Use these links to rapidly review the document

TABLE OF CONTENTS1

TABLE OF CONTENTS 2

TABLE OF CONTENTS3

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

| | |

| (Mark One) | | |

o |

|

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR |

ý |

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

For the fiscal year ended December 31, 2014 |

OR |

o |

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR |

o |

|

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

Date of event requiring this shell company report |

|

|

For the transition period from to . |

Commission file number: 001-36125

ABENGOA, S.A.

(Exact name of Registrant as specified in its charter)

Not applicable

(Translation of Registrant's name into English)

Kingdom of Spain

(Jurisdiction of incorporation or organization)

Campus Palmas Altas

C/ Energía Solar 1

41014, Seville, Spain

Tel: + 34 954 93 71 11

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| | |

| Title of each class | | Name of each exchange on which registered |

|---|

Class B Shares, par value €0.01 per share

American Depositary Shares, each representing Five Class B Shares | | NASDAQ Global Select Market

NASDAQ Global Select Market |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report: 755,526,080 Class B shares.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes ý No

If this report is an annual or transaction report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. o Yes ý No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ý Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). o Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer.

| | | | |

| Large accelerated filer ý | | Accelerated filer o | | Non-accelerated filer o |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAPo International Financial Reporting Standards as issued by the International Accounting Standards Board ý Other o

If "Other" has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow. o Item 17 o Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). o Yes ý No

Table of Contents

ABENGOA, S.A.

TABLE OF CONTENTS

| | |

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING STATEMENTS | | 3 |

CURRENCY PRESENTATION AND DEFINITIONS | | 4 |

PRESENTATION OF FINANCIAL INFORMATION | | 6 |

PART I | | 14 |

Item 1. Identity of Directors, Senior Management and Advisors | | 14 |

Item 2. Offer Statistics and Expected Timetable | | 14 |

Item 3. Key Information | | 14 |

A. Selected Financial Data | | 14 |

B. Capitalization and Indebtedness | | 21 |

C. Reasons for the Offer and Use of Proceeds | | 21 |

D. Risk Factors | | 21 |

Item 4. Information on the Company | | 55 |

A. History and Development of the Company | | 55 |

B. Business Overview | | 59 |

C. Organizational Structure | | 124 |

D. Property, Plant and Equipment | | 125 |

Item 4A. Unresolved Staff Comments | | 125 |

Item 5. Operating and Financial Review and Prospects | | 125 |

A. Operating Results | | 125 |

B. Liquidity and Capital Resources | | 178 |

C. Research and Development | | 210 |

D. Trend Information | | 212 |

E. Off-Balance Sheet Arrangements | | 212 |

F. Tabular Disclosure of Contractual Obligations | | 213 |

G. Safe harbor | | 215 |

Item 6. Directors, Senior Management and Employees | | 216 |

A. Directors and Senior Management | | 216 |

B. Compensation | | 223 |

C. Board Practices | | 225 |

D. Employees | | 227 |

E. Share Ownership | | 228 |

Item 7. Major Shareholders and Related Party Transactions | | 229 |

A. Major Shareholders | | 229 |

B. Related Party Transactions | | 229 |

C. Interests of Experts and Counsel | | 231 |

Item 8. Financial Information | | 231 |

A. Consolidated Statements and Other Financial Information | | 231 |

B. Significant Changes | | 233 |

Item 9. The Offering and Listing | | 234 |

A. Offer and Listing Details | | 234 |

B. Plan of Distribution | | 235 |

C. Markets | | 236 |

D. Selling Shareholders | | 236 |

E. Dilution | | 236 |

F. Expenses of the Issue | | 236 |

Item 10. Additional Information | | 236 |

A. Share Capital | | 236 |

B. Memorandum and Articles of Association | | 236 |

1

Table of Contents

| | |

C. Material Contracts | | 255 |

D. Exchange Controls | | 255 |

E. Taxation | | 255 |

F. Dividends and Paying Agents | | 261 |

G. Statements by Experts | | 261 |

H. Documents on Display | | 261 |

I. Subsidiary Information | | 262 |

Item 11. Quantitative and Qualitative Disclosures About Market Risk | | 262 |

Item 12. Description of Securities Other Than Equity Securities | | 269 |

A. Debt Securities | | 269 |

B. Warrants and Rights | | 269 |

C. Other Securities | | 269 |

D. American Depositary Shares | | 269 |

Part II | | 270 |

Item 13. Defaults, Dividend Arrearages and Delinquencies | | 270 |

Item 14. Material Modifications to the Rights of Security Holders and Use of Proceeds | | 270 |

Item 15. Controls and Procedures | | 270 |

Item 16. [Reserved] | | |

Item 16A. Audit Committee Financial Expert | | 271 |

Item 16B. Code of Ethics | | 271 |

Item 16C. Principal Accountant Fees and Services | | 272 |

Item 16D. Exemptions from the Listing Standards for Audit Committees | | 273 |

Item 16E. Purchases of Equity Securities by the Issuer and Affiliated Purchasers | | 273 |

Item 16F. Change in Registrant's Certifying Accountant | | 275 |

Item 16G. Corporate Governance | | 275 |

Part III | | 276 |

Item 17. Financial Statements | | 276 |

Item 18. Financial Statements | | 276 |

Item 19. Exhibits | | 276 |

2

Table of Contents

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING STATEMENTS

This annual report includes forward-looking statements. These forward-looking statements include, but are not limited to, all statements other than statements of historical facts contained in this annual report, including, without limitation, those regarding our future financial position and results of operations, our strategy, plans, objectives, goals and targets, future developments in the markets in which we operate or are seeking to operate or anticipated regulatory changes in the markets in which we operate or intend to operate. In some cases, you can identify forward-looking statements by terminology such as "aim," "anticipate," "believe," "continue," "could," "estimate," "expect," "forecast," "guidance," "intend," "may," "plan," "potential," "predict," "projected," "should" or "will" or the negative of such terms or other comparable terminology.

By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. Forward-looking statements are not guarantees of future performance and are based on numerous assumptions. Our actual results of operations, financial condition and the development of events may differ materially from (and be more negative than) those made in, or suggested by, the forward-looking statements. Investors should read the section entitled "Item 3.D—Risk Factors" and the description of our segments in the section entitled "Item 4.B—Business" for a more complete discussion of the factors that could affect us. Important risks, uncertainties and other factors that could cause these differences include, but are not limited to:

- •

- Failure to consummate a transaction with a third-party intended to facilitate transition to an asset-light business model;

- •

- Failure to reduce our shareholding in our publicly-traded affiliate;

- •

- Failure to complete the sale of certain concessional assets to our publicly-traded affiliate;

- •

- Changes in general economic, political, governmental and business conditions globally and in the countries in which Abengoa does business;

- •

- Difficult conditions in the global economy and in the global markets; changes in interest rates;

- •

- Changes in inflation rates; changes in prices, including increases in the cost of energy and oil and other operating costs;

- •

- Decreases in government expenditure budgets and reductions in government subsidies;

- •

- Changes to national and international laws and policies that support renewable energy sources;

- •

- Inability to improve competitiveness of our renewable energy services and products;

- •

- Decline in public acceptance of renewable energy sources;

- •

- Changes to regulations, subsidies and incentives that support renewable energy sources;

- •

- Extensive governmental regulation in a number of different jurisdictions, including stringent environmental regulation;

- •

- Our substantial capital expenditure and research and development requirements;

- •

- Management of exposure to credit, interest rate, exchange rate, supply and commodity price risks;

- •

- The termination or revocation of our operations conducted pursuant to concessions;

- •

- Reliance on third party contractors and suppliers;

- •

- Acquisitions or investments in joint ventures with third parties;

- •

- Unexpected adjustments and cancellations of our backlog of unfilled orders;

3

Table of Contents

- •

- Management of our economic, political and other risks inherent in operating in emerging markets;

- •

- Failure to comply with laws and regulations, including anti-bribery laws;

- •

- Inability to obtain new sites and expand existing ones;

- •

- Failure to maintain safe work environments; effects of catastrophes, natural disasters, adverse weather conditions, unexpected geological or other physical conditions, or criminal or terrorist acts at one or more of our plants;

- •

- Insufficient insurance coverage and increases in insurance cost;

- •

- Loss of senior management and key personnel; unauthorized use of our intellectual property and claims of infringement by us of others intellectual property and legal proceedings;

- •

- Our substantial indebtedness;

- •

- Our ability to generate cash to service our indebtedness changes in business strategy;

- •

- Adverse conditions in financial markets, including related to decisions on spending by the U.S. government; and

- •

- Various other factors, including those factors discussed under "Item 3.D—Risk Factors" herein.

