UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-10575

ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND, INC.

(Exact name of registrant as specified in charter)

1345 Avenue of the Americas, New York, New York 10105

(Address of principal executive offices) (Zip code)

Joseph J. Mantineo

AllianceBernstein L.P.

1345 Avenue of the Americas

New York, New York 10105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 221-5672

Date of fiscal year end: October 31, 2010

Date of reporting period: April 30, 2010

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

SEMI-ANNUAL REPORT

Alliance California Municipal

Income Fund

Semi-Annual Report

Investment Products Offered

| | • | | Are Not Bank Guaranteed |

The investment return and principal value of an investment in the Fund will fluctuate as the prices of the individual securities in which it invests fluctuate, so that your shares, when redeemed, may be worth more or less than their original cost. You should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. For a free copy of the Fund’s prospectus, which contains this and other information, visit our web site at www.alliancebernstein.com or call your financial advisor or AllianceBernstein® at (800) 227-4618. Please read the prospectus carefully before you invest.

You may obtain performance information current to the most recent month-end by visiting www.alliancebernstein.com.

This shareholder report must be preceded or accompanied by the Fund’s prospectus for individuals who are not current shareholders of the Fund.

You may obtain a description of the Fund’s proxy voting policies and procedures, and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, without charge. Simply visit AllianceBernstein’s web site at www.alliancebernstein.com, or go to the Securities and Exchange Commission’s (the “Commission”) web site at www.sec.gov, or call AllianceBernstein at (800) 227-4618.

The Fund files its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the Commission’s web site at www.sec.gov. The Fund’s Forms N-Q may also be reviewed and copied at the Commission’s Public Reference Room in Washington, DC; information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330. AllianceBernstein publishes full portfolio holdings for the Fund monthly at www.alliancebernstein.com.

AllianceBernstein Investments, Inc. (ABI) is the distributor of the AllianceBernstein family of mutual funds. ABI is a member of FINRA and is an affiliate of AllianceBernstein L.P., the manager of the funds.

AllianceBernstein® and the AB Logo are registered trademarks and service marks used by permission of the owner, AllianceBernstein L.P.

June 21, 2010

Semi-Annual Report

This report provides management’s discussion of fund performance for Alliance California Municipal Income Fund (the “Fund”) for the semi-annual reporting period ended April 30, 2010. The Fund is a closed-end fund that trades under the New York Stock Exchange symbol “AKP”.

Investment Objective and Policies

This closed-end fund seeks to provide high current income exempt from regular federal and California income tax by investing substantially all of its net assets in municipal securities that are exempt from regular federal and California income tax. The Fund will normally invest at least 80%, and normally substantially all, of its net assets in municipal securities paying interest that is exempt from regular federal and California income tax. In addition, the Fund normally invests at least 75% of its net assets in investment-grade municipal securities or unrated municipal securities considered to be of comparable quality as determined by the Fund’s investment adviser, AllianceBernstein L.P. (the “Adviser”). The Fund may invest up to 25% of its net assets in municipal securities rated below investment-grade and unrated municipal securities considered to be of comparable quality. The Fund intends to invest primarily in municipal securities that pay interest that is not subject to the federal Alternative Minimum Tax (“AMT”), but may invest without limit in municipal securities paying interest that is subject to the federal AMT. For more information regarding the Fund’s risks, please see “A

Word About Risk” on page 4 and “Note G—Risks Involved in Investing in the Fund” of the Notes to Financial Statements on page 24.

Investment Results

The table on page 5 provides performance data for the Fund and its benchmark, the Barclays Capital Municipal Bond Index, for the six- and 12-month periods ended April 30, 2010.

The Fund outperformed its benchmark, which is not leveraged, for both the six- and 12-month periods ended April 30, 2010. The Fund’s relative outperformance during the six-month period was partially due to security selection in the transportation, special tax and leasing sectors. For the 12-month period, security selection in the special tax and transportation sectors drove performance. The Fund’s leveraged structure benefited performance.

Market Review and Investment Strategy

One of the largest concerns on investors’ minds today is the potential for an increase in interest rates. While the US Federal Reserve may likely raise short-term interest rates later in 2010, favorable supply-and-demand factors should keep tax-exempt municipal bond prices higher and yields lower than they would otherwise be for some time. The Build America Bond Program has reduced tax-exempt bond issuance by providing a significant federal subsidy to states and municipalities that issue taxable municipal bonds. The prospect of a

| | |

| ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND • | | 1 |

sharp decline in issuance for refinancing purposes should also limit tax-exempt issuance. The fall in interest rates since the middle of 2007 resulted in a lot of bond issuance to “refund” outstanding municipal bonds. In the past two years, 24% of municipal bond issuance was for refunding purposes1, as state and local governments sought to take advantage of historically low interest rates. While supply is likely to be limited, investor demand for tax-exempt municipal bonds should remain strong due to expected increases in federal income tax rates.

California’s economy has shown a more severe decline during the current recession than that of the rest of the United States. In April 2010, California’s unemployment rate (seasonally adjusted) was 12.6%, much higher than the national rate of 9.9%. However, in a sign of the economy turning around, April marked the fourth month in a row of job gains, albeit small ones. Based on recent tax collections, the state is projecting a $19 billion budget gap through fiscal 2011. The most recent review of tax receipts actually shows the state exceeding revised estimates. However, it is not growing anywhere close to closing the projected gap. The solutions to balancing the budget will entail significant cuts in services. Beyond that, California will also have to borrow for cash-flow purposes to smooth out the timing of revenues and expenditures. Given California’s constitutional requirement of a two-third

majority vote of the Legislature to make necessary budgetary changes, this process is challenging and likely to lead to a late budget. However, the state has closed large budgetary gaps in the past, such as in 2003, through a combination of reduced spending and other financial solutions. And, according to the state constitution, debt service on California’s general obligation bonds remains the number two priority after education.

The Fund may purchase municipal securities that are insured under policies issued by certain insurance companies. Historically, insured municipal securities typically received a higher credit rating, which meant that the issuer of the securities paid a lower interest rate. As a result of declines in the credit quality and associated downgrades of most fund insurers, insurance has less value than it did in the past. The market now values insured municipal securities primarily based on the credit quality of the issuer of the security with little value given to the insurance feature. In purchasing such insured securities, the Adviser evaluates the risk and return of municipal securities through its own research. The ratings of most insurance companies have been downgraded and it is possible that an insurance company may become insolvent. If an insurance company’s rating is downgraded or the company becomes insolvent, the prices of municipal securities insured by the insurance company may decline. As of April 30, 2010, the Fund held 56.3%

| 1 | | Thomson Reuters. “A Decade of Municipal Bond Finance” April 30, 2010. http://www.bondbuyer.com/marketstatistics/decade_1/ (May 4, 2010). |

| | |

| 2 | | • ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND |

of total investments in insured bonds (of this amount 9.3% represents the Fund’s holding in pre-refunded/escrowed to maturity bonds).

Since February 2008, auctions of the Fund’s Auction Preferred Shares (the “Preferred Shares”) have had fewer buyers than sellers and, as a result, the auctions have “failed”. The failed auctions did not lower the credit quality of the Preferred Shares. Instead, the holder was unable to sell the Preferred Shares, thereby creating a loss of liquidity for the holders of the Preferred Shares. When an auction fails, the Preferred Shares pay interest on a formula driven maximum rate based on AA-commercial paper and short-term municipal bond rates. This interest rate has been and remains generally economical versus the earnings of the

Fund’s investments. However, to the extent that the cost of this leverage increases in the future and earnings from the Fund’s investments do not increase, the Fund’s net investment returns may be reduced. The Fund continues to explore other liquidity and leverage options, including as it has used in the past, tender option bonds; this may result in Preferred Shares being redeemed in the future. The Fund is not required to redeem any Preferred Shares and expects to continue to rely on the Preferred Shares for a portion of its leverage exposure.

For additional information about the Preferred Shares, please visit the AllianceBernstein website at www.alliancebernstein.com.

| | |

| ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND • | | 3 |

HISTORICAL PERFORMANCE

An Important Note About the Value of Historical Performance

The performance on the following page represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance information shown. All fees and expenses related to the operation of the Fund have been deducted. Performance assumes reinvestment of distributions and does not account for taxes.

Alliance California Municipal Income Fund Shareholder Information

The Fund’s NYSE trading symbol is “AKP.” Weekly comparative net asset value (NAV) and market price information about the Fund is published each Monday in The Wall Street Journal, each Sunday in The New York Times and each Saturday in Barron’s and other newspapers in a table called “Closed-End Bond Funds.” Daily net asset value and market price information and additional information regarding the Fund is available at www.alliancebernstein.com and www.nyse.com. For additional shareholder information regarding this Fund, please see page 31.

