QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12

|

Dover Downs Gaming & Entertainment, Inc. |

(Name of Registrant as Specified In Its Charter) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

DOVER DOWNS GAMING & ENTERTAINMENT, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD APRIL 28, 2004

DEAR STOCKHOLDER:

PLEASE TAKE NOTICE that the 2004 Annual Meeting of Stockholders of DOVER DOWNS GAMING & ENTERTAINMENT, INC., a Delaware corporation, will be held at the Dover Downs Hotel and Conference Center, 1131 N. DuPont Highway, Dover, Delaware, on Wednesday, April 28, 2004, at 11:45 A.M.:

At the meeting you will be asked to:

- 1.

- elect two Class II Directors to the Board of Directors;

- 2.

- approve the proposed 2002 Stock Incentive Plan, as Amended and Restated; and

- 3.

- consider and act upon such other business as may properly come before the Annual Meeting or any adjournment of the meeting.

| | | By order of the Board of Directors |

|

|

Klaus M. Belohoubek

Senior Vice President—General Counsel and Secretary

|

Dover, Delaware

March 29, 2004

Please complete, sign and date the proxy card as promptly as possible and return it in the

enclosed envelope.

PROXY STATEMENT

DOVER DOWNS GAMING & ENTERTAINMENT, INC.

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD APRIL 28, 2004

INFORMATION CONCERNING SOLICITATION AND VOTING

Your vote is very important. For this reason, our Board of Directors is requesting that you permit your stock to be represented at the 2004 Annual Meeting of Stockholders by the proxies named on the enclosed proxy card. This Proxy Statement contains important information for you to consider when deciding how to vote on the matters brought before the Annual Meeting. Please read it carefully.

References in this Proxy Statement to the "Company," "we," "us" and "our" shall mean DOVER DOWNS GAMING & ENTERTAINMENT, INC., a Delaware corporation, and its subsidiaries, as appropriate. This Proxy Statement is furnished in connection with the solicitation of proxies on behalf of our Board of Directors. Proxies solicited by this Proxy Statement are to be voted at the Annual Meeting or at any adjournment of the meeting.

The mailing address for our principal executive office is 1131 N. DuPont Highway, Route 13, Dover, Delaware 19901. This Proxy Statement and the form of proxy were first sent to our stockholders on or about March 29, 2004.

GENERAL INFORMATION ABOUT THE MEETING

Who may vote

You may vote your stock if our records show that you owned your shares as of the close of business on March 26, 2004. On that date, our outstanding capital stock consisted of 10,333,112 shares of Common Stock, par value $.10 per share (the "Common Stock"), and 16,145,059 shares of Class A Common Stock, par value $.10 per share (the "Class A Common Stock"). Shares of Class A Common Stock are convertible at any time into shares of Common Stock on a share-for-share basis at the option of the holder.

Voting Rights in General

If you hold Common Stock, you are entitled to one vote for each share of Common Stock held. If you hold Class A Common Stock, you are entitled to ten votes for each share of Class A Common Stock held, except to the extent that voting by class is required by law. At a meeting of stockholders at which a quorum is present, a majority of the votes cast decides all questions, unless the matter is one upon which a different vote is required by express provision of law or our Certificate of Incorporation or By-laws. Under the General Corporation Law of the State of Delaware, holders of Common Stock and Class A Common Stock are only entitled to vote as a class with respect to certain limited matters, such as certain amendments to our Certificate of Incorporation which would change the rights of only one class of stock.

1

Voting your proxy

Whether you hold shares in your name or through a broker, bank or other nominee, you may vote without attending the meeting. You may vote by granting a proxy or, for shares held through a broker, bank or other nominee, by submitting voting instructions to that nominee. Instructions for voting are on your proxy card. For shares held through a broker, bank or other nominee, follow the instructions on the voting instruction card included with your voting materials. If you provide specific voting instructions, your shares will be voted as you have instructed and as the proxy holders may determine within their discretion with respect to any other matters that properly come before the meeting.

If you hold shares in your name, and you sign and return a proxy card without giving specific voting instructions, your shares will be voted as recommended by our Board on all matters and as the proxy holders may determine in their discretion with respect to any other matters that properly come before the meeting. If you hold your shares through a broker, bank or other nominee and you do not provide instructions on how to vote, your broker or other nominee may have authority to vote your shares on certain matters. New York Stock Exchange ("NYSE") regulations prohibit brokers or other nominees that are NYSE member organizations from voting in favor of proposals relating to equity compensation plans unless they receive specific instructions from the beneficial owner of the shares to vote in that manner. NASD member brokers are also prohibited from voting on such proposals without specific instructions from beneficial holders. This means that all shares that you hold through a broker or other nominee who is a NASD or NYSE member organization will only be voted on Proposal Number 2 if you have provided specific voting instructions to your broker or other nominee to vote your shares on that proposal.

Vote Required

- •

- Proposal Number 1 – Election of Directors

The election of our Board nominees will require a plurality of the votes cast by the shares entitled to vote. This means that the nominees receiving the greatest number of votes will be elected. Accordingly, abstentions and broker non-votes will not affect the outcome of the election of directors. There is no class voting or cumulative voting with respect to the election of directors.

- •

- Proposal Number 2 – Approval of 2002 Stock Incentive Plan, as Amended and Restated

Approval of the proposed 2002 Stock Incentive Plan, as Amended and Restated will require the affirmative vote of a majority of the voting power present and entitled to vote. Abstentions and broker non-votes, if any, are not treated as votes cast for such purposes.

If you hold your shares in your own name and abstain from voting on this matter, your abstention will have no effect on the vote. If you hold your shares through a broker, bank or other nominee and you do not instruct them on how to vote on this proposal, your broker will not have authority to vote your shares if your broker is a NASD or NYSE member organization. If stockholder approval of the amendments to the 2002 Stock Incentive Plan is not obtained, then the plan shall continue in effect without amendment.

Our Chairman, Henry B. Tippie, owns or has the right, as executor of the Estate of John W. Rollins, Sr., to vote shares of Common Stock and Class A Common Stock that add up to more than fifty percent of the voting power of all of our outstanding capital stock. This means that his vote is all that is needed to approve both of these proposals. Mr. Tippie has indicated that he intends to vote all shares under his control in favor of both of these proposals.

2

Votes needed to hold the meeting ("Quorum")

The Annual Meeting will be held if a majority of our outstanding shares on the record date entitled to vote is represented at the meeting. This is called a quorum. Your shares will be counted for purposes of determining if there is a quorum, even if you wish to abstain from voting on some or all matters introduced at the meeting, if you:

- •

- are present and vote in person at the meeting; or

- •

- have properly submitted a proxy card or voted in such other manner as may be permitted by your proxy card.

Matters to be voted on at the meeting

The following proposals will be presented for your consideration at the meeting:

- •

- to elect two Class II Directors to the Board of Directors;

- •

- to approve the proposed 2002 Stock Incentive Plan, as Amended and Restated; and

- •

- to consider and act upon such other business as may properly come before the Annual Meeting or any adjournment of the meeting.

Cost of this proxy solicitation

We will pay the costs of the solicitation of proxies. We may reimburse brokerage firms and other persons representing beneficial owners of shares for expenses incurred in forwarding the voting materials to their customers who are beneficial owners and obtaining their voting instructions. In addition to soliciting proxies by mail, our Board members, officers and employees may solicit proxies on our behalf, without additional compensation, personally or by telephone, or we may ask our proxy solicitor to solicit proxies on our behalf for a nominal charge.

Voting in person at the meeting

You may vote shares held directly in your name in person at the meeting. If you want to vote shares that you hold in street name at the meeting, you must request a legal proxy from your broker, bank or other nominee that holds your shares.

Changing your vote

You may revoke your proxy and change your vote at any time before the final vote at the meeting. You may do this by signing a new proxy card with a later date, voting on a later date by such means as are permitted by your proxy card, or by attending the meeting and voting in person. However, your attendance at the meeting will not automatically revoke your proxy; you must specifically revoke your proxy.

