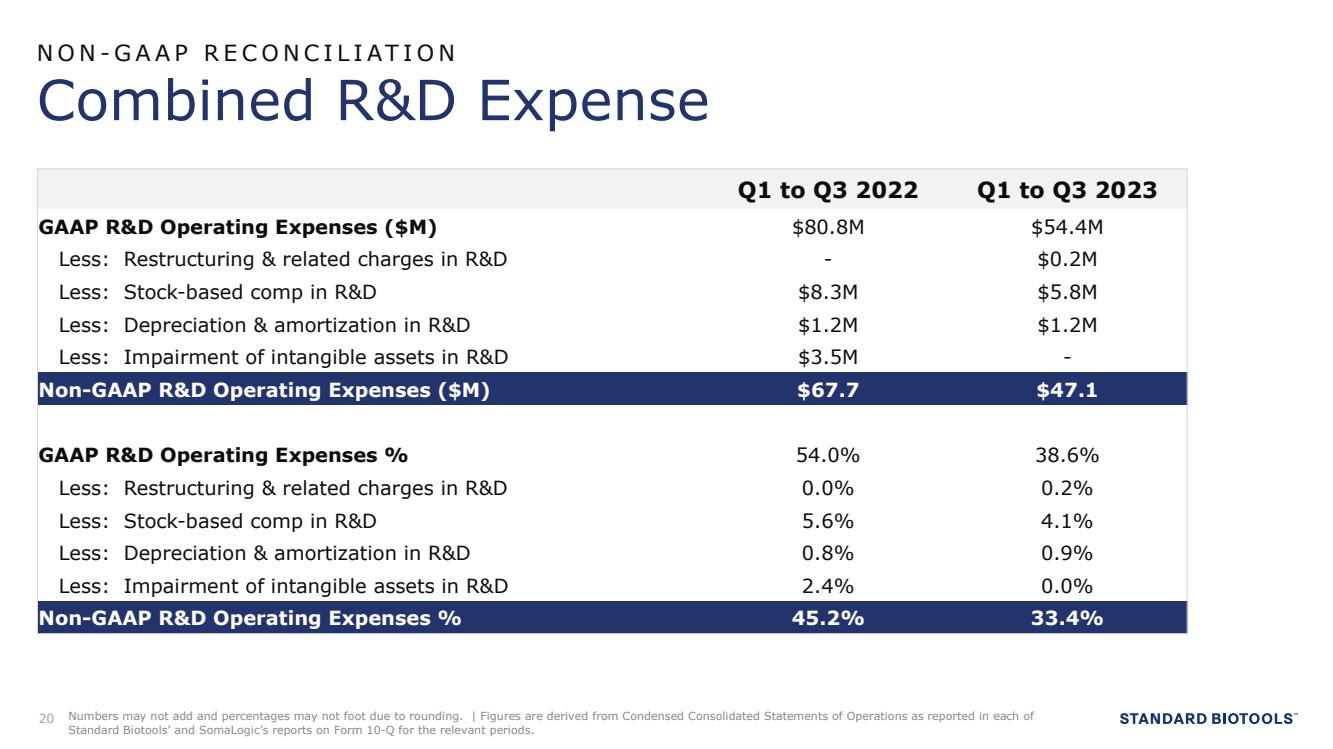

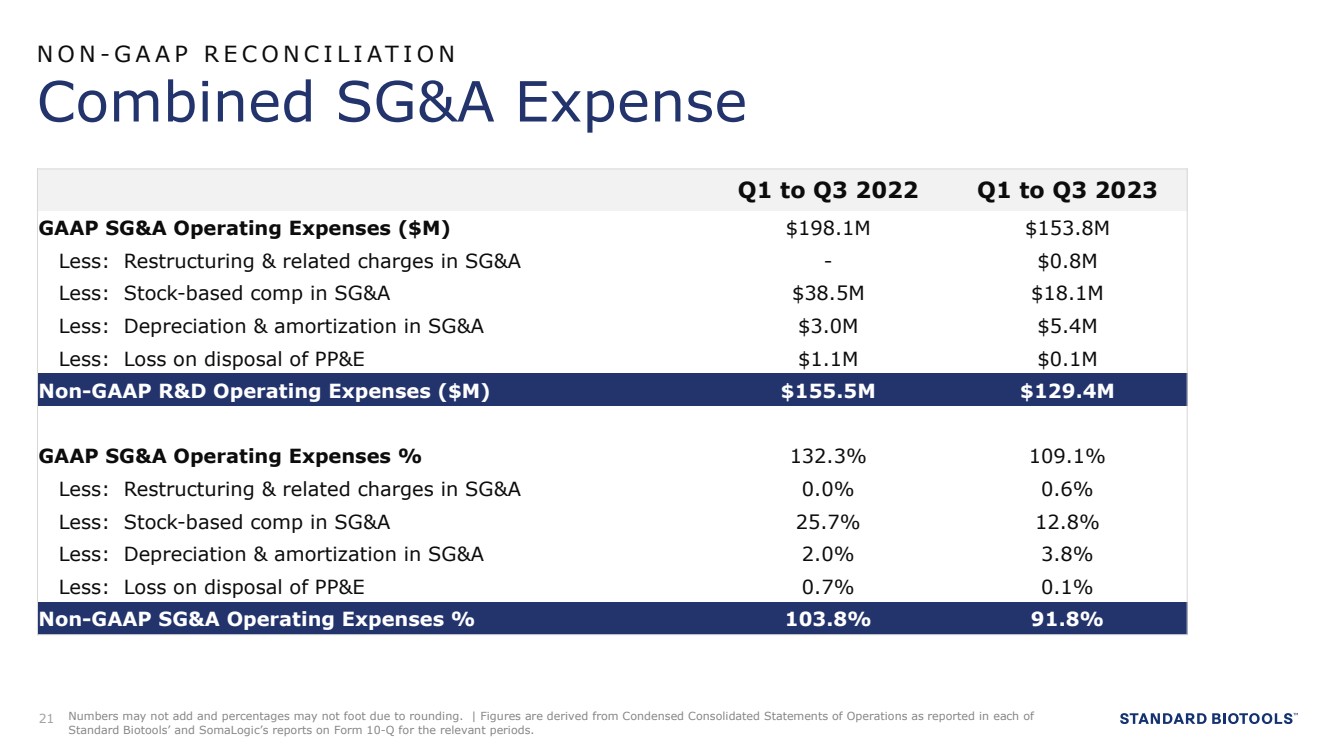

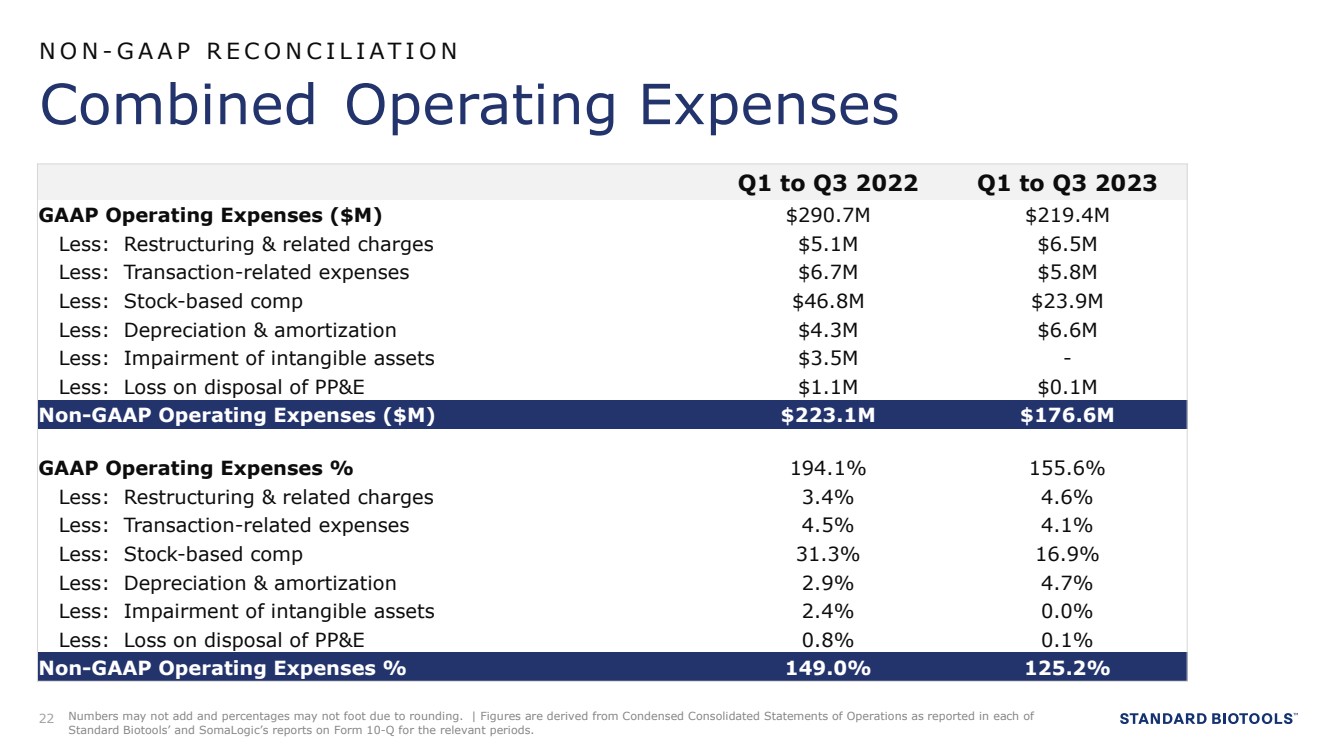

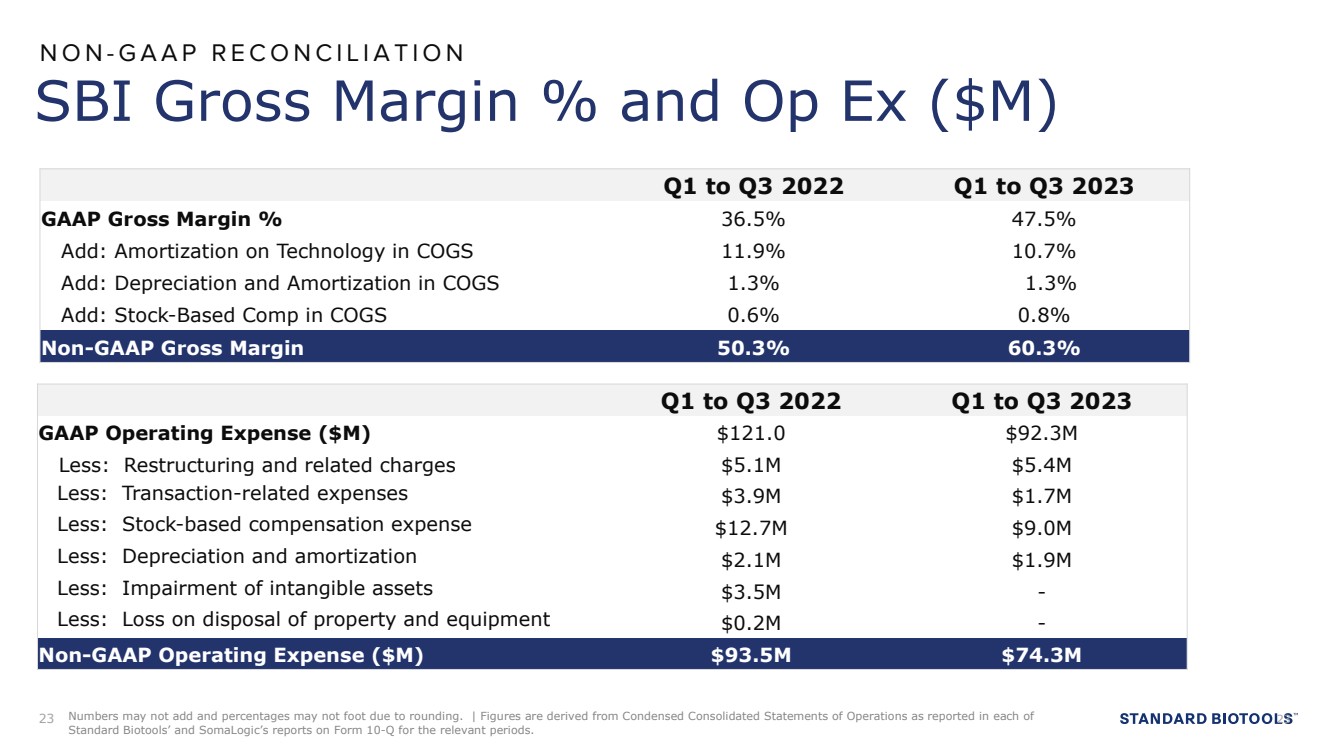

| Legal Information 2 Forward-looking statements This presentation contains forward-looking statements that are subject to various risks, uncertainties and other factors that could cause actual results to differ materially from those referred to in the forward-looking statements, many of which are beyond the control of Standard BioTools and SomaLogic. All statements other than statements of historical fact (including statements containing the words “believes,” “plans,” “anticipates,” “expects,” “estimates” and similar expressions) are statements that could be deemed forward-looking statements, although not all forward-looking statements contain these identifying words. Readers should not place undue reliance on these forward-looking statements. Forward-looking statements may include statements regarding financial outlook, including related to revenues, margin, and operating expenses; statements regarding future financial performance and expectations, operational and strategic plans, deployment of capital, cash runway and sufficiency of cash resources, potential M&A activity, potential restructuring plans; and expectations with respect to the planned merger of Standard BioTools and SomaLogic, including expected timing of the closing of the merger, the ability of the parties to complete the merger considering the various closing conditions, the expected benefits of the merger, including estimations of anticipated cost savings and cash runway, management’s ability to integrate the two companies, the competitive ability and position of the combined company, the success, cost and timing of the combined company’s product development, sales and marketing, and research and development activities, the combined company’s ability to obtain and maintain regulatory approval for its products, the sufficiency of the combined company’s cash, cash equivalents and short-term investments to fund operations, and any assumptions underlying any of the foregoing. Statements regarding future events are based on the parties’ current expectations and