The forward-looking statements made in this annual report relate only to events or information as of the date on which the statements are made in this annual report. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. You should read this annual report and the documents that we reference in this annual report and have filed as exhibits to this annual report, completely and with the understanding that our actual future results or performance may be materially different from what we expect.

CURRENCY PRESENTATION AND DEFINITIONS

In this annual report, all references to "euro" or "€" are to the single currency of the participating member states of the European and Monetary Union of the Treaty Establishing the European Community, as amended from time to time, and all references to "U.S. Dollar", "US$" and "$" are to the lawful currency of the United States.

Definitions

Unless otherwise specified or the context requires otherwise in this annual report:

- •

- references to "Abengoa," "Group," "we," "us", "the Company" and "our" refer to Abengoa, S.A., together with its subsidiaries unless the context otherwise requires;

- •

- references to "Consolidated Financial Statements" refer to the audited Consolidated Financial Statements of Abengoa and its subsidiaries as of December 31, 2014 and 2013 and for each of the years ended December 31, 2014, 2013 and 2012, including the related notes thereto, prepared in accordance with IFRS as issued by the IASB (as such terms are defined herein);

- •

- references to "backlog" refer principally to projects, operations and services for which we have signed contracts and in respect of which we have received non-binding commitments from customers or other operations within our Group, where the related revenues are not eliminated in consolidation. Commitments may be in the form of written contracts for specific projects, purchase orders, subscriptions or indications of the amount of time and materials we need to make available for customers' projects. Our backlog includes expected revenue based on engineering and design specifications that may not be final and could be revised over time, and also includes expected revenue

4

Table of Contents

for government and maintenance contracts that may not specify actual monetary amounts for the work to be performed. For these contracts, our backlog is based on an estimate of work to be performed, which is based on our knowledge of our customers' stated intentions or our historical experience. We do not include in backlog expected future sales from our concession activities, such as energy sales, transmission and water sales or commodity sales. Our definition of backlog may not necessarily be the same as that used by other companies engaged in activities similar to ours. As a result, the amount of our backlog may not be comparable to the backlog reported by such other companies;

- •

- references to the "Befesa Sale" refer to Abengoa's sale of 100% of Abengoa's shares in its subsidiary, Befesa Medio Ambiente, S.L.U. ("Befesa"), to funds advised by Triton Partners;

- •

- references to the "Cemig Sales" refer to (i) the sale by Abengoa of 100% of the shareholding of NTE Nordeste Transmissora de Energia S.A. ("NTE") and 50% of the shareholding of União de Transmissoras de Energia Elétrica Holding S.A. ("UNISA") to Transmissão Aliança de Energia Elétrica S.A. ("TAESA"), an affiliate of Companhia Energetica de Minas Gerais, S.A. ("Cemig"), which occurred on November 30, 2011 (the "First Cemig Sale") and (ii) the sale of our remaining 50% interest in UNISA, which occurred on June 30, 2012 (the "Second Cemig Sale"), which are described in more detail in Note 6 to our Consolidated Financial Statements;

- •

- references to "Concession-Type Infrastructure" or "Concession-Type Infrastructure activity" refer to the operation by us of assets under long-term arrangements, such as "take or pay" contracts, feed-in and ad hoc tariffs or power or water purchase agreements;

- •

- references to "Deposit Agreement" refer to the deposit agreement entered into on October 16, 2013 between Citibank, N.A., as depositary, us and all owners and holders from time to time of the ADSs issued thereunder. The rights of the holders of ADSs are governed by the Deposit Agreement;

- •

- references to "Engineering and Construction" or our "Engineering and Construction activity" refer to our traditional engineering activities in the energy and water sectors, with more than 70 years of experience in the market and development of thermo-solar technology. Abengoa is specialized in carrying out complex turn-key projects for thermo-solar plants, solar-gas hybrid plants, conventional generation plants, biofuels plants and water infrastructures, as well as large-scale desalination plants and transmission lines, among others;

- •

- references to "IFRIC 12" refer to International Financial Reporting Interpretations Committee's Interpretation 12—Service Concessions Arrangements;

- •

- references to "IFRS as issued by the IASB" refer to International Financial Reporting Standards as issued by the International Accounting Standards Board;

- •

- references to "Industrial Production" or our "Industrial Production activity" refer to our traditional activity in the development and production of biofuels and, only until the Befesa Sale, providing a variety of recycling services to industrial customers;

- •

- references to "January 2014 Plan" refer to the variable pay scheme for the senior management approved by the Board of Directors of Abengoa in January 2014;

- •

- references to "July 2014 Plan" refer to the variable pay scheme for the senior management approved by the Board of Directors of Abengoa in July 2014;

- •

- references to "Project Debt" (previously categorized as "Non-Recourse Debt") refer to liabilities related to certain of our projects and significant investments, including capital expenditures typically relating to concessions or fixed tariff take-or-pay agreements, primarily under loan agreements and related documents which require the loans to be repaid solely from the revenue of the project being financed thereby and provide that the repayment of the loans (and interest thereon) is secured solely by the

5

Table of Contents

shares, physical assets, contracts and cash flow of that project company. Project Debt also includes certain obligations guaranteed by Abengoa, S.A. or its subsidiaries (other than non-recourse subsidiaries) in favor of our project companies and categorized as "bridge loan" (previously categorized as "non-recourse debt in process"), whereby Abengoa, S.A. and/or its subsidiaries (other than non-recourse subsidiaries) guarantee obligations in order to act as sponsors for the period prior to such project companies securing long-term project financing (typically periods of less than 2-3 years). Bridge loans will typically relate to bank financing arrangements, but may also include capital markets debt if such indebtedness is, or is expected to be, recorded as "project finance" in our consolidated annual accounts. Although our classification of bridge loans as Project Debt is in compliance with IFRS guidelines, we have discretion, within applicable IFRS guidelines, to reclassify this type of indebtedness. See Note 19 of our Consolidated Financial Statements for further details. See "Item 5—Liquidity and Capital Resources—Project Debt" for a full description;

- •

- references to "non-recourse subsidiaries" refer to our subsidiaries through which we engage in projects involving the design, construction, financing, operation and maintenance of large scale, complex operational assets or infrastructures, which are either owned by such subsidiaries or held under concession for a period of time. The projects undertaken by these non-recourse subsidiaries are initially financed through bridge loans and later by Project Debt. The assets and liabilities, results of operations, and cash flows of our non-recourse subsidiaries are consolidated in our Consolidated Financial Statements;

- •

- references to "OECD" refer to the Organization of Economic Co-operation and Development, an international organization of 34 member countries consisting of advanced economies;

- •

- references to "R&D&i" refer to our research and development and innovation;

- •

- references to "t" and "tons" are to metric tons (one metric ton being equal to 1,000 kilograms or 2,205 pounds);

- •

- references to "total net fixed assets" refer to the sum of intangible assets and property, plant and equipment, and fixed assets and projects, net of depreciation, amortization and provisions for impairment charges;

- •

- references to the "2005 Credit Facility" refer to the €600 million commercial credit facility granted to us by a syndicate of lenders under an agreement executed on July 20, 2005 which matured and was repaid and extinguished on July 20, 2012; and

- •

- references to the "2006 Credit Facility" refer to the €600 million commercial credit facility granted to us by a syndicate of lenders under an agreement executed on June 29, 2006 which matured and was repaid and extinguished on July 20, 2012.

PRESENTATION OF FINANCIAL INFORMATION

The selected financial information as of December 31, 2014 and 2013 and for the years ended December 31, 2014, 2013 and 2012 is derived from, and qualified in its entirety by reference to our Consolidated Financial Statements, which are included elsewhere in this annual report, which are prepared in accordance with IFRS as issued by the IASB. The selected financial information as of December 31, 2012 and as of and for the years ended December 31, 2011 and 2010 is derived from, and qualified in its entirety by reference to our consolidated financial statements and related notes for the years ended December 31, 2012, 2011 and 2010.

Certain numerical figures set out in this annual report, including financial data presented in millions or thousands and percentages describing market shares, have been subject to rounding adjustments, and, as a result, the totals of the data in this annual report may vary slightly from the actual arithmetic totals of such information. Percentages and amounts reflecting changes over time periods relating to financial and other

6

Table of Contents

data set forth in "Operating and Financial Review and Prospects" are calculated using the numerical data in our Consolidated Financial Statements or the tabular presentation of other data (subject to rounding) contained in this annual report, as applicable, and not using the numerical data in the narrative description thereof.