Voting recommendations

Our Board recommends that you vote:

- •

- "FOR" each of the nominees to our Board of Directors; and

- •

- "FOR" approval of our 2002 Stock Incentive Plan, as Amended and Restated

Voting results

The preliminary voting results will be announced at the meeting. The final voting results will be tallied by our Transfer Agent and Inspector of Elections and published in our quarterly report on Form 10-Q for the fiscal quarter ended March 31, 2004.

3

STOCK OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The table below, based on information we have received, shows the number of shares of Common Stock and Class A Common Stock owned as of March 1, 2004 by:

- •

- each of our Directors or nominees for Director;

- •

- each of our Executives named in the Summary Compensation Table;

- •

- our Officers and Directors as a group; and

- •

- Stockholders owning five percent or more of our Common Stock or Class A Common Stock

| | Number of Shares

and Nature of Beneficial

Ownership by Class(1)

| | Percentage Beneficially

Owned by Class

| |

| |

|---|

| | Percentage of

Combined Voting

Power of Both

Classes

| |

|---|

Names and Addresses of

Beneficial Owners

| | Common Stock

| | Class A

Common Stock

| | Common Stock

| | Class A

Common Stock

| |

|---|

Estate of John W. Rollins

P.O. Box 26557

Austin, TX 78755 | | 200,000 | | 7,018,372 | (2) | 1.9 | % | 43.5 | % | 41.0 | % |

Henry B. Tippie

P.O. Box 26557

Austin, TX 78755 |

|

— |

|

2,000,000 |

(2)(3) |

— |

|

12.4 |

% |

11.6 |

% |

R. Randall Rollins

2170 Piedmont Road, NE

Atlanta, GA 30324 |

|

— |

|

1,421,000 |

|

— |

|

8.8 |

% |

8.3 |

% |

Gary W. Rollins

2170 Piedmont Road, NE

Atlanta, GA 30324 |

|

— |

|

1,421,000 |

|

— |

|

8.8 |

% |

8.3 |

% |

Eugene W. Weaver

1131 N. DuPont Highway

Dover, DE 19901 |

|

84,850 |

(4) |

800,000 |

(4) |

0.8 |

% |

5.0 |

% |

4.7 |

% |

Jeffrey W. Rollins

P.O. Box 10767

Wilmington, DE 19850 |

|

32,775 |

(5) |

827,782 |

|

0.3 |

% |

5.1 |

% |

4.8 |

% |

Melvin L. Joseph

RD 7, Box 218

Georgetown, DE 19947 |

|

14,000 |

|

602,000 |

|

0.1 |

% |

3.7 |

% |

3.5 |

% |

Denis McGlynn

1131 N. DuPont Highway

Dover, DE 19901 |

|

140 |

|

531,900 |

(6) |

— |

|

3.3 |

% |

3.1 |

% |

John W. Rollins, Jr.

P.O. Box 1239

Chadds Ford, PA 19317 |

|

135,030 |

(7) |

137,900 |

|

1.3 |

% |

0.9 |

% |

0.9 |

% |

Patrick J. Bagley

1131 N. DuPont Highway

Dover, DE 19901 |

|

700 |

|

— |

|

— |

|

— |

|

— |

|

| | | | | | | | | | | | |

4

Kenneth K. Chalmers

233 South Wacker Drive

Sears Tower, Suite 9650

Chicago, IL 60606 |

|

1,000 |

(8) |

— |

|

— |

|

— |

|

— |

|

Klaus M. Belohoubek

3505 Silverside Road

Plaza Centre Bldg., Suite 203

Wilmington, DE 19810 |

|

3,150 |

|

— |

|

— |

|

— |

|

— |

|

Edward J. Sutor

1131 N. DuPont Highway

Dover, DE 19901 |

|

3,150 |

|

— |

|

— |

|

— |

|

— |

|

Timothy R. Horne

1131 N. DuPont Highway

Dover, DE 19901 |

|

350 |

|

— |

|

— |

|

— |

|

— |

|

Royce & Associates, LLC

1414 Avenue of the Americas

New York, NY 10019 |

|

1,366,800 |

|

— |

|

13.2 |

% |

— |

|

0.8 |

% |

Merrill Lynch & Co., Inc.

250 Vesey Street

World Financial Center, North Tower

New York, NY 10381 |

|

854,214 |

|

— |

|

8.3 |

% |

— |

|

0.5 |

% |

Gabelli Asset Management, Inc.

One Corporate Center

Rye, NY 10580 |

|

850,300 |

|

— |

|

8.2 |

% |

— |

|

0.5 |

% |

Barclays Global Investors, N.A.

45 Fremont Street

San Francisco, CA 94105 |

|

736,525 |

|

— |

|

7.1 |

% |

— |

|

0.4 |

% |

Loomis Sayles & Co., L.P.

One Financial Center

Boston, MA 02111 |

|

579,165 |

|

— |

|

5.6 |

% |

— |

|

0.3 |

% |

All Directors and Officers as a Group (11 persons) |

|

190,295 |

|

5,520,582 |

|

1.8 |

% |

34.2 |

% |

32.2 |

% |

5

- (1)

- For our officers and directors, shares owned directly and of record are reflected in the table and other holdings are noted by footnote. Class A Common Stock is convertible, at any time, on a share-for-share basis into Common Stock at the option of the holder. As a result, pursuant to Rule 13d of the Securities Exchange Act of 1934, a stockholder is deemed to have beneficial ownership of the shares of Common Stock which the stockholder may acquire upon conversion of Class A Common Stock. In order to avoid overstatement, the amount of Common Stock beneficially owned does not take into account shares of Common Stock which may be acquired upon conversion of Class A Common Stock (an amount which is equal to the number of shares of Class A Common Stock held by a stockholder). The above numbers exclude the following shares of Common Stock subject to options granted under the Company's 2002 Stock Incentive Plan, as Amended and Restated, which the employee has the right to acquire beneficial ownership as specified in Rule 13d of the Securities Exchange Act of 1934: Denis McGlynn, 63,398 shares; Edward J. Sutor, 41,740 shares; Timothy R. Horne, 39,168 shares; Klaus M. Belohoubek, 27,585 shares; Patrick J. Bagley, 5,833 shares; and all directors and officers as a group, 177,724 shares.

- (2)

- Henry B. Tippie is the executor of the Estate of John W. Rollins, Sr. His individual holdings are listed separately from the holdings of the Estate.

- (3)

- Does not include 105,000 shares of Common Stock and 100,000 shares of Class A Common Stock held by his wife and 25,000 shares of Common Stock held as Co-Trustee, as to which Mr. Tippie disclaims any beneficial interest.

- (4)

- Does not include 17,000 shares of Common Stock and 60,000 shares of Class A Common Stock held by his wife and 17,220 shares of Common Stock held as Trustee, as to which Mr. Weaver disclaims any beneficial interest, and 420,000 shares of Class A Common Stock owned by a partnership over which Mr. Weaver has sole voting power, as to which Mr. Weaver disclaims beneficial interest in 76.14% of the partnership, and 25,400 shares of Common Stock owned by a limited liability corporation over which Mr. Weaver has sole voting and investment power.

- (5)

- Does not include 15,295 shares of Common Stock owned by a limited liability corporation over which Mr. Rollins has sole voting and investment power.

- (6)

- Does not include 36,400 shares of Class A Common Stock held by his wife, as to which Mr. McGlynn disclaims any beneficial interest.

- (7)

- Does not include 630 shares of Common Stock held by his wife.

- (8)

- Does not include 1,400 shares of Common Stock held by his wife, as to which Mr. Chalmers disclaims any beneficial interest.

6

PROPOSAL NUMBER 1

ELECTION OF DIRECTORS

Two of our Directors are standing for reelection at the Annual Meeting to serve as Class II Directors for a term of three years, and until the election and qualification of their successors. Our other six Directors are not standing for reelection because their terms as Directors extend past the Annual Meeting pursuant to provisions of our Certificate of Incorporation which provide for the election of Directors for staggered terms, with each Director serving a three-year term.

