1934 ACT FILE NO. 001-15264 SECURITIES AND EXCHANGE COMMISSION FORM 6-K Report of Foreign Private IssuerPursuant to Rule 13a-16 or 15d-16 of For the month of March 2017 Aluminum Corporation of China Limited No. 62 North Xizhimen Street Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F X Form 40-F Indicate by check mark if the registrant is submitting the Form 6-K in papers as permitted by Regulation S-T Rule 101(b)(1): __________ Indicate by check mark if the registrant is submitting the Form 6-K in papers as permitted by Regulation S-T Rule 101(b)(7): __________ Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes No X If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- |

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Aluminum Corporation of China Limited (Registrant) | |

Date March 28, 2017 |

By /s/ Zhang Zhankui |

Certain statements contained in this announcement may be regarded as "forward-looking statements" within the meaning of the U.S. Securities Exchange Act of 1934, as amended. Such forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause the actual performance, financial condition or results of operations of the Company to be materially different from any future performance, financial condition or results of operations implied by such forward-looking statements. Further information regarding these risks, uncertainties and other factors is included in the Company's filings with the U.S. Securities and Exchange Commission. The forward-looking statements included in this announcement represent the Company's views as of the date of this announcement. While the Company anticipates that subsequent events and developments may cause the Company's views to change, the Company specifically disclaims any obligation to update these forward-looking statements, unless required by applicable laws. These forward-looking statements should not be relied upon as representing the Company's views as of any date subsequent to the date of this announcement. |

|

| 2 | Corporate Profile | |

| 6 | Corporate Information | |

| 9 | Financial Summary | |

| 15 | Directors, Supervisors, Seniors Management and Employees | |

| 32 | Particulars and Changes of Shareholding Structure, and Details of Substantial Shareholders | |

| 40 | Chairman's Statement | |

| 50 | Management's Discussion and Analysis of Financial Position and Results of Operations | |

| 59 | Report of the Board | |

| 79 | Report of the Supervisory Committee | |

| 85 | Report on Corporate Governance and Internal Control | |

| 108 | Significant Events | |

| 116 | Connected Transactions | |

| 135 | Independent Auditors' Report | |

| 142 | Consolidated Statement of Financial Position | |

| 145 | Consolidated Statement of Comprehensive Income | |

| 147 | Consolidated Statement of Changes in Equity | |

| 149 | Consolidated Statement of Cash Flows | |

| 151 | Notes to Financial Statements |

| • | its leading strategic position in the alumina and primary aluminum markets in the PRC; |

| • | its active promotion on strategic transformation and clear development strategy; |

| • | its ownership of adequate and stable supply of bauxite resources to ensure sustainable development; |

| • | its reasonable industrial chain with alumina, primary aluminum and alloy materials businesses as its core; |

| • | its excellent management team and a group of highly skilled technical expertise of a complete range; |

| • | its sustainable scientific innovation capacity and technological achievement transformation capacity; |

| • | its advanced enterprise culture and good brand image. |

| • | Henan branch (mainly engaged in producing alumina products); |

| • | Guizhou branch (mainly engaged in producing primary aluminum products); |

| • | Shanxi branch (mainly engaged in producing alumina products); |

| • | Guangxi branch (mainly engaged in producing alumina products); |

| • | Qinghai branch (mainly engaged in producing primary aluminum and alloy products); |

| • | Lanzhou branch (mainly engaged in producing primary aluminum and alloy products); |

| • | Liancheng branch (mainly engaged in producing primary aluminum and alloy products). |

| • | Shanxi Huaze Aluminum & Power Co., Ltd. ("Shanxi Huaze") (mainly engaged in producing primary aluminum and alloy products); |

| • | Shanxi Huasheng Aluminum Co., Ltd. ("Shanxi Huasheng") (mainly engaged in producing primary aluminum products); |

| • | Fushun Aluminum Co., Ltd. ("Fushun Aluminum") (mainly engaged in producing carbon products); |

| • | Zunyi Aluminum Co., Ltd. ("Zunyi Aluminum") (mainly engaged in producing primary aluminum products); |

| • | Shandong Huayu Alloy Materials Co., Ltd. ("Shandong Huayu") (mainly engaged in producing alloy products); |

| • | Baotou Aluminum Co., Ltd. ("Baotou Aluminum") (mainly engaged in producing primary aluminum and alloy products); |

| • | Chalco Mining Co., Ltd. ("Chalco Mining") (mainly engaged in mining bauxite); |

| • | Chalco Zhongzhou Mining Co., Ltd. ("Zhongzhou Mining") (mainly engaged in mining bauxite); |

| • | China Aluminum International Trading Co., Ltd. ("Chalco Trading") (mainly engaged in the trading of non-ferrous metal products); |

| • | Chalco Hong Kong Ltd. ("Chalco Hong Kong") (mainly engaged in developing overseas projects); |

| • | Chalco Zunyi Alumina Co., Ltd. ("Zunyi Alumina") (mainly engaged in producing alumina products); |

| • | Chalco Shandong Co., Ltd. ("Chalco Shandong") (mainly engaged in producing alumina products); |

| • | Chalco Zhongzhou Aluminum Co., Ltd. ("Zhongzhou Company") (中鋁中州鋁業有限公司) (mainly engaged in producing alumina products); |

| • | Chalco Zhengzhou Research Institute of Non-ferrous Metal ("Zhengzhou institute") (中國鋁業鄭州有色金屬研究院有限公司) (mainly engaged in research and development services); |

| • | Chalco Energy Co., Ltd. ("Chalco Energy") (mainly engaged in energy development); |

| • | Chalco Ningxia Energy Group Co., Ltd. ("Ningxia Energy") (mainly engaged in power generation and coal resources development); |

| • | Guizhou Huajin Aluminum Co., Ltd. ("Guizhou Huajin") (mainly engaged in producing alumina products); |

| • | China Aluminum Logistics Group Corporation Co., Ltd ("Chalco Logistics") (mainly engaged in logistics transportation); |

| • | Chinalco Shanghai Company Limited ("Chinalco Shanghai")(中鋁(上海)有限公司) (mainly engaged in trading and engineering project management); |

| • | Chinalco Shanxi Jiaokou Xinghua Technology Co., Ltd. ("Xinghua Technology") (中鋁集團山西交口興華科技股份有限公司) (mainly engaged in producing alumina products). |

| • | Guangxi Huayin Aluminum Company Limited ("Guangxi Huayin") (mainly engaged in producing alumina products); |

| • | Shanxi Huaxing Alumina Co., Ltd. ("Shanxi Huaxing") (mainly engaged in producing alumina products). |

| • | Hua Dian Ningxia Ling Wu Power Co., Ltd. ("Ling Wu Power") (華��寧夏靈武發電有限公司) (mainly engaged in thermal power generation). |

| 1. | Registered name | 中國鋁業股份有限公司 |

| Abbreviation of Chinese name | 中國鋁業 | |

| Name in English | ALUMINUM CORPORATION OF CHINA LIMITED | |

| Abbreviation of English name | CHALCO | |

| 2. | First registration date | 10 September 2001 |

| Registered address | No. 62 North Xizhimen Street, Haidian District, Beijing, the PRC (Postal code: 100082) | |

| Place of business | No. 62 North Xizhimen Street, Haidian District, Beijing, the PRC (Postal code: 100082) | |

| Principal place of business in Hong Kong | 6th Floor, Nexxus Building, 41 Connaught Road, Central,Hong Kong | |

| 3. | Legal representative | Yu Dehui |

| Company Secretary (Secretary to the Board) | Zhang Zhankui | |

| Telephone | +86(10) 8229 8322 | |

| Fax | +86(10) 8229 8158 | |

| IR@chalco.com.cn | ||

| Address | No. 62 North Xizhimen Street, Haidian District, Beijing, the PRC (Postal Code: 100082) | |

| Representative for the Company's securities related affairs | Yang Ruijun | |

| Telephone | +86(10) 8229 8322 | |

| Fax | +86(10) 8229 8158 | |

| IR@chalco.com.cn | ||

| Address | No. 62 North Xizhimen Street, Haidian District, Beijing, the PRC (Postal Code: 100082) | |

| Department for corporate information and inquiry | Office to the Board | |

| Telephone for corporate information and inquiry | +86(10) 8229 8560 | |

| 4. | Share registrar and transfer office | |

| H shares: | Hong Kong Registrars Limited 17M Floor, Hopewell Centre, 183 Queen's Road East, Wanchai, Hong Kong | |

| A shares: | China Securities Depository and Clearing Corporation Limited, Shanghai Branch 3/F, China Insurance Building, No. 166, Lujiazui Road (East), Shanghai, the PRC | |

| American Depositary Receipt: | The Bank of New York Corporate Trust Office 101 Barclay Street, New York 10286, USA | |

| 5. | Places of listing | The Stock Exchange of Hong Kong Limited |

| Shanghai Stock Exchange | ||

| New York Stock Exchange, Inc | ||

| Stock name | CHALCO | |

| Stock codes | 2600 (HK) | |

| ACH (US) | ||

| 601600 (China) | ||

| 6. | Principal bankers | China Construction Bank |

| Industrial and Commercial Bank of China | ||

| 7. | Unified social credit code for corporate legal person | 911100007109288314 |