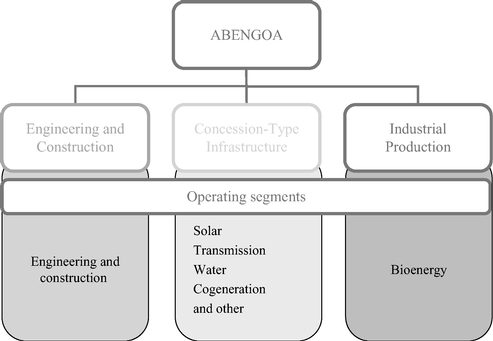

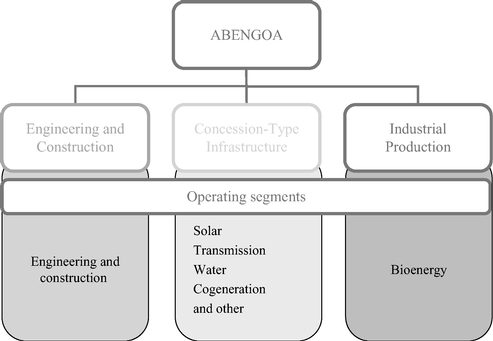

Since the beginning of 2014, our Engineering and Construction activity consists of one operating segment, Engineering and Construction. Previously, the Technology and other segment was also included in this activity. Since 2014, the Technology and other segment has been included in the Engineering and Construction operating segment, in accordance with IFRS 8,Operating Segments.

Geographic Reporting

We report our results in accordance with the following six geographic regions:

- •

- Spain;

- •

- North America;

- •

- Europe (excluding Spain);

- •

- South America (excluding Brazil);

- •

- Brazil; and

- •

- Other (remaining overseas markets).

During 2013 and 2012 we reported results from Mexico as part of South America (excluding Brazil) (formerly Latin America (excluding Brazil)). In the year ended December 31, 2014, in order to better reflect the geographical segmentation of our business we included results from Mexico in the North America segment (formerly the United States segment). The information by geographic areas for the years ended December 31, 2013 and 2012 has been presented according to the new geographic segmentation.

Partial Divestment of Abengoa Yield

On June 18, 2014, we completed an initial public offering (the "Abengoa Yield IPO") of 28,577,500 ordinary shares of Abengoa Yield plc ("Abengoa Yield"), including the exercise in full of the underwriters' over-allotment option, at a price of $29.00 per share for total gross proceeds of $828.7 million (€611.0 million) before fees and expenses. Abengoa Yield is a dividend growth-oriented company formed by us that groups together renewable energy, conventional power, electric transmission lines and other contracted, revenue-generating assets previously reported in different operating segments within the Concession-Type Infrastructure activity. As a result of a second transfer of assets announced on February 9, 2015, Abengoa Yield is now present in the water infrastructure segment, has expanded its geographic presence to the north of Africa and is expected to expand its geographic presence to the United Arab Emirates. As such, Abengoa Yield became a new operating segment within the Concession-Type Infrastructure activity after the Abengoa Yield IPO and we reported that segment's results in our quarterly financial information for the quarters ended June 30, 2014 and September 30, 2014.

Immediately following the Abengoa Yield IPO, we held 64% of the ordinary share capital of Abengoa Yield. On December 15, 2014, our Board of Directors approved a plan to reduce our shareholding in Abengoa Yield to below 50% during 2015, subject to market conditions. On January 22, 2015, we completed an initial divestment of 13% through the sale in an underwritten public offering of 10,580,000 ordinary shares in Abengoa Yield (including 1,380,000 shares sold pursuant to the exercise in full of the underwriters' option to purchase additional shares) at a price of US$31 per share which brought our shareholding in Abengoa Yield to 51%. On February 9, 2015, we announced our intention to reduce our shareholding in Abengoa Yield to below 50% by the end of the first half of 2015, with the objective of maintaining a long-term stake in the range of 40-49%. We have also indicated our intention to reinforce the role of independent directors at

7

Table of Contents

Abengoa Yield in order to effectively transfer control once we reduce our shareholding in Abengoa Yield below 50%.

Taking into account that Abengoa Yield was an operating segment within our Concession-Type Infrastructure activity during part of 2014 and the significance that those activities carried out by Abengoa Yield have for Abengoa, our shareholding in Abengoa Yield during 2014 was treated as a discontinued operation in accordance with the stipulations and requirements of IFRS 5,Non-Current Assets Held for Sale and Discontinued Operations. The treatment of Abengoa Yield as discontinued operations also resulted in the removal of the Abengoa Yield operating segment from our Concession-Type Infrastructure activity.

In accordance with this standard, the assets and liabilities of Abengoa Yield have been reclassified as assets and liabilities held for sale in our consolidated statement of financial position included within our consolidated financial statements as of and for the year ended December 31, 2014. Likewise, our consolidated income statements for the years ended December 31, 2014, 2013, 2012, 2011 and 2010 also include the results of Abengoa Yield under a single heading, "Profit (loss) from discontinued operations, net of tax".

Sale of Additional Assets to Abengoa Yield

Our plan to accelerate the sale of assets to Abengoa Yield through a right of first offer ("ROFO") agreement started at the end of 2014 with our approval of a divestment plan that includes several companies owning concessional projects for water desalination plants in Algeria (Skikda and Honnaine), power transmission lines in Peru (ATN2) and thermo-solar plants in Abu Dhabi (Shams) and Spain (Helioenergy 1/2).

On February 9, 2015, we announced our agreement entered into with Abengoa Yield for a second transfer of assets, including: ATN 2, a transmission power line in Peru (40% stake); Shams, a 100-MW solar power asset in the United Arab Emirates (20% stake); rights of usufruct over Helioenergy 1/2, a 100-MW solar power asset in Spain (29.6% stake); and Honaine and Skikda, two water desalination plants in Algeria with an aggregate capacity of 10.5 Mft3/day (25.5% and 34.17% stakes, respectively) for total proceeds of approximately $142 million. The sale of Honaine and Skikda was closed on February 15, 2015, while the acquisition of the remaining assets is still pending. Regarding Honaine and Skikda, we have entered into a two-year call and put option agreement with Abengoa Yield under which they have put option rights to require us to purchase back these assets at the same price paid by them and we have call option rights to require them to sell back these assets if certain indemnities and guarantees provided by us reach a certain threshold. In addition, discussions between us and Abengoa Yield have already commenced regarding a potential third dropdown for a total equity value in the range of $200 to $250 million. This potential third acquisition falls within the $100 million call option agreement announced between us and Abengoa Yield in December 2014 at a 12% yield. The third dropdown divestment is expected to close by the end of the year.

Given that as of December 31, 2014, the companies holding the above-mentioned companies were available for immediate sale and that we consider the sales to be highly probable, we classified the associated assets and liabilities as held for sale in the consolidated statement of financial position as of December 31, 2014. Until the closing of the respective sale transactions, the assets, other than Helioenergy 1/2, will be reported as held for sale in accordance with the stipulations and requirements of IFRS 5,Non-Current Assets Held For Sale and Discontinued Operations.

Potential Disposition of Greenfield Projects to APW1

On December 23, 2014, we entered into a letter agreement to negotiate exclusively with the energy infrastructure investor EIG Global Energy Partners ("EIG") until March 31, 2015 an investment by EIG-managed investment funds, alongside Abengoa, in a portfolio of greenfield projects currently owned by Abengoa, on the basis of the terms set forth in the term sheet attached to the letter agreement. On February 2, 2015, EIG confirmed to us in writing that its due diligence to date had not revealed facts or circumstances that would cause EIG not to recommend the proposed transaction for approval by the EIG

8

Table of Contents

investment committees overseeing investments by EIG-managed investment funds. On February 9, 2015, we announced that we and EIG were in an advanced stage of documentation and due diligence regarding the proposed transaction.

As part of the transaction, Abengoa is expected to contribute to a newly formed company, Abengoa Projects Warehouse 1 ("APW1"), a portfolio of selected Abengoa projects under construction, including renewable and conventional power generation, power transmission and water management assets in different geographies including, among others, the United States, Mexico, Brazil and Chile. Based on the current status of the negotiations, the total investment in the projects expected to be contributed is approximately $9.2 billion once these projects are fully invested in the coming years, of which approximately $2.5 billion is expected to be equity. Of the total equity estimated to be committed, based on the current status of the negotiations, we expect that a majority stake (approximately 55%) in APW1 will be held by EIG, with the remainder held by Abengoa. Our current estimate of the total amount of EIG's investment, based on the current status of the negotiations, is approximately $1.4 billion over four years based on the projects expected to be contributed.

