As filed with Securities and Exchange Commission on April 15, 2016 |

|

UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

|

_______________ |

|

FORM 20-F |

|

_______________ |

|

[ ] REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF |

THE SECURITIES EXCHANGE ACT OF 1934 |

OR |

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015 |

OR |

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF |

THE SECURITIES EXCHANGE ACT OF 1934 |

OR |

[ ] SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF |

THE SECURITIES EXCHANGE ACT OF 1934 |

|

Commission file number 001-15264 |

|

|

(Exact name of Registrant as specified in its charter) |

|

ALUMINUM CORPORATION OF CHINA LIMITED |

(Translation of Registrant's name into English) |

|

_______________ |

|

People's Republic of China |

(Jurisdiction of incorporation or organization) |

|

_______________ |

|

No. 62 North Xizhimen Street, Haidian District, Beijing

People's Republic of China (100082) |

(Address of principal executive offices) |

|

_______________ |

|

Yu Dehui |

No. 62 North Xizhimen Street, Haidian District, Beijing

People's Republic of China (100082) |

(86) 10 8229 8560 |

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) |

|

_______________ |

|

Securities registered or to be registered pursuant to Section 12(b) of the Act. |

|

CERTAIN TERMS AND CONVENTIONS |

| |

"Chalco", "the Company", "the Group", "our company", "we", "our" and "us" refer to Aluminum Corporation of China Limited and its subsidiaries and, where appropriate, to its predecessors; |

| |

"A Shares" and "domestic shares" refer to our domestic ordinary shares, with a par value of RMB1.00 each, which are listed on the Shanghai Stock Exchange; |

| |

"alumina-to-silica ratio" refers to the ratio of alumina to silica in bauxite by weight; |

| |

"aluminum fabrication" refers to the process of converting primary aluminum or recycled aluminum materials into plates, strips, bars, tubes and other fabricated products; |

| |

"AUD" or "Australian dollars" refers to the lawful currency of the Commonwealth of Australia; |

| |

"Baotou Aluminum" refers to Baotou Aluminum Company Limited, our wholly-owned subsidiary established under the PRC law; |

| |

"Baotou Group" refers to Baotou Aluminum (Group) Co., Ltd., one of our shareholders; |

| |

"bauxite" refers to a mineral ore that is principally composed of aluminum; |

| |

"Bayer process" refers to a refining process that employs a strong solution of caustic soda at an elevated temperature to extract alumina from ground bauxite; |

| |

"Bayer-sintering combined process" and "Bayer-sintering series process" refer to the two methods of refining process developed in China which involve the combined application of the Bayer process and the sintering process to extract alumina from bauxite; |

| |

"Board" refers to our board of directors; |

| |

"CBEX" refers to China Beijing Equity Exchange, an approved equity exchange for the transfer of state-owned assets; |

| |

"Chalco Energy" refers to Chalco Energy Co., Ltd., our wholly-owned subsidiary established under the PRC law; |

| |

"Chalco Hong Kong" refers to Chalco Hong Kong Limited, our wholly-owned subsidiary established under Hong Kong Law; |

| |

"Chalco Iron Ore" refers to Chalco Iron Ore Holding Limited, our subsidiary until December 2013 when we disposed of 65% of its equity interest to Chinalco; |

| |

"Chalco Liupanshui" refer to Chalco Liupanshui Hengtaihe Mining Co., Ltd., 49% of the equity interest of which is owned by us; |

| |

"Chalco Mining" refers to Chalco Mining Co., Ltd., our wholly-owned subsidiary established under the PRC law; |

| |

"Chalco Nanhai" refers to Chalco Nanhai Alloy Company, a wholly-owned subsidiary of our Group established under the PRC law; |

| |

"Chalco Ruimin" refers to Chalco Ruimin Company Limited, our subsidiary until June 2013 when we disposed of 93.30% of its equity interest to Chinalco; |

| |

"Chalco Shandong" refers to Chalco Shandong Co., Ltd., 100% of the equity interest of which is owned by us; |

| |

"Chalco Southwest Aluminum" refers to Chalco Southwest Aluminum Company Limited, our subsidiary until June 2013 when we disposed of 60% of its equity interest to Chinalco; |

| |

"Chalco Southwest Aluminum Cold Rolling" refers to Chalco Southwest Aluminum Cold Rolling Company Limited, our wholly-owned subsidiary until June 2013 when we disposed of its entire equity interest to Chinalco; |

| |

"Chalco Trading" or "CIT" refers to China Aluminum International Trading Co., Ltd., our wholly owned subsidiary established under the PRC law; |

| |

"Chalco Xing County Alumina Project" refers to the Bayer process production system and ancillary facilities at Xing County, Lvliang City of Shanxi Province with production capacity of 800,000 tonnes of metallurgical grade alumina per year; |

| |

"Chalco Zhongzhou" refers to Chalco Zhongzhou Aluminum Co., Ltd., 100% of the equity interest of which is owned by us; |

| |

"China" and the "PRC" refers to the People's Republic of China, excluding for purposes of this annual report, Hong Kong Special Administrative Region, Macao Special Administrative Region and Taiwan; |

| |

"Chinalco" and "Chinalco Group" refer to our controlling shareholder, Aluminum Corporation of China and its subsidiaries (other than Chalco and its subsidiaries) and, where appropriate, to its predecessors; |

| |

"Chinalco Finance" refers to Chinalco Finance Co., Ltd.; |

| |

"CSRC" refers to China Securities Regulatory Commission; |

| |

"Dongdong Coal" refers to Shaanxi Chengcheng Dongdong Coal Co., Ltd., 45% of the equity interest of which is owned by us; |

| |

"Energy-Saving and Emission Reduction Goals" refers to the energy-saving and emission reduction goals set out in China's 12th Five-Year Plan for National Economic and Social Development laid out in 2011, by which China expects to cut its per unit GDP energy consumption by 16 percent compared with the 2010 level by the end of 2015; |

| |

"Exchange Act" refers to the U.S. Securities Exchange Act of 1934, as amended; |

| |

"Euros" or "EUR" refers to the lawful currency of the Euro zone; |

| |

"Fushun Aluminum" refers to Fushun Aluminum Company Limited, our wholly-owned subsidiary established under the PRC law; |

| |

"Gansu Hualu" refers to Gansu Hualu Aluminum Company Limited, 51% of the equity interest of which is owned by us; |

| |

"Gansu Huayang" refers to Gansu Huayang Mining Development Company Limited, 70% of the equity interest of which is owned by us; |

| |

"Guangxi Huayin" refers to Guangxi Huayin Aluminum Company Limited, 33% of the equity interest of which is owned by us; |

| |

"Guangxi Investment" refers to Guangxi Investment (Group) Co., Ltd., formerly known as Guangxi Development and Investment Co., Ltd., a PRC state- owned enterprise and one of our promoters and shareholders; |

| |

"Guizhou Development" refers to Guizhou Provincial Materials Development and Investment Corporation, a PRC state-owned enterprise and one of our promoters and shareholders; |

| |

"Guizhou Huajin" refers to Guizhou Huajin Aluminum Co., Ltd., 60% of the equity interest of which is owned by us; |

| |

"Guizhou Yuneng" refers to Guizhou Yuneng Mining Co., Ltd., 25% of the equity interest of which is owned by us; |

| |

"H Shares" refers to overseas listed foreign shares with a par value RMB1.00 each, which are listed on the Hong Kong Stock Exchange; |

| |

"Henan Aluminum" refers to Chalco Henan Aluminum Company Limited, our subsidiary until June 2013 when we disposed of 90.03% of its equity interest to Chinalco; |

| |

"HK$" and "HK dollars" refer to Hong Kong dollars, the lawful currency of the Hong Kong Special Administrative Region of the PRC; |

| |

"Hong Kong Stock Exchange" refers to The Stock Exchange of Hong Kong Limited; |

| |

"Huaxi Aluminum" refers to Huaxi Aluminum Company Limited, our subsidiary until June 2013 when we disposed of 56.86% of its equity interest to Chinalco; |

| |

"Japanese Yen" refers to the lawful currency of Japan; |

| |

"Jiaozuo Wanfang" refers to Jiaozuo Wanfang Aluminum Manufacturing Co. Ltd., 2.46% of the equity interest of which was owned by us as of December 31, 2015; |

| |

"Ka" refers to kiloamperes, a unit for measuring the strength of an electric current, with one kiloampere equaling to 1,000 amperes; |