| 8. | Independent auditors | Ernst & Young |

| Certified Public Accountants | ||

| 22/F, CITIC Tower, 1 Tim Mei Avenue, | ||

| Central, Hong Kong | ||

| Ernst & Young Hua Ming LLP | ||

| 16/F, Ernst & Young Tower, | ||

| Oriental Plaza, | ||

| 1 East Chang'an Avenue, Dongcheng District, | ||

| Beijing, the PRC | ||

| Postal code:100738 |

| 9. | Legal advisers | as to Hong Kong law and United States law: |

| Baker & McKenzie | ||

| 14/F, Hutchison House, | ||

| 10 Harcourt Road, | ||

| Central, Hong Kong | ||

| as to PRC law: | ||

| Jincheng Tongda & Neal Law Firm | ||

| 10/F, China World Trade Tower 3, | ||

| No. 1 Jianguomenwai Avenue, Chaoyang District, | ||

| Beijing, the PRC | ||

| 10. | Corporate information database | Office to the Board |

| 1. | FINANCIAL SUMMARY PREPARED IN ACCORDANCE WITH INTERNATIONAL FINANCIAL REPORTING STANDARDS |

The revenue of the Group for the year ended 31 December 2016 amounted to RMB144,066 million, representing a year-on-year increase of 16.68%. Profit attributable to the owners of the parent for the year amounted to RMB402 million, and profit per share attributable to the owners of the parent for the year amounted to RMB0.02. The following is the summary of the consolidated statements of comprehensive income for the year 2016 and year 2012 to year 2015: |

| For the year ended 31 December | ||||||||||||||||

| 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||

| RMB'000 | RMB'000 | RMB'000 | RMB'000 | RMB'000 | ||||||||||||

| (Restated | ) | (Restated | ) | (Restated | ) | (Restated | ) | |||||||||

| Continuing operations | ||||||||||||||||

| Revenue | 144,065,518 | 123,475,434 | 142,059,691 | 169,765,244 | 143,781,637 | |||||||||||

| Cost of sales | (133,508,536 | ) | (120,982,778 | ) | (141,438,233 | ) | (167,014,321 | ) | (143,752,327 | ) | ||||||

| Gross profit | 10,556,982 | 2,492,656 | 621,458 | 2,750,923 | 29,310 | |||||||||||

| Selling expenses | (2,065,453 | ) | (1,784,114 | ) | (1,766,666 | ) | (1,875,207 | ) | (1,846,981 | ) | ||||||

| Administrative expenses | (3,348,345 | ) | (2,346,565 | ) | (4,843,400 | ) | (2,958,199 | ) | (2,762,654 | ) | ||||||

| Research and development expenses | (168,862 | ) | (168,870 | ) | (293,766 | ) | (193,620 | ) | (184,683 | ) | ||||||

| Impairment loss on property, plant and equipment | (57,080 | ) | (10,011 | ) | (5,679,521 | ) | (501,159 | ) | (19,903 | ) | ||||||

| Other revenue | 745,206 | 1,771,027 | 823,986 | 805,882 | 734,852 | |||||||||||

| Other gains/(losses), net | 166,633 | 5,023,600 | 356,929 | 7,399,252 | (16,989 | ) | ||||||||||

| Finance costs, net | (4,189,037 | ) | (5,148,626 | ) | (5,686,243 | ) | (5,251,207 | ) | (4,079,152 | ) | ||||||

| Share of profits and losses of joint ventures | (95,508 | ) | 23,238 | 89,510 | 148,749 | 37,040 | ||||||||||

| Share of profits and losses of associates | 115,091 | 284,531 | 350,575 | 511,869 | 256,081 | |||||||||||

| 1. | FINANCIAL SUMMARY PREPARED IN ACCORDANCE WITH INTERNATIONAL FINANCIAL REPORTING STANDARDS (Continued) |

| The following is the summary of the consolidated statements of comprehensive income for the year 2016 and year 2012 to year 2015: (Continued) |

| For the year ended 31 December | ||||||||||||||||

| 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||

| RMB'000 | RMB'000 | RMB'000 | RMB'000 | RMB'000 | ||||||||||||

| (Restated | ) | (Restated | ) | (Restated | ) | (Restated | ) | |||||||||

| Profit/(loss) before income tax from continuing operations | 1,659,627 | 136,866 | (16,027,138 | ) | 837,283 | (7,853,079 | ) | |||||||||

| Income tax (expense)/benefit from continuing operations | (404,172 | ) | 230,147 | (1,074,910 | ) | (339,551 | ) | 371,092 | ||||||||

| Profit/(loss) for the year from continuing operations | 1,255,455 | 367,013 | (17,102,048 | ) | 497,732 | (7,481,987 | ) | |||||||||

| Discontinued operation | ||||||||||||||||

| Profit/(loss) for the year from discontinued operation | — | — | — | 207,144 | (1,187,299 | ) | ||||||||||

| Profit/(loss) for the year | 1,255,455 | 367,013 | (17,102,048 | ) | 704,876 | (8,669,286 | ) | |||||||||

| Profit/(loss) attributable to: | ||||||||||||||||

| Owners of the parent | 402,494 | 148,622 | (16,269,477 | ) | 929,288 | (8,259,457 | ) | |||||||||

| Non-controlling interests | 852,961 | 218,391 | (832,571 | ) | (224,412 | ) | (409,829 | ) | ||||||||

| Proposed final dividend for the year | — | — | — | — | — | |||||||||||

| 1. | FINANCIAL SUMMARY PREPARED IN ACCORDANCE WITH INTERNATIONAL FINANCIAL REPORTING STANDARDS (Continued) |

| The following is the summary of the consolidated total assets and total liabilities of the Group: |

| As at 31 December | ||||||||||||||||

| 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||

| RMB'000 | RMB'000 | RMB'000 | RMB'000 | RMB'000 | ||||||||||||

| (Restated | ) | (Restated | ) | (Restated | ) | (Restated | ) | |||||||||

| Total assets | 190,076,946 | 192,058,404 | 194,821,976 | 201,355,583 | 176,978,732 | |||||||||||

| Total liabilities | 134,489,457 | 140,164,878 | 153,515,916 | 146,067,341 | 122,330,802 | |||||||||||

| Net assets | 55,587,489 | 51,893,526 | 41,306,060 | 55,288,242 | 54,647,930 | |||||||||||

| 2. | FINANCIAL SUMMARY PREPARED IN ACCORDANCE WITH THE PRC ACCOUNTING STANDARDS FOR BUSINESS ENTERPRISES |

| Item | For the year ended 31 December 2016 | |||

| RMB'000 | ||||

| Operating loss | (118,132 | ) | ||

| Profit for the year | 1,255,455 | |||

| Profit attributable to owners of the parent | 402,494 | |||

| Loss attributable to owners of the parent after excluding gains or losses from non-recurring items | (363,723 | ) | ||

| Net cash flows generated from the operating activities | 11,518,674 |

| 2. | FINANCIAL SUMMARY PREPARED IN ACCORDANCE WITH THE PRC ACCOUNTING STANDARDS FOR BUSINESS ENTERPRISES (Continued) |

| Gains or losses from non-recurring items | For the year ended 31 December 2016 | |||

| RMB'000 | ||||

| Gains on disposal of non-current assets | 816,518 | |||

| Other income | 745,206 | |||

| Gain on fair value changes and disposal of financial assets and liabilities at fair value through profit or loss and gain on available-for-sale financial assets | (1,010,658 | ) | ||

| Investment income from financial products | 15,905 | |||

| Interest income from entrusted loans and other borrowings | 31,373 | |||

| Reversal of provision for impairment of receivables | 56,394 | |||

| Other non-operating income and expenses, net | 384,853 | |||

| Gains from non-recurring items before income tax | 1,039,591 | |||

| Income tax expense for gains from non-recurring items | (140,604 | ) | ||

| Gains from non-recurring items, net of income tax | 898,987 | |||

| Attributable to: | ||||

| Owners of the parent | 766,217 | |||

| Non-controlling interests | 132,770 |

| 2. | FINANCIAL SUMMARY PREPARED IN ACCORDANCE WITH THE PRC ACCOUNTING STANDARDS FOR BUSINESS ENTERPRISES (Continued) |

| Principal accounting information and financial indicators for 2016 and 2015 of the Group: |

| 2016 | 2015 | Increase/ (decrease) for the year of 2016 over 2015 | ||||||||

| RMB'000 | RMB'000 | (%) | ||||||||

| (Restated | ) | |||||||||

| Revenue | 144,065,518 | 123,475,434 | 16.68 | |||||||

| Profit before income tax | 1,659,627 | 136,866 | 1,112.59 | |||||||

| Profit attributable to owners of the parent | 402,494 | 148,622 | 170.82 | |||||||

| Loss attributable to owners of the parent after excluding gains from non-recurring items | (363,723 | ) | (6,491,927 | ) | N/A | |||||

Basic earnings per share (RMB) | 0.02 | 0.01 | 100 | |||||||

Diluted earnings per share (RMB) | 0.02 | 0.01 | 100 | |||||||

Basic earnings per share after excluding gains from non-recurring items (RMB) | (0.03 | ) | (0.46 | ) | N/A | |||||

Weighted average rate of return on net assets (%) | 1.03 | 0.43 | Increased by 0.60 percentage point | |||||||