Once APW1 is created and the initial projects contributed to the vehicle, EIG will make an initial payment to us of less than half of their total expected $1.4 billion contribution to purchase 55% of the equity that Abengoa has already invested in the projects that have been contributed to APW1. Abengoa is expecting to receive these cash proceeds before March 31, 2015. The remaining projects are expected to be contributed by us to APW1 over time. The remaining equity expected to be required in order to develop the entire portfolio of projects is expected to be contributed over a period of four years both by Abengoa and EIG pro-rata to their shareholding in APW1 following the construction schedule of the projects in the vehicle as they are contributed to the vehicle, which is expected to take several months.

We expect that the definitive transaction agreements related to the investment by EIG will be entered into by March 31, 2015. Once we have entered into the definitive transaction agreements and the projects have been transferred to APW1, Abengoa will no longer have a controlling interest in these assets. Given that as of December 31, 2014, the companies expected to be transferred to APW1 are available for immediate sale and we consider the sale to be highly probable, we have classified the associated assets and liabilities as held for sale in the consolidated statement of financial position as of December 31, 2014. Until entry into definitive documentation and closing of the sale transaction, the assets will be reported as held for sale in accordance with the stipulations and requirements of IFRS 5,Non-Current Assets Held for Sale and Discontinued Operations. The expectations set forth herein regarding a potential transaction with EIG, the projects to be contributed and related investment amounts are based on the current status of negotiations with EIG and are subject to change as negotiation of definitive transaction agreements progresses, and any such change may be material. We cannot guarantee that we will be successful in consummating the transaction with EIG on the terms described above, on other terms acceptable to us, or at all.

Application of IFRS 10 and 11

IFRS 10 and 11 came into effect on January 1, 2013 under IFRS as issued by the IASB and were initially applied in our interim consolidated financial statements as of and for the six months ended June 30, 2013 included in the final prospectus for our initial public offering in the United States as filed with the SEC on October 17, 2013. The main impacts of the application of the new standards relate to the de-consolidation of companies that do not fulfill the conditions of effective control during the construction phase, now recorded under the equity method, and to the elimination of the proportional consolidation of joint ventures, with the equity method being obligatory for recording our interest in the relevant entities. According to the terms and requirements established in IAS 8 'Accounting policies, changes in accounting estimates and errors', the above standards and amendments were retrospectively applied, recasting the comparative information presented for the year 2012. The above standards and amendments have already been applied in the Consolidated Financial statements as of and for the year ended December 31, 2012, presented in the final prospectus for our initial public offering in the United States. Financial information as of and for the years

9

Table of Contents

ended December, 31, 2011 and 2010 have not been recasted according to the transition guidance of IFRS 10. Consequently, the comparative information presented for the years 2011 and 2010 is not comparable with the more recent periods presented.

Befesa Sale

On June 13, 2013, we entered into a share purchase agreement for the sale of 100% of our shares in our subsidiary Befesa (the "Befesa Sale") to funds advised by Triton Partners (the "Triton Funds"). After customary net debt adjustments and subject to certain other adjustments, total consideration to us amounted to €620 million which was comprised of €348 million total cash, of which a payment of €331 million was received at closing and deferred compensation of €17 million (including €15 million in escrow pending resolution of ongoing litigation and a €2 million long-term receivable from a Befesa customer), a €48 million subordinated vendor note with a five-year maturity and a €225 million (par value) subordinated convertible instrument with a 15-year maturity (subject to two five-year extensions) accruing interest of 6 month Euribor in effect at closing date plus a 6% spread and which, upon the occurrence of certain triggering events including, but not limited to, Befesa's failure to meet certain financial targets or the exit of the Triton Funds from Befesa, may be converted into approximately 14% of the shares of Befesa (subject to certain adjustments). The share purchase agreement contains a two-year non-compete provision concerning Befesa's activities. On February 4, 2015, we sold the €48 million subordinated vendor note to Triton Partners (see Note 7.3 to our Consolidated Financial Statements).

On July 15, 2013, we received €331 million of cash proceeds corresponding to the price agreed for the shares and the sale of the transaction was closed. The gain on the sale amounted to €0.4 million and is included in "Results for the year from discontinued operations, net of taxes" in the Consolidated Income Statement.

Taking into account the significance of the activities carried out between Befesa and Abengoa, the sale of this shareholding is considered as a discontinued operation in accordance with IFRS 5,Non-Current Assets Held For Sale and Discontinued Operations. In accordance with this standard, the results of Befesa until the closing of the sale and the result of this sale are included under a single heading, "Profit (loss) for the year from discontinued operations, net of tax" in our Consolidated Financial Statements. Likewise, the consolidated income statements for the years ended December 31, 2013, 2012, 2011, and 2010 also include the results of Befesa under a single heading. The Befesa Sale also resulted in the removal of the Industrial Recycling segment from our Industrial Production activity.

Sale of Brazilian Transmission Line Assets

We sold, in two portions pursuant to three share purchase agreements, 100% of certain Brazilian transmission line assets to TAESA, an affiliate of Cemig.

Over the course of 2011 and 2012, Abengoa Concessões Brasil Holding S.A. ("Abengoa Concessões") entered into the Cemig Sales with TAESA which comprised the following: (i) on June 2, 2011, we sold 50% of our interest in four project companies: STE—Sul Transmissora de Energia S.A. ("STE"), ATE Transmissora de Energia S.A. ("ATE"), ATE II Transmissora de Energia S.A. ("ATE II") and ATE III Transmissora de Energia S.A. ("ATE III"); (ii) also on June 2, 2011 we sold 100% of the share capital of NTE Nordeste Transmissora de Energia S.A. and; (iii) on March 16, 2012, we signed an additional share purchase agreement to sell our remaining 50% interest in project companies STE, ATE, ATE II and ATE III.

On June 30, 2012, all the conditions necessary to close the transaction were fulfilled, and on July 2, we received €354 million of cash proceeds corresponding to the total price agreed for the shares. The gain from the Second Cemig Sale of €4.5 million is reflected in the "Other operating income" line item in our consolidated income statement for the year ended December 31, 2012. The Second Cemig Sale includes a post-closing adjustment mechanism similar to that described above relating to the First Cemig Sale, and no significant post-closing adjustment was required to be paid.

10

Table of Contents

In our consolidated income statement for the year ended December 31, 2012 included in the Consolidated Financial Statements, the profits and losses of the four project companies we contributed to UNISA (STE, ATE, ATE II and ATE III) are recorded under the equity method as a result of the retrospective application of IFRS 11 from January 1, 2012 until June 30, 2012, when the Second Cemig Sale closed.

Simplification of Engineering and Construction Activity

Prior to 2014, our Engineering and Construction activity was comprised of two operating segments: Engineering and Construction, and Technology and Other. Beginning in 2014, we began including the Technology and Other segment with the Engineering and Construction segment in accordance with IFRS 8, Operating Segments. As a result, our Engineering and Construction activity is now comprised of a single operating segment, Engineering and Construction, and the information by activities for the years ended December 31, 2013 and 2012 has been presented according to the new segmentation.

Commencement of Operations of Projects

The comparability of our results of operations is significantly influenced by the volume of projects that become operational during a particular year. The number of projects becoming operational and the length of projects under construction significantly impact our revenue and operating profit, as well as our consolidated profit after tax during a particular period, which makes the comparison of periods difficult.

