- OIBRQ Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

-

Shorts

-

6-K Filing

Oi (OIBRQ) 6-KOI20200619_6K1

Filed: 22 Jun 20, 3:20pm

Exhibit 1

This document is a free translation of the Brazilian judicial administrator’s report referred to April 2020 financial information of Oi S.A. and some of its subsidiaries (“RJ Debtors”) filled within the 7th Business Court of Rio de Janeiro on June, 15, 2020. Due to the complexities of language translation, translations are not always precise. The original document was prepared in Portuguese, and in case of any divergence, discrepancy or difference between this version and the Portuguese version, the Portuguese version shall prevail. The Portuguese version is the only valid and complete version and shall prevail for any and all purposes. There is no assurance as to the accuracy, reliability or completeness of the translation. Any person reading this translation and relying on it should do so at his or her own risk.

TO THE HON. JUDGE OF THE 7thBUSINESS COURT IN THE JUDICIAL DISTRICT OF THE CAPITAL OF RIO DE JANEIRO STATE

Case No. 0203711-65.2016.8.19.0001

Court-Supervised Reorganization of Oi S.A and others

TheTRUSTEE (Arnoldo Wald Law Firm), appointed in the proceedings of Court-Supervised Reorganization ofOI S.A.et al, respectfully requests the attached Monthly Activity Report ("RMA") for the month of April 2020 to be entered into the docket.

Rio de Janeiro, June 15, 2020.