| |

"kWh" refers to kilowatt hours, a unit of electrical power, meaning one kilowatt of power for one hour; |

| |

"Lanzhou Aluminum" refers to Lanzhou Aluminum Co., Ltd., a wholly-owned subsidiary of us since April 2007 and until July 2007 when it was divided into two wholly-owned entities: Lanzhou branch and Northwest Aluminum; |

| |

"Liancheng branch" refers to our wholly-owned branch, which was formerly known as Lanzhou Liancheng Longxing Aluminum Company Limited, before we acquired 100% of its equity interest; |

| |

"Listing Rules" and "Hong Kong Listing Rules" refer to the Rules Governing the Listing of Securities on the Hong Kong Stock Exchange, as amended; |

| |

"LME" refers to the London Metal Exchange Limited; |

| |

"Longmen Aluminum" refers to Shanxi Longmen Aluminum Co., Ltd., 55% of the equity interest of which is owned by us; |

| |

"MIIT" refers to Ministry of Industry and Information Technology of the PRC; |

| |

"Nanchu Price" refers to the independent reference price for aluminum published on ENanchu (http://www.enanchu.com/), an nonferrous metal related portal site in PRC; |

| |

"NDRC" refers to China National Development and Reform Commission; |

| |

"Ningxia Energy" refers to Chalco Ningxia Energy Group Co., Ltd. (formerly Ningxia Electric Power Group Co., Ltd.) and we acquired 70.82% of its equity interest in January 2013; |

| |

"Northwest Aluminum" refers to Northwest Aluminum Fabrication Branch, our wholly-owned branch until June 2013 when we disposed of all its assets to a subsidiary of Chinalco; |

| |

"NYSE" or "New York Stock Exchange" refers to the New York Stock Exchange Inc.; |

| |

| |

"ore-dressing Bayer process" refers to a refining process we developed to increase the alumina-to-silica ratio of bauxite; |

| |

"Qingdao Light Metal" refers to Chalco Qingdao Light Metal Company Limited, our wholly-owned subsidiary until June 2013 when we disposed of its entire equity interest to Chinalco; |

| |

"Qinghai Energy" refers to Qinghai Province Energy Development (Group) Co., Ltd., 21% of the equity interest of which is owned by us; |

| |

"refining" refers to the chemical process used to produce alumina from bauxite; |

| |

"Rio Tinto" refers to Rio Tinto plc, a company incorporated in England and Wales, the shares of which are listed on the London Stock Exchange and the New York Stock Exchange; |

| |

"RMB" or "Renminbi" refers to the lawful currency of the PRC; |

| |

"SASAC" refers to State-owned Assets Supervision and Administration Commission of the State Council of China; |

| |

"SEC" refers to the U.S. Securities and Exchange Commission; |

| |

"Securities Act" refers to the U.S. Securities Act of 1933, as amended; |

| |

"Shandong Aluminum" refers to Shandong Aluminum Industry Co., Limited, a wholly-owned subsidiary of Chinalco; |

| |

"Shandong Huayu" refers to Shandong Huayu Alloy Material Co., Ltd, 55% of the equity interest of which is owned by us; |

| |

"Shanxi Jiexiu" refers to Shanxi Jiexiu Xinyugou Coal Industry Co., Ltd., 34% of the equity interest of which is owned by us; |

| |

"Shanxi Huasheng" refers to Shanxi Huasheng Aluminum Company Limited, 51% of the equity interest of which is owned by us; |

| |

"Shanxi Huaxing" refers to Shanxi Huaxing Aluminum Co., Ltd., formerly a wholly-owned subsidiary of our Group. We disposed 50% of equity interest in Shanxi Huaxing in 2015, and as a result Shanxi Huaxing has become our joint venture in accordance with relevant accounting standards; |

| |

"Shanxi Huaze" refers to Shanxi Huaze Aluminum and Power Co., Limited, 60% of the equity interest of which is owned by us; |

| |

"Shanxi Other Mines" refers to the seven of mines, in which we entrusted other party to conduct mining activities, including Shangtan mine, Jindui mine, Shicao mine, Nanpo mine, Xishan mine, Niucaogou mine and Sunjiata mine in Shanxi Province that became the mining areas of our new own mine in 2010; |

| |

"SHFE" refers to the Shanghai Futures Exchange; |

| |

"Simandou Project" refers to the project to develop and operate the Simandou iron ore mine located in Guinea in West Africa as further described in the Simandou joint development agreement dated July 29, 2010 entered into amongst Rio Tinto, Rio Tinto Iron Ore Atlantic Limited and us for the purpose of development of the Simandou Project; |

| |

"sintering process" refers to a refining process employed to extract alumina from bauxite by mixing ground bauxite with supplemental materials and burning the mixture in a coal-fired kiln; |

| |

"smelting" refers to the electrolytic process used to produce molten aluminum from alumina; |

| |

"tonne" refers to the metric ton, a unit of weight, that is equivalent to 1,000 kilograms or 2,204.6 pounds; |

| |

"US$", "dollars" or "U.S. dollars" refers to the legal currency of the United States; |

| |

"Xinan Aluminum" refers to Xinan Aluminum (Group) Company Limited; |

| |

| | | Year Ended December 31, |

| | |

|

| | | 2011 | 2012 | 2013 | 2014 | 2015 | 2015 |

| | |

|

|

|

|

|

|

| | | RMB | RMB | RMB | RMB | RMB | US$ |

| | | (in thousands, except per share and per ADS data) |

| | | | | | | | |

| | CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME DATA | | |

| | Continuing Operations | | | | | | |

| | Revenue | 138,474,717 | 143,692,381 | 169,693,800 | 141,999,830 | 123,445,872 | 19,056,759 |

| | Cost of sales | (131,066,801) | (143,646,145) | (166,895,282) | (141,328,954) | (120,927,088) | (18,667,926) |

| | |

|

|

|

|

|

|

| | | | | | | | |

| | Gross profit | 7,407,916 | 46,236 | 2,798,518 | 670,876 | 2,518,784 | 388,833 |

| | Selling and distribution expenses | (1,500,213) | (1,846,424) | (1,873,180) | (1,763,031) | (1,775,254) | (274,052) |

| | General and administrative expenses | (2,559,710) | (2,756,539) | (2,953,232) | (4,838,387) | (2,334,071) | (360,318) |

| | Research and development expenses | (206,430) | (184,683) | (193,620) | (293,766) | (168,869) | (26,069) |

| | Impairment loss on property, plant and equipment | (279,756) | (19,903) | (501,159) | (5,679,521) | (10,011) | (1,545) |

| | Government grants | 159,774 | 734,852 | 805,882 | 823,986 | 1,768,926 | 273,075 |

| | Other gains/(losses), net | 502,462 | (16,989) | 7,399,252 | 356,935 | 5,023,600 | 775,510 |

| | Operating profit/(loss) from continuing operations | 3,524,043 | (4,043,450) | 5,482,461 | (10,722,908) | 5,023,105 | 775,434 |

| | Finance costs, net | (2,935,642) | (4,076,475) | (5,247,905) | (5,682,990) | (5,137,581) | (793,106) |

| | |

|

|

|

|

|

|

| | | | | | | | |

| | Operating profit/(loss) from continuing operations | | | | | | |

| | less finance costs | 588,401 | (8,119,925) | 234,556 | (16,405,898) | (114,476) | (17,672) |

| | Share of profits of joint ventures | 122,262 | 37,040 | 148,749 | 89,510 | 23,238 | 3,587 |

| | Share of profits of associates | 400,706 | 256,081 | 511,869 | 350,575 | 284,531 | 43,924 |

| | |

|

|

|

|

|

|

| | | | | | | | |

| | Profit/(loss) before income tax | | | | | | |

| | from continuing operations | 1,111,369 | (7,826,804) | 895,174 | (15,965,813) | 193,293 | 29,839 |

| | Income tax (expense)/benefit | | | | | | |

| | from continuing operations | (121,175) | 371,092 | (339,551) | (1,074,910) | 230,420 | 35,571 |

| | |

|

|

|

|

|

|

| | | | | | | | |

| | Profit/(loss) for the year from continuing operations | 990,194 | (7,455,712) | 555,623 | (17,040,723) | 423,713 | 65,410 |

| | Profit/(loss) per share from continuing operations | 0.04 | (0.52) | 0.05 | (1.20) | 0.01 | 0.00 |

