FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of April, 2016

Commission File Number 001-15266

BANK OF CHILE

(Translation of registrant’s name into English)

Ahumada 251

Santiago, Chile

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes o No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

BANCO DE CHILE

REPORT ON FORM 6-K

Attached is a Press Release issued by Banco de Chile (“the Bank”) on April 29th, 2016, regarding its financial results for the First Quarter 2016.

Santiago, Chile, April 29th, 2016, Banco de Chile (NYSE: BCH), a full service Chilean financial institution, market leader in a wide variety of lending and non-lending products and services across all segments of the Chilean financial market, today announced its results for the first quarter 2016.

Our Brands

![]()

![]()

Citi and the arc design in Trademark registered by Citigroup Inc. Use under License.

![]()

Credit Ratings

(LT Foreign Currency)

![]()

Moody’s

![]()

Standard & Poor’s

1st Quarter 2016 | Earnings Report

‘New Leadership, the Same Purpose’

HIGHLIGHTS

· Mr. Eduardo Ebensperger was appointed as new CEO of Banco de Chile, effective May 1st, 2016.

· BCH remained the leading bank in net income by recording Ch$133 Bn. in the 1Q16 (14% above the figure of the 1Q15).

· BCH’s shareholders approved the capitalization of Ch$96.9 Bn. with charge to our net distributable earnings for the FY2015.

From the Desk of Eduardo Ebensperger

‘I am pleased to share with you our results for the 1Q16, in which we were able to post a 13.5% YoY increase in net income by recording Ch$133 Bn. This is especially remarkable in light of the less dynamic economic environment we face and, likewise, it endorses the importance of applying a business strategy consistently over time. In this regard, I would like to thank Arturo Tagle for his invaluable contribution to all of the accomplishments we have achieved, including our undisputed market-leading position in net income and profitability, material improvements in service quality, significant advances in efficiency and a distinctive corporate culture that supports our strategic positioning.

Even though it will not be easy to outreach these attainments, I believe we will make it possible based on our key competitive strengths and an experienced management team committed to our corporate goals.

Aligned with this view, we will continue to emphasize profitable growth by enhancing cross-selling, applying business intelligence methodologies when setting offerings for targeted segments, managing carefully all business-related risks and promoting innovation in both business solutions and internal processes. I am sure that all of these actions will reinforce our customer-centric strategy, which will allow us to continue making a difference with respect to our peers while adding value for our shareholders.’

Selected Financial Data (1) |

| 1Q15 |

| 1Q16 |

| YoY |

|

Income Statement (Millions of Ch$) |

|

|

|

|

|

|

|

Net financial income(2) |

| 301,231 |

| 326,863 |

| 8.5 | % |

Net Fees and Commissions |

| 72,101 |

| 77,410 |

| 7.4 | % |

Other operating income |

| 8,147 |

| 6,579 |

| (19.2 | )% |

Total Operating Revenues (2) |

| 381,479 |

| 410,852 |

| 7.7 | % |

Provisions for loan losses |

| (65,432 | ) | (64,830 | ) | (0.9 | )% |

Operating expenses |

| (179,018 | ) | (194,110 | ) | 8.4 | % |

Income Tax |

| (21,005 | ) | (20,052 | ) | (4.5 | )% |

Net income (3) |

| 116,715 |

| 132,527 |

| 13.5 | % |

Earnings per Share |

|

|

|

|

|

|

|

Net income per share (Ch$) |

| 1.23 |

| 1.38 |

| 11.8 | % |

Book value per share (Ch$) |

| 26.71 |

| 28.72 |

| 7.5 | % |

Shares Outstanding (Millions) |

| 94,655 |

| 96,129 |

| 1.6 | % |

Balance Sheet (Millions of Ch$) |

|

|

|

|

|

|

|

Loans to customers |

| 21,882,903 |

| 24,499,399 |

| 12.0 | % |

Total assets |

| 28,156,552 |

| 31,105,826 |

| 10.5 | % |

Demand Deposits |

| 7,047,430 |

| 7,856,852 |

| 11.5 | % |

Equity |

| 2,528,563 |

| 2,760,995 |

| 9.2 | % |

Profitability Ratios |

|

|

|

|

|

|

|

Return on average assets (ROAA) |

| 1.67 | % | 1.71 | % | +4 | bp |

Return on average equity (ROAE) |

| 18.46 | % | 19.41 | % | +96 | bp |

Net Financial Margin(4) |

| 4.74 | % | 4.71 | % | (3 | )bp |

Efficiency ratio |

| 46.93 | % | 47.25 | % | +32 | bp |

Credit Quality Ratios |

|

|

|

|

|

|

|

Total Past Due / Total Loans |

| 1.35 | % | 1.28 | % | (7 | )bp |

Allowances / Total loans |

| 2.46 | % | 2.46 | % | +0 | bp |

Allowances / Total Past Due |

| 1.83 | x | 1.92 | x | 0.09 | x |

Provisions / Avg. Loans |

| 1.20 | % | 1.06 | % | (14 | )bp |

Capital Adequacy Ratios |

|

|

|

|

|

|

|

BIS Ratio (Regulatory Capital / RWA) |

| 13.01 | % | 12.75 | % | (26 | )bp |

Tier I Ratio (Capital / RWA) |

| 10.22 | % | 10.18 | % | (4 | )bp |

(1) See pages 13 to 15.

(2) Net interest income, Net fees and commissions, foreign exchange transactions, net financial operating income and other operating income.

(3) Net Income attributable to Bank’s owners (adjusted by minority interest).

(4) Net financial income divided by average interest earning assets.

1st Quarter 2016 | Business Environment:

Chilean Economy

· Global economic conditions have worsened since the 4Q15. As a result, the IMF revised downwards the outlook for global GDP growth in 2016 from 3.4% (last January) to 3.2%. Also, the IMF reduced the forecasts for economic activity of Chile’s main trading partners.

· Aligned with the above, the Chilean economy continued to perform below the trend growth in the 1Q16. However, the GDP is expected to post an expansion of 1.7% YoY in the 1Q16, which represents a recovery when compared to the 1.3% registered in the previous quarter. This moderate surge would have been fostered by private consumption, which would continue to grow —though to a slower pace— based on higher demand for both services and durable goods. Conversely, gross investment would have remained in negative territory, as a consequence of lower expenditures in machinery and equipment. This trend would have continued to be softened by the dynamism of the construction sector. Lastly, the balance of trade posted a significant increase in the 1Q16, as a result of imports that plummeted 10.2% YoY.

· The unemployment rate remains low at 5.9%. Nevertheless, the labor market started to show some signs of tempered deterioration in the 1Q16. This has been reflected by both a deceleration in the pace of growth of real wages and a YoY decrease in the average of effectively worked hours. On the other hand, job creation continued to be steered by self-employment, which brings about a decline in job quality.

· Regarding prices, inflation has remained above of the upper bound of the Central Bank’s tolerance range. In fact, as of March 31, 2016; 12-month inflation was 4.5% and YTD inflation was 1.1%. These figures continued to be primarily influenced by a 16.9% depreciation of the Chilean Peso during 2015. To a lesser extent, non-tradable inflation has steadily increased in recent months, which has been partly offset by smoothing tradable inflation. In spite of this scenario, the Chilean Central Bank has emphasized that inflation is expected to converge to the target range during the 2H16, mainly as a result of a below-trend economic growth.

· As for monetary policy, after two hikes of 25 basis points during the 4Q15, the Central Bank has maintained the reference rate unchanged at 3.5%. This decision was made in light of Central Bank’s expectations for inflation over the rest of the year. In addition, although the Central Bank’s baseline scenario considers a 25 basis point hike for the monetary policy rate, last meeting’s press release evidenced a more neutral bias that reduces the likelihood of an increase in the short-term.

