FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of November, 2013

Commission File Number 001-15266

BANK OF CHILE

(Translation of registrant’s name into English)

Ahumada 251

Santiago, Chile

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted

by Regulation S-T Rule 101(b)(1): o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted

by Regulation S-T Rule 101(b)(7): o

Indicate by check mark whether by furnishing the information contained in this Form, the

registrant is also thereby furnishing the information to the Commission pursuant to Rule

12g3-2(b) under the Securities Exchange Act of 1934.

Yes o No x

If “Yes” is marked, indicate below the file number assigned to the registrant in

connection with Rule 12g3-2(b): 82-

BANCO DE CHILE

REPORT ON FORM 6-K

Attached is a Press Release issued by Banco de Chile (“the Bank”) on November 8th, 2013, regarding its financial results for the Third Quarter of 2013.

Santiago, Chile, November 8th, 2013, Banco de Chile (NYSE: BCH), a full service Chilean financial institution, market leader in a wide variety of credit and non-credit products and services across all segments of the Chilean financial market, today announced its results for the third quarter 2013.

![]()

![]()

*Citi and the arc design in Trademark registered by Citigroup Inc.

Use under License.

![]()

3rd Quarter 2013 — Banco de Chile Earnings Report

‘Strategy that makes our capital profitable’

HIGHLIGHTS

· In the 3Q13, BCH ranked first in operating revenues and net income with market shares of 20% and 28%, respectively. The Bank also remained the most profitable in Chile with a ROAE of 23%.

· BCH achieved the first place in Total Loans with a 19.3%* market share as of Sep. 30, 2013.

· Furthermore, BCH posted a cost-to-income ratio of 42.7% as of Sep. 30, 2013. This is the best ratio among its peers.

* Market share calculations excludes operarations of subsidaries abroad.

FINANCIAL OVERVIEW

Arturo Tagle (CEO): ‘In the first half of 2013 we dealt with low inflation and weaker economic growth. Whereas the latter remains, in the 3Q13 inflation surged 1.0%. As a result, we maintained an unparalleled first place in profitability and net income, with an YtD ROAE of 21.4% and net results of Ch$381 billion that represent a market share of 30%. Also, we led the industry in total loans again with a market share of 19.3%*. These accomplishments come from a strategy that draws a clear roadmap for profitable growth. This plan is aimed at prioritizing certain segments in order to optimize the risk — return equation, focusing on efficiency and continuously evaluating potential risks. As for the latter, in the 3Q13 we set additional provisions to recognize the signs of deceleration in the economy. In summary, we expect to continue on this path and close 2013 at the top of the industry in most of the relevant indicators’.

Eduardo Ebensperger (Large Companies and Real Estate Division Manager): ‘Market knowledge and execution capabilities. These are the keys for our success. In this line, we have been very active in seeking out and taking advantage of new business opportunities. Our loan portfolio has grown significantly with a YoY expansion of 15%, without compromising our margins. Our growth supported the Bank’s first place in commercial loans. We are proud of it. Also, we have benefited from our funding advantage by acquiring a high-quality portfolio of commercial loans for Ch$430 billion. We believe that knowledge about our customers’ needs is the key for consolidating our position. Thus, we are putting a lot of effort into penetrating the targeted segments while improving service quality. We expect to continue making profits from these actions in the near future’.

Jorge Tagle (Individual Banking Division Manager): ‘As mentioned by our CEO, we have followed the guidelines established by our mid-term strategic plan. Therefore, we have promoted a selective growth in those segments with better risk-return relationship. This strategy has been crucial in achieving the first place in operating revenues within the local banking industry. As for individuals, we have maintained interesting growth rates in the middle and upper income segment, where consumer and mortgage loans have expanded by 11.1 and 13.6% YoY, respectively. Also, our commitment to SMEs has translated into a 15.9% YoY growth in commercial loans. In these segments, service quality is crucial. In 2013, Banco de Chile recommitted itself to continuously improve our service quality. This is not only reflected by our results or business growth but also by our brand recognition. In this regard, Banco de Chile has recently been recognized as the most valuable brand in Chile among banks and in the second place in the overall ranking for Chile. The only way to preserve these attributes is to commit to excellence throughout all areas of our business’.

FINANCIAL SNAPSHOT

Selected Financial Data (1) |

| 3Q12 |

| 3Q13 |

| YoY |

|

Income Statement (Millions of Ch$) |

|

|

|

|

|

|

|

Net financial income(2) |

| 223,309 |

| 301,879 |

| 35.2 | % |

Net Fees and Commissions |

| 72,896 |

| 71,956 |

| (1.3 | )% |

Other operating income |

| 5,975 |

| 5,803 |

| (2.9 | )% |

Total Operating Revenues |

| 302,180 |

| 379,638 |

| 25.6 | % |

Provisions for loan losses |

| (40,349 | ) | (70,056 | ) | 73.6 | % |

Operating expenses |

| (156,840 | ) | (154,004 | ) | (1.8 | )% |

Net income (3) |

| 99,785 |

| 137,386 |

| 37.7 | % |

Earnings per Share |

|

|

|

|

|

|

|

Net income per share (Ch$) |

| 1.13 |

| 1.47 |

| 30.1 | % |

Book value per share (Ch$) |

| 20.84 |

| 23.89 |

| 14.6 | % |

Shares Outstanding (Millions) |

| 88,038 |

| 93,175 |

| 5.8 | % |

Balance Sheet (Millions of Ch$) |

|

|

|

|

|

|

|

Loans to customers |

| 18,376,394 |

| 20,413,670 |

| 11.1 | % |

Total assets |

| 22,739,005 |

| 25,253,318 |

| 11.1 | % |

Equity |

| 1,834,543 |

| 2,225,831 |

| 21.3 | % |

Profitability Ratios |

|

|

|

|

|

|

|

Return on average assets (ROAA) |

| 1.77 | % | 2.21 | % | +44 | bp |

Return on average equity (ROAE)(4) |

| 20.09 | % | 22.80 | % | +271 | bp |

Net Financial Margin(5) |

| 4.27 | % | 5.29 | % | +101 | bp |

Efficiency ratio |

| 51.90 | % | 40.57 | % | (1,134 | )bp |

Credit Quality Ratios |

|

|

|

|

|

|

|

Total Past Due / Total Loans |

| 0.94 | % | 1.14 | % | +20 | bp |

Allowances / Total loans |

| 2.24 | % | 2.24 | % | (1 | )bp |

Allowances / Total Past Due |

| 2.40 | x | 1.97 | x | (0.43 | )x |

Provisions / Avg. Loans |

| 0.88 | % | 1.41 | % | +53 | bp |

Capital Adequacy Ratios |

|

|

|

|

|

|

|

BIS Ratio (Regulatory Capital / RWA) |

| 12.46 | % | 13.17 | % | +71 | bp |

Tier I Ratio (Capital / RWA) |

| 8.93 | % | 9.92 | % | +99 | bp |

(1) See pages 9 to 12.

(2) Net interest income, foreign exchange transactions and net financial operating income.

(3) Net Income attributable to Bank’s owners (adjusted by minority interest).

(4) ROAE excludes provisions for minimum dividends.

(5) Net financial income divided by average interest earning assets.

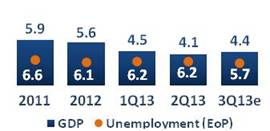

Business Environment:

Chilean Economy

· During the 3Q13, the economic activity maintained the average pace of previous quarters. Thus, GDP grew 4.4% YoY due to a recovery in mining and a solid trend in retail sales. As a result, GDP accumulated an annual expansion of 4.3%. This is the lowest growth rate within the last three years. Consequently, GDP growth expectations have been revised down for 2014. Consensus figures are slightly above 4.0%.

· As for domestic demand, private consumption continues to show a solid growth, in line with a surprisingly low unemployment rate. For upcoming quarters, we are expecting a moderation in these figures, based on a smoothing household confidence and lower expansion in real wages.

· In addition, deceleration in investment has steepened due to a drop in business sentiment. This has been largely influenced by deceleration in emerging markets and delay in mining and energy macro projects.

· As for inflation, CPI has continued to be below historical patterns by posting variations of 1.9% as of Sep. 2013 and 2.0% in twelve months. This is thanks to lower oil prices that have more than offset a rise in food and services prices. We estimate inflation should be about 2.0% for this year and 2.7% for 2014.

· Following the slowdown in economic activity, the Central Bank has recently cut the Monetary Policy Rate by 25 bp. This is the first shift in 20 months, when rate was stuck in 5.0%. The decision surprised the market that did not expect cuts till Dec-13 or the 1Q14. We expect at least one additional reduction in coming months.

