final and unappealable court decision, in which the Company discussed the non-levy of PIS and COFINS on the Tax on Circuation of Merchandises and Services - ICMS tax basis.

○ 2.Judicial Deposits and Freezeof Companies undergoing Reorganization increased BRL 103.3 million (up 1.5%) in the first quarter of 2019 compared to the previous quarter, totaling BRL 6,941 million. According to information provided by Management, the increase that may be noticed concerns the record of monetary restatement, mitigated by the redemptions and suspension of freezes in favor of the Company.

○ 3.Fixed assetsincreased BRL 8,487 million in the quarter (up 30.4%), totaling BRL 36,410 million. According to Management, the increase is a reflection of the registration of the right to use tower, real estate, shops and sites (physical room) lease agreements deriving from the initial adoption of IFRS 16 / CPC 06 (R2) - Leasing and the acceleration of the investments provided for in the Court-supervised reorganization Plan, which will allow the advancement of high-speed broadband service projects, mainly by optical fiber, and the expansion of the mobile access network.

21

4.2 BALANCE SHEET FOR COMPANIES UNDERGOING REORGANIZATION Consolidated Quarterly for the Companies undergoing Reorganization (unaudited) | EXECUTIVE REPORT | |

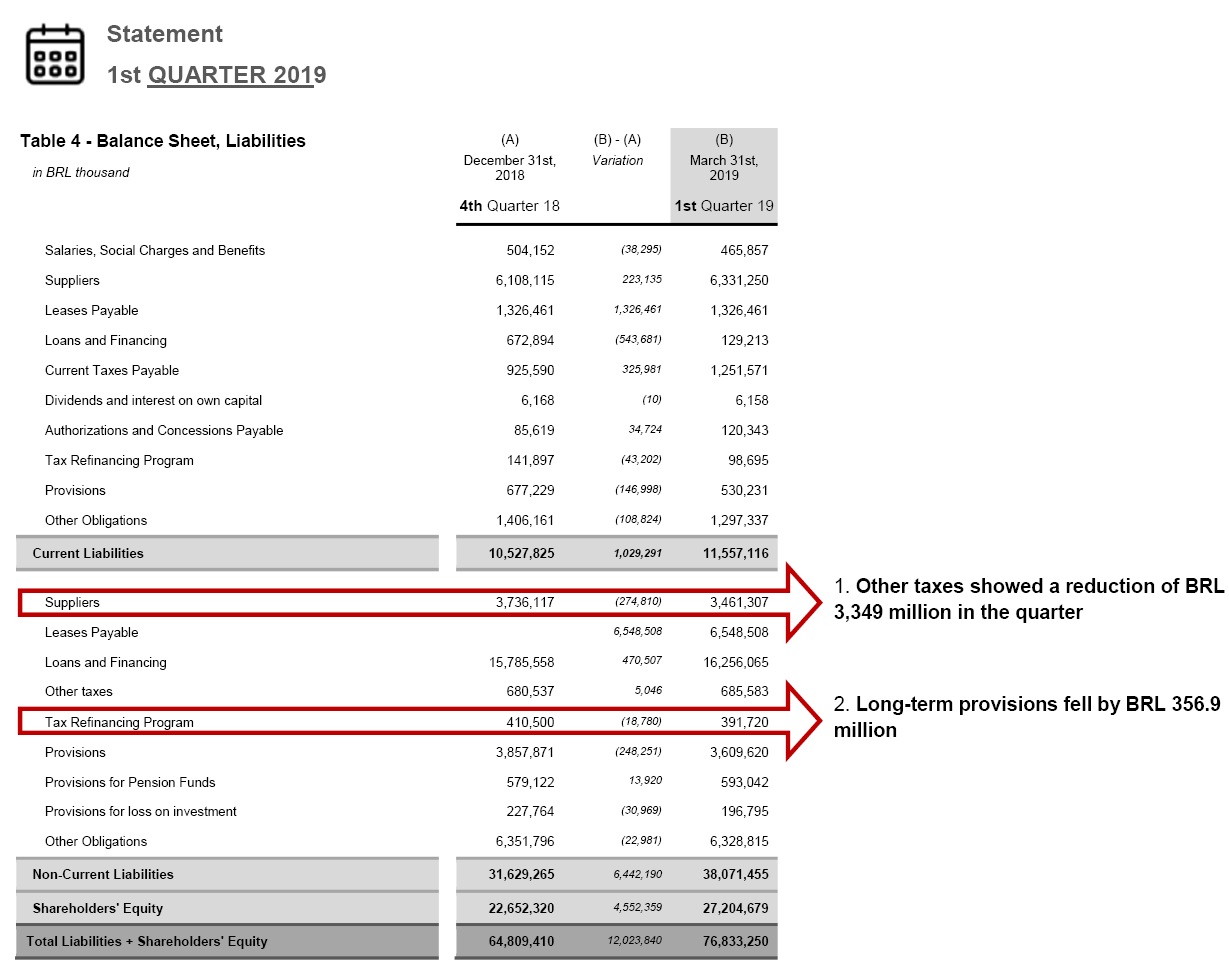

Current Liabilities(page 1 of 1)