Benchmark Disclosure

The unmanaged Barclays Capital Municipal Bond Index does not reflect fees and expenses associated with the active management of a fund portfolio. The Index is a total return performance benchmark for the long-term, investment grade, tax-exempt bond market. An investor cannot invest directly in an index, and its results are not indicative of the performance for any specific investment, including the Fund. In addition, the Index does not reflect the use of leverage, whereas the Fund utilizes leverage.

A Word About Risk

Among the risks of investing in the Fund are changes in the general level of interest rates or changes in bond credit quality ratings. Changes in interest rates have a greater effect on bonds with longer maturities than on those with shorter maturities. Please note, as interest rates rise, existing bond prices fall and can cause the value of your investment in the Fund to decline. While the Fund invests principally in bonds and other fixed-income securities, in order to achieve its investment objectives, the Fund may at times use certain types of investment derivatives, such as options, futures, forwards and swaps. These instruments involve risks different from, and in certain cases, greater than, the risks presented by more traditional investments. At the discretion of the Fund’s Adviser, the Fund may invest up to 25% of its net assets in municipal bonds that are rated below investment grade (i.e., “junk bonds”). These securities involve greater volatility and risk than higher-quality fixed-income securities. The Fund will invest substantially all of its net assets in California Municipal Bonds and is therefore susceptible to political, economic or regulatory factors specifically affecting California municipal bond issuers.

Leverage Risks—The Fund uses financial leverage for investment purposes, which involves leverage risk. The Fund’s outstanding Auction Rate Preferred Stock results in leverage. The Fund may also use other types of financial leverage, including tender option bonds (“TOBs”), either in combination with, or in lieu of, the Auction Preferred Stock. The Fund utilizes leverage to seek to enhance the yield and net asset value attributable to its Common Stock. These objectives may not be achieved in all interest rate environments. Leverage creates certain risks for holders of Common Stock, including the likelihood of greater volatility of the net asset value and market price of the Common Stock. If income from the securities purchased from the funds made available by leverage is not sufficient to cover the cost of leverage, the Fund’s return will be less than if leverage had not been used. As a result, the amounts available for distribution to Common Stockholders as dividends and other distributions will be reduced. During periods of rising short-term interest rates, the interest paid on the Auction Rate Preferred Stock or the floaters issued in connection with the Fund’s TOB transactions would increase. In addition, the interest paid on inverse floaters held by the Fund, whether issued in connection with the Fund’s TOB transactions or purchased in a secondary market transaction, would decrease. Under such circumstances, the Fund’s income and distributions to Common Stockholders may decline, which would adversely affect the Fund’s yield and possibly the market value of its shares.

(Historical Performance continued on next page)

| | |

| 4 | | • ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND |

Historical Performance

HISTORICAL PERFORMANCE

(continued from previous page)

| | | | | | |

| | | | | | |

THE FUND VS. ITS BENCHMARK PERIODS ENDED APRIL 30, 2010 | | Returns | | |

| | 6 Months | | 12 Months | | |

Alliance California Municipal Income Fund (NAV) | | 5.90% | | 16.24% | | |

| |

Barclays Capital Municipal Bond Index | | 3.68% | | 8.85% | | |

| |

The Fund’s Market Price per share on April 30, 2010 was $13.53. The Fund’s Net Asset Value Price per share on April 30, 2010 was $14.27. For additional Financial Highlights, please see page 29. Please keep in mind that high, double-digit returns are highly unusual and cannot be sustained. Investors should also be aware that these returns were primarily achieved during favorable market conditions. |

| | | | | | |

See Historical Performance and Benchmark disclosures on previous page.

| | |

| ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND • | | 5 |

Historical Performance

PORTFOLIO SUMMARY

April 30, 2010 (unaudited)

PORTFOLIO STATISTICS

Net Assets ($mil): $121.8

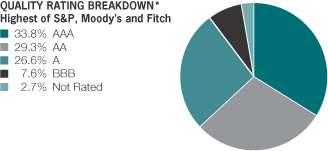

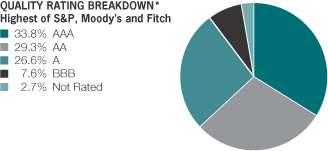

| * | | All data are as of April 30, 2010. The Fund’s quality rating breakdown is expressed as a percentage of the Fund’s total investments in municipal securities and may vary over time. The quality ratings are determined by using the Standard & Poor’s Rating Services, Moody’s Investors Service, Inc. and Fitch Ratings, Ltd. Quality breakdown is the measure of the quality and safety of a bond or portfolio, based on the issuer’s financial condition. AAA is the highest (best) and D is the lowest (worst). Pre-refunded bonds, which are escrowed by U.S. Government Securities, have been rated AAA by the Adviser. |

| | |

| 6 | | • ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND |

Portfolio Summary

PORTFOLIO OF INVESTMENTS

April 30, 2010 (unaudited)

| | | | | | |

| | | Principal

Amount

(000) | | U.S. $ Value |

| |

| | | | | | |

MUNICIPAL OBLIGATIONS – 165.2% | | | | | | |

Long-Term Municipal Bonds – 165.2% | | | | | | |

California – 149.0% | | | | | | |

Assn Bay Area Govt CA Non-prof

(Bijou Woods Apts)

Series 01A

5.30%, 12/01/31 | | $ | 2,735 | | $ | 2,749,222 |

Banning CA Util Auth Wtr

NPFGC-RE Series 05

5.25%, 11/01/30 | | | 1,850 | | | 1,857,048 |

Beaumont CA Fing Auth

AMBAC Series C

5.00%, 9/01/26 | | | 755 | | | 677,046 |

Bellflower CA Redev Agy MFHR

(Bellflower Terrace Apts)

Series 02A

5.50%, 6/01/35(a) | | | 3,000 | | | 3,066,720 |

California Dept Wtr Res Pwr

Series 02A

5.375%, 5/01/22 (Prerefunded/ETM) | | | 4,000 | | | 4,412,360 |

California Econ Recovery

(California Econ Rec Spl Tax)

Series 2009A

5.25%, 7/01/21 | | | 1,465 | | | 1,631,483 |

California Ed Fac Auth

(California Lutheran Univ)

Series 04C

5.00%, 10/01/24 | | | 1,250 | | | 1,233,538 |

California Ed Fac Auth

(Univ of The Pacific)

5.00%, 11/01/21 | | | 260 | | | 269,971 |

California GO

5.25%, 4/01/30 (Prerefunded/ETM) | | | 8,825 | | | 9,601,335 |

5.25%, 4/01/30 | | | 175 | | | 176,188 |

5.30%, 4/01/29 (Prerefunded/ETM) | | | 1,000 | | | 1,149,770 |

NPFGC Series 01BZ 5.375%, 12/01/24 | | | 4,000 | | | 3,958,040 |

Series 03 5.25%, 2/01/24 | | | 1,500 | | | 1,551,720 |

California Hlth Fac Fin Auth

(Cottage Healthcare Sys)

NPFGC Series 03B

5.00%, 11/01/23 | | | 2,770 | | | 2,745,873 |

California Hlth Fac Fin Auth

(Lucile Packard Children’s Hosp)

AMBAC Series 03C

5.00%, 8/15/22 | | | 3,295 | | | 3,405,317 |

| | |

| ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND • | | 7 |

Portfolio of Investments

| | | | | | |

| | |

| | | Principal

Amount

(000) | | U.S. $ Value |

| |

| | | | | | |

California Hlth Fac Fin Auth

(Sutter Health)

Series 00A

6.25%, 8/15/35 | | $ | 5,000 | | $ | 5,068,850 |

California Infra & Eco Dev Bk

(YMCA of Metro Los Angeles)

AMBAC Series 01

5.25%, 2/01/32 | | | 6,295 | | | 6,073,101 |

California Pub Wks Brd

(CA Lease Richmond Lab)

XLCA Series 05B

5.00%, 11/01/30 | | | 3,500 | | | 3,272,955 |

California Statewide CDA

(Bentley School)

6.75%, 7/01/32 | | | 2,415 | | | 2,174,949 |

California Statewide CDA

(Kaiser Permanente)

Series 02

5.50%, 11/01/32 | | | 4,000 | | | 4,024,880 |

Coast CA CCD GO

AGM Series 06B

5.00%, 8/01/23-8/01/24(b) | | | 6,000 | | | 6,466,288 |

Cucamonga CA SD COP

Series 02

5.125%, 6/01/23 | | | 820 | | | 803,526 |

Fontana CA CFD #22

(Fontana CA CFD #22 Sierra Hills South)