KEY FIGURES

GDP & Unemployment

(12 months % change and end of period %)

Inflation & Monetary Policy Rate

(12m % change and %)

Business Environment:

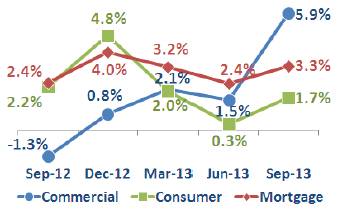

Local Banking Industry

· Total loans of the industry grew 2.1% QoQ, maintaining the average pace observed in the previous quarters. On a YoY basis, total loans rose 10.8%. These figures are aligned with economic activity, which has supported a stable demand for credits.

· A breakdown shows that all of these products maintain double-digit growth rates. Also, all kinds of loans posted a similar YoY expansion rate of approximately 11%. On a QoQ basis, loan growth was steered by mortgage loans (+3.0%), followed by consumer (+2.5%) and commercial loans (+1.7%).

· As for net results, industry’s net income totaled Ch$487 billion in the 3Q13, which represent a significant 60% YoY increase. The improved bottom line had mainly to do with operating revenues that were fostered by higher inflation. In the 3Q13 the UF went up by 1.04% as compared to a 0.16% drop in the 3Q12. This benefited the industry’s net asset exposure to this currency.

· The 22% YoY expansion in operating revenues allowed the industry to largely deal with YoY increases in operating expenses (11%) and loan loss provisions (6%), resulting in an income tax increase of 85% YoY.

· Regarding profitability, industry’s ROAE has shown a sustained improving trend in the last three quarters. The ratio amounted to 15.5% in the 3Q13, which is more than four percentage points above the figure reported in the 3Q12. This is mainly attributable to banks that are making profitable the capital reinforcements carried out in the prior and the current year. Finally, the industry posted reached a YTD ROAE of 14.0%, which is slightly below the 14.1% recorded a year earlier.

KEY FIGURES

Industry’s Loan Nominal Growth*

(%)

* Excludes operations of subsidiaries abroad.

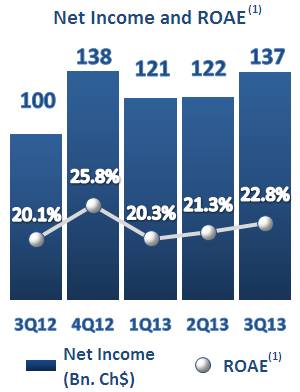

Industry’s Net Income & ROAE

(Billions of Ch$ and %)

Banco de Chile:

Net Income

During the 3Q13 we attained an outstanding net income. In fact, our bottom line totaled Ch$137 billion in this quarter, which is 37.7% and 12.7% above our results in the 3Q12 and the 2Q13, respectively. In addition, this impressive figure permitted us to rank first in net income within the Chilean industry with a 29.5% market share as of Sep. 30, 2013. Our YoY performance in the 3Q13 had mainly to do with:

· A recovered inflation that benefited our UF net asset position.

· Income from loans that continues to be strong based on growing loan balances and higher lending spreads in the 3Q13.

· Our well-known leading position in DDA that keeps on translating into increasing balances, amid a scenario of flat interest rates.

· Our strong cost control policy and an increasing business scale that have resulted in higher efficiencies.

All of the above permitted us to more than offset the YoY rise in loan loss provisions. The higher risk charges were given by a volume effect associated with loan growth, a macroeconomic environment that is showing some signs of slowdown and credit deterioration of specific wholesale customers. Also, the 3Q12 represents a low basis for comparison due to the release of wholesale provisions and a positive exchange rate effect.

Our excellent figures of net income, has enabled us to remain leader in profitability within the local banking industry. Actually, in the 3Q13 we attained a ROAE of 22.8%, which beats the average return recorded by our peers (18.1%)

and the industry (13.7%) in the same period. In comparison with the 2Q13, our ROAE has benefited from an increase in inflation that has been aligned with market expectations.

KEY QUARTERLY FIGURES

(In billions of Ch$, except for %)

(1) ROAE excludes provisions for minimum dividends

Banco de Chile:

Operating Revenues

Our revenue-generating capacity continues to be solid. This is based on growing volumes of loans and deposits, as well as a more favorable inflation rate. Besides, we have been able to combine growth and profitability, as we have not given up lending spreads. As a result, our operating revenues totaled a record figure of Ch$380 billion in the 3Q13, exceeding by 25.6% the figure of the 3Q12. This was explained by:

· A positive inflation effect. The upward trend in consumption and commodity prices caused rises in the CPI for the 3Q13. As a result, the UF rose 1.04%, in comparison with a 0.16% drop in the 3Q12. This resulted in higher income from our UF net asset position.

· An 8.4% YoY growth in average loans. This is composed of a 12.4% annual rise in Retail average loans and a 4.5% YoY rise in Wholesale average loans. To a lesser extent, a slight YoY increase in overall lending spreads also contributed to greater lending revenues.

· Average demand deposits that grew 11.9% in the 3Q12. These greater volumes have been the main driver for higher revenues, as short-term interest rates stay flat.

· A positive exchange rate effect on the hedge of US$-denominated loan loss provisions. This is the result of a low basis for comparison in the 3Q12 (5.3% drop in the Ch$/US$ rate) rather than favorable shifts in the 3Q13 (0.7% decrease in the Ch$/US$).

The above enabled us to offset a tiny decrease in fees and commissions. Besides, the uptick in inflation and steady lending spreads, resulted in margin increases. In the 3Q13 our NFM was 5.29% and our NIM was 4.92%, both exceeding the figures of the 3Q12 by approximately 1%.

KEY QUARTERLY FIGURES

(In millions of Ch$, except for %)

Total Operating Revenues

(in millions of Ch$) |

| 3Q12 |

| 3Q13 |

| YoY |

|

Net Interest Income |

| 209,621 |

| 281,143 |

| 34.1 | % |

Net Fees and Commissions |

| 72,896 |

| 71,956 |

| (1.3 | )% |

Net Financial Operating Income |

| 4,429 |

| 25,952 |

| 486.0 | % |

Foreign Exchange Transactions |

| 9,259 |

| (5,216 | ) | — |

|

Other operating income |

| 5,975 |

| 5,803 |

| (2.9 | )% |

Total Operating Revenues |

| 302,180 |

| 379,638 |

| 25.6 | % |

Net Financial Margin (NFM) |

| 4.27 | % | 5.29 | % | +101 | bp |

Net Interest Margin (NIM) |

| 4.01 | % | 4.92 | % | +91 | bp |

Notes: Expenses related to customer loyalty programs in credit cards were reclassified from operating expenses to paid fees and commissions.

Banco de Chile:

Loan Loss Provisions

We are widely recognized by our prudent risk approach. This includes not only an efficient credit process (assessment / granting / monitoring) but also the ability of anticipating changes in the business environment. Our LLP in the 3Q13 reflects continuous attention to business-related risks. In this quarter we charged LLP of Ch$70.1 billion, representing an annual increase of 73.6%. This YoY variance was due to:

· Loan growth concentrated on Retail Banking. Our average loans expanded 8.4% YoY in the 3Q13, but this was mainly steered by Retail Banking average loans that rose 12.4%. All things equal, this volume effect — isolated from other impacts — represents higher LLPs of Ch$6.0 billion YoY.

· Additional provisions of Ch$7.4 billion in the 3Q13, in view of the actual loan growth, the slowdown shown by the local economy and our expectations on higher volatility over the next years.

· A wholesale customer that suffered financial deterioration in the 3Q13. This translated into higher LLP of ~Ch$4.0 billion. Also, in the 3Q12 we released LLP by ~Ch$8.0 billion, due to an improved risk profile for another wholesale customer.

· A negative exchange rate effect on US$-indexed LLP. The Ch$/US$ rate dropped 5.3% in the 3Q12, which positively impacted our LLP by Ch$4.0 billion. Instead, the exchange rate remained almost flat in the 3Q13.

Based on the above, our LLP ratio was 1.41% in the 3Q13 vis-a-vis the 0.88% posted in the 3Q12. The 53 bp YoY variance is explained by: (i) the mentioned changes in wholesale banking credit risk (49%), (ii) additional provisions (30%), and (iii) exchange rate (14%). Also, our past-due ratio was 1.14% in the 3Q13, rising 20 bp YoY. This uptick is explained by certain wholesale customers that pushed the ratio up in commercial loans. However, this ratio is still below the average of our peers (2.52%) and the industry (2.40%) within the same period.

