- MGEE Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

MGE Energy (MGEE) DEF 14ADefinitive proxy

Filed: 29 Mar 23, 9:00am

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549

|

|

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

| ||

|

Filed by registrant: ☒ Filed by a Party other than the Registrant: ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

MGE Energy, Inc. (Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Check the appropriate box:

☒ No Fee Required

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11

|

|

Board of Directors Information |

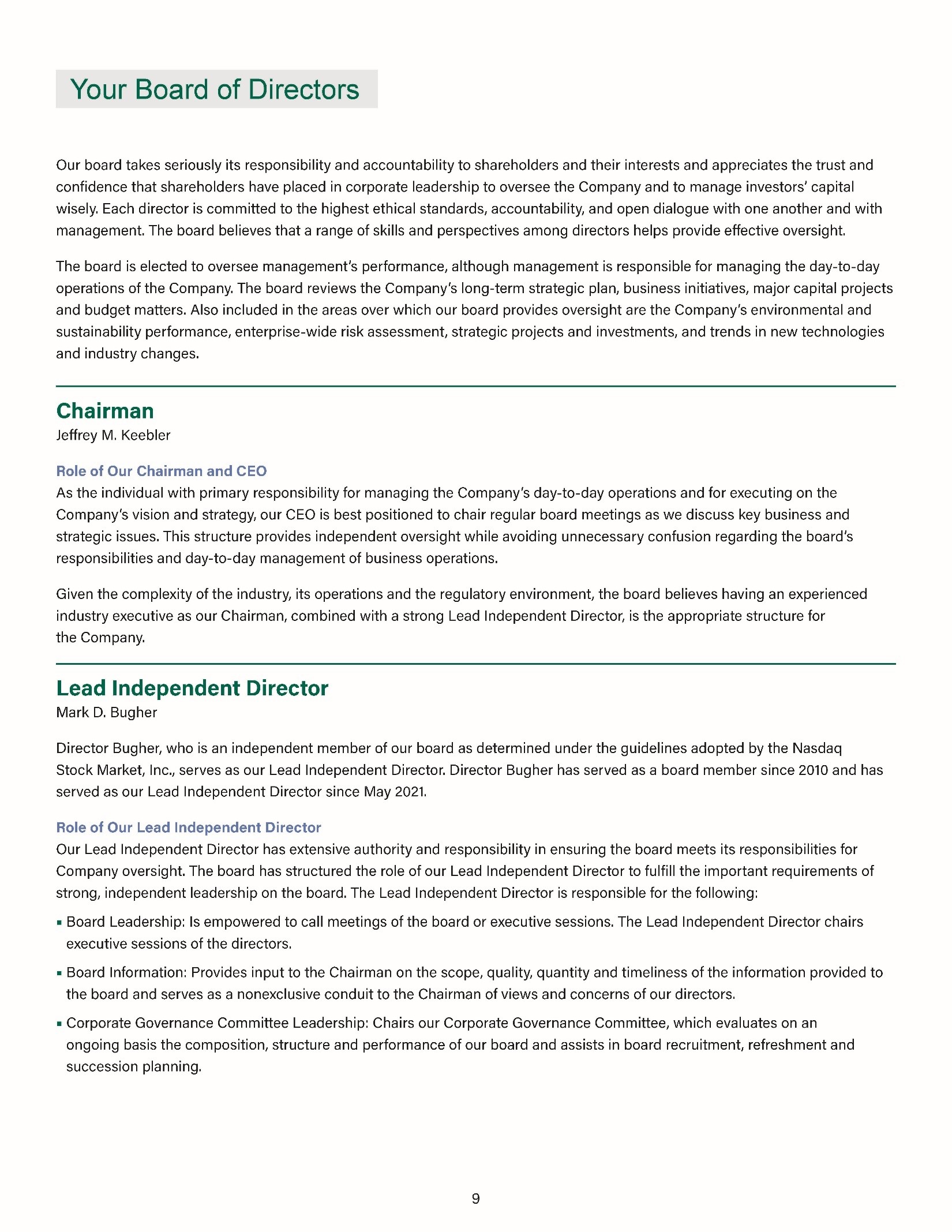

How Our Board Operates

Board meetings are typically held at the Company's corporate headquarters in Madison, Wisconsin. Board meetings are structured to provide for regular presentations by and active dialogue with MGE management. Subject matter experts from across the Company regularly present to the board on issues of strategic importance. These regular interactions provide useful information and insight relative to critical business initiatives and corporate strategy, including financial performance, environmental performance and sustainability, risk management and oversight, and corporate succession planning. In addition, the board takes advantage of external expertise as needed on key strategic topics.

The board holds strategic planning and review sessions periodically with all officers of the Company to review corporate strategy across all aspects of the Company's business and to provide directors with the opportunity to engage the entire senior management team on emerging and continuing issues of importance. The board held a strategic planning session specific to generation investments in the summer of 2022.

The topics reviewed and discussed by the board during the past year include:

Corporate Responsibility and Environmental Performance

The board takes seriously its responsibility to oversee corporate responsibility and environmental performance of the Company. Board members bring a variety of expertise to this responsibility; for example, oversight and administration related to environmental areas, education and training related to environmental matters, and experience holding managerial and/or public positions with environmental purview.

The board receives timely and relevant information on a regular basis related to the Company's sustainability initiatives and performance and ESG-related matters. The board also draws on external expertise as appropriate for education and insights on key topics relevant to its risk oversight responsibilities.

21

Carbon Reduction Goal of 80% by 2030

Reducing carbon emissions is a key component of our strategic business planning. In early 2022, MGE increased its 2030 carbon emissions goal to reduce those emissions at least 80% by 2030 (from 2005 levels). This expands on the Company's previously announced expectation to reduce carbon emissions at least 65% by 2030. The Company expects to achieve its increased 2030 carbon reduction goal due to a number of factors:

The proposal to retire Columbia more than 10 years ahead of schedule and to transition Elm Road to natural gas is subject to state regulatory and other approvals.

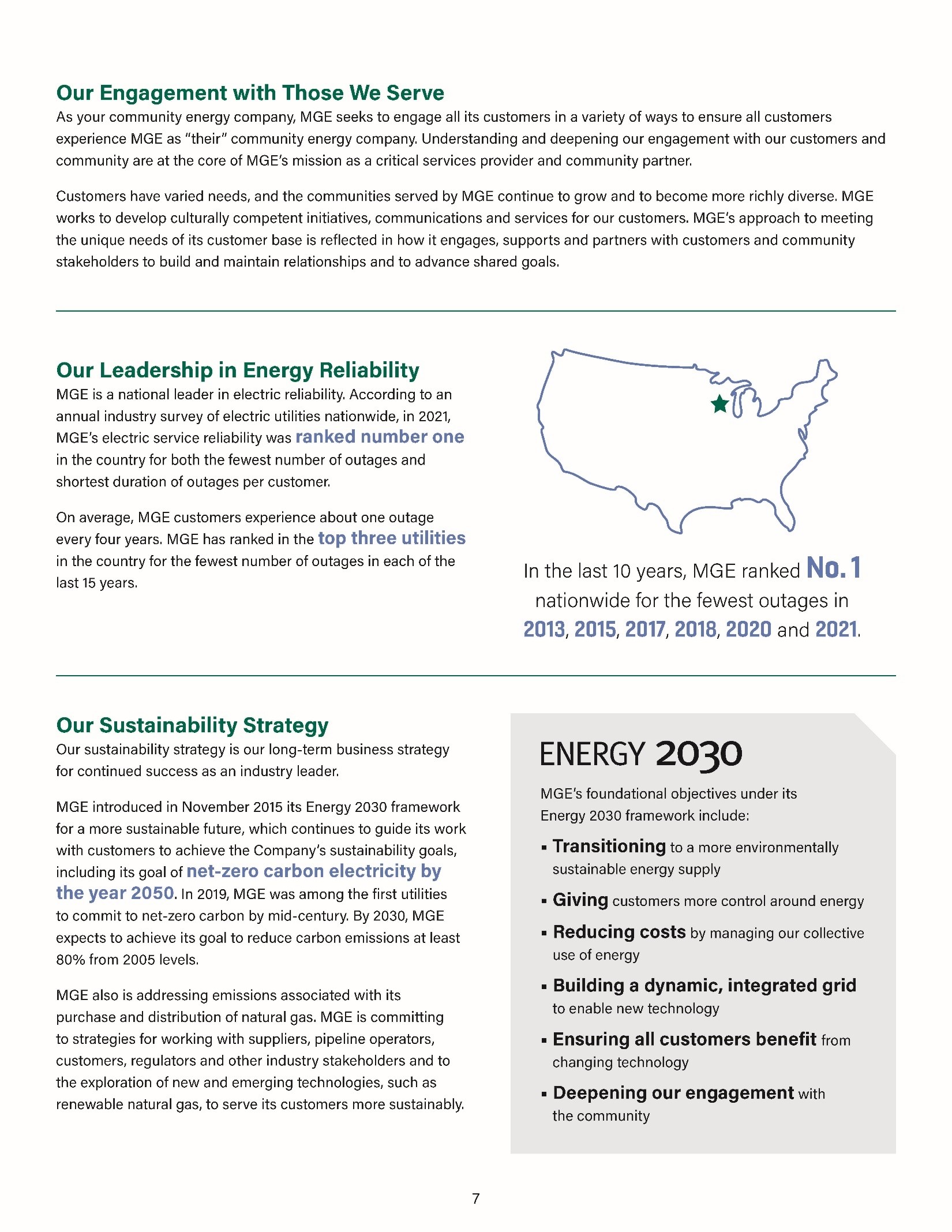

Path Toward Net-Zero Carbon Electricity

In May 2019, MGE was one of the first utilities in the nation to announce a goal of net-zero carbon electricity by 2050. The Company has said that if it can go further faster by working with its customers, it will. Achievement of the Company's net-zero goal will depend on, among other things, the timing, scope and relative costs of technological developments, customer participation in programs and partnerships, and regulatory support.