The following table sets forth the current principal projects that commenced operations during each of the years ended December 31, 2014, 2013 and 2012, including the quarter in which operations began.

| | | | | | | | |

| Segment | | Project | | 2012 | | 2013 | | 2014 |

|---|

Transmission | | Manaus (Brazil) | | | | 1st quarter | | |

| | Norte Brazil (Brazil) | | | | | | 3rd quarter |

Biofuels | | Salamanca (Spain)—Waste to Biofuels plant | | | | 2nd quarter | | |

| | Hugoton (USA) | | | | | | 4th quarter |

Water | | Qingdao (China)(3) | | | | 1st quarter | | |

| | Tenes (Algeria) | | | | | | 4th quarter |

Solar | | Helioenergy 2 (Spain)(1) | | 1st quarter | | | | |

| | Helios 1 (Spain) | | 2nd quarter | | | | |

| | Helios 2 (Spain) | | 3rd quarter | | | | |

| | Shams (UAE)(1) | | | | 1st quarter | | |

| | Solaben 1-6 (Spain) | | | | 4th quarter | | |

Abengoa Yield(2) | | Solacor 1 (Spain) | | 1st quarter | | | | |

(as discontinued operations) | | Solacor 2 (Spain) | | 1st quarter | | | | |

| | Solaben 2 (Spain) | | 4th quarter | | | | |

| | Solaben 3 (Spain) | | 2nd quarter | | | | |

| | ACT (Mexico) | | | | 2nd quarter | | |

| | Solana (USA) | | | | 4th quarter | | |

| | ATS (Peru) | | | | | | 1st quarter |

| | Quadra 2 (Chile) | | | | | | 1st quarter |

| | Quadra 1 (Chile) | | | | | | 2nd quarter |

| | Palmatir (Uruguay) | | | | | | 2nd quarter |

| | Mojave (USA) | | | | | | 4th quarter |

| | Cadonal (Uruguay) | | | | | | 4th quarter |

- (1)

- Assets announced to be transferred to Abengoa Yield.

11

Table of Contents

- (2)

- As of December 31, 2014, we held 64% of the ordinary share capital of Abengoa Yield. On December 15, 2014, our Board of Directors approved a plan to reduce our shareholding in Abengoa Yield to below 50% during 2015, subject to market conditions. On January 22, 2015, we completed an initial divestment of 13% which brought our shareholding in Abengoa Yield to 51%. On February 9, 2015, we announced our intention to reduce our shareholding in Abengoa Yield to below 50% by the end of the first half of 2015, with the objective of maintaining a long-term stake in the range of 40-49%.

- (3)

- Sold in the last quarter of 2014.

Non-GAAP Financial Measures

This annual report contains non-GAAP financial measures and ratios, including Consolidated EBITDA, Corporate EBITDA, Gross Corporate Debt, Net Corporate Debt and constant currency presentation, that are not required by, or presented in accordance with, IFRS as issued by the IASB.

- •

- Consolidated EBITDA is calculated as profit for the year, after adding back income tax expense/(benefit), share of (loss)/profit of associates, finance expense net and depreciation, amortization and impairment charges of Abengoa, S.A. and its subsidiaries.

- •

- Corporate EBITDA is calculated as profit for the year from continuing operations, after adding back income tax expense/(benefit), share of (loss)/profits of associates, finance expense net, depreciation, amortization and impairment charges of Abengoa, S.A. and its subsidiaries less EBITDA from non-recourse activities net of eliminations.

- •

- Gross Corporate Debt consists of our (i) long-term debt (debt with a maturity of greater than one year) incurred with credit institutions, plus (ii) short-term debt (debt with a maturity of one year or less) incurred with credit institutions, plus (iii) notes, obligations, promissory notes, financial leases and any other such obligations or liabilities, the purpose of which is to provide finance and which generate a financial cost for us, plus (iv) obligations relating to guarantees of third-party obligations (other than intra-Group guarantees), but excluding any Project Debt.

- •

- Net Corporate Debt consists of Gross Corporate Debt, excluding obligations relating to guarantees of third parties (other than intragroup guarantees), less total cash and cash equivalents (excluding project cash and cash equivalents), and short-term financial investments at the end of each period (excluding project short-term financial investments).

We present non-GAAP financial measures because we believe that they and other similar measures are widely used by certain investors, securities analysts and other interested parties as supplemental measures of performance and liquidity. The non-GAAP financial measures may not be comparable to other similarly titled measures of other companies and have limitations as analytical tools and should not be considered in isolation or as a substitute for analysis of our operating results as reported under IFRS as issued by the IASB. Non-GAAP financial measures and ratios are not measurements of our performance or liquidity under IFRS as issued by the IASB and should not be considered as alternatives to operating profit or profit for the year or any other performance measures derived in accordance with IFRS as issued by the IASB or any other generally accepted accounting principles or as alternatives to cash flow from operating, investing or financing activities.

Some of the limitations of these non-GAAP measures and ratios are:

- •

- they do not reflect our cash expenditures or future requirements for capital expenditures or contractual commitments;

- •

- they do not reflect changes in, or cash requirements for, our working capital needs;

- •

- they do not reflect the significant interest expense, or the cash requirements necessary, to service interest or principal payments, on our debts;

- •

- although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often need to be replaced in the future and Consolidated EBITDA and Corporate EBITDA do not reflect any cash requirements that would be required for such replacements;

12

Table of Contents

- •

- some of the exceptional items that we eliminate in calculating Consolidated EBITDA and Corporate EBITDA reflect cash payments that were made, or will be made in the future; and

- •

- the fact that other companies in our industry may calculate Consolidated EBITDA, Corporate EBITDA, Gross Corporate Debt and Net Corporate Debt differently than we do, which limits their usefulness as comparative measures.

In our discussion of operating results, we have included foreign exchange impacts in our revenue by providing constant currency revenue growth. The constant currency presentation is a non-GAAP financial measure, which excludes the impact of fluctuations in foreign currency exchange rates. We believe providing constant currency information provides valuable supplemental information regarding our results of operations. We calculate constant currency amounts by converting our current period local currency revenue using the prior period foreign currency average exchange rates and comparing these adjusted amounts to our prior period reported results. This calculation may differ from similarly titled measures used by others and, accordingly, the constant currency presentation is not meant to substitute for recorded amounts presented in conformity with IFRS as issued by the IASB nor should such amounts be considered in isolation.

13

Table of Contents

PART I.

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. Selected Consolidated and Other Financial and Operating Data

The following tables present selected consolidated financial and business level information for Abengoa, S.A. as of and for each of the years ended December 31, 2014, 2013, 2012, 2011 and 2010.

The selected financial information as of December 31, 2014 and 2013 and for the years ended December 31, 2014, 2013 and 2012 is derived from, and qualified in its entirety by reference to, our Consolidated Financial Statements and related notes, prepared in accordance with IFRS as issued by the IASB, which are included elsewhere in this annual report. The selected financial information as of December 31, 2012 and as of and for the years ended December 31, 2011 and 2010 is derived from, and qualified in its entirety by reference to our consolidated financial statements and related notes for the years ended December 31, 2012, 2011 and 2010.

The selected consolidated financial information as of and for the years ended December 31, 2014, 2013, 2012, 2011 and 2010 is not intended to be an indicator of our financial condition or results of operations in the future. You should review such selected consolidated financial information together with our Consolidated Financial Statements and notes thereto, included elsewhere in this annual report.

14

Table of Contents

The following tables should be read in conjunction with "Item 5.A—Operating Results", and our Consolidated Financial Statements and related notes included elsewhere in this annual report.

| | | | | | | | | | | | | | | | |

| | Year ended December 31, | |

|---|

| | 2014(1) | | 2013(1)(3) | | 2012(1)(2)(3) | | 2011(1)(3)(4) | | 2010(1)(3)(4) | |

|---|

| | (€ in millions)

| |

|---|

Consolidated Income Statement Data | | | | | | | | | | | | | | | | |

Revenue | | | 7,150.6 | | | 7,245.1 | | | 6,285.6 | | | 6,682.1 | | | 4,359.4 | |

Changes in inventories of finished goods and work in progress | | | 1.1 | | | 7.7 | | | 19.7 | | | 64.1 | | | 24.1 | |

Other operating income | | | 188.3 | | | 441.4 | | | 481.9 | | | 598.2 | | | 751.5 | |

Raw materials and consumables used | | | (4,083.1 | ) | | (4,469.9 | ) | | (4,244.7 | ) | | (4,655.7 | ) | | (3,257.0 | ) |

Employee benefit expense | | | (871.9 | ) | | (755.4 | ) | | (708.0 | ) | | (609.6 | ) | | (507.6 | ) |

Depreciation, amortization and impairment charges | | | (474.9 | ) | | (516.4 | ) | | (406.3 | ) | | (226.3 | ) | | (228.7 | ) |

Other operating expenses | | | (976.9 | ) | | (1,201.5 | ) | | (907.6 | ) | | (917.3 | ) | | (661.4 | ) |

| | | | | | | | | | | | | | | | | |

Operating profit | | | 933.2 | | | 751.0 | | | 520.6 | | | 935.6 | | | 480.4 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Finance income | | | 62.1 | | | 67.0 | | | 87,5 | | | 105.3 | | | 79.4 | |

