Filed Pursuant to Rule 424(b)(5)

Registration No. 333-282730

This preliminary prospectus supplement and the accompanying base prospectus are part of an effective registration statement filed with the Securities and Exchange Commission under the Securities Act of 1933, as amended, and the information in this preliminary prospectus supplement is not complete and may be changed. This preliminary prospectus supplement and the accompanying base prospectus are not an offer to sell the securities described herein and are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION

PRELIMINARY PROSPECTUS SUPPLEMENT DATED FEBRUARY 7, 2025

PROSPECTUS SUPPLEMENT

(To Prospectus Dated December 20, 2024)

$200,000,000

Prairie Operating Co.

Common Stock

Prairie Operating Co. (the “Company,” “we,” “our” or “us”) is offering shares of our common stock, par value $0.01 per share (“Common Stock”) with an aggregate value of $200,000,000.

Our Common Stock is traded on the Nasdaq Capital Market (“NASDAQ”) under the symbol “PROP.” On February 6, 2025, the last reported sales price of our Common Stock on NASDAQ was $8.64 per share.

Investing in our Common Stock involves risks. See “Risk Factors” beginning on page S-14 of this prospectus supplement and on page 4 of the accompanying base prospectus, as well as the other risk factors that we incorporate by reference into this prospectus supplement and the accompanying base prospectus.

| | | | Per Share | | | | Total | |

| Public offering price | | $ | | | | $ | | |

| Underwriting discount(1) | | $ | | | | $ | | |

| Proceeds, before expenses, to us | | $ | | | | $ | | |

(1) Please read “Underwriting” in this prospectus supplement for a description of all underwriting compensation payable in connection with this offering.

We have granted the underwriters an option, exercisable not later than 30 days after the date of this prospectus supplement, to purchase up to an additional $30,000,000 aggregate value of shares of Common Stock from us on the same terms and conditions set forth above.

None of the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying base prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Delivery of the shares of Common Stock is expected to be made on or about , 2025.

Lead Book-Running Manager

Citigroup

Joint Book-Running Managers

| KeyBanc Capital Markets* | | MUFG* | | Piper Sandler* | | Truist Securities* |

(* presented solely in alphabetical order)

Co-Managers

| Fifth Third Securities | | Clear Street | | First Citizens Capital Securities |

| Johnson Rice & Company | | | | Pickering Energy Partners |

Prospectus Supplement dated , 2025

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

You should rely only on the information contained in or incorporated by reference into this prospectus supplement, the accompanying base prospectus and any free writing prospectus prepared by or on behalf of us relating to this offering of Common Stock. If the information about this offering of Common Stock varies between this prospectus supplement and the accompanying base prospectus, you should rely on the information in this prospectus supplement. We and the underwriters have not authorized anyone to provide you with additional or different information. If anyone provides you with additional, different or inconsistent information, you should not rely on it. We and the underwriters are not making an offer to sell Common Stock in any jurisdiction where an offer or sale is not permitted. The information contained in this prospectus supplement, the accompanying base prospectus or any free writing prospectus is only accurate and complete as of the dates shown in such documents, and any information we have incorporated by reference herein is only accurate and complete as of the date of the document incorporated by reference (or, with respect to particular information contained in such document, as of the date set forth within such document as the date as of which such particular information is provided), regardless of the time of delivery of this prospectus supplement or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since such dates.

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is part of a universal shelf registration statement on Form S-3 that we initially filed with the SEC on October 18, 2024, as amended on November 22, 2024 and December 10, 2024, and that was declared effective by the SEC on December 20, 2024. This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering of Common Stock, including the price, the number of shares of our Common Stock being offered and the risks of investing in this offering of our Common Stock. The second part is the accompanying base prospectus, which gives more general information about the securities we may offer in one or more offerings from time to time under our shelf registration statement, some of which may not apply to this offering of Common Stock. Generally, when we refer to the “prospectus,” we are referring to this prospectus supplement and the accompanying base prospectus combined, including the documents incorporated by reference herein and therein. This prospectus supplement, the accompanying base prospectus and the documents incorporated by reference herein and therein include important information about us, the Common Stock being offered and other information you should know before investing. See “Documents Incorporated by Reference.”

To the extent there is a conflict between the information contained in this prospectus supplement, on the one hand, and the information contained in the accompanying base prospectus or in any document incorporated by reference that was filed with the SEC before the date of this prospectus supplement, on the other hand, you should rely on the information in this prospectus supplement. If any statement in one of these documents is inconsistent with a statement in another document having a later date, the statement in the document having the later date modifies or supersedes the earlier statement.

This prospectus supplement and the accompanying base prospectus contain summaries of certain provisions contained in some of the documents described herein and therein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by reference to the actual documents. Copies of some of the documents referred to in this prospectus supplement and the accompanying base prospectus have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus supplement and the accompanying base prospectus is a part, and you may obtain copies of those documents as described below under the heading “Where You Can Find More Information.”

None of Prairie Operating Co., the underwriters or any of their respective representatives is making any representation to you regarding the legality of an investment in our Common Stock by you under applicable laws. You should consult your own legal, tax and business advisors regarding an investment in our Common Stock. Information in this prospectus supplement and the accompanying base prospectus is not legal, tax or business advice to any prospective investor.

Unless otherwise indicated, all references to “Prairie,” the “Company,” “we,” “us” and “our” mean Prairie Operating Co. and its consolidated subsidiaries. Capitalized terms used but not defined where used are defined under the section titled “Definitions of Certain Terms and Conventions Used Herein.”

Industry and Market Data

The market data and certain other statistical information included or incorporated by reference into this prospectus supplement are based on independent industry publications, government publications or other published independent sources. Although we believe these third-party sources are reliable as of their respective dates, neither we nor the underwriters have independently verified the accuracy or completeness of this information. Some data is also based on our good faith estimates. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described under the heading “Risk Factors” in this prospectus supplement, the accompanying base prospectus and our Annual Report on Form 10-K for the year ended December 31, 2023, as amended, which is incorporated by reference into this prospectus. These and other factors could cause results to differ materially from those expressed in any third-party publications.

Non-GAAP Financial Measures

We have included certain non-GAAP financial measures in this prospectus supplement, including Adjusted EBITDA, Leverage and PV-10, which are intended to supplement, not substitute for, comparable GAAP measures. Please see “Summary—Non-GAAP Financial Measures” for more information relating to such non-GAAP financial measures, including our definitions of such non-GAAP financial measures and reconciliations of such non-GAAP financial measures to the most directly comparable GAAP financial measures.