are necessarily subject to associated risks and uncertainties related to, among other things, (i) the risk that the merger may not be completed in a timely manner or at all, which may adversely affect Standard BioTools’ and SomaLogic’s businesses and the price of their respective securities; (ii) uncertainties as to the timing of the consummation of the merger and the potential failure to satisfy the conditions to the consummation of the merger, including obtaining stockholder and regulatory approvals; (iii) the merger may involve unexpected costs, liabilities or delays; (iv) the effect of the announcement, pendency or completion of the merger on the ability of Standard BioTools or SomaLogic to retain and hire key personnel and maintain relationships with customers, suppliers and others with whom Standard BioTools or SomaLogic does business, or on Standard BioTools’ or SomaLogic’s operating results and business generally; (v) Standard BioTools’ or SomaLogic’s respective businesses may suffer as a result of uncertainty surrounding the merger and disruption of management’s attention due to the merger; (vi) the outcome of any legal proceedings related to the merger or otherwise, or the impact of the merger thereupon; (vii) Standard BioTools or SomaLogic may be adversely affected by other economic, business and/or competitive factors; (viii) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement and the merger; (ix) restrictions during the pendency of the merger that may impact Standard BioTools’ or SomaLogic’s ability to pursue certain business opportunities or strategic transactions; (x) the risk that Standard BioTools or SomaLogic may be unable to obtain governmental and regulatory approvals required for the merger, or that required governmental and regulatory approvals may delay the consummation of the merger or result in the imposition of conditions that could reduce the anticipated benefits from the merger or cause the parties to abandon the Merger; (xi) risks that the anticipated benefits of the merger or other commercial opportunities may otherwise not be fully realized or may take longer to realize than expected; (xii) the impact of legislative, regulatory, economic, competitive