We have eight members and one vacancy on our Board of Directors. There is a position for a Class II Director which will remain vacant. Our Board believes that it is in our and your best interests to keep this vacancy on the Board so that the Board may, if the opportunity arises, appoint a candidate in the future without amending our Certificate of Incorporation. A majority of the members of our Board of Directors may appoint an individual to fill the vacancy.

Unless you WITHHOLD AUTHORITY, the proxy holders will vote FOR the election of each of the nominees named below to a three-year term as a Director. Although our Board of Directors does not contemplate the possibility, in the event a nominee is not a candidate or is unable to serve as director at the time of the election, unless you WITHHOLD AUTHORITY, the proxies will be voted for such nominee as is designated by our Board of Directors to fill the vacancy.

The name and age of each of our Directors and each of the nominees, his principal occupation, and the period during which he has served us as a Director are set forth below.

Names of Nominees

| | Principal Occupation(1)

| | Service as

Director

| | Age

|

|---|

| Class II (Term Expires 2007) | | | | |

| John W. Rollins, Jr. | | Former President, Chief Executive Officer and Director, Rollins Truck Leasing Corp. | | 2002 to date | | 61 |

Melvin L. Joseph |

|

Vice President and Director of Auto Racing, Dover International Speedway, Inc.; President, Melvin Joseph Construction Company |

|

2002 to date |

|

82 |

Names of Directors Whose

Terms Have Not Expired

|

|

|

|

|

|

|

Class III (Term Expires 2005) |

|

|

|

|

| Denis McGlynn | | President and Chief Executive Officer; President, Chief Executive Officer and Director, Dover Motorsports, Inc. | | 2002 to date | | 58 |

Jeffrey W. Rollins |

|

Principal, Context Ventures Inc., LLC |

|

2002 to date |

|

39 |

Kenneth K. Chalmers |

|

Former Executive Vice President, Bank of America |

|

2002 to date |

|

74 |

Class I (Term Expires 2006) |

|

|

|

|

| Henry B. Tippie | | Chairman of the Board; Chairman of the Board and Chief Executive Officer, Tippie Services, Inc.; Chairman of the Board, Dover Motorsports, Inc. | | 2002 to date | | 77 |

R. Randall Rollins |

|

Chairman of the Board, Rollins, Inc.; Chairman of the Board, RPC, Inc.; Chairman of the Board, Marine Products Corporation |

|

2002 to date |

|

72 |

Patrick J. Bagley |

|

Senior Vice President-Finance, Chief Financial Officer and Director, Dover Motorsports, Inc.; Former Vice President-Finance, Treasurer and Director, Rollins Truck Leasing Corp. |

|

2002 to date |

|

56 |

7

- (l)

- Except as noted, the nominees and other Directors have held one or more of the positions of responsibility set out in the above column (but not necessarily their present titles) for more than five years. In addition to the directorships listed in the above column, the following Directors also serve on the board of directors of the following companies: Henry B. Tippie, Rollins, Inc., RPC, Inc. and Marine Products Corporation; R. Randall Rollins, SunTrust Banks Inc., SunTrust Banks of Georgia and Dover Motorsports, Inc.; Kenneth K. Chalmers, John W. Rollins, Jr., Melvin L. Joseph and Jeffrey W. Rollins also serve on the Board of Dover Motorsports, Inc. Jeffrey W. Rollins co-founded Context Ventures Inc., LLC, a firm that provides management and financial services, in 2001. He is also on the Board of Delaware Sterling Bank and is President of Label Dynamics, Inc., a manufacturer of labels, decals and product identification graphics which was acquired by Context Ventures in 2002. From 1997 to 2001 he was Vice President-Development for Brandywine Center Management, L.L.C., a real estate management company. Dover Motorsports, Inc. is a promoter of motorsports events. We were spun-off from Dover Motorsports, Inc. on April 1, 2002. Dover International Speedway, Inc. is a wholly-owned subsidiary of Dover Motorsports, Inc. Rollins Truck Leasing Corp. was merged into a subsidiary of Penske Truck Leasing Co., L.P. in 2001 and was engaged in the business of truck leasing. Rollins, Inc. is a consumer services company engaged in residential and commercial termite and pest control. RPC, Inc. is engaged in oil and gas field services. Marine Products Corporation is engaged in boat manufacturing. SunTrust Banks Inc., SunTrust Banks of Georgia and Delaware Sterling Bank are all financial institutions. Tippie Services, Inc. provides management services. John W. Rollins, Jr. and Jeffrey W. Rollins are brothers. R. Randall Rollins is a cousin of John W. Rollins, Jr. and Jeffrey W. Rollins.

Our Board of Directors recommends a vote FOR the nominees listed.

PROPOSAL NUMBER 2

APPROVAL OF 2002 STOCK INCENTIVE PLAN, AS AMENDED AND RESTATED

Our Board of Directors recommends that you vote FOR the approval of our 2002 Stock Incentive Plan, as Amended and Restated (the "Plan"). The Plan was originally adopted by our Board of Directors in 2002. It was amended and restated by our Board on January 28, 2004, contingent upon your approval. An aggregate of 1,500,000 shares of Common Stock were originally reserved for issuance under the Plan and no change to this number is being made by our proposed amendment. No shares of Class A Common Stock may be issued under the Plan. The Plan originally provided for grants to our officers and key employees of stock options. The primary purpose of the amendment is to add to the Plan the flexibility to make awards to our officers and key employees that are valued in whole or in part by reference to our Common Stock, such as restricted stock awards. No changes are being made relative to option grants previously made under the Plan and the Plan's termination date is not being extended. The Plan will be administered by our Compensation and Stock Incentive Committee (the "Committee"). The Committee consists of non-employee Directors. The Plan will afford us latitude in tailoring incentive compensation to support our corporate and business objectives, and to anticipate and respond to a changing business environment and competitive compensation practices. The following is a description of the principal features of our Plan, a copy of which is attached as Exhibit A to this Proxy Statement.

8

General Provisions

The Committee will have exclusive discretion to select the employees and to determine the type, size and terms of each award, to determine when awards will be granted and paid, and to make all other determinations which it deems necessary or desirable in the interpretation and administration of the Plan. The Plan will terminate on January 14, 2012. With limited exceptions, including termination of employment as a result of death, options and other awards under the Plan are forfeited if an employee's employment or performance of services terminates following the grant of the award but prior to its exercise and/or vesting. Generally, an employee's rights and interest under the Plan will not be transferable except by will or by the laws of descent and distribution.

There is no maximum number of persons eligible to receive options and other awards under the Plan. It is currently estimated that the eligible group will be comprised of less than 35 persons.

Options, which include nonqualified stock options and incentive stock options, are rights to purchase a specified number of shares of our Common Stock at a price fixed by the Committee. The option price may not be less than the fair market value of the underlying shares of Common Stock at the time of grant. On March 1, 2004, the closing price of our Common Stock on the New York Stock Exchange was $10.99 per share. Options generally will expire not later than ten years after the date on which they are granted. Options will become exercisable at such times and in such installments as the Committee shall determine. Payment of the option price must be made in full at the time of exercise in such form (including, but not limited to, cash, unrestricted Common Stock held for at least twelve months, or any combination thereof) as the Committee may determine. In order to comply with certain federal tax restrictions, no employee may be granted an incentive stock option if after taking into account such option the aggregate fair market value of the stock with respect to which incentive stock options are exercisable for the first time by such employee during any given calendar year, under this and all other incentive stock option plans of the Company, would exceed $100,000.

A restricted stock award is an award of a given number of shares of our Common Stock which are subject to a restriction against transfer and/or to a risk of forfeiture during a period set by the Committee. During the restriction period, the employee may or may not have the right to vote and receive dividends on the shares.

The Plan is subject to amendment or termination by the Board of Directors without stockholder approval as deemed in our best interests. However, no such amendment may:

- •

- materially increase the benefits to employees under the Plan;

- •

- materially increase the number of shares which may be issued under the Plan;

- •

- materially modify the requirements as to eligibility for participation in the Plan; or

- •

- reduce the amount of any previously granted award or adversely change its terms and conditions, without the consent of the holder of such award.

