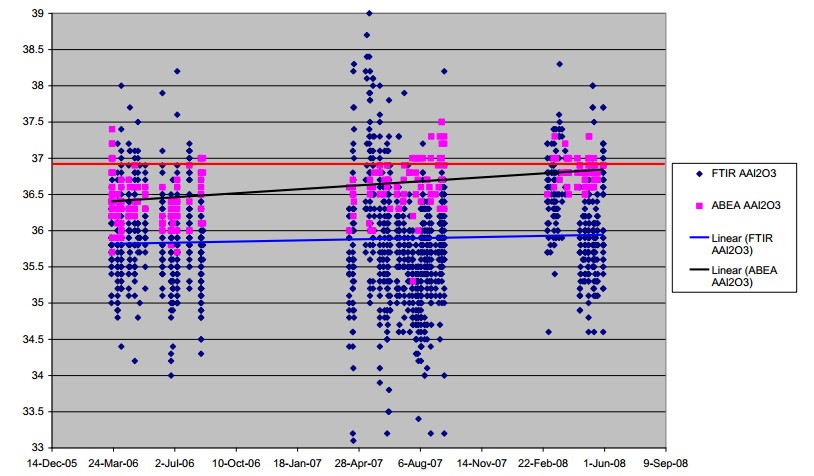

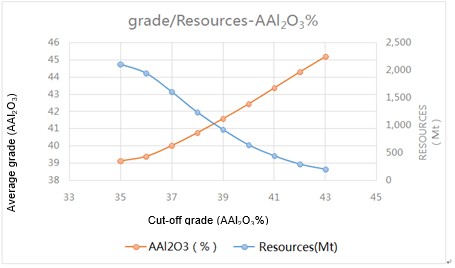

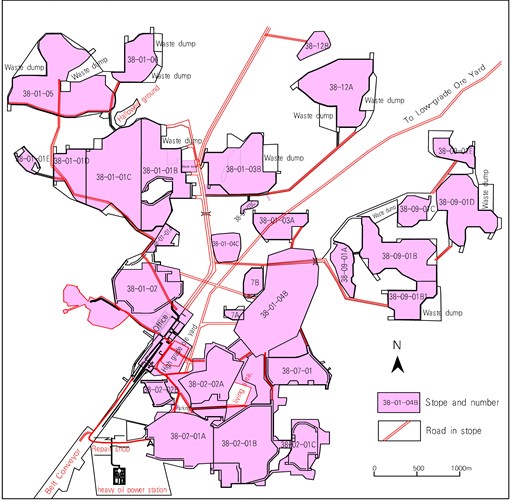

Proven reserves were 58.19Mt with average AAl2O3 of41.71% and RSiO2 of 1.07%, and the probable reserves were 73.22Mt with average AAl2O3 of 41.74% and RSiO2 of 1.35%.

1.7 Capital and Operating Costs

For cost estimation, the time node is August 2017, and the commodity price takes the average price in the past three to five years prior to August 2017.

The total investment of the project is 474,014.92KUSD, of which the construction investment is 435,292.22KUSD, the interest during the construction period is 14,382.05KUSD and the working capital is 24,340.64KUSD.

