These statements are based on assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and future developments, as well as other factors we believe are appropriate in particular circumstances. However, whether actual results and developments will meet our expectations and predictions depends on a number of risks and uncertainties, which could cause actual results to differ materially from our expectations. These risks are more fully described in the section headed "Item 3. Key Information - D. Risk Factors". |

|

Consequently, all of the forward-looking statements made in this annual report are qualified by these cautionary statements. We cannot assure you that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected effect on us or our business or operations. |

|

1 |

|

|

Certain Terms and Conventions |

|

"Chalco", "the Company", "the Group", "our company", "we", "our"and "us" refer to Aluminum Corporation of China Limited and its subsidiaries and, where appropriate, to its predecessors; |

|

"A Shares"and"domestic shares"refer to our domestic ordinary shares, with a par value of RMB1.00 each, which are listed on the Shanghai Stock Exchange; |

|

"alumina-to-silica ratio" refers to the ratio of alumina to silica in bauxite by weight; |

|

"aluminum fabrication"refers to the process of converting primary aluminum or recycled aluminum materials into plates, strips, bars, tubes and other fabricated products; |

|

"AUD"or"Australian dollars"refers to the lawful currency of the Commonwealth of Australia; |

|

"Baotou Aluminum"refers to Baotou Aluminum Limited, our wholly-owned subsidiary established under PRC Law; |

|

"Baotou Group"refers to Baotou Aluminum (Group) Co., Ltd., one of our shareholders; |

|

"bauxite"refers to a mineral ore that is principally composed of aluminum; |

|

"Bayer process"refers to a refining process that employs a strong solution of caustic soda at an elevated temperature to extract alumina from ground bauxite; |

|

"Board"refers to our board of directors; |

|

"Chalco Hong Kong"refers to Chalco Hong Kong Limited, our wholly-owned subsidiary established under Hong Kong Law; |

|

"Chalco Mining"refers to Chalco Mining Co., Ltd., our wholly-owned subsidiary established under PRC law; |

|

"Chalco Nanhai"refers to Chalco Nanhai Alloy Company, our subsidiary established under PRC law; |

|

"Chalco Qingdao"refers to Chalco Qingdao Light Metal Company Limited, our subsidiary established under PRC Law; |

|

"Chalco Ruimin"refers to Chalco Ruimin Company Limited, 92.18% of the equity interest of which is owned by us; |

|

"Chalco Southwest Aluminum"refers to Chalco Southwest Aluminum Company Limited, 60% of the equity interest of which is owned by us; |

|

"Chalco Southwest Aluminum Cold Rolling"refers to Chalco Southwest Aluminum Cold Rolling Company Limited, our wholly-owned subsidiary established under PRC Law; |

|

"Chalco Xing Xian"refers to the construction of Bayer process production system and ancillary facilities at Xing Xian, Lvliang City of Shanxi Province with designed capacity of 800,000 tonnes of metallurgical grade alumina per year; |

|

"China"and the"PRC"refers to the People's Republic of China, excluding for purposes of this annual report, Hong Kong Special Administrative Region, Macao Special Administrative Region and Taiwan; |

|

"China Nonferrous Metals Technology"refers to China Nonferrous Metals Processing Technology Co., Ltd.; |

|

"Chinalco"and"Chinalco Group"refer to our controlling shareholder, Aluminum Corporation of China and its subsidiaries (other than Chalco and its subsidiaries) and, where appropriate, to its predecessors; |

|

"CICL"refers to China Aluminum International Construction Limited, 5% of the equity interest of which was owned by CIT and 95% of the equity interest of which was owned by Chinalco before December 20, 2010, and which has become a wholly-owned subsidiary of Chinalco since December 20, 2010; |

|

"Chalco Trading"or"CIT"refers to China Aluminum International Trading Co., Ltd., 90.5% of the equity interest of which is owned by us; |

|

"CSRC"refers to China Securities Regulatory Commission; |

|

2 |

|

|

"Energy-Saving and Emission Reduction Goals"refer to the energy-saving and emission reduction goals set out in China's 11th Five-Year Plan for National Economic and Social Development laid out in 2006, by which China expects to cut its per unit GDP energy consumption by 20 percent compared with the 2005 level by the end of 2010; |

|

"Exchange Act"refers to the U.S. Securities Exchange Act of 1934, as amended; |

|

"Euros"or"EUR"refers to the lawful currency of the Euro zone; |

|

"Fushun Aluminum"refers to Fushun Aluminum Company Limited, our wholly-owned subsidiary established under PRC law; |

|

"Gansu Hualu"refers to Gansu Hualu Aluminum Company Limited, 51% of the equity interest of which is owned by us; |

|

"Guan Lv"refers to Shanxi Guan Lv Company Limited; |

|

"Guangxi Huayin"refers to Guangxi Huayin Aluminum Company Limited, 33% of the equity interest of which is owned by us; |

|

"Guangxi Investment"refers to Guangxi Investment (Group) Co., Ltd., formerly known as Guangxi Development and Investment Co., Ltd., a PRC state-owned enterprise and one of our promoters and shareholders; |

|

"Guizhou Development"refers to Guizhou Provincial Materials Development and Investment Corporation, a PRC state-owned enterprise and one of our promoters and shareholders; |

|

"H Shares"refers to overseas listed foreign shares with a par value RMB1.00 each, which are listed on the Hong Kong Stock Exchange; |

|

"Henan Aluminum"refers to Chinalco Henan Aluminum Company Limited, 90.03% of the equity interest of which is owned by us; |

|

"HK$"and"HK dollars"refers to Hong Kong dollars, the lawful currency of the Hong Kong Special Administrative Region of the PRC; |

|

"Hong Kong Stock Exchange"refers to The Stock Exchange of Hong Kong Limited; |

|

"Hongrui Chemical"refers to Jiaozuo Hongrui Chemical Company Limited, which we acquired in October 2009 and subsequently ceased its existence as an independent legal person and became part of our Zhongzhou branch; |

|

"Huasheng Jiangquan"refers to Huasheng Jiangquan Group Co., Ltd.; |

|

"Huaxi Aluminum"refers to Huaxi Aluminum Company Limited, 56.86% of the equity interest of which is owned by us; |

|

"series Bayer-sintering process", "parallel Bayer-sintering process" and "hybrid Bayer-sintering process" refer to the three methods of refining process developed in China which involve the combined application of the Bayer process and the sintering process to extract alumina from bauxite; |

|

"Japanese Yen"refers to the lawful currency of Japan; |

|

"Jiaozuo Wanfang"refers to Jiaozuo Wanfang Aluminum Manufacturing Co. Ltd., 24.002% of the equity interest of which is owned by us as of December 31, 2010. Jiaozuo Wanfang has been our subsidiary since January 1, 2008 after we established de facto control over it; |

|

"Ka"refers to kiloamperes, a unit for measuring the strength of an electric current, with one kiloampere equalling to 1,000 amperes; |

|

"kWh"refers to kilowatt hours, a unit of electrical power, meaning one kilowatt of power for one hour; |

|

"Lanzhou Aluminum"refers to Lanzhou Aluminum Co., Ltd.; |

|

"Liancheng branch"refers to our wholly-owned branch, which was formerly known as Lanzhou Liancheng Longxing Aluminum Company Limited, before we acquired 100% of its equity interest; |

|

"Listing Rules"and"Hong Kong Listing Rules"refers to the Rules Governing the Listing of Securities on the Hong Kong Stock Exchange, as amended; |

|

"LME"refers to the London Metal Exchange Limited; |

|

"Longmen Aluminum"refers to Shanxi Longmen Aluminum Co., Ltd., 55% of its equity interests is owned by us; |

|

3 |

|

|

"Luxin Company" refers to Jiexiu Luxin Coal Gasification Company Limited; |

|

"Nanping Aluminum"refers to Fujian Nanping Aluminum Company Limited; |

|

"NDRC"refers to China National Development and Reform Commission; |

|

"Northwest Aluminum"refers to Northwest Aluminum Fabrication Plant, our wholly-owned branch; |

|

"NYSE"or"New York Stock Exchange"refers to the New York Stock Exchange Inc.; |

|

"ore-dressing Bayer process"refers to a refining process we developed to increase the alumina-to-silica ratio of bauxite; |

|

"Pingguo Aluminum"refers to Pingguo Aluminum Company; |

|

"refining"refers to the chemical process used to produce alumina from bauxite; |

|

"Research Institute"refers to Zhengzhou Research Institute, our wholly-owned branch mainly providing research and development services; |

|

"Rio Tinto"refers to Rio Tinto plc, a company incorporated in England and Wales, the shares of which are listed on the London Stock Exchange and the New York Stock Exchange; |

