In January 2011, PPL Energy Supply distributed its 100% membership interest in PPL Global to its parent, PPL Energy Funding, to better align PPL's organizational structure with the manner in which it manages its businesses and reports segment information in its consolidated financial statements.

To manage financing costs and access to credit markets, a key objective for PPL's business is to maintain a strong credit profile. PPL continually focuses on maintaining an appropriate capital structure and liquidity position. In addition, PPL has adopted financial and operational risk management programs that, among other things, are designed to monitor and manage its exposure to earnings and cash flow volatility related to changes in energy and fuel prices, interest rates, foreign currency exchange rates, counterparty credit quality and the operating performance of its generating units. See "Item 1A. Risk Factors" for more information concerning these and other material risks PPL faces in its businesses.

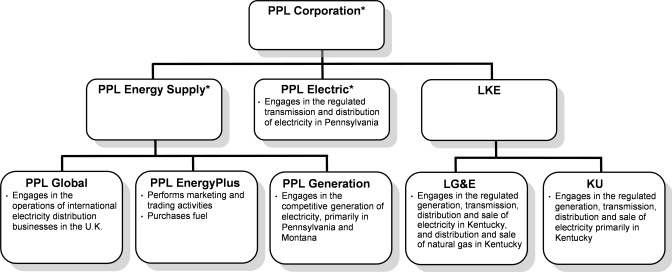

Following the November 1, 2010 acquisition of LKE, PPL is organized into four segments: Kentucky Regulated, International Regulated (formerly International Delivery), Pennsylvania Regulated (formerly Pennsylvania Delivery) and Supply. Other than PPL adding a Kentucky Regulated segment, there were no other changes to reportable segments except the renaming of segments and allocating interest expense related to the Equity Units to the Kentucky Regulated segment. Refer to "Item 1. Business - Background" for additional information on PPL's reportable segments.

"Management's Discussion and Analysis of Financial Condition and Results of Operations" provides information concerning PPL's performance in implementing the strategies and managing the risks and challenges mentioned above. Specifically:

See "Item 1. Business - Background - Segment Information - Pennsylvania Regulated Segment" for a discussion of PPL Electric's PLR obligations, PPL Electric's agreement to provide electricity as a PLR at "capped" rates through the end of 2009, and plans for default electricity supply procurement after 2009.

When comparing 2010 with 2009, certain line items on PPL's financial statements were impacted by the Customer Choice Act, Act 129 and other related issues. Overall, the expiration of generation rate caps and a long-term full requirements contract between PPL EnergyPlus and PPL Electric at the end of 2009 had a significant positive impact on PPL's results of operations, financial condition and cash flows during 2010.

The primary impact of the expiration of these generation rate caps and this contract is reflected in PPL's unregulated gross energy margins. See "Statement of Income Analysis" for an explanation of this non-GAAP financial measure. In 2010, PPL sold the majority of its generation supply to unaffiliated parties under various wholesale and retail contracts at prevailing market rates at the time the contracts were executed. In 2009, the majority of generation produced by PPL's generation plants was sold to PPL Electric's customers as PLR supply under predetermined capped rates.

Regarding PPL's Pennsylvania regulated electric delivery operations, the expiration of generation rate caps, the resulting competitive solicitations for power supply, the migration of customers to alternative suppliers, the Customer Choice Act and Act 129 had minimal impact on Pennsylvania gross delivery margins, as approved recovery mechanisms allow for cost recovery of associated expenses, including the cost of energy provided as a PLR. However, PPL Electric's 2010 Pennsylvania gross delivery margins were negatively impacted by the expiration of CTC recovery in December 2009. PPL Electric continues to remain the delivery provider for all customers in its service territory and charge a regulated rate for the service of delivering electricity. See "Statement of Income Analysis - Margins - Pennsylvania Gros s Delivery Margins" for additional information.

See "Regulatory Issues - Enactment of Financial Reform Legislation" in Note 15 for information on the Dodd-Frank Act.

Tables analyzing changes in amounts between periods within "Segment Results" and "Statement of Income Analysis" are presented on a constant U.K. foreign currency exchange rate basis, where applicable, in order to isolate the impact of the change in the exchange rate on the item being explained. Results computed on a constant U.K. foreign currency exchange rate basis are calculated by translating current year results at the prior year weighted-average foreign currency exchange rate.

The changes in Net Income Attributable to PPL Corporation from year to year were, in part, due to several special items that management considers significant. Details of these special items are provided within the review of each segment's earnings.

The "Statement of Income Analysis" explains the year-to-year changes in significant earnings components, including certain income statement line items, unregulated gross energy margins by region and Pennsylvania gross delivery margins by component. As a result of the November 1, 2010, acquisition, LKE's results for the two months ended December 31, 2010 are included in PPL's results with no comparable amounts for 2009. When discussing PPL's results of operations for 2010 compared with 2009, the results of LKE are isolated for purposes of comparability. LKE's results are shown separately within "Segment Results - Kentucky Regulated Segment." See Note 10 to the Financial Statements for additional information regarding the acquisition.

Net Income Attributable to PPL Corporation by segment and for "Unallocated Costs" was:

The Kentucky Regulated segment consists primarily of LKE's results from the operation of regulated electricity generation, transmission and distribution assets, primarily in Kentucky, as well as in Virginia and Tennessee. This segment also includes LKE's results from the regulated distribution and sale of natural gas in Kentucky.

The Kentucky Regulated segment Net Income Attributable to PPL Corporation for the two-month period from acquisition through December 31, 2010 was:

The following after-tax amounts, which management considers special items, impacted the Kentucky Regulated segment's earnings.

Excluding special items, earnings in 2011 are expected to be generally driven by high-performing utilities in Kentucky, which are in a defined service area with a constructive regulatory environment and by the results of electric and natural gas base rate increases that became effective August 1, 2010. The Kentucky Regulated segment is expected to contribute approximately 20% of PPL's 2011 earnings.

The International Regulated segment primarily includes the electric distribution operations of WPD. See Note 9 to the Financial Statements for additional information on the sale of PPL's Latin American businesses in 2007. The International Regulated segment results in 2009 and 2008 reflect the classification of its Latin American businesses as Discontinued Operations.

The after-tax changes in Net Income Attributable to PPL Corporation between these periods were due to the following factors.

The following after-tax amounts, which management considers special items, also impacted the International Regulated segment's earnings.

Excluding special items, earnings in 2011 are projected to be comparable with 2010 earnings as a result of higher electric delivery revenue and a more favorable currency exchange rate offset by higher income taxes, higher depreciation and higher financing costs.

The Pennsylvania Regulated segment includes the regulated electric delivery operations of PPL Electric. In October 2008, PPL sold its natural gas distribution and propane businesses. See Note 9 to the Financial Statements for additional information.

The Pennsylvania Regulated segment results in 2008 reflect the classification of PPL's natural gas distribution and propane businesses as Discontinued Operations.

The after-tax changes in Net Income Attributable to PPL Corporation between these periods were due to the following factors.

The following after-tax amounts, which management considers special items, also impacted earnings.

Excluding special items, higher earnings are projected in 2011 compared with 2010, due to higher distribution revenues resulting from an approved distribution base rate increase effective January 1, 2011.

The Supply segment primarily consists of the energy marketing and trading activities, as well as the competitive generation and development operations of PPL Energy Supply. In September 2010, certain PPL Energy Supply subsidiaries signed definitive agreements to sell their entire ownership interests in certain non-core generation facilities. The sale is expected to close in the first quarter of 2011, subject to the receipt of necessary regulatory approvals and third-party consents. The operating results of these facilities have been classified as Discontinued Operations. In 2010 and 2009, PPL Energy Supply subsidiaries also completed the sale of several businesses, which have been classified as Discontinued Operations. See Note 9 to the Financial Statements for additional informa tion.

The after-tax changes in Net Income Attributable to PPL Corporation between these periods were due to the following factors.

The following after-tax amounts, which management considers special items, also impacted the Supply segment's earnings.