Weighted average rate of return on net assets after excluding gains from non-recurring items (%) | (0.93 | ) | (18.69 | ) | N/A | |||||

| Net cash flows generated from operating activities | 11,518,674 | 7,297,055 | 57.85 | |||||||

Net cash flows generated from operating activities per share (RMB) | 0.77 | 0.51 | 50.98 | |||||||

| Total assets | 190,076,946 | 192,058,404 | (1.03 | ) | ||||||

| Equity attributable to owners of the parent | 38,107,649 | 39,955,892 | (4.63 | ) | ||||||

Equity attributable to owners of the parent per share (RMB) | 2.56 | 2.80 | (8.57 | ) |

| 3. | COMPARISON BETWEEN THE FINANCIAL INFORMATION PREPARED IN ACCORDANCE WITH INTERNATIONAL FINANCIAL REPORTING STANDARDS AND THE PRC ACCOUNTING STANDARDS FOR BUSINESS ENTERPRISES |

Profit attributable to owners of the parent for the year ended 31 December | Equity attributable to owners of the parent as of 31 December | ||||||||||||

| 2016 | 2015 | 2016 | 2015 | ||||||||||

| RMB'000 | RMB'000 | RMB'000 | RMB'000 | ||||||||||

| (Restated | ) | (Restated | ) | ||||||||||

| Prepared in accordance with the PRC Accounting Standards for Business Enterprises | 402,494 | 148,622 | 38,107,649 | 39,955,892 | |||||||||

| Prepared in accordance with International Financial Reporting Standards | 402,494 | 148,622 | 38,107,649 | 39,955,892 | |||||||||

| 1. | PROFILES OF DIRECTORS, SUPERVISORS, SENIOR MANAGEMENT AT PRESENT AND DURING THE REPORTING PERIOD |

| Name | Position | Gender | Age | Date of appointment/ reappointment | Total emolument paid/payable by the Company for 2016 | Whether receiving emolument or allowance from owners of the parent or other related entity | ||||||

| (Year.Month.Day) | (RMB'000) | |||||||||||

| Directors | ||||||||||||

Ge Honglin Note 1 | Chairman and Executive Director (resigned) | M | 60 | 2015.02.26 | – | Yes | ||||||

Yu Dehui Note 2 | Chairman and Non-executive Director | M | 57 | 2016.06.28 | – | Yes | ||||||

| Ao Hong | Executive Director and President | M | 55 | 2016.06.28 | – | Yes | ||||||

| Liu Caiming | Non-executive Director | M | 54 | 2016.06.28 | – | Yes | ||||||

Liu Xiangmin Note 3 | Executive Director and Senior Vice President (resigned) | M | 54 | 2013.06.27 | – | Yes | ||||||

Lu Dongliang Note 4 | Executive Director and Senior Vice President | M | 43 | 2016.06.28 | – | Yes | ||||||

| Jiang Yinggang | Executive Director and Vice President | M | 53 | 2016.06.28 | 800.9 | No | ||||||

| Wang Jun | Non-executive Director | M | 51 | 2016.06.28 | 150.0 | No | ||||||

| Chen Lijie | Independent Non-executive Director | F | 62 | 2016.06.28 | 204.4 | No | ||||||

| Hu Shihai | Independent Non-executive Director | M | 62 | 2016.06.28 | 204.4 | No | ||||||

| Lie-A-Cheong Tai Chong, David | Independent Non-executive Director | M | 57 | 2016.06.28 | 204.4 | No |

| Name | Position | Gender | Age | Date of appointment/ reappointment | Total emolument paid/payable by the Company for 2016 | Whether receiving emolument or allowance from owners of the parent or other related entity | ||||||

| (Year.Month.Day) | (RMB'000) | |||||||||||

| Supervisors | ||||||||||||

Zhao Zhao Note 5 | Chairman of Supervisory Committee (resigned) | M | 55 | 2013.06.27 | – | Yes | ||||||

Liu Xiangmin Note 3 | Chairman of Supervisory Committee | M | 54 | 2016.06.28 | – | Yes | ||||||

Yuan Li Note 6 | Supervisor (resigned) | M | 58 | 2013.06.27 | – | No | ||||||

| Wang Jun | Supervisor | M | 46 | 2016.06.28 | – | Yes | ||||||

Wu Zuoming Note 7 | Supervisor | M | 50 | 2016.06.28 | 288.3 | No | ||||||

| Senior Management | ||||||||||||

Qiao Guiling Note 8 | Vice President (resigned) | F | 48 | 2011.10.25 | 127.1 | No | ||||||

Xu Bo Note 9 | Vice President (in office) and Company Secretary (Secretary to the Board) (resigned) | M | 52 | 2013.05.09 | 800.9 | No | ||||||

Zhang Zhankui Note 10 | Chief Financial Officer and Company Secretary (Secretary to the Board) | M | 58 | 2016.03.17 | 800.9 | No | ||||||

Leng Zhengxu (冷正旭)Note 11 | Vice President | M | 56 | 2017.01.20 | – | No |

| Note 1: | Due to other work commitment, Mr. Ge Honglin resigned from the positions as Chairman and executive Director of the Company on 16 February 2016. | |

| Note 2: | Mr. Yu Dehui was elected as a non-executive Director of the fifth session of the Board of the Company at the 2016 first extraordinary general meeting held on 8 April 2016; on the same day, Mr. Yu Dehui was elected as the Chairman of the fifth session of the Board of the Company at the 31st meeting of the fifth session of the Board of the Company. On 28 June 2016, Mr. Yu Dehui was re-elected as a non-executive Director and the Chairman of the sixth session of the Board of the Company at the 2015 annual general meeting and the first meeting of the sixth session of the Board. | |

| Note 3: | Due to other work commitment, Mr. Liu Xiangmin resigned from his position as a senior vice president of the Company on 9 May 2016; due to the expiry of the fifth session of the Board of the Company, Mr. Liu Xiangmin retired from his position as an executive Director of the Company on 28 June 2016; Mr. Liu Xiangmin was elected as a Supervisor of the sixth session of the Supervisory Committee at the 2015 annual general meeting held on 28 June 2016 and was elected as the Chairman of the sixth session of the Supervisory Committee at the first meeting of the sixth session of the Supervisory Committee of the Company on the same day. | |

| Note 4: | The appointment of Mr. Lu Dongliang as the senior vice president of the Company was approved at the 33rd meeting of the fifth session of the Board held on 9 May 2016; Mr. Lu Dongliang was elected as an executive Director of the sixth session of the Board of the Company at the 2015 annual general meeting held on 28 June 2016. | |

| Note 5: | Due to the expiry of the fifth session of the Supervisory Committee of the Company, Mr. Zhao Zhao retired from his position as the Chairman of the Supervisory Committee on 28 June 2016. | |

| Note 6: | Due to other work commitment, Mr. Yuan Li ceased to be the general manager of the corporate culture department of the Company since November 2015. Therefore, Mr. Yuan did not receive any remuneration from the Company in 2016, but continued to act as an employee Supervisor. On 28 June 2016, Mr. Yuan Li retired as an employee Supervisor due to expiry of the fifth session of the Supervisory Committee of the Company. | |

| Note 7: | Mr. Wu Zuoming was elected as an employee Supervisor of the sixth session of the Supervisory Committee at the employees' representatives meeting on 28 June 2016. The remuneration received by Mr. Wu as shown in the above table was paid to him for his service as an employee Supervisor. | |

| Note 8: | Due to other work commitment, Ms. Qiao Guiling resigned from her position as a vice president of the Company on 16 February 2016. | |

| Note 9: | Due to other work commitment, Mr. Xu Bo resigned from his position as the Company Secretary (Secretary to the Board) on 17 March 2016. Mr. Xu Bo still serves as a vice president of the Company. | |

| Note 10: | The appointment of Mr. Zhang Zhankui as the Company Secretary (Secretary to the Board) was approved at the 29th meeting of the fifth session of the Board of the Company on 17 March 2016. Mr. Zhang Zhankui also serves as the Chief Financial Officer of the Company. | |

| Note 11: | The appointment of Mr. Leng Zhengxu (冷正旭) as a vice president of the Company was approved at the sixth meeting of the sixth session of the Board of the Company on 20 January 2017. Mr. Leng did not receive any remuneration as vice president of the Company in 2016. |

| 2. | DIRECTORS, SUPERVISORS AND SENIOR MANAGEMENT AS AT THE DATE OF THIS ANNUAL REPORT |

| Major Working Experience of directors ("Directors"), supervisors ("Supervisors") and Senior Management of the Company as at the Date of This Annual Report: | |

| Executive Directors | |

Mr. Ao Hong, aged 55, is currently an executive Director and the President of the Company. Mr. Ao graduated from Central South University with a doctoral degree in management science and engineering. He is a professor-grade senior engineer with over 30 years of work experience in enterprises of non-ferrous metals industry. He successively served as the deputy dean of Beijing General Research Institute for Non-ferrous Metals* (北京有色金屬研究總院) and concurrently the chairman of GRINM Semiconductor Materials Co., Ltd.* (有研半導體矽材料股份有限公司), the chairman of Guorui Electronics Co., Ltd.* (國瑞電子股份有限公司), the chairman of Guowei Silver Anticorrosive Materials Company* (國晶微電子控股公司) in Hong Kong and a deputy general manager of Aluminum Corporation of China* (中國鋁業公司). During this period, he also successively served as the chairman of the supervisory committee of the Company, chairman of the Labour Union of Aluminum Corporation of China (中國鋁業公司), the dean of Chinalco Research Institute of Science and Technology* (中鋁科學技術研究院) and the chairman of China Rare Earth Co., Ltd.* (中國稀有稀土有限公司). | |