|

"Rio Tinto Atlantic"refers to Rio Tinto Ore Atlantic Limited, a limited company incorporated in England and Wales and an affiliate of Rio Tinto; |

|

"RMB"or "Renminbi"refers to the lawful currency of the PRC; |

|

"SASAC"refers to State-owned Assets Supervision and Administration Commission of the State Council of China; |

|

"SEC"refers to the U.S. Securities and Exchange Commission; |

|

"Securities Act"refers to the U.S. Securities Act of 1933, as amended; |

|

"Shandong Aluminum"refers to Shandong Aluminum Industry Co., Limited; |

|

"Shanxi Jiexiu"refers to Shanxi Jiexiu Xinyugou Coal Industry (Group) Corporation; |

|

"Shanxi Huasheng" refers to Shanxi Huasheng Aluminum Company Limited, 51% of the equity interest of which is owned by us; |

|

"Shandong Huayu"refers to Shandong Huayu Aluminum and Power Company Limited, 55% of the equity interest of which is owned by us; |

|

"Shanxi Huaze"refers to Shanxi Huaze Aluminum and Power Co., Limited, 60% of the equity interest of which is owned by us; |

|

"Shanxi Other Mines"refers to the seven of our jointly-operated mines in Shanxi Province that became our new own mines in 2010; |

|

"SHFE"refers to the Shanghai Futures Exchange; |

|

"Simandou Project"refers to the project to develop and operate the Simandou iron ore mine located in Guinea in west Africa as further described in the Simandou joint development agreement dated July 29, 2010 entered into amongst Rio Tinto, Rio Tinto Atlantic and us for the purpose of development of the Simandou Project; |

|

"sintering process"refers to a refining process employed to extract alumina from bauxite by mixing ground bauxite with supplemental materials and burning the mixture in a coal-fired kiln; |

|

"smelting"refers to the electrolytic process used to produce molten aluminum from alumina; |

|

"tonne"refers to the metric ton, a unit of weight, that is equivalent to 1,000 kilograms or 2,204.6 pounds; |

|

"US$","dollars"or"U.S. dollars"refers to the legal currency of the United States; |

|

"Xinan Aluminum"refers to Xinan Aluminum (Group) Company Limited; |

|

4 |

|

|

"Xincheng"refers to Henan Xincheng Construction Supervisory Services Company Limited, a subsidiary that we acquired in October 2009; |

|

"Yichuan Power"refers to Yichuan Power Industries Group Company; |

|

"Zhangze Electric Power"refers to Shanxi Zhangze Electric Power Co., Ltd.; |

|

"Zhongzhou Aluminum"refers to Henan Zhongzhou Aluminum Construction Company Limited, a subsidiary that we acquired in October 2009; |

|

"Zunyi Alumina"refers to Chalco Zunyi Alumina Co., Ltd, 67% of the equity interest of which is owned by us; and |

|

"Zunyi Aluminum"refers to Zunyi Aluminum Co., Ltd., our subsidiary established under PRC law. |

|

Translations of amounts in this annual report from Renminbi to U.S. dollars and vice versa have been made at the rate of RMB6.6000 to US$1.00, the exchange rate as set forth in the H.10 statistical release of the Federal Reserve Board for December 31, 2010. We make no representation that any Renminbi or U.S. dollar amounts could have been, or could be, converted into U.S. dollars or Renminbi, as the case may be, at any particular rate, the rates stated below, or at all. See "Item 3. Key Information - Selected Financial Data - Exchange Rate Information" for historical exchange rates between the Renminbi and the U.S. dollar. |

|

Any discrepancies in any table between the amounts identified as total amounts and the sum of the amounts listed therein are due to rounding. |

|

5 |

|

|

PART I |

|

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

|

Not applicable. |

|

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE |

|

Not applicable. |

|

ITEM 3. KEY INFORMATION |

|

A. SELECTED FINANCIAL DATA |

|

Historical Financial Information |

|

The following tables present selected comprehensive income data and cash flow data for the years ended December 31, 2008, 2009 and 2010 and selected statement of financial position data as of December 31, 2008, 2009 and 2010 that were prepared under International Financial Reporting Standards, or IFRS, which includes all International Accounting Standards and Interpretations, as issued by the International Accounting Standards Board, or the IASB. The selected financial information has been derived from, and should be read in conjunction with, the audited consolidated financial statements and their notes included elsewhere in this annual report. Financial information presented in the following tables as of and for the years ended December 31, 2006 and 2007 has been prepared in accordance with Hong Kong Financial Reporting Standards, or HKFRS, and has not been restated. The selected financial data also includes certain items for the years ended December 31, 2006 and 2007 in accordance with U.S. Generally Accepted Accounting Principles, or U.S. GAAP. |

|

Our consolidated financial statements as of December 31, 2009 and 2010 and for the years ended December 31, 2008, 2009 and 2010 included in this annual report on Form 20-F have been prepared in accordance with IFRS. We make an explicit and unreserved statement of compliance with IFRS with respect to our consolidated financial statements as of December 31, 2009 and 2010 and for the years ended December 31, 2008, 2009 and 2010 included in this annual report. PricewaterhouseCoopers, our independent registered public accounting firm, has issued an unqualified auditor's report on these consolidated financial statements. |

|

On October 29, 2009, we acquired the entire equity interest of Zhongzhou Aluminum, Hongrui Chemical, Xincheng and a limestone mining business from two subsidiaries of Chinalco. On May 30, 2008, we acquired six companies from Chinalco and China Nonferrous Metals Technology, an entity controlled by Chinalco. On October 1, 2008, we acquired an aluminum alloy business from Pingguo Aluminum, another entity controlled by Chinalco. As our Company and all the foregoing companies and businesses were under the common control of Chinalco immediately before and after the acquisitions, these transactions were accounted for as business combinations under common control using the merger accounting method as if the acquisition had been consummated since the inception of common control. |

|

Electricity is the principal production cost in our primary aluminum operations. During 2010, our average cost per kilowatt-hour, or kWh, of electricity increased by 12.3% from the prior year primarily due to the increase in the price of coal and the electricity price adjustment under state policy. We expect the PRC economy to continue its strong growth and as a result, we expect demand for and prices of electricity to increase accordingly. If we are unable to pass on increases in energy costs to our customers, our operating margin, financial condition and results of operations could be materially adversely affected. |

|

Losses caused by disruptions in the supply of power could materially and adversely affect our business, financial condition, results of operations and cash flows. |

|

The production of primary aluminum requires a substantial and continuous supply of electricity. Interruptions in the supply of power can result in costly production shutdowns, increased costs associated with restarting production and the waste of production in progress. A sudden loss of power, if prolonged, can cause damage to or the destruction of production equipment and facilities. In such an event, we may need to expend significant capital and resources to repair or replace the affected production equipment to restore our production capacity. Various regions across China have experienced shortages and disruptions in electrical power, especially during peak demand in the summer or during severe weather conditions. Our operations in Guizhou Province were disrupted due to power blackouts resulting from severe winter conditions in early 2008, and these disruptions damaged some production equipment and temporarily reduced our production capacity. |

|

Our operations consume substantial amounts of coal, and our operations may be adversely affected if we are not able to procure sufficient coal or if coal prices rise significantly. |

|

We rely heavily on coal as our energy and fuel source in our production of alumina. As we increase our refining capacity, our consumption of coal will increase accordingly. If our coal suppliers are not able to supply the amount of coal needed for our production due to a shortage of coal, constraints on coal transportation or any other reason, we may be forced to reduce our production output or suspend our refining operations, which could materially adversely affect our financial condition and results of operations. Although our average price of coal per unit tonne increased by 21.1% from 2009 to 2010, we expect the price of coal to increase as the PRC economy continues its rapid growth. If we are unable to pass on increases in coal prices to our customers or offset price increases through productivity improvements, our operating margin, financial condition and results of operations could be adversely affected. |

|

11 |

|

|

We may be unable to continue competing successfully in the markets in which we operate. |

|

We face competition from both domestic and international primary aluminum producers. Our principal competitors are domestic smelters, some of which are consolidating and expanding their production capacities. These smelters compete with our primary aluminum operations on the basis of cost, quality and pricing. We also face increasing competition from international alumina and primary aluminum suppliers since the elimination of tariffs on imports of primary aluminum and alumina into China. Increasing competition in our markets may reduce our selling prices or sales volumes, which will have a material adverse effect on our financial condition and results of operations. If we are unable to price our products competitively, maintain or increase our current share of China's alumina and primary aluminum markets or otherwise maintain our competitiveness, our financial condition, results of operations and profitability could be materially and adversely affected. |

