Fluidigm Investor Presentation January 2017 ® Exhibit 99.2

Use of Forward-Looking Statements This presentation contains, and accompanying oral statements may contain, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, among others, statements regarding potential applications for, and features and benefits of, Fluidigm products, opportunities for participation by Fluidigm in human cell atlas research, addressable market growth, implementation of strategic initiatives (including anticipated cost savings, modifications to an R&D investment model, new products and enhancements and support for existing products, product launch strategies, collaborations and partnerships, and customer relationships), and expected financial results. Forward-looking statements are subject to numerous risks and uncertainties that could cause actual results to differ materially from currently anticipated results, including but not limited to, risks relating to the future financial performance of Fluidigm product lines; challenges inherent in developing, manufacturing, launching, marketing, and selling new products; potential product performance and quality issues; the possible loss of key employees, customers, or suppliers; intellectual property risks; competition; Fluidigm research and development, sales, marketing, and distribution plans and capabilities; reduction in research and development spending or changes in budget priorities by customers; interruptions or delays in the supply of components or materials for, or manufacturing of, its products; seasonal variations in customer operations; unanticipated increases in costs or expenses; and risks associated with international operations. Information on these and additional risks, uncertainties, and other information affecting Fluidigm business and operating results are contained in Fluidigm’s Annual Report on Form 10-K for the year ended December 31, 2015, and in its other filings with the Securities and Exchange Commission, including Fluidigm’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2016. These forward-looking statements speak only as of the date hereof. Fluidigm disclaims any obligation to update these forward-looking statements except as may be required by law. * * * Fluidigm, the Fluidigm logo, Access Array, Biomark, C1, Callisto, CyTOF, EP1, Helios, Juno, Maxpar and Polaris are trademarks or registered trademarks of Fluidigm Corporation. All other trademarks are the property of their respective owners. January 9, 2017