Short-term leases payable increased by BRL 1,326 million in the quarter

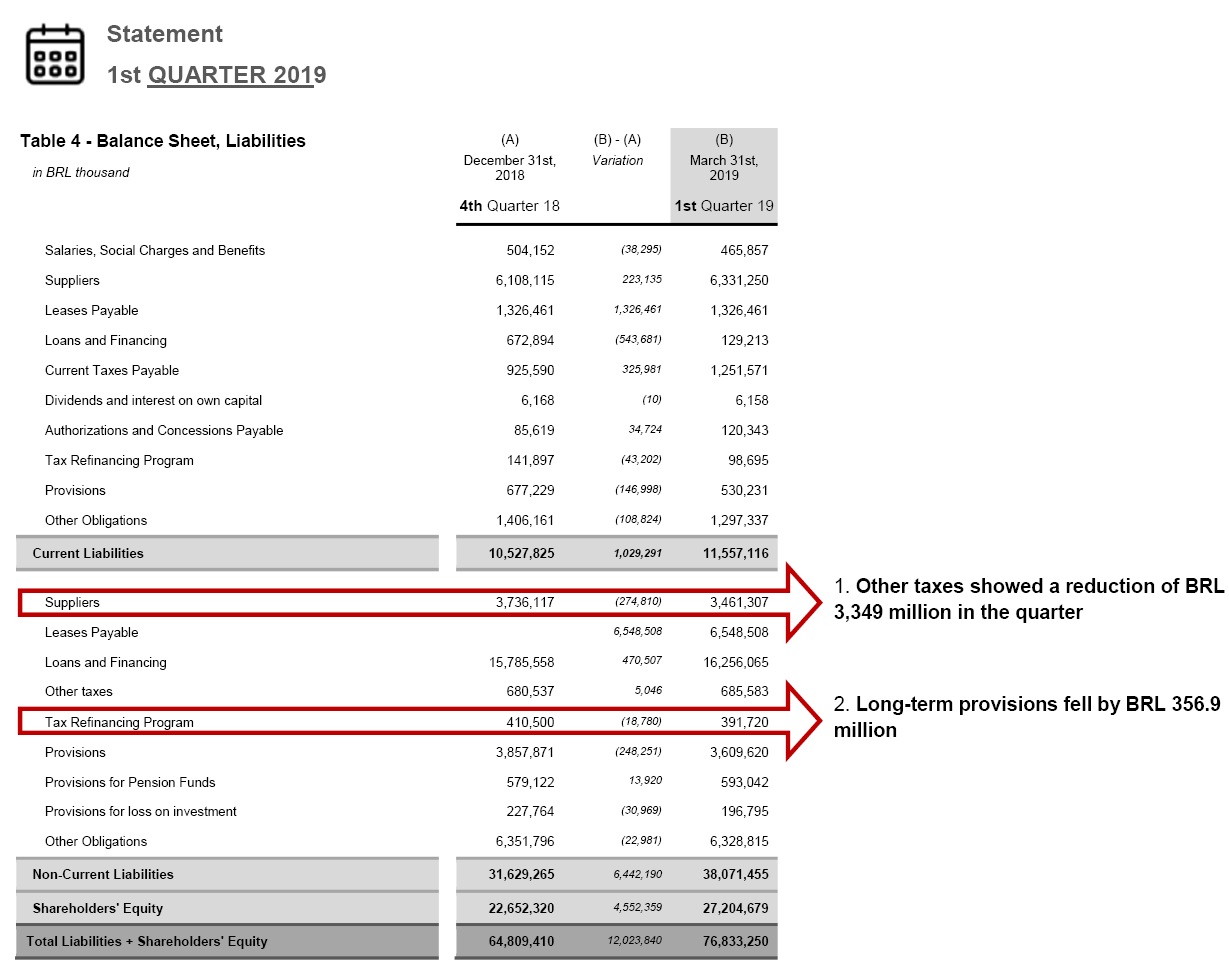

Total liabilities from Companies undergoing Reorganization increased by BRL 12,024 million in the first quarter of 2019 compared to the previous quarter, due to an increase of BRL 1,029 million in current liabilities, an increase of BRL 6,442 million in non-current liabilities and an increase of BRL 4,552 million in shareholders' equity. The increase of BRL 1,029 million inCurrent Liabilitieswas influenced by:

○ 1. Short-term leases payableincreased BRL 1,326 million, while this account was zero in the previous quarter. According to Management, the increase refers to the recognition of liabilities from lease agreements for towers, real estate, stores, vehicles and sites (physical space) recorded due to the initial adoption of IFRS 16 / CPC 06 (R2) – Mercantile Leasing.

○ 2.Current taxes payablein the short term increased by BRL 326.0 million (up 35.2%), totaling BRL 1,251 million. According to Management, the increase in this item is mainly due to the recording of ANATEL's Fistel fee.

22

4.2 BALANCE SHEET FOR COMPANIES UNDERGOING REORGANIZATION Consolidated Quarterly for the Companies undergoing Reorganization (unaudited) | EXECUTIVE REPORT | |

○Long-term Loans and Financingincreased by BRL 470.5 million, totaling BRL16,256 million. Of this total, loans inBrazilian currencyreached BRL 7,881 million. Loans inlocal currency - related partiestotaled only BRL 285 thousand. Finally,foreign currencyloans increased by BRL 217.7 million to BRL 8,375 million.