Definitions of Certain Terms and Conventions Used Herein

Unless the context indicates otherwise, the following terms have the following meanings when used in this prospectus:

“A&R LTIP” means the Amended and Restated Prairie Operating Co. Long Term Incentive Plan.

“Bayswater” means, collectively, Bayswater Resources, LLC, Bayswater Fund III-A, LLC, Bayswater Fund III-B, LLC, Bayswater Fund IV-A, LP, Bayswater Fund IV-B, LP, Bayswater Fund IV-Annex, LP and Bayswater Exploration & Production, LLC.

“Bayswater Acquisition” means the purchase of the Bayswater Assets by the Company pursuant to the Bayswater PSA.

“Bayswater Assets” means the Leases, Lands, Wells, Facilities and Equipment, Fee Mineral Interests, Disposal System and Surface Agreements (each as defined in the Bayswater PSA), in each case located in the DJ Basin, as well as appurtenant equipment, records, vehicles and other assets (including inventory hydrocarbons), that we will purchase from Bayswater pursuant to the Bayswater PSA, but excluding certain excluded assets specified therein.

“Bayswater PSA” means the Purchase and Sale Agreement, dated February 6, 2025 by and between the Company, Prairie Operating Co., LLC, Otter Holdings, LLC, Prairie SWD Co., LLC, Prairie Gathering I, LLC and Bayswater.

“Boe/d” means barrel of oil equivalent, using the ratio of six thousand cubic feet of natural gas to one barrel of crude oil or condensate, per day.

“Central Weld Assets” means the Oil and Gas Leases, Mineral Fee Interests, producing Wells and Units (each as defined in the NR Agreement), in each case located in the DJ Basin in Weld County, Colorado, as well as appurtenant records and equipment and other properties, the we purchased from Nickel Road pursuant to the NR Agreement.

“Convertible Promissory Note” means the means the convertible promissory note with an aggregate principal amount of $15.0 million that we entered into with Yorkville on September 30, 2024 in connection with the Pre-Paid Advance.

“DJ Basin” means the Denver-Julesburg Basin.

“Existing Credit Agreement” means the Credit Agreement, dated as of December 16, 2024, by and between the Company, as borrower, Citibank, N.A., as administrative agent, and the financial institutions party thereto.

“Exok” means Exok, Inc., an Oklahoma corporation.

“Exok Agreement” means the Amended and Restated Purchase and Sale Agreement, dated as of May 3, 2023, by and among the Company, Prairie LLC and Exok.

“Exok Option Purchase” means the optional purchase of oil and gas leases, including all of Exok’s right, title and interest in, to and under certain undeveloped oil and gas leases in Weld County, Colorado, together with certain other associated assets, data and records.

“Exok Transaction” means the purchase of oil and gas leases, including all of Exok’s right, title and interest in, to and under certain undeveloped oil and gas leases located in Weld County, Colorado, together with certain other associated assets, data and records from Exok for $3,000,000 by the Company pursuant to the Exok Agreement.

“Exok Warrants” means the warrants to purchase 670,499 shares of our Common Stock at an exercise price of $6.00 per share issued to the affiliates of Exok on August 14, 2023.

“Financing Transactions” collectively refers to (i) this offering and the use of estimated proceeds therefrom to fund a portion of the purchase price of the Bayswater Acquisition, and (ii) the entering into and borrowing of $315.0 million under the New Credit Agreement to fund a portion of the purchase price of the Bayswater Acquisition.

“Genesis Assets” means the Initial Genesis Assets and the Genesis Bolt-on Assets.

“Genesis Bolt-on Assets” means the oil and gas leases located in the DJ Basin in Weld County, Colorado, acquired from a private party effective as of January 31, 2024.

“gross acres” or “gross wells” means the total acres or wells in which the Company owns a working interest.

“Initial Genesis Assets” means the oil and gas leases located in the DJ Basin in Weld County, Colorado, acquired in connection with the Exok Transaction and the Exok Option Purchase.

“Legacy Warrants” means the pre-existing warrants to purchase shares of our Common Stock remaining after the consummation of the merger of Creek Road Merger Sub, LLC with and into Prairie LLC.

“Mboe” means one thousand barrels of oil equivalent.

“Merger Options” means the options to acquire an aggregate of 8,000,000 shares of Common Stock for an exercise price of $0.25 per share, which are exercisable only if certain production hurdles are achieved, resulting from the conversion of certain non-compensatory options to purchase membership interests in Prairie LLC in connection with the merger of Creek Road Merger Sub with and into Prairie LLC.

“net acres” or “net wells” means the sum of the fractional working interests the Company owns in gross acres or gross wells.

“New Credit Agreement” means the Amended and Restated Credit Agreement that we expect to enter into in connection with the Bayswater Acquisition, which, among other things, would amend or amend and restate our Existing Credit Agreement and provide us with borrowing availability of up to $475.0 million as of the closing of the Bayswater Acquisition.

“NGLs” means natural gas liquids.

“Nickel Road” means NRD and NRO.

“NR Acquisition” means the purchase of the Central Weld Assets by the Company, pursuant to the NR Agreement.

“NR Agreement” means the Asset Purchase Agreement, dated January 11, 2024, by and among the Company, Prairie LLC, and Nickel Road, as amended.

“NRD” means Nickel Road Development LLC, a Delaware limited liability company.

“NRO” means Nickel Road Operating LLC, a Delaware limited liability company.

“Prairie LLC” means Prairie Operating Co., LLC, a Delaware limited liability company.

“Pre-Paid Advance” means the $15.0 million pre-paid advance to the Company under the SEPA pursuant to the Convertible Promissory Note.

“proved reserves” means those quantities of oil, natural gas and NGLs that, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible-from a given date forward, from known reservoirs, and under existing economic conditions, operating methods and government regulations prior to the time at which contracts providing the right to operate expire, unless evidence indicates that renewal is reasonably certain, regardless of whether deterministic or probabilistic methods are used for the estimation. The project to extract the hydrocarbons must have commenced or we must be reasonably certain that it will commence the project within a reasonable time. For a complete definition of proved crude oil and natural gas reserves, refer to the SEC’s Regulation S-X, Rule 4-10(a)(22).

“proved undeveloped reserves,” “PUD” or “PUD reserves” means proved reserves that are expected to be recovered from new wells on undrilled acreage or from existing wells where a relatively major expenditure is required for recompletion. Undrilled locations can be classified as having proved undeveloped reserves only if a development plan has been adopted indicating that such locations are scheduled to be drilled within five years, unless specific circumstances justify a longer time.