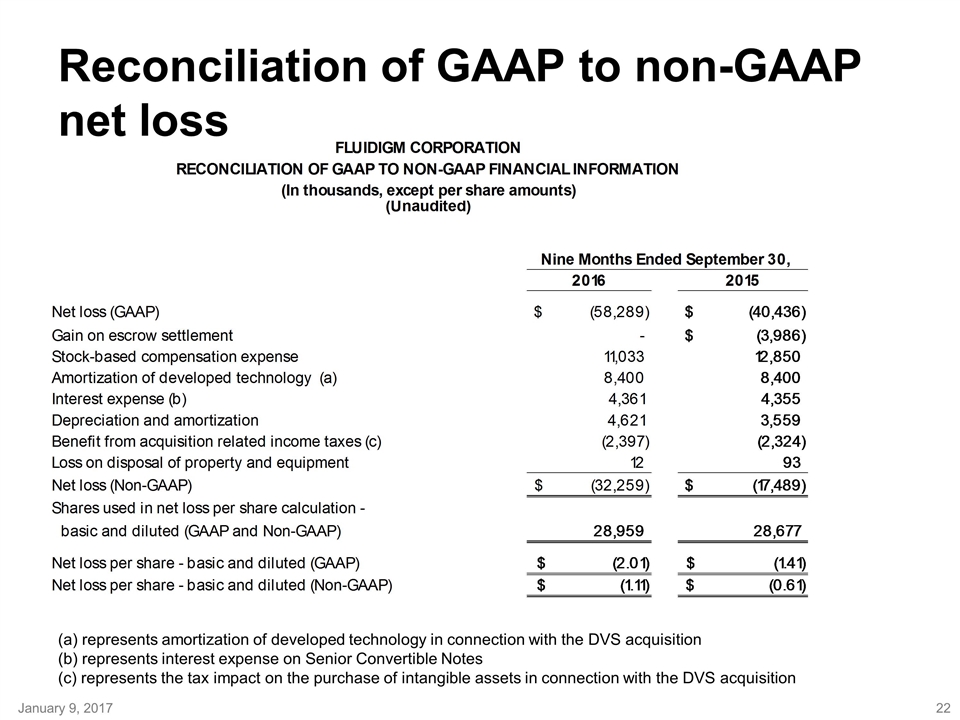

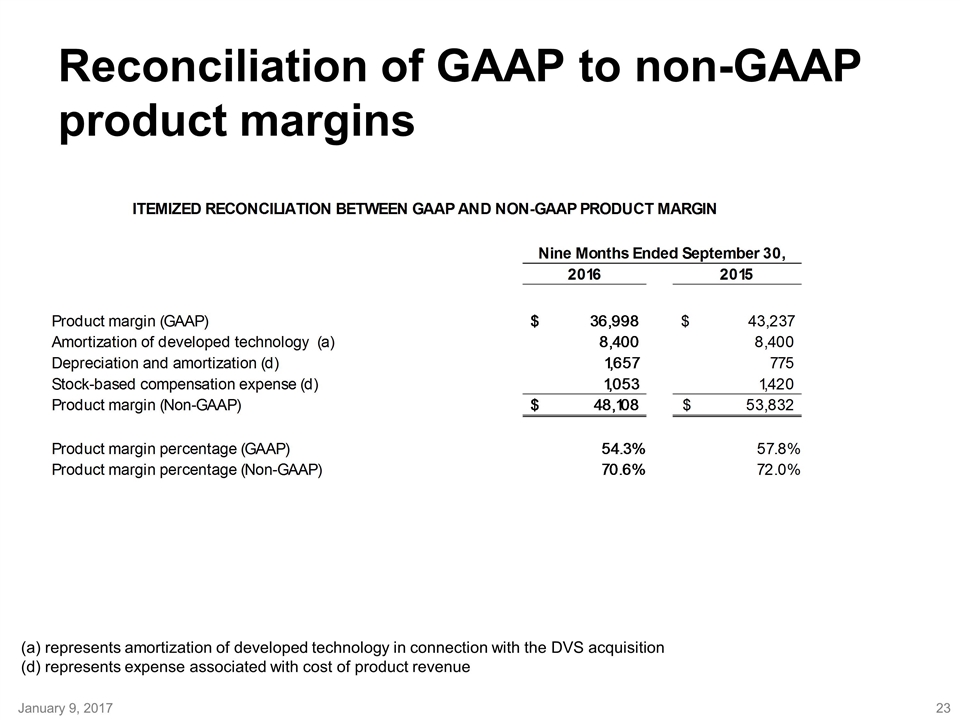

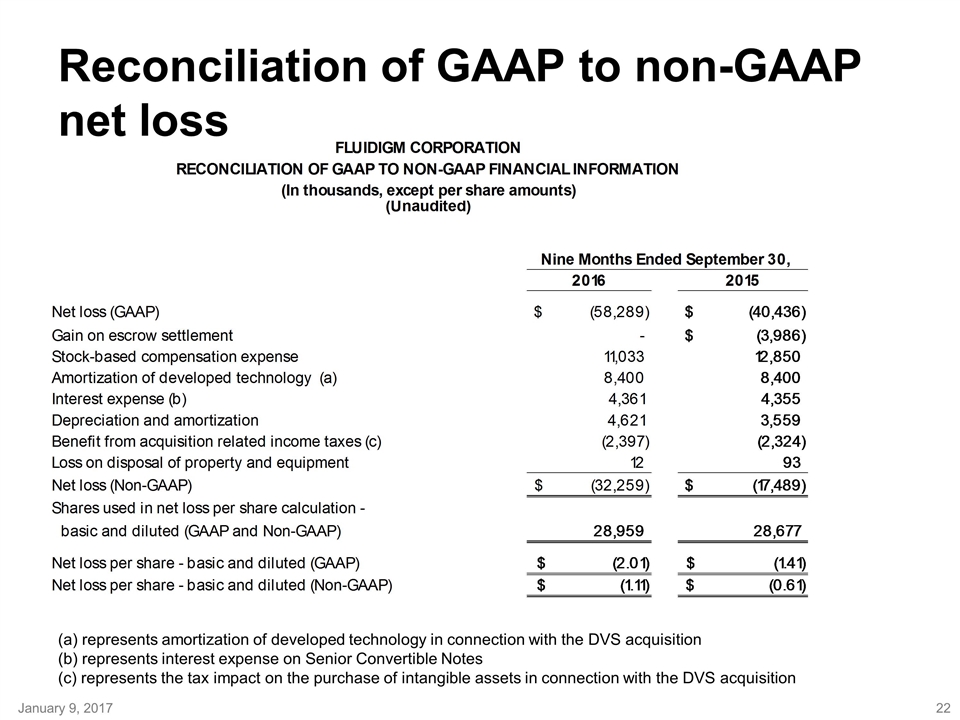

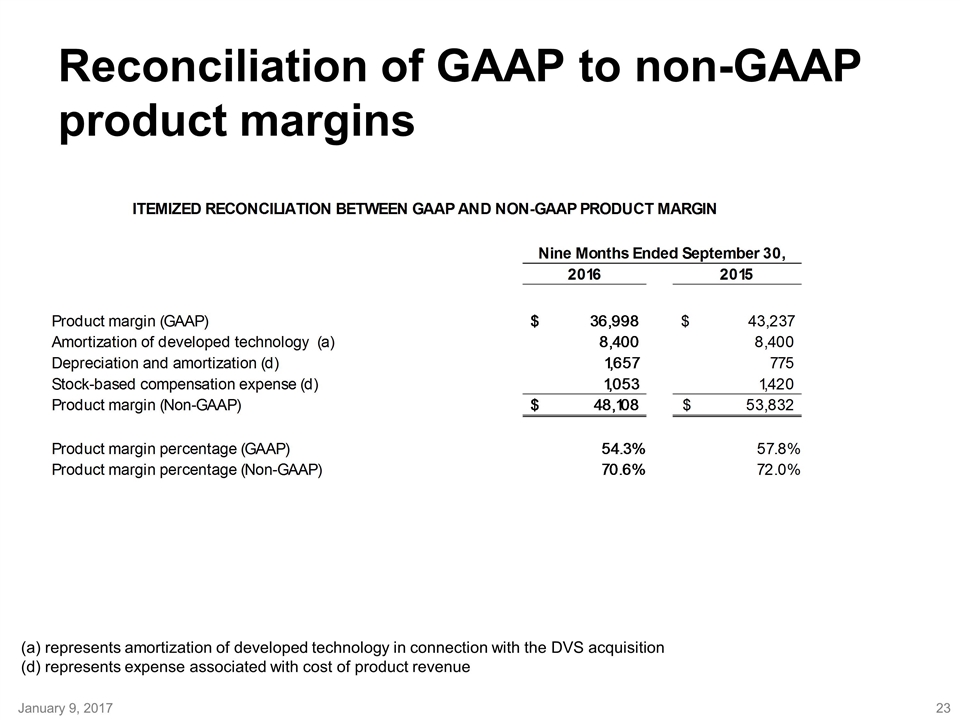

Use of Non-GAAP Financial Information In this presentation, Fluidigm has presented certain financial information in accordance with GAAP and also on a non-GAAP basis for the first nine months of 2016 and 2015. Management believes that non-GAAP financial measures, taken in conjunction with GAAP financial measures, provide useful information for both management and investors by excluding certain non-cash and other expenses that are not indicative of the company’s core operating results. Management uses non-GAAP measures to compare the company’s performance relative to forecasts and strategic plans and to benchmark the company’s performance externally against competitors. Non-GAAP information is not prepared under a comprehensive set of accounting rules and should only be used to supplement an understanding of the company’s operating results as reported under U.S. GAAP. Fluidigm encourages investors to carefully consider its results under GAAP, as well as its supplemental non-GAAP information and the reconciliation between these presentations, to more fully understand its business. Reconciliations between GAAP and non-GAAP operating results are presented in the tables where the non-GAAP measures are provided in this presentation. January 9, 2017

Fluidigm An innovative leader in cell and tissue analysis for translational and clinical research Mass Cytometry Genomics January 9, 2017

Empowering translational, clinical and pharmaceutical research Obtain comprehensive cellular profiles from blood, tissues, and tumors in human and animal model systems. Discover rare cell populations and biomarkers that inform disease progression and therapeutic development. Affordably scale next-generation sequencing (NGS) library preparation, genotyping, and gene expression through automation and miniaturization of reaction volumes. Oncology Immunology Stem cell research Neuroscience Inherited diseases January 9, 2017

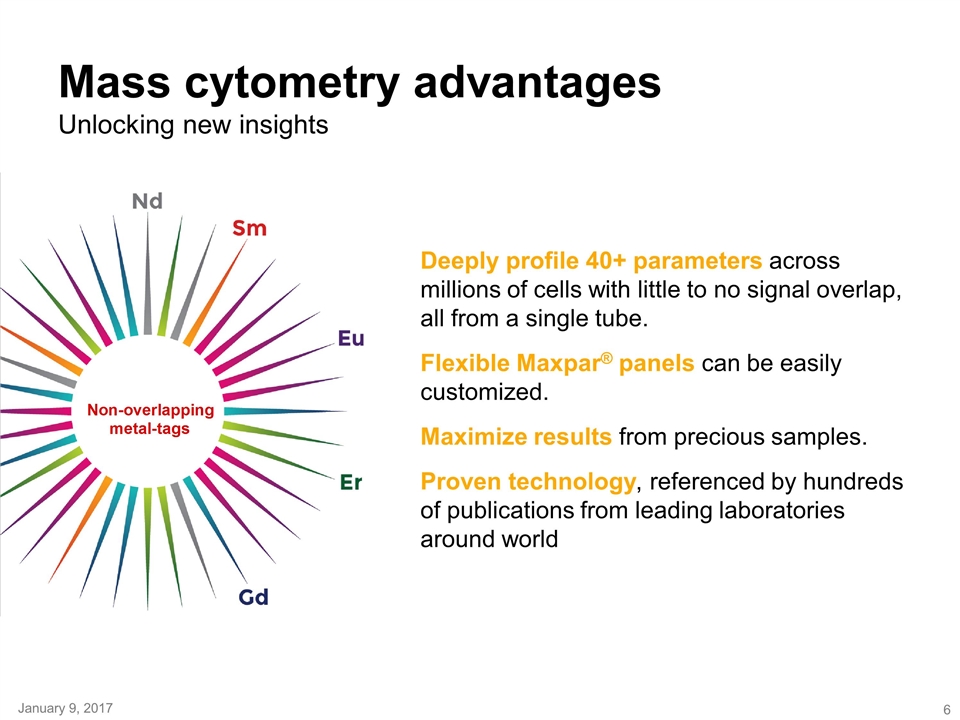

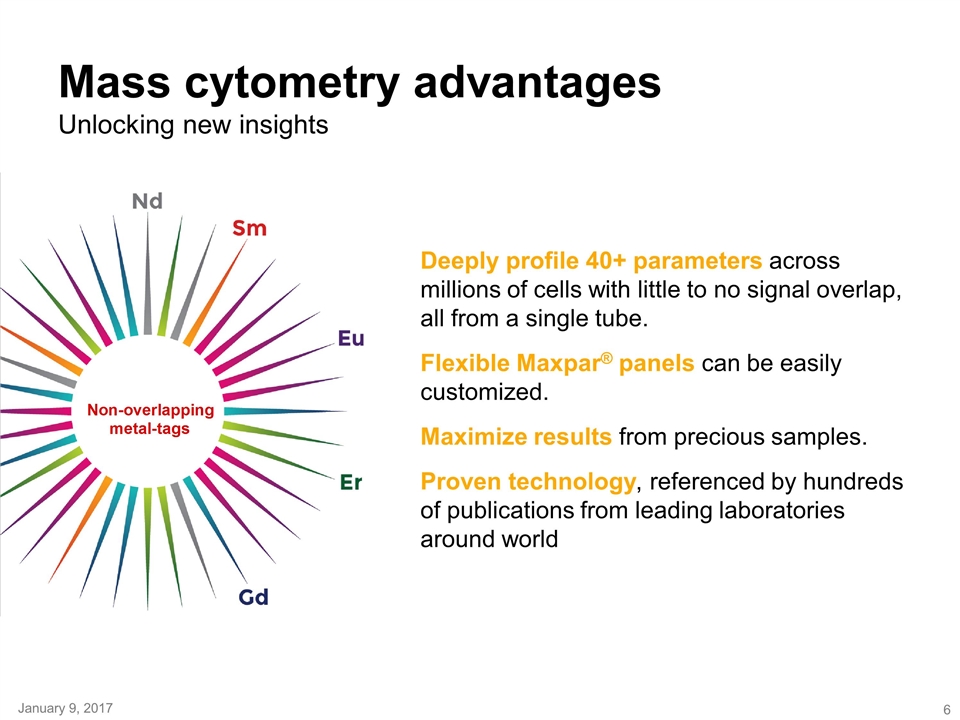

Mass cytometry advantages Unlocking new insights January 9, 2017 Deeply profile 40+ parameters across millions of cells with little to no signal overlap, all from a single tube. Flexible Maxpar® panels can be easily customized. Maximize results from precious samples. Proven technology, referenced by hundreds of publications from leading laboratories around world