○ According to Management, the increase results from the accrual of interest and the exchange devaluation of the period.

23

4.2 BALANCE SHEET FOR COMPANIES UNDERGOING REORGANIZATION Consolidated Quarterly for the Companies undergoing Reorganization (unaudited) | EXECUTIVE REPORT | |

Non-Current Liabilities(page 1 of 1)

Long-term leases payable increased by BRL 6,548 million in the first quarter of 2019

Total liabilities from Companies undergoing Reorganization increased by BRL 12,024 million in the first quarter of 2019 compared to the previous quarter, due to an increase of BRL 1,029 million in current liabilities, an increase of BRL 6,442 million in non-current liabilities and an increase of BRL 4,552 million in shareholders' equity. The increase of BRL 6,442 million in Non-Current Liabilitieswas influenced by:

○1. Long-term leases payablerose BRL 6,548 million in the quarter, while this account was zero in the previous quarter. According to the Company, the increase in the caption refers to the recognition of liabilities from lease contracts for towers, real estate, stores, vehicles and sites (physical space) recorded due to the initial adoption of IFRS 16 / CPC 06 (R2) - Leasing.

○ 2. Long-termprovisionsfell by BRL 248.2 million in the quarter (down 6.4%), totaling BRL 3,610 million. The Company informed that the reduction concerns the reversal of the provisions for contingencies, motivated by the advancement of the work of accounting review of contingencies.