“reserves” means estimated remaining quantities of crude oil and natural gas and related substances anticipated to be economically producible, as of a given date, by application of development projects to known accumulations. In addition, there must exist, or there must be a reasonable expectation that there will exist, the legal right to produce or a revenue interest in the production, installed means of delivering crude oil and natural gas or related substances to market and all permits and financing required to implement the project. Reserves should not be assigned to adjacent reservoirs isolated by major, potentially sealing, faults until those reservoirs are penetrated and evaluated as economically producible. Reserves should not be assigned to areas that are clearly separated from a known accumulation by a non-productive reservoir (i.e., absence of reservoir, structurally low reservoir or negative test results). Such areas may contain prospective resources (i.e., potentially recoverable resources from undiscovered accumulations).

“SEPA” means the Standby Equity Purchase Agreement we entered into with Yorkville on September 30, 2024 pursuant to which we have the right, but not the obligation, to sell to Yorkville up to $40.0 million of our Common Stock at prevailing market prices at the time of such sales, subject to certain conditions.

“Series D A Warrants” means the Series A warrants to purchase 3,475,250 shares of our Common Stock at an exercise price of $6.00 per share issued to the Series D PIPE Investors in the Series D PIPE on May 3, 2023.

“Series D B Warrants” means the Series B warrants to purchase 3,475,250 shares of our Common Stock at an exercise price of $6.00 per share issued to the Series D PIPE Investors in the Series D PIPE on May 3, 2023.

“Series D PIPE” means the sale of an aggregate of approximately $17.38 million of Series D Preferred Stock and Series D PIPE Warrants in a private placement pursuant to the Series D Securities Purchase Agreements in connection with the merger of Creek Road Merger Sub, LLC with and into Prairie LLC.

“Series D PIPE Investors” means the investors in the Series D PIPE.

“Series D PIPE Warrants” means, collectively, the Series D A Warrants and the Series D B Warrants.

“Series D Preferred Stock” means the 17,376 shares of Series D Preferred Stock, par value $0.01 per share, with a conversion price of $5.00 per share, subject to certain adjustments, issued to the Series D PIPE Investors in the Series D PIPE on May 3, 2023.

“Series D Securities Purchase Agreements” means the Securities Purchase Agreements, dated May 3, 2023, by and between the Company and each of the Series D PIPE Investors.

“Series E A Warrants” means the Series A warrants to purchase 4,000,000 shares of our Common Stock at an exercise price of $6.00 per share issued to the Series E PIPE Investors in the Series E PIPE on August 14, 2023.

“Series E B Warrants” means the Series B warrants to purchase 4,000,000 shares of our Common Stock at an exercise price of $6.00 per share issued to the Series E PIPE Investor in the Series E PIPE on August 14, 2023.

“Series E PIPE” means the sale of an aggregate of approximately $20.0 million of Series E Preferred Stock and Series E PIPE Warrants in a private placement pursuant to the Securities Purchase Agreement, dated as of August 15, 2023, by and between the Company and the Series E PIPE Investor.

“Series E PIPE Investor” means Narrogal Nominees PTY LTD ATF Gregory K O’Neill Family Trust, as the sole investor in the Series E PIPE.

“Series E PIPE Warrants” means, collectively, the Series E A Warrants and the Series E B Warrants.

“Series E Preferred Stock” means the 20,000 shares of Series E Preferred Stock, par value $0.01 per share, with a conversion price of $5.00 per share, subject to certain adjustments, issued to the Series E PIPE Investor in the Series E PIPE on August 14, 2023.

“Subordinated Noteholder Warrants” means the warrants to purchase 1,141,552 shares of our Common Stock at an exercise price of $8.89 per share issued to the holders of the Subordinated Promissory Note on September 30, 2024.

“Subordinated Promissory Note” means the subordinated promissory note with an aggregate principal amount of $5.0 million that we entered into on September 30, 2024 in connection with the Subordinated Noteholder Warrants.

“undeveloped acres” or “undeveloped acreage” means lease acreage on which wells have not been drilled or completed to a point that would permit the production of commercial quantities of oil and gas regardless of whether such acreage contains proved reserves.

“Yorkville” means YA II PN, LTD, a Cayman Islands exempt limited company.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference herein contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements, other than statements of historical fact, included in this prospectus and the documents incorporated by reference herein, regarding our strategy, future operations, financial position, estimated reserves, revenues and income or losses, projected costs and capital expenditures, prospects, acquisition opportunities, plans and objectives of management are forward-looking statements. When used in this prospectus and the documents incorporated by reference herein, the words “plan,” “endeavor,” “will,” “would,” “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” “forecast” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are (or were when made) based on current expectations and assumptions about future events and are (or were when made) based on currently available information as to the outcome and timing of future events. Forward-looking statements in this prospectus and in any document incorporated by reference in this prospectus may include, for example, statements about:

| ● | our ability to successfully finance and consummate the Bayswater Acquisition, including the risk that we may fail to complete the Bayswater Acquisition on the terms and timing currently contemplated or at all, fail to enter into the New Credit Agreement on expected terms and/or fail to realize the expected benefits of the Bayswater Acquisition; |

| ● | our financial performance following the Bayswater Acquisition, the NR Acquisition and the other transactions described in or incorporated by reference into this prospectus supplement; |

| ● | this offering, the timing thereof and the use of proceeds therefrom; |

| ● | estimates of reserves of our oil, natural gas and NGLs; |

| ● | drilling prospects, inventories, projects and programs; |

| | | |

| ● | estimates of the future oil and natural gas production from our oil and gas assets, including estimates of any increases or decreases in production; |

| ● | financial strategy, liquidity and capital required for our development program and other capital expenditures; |

| ● | the availability and adequacy of cash flow to meet our requirements; |

| ● | the availability of additional capital for our operations; |

| ● | changes in our business and growth strategy, including our ability to successfully operate and expand our business; |

| ● | our integration of acquisitions, including the Bayswater Acquisition and the NR Acquisition; |

| ● | changes or developments in applicable laws or regulations, including with respect to taxes; and |

| ● | actions taken or not taken by third-parties, including our contractors and competitors. |