Prior to announcing its net-zero carbon by 2050 goal in 2019, MGE already had been on a path to reduce carbon emissions at least 80% by 2050, which aligns with the goals of the U.S. Mid-Century Strategy (MCS) for Deep Decarbonization. The MCS is the U.S. strategy for meeting the goals of the Paris Agreement on climate change to limit global temperature increases to 2 degrees.

MGE's net-zero carbon by 2050 goal is consistent with the 1.5-degree scenario contemplated in the Intergovernmental Panel on Climate Change (IPCC) October 2018 special report and exceeds the U.S. emissions targets and the 2-degree scenario under the U.S. MCS.

In October 2018, the IPCC released a report that analyzed a 1.5-degree scenario as compared to a 2-degree scenario in the U.S. MCS. Both the IPCC report and the MCS rely on decarbonizing electric generation, using energy efficiently and electrifying other energy uses, including transportation. These are the strategies MGE is pursuing and will continue to pursue to achieve deep decarbonization. Using these strategies, MGE expects to reduce carbon emissions as quickly as the state of evolving technology allows, consistent with meeting our obligation to serve our customers. The Company has numerous initiatives to advance its goal of net-zero carbon electricity. These initiatives include:

Since introducing the Company's Energy 2030 framework in November 2015 and as of December 31, 2022, MGE has announced projects that are expected to increase the Company's owned renewable generation capacity by more than nine times when completed. The Company looks forward to additional cost-effective, clean energy investments beyond what is currently planned.

Analysis of Net-Zero Carbon Goal

In fall 2020, the University of Wisconsin-Madison's Nelson Institute for Environmental Studies released its independent analysis of MGE's goal of net-zero carbon electricity by 2050. The analysis, by Dr. Tracey Holloway at the Nelson Institute, compared the utility's goal to the modeled pathways for the electricity sector in industrialized nations to limit global warming to 1.5 degrees Celsius. Relative to publicly available model results for carbon reductions through 2050, the UW's analysis determined MGE's goal is in line with or more aggressive than these model benchmarks for climate solutions. In January 2021, Dr. Holloway presented the findings to our Board of Directors for discussion.

22

Energy 2030 Framework

MGE's Energy 2030 framework, introduced in November 2015, lays out foundational objectives and strategic direction for building customer and shareholder value in the Company's ongoing transition toward greater sustainability underway since 2005. Those objectives continue to guide the Company's long-term business strategy and help to ensure all customers benefit from the Company's clean energy transition. An industry leader, MGE also established the following clean energy goals under Energy 2030:

The Company is continuing its path to achieve a more sustainable energy supply mix using cost-effective technologies to provide customer and shareholder value. To learn more about some of MGE's projects and programs to achieve deep decarbonization, visit mgeenergy.com/environment.

As part of its ongoing assessment of corporate performance, our Board of Directors regularly reviews how well the Company is advancing its overall goals around carbon emissions reductions as well as progress on its specific strategies for deep decarbonization. Additional information related to the Company's carbon emissions reductions is available at mgeenergy.com/environment.

Natural Gas Emissions

Within the last year, the Company completed an in-depth analysis and inventory of all its greenhouse gas emissions. The study included emissions associated with the Company's electric generation and distribution, purchase and distribution of natural gas, and other sources.

Throughout MGE's natural gas distribution system, MGE already has replaced and upgraded all piping made of material considered to be leak-prone. Additionally, MGE's leak inspection schedule already exceeds federal requirements.

To further address emissions associated with MGE's purchase and distribution of natural gas, the Company is building on its Energy 2030 framework. MGE is committing to strategies for working with its suppliers, pipeline operators, customers, regulators and other industry stakeholders and to the exploration of new and emerging technologies, such as renewable natural gas, to serve its customers more sustainably.

Business Operations

In addition to its Energy 2030 framework, goal of at least 80% carbon reduction by 2030 and net-zero carbon goal, the Company is committed to reducing its environmental impacts across all areas of the organization. For example, in 2022, the Company:

To learn more about the Company's environmental initiatives, please see our Corporate Responsibility and Sustainability Report and ESG Data Center at mgeenergy.com/environment.

23

Committees

Corporate Governance Committee

The Corporate Governance Committee is responsible for taking a leadership role in shaping corporate governance of the Company and in officer and director succession planning. The committee reviews and makes recommendations to the board on an ongoing basis regarding corporate governance policies and practices for the Company. The committee also reviews and makes recommendations on board and committee organization, membership, function and effectiveness.

Our board has adopted a Corporate Governance Committee Charter and Corporate Governance Guidelines, which are posted on our website at mgeenergy.com/governance, under the "Governance" caption. More information regarding our corporate governance practices can be found on our website.

The board has determined that no member of the Corporate Governance Committee has a material relationship with the Company and that every member of the committee is independent under the listing requirements of Nasdaq Stock Market, Inc., and the Company's Directors Independence Standards that are contained in its Corporate Governance Guidelines.

On January 19, 2018, our Corporate Governance Committee adopted a "Clawback Policy" on incentive compensation. That policy was updated on February 21, 2020, to include both cash-based and/or stock-based awards that contain performance requirements. See "Executive Compensation - Compensation Discussion and Analysis - Executive Summary."

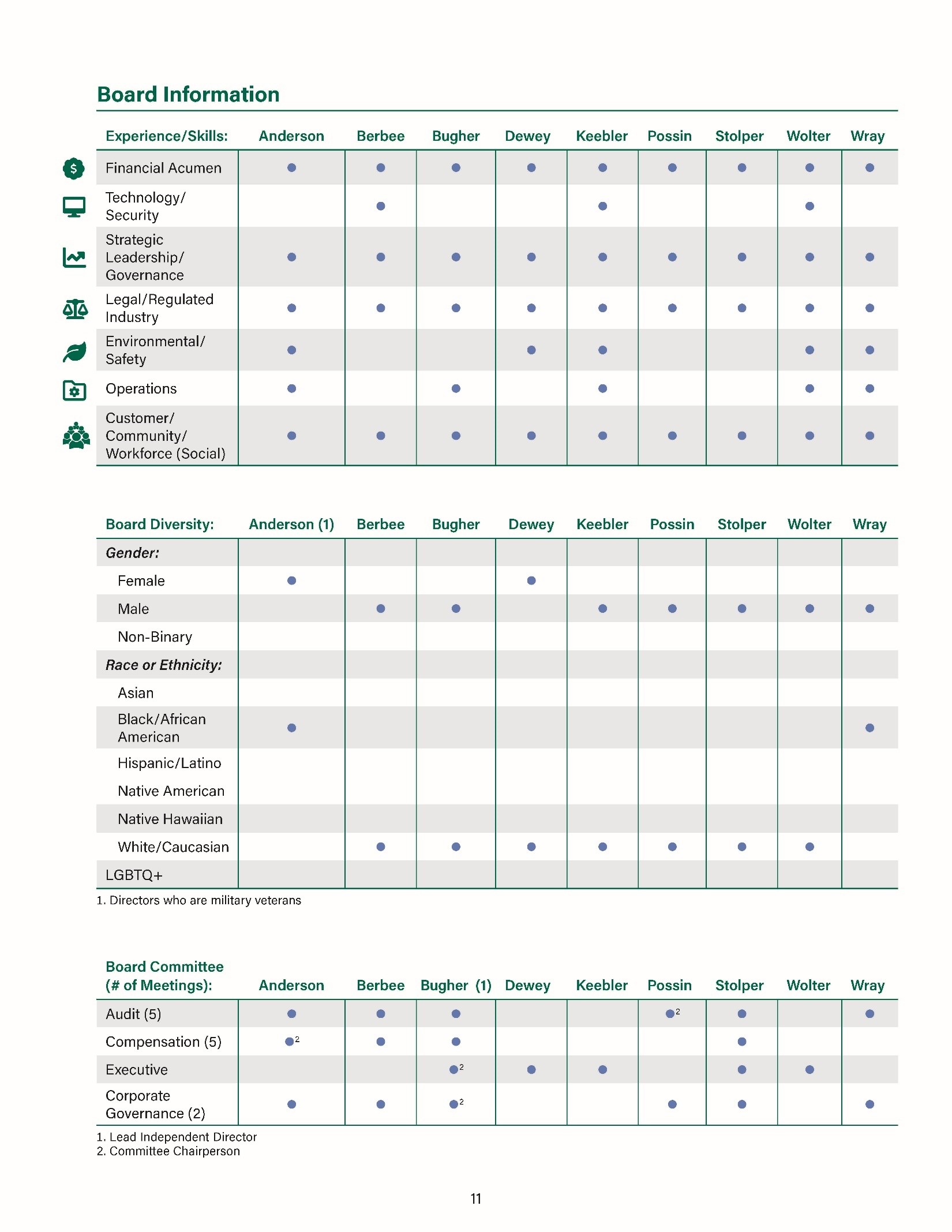

The Corporate Governance Committee also reviews candidates for our board and makes nominations of appropriate candidates for election to the board. As stated in our Corporate Governance Guidelines, the candidate review criteria include characteristics such as integrity, business experience, knowledge and independence of judgment, as well as diversity in business backgrounds in order to bring different experiences and perspectives to the board. Diversity in personal background, race, gender, age and nationality, for the board as a whole, may be taken into account in considering candidates. While screening candidates, the committee will examine potential conflicts of interest, including interlocking directorships and substantial business, civic and social relationships with other members of the board that could impair a prospective board member's ability to act independently.