24

4.2 BALANCE SHEET FOR COMPANIES UNDERGOING REORGANIZATION Consolidated Quarterly for the Companies undergoing Reorganization (unaudited) | EXECUTIVE REPORT | |

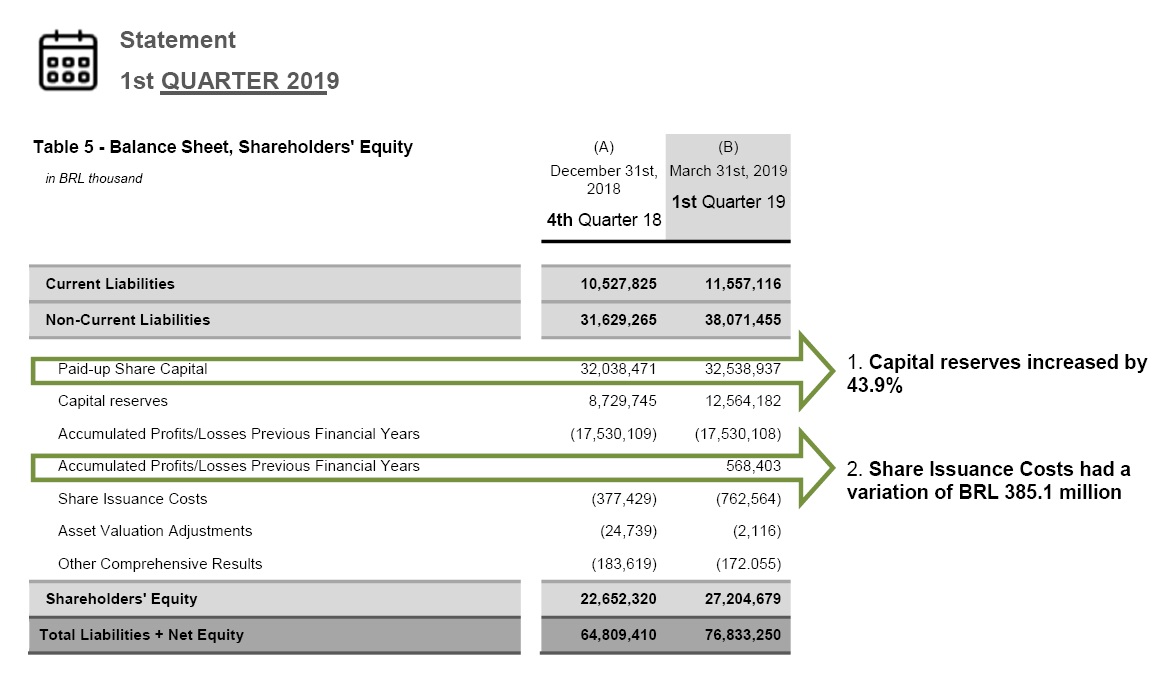

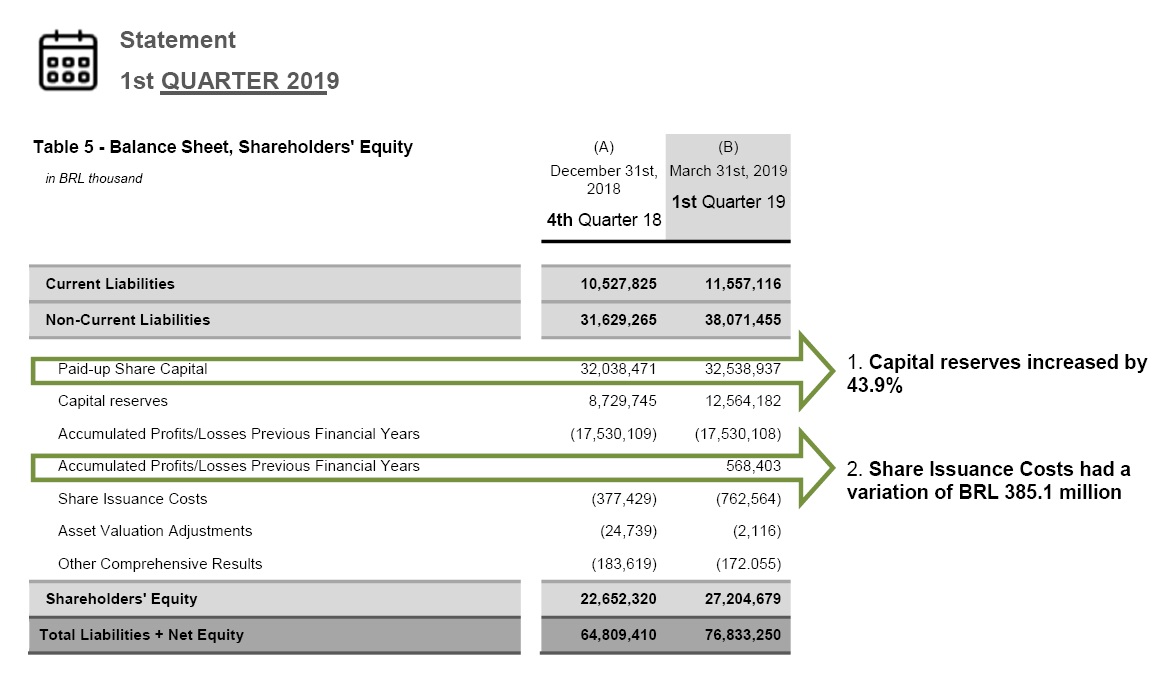

Shareholders' Equity(page 1 of 1)

The Consolidated Profit of the Companies undergoing Reorganization in the 1st Quarter of 2019 was BRL 568.4 million

Other shareholders' equity items with noticeable variations:

○ 1.Capital reservesincreased by BRL 3,834 million (up 43.9%), totaling BRL 12,564 million in the first quarter of 2019. According to Management, the variation observed in the quarter reflects the capital increase, due to the entry of new resources provided for in the Court-supervised reorganization Plan.

○ 2. TheCost of Shares Issuanceshowed a variation of BRL 385.1 million, totaling BRL 762.5 million in the first quarter of 2019. According to the Company, the noticeable increase concerns the cost of issuing the shares to comply with the terms of the commitment agreement with the "Backstoppers" and expenses incurred in the issuance process, recorded as a counterpart to the capital increase.

25

4.3 STATEMENT OF INCOME FROM COMPANIES UNDERGOING REORGANIZATION Consolidated Quarterly for the Companies undergoing Reorganization (unaudited) | EXECUTIVE REPORT | |

STATEMENT OF INCOME FROM COMPANIES UNDERGOING REORGANIZATION

HIGHLIGHTS

| Statement |

1stQUARTER 2019 |

○ Gross Operating Revenuefrom Companies undergoing Reorganization fell by 4.3% in the quarter

○Other Operating Expensesof the Companies undergoing Reorganization reached the level of BRL 239.6 million in the quarter, returning to the level recorded in recent quarters

○Results of the Companies undergoing Reorganization before financial results and taxeswere positive in the amount of BRL 938.5 million