| | Discontinued operation (Loss) /profit for the year

from discontinued operation | (299,048) | (1,187,299) | 207,144 | - | - | - |

| | |

|

|

|

|

|

|

| | | | | | | | |

| | Profit/(loss) for the year | 691,146 | (8,643,011) | 762,767 | (17,040,723) | 423,713 | 65,410 |

| | |

|

|

|

|

|

|

| | | | | | | | |

| | Profit/(loss) Attributable to: | | | | | | |

| | Owners of the parent | 238,616 | (8,233,182) | 987,179 | (16,208,170) | 206,319 | 31,850 |

| | Non-controlling interests | 452,530 | (409,829) | (224,412) | (832,553) | 217,394 | 33,560 |

| | |

|

|

|

|

|

|

| | | | | | | | |

| | Dividends | - | - | - | - | - | - |

| | |

|

|

|

|

|

|

| | | | | | | | |

| | Basic and diluted earnings/(loss) per share | 0.02 | (0.61) | 0.07 | (1.20) | 0.01 | 0.00 |

| | Earnings/(loss) per ADS | 0.44 | (15.22) | 1.82 | (29.96) | 0.35 | 0.06 |

| | Dividends (expressed in RMB and US$ per share

and per ADS) | | | | | | |

| | Final dividends per share | 0.0114 | - | - | - | - | - |

| | Final dividends per ADS | 0.2850 | - | - | - | - | - |

| | Proposed dividends per share | - | - | - | - | - | - |

| | Proposed dividends per ADS | - | - | - | - | - | - |

| | | | | | | | |

| | Volatility in the prices of alumina, primary aluminum, other non-ferrous metal and other commodities may adversely affect our business, financial condition and results of operations. |

| | |

| | The prices of the products we produce and trade, including alumina, primary aluminum, other non-ferrous metal and coal products, have historically fluctuated and are expected to continue fluctuating in response to general economic conditions, supply and demand and the level of global inventories, which are beyond our control. |

| | |

| | We price our alumina and primary aluminum products by reference to international and domestic market prices, and domestic supply and demand, each of which may fluctuate beyond our control. In 2013, demand for alumina and primary aluminum fluctuated. The Australian FOB spot price of alumina reached a high of US$351.5 and a low of US$312.5 per tonne and the international spot price of primary aluminum on the LME reached a high of US$2,123.0 per tonne and a low of US$1,694.5 per tonne in 2013. In 2014, the Australian FOB spot price of alumina and the international cash price of primary aluminum on the LME reached a high of US$357 per tonne and a low of US$307 per tonne and a high of US$2,089 per tonne and a low of US$1,634 per tonne, respectively. As a result of general slowdown of the global economy and overcapacity of global aluminum industry, the market prices for aluminum products were facing downward pressure in 2015. The Australian FOB spot price of alumina and the international cash price of primary aluminum on the LME reached a high of US$354.5 per tonne and a low of US$200 per tonne and a high of US$1,959.1 per tonne and a low of US$1,423.5 per tonne, respectively in 2015. Our average external selling prices of self-produced alumina and primary aluminum were RMB2,377 per tonne and RMB12,075 per tonne respectively in 2015, which decreased by approximately 3.8% and 10.9%, respectively, from 2014 to 2015. Because most of our costs are fixed, we may not be able to respond promptly to a sudden decrease in alumina or primary aluminum prices. There is no assurance that there will be no further falls in prices of our key products, including alumina and primary aluminum, which may materially and adversely affect our business, financial condition and results of operations. |

| | |

| | In addition, as the profit margin of trading is based on price fluctuations in the short term, we need to make the correct prediction of the price fluctuations of the non-ferrous metal products and coal products on the markets to ensure the profit margin. If the price fluctuations on the market do not match our prediction, we may incur substantial losses. In addition, as we generate profit from the differences between the purchasing and sales prices of the non-ferrous metal products we deal in, significant fluctuations in the prices of the commodities we deal in may cause the value of the outsourced products in transit or in inventory to decline, and if the carrying value of our existing inventories exceeds the market price in the future periods, we may need to make additional provisions for our inventories' value. As a result, any significant fluctuation in international market prices could materially and adversely affect our business, financial condition and results of operations. |

| | |

| | |

| | We incurred losses in the past and may not achieve sustained profitability in the future. |

| | |

| | Although we were profitable in 2013 and 2015, we incurred a net loss of approximately RMB17.0 billion in 2014. We may incur losses in the future and we cannot assure you that we will sustain profitability in the future. |

| | |

| | In addition, we expect that we will continue relying on, in addition to our cash flows generated from operating activities, bank and other loans as well as proceeds from bond offerings, to fund our business operations and expansions. Our borrowing costs and access to the debt capital markets, and thus our liquidity, depend significantly on our public credit ratings. These ratings are assigned by rating agencies, which may reduce or withdraw their ratings or place us on "credit watch", which would have negative implications. A history of net losses may result in a deterioration of our credit ratings, which could increase our borrowing costs and limit our access to the capital markets, which in turn, could reduce our earnings and adversely affect our liquidity. |

| | |

| | Our historical results may not be indicative of our future prospects. |

| | |

| | We acquired an aggregate of 70.82% of the equity interest in Ningxia Energy on January 23, 2013. Ningxia Energy is an integrated power generation company with coal mines located in Ningxia Autonomous Region. Its principal business includes conventional coal-fire power generation and renewable energy generation. After the acquisition of Ningxia Energy, we have established an energy segment in January 2013 to include (i) operations of Ningxia Energy and (ii) our other energy related operations that were formerly included in our corporate and other operating segment. In November 2015, we acquired relevant assets and liabilities of High-Purity Aluminum and Light Metal of Baotou Aluminum Group. Baotou Aluminum Group is a subsidiary of Chinalco. In addition, in line with our development strategy to focus on the development of our core business of alumina and primary aluminum operations, where we have established leading market positions, and to reduce future capital expenditures on iron ore development, improve asset-to-debt ratio and generate expected cash flows, we disposed of 65% of the equity interest in Chalco Iron Ore to a wholly-owned subsidiary of Chinalco on December 26, 2013 pursuant to the approval of shareholders at the 2013 second extraordinary general meeting held on November 29, 2013. In December 2015, we entered into Equity Transfer Agreement with Shenzhen CR Yuanda, a state-owned entity, to transfer 50% equity interests in Shanxi Huaxing, a wholly owned subsidiary of our Company, through the Shanghai United Assets and Equity Exchange at a price of RMB2,351 million. For details of the disposal of Chalco Iron Ore and Shanxi Huaxing, please see "Item 4. Information on the Company - A. History and Development of the Company - Overseas Development." |

| | |

| | As a result, our historical results may not be indicative of our future prospects and result of operations. |

| | |

| | Our failure to successfully manage our business expansion, including our expansion into new areas of business, would have a material adverse effect on our results of operations and prospects. |

| | |

| | We have invested in business expansion in line with our development strategy through organic growth, acquisitions and joint ventures. In addition to continuing to expand our existing business lines, we may, from time to time and when we deem appropriate, expand into new industries which we believe have synergies with our existing operations. For example, we have successfully enhanced our energy-related operations through the acquisition of Ningxia Energy in 2013 and participation in joint ventures and strategic investments in coal mining since 2010. |

| | |

| | |

| | Our business and industry may be affected by the development of alternative energy sources and climate change. |

| | |

| | Our operations consume substantial amounts of coal. Coal combustion generates significant greenhouse gas and other pollutants, and the effects of climate change resulting from global warming and increased pollution levels may provide incentives for governments to promote or invest in "green" energy technologies such as wind, solar, nuclear and biomass power plants, or to reduce their consumption of conventional energy sources such as coal. A number of governments or governmental bodies have introduced or are contemplating legislative and regulatory changes in response to the potential impacts of climate change. These regulatory mechanisms may impact our operations directly or indirectly through customers or our supply chain. We may have to increase our capital expenditures in order to comply with such revised or new legislation or regulations, and may realize changes to profit or loss arising from increased or decreased demand for our products and indirectly, from changes in costs of goods sold, which may adversely affect our results of operations and financial condition. |

| | |

| | In addition, we have invested in coal mining operations. We are affected by the growth of the PRC thermal power industry, which relies on coal as main source of fuel. The PRC thermal power industry may be affected by the development of alternative energy sources, climate change and global environmental factors. In particular, pursuant to the draft of China's 13th Five-Year Plan for Environmental Protection, the PRC government plans to continue to encourage the development of alternative energy sources, such as wind power, solar power, biomass and geothermal energy, from 2016 to 2020. As such, alternative energy industries may rapidly develop and gradually gain mainstream acceptance in the PRC and the rest of the world. If alternative energy technologies continue to develop and prove suitable for wide commercial application in the PRC and overseas, demand for conventional energy sources, such as coal, could be reduced, which could have a material and adverse effect on the coal mining industry and, consequently, our business, results of operations and financial condition. |