The following table reconciles unrealized pre-tax gains (losses) from the table within "Commodity Price Risk (Non-trading) - Economic Activity" in Note 19 to the Financial Statements to the special item identified as "Adjusted energy-related economic activity, net."

The following table provides the components of the "Monetization of Certain Full-Requirement Sales Contracts" special item.

Excluding special items, lower earnings are projected from the Supply segment in 2011 compared with 2010 as a result of lower energy margins driven by lower energy and capacity prices in the East, higher average fuel costs, and higher operation and maintenance expense.

The following discussion includes financial information prepared in accordance with GAAP, as well as two non-GAAP financial measures: "Unregulated Gross Energy Margins" and "Pennsylvania Gross Delivery Margins." PPL believes that these measures provide additional criteria to make investment decisions. These performance measures are used, in conjunction with other information, internally by senior management and the Board of Directors to manage its operations. PPL's management also uses "Unregulated Gross Energy Margins" in measuring certain corporate performance goals used in determining variable compensation.

These measures are not intended to replace "Operating Income," which is determined in accordance with GAAP, as an indicator of overall operating performance. Other companies may use different measures to analyze and to report on the results of their operations.

The following table reconciles "Operating Income" to "Unregulated Gross Energy Margins" as defined by PPL.

The following table provides the income statement line items and other adjustments that comprise unregulated gross energy margins.

Unregulated gross energy margins are generated through non-trading and trading activities. The non-trading energy business is managed on a geographic basis that is aligned with its generation assets.

Eastern U.S.

Eastern U.S. non-trading margins were higher in 2010 compared with 2009, primarily due to significantly higher pricing in 2010 for eastern baseload generation compared with prices realized under the PLR contract with PPL Electric that expired at the end of 2009. Partially offsetting the increase were lower realized margins from full-requirement sales contracts due to lower customer demand and customer migration.

Eastern U.S. non-trading margins were lower in 2009 compared with 2008, primarily due to lower margins on full-requirement sales contracts resulting from mild weather, decreased demand, and customer migration. Also contributing to the decrease were higher average baseload generation fuel costs, primarily due to higher coal prices. Partially offsetting these lower margins were net gains resulting from the settlement of economic positions associated with rebalancing portfolios to better align them with current strategies, higher capacity revenue, higher baseload generation output due to unplanned major outages in 2008, and an increase in the PLR sales prices in accordance with the PUC Final Order.

Western U.S.

Western U.S. non-trading margins were higher in 2010 compared with 2009, primarily due to higher average prices, partially offset by lower volumes.

Western U.S. non-trading margins were higher in 2009 compared with 2008, primarily due to higher wholesale volumes and increased generation from the hydroelectric units.

Net energy trading margins decreased in 2010 compared with 2009, consisting of lower trading margins related to power and gas, partially offset by higher trading margins related to FTRs.

Net energy trading margins increased in 2009 compared with 2008, primarily due to increased margins in the power, gas and oil trading positions resulting from unrealized trading losses in 2008 due to a dramatic decline in energy prices and a severe contraction of liquidity in the wholesale power markets.

The following table reconciles "Operating Income" to "Pennsylvania Gross Delivery Margins" as defined by PPL.

The following table provides the income statement line items and other adjustments that comprise Pennsylvania gross delivery margins.

Pennsylvania gross delivery margins are generated through domestic regulated electric distribution activities, including PLR supply, and transmission activities.

The decrease in 2010 compared with 2009 was primarily due to margins realized in 2009 related to the collection of CTC, which ended in December 2009, partially offset by favorable recovery mechanisms for certain energy related costs.

The increase in 2010 compared with 2009 was primarily due to increased investment in rate base, an increase in the cost of capital due to an increase in equity and the recovery of additional costs through FERC formula-based rates.

U.K. electric delivery revenues increased in 2010 compared with 2009, primarily due to price increases in April 2010 and 2009, partially offset by lower regulatory recovery due to a revised estimate of network electricity losses.

U.K. electric delivery revenues increased in 2009 compared with 2008, primarily due to price increases in April 2009 and 2008, increased regulatory recovery due to a revised estimate of network electricity losses, and favorable changes in customer mix. These increases were partially offset by lower volumes due to unfavorable economic conditions, including industrial customers scaling back on production and a decrease in engineering and metering services performed for third parties.

See Note 17 to the Financial Statements for details.

Other-than-temporary impairments decreased by $15 million in 2010 compared with 2009 and by $18 million in 2009 compared with 2008. The decrease for both periods was primarily due to stronger returns on NDT investments caused by improved market conditions within the financial markets.

See Note 5 to the Financial Statements for additional information on income taxes.

See Note 9 to the Financial Statements for information related to various 2010 and 2009 sales, including the anticipated sale of certain non-core generation facilities expected to occur in the first quarter of 2011.

PPL expects to continue to have adequate liquidity available through operating cash flows, cash and cash equivalents and its credit facilities. Additionally, subject to market conditions, PPL currently plans to access capital markets in 2011.

PPL's cash flows from operations and access to cost-effective bank and capital markets are subject to risks and uncertainties including, but not limited to:

See "Item 1A. Risk Factors" for further discussion of risks and uncertainties affecting PPL's cash flows.

Net cash provided by operating activities increased by 10%, or $181 million in 2010 compared with 2009. The expiration of the long-term power purchase agreements between PPL Electric and PPL EnergyPlus at the end of 2009 enabled PPL EnergyPlus to sell power at higher market prices and had a positive impact on net income, and specifically on "unregulated gross energy margins" which increased over $600 million, after-tax, in 2010 compared with 2009, and therefore, was the primary driver to the above increase. The positive impact of additional earnings was partially offset by a reduction in the amount of counterparty collateral received and by additional defined benefit plan contributions.

Net cash provided by operating activities increased by 17%, or $263 million in 2009 compared with 2008, primarily as a result of cash collateral received from counterparties and the benefit of lower income tax payments due to the change in method of accounting for certain expenditures for tax purposes. These increases were partially offset by a decrease in accounts payable and the unfavorable impact of foreign currency exchange rates in 2009 compared with 2008.

A significant portion of PPL's operating cash flows is derived from its Supply segment baseload generation business activities. PPL employs a formal hedging program for its baseload generation fleet, the primary objective of which is to provide a reasonable level of near-term cash flow and earnings certainty while preserving upside potential of power price increases over the medium term. See Note 19 to the Financial Statements for further discussion. Despite its hedging practices, PPL expects its future cash flows from operating activities from its Supply segment to be more influenced by commodity prices than during the past years when long-term supply contracts were in place between PPL EnergyPlus and PPL Electric. In the near-term, PPL expects its Supply segment operating cash flows to decline as a result of lower commodity prices. PPL expects to see an increase in cash flows from operating activities in the near-term from its Pennsylvania Regulated segment due to its $77.5 million, or 1.6% rate increase that became effective on January 1, 2011. Finally, the acquisition of LKE (i.e. Kentucky Regulated segment) is expected to provide additional cash flows from operating activities through its regulated rate base that has been added to PPL's portfolio.

PPL's contracts for the sale and purchase of electricity and fuel often require cash collateral or other credit enhancements, or reductions or terminations of a portion of the entire contract through cash settlement, in the event of a downgrade of PPL's or its subsidiaries' credit ratings or adverse changes in market prices. For example, in addition to limiting its trading ability, if PPL's or its subsidiaries' ratings were lowered to below "investment grade" and there was a 10% adverse movement in energy prices, PPL estimates that, based on its December 31, 2010 positions, it would have had to post additional collateral of approximately $441 million with respect to electricity and fuel contracts. PPL has in place risk management programs that are designed to monitor and manage its exposure to volatility of cash flows related to changes in energy and fuel prices, interest rates, foreign currency exchange rates, counterparty credit quality and the operating performance of its generating units.

The primary use of cash in investing activities in 2010 was for the acquisition of LKE. In 2009 and 2008, the primary use of cash in investing activities was capital expenditures. See "Forecasted Uses of Cash" for detail regarding capital expenditures in 2010 and projected expenditures for the years 2011 through 2015.