· In terms of fiscal policy, the Ministry of Finance cut the 2016 public spending by approximately 0.25% of GDP. This was primarily the result of a pessimistic outlook for long-term copper prices.

KEY ECONOMIC INDICATORS

GDP & Domestic Demand

(12m % change)

Inflation and Monetary Policy Rate

(12m % change and %)

1st Quarter 2016 | Business Environment:

Local Banking Industry (1)(2)(3)

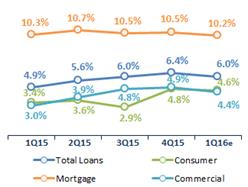

· The industry’s loan book posted a 6.0% YoY (real) growth as of Feb.16, which positively compares to the 4.2% YoY (real) expansion recorded a year earlier. This performance has mainly been prompted by mortgage loans that have continued to grow steadily and, to a lesser extent, by a moderate surge in consumer and commercial loans.

· Mortgage loans grew 10.2% YoY (real) as of Feb.16, figure that was slightly below the 10.3% YoY (real) growth posted as of Feb.15. The strong demand for housing as a result of both the implementation of VAT on construction and increasing housing prices that have triggered purchase intention. It is worth noting that VAT on construction begins in 2016 for real estate developments actually started this year. For all those projects started before 2016 but completed this year, prices should not include VAT effect. Accordingly, mortgage loans are expected to maintain real growth rates of around 10% during 2016.

· Commercial loans increased 4.4% YoY (real) as of Feb.16. This figure favourably compares to the 2.0% YoY (real) expansion posted as of Feb.15. This moderate acceleration in loan growth has still to do with the effect of depreciation of the CLP on loans denominated in USD, which partially offset the effects of deteriorated business sentiment among entrepreneurs.

· On the other hand, consumer loans posted a 4.6% YoY (real) expansion as of Feb.16, which outreached the figure posted as of Feb.15. In spite of this tempered revamping, consumer loan growth still remains well below the figures recorded in prior years. This is in line with consumer confidence indicators that continue to dwell in pessimistic territory.

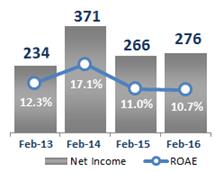

· Regarding YTD earnings, the industry posted a modest increase of 3.7% YoY in net income from Ch$266 Bn. as of Feb.15 to Ch$276 Bn. as of Feb.16. This rise was primarily explained by operating revenues going up by 8.7% YoY, from Ch$1,287 Bn. as of Feb.15 to Ch$1,399 Bn. as of Feb.16, principally due to the effect of a YTD inflation (measured as UF variation) of 0.34% as of Feb.16, as compared to a deflation of 0.33% recorded as of Feb.15.

· The increase in operating revenues allowed the banking industry to partially cope with: (i) operating expenses that increased 12.2% YoY from Ch$678 Bn. as of Feb.15 to Ch$761 Bn. as of Feb.16, mainly as the result of higher personnel expenses (+12.0% YoY) and increasing administrative expenses (+11.2% YoY), which has been the consequence of the effect of FX and inflation, and (ii) a YoY increase of 10.1% in loan loss provisions.

· Despite higher net income, the banking industry recorded a 10.7% ROAE as of Feb.16, which negatively compares to the 11.0% posted in Feb.15.

INDUSTRY’S KEY FIGURES

Loan Growth

(12m % change, in real terms)

Net Income & ROAE

(In billions of Ch$ and %, as of each date)

(1) 12-month growth for the 1Q16 considers YoY 12-month growth for the period February16/February15.

(2) Figures exclude operations of subsidiaries abroad. Also, when necessary, non-recurring effects associated with the consolidation and inclusion of loans coming from other industries (such as the retail industry) are isolated. These is the case of a retailer’s credit card portfolio that was consolidated into the banking system in May 2015 amounting approximately Ch$357 Bn. These consolidation is excluded for calculating YoY and QoQ growth rates, when applicable.

(3) Commercial and consumer loans annual growth adjusted by reclassification effects starting January16.

1st Quarter 2016 | Earnings Report:

Net Income

Aligned with the performance displayed over the last two quarters, we recorded a bottom line of Ch$133 Bn. in the 1Q16. A combination of both customer and non-customer income enabled us to post a YoY increase of 13.5% in net income. In addition, this resulted in a 19.4% ROAE, which outreached the 18.5% recorded a year earlier. In detail, the main factors explaining our YoY performance in the 1Q16 were, as follows:

· A positive inflation effect on the contribution of our UF net asset exposure, given higher inflation in the 1Q16 as compared to 1Q15.

· Higher income from loans as a consequence of increasing loan balances that enabled us to offset a moderate decrease in average lending spreads in the 1Q16 as compared to the 1Q15.

· An annual boost in fee-based income. This was primarily the result of higher fees in retail banking, particularly associated with transactional services (checking & demand accounts, credit cards and ATMs), insurance brokerage and mutual funds management.

· An increase in the contribution of our DDA balances to our cost of funds, given consecutive hikes carried out by the Chilean Central Bank in the marginal standing facility rate by the end of 2015. This effect was amplified by YoY growth in DDA balances.

· A moderate decrease in loan loss provisions, steered by both credit quality improvement and positive FX effect (which is hedged in operating revenues).

The above positive trends permitted us to effectively deal with the following effects: (i) an increase in operating expenses, mostly related to higher personnel and administrative expenses (ii) repricing effect on interest-bearing liabilities denominated in Ch$, following the increase in the monetary policy rate by the end of 2015 that translated into higher nominal interest rates, and (iii) lower revenues associated with sales of AFS securities that were partly offset by both lower charges related to Credit Value Adjustment for derivatives and higher income from trading activities.

NET INCOME: EVOLUTION AND YoY BRIDGE

(In billions of Ch$, except for %)

As of February 29, 2016 (latest available information) we had a market share of 30.4% in net income. This figure permitted us to rank first in the industry and hold a positive gap of 3.4 percentage points with respect to our main peer.

1st Quarter 2016 | Earnings Report:

Operating Revenues

Our operating revenues amounted to Ch$410.9 Bn. in the 1Q16. This figure was 7.7% (or Ch$29.4 Bn.) above the top line posted in the 1Q15 and slightly below the level recorded in the 4Q15. As mentioned earlier, this behaviour in revenues was influenced by both customer and non-customer income. This was based on a solid commercial performance displayed by the core banking business and more favourable market factors that positively impacted on the contribution of certain positions. Thus, the YoY change in operating revenues was mainly the consequence of:

· An annual increase of approximately Ch$29.5 Bn. in the contribution of our UF net asset exposure. This increase was principally the result of more normalized inflation that —measured as UF variation— went up from a deflation of 0.02% in the 1Q15 to an increase of 0.71% in the 1Q16.

· Income from loans increasing by approximately Ch$7.8 Bn. YoY. This increment represented a 4.8% annual rise and was the result of average loan balances growing 12.5% YoY, together with a moderate decrease in average lending spreads. This has been partly attributable to the dynamism evidenced by the housing market, which produced a change in our portfolio mix towards low-risk products while impacting our average lending spreads moderately. In this regard, the share of residential mortgage loans in our loan book increased from 25.2% to 26.6% on a YoY basis, while the stake representing consumer loans remained flat in 15.4%.

· A YoY increase of nearly Ch$5.3 Bn. in fees and commissions income. This advance was mainly related to fee-based income generated in the retail banking segment, particularly linked to transactional services (checking accounts, credit cards and ATM usage) amounting to Ch$2.9 Bn. YoY. This trend was accompanied by higher revenues from insurance brokerage (Ch$1.3 Bn. YoY) and mutual funds management (Ch$0.9 Bn YoY).

· Higher contribution of nearly Ch$3.4 Bn. of demand deposits to our cost of funds in the 1Q16 as compared to the 1Q15. This positive effect was the result of both DDA average balances increasing by 13.1% YoY in conjunction with higher nominal interest rates resulting from two hikes of 25 bp. in the monetary policy interest rate by the end of 2015.

