Exhibit 5.1

March 28, 2018

Teva Pharmaceutical Industries Limited

Teva Pharmaceutical Finance IV, LLC

Teva Pharmaceutical Finance V, LLC

Teva Pharmaceutical Finance VI, LLC

Teva Pharmaceutical Finance Company B.V.

Teva Pharmaceutical Finance IV B.V.

Teva Pharmaceutical Finance V B.V.

Teva Pharmaceutical Finance N.V.

Teva Pharmaceutical Finance Netherlands II B.V.

Teva Pharmaceutical Finance Netherlands III B.V.

Teva Pharmaceutical Finance Netherlands IV B.V.

c/o Teva Pharmaceutical Industries Limited

5 Basel Street

P.O. Box 3190

Petach Tikva 4951033

Israel

Re:Registration Statement on FormS-3

- 1 -

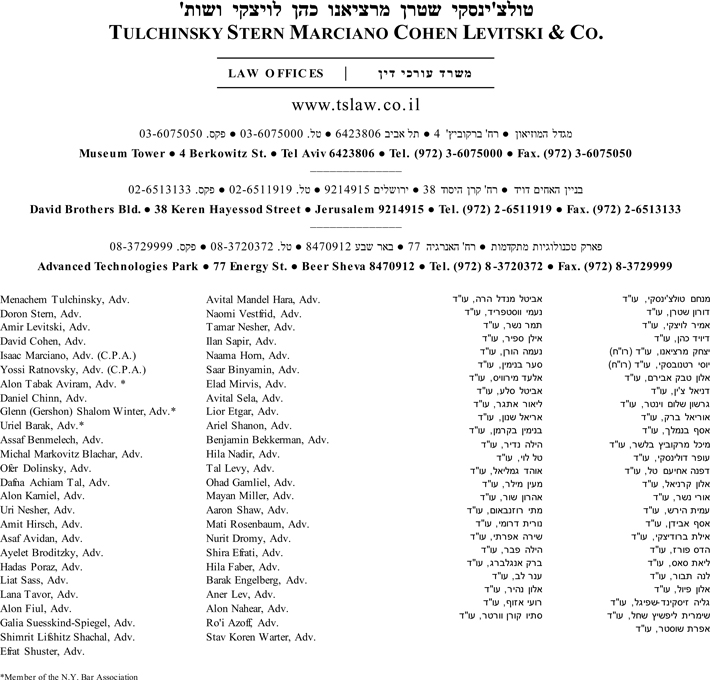

TULCHINSKY STERN MARCIANO COHEN LEVITSKI & CO.

Ladies and Gentlemen:

We have acted as Israeli counsel for Teva Pharmaceutical Industries Limited, an Israeli corporation (“Teva” or the “Company”), in connection with the preparation and filing by Teva with the United States Securities and Exchange Commission pursuant to the Securities Act of 1933, as amended (the “Act”), of the Registration Statement on FormS-3 (the “Registration Statement”) by Teva, Teva Pharmaceutical Finance IV, LLC, a Delaware limited liability company (“Teva Finance IV LLC”), Teva Pharmaceutical Finance V, LLC, a Delaware limited liability company (“Teva Finance V LLC”), Teva Pharmaceutical Finance VI, LLC, a Delaware limited liability company (“Teva Finance VI LLC” and, together with Teva Finance IV LLC and Teva Finance V LLC, the “LLCs”), Teva Pharmaceutical Finance Company B.V., a Curaçao private limited liability company (“Teva Finance Company BV”), Teva Pharmaceutical Finance IV B.V., a Curaçao private limited liability company (“Teva Finance IV BV”), Teva Pharmaceutical Finance V B.V., a Curaçao private limited liability company (“Teva Finance V BV” and, together with Teva Finance Company BV and Teva Finance IV BV, the “Teva BVs”), Teva Pharmaceutical Finance N.V., a Curaçao public limited liability company (“Teva Finance NV”); Teva Pharmaceutical Finance Netherlands II B.V., a Dutch private limited liability company (“Teva Netherlands II”), Teva Pharmaceutical Finance Netherlands III B.V., a Dutch private limited liability company (“Teva Netherlands III”), and Teva Pharmaceutical Finance Netherlands IV B.V., a Dutch private limited liability company (“Teva Netherlands IV” and, together with Teva Netherlands II and Teva Netherlands III, the “Netherlands BVs” and, together with the Teva BVs, Teva Finance NV and the LLCs, the “Finance Subsidiaries”) relating to the registration of the sale from time to time of:

(A) by Teva, (i) American Depositary Shares (“ADSs”), each representing one ordinary share, par value NIS 0.10 per share, of Teva (the “Ordinary Shares”); (ii) senior debt securities (the “Teva Senior Debt Securities”), which may be issued pursuant to an indenture (the “Teva Senior Indenture”) to be executed by Teva and The Bank of New York Mellon, as trustee; and (iii) subordinated debt securities (the “Teva Subordinated Debt Securities” and, together with the Teva Senior Debt Securities, the “Teva Debt Securities”), which may be issued pursuant to an indenture (the “Teva Subordinated Indenture” and, together with the Teva Senior Indenture, the “Teva Indentures”) to be executed by Teva and The Bank of New York Mellon, as trustee; (iv) purchase contracts (the “Purchase Contracts”) for the purchase and sale of Teva’s securities or securities of third parties, a basket of such securities, an index or indices of such securities or any combination of the above; and (v) units (the “Units”) consisting of one or more Purchase Contracts, Teva Debt Securities, Subsidiary Debt Securities, Ordinary Shares, ADSs, other equity securities or any combination of such securities;

(B) by each of the Finance Subsidiaries, (i) senior debt securities (the “Subsidiary Senior Debt Securities”), guaranteed by Teva, which may be issued pursuant to an indenture (each, a “Subsidiary Senior Indenture”) to be executed by the applicable Finance Subsidiary, Teva and The Bank of New York Mellon, as trustee; and (ii) subordinated debt securities (the “Subsidiary Subordinated Debt Securities”, and together with the Subsidiary Senior Debt Securities, the “Subsidiary Debt Securities”), guaranteed by Teva, which may be issued pursuant to an indenture (each, a “Subsidiary Subordinated Indenture” and together with the Subsidiary Senior Indentures, the “Subsidiary Indentures”) to be executed by the applicable Finance Subsidiary, Teva, as guarantor and The Bank of New York Mellon, as trustee.

For purposes of the opinions hereinafter expressed, we have examined originals or copies, certified and otherwise identified to our satisfaction, of such documents, corporate records, certificates of public officials and other instruments as we have deemed necessary as a basis for the opinions expressed herein. Insofar as the opinions expressed herein involve factual matters, we have relied (without independent factual investigation), to the extent we deemed proper or necessary, upon certificates of, and other communications with, officers and employees of Teva and upon certificates of public officials. We have also considered such questions of Israeli law as we have deemed relevant and necessary as a basis for the opinions hereinafter expressed.

- 2 -

TULCHINSKY STERN MARCIANO COHEN LEVITSKI & CO.

In making our examination, we have assumed the genuineness of all signatures, the legal capacity of natural persons, the authenticity of all documents submitted to us as originals, the conformity to original documents of all documents submitted to us as certified, photostatic or facsimile copies and the authenticity of the originals of such copies and the legal capacity and due authenticity of all persons executing such documents. We have assumed the same to have been properly given and to be accurate, and we have assumed the truth of all facts communicated to us by the Company, and have assumed that all consents, minutes and protocols of meetings of the Company’s board of directors and shareholders which have been provided to us are true, accurate and have been properly prepared in accordance with the Company’s incorporation documents and all applicable laws.

In connection with the opinions as to enforceability expressed below, such enforceability may be limited by bankruptcy, insolvency, reorganization, moratorium and other similar laws relating to or affecting creditors’ rights generally, subject to general principles of equity and to limitations on availability of equitable relief, including specific performance (regardless of whether such enforceability is considered in a proceeding in equity or at law) or by an implied covenant of good faith and fair dealing.

In connection with all of the opinions expressed below, we have assumed that, at or prior to the time of the delivery of any such security, (i) the Ordinary Shares or such other securities have been specifically authorized and approved for issuance and sale by the Company by all necessary corporate action, and such authorization shall not have been modified or rescinded; (ii) the Ordinary Shares or such other securities will be issued, sold and delivered as contemplated by the Registration Statement, the prospectuses included therein and one or more purchase, underwriting or similar agreements, if applicable, and such agreements have been duly authorized, executed and delivered by the Company and the other parties thereto and; (iii) the Company has received the consideration provided for pursuant to the relevant corporate action and, if applicable, the underwriting agreements; (iv) the Registration Statement (including any post-effective amendments) is effective under the Act, and such effectiveness shall not have been terminated or rescinded; and (v) there shall not have occurred any change in law affecting the validity or enforceability of any such security. We have also assumed that none of the terms of any security to be established subsequent to the date hereof, nor the issuance and delivery of such security, nor the compliance by Teva with the terms of such security will violate any applicable law or will result in a violation of any provision of any instrument or agreement then binding upon the relevant company (including Teva), or any restriction imposed by any court or governmental body having jurisdiction over Teva.