When considering forward-looking statements, you should keep in mind the risk factors and other cautionary statements described under the heading “Risk Factors” in this prospectus supplement, the accompanying base prospectus and our Annual Report on Form 10-K for the year ended December 31, 2023, as amended, which is incorporated by reference into this prospectus. We caution you that these forward-looking statements are subject to all of these risks and uncertainties, most of which are difficult to predict and many of which are beyond our control. These risks include, but are not limited to:

| ● | our and Bayswater’s ability to satisfy the conditions to the Bayswater PSA in a timely manner or at all, including our ability to successfully finance the Bayswater Acquisition; |

| ● | our ability to recognize the anticipated benefits of the Bayswater Acquisition, the NR Acquisition and the other transactions described in or incorporated by reference into this prospectus supplement, which may be affected by, among other things, competition and our ability to grow and manage growth profitably following the Bayswater Acquisition, the NR Acquisition and such other transactions; |

| ● | our ability to fund our development and drilling plan; |

| ● | the possibility that we may be unable to achieve expected cash flow, production levels, drilling, operational efficiencies and other anticipated benefits within the expected time-frames, or at all, and to successfully integrate the Bayswater Assets, the Central Weld Assets and/or any other assets or operations we have acquired or may acquire in the future with those of the Company; |

| ● | our integration of the Bayswater Assets and/or the Central Weld Assets with those of the Company may be more difficult, time-consuming or costly than expected; |

| ● | our operating costs, customer loss and business disruption may be greater than expected following the Bayswater Acquisition or the public announcement of the Bayswater Acquisition; |

| ● | our ability to grow our operations, and to fund such operations, on the anticipated timeline or at all; |

| ● | uncertainties inherent in estimating quantities of oil, natural gas and NGLs reserves and projecting future rates of production and the amount and timing of development expenditures; |

| ● | commodity price and cost volatility and inflation; |

| ● | our ability to obtain and maintain necessary permits and approvals to develop our assets; |

| ● | safety and environmental requirements that may subject us to unanticipated liabilities; |

| ● | changes in the regulations governing our business and operations, including the businesses, assets and operations we have acquired or may acquire in the future, such as, but not limited to, those pertaining to the environment, our drilling program and the pricing of our future production; |

| ● | our success in retaining or recruiting, or changes required in, our officers, key employees or directors; |

| ● | general economic, financial, legal, political, and business conditions and changes in domestic and foreign markets; |

| ● | the risks related to the growth of our business; |

| ● | the effects of competition on our future business; and |

| ● | other factors detailed under the section entitled “Risk Factors” and in our periodic SEC filings. |

Reserve engineering is a process of estimating underground accumulations of oil, natural gas and NGLs that cannot be measured in an exact way. The accuracy of any reserve estimate depends on the quality of available data, the interpretation of such data and price and cost assumptions made by reserve engineers. In addition, the results of drilling, testing and production activities may justify upward or downward revisions of estimates that were made previously. If significant, such revisions would change the schedule of any further production and development drilling. Accordingly, reserve estimates may differ significantly from the quantities of oil, natural gas and NGLs that are ultimately recovered.

Should one or more of the risks or uncertainties described in or incorporated by reference into this prospectus occur, or should underlying assumptions prove incorrect, our actual results and plans could differ materially from those expressed in any forward-looking statements.

All forward-looking statements, expressed or implied, included in or incorporated by reference into this prospectus are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that we or persons acting on our behalf may issue.

Except as otherwise required by applicable law, we disclaim any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect new information obtained or events or circumstances that occur after the date any such forward-looking statement is made.

SUMMARY

This summary highlights some of the information contained in or incorporated by reference into this prospectus and does not contain all of the information that you should consider before making an investment decision. You should carefully read this entire prospectus, including the information set forth under “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in this prospectus supplement, the information incorporated by reference into this prospectus, including our Annual Report on Form 10-K for the year ended December 31, 2023, as amended, and our Quarterly Reports on Form 10-Q for the periods ended March 31, 2024, June 30, 2024 and September 30, 2024 and the financial statements (and the notes thereto) contained therein, and any other documents to which we refer you, before making an investment decision.

Unless otherwise indicated, information presented in this prospectus supplement assumes the underwriters’ option to purchase additional shares from us is not exercised.

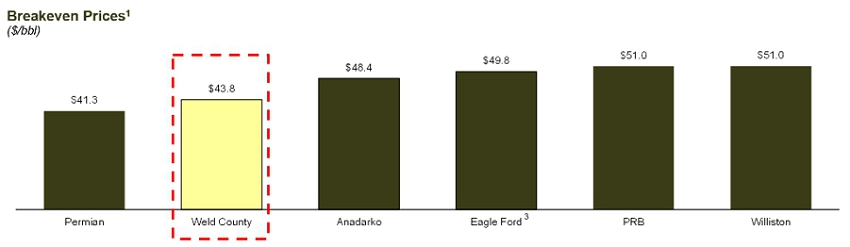

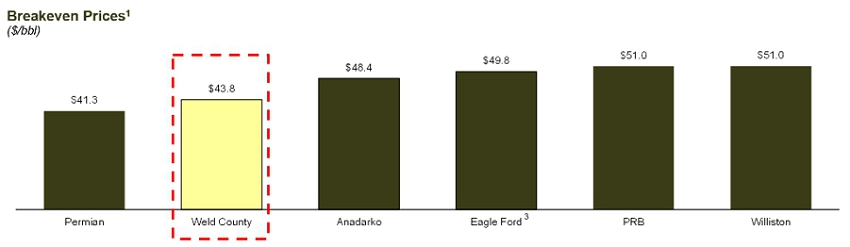

Our Company

We are an independent oil and gas company focused on the acquisition and development of crude oil, natural gas and NGLs. Our assets and operations are strategically located in the oil region of rural Weld County, within the DJ Basin of Colorado. Our drilling program focuses on the ongoing, stacked co-development of the Niobrara and Codell formations. We believe the DJ Basin to be one of the premier resource plays in the United States. Weld County boasts some of the lowest break-even prices in the U.S., and has a long production history that has proven and consistent results. The productivity of this resource is demonstrated by the integral role that Weld County holds in Colorado’s energy economy, having produced 82% of Colorado’s oil production as of December 2024.

Source: Enverus. (1) Includes horizontal wells since 2014. (2) Pertaining to first 90-day production.

Source: Enverus. (1) Includes horizontal wells only, vintage years 2020-2024 and assumes 20:1 WTI/NYMEX.

Our management team has significant public company leadership experience and draws on prior DJ basin operating expertise to optimize drilling our attractive acreage. We seek to deliver energy in an environmentally efficient manner by deploying next-generation technology and techniques. In addition to growing production through our drilling operations, we also seek to grow our business through accretive acquisitions. Since inception, management has announced or closed five transactions, including the Bayswater Acquisition.