_________________________________

Trustee

Arnoldo Wald Law Office

EXECUTIVE REPORT

1 | Introduction | 03 | |

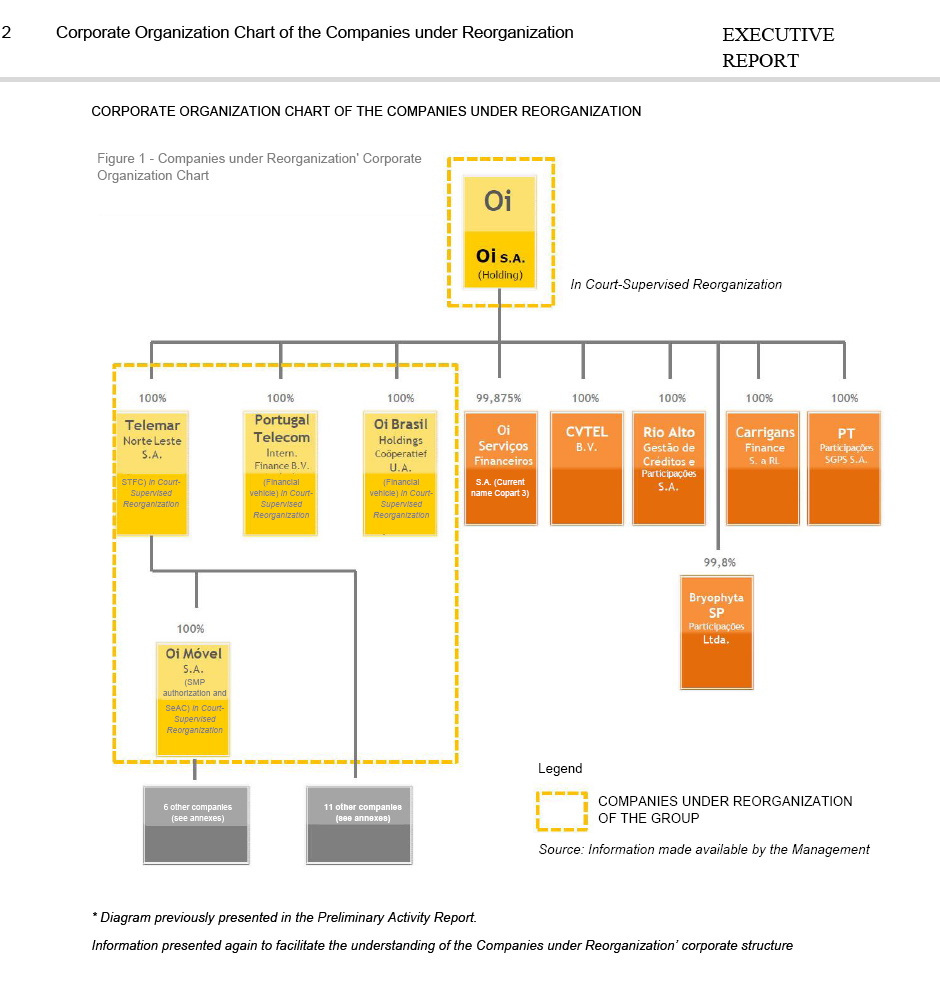

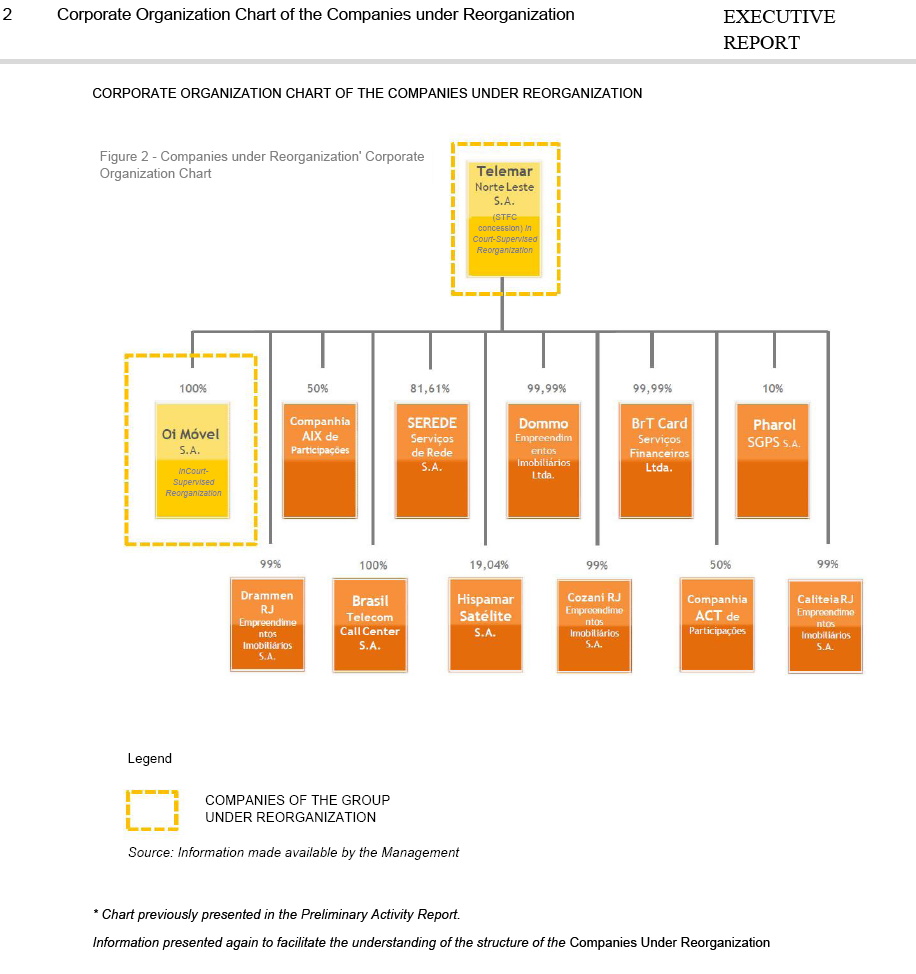

2 | Oi Group Organization Chart / Companies under Reorganization | 05 | |

3 | Relevant Facts & Announcements to the Market published | 09 | |

4 | Financial Information (Consolidated for the Companies under Reorganization) | 10 | |

4.1 | Management Cash Flow Statement | 11 | |

5 | Creditors Service | 16 | |

6 | Statements submitted by the AJ | 17 | |

7 | Supervision and Compliance with the Court Supervised Reorganization Plan - PRJ | 18 | |

2

1 Introduction | EXECUTIVE |

|

INTRODUCTION

To Your Honor, Judge of the 7th Business Court in the Judicial District of Capital of Rio de Janeiro State

The Trustee, Escritório de Advocacia Arnold Wald ("Wald" or "AJ"), appointed in the records of the Court-Supervised Reorganization of Oi Group (case number 0203711- 65.2016.8.19.0001), and Rio Branco Consultores Associados, subcontracted by the AJ to assist it in the preparation of the Monthly Activities Report ("RMA") come, respectfully, to your presence, in accordance with the decision of pages 91,223 / 91,224, present the RMA for the month of April 2020.

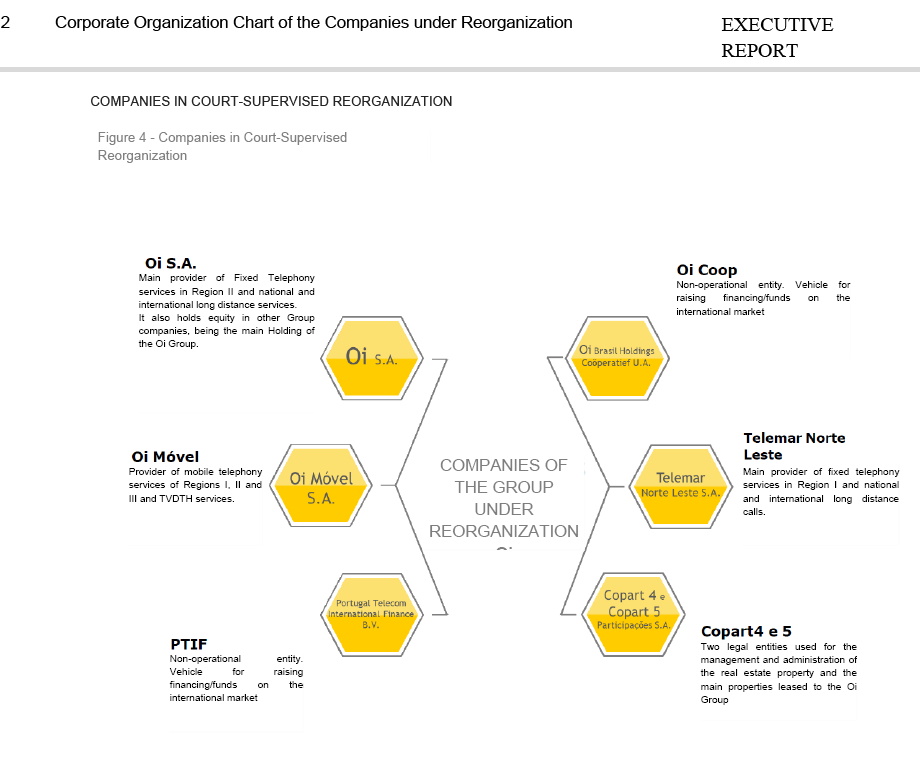

As you know, the Court-Supervised Reorganization involves the following companies:

- Oi S.A. - in Court-Supervised Reorganization ("Oi S.A.");

- Telemar Norte Leste S.A. - in Court-Supervised Reorganization ("Telemar Norte Leste");

- Oi Móvel S.A. - in Court-Supervised Reorganization ("Oi Móvel");

- Copart4Participações S.A. - in Court-Supervised Reorganization ("Copart4")*;

- Copart5Participações S.A. - in Court-Supervised Reorganization ("Copart5")*;

- Portugal Telecom International Finance B.V. - in Court-Supervised Reorganization ("PTIF"); and

- Oi Brasil Holdings Coöperatief U.A. - in Court-Supervised Reorganization ("Oi Coop").

This report, which includes financial information based mainly on elements provided by Companies under Reorganization up to June 15, 2020, contains data referring to the month of April 2020, and must be analyzed together with the preliminary activity report, as well as the other RMA's previously presented.

The RMA will include a chapter specifically focused on the consolidated financial information of the Companies under Reorganization, which in this Report will cover the Managerial Cash Flow Statement for the relevant month, presented in the tables and compared to the immediately preceding month. The report will highlight the main variations that have occurred in the relevant period, presenting the explanations provided by the Management of the Companies under Reorganization.

* Copart4Participações S.A. was acquired by Telemar Norte Leste S.A. in January 2019, as established0 clause 7, annex 7.1, of the PRJ; Copart5Participações S.A. was acquired by Oi S.A. in March 2019, as established in clause 7, annex 7.1 of the PRJ.

3

1 Introduction | EXECUTIVE |

|

This report, prepared through analytical procedures and discussions with the Company's Management, aims to provide the Court and concerned parties with information on the financial status of the Companies under Reorganization and the relevant operations carried out by them, as well as a summary of the activities carried out by AJ up to the closing of this report.

The information presented below is mainly based on data and elements submitted by the Companies under Reorganization. The individual financial statements of all Companies under Reorganization, as well as the consolidated financial statements of the Oi Group (which include but are not limited to the Companies under Reorganization) are audited annually by independent auditors. Limited review procedures are applied by the auditors for filing Oi Group Consolidated Quarterly Financial Information ("ITRs") with the CVM. Regarding the individual financial information of each Debtor, prepared for monthly periods other than those covered by the ITRs delivered to CVM, they are not subject to independent audit review, either by the auditors hired by the Oi Group or by the AJ.

The AJ, honored with this assignment, is available for further clarification on the information contained in this report or other additional information.

Sincerely,

|

|

|

Arnoldo Wald Filho awf@wald.com.br Samantha Mendes Longo samantha@wald.com.br Partners

|

| Thiago Fogaça Almeida Economist tfa@riobranco.adm.br Tel:+55(11)3392-3062 |

|

|

|

Tel: +55(11)3074-6000 |

|

|

4

5

6

7

8

3 Material Facts & Announcements to the Market published | EXECUTIVE |

|

RELEVANTFACTS & ANNOUNCEMENTS TO THE MARKET

Below we present some of the Relevant Facts and announcements to the market released by the Oi Group directly related to the Companies under Reorganization:

Relevant Facts and Announcements to the Market inMAY/2020

May 27 - Postponement of the Disclosure of Financial Information for the 1st Quarter of 2020

Oi S.A. - In Court-Supervised Reorganization ("Company"), in compliance with art. 157, paragraph 4 of Law 6.404/76 and pursuant to CVM Instruction 358/02, hereby informs its shareholders and to the market in general that, in compliance with the new time limits exceptionally established by CVM Resolution No. 852 of April 15, 2020, the Company decided to postpone the disclosure of its quarterly financial information and the independent auditors' review report for the first quarter of 2020, originally due on May 28, 2020, to 15 June 2020.

The entire Relevant Fact can be accessed at

https://www.oi.com.br/ri/download_arquivos.asp?id_arquivo=995BAFDB-4D81-4C48-A099-16DD257A9027

27 May - Fitch Risk Change

Oi S.A. - In Court-Supervised Reorganization ("Oi" or "Company") informs its shareholders and the market in general that on this date, the rating agency Fitch Ratings ("Fitch") announced the revision of the credit rating assigned to the Company.

Fitch Ratings downgraded Oi's ratings, including the Foreign Currency Long Term Issuer (LT) Rating from "B-" to "CCC+", the long-term local currency rating from "B-" to "CCC+", the long-term national rating from "BB- (bra) / Stable" to "B (bra) / Stable", and the 2025 notes from "B-" / "RR4" to "CCC+" / "RR4". The perspective of rating in international ratings has been removed.