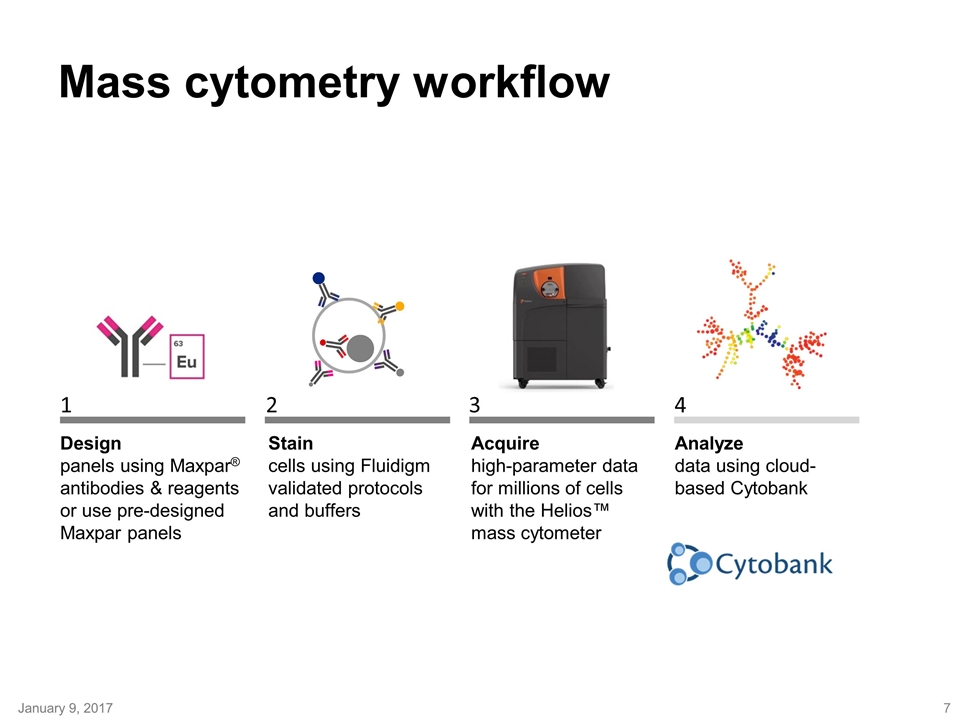

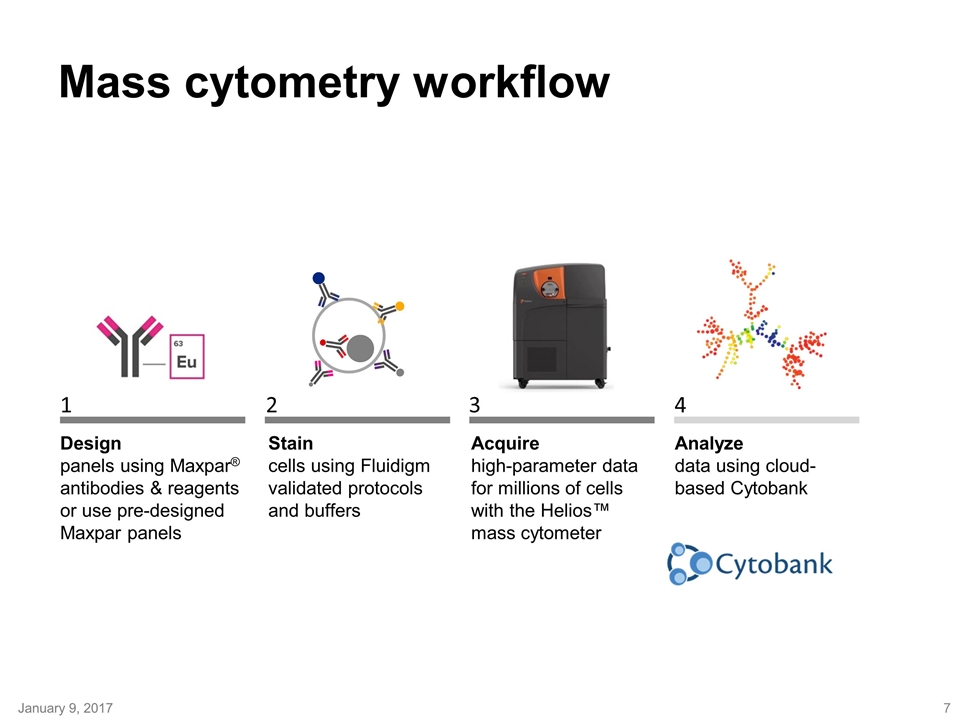

Mass cytometry workflow Stain cells using Fluidigm validated protocols and buffers 3 Acquire high-parameter data for millions of cells with the Helios™ mass cytometer 4 Analyze data using cloud-based Cytobank Design panels using Maxpar® antibodies & reagents or use pre-designed Maxpar panels 1 2 January 9, 2017

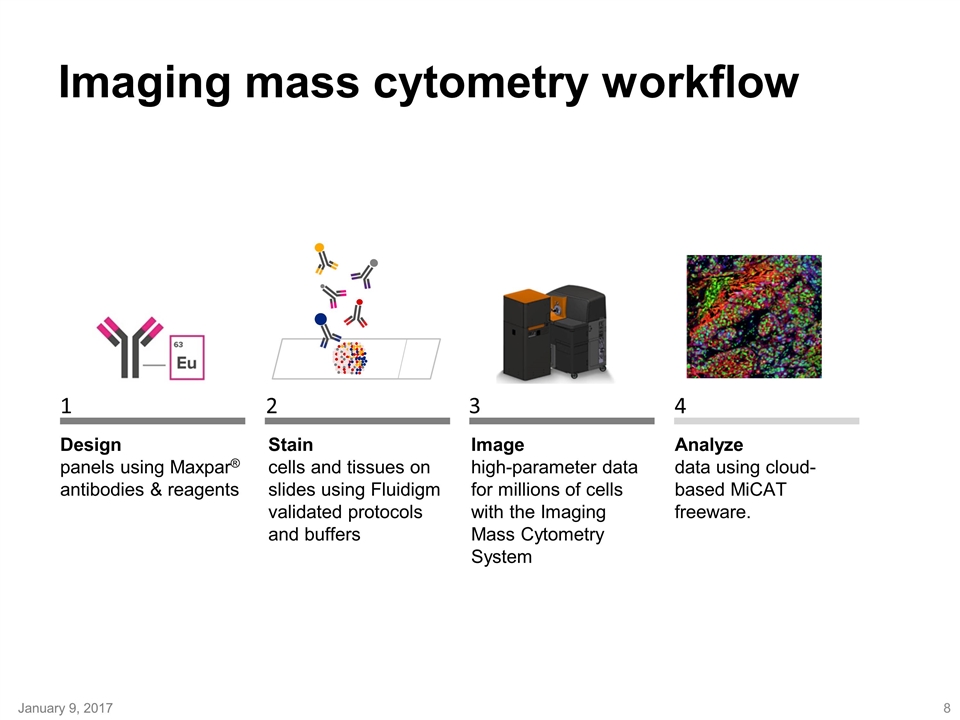

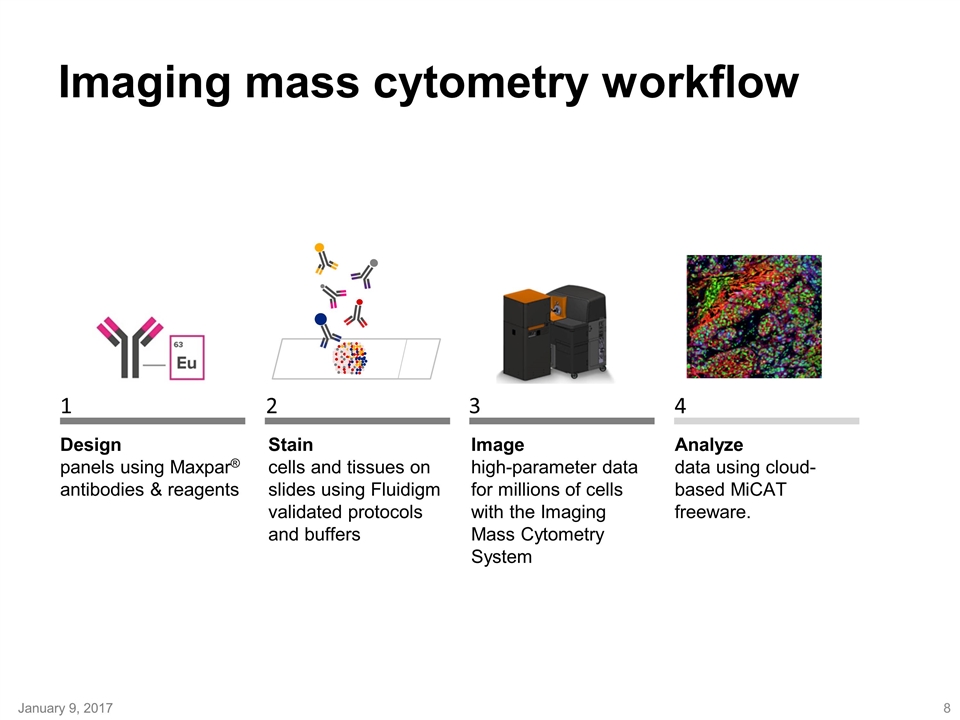

Imaging mass cytometry workflow Stain cells and tissues on slides using Fluidigm validated protocols and buffers 3 Image high-parameter data for millions of cells with the Imaging Mass Cytometry System 4 Analyze data using cloud-based MiCAT freeware. Design panels using Maxpar® antibodies & reagents 1 2 January 9, 2017