Our objective is to maximize returns to investors, organically and inorganically, by focusing on assets with the following criteria: (i) producing reserves, with associated undeveloped bolt-on acreage; (ii) ample, high rate-of-return inventory of drilling locations that can be developed with cash flow reinvestment; (iii) strong well-level economics; (iv) liquids-rich assets; and (v) accretive valuation.

As described further below, on February 6, 2025, we entered into the Bayswater PSA pursuant to which we agreed to acquire from Bayswater the Bayswater Assets, which include approximately 24,000 net mineral acres in, on and under approximately 27,800 gross acres and 22 fully permitted proven undeveloped drilling locations, all of which are located in the DJ Basin and we believe is complementary to our existing acreage. The Bayswater Assets are 69% liquids weighted and produced approximately 25,700 net Boe/d for the month ended December 31, 2024. In addition, on October 1, 2024, we completed the NR Acquisition pursuant to which we acquired oil and gas leases covering approximately 5,400 net leasehold acres, on and under approximately 18,700 gross acres and 63 approved well permits and 26 operated horizontal wells in Weld County, Colorado, which we refer to as the Central Weld Assets, from Nickel Road. We expect the Central Weld Assets and the Bayswater Assets will provide accretive cashflow to our existing DJ Basin operations, strategically expand our core operating area, increase our inventory of high rate-of-return drilling locations, and provide additional optionality to our 2025 drill schedule.

We believe that we are ideally positioned to execute on our development plan of our Genesis Assets, our Central Weld Assets, and the Bayswater Assets following the closing of the Bayswater Acquisition. Following closing of the Bayswater Acquisition, we will hold approximately 586 locations, equating to ten years of inventory life at a one-rig (60 wells per year) pace. Our current development plan contemplates drilling up to 50 wells in 2025 and up to 60 wells in 2026, which assumes consummation of the Bayswater Acquisition in February 2025. We expect this development plan, along with our achievable cost optimization targets, will rapidly grow our production and free cash flow with all proved undeveloped reserves scheduled to be converted to developed status within five years, allowing us to increase our activity in 2026 and beyond. Our drilling plan is based on current commodity prices, and an increase or decrease in commodity prices could impact the number of wells we actually drill.

Recent Developments

Bayswater Acquisition

On February 6, 2025, we entered into the Bayswater PSA with Bayswater pursuant to which we agreed to acquire the Bayswater Assets for a purchase price of $602.75 million, subject to certain closing price adjustments, payable in cash (subject to certain conditions described in the Bayswater PSA, we are entitled to allocate a portion of consideration to newly issued “Cash Consideration”) and shares, not to exceed 5,249,639 shares of the Company’s common stock, par value $0.01 per share (the “Common Stock”) calculated in accordance with the Bayswater PSA (the “Equity Consideration”). We intend to fund the Cash Consideration with the proceeds from this offering, borrowings under our New Credit Agreement (as discussed below) and cash on hand.

The Bayswater PSA provides that we and Bayswater will enter into a registration rights agreement at closing, in substantially the form attached to the Bayswater PSA, pursuant to which, among other things, we will agree to register the resale of the Equity Consideration under the Securities Act.

We expect the Bayswater Acquisition to close in February 2025, subject to completion of the Financing Transactions and other customary closing conditions, with an economic effective date of December 1, 2024. The closing of the Bayswater Acquisition is dependent on the consummation of the Financing Transactions, including this offering. However, the consummation of this offering is not contingent on the closing of the Bayswater Acquisition. See “Risk Factors” — Risks Relating to the Bayswater Acquisition —”We may not consummate the Bayswater Acquisition, and this offering is not conditioned on the consummation of the Bayswater Acquisition on the terms currently contemplated or at all.”

The foregoing description of the Bayswater PSA is not complete and is qualified in its entirety by reference to the full text of the Bayswater PSA, a copy of which is filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed with the SEC on February 7, 2025, and incorporated herein by reference.

Commitment Letter for New Credit Agreement

On December 16, 2024, we entered into a reserve-based credit agreement with Citibank, N.A., as administrative agent, and the financial institutions party thereto, which we refer to as the Existing Credit Agreement. The Existing Credit Agreement has a maximum credit commitment of $1.0 billion. As of January 31, 2025, the Existing Credit Agreement had a borrowing base of $44.0 million and an aggregate elected commitment of $44.0 million each of which were subsequently increased to $60.0 million as of February 3, 2025. As of January 31, 2025, $34.0 million of revolving borrowings and no letters of credit were outstanding under the Existing Credit Agreement, and we also had cash and cash equivalents of approximately $3.0 million. The Existing Credit Agreement is scheduled to mature on December 16, 2026.

In connection with the Bayswater Acquisition, on February 6, 2025, we entered into the Commitment Letter with Citibank, N.A. and the other lenders party thereto, which we refer to as the Commitment Letter, pursuant to which we have received commitments, subject to certain conditions, to amend and restate our Existing Credit Agreement, which we refer to as our New Credit Agreement, to, among other things, increase the borrowing base to $475.0 million as of the closing of the Bayswater Acquisition and extend its maturity date to up to four years after the closing date of the Bayswater Acquisition. We also expect that the New Credit Agreement will include changes to certain provisions of our Existing Credit Agreement, subject to agreement with the lenders, to take into account the Bayswater Acquisition. We expect to enter into our New Credit Agreement prior to or substantially concurrently with the closing of the Bayswater Acquisition and intend to borrow approximately $315.0 million under our New Credit Agreement to fund a portion of the purchase price of the Bayswater Acquisition. However, there can be no assurance that we will enter into our New Credit Agreement within the anticipated time frame, or at all. The Commitment Letter expires on the earlier of March 15, 2025 and the termination of the Bayswater PSA. The obligations of the lenders to provide financing under the Commitment Letter are subject to certain customary conditions.

The foregoing description of the Existing Credit Agreement is not complete and is qualified in its entirety by reference to the full text of the Existing Credit Agreement, a copy of which is filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed with the SEC on December 19, 2024, and incorporated herein by reference.

NR Acquisition

On October 1, 2024, we completed the NR Acquisition pursuant to which we acquired certain the Central Weld Assets from Nickel Road pursuant to the NR Agreement for a purchase price of $84.5 million, subject to certain closing price adjustments. The Central Weld Assets include approximately 5,592 net leasehold acres, 89 approved well permits and 26 operated horizontal wells. We funded the as-adjusted cash purchase price at closing of $49.6 million (after giving effect to $6.0 million of deposits we previously paid to Nickel Road) with proceeds of approximately $15.0 million from a private placement of Common Stock to an investor, the Pre-Paid Advance under the SEPA and cash on hand.