Given the complexity of the industry in which we operate, the board also values experience. Under the Company's retirement guidelines for directors, employee directors may not continue to serve as a director unless requested to do so by the board; and other directors are expected to retire not later than the date and time of the Annual Meeting of Shareholders following the date on which he or she attains the age of 75, unless requested to remain by the board.

The Corporate Governance Committee also considers qualified director candidates suggested by our shareholders. Shareholders can suggest candidates by writing to MGE Energy, Inc., Attention: Corporate Secretary, Post Office Box 1231, Madison, Wisconsin 53701‑1231. Submissions should describe the candidate's background, experience and ownership of our shares and otherwise address the factors considered by the committee as described in our Corporate Governance Guidelines posted on our website at mgeenergy.com/governance, under the "Governance" caption. The Corporate Governance Committee will apply the same standards in considering candidates recommended by shareholders as it applies to other candidates. In 2023, the director nominees are currently members of our board.

Audit Committee

Our board has an Audit Committee that oversees our relationship with our internal auditors and independent registered public accounting firm and discusses with them the scope and results of their audits, accounting practices and the adequacy of our internal controls. The Audit Committee also reviews all "related party transactions" for potential conflict-of-interest situations. A related party transaction is a transaction between us and our directors, executive officers or their immediate family members who are required to be disclosed pursuant to applicable Securities and Exchange Commission (SEC) rules. See "Related Person Transactions" below. The committee has a written charter that is posted on our website at mgeenergy.com/governance, under the "Governance" caption.

The Audit Committee has established a policy to preapprove all audit and non-audit services provided by the independent registered public accounting firm. These services may include audit services, audit-related services, tax services and other services. Preapproval is generally provided for up to one year. Any preapproval is detailed as to the particular service or category of services and is subject to a specific budget. Once preapproved, the services and preapproved amounts are monitored against actual charges incurred and modified if appropriate.

24

Our board has determined that no Audit Committee member has a material relationship with the Company and every member of the committee is otherwise independent under the listing requirements of the Nasdaq Stock Market, Inc., and the Company's Directors Independence Standards set forth in our Corporate Governance Guidelines. In addition, all Audit Committee members must meet the heightened standards for independence for Audit Committee members imposed by the SEC. Under those heightened standards, a director may not serve on the Audit Committee if the director (i) has received any consulting, advisory or other compensatory fees from us (other than in his or her capacity as a director) or (ii) is affiliated with us or any of our subsidiaries. All Audit Committee members meet the heightened standards. The board has determined that all members of the Audit Committee are considered "audit committee financial experts."

Human Resources and Compensation Committee

Functions of the Human Resources and Compensation Committee (Committee) include evaluating performance; reviewing the salaries, fees and other benefits of officers and directors; and recommending compensation adjustments to the board; overseeing the design and development of new, and revisions to, compensation and benefit plans; evaluating the Company's human resource strategies around diversity, equity and inclusion, workplace environment and culture, employee engagement, talent development, retention and recruitment; assisting the board and Governance Committee with policies related to Stock Ownership Guidelines; recovering, or the "clawback" of, excess compensation based on erroneous data; and succession planning.

The board has determined that each of the members of the Committee has no material relationship with the Company and is otherwise independent under the listing requirements of the Nasdaq Stock Market, Inc., and the Company's Directors Independence Standards set forth in our Corporate Governance Guidelines.

All Committee members must meet additional independence standards. Under those standards, a director may not serve on the Committee if the director has received any consulting, advisory or other compensatory fees from the Company (other than in his or her capacity as a director). All Committee members meet these additional standards.

Committee members take into consideration performance on both short- and long-term corporate strategy, among other factors, when evaluating executive compensation. The Committee also considers performance goals that are critical to Company performance. These goals include earnings, system reliability and customer satisfaction. In addition, the board also considers numerous qualitative performance measures that are critical to our business success, including financial strength, environmental performance, cost containment, business operations, safety and efficiency, and progress on corporate initiatives and projects.

The board has adopted a Committee Charter, which is posted on our website at mgeenergy.com/governance, under the "Governance" caption. See "Executive Compensation - Compensation Discussion and Analysis - Role of the Human Resources and Compensation Committee" for further information regarding the role of the Committee in our executive compensation programs.

Executive Committee

The Executive Committee acts in lieu of the full board and between meetings of the board. The Executive Committee has the powers of the board in the management of our business and affairs, except action with respect to dividends to shareholders, election of principal officers or the filling of vacancies on the board or committees created by the board. Since our board meets 10 times a year, there has not been a need for the Executive Committee to meet or take action.

Director Independence

Our board makes an annual assessment of the independence of our directors under the independence guidelines adopted by Nasdaq Stock Market, Inc. Those guidelines are generally aimed at determining whether a director has a relationship which, in the opinion of our board, would interfere with the exercise of independent judgment in carrying out their responsibilities as a director. The guidelines identify certain relationships that are considered to affect independence, such as a current or past employment relationship with us, the receipt by the director or one of his or her family members of compensation in excess of $120,000 from us for other than board or board committee service and commercial relationships exceeding specified dollar thresholds. These guidelines also are reflected in our Corporate Governance Guidelines, which are posted on our website at mgeenergy.com/governance and can be found under the caption "Governance."

Our board has determined that Directors Anderson, Berbee, Bugher, Dewey, Possin, Stolper and Wray are independent under the Nasdaq Stock Market, Inc., definition of independence and the Company's Corporate Governance Principles, which parallel the Nasdaq Stock Market, Inc., definition. In reaching that determination, the board considered certain relationships or arrangements that are described below. In each case, the amounts involved in the transactions between us and our subsidiaries, on the one hand, and the companies with which a director or an immediate family member is associated, on the other hand, fell below the amounts identified in our Corporate Governance Principles and the Nasdaq Stock Market, Inc., requirements as being thresholds for concerns about their effect on director independence. Because we provide utility services through our subsidiary, MGE, and many of our

25

directors live in the area served by MGE, many of our directors either directly receive, or are affiliated with entities that receive, utility services from MGE. Similarly, because we and our subsidiaries are active in the community and make substantial charitable contributions in the areas we serve and many of our directors live in communities served by MGE and are active in those communities, many of our directors are affiliated with charities that receive contributions from us and our subsidiaries. In addition to those relationships and arrangements, our board also considered the information in the following two paragraphs:

Director Dewey is Chief Executive Officer of QTI Management Services, Inc., d/b/a The QTI Group, a human resources and staffing company from which we have procured temporary employment services and nonexecutive consulting services. Payments made by MGE to QTI Management Services, Inc., resulted in less than one-quarter of 1% of QTI Management Services, Inc.'s, gross annual revenue in 2022, 2021 and 2020 and were considered immaterial under the Nasdaq Stock Market, Inc.'s, independence guidelines. Our board did not, and does not, believe that such services have affected Director Dewey's independence in addressing matters before the board.

In evaluating Director Stolper's independence, our board considered the past and present employment relationships that his sister-in-law has with Stafford Rosenbaum LLP, a law firm that has provided a variety of legal services to the Company and its subsidiaries for more than 50 years. Director Stolper's sister-in-law was a partner in that law firm until her retirement in 2016. Since her retirement, Director Stolper's sister-in-law has continued to provide services to the law firm, although she received less than $10,000 for those services in 2022. Director Stolper's election as a director was based upon his accounting and business background and not the indirect relationship with the law firm. Director Stolper has not shared, and does not share, directly or indirectly in any fees received by Stafford Rosenbaum LLP from the Company. Our board did not, and does not, believe that such family relationship has affected Director Stolper's independence in addressing matters before the board.

Related Person Transactions

We have a written policy and procedure for the review, approval or ratification of any transaction with the Company or its subsidiaries involving an amount in excess of $120,000 in which any director, executive officer, nominee for director or any of their immediate family members had a material interest, as contemplated by applicable SEC regulation. Under this policy and procedure, our Audit Committee reviews the information assembled by the Director Internal Audit regarding all transactions identified pursuant to the written policy and procedure. Based upon that review, the committee approves, ratifies or rejects the identified transaction. Information gathered by our Director Internal Audit includes:

The purpose of the information is to enable our Audit Committee to perform its review and to consider whether the transaction is on terms that are at least as favorable to the Company as achievable from an unaffiliated third party or, in the case of unique or sole source procurements, whether the transaction is fair to the Company.

Anti-Pledging and Hedging Policies

On January 19, 2018, our board approved a "no pledging" policy that prohibits directors and executive officers from pledging their shares of the Company's common stock to secure indebtedness, including a prohibition against maintaining those shares in a brokerage margin account.

In 2012, our board approved a "no hedging" policy that prohibits directors and executive officers from engaging in any kind of hedging transaction that seeks to reduce or limit that person's economic risk associated with his or her ownership in shares of the Company's common stock.

Code of Ethics

Our Code of Ethics applies to our directors and all our employees, including our executive officers. A copy of our Code of Ethics is posted on our website at mgeenergy.com/governance, under the "Governance" caption.

26

Nonemployee Director Compensation

Directors who are our employees receive no additional fee for service as a director or a committee member. In 2022, nonemployee directors received compensation as shown below.

2022 Director Compensation | |||||||

Name | Fees Earned or Paid in Cash | Stock Awards | Option Awards | Non-Equity Incentive Plan Compensation | Change in Pension Value and Nonqualified Deferred Compensation Earnings | All Other Compensation | Total |

(a) | ($)(1)(2) | ($)(3) | ($) | ($) | ($) | ($) | ($) |

Marcia M. Anderson | $83,000 | $50,000 | - | - | - | - | $133,000 |

James G. Berbee | $76,500 | $50,000 | - | - | - | - | $126,500 |

Mark D. Bugher | $90,500 | $50,000 | - | - | - | - | $140,500 |

Londa J. Dewey | $78,000 | $50,000 | - | - | - | - | $128,000 |

James L. Possin | $84,500 | $50,000 | - | - | - | - | $134,500 |

Thomas R. Stolper | $78,000 | $50,000 | - | - | - | - | $128,000 |

Gary J. Wolter | $70,500 | $50,000 | - | - | - | - | $120,500 |

Noble L. Wray | $69,000 | $50,000 | - | - | - | - | $119,000 |

Cash Compensation

Meeting Attendance

The board met 10 times in 2022. Each member of the board attended more than 75% of the total number of meetings of the board and the committees on which he or she served.