KEY QUARTERLY FIGURES

(In millions of Ch$, except for %)

Loan Losses Allowances & Provisions

(in millions of Ch$) |

| 3Q12 |

| 3Q13 |

| YoY |

|

Loan Loss Allowances |

|

|

|

|

|

|

|

Initial Allowances |

| 408,120 |

| 434,451 |

| 6.5 | % |

Charge-offs |

| (45,865 | ) | (49,949 | ) | 8.9 | % |

Debt exchange |

| 0 |

| (1 | ) | — |

|

Provisions established, net |

| 49,795 |

| 71,783 |

| 44.2 | % |

Final Allowances |

| 412,050 |

| 456,284 |

| 10.7 | % |

Loan Loss Provisions |

|

|

|

|

|

|

|

Provisions Established |

| (49,795 | ) | (71,783 | ) | 44.2 | % |

Prov. Financial Guarantees |

| 53 |

| (991 | ) | — |

|

Additional Provisions |

| 0 |

| (7,388 | ) | — |

|

Recoveries |

| 9,393 |

| 10,106 |

| 7.6 | % |

Loan Loss Provisions |

| (40,349 | ) | (70,056 | ) | 73.6 | % |

Credit Quality Ratios |

| 3Q12 |

| 3Q13 |

| YoY |

|

Allowances / Total loans |

| 2.24 | % | 2.24 | % | (1 | )bp |

Allowances / Total Past Due |

| 2.40 | x | 1.97 | x | (0.43 | )x |

Provisions / Avg. Loans |

| 0.88 | % | 1.41 | % | +53 | bp |

Charge-offs / Avg. Loans |

| 1.00 | % | 1.01 | % | +1 | bp |

Total Past Due / Total Loans |

| 0.94 | % | 1.14 | % | +20 | bp |

Recoveries / Avg. Loans |

| 0.21 | % | 0.20 | % | (1 | )bp |

Banco de Chile:

Operating Expenses

In line with the rest of the year, we have kept our cost base under control in the 3Q13. This demonstrates the effectiveness of our cost control policies, an efficiency-oriented corporate culture and higher productivity in our core business. As a consequence, our operating expenses amounted to Ch$154.0 billion in the 3Q13, which is 1.8% beneath the figure of the 3Q12. The YoY variance is mainly explained by:

· A YoY decrease of 41.8% or Ch$3.8 billion in other operating expenses. This variance is mostly attributable to lower operational write-offs and contingency provisions incurred in the 3Q12.

· Personnel expenses that decreased by 1.1% YoY or Ch$0.8 billion in the 3Q13 with respect to the 3Q12. The change was primarily related to lower severance payments of Ch$2.0 billion YoY and a decline of Ch$1.2 billion in other expenses. This allowed us to offset higher salary expenses of Ch$2.1 billion YoY.

All of the above enabled us to largely offset the YoY increase of 4.8% in administrative expenses. This increment was mainly fostered by an uptick of Ch$2.1 billion in IT, linked to projects under development.

As a result of the aforesaid, our efficiency has significantly improved. In fact, our cost-to-income ratio improved from 51.9% in the 3Q12 to 40.6% in the 3Q13. This ratio was partly explained by the favorable inflation scenario faced in this quarter.

Nonetheless, we also present a very attractive YtD ratio of 42.7%. This demonstrates our ability and efficiency for keeping expenses under control, in spite of a commercial activity that continues to grow.

KEY QUARTERLY FIGURES

(In millions of Ch$, except for %)

Total Operating Expenses

(in millions of Ch$) |

| 3Q12 |

| 3Q13 |

| YoY |

|

Personnel expenses |

| (79,229 | ) | (78,390 | ) | (1.1 | )% |

Administrative expenses |

| (60,218 | ) | (63,133 | ) | 4.8 | % |

Depreciation and Amort. |

| (7,743 | ) | (7,041 | ) | (9.1 | )% |

Impairments |

| (518 | ) | (124 | ) | (76.1 | )% |

Other Oper. Expenses |

| (9,132 | ) | (5,316 | ) | (41.8 | )% |

Total Oper. Expenses |

| (156,840 | ) | (154,004 | ) | (1.8 | )% |

Additional Information |

| 3Q12 |

| 3Q13 |

| YoY |

|

Efficiency Ratios |

|

|

|

|

|

|

|

Op. Exp. / Op. Rev. |

| 51.9 | % | 40.6 | % | (1,134 | )bp |

Op. Exp. / Avg. Assets |

| 2.8 | % | 2.5 | % | (30 | )bp |

Headcount & Branches |

|

|

|

|

|

|

|

Headcount (#) |

| 14,567 |

| 14,723 |

| +156 |

|

Branches (#) |

| 433 |

| 423 |

| (10 | ) |

Notes: For purposes of comparison certain line items have been reclassified for the 3Q12. Also, expenses related to customer loyalty programs in credit cards were reclassified from operating expenses to paid fees and commissions.

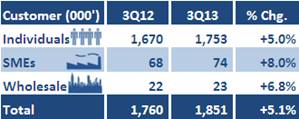

Banco de Chile:

Loan Portfolio and Customer Base

Our loan portfolio accounted for Ch$20.4 trillion as of Sep. 30, 2013. As a result, our loan book pointed a YoY expansion of 11.1% in the 3Q13 and a 4.7% QoQ. This figure has enabled us to rank first in total loans with a market share of 19.3%* as of Sep. 30, 2013. It is important to mention that in the 3Q13 we acquired a loan portfolio of ~Ch$430 billion from a local player. This portfolio is wholly composed of high-quality commercial loans. By excluding this portfolio purchase, our loan growth would have been 8.8% YoY and 2.4% QoQ, maintaining an upward trend in this matter. On a YoY basis, our loan expansion was explained by the following drivers:

· A 13.5% YoY growth in Residential Mortgage loans. We keep on expanding our mortgage portfolio, although at a slower pace. In line with our prudent risk approach and due to some signs of slowdown in the local economy, we have tightened both assessment and credit-granting in this product. Nevertheless, we continue to record attractive quarterly and yearly growth rates. We aspire to keep on growing in this segment as we believe it is functional to our aim of generating long-term relationships with our customers. As of Sep. 30, 2013 we held a balance of Ch$4.6 trillion in residential mortgage loans. As a consequence, our market share was 17.4%*.

· An annual expansion of 10.7% in Commercial loans. As mentioned earlier, in the 3Q13 we acquired a portfolio of commercial loans. This purchase explains 3.7% of the whole YoY growth in this product. Therefore, once adjusted by this effect our balances post a 7.0% YoY increase, which is also remarkable in light of the high competition from local banks and also debt markets. Our growth had mainly to do with an increasing penetration in SMEs (+15.9% YoY) and Large Companies (annual sales between Ch$1.6 and Ch$70.0 billion) whose loans grew 22.0% YoY (ex — portfolio acquisition). Instead, the expansion in the corporate sector has been constrained by our aim of maintaining a balanced risk-return relationship. All in all, as of Sep. 30, 2013 we had a market share of 19.6%* in commercial loans and a balance of Ch$12.9 trillion.

· A lower intensity in consumer lending. There is some consensus about a moderate slowdown in the local economy. Under this scenario, unemployment is one of the main variables subject to correction affecting customers’ payment capacity. Accordingly, as of Sep. 30, 2013 our consumer loans had grown below 10.0% YoY. On the one hand, this is the result of tighter credit-assessment in lower income segments with average consumer loans expanding only 3.2% YoY. On the other hand, we have prioritized growth within middle and upper income customers with consumer lending going up 11.1% YoY. As of Sep. 30, 2013 we had consumer loans of Ch$2.9 billion, which entails a market share of 21.5%*.

Regarding our customer base, worth noting is the expansion in enterprises. In SMEs we have been able to maintain a high penetration, so we have added 5,500 customers on a YoY basis. Also, in the middle and corporate market we expanded our customer base in 1,500 clients. Regarding our individuals’ customer base, it keeps on increasing. However, as

mentioned earlier, we aim to selectively grow in the lower income segment. This has translated into smoothing expansion rates in individuals, although they remain significant at levels of 5.0% in a twelve-month period.

On the whole, our customer base expanded 5.1% YoY from 1.76 million customers in the 3Q12 to 1.85 million clients in the 3Q13.

Loan Portfolio

(In Billions of Ch$, except for %)

Quarterly Loan Growth by Product

(QoQ percentage change)

BCH’s Market Position

(Market Share as of Sep. 30, 2013)

Loans |

| Mkt.Sh.* |

| 12mChg.* |

| Position |

|

Commercial |

| 19.6 | % | +1 | bp | #1 |

|

Mortgage |

| 17.4 | % | +33 | bp | #3 |

|

Consumer |

| 21.5 | % | (30 | )bp | #2 |

|

Total Loans |

| 19.3 | % | +5 | bp | #1 |

|

Customer Base

(In Thousands of Customers)

* Market share calculations exclude operations of subsidiaries abroad..

Banco de Chile:

Funding Structure

We strongly believe that a competitive funding is a key advantage in commercial banking. In this regard, we have strived to set a well diversified funding structure, not only in markets but also in terms. Then, diversification is not only intended to benefit our cost of funding but also improve our liquidity position.

In terms of diversification, our Treasury continues to implementing a strategy in this line. In fact, during the 3Q13 we registered a US$2 billion MTN (mid-term notes) program in the Luxemburg Stock Exchange. This program permits us to ease off-shore debt issuances as it simplifies reporting requirements. We have already placed a US$90 million bond in Hong Kong, under this debt shelf.