Finance expense | | | (745.4 | ) | | (583.2 | ) | | (532.2 | ) | | (569.7 | ) | | (366.8 | ) |

Net exchange differences | | | 5.0 | | | (3.5 | ) | | (36.1 | ) | | (28.3 | ) | | (20.3 | ) |

Other financial income/(expense) net | | | (176.5 | ) | | (119.2 | ) | | (157.9 | ) | | (170.1 | ) | | (18.1 | ) |

| | | | | | | | | | | | | | | | | |

Finance expense, net | | | (854.8 | ) | | (638.9 | ) | | (638.7 | ) | | (662.9 | ) | | (325.8 | ) |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Share of (loss)/profit of associates | | | 7.0 | | | (5.2 | ) | | 17.9 | | | 4.0 | | | 8.5 | |

| | | | | | | | | | | | | | | | | |

Profit (loss) before income tax | | | 85.4 | | | 106.9 | | | (100.2 | ) | | 276.7 | | | 163.1 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Income tax benefit/(expense) | | | 58.7 | | | 26.2 | | | 174.1 | | | (2.2 | ) | | 18.0 | |

| | | | | | | | | | | | | | | | | |

Profit for the year from continued operations | | | 144.1 | | | 133.1 | | | 73.8 | | | 274.5 | | | 181.0 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Profit (loss) for the year from discontinued operations, net of tax | | | (22.2 | ) | | (22.7 | ) | | 20.2 | | | 121.0 | | | 82.3 | |

| | | | | | | | | | | | | | | | | |

Profit for the year | | | 121.9 | | | 110.3 | | | 94.0 | | | 395.5 | | | 263.3 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Profit attributable to non-controlling interest from continued operations | | | 3.6 | | | (7.7 | ) | | (38.2 | ) | | (18.6 | ) | | (53.5 | ) |

Profit attributable to non-controlling interest from discontinued operations | | | (0.2 | ) | | (1.2 | ) | | (0.4 | ) | | (2.8 | ) | | (2.7 | ) |

| | | | | | | | | | | | | | | | | |

Profit for the year attributable to the parent company | | | 125.3 | | | 101.4 | | | 55.4 | | | 374.1 | | | 207.2 | |

Weighted average number of ordinary shares outstanding (thousands)(5) | | | 835,371 | | | 595,905 | | | 538,063 | | | 466,634 | | | 452,348 | |

Basic earnings per Share from continued operations (€ per share) | | | 0.18 | | | 0.21 | | | 0.06 | | | 0.55 | | | 0.28 | |

Basic earnings per Share from discontinued operations (€ per share) | | | (0.03 | ) | | (0.04 | ) | | 0.04 | | | 0.25 | | | 0.18 | |

Basic earnings per share attributable to the parent company (€ per share) | | | 0.15 | | | 0.17 | | | 0.1 | | | 0.8 | | | 0.46 | |

Weighted average number of ordinary shares outstanding (thousands)(5) | | | 835,371 | | | 595,905 | | | 538,063 | | | 466,634 | | | 452,348 | |

Warrants adjustments (average weighted number of shares outstanding since issue)(5) | | | 20.039 | | | 19.995 | | | 20,021 | | | 3,340 | | | — | |

Diluted earnings per Share from continued operations (€ per share) | | | 0.17 | | | 0.20 | | | 0.06 | | | 0.55 | | | n/a(* | ) |

Diluted earnings per Share from discontinued operations (€ per share) | | | (0.02 | ) | | (0.04 | ) | | 0.04 | | | 0.25 | | | n/a(* | ) |

Diluted earnings per share attributable to the parent company (€ per share) | | | 0.15 | | | 0.16 | | | 0.10 | | | 0.8 | | | n/a(* | ) |

Dividend paid per share (€ per share)(6) | | | 0.111 | | | 0.072 | | | 0.070 | | | 0.040 | | | n/a(* | ) |

- *

- Diluted earnings per share equals basic earnings per share for this period.

15

Table of Contents

| | | | | | | | | | | | | | | | |

| | As of December 31, | |

|---|

| | 2014(1) | | 2013 | | 2012(2) | | 2011 | | 2010 | |

|---|

| | (€ in millions)

| |

|---|

Consolidated Statement of Financial Position Data | | | | | | | | | | | | | | | | |

Non-current assets: | | | | | | | | | | | | | | | | |

Intangible assets | | | 1,568.4 | | | 842.1 | | | 1,556.7 | | | 1,290.5 | | | 1,793.5 | |

Property, plant and equipment | | | 1,287.3 | | | 1,273.6 | | | 1,431.6 | | | 1,502.9 | | | 1,640.3 | |

Fixed assets in projects | | | 6,188.4 | | | 9,914.3 | | | 7,786.0 | | | 7,782.5 | | | 5,744.8 | |

Investments in associates carried under the equity method | | | 311.3 | | | 835.7 | | | 920.1 | | | 51.3 | | | 48.6 | |

Financial investments | | | 686.5 | | | 761.2 | | | 479.8 | | | 405.3 | | | 437.8 | |

Deferred tax Assets | | | 1,503.6 | | | 1,281.1 | | | 1,148.3 | | | 939.7 | | | 885.7 | |

| | | | | | | | | | | | | | | | | |

Total non-current assets | | | 11,545.4 | | | 14,908.0 | | | 13,322.6 | | | 11,972.2 | | | 10,550.6 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Current assets: | | | | | | | | | | | | | | | | |

Inventories | | | 294.8 | | | 331.0 | | | 426.8 | | | 384.9 | | | 385.0 | |

Clients and other receivables | | | 2,156.9 | | | 1,870.0 | | | 2,271.3 | | | 1,806.3 | | | 2,141.4 | |

Financial investments | | | 1,048.6 | | | 925.8 | | | 900.0 | | | 1,013.9 | | | 913.6 | |

Cash and cash equivalents | | | 1,810.8 | | | 2,951.7 | | | 2,413.2 | | | 3,738.1 | | | 2,983.2 | |

Assets held for sale (discontinued operations) | | | 8,390.1 | | | 166.4 | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | | |

Total current assets | | | 13,701.2 | | | 6,244.9 | | | 6,011.3 | | | 6,943.2 | | | 6,423.3 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Total assets | | | 25,246.6 | | | 21,152.8 | | | 19,333.9 | | | 18,915.4 | | | 16,973.9 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Total equity | | | 2,646.2 | | | 1,893.0 | | | 1,860.4 | | | 1,848.0 | | | 1,630.3 | |

Non-current liabilities: | | |

| | |

| | |

| | |

| | |

| |

Long-term project debt | | | 4,158.9 | | | 5,736.2 | | | 4,679.0 | | | 4,983.0 | | | 3,557.9 | |

Long-term corporate financing | | | 3,748.7 | | | 4,735.1 | | | 4,356.4 | | | 4,149.9 | | | 4,441.7 | |

Other liabilities | | | 851.5 | | | 1,348.1 | | | 1,067.4 | | | 1,028.2 | | | 952.2 | |

| | | | | | | | | | | | | | | | | |

Total non-current liabilities | | | 8,759.1 | | | 11,819.4 | | | 10,102.8 | | | 10,161.1 | | | 8,951.8 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Current liabilities: | | | | | | | | | | | | | | | | |

Short-term project debt | | | 799.2 | | | 584.8 | | | 577.8 | | | 407.1 | | | 492.1 | |

Short-term corporate financing | | | 1,576.7 | | | 919.3 | | | 590.4 | | | 918.8 | | | 719.9 | |

Other liabilities | | | 5,984.9 | | | 5,815.0 | | | 6,202.6 | | | 5,580.5 | | | 5,179.7 | |

Liabilities held for sale (discontinued operations) | | | 5,480.5 | | | 121.3 | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | | |

Total current liabilities | | | 13,841.4 | | | 7,440.4 | | | 7,370.7 | | | 6,906.4 | | | 6,391.7 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Total Liabilities | | | 22,600.4 | | | 19,259.8 | | | 17,473.6 | | | 17,067.5 | | | 15,343.5 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

16

Table of Contents

Consolidated Cash Flow Statements

| | | | | | | | | | | | | | | | |

| | Year ended December 31, | |

|---|

| | 2014(1) | | 2013(1)(3) | | 2012(1)(2)(3) | | 2011(1)(3)(4) | | 2010(1)(3)(4) | |

|---|

| | (€ in millions)

| |

|---|

Consolidated Cash Flow Statement Data | | | | | | | | | | | | | | | | |

Gross cash flows from operating activities | | | | | | | | | | | | | | | | |

Profit fot the period from continuing operations | | | 144.1 | | | 133.1 | | | 73.8 | | | 274.5 | | | 181.0 | |