The complete Notice to the Market can be accessed at

https://www.oi.com.br/ri/conteudo_pt.asp?http://ri.oi.com.br/Oi2012/web/download_arquivos.asp?id_arquivo=DEB5F7F4-5529-4F66-83EF-6EC3649E5213

9

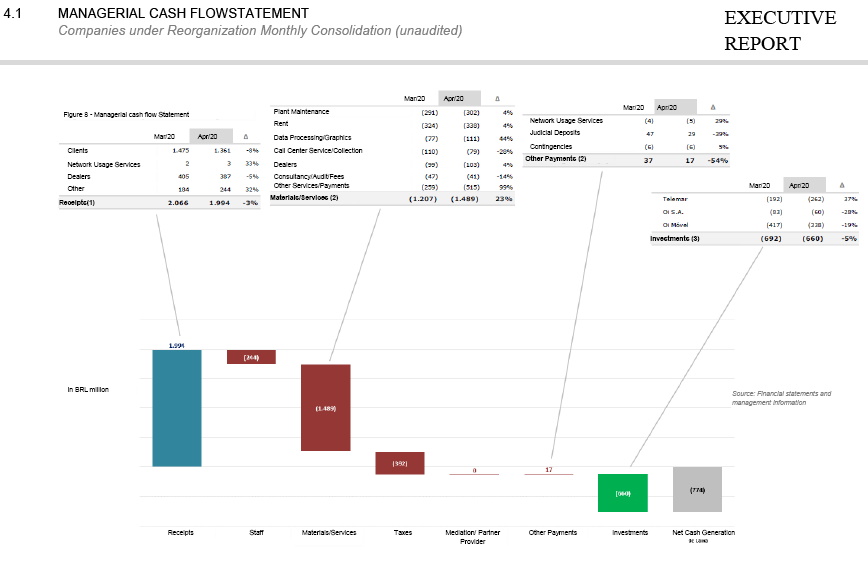

4.1 MANAGERIAL CASH FLOWSTATEMENT Companies under Reorganization Monthly Consolidation (unaudited) | EXECUTIVE |

|

STATEMENT OF MANAGEMENT CASH FLOW

HIGHLIGHTS

| Statement APRIL 1-30, 2020 |

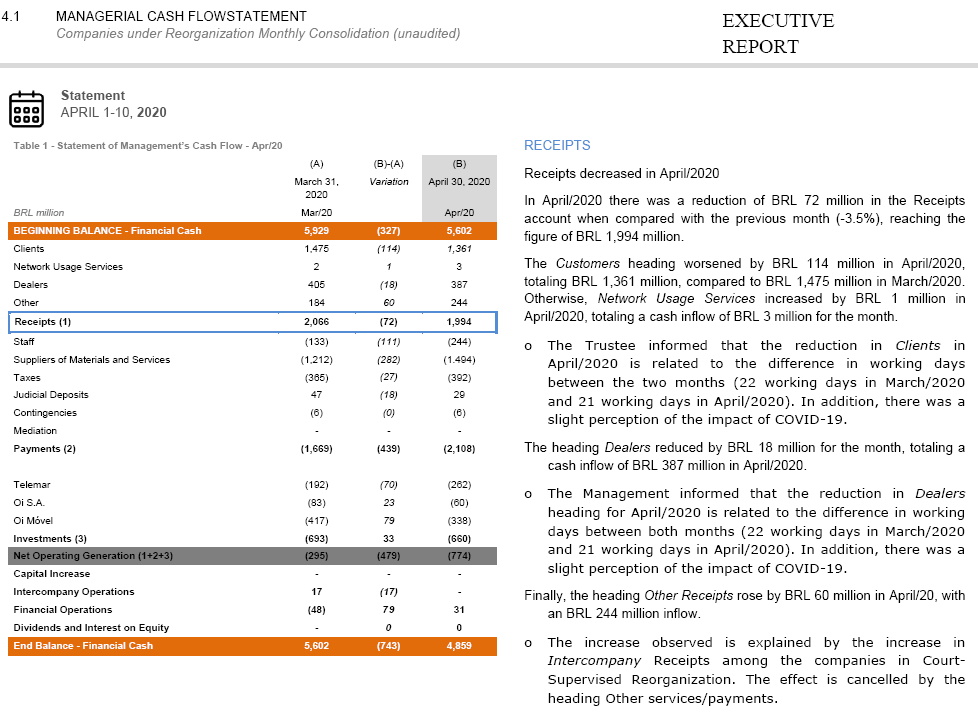

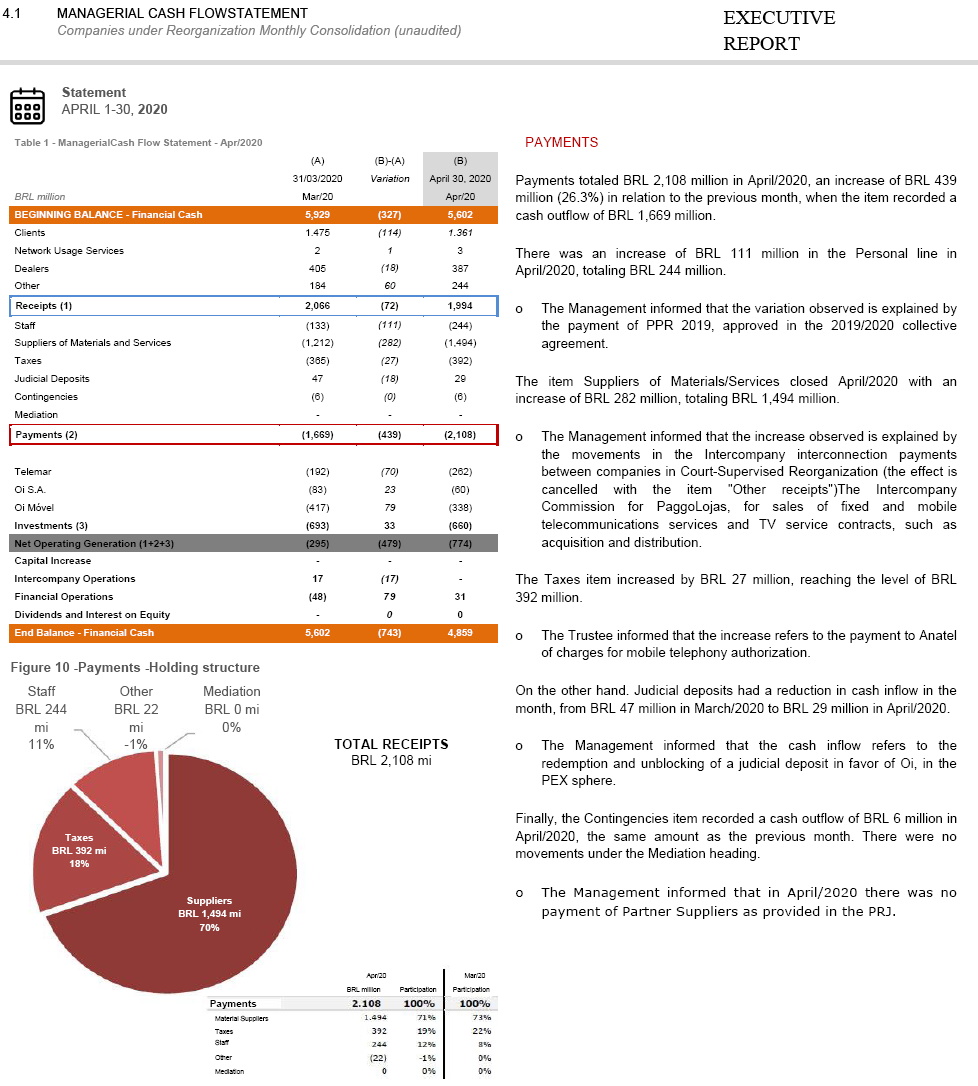

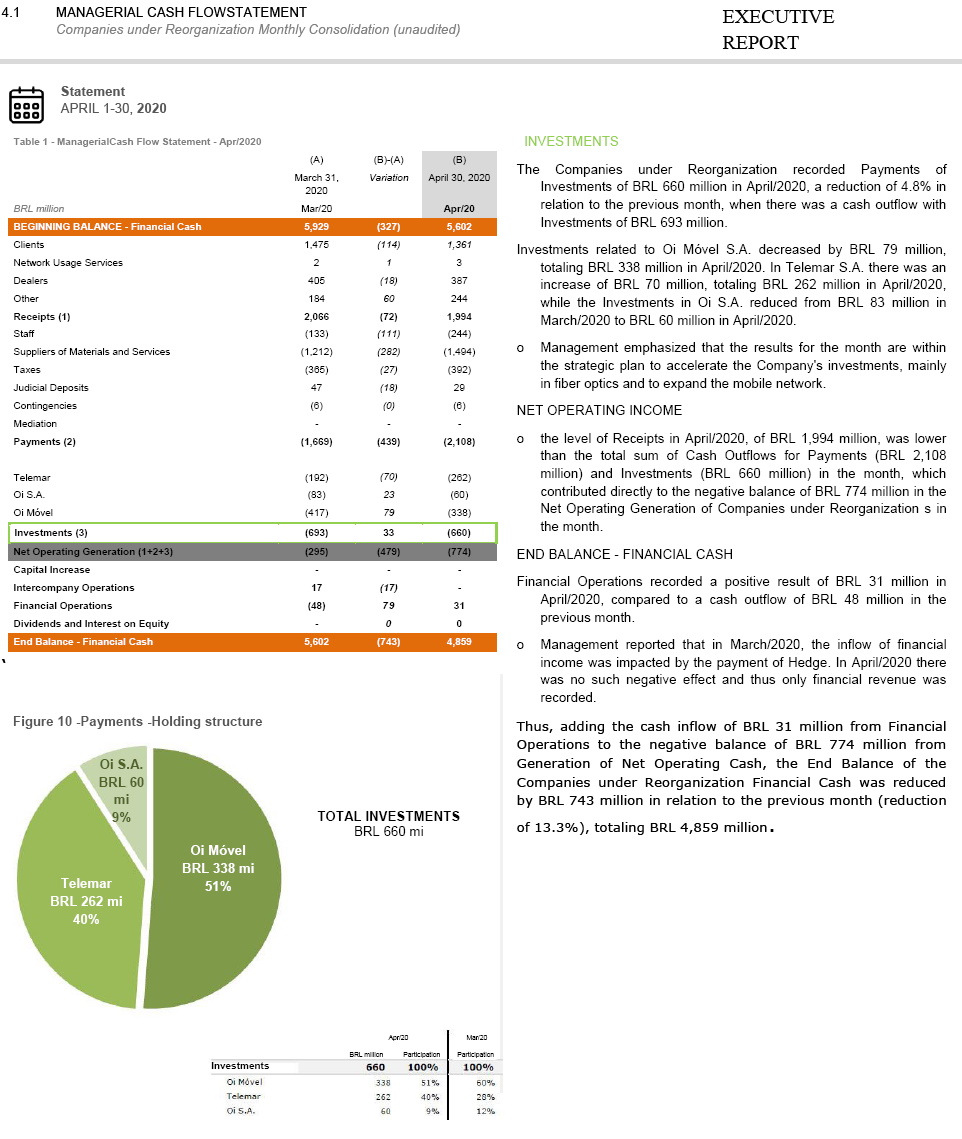

o Companies under Reorganization' Generation of Net Operating Cash was negativeby BRL 774 million in April/2020

o Investmentsreached the level of BRL 660 million in April/2020

o Receiptsdecreased by BRL 72 million in April/2020, totaling BRL 1,994 million

o Paymentspresented an increase of BRL 439 million in April/2020, reaching the level of BRL 2,108 million

o In April/20 there was a cash inflow of BRL 31 million in theFinancial Operations heading

