Exhibit 99.1

| Management Presentation March 2006 TOUCHSTONE RESOURCES USA (Ticker: TSNU) |

| Disclaimer This presentation material contains forward-looking statements within the meaning of Section 27a of the Securities Act of 1933, as amended, and Section 21e of the Securities Exchange Act of 1934, as amended. The opinions, forecasts, projections or other statements, other than statements of historical fact, are forward-looking statements. Although the company believes that the expectations reflected in such forward-looking statements are reasonable, they do involve a number of risks and uncertainties. Among the important factors that could cause actual results to differ materially from those indicated by such forward-looking statements are delays and difficulties in developing currently owned properties, the failure of exploratory drilling to result in commercial wells, delays due to the limited availability of drilling equipment and personnel, fluctuations in oil and gas prices, general economic conditions and the risk factors detailed from time to time in the Company's periodic reports and registration statements filed with the Securities and Exchange Commission. |

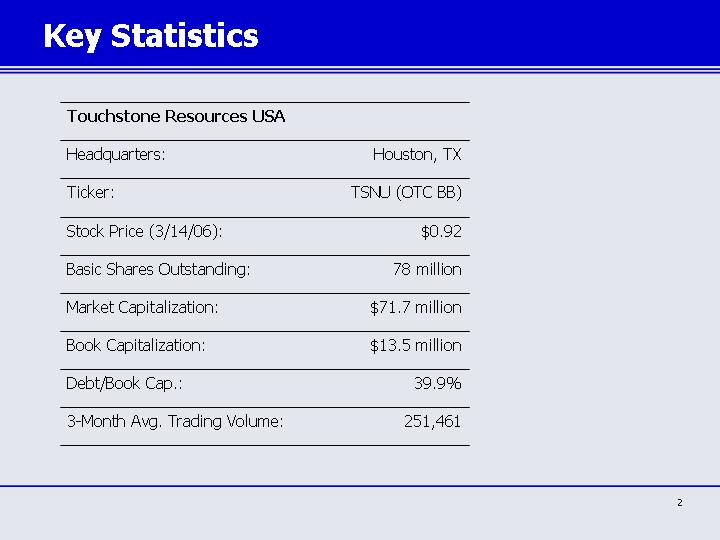

| Key Statistics Touchstone Resources USA Touchstone Resources USA Headquarters: Houston, TX Ticker: TSNU (OTC BB) Stock Price (3/14/06): $0.92 Basic Shares Outstanding: 78 million Market Capitalization: $71.7 million Book Capitalization: $13.5 million Debt/Book Cap.: 39.9% 3-Month Avg. Trading Volume: 251,461 |

| Touchstone Transition Limited operating staff Geographically diverse prospects Non-operated interests High quality management team beginning with CEO Roger Abel (hired 8/2005) CFO Steve Haynes hired to oversee financial controls, reporting and capital markets COO Patrick Oenbring hired to establish operational capabilities and conduct effective operations VP - Land and Business Development Jerry Walrath was hired. He is responsible for revising property ownership structure, land administration, and new business structure. Two highly respected independent directors added (4Q'05) Two high-potential long-lived development projects with drilling in progress on both Significant proven reserve base of low-risk, long-lived development projects Strong cash flows to support development activities High quality operator with a diversified portfolio of opportunities Reliance upon prudent amount of debt to minimize dilution Yesterday Today Tomorrow |

| Management Team Roger Abel, Chairman & CEO 35 years of oil and gas experience Former President & COO of Occidental Oil & Gas Former Chairman of Conoco E&P, Europe; responsible for all of upstream activities in Europe and Russia Awarded Bronze Star Medal for service in Vietnam Stephen C. Haynes, Chief Financial Officer 20+ years experience in petroleum and related industries Recently served as Controller for Carrizo Oil & Gas Former VP-Finance for Atlantic LNG, a JV of British Gas and several industry partners Patrick R. Oenbring, Chief Operating Officer 30+ years oil and gas experience including 22 years at Conoco and 6 years at Occidental Former positions include President and General Manager of Occidental Petroleum of Qatar and U.S. President and General Manager, Occidental Permian B.S. in Chemical Engineering from University of Kansas; registered Professional Engineer Jerry Walrath, Vice President - Land and Business Development 8+ years as a solo legal practitioner serving the oil and gas exploration industry J.D. from University of Houston Law Center, licensed to practice law in Texas |