· A decrease in charges associated with Credit Value Adjustment for derivatives by roughly Ch$2.7 Bn. YoY, given the sharp decrease in the Ch$/USD exchange rate and, to a lesser extent, the positive effect of a new clearing house recently implemented in Chile.

· Higher income from the management of fixed-income securities held for trading by approximately Ch$1.0 Bn. on a YoY basis.

OPERATING REVENUES AND NIM

|

| Quarters |

| YoY Chg. |

| ||

(in millions of Ch$ and %) |

| 1Q15 |

| 1Q16 |

| 1Q15/1Q16 |

|

Net Interest Income |

| 263,723 |

| 301,171 |

| 14.2 | % |

Net Fees and Commissions |

| 72,101 |

| 77,410 |

| 7.4 | % |

Net Financial Operating Income |

| 22,005 |

| 37,684 |

| 71.3 | % |

Foreign Exchange Transactions |

| 15,503 |

| (11,992 | ) | — |

|

Other operating income |

| 8,147 |

| 6,579 |

| (19.2 | )% |

Total Operating Revenues |

| 381,479 |

| 410,852 |

| 7.7 | % |

Net Interest Margin (NIM) |

| 4.15 | % | 4.34 | % | +19 | bp |

All of the above allowed us to largely cope with: (i) a negative exchange rate effect of approximately Ch$12.7 Bn. on the asset position hedging our exposure to US$-denominated loan loss allowances, due to the 5.7% appreciation of the Ch$ in the 1Q16 as compared to the 3.2% depreciation in the 1Q15 (with positive impact in loan loss provisions), (ii) greater sales of AFS securities in the 1Q15 by approximately Ch$7.3 Bn., owing to the prevailing interest rate scenario, and (iii) slightly negative repricing effect due to interest-bearing liabilities that repriced faster than assets as a result of the increase in nominal short-term interest rates by the end of 2015.

On the whole, the increase in net interest income enabled us to increase our NIM by 19 bp. YoY, from 4.15% in the 1Q15 to 4.34% in the 1Q16.

1st Quarter 2016 | Earnings Report:

Loan Loss Provisions & Allowances

As mentioned in previous quarters, our loan loss provisions have remained resilient to the economic backdrop. This has been prompted by certain macroeconomic variables, such as employment, that have positively impacted the credit quality of individuals. On the other hand, Middle Market companies and SMEs have maintained adequate levels of risk.

On the whole, our loan loss provisions posted a tempered YoY decrease of 0.9% from Ch$65.4 Bn. in the 1Q15 to Ch$64.8 Bn. in the 1Q16. This annual decline was a combination of mixed forces, as follows:

· A positive exchange rate effect on our exposure to loan loss allowances denominated in US$. This effect explained approximately Ch$12.7 Bn. in lower loan loss provisions on a YoY basis and was supported by a Ch$-depreciation of 3.2% in the 1Q15 as compared to a Ch$-appreciation of 5.7% in the 1Q16.

· An annual expansion of 12.5% in average loans, which prompted —all things equal— an increase of approximately Ch$9.8 Bn. in loan loss provisions. This expansion was principally concentrated on retail banking. In fact, retail banking loans (average balances) increased by 16.0% YoY as compared to the expansion of 8.3% in wholesale banking loans. However, growth in retail banking was primarily fostered by low-risk lending products, such as mortgage loans, with average balances boosting by 18.4% YoY.

· Regulatory changes related to the treatment of impaired loans, factoring loans and guarantees, which translated into a one-time effect of approximately Ch$3.3 Bn. in loan loss provisions in the 1Q16.

LOAN LOSS PROVISIONS & ALLOWANCES

|

| Quarters |

| % Change |

| ||

(in millions of Ch$ and %) |

| 1Q15 |

| 1Q16 |

| 1Q15/1Q16 |

|

Initial Allowances |

| (528,615 | ) | (601,766 | ) | 13.8 | % |

Charge-offs |

| 66,019 |

| 66,687 |

| 1.0 | % |

Sales of Loans |

| 271 |

| 5,228 |

| 1,829.2 | % |

Provisions established, net |

| (76,669 | ) | (72,696 | ) | (5.2 | )% |

Final Allowances |

| (538,994 | ) | (602,547 | ) | 11.8 | % |

Provisions Established |

| (76,669 | ) | (72,696 | ) | (5.2 | )% |

Prov. Financial Guarantees |

| (1,232 | ) | (2,516 | ) | 104.2 | % |

Recoveries |

| 12,469 |

| 10,382 |

| (16.7 | )% |

Loan Loss Provisions |

| (65,432 | ) | (64,830 | ) | (0.9 | )% |

Credit Quality Ratios |

|

|

|

|

|

|

|

Allowances / Total loans |

| 2.46 | % | 2.46 | % | +0 | bp |

Allowances / Total Past Due |

| 1.83 | x | 1.92 | x | 0.09 | x |

Provisions / Avg. Loans |

| 1.20 | % | 1.06 | % | (14 | )bp |

Charge-offs / Avg. Loans |

| 1.21 | % | 1.09 | % | (12 | )bp |

Total Past Due / Total Loans |

| 1.35 | % | 1.28 | % | (7 | )bp |

Recoveries / Avg. Loans |

| 0.23 | % | 0.17 | % | (6 | )bp |

Based on the above, our ratio of loan loss provisions to average loans posted a 14 bp. improvement (decrease) by going down from 1.20% in the 1Q15 to 1.06% in the 1Q16. This change was in part supported by a decrease in the delinquency ratio (past-due loans over total loans) from 1.35% in the 1Q15 to 1.28% in the 1Q16. Furthermore, shifts in exchange rate also contributed to the path followed by the LLP ratio, which turns into 1.14% for the 1Q15 and 1.21% for the 1Q16 when adjusting by exchange rate effects.

Lastly, it is worth noting the change in charge-offs as a percentage of average loans, which dropped from 1.21% in the 1Q15 to 1.09% in the 1Q16. This trend, together with a YoY decline in net allowances established during the quarter, resulted in a risk index that remained flat YoY at the level of 2.46%.

1st Quarter 2016 | Earnings Report:

Operating Expenses

Our operating expenses totalled Ch$194.1 Bn. in the 1Q16, which represented an 8.4% YoY increase when compared to the Ch$179.0 Bn. recorded a year earlier. The increment experienced by our cost base is partly related to the effect of shifts in market factors, particularly inflation, on some line items. Thus, the YoY variance in operating expenses can be summarized, as follows:

· Personnel expenses that increased 12.5% or Ch$11.7 Bn. on a YoY basis. This increment was mainly the result of: (i) an annual rise of Ch$5.7 Bn. in bonuses including performance bonuses and variable compensation to the sales force, (ii) a YoY increase of Ch$3.6 Bn. associated with inflation-indexed salary adjustments that were applied twice during 2015, amounting to approximately 3.9%, and (iii) higher severance payments of approximately Ch$0.9 Bn. YoY, given recent changes in the organizational structure.

· Administrative expenses that posted an 11.5% or Ch$7.8 Bn. annual increase in the 1Q16 as compared to the 1Q15. This annual growth was primarily prompted by: (i) further advertising expenses of approximately Ch$2.0 Bn. in the 1Q16 as compared to the 1Q15, principally related to commercial campaigns intended to reinforce brand recognition while promoting new strategic alliances that enrich our credit card loyalty programs, (ii) higher IT and communications expenses (including data processing) by approximately Ch$1.5 Bn., (iii) nearly Ch$0.8 Bn. of higher expenses related to security, surveillance and money and valuables transportation, (iv) maintenance expenses that increased Ch$0.5 Bn. YoY, and (v) other administrative expenses growing by roughly Ch$2.3 Bn. YoY, which was prompted by diverse line items.

