QuickLinks -- Click here to rapidly navigate through this documentAs filed with the Securities and Exchange Commission on November 16, 2001

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

NeoGenesis Pharmaceuticals, Inc.

(Exact name of Registrant as specified in its charter)

| Delaware | | 8731 | | 04-3357990 |

| (State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification No.) |

840 Memorial Drive

Cambridge, MA 02139

(617) 868-1500

(Address, including zip code, and telephone number, including

area code, of Registrant's principal executive offices)

Satish Jindal, Ph.D.

Chief Executive Officer

NeoGenesis Pharmaceuticals, Inc.

840 Memorial Drive

Cambridge, MA 02139

(617) 868-1500

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

copies to:

John J. Concannon III, Esq.

Bingham Dana LLP

150 Federal Street

Boston, Massachusetts 02110

Telephone (617) 951-8000

Telecopy (617) 951-8736 | | Gerald S. Tanenbaum, Esq.

Cahill Gordon & Reindel

80 Pine Street

New York, New York 10005-1702

Telephone (212) 701-3000

Telecopy (212) 269-5420 |

Approximate date of commencement of proposed sale to public:As soon as practicable after the effective date hereof.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. / /

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. / /

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. / /

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. / /

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. / /

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered

| | Proposed Maximum Aggregate

Offering Price (1)

| | Amount of

Registration Fee (2)

|

|---|

|

| Common Stock, $.001 par value per share | | $115,000,000 | | $28,750 |

|

- (1)

- Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended.

- (2)

- Calculated pursuant to Rule 457(a) based on an estimate of the proposed maximum aggregate offering price.

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(A), MAY DETERMINE.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated November , 2001

Prospectus

shares

Common stock

This is an initial public offering of common stock by NeoGenesis Pharmaceuticals, Inc. We are selling shares of common stock. The estimated initial public offering price is between $ and $ per share.

We intend to apply for listing of our common stock on The Nasdaq National Market under the symbol NGPI.

|

| | Per share

| | Total

|

|---|

|

| Initial public offering price | | $ | | | $ | |

Underwriting discounts |

|

$ |

|

|

$ |

|

Proceeds to NeoGenesis, before expenses |

|

$ |

|

|

$ |

|

|

We have granted the underwriters an option for a period of 30 days to purchase up to additional shares of our common stock.

Investing in our common stock involves a high degree of risk. See "Risk factors" beginning on page 6.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

JPMorgan

Bear, Stearns & Co. Inc.