|

Our overseas expansion exposes us to political and economic risks, commercial instability and events beyond our control in the countries in which we plan to operate. |

|

We are currently undertaking a number of overseas projects, including our aluminium and power joint venture project in Saudi Arabia, the aluminium plant project in Malaysia, the iron ore mining joint venture project in Guinea in West Africa and Aurukun Project in Australia, which require significant capital investment. See "Item 4. Information on the Company - A. History and Development of the Company- Overseas Development". As we are new to these overseas markets, we cannot assure you that our overseas expansion or investments will be successful or that we will not suffer foreign exchange losses in connection with our overseas investment. In addition, our overseas business is subject to the risk of political and economic instability associated with these countries. |

|

Our profitability and operations could be adversely affected if we are unable to obtain a steady supply of raw materials at competitive prices. |

|

Historically, the price for bauxite, our most important raw material for alumina production, has been volatile. We obtain bauxite for our operations from three major sources, including mines that we own or jointly operate and external suppliers. See "Item 4. Information on the Company - B. Business Overview - Raw Materials - Alumina - Supply". The extent to which we procure bauxite from each of these sources affect the security of our supply or cost of bauxite. Our results of operations will be affected by increases in the cost of other raw materials and other key inputs such as energy. If we cannot obtain a steady supply of key raw materials at competitive prices, our financial condition and results of operations could be materially adversely affected. |

|

Transportation interruptions may affect our shipment of raw material and delivery of products. |

|

Our operations require the reliable transportation of raw materials and supplies to our refining, smelting and fabrication sites and the delivery of finished products to our customers. Our alumina products are mainly transported by rail or truck, and our primary aluminum products are delivered to our customers primarily by rail. In 2008, our deliveries were affected by a snow storm in the first quarter and severe earthquakes in Sichuan Province in May. If we are unable to make timely deliveries due to logistical and transportation disruptions, our production, reputation and results of operations may be adversely affected. |

|

We may not successfully develop and implement new methods and processes. |

|

A main objective of our research and development is to develop new methods and processes to improve the efficiency of our alumina refineries to production increase yield from bauxite with low alumina-to-silica ratio. If the supply of high quality bauxite with a high alumina-to-silica ratio in China declines, our failure to develop such methods and processes and incorporate them into our production could impede our efforts to reduce unit costs and diminish our competiveness. |

|

The bauxite reserve data in this annual report are only estimates, which may prove to be inaccurate. |

|

The bauxite reserve data on which we base our production, revenue and expenditure plans are estimates that we have developed internally and may prove inaccurate. There are numerous uncertainties inherent in estimating quantities of reserves, including many factors beyond our control. If these estimates are inaccurate or the indicated tonnages are not recovered, our business, financial condition, and results of operations may be materially and adversely affected. |

|

Our significant indebtedness could adversely affect our business, financial condition and results of operations. |

|

We require a significant amount of cash to meet our capital requirements, including the expansion and upgrade of our production capacity, as well as to fund our existing operations. As of December 31, 2010, we had approximately RMB41.7 billion (US$6.3 billion) in outstanding short-term bonds and short-term bank borrowings (including the current portion of long-term bank and other borrowings) and RMB27.7 billion (US$4.2 billion) in outstanding long and medium-term bonds and long-term bank and other borrowings (excluding the current portion of these borrowings). This level of debt could have significant consequences on our operations, including: |

|

Our ability to meet our payment and other obligations under our outstanding debt depends on our ability to generate cash flow in the future or to refinance such debt. We cannot assure you that our business will generate sufficient cash flow from operations to satisfy our obligations under our outstanding debt and to fund other liquidity needs. If we are not able to generate sufficient cash flow to meet such obligations, we may need to refinance or restructure our debt, reduce or delay capital investments, or seek additional equity or debt financing. The sale of additional equity securities could result in dilution to our ADS holders. A shortage of financing could in turn impose limitations on our ability to plan for, or react effectively to, changing market conditions or to expand through organic and acquisitive growth, thereby reducing our competitiveness. We cannot assure you that future financing will be available in amounts or on terms acceptable to us, if at all. |

|

We may not realize the economic benefits of our expansion and vertical integration plans. |

|

Cost savings and other economic benefits expected from our expansion and vertical integration plans may not materialize as a result of project delays, cost overruns, or changes in market conditions. Failure to obtain the intended economic benefits from these projects could adversely affect our business, financial condition and results of operations. We may also experience mixed results from our expansion and vertical integration plans in the short term. In 2008, we acquired five aluminum fabrication plants, which significantly increased our annual aluminum fabrication production capacity and increased our total revenues. However, the change in our product mix resulted in a decrease in our average profit margin as the profit margins of aluminum fabrication products are generally lower than those of our other products. |

|

The interests of our controlling shareholder, who exerts significant influence over us, may conflict with ours. |

|

Our largest shareholder, Chinalco, directly owned 38.56% of our issued share capital and indirectly owned an additional 3.26% of our issued share capital through its controlled entities. The interests of Chinalco may conflict or even compete with our interests and those of our public shareholders. Chinalco may take actions that are in the interest of its subsidiaries, associates and other related entities to our detriment. For example, Chinalco may seek to influence our decision as to the amount of dividends we declare and distribute. Any increase in our dividend payout would reduce funds otherwise available for reinvestment in our businesses and thus may adversely affect our future prospects and financial condition. |

|

In addition, Chinalco and a number of its subsidiaries and associates provide a range of services to us, including engineering and construction services, social services, land and property leasing as well as the supply of raw and supplemental materials. It would be difficult to find an alternative source for some services, such as educational and medical care services, that we receive from Chinalco. Our cost of operations may increase if Chinalco, its subsidiaries and associates are unable to continue providing such services to us. |

|

We are subject to, and incur costs to comply with, environmental laws and regulations. |

|

Because we produce air emissions, discharge waste water, and handle hazardous substances at our bauxite mines, alumina smelters, aluminum smelters and fabrication plants we are subject to, and incur costs to comply with, environmental laws and regulations. Each of our production plants has implemented a system to control emissions and ensure compliance with PRC environmental regulations. We may incur significant additional costs if relevant laws and regulations change or enforcement of existing laws and regulations become more rigorous. Further, although all of our overseas expansion projects are at the early stage of preparing feasibility report and have not started operation, these projects are subject to foreign environmental laws and regulations that may materially adversely affect our future operations. Failure to comply with environmental laws and regulations may trigger a variety of administrative, civil and criminal enforcement measures, including the assessment of monetary penalties, the imposition of remedial requirements and the issuance of orders enjoining future operations, all of which may affect our business operations. |

|

We are subject to administrative policies and orders relating to China's Energy-Saving and Emission Reduction Goals that could adversely affect our production capacity and output. |

|

We are subject to administrative energy-saving and emission reduction policies and orders carried out by the central and provincial governments in accordance with China's Energy-Saving and Emission Reduction Goals. In the second half of 2010, some of our primary aluminum production facilities were subject to power rationing carried out by some provincial governments to fulfill the Energy-Saving and Emission Reduction Goals, which reduced our primary aluminum production by approximately 1.65%. Although power rationing only slightly reduced our primary aluminum production and the PRC central government has denounced it as an improper means to fulfill the Energy-Saving and Emission Reduction Goals, some or all of our primary aluminum production facilities may be subject to power rationing or other similar policies and orders from time to time in the future, which may adversely affect our production capacity and output. |

|

13 |

|

|

Our business is subject to unplanned business interruptions that may adversely affect our performance. |

|

We may experience accidents in the course of our operations, which may cause significant property damage and personal injuries. Significant accidents and natural disasters may cause interruptions to our operations or result in property or environmental damage, an increase in operating expenses or loss of revenues. The occurrence of accidents, natural disasters and the resulting consequences may not be covered adequately, or at all, by the insurance policies we carry. In accordance with customary practice in China, we do not carry any business interruption insurance or third-party liability insurance for personal injury or environmental damage arising from accidents on our property or relating to our operations other than for our automobiles. Losses or payments incurred by us as a result of major accidents or natural disasters may have a material adverse effect on our results of operations if such losses or payments are not fully insured. |

|

We are operating a number of mines without a valid permit. |

|

Our permits to mine bauxite in some of our bauxite mines have expired and lapsed. While we are seeking to renew those expired licenses, we may be subject to administrative fines for operating mines without a valid license, or we may be ordered to cease our mining operations at such mines until we obtain the renewed licenses. The failure to renew those expired mining licenses may adversely affect our financial condition and results of operations. |

|

We may be subject to product liability claims. |

|

Some of the products we sell or manufacture may expose us to product liability claims relating to property damage or personal injury. The successful assertion of product liability claims against us could result in significant damage payments and harm to our reputation. A successful product liability claim or series of claims brought against us could have a material adverse effect on our business, financial condition and results of operations. |