· An annual increase of roughly Ch$0.6 Bn. in depreciations and amortizations. This was primarily explained by higher expenses related to ATMs; as a result of the replacement of older devices with newer and more secure platforms, as requested by the authority.

The factors mentioned above were partly offset by other operating expenses decreasing 52.4% YoY or approximately Ch$5.1 Bn. This significant decrease was mainly fostered by: (i) contingency provisions that declined Ch$4.3 Bn. on an annual basis, and (ii) country-risk provisions that decreased by approximately Ch$1.0 Bn. as a result of lowered exposure to those assets.

OPERATING EXPENSES AND EFFICIENCY

|

| Quarters |

| % Change |

| ||

(in millions of Ch$ and %) |

| 1Q15 |

| 1Q16 |

| 1Q15/1Q16 |

|

Personnel expenses |

| (93,557 | ) | (105,298 | ) | 12.5 | % |

Administrative expenses |

| (68,389 | ) | (76,220 | ) | 11.5 | % |

Depreciation and Amort. |

| (7,386 | ) | (7,976 | ) | 8.0 | % |

Impairments |

| — |

| (4 | ) | — |

|

Other Oper. Expenses |

| (9,686 | ) | (4,612 | ) | (52.4 | )% |

Total Oper. Expenses |

| (179,018 | ) | (194,110 | ) | 8.4 | % |

Additional Information |

|

|

|

|

|

|

|

Op. Exp. / Op. Rev. |

| 46.93 | % | 47.25 | % | +32 | bp |

Op. Exp. / Avg. Assets |

| 2.56 | % | 2.51 | % | (5 | )bp |

Headcount (#) |

| 14,686 |

| 14,883 |

| +197 |

|

Branches (#) |

| 423 |

| 418 |

| (5 | ) |

Based on the above, and also given by a proportionally lower expansion of operating revenues, our cost-to-income ratio posted a YoY increase of 32 bp. from 46.9% in the 1Q15 to 47.3% in the 1Q16. However, when considering our expenses as a percentage of total assets, we can figure out that our cost base has evolved in line with our commercial activity, which is reflected by an improvement of 5 bp. in the cost-to-assets ratio.

1st Quarter 2016 | Earnings Report:

Loan Portfolio

Our loan portfolio amounted to Ch$24,499 Bn. as of March 31, 2016. This amount represented a 12.0% YoY growth as compared to the 1Q15 and supported an 18.2% market share in total loans as of February 29, 2016 (latest available data). Although our loan book posted a slight decrease of 0.2% QoQ, this seems to be aligned with trends indicated by the Central Bank (CB) on the last quarterly credit survey. According to the CB, credit offer remains constrained while banks pointed out a weakened demand for credits from both individuals and companies. From a product point-of-view, the CB revealed a weaker demand for residential mortgage loans and corporate loans, in particular, while unveiling a moderate slowdown in the demand for consumer loans.

LOAN PORTFOLIO: EVOLUTION AND QUARTERLY GROWTH

(In Billions of Ch$ and %)

BREAKDOWN AND EVOLUTION

QUARTERLY LOAN GROWTH

As mentioned in previous reports, we aim to grow selectively in those segments that display high potential. In our view, the evolution of our loan book reflects this strategy. First of all, the retail banking segment is today the main segment of our lending business by representing 55% of our total loans. Trends in retail banking have to do with:

· Growth in the middle and upper income segment by means of the expansion in consumer loans (11.8% YoY) and residential mortgage loans (17.9% YoY). Even though mortgage loans continued to be decoupled from the pace of growth shown by the economy; we have set stricter requirements while increasing lending spreads to recognize

potential risks ahead. Accordingly, quarterly growth in mortgage loans decreased from 4.9% in the 4Q15 to 1.6% in the 1Q16. As for consumer loans, we have continued to focus on credit cards by widening value offerings and increasing benefits for loyalty programs. However, the path followed by private consumption has also affected our quarterly growth in consumer loans, which decreased from 6.0% in the 4Q15 to 0.9% in the 1Q16.

· A higher penetration of the SME segment, based on government-backed loans and pre-approved models set by our credit risk division. These initiatives have permitted us to grow while maintaining adequate delinquency levels.

· Stagnated growth in consumer finance. Due to our view of the economic outlook, in 2013 we halted the expansion in the segment. Therefore, we have strived to increase profitability by improving credit quality and making the credit process more efficient.

Concerning to wholesale banking, the impact of economic slowdown on investment, together with our aim of ensuring an efficient use of capital, has led us to grow slightly below the industry. In the 1Q16, loans managed this segment grew by 8.0% YoY while decreasing 2.7% QoQ. This quarterly trend was associated with loans granted to corporations rather than middle market companies. Among the main reasons behind this behavior we can mention narrowed lending spreads and recent events of credit quality deterioration in certain sectors. Likewise, some of the commercial loans acquired last year from a local bank were already paid off. Also, the 5.7% appreciation of the Ch$ in the 1Q16 impacted the balances of certain loans denominated in US$, particularly related to the wholesale segment. On the whole, trends in wholesale banking and SMEs translated into YoY and QoQ growth rates of 9.5% and -1.4%, respectively, in commercial loans during the 1Q16.

1st Quarter 2016 | Earnings Report:

Funding Structure

Based on a consistent diversification strategy executed over the last years, we have been able to widen funding sources in tenors, types of instruments and markets. As we have mentioned in prior quarters, this policy has permitted us to reduce the maturity gap between assets and liabilities by approximately 90 days (when modelling the minimum duration of deposits). Also, we have matched long-term assets denominated in UF (such as residential mortgage loans) with long-term liabilities issued in foreign currency but swapped into UF by means of cross currency swaps in order to avoid any exposure to FX and interest rate risks.

For short-term financing needs, we have also found alternative funding sources. In this regard, the Commercial Paper shelf we have registered in the US permits us to finance specific lending products such as Trade Finance and Working Capital loans.

In addition, our solid leadership in demand deposits, but especially in deposits held by individuals, provides us with a strong competitive advantage in terms of cost of funds and also stability of our funding. As of March 31, 2016 our total demand deposit balances had increased by 11.5% YoY. Similarly, demand deposits held by individuals had grown by 11.6% as of the same date, on a YoY basis. These figures supported our market-leading positions in both total demand deposits and those coming from individuals, which are reflected by market shares of 22.6% (excluding operations of subsidiaries abroad) and 28.6%, respectively, both as of February 29, 2016 (latest available data).

FUNDING: BREAKDOWN & AVERAGE COST

(In percentage)

Notes:

Cost of funding chart considers banks with market share above 7% in total loans as of Dec.15. Also, cost of funding is defined as the annualized sum of interest expenses divided by sum of average balances of demand deposits, Repos, time deposits and saving accounts, borrowings from financial institutions, debt issued and other financial liabilities.

As a result of the above, we have been able to replace deposits from wholesale holders, especially time deposits and borrowings from financial institutions, with local and international short- and long-term debt. Thus, debt issued has changed from 9.0% in March 2011 to 19.2% in March 2016 as a percentage of total liabilities (including equity). On the other hand, deposits coming from retail banking have remained as a stable source of funding by averaging approximately 26% of our total liabilities.

Lastly, as of February 29, 2016 (latest available data), we maintained one of the most competitive funding structures within the Chilean banking industry, as set forth by the chart at the right hand side above.

1st Quarter 2016 | Earnings Report:

Capital Adequacy & Other Topics

Our equity amounted to Ch$2,761.0 Bn. as of March 31, 2016, which was 9.2% above the Ch$2,528.6 Bn. posted in March 2015. The annual variance in equity had primarily to do with:

· Capitalization of approximately Ch$96.9 Bn. from our net distributable earnings for the FY2015. This retention was approved by our shareholders in the annual meeting held on March 24, 2016 and has been already reflected by our paid-in capital, which increased from Ch$2,041.2 Bn. in March 2015 to Ch$2,138.0 Bn. in March 2016.