and technological changes; (xiii) risks relating to the value of the Standard BioTools shares to be issued in the merger; (xiv) the risk that post-closing integration of the merger may not occur as anticipated or the combined company may not be able to achieve the benefits expected from the merger, as well as the risk of potential delays, challenges and expenses associated with integrating the combined company’s existing businesses; (xv) exposure to inflation, currency rate and interest rate fluctuations, as well as fluctuations in the market price of Standard BioTools’ and SomaLogic’s traded securities; (xvi) the lingering effects of the COVID-19 pandemic on Standard BioTools’ and SomaLogic’s industry and individual companies, including on counterparties, the supply chain, the execution of research and development programs, access to financing and the allocation of government resources; (xvii) the ability of Standard BioTools or SomaLogic to protect and enforce intellectual property rights; and (xviii) the unpredictability and severity of catastrophic events, including, but not limited to, acts of terrorism or outbreak of war or hostilities, as well as Standard BioTools’ and SomaLogic’s response to any of the aforementioned factors. Therefore, actual results may differ materially and adversely from those expressed in any forward-looking statements. For information regarding other related risks, see the “Risk Factors” section of Standard BioTools’ most recent quarterly report on Form 10-Q filed with the Securities and Exchange Commission (“SEC”) on November 7, 2023, on its most recent annual report on Form 10-K filed with the SEC on March 14, 2023 and in Standard BioTools’ other filings with the SEC, as well as the “Risk Factors” section of SomaLogic’s most recent quarterly report on Form 10-Q filed with the SEC on November 8, 2023, on its most recent annual report on Form 10-K filed with the SEC on March 28, 2023 and in SomaLogic’s other filings with the SEC. The risks and uncertainties described above and in the SEC filings cited above are not exclusive and further information concerning Standard BioTools and SomaLogic and their respective businesses, including factors that potentially