Disco Topco Holdings (Cayman), L.P.

Notes to Consolidated Financial Statements

(amounts in thousands except unit and per unit amounts)

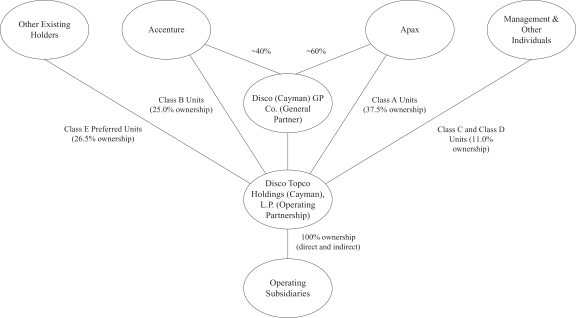

In August 2016, the Company issued 230,700,015 of the Class A Units to entities affiliates with Apax Partners LLC in exchange for cash proceeds of $230,700 which was utilized to fund the acquisition of the Duck Creek entities. Additionally, as part of the consideration paid for the acquisition of the Duck Creek entities, 153,799,943 Class B Units valued at $153,800 were issued to Accenture.

In August 2016, the Company issued 21,441,468 Class A Units and 14,294,312 Class B Units to entities affiliated with Apax Partners LLC in exchange for cash proceeds of $35,736 which was utilized to fund the acquisition of Agencyport.

In August 2016, the Company issued 2,160,106 Class C Units to members of the Company’s management in exchange for cash proceeds of $2,160. A subscriptions receivable in the amount of $1,090 was recorded as of August 31, 2016 to account for cash received in 2017 relating to this transaction.

In October 2018, the Company issued 1,500,000 Class C Units, with an aggregate fair value of $2,025, as part of the purchase price of the Outline acquisition as further described in note 3.

Additionally, the Company issues Class D incentive units and Phantom Unit incentive awards to certain employees and directors of the Company (see note 14). During the year ended August 31, 2018 and 2019, the Company granted an aggregate of 1,335,000 and 9,015,000 Class D incentive units and Phantom Unit incentive awards, respectively. An aggregate total of 46,315,024 Class D incentive units and Phantom Unit incentive awards are issued and outstanding as of August 31, 2019 and an aggregate of 4,873,558 and 5,460,901 of such units vested during the years ended August 31, 2018 and 2019, respectively.

The Class A, Class B, and Class C Units are held by the Company’s limited partners, with the exception of 100 Class A Units which are held by the Company’s general partner.

Profits and losses are allocated to each class in such a manner, as close as possible, to equal the amount that would be distributable to each partner upon dissolution of the Company. The rights and preferences of the Class A, Class B, Class C and Class D Units are as follows:

Voting rights: All units of the limited partners are deemed to be nonvoting units and do not entitle any holder thereof to any right to vote upon or approve any action to be taken by the Company. The Company’s general partner, Disco (Cayman) GP Co., has broad authority to act on behalf of the partnership.

Distribution preferences: The partners of the Company are entitled to receive distributions in the following order priority: (1) first, 100% to the holders of Class A Units, Class B Units and Class C Units in proportion to their unreturned capital amounts, (2) second, to all holders, on a ratable basis, of Class A Units, Class B Units, Class C Units and Class D Units held at the time of distribution.

Liquidation preferences: Upon any liquidation or dissolution of the Company, the partners are entitled to a distribution of the remaining assets of the Company after payment or provision for the Company’s liabilities has been made, in accordance with the distribution preferences described above.

Redemption rights: No units of the Company provide the holder with the right to redeem the units, outside of the distribution and liquidation terms described above. Although units of the Company are not mandatorily or currently redeemable, they are classified outside of partner’s capital because they are potentially redeemable upon certain events outside of the Company’s control, including a change in control, sale, dissolution, or winding up.

Repurchase rights: In the event that an employee holding Class C Units is terminated for cause or upon breach of the agreement between the Company and the employee, the Company has the right to repurchase the Class C Units for the lower of the cost basis (to the holder) of the Class C Units, the fair value of the Class C Units at the date of termination or the fair value of the Class C Units at the date of repurchase. The Company also has the right to repurchase vested Class D Units upon termination as further described in note 14.

F-35