This strategy aims to maintain the leading position in terms of cost of funding, in order to build sustainable value offerings for our customers. As of Sep. 30, 2013 our average cost of funding was 3.3%, which is the lowest among our peers. We expect to maintain this important plus by taking advantage of our outstanding international credit rating and our prestige in overseas markets that allow us to borrow at low rates.

Besides, we aspire to maintain our leading market position in DDA. As of Sep. 30, 2013 we held a market share of 24.2% in these non-interest bearing liabilities. More importantly, as of the same date we had a market share of 32.5% in checking account balances of individuals. These figures provide us with a significant advantage in cost of funding.

Finally, we would like to highlight that for third year in a row, we have been recognized the soundest privately-owned bank in Latin America, based on our ratings of Aa3 and A+ by Moody’s and S&P, respectively.

FUNDING STRUCTURE

(In Billions of Ch$, except times)

INTERNATIONAL RATINGS

(Long-Term Foreign Currency)

Banco de Chile:

Equity

Based on our recent capital increase and a bottom line that has beaten our last year performance, we maintain solid capital adequacy ratios. Actually, our equity amounted to Ch$2,226 billion as of Sep. 30, 2013, which is 21.3% above the Ch$1,835 billion posted a year earlier. The YoY variance, equivalent to Ch$391 billion, is mainly attributable to:

· The equity offering completed on March 2013 for about Ch$253.4 billion through the issuance of 3.9 million shares. This capital increase is intended to support our expected business growth.

· The retention of Ch$86.2 billion from our net distributable income of 2012. This involved a payout ratio of 70% (once deducted the annual payment to the Central Bank equivalent to 100% of SAOS’ stake in our economic rights plus the rights of SM-Chile A shares).

· The capitalization of Ch$36.2 billion associated with the recognition of the cumulative effect of inflation on our shareholders’ equity.

· Roughly Ch$20.1 billion of additional net income (net of provisions for minimum dividends) in 2013 YTD as compared to 2012 YTD.

· The above was partly offset by lower results of Ch$4.4 billion related to mark-to-market and shifts in market factors affecting our AFS portfolio and hedge accounting derivatives (OCI).

Because of the aforesaid, we have been able to significantly improve our capital adequacy ratios. On the one hand, our Tier I ratio (on RWA) went up by 126 bp YoY, reaching 9.9% as of Sep. 30, 2013. Similarly, our Tier I (on total assets) was 7.6% as of the same date. This is 4.7 percentage points above the limit imposed to BCH (3.0%). Also, our BIS ratio was 13.2%. This is not only 85 bp over the figure we recorded last year, but also more than three percentage points above the limit.

EQUITY & CAPITAL ADEQUACY

(In Billions of Ch$, except for %)

Equity |

| Sep-12 |

| Sep-13 |

| YoY |

|

Capital & Reserves |

|

|

|

|

|

|

|

Capital |

| 1,510.0 |

| 1,849.3 |

| 22.5 | % |

Reserves |

| 177.6 |

| 213.8 |

| 20.4 | % |

Other accounts |

| 17.6 |

| 13.2 |

| (25.0 | )% |

Earnings |

|

|

|

|

|

|

|

Retained Earnings |

| 16.4 |

| 16.4 |

| 0.0 | % |

Income for the Period |

| 327.9 |

| 380.7 |

| 16.1 | % |

Provisions for Min. Dividends |

| (214.9 | ) | (247.6 | ) | 15.2 | % |

Minority Interest |

|

|

|

|

|

|

|

Minority Interest |

| 0.0 |

| 0.0 |

| 0.0 | % |

Total Equity |

| 1,834.6 |

| 2,225.8 |

| 21.3 | % |

Capital Adequacy Ratios |

| Sep-12 |

| Sep-13 |

| YoY |

|

Shareholders Equity / Assets(1) |

| 8.1 | % | 8.8 | % | +89 | bp |

Tier I (Basic Capital) / Assets(1),(2) |

| 6.8 | % | 7.6 | % | +81 | bp |

Tier I (Basic Capital) / RWA(2),(3) |

| 8.9 | % | 9.9 | % | +126 | bp |

BIS (Total Capital / RWA)(3),(4) |

| 12.5 | % | 13.2 | % | +85 | bp |

(1) “Assets” refers to Bank’s Total Assets.

(2) “Basic Capital” consists of Bank’s paid-in capital, reserves and retained earnings, excluding capital attributable to subsidiaries and foreign branches.

(3) “RWA” stands for Risk-Weighted Assets.

(4) “Total Capital” refers to “Basic Capital” plus Bank’s supplementary capital.

Banco de Chile: Results by Business Segments

Retail Banking Segment

The performance of our Retail Banking segment in 2013 continues to beat the figures of 2012. In the 3Q13, the segment posted a 45.1% YoY rise in the income before income tax by recording Ch$70.4 billion. The main reasons behind this outstanding performance were, as follows:

· Operating revenues that increased 16.5% YoY in the 3Q13, due to:

· Higher UF variation in the 3Q13 (+1.04%) vis-à-vis the 3Q12 (-0.16%) as a result of an uptick in inflation. The positive gap of 1.20% significantly benefited the segment’s UF exposure.

· Average loans that grew 12.4% YoY. This was prompted by growing commercial loans to SMEs (+14.0% YoY) and mortgage loans to individuals (+13.2% YoY). In turn, average consumer loans grew 9.7% YoY, fostered by a 15.8% rise in credit cards.

· DDA average balances that grew 11.8% YoY and benefited the funding of interest-earning assets held by the segment.

· These positive forces enabled us to offset a 7.5% YoY drop in fees and commissions. This is mostly explained by lower commissions from insurance brokerage and a positive exchange rate effect on expenses related to our credit card loyalty program in the 3Q12.

· All of the above permitted us to offset the 23.7% YoY rise in LLP. Part of this increment had to do with the recognition of nearly Ch$3.7 billion of the additional provisions incurred this quarter. Also, there is a volume effect associated with the increase in loan balances that explain approximately Ch$5.7 billion.

KEY QUARTERLY FIGURES

Retail Banking |

| 3Q12 |

| 3Q13 |

| YoY |

|

Loans to Customers (Billions of Ch$) |

|

|

|

|

|

|

|

Commercial Loans |

| 2,322.0 |

| 2,697.1 |

| 16.2 | % |

Residential Mortgage Loans |

| 4,029.3 |

| 4,574.5 |

| 13.5 | % |

Consumer Loans |

| 2,688.7 |

| 2,932.8 |

| 9.1 | % |

Total Loans |

| 9,040.0 |

| 10,204.4 |

| 12.9 | % |

Profit and Loss Statement (Millions of Ch$) |

|

|

|

|

|

|

|

Net Interest Income |

| 155,956 |

| 189,749 |

| 21.7 | % |

Net Fees and Commissions |

| 40,161 |

| 37,132 |

| (7.5 | )% |

Other Operating Income |

| 3,015 |

| 5,063 |

| 67.9 | % |

Total Operating Revenues |

| 199,132 |

| 231,944 |

| 16.5 | % |

Provisions for Loan Losses |

| (46,088 | ) | (56,994 | ) | 23.7 | % |

Operating Expenses |

| (104,390 | ) | (104,780 | ) | 0.4 | % |

Other |

| (173 | ) | 185 |

| — |

|

Income before income tax |

| 48,481 |

| 70,355 |

| 45.1 | % |

Notes: For purposes of comparison certain line items have been reclassified for the 3Q12.

Banco de Chile: Results by Business Segments

Wholesale Banking Segment

The income before income tax of our Wholesale Banking segment also recorded a significant YoY surge. In the 3Q13 the segment posted a bottom line of Ch$70.5 billion, which is 82.1% above the figure pointed a year earlier. The main source of greater results eas the 74.5% YoY rise in operating revenues, which was mainly explained by:

· A higher contribution from the segment’s UF net asset position, due to the net rise of 1.20% in the UF in the 3Q13 vis-à-vis the 3Q12.

· An annual expansion of 4.5% in average loans. This figure was mainly influenced by a 14.7% YoY increase in average loans rendered to Large Companies (annual sales between Ch$1.6 and Ch$70.0 billion). The growth in Large Companies allowed us to largely counterbalance the YoY decline of 6.5% in average loans granted to Corporations (annual sales above Ch$70.0 billion).

· A 10.2% YoY rise in DDA average balances. Amid a scenario of flat interest rates, the greater volumes benefited the margin associated with interest earning assets.

· A positive exchange rate effect on the hedge of US$-indexed LLP. In the 3Q12 the Ch$/US$��rate decreased 5.3%. This negatively affected the hedge of US$-denominated loan loss provisions. Conversely, in the 3Q13 the exchange rate remained almost flat.