Adjustments to reconcile consolidated after-tax profit to net cash generated by operating activities | | | 1,038.6 | | | 797.7 | | | 679.4 | | | 543.3 | | | 339.0 | |

Variations in working capital and other items | | | (1,164.1 | ) | | (218.3 | ) | | (165.9 | ) | | 563.2 | | | 298.9 | |

| | | | | | | | | | | | | | | | | |

Total net cash flow generated by (used in) operating activities | | | 18.6 | | | 712.5 | | | 587.3 | | | 1,381.0 | | | 818.9 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Net cash flows from investment activities | | | | | | | | | | | | | | | | |

Investments | | | (2,634.1 | ) | | (1,877.1 | ) | | (2,216.1 | ) | | (1,979.3 | ) | | (1,640.7 | ) |

Disposals | | | 134.4 | | | 512.7 | | | 410.4 | | | 1,064.0 | | | 175.7 | |

| | | | | | | | | | | | | | | | | |

Total net cash flows used in investment activities | | | (2,499.7 | ) | | (1,364.4 | ) | | (1,805.7 | ) | | (915.3 | ) | | (1,465.0 | ) |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Net cash flows generated by finance activities | | | 1,590.6 | | | 1,197.5 | | | 5.6 | | | 478.6 | | | 1,946.4 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Net increase/(decrease) in cash and cash equivalents | | | (890.5 | ) | | 545.6 | | | (1,212.8 | ) | | 944.3 | | | 1,300.3 | |

Cash and cash equivalents at the beginning of the year | | | 2,951.7 | | | 2,413.2 | | | 3,723.2 | | | 2,983.2 | | | 1,546.4 | |

Discontinued operations/Assets held for sale | | | (281.7 | ) | | (112.1 | ) | | (31.3 | ) | | (193.0 | ) | | 89.0 | |

Currency translation difference on cash and cash equivalents | | | 31.3 | | | 105.0 | | | (66.0 | ) | | 3.6 | | | 47.5 | |

| | | | | | | | | | | | | | | | | |

Cash and cash equivalents at the end of the year | | | 1,810.8 | | | 2,951.7 | | | 2,413.2 | | | 3,738.1 | | | 2,983.2 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Business and Geographic Activity Data

| | | | | | | | | | |

| | Year ended December 31, | |

|---|

| | 2014(1) | | 2013(1)(3) | | 2012(1)(2)(3) | |

|---|

| | (€ in millions)

| |

|---|

Consolidated Revenue by Activity | | | | | | | | | | |

Engineering and Construction | | | 4,514.5 | | | 4,831.7 | | | 3,789.2 | |

| | | | | | | | | | | |

Engineering and Construction | | | 4,514.5 | | | 4,831.7 | | | 3,789.2 | |

Concession-Type Infrastructure | | | 499.4 | | | 384.3 | | | 358.2 | |

| | | | | | | | | | | |

Solar | | | 335.2 | | | 258.7 | | | 259.8 | |

Transmission | | | 91.4 | | | 47.5 | | | 24.4 | |

Water | | | 40.8 | | | 40.2 | | | 20.7 | |

Co-generation and other | | | 32.0 | | | 38.0 | | | 53.2 | |

Industrial Production | | | 2,136.7 | | | 2,029.1 | | | 2,138.2 | |

| | | | | | | | | | | |

Biofuels | | | 2,136.7 | | | 2,029.7 | | | 2,138.2 | |

| | | | | | | | | | | |

Total revenue | | | 7,150.6 | | | 7,245.1 | | | 6,285.6 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

17

Table of Contents

| | | | | | | | | | |

| | Year ended December 31, | |

|---|

| | 2014(1) | | 2013(1)(3) | | 2012(1)(2)(3) | |

|---|

| | (€ in millions)

| |

|---|

Consolidated Revenue by Geography | | | | | | | | | | |

Spain | | | 889.1 | | | 1,129.3 | | | 925.0 | |

North America | | | 2,253.6 | | | 2,670.4 | | | 2,569.3 | |

Europe (excluding Spain) | | | 892.9 | | | 863.3 | | | 877.8 | |

Brazil | | | 874.7 | | | 726.0 | | | 986.6 | |

South America (excluding Brazil) | | | 1,301.8 | | | 689.6 | | | 522.3 | |

Other regions | | | 938.5 | | | 1,166.5 | | | 404.6 | |

| | | | | | | | | | | |

Total revenue | | | 7,150.6 | | | 7,245.1 | | | 6,285.6 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Non-GAAP Financial Data

| | | | | | | | | | |

| | Year ended December 31, | |

|---|

| | 2014(1) | | 2013(1)(3) | | 2012(1)(2)(3) | |

|---|

| | (€ in millions)

| |

|---|

Consolidated EBITDA by Activity | | | | | | | | | | |

Engineering and Construction | | | 806.0 | | | 806.5 | | | 623.9 | |

| | | | | | | | | | | |

Engineering and Construction | | | 806.0 | | | 806.5 | | | 623.9 | |

Concession-Type Infrastructures | | | 330.6 | | | 220.0 | | | 211.9 | |

| | | | | | | | | | | |

Solar | | | 235.9 | | | 156.8 | | | 190.4 | |

Transmission | | | 64.3 | | | 27.7 | | | 6.9 | |

Water | | | 26.5 | | | 28.1 | | | 11.6 | |

Co-generation and other | | | 3.9 | | | 7.3 | | | 2.9 | |

Industrial Production | | | 271.4 | | | 240.9 | | | 91.1 | |

| | | | | | | | | | | |

Biofuels | | | 271.4 | | | 240.9 | | | 91.1 | |

| | | | | | | | | | | |

Consolidated EBITDA(7) | | | 1,408.0 | | | 1,267.4 | | | 926.9 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

The following table sets forth a reconciliation of Consolidated EBITDA to our consolidated profit for the year:

| | | | | | | | | | |

| | Year ended December 31, | |

|---|

| | 2014(1) | | 2013(1)(3) | | 2012(1)(2)(3) | |

|---|

| | (€ in millions)

| |

|---|

Reconciliation of profit for the year to Consolidated EBITDA | | | | | | | | | | |

Profit for the year | | | 121.9 | | | 110.3 | | | 94.0 | |

Profit (loss) for the year from discontinued operations, net of tax | | | 22.2 | | | 22.7 | | | (20.2 | ) |

Income tax expenses/(benefits) | | | (58.7 | ) | | (26.2 | ) | | (174.1 | ) |

Share of loss/(profit) of associated companies | | | (7.0 | ) | | 5.2 | | | (17.9 | ) |

Net finance expenses | | | 854.8 | | | 638.9 | | | 638.7 | |

| | | | | | | | | | | |

Operating profit | | | 933.2 | | | 751.0 | | | 520.6 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Depreciation, amortization and impairment changes | | | 474.9 | | | 516.4 | | | 406.3 | |

| | | | | | | | | | | |

Consolidated EBITDA(7) | | | 1,408.0 | | | 1,267.4 | | | 926.9 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

18

Table of Contents

The following table sets forth a reconciliation of Consolidated EBITDA to our Net cash generated by operating activities:

| | | | | | | | | | |

| | Year ended December 31, | |

|---|

| | 2014(1) | | 2013(1)(3) | | 2012(1)(2)(3) | |

|---|

| | (€ in millions)

| |

|---|

Reconciliation of Consolidated EBITDA to Net cash generated or used from operating activities | | | | | | | | | | |

Consolidated EBITDA | | | 1,408.0 | | | 1,267.4 | | | 926.9 | |

(Profit)/loss from sale of subsidiaries and property, plant and equipment | | | | | | | | | | |

Other cash finance costs and other | | | (225.3 | ) | | (336.5 | ) | | (173.7 | ) |

Variations in working capital | | | (523.6 | ) | | 221.2 | | | 149.5 | |

Income tax (paid) | | | 8.6 | | | (12.1 | ) | | (35.5 | ) |

Interests (paid)/received | | | (772.3 | ) | | (508.9 | ) | | (397.0 | ) |

Discontinued operations | | | 123.2 | | | 81.5 | | | 117.0 | |

| | | | | | | | | | | |

Net cash generated or used from operating activities | | | 18.6 | | | 712.5 | | | 587.3 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

- (1)