Net cash used in investing activities increased by $7.3 billion in 2010 compared with 2009, primarily as a result of $6.8 billion used for the acquisition of LKE. Net cash used in investing activities also increased, to a lesser extent, due to an increase of $372 million in capital expenditures, a decrease of $154 million from proceeds from the sale of other investments, and a change of $133 million from restricted cash and cash equivalents. See Note 10 to the Financial Statements for a discussion of the acquisition of LKE. The increase in cash used in investing activities from the above items was partially offset by the change in proceeds received from the sale of businesses, which are discussed in Note 9 to the Financial Statements. PPL received proceeds of $81 million from the sale of the maj ority of the Maine hydroelectric generation business in 2009, compared to proceeds of $162 million received in 2010 from the sales of the Long Island generation business and the remaining Maine hydroelectric generation business assets.

Net cash used in investing activities decreased by 46%, or $747 million, in 2009 compared with 2008, primarily as a result of a change of $289 million from restricted cash and cash equivalents, a change of $249 million from purchases and sales of other investments, a change of $241 million from purchases and sales of intangible assets and a decrease of $193 million in capital expenditures. See Note 1 to the Financial Statements for a discussion of restricted cash and cash equivalents and Note 7 to the Financial Statements for a discussion of the purchase and sale by a subsidiary of PPL Energy Supply of Exempt Facilities Revenue Bonds issued by the PEDFA on behalf of PPL Energy Supply. The decrease in cash used in investing activities from the above items was partially offset by the change in proceeds received fr om the sale of businesses, which are discussed in Note 9 to the Financial Statements. PPL received $303 million from the sale of the gas and propane businesses in 2008 compared to proceeds of $81 million received from the sale of the majority of the Maine hydroelectric generation business in 2009.

Net cash provided by financing activities was $6.3 billion in 2010 compared with $1.3 billion of cash used in financing activities in 2009. The change from 2009 to 2010 primarily reflects increased issuances of long-term debt and equity related to the acquisition of LKE in 2010, as well as fewer retirements of long-term debt in 2010.

Net cash used in financing activities was $1.3 billion in 2009 compared with $721 million of cash provided by financing activities in 2008. The change from 2008 to 2009 primarily reflects fewer issuances and increased retirements of long-term debt in 2009, as well as the net repayment of short-term borrowings in 2009.

In 2010, cash provided by financing activities primarily consisted of net debt issuances of $4.7 billion and $2.4 billion of net proceeds from the issuance of common stock, partially offset by common stock dividends paid of $566 million and debt issuance and credit facility costs paid of $175 million.

In 2009, cash used in financing activities primarily consisted of net debt retirements of $770 million and common stock dividends paid of $517 million, partially offset by $60 million of common stock sale proceeds.

In 2008, cash provided by financing activities primarily consisted of net debt issuances of $1.3 billion and $19 million of common stock sale proceeds, partially offset by common stock dividends paid of $491 million and the repurchase of 802,816 shares of common stock for $38 million.

See "Forecasted Sources of Cash" for a discussion of PPL's plans to issue debt and equity securities, as well as a discussion of credit facility capacity available to PPL. Also see "Forecasted Uses of Cash" for a discussion of plans to pay dividends on common and preferred securities in the future, as well as maturities of long-term debt.

See Note 7 to the Financial Statements for more detailed information regarding PPL's financing activities in 2010.

PPL expects to continue to have significant sources of cash available in the near term, including various credit facilities, a commercial paper program and operating leases. PPL currently plans to issue up to $750 million in long-term debt securities in 2011, subject to market conditions, in addition to remarketing certain bonds at LG&E to unaffiliated investors as discussed below. Additionally, PPL's cash flows will include a full year of LKE's cash flows in 2011 and forward.

At December 31, 2010, PPL's total committed borrowing capacity under credit facilities and the use of this borrowing capacity were:

In addition to the financial covenants noted in the table above, the credit agreements governing the credit facilities contain various other covenants. Failure to comply with the covenants after applicable grace periods could result in acceleration of repayment of borrowings and/or termination of the agreements. PPL monitors compliance with the covenants on a regular basis. At December 31, 2010, PPL was in material compliance with these covenants. At this time, PPL believes that these covenants and other borrowing conditions will not limit access to these funding sources.

See Note 7 to the Financial Statements for further discussion of PPL's credit facilities.

PPL Electric maintains a commercial paper program for up to $200 million to provide an additional financing source to fund its short-term liquidity needs, if and when necessary. Commercial paper issuances are currently supported by PPL Electric's $200 million syndicated credit facility, which expires in December 2014, based on available capacity.

PPL Electric did not issue any commercial paper during 2010. Based on its current cash position and anticipated cash flows, PPL Electric currently does not plan to issue any commercial paper during 2011, but it may do so from time to time, subject to market conditions, to facilitate short-term cash flow needs.

PPL and its subsidiaries also have available funding sources that are provided through operating leases. PPL's subsidiaries lease office space, land, buildings and certain equipment. These leasing structures provide PPL additional operating and financing flexibility. The operating leases contain covenants that are typical for these agreements, such as maintaining insurance, maintaining corporate existence and timely payment of rent and other fees.

PPL, through its subsidiary PPL Montana, leases a 50% interest in Colstrip Units 1 and 2 and a 30% interest in Unit 3, under four 36-year, non-cancelable operating leases. These operating leases are not recorded on PPL's Balance Sheets. The leases place certain restrictions on PPL Montana's ability to incur additional debt, sell assets and declare dividends. At this time, PPL believes that these restrictions will not limit access to these funding sources or cause acceleration or termination of the leases. See Note 7 to the Financial Statements for a discussion of other dividend restrictions related to PPL subsidiaries.

See Note 11 to the Financial Statements for further discussion of the operating leases.

In January 2011, LG&E remarketed to unaffiliated investors $163 million of tax-exempt bonds issued by Louisville/Jefferson County, Kentucky on behalf of LG&E. The proceeds from the remarketing were used for the repayment of short-term debt under its syndicated credit facility.

In addition to the remarketing, PPL and its subsidiaries currently plan to issue up to $750 million in long-term debt securities in 2011, subject to market conditions. PPL expects to use the proceeds from the issuance of long-term debt securities primarily to refund PPL Energy Supply's 2011 debt maturity, to fund capital expenditures and for general corporate purposes.

PPL currently plans to issue new shares of common stock in 2011 in an aggregate amount up to $300 million under various employee stock-based compensation plans and its DRIP.

In April 2010, PPL Electric entered into an agreement with the DOE, in which the agency is to provide funding for one-half of a $38 million smart grid project. The project would use smart grid technology to strengthen reliability, save energy and improve electric service for 60,000 Harrisburg, Pennsylvania area customers. It would also provide benefits beyond the Harrisburg region, helping to speed power restoration across PPL Electric's 29-county service territory. Work on the project is progressing on schedule, and PPL Electric is receiving reimbursements under the grant for costs incurred. The project is scheduled to be completed by the end of September 2012.

In addition to expenditures required for normal operating activities, such as purchased power, payroll, fuel and taxes, PPL currently expects to incur future cash outflows for capital expenditures, various contractual obligations, payment of dividends on its common and preferred securities and possibly the purchase or redemption of a portion of debt securities.

The table below shows PPL's actual spending for the year 2010 and current capital expenditure projections for the years 2011 through 2015.

PPL's capital expenditure projections for the years 2011 through 2015 total approximately $15.1 billion. Capital expenditure plans are revised periodically to reflect changes in operational, market and regulatory conditions. For the years presented, this table includes projected costs related to the planned 817 MW of incremental capacity increases, PPL Electric's asset optimization program focused on the replacement of aging transmission and distribution assets, the PJM-approved regional transmission line expansion project, and LKE's and Energy Supply's environmental projects related to anticipated new EPA air compliance standards. See Note 8 to the Financial Statements for information on the PJM-approved regional transmission line expansion project and the other significant development projects.

PPL plans to fund its capital expenditures in 2011 with cash on hand, cash from operations and proceeds from the issuance of common stock and debt securities.

Contractual Obligations

PPL has assumed various financial obligations and commitments in the ordinary course of conducting its business. At December 31, 2010, the estimated contractual cash obligations of PPL were:

| | | | Total | | Less Than 1 Year | | 1-3 Years | | 4-5 Years | | After 5 Years |

| | | | | | | | | | | | | | | | | |

| Long-term Debt (a) | | $ | 12,604 | | $ | 502 | | $ | 1,137 | | $ | 1,610 | | $ | 9,355 |

| Interest on Long-term Debt (b) | | | 11,794 | | | 636 | | | 1,205 | | | 1,113 | | | 8,840 |

| Operating Leases (c) | | | 891 | | | 122 | | | 237 | | | 218 | | | 314 |

| Purchase Obligations (d) | | | 8,605 | | | 2,908 | | | 2,537 | | | 1,336 | | | 1,824 |

| Other Long-term Liabilities | | | | | | | | | | | | | | | |

| | Reflected on the Balance | | | | | | | | | | | | | | | |

| | Sheet under GAAP (e) (f) | | | 480 | | | 260 | | | 185 | | | 35 | | | |

| Total Contractual Cash Obligations | | $ | 34,374 | | $ | 4,428 | | $ | 5,301 | | $ | 4,312 | | $ | 20,333 |

| (a) | Reflects principal maturities only based on stated maturity dates, except for PPL Energy Supply's 5.70% Reset Put Securities (REPS). See Note 7 to the Financial Statements for a discussion of the remarketing feature related to the REPS, as well as discussion of variable-rate remarketable bonds issued on behalf of PPL Energy Supply, LG&E and KU. PPL does not have any significant capital lease obligations. |

| (b) | Assumes interest payments through stated maturity, except for the REPS, for which interest is reflected to the put date. The payments herein are subject to change, as payments for debt that is or becomes variable-rate debt have been estimated and payments denominated in British pounds sterling have been translated to U.S. dollars at a current foreign currency exchange rate. |

| (c) | See Note 11 to the Financial Statements for additional information. |

| (d) | The payments reflected herein are subject to change, as certain purchase obligations included are estimates based on projected obligated quantities and/or projected pricing under the contracts. Purchase orders made in the ordinary course of business are excluded from the amounts presented. The payments also include obligations related to nuclear fuel and the installation of the scrubbers, which are also reflected in the Capital Expenditures table presented above. |

| (e) | The amounts reflected represent WPD's contractual deficit pension funding requirements arising from an actuarial valuation performed in March 2010. The U.K. electricity regulator currently allows a recovery of a substantial portion of the contributions relating to the plan deficit; however, WPD cannot be certain that this will continue beyond the current review period, which extends to March 31, 2015. Based on the current funded status of PPL's U.S. qualified pension plans, no cash contributions are required. See Note 13 to the Financial Statements for a discussion of expected contributions. The amount also represents currently projected cash flows for LKE's construction commitments. |

| (f) | At December 31, 2010, total unrecognized tax benefits of $251 million were excluded from this table as PPL cannot reasonably estimate the amount and period of future payments. See Note 5 to the Financial Statements for additional information. |

Dividends

PPL views dividends as an integral component of shareowner return and expects to continue to pay dividends in amounts that are within the context of maintaining a capitalization structure that supports investment grade credit ratings. In 2010, PPL increased the annualized dividend rate on its common stock from $1.38 to $1.40 per share, effective with the April 1, 2010 dividend payment. Future dividends will be declared at the discretion of the Board of Directors and will depend upon future earnings, cash flows, financial and legal requirements and other relevant factors at the time. As discussed in Note 7 to the Financial Statements, subject to certain exceptions, PPL may not declare or pay any cash dividend on its common stock during any period in which PPL Capital Funding defers interest payments on its 2007 Series A Junior Subordinated Notes due 2067 or its 4.625% Junior Subordinated Notes due 2018 or until deferred contract adjustment payments on PPL's Purchase Contracts have been paid. No such deferrals have occurred or are currently anticipated.

PPL Electric expects to continue to pay quarterly dividends on its outstanding preferred securities, if and as declared by its Board of Directors.

See Note 7 to the Financial Statements for other restrictions related to distributions on capital interests for PPL subsidiaries.

Purchase or Redemption of Debt Securities

PPL will continue to evaluate purchasing or redeeming outstanding debt securities and may decide to take action depending upon prevailing market conditions and available cash.

Credit Ratings

Moody's, S&P and Fitch periodically review the credit ratings on the debt and preferred securities of PPL and its subsidiaries. Based on their respective independent reviews, the rating agencies may make certain ratings revisions or ratings affirmations.

A credit rating reflects an assessment by the rating agency of the creditworthiness associated with an issuer and particular securities that it issues. The credit ratings of PPL and its subsidiaries are based on information provided by PPL and other sources. The ratings of Moody's, S&P and Fitch are not a recommendation to buy, sell or hold any securities of PPL or its subsidiaries. Such ratings may be subject to revisions or withdrawal by the agencies at any time and should be evaluated independently of each other and any other rating that may be assigned to the securities. A downgrade in PPL's or its subsidiaries' credit ratings could result in higher borrowing costs and reduced access to capital markets.

In prior periodic reports, PPL described its then-current debt ratings in connection with, and to facilitate, an understanding of its liquidity position. As a result of the passage of the Dodd-Frank Act and the attendant uncertainties relating to the extent to which issuers of non-asset backed securities may disclose credit ratings without being required to obtain rating agency consent to the inclusion of such disclosure, or incorporation by reference of such disclosure, in a registrant's registration statement or section 10(a) prospectus, PPL is limiting its credit rating disclosure to a description of the actions taken by the rating agencies with respect to PPL's ratings, but without stating what ratings have been assigned to PPL or its subsidiaries, or their securities. The ratings assigned by the rating agencies to PPL and its subsidiaries and their respective securities may be found, without charge, on each of the respective ratings agencies' websites, which ratings together with all other information contained on such rating agency websites is hereby explicitly not incorporated by reference in this report.

The rating agencies took the following actions related to PPL and its subsidiaries in 2010.

Moody's

In April 2010, Moody's took the following actions:

| · | Revised the outlook for PPL, PPL Capital Funding and PPL Electric; |

| · | Lowered the issuer rating of PPL and the senior unsecured debt rating of PPL Capital Funding; |

| · | Lowered the rating of PPL Capital Funding's junior subordinated notes and PPL Electric's preferred securities; |

| · | Lowered the issuer rating of PPL Electric; |

| · | Affirmed the senior secured debt rating and commercial paper rating of PPL Electric; and |

| · | Affirmed the senior unsecured notes rating and the outlook of PPL Energy Supply. |

Moody's stated in its press release that the revisions in the ratings for PPL, PPL Capital Funding, and PPL Electric, while reflective of PPL's then-announced agreement to acquire LKE, are driven more by weakening financial metrics and the outlooks that had been in place for PPL and PPL Electric for the past year.

In August 2010, Moody's affirmed all of PPL Energy Supply's ratings.

In October 2010, Moody's affirmed the ratings for PPL and PPL Capital Funding following PPL's receipt of FERC approval of its then-pending acquisition of LKE.

In November 2010, Moody's took the following actions:

| · | Assigned a senior unsecured debt rating to LG&E and KU Energy LLC; and |

| · | Assigned a senior secured debt rating to LG&E and KU. |

S&P

In April 2010, S&P took the following actions:

| · | Revised the outlook of PPL, PPL Energy Supply and PPL Capital Funding; |

| · | Revised the outlook of WPDH Limited, WPD (South Wales) and WPD (South West); and |

| · | Affirmed its credit ratings for PPL, PPL Capital Funding, PPL Energy Supply, PPL Electric, WPDH Limited, WPD (South Wales) and WPD (South West). |

S&P stated in its press release that the change to the outlook for PPL and PPL Energy Supply considers the greater regulated mix that will result from PPL acquiring LKE, resulting in a pro forma "strong" consolidated business risk profile. S&P also stated that the revision in the outlook for WPD is a reflection of the change to PPL's outlook and is not a result of any change in WPD's stand-alone credit profile.

In October 2010, S&P took the following actions:

| · | Revised the outlook of PPL, PPL Capital Funding, PPL Energy Supply, and PPL Electric; |

| · | Raised the issuer rating of PPL and PPL Energy Supply; |

| · | Raised the senior unsecured and junior subordinated debt ratings of PPL Capital Funding; |

| · | Raised the senior unsecured debt rating of PPL Energy Supply; and |

| · | Affirmed its credit ratings for PPL Electric. |

S&P stated in its press release that the upgrades reflect S&P's opinion of an improved credit profile of the consolidated company following the closing of PPL's then-pending acquisition of LKE.

In November 2010, S&P affirmed its credit rating and revised the outlook for PPL Montana's Pass Through Certificates due 2020.

Also in November 2010, S&P took the following actions:

| · | Assigned a senior unsecured debt rating to LG&E and KU Energy LLC; and |

| · | Assigned a senior secured debt rating to LG&E and KU. |

Fitch

In January 2010, as a result of implementing its revised guidelines for rating preferred stock and hybrid securities, Fitch lowered the rating of PPL Capital Funding's junior subordinated notes and lowered the ratings of PPL Electric's preferred stock and preference stock. Fitch stated in its press release that the new guidelines, which apply to instruments issued by companies in all sectors, typically resulted in downgrades of one notch for many instruments that provide for the ability to defer interest or dividend payments. Fitch stated that it has no reason to believe that such deferral will be activated.

In April 2010, Fitch affirmed its credit ratings for PPL, PPL Capital Funding, PPL Energy Supply and PPL Electric and retained the outlook for these entities following PPL's then-announced agreement to acquire LKE.

In May 2010, Fitch affirmed its rating and issued an outlook for PPL Montana's Pass Through Certificates due 2020.

In October 2010, Fitch affirmed its credit ratings for and revised the outlook of WPDH Limited, WPD (South Wales) and WPD (South West).

In November 2010, Fitch took the following actions:

| · | Assigned an outlook, issuer ratings and senior unsecured debt rating to LG&E and KU Energy LLC; and |

| · | Assigned an outlook, issuer ratings and senior secured debt rating to LG&E and KU. |

Ratings Triggers

As discussed in Note 7 to the Financial Statements, certain of WPD's senior unsecured notes may be put by the holders back to the issuer for redemption if the long-term credit ratings assigned to the notes by Moody's, S&P or Fitch are withdrawn by any of the rating agencies or reduced to a non-investment grade rating of Ba1 or BB+ in connection with a restructuring event. A restructuring event includes the loss of, or a material adverse change to, the distribution license under which WPD (South West) and WPD (South Wales) operate. These notes totaled £1.3 billion (approximately $2.0 billion) at December 31, 2010.

PPL and PPL Energy Supply have various derivative and non-derivative contracts, including contracts for the sale and purchase of electricity and fuel, commodity transportation and storage, tolling agreements, and interest rate and foreign currency instruments, which contain provisions requiring PPL and PPL Energy Supply to post additional collateral, or permit the counterparty to terminate the contract, if PPL's or PPL Energy Supply's credit rating were to fall below investment grade. See Note 19 to the Financial Statements for a discussion of "Credit Risk-Related Contingent Features," including a discussion of the potential additional collateral that would have been required for derivative contracts in a net liability position at December 31, 2010. At December 31, 2010, if PPL's and PPL Energy Supply's cre dit ratings had been below investment grade, PPL would have been required to prepay or post an additional $455 million of collateral to counterparties for both derivative and non-derivative commodity and commodity-related contracts used in its generation, marketing and trading operations and interest rate and foreign currency contracts.

Guarantees for Subsidiaries

PPL guarantees certain consolidated affiliate financing arrangements that enable certain transactions. Some of the guarantees contain financial and other covenants that, if not met, would limit or restrict the consolidated affiliates' access to funds under these financing arrangements, require early maturity of such arrangements or limit the consolidated affiliates' ability to enter into certain transactions. At this time, PPL believes that these covenants will not limit access to relevant funding sources. See Note 15 to the Financial Statements for additional information about guarantees.

Off-Balance Sheet Arrangements

PPL has entered into certain agreements that may contingently require payment to a guaranteed or indemnified party. See Note 15 to the Financial Statements for a discussion of these agreements.

Risk Management - Energy Marketing & Trading and Other

Market Risk

See Notes 1, 18, and 19 to the Financial Statements for information about PPL's risk management objectives, valuation techniques and accounting designations.

The forward-looking information presented below provides estimates of what may occur in the future, assuming certain adverse market conditions and model assumptions. Actual future results may differ materially from those presented. These disclosures are not precise indicators of expected future losses, but only indicators of possible losses under normal market conditions at a given confidence level.

Commodity Price Risk (Non-trading)

PPL segregates its non-trading activities into two categories: hedge activity and economic activity. Transactions that are accounted for as hedge activity qualify for hedge accounting treatment. The economic activity category includes transactions that address a specific risk, but were not eligible for hedge accounting or for which hedge accounting was not elected. This activity includes the changes in fair value of positions used to hedge a portion of the economic value of PPL's generation assets, full-requirement sales contracts and retail activities. This economic activity is subject to changes in fair value due to market price volatility of the input and output commodities (e.g., fuel and power). Although they do not receive hedge accounting treatment, these transaction s are considered non-trading activity. The net fair value of economic positions at December 31, 2010 and 2009 was a net liability of $400 million and $77 million. See Note 19 to the Financial Statements for additional information on economic activity.

To hedge the impact of market price volatility on PPL's energy-related assets, liabilities and other contractual arrangements, PPL sells and purchases physical energy at the wholesale level under FERC market-based tariffs throughout the U.S. and enters into financial exchange-traded and over-the-counter contracts. PPL's non-trading commodity derivative contracts mature at various times through 2017.

The following table sets forth the net fair value of PPL's non-trading commodity derivative contracts. See Notes 18 and 19 to the Financial Statements for additional information.

| | | | Gains (Losses) |

| | | | 2010 | | 2009 |

| | | | | | | | |

| Fair value of contracts outstanding at the beginning of the period | | $ | 1,280 | | $ | 402 |

| Contracts realized or otherwise settled during the period | | | (478) | | | 189 |

| Fair value of new contracts entered into during the period | | | (5) | | | 143 |

| Changes in fair value attributable to changes in valuation techniques | | | (23) | | | |

| Fair value of LKE derivative contracts at the acquisition date | | | (24) | | | |

| Other changes in fair value | | | 197 | | | 546 |

| Fair value of contracts outstanding at the end of the period | | $ | 947 | | $ | 1,280 |

The following table segregates the net fair value of PPL's non-trading commodity derivative contracts at December 31, 2010 based on whether the fair value was determined by prices quoted in active markets for identical instruments or other more subjective means.

| | | | Net Asset (Liability) |

| | | | Maturity | | | | | | | | Maturity | | | |

| | | | Less Than | | Maturity | | Maturity | | in Excess | | Total Fair |

| | | | 1 Year | | 1-3 Years | | 4-5 Years | | of 5 Years | | Value |

| Source of Fair Value | | | | | | | | | | | | | | | |

| Prices based on significant other observable inputs | | $ | 351 | | $ | 592 | | $ | 8 | | | | | $ | 951 |

| Prices based on significant unobservable inputs | | | 3 | | | (29) | | | (4) | | $ | 26 | | | (4) |

| Fair value of contracts outstanding at the end of the period | | $ | 354 | | $ | 563 | | $ | 4 | | $ | 26 | | $ | 947 |

PPL sells electricity, capacity and related services and buys fuel on a forward basis to hedge the value of energy from its generation assets. If PPL were unable to deliver firm capacity and energy or to accept the delivery of fuel under its agreements, under certain circumstances it could be required to pay liquidating damages. These damages would be based on the difference between the market price and the contract price of the commodity. Depending on price changes in the wholesale energy markets, such damages could be significant. Extreme weather conditions, unplanned power plant outages, transmission disruptions, nonperformance by counterparties (or their own counterparties) with which it has energy contracts and other factors could affect PPL's ability to meet its obligations, or cause signi ficant increases in the market price of replacement energy. Although PPL attempts to mitigate these risks, there can be no assurance that it will be able to fully meet its firm obligations, that it will not be required to pay damages for failure to perform, or that it will not experience counterparty nonperformance in the future.

Commodity Price Risk (Trading)

PPL's trading contracts mature at various times through 2015. The following table sets forth changes in the net fair value of PPL's trading commodity derivative contracts. See Notes 18 and 19 to the Financial Statements for additional information.

| | | Gains (Losses) |

| | | 2010 | | 2009 |

| | | | | | | |

| Fair value of contracts outstanding at the beginning of the period | | $ | (6) | | $ | (75) |

| Contracts realized or otherwise settled during the period | | | (12) | | | 2 |

| Fair value of new contracts entered into during the period | | | 39 | | | 31 |

| Other changes in fair value | | | (17) | | | 36 |

| Fair value of contracts outstanding at the end of the period | | $ | 4 | | $ | (6) |

PPL will reverse unrealized losses of approximately $2 million over the next three months as the transactions are realized.

The following table segregates the net fair value of PPL's trading commodity derivative contracts at December 31, 2010 based on whether the fair value was determined by prices quoted in active markets for identical instruments or other more subjective means.

| | | | Net Asset (Liability) |

| | | | Maturity | | | | | | | | Maturity | | | |

| | | | Less Than | | Maturity | | Maturity | | in Excess | | Total Fair |

| | | | 1 Year | | 1-3 Years | | 4-5 Years | | of 5 Years | | Value |

| Source of Fair Value | | | | | | | | | | | | | | | |

| Prices based on significant other observable inputs | | $ | (1) | | $ | 2 | | $ | 3 | | | | | $ | 4 |

| Fair value of contracts outstanding at the end of the period | | $ | (1) | | $ | 2 | | $ | 3 | | | | | $ | 4 |

VaR Models

PPL utilizes a VaR model to measure commodity price risk in domestic gross energy margins for its non-trading and trading portfolios. VaR is a statistical model that attempts to estimate the value of potential loss over a given holding period under normal market conditions at a given confidence level. PPL calculates VaR using a Monte Carlo simulation technique based on a five-day holding period at a 95% confidence level. Given the company's conservative hedging program, PPL's non-trading VaR exposure is expected to be limited in the short term. At December 31, 2010 and December 31, 2009, the VaR for PPL's portfolios using end-of-month results for the period was as follows.

| | | Trading VaR | | Non-Trading VaR |

| | | 2010 | | 2009 | | 2010 | | 2009 |

| 95% Confidence Level, Five-Day Holding Period | | | | | | | | | | | | |

| | Period End | | $ | 1 | | $ | 3 | | $ | 5 | | $ | 8 |

| | Average for the Period | | | 4 | | | 4 | | | 7 | | | 9 |

| | High | | | 9 | | | 8 | | | 12 | | | 11 |

| | Low | | | 1 | | | 1 | | | 4 | | | 8 |

The trading portfolio includes all speculative positions, regardless of the delivery period. All positions not considered speculative are considered non-trading. PPL's non-trading portfolio includes PPL's entire portfolio, including generation, with delivery periods through the next 12 months. Both the trading and non-trading VaR computations exclude FTRs due to the absence of reliable spot and forward markets. The fair value of the non-trading and trading FTR positions was insignificant at December 31, 2010.

Interest Rate Risk

PPL and its subsidiaries have issued debt to finance their operations, which exposes them to interest rate risk. PPL utilizes various financial derivative instruments to adjust the mix of fixed and floating interest rates in its debt portfolio, adjust the duration of its debt portfolio and lock in benchmark interest rates in anticipation of future financing, when appropriate. Risk limits under the risk management program are designed to balance risk exposure to volatility in interest expense and changes in the fair value of PPL's debt portfolio due to changes in the absolute level of interest rates.

At December 31, 2010 and 2009, PPL's potential annual exposure to increased interest expense, based on a 10% increase in interest rates, was insignificant.

PPL is also exposed to changes in the fair value of its domestic and international debt portfolios. PPL estimated that a 10% decrease in interest rates at December 31, 2010 would increase the fair value of its debt portfolio by $420 million, compared with $285 million at December 31, 2009.

PPL had the following interest rate hedges outstanding at:

| | | December 31, 2010 | | December 31, 2009 |

| | | | | | | | | Effect of a | | | | | | | | Effect of a |

| | | | | | Fair Value, | | 10% Adverse | | | | Fair Value, | | 10% Adverse |

| | | | Exposure | | Net - Asset | | Movement | | Exposure | | Net - Asset | | Movement |

| | | | Hedged | | (Liability) (a) | | in Rates (b) | | Hedged | | (Liability) (a) | | in Rates (b) |

| Cash flow hedges | | | | | | | | | | | | | | | | | | |

| | Interest rate swaps (c) | | $ | 500 | | $ | (19) | | $ | (28) | | $ | 425�� | | $ | 24 | | $ | (24) |

| | Cross-currency swaps (d) | | | 302 | | | 35 | | | (18) | | | 302 | | | 8 | | | (41) |

| Fair value hedges | | | | | | | | | | | | | | | | | | |

| | Interest rate swaps (e) | | | 349 | | | 20 | | | (3) | | | 750 | | | 31 | | | (12) |

| Economic hedges | | | | | | | | | | | | | | | | | | |

| | Interest rate swaps (c) | | | 179 | | | (34) | | | (7) | | | | | | | | | |

| (a) | Includes accrued interest, if applicable. |

| (b) | Effects of adverse movements decrease assets or increase liabilities, as applicable, which could result in an asset becoming a liability. |

| (c) | PPL utilizes various risk management instruments to reduce its exposure to the expected future cash flow variability of its debt instruments. These risks include exposure to adverse interest rate movements for outstanding variable rate debt and for future anticipated financing. While PPL is exposed to changes in the fair value of these instruments, any changes in the fair value of such cash flow hedges are recorded in equity and any changes in the fair value of such economic hedges are recorded in regulatory assets and liabilities. The changes in fair value of these instruments are then reclassified into earnings in the same period during which the item being hedged affects earnings. Sensitivities represent a 10% adverse movement in interest rates. |

| (d) | WPDH Limited uses cross-currency swaps to hedge the interest payments and principal of its U.S. dollar-denominated senior notes with maturity dates ranging from December 2017 to December 2028. While PPL is exposed to changes in the fair value of these instruments, any change in the fair value of these instruments is recorded in equity and reclassified into earnings in the same period during which the item being hedged affects earnings. Sensitivities represent a 10% adverse movement in both interest rates and foreign currency exchange rates. |

| (e) | PPL utilizes various risk management instruments to adjust the mix of fixed and floating interest rates in its debt portfolio. The change in fair value of these instruments, as well as the offsetting change in the value of the hedged exposure of the debt, is reflected in earnings. Sensitivities represent a 10% adverse movement in interest rates. |

Foreign Currency Risk

PPL is exposed to foreign currency risk, primarily through investments in U.K. affiliates. In addition, PPL's domestic operations may make purchases of equipment in currencies other than U.S. dollars. See Note 1 to the Financial Statements for additional information regarding foreign currency translation.

PPL has adopted a foreign currency risk management program designed to hedge certain foreign currency exposures, including firm commitments, recognized assets or liabilities, anticipated transactions and net investments. In addition, PPL enters into financial instruments to protect against foreign currency translation risk of expected earnings.

PPL had the following foreign currency hedges outstanding at:

| | | December 31, 2010 | | December 31, 2009 |

| | | | | | | Effect of a 10% | | | | | | Effect of a 10% |

| | | | | Fair Value, | | Adverse Movement | | | | Fair Value, | | Adverse Movement |

| | | Exposure | | Net - Asset | | in Foreign Currency | | Exposure | | Net - Asset | | in Foreign Currency |

| | | Hedged | | (Liability) | | Exchange Rates (a) | | Hedged | | (Liability) | | Exchange Rates (a) |

| | | | | | | | | | | | | | | | | | | |

| Net investment hedges (b) | | £ | 35 | | $ | 7 | | $ | (5) | | £ | 40 | | $ | 13 | | $ | (6) |

| Economic hedges (c) | | | 89 | | | 4 | | | (10) | | | 48 | | | 2 | | | (4) |

| (a) | Effects of adverse movements decrease assets or increase liabilities, as applicable, which could result in an asset becoming a liability. |

| (b) | To protect the value of a portion of its net investment in WPD, PPL executed forward contracts to sell British pounds sterling. The contracts outstanding at December 31, 2010 were settled in January 2011. |

| (c) | To economically hedge the translation of expected income denominated in British pounds sterling to U.S. dollars, PPL entered into a combination of average rate forwards and average rate options to sell British pounds sterling. The forwards and options outstanding at December 31, 2010 have termination dates ranging from January 2011 through December 2011. |

NDT Funds - Securities Price Risk

In connection with certain NRC requirements, PPL Susquehanna maintains trust funds to fund certain costs of decommissioning the Susquehanna nuclear station. At December 31, 2010, these funds were invested primarily in domestic equity securities and fixed-rate, fixed-income securities and are reflected at fair value on PPL's Balance Sheet. The mix of securities is designed to provide returns sufficient to fund Susquehanna's decommissioning and to compensate for inflationary increases in decommissioning costs. However, the equity securities included in the trusts are exposed to price fluctuation in equity markets, and the values of fixed-rate, fixed-income securities are exposed to changes in interest rates. PPL actively monitors the investment performance and periodically reviews asset alloc ation in accordance with its nuclear decommissioning trust policy statement. At December 31, 2010, a hypothetical 10% increase in interest rates and a 10% decrease in equity prices would have resulted in an estimated $45 million reduction in the fair value of the trust assets, compared with $40 million at December 31, 2009. See Notes 18 and 23 to the Financial Statements for additional information regarding the NDT funds.

Defined Benefit Plans - Securities Price Risk

See "Application of Critical Accounting Policies - Defined Benefits" for additional information regarding the effect of securities price risk on plan assets.

Credit Risk

Credit risk is the risk that PPL would incur a loss as a result of nonperformance by counterparties of their contractual obligations. PPL maintains credit policies and procedures with respect to counterparty credit (including requirements that counterparties maintain specified credit ratings) and requires other assurances in the form of credit support or collateral in certain circumstances in order to limit counterparty credit risk. However, PPL has concentrations of suppliers and customers among electric utilities, financial institutions and other energy marketing and trading companies. These concentrations may impact PPL's overall exposure to credit risk, positively or negatively, as counterparties may be similarly affected by changes in economic, regulatory or other conditions.

PPL includes the effect of credit risk on its fair value measurements to reflect the probability that a counterparty will default when contracts are out of the money (from the counterparty's standpoint). In this case, PPL would have to sell into a lower-priced market or purchase from a higher-priced market. When necessary, PPL records an allowance for doubtful accounts to reflect the probability that a counterparty will not pay for deliveries PPL has made but not yet billed, which are reflected in "Unbilled revenues" on the Balance Sheets. PPL also has established a reserve with respect to certain sales to the California ISO for which PPL has not yet been paid, which is reflected in accounts receivable on the Balance Sheets. See Note 15 to the Financial Statements for additional information.

In 2007, the PUC approved PPL Electric's post-rate cap plan to procure default electricity supply for retail customers who do not choose an alternative competitive supplier in 2010. Pursuant to this plan, PPL Electric had contracted for all of the electric supply for customers who elected this service in 2010.

In June 2009, the PUC approved PPL Electric's procurement plan for the period January 2011 through May 2013. Through 2010, PPL Electric has conducted six of its 14 planned competitive solicitations.

Under the standard Supply Master Agreement (the Agreement) for the competitive solicitation process, PPL Electric requires all suppliers to post collateral if their credit exposure exceeds an established credit limit. In the event a supplier defaults on its obligation, PPL Electric would be required to seek replacement power in the market. All incremental costs incurred by PPL Electric would be recoverable from customers in future rates. At December 31, 2010, all of the successful bidders under all of the solicitations had an investment grade credit rating from S&P, and were not required to post collateral under the Agreement. There is no instance under the Agreement in which PPL Electric is required to post collateral to its suppliers.

See "Overview" in this Item 7 and Notes 15, 16, 18 and 19 to the Financial Statements for additional information on the competitive solicitations, the Agreement, credit concentration and credit risk.

Foreign Currency Translation

At December 31, 2010, the British pound sterling had weakened in relation to the U.S. dollar compared with the prior year end. Changes in these exchange rates resulted in a foreign currency translation loss of $63 million for 2010, which primarily reflected a $180 million reduction to PP&E offset by a reduction of $117 million to net liabilities. At December 31, 2009, the British pound sterling had strengthened in relation to the U.S. dollar as compared with the prior year end. Changes in these exchange rates resulted in a foreign currency translation gain of $106 million for 2009, which primarily reflected a $225 million increase in PP&E offset by an increase of $119 million to net liabilities. At December 31, 2008, the British pound sterling had weakened in relation to the U.S. do llar compared with the prior year end. Changes in these exchange rates resulted in a foreign currency translation loss of $520 million for 2008, which primarily reflected a $1.1 billion reduction to PP&E offset by a reduction of $580 million to net liabilities.

Related Party Transactions

PPL is not aware of any material ownership interests or operating responsibility by senior management of PPL, PPL Energy Supply or PPL Electric in outside partnerships, including leasing transactions with variable interest entities, or other entities doing business with PPL. See Note 16 to the Financial Statements for additional information on related party transactions.

Acquisitions, Development and Divestitures

See Note 10 to the Financial Statements for information on the acquisition of LKE.

With limited exceptions LKE took care, custody and control of TC2 on January 22, 2011, and has dispatched the unit to meet customer demand since that date. LG&E and KU and the contractor agreed to a further amendment of the construction agreement whereby the contractor will complete certain actions relating to identifying and completing any necessary modifications to allow operation of TC2 on all fuels in accordance with initial specifications prior to certain dates, and amending the provisions relating to liquidated damages. LKE cannot currently estimate the ultimate outcome of these matters. In addition, incremental capacity increases of 247 MW are currently planned, primarily at existing generating facilities. See "Item 2. Properties" for additional information.

Development projects are continuously reexamined based on market conditions and other factors to determine whether to proceed with the projects, sell, cancel or expand them, execute tolling agreements or pursue other options.

See Notes 8 and 9 to the Financial Statements for additional information on the more significant activities.

Environmental Matters

See "Item 1. Business - Environmental Matters" and Note 15 to the Financial Statements for a discussion of environmental matters.

Competition

See "Item 1. Business - Competition" under each of PPL's reportable segments and "Item 1A. Risk Factors" for a discussion of competitive factors affecting PPL.

New Accounting Guidance

See Note 1 to the Financial Statements for a discussion of new accounting guidance adopted.

Application of Critical Accounting Policies

Financial condition and results of operations are impacted by the methods, assumptions and estimates used in the application of critical accounting policies. The following accounting policies are particularly important to the financial condition or results of operations, and require estimates or other judgments of matters inherently uncertain. Changes in the estimates or other judgments included within these accounting policies could result in a significant change to the information presented in the Financial Statements (these accounting policies are also discussed in Note 1 to the Financial Statements). PPL's senior management has reviewed these critical accounting policies, the following disclosures regarding their application and the estimates and assumptions regarding them, with PPL's Audit Committee.

1) Price Risk Management

See "Price Risk Management" in Note 1 to the Financial Statements as well as "Risk Management - Energy Marketing & Trading and Other" above.

2) Defined Benefits

PPL and certain of its subsidiaries sponsor various defined benefit pension and other postretirement plans applicable to the majority of the employees of PPL and its subsidiaries. PPL and certain of its subsidiaries record an asset or liability to recognize the funded status of all defined benefit plans with an offsetting entry to OCI or regulatory assets and liabilities for amounts that are expected to be recovered through regulated customer rates. Consequently, the funded status of all defined benefit plans is fully recognized on the Balance Sheets. See Note 13 to the Financial Statements for additional information about the plans and the accounting for defined benefits.

PPL makes certain assumptions regarding the valuation of benefit obligations and the performance of plan assets. When accounting for defined benefits, delayed recognition in earnings of differences between actual results and expected or estimated results is a guiding principle. Annual net periodic defined benefit costs are recorded in current earnings based on estimated results. Any differences between actual and estimated results are recorded in OCI or regulatory assets and liabilities for amounts that are expected to be recovered through regulated customer rates. These amounts in AOCI or regulatory assets and liabilities are amortized to income over future periods. The delayed recognition allows for a smoothed recognition of costs over the working lives of the employees who benefit under the plans. The primary assumptions are:

| · | Discount Rate - The discount rate is used in calculating the present value of benefits, which is based on projections of benefit payments to be made in the future. The objective in selecting the discount rate is to measure the single amount that, if invested at the measurement date in a portfolio of high-quality debt instruments, would provide the necessary future cash flows to pay the accumulated benefits when due. |

| · | Expected Return on Plan Assets - Management projects the long-term rates of return on plan assets based on historical performance, future expectations and periodic portfolio rebalancing among the diversified asset classes. These projected returns reduce the net benefit costs PPL records currently. |

| · | Rate of Compensation Increase - Management projects employees' annual pay increases, which are used to project employees' pension benefits at retirement. |

| · | Health Care Cost Trend Rate - Management projects the expected increases in the cost of health care. |

In selecting a discount rate for its U.S. defined benefit plans, PPL starts with an analysis of the expected benefit payment stream for its plans. This information is first matched against a spot-rate yield curve. A portfolio of 604 Aa-graded non-callable (or callable with make-whole provisions) bonds, with a total amount outstanding in excess of $667 billion, serves as the base from which those with the lowest and highest yields are eliminated to develop the ultimate yield curve. The results of this analysis are considered together with other economic data and movements in various bond indices to determine the discount rate assumption. At December 31, 2010, PPL decreased the discount rate for its U.S. pension plans from 6.00% to 5.42% as a result of this assessment and decreased the discou nt rate for its other postretirement benefit plans from 5.81% to 5.14%.

A similar process is used to select the discount rate for the U.K. pension plans, which uses an iBoxx British pounds sterling denominated corporate bond index as its base. At December 31, 2010, the discount rate for the U.K. pension plans was decreased from 5.55% to 5.54% as a result of this assessment.

The expected long-term rates of return for PPL's U.S. defined benefit pension and other postretirement benefit plans have been developed using a best-estimate of expected returns, volatilities and correlations for each asset class. PPL management corroborates these rates with expected long-term rates of return calculated by its independent actuary, who uses a building block approach that begins with a risk-free rate of return with factors being added such as inflation, duration, credit spreads and equity risk. Each plan's specific asset allocation is also considered in developing a reasonable return assumption.

At December 31, 2010, PPL's expected return on plan assets decreased from 8.00% to 7.25% for its U.S. pension plans and decreased from 7.00% to 6.56% for its other postretirement benefit plans. The expected long-term rates of return for PPL's U.K. pension plans have been developed by PPL management with assistance from an independent actuary using a best-estimate of expected returns, volatilities and correlations for each asset class. For the U.K. plans, PPL's expected return on plan assets decreased from 7.91% to 7.86% at December 31, 2010.

In selecting rates of compensation increase, PPL considers past experience in light of movements in inflation rates. At December 31, 2010, PPL's rate of compensation increase changed from 4.75% to 4.88% for its U.S. pension plans and 4.75% to 4.90% for its other postretirement benefit plans. For the U.K. plans, PPL's rate of compensation increase remained at 4.00% at December 31, 2010.

In selecting health care cost trend rates, PPL considers past performance and forecasts of health care costs. At December 31, 2010, PPL's health care cost trend rates were 9.00% for 2011, gradually declining to 5.50% for 2019.

A variance in the assumptions listed above could have a significant impact on accrued defined benefit liabilities or assets, reported annual net periodic defined benefit costs and OCI or regulatory assets and liabilities for LG&E, KU and PPL Electric. While the charts below reflect either an increase or decrease in each assumption, the inverse of this change would impact the accrued defined benefit liabilities or assets, reported annual net periodic defined benefit costs and OCI or regulatory assets and liabilities for LG&E, KU and PPL Electric by a similar amount in the opposite direction. The sensitivities below reflect an evaluation of the change based solely on a change in that assumption and does not include income tax effects.

At December 31, 2010, defined benefit plan liabilities were as follows.

| Pension liabilities | | $ | 1,505 |

| Other postretirement benefit liabilities | | | 307 |

The following chart reflects the sensitivities in the December 31, 2010 Balance Sheet associated with a change in certain assumptions based on PPL's primary defined benefit plans.

| | | Increase (Decrease) |

| | | | | | Impact on | | | | | Impact on |

| | | Change in | | defined benefit | | Impact on | | regulatory |

| Actuarial assumption | | assumption | | liabilities | | OCI | | assets |

| | | | | | | | | | | | | |

| Discount Rate | | | (0.25)% | | $ | 256 | | $ | (188) | | $ | 68 |

| Rate of Compensation Increase | | | 0.25% | | | 43 | | | (32) | | | 11 |

| Health Care Cost Trend Rate (a) | | | 1.00% | | | 14 | | | (8) | | | 6 |

| (a) | Only impacts other postretirement benefits. |

In 2010, PPL recognized net periodic defined benefit costs charged to operating expense of $102 million. This amount represents a $32 million increase from 2009. This increase in expense was primarily attributable to amortization of actuarial losses of the WPD pension plans in the U.K.

The following chart reflects the sensitivities in the 2010 Statement of Income (excluding income tax effects) associated with a change in certain assumptions based on PPL's primary defined benefit plans.

| Actuarial assumption | | | Change in assumption | | | Impact on defined benefit costs |

| | | | | | | |

| Discount Rate | | | (0.25)% | | $ | 14 |

| Expected Return on Plan Assets | | | (0.25)% | | | 12 |

| Rate of Compensation Increase | | | 0.25% | | | 6 |

| Health Care Cost Trend Rate (a) | | | 1.00% | | | 2 |

| (a) | Only impacts other postretirement benefits. |

3) Asset Impairment

Impairment analyses are performed for long-lived assets that are subject to depreciation or amortization whenever events or changes in circumstances indicate that a long-lived asset's carrying value may not be recoverable. For these long-lived assets classified as held and used, such events or changes in circumstances are:

| · | a significant decrease in the market price of an asset; |

| · | a significant adverse change in the manner in which an asset is being used or in its physical condition; |

| · | a significant adverse change in legal factors or in the business climate; |

| · | an accumulation of costs significantly in excess of the amount originally expected for the acquisition or construction of an asset; |

| · | a current-period operating or cash flow loss combined with a history of losses or a forecast that demonstrates continuing losses; or |

| · | a current expectation that, more likely than not, an asset will be sold or otherwise disposed of before the end of its previously estimated useful life. |

For a long-lived asset classified as held and used, an impairment is recognized when the carrying amount of the asset is not recoverable and exceeds its fair value. The carrying amount is not recoverable if it exceeds the sum of the undiscounted cash flows expected to result from the use and eventual disposition of the asset. If the asset is impaired, an impairment loss is recorded to adjust the asset's carrying value to its estimated fair value. Management must make significant judgments to estimate future cash flows, including the useful lives of long-lived assets, the fair value of the assets and management's intent to use the assets. Alternate courses of action are considered to recover the carrying value of a long-lived asset, and estimated cash flows from the "most likely" alternative are used to assess impairment whenever one alternative is clearly the most likely outcome. If no alternative is clearly the most likely, then a probability-weighted approach is used taking into consideration estimated cash flows from the alternatives. For assets tested for impairment as of the balance sheet date, the estimates of future cash flows used in that test consider the likelihood of possible outcomes that existed at the balance sheet date, including the assessment of the likelihood of a future sale of the assets. That assessment is not revised based on events that occur after the balance sheet date. Changes in assumptions and estimates could result in significantly different results than those identified and recorded in the financial statements.