○Financial Resultsof the Companies undergoing Reorganization closed the first quarter of 2019 with a negative value of BRL 332.4 million

○Consolidated Lossof the Companies undergoing Reorganization was BRL 568.4 million in the first quarter of 2019

26

4.3 STATEMENT OF INCOME FROM COMPANIES UNDERGOING REORGANIZATION Consolidated Quarterly for the Companies undergoing Reorganization (unaudited) | EXECUTIVE REPORT | |

Quarterly Income Statement(page 1 of 2)

The Consolidated Profit of BRL 568.4 million recorded by the Companies undergoing Reorganization in the 1st Quarter of 2019 was influenced by:

○ 1. TheGross Operating Revenueof the Companies underoing Reorganization fell by BRL 307.0 million (down 4.3%) in the first quarter of 2019 compared to the previous quarter, totaling BRL 6,861 million. According to information provided by Management, the downturn is justified mainly by the decrease in voice traffic (residential, mobility and Business to business), due to the lower number of working days in the first quarter of 2019 and also due to weak economic activity, with an impact mainly on prepaid and in corporate follow-up.

○ 2.Cost of Services Rendered and Goods Soldrose BRL 110.8 million in the quarter, totaling BRL 3,771 million. According to the Company, the lower costs refer to the reduction in rent and insurance due to the initial adoption of IFRS 16 / CPC 06 (R2).

○ 3.Other Operating Incomeof the companies undergoing Reorgnization rose BRL 765.3 million in the quarter, totaling BRL 1,535 million. According to information provided by Management, the increase observed refers to the recording of Social Integration Program - PIS and Contribution to the Financing of Social Security - COFINS credits arising from a final and unappealable court decision, in which the Company discussed the non-levy of the PIS and of COFINS on the Tax on Circulation of Merchandises and Services - ICMS tax basis.

