Prospectus Supplement dated February 16, 2007 to Prospectus dated February 15, 2007

$700,000,000 Class A(2007-2) Card series Notes

Capital One Bank

Sponsor, Servicer and Originator of Assets

Capital One Funding, LLC

Depositor and Transferor

Capital One Multi-asset Execution Trust

Issuing Entity

| | |

| | | Class A(2007-2) Notes

|

Principal amount | | $700,000,000 |

Interest rate | | One month LIBORplus 0.08% per year |

Interest payment dates | | 15th day of each calendar month, beginning in March 2007 |

Expected principal payment date | | February 15, 2017 |

Legal maturity date | | December 16, 2019 |

Expected issuance date | | February 27, 2007 |

Price to public | | $700,000,000 (or 100.000%) |

Underwriting discount | | $2,625,000 (or 0.375%) |

Proceeds to the issuing entity | | $697,375,000 (or 99.625%) |

The Class A(2007-2) notes are a tranche of Class A Card series notes.

The assets of the issuing entity, the Capital One Multi-asset Execution Trust, securing the Card series notes include:

| | • | | the collateral certificate, Series 2002-CC issued by the Capital One Master Trust, representing an undivided interest in the assets in the Capital One Master Trust; and |

| | • | | the collection account and other supplemental accounts. |

The assets of the Capital One Master Trust primarily include receivables arising in credit card accounts owned by Capital One Bank. The assets of the Capital One Master Trust may, in the future, include receivables arising in credit card accounts owned by Capital One, F.S.B. or any affiliate of Capital One Bank or Capital One, F.S.B.

| | | | |

You should consider the discussion under “Risk Factors” beginning on page 15 of the accompanying prospectus before you purchase any Card series notes. The Card series notes are obligations of the issuing entity only and are not obligations of or interests in Capital One Bank, Capital One, F.S.B., Capital One Funding, LLC, their affiliates or any other person. Noteholders will have no recourse to any other assets of the issuing entity for the payment of the Card series notes. The Card series notes are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency or instrumentality. |

Neither the SEC nor any state securities commission has approved these notes or determined that this prospectus supplement or the prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

Underwriters

| | |

Deutsche Bank Securities | | Morgan Stanley |

| | | | | | | | | | |

| | | Barclays Capital |

| | | | | | | Citigroup |

| | | | | | | | | Merrill Lynch & Co. |

Important Notice about Information Presented in this

Prospectus Supplement and the Accompanying Prospectus

We provide information to you about the Card series notes in two separate documents:

(a) this prospectus supplement, which will describe the specific terms of the Class A(2007-2) notes, and

(b) the accompanying prospectus, which provides general information about the Card series notes and each other series of notes which may be issued by the Capital One Multi-asset Execution Trust some of which may not apply to the Class A(2007-2) notes.

This prospectus supplement may be used to offer and sell the Class A(2007-2) notes only if accompanied by the prospectus.

This prospectus supplement supplements disclosure in the accompanying prospectus. You should rely only on the information provided in this prospectus supplement and the accompanying prospectus including any information incorporated by reference. We have not authorized anyone to provide you with different information.

We are not offering the Class A(2007-2) notes in any State where the offer is not permitted. We do not claim the accuracy of the information in this prospectus supplement or the accompanying prospectus as of any date other than the dates stated on their respective covers.

We include cross-references in this prospectus supplement and in the accompanying prospectus to captions in these materials where you can find further related discussions. The Table of Contents in this prospectus supplement and in the accompanying prospectus provide the pages on which these captions are located.

Table of Contents

i

Summary of Terms

This summary does not contain all the information you may need to make an informed investment decision. You should read this prospectus supplement and the accompanying prospectus in their entirety before you purchase any notes.

This prospectus supplement and the accompanying prospectus use defined terms. You can find a listing of defined terms in the“Glossary of Defined Terms” beginning on page 149 in the accompanying prospectus.

Risk Factors

Investment in the Class A(2007-2) notes involves risks. You should consider carefully the risk factors beginning on page 15 in the accompanying prospectus.

Securities Offered

$700,000,000 Floating Rate Class A(2007-2) notes.

These Class A(2007-2) notes are part of a series of notes called the “Card series.” The Card series consists of Class A notes, Class B notes, Class C notes and Class D notes. The Class A(2007-2) notes are a tranche of the Class A Card series notes.

These Class A(2007-2) notes are issued by, and are obligations of, the issuing entity, the Capital One Multi-asset Execution Trust. The issuing entity has issued and expects to issue other classes and tranches of notes of the Card series which may have different interest rates, interest payment dates, expected principal payment dates, legal maturity dates and other characteristics. In addition, the issuing entity may issue other series of notes which may have different interest rates, interest payment dates, expected principal payment dates, legal maturity dates and other characteristics. See“The Notes—Issuances of New Series, Classes and Tranches of Notes” in the accompanying prospectus.

We refer to the Capital One Multi-asset Execution Trust as the “issuing entity” or “COMET.”

Each class of notes in the Card series may consist of multiple tranches. Notes of any tranche may be issued on any date so long as there is sufficient credit enhancement on that date, either in the form of outstanding subordinated notes or other forms of credit enhancement, and all other conditions to issuance are satisfied. See“The Notes—Issuances ofNew Series, Classes and Tranches of Notes” in the accompanying prospectus.

In general, the subordinated notes of the Card series serve as credit enhancement for all of the senior notes of the Card series, regardless of whether the subordinated notes are issued before, at the same time as or after the senior notes of the Card series. However, each senior tranche of notes has access to credit enhancement in an amount not exceeding its required subordinated amountminusthe amount of usage of that required subordinated amount. See“—Required Subordinated Amount and Conditions to Issuance” below and “The Notes—Required Subordinated Amount and Usage”in the accompanying prospectus for a discussion of required subordinated amounts and usage.

Only the Class A(2007-2) notes are being offered through this prospectus supplement and the accompanying prospectus. Other series, classes and tranches of notes, including other tranches of notes that are included in the Card series as a part of the Class A notes, have been issued by COMET and may be issued by COMET in the future without the consent of, or notice to, any noteholders.

These Class A(2007-2) notes are expected to be the fifty-first tranche of Class A notes issued by COMET in the Card series. On the expected issuance date of the Class A(2007-2) notes, the Card series will be the only outstanding series of notes issued by COMET.

Other series of certificates of Capital One Master Trust and other series, classes and tranches of notes of COMET may be issued without the consent of, or notice to, any noteholders or certificateholders.

See“Annex II: Outstanding Series, Classes and Tranches of Notes”for information on the other

S-1

outstanding notes in the Card series.

The Master Trust

The Card series, including your Class A(2007-2) notes, will be secured by the COMT collateral certificate owned by COMET. The COMT collateral certificate will be the primary source of funds for the payment of principal of and interest on the Class A(2007-2) notes. The COMT collateral certificate issued by the Capital One Master Trust represents an undivided interest in the assets of the Capital One Master Trust.

We refer to the Capital One Master Trust as “COMT” or the “master trust.”

See“Annex III: Outstanding Master Trust Series” for information on the other outstanding series of certificates issued by the master trust.

The master trust’s assets primarily include credit card receivables from selected MasterCard® and VISA® credit card accounts that meet the eligibility criteria for inclusion in the master trust. These eligibility criteria are discussed in“The Master Trust—Addition of Master Trust Assets” in the accompanying prospectus.

As of January 12, 2007, the master trust included $42,242,970,851 of principal receivables and $783,483,701 of finance charge receivables. For more of a description of certain aspects of the master trust, Capital One credit card portfolio, Capital One Bank and Capital One, F.S.B., see“Annex I.”

Interest

These Class A(2007-2) notes will accrue interest at an annual rate equal toone-month LIBORplus0.08%, as determined on the related LIBOR determination date.

Interest on these Class A(2007-2) notes will begin to accrue on the issuance date for the Class A(2007-2) notes, expected to be February 27, 2007, and will be calculated on the basis of a 360-day year and the actual number of days in the related interest period. Each interest period will begin on and include an interest payment date and end on but exclude the next interest payment date. However, the first interest period willbegin on and include the issuance date for the Class A(2007-2) notes and end on but exclude the first interest payment date for the Class A(2007-2) notes, March 15, 2007.

LIBOR for each interest period will be determined on the second business day before the beginning of that interest period. However, LIBOR for the initial interest period will be determined two business days before the issuance date of the Class A(2007-2) notes. For calculating LIBOR only, a business day is any U.S. business day that U.S. dollar deposits are transacted in the London interbank market. A U.S. business day is any business day in New York, New York, Richmond, Virginia or Falls Church, Virginia.

LIBOR will be the rate appearing on Telerate Page 3750 as of 11:00 a.m., London time, on that date for deposits in U.S. dollars for a one-month period. If that rate does not appear on Telerate Page 3750, the indenture trustee will request four prime banks (selected by the beneficiary of COMET) in the London interbank market to provide quotations of their rates for U.S. dollar deposits for a one-month period, at approximately 11:00 a.m., London time, on that day. LIBOR will then be the average of those rates. However, if less than two rates are provided, LIBOR will be the average of the rates for loans in U.S. dollars to leading European banks for a one-month period offered by four major banks (selected by the beneficiary of COMET) in New York City, at approximately 11:00 a.m., New York City time, on that day.

Interest on the Class A(2007-2) notes for any interest payment date will equal the product of:

| • | | the Class A(2007-2) note interest rate for the applicable interest period;times |

| • | | the actual number of days in the related interest period divided by 360;times |

| • | | the outstanding dollar principal amount of the Class A(2007-2) notes as of the related record date |

COMET will make interest payments on these Class A(2007-2) notes on the 15th day of each month, beginning in March 2007. Interest

S-2

payments due on a day that is not a business day in New York, New York, Richmond, Virginia and Falls Church, Virginia will be made on the following business day.

See“Prospectus Summary—Interest Payments”in the accompanying prospectus for a general discussion of the priority of interest payments for different classes of notes.

Principal

COMET expects to pay the stated principal amount of these Class A(2007-2) notes in one payment on February 15, 2017, which is the expected principal payment date, and is obligated to do so if funds are available for that purpose in accordance with the provisions of the indenture and the Card series indenture supplement. If the stated principal amount of these Class A(2007-2) notes is not paid in full on the expected principal payment date due to insufficient funds, noteholders will generally not have any remedies against COMET until December 16, 2019, the legal maturity date of these Class A(2007-2) notes.

If the stated principal amount of these Class A(2007-2) notes is not paid in full on the expected principal payment date, then an early redemption event will occur for these Class A(2007-2) notes. As a result, subject to the principal payment rules described below under “—Subordination; Credit Enhancement” and“—Required Subordinated Amount and Conditions toIssuance,”and“Prospectus Summary—Subordination” and“TheNotes—Subordination of Interest and Principal” in the accompanying prospectus, principal and interest payments on these Class A(2007-2) notes will be made monthly until they are paid in full or until the legal maturity date occurs, whichever is earlier.

Principal of these Class A(2007-2) notes may be paid earlier than the expected principal payment date if any other early redemption event or an event of default and acceleration occurs for these Class A(2007-2) notes. See“The Notes—Early Redemption Events”and“—Events of Default”in the accompanying prospectus.

Nominal Liquidation Amount

The initial nominal liquidation amount of these Class A(2007-2) notes is $700,000,000.

The nominal liquidation amount of a tranche of Card series notes is based on the initial outstanding dollar principal amount of that tranche of notes.

The nominal liquidation amount may be reduced by allocations of charge-offs from uncovered Card series defaulted amounts and, for subordinated tranches of notes, reallocations of principal amounts from those subordinated notes to pay interest on senior classes of Card series notes or to pay a portion of the servicing fees. If the nominal liquidation amount of these Class A(2007-2) notes has been reduced, principal amounts and finance charge amounts allocated to pay principal of and interest on these Class A(2007-2) notes will be reduced. If the nominal liquidation amount of these Class A(2007-2) notes is less than the outstanding dollar principal amount of these Class A(2007-2) notes, the principal of and interest on these Class A(2007-2) notes may not be paid in full.

For a more detailed discussion of nominal liquidation amount, see“The Notes—Stated Principal Amount, Outstanding Dollar Principal Amount, Adjusted Outstanding Dollar Principal Amount and Nominal Liquidation Amount” in the accompanying prospectus.

Subordination; Credit Enhancement

Credit enhancement for the Class A(2007-2) notes will be provided through subordination. The amount of subordination available to provide credit enhancement to any tranche of notes is limited to its available subordinated amount. If the available subordinated amount for any tranche of notes has been reduced to zero, losses will be allocated to that tranche of notespro rata based on the nominal liquidation amount of those notes. The nominal liquidation amount of those notes will be reduced by the amount of losses allocated to that tranche of notes, and it is unlikely that those notes will receive their full payment of principal and accrued interest.

Principal amounts remaining on any payment date after any reallocations to pay interest on the senior

S-3

classes of notes of the Card series or to pay servicing fees will be applied to make targeted deposits to the principal funding subaccounts of the relevant classes of notes in the following order: first to the Class A notes, then to the Class B notes, then to the Class C notes, and finally to the Class D notes. In each case, principal payments to subordinated classes of notes will only be made if senior classes of notes have received full principal payments on that date and the related subordinated notes are no longer needed to provide the required credit enhancement.

Required Subordinated Amount and Conditions to Issuance

The conditions described under“The Notes—Issuances of New Series, Classes and Tranches ofNotes” in the accompanying prospectus must be satisfied in connection with any new issuance of notes. In addition, in order to issue a tranche (or additional notes within a tranche) of Class A notes, Class B notes or Class C notes in the Card series, a tranche’s required subordinated amount of the nominal liquidation amount of subordinated Card series notes must be outstanding and available on the issuance date. See the chart titled “Required Subordinated Amounts” below for a depiction of required subordinated amounts and“The Notes—Required Subordinated Amount and Usage” in the accompanying prospectus for a general discussion of required subordinated amounts.

Class A Required Subordinated Amount. The total required subordinated amount of subordinated notes for a tranche of Class A Card series notes is generally equal to the sum of the required subordinated amount of Class B notes, the required subordinated amount of Class C notes and the required subordinated amount of Class D notes for that tranche of Class A Card series notes.

For each tranche of Class A Card series notes, the required subordinated amount of Class B notes, the required subordinated amount of Class C notes and the required subordinated amount of Class D notes, in each case, will be generally equal to a stated percentage of the adjusted outstanding dollar principal amount of that tranche of Class A notes. Initially, for the Class A(2007-2) notes, that stated percentage is 10.8434% for Class B notes, 8.4338%for Class C notes and 1.2049% for Class D notes. COMET may change any of these percentages so long as the sum of these stated percentages for the Class A(2007-2) notes is equal to or greater than 20.4821%, and provided that change will not result in a shortfall in the available subordinated amount for any tranche of Card series notes. Therefore, any combination of percentages of Class B notes, Class C notes or Class D notes would satisfy the required subordinated amount for the Class A(2007-2) notes, as long as they added up to 20.4821%, and provided that change would not result in a shortfall in the available subordinated amount for any tranche of Card series notes.

Class B Required Subordinated Amount. The total required subordinated amount of subordinated notes for a tranche of Class B Card series notes is equal to the sum of the required subordinated amount of Class C notes and the required subordinated amount of Class D notes for that tranche of Class B Card series notes. Generally, Class B Card series notes which provide credit enhancement for the Class A Card series notes will share the same credit enhancement provided to those Class A notes by the Class C notes and Class D notes in the Card series. Therefore, (i) the required subordinated amount of Class C notes for a tranche of Class B Card series notes will generally be equal to that Class B tranche’spro rata share of the aggregate required subordinated amount of Class C notes for all Class A notes in the Card series and (ii) the required subordinated amount of Class D notes for a tranche of Class B Card series notes will generally be that Class B tranche’spro rata share of the required subordinated amount of Class D notes for all Class A notes in the Card series. See“The Notes—Required Subordinated Amount and Usage—Class B Required Subordinated Amount” in the accompanying prospectus for exceptions to these rules.

In addition, if the adjusted outstanding dollar principal amount of the Class B Card series notes is greater than the total required subordinated amount of Class B notes for all Class A Card series notes, the required subordinated amount of subordinated notes for each tranche of Class B Card series notes will include that Class B tranche’spro rata share of that excess,timesa stated percentage. Similarly, the required subordinated amount of Class C notes and

S-4

the required subordinated amount of Class D notes for each tranche of Class B Card series notes will include that Class B tranche’spro rata share of the related excess for each such class,times a stated percentage.

For example, prior to the issuance of any Class A Card series notes, the Class B required subordinated amount of subordinated notes will be based entirely on the calculation described in the preceding paragraph. Once Class A Card series notes are issued that rely on Class B notes for credit enhancement, the Class B required subordinated amount of subordinated notes will be based on the calculations described in each of the preceding two paragraphs. However, reductions in the adjusted outstanding dollar principal amount of a tranche of Class A Card series notes will generally result in a reduction in the required subordinated amount for that tranche of Class A notes. Consequently, for each tranche of Class B Card series notes, a reduction in the required subordinated amount of subordinated notes for that tranche of Class B notes may occur due to more Class B Card series notes being outstanding than is required for the Class A Card series notes.

Class C Required Subordinated Amount.Generally, Class C Card series notes will share the same credit enhancement provided to the Class A notes and the Class B notes by the Class D Card series notes. Therefore, the required subordinated amount of Class D notes for a tranche of Class C Card series notes will generally be that Class C tranche’spro rata share of the aggregate required subordinated amount of Class D notes for all Class A Card series notesplus that Class C tranche’spro rata share of the required subordinated amount of Class D notes for all Class B Card series notes which do not provide credit enhancement for the Class A notes.

In addition, if the adjusted outstanding dollar principal amount of the Class C Card series notes is greater than the total required subordinated amount of Class C notes for all Class A notes and for all Class B notes which do not provide credit enhancement for the Class A Card series notes, the required subordinated amount of Class D notes for each tranche of Class C Card series notes will include that Class C tranche’spro rata share of that excess,times a stated percentage.

For example, prior to the issuance of any Class A notes or Class B notes in the Card series, the Class C required subordinated amount of Class D notes will be based entirely on the calculation described in the preceding paragraph. Once any tranche of Class A notes or Class B notes of the Card series is issued, the Class C required subordinated amount of Class D notes will be based on the calculations described in each of the preceding two paragraphs. However, reductions in the adjusted outstanding dollar principal amount of a tranche of Class A notes or Class B notes in the Card series will generally result in a reduction in the required subordinated amount for that tranche of Class A notes or Class B notes. Consequently, for each tranche of Class C Card series notes, a reduction in the required subordinated amount of Class D notes for that tranche of Class C notes may occur due to more Class C Card series notes being outstanding than is required as subordination for the Class A notes or the Class B notes of the Card series.

At any time, COMET may change the required subordinated amount and related stated percentages for any tranche of Card series notes or utilize forms of credit enhancement other than subordinated Card series notes upon (i) confirmation from each rating agency listed under “—Ratings” below that has rated any outstanding Card series notes that the change in the required subordinated amount or the form of credit enhancement will not cause a reduction, qualification or withdrawal of the ratings of the related tranche or any outstanding tranche of Card series notes, and (ii) delivery by COMET to the rating agencies and the indenture trustee of an opinion that the change in the required subordinated amount or the additional form of credit enhancement will not have certain adverse tax consequences for holders of outstanding notes. Any such change or use will be implemented without the consent of or notice to any noteholders. Despite the conditions described above, to the extent that the required subordinated amount of your notes is reduced, you may experience losses due to reductions in the nominal liquidation amount of your notes earlier than would have occurred had the required subordinated amount for your notes remained at a higher level. Any reduction in the nominal liquidation amount of your notes may delay or reduce interest and principal payments on your notes. See“Deposit and Application of Funds

S-5

for Card Series Notes—Allocations of Reductions ofNominal Liquidation Amounts from Charge-Offs” and“—Allocations of Reductions of Nominal Liquidation Amounts from Reallocations”in the accompanying prospectus for a description of the allocation of reductions in nominal liquidation amounts.

See“—Required Subordinated Amounts” below and“The Notes—Required Subordinated Amount and Usage” in the accompanying prospectus.

Security for the Notes

The Class A(2007-2) notes share a security interest with other notes in:

| | • | | the COMT collateral certificate; |

| | • | | the collection account; |

| | • | | the applicable principal funding subaccount; |

| | • | | the applicable interest funding subaccount; and |

| | • | | the applicable accumulation reserve subaccount. |

However, the Class A(2007-2) notes are entitled to the benefits of only that portion of those assets allocated to them under the indenture, the asset pool supplement, the Card series indenture supplement and the related terms document.

See “Sources of Funds to Pay the Notes—General,” “—The COMT Collateral Certificate”and“—COMET Trust Accounts” in the accompanying prospectus.

Accumulation Reserve Account

COMET will establish an accumulation reserve subaccount to cover shortfalls in investment earnings on amounts (other than prefunded amounts) on deposit in the principal funding subaccount for these Class A(2007-2) notes.

The amount targeted to be deposited in the accumulation reserve subaccount for these Class A(2007-2) notes is zero. However, if more than one budgeted deposit is required to accumulate and pay the principal of the Class A(2007-2) notes on itsexpected principal payment date, in which case, the amount targeted to be deposited is 0.5% of the outstanding dollar principal amount of the Class A(2007-2) notes, or any other amount designated by COMET. See“Deposit andApplication of Funds for Card Series Notes—Targeted Deposits to the Accumulation Reserve Account” in the accompanying prospectus.

Limited Recourse to COMET

The sole sources of payment for principal of or interest on these Class A(2007-2) notes are provided by:

| | • | | the portion of the principal amounts and finance charge amounts allocated to the Card series and available to these Class A(2007-2) notes after giving effect to any reallocations, payments and deposits for senior notes; and |

| | • | | funds in the applicable COMET trust accounts for these Class A(2007-2) notes. |

Class A(2007-2) noteholders will have no recourse to any other assets of COMET—other than any shared excess finance charge amounts and shared excess principal amounts—or recourse to any other person or entity for the payment of principal of or interest on these Class A(2007-2) notes.

However, if there is a sale of assets in the master trust or COMET (i) if required under the pooling agreement following the bankruptcy or insolvency of Capital One Funding or any other transferor, (ii) following an event of default and acceleration for the Class A(2007-2) notes or (iii) on the legal maturity date of the Class A(2007-2) notes, as described in“Deposit and Application of Funds forCard Series Notes—Sale of Assets”and“Sources of Funds to Pay the Notes—Sale of Assets” in the accompanying prospectus, the Class A(2007-2) noteholders have recourse only to (1) the proceeds of that sale allocable to the Class A(2007-2) noteholders and (2) any amounts then on deposit in COMET trust accounts allocated to and held for the benefit of the Class A(2007-2) noteholders.

S-6

Stock Exchange Listing

COMET will apply to list these Class A(2007-2) notes on a stock exchange in Europe. The issuer cannot guarantee that the application for the listing will be accepted or that, if accepted, such listing will be maintained. To determine whether these Class A(2007-2) notes are listed on a stock exchange, you may contact the issuer at c/o Deutsche Bank Trust Company Delaware, E.A. Delle Donne Corporate Center, Montgomery Building, 1011 Centre Road, Wilmington, Delaware 19805-1266; the telephone number is (201) 593-6792.

Ratings

COMET will issue these Class A(2007-2) notes only if they are rated by at least one of the following nationally recognized rating agencies as follows:

| | |

Standard & Poor’s Ratings Services: | | AAA |

Moody’s Investors Service, Inc.: | | Aaa |

Fitch, Inc.: | | AAA |

Other tranches of Class A notes may have different rating requirements from these Class A(2007-2) notes.

A rating addresses the likelihood of the payment of interest on a note when due and the ultimate payment of principal of that note by its legal maturity date. A rating does not address the likelihood of payment of principal of a note on its expected principal payment date. In addition, a rating does not address the possibility of an early payment or acceleration of a note, which could be caused by an early redemption event or an event of default. A rating is not a recommendation to buy, sell or hold notes and may be subject to revision or withdrawal at any time by the assigning rating agency. A rating is based on each rating agency’s independent evaluation of the receivables and the availability of any credit enhancement for the notes. A rating, or a change or withdrawal of a rating, by one rating agency will not necessarily correspond to a rating, or a change or a withdrawal of a rating, from any other rating agency. If any of the ratings of these Class A(2007-2) notes changes, Class A(2007-2) noteholders will not be so notified by Capital One Bank, Capital One Funding or COMET.

See“Risk Factors—The market value of the notes could decrease if the ratings of the notes are lowered or withdrawn” in the accompanying prospectus.

Federal Income Tax Consequences

Subject to important considerations described under “Federal Income Tax Consequences” in the accompanying prospectus, Orrick, Herrington & Sutcliffe LLP, as special tax counsel to COMET, is of the opinion that under existing law your Class A(2007-2) notes will be characterized as debt for federal income tax purposes, and that COMET will not be classified as an association or publicly traded partnership taxable as a corporation and accordingly will not be subject to federal income tax. By your acceptance of a Class A(2007-2) note, you will agree to treat your Class A(2007-2) note as debt for federal, state and local income and franchise tax purposes. See “Federal Income Tax Consequences” in the accompanying prospectus for additional information concerning the application of federal income tax laws.

ERISA Considerations

Subject to important considerations described under “Benefit Plan Investors” in the accompanying prospectus, the Class A(2007-2) notes are eligible for purchase by persons investing assets of employee benefit plans or individual retirement accounts. By purchasing the notes, each investor purchasing on behalf of employee benefit plans or individual retirement accounts will be deemed to certify that the purchase and subsequent holding of the notes by the investor would be exempt from the prohibited transaction rules of ERISA and/or Section 4975 of the Internal Revenue Code. A fiduciary or other person contemplating purchasing a Class A(2007-2) note on behalf of someone with “plan assets” of any plan or account should consult with its counsel regarding whether the purchase or holding of these Class A(2007-2) note could give rise to a transaction prohibited or not otherwise permissible under ERISA and/or Section 4975 of the Internal Revenue Code. For further information regarding the application of ERISA, see “Benefit Plan Investors” in the accompanying prospectus.

S-7

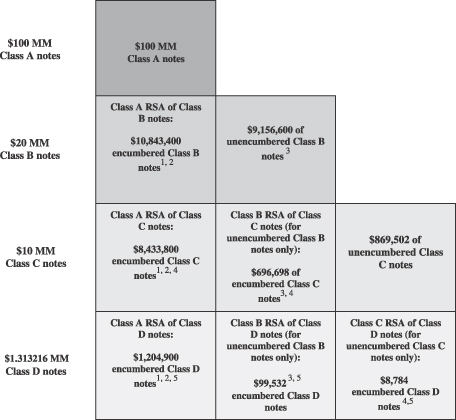

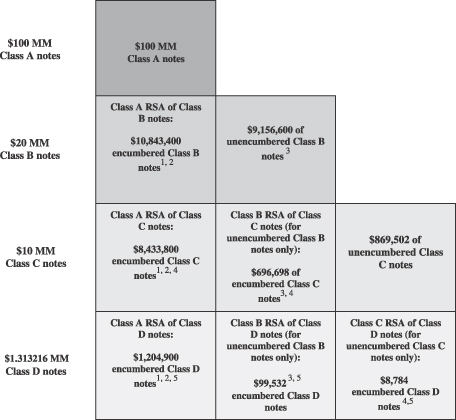

Required Subordinated Amounts

The chart and the accompanying text below provide an illustrative example of the concept of required subordinated amounts. The stated percentages used in this example are applicable to the current calculation for required subordinated amounts for these notes. The dollar amounts used in this example are illustrative only and are not intended to represent any allocation of tranches of Card series notes outstanding at any time. COMET may change the required subordinated amount and related stated percentages for any tranche of Card series notes, the methodology of computing the required subordinated amount, or utilize forms of credit enhancement other than subordinated Card series notes at any time without the consent of any noteholders. However, each rating agency must confirm that the change will not cause a reduction, qualification or withdrawal of the ratings of the related tranche of notes or any outstanding tranche of Card series notes. If such a change is made, noteholders will not be provided any notice of the change. See“—Required Subordinated Amount and Conditions to Issuance” above and “The Notes—Required Subordinated Amount and Usage” in the accompanying prospectus.

Generally, the required subordinated amount (“RSA”) of a subordinated class of notes for any date is an amount equal to a stated percentage of the adjusted outstanding dollar principal amount of the senior tranche of notes for that date.

1 | | The Class A RSA of Class B notes is 10.8434% of $100 MM Class A notes, the Class A RSA of Class C notes is 8.4338% of $100 MM Class A notes, and the Class A RSA of Class D notes is 1.2049% of $100 MM Class A notes. Therefore, the aggregate Class A RSA of Class B notes, Class C notes and Class D notes for the $100 MM of Class A notes is $20,482,100 ($10,843,400 + $8,433,800 + $1,204,900). |

2 | | The amount of encumbered Class B notes is equal to the Class A RSA of Class B notes. The RSA for those encumbered Class B notes is equal to the sum of the Class A RSA of Class C notes and the Class A RSA of Class D notes. |

S-8

3 | | The amount of unencumbered Class B notes is equal to $9,156,600, which is the total amount of Class B notes ($20 MM)minus the encumbered Class B notes ($10,843,400). The Class B RSA of Class C notes for those unencumbered Class B notes only is equal to $696,698, which is 7.6087% of $9,156,600. The Class B RSA of Class D notes for those unencumbered Class B notes only is equal to $99,532, which is 1.0870% of $9,156,600. |

4 | | The amount of encumbered Class C notes is equal to the sum of the Class A RSA of Class C notes and the Class B RSA of Class C notes (for unencumbered Class B notes only). The amount of unencumbered Class C notes is equal to $869,502, which is the total amount of Class C notes ($10 MM)minus the encumbered Class C notes ($9,130,498). The Class C RSA of Class D notes for those unencumbered Class C notes only is equal to $8,784, which is 1.0102% of $869,502. |

5 | | The amount of encumbered Class D notes is equal to the sum of the Class A RSA of Class D notes, the Class B RSA of Class D notes (for unencumbered Class B notes only) and the Class C RSA of Class D notes (for unencumbered Class C notes only) ($1,313,216). |

S-9

Underwriting

Subject to the terms and conditions of the underwriting agreement for these Class A(2007-2) notes, COMET has agreed to sell to each of the underwriters named below, and each of those underwriters has severally agreed to purchase, the principal amount of these Class A(2007-2) notes set forth opposite its name:

| | | |

Underwriters

| | Principal

Amount

|

Deutsche Bank Securities Inc. | | $ | 140,000,000 |

Morgan Stanley & Co. Incorporated | | | 140,000,000 |

Barclays Capital Inc. | | | 140,000,000 |

Citigroup Global Markets Inc. | | | 140,000,000 |

Merrill Lynch, Pierce, Fenner & Smith

Incorporated | | | 140,000,000 |

| | |

|

|

Total | | $ | 700,000,000 |

The several underwriters have agreed, subject to the terms and conditions of the underwriting agreement, to purchase all $700,000,000 aggregate principal amount of these Class A(2007-2) notes if any of these Class A(2007-2) notes are purchased.

The underwriters have advised COMET that the several underwriters propose initially to offer these Class A(2007-2) notes to the public at the public offering price determined by the several underwriters and set forth on the cover page of this prospectus supplement, and to certain dealers at that public offering price less a concession not in excess of 0.2250% of the principal amount of these Class A(2007-2) notes. The underwriters may allow, and those dealers may reallow to other dealers, a concession not in excess of 0.1125% of the principal amount. The underwriters may sell some or all of the Class A(2007-2) notes to one or more trusts or other special purpose entities.

After the public offering, the public offering price and other selling terms may be changed by the underwriters.

In the ordinary course of business, one or more of the underwriters or their affiliates have engaged, and may engage in the future, in certain investment banking or commercial banking transactions with the bank, the savings bank, the transferor and their affiliates.

Each underwriter of these Class A(2007-2) notes has agreed that:

| | • | | it has complied and will comply with all applicable provisions of the Financial Services and Markets Act 2000 (the “FSMA”) with respect to anything done by it in relation to the Class A(2007-2) notes in, from or otherwise involving the United Kingdom; and |

| | • | | it has only and will only communicate or cause to be communicated an invitation or inducement to engage in investment activity (within the meaning of Section 21 of the FSMA) received by it in connection with the issue or sale of any Class A(2007-2) notes in circumstances in which Section 21(1) of the FSMA does not apply to COMET. |

In connection with the sale of these Class A(2007-2) notes, the underwriters may engage in:

| | • | | over-allotments, in which members of the syndicate selling these Class A(2007-2) notes sell more notes than COMET actually sold to the syndicate, creating a syndicate short position; |

| | • | | stabilizing transactions, in which purchases and sales of these Class A(2007-2) notes may be made by the members of the selling syndicate at prices that do not exceed a specified maximum; |

| | • | | syndicate covering transactions, in which members of the selling syndicate purchase these Class A(2007-2) notes in the open market after the distribution has been completed in order to cover syndicate short positions; and |

S-10

| | • | | penalty bids, by which underwriters reclaim a selling concession from a syndicate member when any of these Class A(2007-2) notes originally sold by that syndicate member are purchased in a syndicate covering transaction to cover syndicate short positions. |

These stabilizing transactions, syndicate covering transactions and penalty bids may cause the price of these Class A(2007-2) notes to be higher than it would otherwise be. These transactions, if commenced, may be discontinued at any time.

COMET, the banks and the transferor, jointly and severally, will indemnify the underwriters against certain liabilities, including liabilities under applicable securities laws, or contribute to payments the underwriters may be required to make in respect of those liabilities. COMET’s obligation to indemnify the underwriters will be limited to Finance Charge Amounts from the COMT collateral certificate received by COMET after making all required payments and required deposits under the indenture and any supplement thereto.

COMET will receive proceeds of approximately $697,375,000 from the sale of these Class A(2007-2) notes. This amount represents 99.625% of the principal amount of those notes. The underwriting discount is $2,625,000, or 0.375% of the principal amount of those notes. Proceeds received by COMET will be paid to the transferor. See “Use of Proceeds” in the accompanying prospectus. Additional offering expenses are estimated to be $600,000.

S-11

Annex I

The information provided in this Annex I is an integral part of the prospectus supplement.

The Capital One Credit Card Portfolio

The Capital One credit card portfolio (referred to in this prospectus supplement and the accompanying prospectus as the “Bank Portfolio”) is primarily comprised of VISA and MasterCard accounts originated by Capital One Bank and its predecessor. The Master Trust Portfolio is currently comprised of accounts that have been selected from the Bank Portfolio.

Capital One, F.S.B. also originates accounts that may be included in the Master Trust Portfolio. See“The Transferor, The Depositor and The Receivables Purchase Agreements” in the accompanying prospectus. However, as of the date of this prospectus supplement, no accounts originated by Capital One, F.S.B. have been selected for designation to the Master Trust Portfolio.

As of the years ended December 31, 2006, December 31, 2005 and December 31, 2004, U.S. card loans originated by Capital One Bank and Capital One, F.S.B. and their predecessors consisted of receivables totaling approximately $53.624 billion, $49.464 billion and $48.610 billion, respectively.

As of the years ended December 31, 2006, December 31, 2005 and December 31, 2004, the aggregate invested amount of the outstanding series of certificates issued by the master trust totaled approximately $35.012 billion, $32.289 billion and $31.041 billion, respectively.

The Originators

Capital One Bank, a Virginia banking corporation, is a subsidiary of Capital One Financial Corporation. At September 30, 2006, Capital One Bank had assets of approximately $31.4 billion and stockholders’ equity of approximately $3.6 billion.

Capital One, F.S.B., a federal savings bank, is a subsidiary of Capital One Financial Corporation. At September 30, 2006, Capital One, F.S.B. had assets of approximately $17.0 billion and stockholders’ equity of approximately $2.4 billion.

For a more detailed description of Capital One Bank and Capital One, F.S.B., see“The Banks” in the accompanying prospectus.

The Master Trust Portfolio

General

The receivables conveyed to the master trust arise in accounts selected from the Bank Portfolio based on the eligibility criteria specified in the pooling agreement as applied on the Master Trust Cut-Off Date and subsequent additional cut-off dates. See“The Master Trust—Master Trust Assets,” “—Conveyance of Receivables”and“—Representations and Warranties”in the accompanying prospectus. Subject to those eligibility requirements and applicable regulatory guidelines, the decision regarding the method of selection of accounts to be designated for addition to the master trust portfolio resides at the discretion of the transferor. See“The Master Trust—Addition of Master Trust Assets” in the accompanying prospectus.

A-I-1

Delinquency and Loss Experience

Because new accounts usually initially exhibit lower delinquency rates and credit losses, the growth of the Master Trust Portfolio from approximately $29.262 billion at year end 2002, to approximately $43.975 billion at year end 2006, has had the effect of significantly lowering the charge-off and delinquency rates for the entire portfolio from what they otherwise would have been. However, as the proportion of new accounts to seasoned accounts becomes smaller, this effect should be lessened. As seasoning occurs or if new account origination slows, the originator expects that the charge-off rates and delinquencies will increase over time. The delinquency and net loss rates at any time reflect, among other factors, the quality of the credit card loans, the average seasoning of the accounts, the success of the originator’s collection efforts, the product mix of the Master Trust Portfolio and general economic conditions.

Gross losses represent the arithmetic sum of all receivables in the Master Trust Portfolio that were charged-off during the period indicated in the charts below. See “The Master Trust—Defaulted Receivables; Rebates and Fraudulent Charges; Recoveries” in the accompanying prospectus. Recoveries are collections received in respect of charged-off accounts in the Master Trust Portfolio during the period indicated in the charts below. Recoveries are treated as Finance Charge Collections for the Master Trust Portfolio. See “The Master Trust—The Receivables” in the accompanying prospectus. Net losses are an amount equal to gross losses minus recoveries, each for the applicable period.

The following tables set forth the delinquency and loss experience for the Master Trust Portfolio for each of the periods shown. There can be no assurance that the delinquency and loss experience for the receivables in the future will be similar to the historical experience set forth below for the Master Trust Portfolio.

Delinquencies as a Percentage of the Master Trust Portfolio(1)(2)

(Dollars in Thousands)

| | | | | | | | | | | | | | | | | | |

| | | At Year End

| |

| | | 2006

| | | 2005

| | | 2004

| |

| | | Receivables

| | Percentage of

Total Receivables

| | | Receivables

| | Percentage of

Total Receivables

| | | Receivables

| | Percentage of

Total Receivables

| |

Receivables Outstanding | | $ | 43,974,624 | | 100.00 | % | | $ | 38,465,692 | | 100.00 | % | | $ | 36,957,333 | | 100.00 | % |

Receivables Delinquent: | | | | | | | | | | | | | | | | | | |

30 - 59 days | | $ | 522,078 | | 1.19 | % | | $ | 442,033 | | 1.15 | % | | $ | 500,336 | | 1.35 | % |

60 - 89 days | | | 350,467 | | 0.80 | | | | 294,002 | | 0.76 | | | | 338,986 | | 0.92 | |

90 - 119 days | | | 308,722 | | 0.70 | | | | 254,865 | | 0.66 | | | | 300,917 | | 0.82 | |

120 - 149 days | | | 265,101 | | 0.60 | | | | 217,762 | | 0.57 | | | | 251,138 | | 0.68 | |

150+ days | | | 240,123 | | 0.55 | | | | 195,650 | | 0.51 | | | | 226,897 | | 0.61 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

TOTAL | | $ | 1,686,491 | | 3.84 | % | | $ | 1,404,312 | | 3.65 | % | | $ | 1,618,274 | | 4.38 | % |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| | | | | | | | | | | | | | | | |

| |

| | | At Year End

| |

| | | | | 2003

| | | 2002

| |

| | | Receivables

| | Percentage of

Total Receivables

| | | Receivables

| | Percentage of

Total Receivables

| |

Receivables Outstanding | | $ | 33,875,607 | | 100.00 | % | | $ | 29,262,005 | | 100.00 | % |

Receivables Delinquent: | | | | | | | | | | | | |

30 - 59 days | | $ | 513,831 | | 1.51 | % | | $ | 502,655 | | 1.72 | % |

60 - 89 days | | | 348,024 | | 1.03 | | | | 346,070 | | 1.18 | |

90 - 119 days | | | 303,714 | | 0.90 | | | | 292,704 | | 1.00 | |

120 - 149 days | | | 262,232 | | 0.77 | | | | 257,752 | | 0.88 | |

150+ days | | | 240,466 | | 0.71 | | | | 238,968 | | 0.82 | |

| | | | | | |

|

| |

|

| |

|

| |

|

|

TOTAL | | $ | 1,668,267 | | 4.92 | % | | $ | 1,638,149 | | 5.60 | % |

| | | | | | |

|

| |

|

| |

|

| |

|

|

| (1) | | The percentages are the result of dividing the delinquent amount by the end of period receivables outstanding for the applicable period. The delinquent amount is the dollar amount of end of period delinquencies for the period. |

| (2) | | Figures and percentages in this table are reported on a processing month basis. |

A-I-2

Delinquencies by Accounts as a

Percentage of the

Master Trust Portfolio (1)(2)

| | | | | | | | | | | | | | | |

| | | At Year End

| |

| | | 2006

| | | 2005

| | | 2004

| |

| | | Accounts

| | Percentage

of Total

Accounts

| | | Accounts

| | Percentage

of Total

Accounts

| | | Accounts

| | Percentage

of Total

Accounts

| |

Total Accounts | �� | 27,332,468 | | 100.00 | % | | 26,105,623 | | 100.00 | % | | 25,578,611 | | 100.00 | % |

Accounts Delinquent: | | | | | | | | | | | | | | | |

30 - 59 days | | 387,583 | | 1.42 | % | | 387,171 | | 1.48 | % | | 458,519 | | 1.79 | % |

60 - 89 days | | 241,842 | | 0.88 | | | 236,236 | | 0.91 | | | 285,800 | | 1.12 | |

90 - 119 days | | 203,940 | | 0.75 | | | 200,007 | | 0.77 | | | 241,352 | | 0.94 | |

120 - 149 days | | 164,858 | | 0.60 | | | 168,351 | | 0.64 | | | 193,313 | | 0.76 | |

150+ days | | 152,888 | | 0.56 | | | 149,719 | | 0.57 | | | 173,672 | | 0.68 | |

| | |

| |

|

| |

| |

|

| |

| |

|

|

TOTAL | | 1,151,111 | | 4.21 | % | | 1,141,484 | | 4.37 | % | | 1,352,656 | | 5.29 | % |

| | |

| |

|

| |

| |

|

| |

| |

|

|

| | | | | | | | | | |

| | | At Year End

| |

| | | 2003

| | | 2002

| |

| | | Accounts

| | Percentage

of Total

Accounts

| | | Accounts

| | Percentage

of Total

Accounts

| |

Total Accounts | | 23,512,508 | | 100.00 | % | | 22,138,065 | | 100.00 | % |

Accounts Delinquent: | | | | | | | | | | |

30 - 59 days | | 447,736 | | 1.90 | % | | 449,942 | | 2.03 | % |

60 - 89 days | | 267,719 | | 1.14 | | | 289,860 | | 1.31 | |

90 - 119 days | | 215,007 | | 0.92 | | | 234,808 | | 1.06 | |

120 - 149 days | | 176,537 | | 0.75 | | | 203,426 | | 0.92 | |

150+ days | | 159,296 | | 0.68 | | | 185,713 | | 0.84 | |

| | |

| |

|

| |

| |

|

|

TOTAL | | 1,266,295 | | 5.39 | % | | 1,363,749 | | 6.16 | % |

| | |

| |

|

| |

| |

|

|

| (1) | | The percentages are the result of dividing the number of delinquent accounts by the end of period accounts for the applicable period. |

| (2) | | Figures and percentages in this table are reported on a processing month basis. |

Loss Experience for the Master Trust Portfolio

(Dollars in Thousands)

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended

| |

| | | 2006

| | | 2005

| | | 2004

| | | 2003

| | | 2002

| |

Average Principal Receivables Outstanding | | $ | 40,335,995 | | | $ | 36,333,164 | | | $ | 34,333,419 | | | $ | 29,213,922 | | | $ | 25,210,883 | |

Average Accounts | | | 27,212,401 | | | | 26,301,008 | | | | 24,649,889 | | | | 22,224,499 | | | | 22,477,448 | |

Gross Losses | | $ | 1,910,335 | | | $ | 2,330,842 | | | $ | 2,126,329 | | | $ | 2,022,487 | | | $ | 1,545,916 | |

Gross Losses as a Percentage of Average Principal Receivables Outstanding | | | 4.74 | % | | | 6.42 | % | | | 6.19 | % | | | 6.92 | % | | | 6.13 | % |

Recoveries | | $ | 819,245 | | | $ | 723,573 | | | $ | 657,652 | | | $ | 543,141 | | | $ | 412,269 | |

Net Losses | | $ | 1,091,090 | | | $ | 1,607,269 | | | $ | 1,468,676 | | | $ | 1,479,346 | | | $ | 1,133,646 | |

Net Losses as a Percentage of Average Principal Receivables Outstanding | | | 2.71 | % | | | 4.42 | % | | | 4.28 | % | | | 5.06 | % | | | 4.50 | % |

Accounts Experiencing a Loss | | | 1,764,288 | | | | 2,236,212 | | | | 2,088,008 | | | | 2,130,664 | | | | 2,161,561 | |

Accounts Experiencing a Loss as a Percentage of Average Accounts Outstanding | | | 6.48 | % | | | 8.50 | % | | | 8.47 | % | | | 9.59 | % | | | 9.62 | % |

Average Net Loss of Accounts with a Loss | | $ | 618 | | | $ | 719 | | | $ | 703 | | | $ | 694 | | | $ | 524 | |

A-I-3

See “The Banks—The Bank’s Credit Card and Lending Business—Billing and Payments” in the accompanying prospectus for a discussion of the assessment of finance charges, annual membership fees and other charges.

Revenue Experience

The following table sets forth the revenues from finance charges and fees billed and interchange received with respect to the Master Trust Portfolio for the periods shown.

Revenue Experience for the Master Trust Portfolio (1)

(Dollars in Thousands)

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended

| |

| | | 2006

| | | 2005

| | | 2004

| | | 2003

| | | 2002

| |

Average Principal Receivables Outstanding | | $ | 40,335,995 | | | $ | 36,333,164 | | | $ | 34,333,419 | | | $ | 29,213,922 | | | $ | 25,210,883 | |

Finance Charges and Fees(2) | | $ | 6,368,438 | | | $ | 6,013,533 | | | $ | 5,612,785 | | | $ | 4,892,493 | | | $ | 4,828,868 | |

Yield from Finance Charges and Fees | | | 15.79 | % | | | 16.55 | % | | | 16.35 | % | | | 16.75 | % | | | 19.15 | % |

Interchange | | $ | 1,295,353 | | | $ | 1,064,342 | | | $ | 868,744 | | | $ | 730,395 | | | $ | 595,702 | |

Yield from Interchange | | | 3.21 | % | | | 2.93 | % | | | 2.53 | % | | | 2.50 | % | | | 2.36 | % |

| (1) | | The percentages are calculated by dividing the amount of prior month billed finance charges and fees, and interchange by the average principal receivables outstanding for the applicable period. |

| (2) | | Finance Charges and Fees do not include interest on subsequent collections on accounts previously charged off. Finance Charges and Fees include monthly periodic rate finance charges, the portion of the annual membership fees amortized on a monthly basis, cash advance fees, late charges, overlimit fees and other miscellaneous fees. |

There can be no assurance that the yield experience for the receivables in the future will be similar to the historical experience set forth above for the Master Trust Portfolio. In addition, revenue from the receivables will depend on the types of fees and charges assessed on the accounts, and could be adversely affected by future changes made by the bank or the servicer in those fees and charges or by other factors. See “Risk Factors” in the accompanying prospectus.

The revenue from finance charges and fees for the accounts in the Master Trust Portfolio shown in the above table is comprised of three primary components: periodic rate finance charges, the amortized portion of annual membership fees and other charges, such as cash advance fees, late charges, overlimit fees and other miscellaneous fees. See “The Banks—The Bank’s Credit Card and Lending Business—Billing and Payments” in the accompanying prospectus for a discussion of the assessment of finance charges, annual membership fees and other charges. If payment rates decline, the balances subject to monthly periodic rate finance charges tend to grow, assuming no change in the level of purchasing activity. Accordingly, under these circumstances, the yield related to monthly periodic rate finance charges normally increases. Conversely, if payment rates increase, the balances subject to monthly periodic rate finance charges tend to fall, assuming no change in the level of purchasing activity. Accordingly, under these circumstances, the yield related to monthly periodic rate finance charges normally decreases.

The Master Trust Portfolio may experience growth in receivables through the originator’s origination of accounts having an introductory period during which a relatively low annual percentage rate is charged. As the introductory period on these accounts expire, the originator may choose to waive all or part of the annual percentage rate increase for such accounts. Under these circumstances, the yield related to monthly periodic rate finance charges would be adversely affected. The impact of service charges on the Master Trust Portfolio’s yield varies with the type and volume of activity in and the amount of each account, as well as with the number of delinquent accounts. As aggregate account balances increase, annual membership fees, which remain constant, represent a smaller percentage of the aggregate account balances.

A-I-4

Payment Rates

The following table sets forth the highest and lowest accountholder monthly payment rates for the Master Trust Portfolio during any single month in the periods shown and the average accountholder monthly payment rates for all months during the periods shown, in each case calculated as a percentage of average monthly account balances during the periods shown. Payment rates shown in the table are based on amounts which would be payments of principal receivables on the accounts.

Accountholder Monthly Payment Rates

for the Master Trust Portfolio(1)

| | | | | | | | | | | | | | | |

| | | Year Ended

| |

| | | 2006

| | | 2005

| | | 2004

| | | 2003

| | | 2002

| |

Lowest Month(2) | | 15.34 | % | | 14.23 | % | | 13.93 | % | | 13.99 | % | | 13.98 | % |

Highest Month(2) | | 18.25 | % | | 16.92 | % | | 16.10 | % | | 16.62 | % | | 15.38 | % |

Average Payment Rate for the Period | | 16.28 | % | | 15.89 | % | | 14.82 | % | | 15.55 | % | | 14.77 | % |

| (1) | | The monthly payment rates include amounts which are payments of principal receivables with respect to the accounts. |

| (2) | | The monthly principal payment rate for any month is calculated as the total amount of principal payments received during such month divided by the sum of (i) the amount of principal receivables outstanding as of the beginning of such month and (ii) with respect to accounts added to the Master Trust Portfolio during such month, the amount of principal receivables outstanding in such accounts as of the related addition date. For each period presented, the principal payment rate is calculated as the average of the monthly principal payment rates during such period. |

The Receivables

��

As of January 12, 2007:

| | • | | the Master Trust Portfolio included $42,242,970,851 of principal receivables and $783,483,701 of finance charge receivables; |

| | • | | the accounts had an average principal receivable balance of $1,542 and an average credit limit of $5,579; |

| | • | | the percentage of the aggregate total receivable balance to the aggregate total credit limit was 27.63%; |

| | • | | the average age of the accounts was approximately 52 months; and |

| | • | | approximately 50.29% of the accounts in the Master Trust Portfolio were assessed a variable rate periodic finance charge and approximately 49.71% were assessed a fixed rate periodic finance charge. |

As of the month ended January 31, 2007:

| | • | | 8.76% of the accounts in the Master Trust Portfolio made minimum payments as of their respective latest statement date, in each case based on the prior month statement minimum payment; and |

| | • | | 13.36% of the accounts in the Master Trust Portfolio made full payments as of their respective latest statement date, in each case based on the prior month statement outstanding balance. |

The information in the preceding paragraph does not include $1,512,475,053.60 of receivables in additional accounts added to the master trust on February 8, 2007.

The following five tables summarize the Master Trust Portfolio by various criteria as of January 12, 2007. References to “Receivables Outstanding” in the following tables include both finance charge receivables and principal receivables. Because the future composition of the Master Trust Portfolio may change over time, these tables are not necessarily indicative of the composition of the Master Trust Portfolio at any specific time in the future.

A-I-5

Composition by Account Balance

Master Trust Portfolio

| | | | | | | | | | | | |

Account Balance Range

| | Number of

Accounts

| | % of Total Number

of Accounts

| | | Receivables

Outstanding

| | | % of Total

Receivables

| |

Credit Balance(1) | | 486,306 | | 1.74 | % | | $ | (45,418,673 | ) | | (0.11 | )% |

No Balance(2) | | 7,335,503 | | 26.28 | | | | 0 | | | 0.00 | |

More than $0 and less than or equal to $1,500.00 | | 12,569,028 | | 45.03 | | | | 6,712,300,640 | | | 15.60 | |

$1,500.01-$5,000.00 | | 5,197,854 | | 18.62 | | | | 14,842,467,016 | | | 34.50 | |

$5,000.01-$10,000.00 | | 1,618,240 | | 5.80 | | | | 11,220,151,090 | | | 26.08 | |

Over $10,000.00 | | 704,468 | | 2.53 | | | | 10,296,954,479 | | | 23.93 | |

| | |

| |

|

| |

|

|

| |

|

|

TOTAL | | 27,911,399 | | 100.00 | % | | $ | 43,026,454,552 | | | 100.00 | % |

| | |

| |

|

| |

|

|

| |

|

|

| (1) | | Credit balances are a result of cardholder payments and credit adjustments applied in excess of the unpaid balance on an account. Accounts which currently have a credit balance are included because receivables may be generated with respect to those accounts in the future. |

| (2) | | Accounts which currently have no balance are included because receivables may be generated with respect to those accounts in the future. Zero balance accounts described in“The Master Trust—The Receivables” in the accompanying prospectus are not included in these figures. |

Composition by Credit Limit(1)

Master Trust Portfolio

| | | | | | | | | | | |

Credit Limit Range

| | Number of

Accounts

| | % of Total Number

of Accounts

| | | Receivables

Outstanding

| | % of Total

Receivables

| |

Less than or equal to $1,500.00 | | 11,989,402 | | 42.96 | % | | $ | 4,502,268,035 | | 10.46 | % |

$1,500.01-$5,000.00 | | 6,846,993 | | 24.53 | | | | 10,194,377,787 | | 23.69 | |

$5,000.01-$10,000.00 | | 3,885,599 | | 13.92 | | | | 8,234,707,105 | | 19.14 | |

Over $10,000.00 | | 5,189,405 | | 18.59 | | | | 20,095,101,625 | | 46.71 | |

| | |

| |

|

| |

|

| |

|

|

TOTAL | | 27,911,399 | | 100.00 | % | | $ | 43,026,454,552 | | 100.00 | % |

| | |

| |

|

| |

|

| |

|

|

| (1) | | References to “Credit Limit” herein include both the line of credit established for purchases, cash advances and balance transfers as well as receivables originated under temporary extensions of credit through account management programs. Credit limits relating to these temporary extensions decrease as cardholder payments are applied to the accounts. |

Composition by Payment Status

Master Trust Portfolio

| | | | | | | | | | | |

Payment Status

| | Number of

Accounts

| | % of Total Number

of Accounts

| | | Receivables

Outstanding

| | % of Total

Receivables

| |

Current to 29 days (1) | | 26,772,297 | | 95.92 | % | | $ | 41,339,688,327 | | 96.08 | % |

Past due 30 – 59 days | | 376,629 | | 1.35 | | | | 512,848,207 | | 1.19 | |

Past due 60 – 89 days | | 243,615 | | 0.87 | | | | 354,054,049 | | 0.82 | |

Past due 90 – 119 days | | 197,335 | | 0.71 | | | | 301,239,507 | | 0.70 | |

Past due 120 – 149 days | | 169,396 | | 0.61 | | | | 272,851,761 | | 0.64 | |

Past due 150 + days | | 152,127 | | 0.54 | | | | 245,772,701 | | 0.57 | |

| | |

| |

|

| |

|

| |

|

|

TOTAL | | 27,911,399 | | 100.00 | % | | $ | 43,026,454,552 | | 100.00 | % |

| | |

| |

|

| |

|

| |

|

|

| (1) | | Accounts designated as current include accounts on which the minimum payment has not been received prior to the second billing date following the issuance of the related bill. |

A-I-6

Composition by Account Age

Master Trust Portfolio

| | | | | | | | | | | |

Account Age

| | Number of

Accounts

| | % of Total Number

of Accounts

| | | Receivables

Outstanding

| | % of Total

Receivables

| |

Not More than 6 Months | | 209,253 | | 0.75 | % | | $ | 906,943,886 | | 2.11 | % |

Over 6 Months to 12 Months | | 1,725,923 | | 6.18 | | | | 3,132,267,229 | | 7.28 | |

Over 12 Months to 24 Months | | 4,493,262 | | 16.10 | | | | 6,006,374,013 | | 13.96 | |

Over 24 Months to 36 Months | | 4,346,138 | | 15.57 | | | | 5,596,469,827 | | 13.01 | |

Over 36 Months to 48 Months | | 4,281,315 | | 15.34 | | | | 6,681,968,516 | | 15.53 | |

Over 48 Months to 60 Months | | 3,248,907 | | 11.64 | | | | 5,535,059,012 | | 12.86 | |

Over 60 Months | | 9,606,601 | | 34.42 | | | | 15,167,372,069 | | 35.25 | |

| | |

| |

|

| |

|

| |

|

|

TOTAL | | 27,911,399 | | 100.00 | % | | $ | 43,026,454,552 | | 100.00 | % |

| | |

| |

|

| |

|

| |

|

|

Composition by Accountholder Billing Address

Master Trust Portfolio

| | | | | | | | | | | |

State or Territory

| | Number of

Accounts

| | % of Total Number

of Accounts

| | | Receivables

Outstanding

| | % of Total

Receivables

| |

California | | 3,476,222 | | 12.45 | % | | $ | 4,943,851,793 | | 11.49 | % |

Florida | | 1,951,616 | | 6.99 | | | | 2,640,831,304 | | 6.14 | |

Texas | | 1,936,617 | | 6.94 | | | | 2,795,991,737 | | 6.50 | |

New York | | 1,834,335 | | 6.57 | | | | 2,687,800,163 | | 6.25 | |

Illinois | | 1,207,459 | | 4.33 | | | | 1,929,127,710 | | 4.48 | |

Pennsylvania | | 1,176,529 | | 4.22 | | | | 1,892,942,917 | | 4.40 | |

Ohio | | 1,079,474 | | 3.87 | | | | 1,849,035,408 | | 4.30 | |

New Jersey | | 953,742 | | 3.42 | | | | 1,458,627,392 | | 3.39 | |

Michigan | | 891,274 | | 3.19 | | | | 1,568,522,692 | | 3.64 | |

Virginia | | 795,177 | | 2.85 | | | | 1,269,542,810 | | 2.95 | |

Others(1) | | 12,608,954 | | 45.17 | | | | 19,990,180,626 | | 46.46 | |

| | |

| |

|

| |

|

| |

|

|

TOTAL | | 27,911,399 | | 100.00 | % | | $ | 43,026,454,552 | | 100.00 | % |

| | |

| |

|

| |

|

| |

|

|

| (1) | | No other state individually accounts for more than 2.85% of the Percentage of Total Number of Accounts. |

Since the largest number of accountholders (based on billing addresses) whose accounts were included in the master trust as of January 12, 2007 were in California, Florida, Texas and New York, adverse economic conditions affecting accountholders residing in these areas could affect timely payment by the related accountholders of amounts due on the accounts and, accordingly, the actual rates of delinquencies and losses with respect to the Master Trust Portfolio. See“Risk Factors”in the accompanying prospectus.

FICO®*. The following table summarizes the Master Trust Portfolio by FICO® score. A FICO® score is a measurement determined by Fair, Isaac & Company using information collected by the major credit bureaus to assess credit risk. The bank obtains, to the extent available, FICO® scores at the origination of each account and each month thereafter. In the following table, Receivables Outstanding are determined as of January 12, 2007, and FICO® scores are determined during the month of January 2007. References to “Receivables Outstanding” in the following table include both finance charge receivables and principal receivables. Because the future composition of the Master Trust Portfolio may change over time, this table is not necessarily indicative of the composition of the Master Trust Portfolio at any specific time in the future. FICO® scores may change over time, depending on the conduct of the accountholder and changes in credit score technology.

| * | | FICO® is a federally registered servicemark of Fair, Isaac & Company. |

A-I-7

Composition by FICO® Score

Master Trust Portfolio

| | | | | | |

FICO® Score(1)

| | Receivables

Outstanding

| | Percentage of

Total Receivables

Outstanding

| |

No score | | $ | 321,733,894 | | 0.75 | % |

Less than or equal to 600 | | | 5,122,368,674 | | 11.91 | |

601-660 | | | 7,658,079,458 | | 17.80 | |

661-720 | | | 12,999,979,628 | | 30.21 | |

Over 720 | | | 16,924,292,898 | | 39.33 | |

| | |

|

| |

|

|

TOTAL | | $ | 43,026,454,552 | | 100.00 | % |

| | |

|

| |

|

|

| (1) | | The FICO® score is the Equifax Enhanced Beacon 3.0 FICO® score. |

Data from an independent credit reporting agency, such as FICO® score, is one of several factors that may be used by the bank in its credit scoring system to assess the credit risk associated with each applicant. See “The Banks—The Bank’s Credit Card and Lending Business—Underwriting Procedures” in the accompanyingprospectus. Additionally, FICO® scores are based on independent third party information, the accuracy of which cannot be verified. FICO® scores should not necessarily be relied upon as a meaningful predictor of the performance of the receivables in the Master Trust Portfolio. For information regarding the historical performance of the receivables in the Master Trust Portfolio, see “—Delinquency and Loss Experience,” “—Revenue Experience” and “—Payment Rates” above, as well as “—Static Pool Information”below.

Static Pool Information

Static pool information regarding the performance of the receivables in the master trust is being provided through an Internet Web site at www.capitalone.com/staticpool. See “Where You Can Find More Information” in the accompanying prospectus. All static pool information regarding the performance of those receivables on such Internet Web site for periods prior to January 1, 2006 will not form a part of this prospectus supplement, the accompanying prospectus or the registration statement relating to the notes. Static pool information for periods prior to January 1, 2003 is not available and cannot be obtained without unreasonable expense or effort.

A-I-8

Annex II

Outstanding Series, Classes and Tranches of Notes

The information provided in this Annex II is an integral part of the prospectus supplement.

The total Nominal Liquidation Amount and Outstanding Dollar Principal Amount for all outstanding classes and tranches of the Card series notes, including any expected issuances listed in this Annex II, are $27,832,105,0001 and $27,832,105,0002, respectively.

Card series

| | | | | | | | | | | | |

Class A

| | Issuance Date

| | Nominal Liquidation Amount

| | Outstanding

Dollar Principal

Amount

| | Note Interest Rate

| | Expected Principal

Payment Date

| | Legal Maturity Date

|

Class A(2002-1) | | 10/9/02 | | $500,000,000 | | $500,000,000 | | One Month LIBOR + 0.27% | | September 2007 | | July 2010 |

Class A(2003-A) | | 5/20/03 | | $400,000,000 | | $400,000,000 | | Not to exceed One Month LIBOR + 0.39% | | May 2008 | | March 2011 |

Class A(2003-3) | | 8/13/03 | | $500,000,000 | | $500,000,000 | | One Month LIBOR + 0.25% | | July 2008 | | May 2011 |

Class A(2003-4) | | 9/26/03 | | $750,000,000 | | $750,000,000 | | 3.65% | | September 2008 | | July 2011 |

Class A(2003-5) | | 10/10/03 | | $500,000,000 | | $500,000,000 | | One Month LIBOR + 0.29% | | September 2010 | | July 2013 |

Class A(2003-7) | | 11/21/03 | | $750,000,000 | | $750,000,000 | | One Month LIBOR + 0.18% | | November 2008 | | September 2011 |

Class A(2004-1) | | 2/26/04 | | $500,000,000 | | $500,000,000 | | One Month LIBOR + 0.21% | | February 2014 | | December 2016 |

Class A(2004-2) | | 4/8/04 | | $750,000,000 | | $750,000,000 | | One Month LIBOR + 0.09% | | March 2009 | | January 2012 |

Class A(2004-3) | | 5/6/04 | | $500,000,000 | | $500,000,000 | | One Month LIBOR + 0.10% | | April 2009 | | February 2012 |

Class A(2004-4) | | 6/10/043 | | $500,000,000 | | $500,000,000 | | One Month LIBOR + 0.22% | | May 2014 | | March 2017 |

Class A(2004-5) | | 6/10/04 | | $200,000,000 | | $200,000,000 | | One Month LIBOR + 0.15% | | May 2011 | | March 2014 |

Class A(2004-6) | | 7/14/04 | | $750,000,000 | | $750,000,000 | | Three Month LIBOR + 0.04% | | June 2007 | | April 2010 |

Class A(2004-7) | | 9/9/04 | | $500,000,000 | | $500,000,000 | | Three Month LIBOR + 0.15% | | August 2011 | | June 2014 |

Class A(2004-8) | | 11/10/04 | | $500,000,000 | | $500,000,000 | | One Month LIBOR + 0.13% | | October 2011 | | August 2014 |

Class A(2004-NOVA) | | 11/16/04 | | Up to $3,000,000,0004 | | Up to $3,000,000,0004 | | — | | — | | — |

Class A(2005-1) | | 4/1/05 | | $750,000,000 | | $750,000,000 | | One Month LIBOR + 0.07% | | March 2012 | | January 2015 |

Class A(2005-2) | | 5/6/05 | | $500,000,000 | | $500,000,000 | | 4.05% | | April 2008 | | February 2011 |

Class A(2005-3) | | 6/10/05 | | $500,000,000 | | $500,000,000 | | 4.05% | | May 2010 | | March 2013 |

Class A(2005-4) | | 6/13/05 | | $300,000,000 | | $300,000,000 | | One Month LIBOR + 0.00% | | September 2010 | | July 2013 |

Class A(2005-5) | | 7/8/05 | | $500,000,000 | | $500,000,000 | | One Month LIBOR + 0.025% | | June 2009 | | April 2012 |

Class A(2005-6) | | 7/28/05 | | $455,000,000 | | $455,000,000 | | Three Month LIBOR + 0.05% | | September 2012 | | July 2015 |

Class A(2005-7) | | 8/18/05 | | $500,000,000 | | $500,000,000 | | 4.70% | | August 2012 | | June 2015 |

Class A(2005-8) | | 8/26/05 | | $500,000,000 | | $500,000,000 | | 4.40% | | October 2008 | | August 2011 |

Class A(2005-9) | | 10/19/05 | | $325,000,000 | | $325,000,000 | | One Month LIBOR + 0.09% | | October 2015 | | August 2018 |

Class A(2005-10) | | 11/15/05 | | $500,000,000 | | $500,000,000 | | One Month LIBOR + 0.08% | | November 2012 | | September 2015 |

Class A(2005-11) | | 11/23/05 | | $500,000,000 | | $500,000,000 | | One Month LIBOR + 0.04% | | November 2010 | | September 2013 |

(continued on next page)

1 | | This amount does not include up to $3,000,000,000 (subject to increase) Nominal Liquidation Amount of Class A(2004-NOVA) notes, up to $1,500,000,000 (subject to increase) Nominal Liquidation Amount of Class A(2006-A) notes, up to $500,000,000 (subject to increase) Nominal Liquidation Amount of Class A(2006-B) notes, up to $1,250,000,000 (subject to increase) Nominal Liquidation Amount of Class A(2006-C) notes, up to $600,000,000 (subject to increase) Nominal Liquidation Amount of Class A(2006-D) notes or up to $500,000,000 (subject to increase) Nominal Liquidation Amount of Class A(2006-E) notes. |

2 | | This amount does not include up to $3,000,000,000 (subject to increase) Outstanding Dollar Principal Amount of Class A(2004-NOVA) notes, up to $1,500,000,000 (subject to increase) Outstanding Dollar Principal Amount of Class A(2006-A) notes, up to $500,000,000 (subject to increase) Outstanding Dollar Principal Amount of Class A(2006-B) notes, up to $1,250,000,000 (subject to increase) Outstanding Dollar Principal Amount of Class A(2006-C) notes, up to $600,000,000 (subject to increase) Outstanding Dollar Principal Amount of Class A(2006-D) notes or up to $500,000,000 (subject to increase) Outstanding Dollar Principal Amount of Class A(2006-E) notes. |

3 | | Of the $500,000,000 principal amount of the Class A(2004-4) notes, $400,000,000 was issued on 6/10/04 and $100,000,000 was issued on 11/23/04. |

A-II-1

(continued from previous page)

| | | | | | | | | | | | |

Class A

| | Issuance Date

| | Nominal Liquidation Amount

| | Outstanding

Dollar Principal

Amount

| | Note Interest Rate

| | Expected Principal

Payment Date

| | Legal Maturity Date

|

Class A(2006-1) | | 1/20/06 | | $500,000,000 | | $500,000,000 | | One Month LIBOR + 0.035% | | March 2013 | | January 2016 |

Class A(2006-2) | | 2/3/06 | | $500,000,000 | | $500,000,000 | | 4.85% | | January 2011 | | November 2013 |

Class A(2006-3) | | 3/1/06 | | $400,000,000 | | $400,000,000 | | 5.05% | | February 2016 | | December 2018 |

Class A(2006-4) | | 3/8/06 | | $1,000,000,000 | | $1,000,000,000 | | One Month LIBOR + 0.04% | | February 2011 | | December 2013 |

Class A(2006-5) | | 4/4/06 | | $500,000,000 | | $500,000,000 | | One Month LIBOR + 0.06% | | March 2013 | | January 2016 |

Class A(2006-6) | | 4/25/06 | | $500,000,000 | | $500,000,000 | | 5.30% | | April 2011 | | February 2014 |

Class A(2006-7) | | 5/17/06 | | $1,000,000,000 | | $1,000,000,000 | | One Month LIBOR + 0.03% | | May 2011 | | March 2014 |

Class A(2006-8) | | 6/30/06 | | $300,000,000 | | $300,000,000 | | One Month LIBOR + 0.03% | | June 2013 | | April 2016 |

Class A(2006-A) | | 7/7/06 | | Up to $1,500,000,0001 | | Up to $1,500,000,0001 | | Floating Rate | | — | | July 2009 |

Class A(2006-9) | | 7/31/06 | | $750,000,000 | | $750,000,000 | | One Month LIBOR + 0.015% | | July 2010 | | May 2013 |

Class A(2006-B) | | 8/9/06 | | Up to $500,000,0001 | | Up to $500,000,0001 | | Floating Rate | | — | | August 2009 |

Class A(2006-C) | | 8/3/06 | | Up to $1,250,000,0001 | | Up to $1,250,000,0001 | | Floating Rate | | — | | July 2009 |