o TheEnd Balance of the Financial Cash ofCompanies under Reorganization was reduced by BRL 743 million in April/2020, totaling BRL 4,859 million

10

11

12

13

14

15

16

4.1 MANAGERIAL CASH FLOWSTATEMENT Companies under Reorganization Monthly Consolidation (unaudited) | EXECUTIVE |

|

| Statement APRIL 1-30,2020 |

|

Table 2 - Direct Cash Flow

COMPANIES UNDER REORGANIZATION CONSOLIDATED | AUG/18 | SEP/18 | OCT/18 | NOV/18 | DEC/18 | JAN/19 | FEB/19 | MAR/19 | APR/19 | MAY/19 | JUN/19 | JUL/19 | AUG/19 | SEP/19 | OCT/19 | NOV/19 | DEC/19 | JAN/20 | FEB/20 | MAR/20 | APR/20 |

Opening Balance - Financial Cash | 4,677 | 4,721 | 4,815 | 4,379 | 4,362 | 4,469 | 7,515 | 5,943 | 6,010 | 4,614 | 4,306 | 4,145 | 3,621 | 3,083 | 3,060 | 2,612 | 2,239 | 1,910 | 3,761 | 5,929 | 5,602 |

Receipts | 2,659 | 2,694 | 2,898 | 2,815 | 2,645 | 2,463 | 2,400 | 2,248 | 2,090 | 2,815 | 2,110 | 2,369 | 1,991 | 2,033 | 2,119 | 2,013 | 2,412 | 2,303 | 1,782 | 2,066 | 1,994 |

Clients | 1,731 | 1,681 | 1,808 | 1,807 | 1,697 | 1,628 | 1,541 | 1,572 | 1,570 | 1,660 | 1,496 | 1,616 | 1,511 | 1,495 | 1,563 | 1,473 | 1,652 | 1,494 | 1,353 | 1,475 | 1,361 |