| | |

| | We may be unable to continue competing successfully in the markets in which we operate. |

| | |

| | We face competition from both domestic and international primary aluminum producers. Our principal competitors are domestic smelters, some of which are consolidating and expanding their production capacities. These smelters compete with our primary aluminum operations on the basis of cost, quality and pricing. In addition, we face increasing competition from international alumina and primary aluminum suppliers as a result of the elimination of tariffs on imports of primary aluminum and alumina into China. Increasing competition in our product markets may reduce our selling prices or sales volumes, which will have a material adverse effect on our financial condition and results of operations. If we are unable to price our products competitively, maintain or increase our current share of China's alumina and primary aluminum markets or otherwise maintain our competitiveness, our financial condition, results of operations and profitability could be materially and adversely affected. |

| | |

| | Our overseas expansion exposes us to political and economic risks, commercial instability and events beyond our control in the countries in which we plan to operate. |

| | |

| | We are currently undertaking a couple of overseas projects, including the bauxite mining projects in Laos and Indonesia. As we are new to these overseas markets, we cannot assure you that our overseas expansion or investments will be successful or that we will not suffer foreign exchange losses in connection with our overseas investment. |

| | |

| | In addition, operations in the overseas markets also expose us to a number of risks including expropriation and nationalization of our assets in foreign countries, civil unrest, acts of terrorism, war, or other armed conflict; natural disasters; inflation; currency fluctuations, devaluations and conversion restrictions; confiscatory taxation or other adverse tax policies, governmental activities that limit or disrupt markets, restrict payments or limit the movement of funds, governmental activities that may result in the deprivation of contractual rights; lack of a well-developed legal system that makes it difficult to enforce our contractual rights; and governmental activities that may result in the inability to obtain or retain licenses required for operations. |

| | |

| | Our profitability and operations could be adversely affected if we are unable to obtain a steady supply of raw materials at competitive prices. |

| | |

| | Historically, the price for bauxite, our most important raw material for alumina production, has been volatile. We obtain bauxite for our operations from our own mines and external suppliers. See "Item 4. Information on the Company - B. Business Overview - Raw Materials - Alumina - Supply." The extent to which we procure bauxite from each of these sources affect the security of our supply or cost of bauxite. The supply of bauxite could be affected by various factors, including geographic conditions of bauxite mines, government policies, market prices and competition, many of which are beyond our control. We rely on overseas suppliers to obtain a portion of bauxite we use for production. Indonesia used to be a major source of our imported bauxite. As a result of the ban imposed by the Government of Indonesia on the exportation of unprocessed bauxite and nickel, since January 2014, we were not able to export the bauxite produced by our bauxite mines in Indonesia for the use of our alumina refineries in China, and our operation of bauxite mining in Indonesia has been suspended since September 2014. If we exhaust our stockpiles or our procurement of bauxite from Australia are interrupted for any reasons, and cannot find an alternative source of imported bauxite at competitive prices, our financial condition, results of operations and profitability could be adversely affected. |

| | |

| | In addition, our results of operations can be affected by increases in the cost of other raw materials and other key inputs such as energy. If we cannot obtain a steady supply of key raw materials at competitive prices, our financial condition and results of operations could be materially and adversely affected. |

| | |

| | Any transportation interruption or any material increase in our transportation costs could have a material and adverse effect on our business, financial condition and results of operations. |

| | |

| | Our operations require the reliable transportation of raw materials and supplies to our refining and smelting sites and finished products to our customers. Our alumina products are mainly transported by rail or trucks and our primary aluminum products are delivered to our customers primarily by rail. There is no assurance that we can always enjoy sufficient transportation capacity or we will not experience transportation interruption in the future. Furthermore, natural disasters may cause interruption to the transportation system, which could in turn affect the transportation of our products. In addition, any changes in fuel prices or fuel supply may be unpredictable and beyond our control. There is no assurance that shortage of fuel will not occur in the future. Any surge in fuel prices or shortage of fuel supply may lead to increases in our operation and transportation costs. If we are unable to make timely deliveries due to logistical and transportation disruptions, or transfer the increased costs to our customers, our production, reputation and results of operations may be adversely affected. |

| | |

| | We may not successfully develop and implement new methods and processes. |

| | |

| | A main objective of our research and development is to develop new methods and processes to improve the efficiency of our alumina refineries to increase our production yield from bauxite with low alumina-to-silica ratio. If the supply of high quality bauxite with a high alumina-to-silica ratio in China declines, our failure to develop such methods and processes and incorporate them into our production could impede our efforts to reduce unit costs and diminish our competiveness. |

| | |

| | The bauxite reserve data in this annual report are only estimates, which may prove to be inaccurate. |

| | |

| | The bauxite reserve data on which we base our production, revenue and expenditure plans are estimates that we have developed internally and may prove inaccurate. There are numerous uncertainties inherent in estimating quantities and qualities of reserves, including many factors beyond our control. If these estimates are inaccurate or the indicated tonnages are not recovered, our business, financial condition, and results of operations may be materially and adversely affected. |

| | |

| | The Securities are guaranteed by certain of our subsidiaries. A breach of any of the covenants in the indenture governing the Securities could result in a redemption of the Securities at our discretion or an increase of coupon rate if we do not redeem the Securities upon a breach of such covenants. If we default under the Securities in the future, the holders may enforce their claims against the guarantors to satisfy our obligations to them. In addition, such default may result in a default and acceleration of our senior debt and the holders of our senior debt could gain ownership of the capital stock of certain of our wholly owned subsidiaries (if such capital stock is pledged for such senior debt) and/or enforce their claims against the assets of the guarantors (if guarantee is provided for such senior debt). We conduct substantially all of our operations in China and substantially all of our assets are located in China and, if we default under our senior debt, we would lose control or ownership of our assets and operations in China and there may be few or no assets remaining with which we could conduct our business or from which the claims of our other creditors could be satisfied. |

| | |

| | The interests of our controlling shareholder who exerts significant influence over us may conflict with ours. |

| | |

| | As of December 31, 2015, our largest shareholder, Chinalco, directly owned 32.81% of our issued share capital and indirectly owned an additional 2.00% of our issued share capital through its controlled entities. The interests of Chinalco may conflict or even compete with our interests and those of our public shareholders. Chinalco may take actions that are in the interest of its subsidiaries, associates and other related entities to our detriment. For example, Chinalco may seek to influence our decision as to the amount of dividends we declare and distribute. Any increase in our dividend payout would reduce funds otherwise available for reinvestment in our businesses and thus may adversely affect our future prospects and financial condition. |

| | |

| | In addition, Chinalco and a number of its subsidiaries and associates provide a range of services to us, including engineering and construction services, social services, land and property leasing as well as the supply of raw and supplemental materials. It would be difficult to find an alternative source for some services that we receive from Chinalco. Our cost of operations may increase if Chinalco, its subsidiaries and associates are unable to continue providing such services to us. |

| | |

| | We are subject to, and incur costs to comply with, environmental laws and regulations. |

| | |

| | As we produce air emissions, discharge waste water, and handle hazardous substances at our bauxite mines, alumina refineries and aluminum smelters, we are subject to, and incur costs to comply with, environmental laws and regulations. |

| | |

| | Given the magnitude, complexity and continuous amendments to these laws and regulations, compliance therewith may be onerous or may involve substantial financial resources and other resources to establish efficient compliance and monitoring systems. The liabilities, costs, obligations and requirements associated with these laws and regulations may therefore be substantial and may delay the commencement of, or cause interruptions to, our operations. Non-compliance with the relevant laws and regulations applicable to our operations may even result in substantial penalties or fines, suspension or revocation of our relevant licenses or permits, termination of government contracts or suspension of our operations. Such events could impact our operating results, financial condition and reputation, all of which could adversely impact the Group's ability to be profitable and attract new customers. We were fined for breaches of environmental laws and regulations and there is no assurance that there will not be any further breaches in the future. |

| | |

| | In addition, the environmental laws and regulations in the PRC and other jurisdictions in which we operate continue to evolve. As a result, we may incur significant additional costs if relevant laws and regulations change or enforcement of existing laws and regulations becomes more rigorous. For instance, to comply with the requirement of desulphurization and denitration in China, we were requested to invest in upgrading or remoulding certain production facilities. Further, our overseas expansion projects are subject to foreign environmental laws and regulations. Failure to comply with environmental laws and regulations may trigger a variety of administrative, civil and criminal enforcement measures, including the assessment of monetary penalties, the imposition of remedial requirements and the issuance of orders enjoining future operations, all of which may materially and adversely affect our business operations. |

| | |

| | We face counterparty risks. |

| | |

| | While we generally sell goods and provide services to reputable customers and evaluate the customers' credit in accordance with our internal risk management criteria, such as their credit history and likelihood of default, we have limited access to information about our customers and we may encounter difficulties in the collection of receivables in certain countries that we have less experience in our dealings. Therefore, we cannot guarantee that all of our customers will fully perform their obligations under their respective contracts with us, and the deterioration of any customers' credit or payment conditions may result in those customers defaulting on their contractual obligations, which could materially and adversely affect our business, financial condition and results of operations. In addition, disputes with governmental entities and other public organizations could potentially lead to contract termination if these remain unresolved or may take a considerably longer period of time to resolve than disputes with counterparties in the private sector, and payments from these entities and organizations may be delayed as a result. |

| | |

| | We may be exposed to claims in relation to the unsatisfactory performance of third-party service providers, and disputes with business partners may also adversely affect our business. |

| | |

| | We rely on third-party service providers for certain services, including but not limited to mining infrastructure construction, logistics services or warehouse management. Therefore, we are exposed to the risk that our third-party service providers may fail to perform their obligations, which may adversely affect our business operations. In addition, from time to time, we co-operate with business partners to develop our business, including acquiring strategic mining resources or businesses that complement our own business line. Furthermore, we operate certain mining projects through joint venture arrangements and may enter into further joint ventures in the future along with the expansion of our operations. We may have disputes with these business partners or joint venture partners over various aspects, such as performance of each party's obligations, scope of each party's responsibilities, product quality and logistics services. If such disputes cannot be settled in a timely manner, our financial condition and business may be adversely affected. |

| | |

| | Failure to hire and retain management executives, technicians and other qualified personnel could adversely affect our business and prospects. |

| | |

| | The growth of our business operations depends on the continued services of our senior management team. The industry experience, expertise and contributions of our executives and other members of our senior management are essential to our continued success. We will require an increasing number of experienced and competent executives in the future to implement our growth plans. If we were to lose the services of any of our key management members and were unable to recruit and retain personnel with equivalent qualifications at any time, the management and growth of our business could be adversely affected. |

| | |

| | Competition for qualified personnel in general is intense in the PRC and other markets where we operate. We cannot guarantee that we will be able to maintain an adequate skilled labor force necessary for us to execute our projects or to perform other corporate activities, nor can we guarantee that staff costs will not increase as a result of a shortage in the supply of skilled personnel. If we fail to attract and retain personnel with suitable managerial, technical or marketing expertise or maintain an adequate labor force on a continuous basis, our business operations could be adversely affected and our future growth and expansions may be inhibited. |

| | Disposal of Aluminum Fabrication Business |

| | |

| | In line with our development strategy to focus on the upstream sectors of the aluminum industry chain and the production of high value added products, we disposed of substantially all of our aluminum fabrication operations to Chinalco pursuant to the approval of shareholders at the 2012 annual general meeting on June 27, 2013. |

| | |

| | On May 13, 2013, we submitted the tender notice to CBEX to dispose of the equity interest we held in eight aluminum fabrication enterprises, including Henan Aluminum, Chalco Southwest Aluminum, Chalco Southwest Aluminum Cold Rolling, Huaxi Aluminum, Qingdao Light Metal, Chalco Ruimin, Chalco Sapa Aluminum Products (Chongqing) Co., Ltd. and Guizhou Chalco Aluminum Co., Ltd. (collectively, "Aluminum Fabrication Interests") through open tender. Chinalco participated in and won the bid for the Aluminum Fabrication Interests on June 7, 2013. We entered into an agreement (the "Aluminum Fabrication Interests Transfer Agreement") with Chinalco on June 9, 2013 for the disposal of Aluminum Fabrication Interests for a consideration of RMB3,242.2 million. Such consideration was the initial bidding price, which was determined with reference to the appraised value of the Aluminum Fabrication Interests. Pursuant to the Aluminum Fabrication Interests Transfer Agreement, Chinalco agreed to pay the consideration in cash in two installments, namely, 30% of the consideration to be paid within five business days after the effective date of the agreement and 70% of the consideration to be paid by June 30, 2014. Chinalco must pay interest for the second installment for the period starting from the date immediately after the effective date until the payment date at the one-year lending rate set by the PBOC. The disposal was approved at the 2012 annual general meeting held on June 27, 2013 and we completed the disposal on June 27, 2013. As of the date of this annual report, Chinalco had paid the consideration in full. |

| | |

| | As a condition of the disposal of the Aluminum Fabrication Interests, on June 9, 2013, we entered into an agreement with Chinalco to transfer the outstanding entrusted loans we provided to Henan Aluminum and Qingdao Light Metal as of December 31, 2012 to Chinalco for a consideration of RMB1,756.0 million. Such consideration was determined based on negotiations between the parties, with reference to the appraised total value of the loans. Pursuant to the agreement, Chinalco agreed to pay the consideration in cash in five equal instalments of RMB351.2 million, with the last installment, together with the relevant interests at the one-year lending rate set by the PBOC, to be paid by June 30, 2017. The transfer was approved at the 2012 annual general meeting held on June 27, 2013 and we completed the transfer on June 27, 2013. As of the date of this annual report, Chinalco had paid the first three installments had been paid in accordance with the agreement. |

| | |

| | In addition, we entered into an agreement with Northwest Aluminum Fabrication Plant, a subsidiary of Chinalco, on June 6, 2013 to dispose of all the assets of Northwest Aluminum for RMB1,659.6 million. Such consideration was determined based on negotiations between the parties, with reference to the appraised net asset value of Northwest Aluminum. Pursuant to the agreement, Northwest Aluminum Fabrication Plant agreed to pay the consideration in cash in five equal instalments of RMB331.9 million, with the last installment, together with the relevant interests at the one-year lending rate set by the PBOC, to be paid by June 30, 2017. The disposal was approved at the 2012 annual general meeting held on June 27, 2013 and we completed the disposal on June 27, 2013. As of the date of this annual report, Northwest Aluminum Fabrication Plant had paid the first three installments in accordance with the agreement. |

| | |

| | Disposal of Assets of Alumina Production Line of Guizhou Branch |

| | |

| | On June 6, 2013, we entered into an agreement with Guizhou Aluminum Plant, a subsidiary of Chinalco, to dispose of the assets of alumina production line of our Guizhou branch for a consideration of RMB4,429.0 million. Such consideration was determined based on negotiations between the parties, with reference to the appraised net asset value of such alumina assets of our Guizhou branch. Pursuant to the agreement, Guizhou Aluminum Plant agreed to pay the consideration in cash in five equal instalments of RMB885.8 million, with the last installment, together with the relevant interests at the one-year lending rate set by the PBOC, to be paid by June 30, 2017. The disposal was approved at the 2012 annual general meeting held on June 27, 2013 and we completed the disposal on June 27, 2013. As of the date of this annual report, the first three installments had been paid in accordance with the agreement. |

| | |

| | We decided to dispose of the assets of alumina production line of Guizhou branch because the district in which they were located had been changed from an industrial district to a commercial district based on the local urban plan, which will significantly increase Guizhou branch's environmental compliance costs. We built a new alumina refinery in an area relatively close to major bauxite and coal mines in Guizhou Province, which commenced production with an annual capacity of 1.6 million tons of alumina in 2015. |