|

Our H Shares may not be able to maintain its status as a constituent stock of the Hang Seng Index. |

|

Our H Shares is a constituent stock of the Hang Seng Index and, as a result, may attract the interest of tracker funds that maintain investment portfolios that track the performance of the Hang Seng Index. We have no control over the selection of the Hang Seng Index constituent stocks and may not be able to maintain our H Shares as a constituent stock. If our H Shares are removed from the Hang Seng Index, tracker funds may cease investing in our H Shares and our share price may decline. |

|

The interests of the shareholders of Jiaozuo Wanfang may conflict with our interests. |

|

The interests of non-controlling shareholders of Jiaozuo Wanfang, whose A Shares are listed on the Shenzhen Stock Exchange, may be inconsistent with our interests in certain circumstances. Jiaozuo Wanfang must comply with a number of PRC regulations designed to protect the interests of non-controlling shareholders. According to the relevant PRC laws, when shareholders of Jiaozuo Wanfang vote by poll on connected transactions, connected parties such as us must abstain from voting. If we are unable to obtain approval of connected transactions from the non-controlling shareholders of Jiaozuo Wanfang, such transactions cannot be implemented, which may affect our overall operational efficiency. Furthermore, we may be subject to legal proceedings initiated by the non-controlling shareholders of Jiaozuo Wanfang challenging our actions as its controlling shareholder. Such legal proceedings could result in significant damage awards payable by us and disruption to our businesses, which in turn could have an adverse effect on our business and financial condition. |

|

Our operations are affected by a number of risks relating to conducting business in the PRC. |

|

As a significant majority of our assets and operations are located in the PRC, we are subject to a number of risks relating to conducting business in the PRC, including the following: |

|

ITEM 4. INFORMATION ON THE COMPANY |

|

A. HISTORY AND DEVELOPMENT OF THE COMPANY |

|

We were incorporated as a joint stock limited company under the Company Law of the PRC on September 10, 2001 under the corporate name Aluminum Corporation of China Limited. Our principal executive and registered office is located in the People's Republic of China at No. 62 North Xizhimen Street, Haidian District, Beijing, China 100082, and our telephone number is (86) 10 8229 8103. |

|

Pursuant to a reorganization agreement entered into among Chinalco, Guangxi Investment and Guizhou Development in 2001, substantially all of Chinalco's alumina and primary aluminum production operations, as well as a research institute and other related assets and liabilities, were transferred to us upon our formation. We acquired our bauxite mining operations and associated mining rights from Chinalco in a separate mining rights agreement. |

|

We are a vertically integrated aluminum producer with operations in bauxite mining, alumina refining, primary aluminum smelting and aluminum fabrication. We also produce ancillary products and services derived from or related to our aluminum operations. In addition, we are engaged in trading of alumina, primary aluminum, aluminum fabrication products, other non-ferrous metal products and raw and ancillary materials in bulk domestically and internationally. In 2010, we expanded our business activities into the areas of iron ore mining and coal mining. |

|

We have substantially increased the size and scope of our operations through organic growth as well as selective acquisitions and joint ventures. Our key operating assets include three subsidiaries mainly engaged in bauxite mining; four integrated alumina and primary aluminum production plants; six stand-alone alumina refineries, including our jointly-controlled entity, Guangxi Huayin, and one research institute; thirteen stand-alone primary aluminum smelters, including our research institute; eight aluminum fabrication plants; and one carbon production plant. In addition, as of December 31, 2010, we were constructing a bauxite mining facility, one alumina refinery and two aluminum smelters. All of our production facilities are operated in accordance with ISO14001 standards. |

|

Acquisitions and Joint Ventures |

|

In May 2008, we acquired five aluminum fabrication plants and a primary aluminum smelter from Chinalco and China Nonferrous Metals Technology for a total consideration of RMB4, 181.0 million (US$633.5 million) to achieve greater vertical integration. These acquisitions significantly increased our aluminum fabrication production capacity and enhanced our offering of aluminum fabrication products. In October 2008, we also acquired the aluminum alloy business of Pingguo Aluminum for RMB69.0 million (US$10.5 million). |

|

In October 2009, we acquired Zhongzhou Aluminum, Hongrui Chemical, Xincheng and the limestone mining business of Zhongzhou Aluminum Fengying Company Ltd. from two wholly-owned subsidiaries of Chinalco for a total cash consideration of RMB35.0 million (US$5.3 million), which was subsequently adjusted to RMB37.0 million (US$5.6 million) pursuant to a valuation adjustment provision in the equity transfer agreement for these acquisitions. Zhongzhou Aluminum and Hongrui Chemical are principally engaged in the provision of construction and engineering services and supply of chemical products and accessory supplies, respectively, for the mining industry. Xincheng is principally engaged in the provision of supervisory services for construction projects. |

|

In October 2010, we entered into a joint venture contract with Luxin Company, Shanxi Aluminum Plant, a subsidiary of Chinalco, and natural person shareholders, for the establishment of Shanxi Jiexiu. We and Shanxi Aluminum Plant hold approximately 34% and 16% of the equity interest of Shanxi Jiexiu, respectively. The remaining equity interest is held by Luxin Company and the other investors, who are independent of and not related to us. Shanxi Jiexiu engages in integration of coal resources in Shanxi Province by investing in and reorganizing five coal mining companies in the Jiexiu area, Shanxi Province, with total retained reserves of approximately 300 million tonnes. As of the date of this annual report, Shanxi Jiexiu is in construction in progress. |

|

15 |

|

|

Construction Projects |

|

In December 2009, we completed the construction of production facilities at Chalco Nanhai, which increased our annual aluminum fabrication capacity by approximately 110,000 tonnes. |

|

We invested approximately RMB8.5 billion (US$1.3 billion) on infrastructure construction and facility upgrades in 2010 and expect to increase our capital expenditure for the foregoing purposes to RMB15.8 billion (US$2.4 billion) in 2011. As of the date of this annual report, we have undertaken a number of facility expansion projects in China, each of which is expected to be completed in 2011. See "- D. Property, Plants and Equipment - Our Expansion". |

|

Overseas Development |

|

On March 23, 2007, we entered into a development agreement with the Queensland State Government of Australia (Queensland Government) to develop a bauxite and alumina project, the Aurukun Project. We were issued a bauxite exploration permit in September 2007 by the Queensland Government. However, the market conditions of global aluminum industries incurred substantial negative changes after we executed the development agreement and the Aurukun Project could no longer continue under the original framework. We engaged in active negotiations with the Queensland Government on this and both parties agreed that the development agreement would not be renewed after its term expired on June 30, 2010. However, subsequent to the termination, we have engaged a new round of discussions with the Queensland State Government. In December 2010, the Queensland State Government offered a revised development agreement to us for further discussion. Refer to Note 8 to the consolidated financial statements for details. |

|

On November 24, 2007, we entered into a framework agreement to jointly construct a one million tonne primary aluminum plant in Saudi Arabia with Malaysia Mining Company ("MMC") and Saudi Arabia Binladin Group ("SBG") and received the permit for the project from the Saudi Arabia General Investment Authority. On May 9, 2008, we entered into a joint venture arrangement with MMC and SBG, which provides for the establishment of a joint venture that will develop and operate the primary aluminum plant with an annual capacity of approximately one million tonnes, as well as an adjoining power plant. We have finished the initial draft of the feasibility report for this project. |

|

On February 9, 2010, we entered into a framework agreement with GIIG Holding Sdn Bhd ("GIIG") to develop, own and operate a primary aluminum plant in Sarawak, Malaysia with an annual capacity of approximately 330,000 tonnes. Smelter Asia Sdn Bhd, a wholly-owned subsidiary of GIIG will be reorganized as a joint venture to oversee the development and operation of the primary aluminum plant project. The total investment of this project is estimated to be US$1.0 billion, and we will contribute between US$350 million and US$400 million for 35% to 40% of the equity interests in the joint venture. We are currently preparing the feasibility report for this project. |

|

On July 29, 2010, we entered into a joint development agreement with Rio Tinto and Rio Tinto Atlantic, an affiliate of Rio Tinto for the development and operation of the Simandou Project, a premium open-pit iron ore mine located in Guinea, West Africa. Pursuant to the agreement, we (via our subsidiary) will acquire by stages up to a 47% equity interest in a joint-venture company to be incorporated by Rio Tinto, to which Rio Tinto will transfer its entire 95% equity interest in the Simandou Project. The total consideration of US$1.35 billion (equivalent to approximately RMB9.17 billion) for the acquisition will be paid in instalments by us fulfilling the sole funding obligation for the development of the Simandou Project over a period of approximately 3 to 5 years. The joint development agreement shall become effective upon prior satisfaction or prior waiver of each of (i) the condition that the approval of the transaction by the competent authorities of the PRC is obtained and (ii) certain competition law conditions. Such project is in active progress. |