Policy Regarding Annual Meeting Attendance

Our policy is to encourage our directors to attend the Annual Meeting of Shareholders. All our directors attended last year's Annual Meeting of Shareholders virtually.

27

Beneficial Ownership |

Beneficial Ownership of Common Stock

The first three columns of the following tables list the beneficial ownership of our common stock as of December 31, 2022 (except as otherwise noted), of each director and nominee, the individuals named in the Summary Compensation Table and the directors and executive officers as a group, and each shareholder known to us to be the beneficial owner of more than 5% of our outstanding common stock. Except as noted, the individuals in the table below have sole voting power and sole investment power with respect to the shares shown. The table below also includes columns showing the shares considered owned for the purposes of our common stock ownership guideline.

Name | Number of Shares Beneficially Owned |

| Percent of Class | Restricted Stock Units (1) | Total Shares Considered Owned Under Our Common Stock Ownership Guideline |

Marcia M. Anderson | 551 |

| * | 1,452 | 2,003 |

James G. Berbee | 6,575 |

| * | 1,452 | 8,027 |

Mark D. Bugher | 1,380 |

| * | 1,452 | 2,832 |

Jared J. Bushek | 413 | (2) | * | 1,798 | 2,211 |

Londa J. Dewey | 4,500 |

| * | 1,452 | 5,952 |

Lynn K. Hobbie | 8,348 | (2)(3) | * | 2,422 | 10,770 |

Tamara J. Johnson | 530 | (2) | * | 1,597 | 2,127 |

Jeffrey M. Keebler | 2,452 | (2) | * | 6,490 | 8,942 |

James L. Possin | 3,422 |

| * | 1,452 | 4,874 |

Cari Anne Renlund | 200 | (2) | * | 2,234 | 2,434 |

Thomas R. Stolper | 5,100 |

| * | 1,452 | 6,552 |

Gary J. Wolter | 19,981 | (2)(3) | * | 1,452 | 21,433 |

Noble L. Wray | 26 |

| * | 692 | 718 |

All directors and executive officers | 54,384 |

| * | 27,893 | 82,277 |

* Less than 1%.

28

Company records and information filed with the SEC indicate that the following shareholders beneficially owned more than 5% of the Company's common stock as of December 31, 2022.

Name | Number of Shares |

| Percent of Class |

The Vanguard Group, Inc. | 4,142,825 | (4) | 11.46% |

Blackrock, Inc. | 2,769,077 | (5) | 7.73% |

T. Rowe Price Investment Management, Inc. | 2,663,504 | (6) | 7.36% |

Our board believes directors and executive officers should be shareholders and have a financial stake in the Company. On February 17, 2023, our board amended the guidelines for its directors and officers intended to increase their alignment with shareholders concerning the long-term performance of our common stock. The guidelines measure that alignment through a combination of minimum stock ownership and long-term compensation awards that are directly tied to the performance of our stock. The guidelines expand upon the prior "Share Ownership Requirements" in MGE Energy's Corporate Governance Guidelines.

The guidelines vary by position. For the Chief Executive Officer, they are equal to a multiple of three times annual base salary. For Executive Presidents, Senior Vice Presidents or the Chief Financial Officer, they are equal to a multiple of 1.5 times annual base salary; and for all other Vice Presidents, they are equal to a multiple of one times base salary. For directors, they are equal to three times the annual cash retainer (excluding retainers for lead director service and board committee chair service). The guidelines provide for a transition period of five years for officers and three years for directors from adoption, or from election, in the case of new directors or executive officers, to meet the guidelines.

An officer or director can meet the ownership guidelines through the following combination of "Qualifying Shares": (i) shares of common stock owned outright, (ii) vested and unvested restricted stock and restricted stock units awarded under the 2021 LTI Plan, and (iii) notional shares in the "MGEE Deemed Investment Fund" under MGE's 2023 Deferred Compensation Supplemental Executive Retirement Plan (2023 DC SERP) and/or other Deferred Compensation Agreements. Once notional shares are allocated to the "MGEE Deemed Investment Fund," such allocation may not be reallocated again to any other Deemed Investment Fund before a participant incurs a "Separation from Service." You can reference our Stock Ownership Guidelines, which are part of the Company's Corporate Governance Guidelines, Exhibit B, on our website at mgeenergy.com/governance, under the "Governance" caption.

Delinquent Section 16(a) Reports

Section 16(a) of the Securities Exchange Act of 1934 requires our directors, executive officers and persons who own more than 10% of our common stock to file reports of ownership and changes in ownership with the SEC. Based solely on our review of copies of reports filed with the SEC and written representations from certain reporting persons, we believe that all our directors and executive officers filed all required reports during or with respect to the years ended December 31, 2021, and December 31, 2022, on a timely basis, except for one late Form 4 filing in each of 2021 and 2022 reporting the grant of restricted stock units awarded to each of our then-serving directors and executive officers under the 2021 LTI Plan. Under the 2021 LTI Plan, the restricted stock units will vest at the end of a three-year period from the date of grant. Restricted stock units that are subject only to time-based vesting requirements are treated as "derivative securities" and should have been reported on Form 4 at the time of grant. Our directors and executive officers during 2022 are identified under "Beneficial Ownership" on page 28 of this Proxy Statement and also include J. Lorenz and S. Smith.

29

PROPOSAL 2 |

Ratification of PricewaterhouseCoopers LLP as our Independent Registered Public Accounting Firm |

Our Audit Committee and our board have recommended that PricewaterhouseCoopers LLP (PwC) be retained as our independent registered public accounting firm in 2023. We are seeking ratification of that retention by our shareholders.

Representatives of PwC will be present at the Annual Meeting and will have the opportunity to make a statement if they choose to do so. They are also expected to be available to respond to appropriate questions.

Our Audit Committee approves each engagement of the independent registered public accounting firm to render any audit or non-audit services before the firm is engaged to render those services. The Chairman of the Audit Committee or other designated Audit Committee member may represent the entire Audit Committee for purposes of this approval. Any services approved by the Chairman or other designated Audit Committee member are reported to the full Audit Committee at the next scheduled Audit Committee meeting after such approval has been given. No exceptions to this approval process are allowed under the Audit Committee Charter; and thus, none of the services described in the following table were approved pursuant to Rule 2-01(c)(7)(i)(C) of Regulation S-X, which otherwise would allow de minimus amounts of services to be provided without specific approval.

The following table presents fees for professional services rendered by PwC for the years ended December 31, 2022 and 2021. (Fees include amounts related to the year indicated, which may differ from amounts billed.)

Independent Registered Public Accounting Firm Fees Disclosure | 2022 Fees | 2021 Fees |

Audit Fees (a) | $1,135,000 | $1,187,000 |

Audit-Related Fees (b) | $80,000 | $316,700 |

Tax Fees (c) | $45,700 | $37,700 |

All Other Fees (d) | $4,500 | $607,800 |

THE AUDIT COMMITTEE AND THE BOARD RECOMMEND A VOTE "FOR" THE RATIFICATION OF PRICEWATERHOUSECOOPERS LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR 2023.

30

Audit Committee Report

Our Audit Committee consists of six directors who are independent as required by the Nasdaq Stock Market, Inc., listing standards and applicable SEC rules. Pursuant to the Audit Committee's Charter, the Audit Committee assists our board in fulfilling its oversight responsibilities relating to the integrity of financial reporting and accounting practices, the system of internal controls; the independence of the external auditor, the performance of the internal and external audit processes, and the Company's process for monitoring compliance with laws and regulations. Management is responsible for the preparation of the Company's financial statements and for establishing and maintaining adequate internal financial controls.

Our independent registered public accounting firm for 2022, PwC, has been retained to audit those statements in accordance with professional auditing standards and is responsible for expressing opinions on the conformity of the Company's audited financial statements with generally accepted accounting principles and on the Company's internal control over financial reporting. The Audit Committee's responsibility is to monitor and oversee these processes. Their duties and responsibilities are set forth in more detail in the Audit Committee Charter adopted by the board. The Audit Committee Charter is available on our website at mgeenergy.com/governance, under the "Governance" caption.

As in prior years, the Audit Committee and management have engaged in a review in connection with the Audit Committee's consideration of whether to recommend that shareholders ratify the selection of PwC as the Company's independent auditor for 2023. In that review, the Audit Committee considered both the continued independence of PwC and whether retaining PwC is in the best interests of the Company and its shareholders. In addition to independence, other factors considered by the Audit Committee included:

Our Audit Committee has issued the following report:

In the course of fulfilling our responsibilities, we have:

Based on the foregoing, we have recommended to the board that the audited financial statements referred to above be included in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2022.

Marcia M. Anderson James G. Berbee Mark D. Bugher | James L. Possin (Chair) Thomas R. Stolper Noble L. Wray |

31

PROPOSAL 3 |

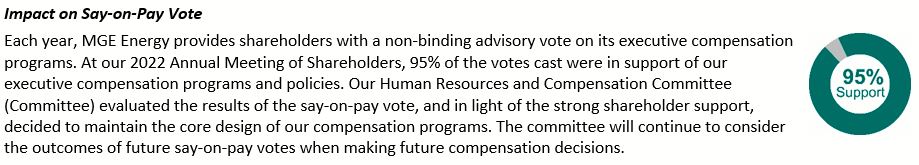

Advisory Vote on Executive Compensation |

We seek your approval of the compensation paid to our named executive officers as described under "Executive Compensation - Compensation Discussion and Analysis" and the related compensation tables in this Proxy Statement. Because your vote is advisory, it will not be binding on our board or the Company. However, our board will receive and review the voting results and take them into consideration when making future decisions regarding executive compensation.