Series 04

5.85%, 9/01/25 | | | 2,000 | | | 1,944,660 |

Fontana CA Pub Fin Auth

(North Fontana CA Redev Area)

AMBAC Series 03A

5.50%, 9/01/32 | | | 4,800 | | | 4,726,848 |

Fullerton CA Redev Agy

RADIAN

5.00%, 4/01/21 | | | 2,200 | | | 2,203,718 |

Golden St Tobacco Sec CA

XLCA Series 03B

5.50%, 6/01/33 (Prerefunded/ETM) | | | 1,000 | | | 1,126,400 |

Grossmont-Cuyamaca CCD GO

ASSURED GTY

5.00%, 8/01/22-8/01/23(b) | | | 6,000 | | | 6,486,024 |

Huntington Pk CA Pub Fin Auth

(Huntington Pk CA Tax Alloc)

AGM Series 04A

5.25%, 9/01/17 | | | 1,000 | | | 1,094,410 |

La Quinta CA Fin Auth

(La Quinta CA Local Agy Pool)

AMBAC Series 04A

5.25%, 9/01/24 | | | 3,000 | | | 3,073,080 |

| | |

| 8 | | • ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND |

Portfolio of Investments

| | | | | | |

| | |

| | | Principal

Amount

(000) | | U.S. $ Value |

| |

| | | | | | |

Loma Linda CA Hosp

(Loma Linda Univ Med Ctr)

Series 05A

5.00%, 12/01/23 | | $ | 500 | | $ | 470,815 |

Los Angeles CA CCD GO

Series F-1

5.00%, 8/01/28 | | | 4,200 | | | 4,404,834 |

Los Angeles CA Cmnty Redev Agy

(Los Angeles CA CRA Bunker Hill)

Series 04L

5.00%, 3/01/18 | | | 1,000 | | | 987,210 |

Los Angeles CA Cmnty Redev Agy

(Los Angeles CA CRA Grand Ctrl)

AMBAC Series 02

5.375%, 12/01/26 | | | 6,635 | | | 6,649,730 |

Los Angeles CA Dept Arpts

(Los Angeles Intl Airpot)

Series 2009A

5.25%, 5/15/29 | | | 1,700 | | | 1,810,585 |

Los Angeles CA Dept W&P Pwr

NPFGC-RE Series 01A

5.125%, 7/01/41 | | | 10,000 | | | 10,084,700 |

Los Angeles CA Harbor Dept

5.00%, 8/01/26 | | | 5,550 | | | 5,895,487 |

Los Angeles CA USD GO

NPFGC Series 02E

5.125%, 1/01/27 (Prerefunded/ETM) | | | 10,000 | | | 10,944,900 |

Napa CA Hsg Auth

(Vintage at Napa Apts)

Series 01A

5.20%, 6/15/34 | | | 4,500 | | | 4,525,290 |

Norco CA Redev Agy

(Norco CA Redev Agy Proj #1)

Series 2010

5.875%, 3/01/32(c) | | | 420 | | | 415,128 |

6.00%, 3/01/36(c) | | | 325 | | | 320,353 |

Palo Alto CA Univ Ave AD

Series 02A

5.875%, 9/02/30 | | | 8,020 | | | 7,544,093 |

Pomona CA COP

AMBAC Series 03

5.50%, 6/01/34 | | | 1,640 | | | 1,703,288 |

Port of Oakland CA

NPFGC-RE Series 02L

5.375%, 11/01/27 | | | 4,445 | | | 4,378,147 |

5.375%, 11/01/27 (Prerefunded/ETM) | | | 555 | | | 610,500 |

Richmond CA Cmnty Redev Agy

(Richmond CA Merged Proj Areas)

Series 2010A

5.75%, 9/01/24-9/01/25 | | | 530 | | | 531,491 |

6.00%, 9/01/30 | | | 370 | | | 369,660 |

| | |

| ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND • | | 9 |

Portfolio of Investments

| | | | | | |

| | |

| | | Principal

Amount

(000) | | U.S. $ Value |

| |

| | | | | | |

Riverside CA CCD GO

NPFGC Series C

5.00%, 8/01/25 | | $ | 455 | | $ | 478,942 |

Riverside Cnty CA PFA

(Riverside Cnty CA Tax Alloc)

XLCA Series 04

5.00%, 10/01/23-10/01/24 | | | 2,860 | | | 2,726,009 |

Salinas Vly CA Solid Wst

AMBAC Series 02

5.25%, 8/01/31 | | | 3,930 | | | 3,285,480 |

San Diego CA USD GO

NPFGC Series 04E-1

5.00%, 7/01/23-7/01/24 | | | 2,000 | | | 2,143,180 |

San Francisco CA Arpt

(San Francisco CA Intl Airport)

NPFGC Series 02-28A

5.125%, 5/01/32 | | | 2,500 | | | 2,372,075 |

NPFGC-RE Series 03 5.125%, 5/01/19 | | | 1,000 | | | 1,048,920 |

San Francisco CA Lease

(San Francisco Lease San Bruno)

AMBAC Series 00

5.25%, 10/01/33 | | | 5,000 | | | 5,008,100 |

San Joaquin Hls Trnsp Corr CA

(San Joaquin Hills Toll Road CA)

NPFGC Series 97

5.25%, 1/15/30 | | | 5,000 | | | 4,315,750 |

Southern CA Pub Pwr Auth

Series 2010 PJ-1

5.00%, 7/01/27 | | | 2,525 | | | 2,671,500 |

Temecula CA Redev Agy

NPFGC Series 02

5.25%, 8/01/36 | | | 6,270 | | | 5,628,391 |

Torrance CA COP

(Torrance CA COP Pub Impt)

AMBAC Series 04A

5.00%, 6/01/24 | | | 2,275 | | | 2,375,282 |

AMBAC Series 05B 5.00%, 6/01/24 | | | 665 | | | 694,313 |

| | | | | | |

| | | | | | 181,419,473 |

| | | | | | |

Colorado – 0.2% | | | | | | |

Murphy Creek Met Dist Co.

Series 06

6.00%, 12/01/26 | | | 500 | | | 289,695 |

| | | | | | |

Nevada – 1.7% | | | | | | |

Henderson NV LID # T-14 | | | | | | |

AGM Series A | | | | | | |

5.00%, 3/01/18 | | | 2,110 | | | 2,129,159 |

| | | | | | |

| | |

| 10 | | • ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND |

Portfolio of Investments

| | | | | | | |

| | |

| | | Principal

Amount

(000) | | U.S. $ Value | |

| | |

| | | | | | | |

Ohio – 0.4% | | | | | | | |

Columbiana Cnty Port Auth OH

(Apex Environmental LLC)

Series 04A

7.125%, 8/01/25 | | $ | 500 | | $ | 432,225 | |

| | | | | | | |

Puerto Rico – 13.9% | | | | | | | |

Puerto Rico Elec Pwr Auth

XLCA Series 02-2

5.25%, 7/01/31 (Prerefunded/ETM) | | | 6,000 | | | 6,642,060 | |

Puerto Rico GO

Series 01A

5.50%, 7/01/19 | | | 500 | | | 539,875 | |

Series 04A 5.25%, 7/01/19 | | | 900 | | | 936,333 | |

Series 06A 5.25%, 7/01/22 | | | 500 | | | 517,760 | |

Puerto Rico Govt Dev Bank

Series 06B

5.00%, 12/01/15 | | | 500 | | | 537,395 | |

Puerto Rico Hwy & Trnsp Auth

Series 02D

5.375%, 7/01/36 (Prerefunded/ETM) | | | 6,450 | | | 7,057,461 | |

Puerto Rico Pub Bldgs Auth

(Puerto Rico GO)

Series N

5.50%, 7/01/22 | | | 700 | | | 730,191 | |

| | | | | | | |

| | | | | | 16,961,075 | |

| | | | | | | |

| |

Total Investments – 165.2%

(cost $198,887,037) | | | 201,231,627 | |

Other assets less liabilities – (5.6)% | | | (6,882,024 | ) |

Preferred Shares at liquidation value – (59.6)% | | | (72,550,000 | ) |

| | | | | | | |

| |

Net Assets Applicable to Common

Shareholders – 100.0%(d) | | $ | 121,799,603 | |

| | | | | | | |

| | |

| ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND • | | 11 |

Portfolio of Investments

INTEREST RATE SWAP TRANSACTIONS (see Note C)

| | | | | | | | | | | | | | |

| | | | | Rate Type | | | | |

Swap

Counterparty | | Notional

Amount

(000) | | Termination

Date | | Payments

made

by the

Portfolio | | | Payments

received

by the

Portfolio | | | Unrealized

Appreciation/

(Depreciation) | |

Goldman Sachs | | $ | 13,500 | | 12/15/11 | | 1.828 | % | | SIFMA | * | | $ (250,322 | ) |