|

Proposed non-public Offering of A Shares |

|

On June 30, 2009, we passed the resolutions of proposed non-public offering of A Shares to no more than ten target subscribers. According to the resolutions, not more than RMB10.0 billion (US$1.5 billion) denominated ordinary shares (A Shares) would be issued. The issue price of A Shares to be offered would be not less than 90% of the average trading price of our A Shares in twenty trading days immediately preceding the pricing determination date. We intended to apply proceeds from this non-public offering to finance part of the 800,000 tonne alumina project at our Chongqing branch and Zunyi Aluminum and to supplement our working capital. The implementation of the proposal was approved by our shareholders at the extraordinary general meeting, A Share class meeting and H Share class meeting held on August 24, 2009. The period of validity of the resolutions was 12 months from the date of the resolutions passed at the extraordinary general meeting, A Share class meeting and H Share class meeting. The non-public offering of A Shares was also approved by CSRC on April 12, 2010, with a valid period of six months starting from the approval date. On August 23, 2010, the extraordinary general meeting, A Share class meeting and H Share class meeting passed a special resolution to approve the extension of the period of validity of the resolutions in respect of the non-public offering of A Shares by us and the related authorizations for a 12-month period to expire on August 23, 2011. Except for the period of validity, the original plan and the authorization scope for issuance of A Shares remained unchanged. |

|

As approvals of CSRC and the relevant government authorities for such A Share issue have expired and as a result of changes in our capital requirements which require changes to be made to the use of proceeds and the proposed adjustments in the issue price, our Board approved a new issue plan on January 30, 2011. Under the new plan, we will issue up to one billion A Shares, with a nominal value of RMB1.00 each, by way of non-public issuance for expected proceeds not exceeding RMB9 billion (US$1.4 billion). The authorization given by the resolutions are valid for 12 months from the date of passage. We will issue the A Shares to no more than ten specific target subscribers within six months from obtaining the approval of CSRC. We intend to apply proceeds from this private placement to finance Chalco Xing Xian alumina project, Chalco Zhonghzhou Ore-dressing Bayer Process expansion construction project, and to supplement working capital. On April 14, 2011, the extraordinary general meeting, A Share class meeting and H Share class meeting passed special resolutions in relation to the new plan of issue of A Shares. We will apply to CSRC for approval upon passing the special resolutions. |

|

Proposed Issuance of H Shares |

|

On June 22, 2010, the shareholders of the 2009 annual general meeting passed special resolutions, which are valid until the earliest of the end of 12 months from the date of passage, the conclusion of our next annual general meeting or the date on which the authority set out in these resolutions or varied by a special resolution in a general meeting. The resolutions authorize us to issue up to 20% of the total nominal value of H Shares in issue as of the resolution date. Our Board is authorized to determine the use of the proceeds. The proposed issuance is subject to the approval by the CSRC and/or other relevant PRC government authorities. |

|

16 |

|

|

B. BUSINESS OVERVIEW |

|

Our Principal Products |

|

Chalco is China's largest producer of alumina, primary aluminum and aluminum fabrication products in terms of production volume. We have benefited from the strong growth of the PRC aluminum market, one of the world's fastest growing major aluminum markets. Based on 2010 production volume, we were the world's second largest producer of alumina and third largest producer of primary aluminum. Our aluminum operations span the aluminum market value and industry chain from bauxite mining to aluminum fabrication. Bauxite is refined into alumina, which is then smelted into primary aluminum. Primary aluminum, in turn, is a widely used metal and the key raw material in aluminum fabrication. Aluminum fabrication products have applications in the construction, transportation, power generation, automobile, packaging, machinery and durable goods industries. In addition to alumina, primary aluminum and aluminum fabrication products, we also produce and sell a comparatively small amount of alumina chemical products (alumina hydrate and alumina-based industrial chemical products), carbon products (carbon anodes and cathodes) and gallium. We organize and manage our operations according to our three principal products: alumina, primary aluminum and aluminum fabrication products. Revenues attributable to our alumina, primary aluminum and aluminum fabrication segments accounted for approximately 1.8%, 21.8% and 8.5%, respectively, of our total revenues in 2010. We also engage in the trading of alumina, primary aluminum, aluminum fabrication products, relevant metal products and raw and ancillary materials in bulk both manufactured by us and sourced from external suppliers domestically and abroad. Revenues attributed to our trading segment accounted for approximately 67.8% of our total revenues in 2010. The remainder of our revenues were derived from research and development activities and other products and services. |

|

Our alumina segment includes the mining and purchasing of bauxite and other raw materials, and production and sale of alumina as well as alumina-related products, such as alumina hydrate, alumina-based chemical products and gallium. Alumina accounted for approximately 93.1% of the total production volume for this segment in 2010. Alumina chemical products are used in the production of chemical, pharmaceutical, ceramic and construction materials. In the process of refining bauxite into alumina, we produce a small amount of gallium as a by-product. Gallium is a rare, high value metal with applications in the electronics and telecommunication industries. |

|

Our primary aluminum segment includes the production and sale of primary aluminum and aluminum-related products, such as carbon products. Our principal primary aluminum product is ingots, which accounted for approximately 85% of our total production volume for this segment in 2010. Our standard 20 kilogram remelt ingots are used for general aluminum fabrication in the construction, power generation, automobile, packaging, machinery and durable goods industries. We internally produce substantially all the carbon products used at our smelters and sell a portion of our remaining carbon products to external customers. |

|

Our aluminum fabrication segment includes the production and sale of aluminum fabrication products, including casts, planks, screens, extrusions, forges, powder and die castings, which are widely used in the construction, power generation, automobile, packaging, machinery and durable goods industries. We use recycled aluminum materials at Chalco Qingdao and Chalco Nanhai, two of our aluminum fabrication plants, to produce aluminum fabrication products. |

|

Our trading segment includes sales of alumina, primary aluminum, aluminum fabrication products, relevant metal products and raw and ancillary materials in bulk both manufactured by us and sourced from external suppliers domestically and abroad. We established our trading business as a separate segment in July 2010, as a result of the implementation of our operational structural exercise. |

|

Our Production Capacity |

|

Our alumina production capacity has increased rapidly in the past few years, from approximately 5.4 million tonnes in 2002 to approximately 12.9 million tonnes in 2010. During the same period, our annual primary aluminum production capacity increased from approximately 750,000 tonnes to approximately 4.0 million tonnes. Our alumina and primary aluminum represented approximately 35.0% and 24.5%, respectively, of China's production in 2010. Since 2008, we have significantly expanded our aluminum fabrication operations. Our annual aluminum fabrication production capacity increased from approximately 1.3 million tonnes as of December 31, 2009 to approximately 1.7 million tonnes as of December 31, 2010. Our aluminium fabrication represented approximately 3% of China's production in 2010. |

|

The following table sets forth the production capacity of each of our principal production facilities by business segment as of the indicated date: |

|

17 |

|

|

Delivery |

|

We rely on rail shipping and trucking for the delivery of products within China. Our alumina is transported by rail or truck, and transportation costs are generally borne by the customer and excluded from our sales price. For long-distance deliveries, we maintain spur lines connecting our plants to the national railway routes. The price of rail shipping on the PRC national railway system is fixed by the government. |

|

Most of our primary aluminum products are transported by rail. In view of the substantial distance between our smelters and aluminum fabrication plants, most of which are concentrated in southern and eastern China, we maintain subsidiaries (often with warehousing capacity leased from third parties) in major cities in eastern and southern China to facilitate and coordinate deliveries. |

|

Our customers are generally responsible for arranging and bear the associated costs with transporting aluminum fabrication products from our production facilities. |

|

Principal Facilities |

|

Our principal facilities include 27 principal production plants and our Research Institute. Set forth below is a description of our principal production plants. Our production is organized and managed according to our three business segments: alumina, primary aluminum and aluminum fabrication. |