○ 4.Other Operating Expensesof the Companies undergoing Reorganization fell by BRL 5,610 million in the quarter, totaling BRL 239.6 million. According to information provided by Management, the atypical level recorded in the previous quarter resulted from the acknowledgment of the onerous obligation of the contract for the supply of telecommunication signal transmission capacity through submarine cables and amortization of capital gains arising from the acquisition of control of Brasil Telecom S.A., events that did not occur in the first quarter of 2019.

Added to the other operating items, the Companies undergoing Reorganization presentedResults Before Financial Results andpositiveTaxesin the amount of BRL 938,5million in the first quarter of 2019.

27

4.3 STATEMENT OF INCOME FROM COMPANIES UNDERGOING REORGANIZATION Consolidated Quarterly for the Companies undergoing Reorganization (unaudited) | EXECUTIVE REPORT | |

Quarterly Income Statement(page 2 of 2)

The Consolidated Profit of BRL 568.4 million recorded by the Companies undergoing Reorganization in the 1st Quarter of 2019 was influenced by:

○ 5.Financial Incomeof the Companies undergoing Reorganization increased by BRL 1,522 million, totaling BRL 1,346 million in the first quarter of 2019. According to information provided by Management, the increase in financial revenues is mainly due to the monetary restatement of Social integration Program - PIS and Contribution to the Financing of Social Security - COFINS credits arising from a final and unappealable court decision, in which the Company discussed the non-levy of PIS and COFINS on the Tax on Circulation of Merchandises and Services - ICMS calculation basis.

○ 6.Financial Expenses, in turn, increased by BRL 806.0 million in the first quarter of 2019, totaling BRL 1,678 million. According to Management, the observed increase refers to higher monetary and exchange variation expenses on loans payable to third parties, due to the devaluation of the real in relation to the dollar, associated with the recording of higher financial expenses due to the implementation of IFRS 16 / CPC 06 (R2) - Leasing.

○ 7. TheDeferredRecoverables account showed a negative result of BRL 24.5 million in the first quarter of 2019, compared to a positive result of BRL 3,210 million in the previous quarter. According to information provided by Management, the significant reduction observed refers to the reversal of the provision for deferred tax liabilities, made in December 2018.

28

5 Creditor Care | EXECUTIVE REPORT | |

CREDITOR CARE

The Judicial Administrator - AJ continues to support this Honorable Court in the organization of the numerous letters received from other Courts requesting authorization to constrict the assets of the Companies undergoing Roerganization for the payment of extra-competition claims, in a procedure that, on one hand, unites speed and security for the benefit of the Creditors, and, on the other hand, allows the Oi Group to stand up and comply with the Court-supervised reorganization Plan - PRJ.

For this purpose, this Board of Directors has published a list of the letters received last month by the 7th Corporate Court and the list of noncompetition loans paid by the Oi Group, which is already available for consultation on the court-supervised reorganization website (www.recuperacaojudicaloi.com.br), and currently totals 817,227 accesses.

In relation to tender claims, the Judicial Administrator - AJ remains focused on clarifying doubts about mediation procedures, clauses and compliance with the approved Court-supervised reorganization Plan, being constantly contacted by national and international creditors, either by telephone, through the line +55 (21) 2272-9300, or by e-mail credoroi@wald.com.br.

The Judicial Administrator - AJ reports that, throughout the month, it followed the mediation procedure related to the procedural incidents, pursuant to the decision of pages 341.970/341.973. The purpose of this mediation is to encourage a composition between creditors and debtors for the definition of the amount of the credits, from na online platform, and more than 1,933 agreements have already been reached on the online platform.

In addition, after the Judicial Administrator AJ revisited the approximately 19,000 procedural incidents in order to verify those not included in the mediations currently in progress, 4,997 cases resumed the course of their movements, as determined by this Honorable Court.

In addition, this Management makes available monthly the General Creditor List on the site of the court-supervised reorganization (www.recuperacaojudicaloi.com.br), based on the incidents of qualifications and challenges that have already been tried.

29

6 Manifestations submitted by the Judicial Administrator - AJ | EXECUTIVE REPORT | |

SUMMARY OF THE MANIFESTATIONS OF THE JUDICIAL ADMINISTRATOR AJ IN THE CASE FILES

Below, the Judicial Administrator AJ lists the manifestations presented in the records of the electronic case files after the last Monthly Activity Report, with an indication of the respective pages.