Mr. Lu Dongliang, aged 43, is currently an executive Director and a senior vice president of the Company. Mr. Lu graduated from North China University of Technology majoring in accounting. He holds a bachelor's degree in economics and is an accountant. Mr. Lu has more than 20 years of work experience in financial management and in non-ferrous metals industry. He had subsequently served as the cadre in the audit department of China Non-ferrous Metals Industry Corporation* (中國有色金屬工業總公司), the officer-in-charge of the capital division of the finance department of China Copper Lead & Zinc Group Corporation* (中國銅鉛鋅集團公司), the head of the accounting division and the capital division of the finance department of Aluminum Corporation of China* (中國鋁業公司), the deputy manager and manager of the treasure management division of the finance department, the manager of the general management office, the deputy general manager and general manager of the finance department of the Company, the chief financial officer of Chalco Gansu Aluminum Electricity Co., Ltd.* (中國鋁業甘肅鋁電有限責任公司), the assistant to the president of the Company and the general manager of Lanzhou Branch of the Company, and the executive director and president of Chalco Gansu Aluminum Electricity Co., Ltd. |

Mr. Jiang Yinggang, aged 53, is currently an executive Director and a vice president of the Company. Graduated from Central South University of Mining and Metallurgy majoring in the metallurgy of non-ferrous metals, Mr. Jiang holds a master degree in metallurgy engineering of non-ferrous metals and is a professor-grade senior engineer. Mr. Jiang has long been engaged in production operation and corporate management of production enterprises and has extensive and professional experience. He formerly served as deputy head and then head of Corporate Management Department of Qinghai Aluminum Plant; head of Qinghai Aluminum Smelter; deputy manager and manager of Qinghai Aluminum Company Limited, and general manager of Qinghai branch of the Company. | |

| Non-executive Directors | |

Mr. Yu Dehui, aged 57, is the Chairman and a non-executive Director of the Company. Mr. Yu graduated from Ecole des Hautes Etudes en Sciences Sociales (EHESS) and School of Economics of Paris West University Nanterre La Défense, majoring in development economics, with a doctoral degree in economics, and he is a professor. Mr. Yu has extensive experience in energy, non-ferrous metals, economics and management areas. He had successively served as the deputy general manager for technology and the general manager of SPEIC* (法國斯佩克環保工程股份公司), the deputy head of department of science & technology and standards of State Bureau of Environmental Protection* (國家環境保護局), the deputy head and head of department of science & technology and standards of State Environmental Protection Administration* (國家環境保護總局). And he took temporary posts as an assistant to the chairman of the government of the Inner Mongolia Autonomous Region* (內蒙古自治區), a standing member of the Municipal Committee and a deputy mayor of Baotou City. He had also served as a vice chairman of the government of the Inner Mongolia Autonomous Region*, a member of the Communist Party Committee and a deputy general manager of China Power Investment Corporation* (中國電力投資集團公司), and a member of the Communist Party Committee and a deputy general manager of State Power Investment Corporation* (國家電力投資集團公司). Mr. Yu currently serves as the general manager, a director and the deputy secretary of the Communist Party Committee of Aluminum Corporation of China. |

Mr. Liu Caiming, aged 54, is currently a non-executive Director of the Company. He graduated from Fudan University majoring in political economics and obtained a doctoral degree in Economics. He is a senior accountant and engaged in the financial and accounting industry for more than 30 years. Mr. Liu has extensive experience in corporate management and financial management. He had subsequently served as deputy head and head of the Finance Department of China Non-ferrous Metals Foreign-Engineering Corporation* (中國有色金屬對外工程公司), deputy general manager of China Non-ferrous Metals Construction Group Limited* (中國有色金屬建設集團), deputy general manager of China Nonferrous Construction Group Limited* (中色建設集團有限公司), director and deputy general manager of China Non-ferrous Metal Industry's Foreign Engineering and Construction Co., Ltd.* (中國有色金屬建設股份有限公司), and deputy general manager of China Non-ferrous Metal Mining and Construction (Group) Co., Ltd.* (中國有色礦業建設集團有限公司). Mr. Liu has also acted as titular deputy head of Department of Finance of Yunnan Province, director of SASAC of Yunnan Province and assistant to the governor of Yunnan Province and director of SASAC of Yunnan Province. Mr. Liu also acted as deputy general manager of Aluminum Corporation of China, chairman of Yunnan Copper Industry (Group) Co., Ltd.* (雲南銅業(集團)有限公司), and president of China Copper Co., Ltd.* (中國銅業有限公司). He acted as senior vice president and chief financial officer of the Company since 23 February 2011 and an executive Director of the Company since 31 May 2011. Mr. Liu resigned as executive Director, senior vice president and chief financial officer of the Company and was re-designated as non-executive Director on 8 March 2013. He resigned as non-executive Director of the Company on 18 March 2014 and was re-appointed as the non-executive Director on 26 February 2015. Mr. Liu currently serves as the deputy general manager of Aluminum Corporation of China and a non-executive director of Aluminum Corporation of China Overseas Holdings Limited. | |

Mr. Wang Jun, aged 51, is currently a non-executive Director of the Company. Graduated from Huazhong Institute of Engineering with a degree of industrial and civil construction, and he is an engineer. He has extensive experience in financial and corporate management. Mr. Wang formerly served as the engineer in the engineering department of Babcock & Wilcox Beijing Company Ltd.; deputy manager of the real estate development department of China Yanxing Company; senior deputy manager of equity management department and senior manager of business management department, senior manager, deputy general manager, general manager of custody and settlement department in China Cinda Asset Management Co., Ltd and general manager of the equity management department of China Cinda Asset Management Co., Ltd. Mr. Wang currently serves as the business director of China Cinda Asset Management Co., Ltd. |

| Independent Non-executive Directors | |

Ms. Chen Lijie, aged 62, is currently an independent non-executive Director of the Company. Ms. Chen graduated from Renmin University of China Law School and obtained a doctoral degree in Laws. Ms. Chen Lijie has more than 30 years of experience in laws. She acted as director and deputy director of Commercial Affairs of the Office of Legislative Affairs of the State Council, deputy director of Department of Policies and Laws of the National Economic and Trade Commission, patrol officer of Bureau of Policies, Laws and Regulations of SASAC and chief legal consultant of China Mobile Communications Corporation. | |

Mr. Hu Shihai, aged 62, is currently an independent non-executive Director of the Company. Mr. Hu graduated from Shanghai Jiao Tong University majoring in thermal energy engineering. He is a professor-level senior engineer with more than 40 years of working experience in power industry. Mr. Hu has extensive experience in corporate management and technical management and successively served as the supervisor, director and deputy head of the Huaneng Shanghai Shidongkou No. 2 Power Plant (華能上海石洞口第二發電廠), deputy director of the preparatory office of the Shanghai Waigaoqiao No. 2 Power Plant (上海外高橋第二電廠籌建處), manager of the production department and assistant to the general manager of Huaneng Power International, Inc. (華能電力股份有限公司) and assistant to the general manager and director of the safety production department, and chief engineer of China Huaneng Group (中國華能集團公司). | |

Mr. LIE-A-CHEONG Tai Chong, David, aged 57, honoured with the Silver Bauhinia Star (SBS), Officier de l'Ordre National du Merite and Justice of Peace. Mr. Lie is currently an independent non-executive Director of the Company. Mr. Lie is the executive chairman of Newpower International (Holdings) Co., Ltd. and China Concept Consulting Ltd. He was selected as a member of the National Committee of the 8th, 9th, 10th and 11th Chinese People's Political Consultative Conference since 1993. From 2007 to 2013, he acted as a panel convenor cum member of the Financial Reporting Review Panel of Hong Kong Special Administrative Region ("HKSAR"). Mr. Lie is currently the honorary consul of the Hashemite Kingdom of Jordan in the HKSAR, the chairman of the Hong Kong-Taiwan Economic and Cultural Cooperation and Promotion Council, a member of the Commission on Strategic Development of the HKSAR, a standing committee member of the China Overseas Friendship Association, and a member of the Hong Kong General Chamber of Commerce (HKGCC). Currently, Mr. Lie is also an independent non-executive director of Herald Holdings Limited, a listed company in Hong Kong. |

| Supervisors | |

Mr. Liu Xiangmin, aged 54, is currently the Chairman of the Supervisory Committee of the Company. Mr. Liu graduated from Central South University, majoring in non-ferrous metallurgy; he has a doctorate degree in engineering and is a professor-grade senior engineer. Mr. Liu has long engaged in non-ferrous metal metallurgy research and corporate management and has accumulated extensive and professional experience. He had previously served as the deputy head and head of the Alumina branch of Zhongzhou Aluminum Plant, deputy head of Zhongzhou Aluminum Plant, general manager of Zhongzhou Branch of the Company as well as an executive Director, vice president and a senior vice president of the Company. | |