Network Usage Services | 210 | 205 | 204 | 192 | 192 | 177 | 191 | 151 | 6 | 252 | 5 | 43 | 9 | 9 | 8 | 5 | 19 | 6 | 14 | 2 | 3 |

Dealers | 518 | 420 | 414 | 478 | 412 | 498 | 400 | 411 | 427 | 446 | 395 | 453 | 433 | 421 | 443 | 421 | 443 | 488 | 368 | 405 | 387 |

Other | 200 | 388 | 472 | 338 | 344 | 160 | 268 | 114 | 87 | 457 | 214 | 257 | 38 | 108 | 105 | 114 | 298 | 315 | 47 | 184 | 244 |

Payments | (2,279) | (2,276) | (2,751) | (2,432) | (2,285) | (2,733) | (2,805) | (1,821) | (2,964) | (2,560) | (1,743) | (2,207) | (1,577) | (1,471) | (1,694) | (1,792) | (2,082) | (2,031) | (2,057) | (1,669) | (2,108) |

Staff | (170) | (140) | (137) | (133) | (244) | (200) | (172) | (144) | (320) | (180) | (152) | (151) | (138) | (136) | (125) | (134) | (235) | (177) | (147) | (133) | (244) |

Suppliers of Materials and Services | (1,604) | (1,640) | (2,048) | (1,775) | (1,508) | (1,829) | (1,670) | (1,239) | (1,496) | (1,905) | (1,112) | (1,640) | (1,178) | (960) | (1,273) | (1,274) | (1,553) | (1,646) | (1,125) | (1,212) | (1,494) |