· �� Retention of nearly Ch$95.5 Bn. associated with the recognition of the effect of inflation on our shareholders’ equity. As mentioned in previous reports, this amount is intended to hedge our equity to changes in inflation or, in other words, to maintain the real value of our capital base.

· Higher net income (net of provisions for minimum dividends) by nearly Ch$30.9 Bn. YoY. This amount can be broken down in: (i) a YoY increase of approximately Ch$15.8 Bn. in net income for the period (Ch$133 Bn. in 2016 as compared to Ch$117 Bn. in 2015), and (ii) a decrease of roughly Ch$15.1 Bn. in provisions for minimum dividends. The lower provisions for minimum dividends are primarily related to a change in the percentage of net distributable earnings provisioned for dividends from 70% in 2015 to 60% in 2016, as mentioned in our previous earnings release (4Q15).

· Finally, there was an increment of approximately Ch$9.2 Bn. in other equity accounts. This annual increase was mainly related to equivalent fair value adjustments in derivatives held for cash flows hedge accounting.

EQUITY & CAPITAL ADEQUACY

(In Billions of Ch$ and %)

Equity |

| Mar-15 |

| Mar-16 |

| YoY Chg. |

|

Capital & Reserves |

|

|

|

|

|

|

|

Capital |

| 2,041.2 |

| 2,138.0 |

| 4.7 | % |

Reserves |

| 390.6 |

| 486.1 |

| 24.4 | % |

Other accounts |

| 45.7 |

| 54.9 |

| 20.2 | % |

Earnings |

|

|

|

|

|

|

|

Retained Earnings |

| 16.1 |

| 16.1 |

| — |

|

Income for the Period |

| 116.7 |

| 132.5 |

| 13.5 | % |

Provisions for Min. Dividends |

| (81.7 | ) | (66.6 | ) | (18.4 | )% |

Minority Interest |

|

|

|

|

|

|

|

Minority Interest |

| — |

| — |

| — |

|

Total Equity |

| 2,528.6 |

| 2,761.0 |

| 9.2 | % |

Notes:

Assets: Total Assets | RWA: Risk-Weighted Assets | Total Capital: Basic Capital + Supplementary Capital (if any).

Basic Capital: paid-in capital, reserves and retained earnings, excluding capital of subsidiaries and foreign branches.

On the whole, given the expansion experienced by our balance sheet and —particularly— as a result of the loan portfolio acquired in the 3Q15, our capital adequacy ratios posted a moderate decrease YoY. In this regard, our BIS ratio changed from 13.0% in March 2015 to 12.8% in March 2016. Nonetheless, this ratio continued to dwell well above the regulatory threshold of 10% required by the Chilean regulation. On the other hand, our Tier I ratios remained at suitable levels. Firstly, the Tier I ratio on Assets was 7.6% in March 2016, only 11 pb. below the figure posted last year and 4.6 percentage points above the regulatory limit. Also, our Tier I ratio on RWA posted a tempered 4 bp. decrease by totalling 10.2% in March 2016.

1st Quarter 2016 | Earnings Report:

Business Model: Loans | Income before Taxes | Customers

LOANS BREAKDOWN BY SEGMENT

(In Billions of Ch$ and %)

As of March 31, 2015 | As of March 31, 2016 |

|

|

| |

INCOME BEFORE INCOME TAX BY SEGMENT

(In Millions of Ch$ and %)

|

| Quarter |

| % Change |

| ||

Business Segment |

| 1Q15 |

| 1Q16 |

| 1Q16/1Q15 |

|

Retail Banking |

| 54,340 |

| 56,575 |

| 4.1 | % |

Wholesale Banking |

| 52,504 |

| 59,488 |

| 13.3 | % |

Treasury |

| 20,834 |

| 28,267 |

| 35.7 | % |

Subsidiaries |

| 10,042 |

| 8,249 |

| (17.9 | )% |

Income before income tax |

| 137,720 |

| 152,579 |

| 10.8 | % |

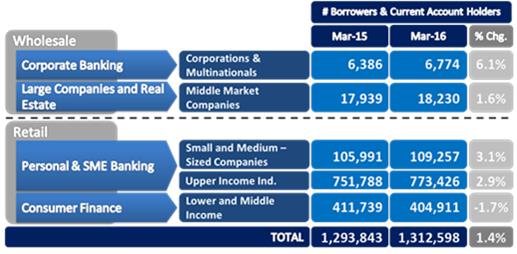

CUSTOMER BASE BY SEGMENT

(Borrowers + Current Account Holders)

1st Quarter 2016 | Financial Information:

Consolidated Statement of Income (Chilean-GAAP)

(In millions of Chilean pesos (MCh$) and millions of US dollars (MUS$))

|

| Quarters |

|

|

|

|

| Year Ended |

|

|

| ||||||||||

|

| 1Q15 |

| 4Q15 |

| 1Q16 |

| 1Q16 |

| % Change |

| Mar-15 |

| Mar-16 |

| Mar-16 |

| % Change |

| ||

|

| MCh$ |

| MCh$ |

| MCh$ |

| MUS$ |

| 1Q16/1Q15 |

| 1Q16/4Q15 |

| MCh$ |

| MCh$ |

| MUS$ |

| Mar-16/Mar-15 |

|

Interest revenue and expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest revenue |

| 365,618 |

| 503,036 |

| 469,729 |

| 703.5 |

| 28.5 | % | (6.6 | )% | 365,618 |

| 469,729 |

| 703.5 |

| 28.5 | % |

Interest expense |

| (101,895 | ) | (190,455 | ) | (168,558 | ) | (252.4 | ) | 65.4 | % | (11.5 | )% | (101,895 | ) | (168,558 | ) | (252.4 | ) | 65.4 | % |

Net interest income |

| 263,723 |

| 312,581 |

| 301,171 |

| 451.1 |

| 14.2 | % | (3.7 | )% | 263,723 |

| 301,171 |

| 451.1 |

| 14.2 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fees and commissions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from fees and commissions |

| 102,372 |

| 115,556 |

| 107,636 |

| 161.2 |

| 5.1 | % | (6.9 | )% | 102,372 |

| 107,636 |

| 161.2 |

| 5.1 | % |

Expenses from fees and commissions |

| (30,271 | ) | (32,736 | ) | (30,226 | ) | (45.3 | ) | (0.1 | )% | (7.7 | )% | (30,271 | ) | (30,226 | ) | (45.3 | ) | (0.1 | )% |

Net fees and commissions income |

| 72,101 |

| 82,820 |

| 77,410 |

| 115.9 |

| 7.4 | % | (6.5 | )% | 72,101 |

| 77,410 |

| 115.9 |

| 7.4 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Financial Operating Income |

| 22,005 |

| (384 | ) | 37,684 |

| 56.4 |

| 71.3 | % | — |

| 22,005 |

| 37,684 |

| 56.4 |

| 71.3 | % |

Foreign exchange transactions, net |

| 15,503 |

| 12,720 |

| (11,992 | ) | (18.0 | ) | — |

| — |

| 15,503 |

| (11,992 | ) | (18.0 | ) | — |

|

Other operating income |

| 8,147 |

| 6,644 |

| 6,579 |

| 9.9 |

| (19.2 | )% | (1.0 | )% | 8,147 |

| 6,579 |

| 9.9 |

| (19.2 | )% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Operating Revenues |

| 381,479 |

| 414,381 |

| 410,852 |

| 615.3 |

| 7.7 | % | (0.9 | )% | 381,479 |

| 410,852 |

| 615.3 |

| 7.7 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provisions for loan losses |

| (65,432 | ) | (74,011 | ) | (64,830 | ) | (97.1 | ) | (0.9 | )% | (12.4 | )% | (65,432 | ) | (64,830 | ) | (97.1 | ) | (0.9 | )% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating revenues, net of provisions for loan losses |

| 316,047 |

| 340,370 |

| 346,022 |

| 518.2 |

| 9.5 | % | 1.7 | % | 316,047 |

| 346,022 |

| 518.2 |

| 9.5 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Personnel expenses |

| (93,557 | ) | (103,002 | ) | (105,298 | ) | (157.7 | ) | 12.5 | % | 2.2 | % | (93,557 | ) | (105,298 | ) | (157.7 | ) | 12.5 | % |