SG Cowen

, 2001

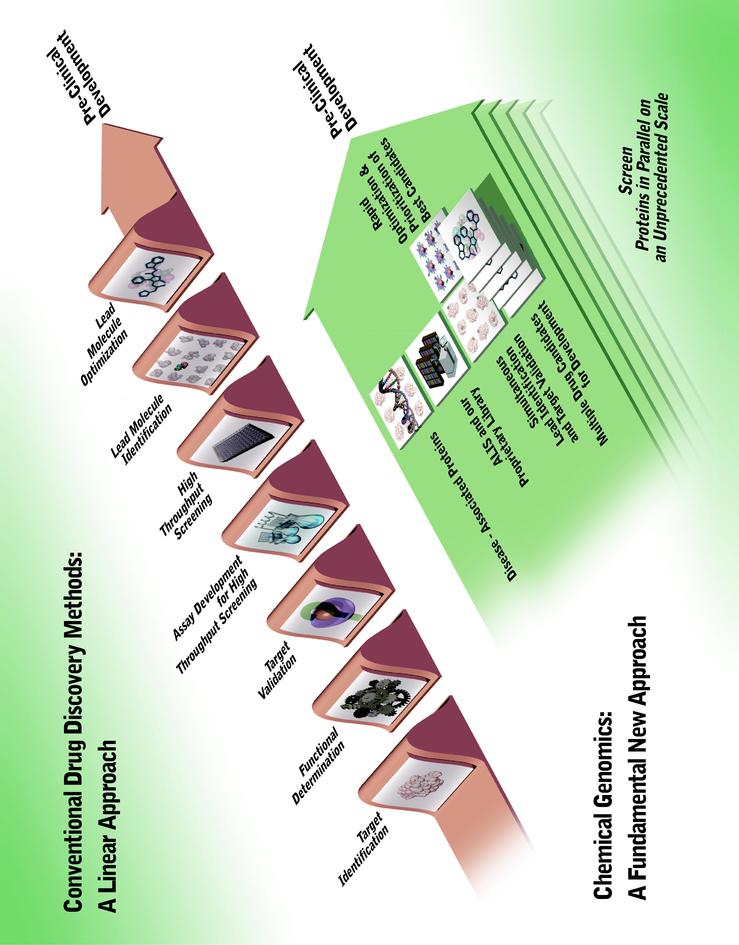

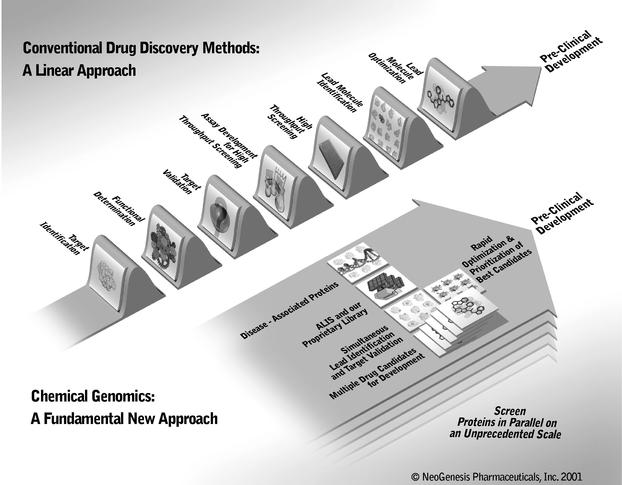

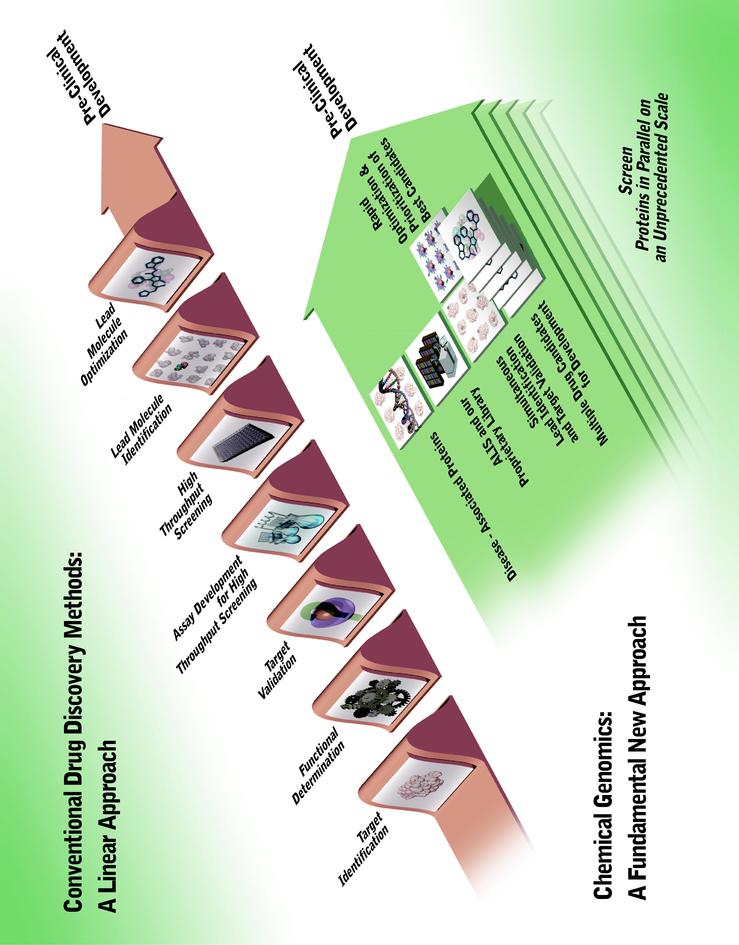

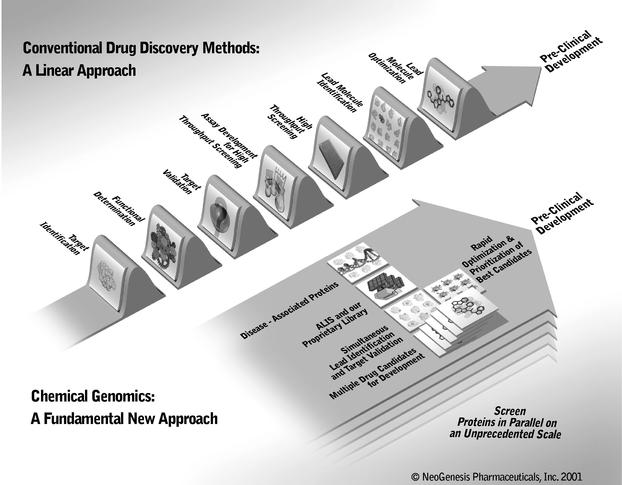

This diagram compares conventional drug discovery methods to our chemical genomics approach for the discovery of small molecule drugs.

© NeoGenesis Pharmaceuticals, Inc. 2001

Table of contents

| | Page

|

|---|

| Prospectus summary | | 1 |

| Risk factors | | 6 |

| Forward-looking statements | | 20 |

| Use of proceeds | | 21 |

| Dividend policy | | 21 |

| Capitalization | | 22 |

| Dilution | | 23 |

| Selected financial data | | 25 |

| Management's discussion and analysis of financial condition and results of operations | | 26 |

| Business | | 32 |

| Management | | 47 |

| Principal stockholders | | 55 |

| Certain transactions | | 57 |

| Description of capital stock | | 61 |

| Shares eligible for future sale | | 65 |

| U.S. Federal tax considerations for non-U.S. holders | | 67 |

| Underwriting | | 70 |

| Legal matters | | 73 |

| Experts | | 73 |

| Where you can find more information | | 74 |

| Index to financial statements | | F-1 |

"ALIS", "Nano-ALIS", "NeoGenesis", "NeoMorph" and "QSC" are our trademarks. All other trademarks or tradenames referred to in this prospectus are the property of their respective owners.

Prospectus summary

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all the information you should consider before investing in shares of our common stock. You should read this entire prospectus carefully, including "Risk factors" beginning on page 6 and our financial statements and the notes to those financial statements beginning on page F-1, before making an investment decision.

NeoGenesis Pharmaceuticals, Inc.

We are focused on the discovery of small molecule drugs on a proteome and genome-wide scale. We believe that we are the only company currently capable of delivering small molecule drug candidates for virtually every medically important protein encoded by the human genome. We believe the rate at which we are forming discovery alliances validates the vast opportunity presented by the convergence of our technologies with genomics and proteomics. By using our chemical genomics technologies, we believe that, over time, we will derive economic benefit from hundreds of drug candidates at levels of participation ranging from single digit royalties to full ownership.

Our success has motivated leading biotechnology and pharmaceutical companies to enter into collaborations with us. Since May 2001, we have entered into seven new collaborations, including the expansion of our existing relationships with Biogen, Inc. and Schering-Plough Ltd. Our expanded relationships have further validated our technologies and increased the overall value of our portfolio of collaborations. Current collaborators include Biogen, Celltech R&D Limited, Immusol Incorporated, Merck & Co., Inc., Mitsubishi Pharma Corporation, Oxford GlycoSciences (UK) Limited, Schering-Plough and Tularik Inc.

The human genome was sequenced to gain insight into human health and to better understand the relationship between genes and diseases, referred to as genomics, and between proteins and diseases, referred to as proteomics. Proteomic and genomic efforts are expected to identify approximately 20,000 to 30,000 proteins associated with disease, of which in excess of 5,000 are expected to be potential drug targets that the industry can exploit for small molecule drug development, which is the process of developing an orally administered drug.

Conventional drug discovery technologies are limited in their ability to validate and prioritize disease-associated proteins as small molecule drug targets. In addition, conventional methods cannot increase proportionally, or scale, to efficiently exploit the wealth of information being generated from genomics and proteomics for the discovery and development of small molecule drug candidates. Moreover, given the current research and development budgets of pharmaceutical and biotechnology companies, we believe that commercial exploitation of thousands of disease-associated proteins using conventional technologies would be economically prohibitive.

Our solution

We believe that we provide a comprehensive solution for the discovery of small molecule drugs by exploiting virtually all disease-associated proteins in the human genome. Our chemical genomics technologies represent a fundamental new approach that overcomes the scaling and

1

associated limitations inherent in conventional drug discovery methods. Our industrialized chemical genomics platform is designed to scale to the genome. We believe it will:

- •

- screen disease-associated proteins in parallel on an unprecedented scale and in an unbiased fashion;

- •

- prioritize disease-associated proteins amenable to drug discovery and confirm their roles as validated drug targets for the treatment of disease;

- •

- significantly increase the number of novel small molecules directed to each disease-associated protein;

- •

- deliver drug candidates for newly validated drug targets identified from the expanding inventory of disease-associated proteins;

- •

- deliver drug candidates for known drug targets for which conventional drug discovery methods have failed;

- •

- accelerate the process of drug discovery and development; and

- •

- increase the likelihood that drug candidates will be developed successfully.

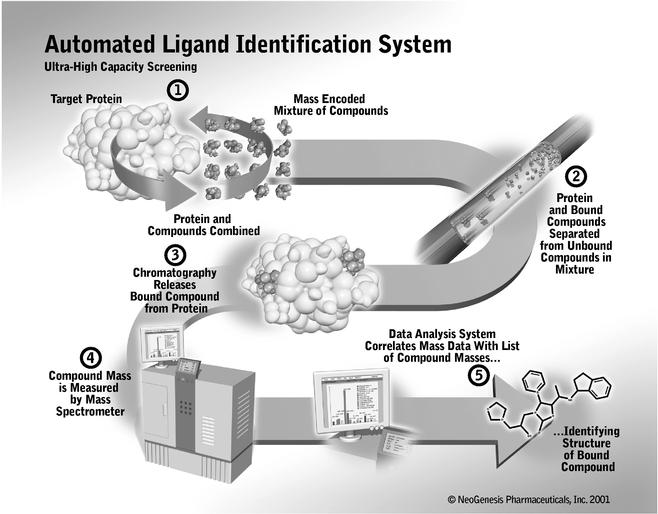

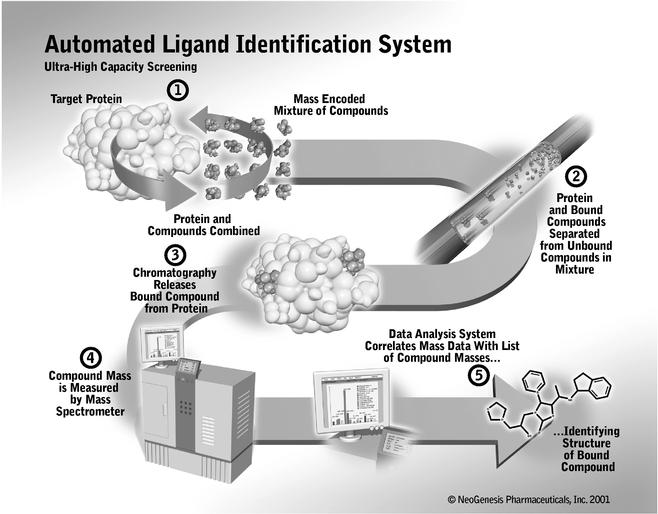

We have developed an integrated, proprietary suite of drug discovery technologies that form our scalable chemical genomics platform. At the heart of our solution is the seamless integration of our Automated Ligand Identification System, or ALIS, a powerful, scalable and broadly-applicable screening system, with our large, proprietary library of diverse, medicinally relevant small molecules. Our solution permits the discovery and development of drug candidates by identifying specific small molecules that bind to proteins. By evaluating the small molecules that bind to disease-associated proteins in relevant biological tests, or assays, our chemical genomics technologies simultaneously validate a disease-associated protein as a useful drug target and deliver small molecule drug candidates for pre-clinical and clinical development.