Mr. Wang Jun, aged 46, is currently a Supervisor of the Company. Mr. Wang obtained a master's degree in business administration from Tsinghua University. He is a senior accountant, and has extensive experience in corporate financial accounting, fund management and auditing. Mr. Wang successively served as the deputy manager and manager of treasure management division of finance department of Aluminum Corporation of China* (中國鋁業公司), the general representative of the Peru office of Aluminum Corporation of China, a director and senior auditing manager of Minera Chinalco PerúS.A.* (中鋁秘魯礦業公司), the chief financial officer and the manager of finance department of Chinalco Resources Corporation* (中鋁礦產資源有限公司), the chief financial officer of China Aluminum International Engineering Co., Ltd.* (中鋁國際工程有限責任公司), an executive director, the chief financial officer and the secretary to the board of directors of China Aluminum International Engineering Corporation Limited* (中鋁國際工程股份有限公司). Mr. Wang currently serves as the deputy chief accountant, general manager of finance department and capital operating department of Aluminum Corporation of China. He is also a director of China Aluminum International Engineering Corporation Limited and a director and the president of Aluminum Corporation of China Overseas Holdings Limited* (中鋁海外控股有限公司). | |

Mr. Wu Zuoming, aged 50, is currently a Supervisor of the Company, the deputy secretary of the Communist Party Committee, deputy general manager and the chairman of the labor union of Guangxi Branch of the Company. Mr. Wu holds an MBA degree from Renmin University of China. He is a senior engineer. Mr. Wu has extensive experience in human resource management. He successively acted as the deputy manager of Personnel Division, Human Resource Department of China Aluminum Corporation* (中國鋁業集團公司); the person in charge of the Personnel Division, Human Resource Department for the Preparatory Team of Aluminum Corporation of China* (中國鋁業公司); the deputy manager of the Personnel Division(Training Division), Human Resource Department of Aluminum Corporation of China*; the deputy manager of Assessment and Training Division, the manager of Employee Management Division and the manager of General Division of the Company; the senior manager of the Human Resource Department (Retired Cadres Department) and the manager of the General Division of Aluminum Corporation of China*; and the deputy general manager and general manager of the Human Resource Department of the Company. |

| Other Senior Management | |

Mr. Xu Bo, aged 52, is currently a vice president of the Company. Mr. Xu graduated from North China University of Water Resources and Electric Power, majoring in hydraulic structure engineering, and obtained a master's degree in engineering. He also obtained a Ph.D. degree in economics from Renmin University of China. He is a senior engineer. Mr. Xu has extensive experience in mergers and acquisitions, capital operation, corporation management, and enjoys a high reputation in energy sectors such as coal and electric power. He formerly served as deputy head of hydropower and operations department and office manager of Power and Machinery Bureau; general manager and assistant to the head of the bureau in Steel Structure Department of China Huadian Power Station Equipment Engineering Group Corporation (中國華電電站裝備工程(集團)總公司); deputy general manager of China Huadian Power Station Equipment Engineering Group Corporation, standing deputy general manager and general manager of China Huadian Engineering Co., Ltd.; deputy general manager of Huadian Coal Industry Group Company Limited; head of China Huadian Corporation Shaanxi Office; general manager of China Huadian Corporation Shaanxi Branch; executive director and general manager of Huadian Shaanxi Energy Company, the assistant to the president of the Company and executive director and general manager of Chalco Energy Co., Ltd., a vice president and Company Secretary (Secretary to the Board) of the Company. | |

Mr. Zhang Zhankui, aged 58, is currently the Chief Financial Officer and Company Secretary (Secretary to the Board) of the Company. Mr. Zhang is a postgraduate in economic management and a senior accountant. He has extensive experience in corporate financial accounting, fund management and auditing. Mr. Zhang had formerly served as deputy head, the head of the Finance Division and then the head of the Audit Division of China General Design and Research Institute for Non-ferrous metallurgy; deputy general manager of Beijing Enfei Techindustry Group; the head of the Accounting Division of the Finance Department and deputy head of the Finance Department of China Copper Lead & Zinc Group Corporation; officer-in-charge of the Company's assets and finance in the Listing Office of the Company; head of the Fund Management Division of the Finance Department of Company and manager of the General Division of the Finance Department of the Company as well as deputy head and head of the Finance Department and deputy chief accountant of Aluminum Corporation of China and a Supervisor of the Company. |

Mr. Leng Zhengxu (冷正旭), aged 56, is currently a vice president of the Company. Mr. Leng graduated from Guizhou Industrial College (貴州工學院), majoring in non-ferrous metallurgy. He is a bachelor of engineering and a professor-level senior engineer. Mr. Leng has over 30 years of working experience in the non-ferrous metals industry and has extensive experiences in corporate management and production technology. He had served as deputy director of the No.1 workshop and deputy secretary of Chinese Communist Party of No.2 Aluminum Smelter (第二電解廠) of Guizhou Aluminum Plant (貴州鋁廠), director of the No.2 workshop of No.3 Aluminum Smelter (第三電解鋁廠) of Guizhou Aluminum Plant, chief engineer of No. 1 Aluminum Smelter (第一電解鋁廠) of Guizhou Aluminum Plant, chief engineer of Guizhou Aluminum Plant, deputy general manager of Guizhou Branch of Aluminum Corporation of China, general manager of the production department and general manager of corporate management department of the Company, general manager of Shanxi Branch of Aluminum Corporation of China, head of Shanxi Aluminum Plant, executive director of Shanxi Huaxing Alumina Co., Ltd. (山西華興鋁業有限公司), general manager of Guizhou Branch of the Company, head and deputy secretary of the Chinese Communist Party of Guizhou Aluminum Plant, chairman of Guizhou Huajin Alumina Co., Ltd. (貴州華錦鋁業股份有限公司), chairman of Zunyi Aluminum Co., Ltd. (遵義鋁業股份有限公司), chairman of Chalco Zunyi Alumina Co., Ltd. (中國鋁業遵義氧化鋁有限公司) and assistant to the president of the Company. |

| 3. | POSITIONS HELD IN SHAREHOLDER ENTITIES OF THE COMPANY BY DIRECTORS, SUPERVISORS AND SENIOR MANAGEMENT AT PRESENT AND DURING THE YEAR |

| Positions in the Shareholders of the Company |

| Name | Name of Shareholder | Position(s) | Date of appointment | Whether receiving remuneration or allowance | ||||

| Ge Honglin (resigned) | Chinalco | Chairman | 2014.10.16 | Yes | ||||

| Yu Dehui | Chinalco | General Manager | 2016.01.08 | Yes | ||||

| Liu Caiming | Chinalco | Deputy General Manager | 2007.01.25 | Yes | ||||

| Wang Jun (Director) | China Cinda Asset Management Co., Ltd | Business Director | 2013.08.19 | Yes | ||||

| Zhao Zhao (resigned) | Chinalco | Head of the CPC Discipline Inspection Committee | 2008.09.10 | Yes | ||||

| Wang Jun (Supervisor) | Chinalco | Deputy Chief Accountant, Director of the Finance Department and Capital Operation Department | 2015.11.13 | Yes |

| Name | Name of other entities | Position(s) | Date of appointment | Whether receiving remuneration or allowance | ||||

| Liu Caiming | Aluminum Corporation of China Overseas Holdings Limited* (中鋁海外控股有限公司) | Non-executive Director | 2013.04.25 | No | ||||

| Wang Jun (Director) | China Nuclear Engineering Corporation Limited | Director | 2014.03.12 | No | ||||

LIE-A-CHEONG Tai-Chong, David | Newpower International (Holdings) Co., Ltd. | Executive Chairman | 1992.01.30 | Yes | ||||

| China Concept Consulting Ltd. | Executive Chairman | 1991.07.26 | Yes | |||||

| Herald Holdings Limited | Independent Director | 2005.06.16 | Yes | |||||

| Wang Jun (Supervisor) | China Aluminum International Engineering Corporation Limited* (中鋁國際工程股份有限公司) | Non-executive Director | 2015.05.22 | No | ||||

| Aluminum Corporation of China Overseas Holdings Limited* | Director and President | 2015.11.13 | No |

| 4. | DECISION MAKING PROCESS AND BASIS OF DETERMINATION OF REMUNERATION OF DIRECTORS, SUPERVISORS AND SENIOR MANAGEMENT AND REMUNERATION |

| Based on the prevailing market standards and the remuneration strategy of the Company, the human resources department of the Company would formulate proposals for the remuneration of the Company's Directors, Supervisors and senior management and submit the proposals to to the Board for consideration upon approval by the Remuneration Committee of the Board of the Company. Particularly, remuneration of the senior management will be considered and approved by the Board whereas those of the Directors and the Supervisors will be submitted to the shareholders' general meeting for consideration and approval upon being approved by the Board. | |

| The Company determined its remuneration for the Directors, Supervisors and senior management based on its development strategy, corporate culture and remuneration strategy, taking into account the remuneration standards of corresponding positions in comparable enterprises in the market (in terms of scale, industry and nature etc.), as well as the Company's annual operating results, fulfilment of duties by the Directors and Supervisors as well as the appraisal results for performance of senior management. | |

| In 2016, the total pre-tax remunerations of the Directors, Supervisors and senior management received from the Company amounted to RMB3.58 million (including the travelling expenses of the independent non-executive Directors). |