Administrative expenses |

| (68,389 | ) | (75,803 | ) | (76,220 | ) | (114.2 | ) | 11.5 | % | 0.6 | % | (68,389 | ) | (76,220 | ) | (114.2 | ) | 11.5 | % |

Depreciation and amortization |

| (7,386 | ) | (7,538 | ) | (7,976 | ) | (11.9 | ) | 8.0 | % | 5.8 | % | (7,386 | ) | (7,976 | ) | (11.9 | ) | 8.0 | % |

Impairments |

| — |

| (119 | ) | (4 | ) | — |

| — |

| (96.6 | )% | — |

| (4 | ) | — |

| — |

|

Other operating expenses |

| (9,686 | ) | (1,485 | ) | (4,612 | ) | (6.9 | ) | (52.4 | )% | 210.6 | % | (9,686 | ) | (4,612 | ) | (6.9 | ) | (52.4 | )% |

Total operating expenses |

| (179,018 | ) | (187,947 | ) | (194,110 | ) | (290.7 | ) | 8.4 | % | 3.3 | % | (179,018 | ) | (194,110 | ) | (290.7 | ) | 8.4 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net operating income |

| 137,029 |

| 152,423 |

| 151,912 |

| 227.5 |

| 10.9 | % | (0.3 | )% | 137,029 |

| 151,912 |

| 227.5 |

| 10.9 | % |

Income attributable to affiliates |

| 691 |

| 967 |

| 667 |

| 1.0 |

| (3.5 | )% | (31.0 | )% | 691 |

| 667 |

| 1.0 |

| (3.5 | )% |

Income before income tax |

| 137,720 |

| 153,390 |

| 152,579 |

| 228.5 |

| 10.8 | % | (0.5 | )% | 137,720 |

| 152,579 |

| 228.5 |

| 10.8 | % |

Income tax |

| (21,005 | ) | (13,291 | ) | (20,052 | ) | (30.0 | ) | (4.5 | )% | 50.9 | % | (21,005 | ) | (20,052 | ) | (30.0 | ) | (4.5 | )% |

Net Income for the period |

| 116,715 |

| 140,099 |

| 132,527 |

| 198.5 |

| 13.5 | % | (5.4 | )% | 116,715 |

| 132,527 |

| 198.5 |

| 13.5 | % |

Non-Controlling interest |

| — |

| 1 |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

|

Net Income attributable to bank’s owners |

| 116,715 |

| 140,098 |

| 132,527 |

| 198.5 |

| 13.5 | % | (5.4 | )% | 116,715 |

| 132,527 |

| 198.5 |

| 13.5 | % |

These results have been prepared in accordance with Chilean GAAP on an unaudited, consolidated basis.

All figures are expressed in nominal Chilean pesos (historical pesos), unless otherwise stated. All figures expressed in US dollars (except earnings per ADR) were converted using the exchange rate of Ch$667.70 per US$1.00 as of March 31, 2016. Earnings per ADR were calculated considering the nominal net income, the exchange rate and the number of shares outstanding at the end of each period.

Banco de Chile files its consolidated financial statements, together with those of its subsidiaries, with the Chilean Superintendency of Banks and Financial Institutions, on a monthly basis. In addition, Banco de Chile files its quarterly financial statements (notes included) with the SEC in form 6K, simultaneously or previously to file this quarterly earnings report. Such documentation is equally available at Banco de Chile’s website both in Spanish and English.

1st Quarter 2016 | Financial Information:

Consolidated Balance Sheets (Chilean-GAAP)

(In millions of Chilean pesos (MCh$) and millions of US dollars (MUS$))

|

| Mar-15 |

| Dec-15 |

| Mar-16 |

| Mar-16 |

| % Change |

| ||

ASSETS |

| MCh$ |

| MCh$ |

| MCh$ |

| MUS$ |

| Mar-16/Mar-15 |

| Mar-16/Dec-15 |

|

Cash and due from banks |

| 836,428 |

| 1,361,222 |

| 936,459 |

| 1,402.5 |

| 12.0 | % | (31.2 | )% |

Transactions in the course of collection |

| 558,183 |

| 526,046 |

| 627,906 |

| 940.4 |

| 12.5 | % | 19.4 | % |

Financial Assets held-for-trading |

| 513,743 |

| 866,654 |

| 1,230,122 |

| 1,842.3 |

| 139.4 | % | 41.9 | % |

Receivables from repurchase agreements and security borrowings |

| 30,992 |

| 46,164 |

| 37,358 |

| 56.0 |

| 20.5 | % | (19.1 | )% |

Derivate instruments |

| 959,203 |

| 1,127,122 |

| 1,102,172 |

| 1,650.7 |

| 14.9 | % | (2.2 | )% |

Loans and advances to Banks |

| 1,471,506 |

| 1,395,195 |

| 1,558,556 |

| 2,334.2 |

| 5.9 | % | 11.7 | % |

Loans to customers, net |

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial loans |

| 12,985,453 |

| 14,416,918 |

| 14,217,819 |

| 21,293.7 |

| 9.5 | % | (1.4 | )% |

Residential mortgage loans |

| 5,524,331 |

| 6,404,986 |

| 6,510,653 |

| 9,750.9 |

| 17.9 | % | 1.6 | % |

Consumer loans |

| 3,373,119 |

| 3,736,137 |

| 3,770,927 |

| 5,647.6 |

| 11.8 | % | 0.9 | % |

Loans to customers |

| 21,882,903 |

| 24,558,041 |

| 24,499,399 |

| 36,692.2 |

| 12.0 | % | (0.2 | )% |

Allowances for loan losses |

| (538,994 | ) | (601,766 | ) | (602,547 | ) | (902.4 | ) | 11.8 | % | 0.1 | % |

Total loans to customers, net |

| 21,343,909 |

| 23,956,275 |

| 23,896,852 |

| 35,789.8 |

| 12.0 | % | (0.2 | )% |

Financial Assets Available-for-Sale |

| 1,566,813 |

| 1,000,001 |

| 778,194 |

| 1,165.5 |

| (50.3 | )% | (22.2 | )% |

Financial Assets Held-to-maturity |

| — |

| — |

| — |

| — |

| — |

| — |

|

Investments in other companies |

| 25,917 |

| 28,126 |

| 28,718 |

| 43.0 |

| 10.8 | % | 2.1 | % |

Intangible assets |

| 26,815 |

| 26,719 |

| 26,464 |

| 39.6 |

| (1.3 | )% | (1.0 | )% |

Property and Equipment |

| 204,941 |

| 215,671 |

| 214,641 |

| 321.5 |

| 4.7 | % | (0.5 | )% |

Current tax assets |

| 3,931 |

| 3,279 |

| 4,219 |

| 6.3 |

| 7.3 | % | 28.7 | % |

Deferred tax assets |

| 199,808 |

| 255,972 |

| 257,877 |

| 386.2 |

| 29.1 | % | 0.7 | % |

Other assets |

| 414,363 |

| 484,498 |

| 406,288 |

| 608.5 |

| (1.9 | )% | (16.1 | )% |

Total Assets |

| 28,156,552 |

| 31,292,944 |

| 31,105,826 |

| 46,586.5 |

| 10.5 | % | (0.6 | )% |

|

| Mar-15 |

| Dec-15 |

| Mar-16 |

| Mar-16 |

| % Change |

| ||

LIABILITIES & EQUITY |

| MCh$ |

| MCh$ |

| MCh$ |

| MUS$ |

| Mar-16/Mar-15 |

| Mar-16/Dec-15 |

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current accounts and other demand deposits |