Preliminary Fourth Quarter and Year-End 2024 Information

As of the date of this prospectus supplement, we have not finalized our financial and operational results for the three months or year ended December 31, 2024. However, based on preliminary information, we estimate that, for each of the three months and year ended December 31, 2024, our production ranged from approximately 1,800 to 1,900 Boe/d (74-78% liquids). Pro forma for the Bayswater Acquisition discussed above and including our estimated production, for each of the three months and year ended December 31, 2024, we estimate our production would have ranged from approximately 28,000 to 30,000 Boe/d (70% liquids). Similarly, we estimate that our revenues for each of the three months and year ended December 31, 2024 ranged from approximately $7.5 million to $8.4 million. Pro forma the Bayswater Acquisition, we estimate that our revenues for the three months and year ended December 31, 2024 would have ranged from approximately $100 million to $110 million and $440 million to $450 million, respectively.

For additional pro forma information about us, after giving effect to the Bayswater Acquisition, please see “—Non-GAAP Financial Measures” below. The closing of the Bayswater Acquisition is not complete and subject to certain conditions. Further, this offering is not contingent upon, and is expected to be completed before, the Bayswater Acquisition. Please see “Risk Factors—Risks Relating to the Bayswater Acquisition” for more information.

These preliminary estimates are derived from our internal records and are based on the most current information available to management. These estimates are preliminary and inherently uncertain. Our normal reporting processes with respect to the foregoing preliminary estimates have not been fully completed. Our independent auditors have not completed an audit or review of such preliminary estimates. During the course of our and their review on these preliminary estimates, we could identify items that would require us to make adjustments and which could affect our final results. Any such adjustments could be material. These preliminary estimates should not be viewed as indicative of our financial condition or results as of or for any future period. Actual results could differ from the estimates, trends and expectations discussed herein, and such differences could be material.

Implications of a Smaller Reporting Company and Non-Accelerated Filer

We are a “smaller reporting company” as defined under the Securities Act and Exchange Act. We may continue to be a smaller reporting company so long as either (i) the market value of shares of our common stock held by non-affiliates is less than $250 million or (ii) our annual revenues were less than $100 million during the most recently completed fiscal year and the market value of shares of our common stock held by non-affiliates is less than $700 million. As a smaller reporting company, we have presented only the two most recent fiscal years of audited financial statements in our Annual Report on Form 10-K incorporated by reference into this prospectus supplement and have provided reduced disclosure obligations regarding executive compensation. In addition, as a “non-accelerated filer” under the Exchange Act, we were not required to, and did not, obtain an attestation report on internal control over financial reporting issued by our independent registered public accounting firm in our Annual Report on Form 10-K incorporated by reference into this prospectus supplement.

Corporate Information

The mailing address of our principal executive office is 55 Waugh Drive, Suite 400, Houston, Texas 77007, and our phone number is (713) 424-4247. Our website address is www.prairieopco.com. We make our periodic reports and other information filed with, or furnished to, the SEC available free of charge through our website as soon as reasonably practicable after those reports and other information are electronically filed with, or furnished to, the SEC. The information on, or otherwise accessible through, our website or any other website is not incorporated by reference herein and does not constitute a part of this prospectus.

THE OFFERING

| Issuer | | Prairie Operating Co. |

| | | |

Shares of Common Stock offered by us | | shares (or shares if the underwriters exercise in full their option to purchase additional shares). |

| | | |

Shares of Common Stock to be outstanding after the offering | | 49,396,347 shares (or 52,868,569 shares if the underwriters exercise in full their option to purchase additional shares), each of which assumes our Common Stock is sold in the offering at a price per share of $8.64, which was the closing price of our Common Stock on NASDAQ on February 6, 2025.(1) |

| | | |

| Use of proceeds | | We expect to receive approximately $ million of net proceeds from this offering, or approximately $ million if the underwriters exercise in full their option to purchase additional shares, in each case after deducting underwriting discounts and commissions and our estimated offering expenses. |

| | | |

| | | We intend to use $186.5 million of the net proceeds from this offering to fund a portion of the purchase price for the Bayswater Acquisition. We expect to use any remaining net proceeds from this offering, including any net proceeds from the underwriters’ exercise of their option to purchase additional shares, for other general corporate purposes, which may include advancing our development and drilling program, repayment of existing indebtedness or financing other potential acquisition opportunities. This offering is not conditioned on the closing of the Bayswater Acquisition. If we do not complete the Bayswater Acquisition, we intend to use the net proceeds from this offering for the other purposes set forth above. |

| | | |

| | | Please read “Use of Proceeds” in this prospectus supplement for more information. |

| | | |

| Risk factors | | You should carefully read and consider the information set forth under the heading “Risk Factors” in this prospectus supplement, the accompanying base prospectus and our Annual Report on Form 10-K for the year ended December 31, 2023, which is incorporated by reference into this prospectus, along with all other information included in and incorporated by reference into this prospectus before deciding to invest in our common stock. |

| | | |

| Listing and trading symbol | | Our Common Stock is listed on NASDAQ under the symbol “PROP.” |

(1) The number of shares of Common Stock to be outstanding immediately following this offering is based on 26,248,199 shares of Common Stock outstanding as of January 31, 2025 and does not reflect as of such date:

| ● | 5,627,028 shares of Common Stock that are reserved for future issuance under the A&R LTIP; |

| ● | 1,463,302 shares of Common Stock represented by restricted stock units and performance-based restricted stock units that have been granted and are unvested pursuant to the A&R LTIP; |

| ● | 3,215,761 shares of Common Stock that are reserved for future issuance upon exercise of the Series D A Warrants; |

| ● | 4,000,000 shares of Common Stock that are reserved for future issuance upon exercise of the Series E A Warrants; |

| ● | 670,499 shares of Common Stock that are reserved for future issuance upon exercise of the Exok Warrants; |

| ● | 37,138 shares of Common Stock that are reserved for future issuance upon exercise of the Legacy Warrants; |

| ● | 1,196,337 shares of Common Stock that are reserved for future issuance upon conversion of our Series D Preferred Stock; |

| ● | 2,588,255 shares of Common Stock that are reserved for issuance under the SEPA; |

| | | |

| | ● | 8,000,000 shares of Common Stock issuable upon exercise of the Merger Options; |

| ● | 1,141,552 shares of Common Stock that are reserved for issuance upon exercise of the Subordinated Noteholder Warrants; and |

| ● | a maximum of 5,249,639 shares of Common Stock issuable to Bayswater as Equity Consideration in the Bayswater Acquisition (see “—Recent Developments— Bayswater Acquisition” above). |

Non-GAAP Financial MeasureS

Adjusted EBITDA

This prospectus contains Adjusted EBITDA, which is a financial measure not presented in accordance with U.S. GAAP. Adjusted EBITDA is used by management to evaluate the performance of our business, make operational decisions, and assess our ability to generate cashflows. Management believes Adjusted EBITDA provides investors with helpful information to better understand the underlying performance trends of our business, facilitate period-to-period comparisons, and assess the company’s operating results.