The above was partly offset by higher loan loss provisions. Albeit this increase seems to be significant, it is explained by: (i) Ch$4.0 billion of greater provisions linked to a deterioration in the financial condition of a specific customer in the 3Q13 , (ii) roughly Ch$3.7 billion related to part of the additional provisions recognized in this quarter, (iii) a positive exchange rate effect of ~Ch$4.0 billion in the 3Q12 on the US$-denominated LLP due to the mentioned 5.3% drop in the Ch$/US$ rate, and (iv) a release of ~Ch$8.0 billion in the 3Q12 owing to an improvement in the risk profile of a specific customer.

KEY QUARTERLY FIGURES

Wholesale Banking |

| 3Q12 |

| 3Q13 |

| YoY |

|

Loans to Customers (Billions of Ch$) |

|

|

|

|

|

|

|

Commercial Loans |

| 8,852.2 |

| 10,037.2 |

| 13.4 | % |

Residential Mortgage Loans |

| 8.6 |

| 7.7 |

| (10.8 | )% |

Consumer Loans |

| 12.4 |

| 12.4 |

| (0.1 | )% |

Total Loans |

| 8,873.2 |

| 10,057.3 |

| 13.3 | % |

Profit and Loss Statement (Millions of Ch$) |

|

|

|

|

|

|

|

Net Interest Income |

| 51,889 |

| 89,495 |

| 72.5 | % |

Net Fees and Commissions |

| 9,427 |

| 10,959 |

| 16.3 | % |

Other Operating Income |

| 1,593 |

| 9,338 |

| 486.2 | % |

Total Operating Revenues |

| 62,909 |

| 109,792 |

| 74.5 | % |

Provisions for Loan Losses |

| 5,594 |

| (13,189 | ) | — |

|

Operating Expenses |

| (29,858 | ) | (26,284 | ) | (12.0 | )% |

Other |

| 72 |

| 191 |

| 165.3 | % |

Income before income tax |

| 38,717 |

| 70,510 |

| 82.1 | % |

Notes: For purposes of comparison certain line items have been reclassified for the 3Q12.

Banco de Chile: Results by Business Segments

Treasury

Our Treasury segment recorded a significant 74.0% YoY increase in income before income tax that amounted to Ch$8.1 billion in the 3Q13. This annual change is mainly attributable to a 50.6% annual increment in the segment’s operating revenues.

The YoY variance in revenues is principally explained by higher inflation that resulted in a UF increase of 1.04% in the 3Q13 in comparison with a drop of 0.16% in the 3Q12. Accordingly, the segment obtained a higher contribution from the accrual of UF-indexed fixed-income securities held in the investment portfolio. This positive inflation effect was partly offset by:

· Lower results from assets held for trading in the 3Q13 as compared to the 3Q12. This was the consequence of unfavorable shifts in the USD/CLP long-term yield curve that affected our derivatives position in these securities.

· Nearly Ch$2.2 billion of lower revenues associated with a decrease in sales of AFS securities in the 3Q13 as compared to the 3Q12.

In line with our expectations on upcoming interest rates reductions, we continued taking positions in AFS securities. Accordingly, in the 3Q13 we posted a 17.8% YoY rise in these kinds of instruments.

As for our O.C.I., this line item scaled down by 86.5% YoY in the 3Q13. This shrink was mainly prompted by significant unrealized gains in the 3Q12, as a result of improved risk premiums worldwide that translated into greater mark-to-market of AFS securities.

KEY QUARTERLY FIGURES

Treasury Division |

| 3Q12 |

| 3Q13 |

| YoY |

|

Securities Portfolio (Billions of Ch$) |

|

|

|

|

|

|

|

Trading Securities |

| 56.8 |

| 96.6 |

| 70.0 | % |

Available for Sale Instruments |

| 1,514.9 |

| 1,784.4 |

| 17.8 | % |

Securities Portfolio |

| 1,571.7 |

| 1,881.0 |

| 19.7 | % |

Profit and Loss Statement (Millions of Ch$) |

|

|

|

|

|

|

|

Net Interest Income |

| (1,815 | ) | 3,093 |

| — |

|

Net Fees and Commissions |

| 9 |

| (78 | ) | — |

|

Other Operating Income |

| 9,133 |

| 8,018 |

| (12.2 | )% |

Total Operating Revenues |

| 7,327 |

| 11,033 |

| 50.6 | % |

Provisions for Loan Losses |

| 175 |

| 16 |

| (90.9 | )% |

Operating Expenses |

| (2,843 | ) | (2,938 | ) | 3.3 | % |

Other |

| 15 |

| 20 |

| 33.3 | % |

Income before income tax |

| 4,674 |

| 8,131 |

| 74.0 | % |

O.C.I. (Millions of Ch$) |

|

|

|

|

|

|

|

Net unrealized gains (losses) on AFS & Derivatives |

| 13,003 |

| 1,750 |

| (86.5 | )% |

Notes: For purposes of comparison certain line items have been reclassified for the 3Q12.

Banco de Chile: Results by Business Segments

Subsidiaries

Our subsidiaries recorded a 46.3% YoY drop in the income before income tax, which totaled Ch$7.0 billion in the 3Q13. This YoY decrease of Ch$6.0 billion in the overall bottom line of our subsidiaries is mainly attributable to:

· The absorption of our former Factoring subsidiary by the Bank. This decision was made due to the synergies and efficiencies that could arise from joint operations. We estimate this effect explains approximately Ch$4.6 billion of the total variance in the bottom line of our subsidiaries. This figure can be broken down in: (i) an average quarter of net result for this subsidiary amounting to Ch$3.2 billion and (ii) Ch$1.4 billion of greater results in the 3Q12 due to a negative inflation that benefited the former subsidiary’s UF net liability position.

· Approximately Ch$1.2 billion of lower income before income tax in our Securities Brokerage subsidiary. On the positive hand, the total stock trading turnover increased by 27.8% in the 3Q13 as compared to the 3Q12. Instead, there have been lower results from repurchase agreements, as well as the trading of fixed-income and currencies, mainly owing to a scenario of steady interest and exchange rates.

· Nearly Ch$0.4 billion of lower income before income tax in our Mutual Funds subsidiary. This has been mainly attributable to higher personnel expenses that are the consequence of an organizational restructuring intended to enhance certain commercial initiatives.

KEY QUARTERLY FIGURES

Subsidiaries |

| 3Q12 |

| 3Q13 |

| YoY |

|

Securities Portfolio (Billions of Ch$) |

|

|

|

|

|

|

|

Trading Securities |

| 284.9 |

| 269.3 |

| (5.5 | )% |

Securities Portfolio |

| 284.9 |

| 269.3 |

| (5.5 | )% |

Loans to Customers (Billions of Ch$) |

|

|

|

|

|

|

|

Commercial Loans |

| 463.2 |

| 5.8 |

| (98.8 | )% |

Total Loans |

| 463.2 |

| 5.8 |

| (98.8 | )% |

Profit and Loss Statement (Millions of Ch$) |

|

|

|

|

|

|

|

Net Interest Income |

| 2,641 |

| (2,723 | ) | — |

|

Net Fees and Commissions |

| 26,655 |

| 26,719 |

| 0.2 | % |

Other Operating Income |

| 7,584 |

| 6,361 |

| (16.1 | )% |

Total Operating Revenues |

| 36,880 |

| 30,357 |

| (17.7 | )% |

Provisions for Loan Losses |

| (30 | ) | 111 |

| — |

|

Operating Expenses |

| (23,819 | ) | (23,491 | ) | (1.4 | )% |

Other |

| 69 |

| 57 |

| (17.4 | )% |

Income before income tax |

| 13,100 |

| 7,034 |

| (46.3 | )% |

Notes: For purposes of comparison certain line items have been reclassified for the 3Q12.