JP Morgan Chase | | | 13,500 | | 9/18/10 | | 2.080 | % | | SIFMA | * | | (109,068 | ) |

JP Morgan Chase | | | 13,500 | | 11/20/10 | | 1.855 | % | | SIFMA | * | | (140,038 | ) |

Merrill Lynch | | | 2,300 | | 10/21/16 | | SIFMA | * | | 4.128 | % | | 250,939 | |

Merrill Lynch | | | 3,000 | | 8/9/26 | | 4.063 | % | | SIFMA | * | | (318,105 | ) |

| * | | Variable interest rate based on the Securities Industry & Financial Markets Association (SIFMA). |

| (a) | | Variable rate coupon, rate shown as of April 30, 2010. |

| (b) | | Security represents the underlying municipal obligation of an inverse floating rate obligation held by the Fund (see Note I). |

| (c) | | When-Issued or delayed delivery security. |

| (d) | | Portfolio percentages are calculated based on net assets applicable to common shareholders. |

As of April 30, 2010, the Fund held 93.0% of net assets in insured bonds (of this amount 16.5% represents the Fund’s holding in prerefunded or escrowed to maturity bonds). 30.9% and 26.8% of the Fund’s insured bonds were insured by AMBAC and NPFGC, respectively.

Glossary:

AD – Assessment District

AGM – Assured Guaranty Municipal

AMBAC – Ambac Assurance Corporation

ASSURED GTY – Assured Guaranty Ltd.

CCD – Community College District

CDA – Community Development Authority

CFD – Community Facilities District

COP – Certificate of Participation

CRA – Community Redevelopment Agency

ETM – Escrowed to Maturity

FGIC – Financial Guaranty Insurance Company

GO – General Obligation

LID – Local Improvement District

MFHR – Multi-Family Housing Revenue

NPFGC – National Public Finance Guarantee Corporation

NPFGC-RE – National Public Finance Guarantee Corporation reinsuring FGIC

PFA – Public Finance Authority

RADIAN – Radian Asset Assurance Inc.

SD – School District

USD – Unified School District

XLCA – XL Capital Assurance Inc.

See notes to financial statements.

| | |

| 12 | | • ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND |

Portfolio of Investments

STATEMENT OF ASSETS & LIABILITIES

April 30, 2010 (unaudited)

| | | | |

| Assets | | | | |

Investments in securities, at value (cost $198,887,037) | | $ | 201,231,627 | |

Interest receivable | | | 3,094,430 | |

Unrealized appreciation on interest rate swap contracts | | | 250,939 | |

| | | | |

Total assets | | | 204,576,996 | |

| | | | |

| Liabilities | | | | |

Due to custodian | | | 13,983 | |

Payable for floating rate notes issued* | | | 8,450,000 | |

Unrealized depreciation on interest rate swap contracts | | | 817,533 | |

Payable for investment securities purchased | | | 732,724 | |

Advisory fee payable | | | 93,100 | |

Dividends payable—preferred shares | | | 5,240 | |

Dividends payable | | | 31 | |

Accrued expenses | | | 114,782 | |

| | | | |

Total liabilities | | | 10,227,393 | |

| | | | |

| Preferred Shares, at Liquidation Value | | | | |

Preferred Shares, $.001 par value per share; 3,240 shares authorized, 2,902 shares issued and outstanding at $25,000 per share liquidation preference | | | 72,550,000 | |

| | | | |

Net Assets Applicable to Common Shareholders | | $ | 121,799,603 | |

| | | | |

| Composition of Net Assets Applicable to Common Shareholders | | | | |

Common stock, $.001 par value per share; 1,999,996,760 shares authorized, 8,536,533 shares issued and outstanding | | $ | 8,537 | |

Additional paid-in capital | | | 119,896,902 | |

Undistributed net investment income | | | 1,117,050 | |

Accumulated net realized loss on investment transactions | | | (1,000,882 | ) |

Net unrealized appreciation on investments | | | 1,777,996 | |

| | | | |

Net Assets Applicable to Common Shareholders | | $ | 121,799,603 | |

| | | | |

Net Asset Value Applicable to Common Shareholders

(based on 8,536,533 common shares outstanding) | | $ | 14.27 | |

| | | | |

| * | | Represents short-term floating rate certificates issued by tender option bond trusts (see Note I). |

See notes to financial statements.

| | |

| ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND • | | 13 |

Statement of Assets & Liabilities

STATEMENT OF OPERATIONS

Six Months Ended April 30, 2010 (unaudited)

| | | | | | | | |

| Investment Income | | | | | | | | |

Interest | | | | | | $ | 5,146,882 | |

| Expenses | | | | | | | | |

Advisory fee (see Note B) | | $ | 626,741 | | | | | |

Custodian | | | 43,793 | | | | | |

Audit | | | 34,046 | | | | | |

Printing | | | 27,974 | | | | | |

Preferred Shares-auction agent’s fees | | | 22,046 | | | | | |

Directors’ fees | | | 20,874 | | | | | |

Registration fees | | | 11,666 | | | | | |

Legal | | | 9,824 | | | | | |

Transfer agency | | | 416 | | | | | |

Miscellaneous | | | 21,365 | | | | | |

| | | | | | | | |

Total expenses before interest expense and fees | | | 818,745 | | | | | |

Interest expense and fees | | | 45,433 | | | | | |

| | | | | | | | |

Total expenses | | | 864,178 | | | | | |

Less: expenses waived and reimbursed by the Adviser (see Note B) | | | (119,510 | ) | | | | |

| | | | | | | | |

Net expenses | | | | | | | 744,668 | |

| | | | | | | | |

Net investment income | | | | | | | 4,402,214 | |

| | | | | | | | |

| Realized and Unrealized Gain (Loss) on Investment Transactions | | | | | | | | |

Net realized gain (loss) on: | | | | | | | | |

Investment transactions | | | | | | | 423,429 | |

Swap contracts | | | | | | | (299,209 | ) |

Net change in unrealized appreciation/depreciation of: | | | | | | | | |

Investments | | | | | | | 2,021,193 | |

Swap contracts | | | | | | | 143,296 | |

| | | | | | | | |

Net gain on investment transactions | | | | | | | 2,288,709 | |

| | | | | | | | |

| Dividends to Preferred Shareholders from | | | | | | | | |

Net investment income | | | | | | | (141,889 | ) |

| | | | | | | | |

Net Increase in Net Assets Applicable to Common Shareholders Resulting from Operations | | | | | | $ | 6,549,034 | |

| | | | | | | | |

See notes to financial statements.

| | |

| 14 | | • ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND |

Statement of Operations

STATEMENT OF CHANGES IN NET ASSETS

APPLICABLE TO COMMON SHAREHOLDERS

| | | | | | | | |

| | | Six Months Ended

April 30, 2010

(unaudited) | | | Year Ended

October 31,

2009 | |

| Increase (Decrease) in Net Assets Applicable to Common Shareholders Resulting from Operations | | | | | | | | |

Net investment income | | $ | 4,402,214 | | | $ | 8,687,678 | |

Net realized gain on investment transactions | | | 124,220 | | | | 338,864 | |

Net change in unrealized appreciation/depreciation of investments | | | 2,164,489 | | | | 10,319,763 | |

| Dividends to Preferred Shareholders from | | | | | | | | |

Net investment income | | | (141,889 | ) | | | (655,199 | ) |

| | | | | | | | |

Net increase in net assets applicable to Common Shareholders resulting from operations | | | 6,549,034 | | | | 18,691,106 | |

| Dividends to Common Shareholders from | | | | | | | | |

Net investment income | | | (3,862,781 | ) | | | (6,982,829 | ) |

| | | | | | | | |

Total increase | | | 2,686,253 | | | | 11,708,277 | |

| Net Assets Applicable to Common Shareholders | | | | | | | | |

Beginning of period | | | 119,113,350 | | | | 107,405,073 | |

| | | | | | | | |

End of period (including undistributed net investment income of $1,117,050 and $719,506, respectively) | | $ | 121,799,603 | | | $ | 119,113,350 | |

| | | | | | | | |

See notes to financial statements.

| | |

| ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND • | | 15 |

Statement of Changes In Net Assets

NOTES TO FINANCIAL STATEMENTS

April 30, 2010 (unaudited)

NOTE A

Significant Accounting Policies

Alliance California Municipal Income Fund, Inc. (the “Fund”) was incorporated in the State of Maryland on November 9, 2001 and is registered under the Investment Company Act of 1940 as a diversified, closed-end management investment company. The financial statements have been prepared in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”) which require management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities in the financial statements and amounts of income and expenses during the reporting period. Actual results could differ from those estimates. The following is a summary of significant accounting policies followed by the Fund.