We believe that our solution will yield a larger inventory of small molecule drug candidates for clinical trials with a higher rate of success than achieved by conventional methods and will establish the standard for small molecule drug discovery and development.

Our strategy

Our goal is to derive economic benefit from virtually every disease-associated protein in the human genome. We plan to use our chemical genomics technologies to exploit these proteins, which include members of all medically important protein families.

Key elements of our strategy include:

- •

- broad collaborations with pharmaceutical and biotechnology companies that provide research and development funding, milestone payments and royalties;

- •

- strategic collaborations with pharmaceutical and biotechnology companies in which we retain substantial commercial rights; and

- •

- internal drug discovery, development and commercialization.

2

To accomplish our strategy we will continue to:

- •

- increase our annual screening capacity from 72 proteins to approximately 500 proteins by the end of 2003;

- •

- enhance ALIS technology;

- •

- expand our screening library;

- •

- advance our medicinal chemistry capabilities;

- •

- develop drug candidates with a greater likelihood of success; and

- •

- develop a robust intellectual property estate.

We were formed on March 13, 1997, as a Delaware corporation. Our principal executive offices are located at 840 Memorial Drive, Cambridge, Massachusetts 02139, and our telephone number is (617) 868-1500. Our web site address iswww.neogenesis.com. Information contained in our web site is not a part of this prospectus.

3

The offering

Common stock offered by NeoGenesis: shares

Common stock to be outstanding after this offering: shares

Proposed Nasdaq National Market symbol: NGPI

Use of proceeds

For research and development activities relating to our collaborations and internal drug development programs, the scaling and further development of our drug discovery technologies and other general corporate purposes. See "Use of proceeds" on page 21 for more information on our use of the net proceeds from this offering.

The number of shares of our common stock that will be outstanding after this offering is based on the number of shares outstanding as of October 31, 2001 and excludes:

- •

- 2,646,875 shares of our common stock issuable upon the exercise of stock options outstanding as of October 31, 2001 with a weighted average exercise price of $0.49 per share, of which options to purchase 720,500 shares of our common stock were then exercisable, and

- •

- 1,074,000 shares of our common stock reserved for future grant under our 1997 stock option plan, as amended, as of October 31, 2001.

Unless specifically stated otherwise, the information in this prospectus:

- •

- assumes no exercise of the underwriters' over-allotment option;

- •

- assumes an initial public offering price of $ per share, the midpoint of the initial public offering price range indicated on the cover of this prospectus;

- •

- reflects the automatic conversion of all shares of our preferred stock outstanding as of October 31, 2001 into 14,359,145 shares of our common stock upon the completion of this offering;

- •

- reflects the automatic conversion of a $2.0 million convertible note payable into shares of our common stock upon the completion of this offering;

- •

- reflects a five-for-one split of our common and preferred stock outstanding as of October 5, 2000; and

- •

- reflects the filing, prior to the completion of this offering, of our Fourth Amended and Restated Certificate of Incorporation, referred to in this prospectus as our certificate of incorporation, and the adoption of our Amended and Restated By-Laws, referred to in this prospectus as our by-laws, implementing the provisions described under "Description of capital stock."

4

Summary financial data

The summary financial data set forth below should be read in conjunction with our financial statements and the related notes to our financial statements and "Management's discussion and analysis of financial condition and results of operations" contained elsewhere in this prospectus. The unaudited pro forma basic and diluted net loss per share data give effect to the conversion of our convertible preferred stock from the date of original issuance. The unaudited pro forma balance sheet data reflect 5,846,625 shares of our common stock outstanding at September 30, 2001, the automatic conversion of all outstanding shares of our preferred stock into 14,341,075 shares of our common stock upon the completion of this offering and the automatic conversion of a $2.0 million convertible note payable into shares of our common stock upon the completion of this offering. The pro forma as adjusted balance sheet data reflect the pro forma adjustments and the sale of the shares of our common stock offered by this prospectus at an assumed initial public offering price of $ per share after deducting the underwriting discount and estimated offering expenses payable by us.

| |

|---|

| | Period from

inception

(March 13,

1997)

through

December 31,

1997

| |

| |

| |

| |

| |

| |

|---|

| | Year ended December 31,

| | Nine months ended

September 30,

| |

|---|

(in thousands, except share and per share data)

| |

|---|

| | 1998

| | 1999

| | 2000

| | 2000

| | 2001

| |

|---|

| |

|---|

| Statements of operations data: | | | | | | | | | | | | | |

| Total revenue | | $ — | | $ 568 | | $ 1,867 | | $ 1,594 | | $ 759 | | $ 2,647 | |

| Total operating expenses | | 1,169 | | 3,817 | | 4,848 | | 6,899 | | 4,740 | | 11,043 | |

| | |

| |

| Loss from operations | | (1,169 | ) | (3,249 | ) | (2,981 | ) | (5,305 | ) | (3,981 | ) | (8,396 | ) |

| | |

| |

| Net loss | | $(1,169 | ) | $(3,276 | ) | $(3,139 | ) | $(5,390 | ) | $(4,046 | ) | $(7,661 | ) |

| | |

| |

| |

| |

| |

| |

| |

| | |

| |

| Net loss per common share: | | | | | | | | | | | | | |

| | Basic and diluted | | $ (0.59 | ) | $ (1.13 | ) | $ (0.86 | ) | $ (1.14 | ) | $ (0.91 | ) | $ (1.40 | ) |

| | |

| |

| |

| |

| |

| |

| |

| | Unaudited pro forma basic and diluted | | | | | | | | $ (0.55 | ) | | | $ (0.45 | ) |

| | | | | | | | |

| | | |

| |

| | |

| |

Shares used in computing basic and diluted net loss per common share |

|

1,983,811 |

|

2,905,651 |

|

3,665,247 |

|

4,722,259 |

|

4,424,509 |

|

5,466,846 |

|

| | |

| |

| |

| |

| |

| |

| |

| Shares used in computing unaudited pro forma basic and diluted net loss per common share | | | | | | | | 9,844,493 | | | | 17,103,824 | |

| | | | | | | | |

| | | |

| |

| |

|

September 30, 2001

(in thousands)

| | Actual

| | Pro forma

| | Pro forma

as adjusted

|

|---|

|

| Balance sheet data: | | | | | | | |

| Cash and cash equivalents | | $ | 37,896 | | $37,896 | | $ |

| Working capital | | | 33,423 | | 33,423 | | |

| Total assets | | | 44,083 | | 44,083 | | |

| Long-term liabilities, less current maturities | | | 2,547 | | 528 | | |

| Convertible preferred stock | | | 54,250 | | — | | — |

| Total stockholders' equity (deficit) | | $ | (19,033 | ) | $37,236 | | $ |

|

5

Risk factors

You should carefully consider the risks described below and all other information contained in this prospectus before making an investment decision. If any of the following risks, as well as other risks and uncertainties that we have not yet identified or that we currently think are immaterial, actually occur, our business, financial condition and results of operations could be materially and adversely affected. In that event, the trading price of shares of our common stock could decline and you may lose part or all of your investment.

Risks related to our business

Our success depends on our ability to apply our chemical genomics technologies on an industrial scale.

Our success as a company depends on our ability to rapidly screen a large number of proteins to identify potential small molecule drug candidates. In order to accomplish this successfully, we will be required to implement our chemical genomics technologies on a larger scale, which will include building and implementing additional ALIS workstations and hiring additional qualified personnel.