In general, if there are any changes in our capitalization affecting the number or kind of outstanding shares of our Common Stock, whether by declaration of stock dividends, stock splits, reclassifications or recapitalizations, then the number and kind of shares then subject to options and awards shall be proportionately adjusted by the Committee to whatever extent the Committee determines that any such change equitably requires an adjustment.

In general, subject to the discretion of the Committee, if we are merged into or consolidated with another corporation under circumstances in which the Company is not the surviving corporation, or if the Company is liquidated, or sells or otherwise disposes of substantially all of its assets to another corporation while unexercised options are outstanding under the Plan, then adjustments will be made so that employees will be entitled, upon exercise of such option to receive such stock or other securities

9

as the holders of the same class of stock as those shares subject to the option would be entitled to receive in the transaction. Other awards under the Plan will receive such treatment in connection with these transactions as the Committee shall determine at or after the date of grant.

For information concerning options we awarded in our last fiscal year under the Plan, please refer to "Executive Compensation" beginning on page 18 of this Proxy Statement. The Plan was originally approved by our stockholders in 2002. The following table sets forth certain information relative to outstanding options and securities available for future issuance under the Plan as of December 31, 2003. The amendments being proposed to the Plan will not change any of these numbers.

2002 Stock Incentive Plan Information

Plan category

| | Number of securities to be issued upon exercise of outstanding options, warrants and rights

(a)

| | Weighted-average exercise price of outstanding options, warrants and rights

(b)

| | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))

(c)

|

|---|

| Equity Compensation Plan Approved by Security Holders | | 862,360 | | $10.02 | | 626,859 |

Certain Federal Tax Consequences under the Plan

The following discussion addresses certain anticipated federal income tax consequences to recipients of awards made under the Plan. It is based on the Internal Revenue Code and interpretations in effect on the date of this Proxy Statement.

A person granted a nonqualified stock option will not recognize income as a result of the grant of the option. However, upon exercise of the nonqualified stock option, the person will generally recognize ordinary compensation income equal to the excess, if any, of the fair market value of the shares at time of exercise over the exercise price. The person's tax basis for the shares will be equal to the exercise price paid by the person plus the amount includable in the person's gross income as compensation income, and the person's holding period for the shares will commence on the date on which the shares are acquired.

A person granted an incentive stock option which qualifies under Section 422 of the Code generally will not recognize income at the time of grant of the incentive stock option or at the time of its exercise. However, the excess of the fair market value of the shares of stock subject to the option over the exercise price of the option at the time of its exercise is an adjustment to taxable income in determining a person's alternative minimum taxable income. As a result, this adjustment could cause the person to be subject to alternative minimum tax or increase his or her alternative minimum tax liability.

If a person who has exercised an incentive stock option does not sell the shares until more than one year after exercise and more than two years after the date of grant, the person will normally recognize a capital gain or loss equal to the difference, if any, between the selling price of the shares and the exercise price. If the person sells the shares before the time periods expire (a "disqualifying disposition") he or she will recognize ordinary compensation income equal to the lesser of (i) the difference, if any, between the fair market value of the shares on the date of exercise and the exercise price of the option, or (ii) the difference, if any, between the selling price for the shares and the exercise price of the option. Any other gain or loss on such sale will normally be a capital gain or loss. The tax basis of the shares to the person, for purposes of computing such other gain or loss, should be

10

equal to the exercise price paid (plus, in the case of disqualifying disposition, the amount includable in the person's gross income as compensation, if any).

With respect to either nonqualified or incentive stock options, if a person delivers shares of our Common Stock in part or full payment of the option price, the person generally will be treated as having exchanged such shares for an equivalent number of the shares received upon exercise of the option (the "Exchange Shares"), and no gain or loss will be recognized with respect to the shares surrendered to the Company in payment of the option price. In such a case, the person will have a tax basis in the Exchange Shares which is the same as the person's tax basis in the shares of stock delivered in payment of the option price. The remaining shares received upon exercise of the option (other than the Exchange Shares) will, in the case of nonqualified options, have a tax basis equal to the income recognized on the exercise of the option plus any additional consideration paid pursuant to the exercise of the option, and in the case of incentive stock options, will have a tax basis equal to any additional consideration paid pursuant to the exercise of the option.

A person who receives stock pursuant to a restricted stock award should not recognize any taxable income upon the receipt of such award (unless such person makes an Internal Revenue Code Section 83(b) Election). The person will recognize taxable compensation income at the vesting date, or the date the person's interest in the stock is freely tradable. The amount of income is equal to the fair market value of the shares on that date. The tax basis of the shares to the person should be equal to the amount includable in the person's gross income as compensation, and the person's holding period for the shares should normally commence on the day following the date on which the value of such shares is includable in income. Dividends paid on shares prior to the lapse of the restrictions (if a Section 83(b) Election is not made) should be included in the income of the person as taxable compensation income when received.

Different tax rules will apply to a person who receives a restricted stock award if the person makes a Section 83(b) Election. In such an event the person will recognize the fair market value of the shares as taxable compensation income at the time of their receipt. Any gain recognized on a subsequent sale of the shares will be treated as a capital gain.

The Company will be entitled to a tax deduction corresponding in amount and time to the person's recognition of ordinary compensation income in the circumstances described above, provided, among other things, that such deduction is not limited by Section 162(m) of the Code, meets the test of reasonableness, is an ordinary and necessary business expense, and is not an "excess parachute payment" within the meaning of Section 280G of the Code and that the Company satisfies any applicable federal tax withholding requirements. In the case of an incentive stock option, the person will not recognize ordinary income, and the Company will not be entitled to a deduction, unless there is a disqualifying disposition.

Our Board of Directors recommends a vote FOR the approval of our 2002 Stock Incentive Plan,

as Amended and Restated.

11

BOARD OF DIRECTORS AND BOARD COMMITTEES

Our Board of Directors held four meetings during the year ended December 31, 2003. All meetings were attended by one hundred percent of the Board except for one meeting attended by all but one Board member. Board members are encouraged to attend our Annual Meeting of Stockholders and all Board members were in attendance at last year's meeting.

Audit Committee

Our Audit Committee consists of Kenneth K. Chalmers, Chairman, R. Randall Rollins and Jeffrey W. Rollins. The Audit Committee held five meetings during the year ended December 31, 2003. The Committee's functions are described under the caption "Report of the Audit Committee." Our Board has determined that each of our Audit Committee members is an "independent director" and that each member qualifies as an "audit committee financial expert" as those terms are defined by applicable New York Stock Exchange and Securities and Exchange Commission rules and regulations.

Executive Committee

Our Executive Committee consists of Henry B. Tippie, Chairman, and Denis McGlynn. The Executive Committee held four meetings during the year ended December 31, 2003. The Executive Committee has the power to exercise all of the powers and authority of our Board of Directors in the management of the business and affairs of the Company in accordance with the provisions of our By-laws.

Compensation and Stock Incentive Committee

Our Compensation and Stock Incentive Committee consists of Henry B. Tippie, Chairman, and R. Randall Rollins. The Compensation and Stock Incentive Committee held four meetings during the year ended December 31, 2003. The Committee establishes compensation and benefits for the Company's directors, officers and key employees and administers the Company's outstanding Stock Incentive Plan, including the granting of options and other awards to various employees of the Company and its subsidiaries.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee consists of Henry B. Tippie, Chairman, and R. Randall Rollins. The Committee was formed by resolution of the full Board of Directors in 2002 for the following purposes:

- •

- to recommend to our Board of Directors nominees for director and to consider any nominations properly made by a stockholder;

- •

- upon request of our Board of Directors, to review and report to the Board with regard to matters of corporate governance; and

- •

- to make recommendations to our Board of Directors regarding the agenda for our annual stockholder's meetings and with respect to appropriate action to be taken in response to any stockholder proposals.

We are not required by law or by NYSE rules to have a nominating committee since we are a "controlled corporation" as defined by NYSE Rule 303A. We are a "controlled corporation" because a single person, our Chairman of the Board, controls in excess of fifty percent of our voting power. We established the Nominating and Corporate Governance Committee to promote responsible corporate governance practices and we currently intend to maintain the Committee going forward.