Pages 371.049/371.085 | Monthly report on the activities performed by the Companies undergoing Reorganization (for the month of February 2019). | April 15th, 2019 |

Pages 370.483/370.485 | Manifestation of the Judicial Administration regarding: (i) the nature of the referred claim, if it belongs to the reorganization procedure or is extra-competition, the payment of which is requested by the Judge of the 2nd Civil Court of Poços de Caldas - MG; (ii) a petition by Priscila Pereira Volta, alleging the noncompetition of her credit; (iii) the documents attached by Banco Santander S.A. in order to regularize its procedural representation; and (iv) numerous requests for arrangements for the payment of noncompetition claims. | April 17th, 2019 |

Pages 373.241/373.244 | Manifestations of the Judicial Administrator- AJ on: (i) assignment of credit signed between Copperteel Bimetálicos Ltda. and Athena Securitizadora S.A.; (ii) numerous requests for arrangements for the payment of noncompetition claims; (iii) a petition from Bondholders claimants alleging a problem related to the action of the Custodian Bank in the bond liquidation procedure; and (iv) petition by Alessandro Granato Rodrigues, in which he claims that his credit would be non-competition. | May 7th, 2019 |

30

6 Manifestations submitted by the Judicial Administrator - AJ | EXECUTIVE REPORT | |

SUMMARY OF THE MANIFESTATIONS OF THE JUDICIAL ADMINISTRATOR AJ IN THE CASE FILES

Appeals in which the Judicial Administrator submitted a statement:

0011431-65.2019.8.19.0000 | An interlocutory appeal lodged by ANATEL against the decision ordering the dispatch of a letter to refrain from requiring the Companies undergoing Reorganization to produce negative debt certificates. | May 3rd, 2019 |

In addition, in response to letters and requests addressed directly to the Judicia Administrator AJ by the most diverse Courts of the country, the Judicial Administrator presented several manifestations in cases filed against the Companies undergoing Reorganization

31

7 Supervision of compliance with the Court-supervised reorganization Plan | EXECUTIVE REPORT | |

SUPERVISION OF COMPLIANCE WITH THE COURT-SUPERVISED REORGANIZATION PLAN

The Court-supervised reorganization Plan ("PRJ") presented by the Companies undergoing Reorganization was approved by the Creditors present at the General Meeting of Creditors held on December 19, 2017, being ratified, with reservations, by this Honorable Court, under the terms of the court's decision of pages 254.741/254.756.

Thus, this Management remains focused on the supervision of compliance with the obligations of the approved Court-supervised reorganization Plan – PRJ by the Companies undergoing Reorganization, having, for such purpose, held periodic meetings with the Company and analyzed all pertinent documentation.

As a result of this inspection, the AJ informs that in the month ofMarch 2019,only the obligations that have a maturity term linked to the final and unappealable decision of the origin records stayed open, as established in the Court-supervised reorganization Plan. Monthly, this Management receives the list of labor credits settled during the month, due to the end of the grace period (180 days counted from the final and unappealable decision of the lawsuit of origin - clause 4.1.1 of the Court-supervised reorganization Plan - PRJ).

With regard to mediation with illiquid credits, which already has 4,226 agreements signed, the Judicial Administrator AJ informs that it has been following the procedure and the operation of the FGV Platform, available for access since July 26th, 2018.

Finally, the Judicial Administrator informs that, pursuant to Clause 7, Annex 7.1, of the Court-supervised reorganization Plan PRJ, Copart5 Participações S.A. was merged into Oi S.A..

32

|

Avenida Franklin Roosevelt, | Avenida Juscelino Kubitschek, |

nº 115, 4º andar | nº 510, 8º andar |

Postatl Code 20021-120 | Postal Code 04543-906 |

Rio de Janeiro, RJ - Brazil | São Paulo, SP - Brazil |

|

|

|

|

| |

|

| Rua James Joule, | |

| Nº 92, 10º andar | |

| Brooklyn Novo, | |

| Postal Code 04576-080 | |

| São Paulo, SP - Brazil | |