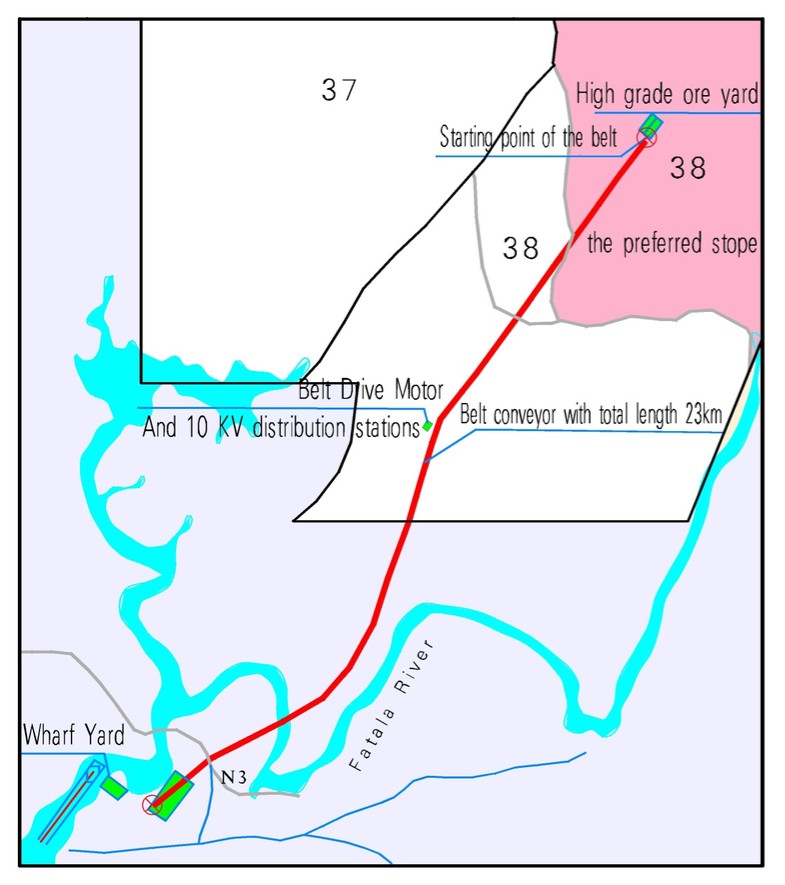

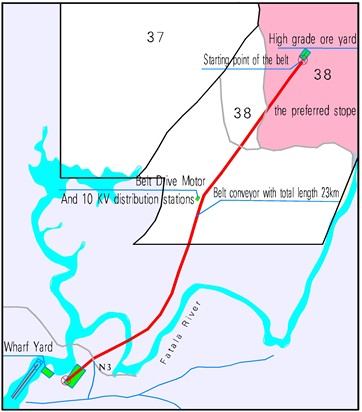

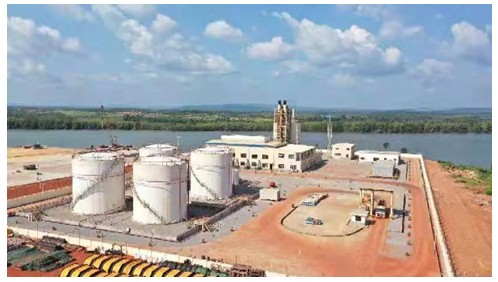

The average annual operating cost of the project is estimated to be 240,528KUSD /a, with 74,568KUSD /a for mining, 55,318KUSD for belt conveyor, 7,785KUSD for wharf yard, 22,980KUSD /a for administration, 5,285KUSD /a for business expenses, 2,708KUSD /a for financial and 22,242KUSD /a for value added tax, 17,570KUSD /a for export duty, 17,570KUSD /a for mineral tax, 10,318KUSD /a for income tax, and 4,184KUSD /a for stock dividend.

The ROI is 8.63%, and the ROE is 16.48%.

The financial internal rate of return before income tax is 11.85%, the payback period of investment is 8.44 years (including the construction period). The financial internal rate of return after income tax is 8.72%, the payback period is 10.10 years (including the construction period).

The financial internal rate of return on capital of the project is 10.16%.

The repayment period of the loan is 7.92 years (including the construction period) according to the maximum repayment ability of the project, which indicates that the project has good repayment ability.

1.8 Permitting

The mining permit is valid for 15 years (from July 9, 2018 to July 8, 2033), and can be renewed upon expiry. An EIA permit is granted to Chalco by the Government of Guinea, with a valid period of one year, and the period may be extended if the evaluation of the implementation of the Social Environmental Management Plan is acceptable.

1.9 Conclusions and Recommendations

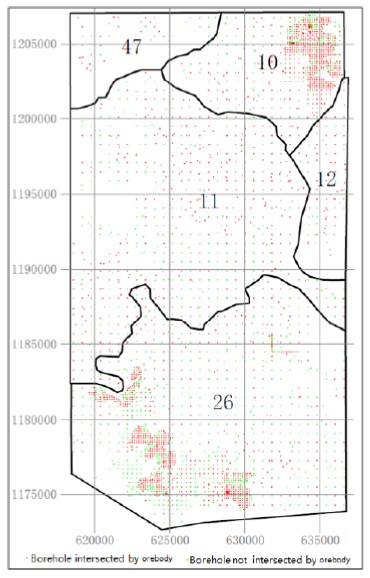

The report summarizes the basic situation of mineral properties and the status of mining operation. This is an operating open-pit mine, whose products are sold to China. The designed annual capacity is 12Mt, and the service life is 60 years. The current reserves can meet the mine production for 12 years. The output in 2021 was 12.32Mt, reaching the designed production scale.