could materially affect their respective businesses, financial conditions or operating results, may emerge from time to time. Readers are urged to consider these factors carefully in evaluating these forward-looking statements, and not to place undue reliance on any forward-looking statements. The parties undertake no obligation to revise or update any forward-looking statements for any reason. Additional Information and Where to Find It In connection with the proposed merger and required stockholder approval, Standard BioTools has filed with the SEC a registration statement on Form S-4, dated November 13, 2023 (the “Form S-4”), that includes a joint preliminary proxy statement of Standard BioTools and SomaLogic that also constitutes a preliminary prospectus of Standard BioTools and SomaLogic. Each of Standard BioTools and SomaLogic also plan to file other relevant documents with the SEC regarding the proposed merger. Any definitive joint proxy statement/prospectus (if and when available) will be mailed to stockholders of Standard BioTools and SomaLogic. Standard BioTools’ and SomaLogic’s stockholders are urged to carefully read the joint proxy statement/prospectus (including all amendments, supplements and any documents incorporated by reference therein) and other relevant materials filed or to be filed with the SEC and in their entirety when they become available because they will contain important information about the proposed merger and the parties to the merger. Investors and stockholders may obtain free copies of these documents (when they are available) and other documents filed with the SEC at its website at http://www.sec.gov. In addition, investors may obtain free copies of the documents filed with the SEC by Standard BioTools by going to Standard BioTools’ Investor Relations website at http://investors.standardbio.com or contacting Standard BioTools’ Investor Relations department at investors@standardbio.com or by going to SomaLogic’s Investor Relations page on its corporate website at https://investors.somalogic.com or by contacting SomaLogic Investor Relations at investors@somalogic.com. Participants in the Solicitation Standard BioTools, SomaLogic and each of their respective executive officers and directors may be deemed to be participants in the solicitation of proxies from Standard BioTools’ and SomaLogic’s stockholders with respect to the merger. Information about Standard BioTools’ directors and executive officers, including their ownership of Standard BioTools securities, is set forth in the Form S-4, which was filed with the SEC on November 13, 2023, Standard BioTools’ proxy statement for its 2023 Annual Meeting of Stockholders, which was filed with the SEC on April 28, 2023, Current Reports on Form 8-K, which were filed with the SEC on May 3, 2023, May 15, 2023, June 16, 2023 and July 28, 2023, and Standard BioTools’ other filings with the SEC. Information concerning SomaLogic’s directors and executive officers, including their ownership of SomaLogic securities, is set forth in the Form S-4, which was filed with the SEC on November 13, 2023, SomaLogic’s proxy statement for its 2023 Annual Meeting of Stockholders, which was filed with the SEC on April 25, 2023, Current Reports on Form 8-K, which were filed with the SEC on June 6, 2023, as amended on June 14, 2023, June 9, 2023 and October 4, 2023, and SomaLogic’s other filings with the SEC. Investors may obtain more detailed information regarding the direct and indirect interests of Standard BioTools and SomaLogic and its respective executive officers and directors in the merger, which may be different than those of Standard BioTools’ and SomaLogic’s stockholders generally, by reading the preliminary and definitive proxy statements regarding the merger, which have been or will be filed with the SEC. These documents are available free of charge at the SEC’s website at www.sec.gov, by going to Standard BioTools’ Investor Relations website at http://investors.standardbio.com or contacting Standard BioTools’ Investor Relations department at investors@standardbio.com or by going to SomaLogic’s Investor Relations page on its corporate website at https://investors.somalogic.com or by contacting SomaLogic Investor Relations at investors@somalogic.com. No Offer or Solicitation This presentation and the accompanying oral presentation shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Non-GAAP financial information Standard BioTools has presented certain financial information in accordance with U.S. GAAP and also on a non-GAAP basis. The non-GAAP financial measures included in this presentation are non-GAAP gross margin, non-GAAP operating expenses, adjusted EBITDA, non-GAAP SG&A and non-GAAP R&D . Management uses these non-GAAP financial measures, in addition to GAAP financial measures, as a measure of operating performance because the non-GAAP financial measures do not include the impact of items that management does not consider indicative of the Company’s core operating performance. Management believes that non-GAAP financial measures, taken in conjunction with GAAP financial measures, provide useful information for both management and investors by excluding certain non-cash and other expenses that are not indicative of the Company’s core operating results. Management uses non-GAAP measures to compare the Company’s performance relative to forecasts and strategic plans and to benchmark the company’s performance externally against competitors. Non-GAAP information is not prepared under a comprehensive set of accounting rules and should only be used to supplement an understanding of the company’s operating results as reported under U.S. GAAP. Standard BioTools encourages investors to carefully consider its results under GAAP, as well as its supplemental non-GAAP information and the reconciliations between these presentations, to more fully understand its business. Reconciliations between GAAP and non-GAAP operating results are presented in the accompanying tables of this release. Trademarks Standard BioTools, the Standard BioTools logo, Biomark, CyTOF, CyTOF XT, EP1, Helios, Hyperion and Hyperion+ are trademarks and/or registered trademarks of Standard BioTools Inc. (f.k.a. Fluidigm Corporation) or its affiliates in the United States and/or other countries. SomaLogic, the SomaLogic logo, SomaSignal, SOMAmer, SomaScan, SomaScan by SomaLogic, DataDelve, LabThread LX, CardioDM and Powered by SomaLogic are trademarks and/or registered trademarks of SomaLogic, Inc. or its affiliates in the United States and/or other countries. \ All other trademarks are the sole property of their respective owners. |