|

Guangxi Branch |

|

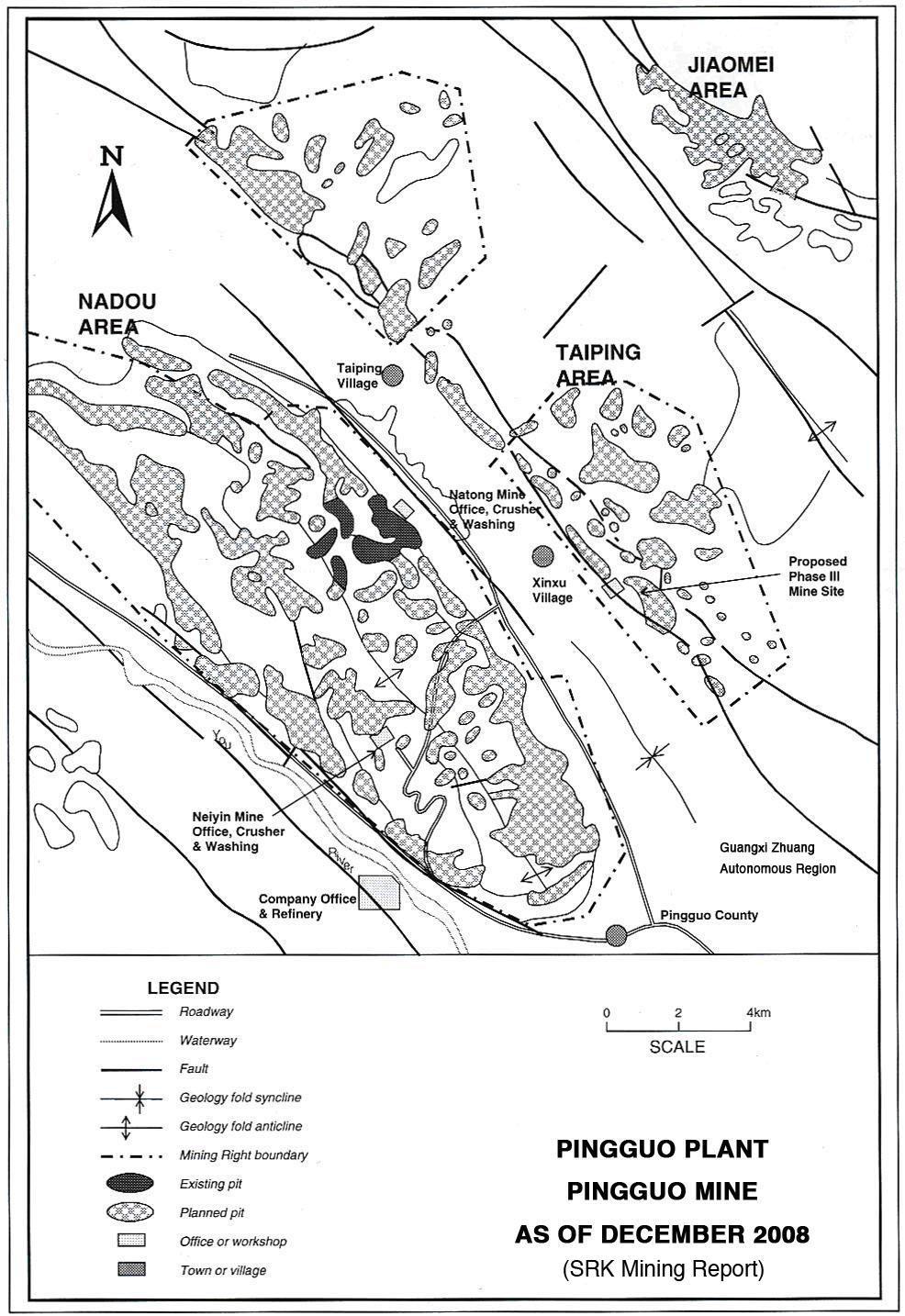

The Guangxi branch commenced operations in 1994 and is located in the Guangxi Zhuang Autonomous Region in southwestern China, an area rich in bauxite reserves. The Guangxi branch receives bauxite delivered via highway from the Pingguo mine, one of our wholly-owned mines, located less than 17 kilometers from the Guangxi branch. |

|

The Pingguo mine contains large, easily exploitable bauxite reserves with high alumina-to-silica ratios. The Guangxi branch is our only principal refinery that uses the Bayer process exclusively. With technology and production equipment imported from Europe, the Guangxi refinery features a high level of automation and energy efficiency. Since its inception, we have continually increased the designed production capacity at this branch by removing production bottlenecks and investing in capacity expansions. As of December 31, 2010, the Guangxi branch had an annual production capacity of 1,730,000 tonnes of alumina. In 2010, the Guangxi branch produced approximately 1,990,200 tonnes of alumina, exceeding its production capacity due to the high quality bauxite ore in its proximity, along with approximately 102,200 tonnes of alumina chemical products. Most of the alumina output at the Guangxi branch is used in the primary aluminum smelter at the same branch and the remainder is sold to third-party smelters. |

|

Our Guangxi branch also uses advanced 160 kA and 320 kA pre-bake reduction pot-lines developed by us in its smelting operations. As of December 31, 2010, the branch's primary aluminum production capacity reached 139,500 tonnes per annum. In 2010, our Guangxi branch produced approximately 114,600 tonnes of primary aluminum. |

|

Guizhou Branch |

|

The Guizhou branch commenced its smelting operations in 1966 and was subsequently expanded to include a refining operations in 1978. Our refinery at this branch is one of the most advanced alumina refineries in China, having imported many of its key technologies and equipment. The Guizhou refinery uses the hybrid Bayer-sintering process to refine bauxite supplied from our own mines as well as external suppliers into alumina. Bauxite from our own mines is delivered by trucks and train. The alumina produced at the Guizhou branch is mostly used in the smelting operations at the same plant and the remainder is sold to third-party smelters. Our Guizhou branch uses 160 kA, 186kA and 230 kA pre-bake reduction pot-lines in its primary aluminum production. As a result of technological innovations and overhauls since its inception, our Guizhou smelter is among the most technologically advanced smelters in China. As of December 31, 2010, the annual production capacity for alumina at our Guizhou branch was approximately 1,200,000 tonnes of alumina and 403,700 tonnes for primary aluminum. In 2010, our Guizhou branch produced approximately 1,078,300 tonnes of alumina, 69,600 tonnes of alumina chemical products and 432,300 tonnes of primary aluminum. |

|

Our Guizhou branch also contains a modern carbon production facility, which produces carbon cathodes in addition to carbon anodes. As the Guizhou branch is our only facility that produces carbon cathodes, it supplies carbon cathodes to seven of our facilities and our Research Institute. Its carbon cathodes are also sold to external customers throughout China. |

|

Henan Branch |

|

The Henan branch commenced its refining and smelting operations in 1966 and 1967, respectively, in Henan Province, a province rich in bauxite reserves. Bauxite is delivered to our Henan branch via railway and highway from the following mines: Xiaoguan mine located in Zhengzhou, Luoyang mine in Luoyang, Mianchi mine in Mianchi, Xuchang mine in Zhengzhou, Sanmenxia mine in Sanmenxia and Jiaozuo mine in Jiaozuo. Our Henan branch was the first refinery in China to develop the hybrid Bayer-sintering process. We also have alumina production line that uses the ore-dressing Bayer process, which we developed to refine low alumina-to-silica ratio bauxite. Since its inception, the Henan branch's production facilities have undergone substantial technological upgrades, based on equipment imported from Germany and Denmark. The refinery has also benefited from its access to high alumina-to-silica ratio bauxite from our own mines and through purchases on the market. Its alumina output is first used to satisfy its primary aluminum production, and the remainder is sold to our other smelters and external customers. The designed annual production capacity of alumina of our Henan branch was 2,050,000 tonnes as of December 31, 2010. In 2010, our Henan branch produced approximately 1,921,500 tonnes of alumina and 32,900 tonnes of alumina chemical products. |

|

29 |

|

|

We have upgraded a portion of the primary aluminum facilities at this branch, which now utilizes 85 kA pre-bake reduction pot-lines. Its carbon plant produces high quality carbon products for sales to external customers in China as well as for export, after meeting the needs of our various smelting operations. As of December 31, 2010, Henan branch's annual primary aluminum production capacity reached 56,000 tonnes. In 2010, our Henan branch did not produce any primary aluminum. |

|

Shandong Branch |

|

The Shandong branch commenced operations in 1954 and has the capacity to produce both alumina and primary aluminum. Bauxite is delivered to our Shandong branch via railway and highway from the Yangquan mine in Yangquan, Shanxi Province. Its alumina refinery was China's first production facility for alumina. It produces the majority of its alumina through the parallel Bayer-sintering process, but has an ore-dressing sintering operation. The Shandong branch purchases the majority of the bauxite required for its production from small third-party mines in Henan and Shanxi Provinces. Its alumina output is first used to satisfy its primary aluminum production, and the remainder is sold to our other smelters as well as external customers. As of December 31, 2010, the annual capacity of our Shandong branch reached 1,500,000 tonnes of alumina and it produced approximately 1,599,200 tonnes of alumina in 2010. |