Adjusted EBITDA is derived from net income (loss) and revenue in excess of direct operating expenses, as applicable, and is adjusted for income tax expense, depreciation, depletion, and amortization (DD&A), accretion of asset retirement obligations, non-cash stock-based compensation, interest expense (income), loss on issuance of debt and loss on unrealized commodity derivatives, all as applicable. We adjust net income (loss) from continuing operations and revenue in excess of direct operating expenses, as applicable, for the items listed above to arrive at Adjusted EBITDA because these amounts can vary substantially between periods and companies within our industry depending upon accounting methods, book values of assets, capital structures, and the method by which assets were acquired. Additionally, we estimated the full year amount of Adjusted EBITDA by annualizing the Adjusted EBITDA for the nine months ended September 30, 2024. The presentation of Adjusted EBITDA or the annualization of Adjusted EBITDA does not imply that our operating results will not be affected by unusual or non-recurring items.

Adjusted EBITDA has limitations as an analytical tool, including that it excludes certain items that affect our reported financial results. Adjusted EBITDA should not be considered as an alternative to, or more meaningful than, net income calculated in accordance with GAAP or as an indicator of our operating performance or liquidity. Additionally, our calculation of Adjusted EBITDA may not be comparable to similarly titled measures used by other companies.

The following table reconciles Adjusted EBITDA to net income (loss), which is the most directly comparable financial measure prepared in accordance with GAAP.

| | | Prairie | | | Bayswater | | | | |

| ADJUSTED EBITDA | | Operating Co. | | | Assets | | | Total | |

| ($ - millions) | | Nine months ended September 30, 2024 | |

| | | | | | | | | | |

| Net loss from continuing operations | | | (27.9 | ) | | | - | | | | (27.9 | ) |

| Revenue in excess of direct operating expenses | | | - | | | | 288.5 | | | | 288.5 | |

| | | | | | | | | | | | | |

| Loss on issuance of debt (non-cash) | | | 3.0 | | | | - | | | | 3.0 | |

| Interest income | | | (0.5 | ) | | | - | | | | (0.5 | ) |

| Stock based compensation | | | 5.8 | | | | - | | | | 5.8 | |

| | | | | | | | | | | | | |

| Adjusted EBITDA for nine months ended September 30, 2024 | | | (19.6 | ) | | | 288.5 | | | | 268.9 | |

| | | | Year ended December 31, 2024 | |

| x annualization factor | | | 1.33 | | | | 1.33 | | | | 1.33 | |

| | | | | | | | | | | | | |

| Adjusted EBITDA for the year ended December 31, 2024 | | | (26.1 | ) | | | 384.7 | | | | 358.5 | |

PV-10

This prospectus contains PV-10, which is a financial measure not presented in accordance with U.S. GAAP. PV-10 is derived from the Standardized Measure of Discounted Future Net Cash Flows (“Standardized Measure”), which is the most directly comparable GAAP financial measure for proved reserves. PV-10 is a computation of the Standardized Measure on a pre-tax basis. PV-10 is equal to the Standardized Measure at the applicable date, before deducting future income taxes discounted at 10%. Neither PV-10 nor standardized measure represents an estimate of the fair market value of the applicable crude oil, natural gas and NGLs properties. We believe that the presentation of PV-10 is relevant and useful to our investors as supplemental disclosure to the Standardized Measure, or after-tax amount, because it presents the discounted future net cash flows attributable to our reserves before considering future corporate income taxes and our current tax structure. While the standardized measure is dependent on the unique tax situation of each company, PV-10 is based on prices and discount factors that are consistent for all companies.

The following table reconciles PV-10 to the standard measure of discounted future net cash flows, which is the most directly comparable GAAP financial measure:

| $ - millions | | Proved Developed Producing | | | Proved Developed Not Producing | | | Proved Undeveloped | | | Total Proved | |

| Standardized Measure, November 30, 2024 | | | 735 | | | | 4 | | | | 375 | | | | 1,114 | |

| Present value of future income taxes discounted at 10% | | | 125 | | | | 1 | | | | 120 | | | | 246 | |

| PV-10 (Non-GAAP), November 30, 2024 | | | 860 | | | | 5 | | | | 495 | | | | 1,360 | |

Leverage

This presentation contains Leverage, which is a financial measure not presented in accordance with U.S. GAAP. As used herein, Leverage is calculated by the total short-term and long-term debt outstanding at close divided by Adjusted EBITDA for the year ended December 31, 2024.

Leverage is a financial liquidity metric used by investors, financial analysts and management to evaluate the ability of a company to repay its debt and is useful to investors in evaluating our overall debt position and future debt capacity. We use this measure to assess our leverage. Leverage is not meant as an alternative measure of debt and should be considered only as a supplement in understanding and assessing our leverage and to U.S. GAAP measures such as debt and net income (loss) computed in accordance with U.S. GAAP.

The following table reconciles our Leverage to expected total short-term and long-term debt outstanding at the closing date, which is the most directly comparable financial measure prepared in accordance with GAAP:

| | | Prairie | |

| LEVERAGE | | Operating Co. | |

| ($ - millions) | | | |

| | | | |

| Expected debt at closing | | | 349 | |

| | | | | |

| Divided by: Adjusted EBITDA for the year ended December 31, 2024 | | | 359 | |

| | | | | |

| Leverage | | | 1.0x | |

RISK FACTORS

Investing in our Common Stock involves a significant degree of risk. You should carefully consider all of the information contained in this prospectus, including the risks and uncertainties described below and under “Cautionary Note Regarding Forward-Looking Statements” in this prospectus supplement, and the other documents incorporated by reference into this prospectus, including the risks and uncertainties described under “Risk Factors” in the accompanying base prospectus and our Annual Report on Form 10-K for the year ended December 31, 2023, as amended, before making an investment decision. If any of such risks and uncertainties actually occur, our business, financial condition and results of operations could be adversely affected. In that case, the trading price of our Common Stock could decline, and you may lose all or part of your investment.