We believe our executive compensation policies and practices are effective in tying a significant portion of pay to performance, while at the same time providing competitive compensation that attracts and retains talented personnel and aligns the interests of our executive officers with those of our shareholders.

As described under "Executive Compensation - Compensation Discussion and Analysis," of this Proxy Statement, we believe our annual executive compensation is competitive with the market, and our Human Resources and Compensation Committee (Committee) considers market data obtained from Willis Towers Watson, its independent compensation consultant, to help establish compensation levels. Our board believes it has been careful and prudent in its approach to executive compensation and has generally taken a conservative approach, taking into account the impact of such programs on our cost to customers and returns to our shareholders. Our program for 2022 was based on cash compensation and share-based awards, consisting of salary and short-term and long-term incentive compensation. Including both cash-based and share-based incentives is intended to encourage attention to, and reward participants for, the performance of our stock over a long-term period. Our Committee monitors executive compensation programs and adopts changes to reflect the dynamic marketplace in which we compete for talent as well as general economic, regulatory and legislative developments affecting executive compensation. We will continue to emphasize compensation arrangements that align the financial interests of our executives with the interests of long-term shareholders.

You have the opportunity to vote "For," "Against" or "Abstain" from voting on the following resolution relating to executive compensation:

RESOLVED, that the shareholders of MGE Energy, Inc., approve the compensation of the Company's named executive officers as disclosed pursuant to the compensation disclosure rules of the SEC, including the Compensation Discussion and Analysis, the compensation tables and related material disclosed in the Proxy Statement for the 2023 Annual Meeting of Shareholders.

THE BOARD RECOMMENDS A VOTE "FOR" ON THE ADVISORY VOTE ON EXECUTIVE COMPENSATION.

PROPOSAL 4 |

Advisory Vote on the Frequency of Future Executive Compensation Voting |

We also seek a nonbinding advisory vote from shareholders regarding how frequently the Company should include in its proxy materials a proposal seeking a nonbinding advisory vote to approve executive compensation, as set forth in Proposal 3. Shareholders are not being asked to approve or disapprove of the board's recommendation but rather to indicate their own choice from among the frequency options. This vote is advisory and, as such, is not binding on the board. However, the board will take the results of the vote into account in making a determination concerning the frequency of advisory shareholder votes on executive compensation.

The Company believes that say-on-pay votes should be conducted every year so that shareholders may annually express their views on the Company's executive compensation program. The Committee, which administers the Company's executive compensation program, values the opinions of shareholders and believes that an annual vote will be helpful in making its decisions on executive compensation.

RESOLVED, that an advisory vote of the shareholders of MGE Energy, Inc., relating to the compensation of the Company's named executive officers be held at an annual meeting of shareholders according to the frequency that receives the highest number of shareholder votes in connection with the adoption of this resolution.

THE BOARD RECOMMENDS A VOTE "FOR" THE OPTION OF ONCE EVERY YEAR AS THE FREQUENCY WITH WHICH SHAREHOLDERS ARE PROVIDED AN ADVISORY VOTE ON EXECUTIVE COMPENSATION.

32

Executive Compensation |

Compensation Discussion and Analysis

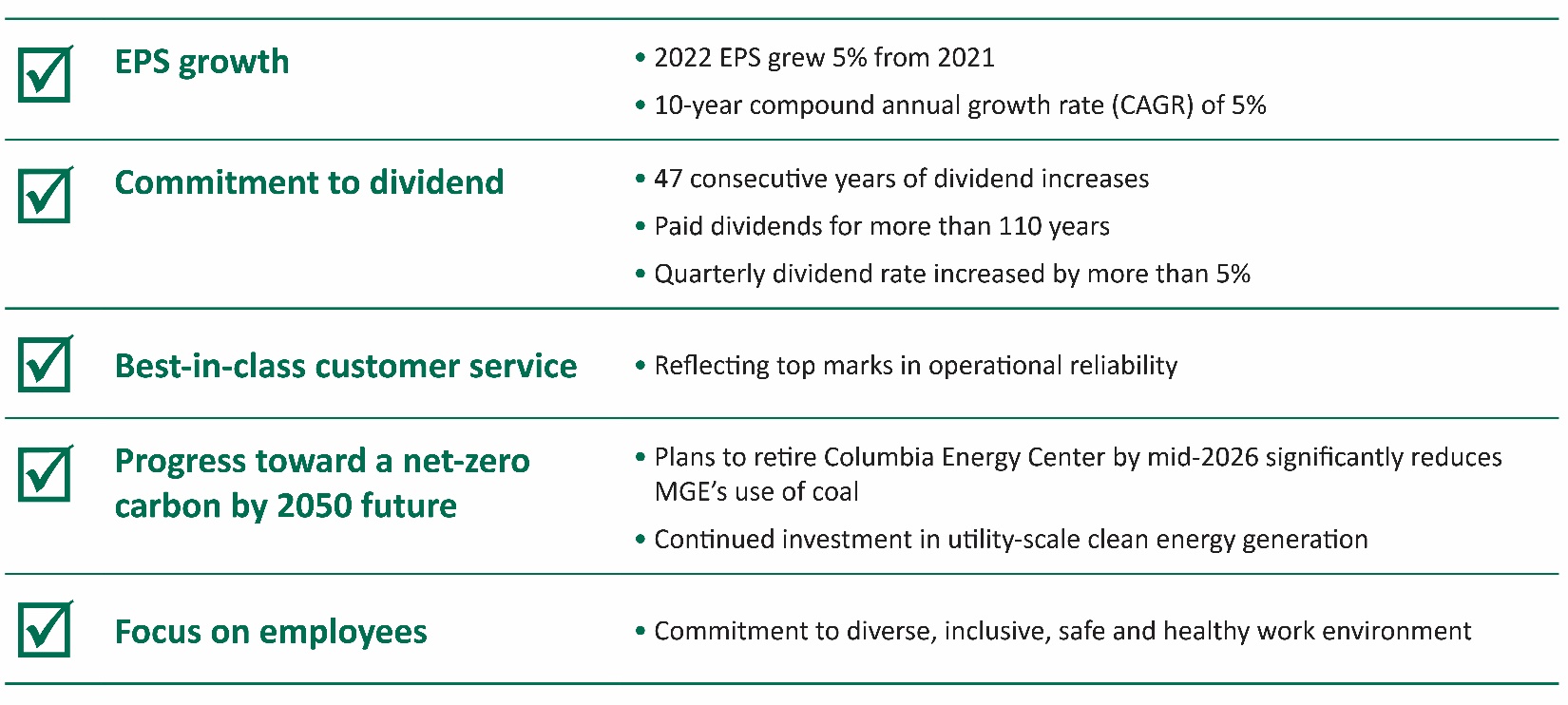

Highlights - 2022 Performance

Executive Summary

Our compensation program is designed to compensate our executives fairly based upon an assessment of compensation available in the marketplace where we compete for executive personnel and our desire to achieve a balance of short-term and long-term rewards for maintaining and improving Company performance and shareholder value. It is administered by our committee, which is composed of independent directors. They are assisted by Willis Towers Watson, who was hired by the committee as an independent compensation consultant.

Our approach to establishing executive compensation is to benchmark periodically the ranges of executive compensation and then to set overall compensation within a competitive market range. Market-based salary ranges are examined for each position, and an executive's positioning within that range is determined by that individual's experience in their position as well as the committee's evaluation of that individual's performance during the year. Our overall executive compensation for 2022 included:

Due to their structure, awards under our legacy 2006 Performance Unit Plan and 2020 Performance Unit Plan are shown according to applicable guidelines as stock-based incentives in the various compensation tables that follow; however, no stock is issuable or

33

issued under these cash-based long-term incentive arrangements. Prior to shareholder approval of our 2021 LTI Plan in May 2020, we did not have a plan allowing the issuance of stock.

Our compensation program is designed to link a significant portion of the compensation of our named executive officers to defined performance standards that promote a balance of the drive for near-term earnings and returns with growth in long-term shareholder value.