- On December 15, 2014, our Board of Directors approved a plan to further improve our financial structure through three main initiatives which contemplated the sale of certain companies, including Abengoa Yield. Given that as of December 31, 2014, those certain companies were available for immediate sale and we considered the sale to be highly probable, we have classified their associated assets and liabilities as held for sale in our annual consolidated financial statements as of December 31, 2014, prepared in accordance with IFRS as issued by the IASB, which are included elsewhere in this annual report. Until the closing of the sale of those certain companies, the assets will be reported as held for sale in accordance with the stipulations and requirements of IFRS 5,Non-Current Assets Held For Sale and Discontinued Operations. Furthermore, during June 2014, we completed the initial public offering of Abengoa Yield, which grouped assets previously reported in different operating segments within the Concession-Type Infrastructure activity. As such, Abengoa Yield became a new operating segment within the Concession-Type Infrastructure activity after the Abengoa Yield IPO. Consequently, it has been reported as a separate segment in our quarterly financial information for the quarters ended June 30, 2014 and September 30, 2014. Taking into account that Abengoa Yield was an operating segment within our Concession-Type Infrastructure activity during part of 2014 and the significance that those activities carried out by Abengoa Yield have for Abengoa, our shareholding in Abengoa Yield during 2014 was treated as a discontinued operation in accordance with the stipulations and requirements of IFRS 5,Non-Current Assets Held for Sale and Discontinued Operations. The treatment of Abengoa Yield as discontinued operations also resulted in the removal of the Abengoa Yield operating segment from our Concession-Type Infrastructure activity. In accordance with this standard, the assets and liabilities of Abengoa Yield have been reclassified as assets and liabilities held for sale in our consolidated statement of financial position included within our consolidated financial statements as of and for the year ended December 31, 2014. Likewise, our consolidated income statements for the years ended December 31, 2014 and 2013 also include the results of Abengoa Yield under a single heading, "Profit (loss) from discontinued operations, net of tax".

- (2)

- In the consolidated financial statements of Abengoa and its subsidiaries as of December 31, 2013, prepared in accordance with IFRS as issued by the IASB, the Group applied IFRS 10 and 11 that came into effect on January 1, 2013 under IFRS-IASB. According to the terms and requirements established in IAS 8 "Accounting Policies, Changes in Accounting Estimates and Errors" and to the specific transition guidance of the new standards, we recasted the financial information as of and for the year ended December 31, 2012 and the recasted financial information is included herein. Financial information for prior periods was not recasted therein or herein for IFRS 10 and 11 according to the transition guidance and consequently is not comparable with other periods presented. See "Presentation of Financial Information".

- (3)

- On July 15, 2013, we closed the sale of 100% of our shares in our subsidiary Befesa. On that date, we received €331 million of cash proceeds. Taking into account the significance of the activities carried out by Befesa to Abengoa, the sale of this shareholding is considered as a discontinued operation to in accordance with IFRS 5,Non-Current Assets Held for Sale and Discontinued Operations. In accordance with this standard, the results of Befesa until the closing of the sale and the result of this sale are included under a single heading, "Profit (loss) for the year from discontinued operations, net of tax" in our Consolidated Financial Statements and under separate line items in the consolidated cash-flow statement for the year ended December 31, 2013. The consolidated income statement for the years ended December 31, 2012, 2011 and 2010 also includes the results of Befesa under a single heading. See "Presentation of Financial Information". The Befesa Sale also resulted in the removal of the Industrial Recycling segment from our Industrial Production activity.

- (4)

- As of December 31, 2010 and during part of the year 2011, we held a 40% shareholding in Telvent GIT, S.A. ("Telvent"). Despite partially reducing our share ownership in Telvent during 2009, we remained the largest shareholder and our 40% shareholding,

19

Table of Contents

along with our control of certain treasury shares held by Telvent, permitted us to exercise de facto control over Telvent. Therefore Telvent's financial information was fully consolidated with our consolidated financial statements for the year ended December 31, 2010 and the period of 2011 in which we held control over Telvent. On June 1, 2011, we announced the sale of our investment in Telvent to Schneider Electric S.A. ("SE") and on September 5, 2011 the transaction was completed. As a result and taking into account the significance of Telvent to us, Telvent was treated as discontinued operations in accordance with IFRS 5,Non-Current Assets Held for Sale and Discontinued Operations. The results obtained from this sale are included under a single heading in the consolidated income statement and under separate line items in the consolidated cash flow statement for the year 2011 and the consolidated income statement for 2010 has been recasted to present Telvent as discontinued operations.

- (5)

- Number of shares considered in all periods is after the increase in Class B shares distributed for no consideration approved by the Extraordinary General Shareholders' Meeting on September 30, 2012 and considered effective on October 2, 2012, equivalent to a split of shares, as described in Note 18 to our Consolidated Financial Statements.

- (6)

- Dividends paid per share have been calculated considering the post-split number of shares, restating prior periods in order to be consistent with the earnings per share calculation. Dividends paid in 2014, 2013, 2012 (in April, July and April, respectively) were €0.111 per share in the aggregate (US$0.153), €0.072 per share in the aggregate (US$0.094) and €0.070 per share in the aggregate (US$0.088), respectively.

- (7)

- Consolidated EBITDA is calculated as profit for the year, after adding back income tax expense/(benefit), share of (loss)/profit of associates, finance expense net and depreciation, amortization and impairment charges of Abengoa, S.A. Consolidated EBITDA is not a measurement of performance under IFRS as issued by the IASB and you should not consider Consolidated EBITDA as an alternative to operating income or consolidated profits as a measure of our operating performance, cash flows from operating, investing and financing activities as a measure of our ability to meet our cash needs or any other measures of performance under generally accepted accounting principles. We believe that Consolidated EBITDA is a useful indicator of our ability to incur and service our indebtedness and can assist securities analysts, investors and other parties to evaluate us. Consolidated EBITDA and similar measures are used by different companies for different purposes and are often calculated in ways that reflect the circumstances of those companies. Consolidated EBITDA may not be indicative of our historical operating results, nor are meant to be predictive of potential future results. See "Presentation of Financial Information—Non-GAAP Financial Measures."

Exchange Rate Information

The following table sets forth, for the periods indicated, the Noon Buying Rate certified by the Federal Reserve Bank of New York expressed in U.S. Dollar per €1.00. The Noon Buying Rate refers to the exchange for euro, expressed in U.S. Dollars per euro, in the City of New York for cable transfers payable in foreign currencies as certified by the Federal Reserve Bank of New York for customs purposes. The rates may differ from the actual rates used in the preparation of the Consolidated Financial Statements and other financial information appearing in this annual report. We do not represent that the U.S. Dollar amounts referred to below could be or could have been converted into euro at any particular rate indicated or any other rate.

The average rate of the Noon Buying Rate means the average rates for the euro on the last day reported of each month during the relevant period.

20

Table of Contents

The Federal Reserve Bank of New York Noon Buying Rate of the euro on February 13, 2015 was $1.1408 per €1.00.

| | | | | | | | | | | | | |

| | U.S. Dollar per €1.00 | |

|---|

| | High | | Low | | Average | | Period End | |

|---|

Year | | | | | | | | | | | | | |

2010 | | | 1.4536 | | | 1.1959 | | | 1.3218 | | | 1.3269 | |

2011 | | | 1.4875 | | | 1.2926 | | | 1.4002 | | | 1.2973 | |

2012 | | | 1.3463 | | | 1.2062 | | | 1.2909 | | | 1.3186 | |

2013 | | | 1.3816 | | | 1.2774 | | | 1.3303 | | | 1.3779 | |

2014 | | | 1.3927 | | | 1.2101 | | | 1.3297 | | | 1.2101 | |

Month | | | | | | | | | | | | | |

August 2014 | | | 1.3436 | | | 1.3150 | | | 1.3315 | | | 1.3150 | |

September 2014 | | | 1.3126 | | | 1.2628 | | | 1.2889 | | | 1.2628 | |

October 2014 | | | 1.2812 | | | 1.2517 | | | 1.2677 | | | 1.2530 | |

November 2014 | | | 1.2554 | | | 1.2394 | | | 1.2472 | | | 1.2438 | |

December 2014 | | | 1.2504 | | | 1.2101 | | | 1.2329 | | | 1.2101 | |

January 2015 | | | 1.2015 | | | 1.1279 | | | 1.1615 | | | 1.1290 | |

February 2015 (through February 13, 2015 | | | 1.1462 | | | 1.1300 | | | 1.1373 | | | 1.1408 | |

B. Capitalization and Indebtedness

Not applicable.