Banco de Chile:

Consolidated Statement of Income (Chilean-GAAP)

(In millions of Chilean pesos (MCh$) and millions of US dollars (MUS$))

|

| Quarters |

|

|

|

|

| YearEnded |

|

|

| ||||||||||

|

| 3Q12 |

| 2Q13 |

| 3Q13 |

| 3Q13 |

| % Change |

| Sep-12 |

| Sep-13 |

| Sep-13 |

| % Change |

| ||

|

| MCh$ |

| MCh$ |

| MCh$ |

| MUS$ |

| 3Q13/3Q12 |

| 3Q13/2Q13 |

| MCh$ |

| MCh$ |

| MUS$ |

| Sep-13/Sep-12 |

|

Interest revenue and expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest revenue |

| 353,345 |

| 383,762 |

| 491,291 |

| 973.5 |

| 39.0 | % | 28.0 | % | 1,182,658 |

| 1,272,595 |

| 2,521.7 |

| 7.6 | % |

Interest expense |

| (143,724 | ) | (140,672 | ) | (210,148 | ) | (416.4 | ) | 46.2 | % | 49.4 | % | (497,974 | ) | (503,902 | ) | (998.5 | ) | 1.2 | % |

Net interest income |

| 209,621 |

| 243,090 |

| 281,143 |

| 557.1 |

| 34.1 | % | 15.7 | % | 684,684 |

| 768,693 |

| 1,523.2 |

| 12.3 | % |

Fees and commissions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from fees and commissions |

| 91,393 |

| 97,976 |

| 95,757 |

| 189.7 |

| 4.8 | % | (2.3 | )% | 275,326 |

| 288,089 |

| 570.8 |

| 4.6 | % |

Expenses from fees and commissions |

| (18,497 | ) | (25,672 | ) | (23,801 | ) | (47.2 | ) | 28.7 | % | (7.3 | )% | (62,826 | ) | (72,239 | ) | (143.1 | ) | 15.0 | % |

Net fees and commissions income |

| 72,896 |

| 72,304 |

| 71,956 |

| 142.6 |

| (1.3 | )% | (0.5 | )% | 212,500 |

| 215,850 |

| 427.7 |

| 1.6 | % |

Net Financial Operating Income |

| 4,429 |

| (7,135 | ) | 25,952 |

| 51.4 |

| 486.0 | % | — |

| 15,766 |

| 23,687 |

| 46.9 |

| 50.2 | % |

Foreign exchange transactions, net |

| 9,259 |

| 32,020 |

| (5,216 | ) | (10.3 | ) | — |

| — |

| 24,829 |

| 36,764 |

| 72.8 |

| 48.1 | % |

Other operating income |

| 5,975 |

| 4,229 |

| 5,803 |

| 11.5 |

| (2.9 | )% | 37.2 | % | 16,341 |

| 17,924 |

| 35.5 |

| 9.7 | % |

Total Operating Revenues |

| 302,180 |

| 344,508 |

| 379,638 |

| 752.2 |

| 25.6 | % | 10.2 | % | 954,120 |

| 1,062,918 |

| 2,106.1 |

| 11.4 | % |

Provisions for loan losses |

| (40,349 | ) | (53,918 | ) | (70,056 | ) | (138.8 | ) | 73.6 | % | 29.9 | % | (137,584 | ) | (173,817 | ) | (344.4 | ) | 26.3 | % |

Operating revenues, net of provisions for loan losses |

| 261,831 |

| 290,590 |

| 309,582 |

| 613.4 |

| 18.2 | % | 6.5 | % | 816,536 |

| 889,101 |

| 1,761.7 |

| 8.9 | % |

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Personnel expenses |

| (79,229 | ) | (77,869 | ) | (78,390 | ) | (155.3 | ) | (1.1 | )% | 0.7 | % | (231,632 | ) | (234,191 | ) | (464.0 | ) | 1.1 | % |

Administrative expenses |

| (60,218 | ) | (61,877 | ) | (63,133 | ) | (125.1 | ) | 4.8 | % | 2.0 | % | (176,048 | ) | (184,309 | ) | (365.2 | ) | 4.7 | % |

Depreciation and amortization |

| (7,743 | ) | (7,090 | ) | (7,041 | ) | (14.0 | ) | (9.1 | )% | (0.7 | )% | (23,267 | ) | (21,332 | ) | (42.3 | ) | (8.3 | )% |

Impairments |

| (518 | ) | (4 | ) | (124 | ) | (0.2 | ) | (76.1 | )% | 3000.0 | % | (648 | ) | (133 | ) | (0.3 | ) | (79.5 | )% |

Other operating expenses |

| (9,132 | ) | (3,700 | ) | (5,316 | ) | (10.5 | ) | (41.8 | )% | 43.7 | % | (25,125 | ) | (13,789 | ) | (27.3 | ) | (45.1 | )% |

Total operating expenses |

| (156,840 | ) | (150,540 | ) | (154,004 | ) | (305.1 | ) | (1.8 | )% | 2.3 | % | (456,720 | ) | (453,754 | ) | (899.1 | ) | (0.6 | )% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net operating income |

| 104,991 |

| 140,050 |

| 155,578 |

| 308.3 |

| 48.2 | % | 11.1 | % | 359,816 |

| 435,347 |

| 862.6 |

| 21.0 | % |

Income attributable to affiliates |

| (17 | ) | 983 |

| 453 |

| 0.9 |

| — |

| (53.9 | )% | 857 |

| 2,044 |

| 4.1 |

| 138.5 | % |

Income before income tax |

| 104,974 |

| 141,033 |

| 156,031 |

| 309.2 |

| 48.6 | % | 10.6 | % | 360,673 |

| 437,391 |

| 866.7 |

| 21.3 | % |

Income tax |

| (5,188 | ) | (19,169 | ) | (18,645 | ) | (36.9 | ) | 259.4 | % | (2.7 | )% | (32,762 | ) | (56,671 | ) | (112.3 | ) | 73.0 | % |

Net Income for the period |

| 99,786 |

| 121,864 |

| 137,386 |

| 272.3 |

| 37.7 | % | 12.7 | % | 327,911 |

| 380,720 |

| 754.4 |

| 16.1 | % |

Non-Controlling interest |

| 1.00 |

| — |

| — |

| — |

| — |

| — |

| 1 |

| — |

| — |

| — |

|

Net Income attributable to bank’s owners |

| 99,785 |

| 121,864 |

| 137,386 |

| 272.3 |

| 37.7 | % | 12.7 | % | 327,910 |

| 380,720 |

| 754.4 |

| 16.1 | % |

These results have been prepared in accordance with Chilean GAAP on an unaudited, consolidated basis.

All figures are expressed in nominal Chilean pesos (historical pesos), unless otherwise stated. All figures expressed in US dollars (except earnings per ADR) were converted using the exchange rate of Ch$504.67 for US$1.00 as of September 30, 2013. Earnings per ADR were calculated considering the nominal net income, the exchange rate and the number of shares outstanding at the end of each period.

Banco de Chile files its consolidated financial statements, together with those of its subsidiaries, with the Chilean Superintendency of Banks and Financial Institutions, on a monthly basis. In addition, Banco de Chile files its quarterly financial statements (notes included) with the SEC in form 6K, simultaneously or previously to file this quarterly earnings report. Such documentation is equally available at Banco de Chile’s website both in Spanish and English.

Banco de Chile:

Consolidated Balance Sheets (Chilean-GAAP)

(In millions of Chilean pesos (MCh$) and millions of US dollars (MUS$))

|

| Sep-12 |

| Jun-13 |

| Sep-13 |

| Sep-13 |

| % Change |

| ||

ASSETS |

| MCh$ |

| MCh$ |

| MCh$ |

| MUS$ |

| Sep-13/Sep-12 |

| Sep-13/Jun-13 |

|

Cash and due from banks |

| 610,396 |

| 1,186,226 |

| 998,770 |

| 1,979.1 |

| 63.6 | % | (15.8 | )% |

Transactions in the course of collection |

| 409,937 |

| 775,311 |

| 513,900 |

| 1,018.3 |

| 25.4 | % | (33.7 | )% |

Financial Assets held-for-trading |

| 341,668 |

| 388,921 |

| 365,892 |

| 725.0 |

| 7.1 | % | (5.9 | )% |

Receivables from repurchase agreements and security borrowings |

| 46,830 |

| 25,371 |

| 20,501 |

| 40.6 |

| (56.2 | )% | (19.2 | )% |

Derivate instruments |

| 381,177 |

| 367,417 |

| 290,487 |

| 575.6 |

| (23.8 | )% | (20.9 | )% |

Loans and advances to Banks |

| 793,033 |

| 313,541 |

| 676,953 |

| 1,341.4 |

| (14.6 | )% | 115.9 | % |

Loans to customers, net |

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial loans |

| 11,637,433 |

| 12,163,084 |

| 12,886,289 |

| 25,534.1 |

| 10.7 | % | 5.9 | % |

Residential mortgage loans |

| 4,037,918 |

| 4,437,645 |

| 4,582,231 |

| 9,079.7 |

| 13.5 | % | 3.3 | % |

Consumer loans |

| 2,701,043 |

| 2,897,349 |

| 2,945,150 |

| 5,835.7 |

| 9.0 | % | 1.6 | % |

Loans to customers |

| 18,376,394 |

| 19,498,078 |

| 20,413,670 |

| 40,449.5 |

| 11.1 | % | 4.7 | % |

Allowances for loan losses |

| (412,050 | ) | (434,451 | ) | (456,284 | ) | (904.1 | ) | 10.7 | % | 5.0 | % |

Total loans to customers, net |

| 17,964,344 |

| 19,063,627 |

| 19,957,386 |

| 39,545.4 |

| 11.1 | % | 4.7 | % |

Financial Assets Available-for-Sale |

| 1,514,891 |

| 1,613,767 |

| 1,784,353 |

| 3,535.7 |

| 17.8 | % | 10.6 | % |

Financial Assets Held-to-maturity |

| — |

| — |

| — |

| — |

| 0.0 | % | 0.0 | % |

Investments in other companies |

| 15,368 |

| 14,848 |

| 16,697 |

| 33.1 |

| 8.6 | % | 12.5 | % |

Intangible assets |

| 33,681 |

| 32,202 |

| 30,947 |

| 61.3 |

| (8.1 | )% | (3.9 | )% |

Property and Equipment |

| 207,655 |

| 202,235 |

| 198,797 |

| 393.9 |

| (4.3 | )% | (1.7 | )% |

Current tax assets |

| 1,629 |

| 4,608 |

| 3,018 |

| 6.0 |

| 85.3 | % | (34.5 | )% |

Deferred tax assets |

| 127,511 |

| 118,949 |

| 135,961 |

| 269.4 |

| 6.6 | % | 14.3 | % |

Other assets |

| 290,885 |

| 297,051 |

| 259,656 |

| 514.5 |

| (10.7 | )% | (12.6 | )% |

Total Assets |

| 22,739,005 |

| 24,404,074 |

| 25,253,318 |

| 50,039.3 |

| 11.1 | % | 3.5 | % |

These results have been prepared in accordance with Chilean GAAP on an unaudited, consolidated basis.