| 7,047,430 |

| 8,327,048 |

| 7,856,852 |

| 11,767.0 |

| 11.5 | % | (5.6 | )% |

Transactions in the course of payment |

| 308,261 |

| 241,842 |

| 421,078 |

| 630.6 |

| 36.6 | % | 74.1 | % |

Payables from repurchase agreements and security lending |

| 249,784 |

| 184,131 |

| 189,331 |

| 283.6 |

| (24.2 | )% | 2.8 | % |

Saving accounts and time deposits |

| 9,736,875 |

| 9,907,692 |

| 10,730,905 |

| 16,071.4 |

| 10.2 | % | 8.3 | % |

Derivate instruments |

| 980,639 |

| 1,127,927 |

| 1,129,658 |

| 1,691.9 |

| 15.2 | % | 0.2 | % |

Borrowings from financial institutions |

| 1,193,195 |

| 1,529,627 |

| 1,207,364 |

| 1,808.2 |

| 1.2 | % | (21.1 | )% |

Debt issued |

| 5,305,301 |

| 6,102,208 |

| 5,957,559 |

| 8,922.5 |

| 12.3 | % | (2.4 | )% |

Other financial obligations |

| 165,620 |

| 173,081 |

| 175,266 |

| 262.5 |

| 5.8 | % | 1.3 | % |

Current tax liabilities |

| 18,728 |

| 27,993 |

| 22,325 |

| 33.4 |

| 19.2 | % | (20.2 | )% |

Deferred tax liabilities |

| 37,686 |

| 32,953 |

| 34,908 |

| 52.3 |

| (7.4 | )% | 5.9 | % |

Provisions |

| 329,229 |

| 639,043 |

| 363,075 |

| 543.8 |

| 10.3 | % | (43.2 | )% |

Other liabilities |

| 255,241 |

| 259,312 |

| 256,510 |

| 384.2 |

| 0.5 | % | (1.1 | )% |

Total liabilities |

| 25,627,989 |

| 28,552,857 |

| 28,344,831 |

| 42,451.4 |

| 10.6 | % | (0.7 | )% |

Equity of the Bank’s owners |

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital |

| 2,041,173 |

| 2,041,173 |

| 2,138,047 |

| 3,202.1 |

| 4.7 | % | 4.7 | % |

Reserves |

| 390,640 |

| 390,616 |

| 486,083 |

| 728.0 |

| 24.4 | % | 24.4 | % |

Other comprehensive income |

| 45,675 |

| 57,709 |

| 54,918 |

| 82.2 |

| 20.2 | % | (4.8 | )% |

Retained earnings from previous periods |

| 16,060 |

| 16,060 |

| 16,060 |

| 24.1 |

| — |

| — |

|

Income for the period |

| 116,715 |

| 558,995 |

| 132,527 |

| 198.5 |

| 13.5 | % | (76.3 | )% |

Provisions for minimum dividends |

| (81,701 | ) | (324,469 | ) | (66,641 | ) | (99.8 | ) | (18.4 | )% | (79.5 | )% |

Non-Controlling Interest |

| 1 |

| 3 |

| 1 |

| — |

| — |

| (66.7 | )% |

Total equity |

| 2,528,563 |

| 2,740,087 |

| 2,760,995 |

| 4,135.1 |

| 9.2 | % | 0.8 | % |

Total Liabilities & Equity |

| 28,156,552 |

| 31,292,944 |

| 31,105,826 |

| 46,586.5 |

| 10.5 | % | (0.6 | )% |

These results have been prepared in accordance with Chilean GAAP on an unaudited, consolidated basis.

All figures are expressed in nominal Chilean pesos (historical pesos), unless otherwise stated. All figures expressed in US dollars (except earnings per ADR) were converted using the exchange rate of Ch$667.70 per US$1.00 as of March 31, 2016. Earnings per ADR were calculated considering the nominal net income, the exchange rate and the number of shares outstanding at the end of each period.

Banco de Chile files its consolidated financial statements, together with those of its subsidiaries, with the Chilean Superintendency of Banks and Financial Institutions, on a monthly basis. In addition, Banco de Chile files its quarterly financial statements (notes included) with the SEC in form 6K, simultaneously or previously to file this quarterly earnings report. Such documentation is equally available at Banco de Chile’s website both in Spanish and English.

1st Quarter 2016 | Financial Information:

Selected Financial Information (Chilean-GAAP)

(In millions of Chilean pesos (MCh$) and millions of US dollars (MUS$))

|

| Quarters |

| Year Ended |

| ||||||||

Key Performance Ratios |

| 1Q15 |

| 4Q15 |

| 1Q16 |

| Mar-15 |

| Dec-15 |

| Mar-16 |

|

Earnings per Share (1) (2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per Share (Ch$) |

| 1.23 |

| 1.46 |

| 1.38 |

| 1.23 |

| 5.82 |

| 1.38 |

|

Net income per ADS (Ch$) |

| 739.83 |

| 874.44 |

| 827.18 |

| 739.83 |

| 3,489.03 |

| 827.18 |

|

Net income per ADS (US$) |

| 1.18 |

| 1.23 |

| 1.24 |

| 1.18 |

| 4.93 |

| 1.24 |

|

Book value per Share (Ch$) |

| 26.71 |

| 28.50 |

| 28.72 |

| 26.71 |

| 28.50 |

| 28.72 |

|

Shares outstanding (Millions) |

| 94,655 |

| 96,129 |

| 96,129 |

| 94,655 |

| 96,129 |

| 96,129 |

|

Profitability Ratios (3)(4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Interest Margin |

| 4.15 | % | 4.54 | % | 4.34 | % | 4.15 | % | 4.62 | % | 4.34 | % |

Net Financial Margin |

| 4.74 | % | 4.72 | % | 4.71 | % | 4.74 | % | 4.98 | % | 4.71 | % |

Fees & Comm. / Avg. Interest Earnings Assets |

| 1.14 | % | 1.20 | % | 1.12 | % | 1.14 | % | 1.16 | % | 1.12 | % |

Operating Revs. / Avg. Interest Earnings Assets |

| 6.01 | % | 6.02 | % | 5.92 | % | 6.01 | % | 6.24 | % | 5.92 | % |

Return on Average Total Assets |

| 1.67 | % | 1.81 | % | 1.71 | % | 1.67 | % | 1.91 | % | 1.72 | % |

Return on Average Equity |

| 18.46 | % | 20.64 | % | 19.41 | % | 18.46 | % | 21.41 | % | 19.41 | % |

Capital Ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity / Total Assets |

| 8.98 | % | 8.76 | % | 8.88 | % | 8.98 | % | 8.76 | % | 8.88 | % |

Tier I (Basic Capital) / Total Assets |

| 7.71 | % | 7.45 | % | 7.60 | % | 7.71 | % | 7.45 | % | 7.60 | % |

Tier I (Basic Capital) / Risk-Wighted Assets |

| 10.22 | % | 9.97 | % | 10.18 | % | 10.22 | % | 9.97 | % | 10.18 | % |

Total Capital / Risk- Weighted Assets |

| 13.01 | % | 12.58 | % | 12.75 | % | 13.01 | % | 12.58 | % | 12.75 | % |

Credit Quality Ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Past Due / Total Loans to Customers |