|

In addition, our Shandong branch produces substantial amounts of alumina chemical products and produced approximately 682,500 tonnes of alumina chemical products in 2010. It is the largest and most technologically advanced alumina chemical products production facility in China with the ability to produce the widest variety of alumina chemical products. Alumina chemical products produced by our Shandong branch are used domestically and internationally in the pharmaceutical, ceramics, construction materials and other industries. |

|

Our Shandong branch's primary aluminum operations have undergone technological and equipment upgrades. As of December 31, 2010, our Shandong branch's primary aluminum production capacity reached 75,000 tonnes per annum and it produced approximately 58,300 tonnes of primary aluminum in 2010. |

|

Qinghai Branch |

|

Located in Qinghai Province, our Qinghai branch is a stand-alone primary aluminum production facility. This branch commenced operations in 1987 and is one of the most technologically advanced primary aluminum smelters in China. It operates 160 kA and 200kA automated pre-bake anode reduction pot-lines that were developed domestically. It benefits from relatively low electricity costs in Qinghai Province due to the hydroelectric power stations in the region. The Qinghai Branch supplies alumina from our Shanxi, Shandong, Henan and Zhongzhou branches, but incurs higher transportation costs for both raw materials and its primary aluminum products than our other branches. The Qinghai branch produced approximately 384,300 tonnes of primary aluminum in 2010, slightly exceeding its designed annual production capacity of 367,000 tonnes as of December 31, 2010. |

|

Shanxi Branch |

|

Our Shanxi branch commenced operations in 1987 and is located in Shanxi Province, a province rich in bauxite deposits. Bauxite is transported to our Shanxi branch via railway and highway from the Xiaoyi mine in Shanxi Province. Our Shanxi branch is a stand-alone alumina plant and is currently China's largest alumina refinery in terms of production capacity, with a capacity of 2,217,000 tonnes as of December 31, 2010. Our Shanxi branch produced approximately 1,775,100 tonnes of alumina and 19,800 tonnes of alumina chemical products in 2010. |

|

Our Shanxi branch's production facilities are primarily imported. Shanxi branch relies on bauxite from our own mines as well as external suppliers. Due to its proximity to large coal mines and substantial water resources, it currently has the largest power generation capacity among our alumina manufacturing facilities. |

|

Zhongzhou Branch |

|

Located in Henan Province, our Zhongzhou branch is a stand-alone alumina plant, located near abundant bauxite, coal and water supplies. It commenced operations in 1993 and is equipped with imported and self-developed technology and has undergone various improvements and upgrades, in particular to its parallel Bayer-sintering process. We purchase bauxite supplies from Henan Province and Shanxi Province. |

|

Its production capacity reached 2,030,000 tonnes of alumina per annum as of December 31, 2010. Our Zhongzhou branch produced approximately 1,692,800 tonnes of alumina and approximately 266,700 tonnes of alumina chemical products in 2010. |

|

30 |

|

|

Zunyi Alumina |

|

Zunyi Alumina is located in Zunyi, Guizhou Province. In April 2006, we entered into a joint venture agreement with Guizhou Wujiang Hydroelectric Co., Ltd, to establish a joint venture company, Zunyi Alumina. We hold 67% of the equity interests in Zunyi Alumina. Zunyi Alumina completed the construction of alumina facilities and commenced operations in 2010. Its annual alumina production capacity reached 800,000 tonnes as of December 31, 2010. Zunyi Alumina produced approximately 74,300 tonnes of alumina in 2010. |

|

Chongqing Branch |

|

Our Chongqing branch is located in Chongqing. Chongqing branch completed the construction of alumina facilities in 2010 and its an annual alumina production capacity reached 800,000 tonnes as of December 31, 2010. Chongqing branch launched test operation in December 2010. |

|

Lanzhou Branch |

|

Located in Lanzhou city in Gansu Province, our Lanzhou branch is a stand-alone primary aluminum plant. It was part of Lanzhou Aluminum before July 2007 and acquired by us through share exchange in April 2007. In July 2007, Lanzhou Aluminum was divided into two wholly-owned entities: Lanzhou branch and Northwest Aluminum. Our Lanzhou branch owns a primary aluminum smelting plant with a designed annual production capacity of approximately 388,000 tonnes as of December 31, 2010. It produced approximately 429,300 tonnes of primary aluminum in 2010. |

|

Jiaozuo Wanfang |

|

Jiaozuo Wanfang is situated in Jiaozuo city in Henan Province and is a stand-alone primary aluminum plant. Jiaozuo Wanfang was established in 1993. In May 2006, we acquired 29% of the issued share capital and thus became its largest shareholder. In 2010, we partially disposed our equity in Jiaozuo Wanfang. As of December 31, 2010, we held 24.002% equity interest of Jiaozuo Wanfang. In 2008, we obtained de facto control over Jiaozuo Wanfang and accordingly, it became our subsidiary. Jiaozuo Wanfang had an annual production capacity of 412,000 tonnes of primary aluminum as of December 31, 2010 and produced approximately 408,900 tonnes of primary aluminum in 2010. |

|

Shanxi Huaze |

|

Shanxi Huaze is situated in Shanxi Province. In March 2003, we established the joint venture company, Shanxi Huaze, with Zhangze Electric Power to commence the construction of a primary aluminum production facility. Following the completion of its capacity expansion in June 2008, Shanxi Huaze's designed annual production capacity of primary aluminum reached 350,000 tonnes as of December 31, 2010 and it produced approximately 341,500 tonnes of primary aluminum in 2010. We currently hold 60% of the equity interest of Shanxi Huaze. |

|

Shanxi Huasheng |

|

Shanxi Huasheng is situated in Shanxi Province. In December 2005, we entered into a joint venture agreement with Guan Lv, to establish a joint venture company, Shanxi Huasheng. The joint venture company commenced operations in March 2006. Its designed annual production capacity of primary aluminum reached approximately 220,000 tonnes as of December 31, 2010. In 2010, Shanxi Huasheng produced 223,200 tonnes of primary aluminum. We currently hold a 51% equity interest in Shanxi Huasheng. |

|

Zunyi Aluminum |

|

Zunyi Aluminum is situated in Guizhou Province. In June 2006, we entered into a share purchase agreement with Guizhou Wujiang Hydropower Development Co., Ltd. and eight other companies, which were the shareholders of Zunyi Aluminum, to purchase part of the equity interest from Guizhou Wujiang Hydropower Development Co., Ltd. and all the equity interest held by the other eight companies. We have completed our purchase and currently hold 62.1% of the equity interest in Zunyi Aluminum. Zunyi Aluminum's primary aluminum annual production capacity reached 235,000 tonnes as of December 31, 2010 and it produced approximately 190,800 tonnes of primary aluminum in 2010. |

|

Fushun Aluminum |

|

Fushun Aluminum is situated in Liaoning Province, and is a stand-alone primary aluminum plant. In March 2006, we entered into a share transfer agreement with Liaoning Fushun Aluminum Plant to acquire 100% of the equity interests in Fushun Aluminum for a consideration of RMB500 million (US$75.8 million). Fushun Aluminum's primary business is the production of primary aluminum and carbon products. With the partial completion of a new primary aluminum project at the end of 2008 which increased the primary aluminum production capacity of Fushun Aluminum by 100,000 tonnes, Fushun Aluminum's annual primary aluminum production capacity reached 240,000 tonnes as of December 31, 2010. Fushun Aluminum produced approximately 205,800 tonnes of primary aluminum in 2010. |

|

31 |

|

|

Shandong Huayu |

|

Shandong Huayu is situated in Shandong Province and is a stand-alone primary aluminum plant. In July 2006, we entered into a share transfer agreement with Shandong Huasheng Jiangquan Group to acquire 55% of the equity interest of Shandong Huayu, a subsidiary of Shandong Huasheng Jiangquan Group. After the completion of its expansion plan in 2008, Shandong Huayu's annual primary aluminum production capacity reached 200,000 tonnes as of December 31, 2010. It also has supporting facilities and coal-fired generators. In 2010, Shandong Huayu produced approximately 215,700 tonnes of primary aluminum. |