Materials/Services | (1,393) | (1,433) | (1,842) | (1,581) | (1,315) | (1,649) | (1,478) | (1,087) | (1,490) | (1,654) | (1,105) | (1,594) | (1,169) | (951) | (1,264) | (1,268) | (1,536) | (1,640) | (1,111) | (1,208) | (1,489) |

Plant Maintenance | (297) | (299) | (300) | (347) | (425) | (406) | (344) | (305) | (324) | (322) | (331) | (336) | (348) | (329) | (339) | (371) | (393) | (357) | (287) | (291) | (302) |

Rent | (349) | (329) | (336) | (338) | (297) | (401) | (438) | (273) | (407) | (432) | (255) | (424) | (292) | (194) | (368) | (311) | (254) | (424) | (336) | (324) | (338) |

Data Processing/Graphics | (122) | (103) | (134) | (129) | (97) | (134) | (122) | (108) | (139) | (94) | (99) | (126) | (94) | (10) | (28) | (156) | (185) | (185) | (66) | (77) | (111) |

Call Center Service/Collection | (138) | (104) | (138) | (147) | (163) | (129) | (155) | (113) | (135) | (138) | (121) | (116) | (128) | (124) | (103) | (125) | (143) | (112) | (134) | (110) | (79) |

Dealers | (108) | (109) | (112) | (116) | (110) | (115) | (115) | (105) | (100) | (109) | (99) | (103) | (98) | (102) | (101) | (103) | (99) | (103) | (128) | (99) | (103) |

Consultancy / Audits / Fees | (71) | (45) | (96) | (74) | (52) | (124) | (50) | (34) | (76) | (42) | (24) | (71) | (41) | (25) | (39) | (32) | (31) | (76) | (95) | (47) | (41) |

Other Services/Payments | (308) | (444) | (726) | (430) | (171) | (340) | (254) | (149) | (309) | (517) | (176) | (418) | (168) | (167) | (286) | (170) | (431) | (383) | (65) | (259) | (515) |

Network Usage Services | (211) | (207) | (206) | (194) | (193) | (180) | (192) | (152) | (6) | (251) | (7) | (46) | (9) | (9) | (9) | (6) | (17) | (6) | (14) | (4) | (5) |

Taxes | (487) | (516) | (551) | (543) | (523) | (683) | (566) | (524) | (1.221) | (500) | (501) | (478) | (407) | (400) | (384) | (404) | (368) | (402) | (365) | (365) | (392) |

Judicial Deposits | 46 | 40 | 41 | 55 | 75 | 34 | 51 | 91 | 78 | 41 | 32 | 71 | 153 | 29 | 88 | 33 | 86 | 200 | 41 | 47 | 29 |

Contingencies | - | (4) | (2) | (1) | (12) | (5) | (6) | (5) | (5) | (16) | (10) | (9) | (7) | (4) | - | (13) | (12) | (6) | (4) | (6) | (6) |

Mediation | (64) | (16) | (54) | (35) | (73) | (50) | (442) | - | - | - | - | - | - | - | - | - | - | - | (457) | - | - |

Investments | (363) | (339) | (582) | (421) | (344) | (603) | (482) | (384) | (540) | (672) | (544) | (702) | (656) | (592) | (881) | (596) | (661) | (685) | (748) | (693) | (660) |

Telemar | (178) | (147) | (222) | (193) | (174) | (234) | (208) | (172) | (230) | (279) | (206) | (245) | (232) | (215) | (245) | (212) | (185) | (195) | (195) | (192) | (262) |

Oi S.A. | (47) | (64) | (76) | (58) | (46) | (103) | (83) | (51) | (81) | (99) | (54) | (83) | (61) | (62) | (88) | (54) | (62) | (66) | (88) | (83) | (60) |

Oi Móvel | (138) | (128) | (284) | (170) | (124) | (266) | (191) | (161) | (229) | (294) | (284) | (374) | (363) | (315) | (548) | (330) | (414) | (424) | (465) | (417) | (338) |

Operational Generation | 17 | 79 | (435) | (38) | 16 | (873) | (887) | 43 | (1,414) | (417) | (177) | (540) | (242) | (30) | (456) | (375) | (331) | (413) | (1,023) | (295) | (774) |

Capital Increase | - | - | - | - | - | 4.007 | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - |

Pharol Agreement | - | - | - | - | - | (106) | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - |

Non Core | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | 121 | - | - |

Intercompany Operations | (1) | - | - | - | 14 | - | - | - | - | 100 | - | - | - | - | - | - | - | - | - | 17 | - |

Financial Operations | 28 | 15 | (1) | 21 | 23 | 18 | (685) | 24 | 17 | 9 | 16 | 16 | (296) | 7 | 8 | 2 | 2 | 2.264 | 3.070 | (48) | 31 |

Dividends and Interest on Equity | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | 0 |

End Balance - Financial Cash | 4,721 | 4,815 | 4,379 | 4,362 | 4,469 | 7,515 | 5,943 | 6,010 | 4,614 | 4,306 | 4,145 | 3,621 | 3,083 | 3,060 | 2,612 | 2,239 | 1,910 | 3,761 | 5,929 | 5,602 | 4,859 |

17

5 Creditors’ Service | EXECUTIVE |

|

CREDITORS’ SERVICE

In the last month, the Trustee continued to dedicate itself to the organization of the new General Assembly of Creditors that will be held to debate the proposal of the Term Companies under Reorganization Plan, in accordance with the terms of the decision rendered on pages 425.465/425.471.