12

Under Delaware law, there are no statutory criteria or qualifications for directors. The law does permit a corporation to prescribe reasonable qualifications in its by-laws or certificate of incorporation. Our By-laws require that at the time of nomination for a directorship, the nominee must own no less than 500 shares of our Common Stock. No other criteria or qualifications have been prescribed by us at this time. Our Nominating and Corporate Governance Committee does not have a formal charter or a formal policy with regard to the consideration of director candidates, however, it acts under the guidance of the Corporate Governance Guidelines approved by our Board and posted on our website (www.doverdowns.com) under the heading "Investor Relations." We believe that we should preserve maximum flexibility in order to select directors with sound judgment and other qualities which are desirable in corporate governance. According to our Corporate Governance Guidelines, we believe our Board of Directors should be responsible for selecting its own members. Our Board delegates the screening process involved to the Nominating and Corporate Governance Committee. This Committee is responsible for determining the appropriate skills and characteristics required of Board members in the context of the then current make-up of our Board. This determination should take into account all factors which the Committee considers appropriate, such as independence, experience, strength of character, mature judgment, technical skills, diversity, age and the extent to which the individual would fill a present need on the Board. Our By-laws provide that nominations for the election of directors may be made by any stockholder entitled to vote for the election of directors. Nominations must comply with an advance notice procedure which generally requires that written notice be received by our Secretary not less than ninety days prior to the anniversary of the prior year's annual meeting and set forth the name, age, business address and, if known, residence address of the nominee proposed in the notice, the principal occupation or employment of the nominee for the past five years and evidence that the nominee owns not less than 500 shares of our Common Stock. We have not received a recommendation for a director nominee from a stockholder. All of the nominees to be voted on at our Annual Meeting are existing directors standing for reelection.

Corporate Governance Guidelines

During fiscal 2004, the Board adopted Corporate Governance Guidelines. A copy of the Corporate Governance Guidelines may be found at our website (www.doverdowns.com) under the heading "Investor Relations." Included on our website is a process for interested parties, including stockholders, to send communications to our Board.

DIRECTORS' COMPENSATION

Directors who are not our employees are each paid an annual retainer for Board service of $12,000, an attendance fee of $1,000 for each Board of Directors or Committee meeting attended and are permitted to participate in the Company's health plans on the same basis as Company employees. In addition to the Board of Directors or Committee meeting attendance fees, the Chairman of the Board receives $3,000 per quarter and the Chairman of the Audit Committee receives $2,000 per quarter.

Notwithstanding anything to the contrary set forth in any of the Company's previous filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate future filings, including this Proxy Statement, in whole or in part, the following reports and the Performance Graph on page 17 shall not be incorporated by reference into any such filings.

13

REPORT OF THE AUDIT COMMITTEE

Our Audit Committee is established pursuant to our Bylaws and the revised Audit Committee Charter adopted by the Board of Directors on January 28, 2004, a copy of which is attached to this Proxy Statement as Exhibit B and is also available at our website (www.doverdowns.com) under the heading "Investor Relations."

Management is responsible for our internal controls and the financial reporting process. Our independent auditors are responsible for performing an independent audit of our consolidated financial statements in accordance with auditing standards generally accepted in the United States of America and for issuing a report. The Audit Committee's responsibility is generally to monitor and oversee these processes, as described in our Audit Committee Charter. It is not the duty of the Audit Committee to plan or conduct audits or to determine that our financial statements are complete and accurate and in accordance with accounting principles generally accepted in the United States of America; these are the responsibility of our independent public accountants and management, respectively.

Each member of our Audit Committee is independent in the judgment of the Company's Board of Directors and as required by the listing standards of the New York Stock Exchange.

In fulfilling its oversight responsibilities with respect to the year ended December 31, 2003, our Audit Committee:

- •

- Approved the terms of the engagement of KPMG LLP as our independent auditors for the year ended December 31, 2003;

- •

- Reviewed and discussed with our management and the independent auditors our audited consolidated financial statements as of December 31, 2003 and for the year then ended;

- •

- Discussed with the independent auditors the matters required to be discussed by American Institute of Certified Public Accountants Statement on Auditing Standards No. 61,Communication with Audit Committees, and the rules of the Securities and Exchange Commission; and

- •

- Received from the independent auditors written affirmation of their independence required by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees, and discussed with the auditors the firm's independence from the Company.

Based upon the review and discussions referred to above, the Committee recommended to our Board of Directors that our audited consolidated financial statements, as of December 31, 2003 and for the year then ended, be included in our Annual Report on Form 10-K for the year ended December 31, 2003 for filing with the Securities and Exchange Commission. In giving this recommendation to our Board of Directors, the Audit Committee has relied in part on:

- •

- management's representation that such consolidated financial statements have been prepared with integrity and objectivity and in conformity with accounting principles generally accepted in the United States of America; and

- •

- the report of our independent auditors with respect to such consolidated financial statements.

Audit Committee

Kenneth K. Chalmers, Chairman

R. Randall Rollins

Jeffrey W. Rollins

14

REPORT OF THE COMPENSATION AND STOCK INCENTIVE COMMITTEE OF THE

BOARD OF DIRECTORS ON EXECUTIVE COMPENSATION

During the fiscal year ending December 31, 2003, the members of our Compensation and Stock Incentive Committee held primary responsibility for determining executive compensation levels.

We are engaged in a highly competitive industry. As a consequence, we view our ability to attract and retain qualified executives as the cornerstone of our future success. In order to accomplish this objective, we have endeavored to structure our executive compensation in a fashion that takes into account our operating performance and the individual performance of the executive.

Of necessity, this analysis is subjective in nature and not based upon a structured formula. The factors referred to above are not weighted in an exact fashion.

Pursuant to the above compensation philosophy, the total annual compensation of our executive officers is made up of one or more of three elements. The three elements are salary, an annual incentive and, in some years, grants of stock options or other stock based awards.

The salary of each executive officer is determined by the Compensation and Stock Incentive Committee. In making its determinations the Committee gives consideration to our operating performance for the prior fiscal year and the individual executive's performance.

The annual incentive compensation package for our executive officers is developed by our Chief Executive Officer (CEO) prior to the end of each fiscal year and presented to the Committee for review, modification or approval. The package is based upon a performance formula for the ensuing fiscal year but its payment is within the discretion of the Chief Executive Officer based on each individual officer's performance.

Awards under the Company's 2002 Stock Incentive Plan, as Amended and Restated, are purely discretionary, are not based upon any specific formula and may or may not be granted in any given fiscal year. Grants are made under the Plan and the Plan is administered pursuant to Rule 16b-3 of the Securities Exchange Act of 1934. When considering the grant of stock options, the Committee gives consideration to our overall performance and the performance of individual employees.

We expect that, as in past years, the salary and other compensation paid to our executive officers will qualify for income tax deductibility under the limits of Section 162(m) of the Internal Revenue Code. However, it is possible that, where merited, the Committee may authorize compensation which may not, in a specific case, be fully deductible by the Company.

15

CEO COMPENSATION

The CEO's compensation is determined by the Compensation and Stock Incentive Committee. As is the case with respect to the executive officers, the CEO's compensation is based upon our operating performance and his individual performance. The CEO's compensation consists of the same three elements identified above with respect to executive officers: salary, an annual incentive, and, in some years, grants of stock options or other stock based awards. The determination of salary and the award of stock options, if any, are subjective and not based upon any specific formula or guidelines. The determination of an annual incentive depends on a favorable overall evaluation of the CEO's performance and is calculated as five percent of the year over year increase in the Company's pre-tax earnings less $125,000. The formula is revised annually. The CEO is not a member of the Committee and does not participate in the deliberations of the Committee when his salary or incentive is determined.