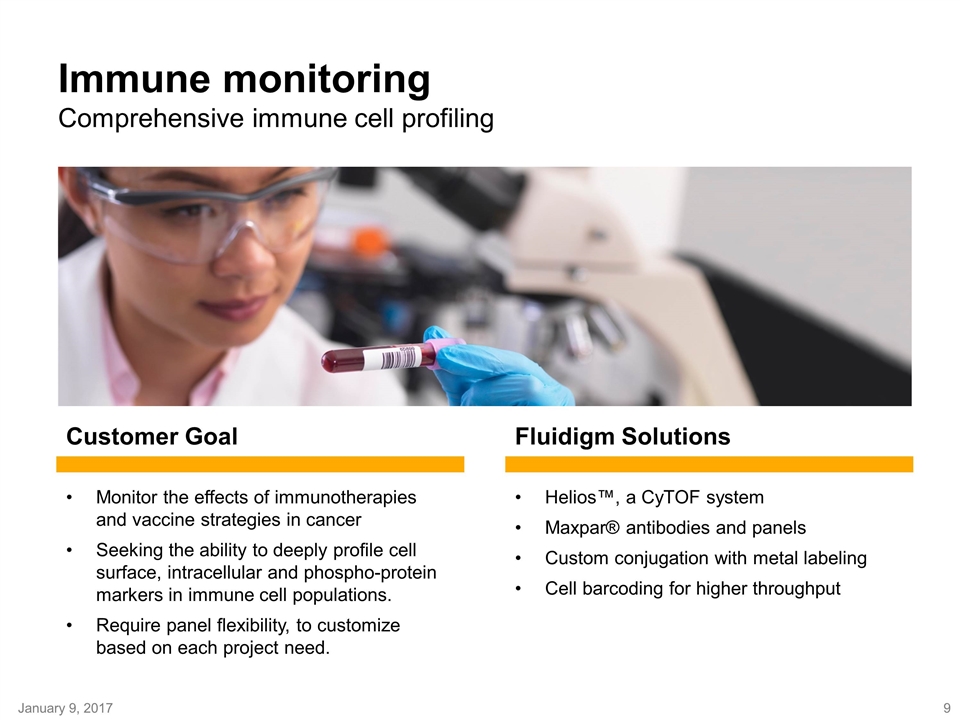

Immune monitoring Comprehensive immune cell profiling Monitor the effects of immunotherapies and vaccine strategies in cancer Seeking the ability to deeply profile cell surface, intracellular and phospho-protein markers in immune cell populations. Require panel flexibility, to customize based on each project need. Customer Goal Helios™, a CyTOF system Maxpar® antibodies and panels Custom conjugation with metal labeling Cell barcoding for higher throughput Fluidigm Solutions January 9, 2017

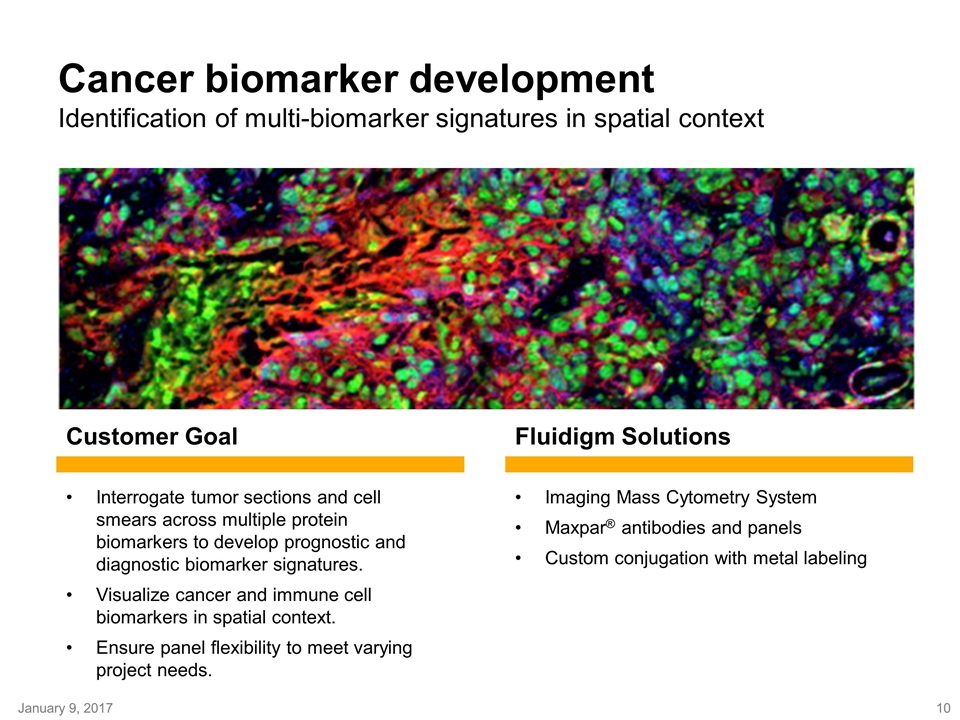

Cancer biomarker development Identification of multi-biomarker signatures in spatial context Interrogate tumor sections and cell smears across multiple protein biomarkers to develop prognostic and diagnostic biomarker signatures. Visualize cancer and immune cell biomarkers in spatial context. Ensure panel flexibility to meet varying project needs. Customer Goal Imaging Mass Cytometry System Maxpar® antibodies and panels Custom conjugation with metal labeling Fluidigm Solutions January 9, 2017

Genomics: the power of microfluidics Greater cost-effectiveness with reagent miniaturization Scalable sample throughput without changing technologies Flexible panel design allowing additional markers to be easily added over time. Maximize results from precious samples Trusted performance similar to established market platforms January 9, 2017

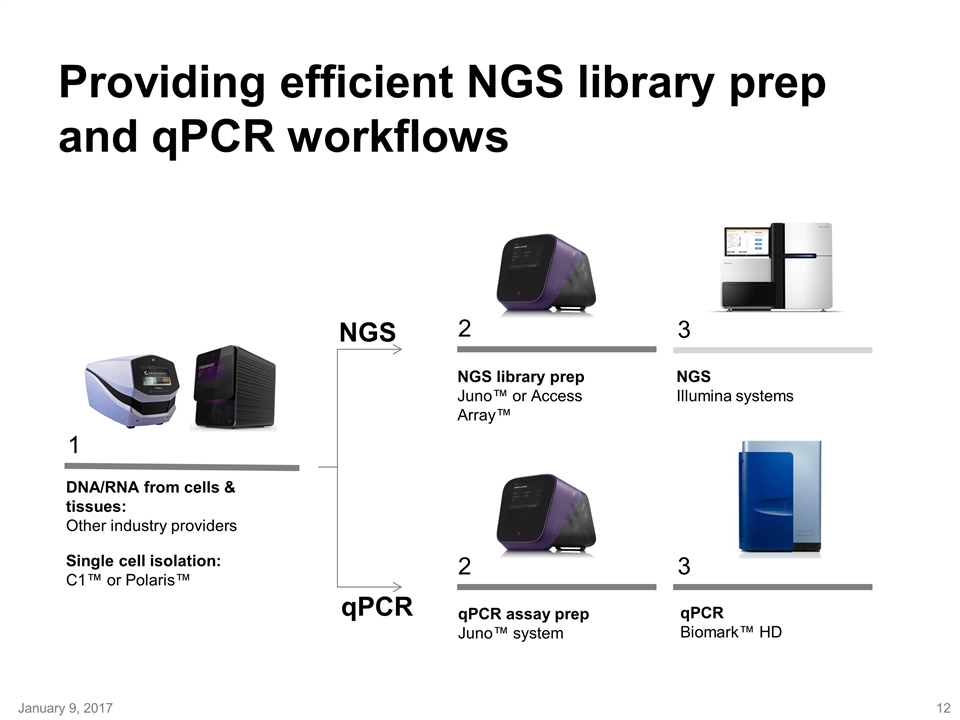

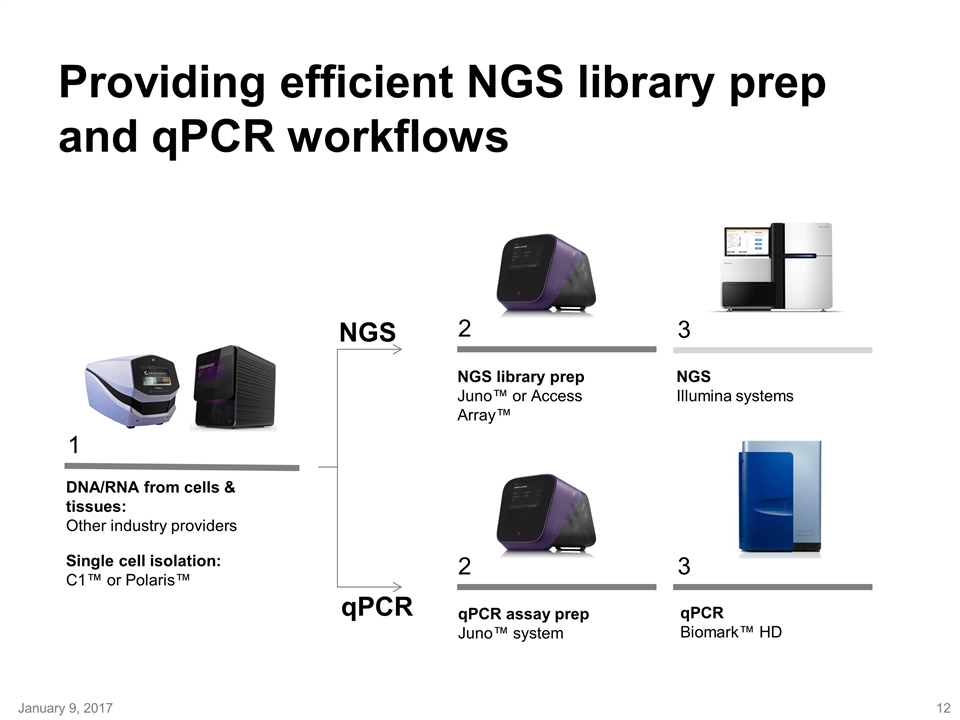

Providing efficient NGS library prep and qPCR workflows 1 3 qPCR Biomark™ HD 2 qPCR assay prep Juno™ system 2 NGS library prep Juno™ or Access Array™ 3 NGS Illumina systems qPCR DNA/RNA from cells & tissues: Other industry providers Single cell isolation: C1™ or Polaris™ NGS January 9, 2017

Clinical Research laboratories Scalable and cost efficient genomic analysis Routine screening of somatic and inherited mutations. Lower cost per sample, reduced hands on time to maximize profitability Access to proven pre-designed clinical research panels and flexible options to customize over time. Customer Goal Biomark™ HD allowing easy migration of TaqMan qPCR assays Juno™ for targeted NGS Access to growing list of Fluidigm clinical research panels in development Fluidigm Solutions For Research Use Only. Not for use in diagnostic procedures. FPO January 9, 2017

Human atlas initiative Development of a comprehensive atlas at single cell resolution Develop a comprehensive cell atlas of the human cells and tissues. Large scale screening to identify unique cell populations. Deep profiling of defined cell populations to bring greater meaning in health and disease. Customer Goal Fluidigm is an active partner in the Human Cell Atlas Initiative. Fluidigm provides the broadest menu of single cell applications for deep characterization and functional analysis, including high quality single-cell full length mRNA sequencing, epigenetics profiling, and imaging mass cytometry. Fluidigm Solutions January 9, 2017

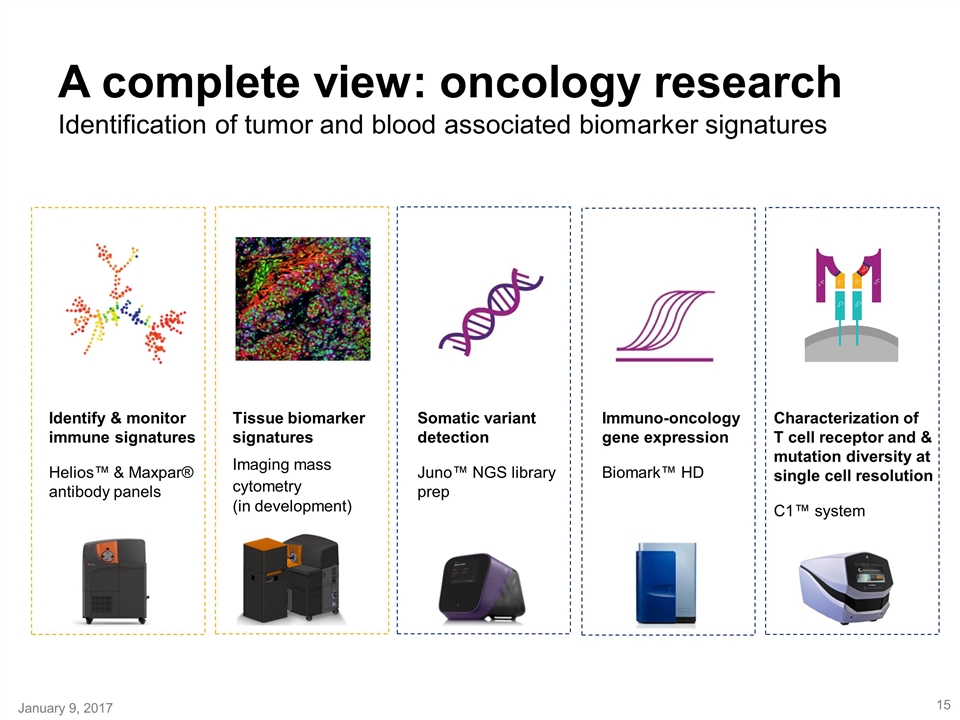

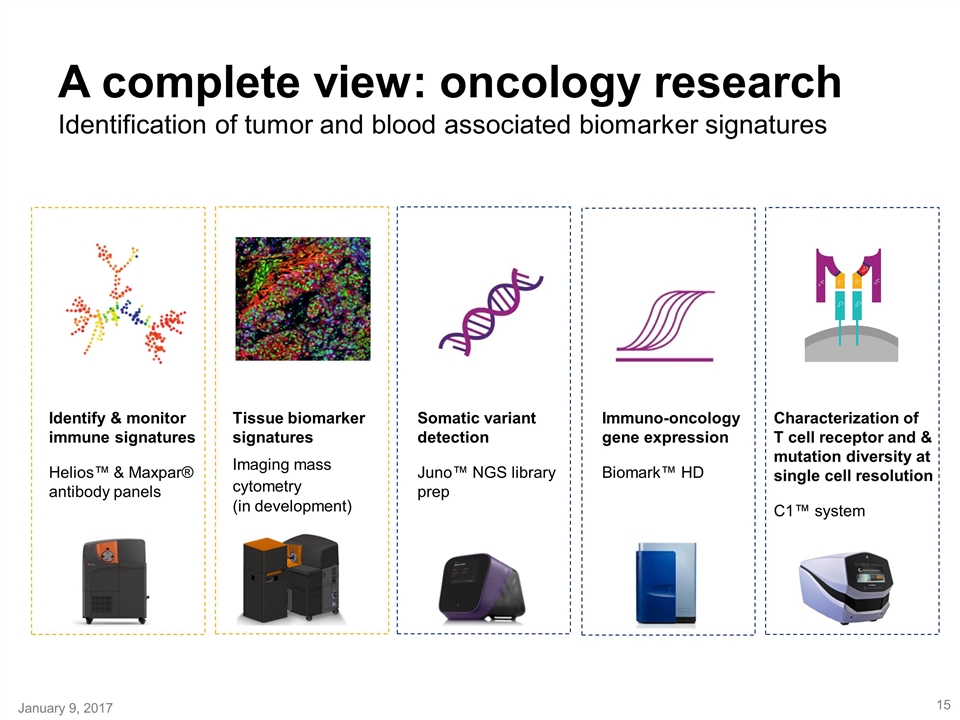

A complete view: oncology research Identification of tumor and blood associated biomarker signatures Somatic variant detection Juno™ NGS library prep Immuno-oncology gene expression Biomark™ HD Tissue biomarker signatures Imaging mass cytometry (in development) Identify & monitor immune signatures Helios™ & Maxpar® antibody panels Characterization of T cell receptor and & mutation diversity at single cell resolution C1™ system January 9, 2017

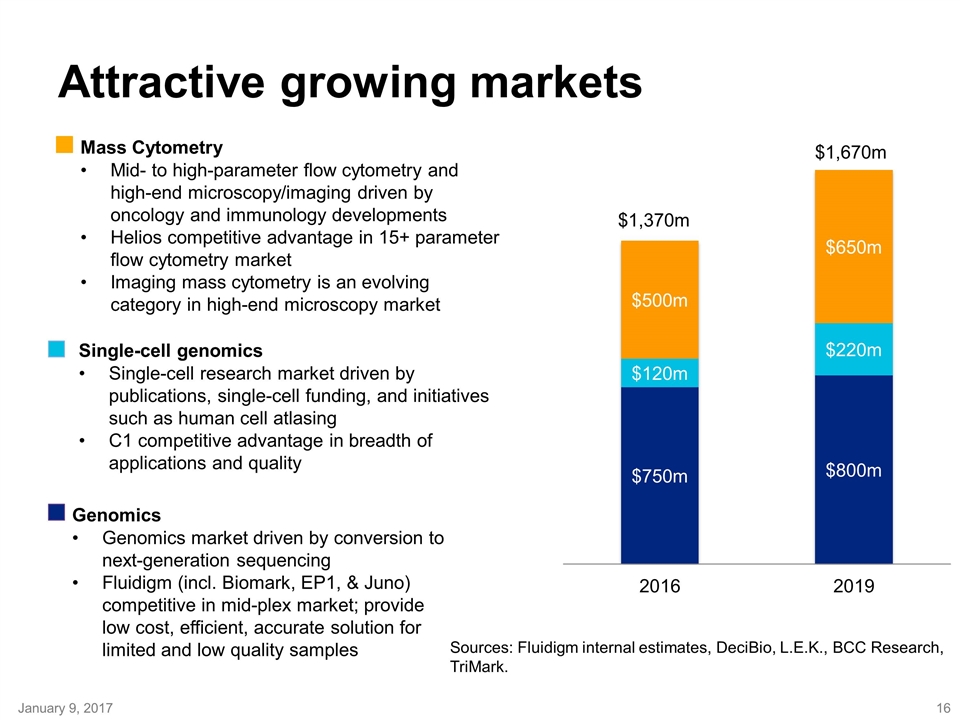

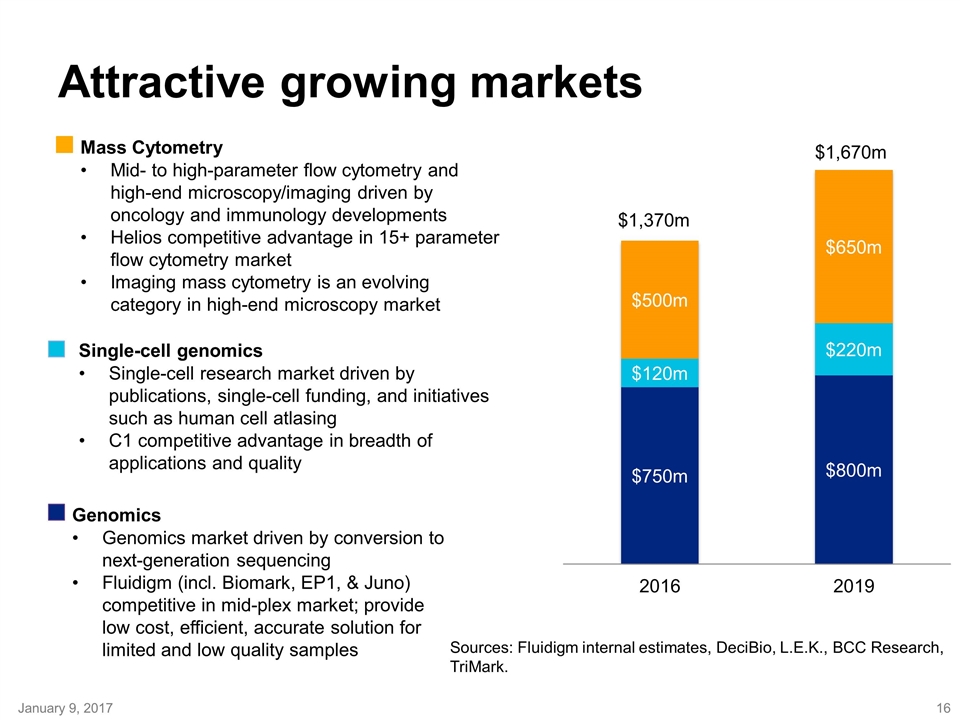

Attractive growing markets Genomics Genomics market driven by conversion to next-generation sequencing Fluidigm (incl. Biomark, EP1, & Juno) competitive in mid-plex market; provide low cost, efficient, accurate solution for limited and low quality samples Sources: Fluidigm internal estimates, DeciBio, L.E.K., BCC Research, TriMark. Mass Cytometry Mid- to high-parameter flow cytometry and high-end microscopy/imaging driven by oncology and immunology developments Helios competitive advantage in 15+ parameter flow cytometry market Imaging mass cytometry is an evolving category in high-end microscopy market Single-cell genomics Single-cell research market driven by publications, single-cell funding, and initiatives such as human cell atlasing C1 competitive advantage in breadth of applications and quality January 9, 2017

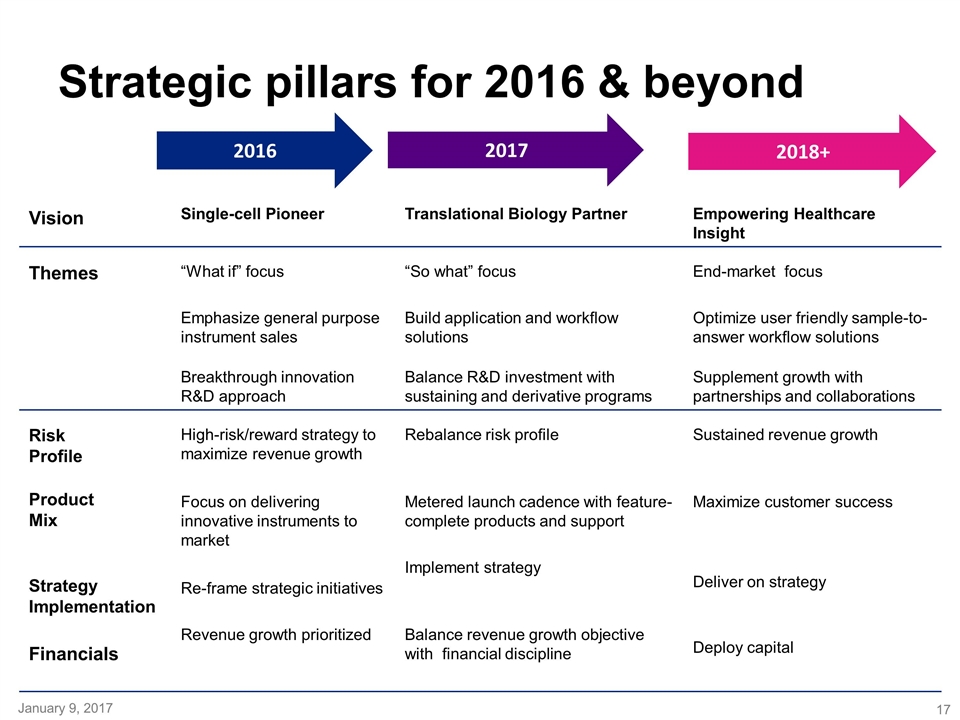

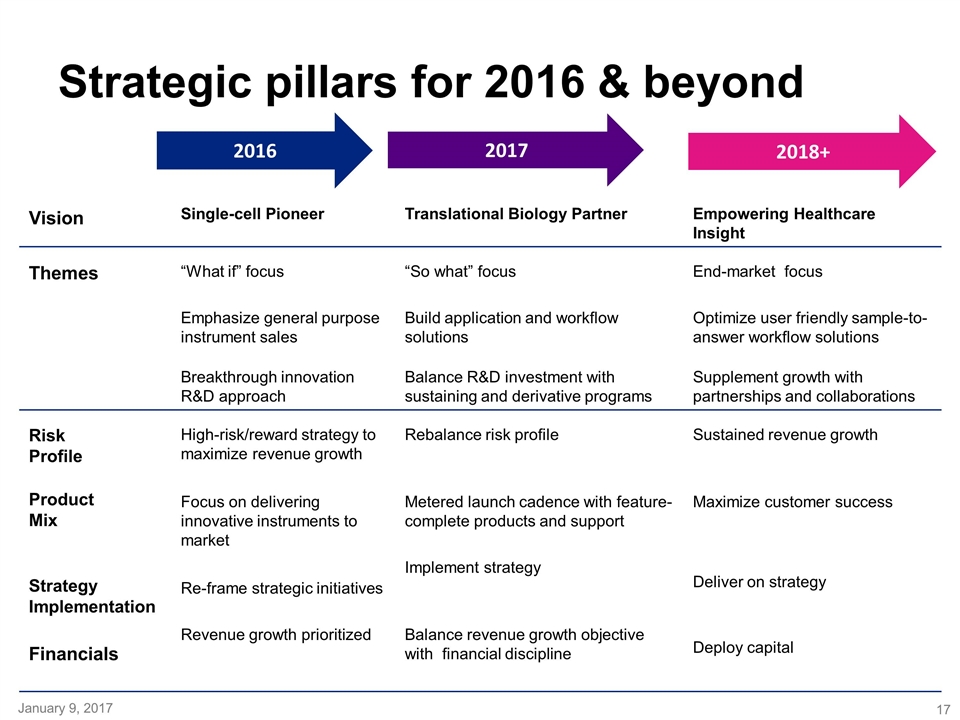

Vision Single-cell Pioneer Translational Biology Partner Empowering Healthcare Insight Themes “What if” focus Emphasize general purpose instrument sales Breakthrough innovation R&D approach “So what” focus Build application and workflow solutions Balance R&D investment with sustaining and derivative programs End-market focus Optimize user friendly sample-to-answer workflow solutions Supplement growth with partnerships and collaborations Risk Profile Product Mix Strategy Implementation Financials High-risk/reward strategy to maximize revenue growth Focus on delivering innovative instruments to market Re-frame strategic initiatives Revenue growth prioritized Rebalance risk profile Metered launch cadence with feature-complete products and support Implement strategy Balance revenue growth objective with financial discipline Sustained revenue growth Maximize customer success Deliver on strategy Deploy capital Strategic pillars for 2016 & beyond 2016 2017 2018+ January 9, 2017

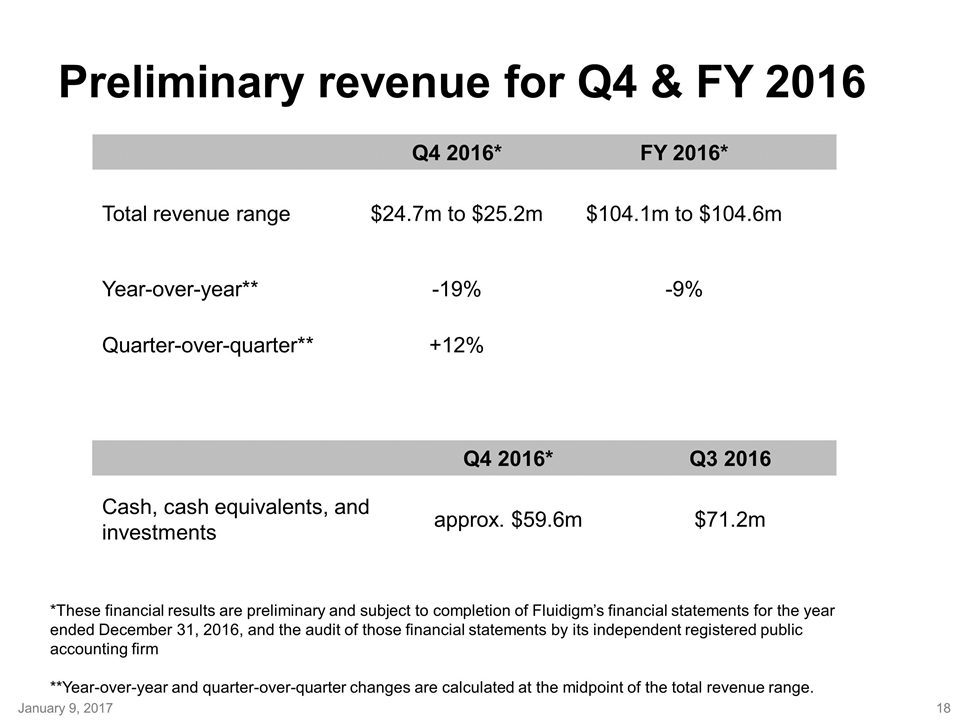

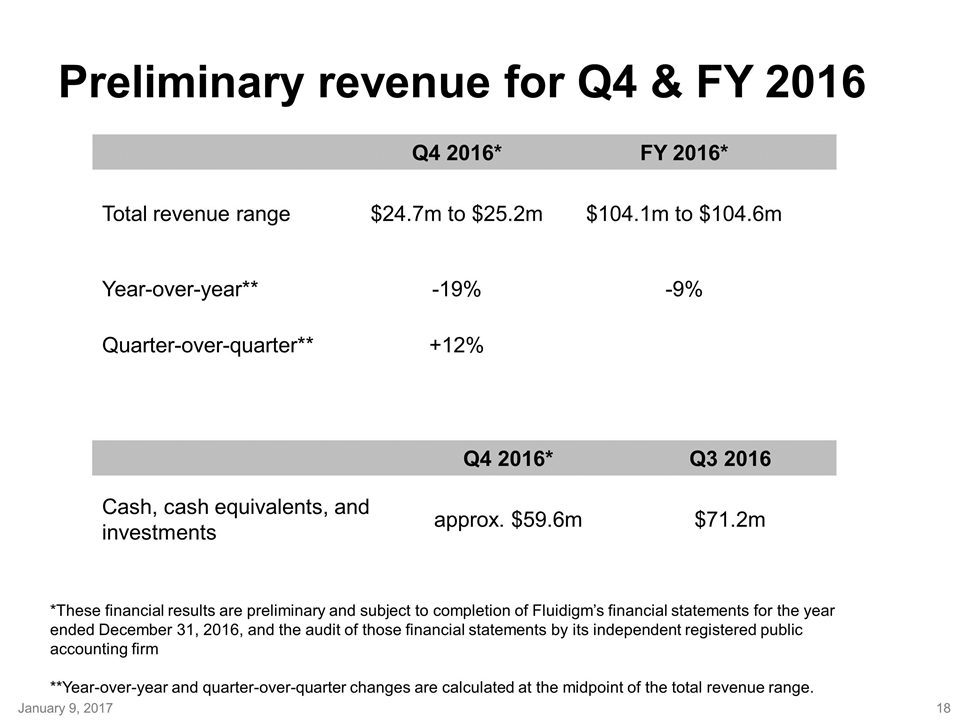

Preliminary revenue for Q4 & FY 2016 *These financial results are preliminary and subject to completion of Fluidigm’s financial statements for the year ended December 31, 2016, and the audit of those financial statements by its independent registered public accounting firm **Year-over-year and quarter-over-quarter changes are calculated at the midpoint of the total revenue range. Q4 2016* FY 2016* Total revenue range $24.7m to $25.2m $104.1m to $104.6m Year-over-year** -19% -9% Quarter-over-quarter** +12% Q4 2016* Q3 2016 Cash, cash equivalents, and investments approx. $59.6m $71.2m January 9, 2017

Appendix

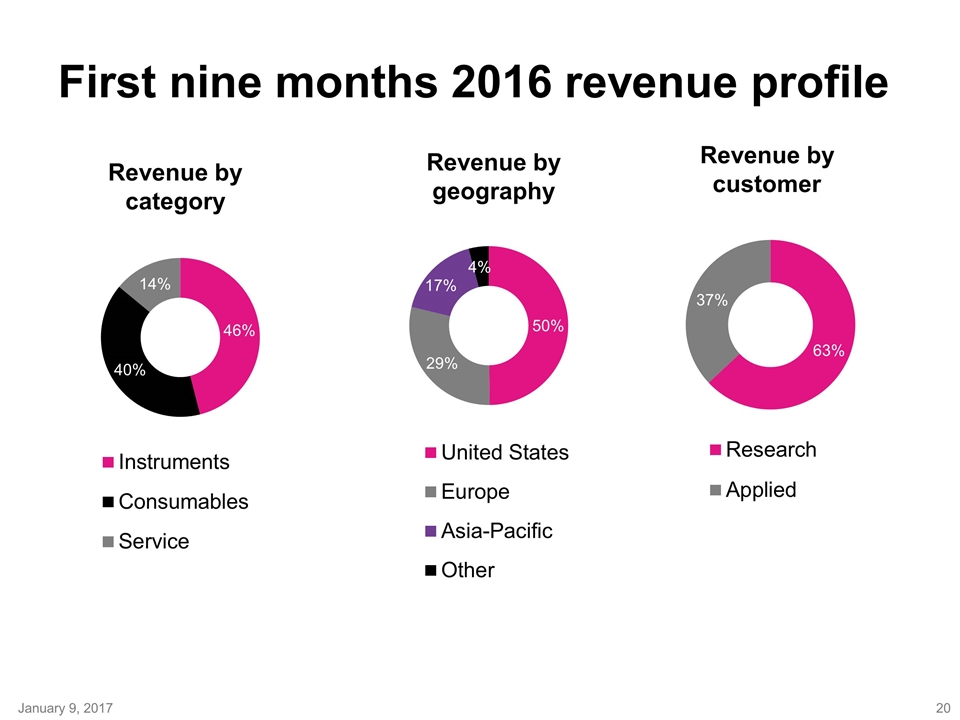

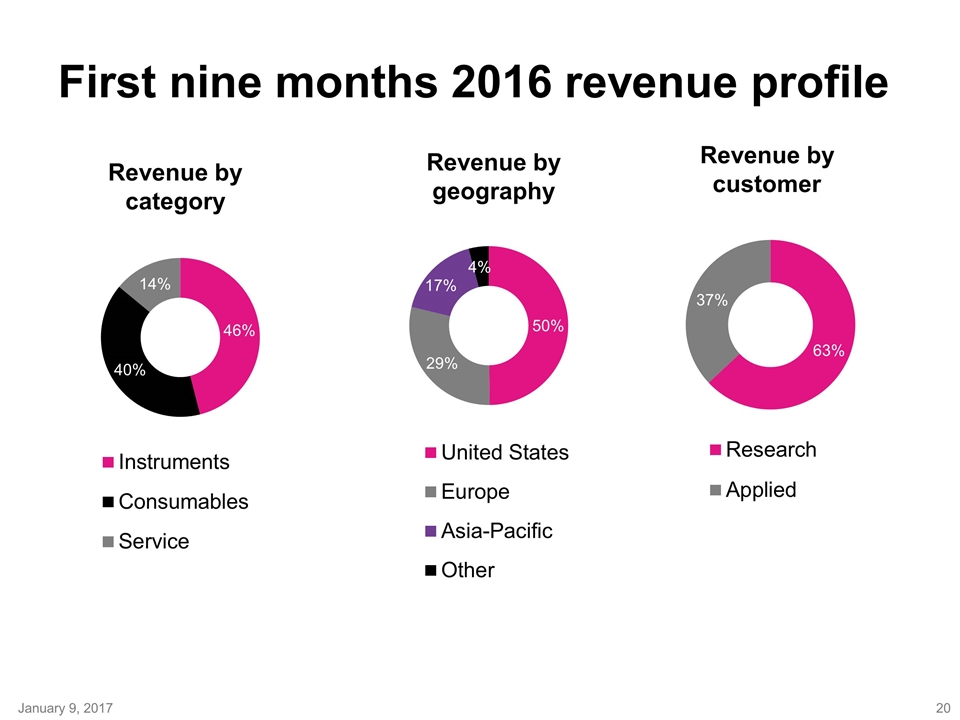

First nine months 2016 revenue profile Revenue by geography Revenue by category Revenue by customer January 9, 2017

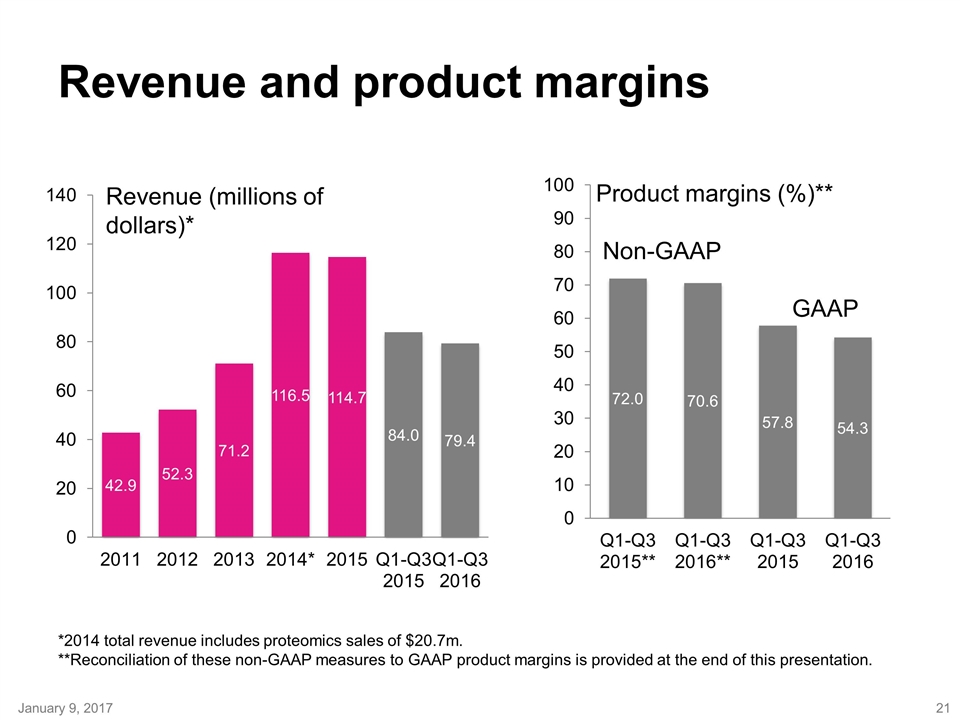

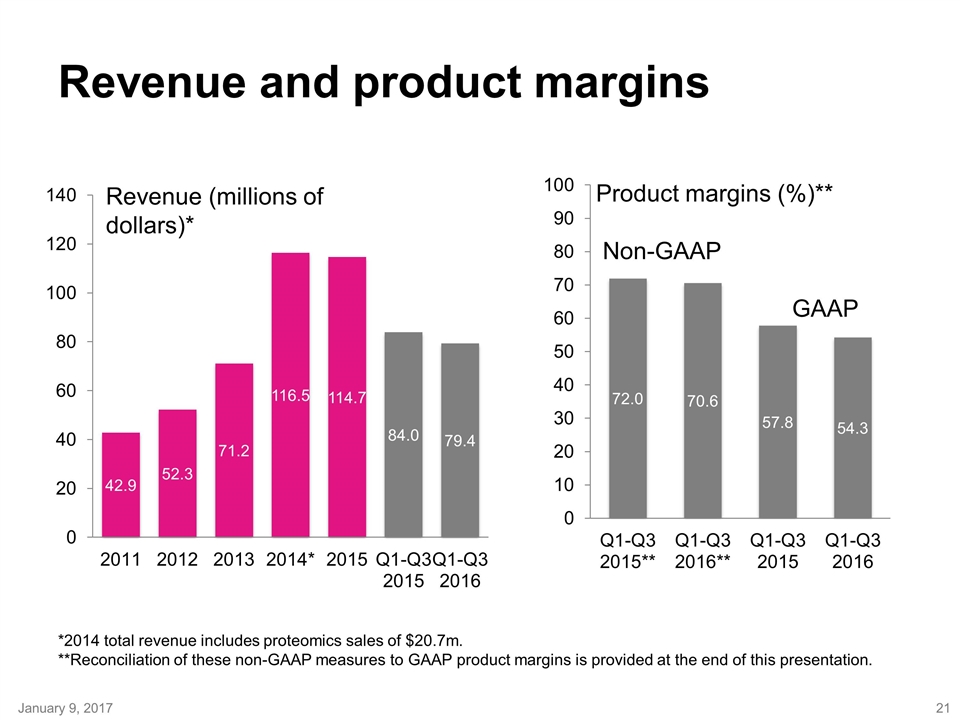

*2014 total revenue includes proteomics sales of $20.7m. **Reconciliation of these non-GAAP measures to GAAP product margins is provided at the end of this presentation. Revenue and product margins Revenue (millions of dollars)* Product margins (%)** Non-GAAP GAAP January 9, 2017

Reconciliation of GAAP to non-GAAP net loss January 9, 2017 (a) represents amortization of developed technology in connection with the DVS acquisition (b) represents interest expense on Senior Convertible Notes (c) represents the tax impact on the purchase of intangible assets in connection with the DVS acquisition

Reconciliation of GAAP to non-GAAP product margins January 9, 2017 (a) represents amortization of developed technology in connection with the DVS acquisition (d) represents expense associated with cost of product revenue

©2017 Fluidigm Corporation. All rights reserved. Fluidigm, the Fluidigm logo, Helios, CyTOF, Maxpar, Juno, Biomark, C1, Polaris, and Callisto are trademarks or registered trademarks of Fluidigm Corporation in the United States and/or other countries. All other trademarks are property of their respective holders.