Among the work for the new AGC is the examination and validation of the documentation that has already been submitted by creditors with voting rights through the online platform made available to creditors, as was done for the Creditors' Meeting held in 2017, allowing creditors to exercise their right to vote without the need to travel (https://credor.oi.com.br).

In addition, the AJ remains assisting Your Honor the organization of the numerous letters received from other Judges requesting authorization to build up the assets of the Companies under Reorganization for payment of extra-curricular credits, in a procedure that, on the one hand, unites speed and security for the benefit of the Creditors, and, on the other, allows the Oi Group to be set up and the PRJ to be complied with.

For this purpose, the Trustee makes available on a monthly basis on the site of Court-Supervised Reorganization (www.recuperacaojudicaloi.com.br), which already has 1,525,470 hits, the list of letters received from the registry office of the 7th Business Court - 25,833 requests having already been processed - and the credits paid by the Oi Group.

In a decision dated 03.06.2020, the Recovering Judge determined that the Companies under Reorganization Judges increased the amount made available for payment of claims not included in the composition with creditors of BRL 7,000,000 per month.

In relation to the competition credits, the AJ remains focused on clarifying doubts about mediation procedures, clauses and compliance with the approved Court-Supervised Reorganization Plan, being constantly contacted by national and international creditors, either by telephone on +55 (21) 2272-9300, or by e-mail credoroi@wald.com.br.

During the month, the Trustee followed the mediation procedure related to the procedural incidents, in accordance with the decision on page 341.970/341.973. This mediation aims to encourage a composition between creditors and Companies under Reorganization to define the value of the claims, based on an online platform, which already has 11,271 agreements signed.

In addition, the Trustee makes available on the Court-Supervised Reorganization website the list of procedural incidents addressed by judgment, which list is updated periodically.

18

6 Statements presented by the Trustee (AJ) | EXECUTIVE |

|

Below, the AJ lists the statements presented in the electronic records after the last Monthly Activity Report, showing the corresponding pages. | ||

Pages 436.214/436.234 | Monthly report on the activities carried out by Companies under Reorganization (in March 2020). | May 15, 2020 |

| Trustee statement on the following: |

|

| (i) claim of Companies under Reorganization that American Tow do Brasil would no longer fit into the condition of Partner Supplier Creditor; |

|

| (ii) request made by AEC Centro de Contatos S/A, regarding the "change of register data" for purposes of claim payment to a branch office; | June 15, 2020 |

Pages | (iii) petition of creditor Maria Luiza Valente Barbosa regarding payment of her claim; |

|

| (iv) letters of courts requesting the cancellation of requests for payment of claims; and |

|

| (v) letters from various courts requesting the payment of claims not included in the composition with creditors. |

|

| ||

Appeals in which the Trustee presented statements: | ||

0023413-42.2020.8.19.0000 | Interlocutory Appeal filed by the Public Prosecution Service against the decision granting the direct sale of certain real estate, "free of any encumbrance and without succession for the acquirers of debtor's obligations, including those of a tax nature." | June 5, 2020 |

In addition, in response to letters and requests addressed directly to the AJ by the most diverse Courts in the country, the Trustee presented several statements in lawsuits filed against the Companies under Reorganization.

19

7 Supervision of compliance with the Court-Supervised Reorganization Plan | EXECUTIVE |

|

THE SUPERVISION OF THE FULFILLMENT OF THE COURT-SUPERVISED REORGANIZATION PLAN

The Court-Supervised Reorganization Plan ("PRJ") submitted by the Companies under Reorganization was approved by the Creditors attending the General Meeting of Creditors held on December 19, 2017, and approved by homologation, with exceptions, by Your Honor, according to the decision on pages 254.741/254.756.

Thus, the Trustee remains focused on the supervision of the fulfillment of the obligations by the Companies under Reorganization under the PRJ approved, having, for this purpose, held periodic meetings with the Company and reviewed all relevant documentation.

As a result of this supervision, the AJ informs that as of April 2020, only the obligations that have a maturity linked to a final and unappealable decision (res judicata) in the original proceedings have come due, as set forth in the Court-Supervised Reorganization Plan. Monthly, this Trustee receives the list of labor claims paid over the month, as a result of the end of the grace period (180 days counted from the res judicata in the original proceedings - clause 4.1.1 of PRJ).

Finally, regarding mediation with illiquid credits, the AJ informs that it has been monitoring the procedure and the operation of the FGV Platform, available for access since July 26, 2018.

20

| ||

Admiral Barroso, 52, 24º andar CEP 20031-000 Rio de Janeiro, RJ - Brazil |

| Avenida Juscelino Kubitschek, no. 510, 8th floor CEP 04543-906 São Paulo, SP - Brazil |

|

|

|

| Marquês de São Vicente, 446 - Conj. 1206 Barra Funda CEP 01139-000 São Paulo, SP – Brazil |

|

21