| 5. | CHANGES IN DIRECTORS, SUPERVISORS AND SENIOR MANAGEMENT AS AT THE DATE OF THIS ANNUAL REPORT |

| Name | Position | Status | Reason of change | |||

| Ge Honglin | Chairman and Executive Director | Resigned | Due to other work commitment, Mr. Ge Honglin resigned from the positions of executive Director and chairman of the Company on 16 February 2016. | |||

| Yu Dehui | Chairman and Non-executive Director | Elected | Mr. Yu Dehui was elected as a non-executive Director of the fifth session of the Board of the Company at the 2016 first extraordinary general meeting of the Company held on 8 April 2016. On the same day, Mr. Yu Dehui was elected as the chairman of the fifth session of the Board of the Company at the 31st meeting of the fifth session of the Board. Mr. Yu Dehui was re-elected as a non-executive Director and the chairman of the sixth session of the Board of the Company at the 2015 annual general meeting and the first meeting of the sixth session of the Board of the Company held on 28 June 2016. | |||

| Zhao Zhao | Chairman of the Supervisory Committee | Resigned | Mr. Zhao Zhao resigned as the chairman of the Supervisory Committee of the Company on 28 June 2016 due to the expiration of the term of office of the fifth session of the Supervisory Committee. |

| Name | Position | Status | Reason of change | |||

| Liu Xiangmin | Executive Director and Senior vice president | Resigned | Mr. Liu Xiangmin resigned from the position as the senior vice president of the Company on 9 May 2016 due to his work commitment; He resigned as an executive Director of the Company on 28 June 2016 due to the expiration of the term of office of the fifth session of the Board. | |||

| Chairman of the Supervisory Committee | Elected | Mr. Liu Xiangmin was elected as a supervisor of the sixth session of the Supervisory Committee of the Company at the 2015 annual general meeting on 28 June 2016; He was elected as the chairman of the sixth session of the Supervisory Committee of the Company at the first meeting of the sixth session of the Supervisory Committee on the same day. | ||||

| Lu Dongliang | Executive Director | Elected | Mr. Lu Dongliang was elected as an executive Director of the sixth session of the Board of the Company at the 2015 annual general meeting of the Company held on 28 June 2016. | |||

| Senior vice president | Appointed | Mr. Lu Dongliang was appointed as the senior vice president of the Company at the 33rd meeting of the fifth session of the Board of the Company held on 9 May 2016. | ||||

| Qiao Guiling | Vice president | Resigned | Due to other work commitment, Ms. Qiao Guiling resigned from the position of vice president of the Company on 16 February 2016. |

| Name | Position | Status | Reason of change | |||

| Xu Bo | Company Secretary (Secretary to the Board) | Resigned | Due to other work commitment, Mr. Xu Bo resigned from the position of the Company Secretary (Secretary to the Board) on 17 March 2016. Mr. Xu Bo still serves as a vice president of the Company. | |||

| Zhang Zhankui | Company Secretary (Secretary to the Board) | Appointed | Mr. Zhang Zhankui was appointed as the Company Secretary (Secretary to the Board) at the 29th meeting of the fifth session of the Board of the Company on 17 March 2016. Mr. Zhang Zhankui also serves as the Chief Financial Officer of the Company. | |||

| Leng Zhengxu | Vice president | Appointed | Mr. Leng Zhengxu was appointed as the vice president of the Company at the sixth meeting of the sixth session of the Board of the Company on 20 January 2017. | |||

| Yuan Li | Supervisor | Resigned | Mr. Yuan Li resigned as a supervisor of the Company on 28 June 2016 due to the expiration of the term of office of the fifth session of the Supervisory Committee of the Company. | |||

| Wu Zuoming | Supervisor | Elected | Mr. Wu Zuoming was elected as an employee representative supervisor of sixth session of the Supervisory Committee of the Company at the employee's representatives meeting held on 28 June 2016. |

| 6. | EMPLOYEES OF THE COMPANY |

| As of 31 December 2016, the Group had 65,755 employees. The structure of employees is as follows: | |

| Composition by Function |

| Category | Headcounts | |

| Production personnel | 53,373 | |

| Sales personnel | 487 | |

| Technology personnel | 3,715 | |

| Finance personnel | 1,466 | |

| Administration personnel | 6,714 | |

| Total | 65,755 |

| Category | Headcounts | |

| Post-graduates | 611 | |

| University graduates | 8,693 | |

| Technical institute graduates | 14,163 | |

| Secondary/technical school graduates or below | 42,288 | |

| Total | 65,755 |

| 1. | SHARE CAPITAL STRUCTURE |

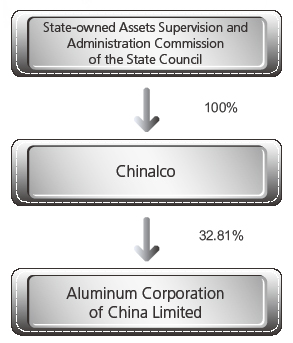

| Aluminum Corporation of China is the single largest shareholder of the Company, which directly holds 32.81% equity interest of the Company and together with its subsidiaries holds an aggregate of 35.77% equity interest of the Company. As of 31 December 2016, Aluminum Corporation of China was the Company's ultimate holding company. | |

| As of 31 December 2016, the share capital structure of the Company was as follows: |

| As of 31 December 2016 | |||

| Number of shares | Percentage to total issued share capital | ||

| (In million) | (%) | ||

| Holders of A shares | 10,959.83 | 73.54 | |

| Holders of H shares | 3,943.97 | 26.46 | |

| Total | 14,903.80 | 100 | |

| 2. | CHANGES IN SHAREHOLDING AND SHAREHOLDERS |

| In 2016, there were no changes in share capital of the Company. As of 31 December 2016, the total share capital of the Company was 14,903,798,236 shares. | |

| Particulars of Shareholding as of 31 December 2016 |

| Share | Percentage | |||

| (Number) | (%) | |||

| Shares subject to trading moratorium | 0 | 0 | ||

| Shares not subject to trading moratorium | ||||

1. Renminbi ordinary shares | 10,959,832,268 | 73.54 | ||

2. Overseas listed foreign invested shares | 3,943,965,968 | 26.46 | ||

| Total shares not subject to trading moratorium | 14,903,798,236 | 100 | ||

| Total shares | 14,903,798,236 | 100 |

| Approval of Changes in Shareholding | |

On 24 April 2015, the Company received the Approval in Relation to the Non-public Issuance of Shares by Aluminum Corporation of China Limited (Zheng Jian Xu Ke (2015) No. 684) (《關於核准中國鋁業股份有限公司非公開發行股票的批覆》) issued by the China Securities Regulatory Commission approving the non-public issuance of no more than 1,450 million new shares by the Company. On 15 June 2015, the Company completed the non-public issuance of 1,379,310,344 A shares. Target subscribers, including Truvalue Asset Management Co., Ltd.* (創金合信基金管理有限公司), SWS MU (Shanghai) Asset Management Co., Ltd.* (申萬菱信(上海)資產管理有限公司), Caitong Fund Management Co., Ltd.* (財通基金管理有限公司), Tian An Property Insurance Co., Ltd.* (天安財產保險股份有限公司), Huaxia Life Insurance Co., Ltd.* (華夏人壽保險股份��限公司), Shangyin Ruijin Capital Management Co., Ltd.* (上銀瑞金資本管理有限公司), Bosera Fund Management Co., Ltd.* (博時基金管理有限公司) and Ping An UOB Fund Management Company Ltd.* (平安大華基金管理有限公司), undertook not to transfer such shares subscribed by each of them within 12 months from the completion of the issuance. On 15 June 2016, the Company published the Announcement on the Listing and Trading of Shares Subject to Trading Moratorium Issued under Non-public Issuance by Aluminum Corporation of China Limited. Following the expiry of the period of trading moratorium for the above target subscribers, the shares were officially listed and traded on 20 June 2016. |

| Transfer of Changes in Shareholding | |

| In 2016, there was no transfer of changes in shareholding of the Company. | |

| 3. | SHARE ISSUANCE AND LISTING |

| (1) | Status of Share Issuance in the Past Three Years | |

On 24 April 2015, the Company received the Approval in Relation to the Non-public Issuance of Shares by Aluminum Corporation of China Limited (Zheng Jian Xu Ke (2015) No. 684) (《關於核准中國鋁業股份有限公司非公開發行股票的批覆》) issued by the China Securities Regulatory Commission, which approved the Company to issue not more than 1,450 million new shares through non-public issue. In May 2015, the Company initiated the non-public issuance of shares and completed setting the price through book-building on 10 May 2015 to issue 1,379,310,344 shares with issue price of RMB5.8 per share to qualified investors, raising a total proceeds of RMB7,999,999,995.20 and a net proceeds of RMB7,897,472,064.17 after deducting all relevant expenses in respect of this non-public issuance of RMB102,527,931.03. On 21 May 2015, the total proceeds were transferred to the designated account of the Company. On 15 June 2015, the Company completed relevant procedures on registration and custody for the issuance of 1,379,310,344 new shares at Shanghai Branch of China Securities Depository and Clearing Corporation Limited. | ||

| (2) | Changes in Total Number of Shares and the Shareholding Structure of the Company | |

| In 2016, there were no changes in total number of shares or the shareholding structure of the Company. |

| 4. | SUBSTANTIAL SHAREHOLDERS WITH SHAREHOLDING OF 5% OR MORE |

| So far as the Directors are aware, as of 31 December 2016, the following persons (other than the Directors, Supervisors and Chief Executive of the Company) had interests or short positions in the shares or underlying shares of the Company which would fall to be disclosed under the provisions of Divisions 2 and 3 of Part XV of the Securities and Futures Ordinance of Hong Kong ("SFO"), or which were recorded in the register required to be kept by the Company pursuant to Section 336 of the SFO, or as otherwise notified to the Company and the Hong Kong Stock Exchange. |