Our technologies may fail to scale to the level necessary to successfully pursue our business strategy and sustain our growth. In addition, our technologies will have to scale to meet the anticipated demand of our collaboration agreements in the screening of proteins supplied to us by our collaborators. We do not have experience in scaling our technologies to meet these expected demands. If we are unable to effectively scale our technologies, we may be in breach of our existing collaboration agreements and may not be able to enter into new collaboration agreements in the future. In addition, we may not be able to pursue our internal drug discovery efforts.

Our chemical genomics technologies are unproven and may not be commercially successful.

The use of chemical genomics for drug discovery is unproven. Our current focus is to develop our chemical genomics technologies to probe the human genome in an effort to identify small molecule compounds that might be useful as drugs. Our chemical genomics technologies may not be successful because of, among other reasons, the size and complexity of the undertaking, the uncertainty that our library contains relevant and novel small molecule compounds, the possibility that using small molecule compounds to identify drugs against all disease-associated proteins is not a useful way to study biological processes such as disease or the possibility that our collaborators may adopt alternative technologies of our competitors.

We may not identify small molecule drug candidates that we or our collaborators may develop into commercial drugs.

We may not identify small molecule drug candidates with the most commercial potential. If we or our collaborators fail to allocate resources towards those drug candidates with the most commercial potential, if any, our business will be materially affected. Further, our collaborators may elect not to develop products arising out of our collaborative arrangements or to devote sufficient resources to the development, manufacturing, marketing or sale of these products, if any. If any of these events occur, we may not achieve our business objectives.

6

Our success will depend on our ability to grow and to manage our growth.

We are an early stage company. We have experienced and expect to continue to experience growth in the number of our employees and the scope of our operating and financial systems. We expect our growth will continue to place a significant strain on our operational, managerial, human and financial resources. Our ability to compete effectively will depend, in large part, on our ability to hire, train and retain additional management and professional, scientific and technical personnel and our ability to expand, improve and effectively use our operating, management, business development and financial systems to accommodate our expanded operations. The physical expansion of our operations may lead to significant costs and may divert our management and business development resources. If we fail to effectively anticipate, implement or manage the changes required to sustain our growth, we may not be able to compete successfully.

We have a history of substantial net losses and cannot predict when we will become profitable, if at all.

We were incorporated in March 1997 and have a limited operating history upon which an investor may evaluate our operations and future prospects. We have incurred net losses since our inception, including net losses of $5.4 million for the year ended December 31, 2000 and $7.7 million for the nine months ended September 30, 2001. As of September 30, 2001, we had an accumulated deficit of $20.6 million. We expect to continue to incur significant operating losses in future periods and cannot predict when we will become profitable, if at all. We expect to make substantial expenditures to further develop our drug discovery programs and technologies. We expect that our rate of spending will accelerate as a result of the increased costs and expenses associated with our collaborations and with our internal drug discovery programs and technologies. In particular, under some of our recent collaboration agreements, we are required to bear up to 50% of the costs associated with the development of small molecule drug candidates identified in the collaboration and we will be required to bear 100% of the costs associated with the development of small molecule drug candidates that we choose to pursue independently. We expect to enter into similar collaboration agreements in the future. While we expect our revenues to be derived from milestone payments, royalties and other fees under our existing and possible future collaborative arrangements, our revenue and profit potential is unproven and our limited operating history makes our future operating results difficult to predict. Additionally, our quarterly revenues and operating results are difficult to predict and may fluctuate significantly from quarter to quarter for numerous reasons, including the timing of the receipt of milestone payments and royalties, both of which are not within our control. Consequently, an investor in our common stock may be unable to evaluate our future operations or drug products, if any.

We will require funds in addition to the proceeds of this offering that we may not be able to raise.

We will require substantial funds to pursue our business strategy. Additional financing may not be available when we need it or, if available, it may not be on terms that are favorable to us. If we are unable to obtain adequate funding on a timely basis, we may be required to cease one or more of our drug discovery programs. We could be required to seek funds through arrangements with collaborators or others that may require us to relinquish certain rights to our technologies or drug candidates, which we would otherwise pursue on our own.

7

Our collaboration agreements are of limited scope and duration and if we are unable to expand the scope of our existing collaborations or enter into new ones, our revenues will be negatively impacted and our drug discovery programs may be slowed or halted.

Our collaboration agreements are of limited scope and duration and may be terminated by our collaborators on little or no notice. We may not develop long-term relationships with our collaborators that could lead to expanded or additional collaborations. If we are unable to maintain or expand our existing collaborations or enter into new ones, we may have reduced revenues and be forced to slow or halt our drug discovery programs. In addition, each collaboration will involve the negotiation of terms that may be unique to each collaborator. These business development efforts may take an extended period of time and require significant attention of our management and may not result in collaborations.

Our existing collaboration agreements are, and we would expect any future collaboration agreements to be, based on our success in using our chemical genomics technologies. Under our collaboration agreements, we expect to receive revenue for the research and development of products based on achievement of specific milestones and the development and commercialization of successful products. Achieving these milestones will depend, in part, on the efforts of our collaborators as well as our own efforts. If we or any of our collaborators fail to meet specific milestones, then the collaboration can be terminated, which could result in a decrease in our future revenues.

Conflicts with our collaborators and strategic partners could harm our business.

Disagreements with our existing or future collaborators or strategic partners, such as clinical development partners, manufacturing partners or sales and marketing partners, could develop over rights to our intellectual property with respect to our drug discovery programs. Any conflict with our collaborators or strategic partners could reduce our ability to enter into future collaboration or strategic partnering arrangements and negatively impact our relationship with existing collaborators and strategic partners, which could reduce our revenues and delay or terminate our drug discovery programs.

If we are unable to obtain patent protection for our discoveries, most significantly the small molecule drug candidates that we identify and our chemical genomics technologies, our business will be adversely affected.

Our success depends on our ability to obtain patent protection for the small molecule drug candidates that we may develop and for our chemical genomics technologies. Our patent positions and those of other pharmaceutical and biotechnology companies are generally uncertain and involve complex legal, scientific and factual questions. There is significant uncertainty both in the United States and abroad regarding the patentability of drug discovery processes and the scope of patent protection available for our drug discovery processes. There is a substantial backlog of biotechnology patent applications at the U.S. Patent and Trademark Office and no clear policy has emerged regarding the breadth of claims covered in biotechnology patents. The biotechnology patent situation outside the United States is even more uncertain and is currently undergoing review and revision in many countries. These proposals and other changes in patent laws in the United States and other countries may result in changes in, or interpretations of, the patent laws that will adversely affect our patent

8

position. If we are unable to obtain patent protection for our discoveries, most significantly the small molecule compounds that we identify and our chemical genomics technologies, our business will be adversely affected.

It is difficult and costly to protect our intellectual property rights and we cannot ensure their protection.

The protection of our intellectual property, including obtaining patents for the small molecule compounds that we may develop and our chemical genomics technologies, is a costly and time-consuming process. We may fail to secure patent protection relating to any of our existing or future drug candidates, discoveries or technologies despite the expenditure of considerable resources. Our success depends in part on the establishment of patent protection for small molecule compounds, methods of treatment, proteins and related technologies we discover or invent. Consequently, we intend to continue our efforts in applying for patent protection and prosecuting pending and future patent applications. Historically, such efforts have required the expenditure of considerable time and money, and we expect that we will be required to expend significant amounts to pursue our intellectual property strategy. If future changes in U.S. or foreign patent laws complicate or hinder our efforts to obtain patent protection, the costs associated with patent prosecution may increase significantly.

We rely on trade secret protection to protect our confidential and proprietary information. However, trade secrets are generally difficult to protect. While we have entered into confidentiality agreements with our employees and our collaborators who are provided data or materials, we may not be able to prevent their disclosure of these data or materials. Others may independently develop substantially equivalent proprietary information and techniques or otherwise gain access to our trade secrets or disclose our technologies. We may not be able to protect our trade secrets.

With respect to our software and the specific content of our library of small molecule compounds, we rely primarily on a combination of copyright, trademark and trade secret laws, confidentiality procedures and contractual provisions to protect our proprietary rights. There can be no assurance that our trademarks or copyrights will offer any protection or that they will not be challenged, invalidated or circumvented. Furthermore, there can be no assurance that others will not develop technologies that are similar or superior to our existing technologies or the content of our library. Unauthorized parties may attempt to copy aspects of our software, our technologies or our library or to obtain and use information that we regard as proprietary. Policing unauthorized use of our materials or information may be difficult. In addition, the laws of some foreign countries do not protect proprietary rights as fully as do U.S. laws. There can be no assurance that our means of protecting our proprietary rights in the U.S. or abroad will be adequate.

To the extent we are unable to protect our intellectual property, our investment in our chemical genomics technologies and compositions of small molecule compounds may not yield the benefits we expect. The degree of patent protection afforded to pharmaceutical inventions is uncertain and any patents that may be issued concerning our potential products and services will be subject to this uncertainty. There can be no assurance that other parties will not develop competitive products and services outside the protection that may be afforded by the claims of our patents.

9

We may be unable to develop any of the small molecule compounds in our library that we discover using our drug discovery technologies because we may be unable to obtain certain rights from third parties at a reasonable price.

Our strategy depends upon identifying small molecule compounds that are suitable as drugs for virtually all disease-associated proteins in the human genome. We cannot assure you that a disease-associated protein with which any specific small molecule drug candidate interacts or the use of that small molecule compound as a therapy for disease is not or will not be subject to the intellectual property rights of third parties. Furthermore, we cannot assure you that any specific small molecule drug candidate's role in disease or the tests used to determine whether the small molecule compound is useful as a medical treatment is not or will not be subject to the intellectual property rights of third parties. There are many issued patents and published patent applications that disclose proteins, methods of treating diseases associated with such proteins, tests for measuring the utility of small molecule compounds and individual therapeutic approaches against diseases associated with such proteins. If any of our activities with respect to a specific small molecule compound are subject to the intellectual property rights of third parties, we will not be able to commercially develop that small molecule compound without obtaining a license or challenging the applicable patent or other intellectual property right. We cannot assure you that a license will be available on commercially reasonable terms, if at all, or that we could successfully challenge any applicable intellectual property right.

We may be unable to commercialize any particular small molecule compound in our library or any potential small molecule drug candidate identified from using our library.

Our success relies, in part, on the novelty of the small molecule compounds in our library or small molecule compounds that we develop based upon our library. We have not undertaken a comprehensive review of all ten million small molecules of our current library to determine whether each small molecule is either novel or patentable. We cannot assure you that any specific small molecule compound in our library or any small molecule drug candidate we may later select for further analysis is not subject to a patent held by another party or even that we would have exclusive rights to either the small molecule compound itself or its use as a drug. Chemists often claim small molecule compounds by reference to large classes of small molecule compounds identified by chemical formula or characteristics. In addition, many patents claim the process by which intellectual property rights to small molecule compounds are made, or may claim small molecule compounds by describing the process by which they are made. It is probable that some subsets of the small molecule compounds in our library are or will be covered by patents owned by third parties. Furthermore, the best drug candidates selected from our library or even the best small molecule compound to treat any specific condition resulting from or relating to a disease-associated protein may be subject to patents owned by third parties. We may be unable to commercialize a portion of our library or specific drug candidates we discover without a license, which we cannot assure that we will be able to obtain on commercially acceptable terms, if at all. If we do not have or cannot obtain exclusivity with respect to any small molecule compound we select from our library or any specific drug candidate, the likelihood of it being developed as a drug decreases dramatically.

10

The availability of novel genomic and proteomic data may decrease in the future and may adversely affect our ability to discover novel small molecule compounds.

We rely on the continuing availability of existing genomic and proteomic data and the continuous generation of new genomic and proteomic data for the discovery of new disease- associated proteins. Our strategy relies on the assumption that thousands of new disease-associated proteins are yet to be discovered. Since many companies and government or public agencies are analyzing the genomic and proteomic data that is currently publicly available and are generating additional publicly available information, it has become increasingly difficult for other entities to be the first to discover novel proteins through the analysis of this data. Companies and government or public agencies have already mapped and made available significant portions of the genome, and the flow of novel genomic and proteomic data will likely decrease significantly in the future and may impact our ability or the ability of our collaborators to establish a proprietary patent position.

We may incur substantial costs or lose important rights as a result of litigation or other proceedings relating to patent and other intellectual property rights.

The defense and prosecution of intellectual property rights, U.S. Patent and Trademark Office interference proceedings and related legal and administrative proceedings in the United States and elsewhere involve complex legal and factual questions. As a result, these proceedings are costly and time-consuming and their outcome is uncertain. Litigation may be necessary to:

- •

- assert claims of infringement;

- •

- enforce our issued and licensed patent and our pending patent applications;

- •

- protect trade secrets or know-how; or

- •

- determine the enforceability, scope and validity of the proprietary rights of others.

If we become involved in any litigation, interference or other administrative proceedings, we will incur substantial expense and it will divert the efforts of our technical and management personnel. An adverse determination may subject us to significant liabilities or require us to seek licenses that may not be available from third parties on commercially reasonable terms, if at all. We or our collaborators may be restricted or prevented from developing and commercializing our drug product candidates, if any, in the event of an adverse determination in a judicial or administrative proceeding, or if we fail to obtain necessary licenses. Any of these outcomes could harm our business.

We are aware that, in several countries, another entity has filed patent applications relating to a technique for creating a mass-encoded combinatorial library. We believe that the method described in those applications is different from the method that we employ, and at this time, no patents on this method have been issued to this other entity. If valid patents were to be issued to this other entity in countries that are important to our business strategy and if it were deemed that we infringed on those patents, we would be required to alter our method or obtain a license in order to expand and use our mass-encoded library. If we were unable to obtain a license on commercially acceptable terms, our ability to conduct our business would be significantly impaired.

In addition, some of our competitors have, or are affiliated with companies having, substantially greater resources than we and those competitors may be able to sustain the costs

11

of complex patent litigation to a greater degree and for longer periods of time than we. Uncertainties resulting from the initiation and continuation of any patent or related litigation could have a material adverse effect on our ability to compete in the marketplace pending resolution of the disputed matters.

As is commonplace in the biotechnology and pharmaceutical industry, we employ individuals who were previously employed at other biotechnology or pharmaceutical companies, including our competitors or potential competitors. To the extent our employees are involved in research areas which are similar to those areas in which they were involved at their former employers, we may be subject to claims that such employees and/or we have inadvertently or otherwise used or disclosed the alleged trade secrets or other proprietary information of the former employers. Litigation may be necessary to defend against such claims, which could result in substantial costs and be a distraction to management and which may have a material adverse effect on us, even if we are successful in defending such claims.

Our patent applications may not result in issued patents that are enforceable.

We have two issued U.S. patents and ten U.S. patent applications pending. In addition, we have five patent applications pending elsewhere. There can be no assurance that additional patents will be issued to us or our licensors as a result of their pending applications or that, if issued, such patents will be sufficiently broad to afford protection against competitors with similar technologies. There can be no assurance that any patents issued to us or our collaborative partners, or for which we have license rights, will not be challenged, invalidated or circumvented, or that the rights granted thereunder will provide competitive advantages to us.

To date, we have not developed any drug products and may not be able to successfully develop any drug products.

A part of our business strategy is to develop and commercialize small molecule drug candidates discovered through our collaborations and that we discover independently. Our ability to develop and commercialize drug products in the future will depend on our:

- •

- successfully completing pre-clinical and clinical testing;

- •

- obtaining necessary regulatory approvals;

- •

- effectively deploying sales and marketing resources;

- •

- producing and manufacturing drug products;

- •

- successfully obtaining intellectual property protection for our drug products; and

- •

- entering into arrangements with third parties to provide any of these functions.