Compensation and Stock Incentive Committee

Henry B. Tippie, Chairman

R. Randall Rollins

COMPLIANCE WITH SECTION 16(a) OF THE SECURITIES EXCHANGE ACT

Section 16(a) of the Securities Exchange Act of 1934 requires our officers and directors and persons who own more than ten percent of a registered class of the Company's equity securities to file reports of ownership and changes in ownership with the Securities and Exchange Commission. Officers, directors and greater than ten percent stockholders are required to furnish the Company with copies of all Section 16(a) forms they file.

Based on our review of the copies of such forms, we believe that during fiscal year ended December 31, 2003, all filing requirements applicable to our officers, directors and greater than ten percent beneficial owners were complied with.

16

COMMON STOCK PERFORMANCE

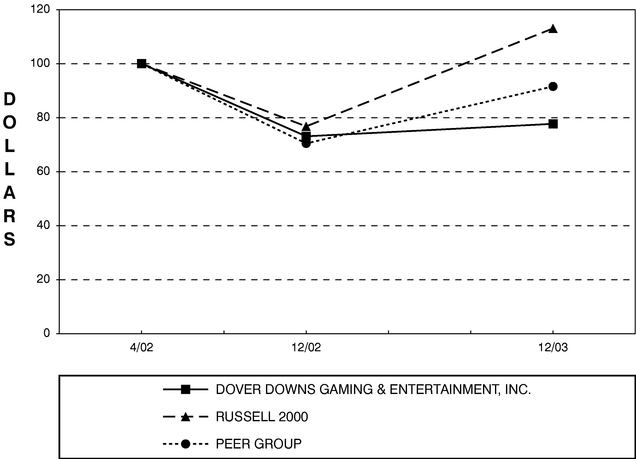

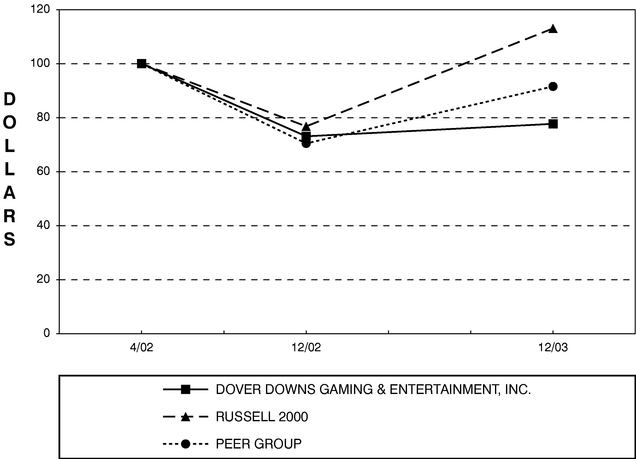

The graph below compares the cumulative total return of the following:

- •

- our Common Stock;

- •

- the Russell 2000 Index; and

- •

- an index of peer companies

The peer index we selected consists of the following companies engaged in the gaming business: the Company, MTR Gaming Group, Inc., Ameristar Casinos, Inc., Penn National Gaming, Inc., Churchill Downs, Inc., Argosy Gaming Company, Pinnacle Entertainment, Inc. and Magna Entertainment Corp. The graph assumes that the value of the investment in our Common Stock and each index was 100 at April 1, 2002 (the date of our spin-off from Dover Motorsports, Inc.) and all dividends were reinvested. The comparisons in this table are required by the Securities and Exchange Commission and, therefore, are not intended to forecast or be necessarily indicative of any future return on our Common Stock.

COMPARISON OF 21 MONTH CUMULATIVE TOTAL RETURN*

AMONG DOVER DOWNS GAMING & ENTERTAINMENT, INC., THE RUSSELL 2000 INDEX

AND A PEER GROUP

* $100 invested on 4/1/02 in stock or index—including reinvestment of dividends. Fiscal year ending December 31.

17

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The following non-employee directors serve on our Compensation and Stock Incentive Committee: Henry B. Tippie, Chairman and R. Randall Rollins.

EXECUTIVE COMPENSATION

Shown below is information concerning the annual compensation for the fiscal years ended December 31, 2003 and 2002 of those persons who were, at December 31, 2003:

- •

- our Chief Executive Officer; and

- •

- our three other most highly compensated executive officers whose total annual salary exceeded $100,000:

SUMMARY COMPENSATION TABLE

| |

| | Annual Compensation

| | Long-Term Compensation

| |

|

|---|

| |

| |

| |

| |

| | Awards

| | Payouts

| |

|

|---|

Name and Principal Position

| | Fiscal

Year

| | Salary(1)

$

| | Incentive

$

| | Other

Annual

Comp.(2)

$

| | Restricted

Stock

Awards(3)

$

| | Stock

Options/

SARs

#

| | LTIP

Payouts

$

| | All Other

Compensation

$

|

|---|

Denis McGlynn

President and Chief Executive Officer | | 12/03

12/02 | | $

| 200,000

200,000 | | | —

— | | —

— | | —

— | | 25,000

20,000 | | —

— | | —

— |

Edward J. Sutor

Executive Vice President |

|

12/03

12/02 |

|

$

|

190,000

190,000 |

|

$ |

—

5,730 |

|

—

— |

|

—

— |

|

20,000

18,000 |

|

—

— |

|

—

— |

Timothy R. Horne

Senior Vice President—Finance, Treasurer and Chief Financial Officer |

|

12/03

12/02 |

|

$

|

125,000

115,673 |

|

|

—

— |

|

—

— |

|

—

— |

|

20,000

12,000 |

|

—

— |

|

—

— |

Klaus M. Belohoubek

Senior Vice President-General Counsel and Secretary |

|

12/03

12/02 |

|

$

|

145,000

132,000 |

|

|

—

— |

|

—

— |

|

—

— |

|

15,000

15,000 |

|

—

— |

|

—

— |

- (1)

- The Company was formed in connection with the spin-off of the gaming business from Dover Motorsports, Inc. on April 1, 2002. Salaries noted are for the periods beginning January 1, 2002. Denis McGlynn and Klaus M. Belohoubek hold similar positions with Dover Motorsports, Inc. and are separately compensated by that entity.

- (2)

- The only type of Other Annual Compensation for each of the named officers was in the form of perquisites and was less than the level required for reporting.

- (3)

- No awards have ever been made.

18

OPTION AND STOCK APPRECIATION RIGHTS GRANTS IN LAST FISCAL YEAR

The following table sets forth stock options granted in the fiscal year ending December 31, 2003 to each of our executives named in the Summary Compensation Table. Employees of the Company and its subsidiaries are eligible for stock incentive grants based on individual performance. We have never issued any stock appreciation rights. The table also sets forth the hypothetical gains that would exist for options at the end of their eight-year terms, assuming compound rates of stock appreciation of 0%, 5% and 10%. The actual future value of the options will depend on the market value of our Common Stock.

| | Individual Grants(1)

| |

| |

| |

|

|---|

| |

| |

| |

| |

| | Potential Realizable Value

at Assumed Annual Rates of

Stock Price Appreciation for

Option Term($)(2)

|

|---|

| |

| | % of Total

Options

Granted To

Employees

in Fiscal Year

| |

| |

|

|---|

Name

| | Options

Granted

(#)

| | Exercise

Price

($/Sh)

| | Expiration

Date

|

|---|

| | 0%

| | 5%

| | 10%

|

|---|

| Denis McGlynn | | 25,000 | | 8.1 | % | $ | 9.51 | | 1/02/11 | | — | | $ | 113,515 | | $ | 271,888 |

| Edward J. Sutor | | 20,000 | | 6.5 | | | 9.51 | | 1/02/11 | | — | | | 90,812 | | | 217,511 |

| Timothy R. Horne | | 20,000 | | 6.5 | | | 9.51 | | 1/02/11 | | — | | | 90,812 | | | 217,511 |

| Klaus M. Belohoubek | | 15,000 | | 4.9 | | | 9.51 | | 1/02/11 | | — | | | 68,109 | | | 163,133 |

| All employees as a group | | 309,000 | | 100.0 | | | 9.51 | | 1/02/11 | | — | | | 1,405,099 | | | 3,365,456 |

| | | | | | | | and | | and | | | | | | | | |

| | | | | | | | 9.94 | | 7/09/11 | | | | | | | | |

- (1)

- Options were granted on January 3, 2003 and July 10, 2003. All option exercise prices are based on the market price on the grant date. All options relate to shares of our Common Stock, typically have an eight-year term and vest in equal one-sixth increments on the first through the sixth year anniversaries of the date of grant.