1. Security Valuation

Portfolio securities are valued at their current market value determined on the basis of market quotations or, if market quotations are not readily available or are deemed unreliable, at “fair value” as determined in accordance with procedures established by and under the general supervision of the Fund’s Board of Directors.

In general, the market value of securities which are readily available and deemed reliable are determined as follows. Securities listed on a national securities exchange (other than securities listed on the NASDAQ Stock Market, Inc. (“NASDAQ”)) or on a foreign securities exchange are valued at the last sale price at the close of the exchange or foreign securities exchange. If there has been no sale on such day, the securities are valued at the mean of the closing bid and asked prices on such day. Securities listed on more than one exchange are valued by reference to the principal exchange on which the securities are traded; securities listed only on NASDAQ are valued in accordance with the NASDAQ Official Closing Price; listed put or call options are valued at the last sale price. If there has been no sale on that day, such securities will be valued at the closing bid prices on that day; open futures contracts and options thereon are valued using the closing settlement price or, in the absence of such a price, the most recent quoted bid price. If there are no quotations available for the day of valuation, the last available closing settlement price is used; securities traded in the over-the-counter market (“OTC”) are valued at the mean of the current bid and asked prices as reported by the National Quotation Bureau or other comparable sources; U.S. government securities and other debt instruments having 60 days or less remaining until maturity are valued at amortized cost if their original maturity was 60 days or less; or by amortizing their fair value as of the 61st day prior to maturity if their original term to maturity exceeded 60 days; fixed-income securities, including mortgage backed and asset backed securities, may be valued on the basis of prices provided by a pricing service or at a price obtained from one or more of the major broker/dealers. In cases where broker/dealer quotes are obtained, AllianceBernstein L.P. (the “Adviser”) may establish procedures whereby changes in market yields or spreads are used to adjust, on a

| | |

| 16 | | • ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND |

Notes to Financial Statements

daily basis, a recently obtained quoted price on a security; and OTC and other derivatives are valued on the basis of a quoted bid price or spread from a major broker/dealer in such security. Investments in money market funds are valued at their net asset value each day.

Securities for which market quotations are not readily available (including restricted securities) or are deemed unreliable are valued at fair value. Factors considered in making this determination may include, but are not limited to, information obtained by contacting the issuer, analysts, analysis of the issuer’s financial statements or other available documents. In addition, the Fund may use fair value pricing for securities primarily traded in non-U.S. markets because most foreign markets close well before the Fund values its securities at 4:00 p.m., Eastern Time. The earlier close of these foreign markets gives rise to the possibility that significant events, including broad market moves, may have occurred in the interim and may materially affect the value of those securities.

2. Fair Value Measurements

In accordance with U.S. GAAP regarding fair value measurements, fair value is defined as the price that the Fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. The U.S. GAAP disclosure requirements establish a framework for measuring fair value, and a three-level hierarchy for fair value measurements based upon the transparency of inputs to the valuation of an asset or liability. Inputs may be observable or unobservable and refer broadly to the assumptions that market participants would use in pricing the asset or liability. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Fund. Unobservable inputs reflect the Fund’s own assumptions about the assumptions that market participants would use in pricing the asset or liability based on the best information available in the circumstances. Each investment is assigned a level based upon the observability of the inputs which are significant to the overall valuation. The three-tier hierarchy of inputs is summarized below.

| | • | | Level 1—quoted prices in active markets for identical investments |

| | • | | Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| | • | | Level 3—significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

| | |

| ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND • | | 17 |

Notes to Financial Statements

The following table summarizes the valuation of the Fund’s investments by the above fair value hierarchy levels as of April 30, 2010:

| | | | | | | | | | | | | | |

Investments in Securities | | Level 1 | | Level 2 | | | Level 3 | | Total | |

Assets: | | | | | | | | | | | | | | |

Long-Term Municipal Bonds | | $ | — | | $ | 201,231,627 | | | $ | — | | $ | 201,231,627 | |

| | | | | | | | | | | | | | |

Total Investments in Securities | | | — | | | 201,231,627 | | | | — | | | 201,231,627 | |

Other Financial Instruments*: | | | | | | | | | | | | | | |

Assets | | | — | | | 250,939 | | | | — | | | 250,939 | |

Liabilities | | | — | | | (817,533 | ) | | | — | | | (817,533 | ) |

| | | | | | | | | | | | | | |

Total | | $ | — | | $ | 200,665,033 | | | $ | — | | $ | 200,665,033 | |

| | | | | | | | | | | | | | |

| * | | Other financial instruments are derivative instruments, such as futures, forwards and swap contracts, which are valued at the unrealized appreciation/depreciation on the instrument. |

3. Taxes

It is the Fund’s policy to meet the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its investment company taxable income and net realized gains, if any, to shareholders. Therefore, no provisions for federal income or excise taxes are required.

In accordance with U.S. GAAP requirements regarding accounting for uncertainties in income taxes, management has analyzed the Fund’s tax positions taken on federal and state income tax returns for all open tax years (the current and the prior three tax years) and has concluded that no provision for income tax is required in the Fund’s financial statements.

4. Investment Income and Investment Transactions

Interest income is accrued daily. Investment transactions are accounted for on the date the securities are purchased or sold. Investment gains or losses are determined on the identified cost basis. The Fund amortizes premiums and accretes discounts as adjustments to interest income.

5. Dividends and Distributions

Dividends and distributions to shareholders, if any, are recorded on the ex-dividend date. Income dividends and capital gains distributions are determined in accordance with federal tax regulations and may differ from those determined in accordance with U.S. GAAP. To the extent these differences are permanent, such amounts are reclassified within the capital accounts based on their federal tax basis treatment; temporary differences do not require such reclassification.

| | |

| 18 | | • ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND |

Notes to Financial Statements

NOTE B

Advisory, Administrative Fees and Other Transactions with Affiliates

Under the terms of an investment advisory agreement, the Fund pays the Adviser, an advisory fee at an annual rate of .65 of 1% of the Fund’s average daily net assets applicable to common and preferred shareholders. Such fee is accrued daily and paid monthly. The Adviser has voluntarily agreed to waive a portion of its fees or reimburse the Fund for expenses in the amount of 0.30% of the Fund’s average daily net assets applicable to common and preferred shareholders for the first 5 full years of the Fund’s operations, 0.25% of the Fund’s average daily net assets applicable to common and preferred shareholders in year 6, 0.20% in year 7, 0.15% in year 8, 0.10% in year 9, and 0.05% in year 10. For the six months ended April 30, 2010, which is year 9 of operations, the amount of such fees waived was $119,510. The Fund commenced operations on January 29, 2002.

Under the terms of the Shareholder Inquiry Agency Agreement with AllianceBernstein Investor Services, Inc. (“ABIS”), a wholly-owned subsidiary of the Adviser, the Fund reimburses ABIS for costs relating to servicing phone inquiries on behalf of the Fund. During the six months ended April 30, 2010, the Fund reimbursed $25 to ABIS.

NOTE C

Investment Transactions

Purchases and sales of investment securities (excluding short-term investments) for the six months ended April 30, 2010 were as follows:

| | | | | | | | |

| | | Purchases | | | Sales | |

Investment securities (excluding U.S. government securities) | | $ | 11,010,328 | | | $ | 11,767,662 | |

U.S. government securities | | | – 0 | – | | | – 0 | – |

The cost of investments for federal income tax purposes was substantially the same as the cost for financial reporting purposes. Accordingly, gross unrealized appreciation and unrealized depreciation (excluding swap transactions) are as follows:

| | | | |

Gross unrealized appreciation | | $ | 6,552,570 | |

Gross unrealized depreciation | | | (4,207,980 | ) |

| | | | |

Net unrealized appreciation | | $ | 2,344,590 | |

| | | | |

1. Derivative Financial Instruments

The Fund may use derivatives to earn income and enhance returns, to hedge or adjust the risk profile of its portfolio, to replace more traditional direct investments, or to obtain exposure to otherwise inaccessible markets.

| | |

| ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND • | | 19 |

Notes to Financial Statements

The principal types of derivatives utilized by the Fund, as well as the methods in which they may be used are:

The Fund may buy or sell futures contracts for the purpose of hedging its portfolio against adverse effects of anticipated movements in the market. The Fund bears the market risk that arises from changes in the value of these instruments and the imperfect correlation between movements in the price of the futures contracts and movements in the price of the securities hedged or used for cover.