Our opinions expressed below are based upon our consideration of only those statutes, rules and regulations of the State of Israel which, in our experience, are normally applicable to guarantors or issuers of securities of the nature of the Ordinary Shares, ADSs, Teva Debt Securities, Purchase Contracts, Units and Subsidiary Debt Securities.

Based on and subject to the foregoing, we are of the opinion that:

| 1. | The Amended and Restated Deposit Agreement, dated as of November 5, 2012, among Teva, JPMorgan Chase Bank N.A., as depositary, and the Owners and Holders (each as defined therein) from time to time of ADSs issued thereunder, as amended on February 29, 2016 (the “Deposit Agreement”) has been duly authorized, executed and delivered by Teva. |

| 2. | When the Ordinary Shares, including the Ordinary Shares underlying the ADSs or any Purchase Contracts or Units, are issued in accordance with the assumptions above, such Ordinary Shares will be validly issued, fully paid and non-assessable. |

| 3. | When the Teva Indentures have been duly authorized, executed and delivered by the parties thereto in accordance with applicable law, and when the specific terms of a particular series of Teva Debt Securities have been duly authorized and established by the parties in accordance with the relevant Teva Indenture and such Teva Debt Securities have been duly authorized, executed, authenticated, issued and delivered in accordance with the relevant Teva Indenture and any applicable underwriting or other agreement, such Teva Debt Securities will constitute valid and binding obligations of Teva, enforceable against Teva in accordance with their terms. |

| 4. | When the Purchase Contracts and related agreements have been duly authorized, executed, issued and delivered by the parties thereto in accordance with applicable law and with the specific terms of such related purchase contract agreement, such Purchase Contracts will constitute valid and binding obligations of Teva, enforceable against Teva in accordance with their terms. |

| 5. | When the Units and the related unit agreement have been duly authorized, executed, issued and delivered by the parties thereto in accordance with applicable law and with the specific terms of such related unit agreement, such Units will constitute valid and binding obligations of Teva, enforceable against Teva in accordance with their terms. |

- 3 -

TULCHINSKY STERN MARCIANO COHEN LEVITSKI & CO.

| 6. | When the Subsidiary Indentures have been duly authorized, executed and delivered by the parties thereto (including Teva as guarantor) in accordance with applicable law, and when the specific terms of a particular series of Subsidiary Debt Securities have been duly authorized and established in accordance with the relevant Subsidiary Indenture and such Subsidiary Debt Securities have been duly authorized, executed, authenticated, issued and delivered in accordance with the relevant Subsidiary Indenture and any applicable underwriting or other agreement, Teva’s guarantee under each Subsidiary Indenture with respect to such Subsidiary Debt Securities will constitute a valid and binding obligation of Teva, enforceable against Teva in accordance with its terms. |

| 7. | Under the choice of law or conflicts of law doctrines of Israel, a court, tribunal or other competent authority sitting in Israel has discretion, but should apply to any claim or controversy arising under a Teva Indenture, a Subsidiary Indenture or the Deposit Agreement, the law of the State of New York, which is the local law governing the Teva Indentures, the Subsidiary Indentures and the Deposit Agreement, designated therein by the parties thereto, if properly brought to the attention of the court, tribunal or other competent authority in accordance with the laws of the State of Israel, provided there are no reasons for declaring such designation void on the grounds of public policy or as being contrary to Israeli law and provided further that, the choice of law isbona fide and is not made for the purpose of evading the laws of another jurisdiction. |

With respect to our opinions as to the Ordinary Shares, we have assumed that, at the time of issuance and sale, a sufficient number of Ordinary Shares are registered (authorized) and available for issuance under the Company’s Memorandum of Association and Articles of Association as then in effect and that the consideration for the issuance and sale of any such Ordinary Shares is in an amount that is not less than the nominal (par) value thereof.

We do not purport to be expert on the laws of any jurisdiction other than the laws of the State of Israel, and we express no opinion herein as to the effect of any other laws.

We hereby consent to the filing of this opinion as an exhibit to the Registration Statement. By giving our consent, we do not admit that we are in the category of persons whose consent is required under Section 7 of the Act or the rules and regulations issued or promulgated thereunder.

This opinion is being delivered to you for your information in connection with the above matter and addresses matters only as of the date hereof.

Very truly yours,

/s/ Tulchinsky Stern Marciano Cohen Levitski & Co.,

Law Offices

Tulchinsky Stern Marciano Cohen Levitski & Co.

Law Offices

- 4 -