All figures are expressed in nominal Chilean pesos (historical pesos), unless otherwise stated. All figures expressed in US dollars (except earnings per ADR) were converted using the exchange rate of Ch$504.67 for US$1.00 as of September 30, 2013. Earnings per ADR were calculated considering the nominal net income, the exchange rate and the number of shares outstanding at the end of each period.

Banco de Chile files its consolidated financial statements, together with those of its subsidiaries, with the Chilean Superintendency of Banks and Financial Institutions, on a monthly basis. In addition, Banco de Chile files its quarterly financial statements (notes included) with the SEC in form 6K, simultaneously or previously to file this quarterly earnings report. Such documentation is equally available at Banco de Chile’s website both in Spanish and English.

Banco de Chile:

Consolidated Balance Sheets (Chilean-GAAP)

(In millions of Chilean pesos (MCh$) and millions of US dollars (MUS$))

|

| Sep-12 |

| Jun-13 |

| Sep-13 |

| Sep-13 |

| % Change |

| ||

LIABILITIES & EQUITY |

| MCh$ |

| MCh$ |

| MCh$ |

| MUS$ |

| Sep-13/Sep-12 |

| Sep-13/Jun-13 |

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current accounts and other demand deposits |

| 5,001,775 |

| 5,567,606 |

| 5,927,692 |

| 11,745.7 |

| 18.5 | % | 6.5 | % |

Transactions in the course of payment |

| 211,450 |

| 438,056 |

| 314,489 |

| 623.2 |

| 48.7 | % | (28.2 | )% |

Payables from repurchase agreements and security lending |

| 309,049 |

| 495,812 |

| 223,409 |

| 442.7 |

| (27.7 | )% | (54.9 | )% |

Saving accounts and time deposits |

| 9,947,950 |

| 9,564,872 |

| 10,332,890 |

| 20,474.5 |

| 3.9 | % | 8.0 | % |

Derivate instruments |

| 453,291 |

| 431,162 |

| 375,028 |

| 743.1 |

| (17.3 | )% | (13.0 | )% |

Borrowings from financial institutions |

| 1,124,497 |

| 1,157,728 |

| 876,247 |

| 1,736.3 |

| (22.1 | )% | (24.3 | )% |

Debt issued |

| 2,978,444 |

| 3,763,946 |

| 4,056,885 |

| 8,038.7 |

| 36.2 | % | 7.8 | % |

Other financial obligations |

| 147,554 |

| 160,253 |

| 174,967 |

| 346.7 |

| 18.6 | % | 9.2 | % |

Current tax liabilities |

| 26,222 |

| 261 |

| 2,043 |

| 4.0 |

| (92.2 | )% | 682.8 | % |

Deferred tax liabilities |

| 21,329 |

| 26,211 |

| 36,851 |

| 73.0 |

| 72.8 | % | 40.6 | % |

Provisions |

| 416,987 |

| 374,342 |

| 467,405 |

| 926.2 |

| 12.1 | % | 24.9 | % |

Other liabilities |

| 265,914 |

| 256,628 |

| 239,581 |

| 474.7 |

| (9.9 | )% | (6.6 | )% |

Total liabilities |

| 20,904,462 |

| 22,236,877 |

| 23,027,487 |

| 45,628.8 |

| 10.2 | % | 3.6 | % |

Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

Belong to the Bank’s Owners |

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital |

| 1,509,994 |

| 1,849,351 |

| 1,849,351 |

| 3,664.5 |

| 22.5 | % | 0.0 | % |

Reserves |

| 177,574 |

| 213,767 |

| 213,767 |

| 423.6 |

| 20.4 | % | 0.0 | % |

Other comprehensive income |

| 17,570 |

| 11,783 |

| 13,182 |

| 26.1 |

| (25.0 | )% | 11.9 | % |

Retained earnings |

|

|

|

|

|

|

|

|

|

|

|

|

|

Retained earnings from previous periods |

| 16,379 |

| 16,379 |

| 16,379 |

| 32.5 |

| 0.0 | % | 0.0 | % |

Income for the period |

| 327,910 |

| 243,334 |

| 380,720 |

| 754.4 |

| 16.1 | % | 56.5 | % |

Provisions for minimum dividends |

| (214,885 | ) | (167,418 | ) | (247,569 | ) | (490.6 | ) | 15.2 | % | 47.9 | % |

Non-Controlling Interest |

| 1 |

| 1 |

| 1 |

| — |

| 0.0 | % | 0.0 | % |

Total equity |

| 1,834,543 |

| 2,167,197 |

| 2,225,831 |

| 4,410.5 |

| 21.3 | % | 2.7 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities & Equity |

| 22,739,005 |

| 24,404,074 |

| 25,253,318 |

| 50,039.3 |

| 11.1 | % | 3.5 | % |

These results have been prepared in accordance with Chilean GAAP on an unaudited, consolidated basis.

All figures are expressed in nominal Chilean pesos (historical pesos), unless otherwise stated. All figures expressed in US dollars (except earnings per ADR) were converted using the exchange rate of Ch$504.67 for US$1.00 as of September 30, 2013. Earnings per ADR were calculated considering the nominal net income, the exchange rate and the number of shares outstanding at the end of each period.

Banco de Chile files its consolidated financial statements, together with those of its subsidiaries, with the Chilean Superintendency of Banks and Financial Institutions, on a monthly basis. In addition, Banco de Chile files its quarterly financial statements (notes included) with the SEC in form 6K, simultaneously or previously to file this quarterly earnings report. Such documentation is equally available at Banco de Chile’s website both in Spanish and English.

Banco de Chile:

Selected Financial Information (Chilean-GAAP)

(In millions of Chilean pesos (MCh$) and millions of US dollars (MUS$))

|

| Quarters |

| YearEnded |

| ||||||||

Key Performance Ratios |

| 3Q12 |

| 2Q13 |

| 3Q13 |

| Sep-12 |

| Jun-13 |

| Sep-13 |

|

Earnings per Share (1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per Share (Ch$) |

| 1.13 |

| 1.31 |

| 1.47 |

| 3.72 |

| 2.61 |

| 4.09 |

|

Net income per ADS (Ch$) |

| 680.06 |

| 784.74 |

| 884.70 |

| 2,234.79 |

| 1,566.95 |

| 2,451.64 |

|

Net income per ADS (US$) (2) |

| 1.43 |

| 1.54 |

| 1.75 |

| 4.71 |

| 3.08 |

| 4.86 |

|

Book value per Share (Ch$) |

| 20.84 |

| 23.26 |

| 23.89 |

| 20.84 |

| 23.26 |

| 23.89 |

|

Shares outstanding (Millions) |

| 88,038 |

| 93,175 |

| 93,175 |

| 88,038 |

| 93,175 |

| 93,175 |

|

Profitability Ratios (3)(4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Interest Margin |

| 4.01 | % | 4.41 | % | 4.92 | % | 4.46 | % | 4.46 | % | 4.62 | % |

Net Financial Margin |

| 4.27 | % | 4.86 | % | 5.29 | % | 4.72 | % | 4.82 | % | 4.98 | % |

Fees and commissions / Avg. Interest Earnings Assets |

| 1.39 | % | 1.31 | % | 1.26 | % | 1.38 | % | 1.32 | % | 1.30 | % |

Operating Revenues / Avg. Interest Earnings Assets |

| 5.78 | % | 6.25 | % | 6.65 | % | 6.21 | % | 6.25 | % | 6.38 | % |

Return on Average Total Assets |

| 1.77 | % | 2.10 | % | 2.21 | % | 1.97 | % | 2.10 | % | 2.14 | % |

Return on Average Equity (5) |

| 20.09 | % | 21.28 | % | 22.80 | % | 22.29 | % | 20.76 | % | 21.45 | % |

Capital Ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity / Total Assets |

| 8.07 | % | 8.88 | % | 8.81 | % | 8.07 | % | 8.88 | % | 8.81 | % |

Tier I (Basic Capital) / Total Assets |

| 6.83 | % | 7.62 | % | 7.60 | % | 6.83 | % | 7.62 | % | 7.60 | % |

Tier I (Basic Capital) / Risk-Wighted Assets |

| 8.93 | % | 10.00 | % | 9.92 | % | 8.93 | % | 10.00 | % | 9.92 | % |

Total Capital / Risk- Weighted Assets |

| 12.46 | % | 13.29 | % | 13.17 | % | 12.46 | % | 13.29 | % | 13.17 | % |

Credit Quality Ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Past Due / Total Loans to Customers |

| 0.94 | % | 1.08 | % | 1.14 | % | 0.94 | % | 1.08 | % | 1.14 | % |

Allowance for Loan Losses / Total Past Due |

| 239.70 | % | 206.29 | % | 196.72 | % | 239.70 | % | 206.29 | % | 196.72 | % |

Impaired Loans / Total Loans to Customers |

| 3.05 | % | 3.20 | % | 3.27 | % | 3.05 | % | 3.20 | % | 3.27 | % |

Allowance for Loan Losses / Impaired Loans |

| 73.63 | % | 69.59 | % | 68.39 | % | 73.63 | % | 69.59 | % | 68.39 | % |

Allowance for Loans Losses / Total Loans to Customers |

| 2.24 | % | 2.23 | % | 2.24 | % | 2.24 | % | 2.23 | % | 2.24 | % |

Provision for Loan Losses / Avg. Loans to customers (4) |

| 0.88 | % | 1.12 | % | 1.41 | % | 1.02 | % | 1.08 | % | 1.20 | % |

Operating and Productivity Ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses / Operating Revenues |

| 51.90 | % | 43.70 | % | 40.57 | % | 47.87 | % | 43.87 | % | 42.69 | % |

Operating Expenses / Average Total Assets (3) (4) |

| 2.78 | % | 2.60 | % | 2.48 | % | 2.74 | % | 2.58 | % | 2.55 | % |

Balance Sheet Data (1)(3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Avg. Interest Earnings Assets (million Ch$) |

| 20,913,612 |

| 22,051,737 |

| 22,846,736 |

| 20,475,269 |

| 21,882,278 |

| 22,203,764 |

|

Avg. Assets (million Ch$) |

| 22,554,522 |

| 23,193,385 |

| 24,847,813 |

| 22,239,454 |

| 23,219,290 |

| 23,762,131 |

|

Avg. Equity (million Ch$) |

| 1,796,722 |

| 2,164,713 |

| 2,200,689 |

| 1,777,829 |

| 2,137,928 |

| 2,158,848 |

|

Avg. Adjusted Shareholders Equity (million Ch$) (6) |

| 1,987,100 |

| 2,290,251 |

| 2,410,456 |

| 1,961,208 |

| 2,344,724 |

| 2,366,635 |

|

Avg. Loans to customers (million Ch$) |

| 18,305,165 |

| 19,334,480 |

| 19,839,488 |

| 17,900,072 |

| 19,141,533 |

| 19,374,185 |

|

Avg. Interest Bearing Liabilities (million Ch$) |

| 14,171,661 |

| 14,745,688 |

| 15,315,837 |

| 13,950,701 |

| 14,504,522 |

| 14,774,960 |

|

Risk-Weighted Assets (Million Ch$) |

| 20,551,191 |

| 21,674,002 |

| 22,447,187 |

| 20,551,191 |

| 21,674,002 |

| 22,447,187 |

|

Additional Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

Exchange rate (Ch$) |

| 474.70 |

| 508.42 |

| 504.67 |

| 474.70 |

| 508.42 |

| 504.67 |

|

Employees (#) |

| 14,567 |

| 14,641 |

| 14,723 |

| 14,567 |

| 14,641 |

| 14,723 |

|

Notes |

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Figures are expressed in nominal Chilean pesos.

(2) Figures are calculated considering nominal net income, the shares outstanding and the exchange rate existing at the end of each period.

(3) Ratios consider daily average balances.

(4) Annualized data.

(5) ROAE excludes provisions for minimum dividends.

(6) Adjusted by provisions for minimum dividends.

These results have been prepared in accordance with Chilean GAAP on an unaudited, consolidated basis.

All figures are expressed in nominal Chilean pesos (historical pesos), unless otherwise stated. All figures expressed in US dollars (except earnings per ADR) were converted using the exchange rate of Ch$504.67 for US$1.00 as of September 30, 2013. Earnings per ADR were calculated considering the nominal net income, the exchange rate and the number of shares outstanding at the end of each period.

Banco de Chile files its consolidated financial statements, together with those of its subsidiaries, with the Chilean Superintendency of Banks and Financial Institutions, on a monthly basis. In addition, Banco de Chile files its quarterly financial statements (notes included) with the SEC in form 6K, simultaneously or previously to file this quarterly earnings report. Such documentation is equally available at Banco de Chile’s website both in Spanish and English.

Appendix

Summary of Differences between Chilean GAAP and IFRS

The most significant differences are as follows:

· Under Chilean GAAP, the merger of Banco de Chile and Citibank Chile was accounted for under the pooling-of-interest method, while under IFRS, and for external financial reporting purposes, the merger of the two banks was accounted for as a business combination in which the Bank is the acquirer as required by IFRS 3 “Business Combinations”. Under IFRS 3, the Bank recognized all acquired net assets at fair value as determined at the acquisition date, as well as the goodwill resulting from the purchase price consideration in excess of net assets recognized.

· Allowances for loan losses are calculated based on specific guidelines set by the Chilean Superintendency of Banks based on an expected losses approach. Under IFRS, IAS 39 “Financial instruments: Recognition and Measurement,” allowances for loan losses should be adequate to cover losses in the loan portfolio at the respective balance sheet dates based on an analysis of estimated future cash flows. According to Chilean GAAP, the Bank records additional allowances related to expected losses not yet incurred, whereas under IFRS these expected losses must not be recognized.

· Assets received in lieu of payments are measured at historical cost or fair value, less cost to sell, if lower, on a portfolio basis and written-off if not sold after a certain period in accordance with specific guidelines set by the Chilean Superintendency of Banks. Under IFRS, these assets are deemed non-current assets held-for-sale and their accounting treatment is set by IFRS 5 “Non-current assets held for sale and Discontinued operations”. In accordance with IFRS 5 these assets are measured at historical cost or fair value, less cost to sell, if lower. Accordingly, under IFRS these assets are not written off unless impaired.

· Chilean companies are required to distribute at least 30% of their net income to shareholders unless a majority of shareholders approve the retention of profits. In accordance with Chilean GAAP, the Bank records a minimum dividend allowance based on its distribution policy, which requires distribution of at least 70% of the period net income, as permitted by the Chilean Superintendency of Banks. Under IFRS, only the portion of dividends that is required to be distributed by Chilean Law must be recorded, i.e., 30% as required by Chilean Corporations Law.

Forward-Looking Information

The information contained herein incorporates by reference statements which constitute ‘‘forward-looking statements,’’ in that they include statements regarding the intent, belief or current expectations of our directors and officers with respect to our future operating performance. Such statements include any forecasts, projections and descriptions of anticipated cost savings or other synergies. You should be aware that any such forward-looking statements are not guarantees of future performance and may involve risks and uncertainties, and that actual results may differ from those set forth in the forward-looking statements as a result of various factors (including, without limitations, the actions of competitors, future global economic conditions, market conditions, foreign exchange rates, and operating and financial risks related to managing growth and integrating acquired businesses), many of which are beyond our control. The occurrence of any such factors not currently expected by us would significantly alter the results set forth in these statements.

Factors that could cause actual results to differ materially and adversely include, but are not limited to:

· changes in general economic, business or political or other conditions in Chile or changes in general economic or business conditions in Latin America;

· changes in capital markets in general that may affect policies or attitudes toward lending to Chile or Chilean companies;

· unexpected developments in certain existing litigation;

· increased costs;

· unanticipated increases in financing and other costs or the inability to obtain additional debt or equity financing on attractive terms.

Undue reliance should not be placed on such statements, which speak only as of the date that they were made. Our independent public accountants have not examined or compiled the forward-looking statements and, accordingly, do not provide any assurance with respect to such statements. These cautionary statements should be considered in connection with any written or oral forward-looking statements that we may issue in the future. We do not undertake any obligation to release publicly any revisions to such forward-looking statements to reflect later events or circumstances or to reflect the occurrence of unanticipated events.

CONTACTS

Mr. Pablo Mejía Head of Investor Relations Banco de Chile Phone Nr. (56-2) 2653.3554 Email: pmejiar@bancochile.cl | Mr. Rolando Arias Research & Planning Manager Banco de Chile Phone Nr. (56-2) 2653.3535 Email: rarias@bancochile.cl |