At the time the Fund enters into a futures contract, the Fund deposits and maintains as collateral an initial margin with the broker, as required by the exchange on which the transaction is effected. Pursuant to the contract, the Fund agrees to receive from or pay to the broker an amount of cash equal to the daily fluctuation in the value of the contract. Such receipts or payments are known as variation margin and are recorded by the Fund as unrealized gains or losses. Risks may arise from the potential inability of a counterparty to meet the terms of the contract. The credit/counterparty risk for exchange-traded futures contracts is generally less than privately negotiated futures contracts, since the clearinghouse, which is the issuer or counterparty to each exchange-traded future, provides a guarantee of performance. This guarantee is supported by a daily payment system (i.e., margin requirements). When the contract is closed, the Fund records a realized gain or loss equal to the difference between the value of the contract at the time it was opened and the time it was closed.

Use of long futures contracts subjects the Fund to risk of loss in excess of the amounts shown on the statement of assets and liabilities, up to the notional value of the futures contracts. Use of short futures contracts subjects the Fund to unlimited risk of loss. Under some circumstances, futures exchanges may establish daily limits on the amount that the price of a futures contact can vary from the previous day’s settlement price, which could effectively prevent liquidation of unfavorable positions.

The Fund may enter into swaps to hedge its exposure to interest rates or credit risk. A swap is an agreement that obligates two parties to exchange a series of cash flows at specified intervals based upon or calculated by reference to changes in specified prices or rates for a specified amount of an underlying asset. The payment flows are usually netted against each other, with the difference being paid by one party to the other. In addition, collateral may be pledged or received by the Fund in accordance with the terms of the respective swap agreements to provide value and recourse to the Fund or its counterparties in the event of default, bankruptcy or insolvency by one of the parties to the swap agreement.

| | |

| 20 | | • ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND |

Notes to Financial Statements

Interest Rate Swaps:

The Fund is subject to interest rate risk exposure in the normal course of pursuing its investment objectives. Because the Fund holds fixed rate bonds, the value of these bonds may decrease if interest rates rise. To help hedge against this risk and to maintain its ability to generate income at prevailing market rates, the Fund may enter into interest rate swap contracts. Interest rate swaps are agreements between two parties to exchange cash flows based on a notional amount. The Fund may elect to pay a fixed rate and receive a floating rate, or, receive a fixed rate and pay a floating rate on a notional amount.

A Fund may enter into interest rate swap transactions to reserve a return or spread on a particular investment or portion of its portfolio, or protecting against an increase in the price of securities the Fund anticipates purchasing at a later date. Interest rate swaps involve the exchange by a Fund with another party of their respective commitments to pay or receive interest (e.g., an exchange of floating rate payments for fixed rate payments) computed based on a contractually-based principal (or “notional”) amount. Interest rate swaps are entered into on a net basis (i.e., the two payment streams are netted out, with the Fund receiving or paying, as the case may be, only the net amount of the two payments).

Risks may arise as a result of the failure of the counterparty to the swap contract to comply with the terms of the swap contract. The loss incurred by the failure of a counterparty is generally limited to the net interim payment to be received by the Fund, and/or the termination value at the end of the contract. Therefore, the Fund considers the creditworthiness of each counterparty to a swap contract in evaluating potential counterparty risk. This risk is mitigated by having a netting arrangement between the Fund and the counterparty and by the posting of collateral by the counterparty to the Fund to cover the Fund exposure to the counterparty. Additionally, risks may arise from unanticipated movements in interest rates or in the value of the underlying securities. The Fund accrues for the interim payments on swap contracts on a daily basis, with the net amount recorded within unrealized appreciation/depreciation of swap contracts on the statement of assets and liabilities. Once the interim payments are settled in cash, the net amount is recorded as realized gain/(loss) on swaps on the statement of operations, in addition to any realized gain/(loss) recorded upon the termination of swap contracts. Fluctuations in the value of swap contracts are recorded as a component of net change in unrealized appreciation/depreciation of swap contracts on the statement of operations.

Documentation governing the Fund’s swap transactions may contain provisions for early termination of a swap in the event the net assets of the Fund decline below specific levels set forth in the documentation (“net asset contingent features”). If these levels are triggered, the Fund’s

| | |

| ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND • | | 21 |

Notes to Financial Statements

counterparty has the right to terminate the swap and require the Fund to pay or receive a settlement amount in connection with the terminated swap transaction. As of April 30, 2010, the Fund had interest rate swap contracts in liability positions with net asset contingent features. The fair value of such contracts amounted to $817,533 at April 30, 2010.

At April 30, 2010, the Fund had entered into the following derivatives:

| | | | | | | | | | |

| | | Asset Derivatives | | Liability Derivatives |

Derivative Type | | Statement of

Assets and

Liabilities

Location | | Fair Value | | Statement of

Assets and

Liabilities

Location | | Fair Value |

Interest rate

contracts | | Unrealized appreciation on interest rate swap contracts | | $ | 250,939 | | Unrealized depreciation on interest rate swap contracts | | $ | 817,533 |

| | | | | | | | | | |

Total | | | | $ | 250,939 | | | | $ | 817,533 |

| | | | | | | | | | |

The effect of derivative instruments on the statement of operations for the six months ended April 30, 2010:

| | | | | | | | | |

Derivative Type | | Location of Gain

or (Loss) on

Derivatives | | Realized Gain

or (Loss) on

Derivatives | | | Change in

Unrealized

Appreciation or

(Depreciation) |

Interest rate

contracts | | Net realized gain (loss) on swap contracts; Net change in unrealized appreciation/depreciation of swap contracts | | $ | (299,209 | ) | | $ | 143,296 |

| | | | | | | | | |

Total | | | | $ | (299,209 | ) | | $ | 143,296 |

| | | | | | | | | |

For the six months ended April 30, 2010, the average monthly notional amount of interest rate swaps was $45,800,000.

NOTE D

Common Stock

There are 8,536,533 shares of common stock outstanding at April 30, 2010. During the six months ended April 30, 2010 and the year ended October 31, 2009, the Fund did not issue any shares in connection with the Fund’s dividend reinvestment plan.

| | |

| 22 | | • ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND |

Notes to Financial Statements

NOTE E

Preferred Shares

The Fund has 3,240 shares authorized, and 2,902 shares issued and outstanding of Auction Preferred Stock (the “Preferred Shares”), consisting of 1,451 shares each of Series M and Series T. The Preferred Shares have a liquidation value of $25,000 per share plus accumulated, unpaid dividends. The dividend rate on the Preferred Shares may change generally every 7 days as set by the auction agent for Series M and T. Due to the recent failed auctions, the dividend rate is the “maximum rate” set by the terms of the Preferred Shares, which is based on AA commercial paper rates and short-term municipal bond rates. The dividend rate on Series M is 0.49% effective through May 3, 2010. The dividend rate on Series T is 0.47% effective through May 4, 2010.

At certain times, the Preferred Shares are redeemable by the Fund, in whole or in part, at $25,000 per share plus accumulated, unpaid dividends. The Fund voluntarily may redeem the Preferred Shares in certain circumstances.

The Fund is not required to redeem any of its Preferred Shares and expects to continue to rely on the Preferred Shares for a portion of its leverage exposure. The Fund may also pursue other liquidity solutions for the Preferred Shares.

The Preferred Shareholders, voting as a separate class, have the right to elect at least two Directors at all times and to elect a majority of the Directors in the event two years’ dividends on the Preferred Shares are unpaid. In each case, the remaining Directors will be elected by the Common Shareholders and Preferred Shareholders voting together as a single class. The Preferred Shareholders will vote as a separate class on certain other matters as required under the Fund’s Charter, the Investment Company Act of 1940 and Maryland law.