Name of substantial shareholder | Class of shares | Number of shares held | Capacity | Percentage in the relevant class of issued share capital | Percentage in total issued share capital | ||||||

| Aluminum Corporation of China | A shares | 5,135,382,055 (L) Note 1 | Beneficial owner and interests of controlled corporation | 46.86%(L) | 34.46%(L) | ||||||

| H shares | 196,000,000(L) Note 1 | Interests of controlled corporation | 4.97%(L) | 1.31%(L) | |||||||

| JPMorgan Chase & Co. | H shares | 960,017,020(L) | Beneficial owner, investment manager and custodian corporation/approved lending agent | 24.34%(L) | 6.44%(L) | ||||||

| 17,915,384(S) | Beneficial owner | 0.45%(S) | 0.12%(S) | ||||||||

| 855,016,761(P) | Custodian corporation/approved lending agent | 21.67%(P) | 5.74%(P) | ||||||||

| Templeton Asset Management Ltd. | H shares | 857,606,000(L) | Beneficial owner | 21.74%(L) | 5.75%(L) | ||||||

| BlackRock, Inc. | H shares | 488,313,992(L) Note 2 | Interests of controlled corporation | 12.38%(L) | 3.28%(L) | ||||||

791,425(S) Note 2 | Interests of controlled corporation | 0.02%(S) | 0.01%(S) |

Name of substantial shareholder | Class of shares | Number of shares held | Capacity | Percentage in the relevant class of issued share capital | Percentage in total issued share capital | ||||||

| The Goldman Sachs Group, Inc. | H shares | 350,541,919(L) Note 3 | Interests of controlled corporation | 8.89%(L) | 2.35%(L) | ||||||

342,714,270(S) Note 3 | Interests of controlled corporation | 8.69%(S) | 2.30%(S) | ||||||||

| BlackRock Global Funds | H shares | 238,548,000(L) | Beneficial owner | 6.05%(L) | 1.60%(L) |

| (L) | The letter (L) denotes a long position, the letter (S) denotes a short position, and the letter (P) denotes a lending pool. The information of H shareholders is based on the disclosure of interests system of the Hong Kong Stock Exchange. |

| Note 1: | These interests included 4,889,864,006 A shares directly held by Aluminum Corporation of China, and an aggregate interest of 245,518,049 A shares and 196,000,000 H shares held by various controlled subsidiaries of Aluminum Corporation of China, comprising 238,377,795 A shares held by Baotou Aluminum (Group) Co., Ltd., 7,140,254 A shares held by Shanxi Aluminum Plant and 196,000,000 H shares held by Aluminum Corporation of China Overseas Holdings Limited* (中鋁海外控股有限公司). | ||

| Note 2: | These interests were held directly by various corporations controlled by BlackRock, Inc.. Among the aggregate interests in the short position in H shares, 202,000 H shares were held as derivatives. | ||

| Note 3: | These interests were held directly by various corporations controlled by The Goldman Sachs Group, Inc.. Among the aggregate interests in the long position in H shares, 14,142,500 H shares were held as derivatives. Among the aggregate interests in the short position in H shares, 1,140,697 H shares were held as derivatives. |

| Save as disclosed above and so far as the Directors are aware, as of 31 December 2016, no other person (other than the Directors, Supervisors and Chief Executive of the Company) had any interest or short position in the shares or underlying shares of the Company (as the case may be) which would fall to be disclosed to the Company and the Hong Kong Stock Exchange under the provisions of Divisions 2 and 3 of Part XV of the SFO and as recorded in the register required to be kept under section 336 of the SFO, or was otherwise a substantial shareholder of the Company. |

| 5. | NUMBER OF SHAREHOLDERS |

| Unit: Number of Shareholders | ||

| Total number of shareholders as of 31 December 2016 | 478,870 |

| 6. | PARTICULARS OF SHAREHOLDINGS HELD BY TOP TEN SHAREHOLDERS |

| Name | Number of shares held at the end of the period | Nature of shareholders | Percentage of shareholding | |||

| (%) | ||||||

Chinalco Note1, Note2 | 4,889,864,006 | A shares | 32.81 | |||

HKSCC Nominees Limited Note3 | 3,930,070,464 | H shares | 26.37 | |||

China Securities Finance Corporation Limited | 406,481,590 | A shares | 2.73 | |||

| Baotou Aluminum (Group) Co., Ltd. | 238,377,795 | A shares | 1.60 | |||

| China Cinda Asset Management Co., Ltd. (中國信達資產管理股份有限公司) | 147,253,426 | A shares | 0.99 | |||

Huaxia Life Insurance Co., Ltd. – Universal life Insurance Product (華夏人壽保險股份有限公司-萬能保險產品) | 138,889,655 | A shares | 0.93 | |||

| Central Huijin Investment Ltd. (中央匯金資產管理有限責任公司) | 137,295,400 | A shares | 0.92 | |||

Truvalue Asset Management – China Merchants Bank – Pengde Growth No. 1 Asset Management Plan (創金合信基金-招商銀行-鵬德成長1號資產管理計劃) | 124,583,103 | A shares | 0.84 | |||

National Social Security Fund – Portfolio 109 | 76,881,679 | A shares | 0.52 | |||

National Social Security Fund – portfolio 116 | 63,470,502 | A shares | 0.43 |

| Note 1: | The number of shares held by Chinalco doesn't include the A shares of the Company indirectly held by Chinalco through its subsidiaries Baotou Aluminum (Group) Co., Ltd. and Shanxi Aluminum Plant and the H shares of the Company indirectly held by Chinalco through its subsidiary Aluminum Corporation of China Overseas Holdings Limited. Chinalco together with its subsidiaries holds 5,331,382,055 shares in the Company, accounting for 35.77% of the total share capital. | |

| Note 2: | HKSCC Nominees Limited holds the 196,000,000 overseas listed foreign shares (H shares) of the Company on behalf of Aluminum Corporation of China Overseas Holdings Limited, the subsidiary of Chinalco. | |

| Note 3: | The 3,930,070,464 overseas listed foreign shares (H shares) of the Company held by HKSCC Nominees Limited include the 196,000,000 overseas listed foreign shares (H shares) it holds on behalf of Aluminum Corporation of China Overseas Holdings Limited, the subsidiary of Chinalco, and include shares held by many H shareholders of the Company. |

| 7. | PARTICULARS OF THE CONTROLLING SHAREHOLDER |

| (1) | Particulars of the Controlling Shareholder |

| Name of the controlling shareholder: | Chinalco | |

| Legal representative: | Ge Honglin | |

| Registered capital: | RMB25.201 billion | |

| Date of incorporation: | 21 February 2001 | |

Principal operating or managing activities: | Bauxite mining (limited to the bauxite mining at Guizhou Maochang Mine of Chinalco); deployment of personnel necessary for overseas engineering projects commensurating with its capacity, scale and performance; operation and management of state-owned assets and equities; production and sales of aluminum, copper, rare earth and related non-ferrous metals mineral products, smelted products, processed products and carbon products; exploration design, general project contracting, construction and installation; equipment manufacturing; technological development and technical service; import and export businesses. |

| (2) | Diagram of the Direct Equity Interests and Controlling Relationship between the Company and the Controlling Shareholder |

| Note: | Chinalco is the largest shareholder of the Company and directly holds 32.81% equity interest in the Company and holds 5,331,382,055 shares in the Company together with its subsidiaries, including 238,377,795 A shares held by Baotou Aluminum (Group) Co., Ltd, 7,140,254 A shares held by Shanxi Aluminum Plant and 196,000,000 H shares held by Aluminum Corporation of China Overseas Holdings Limited* (中鋁海外控股有限公司). Its ratio of voting rights in the Company is 35.77%. |

| 1. | Comprehensively implementing the special action for improvement of quality and efficiency to guide the overall development of the Company. In 2016, the Company carried out an extremely extensive and ultimately downright special action for improvement of quality and efficiency featuring participation by all employees, control over the whole process, and devotion of all-dimensional efforts, whereby to intensify the responsibilities and goals of the management, the functional departments and entities under the Company, and optimize technical indicators. By seizing opportunities involving system reform in the power industry, it reduced the accounts receivable and the capital occupation of inventory, repositioned redundant personnel, and pressed ahead key projects under transformation and upgrading in an orderly manner. In 2016, the amount from the cost reduction and efficiency improvement of the Company fully covered the decrease in profit as affected by lower product price, which enable the Company to outperform the market. |