| 1.35 | % | 1.22 | % | 1.28 | % | 1.35 | % | 1.22 | % | 1.28 | % |

Allowance for Loan Losses / Total Past Due |

| 183.01 | % | 200.73 | % | 191.67 | % | 183.01 | % | 200.73 | % | 191.67 | % |

Impaired Loans / Total Loans to Customers |

| 3.80 | % | 3.77 | % | 3.40 | % | 3.80 | % | 3.77 | % | 3.40 | % |

Loan Loss Allowances / Impaired Loans |

| 64.74 | % | 65.03 | % | 72.38 | % | 64.74 | % | 65.03 | % | 72.38 | % |

Loan Loss Allowances / Total Loans to Customers |

| 2.46 | % | 2.45 | % | 2.46 | % | 2.46 | % | 2.45 | % | 2.46 | % |

Loan Loss Provisions / Avg. Loans to Customers (4) |

| 1.20 | % | 1.22 | % | 1.06 | % | 1.20 | % | 1.32 | % | 1.06 | % |

Operating and Productivity Ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses / Operating Revenues |

| 46.93 | % | 45.36 | % | 47.25 | % | 46.93 | % | 44.11 | % | 47.25 | % |

Operating Expenses / Average Total Assets (3) (4) |

| 2.56 | % | 2.43 | % | 2.51 | % | 2.56 | % | 2.47 | % | 2.51 | % |

Balance Sheet Data (1)(3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Avg. Interest Earnings Assets (million Ch$) |

| 25,401,110 |

| 27,549,470 |

| 27,768,363 |

| 25,401,110 |

| 26,376,402 |

| 27,768,363 |

|

Avg. Assets (million Ch$) |

| 27,994,848 |

| 30,894,230 |

| 30,960,462 |

| 27,994,848 |

| 29,343,631 |

| 30,960,462 |

|

Avg. Equity (million Ch$) |

| 2,529,518 |

| 2,715,088 |

| 2,730,693 |

| 2,529,518 |

| 2,610,426 |

| 2,730,693 |

|

Avg. Loans to customers (million Ch$) |

| 21,759,270 |

| 24,240,178 |

| 24,481,482 |

| 21,759,270 |

| 22,899,765 |

| 24,481,482 |

|

Avg. Interest Bearing Liabilities (million Ch$) |

| 16,028,832 |

| 17,792,203 |

| 17,798,405 |

| 16,028,832 |

| 16,912,499 |

| 17,798,405 |

|

Risk-Weighted Assets (Million Ch$) |

| 24,744,959 |

| 27,476,645 |

| 27,127,488 |

| 24,744,959 |

| 27,476,645 |

| 27,127,488 |

|

Additional Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

Exchange rate (Ch$/US$) |

| 625.29 |

| 708.24 |

| 667.70 |

| 625.29 |

| 708.24 |

| 667.70 |

|

Employees (#) |

| 14,686 |

| 14,973 |

| 14,883 |

| 14,686 |

| 14,973 |

| 14,883 |

|

Branches (#) |

| 423 |

| 419 |

| 418 |

| 423 |

| 419 |

| 418 |

|

Notes

(1) Figures are expressed in nominal Chilean pesos.

(2) Figures are calculated considering nominal net income, the shares outstanding and the exchange rate existing at the end of each period.

(3) Ratios consider daily average balances.

(4) Annualized data.

These results have been prepared in accordance with Chilean GAAP on an unaudited, consolidated basis.

All figures are expressed in nominal Chilean pesos (historical pesos), unless otherwise stated. All figures expressed in US dollars (except earnings per ADR) were converted using the exchange rate of Ch$667.70 per US$1.00 as of March 31, 2016. Earnings per ADR were calculated considering the nominal net income, the exchange rate and the number of shares outstanding at the end of each period.

Banco de Chile files its consolidated financial statements, together with those of its subsidiaries, with the Chilean Superintendency of Banks and Financial Institutions, on a monthly basis. In addition, Banco de Chile files its quarterly financial statements (notes included) with the SEC in form 6K, simultaneously or previously to file this quarterly earnings report. Such documentation is equally available at Banco de Chile’s website both in Spanish and English.

1st Quarter 2016 | Financial Information:

Summary of Differences between Chilean GAAP and IFRS

The most significant differences are as follows:

· Under Chilean GAAP, the merger of Banco de Chile and Citibank Chile was accounted for under the pooling-of-interest method, while under IFRS, and for external financial reporting purposes, the merger of the two banks was accounted for as a business combination in which the Bank is the acquirer as required by IFRS 3 “Business Combinations”. Under IFRS 3, the Bank recognised all acquired net assets at fair value as determined at the acquisition date, as well as the goodwill resulting from the purchase price consideration in excess of net assets recognised.

· Allowances for loan losses are calculated based on specific guidelines set by the Chilean Superintendency of Banks based on an expected losses approach. Under IFRS, IAS 39 “Financial instruments: Recognition and Measurement,” allowances for loan losses should be adequate to cover losses in the loan portfolio at the respective balance sheet dates based on an analysis of estimated future cash flows. According to Chilean GAAP, the Bank records additional allowances related to expected losses not yet incurred, whereas under IFRS these expected losses must not be recognised.

· Assets received in lieu of payments are measured at historical cost or fair value, less cost to sell, if lower, on a portfolio basis and written-off if not sold after a certain period in accordance with specific guidelines set by the Chilean Superintendency of Banks. Under IFRS, these assets are deemed non-current assets held-for-sale and their accounting treatment is set by IFRS 5 “Non-current assets held for sale and Discontinued operations”. In accordance with IFRS 5 these assets are measured at historical cost or fair value, less cost to sell, if lower. Accordingly, under IFRS these assets are not written off unless impaired.

· Chilean companies are required to distribute at least 30% of their net income to shareholders unless a majority of shareholders approve the retention of profits. In accordance with Chilean GAAP, the Bank records a minimum dividend allowance based on its distribution policy, which requires distribution of at least 70% of the period net income, as permitted by the Chilean Superintendency of Banks. Under IFRS, only the portion of dividends that is required to be distributed by Chilean Law must be recorded, i.e., 30% as required by Chilean Corporations Law.

Forward-Looking Information

The information contained herein incorporates by reference statements which constitute ‘‘forward-looking statements,’’ in that they include statements regarding the intent, belief or current expectations of our directors and officers with respect to our future operating performance. Such statements include any forecasts, projections and descriptions of anticipated cost savings or other synergies. You should be aware that any such forward-looking statements are not guarantees of future performance and may involve risks and uncertainties, and that actual results may differ from those set forth in the forward-looking statements as a result of various factors (including, without limitations, the actions of competitors, future global economic conditions, market conditions, foreign exchange rates, and operating and financial risks related to managing growth and integrating acquired businesses), many of which are beyond our control. The occurrence of any such factors not currently expected by us would significantly alter the results set forth in these statements.

Factors that could cause actual results to differ materially and adversely include, but are not limited to:

· changes in general economic, business or political or other conditions in Chile or changes in general economic or business conditions in Latin America;

· changes in capital markets in general that may affect policies or attitudes toward lending to Chile or Chilean companies;

· unexpected developments in certain existing litigation;

· increased costs;

· unanticipated increases in financing and other costs or the inability to obtain additional debt or equity financing on attractive terms.

Undue reliance should not be placed on such statements, which speak only as of the date that they were made. Our independent public accountants have not examined or compiled the forward-looking statements and, accordingly, do not provide any assurance with respect to such statements. These cautionary statements should be considered in connection with any written or oral forward-looking statements that we may issue in the future. We do not undertake any obligation to release publicly any revisions to such forward-looking statements to reflect later events or circumstances or to reflect the occurrence of unanticipated events.

CONTACTS

Mr. Pablo Mejía | Mr. Daniel Galarce |

Head of Investor Relations | Head of Research |

Investor Relations | Banco de Chile | Research Department | Banco de Chile |

Phone Nr. (56-2) 2653.3554 | Phone Nr. (56-2) 2653.0667 |

Email: pmejiar@bancochile.cl | Email: dgalarce@bancochile.cl |