NOTE F

Distributions to Common Shareholders

The tax character of distributions to be paid for the year ending October 31, 2010 will be determined at the end of the current fiscal year. The tax character of distributions paid during the fiscal years ended October 31, 2009 and October 31, 2008 were as follows:

| | | | | | |

| | | 2009 | | 2008 |

Distributions paid from: | | | | | | |

Ordinary income | | $ | 68,528 | | $ | 443,260 |

Tax-exempt income | | | 6,914,301 | | | 5,856,701 |

| | | | | | |

Total distributions paid | | $ | 6,982,829 | | $ | 6,299,961 |

| | | | | | |

| | |

| ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND • | | 23 |

Notes to Financial Statements

As of October 31, 2009, the components of accumulated earnings/(deficit) on a tax basis were as follows:

| | | | |

Undistributed tax-exempt income | | $ | 630,261 | |

Accumulated capital and other losses | | | (1,099,040 | )(a) |

Unrealized appreciation/(depreciation) | | | (319,504 | )(b) |

| | | | |

Total accumulated earnings/(deficit) | | $ | (788,283 | )(c) |

| | | | |

| (a) | | On October 31, 2009, the Fund had a net capital loss carryforward of $1,099,040 of which $763,965 expires in the year 2012, and $335,075 expires in the year 2016. To the extent future capital gains are offset by capital loss carryforwards, such gains will not be distributed. The Fund utilized $614,867 of capital loss carryforward for the fiscal year ended October 31, 2009. |

| (b) | | The differences between book-basis and tax-basis unrealized appreciation/(depreciation) are attributable primarily to the difference between the book and tax treatment of swap income and the tax treatment of tender option bonds. |

| (c) | | The difference between book-basis and tax-basis components of accumulated earnings/(deficit) is attributed to dividends payable. |

NOTE G

Risks Involved in Investing in the Fund

Interest Rate Risk and Credit Risk—Interest rate risk is the risk that changes in interest rates will affect the value of the Fund’s investments in fixed-income debt securities such as bonds or notes. Increases in interest rates may cause the value of the Fund’s investments to decline. Credit risk is the risk that the issuer or guarantor of a debt security, or the counterparty to a derivative contract, will be unable or unwilling to make timely principal and/or interest payments, or to otherwise honor its obligations. The degree of risk for a particular security may be reflected in its credit risk rating. Credit risk is greater for medium quality and lower-rated securities. Lower-rated debt securities and similar unrated securities (commonly known as “junk bonds”) have speculative elements or are predominantly speculative risks.

Municipal Market Risk and Concentration of Credit Risk—This is the risk that special factors may adversely affect the value of municipal securities and have a significant effect on the yield or value of the Fund’s investments in municipal securities. These factors include economic conditions, political or legislative changes, uncertainties related to the tax status of municipal securities, or the rights of investors in these securities. The Fund invests primarily in securities issued by the State of California and its various political subdivisions. The Fund’s investments in California municipal securities may be vulnerable to events adversely affecting its economy, California’s economy, the largest of the 50 states, is relatively diverse, which makes it less vulnerable to events affecting a particular industry. Its economy, however, continues to be affected by serious fiscal conditions as a result of voter passed initiatives that limit the ability of state and local governments to raise revenues, particularly with respect to real property taxes. In addition, state expenditures are difficult to reduce because of constitutional provisions that require a minimum level of spending, for certain

| | |

| 24 | | • ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND |

Notes to Financial Statements

government programs, such as education. California’s economy may also be affected by natural disasters, such as earthquakes or fires. Recent adverse economic conditions have not affected the Fund’s investments or performance. The Fund’s investments in certain municipal securities with principal and interest payments that are made from the revenues of a specific project or facility, and not general tax revenues, may have increased risks. Factors affecting the project or facility, such as local business or economic conditions, could have a significant effect on the project’s ability to make payments of principal and interest on these securities.

Bond Insurer Risk—The Fund may purchase municipal securities that are insured under policies issued by certain insurance companies. Historically, insured municipal securities typically received a higher credit rating, which meant that the issuer of the securities paid a lower interest rate. As a result of declines in the credit quality and associated downgrades of most fund insurers, insurance has less value than it did in the past. The market now values insured municipal securities primarily based on the credit quality of the issuer of the security with little value given to the insurance feature. In purchasing such insured securities, the Adviser evaluates the risk and return of municipal securities through its own research.

The ratings of most insurance companies have been downgraded and it is possible that an insurance company may become insolvent. If an insurance company’s rating is downgraded or the company becomes insolvent, the prices of municipal securities insured by the insurance company may decline.

The Adviser believes that downgrades in insurance company ratings or insurance company insolvencies present limited risk to the Fund. The generally investment grade underlying credit quality of the insured municipal securities reduces the risk of a significant reduction in the value of the insured municipal security.

Derivatives Risk—The Fund may invest in derivatives such as forwards, options, futures and swaps. These investments may be illiquid, difficult to price, and leveraged so that small changes may produce disproportionate losses for the Fund, and subject to counterparty risk to a greater degree than more traditional investments.

Financing and Related Transactions; Leverage and Other Risks—The Fund utilizes leverage to seek to enhance the yield and net asset value attributable to its Common Stock. These objectives may not be achieved in all interest rate environments. Leverage creates certain risks for holders of Common Stock, including the likelihood of greater volatility of the net asset value and market price of the Common Stock. If income from the securities purchased from the funds made available by leverage is not sufficient to cover the cost of leverage, the Fund’s return will be less than if leverage had not been used. As a result, the

| | |

| ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND • | | 25 |

Notes to Financial Statements

amounts available for distribution to Common Stockholders as dividends and other distributions will be reduced. During periods of rising short-term interest rates, the interest paid on the Preferred Shares or floaters in tender option bond transactions would increase, which may adversely affect the Fund’s income and distribution to Common Stockholders. A decline in distributions would adversely affect the Fund’s yield and possibly the market value of its shares. If rising short-term rates coincide with a period of rising long-term rates, the value of the long-term municipal bonds purchased with the proceeds of leverage would decline, adversely affecting the net asset value attributable to the Fund’s Common Stock and possibly the market value of the shares.

The Fund’s outstanding Preferred Shares results in leverage. The Fund may also use other types of financial leverage, including tender option bond transactions, either in combination with, or in lieu of, the Preferred Shares. In a tender option bond transaction, the Fund may transfer a highly rated fixed-rate municipal security to a broker, which, in turn, deposits the bond into a special purpose vehicle (typically, a trust) usually sponsored by the broker. The Fund receives cash and a residual interest security (sometimes referred to as an “inverse floater”) issued by the trust in return. The trust simultaneously issues securities, which pay an interest rate that is reset each week based on an index of high-grade short-term seven-day demand notes. These securities, sometimes referred to as “floaters”, are bought by third parties, including tax-exempt money market funds, and can be tendered by these holders to a liquidity provider at par, unless certain events occur. The Fund continues to earn all the interest from the transferred bond less the amount of interest paid on the floaters and the expenses of the trust, which include payments to the trustee and the liquidity provider and organizational costs. The Fund also uses the cash received from the transaction for investment purposes or to retire other forms of leverage. Under certain circumstances, the trust may be terminated and collapsed, either by the Fund or upon the occurrence of certain events, such as a downgrade in the credit quality of the underlying bond, or in the event holders of the floaters tender their securities to the liquidity provider. See Note I to the Financial Statements “Floating Rate Notes Issued in Connection with Securities Held” for more information about tender option bond transactions.

The Fund may also purchase inverse floaters from a tender option bond trust in a secondary market transaction without first owning the underlying bond. The income received from an inverse floater varies inversely with the short-term interest rate paid on the floaters issued by the trust. The prices of inverse floaters are subject to greater volatility than the prices of fixed-income securities that are not inverse floaters. Investments in inverse floaters may amplify the risks of leverage. If short-term interest rates rise, the interest payable on the floaters would increase and income from the inverse floaters decrease, resulting in decreased amounts of income available for distribution to Common Stockholders.

| | |

| 26 | | • ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND |

Notes to Financial Statements

The use of derivative instruments by the Fund, such as forwards, futures, options and swaps, may also result in a form of leverage.

Indemnification Risk—In the ordinary course of business, the Fund enters into contracts that contain a variety of indemnifications. The Fund’s maximum exposure under these arrangements is unknown. However, the Fund has not had prior claims or losses pursuant to these indemnification provisions and expects the risk of loss thereunder to be remote. As such, the Fund has not accrued any liability in connection with these indemnification provisions.

NOTE H

Legal Proceedings

As has been previously reported, the staff of the U.S. Securities and Exchange Commission (“SEC”) and the Office of the New York Attorney General (“NYAG”) have been investigating practices in the mutual fund industry identified as “market timing” and “late trading” of mutual fund shares. Certain other regulatory authorities have also been conducting investigations into these practices within the industry and have requested that the Adviser provide information to them. The Adviser has been cooperating and will continue to cooperate with all of these authorities. The shares of the Fund are not redeemable by the Fund, but are traded on an exchange at prices established by the market. Accordingly, the Fund and its shareholders are not subject to the market timing and late trading practices that are the subject of the investigations mentioned above or the lawsuits described below.

Numerous lawsuits have been filed against the Adviser and certain other defendants in which plaintiffs make claims purportedly based on or related to the same practices that are the subject of the SEC and NYAG investigations referred to above. Some of these lawsuits name the Fund as a party. The lawsuits are now pending in the United States District Court for the District of Maryland pursuant to a ruling by the Judicial Panel on Multidistrict Litigation transferring and centralizing all of the mutual funds involving market and late trading in the District of Maryland.

The Adviser believes that these matters are not likely to have a material adverse effect on the Fund or the Adviser’s ability to perform advisory services relating to the Fund.