Each of these will require significant expenditures of our resources, including financial and managerial resources, and may not result in a successful drug product. Our inability to develop effectively any drug product will have a negative impact on our business.

12

Pre-clinical development and clinical trials for our potential small molecule drug candidates, if any, are expensive and time consuming and their outcome is uncertain.

Before we can obtain regulatory approval for the commercial sale of any drug candidate that we wish to develop, we will be required to complete pre-clinical development and extensive clinical trials in humans to demonstrate its safety and efficacy. Each of these clinical trials requires the investment of substantial expense and time. In addition, under some of our collaboration agreements, we will be required to share in the expense incurred by our collaborators in obtaining regulatory approval for the potential drug products developed.

Success in pre-clinical development and early clinical trials does not ensure that large-scale trials will be successful nor does it predict final results. Acceptable results in early trials may not be repeated in later trials. A number of companies in the pharmaceutical and biotechnology industry have suffered significant setbacks in advanced clinical trials, even after promising results in earlier clinical trials. Negative or inconclusive results or adverse medical events during a clinical trial could cause that trial to be redone or terminated. In addition, failure to construct appropriate clinical trial protocols could result in the test or control group experiencing a disproportionate number of adverse events and could cause a clinical trial to be redone or terminated.

We currently have no experience in conducting pre-clinical and clinical development activities.

We currently have no experience in conducting pre-clinical and clinical development activities. In order to successfully develop and commercialize our drug products, if any, we will be required to develop the internal capability to conduct pre-clinical and clinical development activities. In the event we are unable to do so, we may rely in large part on our collaborators and third-party clinical research organizations to design and conduct most of these activities. Our inability to contract for any necessary clinical activities on acceptable terms would impair or delay our ability to complete our drug development programs, which could adversely affect our business. If we rely on collaborators and third parties for pre-clinical and clinical development activities, it may reduce our control over these activities and may make us dependent upon these parties. We may choose to, or may be required to, suspend, repeat or terminate our clinical trials if they are not conducted in accordance with regulatory requirements, the results are negative or inconclusive or the clinical trials are not well designed.

Since we may be subject to extensive and uncertain government regulatory requirements, we may be unable to obtain government approval of any drugs in a timely manner.

Any drugs that we may develop will be subject to an extensive regulatory approval process by the U.S. Food and Drug Administration, or FDA, and comparable agencies in other countries. The regulation of new drugs is extensive and the required pre-clinical and clinical testing is lengthy and expensive. We may not obtain FDA approvals in a timely manner, or at all. We or our collaborators may encounter significant delays or excessive costs in our efforts to secure necessary approvals or licenses. Even if FDA regulatory approvals are obtained, the FDA extensively regulates manufacturing, labeling, distributing, marketing, promotion and advertising after drug approval. Regulatory requirements ultimately imposed on these and other areas could adversely affect our ability to clinically test, manufacture and market drugs that we develop, if any.

13

We will rely on third-party manufacturers to produce our drugs, if any.

We do not currently have the ability to manufacture drugs and, initially, would likely rely on contract manufacturers to produce our drug candidates, if any, for use in our clinical trials. If our contract manufacturers fail to deliver the required quantities of our drug candidates for clinical use on a timely basis, with sufficient quality and at commercially reasonable prices, and we fail to find replacement manufacturers or to develop our own manufacturing capabilities, we may be unable to continue development and production of our drug candidates, if any.

In addition, contract manufacturers have a limited number of facilities in which our drug product candidates can be produced. Contract manufacturers may not perform or may discontinue their business for the time required by us to successfully produce and market our drug product candidates, if any.

We currently have no marketing capability.

We have no internal capability to market drug products, if any, that we develop. In order to successfully commercialize our drugs, if any, we may be required to develop an internal sales force. In the event we are unable to do so, we will rely on our collaborators or contract with other third parties to market any drugs that we may develop internally. Our collaborators or other third parties may not be successful in marketing our drug products, if any, and we may not be able to establish a successful marketing force.

Catastrophic damage to our facility could impair our business.

While some of our electronic data is stored off-site, all of our equipment and operations are located in our headquarters in Cambridge, Massachusetts. If this facility were to be damaged or destroyed, we would be unable to conduct our business for an indefinite period of time. Further, our library of small molecule compounds against which we screen potential drug targets is stored in this location and no back-up library exists. If these small molecule compounds or the equipment in which they are stored were compromised, it could take years to generate a replacement library, which would substantially impair our business.

We may seek to expand our business through possible acquisitions and may have difficulty in identifying targets and integrating those targets with our business and operations.

In the future, we may from time to time seek to expand our business through acquisitions. Our acquisition of companies and businesses and our expansion of operations would involve risks such as the following:

- •

- the potential inability to identify target companies best suited to our business strategy;

- •

- the potential inability to successfully integrate acquired operations and businesses and to realize anticipated synergies, economies of scale or other expected values;

- •

- unanticipated costs associated with the acquisition;

- •

- adverse effects on existing business relationships, particularly our collaborators;

- •

- potential loss of the acquired organization's or our own key employees;

14

- •

- the incurrence of expenses related to transactions that may or may not be consummated; and

- •

- the inability to effectively manage and coordinate operations at multiple venues, which, among other things, could divert our management's attention from other important business matters.

In addition, any acquisition of companies and businesses or expansion of operations could result in dilutive issuances of equity securities, the incurrence of additional debt, large one-time write-offs and the creation of goodwill or other intangible assets that could negatively affect our financial condition and the reported results of our operations. Furthermore, we cannot guarantee that the terms of any acquisition will be favorable to us.

Risks related to our industry

The pharmaceutical and biotechnology industry is highly concentrated and any further consolidation could reduce the number of our potential collaborators and may affect our ability to increase our revenue and achieve our business strategies.

We believe there are a limited number of large pharmaceutical and biotechnology companies and these companies represent the market for our drug discovery programs. The number of our potential collaborators could decline even further through consolidation among or growth of these companies. If the number of our potential collaborators declines, their relative negotiating power with us may increase. If we are unable to enter additional collaborations on commercially acceptable terms, we may not be able to increase our revenue or achieve our business strategies.

Failure to attract, retain and motivate skilled personnel may have an adverse effect on our business strategies.

Our success depends on our continued ability to attract, retain and motivate highly qualified management and scientific personnel and our ability to develop and maintain important relationships with leading academic and other research institutions and scientists. Competition for personnel and relationships in our industry is intense. If we lose the services of our management or scientific personnel or our relationships with academic and other research institutions and scientists are compromised, it could significantly delay our drug discovery programs and impede the achievement of our research and development objectives.

At present, the scope of our needs is largely limited to the expertise of personnel who are able to work with our chemical genomics technologies. In the future, we will need to hire additional personnel as we continue to expand our internal drug discovery programs since these activities will require additional expertise in disciplines applicable to the products we hope to develop and commercialize. For example, we may need to hire qualified sales and marketing personnel to commercialize any drug products we develop. Qualified personnel will also be required to conduct pre-clinical and clinical trials. Further, our business strategy will require that our management team expand to incorporate additional expertise. We do not know if we will be able to attract, retain or motivate the required personnel to achieve our business strategies.

15

We face substantial competition with respect to discovering, developing and commercializing drug products.

The biotechnology and pharmaceutical industry is highly competitive. Many of our competitors are substantially larger than we are and have substantially greater capital resources, research and development staffs and facilities than we have. Furthermore, many of our competitors are more experienced than we are in drug discovery, development and commercialization. In addition, our competitors may discover, develop and commercialize drug products that render non-competitive or obsolete our chemical genomics technologies or the drug targets, if any, that we or our collaborators seek to develop and commercialize. We also may experience competition from companies that have acquired or may acquire technologies from universities or other research institutions.

Healthcare reform and restrictions on reimbursements may limit our financial returns.