|

Gansu Hualu |

|

Gansu Hualu is situated in Gansu Province, and is a stand-alone primary aluminum plant. In August 2006, we entered into a share transfer agreement with Baiyin Nonferrous Metal (Group) Co., Ltd. ("Baiyin Nonferrous") and Baiyin Ibis Aluminum Co., Ltd. ("Baiyin Ibis"). Baiyin Nonferrous contributed 127,000 tonnes of primary aluminum smelting and supporting facilities owned by Baiyin Ibis as capital contribution and holds a 49% equity interest in Gansu Hualu, a subsidiary of Baiyin Ibis, and we hold 51% of the equity interest in Gansu Hualu. In 2010, we have completed the expansion project of the Gansu Hualu's primary aluminum smelters, which increased its annual production capacity from 160,000 tonnes to 230,000 tonnes of primary aluminum as of December 31, 2010. Gansu Hualu produced approximately 165,000 tonnes of primary aluminum in 2010. |

|

Baotou Aluminum |

|

Baotou Aluminum is located in Inner Mongolia Autonomous Region, and is a stand-alone primary aluminum plant. On December 28, 2007, through A Shares issuance and exchange for Baotou Aluminum shares, we acquired 100% of the equity interest of Baotou Aluminum. Baotou Aluminum had a designed annual production capacity of 388,000 tonnes as of December 31, 2010. In 2010, it produced approximately 412,000 tonnes of primary aluminum. |

|

Liancheng branch |

|

Liancheng branch is located in Gansu Province. In late May, 2008, we acquired 100% of the equity interest of Liancheng Longxing Aluminum Company Limited from Chinalco on the China Beijing Equity Exchange and subsequently turned it into our Liancheng branch which specializes in producing primary aluminum. As of December 31, 2010, Liancheng branch had an annual primary aluminum production capacity of 225,000 tonnes and produced approximately 230,400 tonnes of primary aluminum in 2010. |

|

Chalco Qingdao |

|

Located in Qingdao, Shandong Province, Chalco Qingdao specializes in using recycled aluminum materials to produce aluminum fabrication products. As of December 31, 2010, Chalco Qingdao had an annual production capacity of 120,000 tonnes and produced 25,000 tonnes of aluminum fabrication products in 2010. |

|

Longmen Aluminum |

|

Located in Shanxi Province, Longmen Aluminum is established in1991. We hold 55% of its equity interests. It specializes in producing primary aluminum. As of December 31, 2010, Longmen Aluminum had an annual primary aluminum production capacity of 17,000 tonnes and produced 11,800 tonnes of primary aluminum in 2010. |

|

Northwest Aluminum |

|

Northwest Aluminum is situated in Lanzhou city in Gansu Province and is an aluminum fabrication plant. It was part of Lanzhou Aluminum before July 2007 which we acquired through share exchange in April 2007, whose A Shares were listed on Shanghai Stock Exchange until April 24, 2007, when we acquired Lanzhou Aluminum through share exchange. In July 2007, Lanzhou Aluminum was divided into two wholly-owned entities: Lanzhou branch and Northwest Aluminum. Northwest Aluminum has an annual production capacity for aluminum fabrication products of approximately120,000 tonnes as of December 31, 2010 and produced approximately 62,000 tonnes of aluminum fabrication products in 2010. Northwest Aluminum has undertaken an expansion plan which is expected to be completed in 2011 and we expect the completion of this project to increase Northwest Aluminum's aluminum fabrication capacity by 35,000 tonnes. |

|

Chalco Ruimin |

|

Located in Fujian, Chalco Ruimin commenced production in 1996 and specializes in aluminum fabrication. In late May 2008, we purchased 75% of the equity interest of Chalco Ruimin from Chinalco on the China Beijing Equity Exchange. Chalco Ruimin completed a RMB2.87 billion (US$0.4 billion) expansion plan in 2010, which increased Chalco Ruimin's annual aluminum fabrication capacity to approximately 370,000 tonnes as of December 31, 2010. Chalco Ruimin produced approximately 131,000 tonnes of aluminum fabrication products in 2010. We currently hold a 92.18% equity interest in Chalco Ruimin. |

|

32 |

|

|

Huaxi Aluminum |

|

Located in Chengdu, Sichuan Province, Huaxi Aluminum commenced production in 1997 and specializes in aluminum fabrication. In late May 2008, we purchased 56.86% of the equity interest of Huaxi Aluminum from Chinalco on the China Beijing Equity Exchange. As of December 31, 2010, Huaxi Aluminum had an annual aluminum fabrication production capacity of 22,000 tonnes and it produced approximately 25,000 tonnes of aluminum fabrication products in 2010. |

|

Chalco Southwest Aluminum |

|

Established in September 2004 and located in Chongqing, Chalco Southwest Aluminum specializes in aluminum fabrication. On May 30, 2008, we purchased 60% of the equity interest of Chalco Southwest Aluminum from Chinalco on the China Beijing Equity Exchange. As of December 31, 2010, Chalco Southwest Aluminum had an annual aluminum fabrication production capacity of 350,000 tonnes and produced approximately 234,000 tonnes of aluminum fabrication products in 2010. |

|

Chalco Southwest Aluminum Cold Rolling |

|

Established in March 2006 and located in Chongqing, Chalco Southwest Aluminum Cold Rolling specializes in rolling aluminum and aluminum alloy processing, development of high precision aluminum strip production technology and import and export activities on goods and technology. On May 30, 2008, we acquired 100% of the equity interests of Chalco Southwest Aluminum Cold Rolling from Chinalco. In 2010 we completed the construction of production facilities of Chalco Southwest Aluminum Cold Rolling. As of December 31, 2010, Chalco Southwest Aluminum Cold Rolling had an annual aluminum fabrication production capacity of 250,000 tonnes. It has commenced production in 2010. |

|

Henan Aluminum |

|

Established in August 2005 and located in Luoyang, Henan Province, Henan Aluminum specializes in aluminum fabrication. In late May 2008, we acquired 84.02% of the equity interest of Henan Aluminum from Chinalco and China Nonferrous Metals Technology on the China Beijing Equity Exchange. As of December 31, 2010, Henan Aluminum had an annual aluminum fabrication production capacity of 355,000 tonnes and produced approximately 111,000 tonnes of aluminum fabrication products in 2010. We currently hold 90.03% of the equity interest in Henan Aluminum. |

|

Chalco Nanhai |

|

Established in June 2007 and located in Foshan, Chalco Nanhai specializes in aluminum fabrication. Chalco Nanhai had an annual aluminum fabrication capacity of 110,000 tonnes. Chalco Nanhai launched test operation in December 2010. |

|

Research Institute |

|

Established in August 1965 and located in Zhengzhou, Henan Province, the Research Institute specializes in the research and development of technology for smelting aluminum. It is the only research institute in China dedicated to light metals research and has played a key role in bringing about technological innovations in China's aluminum industry. The Research Institute is central to our research and development efforts. The Research Institute operates test facilities, which produce alumina chemical products and primary aluminum. The Research Institute was approved by the Ministry of Science and Technology of the PRC in 2003 to establish the National Research Center of Aluminum Refinery Technologies and Engineering. Our Research Institute has a limited alumina and primary aluminum production capacity, which it uses in connection with its research and development efforts. |

|

Competition |

|

Alumina |

|

As the largest producer of alumina in China, we believe that we will not face significant competition from domestic alumina producers in the short-term for the following reasons: |

|

Aluminum Fabrication Products |

|

We derived 87% of our aluminum fabrication products revenues from sales in China in 2010. Our competitors include other domestic and international producers of aluminum fabrication products that sell aluminum fabrication products in China. There are approximately 750 aluminum fabrication producers in China with an aggregate annual capacity of approximately 24.0 million tonnes as of the end of 2010. In 2010, the aluminum fabrication producers in China produced approximately 19.5 million tonnes of aluminum fabrication products. |

|

The tariff rate for alumina and primary aluminum imports was reduced to nil on January 1, 2008 and August 1, 2007, respectively. In 2010, China imported approximately 4.31 million tonnes of alumina, representing a 16.3% decrease from 2009. China had net import of approximately 0.30 million tonnes of primary aluminum in 2010, which represented a significant decrease from 2009. Competition from international suppliers of alumina and primary aluminum is expected to increase. Such competitors are likely to be large international companies. Some competitors may also consider establishing joint venture companies with local producers in China to gain access to the resources in China and to lower transportation costs. However, we expect to continue benefitting from certain PRC governmental policies that promote the growth of large domestic smelters. |

|

34 |

|

|

Research and Development |

|

Our research and development efforts over the years have facilitated the expansion of our production capacity and reduced our unit costs. We have successfully commercialized our previous research and development results in various technologies. We completed 63 technological projects, including 32 technology development projects, 23 industrialization, promotion and application of advanced technologies projects and 8 basic application projects. We filed a total of 176 patent applications in 2010. |

|

As of December 31, 2010, we owned 1043 patents, which were primarily related to technologies and know-how, equipment and new products. Once registered, a patent in China for a new invention is valid for 20 years and for a new function or a new design, 10 years from the date of the patent application. |

|