| | Disposal of Equity Interest in Shanxi Huaxing |

| | |

| | The proceeds from the private placement of A shares was proposed to invest in Chalco Xing County Alumina Project, the Chalco Zhongzhou Bayer Ore-dressing Process Expansion Construction Project, and the replenishment of our working capital. The Chalco Xing County Alumina Project, which was carried out by Shanxi Huaxing, commenced construction in May 2011 and undertook full operation in 2014. After the completion of private placement of A shares in June 2015, the Board resolved to replace the funds which has been invested by us in advance with the proceeds raised from the private placement of A shares. In light of our strategic blueprint for the development of Shanxi aluminum recycle industrial park, we planned to introduce strategic investors for joint investment and cooperation to develop new model of integrated coal, electricity and aluminum operations. In December 2015, the Group entered into an equity transfer agreement with Shenzhen CR Yuanda Asset Management Co., Ltd, a state-owned entity, to transfer 50% equity interests in Shanxi Huaxing, a wholly owned subsidiary, through the Shanghai United Assets and Equity Exchange at a price of RMB2,351 million. The price was determined based on the appraisal value provided by an independent qualified appraisal company. According to the Equity Transfer Agreement, 30% of the consideration amounting to RMB705 million has been received by us in December 2015, whereas the remaining amount of RMB1,646 million would be paid within one year from the effective date of the Equity Transfer Agreement and the balance is interest bearing charged at prevailing lending interest rate. |

| | |

| | Transfer of Shares of Jiaozuo Wanfang |

| | |

| | On January 22, 2015 and January 23, 2015, we decreased our shareholding in Jiaozuo Wanfang by 4,758,858 shares through the securities exchange system of the Shenzhen Stock Exchange. In March 2015, we transferred 100,000,000 shares of Jiaozuo Wanfang to Geo-Jade Petroleum Corporation by way of agreement after the public solicitation for potential transferees. On June 25, 2015, we further transferred 42,550,900 shares of Jiaozuo Wanfang by way of block trading through the securities exchange system of the Shenzhen Stock Exchange. On December 18, 21 and 22, 2015, we reduced our shareholding in Jiaozuo Wanfang by 16,695,100 shares through centralized bidding trading system of the Shenzhen Stock Exchange. From December 23 to 25, 2015, we reduced our shareholding in Jiaozuo Wanfang by 13,865,000 shares through centralized bidding trading system of the Shenzhen Stock Exchange and block trading. As a result, we held 29,582,057 shares of Jiaozuo Wanfang as of December 31, 2015, representing 2.46% of total share capital of Jiaozuo Wanfang. |

| | |

| | Disposal of Certain Assets of Guizhou Branch |

| | | |

| | Guizhou Branch entered into a land reserve acquisition cooperation agreement with the People's Government of the Baiyun District of Guiyang, Guiyang Land Reserve Center, and Guizhou Aluminum Plant on November 13, 2015. As the land of Guizhou Aluminum Plant occupied by the electrolytic aluminum plant of Guizhou Branch shall be transferred to the respective land resources and reserve authorities, Guizhou Branch agreed to sell the relevant assets, including buildings and structures located on the land occupied by the electrolytic aluminum plant of Guizhou Branch to the Guiyang Land Reserve Center for a total consideration of RMB1.95 billion. The consideration was determined based on the asset appraisal conducted by an independent asset appraisal firm. |

| | |

| | Construction Projects |

| | |

| | As of the date of this annual report, we have undertaken a number of facility expansion projects in China. See "- D. Property, Plants and Equipment - Our Expansion." |

| | |

| | Overseas Development |

| | |

| | On July 29, 2010, we entered into a joint development agreement with Rio Tinto and Rio Tinto Iron Ore Atlantic Limited, an affiliate of Rio Tinto, for the development and operation of the Simandou Project, a premium open-pit iron ore mine located in Guinea, West Africa. This agreement provides that we (via our subsidiary) would acquire 47% of the equity interest in a joint venture company to be incorporated by Rio Tinto for an earn-in payment of US$1.35 billion, and Rio Tinto would transfer its entire 95% of the equity interest in its project company for the Simandou Project, Simfer S.A., to the joint venture company. |

| | |

| | On April 22, 2011, Rio Tinto Mining & Exploration Limited, a wholly-owned subsidiary of Rio Tinto, Simfer S.A. and the Government of Guinea entered into a settlement agreement, which, amongst other things, provided that the Government of Guinea would be entitled to acquire up to 35% of the equity interest in Simfer S.A. On November 28, 2011, we, through Chalco Hong Kong, established Chalco Iron Ore under the laws of Hong Kong with the China-Africa Development Fund and three leading PRC enterprises in the steel, port building and railway construction industries to serve as an investment vehicle for investing in the Simandou Project. We, through Chalco Hong Kong, hold 65% and the other investors collectively hold 35% of the equity interest in Chalco Iron Ore. |

| | |

| | Following the approvals of the relevant PRC authorities in March and April 2012, Chalco Hong Kong contributed approximately US$878 million to Chalco Iron Ore, representing 65% of the US$1.35 billion earn-in to be paid by Chalco Iron Ore to Simfer Jersey Limited, the joint venture company incorporated by Rio Tinto under the laws of Jersey to implement the joint development agreement, as amended. On April 24, 2012, Chalco Iron Ore paid in full the total earn-in payment of US$1.35 billion to Rio Tinto and acquired its 47% equity interest in Simfer Jersey Limited. Simfer Jersey Limited currently holds 95% of the equity interest in Simfer S.A., with the remaining 5% being held by International Finance Corporation. In addition, during the period from May 2012 to the end of 2013, Chalco Iron Ore injected approximately US$561.5 million in the form of capital contribution based on its proportion of equity interest to Simfer Jersey Limited for the development and operation of the Simandou Project pursuant to the joint development agreement, as amended. Meanwhile, the other shareholder of Simfer Jersey Limited also injected the capital contribution based on its proportion of equity interest to Simfer Jersey Limited. On October 18, 2013, we entered into a share purchase agreement with Chinalco and its wholly-owned subsidiary, Aluminum Corporation of China Overseas Holdings Limited ("Chinalco Overseas Holdings"), to dispose of 65% of the equity interest in Chalco Iron Ore and transfer outstanding bank loans provided by China Development Bank Corporation ("CDB") to Chinalco Overseas Holdings for a consideration of US$2,066.5 million (the "Equity Interest") and US$438.8 million (the "Loan Consideration"), respectively. The bank loans were used for Chalco Hong Kong's capital contribution in Chalco Iron Ore. The Equity Interest was determined with reference to 65% of the valuation of Chalco Iron Ore and the Loan Consideration was determined based on the principal amount of such outstanding bank loans as shown in the financial statements of Chalco Hong Kong. |

| | |

| | We believe that such disposal will enable us to focus on the development of our core business of alumina and primary aluminum operations, where we have established leading market positions, and to reduce future capital expenditures on iron ore development and to improve asset-to-debt ratio and generate expected cash flows. Pursuant to the agreement, in the event that we obtain the consent from CDB on the transfer of the bank loans, Chinalco agreed to pay the consideration for the Equity Interest in five installments, namely, US$438.8 million (which will be net off by the Loan Consideration), US$387.9 million, US$413.3 million, US$413.3 million and US$413.3 million, with the relevant interests at the London Interbank Offered Rate plus 0.9%, with the last installment to be paid by December 31, 2017. In the event that we could not obtain the consent from CDB on the transfer of the bank loan, Chinalco agreed to pay the consideration for the Equity Interest in five equal instalments of US$413.3 million, with the relevant interests at the London Interbank Offered Rate plus 0.9%, with the last installment to be paid by December 31, 2017. The transactions were approved at the 2013 second extraordinary general meeting held on November 29, 2013. We obtained the consent from Rio Tinto relating to such disposal on December 19, 2013. We completed the transactions on December 26, 2013. As of the date of this annual report, the bank loans have been transferred to net off the first installment and Chinalco had paid the second and third installments. |

| | |

| | Private Placement of A Shares |

| | |

| | On March 8, 2012, our Board resolved to issue up to 1.25 billion A Shares in the PRC. The A Share issue plans previously proposed by our Board on June 30, 2009 and January 30, 2011 and approved by our shareholders at the extraordinary general meeting, A Share class meeting and H Share class meeting held on August 24, 2009 and on April 14, 2011, respectively, ceased. Pursuant to the new issue plan approved by our Board on March 8, 2012, we planned to issue up to 1.25 billion A Shares, with a nominal value of RMB1.00 each, by way of private placement for expected proceeds of not exceeding RMB8 billion. We intended to issue the A Shares to no more than ten specific target subscribers within six months from obtaining the approval of the CSRC. The issue price of A Shares to be offered shall be not less than 90% of the average trading price of our A Shares in twenty trading days immediately preceding the pricing determination date. We intended to apply proceeds from this private placement to finance Chalco Xing County Alumina Project, Chalco Zhongzhou Ore-dressing Bayer Process expansion construction project and to supplement working capital. The issue plan was approved by the SASAC on April 5, 2012 and by our shareholders at the extraordinary general meeting, A Share class meeting and H Share class meeting held on May 4, 2012. On August 24, 2012, our Board resolved to adjust the issue plan by proposing, among others, to increase the number of A Shares to be issued to up to 1.45 billion A Shares. The adjusted issue plan was approved by the SASAC and our shareholders at an extraordinary general meeting, A Share class meeting and the H Share class meeting on October 12, 2012 and by the CSRC on December 7, 2012. On March 14, 2013, we obtained the approval from the CSRC on our proposed private placement of A Shares under such adjusted issue plan, with effective period of six months after the approval date. However, the CSRC temporarily retrieved its approval in July 2013 due to its on-going investigation on the sponsor of our proposed private placement of A Shares. The period of authorization to the Board relating to the adjusted issue plan was extended by our shareholders at the 2013 annual general meeting, A Share class meeting held on June 27, 2014 and H Share class meeting held on June 27, 2014, with an effective period of 12 months after the approval date. On January 4, 2015, we submitted the "Report regarding the resumption of the approval of non-public offering of shares of Aluminum Corporation of China Limited" to CSRC. On April 24, 2015, we received the Approval in Relation to the Non-public Issuance of Shares by Aluminum Corporation of China Limited issued by CSRC, pursuant to which we were approved to issue no more than 1,450,000,000 new shares. We completed the non-public issuance of A shares on June 15, 2015 and issued an additional 1,379,310,344 A Shares pursuant to the specific mandate as approved at the annual general meeting of the Company on June 27, 2014. Upon completion of this non-public issuance, the total number of Shares of the Company were increased from 13,524,487,892 to 14,903,798,236. |

| | |

| | Proposed Issuance of H Shares |

| | |

| | On June 25, 2015, our shareholders at the 2014 annual general meeting passed a special resolution, which is valid until the earliest of (i) the conclusion of our next general meeting, (ii) the expiration of 12 months following the date of passage, or (iii) the date on which the authority set out in this resolution is revoked or varied by a special resolution at a general meeting. The resolution authorizes us to issue up to 20% of the total nominal value of H Shares in issue as of the resolution date. Our Board is authorized to determine the use of the proceeds. The proposed issuance is subject to all the necessary approval by the CSRC and/or other relevant PRC government authorities. |

| | Our alumina segment includes the mining and purchasing of bauxite and other raw materials, and production and sale of alumina as well as alumina-related products, such as alumina hydrate, alumina-based chemical products and gallium. Alumina accounted for approximately 91.7% of the total production volume for this segment in 2015. Alumina chemical products are used in the production of chemical, pharmaceutical, ceramic and construction materials. In the process of refining bauxite into alumina, we also produce gallium as a by-product. Gallium is a rare, high value metal with applications in the electronics and telecommunication industries. |

| | |

| | Our primary aluminum segment includes the procurement of alumina, other raw materials, supplemental materials and electricity power, the production and sale of primary aluminum and aluminum-related products, such as carbon products, aluminum alloy products and other electrolytic aluminum products. Our principal primary aluminum products are ingots, molten aluminum and aluminum alloy, which, accounted for approximately 33.5%, 42.5% and 24.0%, respectively, of our total production volume of primary aluminum in 2015. Our standard 20 kilogram remelt ingots are used for general aluminum fabrication in the construction, electricity, electronics, transportation, packaging, machinery and durable goods industries. We internally produce substantially all the carbon products used at our smelters and sell our remaining carbon products to external customers. |

| | |

| | Our trading segment is mainly engaged in the trading of alumina, primary aluminum, other non-ferrous metal products, and crude fuels such as coal products, as well as supplemental materials to our internal manufacturing plants and external customers. We established our trading business as a separate segment in July 2010 as a result of the implementation of our operational structural exercise. |

| | |

| | Our energy segment includes coal mining and power generation, including conventional coal-fire power generation and renewable energy generation such as wind power and photovoltaic power. We established our energy segment in January 2013 as a result of our acquisition of Ningxia Energy in line with our development strategy to partially offset our future energy costs and secure a portion of the coal we consume in our operations. In 2015, we supplied part of the electricity we generated for our own production use, supplied a portion of the coal output to our own electric power plant and sold the remaining portion to external customers, including power generation enterprises and cement plants. |

| | |

| | Our corporate and other operating segment mainly includes corporate and other aluminum-related research, development, and other activities of the Group. |

| | |

| | We used to be engaged in aluminum fabrication operations, where we process primary aluminum for the production and sales of various aluminum fabrication products. As approved at our 2012 annual general meeting held on June 27, 2013, we disposed of substantially all of our aluminum fabrication operations to Chinalco in line with our development strategy to focus on the upstream sectors of the aluminum industry chain and the production of high value added products. As a result, we ceased to have our aluminum fabrication business as a separate segment in June 2013. |

| | |

| | Raw Materials |

| | |

| | Alumina |

| | |

| | Bauxite is the principal raw material in alumina production. Most of the bauxite in China is Al2O3.H2O mineral. Bauxite deposits have been discovered across a broad area of central China and are especially abundant in the southern and northern parts of central China. The largest bauxite deposit in China lies in Shanxi Province. |

| | |

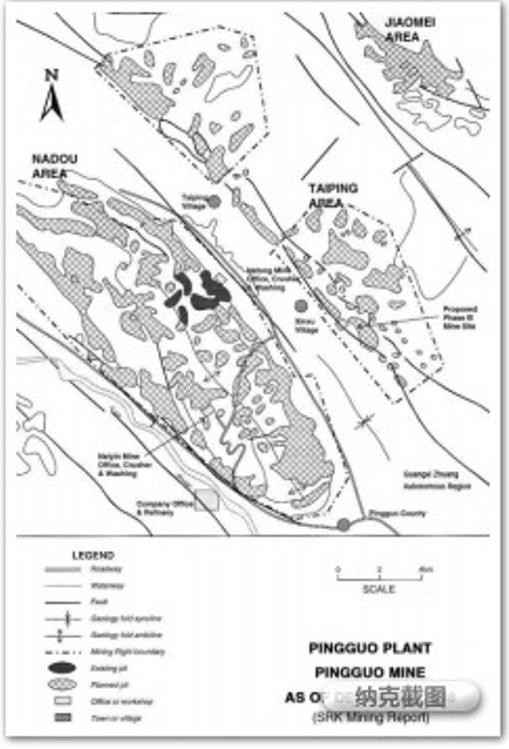

| | Rock Formation and Mineralization. The bauxite deposits of our mines in China, except those of Guangxi Pingguo mine which is an accumulation deposit due to original erosion, usually have similar stratigraphical sequences. Primary bauxite deposit, as a type of sedimentary Al2O3.H2O of Carboniferous or Permian age, is contained in clay rock, limestone or coal seams. A zonary red shale is usually located at the bottom of the bauxite and the red seam distributes over the irregular "karst-type" erosion face on the top of Ordovician limestone. Aluminum deposits in northern China are usually covered with a very thick Quaternary weathering. |

| | |

| | The thickness and quality of deposits vary with our mine locations. Quality is usually consistent in smooth sections but changes sharply in karst "billabong" terrain. The level of hardness of minerals also varies. A sequence that includes a seam of hard bauxite of fine quality in the middle and soft bauxite of inferior quality on the bottom and top seams is common in deposits. |

| | |

| | Generally, deposits are horizontal or with an obliquity of 0 to 8 degrees, but there are also steep deposits at an angle of 75 degrees, such as the Guizhou No. 2 mine. Most of the original mineralization is not influenced by folds and faults, and some fractures of a low obliquity and folds emerge in certain deposits, which is evident in the Guizhou No. 2 mine area where the underground mining method must be used due to the obliquity of its bauxite body reaching 70 degrees with the influence of folds and several meters of dislocation arising from partial faults. |

| | |

| | Economic Significance. Our bauxite deposits in China are divided into three groups. They are primarily distinguished by drill hole spacing and the composition of the deposit, which can encompass rock formations such as intercalated clays, bauxite, footwall iron clay or Ordovician limestone. Bauxite deposit groups vary in the thickness and mineral quality of its reserves. |

| | |

| | We use the Chinese bauxite deposit estimation method, which is calculated using cutoff grades and thickness to outline continuous areas within the limits defined by samples of marginal grade. We utilize actual limiting sample points that are joined to create a polygonal outline, and grades are then calculated using a length weighted arithmetic average. The Chinese program of systematic and accurate method of test boring, inspection pit, trial trench, density, tonnage analysis and calculation applied to the geological work of bauxite in China is an appropriate method to analyze these types of deposits. |

| | |

| | Supply. To support the growth of our alumina production, we continuously seek opportunities to streamline and optimize our bauxite procurement Except for Chalco Shandong, all of our refineries are located in the four provinces where over 90% of China's potentially mineable bauxite has been found. We generally source our bauxite from mines close to our refineries to control transportation costs. Historically, we have procured our bauxite supply principally from three sources: |

| | |

| | Mine | Location | Nature of ownership(1) | Mining method | Permit Renewal(1) | Present Condition/Current

State of Exploration | Bauxite Production(in thousand tonnes) |

| |

|

|

|

|

|

|

|

| | | | | | | | |

| | Pingguo mine | Guangxi Zhuang

Autonomous Region, China | 100% owned and operated by Chalco | Open pit | October 2030 -

April 2036 | Fully developed

and operational | 5,670 |

| | | | | | | | |

| | Guizhou mine(2) | Guizhou Province, China | 100% owned and operated by Chalco | Open pit/underground | September 2016 -

December 2038 | Fully developed

and operational | 1,312 |

| | | | | | | | |

| | Zunyi mine | Guizhou Province, China | 100% owned and operated by Chalco | Open pit/underground | August 2017 -

May 2021 | Two stopes are currently

under development | 306 |

| | | | | | | | |

| | Xiaoyi mine | Shanxi Province, China | 100% owned and operated by Chalco | Open pit | December 2015 -

September 2031 | Fully developed and operational | 2,376 |

| | | | | | | | |

| | Shanxi Other Mines | Shanxi Province, China | 100% owned and operated by Chalco | Open pit/underground | December 2015(3) -

July 2035 | Fully developed and

operational or under

development | 2,837 |

| | | | | | | | |

| | Mianchi mine | Henan Province, China | 100% owned and operated by Chalco | Open pit/underground | December 2015(3)-

October 2031 | Four stopes are currently

under development | 441 |

| | | | | | | | |

| | Luoyang mine | Henan Province, China | 100% owned and operated by Chalco | Open pit/underground | December 2015(3)- October 2031 | Two stopes are currently

under development | 928 |

| | | | | | | | |

| | Xiaoguan mine | Henan Province, China | 100% owned and operated by Chalco | Open pit/underground | May 2017 -

October 2031 | Fully developed and

operational | 341 |

| | Gongyi mine | Henan Province, China | 100% owned and operated by Chalco | Open pit/underground | August 2016-

April 2029 | Fully developed and

operational | 702 |

| | | | | | | | |

| | Dengfeng mine | Henan Province, China | 100% owned and operated by Chalco | Open pit/underground | June 2016 - July 2019 | Fully developed and

operational | 209 |

| | | | | | | | |

| | Xinmi mine | Henan Province, China | 100% owned and operated by Chalco | Open pit/underground | July 2017 - July 2020 | Three stopes are currently

under infrastructure

development | 11 |

| | | | | | | | |

| | Sanmenxia mine | Henan Province, China | 100% owned and operated by Chalco | Underground | April 2017 - October 2026 | Fully developed and

operational | 12 |

| | | | | | | | |

| | Xuchang mine | Henan Province, China | 100% owned and operated by Chalco | Open pit/underground | September 2015(3) -

August 2024 | Fully developed and

operational | 204 |

| | | | | | | | |

| | Jiaozuo mine | Henan Province, China | 100% owned and operated by Chalco | Open pit/underground | September 2016 -

October 2024 | Two stopes are currently

under development | 124 |

| | | | | | | | |

| | Pingdingshan mine | Henan Province, China | 100% owned and operated by Chalco | Open pit/underground | June 2015(3)-

October 2024 | Fully developed and

operational | 301 |

| | | | | | | | |

| | Ruzhou mine(4) | Henan Province, China | 100% owned and operated by Chalco | Open pit | October 2015(3) -

December 2018 | One stope is current under

development | 63.8 |

| | | | | | | | |

| | Yangquan mine | Shanxi Province, China | 100% owned and operated by Chalco | Open pit | June 2016 -

November 2035 | Suspended production | - |

| | | | | | | | |

| | Nanchuan mine | Chongqing Municipality, China | 100% owned and operated by Chalco | Underground | November 2016 -

December 2026 | Suspended production | - |

| | | | | | | | |

| | Huaxing mine(5) | Shanxi Province, China | 100% owned and operated by Chalco | Underground | August 2018 -

September 2018 | Fully developed and

operational | 2,020 |

| | | | | | | | |

| | PT ALUSENTOSA | West Kalimantan, Indonesia | Owned and operated by PT

NusapatiPrima, a 96.28%

subsidiary of Chalco | Open pit | December 2027 | Suspended production | - |

| | | | | | | | |

| | PT KALMIN | West Kalimantan, Indonesia | Owned and operated by PT

NusapatiPrima, a 96.28%

subsidiary of Chalco | Open pit | December 2027 | Suspended production | - |

| | | | | | | | |

| | PT VISITAMA | West Kalimantan, Indonesia | Owned and operated by PT

NusapatiPrima, a 96.28%

subsidiary of Chalco | Open pit | December 2015 (3) | Under exploration | - |

| | | | | | | | |

| | Laos bauxite mine | Attapeu Province and Sekong Province, Laos | Owned and operated by Laos Mineral

Services Co., Ltd., a 60%

subsidiary of Chalco | Open pit | June 2017 | Exploration completed | - |

| | | | | | | | |

| | We sell substantially all of our self-produced and outsourced primary aluminum to domestic customers. We expect China to remain our key market for primary aluminum for the foreseeable future. Customers of our primary aluminum products principally consist of aluminum fabricators and distributors that resell our primary aluminum products to aluminum fabricators or other purchasers. |

| | |

| | We establish pricing guidelines for Chalco Trading to conduct external domestic sales of our self-produced primary aluminum products, taking into account three main factors: the primary aluminum spot prices and futures price on the SHFE; spot price in the regions of eastern China and southern China; our production costs and expected profit margins; and supply and demand. We determine our sales prices of the outsourced primary aluminum through negotiations with our customers, taking into consideration factors including our procurement prices and the prevailing market conditions. The smelter filling an order from an external customer is generally responsible for negotiating the pricing and delivery terms and must comply with the market pricing guidelines. In general, we satisfy each purchase order with products from our nearest smelter to minimize transportation costs. |

| | |

| | Alumina Chemical Products and Gallium |

| | |

| | Alumina chemical products and gallium are derived from our alumina production. We adjust our production of these products based on market demand. Our alumina refineries sell our alumina chemical products directly to external customers or indirectly to external customers through Chalco Trading for subsequent external trading. |

| | |

| | We sell most of our alumina chemical products and gallium in China. Prices for our alumina chemical products and gallium are determined through negotiations with our customers, taking into consideration the market conditions. Our total sales of gallium in 2013, 2014 and 2015 amounted to approximately RMB149.8 million, RMB140.9 million and RMB27.99 million, respectively. |

| | |

| | Coal |

| | |

| | Ningxia Energy sells a portion of its self-produced coal directly to external customers through short-term contracts at prices determined through negotiations with our customers, taking into consideration factors including our procurement prices and the prevailing market conditions. Ningxia Energy consumes the rest of its self-produced coal at its own electric power plant. |

| | |

| | In addition, we also procure and sell outsourced coal under long-term agreements or on the spot market through Chalco Trading. We sold approximately 6.1 million tonnes of outsourced coal in 2015. |

| | |

| | Trading of Outsourced Non-ferrous Metal Products and Other Materials |

| | |

| | Since late 2009, we have been substantially engaged in the trading of alumina and primary aluminum sourced from third-party suppliers. Please see "- Alumina" and "- Primary Aluminum" for more details. We also sell other non-ferrous metal products such as copper, zinc and lead as well as coal products that we procure from our third-party suppliers to external customers on the spot market or under long-term sales agreements. Please see "- Coal." In 2015, we sold approximately 1.1 million tonnes of outsourced copper, zinc and lead. In addition, we also sell outsourced raw and ancillary materials in bulk to customers such as steel manufacturers and copper processing companies on the spot market. |

| | |

| | Chalco Trading has a team with trading expertise to conduct research on the markets of non-ferrous metal products and other materials. From time to time, we may enter into futures and options transactions to hedge against price fluctuations in the non-ferrous metal product market. |

| | |

| | |

| | Chalco Zhongzhou |

| | |