| 2. | Introducing bottom-line thinking and establishing a more efficient appraisal and incentive mechanism. The Company abandoned the traditional budget management standards and adopted the bottom-line thinking in this regard to cope with the risks regarding the product price. Based upon the principle of reasoning out the costs based on the market conditions and promoting reform with costs, the Company established the cost benchmarking system to strengthen the assessment on cost budgeting; and established a classified and stratified performance appraisal system that gave priority to the cost assessment while taking account of the profit assessment and linked the relevant results with the performance appraisal of person in charge, the remuneration distribution and the total payroll of the entities. |

| 3. | Grasping opportunities along with system reform in the power industry, reducing costs of electricity consumption. The Company applied the principle of cost reduction by comprehensive energy management. It seized the opportunities along with system reform in the power industry of the PRC, on one hand, it negotiated and communicated with power plants under direct supply contracts and grid companies externally, with a view to reduce purchase cost of electricity, on the other hand, it implemented precise management internally to reduce non-stop services, coal consumption as well as power generation costs in its ancillary power plants. In addition, certain enterprises have completed swap between linkage of aluminum and electricity and new energy. In 2016, the costs of electricity consumption decreased by approximately 16%. |

| 4. | Reinforcing the analysis and judgment on the market and optimizing the marketing strategies. The Company attached great importance to collection and analysis on new developments and tendencies in the industry. The agile response, quick decisions and flexible adaptability enabled the Company to capitalize on the marketing pace and market opportunities, devise marketing strategy aiming at stabilizing the performance of the Company. The Company continued to intensify centralized procurement, and made adjustments to the inventory of bulk raw materials, ancillary materials based on full understanding of the supply and demand in the market. In addition, it continued to cut out the intermediary suppliers and increase the percentage of direct supply which have resulted in virtuous effects of cost reduction and efficiency improvement. |

| 5. | Leveraging on the combined driving effects of investment and technologies to bring forth vitality to the development of the Company. The Company adopted the investment philosophy of "ensuring the completion and profitability of each investment project", accelerated the mine and key upgrade and renovation projects, witnessed by Duancun Leigou mine and Maochang mine ready for mining operation, completion of investment in Baotou Huayun New Materials project of RMB2.2 billion, thus enhanced its support capacity and profitability of mine supply. In 2016, a batch of scientific and technological research and development projects were put to practice, breakthroughs were made in certain key technologies including DC consumption in aluminum electrolysis of 12000kWh/t-AL and the demonstrating projects for the industrialization of new technology were successively completed and put into operation. Technological innovation and the achievements transformation provided strong support for the improvement of quality and efficiency as well as the transformation and upgrade of the Company. |

| 6. | Carrying out in-depth precise management and continuing optimization of technical indicators. In 2016, the Company successively put into use its operation and monitoring center, the command system for the production safety and emergency rescue in coal mines and power plants. Through morning scheduling meeting, it closely combined management instructions with in-process supervision, prioritized hot issues, responded to trigger points, attacked rigors, thoroughly traced and solved problems upon identification to improve its operating efficiency. The Company initiated special mines schemes to systematically follow and comprehensively clean up relevant issues by spotting 18 issues accompanied with 86 countermeasures, thus promoting cost reduction and efficiency enhancement. The Company has also achieved remarkable improvements in 19 key project indicators, completed 634 rectifications regarding "exact identification and avoiding waste" by advancing precise management involving all stages of production, as such, positive results were recorded in terms of cost reduction and efficiency enhancement. |

| 7. | Applying the "larger, efficient, stronger and dynamic" principle in an innovative manner to revitalize enterprises in difficulties. The Company broke the conventional routine and formulated the new strategy of "one policy for one plant" for enterprises in difficulties. Measures such as relocation, transformation reinvigorated the enterprises in difficulties, which paved the way for the Company to turn losses into profits. Meanwhile, aligning with the advanced labor productivity of the industry, the Company further consummated the personnel allocation and reassigned employees by different means. The reposition resulted in a substantial increase in the labor productivity of the Company, of which, the labor productivity for alumina and electrolytic aluminum, the principal businesses of the Company, increased by 56% and 20%, respectively. |

| 8. | Blazing new trail in capital operation, expanding the financing channel. Resorting to new trail of thoughts on capital operation, the Company sought cooperation with social capital by virtue of the stock assets and participated in the operation of environmental protection assets, which brought about satisfactory results. The Company innovated in the gold leasing financing mode and obtained a funding of RMB3 billion at low cost; it also registered with the Shanghai Stock Exchange for quota of the non-public issuance corporate bonds and completed the issue of its first tranche of RMB3,215 million; in addition, it capitalized on the favorable opportunities and issued overseas senior perpetual securities of USD500 million at a low interest rate; besides, it guaranteed the stable cash flow while optimized the debt structure of the Company, with the debt to asset ratio reduced by 2.22 percentage points. |

| 1. | Continuing to push ahead the comprehensive and in-depth special action for improvement of quality and efficiency. In adherence to the gist of improving quality and efficiency and the bottom-line thinking, the Company will further boost the consumption reduction and production indicator optimization of alumina and electrolytic aluminum enterprises; accelerate the construction progress of a number of key projects; advance the special actions for improving production management including the alloying of electrolytic aluminum, carbon as well as mines; carry forward the special actions on management and operation including marketing and procurement, human resources as well as risk prevention and control; and implement precise management for energy cost cutting. The Company will make full use of the leading role of the special actions for improvement of quality and efficiency and assure the fulfillment of the business objective of the Company. |

| 2. | Optimizing the incentive mechanism to gear up cost reduction and efficiency enhancement. The Company will continue to insist on the appraisal mechanism featuring "reasoning out the costs based on the market conditions, promoting reform with costs and reinforcing the in-process management". Leveraging on the constantly perfected appraisal mechanism, it aims to enable the functional departments to undertake responsibilities and share benefits together with body corporates. In the light |

| of the principle of "conciseness, straightforwardness, promptness and effectiveness", the Company will implement the incentive principle of "quarterly appraisal and quarterly reward" and will stimulate the enterprises to further reduce cost and improve efficiency. In addition, the Company will establish dynamic cost management aligning with the external market for the sake of reviewing the cost competitiveness of the Company every now and then. | |

| 3. | Strengthening the obligations in safety and environmental protection and comprehensively improving the management level regarding safety and environmental protection. The Company will foster solid concept of safety and green development, make up the deficiencies based on lessons of the past accidents in regard to safety and environmental protection, fill the leak and concentrate on deepening the safety standards and perfect the safety production system. Besides, it will carry out safety trainings involving the entire personnel with an aim to improve the safety consciousness of the personnel; consolidate the basic management so as to improve the capability of safety and environmental protection management; and intensify monitoring on safety and environmental protection and consolidate the consciousness of safety warning standards following the lead of risk identification and risk prevention and control. Furthermore, the Company will hold fast to maintain the ecological integrity by means of enhancing the sense of law and responsibility with regard to environmental protection, further control over the pollutant discharges, increasing investment in environmental protection facilities and making more efforts to carry through responsibilities, thus ensuring the occupational health and safety of the employees and providing adequate guarantee for the sustainable development of the Company. |

| 4. | Improving the capability of efficiency enhancement through marketing and creating new strengths in trading and logistics. Sticking to the market-oriented development strategy, the Company will fully capitalize on its centralized management strengths on sale, procurement and logistics, and deepen the organic integration of various business forms such as marketing, logistics, finance and e-commerce, so as to tap the potentials in the market and improve the operating capability of the Company; it will devote further efforts to develop the market of products with high added value so as to guide the industrial restructuring and transformational development of the Company; meanwhile, it will further consummate the price management system of the Company, make innovation in the management of marketing and procurement, and enhance its market influence and leading position; it will give free rein to platform and brand advantages of the Company and make new breakthrough in the international trading segment and it will further improve its competitiveness in intensive operation from the perspective of procurement management, press ahead strategic cooperation and build up new competitive advantages of the Company; in addition, the Company will speed up the integration of logistics resources, improve logistics operation mechanism and management mode, improve working efficiency, put efforts in business expansion, strengthen the capabilities for internal cost reduction and profitability. |

| 5. | Continuing to utilize the combined driving effects of investment and the technology to improve the core competitiveness of the Company. In terms of investment projects, the Company will seek a favorable pattern of "sufficient projects in operation, under construction and in pipeline". In addition, it will emphasize economic benefits for projects in operation, focus on the progress for projects under construction and highlight preparations for the projects in pipeline. The Company follow the assessment, rewards and penalty mechanism of the project principal to assure the completion of Inner Mongolia Huayun New Materials Project (內蒙古華雲新材料項目) and Relocation of Industries from City Urban Area to Industrial Parks conducted by Guizhou Light Alloy New Materials (貴州輕合金新材料退城進園項目) during the year. In terms of scientific and technological innovation, the Company will devote more efforts on the key points such as guarantee of ore resources and enhancement of ore utilization, energy conservation and environment protection, quality improvement and consumption reduction, industrial upgrade as well as the development of new products. It will adopt flexible operation mechanism for research and development projects, promote the demonstration projects of new technology industrialization and accelerate the transformation and application of the scientific and technological achievements. Furthermore, in close allusion to the integration of intelligent manufacturing and management, it will spare no effort to carry forward the construction of the integrated platform for the production and management based on the intelligent production and energy management of the enterprises and progressively deepen the application of information technology to the management, production and operation of the Company, thus providing technological support for the transformation and upgrade as well as improvement of quality and efficiency of the Company. |