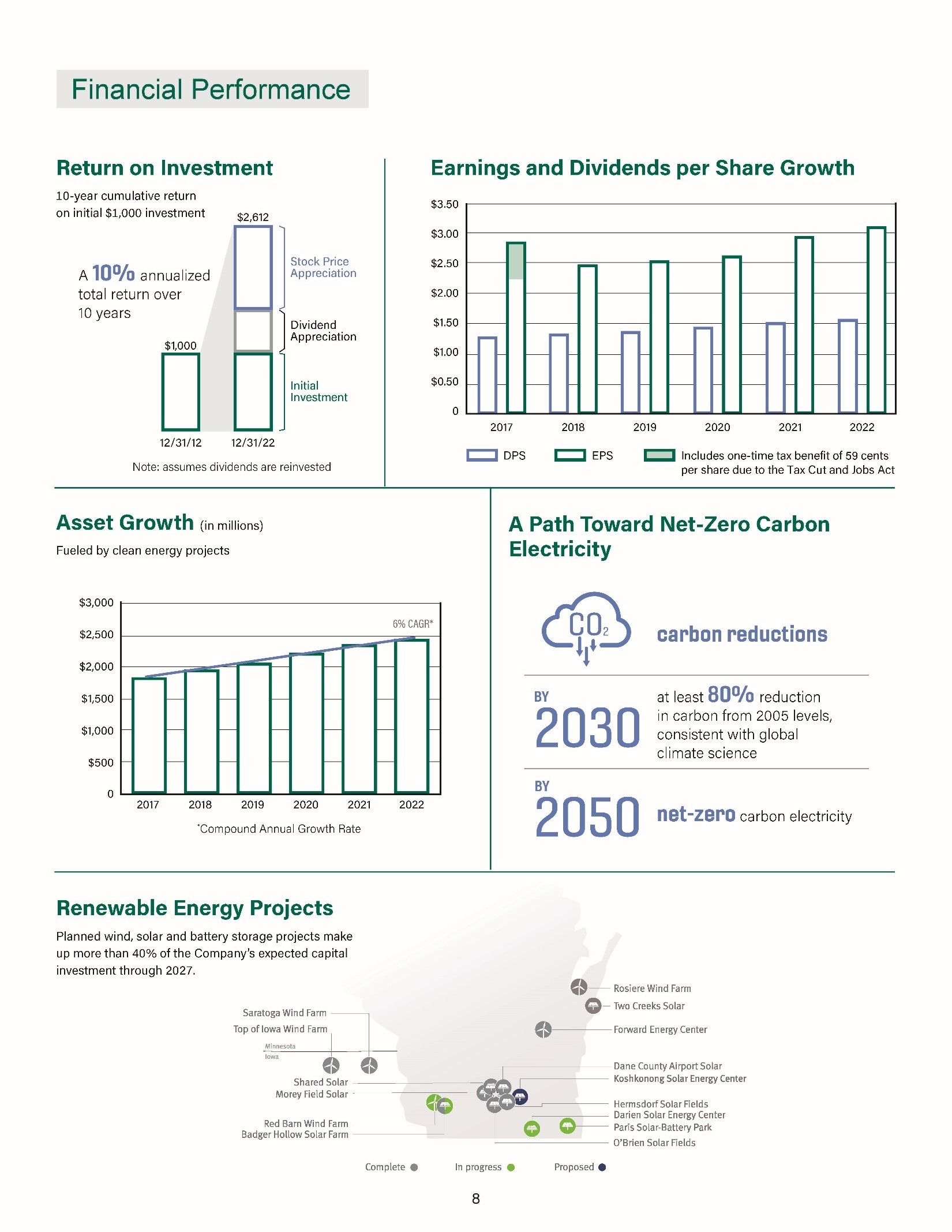

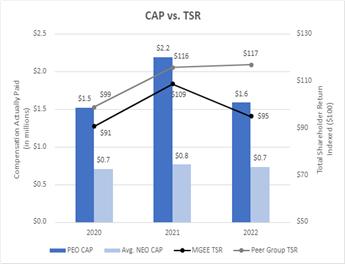

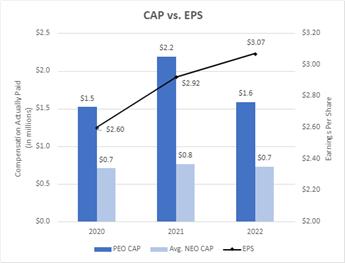

We believe our compensation program has assisted us in achieving performance for our customers, employees and shareholders. During 2022, we exceeded performance goals related to electric reliability and customer satisfaction targets. In addition, earnings per share in 2022 exceeded our earnings per share target for 2022 by 12% (target shown on page 40). At the end of 2022, our annualized total shareholder return over the last five years was over 4%.

2021 Long-Term Incentive Plan

In 2022, we issued awards under our 2021 LTI Plan. Under that Plan, eligible employees who are officers or otherwise determined to be key employees may receive awards of:

Non-employee directors may receive awards of restricted units and restricted stock under the Plan but may not receive awards of performance units. The Plan does not allow the grant of stock options or stock appreciation rights.

Awards under the Plan are subject to vesting provisions providing for 100% vesting at the end of the performance period, in the case of performance units, and at the end of the time period, in the case of restricted units and restricted stock, in each case as set by the committee in the particular award.

The discussion that follows focuses on our compensation programs that were in effect during 2022, which would include our 2021 LTI Plan and our legacy 2006 Performance Unit Plan and our 2020 Performance Unit Plan. References to "Performance Unit Plans" in that discussion refer to both the 2006 and 2020 Performance Unit Plans. Collectively, all plans are referred to as "Incentive Plans."

Compensation Objective and Strategy

The principal goal of our compensation program has been to pay our employees, including all our executive officers, at levels which are:

Our Committee strives to administer our compensation programs in a manner that is fair and consistent over time. Through our compensation design (and with the help of the committee's compensation consultant), the committee seeks to:

34

Our compensation program considers performance goals that are critical to our business success. These goals include specific objectives developed by our committee with input from our management and Board of Directors. These goals include earnings, system reliability and customer satisfaction. The committee and board also consider other corporate performance measures, such as debt ratings, cost containment, environmental performance and management of day-to-day operations as well as individual performance measures.

In addition to its review of external competitive factors, the committee considers internal equity among colleagues in determining compensation levels. This means that while the committee considers competitive pay data for specific positions, such data is not the sole factor considered in setting pay levels as the committee believes promoting internal equity helps to provide long-term stability among its senior management.

Our committee believes it is important to place a significant amount of an executive's total compensation at risk in the form of variable pay, including both short-term and long-term incentives, in order to better align the Company's pay packages with the interests of our shareholders and customers. Actual award levels are determined based on a variety of factors examined by the committee, including Company performance, individual performance and market data. In addition, the board considers progress on long-term corporate strategy and performance in setting incentive targets under this program.

An additional element of our compensation strategy is to promote a long-term commitment to the Company. As a consequence, while we believe compensation should have a strong performance link, we also believe the Company benefits from creating a team of tenured, seasoned professionals with significant industry experience. To encourage the long-term commitment we seek, the long-term incentive portion of our compensation structure offers awards that vary in value directly with increases and decreases in our stock price and dividends paid to shareholders. The purpose of this long-term compensation mechanism, including vesting requirements and annual grant design, is to promote long-term retention and stability among the senior management team by creating significant potential forfeitures of value for employees who depart for other employment opportunities. The committee believes this approach will appropriately reward our executives while protecting the Company's long-term investment in its executives.

Our committee does not believe that our policies and practices with respect to executive and nonexecutive compensation are likely to encourage risk taking outside our established policies, practices and risk management programs.

Role of the Human Resources and Compensation Committee

Our Human Resources and Compensation Committee (Committee) is composed of four directors–Marcia M. Anderson (Chair), James G. Berbee, Mark D. Bugher and Thomas R. Stolper–all of whom have been determined by our board to be independent directors under the Nasdaq Stock Market, Inc., governance requirements. The Committee's function is described in its charter, which can be found on the website mgeenergy.com/governance.

The Committee, in consultation with its compensation consultant and the other independent directors on our board, determines the amounts and elements of compensation for our executive officers and provides overall guidance for our executive compensation policies and programs. Our independent directors are responsible for the final approval of those recommendations, as they relate to the compensation of our CEO; and our board, including our CEO, is responsible for the final approval of those recommendations as they relate to the compensation of our executive officers other than our CEO.

Under its charter, our Committee is empowered to retain, compensate and terminate compensation consultants and other advisors as considered necessary to the accomplishment of its work. Willis Towers Watson was hired as an independent compensation consultant in 2013 to assist the Committee with a review and benchmarking of the Company's compensation programs and levels. Willis Towers Watson has provided updates, most recently in December 2022. The consultant was hired directly by the Committee, and the Committee retains full autonomy to direct the consultant's activities. The consultant has no prior relationship with our CEO or any of our Company's senior management. The consultant was determined by the Committee to be independent in connection with its original retention and was redetermined to be independent in 2022, after considering the independence factors prescribed by Nasdaq Stock Market, Inc., in connection with the selection of compensation consultants.

In the process of assisting the Committee, the compensation consultant may interact directly with our CEO, Company General Counsel, Chief Financial Officer, head of Human Resources and their staffs to provide the Committee with relevant compensation and performance data for our executives and the Company. In addition, the consultant may seek comments and feedback from specific members of our Company's management to the extent the consultant finds it necessary or desirable to do so.

To arrive at informed decisions, the Committee collects and/or considers input from various sources and may invite certain senior executives or non-Committee board members to attend Committee meetings to discuss executive compensation and individual performance. Subject to the Committee's direction, invitees provide additional insight, suggestions or recommendations regarding compensation decisions. Deliberations generally occur with input from the compensation consultant, management or other board members. Only independent board members may vote on compensation decisions for the CEO, which are always done without the CEO or any other members of management being present.

35

The Committee also considers the results of the shareholder advisory vote on executive compensation. That vote, which last occurred at our Annual Meeting in 2022, expressed strong approval for our executive compensation programs. As a result, the Committee has not changed its basic compensation policies. Shareholders are being asked at this Annual Meeting to consider and vote on a shareholder advisory vote on executive compensation.

Compensation/Benefits Structure

Our compensation and benefits structure involves the following:

Pay Levels

Pay levels for all employees, including our named executive officers, are determined based on a number of factors, including each individual's roles and responsibilities, the individual's experience and expertise and expected contribution, pay levels for peer positions within the Company, pay levels for similar job functions in the marketplace and performance of our Company as a whole.

The Committee asked its compensation consultant to develop an approach and conduct studies to determine "competitive market" compensation. Working with the Committee, the compensation consultant identified a peer group for the study, looking at general industry survey data, industry-specific survey data and information available from published Proxy Statements. The objective was to identify companies representing the Company's broad labor market for talent while maintaining comparability, having sufficient size to avoid distortions from a single company, and ensuring sufficient and credible data are available. Willis Towers Watson provided updates regarding this peer group to the Committee, most recently in December 2022.