NOTE I

Floating Rate Notes Issued in Connection with Securities Held

The Fund may engage in tender option bond transactions in which the Fund may transfer a fixed rate bond to a broker for cash. The broker deposits the fixed rate bond into a Special Purpose Vehicle (the “SPV”, which is generally organized as a trust), organized by the broker. The Fund buys a residual interest in the assets and cash flows of the SPV, often referred to as an inverse floating

| | |

| ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND • | | 27 |

Notes to Financial Statements

rate obligation (“Inverse Floater”). The SPV also issues floating rate notes (Floating Rate Notes) which are sold to third parties. The Floating Rate Notes pay interest at rates that generally reset weekly and their holders have the option to tender their notes to a liquidity provider for redemption at par. The Inverse Floater held by the Fund gives the Fund the right (1) to cause the holders of the Floating Rate Notes to tender their notes at par, and (2) to have the trustee transfer the Fixed Rate Bond held by the SPV to the Fund, thereby collapsing the SPV. The SPV may also be collapsed in certain other circumstances. In accordance with U.S. GAAP disclosure requirements regarding accounting for transfers and servicing of financial assets and extinguishments of liabilities, the Fund accounts for the transaction described above as a secured borrowing by including the Fixed Rate Bond in its portfolio of investments and the Floating Rate Notes as a liability under the caption “Payable for floating rate notes issued” in its statement of assets and liabilities. Interest expense related to the Fund’s liability with respect to Floating Rate Notes is recorded as incurred. The interest expense is also included in the Fund’s expense ratio. At April 30, 2010, the amount of the Fund’s Floating Rate Notes outstanding was $8,450,000 and the related interest rates were 0.30% and 0.35%.

The Fund may also purchase Inverse Floaters in the secondary market without first owning the underlying bond. Such an Inverse Floater is included in the Fund’s portfolio of investments but is not required to be treated as a secured borrowing and reflected in the Fund’s financial statements as a secured borrowing.

NOTE J

Subsequent Events

Management has evaluated subsequent events for possible recognition or disclosure in the financial statements through the date the financial statements are issued. Management has determined that there are no material events that would require disclosure in the Fund’s financial statements through this date.

| | |

| 28 | | • ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND |

Notes to Financial Statements

FINANCIAL HIGHLIGHTS

Selected Data For A Share Of Common Stock Outstanding Throughout Each Period

| | | | | | | | | | | | | | | | | | |

| | | Six Months

Ended

April 30,

2010

(unaudited) | | | Year Ended October 31, | |

| | | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ 13.95 | | | $ 12.58 | | | $ 15.00 | | | $ 15.31 | | | $ 15.11 | | | $ 15.18 | |

Income From Investment Operations | | | | | | | | | | | | | | | | | | |

Net investment income(a)(b) | | .52 | | | 1.02 | | | 1.02 | | | 1.05 | | | 1.08 | | | 1.07 | |

Net realized and unrealized gain (loss) on investment transactions | | .27 | | | 1.25 | | | (2.35 | ) | | (.28 | ) | | .38 | | | .00 | (c) |

Dividends to preferred shareholders from net investment income (common stock equivalent basis) | | (.02 | ) | | (.08 | ) | | (.35 | ) | | (.34 | ) | | (.30 | ) | | (.18 | ) |

| | | |

Net increase (decrease) in net asset value from operations | | .77 | | | 2.19 | | | (1.68 | ) | | .43 | | | 1.16 | | | .89 | |

| | | |

Less: Dividends to Common Shareholders from | | | | | | | | | | | | | | | | | | |

Net investment income | | (.45 | ) | | (.82 | ) | | (.74 | ) | | (.74 | ) | | (.96 | ) | | (.96 | ) |

| | | |

Net asset value, end of period | | $ 14.27 | | | $ 13.95 | | | $ 12.58 | | | $ 15.00 | | | $ 15.31 | | | $ 15.11 | |

| | | |

Market value, end of period | | $ 13.53 | | | $ 12.68 | | | $ 11.17 | | | $ 13.82 | | | $ 14.88 | | | $ 14.90 | |

| | | |

Discount, end of period | | (5.19 | ) % | | (9.10 | ) % | | (11.21 | )% | | (7.87 | )% | | (2.81 | )% | | (1.39 | )% |

Total Return | | | | | | | | | | | | | | | | | | |

Total investment return based on:(d) | | | | | | | | | | | | | | | | | | |

Market value | | 10.47 | % | | 22.04 | % | | (14.69 | )% | | (2.37 | )% | | 6.30 | % | | 12.03 | % |

Net asset value | | 5.90 | % | | 19.22 | % | | (11.40 | )% | | 2.99 | % | | 7.85 | % | | 6.27 | % |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | |

Net assets applicable to common shareholders, end of period (000’s omitted) | | $121,800 | | | $119,113 | | | $107,405 | | | $128,062 | | | $130,667 | | | $128,741 | |

Preferred Shares, at liquidation value ($25,000 per share) (000’s omitted) | | $72,550 | | | $72,550 | | | $72,550 | | | $81,000 | | | $81,000 | | | $81,000 | |

| | | |

See footnote summary on page 30.

| | |

| ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND • | | 29 |

Financial Highlights

Selected Data For A Share Of Common Stock Outstanding Throughout Each Period

| | | | | | | | | | | | | | | | | | |

| | | Six Months

Ended

April 30,

2010

(unaudited) | | | Year Ended October 31, | |

| | | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

| | | |

| | | | | | | | | | | | | | | | | | |

Ratio to average net assets applicable to common shareholders of: | | | | | | | | | | | | | | | | | | |

Expenses, net of waivers(e) | | 1.24 | %(f) | | 1.37 | % | | 1.30 | % | | 1.09 | % | | 1.00 | % | | 1.05 | % |

Expenses, net of waivers, excluding interest expense(e) | | 1.16 | %(f) | | 1.27 | % | | 1.22 | % | | 1.09 | % | | 1.00 | % | | 1.05 | % |

Expenses, before waivers(e) | | 1.44 | %(f) | | 1.64 | % | | 1.65 | % | | 1.52 | % | | 1.49 | % | | 1.54 | % |

Expenses, before waivers, excluding interest expense(e) | | 1.36 | %(f) | | 1.54 | % | | 1.57 | % | | 1.52 | % | | 1.49 | % | | 1.54 | % |

Net investment income, before Preferred Shares dividends(b)(e) | | 7.33 | %(f) | | 7.81 | % | | 7.02 | % | | 6.99 | % | | 7.16 | % | | 6.96 | % |

Preferred Shares dividends | | .24 | %(f) | | .59 | % | | 2.41 | % | | 2.29 | % | | 2.00 | % | | 1.19 | % |

Net investment income, net of Preferred Shares dividends(b) | | 7.09 | %(f) | | 7.22 | % | | 4.61 | % | | 4.70 | % | | 5.16 | % | | 5.77 | % |

Portfolio turnover rate | | 6 | % | | 4 | % | | 8 | % | | 9 | % | | 3 | % | | 4 | % |

Asset coverage ratio | | 268 | % | | 264 | % | | 248 | % | | 258 | % | | 261 | % | | 259 | % |

| (a) | | Based on average shares outstanding. |

| (b) | | Net of fees waived by the Adviser. |

| (c) | | Amount is less than $0.005. |

| (d) | | Total investment return is calculated assuming a purchase of common stock on the opening of the first day and a sale on the closing of the last day of each period reported. Dividends and distributions, if any, are assumed for purposes of this calculation, to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. Generally, total investment return based on net asset value will be higher than total investment return based on market value in periods where there is an increase in the discount or a decrease in the premium of the market value to the net asset value from the beginning to the end of such periods. Conversely, total investment return based on net asset value will be lower than total investment return based on market value in periods where there is a decrease in the discount or an increase in the premium of the market value to the net asset value from the beginning to the end of such periods. Total investment return calculated for a period of less than one year is not annualized. |

| (e) | | These expense and net investment income ratios do not reflect the effect of dividend payments to preferred shareholders. |

See notes to financial statements.

| | |

| 30 | | • ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND |

Financial Highlights

ADDITIONAL INFORMATION

(unaudited)

Shareholders whose shares are registered in their own names can elect to participate in the Dividend Reinvestment Plan (the “Plan”), pursuant to which dividends and capital gain distributions to shareholders will be paid in or reinvested in additional shares of the Fund (the “Dividend Shares”). Computershare Trust Company N.A. (the “Agent”) will act as agent for participants under the Plan. Shareholders whose shares are held in the name of broker or nominee should contact such broker or nominee to determine whether or how they may participate in the Plan.

If the Board declares an income distribution or determines to make a capital gain distribution payable either in shares or in cash, non-participants in the Plan will receive cash and participants in the Plan will receive the equivalent in shares of Common Stock of the Fund valued as follows: