UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Under §240.14a-12 |

Standard BioTools Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

2 Tower Place, Suite 2000

South San Francisco, California 94080

(650) 266-6000

SUPPLEMENT NO. 1 TO THE PROXY STATEMENT FOR THE STANDARD BIOTOOLS INC.

ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 27, 2024

This Supplement No. 1 (this “Supplement”), dated June 3, 2024, supplements the definitive proxy statement on Schedule 14A (the “Proxy Statement”) filed by Standard BioTools Inc., a Delaware corporation (referred to herein as “we”, “us”, “our” or the “Company”) with the U.S. Securities and Exchange Commission (the “SEC”) on May 21, 2024, in connection with the solicitation by the Company’s Board of Directors (the “Board”) of proxies to be voted at the Company’s 2024 Annual Meeting of Stockholders, or any adjournment or postponement thereof (the “Annual Meeting”).

THIS SUPPLEMENT SHOULD BE READ IN CONJUNCTION WITH THE PROXY STATEMENT, WHICH CONTAINS IMPORTANT ADDITIONAL INFORMATION. Except as to the matters specifically discussed herein, this Supplement does not otherwise modify or update any information or disclosure contained in the Proxy Statement. Capitalized terms used but not otherwise defined in this Supplement shall have the meanings assigned to such terms in the Proxy Statement.

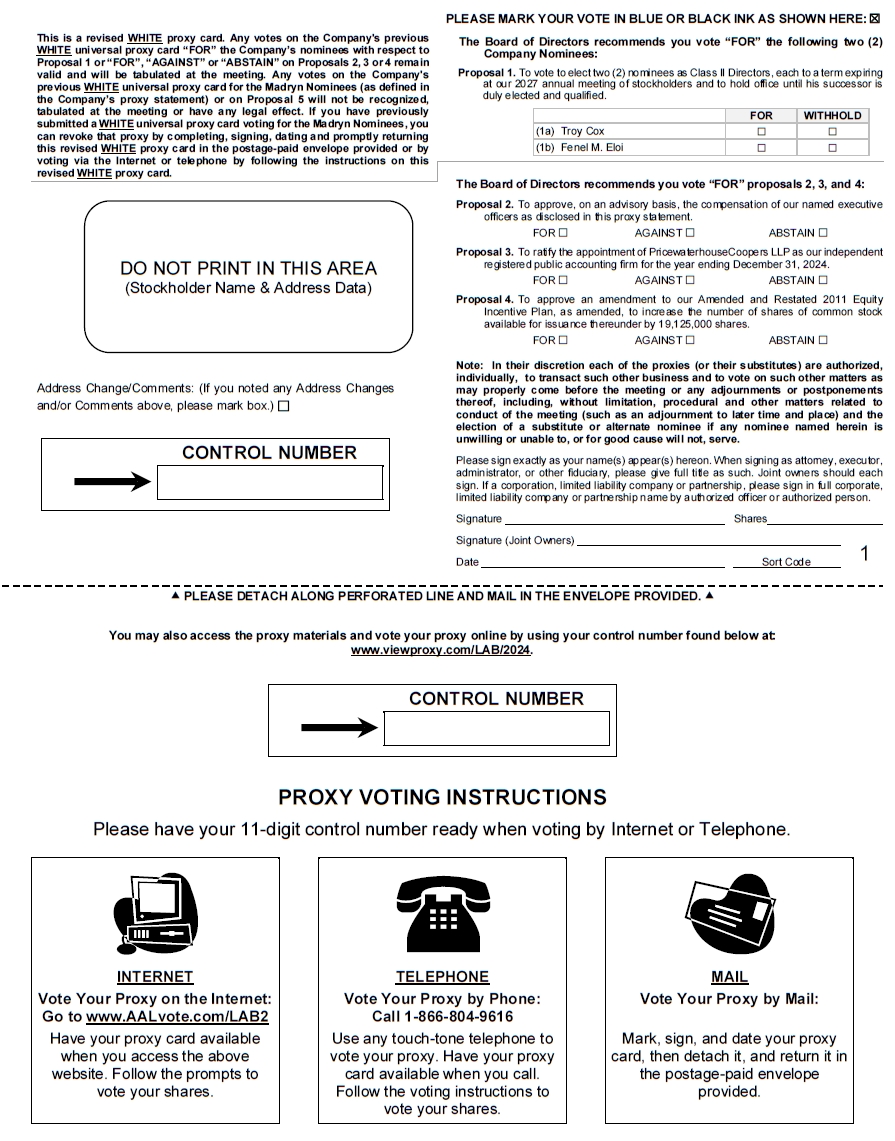

As described in the Proxy Statement, Madryn previously notified the Company that it intended to (i) nominate two nominees (the “Madryn Nominees”) to stand for election as directors of the Company at the Annual Meeting in opposition to the nominees recommended by the Board and (ii) submit for stockholder consideration at the Annual Meeting a non-binding proposal urging the Board to take all steps necessary to declassify the Board (the “Declassification Proposal”). On May 31, 2024, Madryn notified the Company that it has irrevocably withdrawn its notice with respect to the Madryn Nominees and the Declassification Proposal and that Madryn no longer intends to solicit the holders of shares of the Company’s common stock representing at least 67% of the total voting power of shares entitled to vote on the election of the Company’s directors (the minimum solicitation required under Rule 14a-19 under the Securities Exchange Act of 1934, as amended) in support of the Madryn Nominees at the Annual Meeting. Because Madryn has withdrawn the Madryn Nominees and the Declassification Proposal, the election of the Madryn Nominees and the Declassification Proposal will not be brought before the Annual Meeting.

In light of the development described above, this Supplement includes (i) additional information you should read in conjunction with the Proxy Statement and (ii) a new WHITE proxy card that removes the Madryn Nominees and the Declassification Proposal.

As a result of Madryn’s withdrawal of its notice with respect to the Madryn Nominees and the Declassification Proposal, any vote cast in favor of the Madryn Nominees or Declassification Proposal on the previous WHITE universal proxy card will not be recognized, tabulated at the Annual Meeting or have any legal effect. Stockholders who submitted the previous WHITE universal proxy card voting “FOR” the Madryn Nominees or Declassification Proposals can revoke that proxy by completing, signing, dating and promptly returning the new WHITE proxy card in the postage-paid envelope provided or by voting via the Internet or telephone by following the instructions on the new WHITE proxy card. Any votes on the Company’s previous WHITE universal proxy card “FOR” the Company’s nominees with respect to Proposal 1 or “FOR”, “AGAINST” or “ABSTAIN” on Proposals 2, 3 or 4 remain valid and will be tabulated at the Annual Meeting. Stockholders who submitted the Company’s previous WHITE universal proxy card voting “FOR” the Company’s nominees with respect to Proposal 1 or “FOR”, “AGAINST” or “ABSTAIN” on Proposals 2, 3 or 4 do not need to take any further action.

If your shares are held in “street name” through an intermediary such as a broker, bank, trustee or other nominee, you will receive voting instructions from your broker, bank, trustee or other nominee. You must follow these instructions in order for your shares to be voted on Proposals 1, 2, and 4. Your broker, bank, trustee or other nominee is required to vote those shares in accordance with your instructions. We urge you to instruct your broker, bank, trustee or other nominee, by following the instructions on the voting instruction form, to vote your shares in line with the Board’s recommendations on the voting instruction form, whether or not you plan to attend the Annual Meeting.

This Supplement, the Proxy Statement, the Notice of 2024 Annual Meeting of Stockholders, the new form of WHITE proxy card and our 2023 Annual Report are available for viewing, printing and downloading at www.viewproxy.com/LAB/2024. To view these materials please have your control number(s) available that appears on your WHITE proxy card. On this website, you can also elect to receive future distributions of our proxy statements and annual reports to stockholders by electronic delivery.

Additionally, you can find a copy of our Annual Report on Form 10-K, which includes our financial statements for the fiscal year ended December 31, 2023, on the website of the SEC at www.sec.gov, or in the “Latest Reports” section of the “Investors” section of our website at https://investors.StandardBio.com. You may also obtain a printed copy of our Annual Report on Form 10-K, including our financial statements, free of charge, from us by sending a written request to: Standard BioTools Inc., Attn: Investor Relations, 2 Tower Place, Suite 2000 South San Francisco, California 94080. Exhibits will be provided upon written request and payment of an appropriate processing fee.

If you have any questions or need assistance voting, please contact our proxy solicitor:

ALLIANCE ADVISORS LLC

Stockholders, banks, and brokers may call 800-574-5969 (toll-free from the U.S. and Canada) or

+1-209-692-6142 (from other countries)