Our ability or the ability of our collaborators to commercialize drug products, if any, may depend in part on the extent to which government health administration authorities, private health insurers and other organizations will reimburse consumers for the cost of these products. These third parties are increasingly challenging both the need for and the price of new drug products. Significant uncertainty exists as to the reimbursement status of newly approved therapeutics. Adequate third party reimbursement may not be available for our own or our collaborator's drug products to enable us or them to maintain price levels sufficient to realize an appropriate return on their and our investments in research and product development. We cannot predict the effect that changes in the healthcare system may have on our business and these changes adversely effect our business.

Risks related to this offering

Our stock price will likely be volatile and your investment could decline in value.

The trading price of our common stock is likely to be volatile and subject to wide price fluctuations in response to various factors, including:

- •

- actual or anticipated variations in our quarterly operating results;

- •

- introductions or announcements of technological innovations or new products by us, our collaborators or our competitors;

- •

- disputes or other developments relating to proprietary rights, including patents, litigation matters and our ability to patent our technologies;

- •

- changes in our financial estimates by securities analysts;

- •

- conditions or trends in the pharmaceutical and biotechnology industries;

- •

- additions or departures of key personnel;

- •

- the loss of a significant customer or collaborator;

- •

- announcements by us or our competitors of significant acquisitions, strategic partnerships, joint ventures or capital commitments;

- •

- regulatory developments in the United States and abroad;

- •

- public concern or opinion as to new drug discovery techniques; and

- •

- economic and political factors.

16

In addition, the stock market in general, and the market for biotechnology and pharmaceutical companies in particular, have experienced significant price and volume fluctuations that have often been unrelated or disproportionate to operating performance. These broad market and industry factors may seriously harm the market price of our common stock, regardless of our operating performance. In the past, following periods of volatility in the market price of a company's securities, securities class action litigation has often been instituted. A securities class action suit against us could result in potential liabilities, substantial costs and the diversion of our management's attention and resources, regardless of whether we win or lose.

There may not be an active, liquid trading market for our common stock.

Prior to this offering, there has been no public market for our common stock. An active, liquid trading market for our common stock may not develop or be maintained following this offering. As a result, you may not be able to sell your shares of our common stock quickly or at the market price. The initial public offering price of our common stock was determined by negotiation between us and representatives of the underwriters based upon a number of factors and may not be indicative of prices that will prevail following the completion of this offering. The market price of our common stock may decline below the initial public offering price and you may not be able to resell your shares of our common stock at or above the initial offering price.

Future sales of our common stock may depress our stock price.

The market price of our common stock could decline as a result of sales of substantial amounts of our common stock in the public market after the closing of this offering, or the perception that these sales could occur. In addition, these factors could make it more difficult for us to raise funds through future offerings of common stock. There will be shares of our common stock outstanding immediately after this offering, based on the number of shares of our common stock outstanding as of October 31, 2001. All of the shares of our common stock sold in this offering will be freely transferable without restriction or further registration under the Securities Act of 1933, except for any shares of our common stock purchased by our executive officers, directors, principal stockholders and some related parties.

The remaining shares of our common stock will be eligible for sale in the public market as follows:

- •

- shares of our common stock after 180 days from the date of this prospectus, and

- •

- shares of our common stock at various times after 180 days from the date of this prospectus.

All of our officers, directors and stockholders have agreed with our underwriters to be bound by a 180-day lock-up agreement that prohibits these holders from selling or transferring their stock except in limited circumstances. The lock-up agreements signed by our stockholders are only contractual agreements and J.P. Morgan Securities Inc., on behalf of the underwriters, at their discretion, can waive the restrictions of the lock-up agreement at an earlier time without prior notice or announcement and allow stockholders to sell their shares of our common stock. If the restrictions of the lock-up agreement are waived, shares of our common stock will be available for sale into the market, subject only to applicable securities rules and regulations, which would likely reduce the market price for shares of our common stock.

17

After this offering, we intend to register 7,125,000 shares of our common stock that are reserved for issuance upon the exercise of options granted or reserved for grant under our stock option plan and our employee stock purchase plan. Once we register these shares of our common stock, stockholders can sell them in the public market upon issuance, subject to restrictions under the securities laws. In addition, some of our existing stockholders will be entitled to register their shares of our common stock after this offering.

You will experience immediate and substantial dilution as a result of this offering and may experience additional dilution in the future.

You will pay a price per share that substantially exceeds the per share value of our tangible assets after subtracting our total liabilities. As a result, if we were to distribute our net tangible assets to our stockholders immediately following this offering, you would receive less than the amount you paid for your shares of our common stock. In addition, purchasers of shares of our common stock in this offering will have contributed approximately % of the aggregate price paid by all purchasers of our stock, but will own only approximately % of the shares of our common stock outstanding after the offering based on the number of shares of our common stock outstanding as of October 31, 2001. If the holders of outstanding options exercise those options at prices below the initial public offering price, you will incur further dilution. We may also acquire other companies or technologies or finance strategic alliances by issuing equity, which may result in additional dilution to our stockholders.

Our executive officers, directors and principal stockholders own a large percentage of our voting common stock and could limit new stockholders from influencing corporate decisions.

Immediately after this offering, our executive officers, directors, current principal stockholders and their respective affiliates will beneficially own, in the aggregate, approximately % of our outstanding common stock. These stockholders, as a group, would be able to control substantially all matters requiring approval by our stockholders, including mergers, sales of assets, the election of all directors and approval of other significant corporate transactions in a manner with which you may not agree or that may not be in the best interest of other stockholders.

Our management will have broad discretion in the use of net proceeds from this offering and may not use them effectively.

As of the date of this prospectus, we cannot specify with certainty the amounts we will spend on particular uses from the net proceeds we will receive from this offering. Our management will have broad discretion in the application of the net proceeds but currently intends to use the net proceeds as described in "Use of proceeds." The failure by our management to apply these funds effectively could affect our ability to continue to develop our business.

18

Delaware law and our charter documents contain provisions that could discourage or prevent a potential takeover, even if the transaction would benefit our stockholders and could depress our stock price.

We are incorporated in Delaware. Certain provisions of our certificate of incorporation and bylaws and the provisions of Delaware General Corporation Law could have the effect of delaying, deferring or preventing an acquisition of us, even if an acquisition would be beneficial to our stockholders. These provisions include:

- •

- authorizing the board of directors to issue additional preferred stock;

- •

- prohibiting cumulative voting in the election of directors;

- •

- limiting the persons who may call special meetings of stockholders;

- •

- maintaining a classified board of directors;

- •

- prohibiting stockholder action by written consent;

- •

- establishing advance notice requirements for nominations for election to the board of directors and for proposing matters that can be acted on by stockholders at stockholder meetings; and

- •

- prohibiting a combination with any holder of 15% or more of our capital stock until the holder has held the stock for three years unless, among other things, the board of directors approves the transaction.

19

Forward-looking statements

This prospectus includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934. We have based these forward-looking statements on our current expectations and projections about future events. These forward-looking statements include statements about the following:

- •

- our chemical genomics technologies and the implications of their preliminary results against groups of proteins;

- •

- our ability to rapidly find a small molecule candidate for virtually every disease-associated protein in the human genome on an industrial scale;

- •

- the commercialization of small molecule drug candidates identified with our collaborators;

- •

- our expectations regarding the expansion of existing collaborations and development of new collaborations;

- •

- the protection of intellectual property rights in our drug discovery and development efforts;

- •

- anticipated operating losses, future revenues, capital expenditures and the need for additional financing;

- •

- the success of our internal drug discovery programs and technologies; and

- •

- the revenue to be derived from our collaborative efforts.

The forward-looking statements are principally contained in the sections entitled "Prospectus summary," "Risk factors," "Business" and "Management's discussion and analysis of financial condition and results of operations." These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. We discuss many of these risks in greater detail under the heading "Risk factors." In some cases, you can identify forward-looking statements by terminology such as "may," "will," "should," "could," "would," "expect," "plan," "anticipate," "believe," "estimate," "project," "predict," "intend," "potential" or the negative of such terms or other similar expressions. These statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements.

You should read this prospectus and the documents that we reference in this prospectus and have filed as exhibits to the registration statement, of which this prospectus is part, completely and with the understanding that our actual future results may be materially different from what we expect. We may not update these forward-looking statements, even though our situation may change in the future, unless we have obligations under the Federal securities laws to update and disclose material developments related to previously disclosed information. We qualify all of our forward-looking statements by these cautionary statements.

20

Use of proceeds

Our net proceeds from this offering are estimated to be $ million, or $ million if the underwriters' over-allotment option is exercised in full, based on an assumed initial public offering price of $ per share and after deducting the underwriting discount and estimated offering expenses payable by us.

We intend to use the net proceeds of this offering primarily for research and development activities relating to our collaborations and internal drug development programs, the scaling and further development of our drug discovery technologies and other general corporate and working capital purposes, which may include investing in complementary products, licensing additional technologies or making potential acquisitions. We have no current agreements or understandings relating to potential acquisitions and are not currently engaged in any negotiations with respect to future transactions.

The foregoing use of the net proceeds from this offering represents our current intentions based upon our present plans and business condition. We retain broad discretion in the allocation and use of the net proceeds of this offering and a change in our plans or business condition could result in the application of the net proceeds from this offering in a manner other than as described in this prospectus. Pending the uses described above, we intend to invest the net proceeds from this offering in short-term, investment grade, interest-bearing securities.

Dividend policy

We have never declared or paid cash dividends on our capital stock. We currently intend to retain our future earnings, if any, to support the growth and development of our business and we do not anticipate paying any cash dividends in the foreseeable future. Any future determination to pay dividends will be at the discretion of our board of directors and will depend on our financial condition, results of operations, capital requirements and other factors that our board of directors may deem relevant.

21

Capitalization

The following table shows our capitalization as of September 30, 2001:

- •

- on an actual basis;

- •

- on a pro forma basis to reflect the automatic conversion of all outstanding shares of our preferred stock into 14,341,075 shares of our common stock upon the completion of this offering and the automatic conversion of a $2.0 million convertible note payable into shares of our common stock upon the completion of this offering; and

- •

- on a pro forma as adjusted basis to reflect the pro forma adjustments and the sale of the shares of our common stock offered by this prospectus at an assumed initial public offering price of $ per share after deducting the underwriting discount and estimated offering expenses payable by us.

This table does not include:

- •

- 2,741,875 shares of our common stock issuable upon the exercise of stock options outstanding as of September 30, 2001 with a weighted average exercise price of $0.47 per share, of which options to purchase 769,500 shares of our common stock were then exercisable, and

- •

- 1,074,000 shares of our common stock reserved for future grant under our 1997 Stock Option Plan as of September 30, 2001.

You should read this table in conjunction with "Management's discussion and analysis of financial condition and results of operations" and our financial statements and related notes appearing elsewhere in this prospectus.

|

September 30, 2001

(in thousands, except share data)

| | Actual

| | Pro forma

| | Pro forma

as adjusted

|

|---|

|

| Cash and cash equivalents | | $ | 37,896 | | $37,896 | | $ |

| | |

|

| Long-term debt and capital lease obligations, less current maturities | | | 528 | | 528 | | 528 |

| Convertible note payable | | | 2,019 | | — | | — |

| Convertible preferred stock, $.001 par value per share — 14,359,145 shares authorized, 14,341,075 shares issued and outstanding, actual, and no shares authorized, issued and outstanding pro forma and pro forma as adjusted | | | 54,250 | | — | | — |

| Stockholders' equity (deficit): | | | | | | | |

| | Preferred stock, $.001 par value per share — no shares authorized, issued and outstanding, actual, 5,000,000 shares authorized and no shares issued and outstanding, pro forma and pro forma as adjusted | | | — | | — | | — |

| | Common stock, $.001 par value per share — 24,021,645 shares authorized, 5,846,625 shares issued and outstanding, actual, 95,000,000 shares authorized, issued and outstanding pro forma and 95,000,000 shares authorized, shares issued and outstanding pro forma as adjusted | | | 6 | | 20 | | |

| | Deferred compensation | | | (1,568 | ) | (1,568 | ) | (1,568) |

| | Additional paid-in capital | | | 3,164 | | 59,419 | | |

| | Accumulated deficit | | | (20,635 | ) | (20,635 | ) | (20,635) |

| | |

|

| | | | Total stockholders' equity (deficit) | | | (19,033 | ) | 37,236 | | |

| | |

|

| | | | | Total capitalization | | $ | 37,764 | | $37,764 | | $ |

| | |

| |

| |

|

|

22

Dilution

The pro forma net tangible book value of our common stock as of September 30, 2001 was $ million, or $ per share. The pro forma net tangible book value per share of our common stock is the difference between our tangible assets and our liabilities, divided by the number of shares of our common stock outstanding as of September 30, 2001, after giving effect to the automatic conversion of all outstanding shares of our preferred stock into 14,341,075 shares of our common stock upon the completion of this offering and the automatic conversion of a $2.0 million convertible note payable into shares of our common stock upon the completion of this offering. For new investors in our common stock, dilution is the per share difference between the initial public offering price of our common stock and the pro forma net tangible book value of our common stock immediately after completing this offering. Dilution in this case results from the fact that the per share offering price of our common stock is substantially in excess of the per share price paid by our current stockholders.

As of September 30, 2001, after giving effect to the sale of the shares of our common stock offered by the prospectus at an assumed initial public offering price of $ per share and after deducting the underwriting discount and estimated offering expenses payable by us, the pro forma net tangible book value per share of our common stock would have been $ per share. Therefore, new investors in our common stock would have paid $ for a share of common stock having a pro forma net tangible book value of approximately $ per share after this offering. That is, their investment would have been diluted by approximately $ per share. At the same time, our current stockholders would have realized an increase in pro forma net tangible book value of $ per share after this offering without further cost or risk to themselves. The following table illustrates this per share dilution:

|

| Assumed initial public offering price per share | | | | | $ | |

| | Pro forma net tangible book value per share as of September 30, 2001 | | $ | | | | |

| | Increase in pro forma net tangible book value per share attributable to investors in this offering | | | | | | |

| | |

| | | |

| Pro forma net tangible book value per share after this offering | | | | | $ | |

| | | | | |

|

| Dilution per share to new investors | | | | | $ | |

| | | | | |

|

|

The following table sets forth, on a pro forma as adjusted basis as of September 30, 2001, the number of shares of our common stock purchased, the total consideration paid and the average price per share paid by existing and new stockholders, including $2.0 million relating to the convertible note payable, before deducting the underwriting discount and our offering expenses payable by us:

| | | |

| | Shares purchased

| | Total consideration

| |

| |

|

|---|

| | Average price

per share

|

|---|

| | Number

| | Percent

| | Amount

| | Percent

|

|---|

|

| Existing stockholders | | | | % | | $ | 56,837,656 | | % | | | | $ | |

| New investors | | | | | | | | | | | | | | |

| | |

|

| | Total | | | | 100% | | $ | | | 100% | | | | $ | |

| | |

| |

| |

| |

| | | |

|

|

23

The foregoing discussion and tables assume no exercise of any outstanding stock options or warrants. As of September 30, 2001, there were options outstanding to purchase a total of 2,741,875 shares of our common stock with a weighted average exercise price of $0.47 per share and a warrant outstanding to purchase a total of 18,070 shares of our series C preferred stock with an exercise price of $2.2126 per share. To the extent that any of these options or warrants are exercised, your investment will be further diluted. In addition, on November 9, 2001, we granted options to purchase a total of 665,500 shares of our common stock with an exercise price of $5.00 per share under our 1997 Stock Option Plan, as amended.

24

Selected financial data