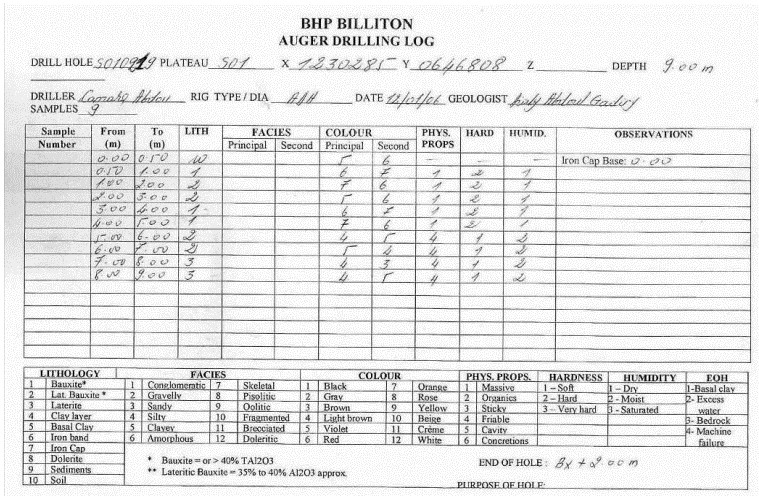

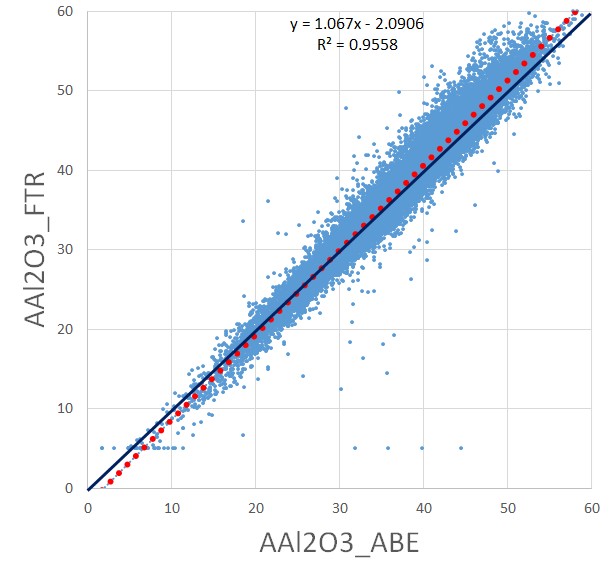

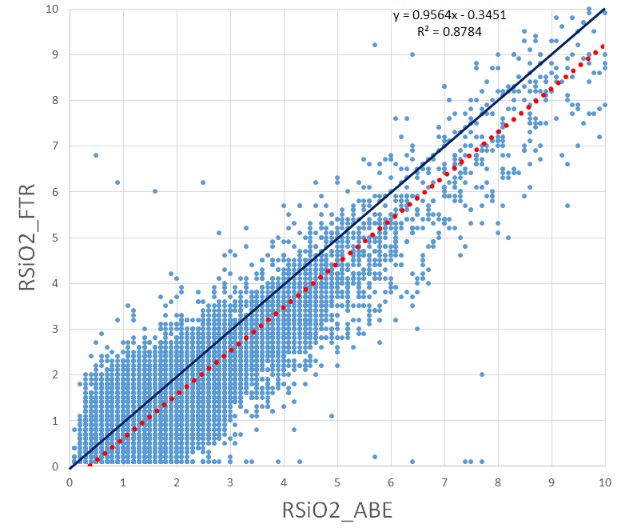

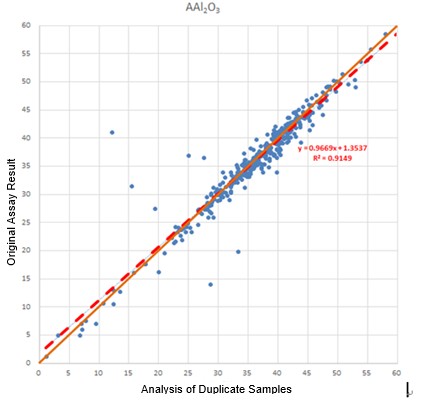

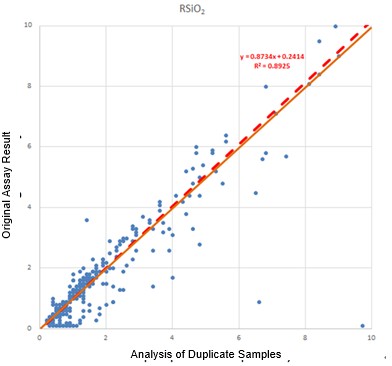

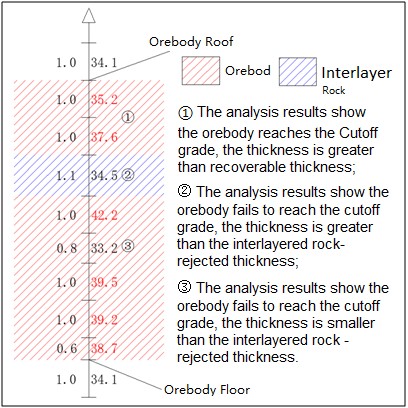

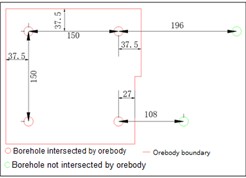

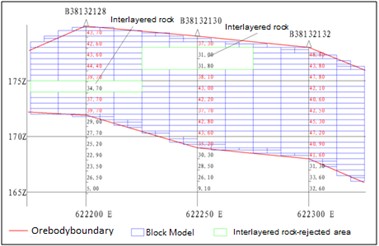

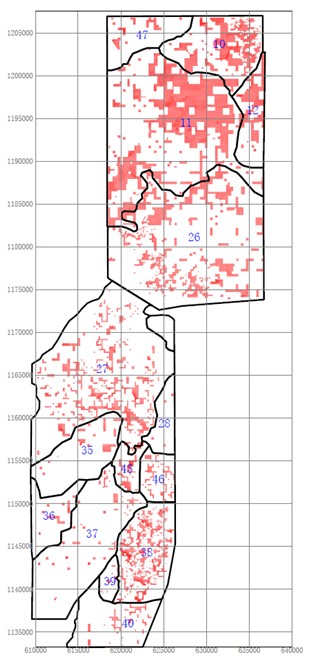

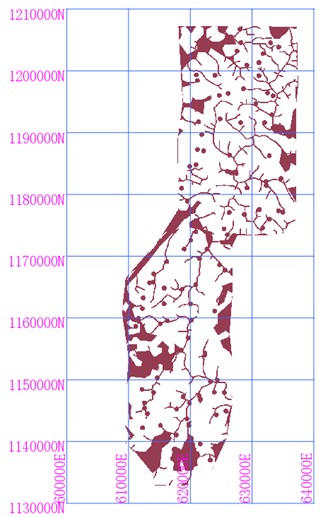

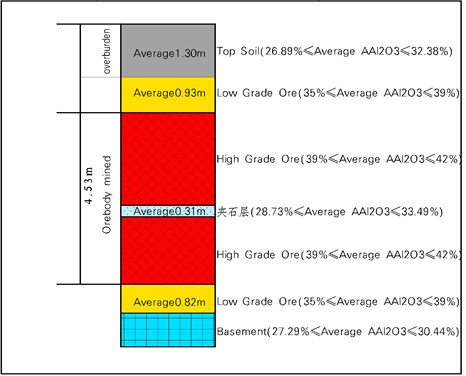

The quality of drilling and sampling, processing and testing is high, and the exploration data is credible. The principle of delineation of ore bodies and the resource classification are reasonable. The resource is estimated by the Distance Power Inverse Ratio method. The resource estimation data is reliable.

The feasibility study of the deposit and the design of the mine have been carried out, the comprehensive investigation of the modifying factors related to the reserve estimation has been carried out, and the mining design has been completed. The reserves have been estimated and the data are reliable.

This report reviewed the capital and operating cost of the mine. The principle of estimation and the selection of main parameters is reasonable, and the conclusion is credible. The precision requirement of the feasibility study is achieved.

The economic analysis of the project has been carried out, and the discount cash flow method is used in the analysis. The main parameters are demonstrated in detail. Major commodity prices have been demonstrated, using the average three to five-year prior to August 2017. The equipment price is quoted from the contract price. The conclusion is reliable.

It is estimated that the bauxite price (Deliver at the Wharf) (water content 8%) is 22.02USD/t (wet basis).

The Bauxite is mainly sold to the alumina plant of Chalco, and the commodity market is guaranteed.

The construction fund and operation cost is as follows:

①The total investment of the project is 474,014.92KUSD, of which the construction investment is 435,292.22KUSD, the interest is 14,382.05KUSD and the working capital is 24,340.64KUSD.

②The ROI is 8.63% and the ROE is 16.48% .