| Board of Directors R. Gerald Bennett, Director Former President, CEO and Chairman of Total Safety Inc., a safety service provider in the Energy industry Former Senior Vice President of Equitable Resources and President & CEO of its ERI Supply Logistics Served as Director of El Paso Corporation Robert E. Irelan, Director 37 years of oil and gas experience Former Executive Vice President of Worldwide Operations of Occidental Oil and Gas Held a variety of managerial positions for Conoco's domestic and international operations |

| Management Platform Public Entity Management weighed options with private equity firms but chose public vehicle to maximize value: Provides liquidity for investors Ability to use stock as currency for future acquisitions Benefit of full public valuation metrics as company grows Ability to attract and retain quality management and directors Corporate Profile Organize strong management team with long, successful track record Set standard of excellence for Company's controls and reporting Operational Profile Focus primarily on unconventional onshore, long-lived projects with potential for multiple producing horizons Utilize cost-effective development and completion techniques Leverage 3-D seismic and other technology to mitigate drilling risk Constantly evaluate portfolio to assess reward vs. risk |

| Legacy Assets & Zapata Legacy Assets Overview Interests in 15 oil and gas projects with ~536,000 gross acres in Texas, Louisiana, Mississippi and New Zealand Several wells currently on production in Starr, Hidalgo, and Zapata Counties in South Texas One well drilled and shut-in in coastal offshore Louisiana Harvesting or monetizing assets without significant future development potential and performing additional seismic acquisition on those with potential |

| SABINE UPLIFT LLANO UPLIFT Recent Focus on Gas Shales 4 active NFX rigs LOUISIANA ARKANSAS OKLAHOMA TEXAS BARNETT SHALE WOODFORD/CANEY SHALE FAYETTEVILLE SHALE OUACHITA MOUNTAINS ARBUCKLE MOUNTAINS FRONTAL BELT |

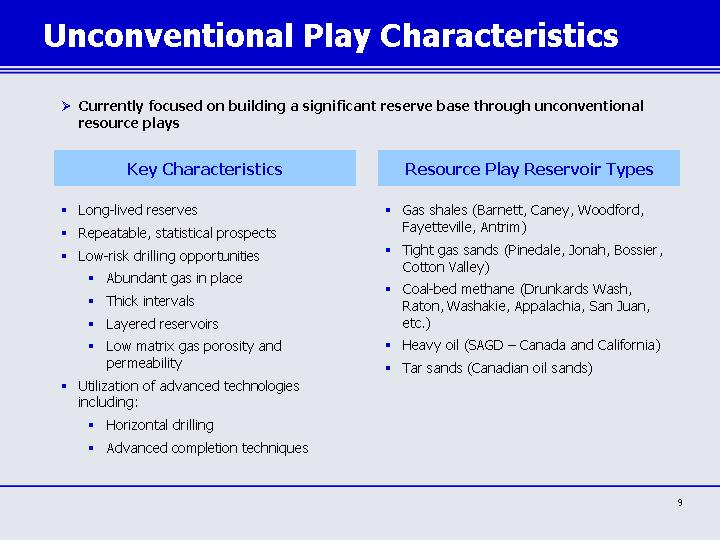

| Unconventional Play Characteristics Long-lived reserves Repeatable, statistical prospects Low-risk drilling opportunities Abundant gas in place Thick intervals Layered reservoirs Low matrix gas porosity and permeability Utilization of advanced technologies including: Horizontal drilling Advanced completion techniques Gas shales (Barnett, Caney, Woodford, Fayetteville, Antrim) Tight gas sands (Pinedale, Jonah, Bossier, Cotton Valley) Coal-bed methane (Drunkards Wash, Raton, Washakie, Appalachia, San Juan, etc.) Heavy oil (SAGD - Canada and California) Tar sands (Canadian oil sands) Key Characteristics Resource Play Reservoir Types Currently focused on building a significant reserve base through unconventional resource plays |