- (2)

- These amounts, based on assumed appreciation rates of 0% and the 5% and 10% prescribed by the Securities and Exchange Commission rules, are not intended to forecast possible future appreciation, if any, of our stock price. These numbers do not take into account certain provisions providing for termination of the option following termination of employment, nontransferability or phased-in vesting.

AGGREGATED OPTION/SAR EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR-END OPTION/SAR VALUES

The following table summarizes option exercises for the fiscal year ending December 31, 2003 by our executives named in the Summary Compensation Table and the value of the options held by them as of December 31, 2003. We have never granted and we do not have any Stock Appreciation Rights outstanding.

Name

| | Shares Acquired

on Exercise (#)

| | Value

Realized ($)

| | Number of Unexercised

Options at FY-End (#)

Exercisable/Unexercisable

| | Value of Unexercised

In-the-Money Options

at FY-End ($)(1)

Exercisable/Unexercisable

|

|---|

| Denis McGlynn | | — | | — | | 53,517 / 77,953 | | $120,958 / $11,760 |

| Edward J. Sutor | | — | | — | | 38,407 / 62,603 | | 2,881 / 6,192 |

| Timothy R. Horne | | — | | — | | 34,668 / 39,332 | | 52,080 / 3,360 |

| Klaus M. Belohoubek | | — | | — | | 22,515 / 51,585 | | 2,243 / 6,367 |

- (1)

- The value of our Common Stock on December 31, 2003 was $9.46 per share.

19

LONG-TERM INCENTIVE PLAN AWARDS IN LAST FISCAL YEAR

There were no Long-Term Incentive Plan Awards to our executives named in the Summary Compensation Table, during the fiscal year ended December 31, 2003.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

In conjunction with our spin-off from Dover Motorsports, Inc. ("DVD") on April 1, 2002, we entered into various agreements with DVD that address the allocation of assets and liabilities between the companies and that define the companies' relationship after the separation. These include the Real Property Agreement, the Transition Support Services Agreement, and the Tax Sharing Agreement. Patrick J. Bagley, Kenneth K. Chalmers, Melvin L. Joseph, Denis McGlynn, Jeffrey W. Rollins, John W. Rollins, Jr., R. Randall Rollins and Henry B. Tippie are all Directors of both companies. Denis McGlynn and Klaus M. Belohoubek are executive officers of both companies.

The Real Property Agreement governs certain leases and easements affecting our Dover, Delaware facility. The Transition Support Services Agreement provides for each of the Company and DVD to provide each other with certain administrative and operational services and may be terminated by the party receiving the service or by the party providing the service at any time. The Tax Sharing Agreement provides for the treatment of income tax matters for periods beginning before and including the date of the spin-off and any taxes resulting from transactions effected in connection with the spin-off.

During the year ended December 31, 2003 we allocated corporate costs of $1,969,000 to DVD for certain administrative and operational services, including use of office space. The allocation was based on both an allocation to the business that directly incurred the costs and an analysis of each company's share of the costs. In connection with DVD's 2003 NASCAR event weekends, we provided certain catering services for which DVD was invoiced $443,000. DVD invoiced us $206,000 for tickets purchased to the 2003 events and other event related items. The net costs incurred by each company for these services are not necessarily indicative of the costs that would have been incurred if the companies had been independent entities and/or had otherwise independently managed these functions; however, management believes that these allocations are reasonable.

For the year ended December 31, 2003, DVD reported a net operating loss for federal income tax purposes. The loss was carried back to 2001, a period prior to the spin-off, which generated an alternative minimum tax credit carryforward, a portion of which is required to be paid to DVD under the Tax Sharing Agreement. Therefore, during the fourth quarter of 2003 we recorded a $330,000 payable to DVD for our portion of the carryforward.

Our use of DVD's 5/8-mile harness racing track is under an easement granted to us by DVD which does not require the payment of any rent. Under the terms of the easement we have exclusive use of the harness track during the period beginning November 1 of each year and ending April 30 of the following year, together with set up and tear down rights for the two weeks before and after such period. The harness track is located on property owned by DVD and is on the inside of DVD's one-mile motorsports superspeedway. Our indoor grandstands are used by DVD at no charge in connection with DVD's motorsports events. DVD also leases their principal executive office space from us. Various easements and agreements relative to access, utilities and parking have also been entered into between DVD and us relative to our respective Dover, Delaware facilities.

20

BENEFIT PLANS

Pension Plans

Our Pension Plan is a non-contributory qualified defined benefit plan. All of our full time employees are eligible to participate in the Pension Plan. Up to September 30, 1989, retirement benefits were equal to the sum of from 1% to 1.8% of an employee's annual cash compensation for each year of service to age 65. Commencing October 1, 1989 and thereafter, retirement benefits are equal to the sum of 1.35% of earnings up to covered compensation, as that term is defined in the Plan, and 1.7% of earnings above covered compensation. Pensionable earnings includes regular salaries or wages, commissions, bonuses, overtime earnings and short-term disability income protection benefits.

Retirement benefits are not subject to any reduction for Social Security benefits or other offset amounts. An employee's benefits may be paid in certain alternative forms having actuarially equivalent values. Retirement benefits are fully vested after the completion of five years of credited service or, if earlier, upon reaching age 55. The maximum annual benefit under a qualified pension plan is currently $165,000 beginning at the Social Security retirement age (currently age 65).

The Company maintains a non-qualified, defined benefit plan, called the Excess Benefit Plan, which covers those participants of the Pension Plan whose benefits are limited by the Internal Revenue Code. A participant in the Excess Benefit Plan is entitled to a benefit equaling the difference between the amount of the benefit payable without limitation and the amount of the benefit payable under the Pension Plan.

Annual pension benefit projections for the executives whose salary is reported in the Summary Compensation Table assume:

- •

- that the participant remains in the service of the Company until age 65;

- •

- that the participant's earnings continue at the same rate as paid in the fiscal year ended December 31, 2003 during the remainder of his service until age 65; and

- •

- that the Plans continue without substantial modification.

The estimated annual benefit at retirement for each of these executives is: Denis McGlynn, $30,100; Edward J. Sutor, $48,200; Timothy R. Horne, $53,500; and Klaus M. Belohoubek, $49,200.

401(k) Retirement Plan

We have a deferred compensation plan pursuant to section 401(k) of the Internal Revenue Code for all of our full time employees who have completed ninety (90) days of service. Covered employees may contribute up to 15% of their compensation for each calendar year. In addition, the Company contributes up to an additional 100% of the first $250 of compensation contributed by any covered employee to the plan. An employee's maximum annual contribution to the plan is $13,000. All contributions are funded currently.

21

AUDITORS

Our Board of Directors has not selected or recommended the name of an independent public accounting firm for approval or ratification by the stockholders. Our Board of Directors believes that it will be in our and your best interests if it is free to make such determination based upon all factors that are then relevant.

KPMG LLP served as our auditors for the fiscal year ended December 31, 2003. A representative of KPMG LLP will be present at the Annual Meeting and will have the opportunity to make a statement should the representative so desire. The representative also will be available to answer appropriate questions from stockholders.

During the fiscal year ended December 31, 2003, KPMG LLP's services rendered to us primarily consisted of auditing our consolidated financial statements and performing quarterly reviews.

AUDIT AND NON-AUDIT FEES

The following table sets forth fees for services KPMG LLP provided during fiscal years 2003 and 2002:

| | 2003

| | 2002

|

|---|

| Audit fees(1) | | $ | 132,275 | | $ | 98,500 |

| Audit-related fees(2) | | | 1,194 | | | 5,000 |

| Tax fees(3) | | | N/A | | | 22,500 |

| All other fees(4) | | | N/A | | | N/A |

| | |

| |

|

| | Total | | $ | 133,469 | | $ | 126,000 |

| | |

| |

|

- (1)

- Represents fees for professional services provided in connection with the audit of our annual financial statements and review of our quarterly financial statements and audit services provided in connection with regulatory filings.

- (2)

- Represents fees for services in connection with audits of the Company's benefit plans.

- (3)

- Represents fees for services provided in connection with tax advice and tax planning.

- (4)

- Represents fees for services provided to the Company not otherwise included in the categories above.

The Audit Committee has determined that the provision of non-audit services by KPMG LLP is compatible with maintaining KPMG LLP's independence. In accordance with its charter, the Audit Committee approves in advance all audit and non-audit services to be provided by KPMG LLP. In other cases, the Chairman of the Audit Committee has the delegated authority from the Committee to pre-approve certain additional services, and such pre-approvals are communicated to the full Committee at its next meeting. During the fiscal years ended December 31, 2003 and 2002, all services were pre-approved by the Audit Committee in accordance with this policy.

STOCKHOLDER PROPOSALS

Appropriate proposals of eligible stockholders (an eligible stockholder must be a record or beneficial owner of at least l% or $2,000 in market value of securities entitled to be voted at the meeting and have held such securities for at least one year) intended to be presented at our next Annual Meeting of Stockholders must be received by us no later than November 27, 2004 for inclusion in the Proxy Statement and form of proxy relating to that meeting. Stockholders are also advised to review our By-laws, which contain additional advance notice requirements, including requirements with respect to advance notice of stockholder proposals and Director nominations.

22

MISCELLANEOUS

ON WRITTEN REQUEST OF ANY RECORD OR BENEFICIAL STOCKHOLDER, WE WILL PROVIDE, FREE OF CHARGE, A COPY OF OUR ANNUAL REPORT ON FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2003, WHICH INCLUDES THE CONSOLIDATED FINANCIAL STATEMENTS. REQUESTS FOR A COPY OF FORM 10-K SHOULD BE MADE IN WRITING AND ADDRESSED TO:

TIMOTHY R. HORNE

SENIOR VICE PRESIDENT—FINANCE, TREASURER AND CHIEF FINANCIAL OFFICER

DOVER DOWNS GAMING & ENTERTAINMENT, INC.

P. O. BOX 1412

DOVER, DE 19903

WE WILL CHARGE REASONABLE OUT-OF-POCKET EXPENSES FOR THE REPRODUCTION OF EXHIBITS TO FORM 10-K SHOULD A STOCKHOLDER REQUEST COPIES OF SUCH EXHIBITS.

Our Annual Report as of and for the year ended December 31, 2003 is being provided to you with this proxy statement.

Our Board of Directors knows of no business other than the matters set forth herein which will be presented at the meeting. Since matters not known at this time may come before the meeting, the enclosed proxy gives discretionary authority with respect to such matters as may properly come before the meeting and it is the intention of the persons named in the proxy to vote in accordance with their judgment on such matters.

Dover, Delaware

March 29, 2004

23

EXHIBIT A

DOVER DOWNS GAMING & ENTERTAINMENT, INC.

2002 Stock Incentive Plan, as Amended and Restated

WHEREAS, the Company originally adopted a 2002 Stock Option Plan and desires to amend and restate the Plan (which shall hereafter be renamed the 2002 Stock Incentive Plan);

WHEREAS, the purpose of amending and restating the Plan is to provide additional flexibility in the awarding of incentives to Plan Participants; and

WHEREAS, the Plan will, from the date of adoption of this amendment and restatement by the Board of Directors on January 28, 2004 (subject to shareholder approval of the Plan), allow for awards of stock of the Company and other awards that are valued in whole or in part by reference to such stock; and

WHEREAS, no change is being made by this amendment and restatement to (a) the number of shares of common stock originally reserved and available for distribution under the Plan, or (b) the original termination date of the Plan; and

WHEREAS, this amendment and restatement shall not adversely effect any Options previously granted under the Plan;

NOW THEREFORE, the Plan, as amended and restated, is set forth below.

1. Purpose. The 2002 Stock Incentive Plan (the "Plan") is intended to advance the best interests of Dover Downs Gaming & Entertainment, Inc. (the "Company") by providing its employees and the employees of its subsidiaries with additional incentive and by increasing their proprietary interest in the success of the Company and its subsidiary corporations.

2. Administration. The Plan shall be administered by the Compensation and Stock Incentive Committee of the Board of Directors of the Company (the "Committee"). The Committee shall consist of two or more non-employee Directors of the Company. Meetings shall be held at such time and place as shall be determined by the Committee. A majority of the members of the Committee shall constitute a quorum for the transaction of business, and the vote of a majority of those members present at any meeting shall decide any questions brought before that meeting. In addition, the Committee may take any action otherwise proper under the Plan by the unanimous written consent of its members. No member of the Committee shall be liable for any act or omission of any other member of the Committee or for any act or omission of such member, including, but not limited to, the exercise of any power or discretion under the Plan, except those resulting from gross negligence or willful misconduct. All questions of interpretation and application of the Plan, of incentives granted hereunder (the "Incentives"), or of the agreements pursuant to which the Incentives are granted (the "Award Agreements") shall be subject to the determination, which shall be final and binding, of a majority of the whole Committee. "Incentives" shall refer both to options granted under the Plan (the "Options") and to awards of Stock and other awards that are valued in whole or in part by reference to, or are otherwise based on, Stock ("Other Stock-Based Awards").

3. Option Shares. The stock referred to in the Plan shall be shares of the Company's Common Stock, $0.10 par value (the "Stock"). The total amount of the Stock reserved and available for distribution under the Plan shall not exceed in the aggregate 1,500,000 shares; provided, however, that the class and aggregate number of shares which may be subject to Incentives granted hereunder shall be subject to adjustment in accordance with the provisions of Section 17 hereof. Such shares may be treasury shares or authorized but unissued shares. If any shares of Stock that have been optioned hereunder cease to be subject to an Option, or if any such shares of Stock that are subject to any Other Stock-Based Award granted hereunder are forfeited or any such award otherwise terminates

24

without a payment being made to the participant in the form of Stock, such shares shall again be available for distribution in connection with future awards under this Plan.

4. Termination of Plan. The Plan shall terminate on January 14, 2012; provided, however, that the Board of Directors of the Company within its absolute discretion may terminate the Plan at any time. No such termination, other than as provided for in Section 17 hereof, shall in any way affect any Option then outstanding.

5. Authority to Grant Options. The Committee may grant from time to time to such eligible individuals (the "Participants") as it shall from time to time determine an Option, or Options, to buy a stated number of shares of Stock under the terms and conditions of the Plan. Subject only to any applicable limitations set forth in the Plan, the number of shares of Stock to be covered by any Option shall be as determined by the Committee. The Committee shall determine whether an Option shall be an "incentive stock option" qualified under Section 422 of the Internal Revenue Code of 1986 as amended (the "Code"), or a "non-qualified stock option" (that is, any Option which is not considered an incentive stock option). The aggregate Fair Market Value (determined as provided in Section 7 of the Plan) of the Stock with respect to which incentive stock options are granted hereunder which are exercisable for the first time by such employee during any calendar year (under all the stock option plans maintained by the Company and subsidiary corporations) shall not exceed $100,000 in accordance with Section 422 of the Code (or such greater or lesser dollar amount as may be in effect under the Code on the date of grant). No Option shall be granted under the Plan after ten (10) years from the date the Plan is adopted.

6. Eligibility. Participants shall be employees of the Company, or of any subsidiary corporation, as the Committee shall determine from time to time; provided, however, that no employee owning more than ten percent (10%) of the stock of the Company at the time an Incentive is granted shall be eligible to participate in the Plan. For all purposes of the Plan, the term "subsidiary corporation" shall mean any corporation of which the Company is the "parent corporation" as that term is defined in Section 424(e) of the Code. The aggregate number of shares of Stock subject to Incentives granted under this Plan during any calendar year to one Participant shall not exceed 150,000 (subject to adjustment as provided in Section 17).