The industry-specific and general industry survey data are based on companies from the Willis Towers Watson's Energy Services Executive Compensation Survey and were not selected by the Committee. The survey samples used for the named executive officers are controlled to reflect only organizations of comparable size to the Company in terms of revenues. The industry peer group companies selected by Willis Towers Watson from the database, as updated in December 2022, are listed below. The changes in the composition of the peer group reflected mergers and acquisitions involving prior members of the group.

Companies Used for Compensation and Benchmark Purposes | ||

ALLETE, Inc. | Northwest Natural Holding Company | Star Group, LP |

Black Hills Corporation | NorthWestern Corporation | Suburban Propane Partners LP |

Chesapeake Utilities Corporation | Ormat Technologies Inc. | Unitil Corporation |

Genie Energy Ltd. | Otter Tail Corporation |

|

IDACORP, Inc. | South Jersey Industries, Inc. |

|

When reviewing competitive market data, the Committee examines the range of market data but does not set a specific targeted percentile as part of its compensation philosophy. An executive's positioning against the competitive labor market is intended to reflect that executive's experience, marketability and performance over a period of time. While we use benchmarking as described above in determining appropriate compensation ranges, the Committee avoids making "automatic" adjustments based on an employee's positioning relative to the market. The Committee believes this approach better utilizes competitive data to facilitate rather than drive the Company's pay decisions, which results in appropriate recognition of our top performers.

Depending on whether the Company and individual performance meets expectations, realized total compensation during any given year may be above or below the benchmark compensation levels. The amount and structure of compensation can also vary by executive due to negotiations and competitive pressures inherent in attracting and hiring experienced utility managerial talent in the utilities industry. To help attract and retain such talent, the Committee also seeks to provide an appropriate level of employee benefits comparable to those in the utility industry and to publicly traded companies.

36

Pay Mix

The Committee believes a balanced mix of compensation with a blend of short-term and long-term incentives encourages short-range and long-range strategic thinking, which is important given the nature of utility operations and the capital investment necessary in the coming years.

Our compensation program consists of each of the following components:

We pay base salaries to assure management with a level of fixed compensation at competitive levels to reflect their professional skills, responsibilities and performance in order to attract and retain key executives. We adjust base salaries taking into consideration changes in the market, changes in responsibilities and performance against job expectations. We also consider the nature of the position, responsibilities, skills, internal equity and experience of the officer and his or her past performance. The Committee and board also consider expectations with respect to the economic and regulatory climate at the time of review.

Our executive officers, including the named executive officers, are partially compensated through annual short-term incentives or bonuses. The incentives are based on objective metric-specific targets, a subjective assessment of overall corporate performance and a subjective assessment of individual performance. The program is structured to allow payments in excess of the target bonus amount in the event of performance exceeding the target levels, subject to an overall individual limit of 150% of the target. This element of compensation provides executive officers with the opportunity for annual cash bonuses tied directly to the achievement of the Company and individual performance goals. The Committee and board encourage executive officers to achieve superior annual performance on key financial, strategic and operational goals. The board recognizes that not every opportunity or threat that may present itself over the course of the year can be anticipated when the goals for the year are established. The board expects management to be attentive to finding opportunities and aggressive in addressing unanticipated problems. Consequently, in order to address these situations, the board does not tie all bonus compensation to a predetermined formula.

The board also recognizes that making decisions takes judgment to balance the interests of various constituencies. Exclusively adopting formula incentives without some flexibility may discourage needed adjustments during the year and could have unanticipated consequences. The board recognizes that success in some areas is not quantifiable and requires the board to weigh the overall outcomes. The board encourages management to take a long-term focus and reserves the right to assess how well management exercises judgment in the running of the business.

The components that make up the target bonus opportunity are shown below:

As described in more detail under "2022 Executive Compensation Determination - 2022 Short-Term Incentives," the objective targets consist of earnings per share, customer satisfaction and service reliability. Our Committee and board believe these matters are important goals and represent our twin objectives of achieving value for our shareholders and customers.

The specific corporate goals consist of accomplishments the board deems important. As examples, goals related to environmental, social and governance, operations and financial goals not considered in the objective measures are reviewed by the board in assessing management as follows:

37

As part of assessing the degree of achievement in this component, the Chair/CEO reviews information with the Board of Directors on how Company activities, initiatives and programs have advanced all the above goals over the year. His review includes information on how the Company has advanced overall corporate strategies.

The final component of short-term incentive compensation reflects individual performance. The individual performance goals are based on the goals of the division run by that officer and on personal improvement goals for that officer. Achievement of performance goals for executive officers other than the CEO is judged by the CEO in consultation with the Committee and board. Among other things, these goals may include division safety goals, projects within the division and appropriate metrics for the division. It is expected that individual performance goals will support the broader corporate goals and officers will be measured by their contributions to the broader team effort. The board does not expect the payout percentage against the target to vary significantly between named executive officers because of the team approach encouraged by the board.

Awards under our 2021 LTI Plan, which consist of performance awards tied to performance metrics and time-based restricted stock awards, seek to reward performance by selected executives over a three-year period. Similarly, awards under the Performance Unit Plans, which consist of cash-based awards, seek to reward performance by selected executives over a three- or five-year period. In each case, the awards allow participants who retire from the Company during the term of an award to receive full vesting credit with respect to any awarded units so long as the participant does not compete with the Company following retirement. The awards will also continue to vest in the event of the executive's death, disability or change in control.

Our Committee believes that combining the annual bonus awards and the longer-term incentive awards provides appropriate short- and long-term incentives to perform while creating additional and necessary retention for our key executives. While cash-settled awards under the legacy Performance Unit Plans have been an important element, the 2021 LTI Plan will provide greater flexibility by allowing both cash-based and stock-based incentives, will reflect conversations with shareholders in which stock-based awards were preferred over cash-based awards and will be expected to be the sole vehicle used for future long-term awards. Cash-settled awards are accounted for differently, and potentially less favorably during the vesting period to the Company, than stock-based awards.

The grants under the 2021 LTI Plan and the legacy Performance Unit Plans were reviewed and recommended by the Committee and approved by our Company's independent directors. The grant date for these awards occurred on the meeting date at which the grants were approved. Payment under the awards generally occurs shortly after the end of the vesting and/or performance periods. Administration of the awards is managed by our internal Human Resources and Finance departments, and specific instructions related to timing of grants are given directly from the Committee.

On December 16, 2022, the Board of Directors of the Company approved the Madison Gas and Electric Company 2023 Deferred Compensation Supplemental Executive Retirement Plan (2023 DCSERP). The purpose of the 2023 DCSERP is to provide participants with options to defer compensation into market-based notional investments (including Company stock), provide restoration benefits lost as a result of defined contribution plan compensation limits and provide supplemental market-based retirement benefits to recruit and retain executives. Discretionary contributions are also permitted under the 2023 DCSERP. The 2023 DCSERP is unfunded. "Contributions" under the 2023 DCSERP are made by credits to a participant's account(s). 2023 DCSERP participants direct investments in their account(s) under the Plan to market-based investment options, including a Company Stock fund (unfunded credit). The board has ultimate authority over Plan administration.

38

The 2023 DCSERP permits (i) a select group of highly compensated employees of the Company (and its selected subsidiaries and/or affiliates) to defer the receipt of income that would otherwise become payable to those employees, (ii) the Company to provide supplemental retirement benefits to those employees or (iii) both those deferrals and supplemental retirement benefits. It is the intent that the Plan at all times be maintained on an unfunded basis and that all the amounts deferred and benefits provided under the Plan comply with the requirements of Section 409A of the Internal Revenue Code of 1986, as amended (the "Code").

The board approved contributions for all eligible participants under the 2023 DCSERP consisting of a restoration contribution equal to 9% of compensation above Code limits applicable to the defined contribution tax-qualified retirement plans and a supplemental contribution of 6% of compensation, with both contribution levels remaining in effect for future plan years until otherwise changed by the board.

In addition, participants in the Company's existing Defined Contribution Supplemental Executive Retirement Plan (Old Plan) had the option to continue benefits under the Old Plan or waive their rights under the Old Plan and receive supplemental benefits under the Plan. The board approved a one-time discretionary contribution for participants who chose to waive their rights under the Old Plan and move to the Plan. These participants include J. Bushek, Vice President Finance, Chief Information Officer and Treasurer, and C. A. Renlund, Vice President, General Counsel and Secretary. The amount of the one-time discretionary contribution was determined based on the participant's account balance as of December 31, 2022, under the Old Plan, plus an amount determined based on the restoration contribution and supplemental contribution levels approved under the Plan for the time period the participant was a participant under the Old Plan. Both J. Bushek and C. A. Renlund waived their participation in the Old Plan before the close of 2022, making them eligible for the discretionary contribution under the Plan in 2023. Both J. Bushek and C. A. Renlund have been participants under the Old Plan since January 1, 2016.

As Company employees, our named executive officers are eligible to participate in all of the broad-based, Company-sponsored benefits programs on the same basis as other full-time salaried employees. These include the Company's health and welfare benefits (e.g., medical/dental plans, disability plans, life insurance, etc.). Certain executives participate in the Company's pension plan and all participate in 401(k) retirement plans.

The Company also offers certain executives, including the named executive officers except for C. A. Renlund and J. Bushek, supplemental retirement benefits under individual income continuation agreements. Retirement benefits under the agreements supplement benefits from the qualified pension plan (Retirement Plan). The benefit formulas are outlined below in the Pension Benefits Table.

Executives hired after December 31, 2006, are not eligible to participate in the Retirement Plan but do participate, like all employees hired after December 31, 2006, in a 401(k) retirement plan. C. A. Renlund and J. Bushek were hired after December 31, 2006, and participate in that 401(k) plan. As a further inducement to those executives, we have entered into defined contribution supplemental retirement agreements. See "Nonqualified Deferred Compensation Table" for a description of those agreements.

2022 Executive Compensation Determination

For 2022, these pay-mix components reflected the following decisions and determinations:

For 2022, the adjustment of named executive officer base salaries reflects a combination of annual adjustments and increased salaries due to promotions and the assumption of additional duties and responsibilities. When adjusting base salaries on an annual basis or in the event of organizational realignment, due to promotions or retirements, we take into consideration the external market, changes in responsibilities and performance against job expectations. We also consider skills and experience of the named executive officer, internal equity and his or her past performance. Additionally, expectations with respect to the economy and regulatory climate at the time of the review are considered.

The size of the 2022 short-term incentive pool at the target level of named executive officer performance was $909,997, a decrease of $42,069 from the amount of that pool for 2021. The number of named executive officers decreased from 2021 to 2022 due to the retirement of a long-tenured officer in 2021. The pool size, as a percentage of base salary, did not change from 2021 to 2022 for the named executive officers. The CEO's target percentage remained unchanged at 55%, and the named executive officers' targets remained unchanged at a range of 35% to 45%. The Committee determined that incentive opportunities are appropriate after reviewing market benchmark data. The actual aggregate payouts to the named executive officers for 2022 were $1,125,504, which was 124% of the incentive pool at the target level of performance and 82% of the incentive pool at the maximum level of performance.

39

For 2022, the target bonus amount for our CEO was set at 55% and the remaining named executive officers was set at 35% to 45% of annualized base pay at December 31, 2022. The actual award may be above or below the target, with the maximum equal to 150% of the target. In assessing the short-term incentive payout for the CEO versus the targeted levels, we took into consideration the strong overall performance level of the Company in 2022, which is discussed below. The actual payout for the CEO was 127% of the target amount and 84% of the maximum opportunity set for 2022.

The three components that make up the target bonus opportunity–objective targets, subjective assessment of the achievement of specified corporate goals and subjective assessment of the achievement of individual goals–are discussed below and on the following pages:

Consistent with the approach used in recent years, the Committee developed objective targets for 2022 based on earnings per share, customer satisfaction ratings and service reliability. Those targets are shown below. Actual payouts for the named executive officers reflected an assessment that performance exceeded the target level of performance, resulting in a payout equal to 50.500% of the overall incentive pool versus a targeted level of 40%.

Metric-Specific Targets - 40% at Targeted Level of Performance | ||||||

| Percent of | Required Level of Performance (1) |

| Percent of | ||

Goals | Target | Threshold | Target | Maximum | Actual | Actual |

Earnings Per Share | 20% | $2.48 | $2.75 | $3.03 | $3.07 | 30.000% |

Customer Satisfaction Ratings: |

|

|

|

|

|

|

Overall satisfaction rating in annual customer survey for residential customers (2) | 5% | 4.10 | 4.40 | 4.70 | 4.57 | 6.417% |

Overall satisfaction rating in annual customer survey for commercial customers (2) | 5% | 4.10 | 4.40 | 4.70 | 4.59 | 6.583% |

Service Reliability: |

|

|

|

|

|

|

Electric reliability (average of SAIFI and SAIDI reported in national survey based on 2021 results) (3) | 5% | Top-half | Top-quartile | Top-decile | Top-decile | 7.500% |

Gas system response time (average response time for Priority 1 calls) (4) | 5% | 18.5 minutes | 16.5 minutes | 14.5 minutes | 19.14 | 0.000% |

Total | 40% | - | - | - | - | 50.500% |

For 2022, the Committee and board determined that management's performance on the measures discussed under "Pay Mix - Short-Term Incentives" above will be compensated at 38% versus the target level of 30%. All named executive officers are compensated at the same percentage of target for the Other Corporate Goals category because of the interrelated nature of these items amongst the officers. We believe this encourages a team approach. In considering the decision, our Committee and board took into account the following management and Company achievements:

40

When determining the CEO's individual performance percentage for 2021, we considered the Company's strong performance against the metrics-driven targets discussed above, such as strong earnings and continued top-decile performance in electric reliability, as well as the subjective assessment of management's overall performance against other measures identified by the board. As a result, our CEO will be compensated at 38% versus the target level of 30% for his individual performance. Similar considerations were taken into account for the remaining named executive officers, including the strong financial performance of the Company and the degree of accomplishment of individual goals within their respective functions. The remaining named executive officers will be compensated between 32% and 37% for their individual performance.

In 2022, we issued awards under the 2021 LTI Plan that are intended to align long-term compensation incentives with shareholders' interests. Each award consists of equal amounts of restricted units and performance units:

The two performance measures are equally weighted and were set to be moderately difficult to achieve. Each performance measure is measured using a threshold, target and maximum level of 50%, 100% and 150%, with performance below threshold resulting in no contribution of that measure to aggregate performance measures. Our board retained limited rights to adjust the measures for circumstances beyond the control of management; however, no such adjustments have been made since the issuance of the

41

awards. Actual targets used in our performance unit cycles are not disclosed until each cycle is completed to safeguard the confidentiality of our long-term outlook on projected performance. This policy supports our long-standing disclosure practices not to provide performance guidance.

Market performance accounts for up to 50% of the award target. If the Company's relative total shareholder return compared to the EEI index companies is at or below 50%, between 50% to 75%, or at or above 75%, the numbers of units earned will be 0%, 25% and 50% of the initial units granted, respectively.

The total number of performance units ultimately settled shall equal the percentage achievement of the performance measures plus the percentage achievement of the market measure, multiplied by the initial number of performance units granted.

For 2022, our CEO was granted aggregate restricted and performance units equal to 70% of base salary, while the remaining named executive officers were granted aggregate restricted and performance units equal to 40% to 50% of base salary. Granted units were valued at the grant date price of a share of our stock.

The board granted performance unit awards to participants under the 2020 Performance Unit Plan in 2020. Payouts on those performance units were measured over a three-year period ended December 31, 2022, based upon a target aggregate Earnings Per Share over the three-year period of $7.38 and a target Return on Equity of 9.53% for the three-year period. Similar to the performance units awarded in 2022, as described above, the number of units earned was subject to adjustment, from 0% to 50%, based upon total shareholder return over the three-year period relative to the total shareholder return of the Edison Electric Institute (EEI) Index companies. Our total shareholder return for that three-year period was at the 15th percentile of the peer group, resulting in no adjustment. The cumulative three-year impact of the Company's performance against the additional performance measures, Earnings Per Share and Return on Equity, was a 46% increase in the vesting percentage of the performance units for a total vesting level of 146%. The actual payouts were determined by multiplying the number of vested performance units by the closing price of our common stock on December 30, 2022, the last trading day of the performance period.

Clawback Policy

The Company has a policy on Recoupment of Incentive Compensation, or clawback policy, providing for the recovery of previously paid incentive compensation to the extent there has been a subsequent financial statement restatement or fraudulent activity or other intentional misconduct that resulted in a material violation of federal or state law or a material violation of the Company's Code of Ethics and the incentive compensation would have been lower had it been calculated based upon the factors above. The Committee is responsible for making all determinations with respect to the application or operation of the policy. The policy is being applied prospectively and will not apply to, or affect, any incentive compensation paid or payable in respect of fiscal years prior to January 1, 2018. Also, the policy will not apply to cash payments in respect to time-based units granted under the 2006 Performance Unit Plan, restricted units made under the 2020 Performance Unit Plan or restricted stock units made under the 2021 LTI Plan. The clawback policy does apply to awards based upon the achievement of performance goals.

Post-Termination Compensation

The Company recognizes that, as with any public company, it is possible that a change in control of the Company may take place in the future. The Company also recognizes the threat or occurrence of a change in control can result in significant distractions of key management personnel because of the uncertainties inherent in such a situation. The Company also believes that it is essential and in the best interests of its shareholders to retain the services of its key management personnel in the event of a threat or occurrence of a change in control and to ensure their continued dedication and efforts in such event. In keeping with this belief and its objective of retaining and motivating highly talented individuals to fill key positions, the Company has entered into severance agreements with all of the named executive officers.

The severance agreements guarantee the named executive officers specific payments and benefits upon termination of employment as a result of change in control of the Company or if the employee voluntarily terminates employment within a specified period following a change in control. Effective December 30, 2010, these agreements were amended to limit the payments under those agreements as well as to eliminate a provision that required the Company to "gross-up" the executive for any excise tax due as a result of the change in control payments. Additional details of the terms of the change in control agreements are provided below in the "Potential Payments on Employment Termination or Change in Control" section of this Proxy Statement.

42

Impact of Tax and Accounting on Compensation Decisions

Under Section 162(m) of the Internal Revenue Code (the Code), generally executive compensation over $1 million for any year is not deductible for United States income tax purposes. The Committee believes that it must maintain flexibility in its approach to executive compensation in order to structure a program that it considers to be the most effective in attracting, motivating and retaining the Company's key executives and, therefore, the deductibility of and accounting for compensation are part of the factors considered when making executive compensation decisions.

Human Resources and Compensation Committee Report

The Human Resources and Compensation Committee (Committee) of the Board of Directors of MGE Energy oversees the Company's compensation program on behalf of the board. In fulfilling its oversight responsibilities, the Committee reviewed and discussed with management the "Executive Compensation - Compensation Discussion and Analysis" set forth in this Proxy Statement.

In reliance on the review and discussions referred to above, the Committee recommended to the board that the "Executive Compensation - Compensation Discussion and Analysis" be included in this Proxy Statement, which is incorporated by reference in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2022.

Marcia M. Anderson (Chair)

James G. Berbee

Mark D. Bugher

Thomas R. Stolper

43

2022 Summary Compensation Table