| Caney/Woodford Shale Play Overview of the Caney / Woodford Shale Play Located in Pittsburg, Hughes, McIntosh and Coal Counties, Oklahoma Overlies Deeper Hunton and Simpson 100+ Wells Drilled Thru Woodford 100+ Producing Vertical WACCAWH Wells Shallow Cromwell, Wapanucka & Hartshorne Production Thick Shale Section (120' - 200') Gas Saturated - Within "Gas Window" Major Source Rock For Arkoma Basin Depth (6,000' - 12,000') High Total Organic Content (6-8%) Source: Newfield Exploration Company Presentation. |

| Woodford vs. Barnett Reservoir Property Woodford Shale Barnett Shale Depth (ft): 6,000 - 12,000 6,500 - 8,500 Thickness (ft): 120 - 200 200 - 300 Source: Newfield Exploration Company Presentation. Reserves and Production Woodford Shale Barnett Shale Resource Potential 30 - 100+ Bcf/section Range of Estimates Reserves per Well (Horizontal) Reserves per Well (Horizontal) Reserves per Well (Horizontal) Current Estimates (Bcfe/Well) 1.5 - 3.5 1.5 - 3.0 Horizontal Well Producibility Horizontal Well Producibility Horizontal Well Producibility Initial Production Rate (Mcf/d) 1000 - 3500 660 - 3600 Max 30 Day Avg. Rate (Mcf/d) 750 - 2500 500 - 3000 # of Horizontal Wells (To date) <10 >350 |

| Touchstone's Checotah Prospect |

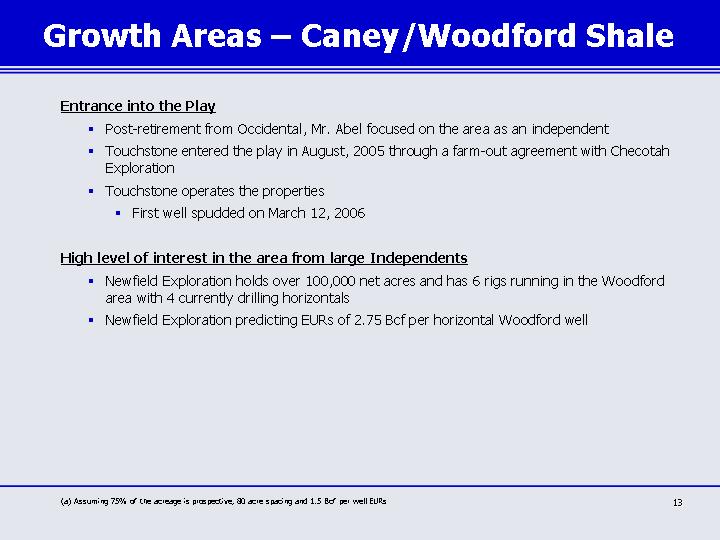

| Growth Areas - Caney/Woodford Shale Entrance into the Play Post-retirement from Occidental, Mr. Abel focused on the area as an independent Touchstone entered the play in August, 2005 through a farm-out agreement with Checotah Exploration Touchstone operates the properties First well spudded on March 12, 2006 High level of interest in the area from large Independents Newfield Exploration holds over 100,000 net acres and has 6 rigs running in the Woodford area with 4 currently drilling horizontals Newfield Exploration predicting EURs of 2.75 Bcf per horizontal Woodford well (a) Assuming 75% of the acreage is prospective, 80 acre spacing and 1.5 Bcf per well EURs |

| Touchstone's Checotah Prospect Multiple Stacked Pay Opportunities in McIntosh County, Oklahoma Large contiguous acreage position in McIntosh County Touchstone earns a 50% operated interest in JV's 10,600 mineral acres for 5,300 acres net to TSNU Heart of the Caney shale play Excellent opportunity in the Woodford formation as well Shallow inexpensive drilling program Opportunities to drill in excess of 250 development wells Prior Caney wells completed with IP's of 300 to 1,000 Mcf/d 22" Intrastate pipeline five miles from the corner of the block of leases and temporary outlets for minimal amounts of gas through low pressure lines in the area |

| Checotah - Economics Typical Gross Development Well Days to Drill 15 Days to Complete 5 Total Development Costs $1.0 million Finding & Dev. Costs/Mcf $1.00 Typical Gross Production Per Well Est. Ultimate Recovery (Bcf) 1.0 IP Rate (MMcf/d) 1.5 Decline Rate (1st year) 50% Development Project Economics Realized Price/Mcf $5.00 Operating Exp./Mcf $0.50 Potential No. Net Wells (a) 132 PV-10 Per Well $1.0 million N.R.I. 40% (a) Assumes separate Caney and Woodford wells per site on 40-acre spacing with 50% of acreage productive. |

| Arkansas - Fayetteville Shale |

| Fayetteville vs. Barnett Reservoir Property Fayetteville Shale Barnett Shale Depth (ft): 1,500 - 6,500 6,500 - 8,500 Gross Thickness (ft): 50 - 325 200 - 500 Net Thickness (ft): 20 - 300 150 - 300 TOC: 2.0 - 9.5% 4.5% Thermal Maturity (Ro): 1.5 - 4.0% 1.0 - 2.1% Total Porosity: 2.0 - 8.0% 4.0 - 5.0% Gas Content (SCF/Ton): 60 - 220 100 - 200 Absorbed Gas: 50 - 70% 20 - 40% Reservoir Pressure (psi): 600 - 2,000 3,400 - 4,400 Completed Well Cost ($ in thousands): $300 - 525 $550 - 850 Prod/Well/Day (Mcf): 150 - 750 100 - 1,000 EUR per well (MMcf): 550 - 1,500 1,000 - 2,500 Gas in Place (Bcf/Sq. Mile): 25 - 60 50 - 150 |

| Illustrative Fayetteville Reserves (a) Bank of America Equity Research Report dated 12/15/05. Note: Analogue to Southwestern based only on potential in the Fayetteville shale, excluding potential of the Chattanooga and Moorefield. |

| Growth Areas - Fayetteville Shale Entrance into the Play TSNU formed an AMI with Maverick Oil and Gas in September, 2005 to acquire acreage in the Fayetteville Shale The parties built a substantial acreage position through concentrated leasing efforts "Grass-roots" leasing strategy allowed Maverick and Touchstone to successfully compete against larger players including Chesapeake and Shell High level of interest in the area from large Independents Southwestern Energy holds over 850,000 net acres Chesapeake holds over 800,000 net acres and actively competed for TSNU's Woodruff County acreage Shell holds over 100,000 acres |

| Large Acreage Position in Fayetteville Shale Play Started leasing program in September, 2005 in Woodruff County TSNU has 45% W.I. in a 160,000 acres leased and committed position 72,000 net acres to TSNU Net acreage implies up to 2.7 Tcf of recoverable reserves to TSNU (a) Maverick Oil and Gas to operate Fayetteville shale thickness of 50 - 325 feet in this area Early leasing focused around 20" pipeline EUR estimates from 0.5 to 2.0 Bcf per well Drilling and completion costs estimated to be from $1.5 to 2.7 MM/well (horizontal wells) Arkansas - Fayetteville Shale Williamson Bros. #1-36H in Woodruff Cty. (a) Assumes 50% of the acreage is prospective, 1.5 Bcf per well EURs with separate wells in the Fayetteville and Moorefield per 40 acre spacing |

| Fayetteville - Target Well Profile Typical Gross Development Well Days to Drill 20 Days to Complete 5 Total Development Costs $1.5 million Finding & Dev. Costs/Mcf $1.00 Typical Gross Production Per Well Est. Ultimate Recovery (Bcf) 1.5 IP Rate (MMcf/d) 2.0 Decline Rate (1st year) 50% Development Project Economics Realized Price/Mcf $5.00 Operating Exp./Mcf $0.50 Potential No. Net Wells (a) 1,800 PV-10 Per Well $1.5 million N.R.I. 36.6% (a) Assumes separate Fayetteville and Moorefield wells per 40-acre spacing with 50% of acreage prospective. |

| Conventional Play Characteristics Onshore focused Long-lived reserves Low-risk drilling opportunities Reliance on use of 3-D seismic Complementary to past technical expertise Farm-in technical expertise and prospect evaluation Black Warrior Basin Gulf Coast onshore Permian Basin Mid-Continent Key Characteristics Conventional Play Areas Conventional activity to focus on onshore plays in which TSNU can leverage science and its own expertise |

| Current Capitalization (Dollars in Thousands) Sept. 30, 2005 Cash $4,756 Minority Interest 2,955 Convertible Debentures(a) 3,050 Notes Payable to 3rd Parties 2,366 Stockholder's Equity: Preferred Stock 1 Common Stock 66 Additional Paid-In Capital 32,609 Accumulated Deficit (27,501) Total Stockholder's Equity: $5,174 Total Capitalization $13,515 (a) 12% cash interest; $0.86 conversion price on $2.05 MM maturing on 3/24/06 and $1.00 conversion price on $1 MM maturing on 5/18/06. |

| Current Capitalization As of January 31, 2006 Shares Common stock issued and outstanding 78.0 million Convertible Notes and Warrants 31.6 million Options 5.4 million Fully diluted 115.0 million Common stock authorized 150.0 million Preferred stock authorized 5.0 million shares Preferred stock issued and outstanding 0.7 million shares |

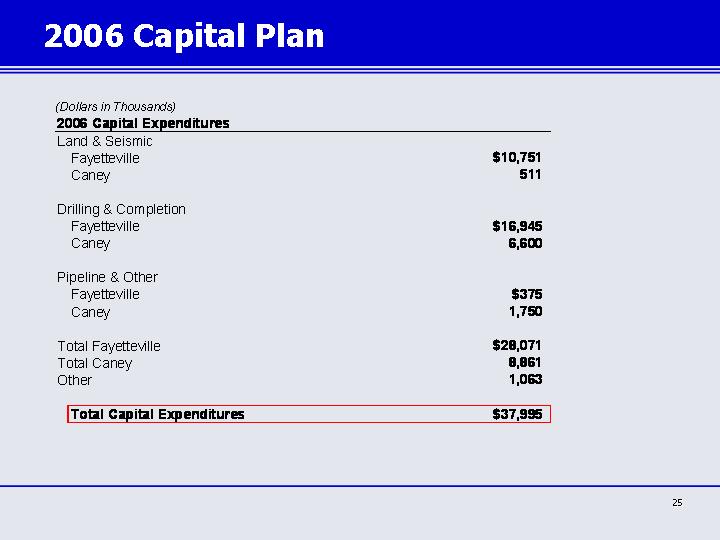

| 2006 Capital Plan (Dollars in Thousands) |

| Near-Term Priorities Near-Term Priorities Securing adequate funding for 2006 capital budget Evaluating science on first wells in Arkoma and Fayetteville plays Listing on the American Exchange Adding independent board members Integrating full management team and establishing new control systems |