Risks Relating to the Bayswater Acquisition

We may not consummate the Bayswater Acquisition, and this offering is not conditioned on the consummation of the Bayswater Acquisition on the terms currently contemplated or at all.

We may not consummate the Bayswater Acquisition, which is subject to a number of closing conditions. Satisfaction of some of these conditions is beyond our control. If these conditions are not satisfied or waived, the Bayswater Acquisition will not be completed. Certain of the conditions that remain to be satisfied include, but are not limited to:

| ● | the accuracy of the representations and warranties of each party (subject to specified materiality standards); |

| ● | compliance by each party in all material respects with their respective covenants; |

| ● | the absence of any government order that restrains or prohibits the Bayswater Acquisition; and |

| ● | our ability to complete the New Credit Agreement. |

As a result, the Bayswater Acquisition may not close as scheduled, or at all. The closing of this offering is not conditioned on, and is expected to be consummated before, the closing of the Bayswater Acquisition. Accordingly, if you decide to purchase Common Stock in this offering, you should be willing to do so whether or not we complete the Bayswater Acquisition. If we fail to complete the Bayswater Acquisition, our management will have broad discretion in the use of proceeds from this offering, and may use such proceeds in ways in which you do not approve.

Failure to complete the Bayswater Acquisition or any delays in completing the Bayswater Acquisition, including as a result of a failure to complete this offering, could have significant adverse impacts on our future business, including the following:

| ● | we will be unable to achieve the expected cash flow, production levels, drilling, operational efficiencies and other anticipated benefits from the Bayswater Acquisition, which could hinder our ability to fund our development and drilling plan; |

| ● | we may experience negative reactions from the financial markets, including a negative impact on our stock price; |

| ● | we may experience negative reactions from our current or future customers, distributors, suppliers, vendors, landlords, employees, joint venture partners and other business partners; |

| ● | we will still be required to pay certain significant costs relating to the Bayswater Acquisition, such as legal, accounting, advisor and printing fees; |

| ● | we may have foregone certain business opportunities, including other acquisitions and other aspects of our development plan, that, absent the Bayswater PSA, may have been pursued; |

| ● | matters relating to the Bayswater Acquisition have required and continue to require substantial commitments of time and resources by our management, which may have resulted in the distraction of our management from other aspects of our development plan, our operations and the pursuit of other business opportunities that could have been beneficial to us; and |

| ● | litigation that may arise as a result of any termination or delay in completion of the Bayswater Acquisition for failure to perform our obligations under the Bayswater PSA. |

If the Bayswater Acquisition is not completed, the risks described above may materialize and they may have a material adverse effect on our results of operations, cash flows, financial position and stock price.

We do not currently have sufficient funds or committed financing necessary to consummate the Bayswater Acquisition.

We intend to fund the Bayswater Acquisition with the proceeds from this offering and borrowings under our New Credit Agreement. Accordingly, if these Financing Transactions are not completed, the consummation of the Bayswater Acquisition may be delayed or may not occur at all. If the Financing Transactions are not completed, we may be required to seek alternative financing arrangements to fund the Bayswater Acquisition, and such financing may not be available on favorable terms, or at all. If we are unable to secure the necessary financing to consummate the Bayswater Acquisition, we will unable to complete the Bayswater Acquisition, and thus, will not receive the anticipated benefits of the Bayswater Assets.

We may be unsuccessful in integrating the Bayswater Assets or in realizing all or any part of the anticipated benefits of the Bayswater Acquisition.

We believe that the Bayswater Acquisition will complement our growth strategy by providing operational and financial scale and increasing free cash flow. However, achieving these goals requires, among other things, realization of the targeted synergies expected from the Bayswater Acquisition and other recent acquisitions, and there can be no assurance that we will be able to successfully integrate the Bayswater Assets or other recently acquired assets or otherwise realize the expected benefits of the Bayswater Acquisition or such acquisitions. This growth and the anticipated benefits of the Bayswater Acquisition may not be realized fully, or at all, or may take longer to realize than expected. Difficulties in integrating the Bayswater Assets or other assets may result in the Company performing differently than expected, or in operational challenges or failures to realize anticipated efficiencies. Potential difficulties in realizing the anticipated benefits of the Bayswater Acquisition and other acquisitions include, but are not limited to, the following:

| ● | disruptions of relationships with customers, distributors, suppliers, vendors, landlords, joint venture partners and other business partners as a result of uncertainty associated with the Bayswater Acquisition; |

| | | |

| ● | difficulties integrating our existing assets and business with the Bayswater Assets in a manner that permits us to achieve the full revenue and cost savings anticipated from the Bayswater Acquisition; |

| | | |

| ● | the potential for unexpected costs, delays or challenges that may arise in integrating the Bayswater Assets into our existing assets and business; |

| | | |

| ● | limitations on our ability to realize any expected cost savings and operating synergies from the Bayswater Acquisition; |

| | | |

| ● | difficulties integrating vendors and business partners; |

| ● | discovery of previously unknown liabilities following the Bayswater Acquisition for which we cannot receive reimbursement under any applicable indemnification provisions; |

| | | |

| ● | environmental, regulatory, permitting and similar matters; |

| | | |

| ● | performance shortfalls at the Company as a result of the diversion of management’s attention to integration efforts; and |

| | | |

| ● | disruption of, or the loss of momentum in, the Company’s ongoing business. |

We have incurred, and expect to continue to incur, a number of costs associated with completing the Bayswater Acquisition and the Financing Transactions. The elimination of duplicative costs, as well as the realization of other efficiencies related to the integration of the Bayswater Assets, may not initially offset integration-related costs or achieve a net benefit in the near term, or at all.

Our acquisition of a significant portion of Bayswater’s working interests is subject to third-party consent. If such third party does not consent or our arrangement with Bayswater with respect to such working interests pursuant to the Bayswater PSA is challenged, we will be able to acquire such working interest as part of the Bayswater Acquisition without any adjustment to the purchase price and we may have limited recourse against Bayswater.

Our acquisition of a significant portion of Bayswater’s working interests is subject to the consent of a third-party operator. We and the Seller have agreed to use commercially reasonable efforts to obtain all required consents with respect to our acquisition of the Bayswater Assets. However, we cannot assure you that we will be able to timely obtain such consent, if at all. If such third-party operator does not grant the necessary consent, the Bayswater PSA provides for a contractual arrangement pursuant to which we would be entitled to receive the economic benefits of such working interests. However, there can be no assurance that any such arrangement will not be challenged legally or by a third-party and, thus, that we will actually receive such economic benefits under these circumstances. The receipt of this third-party consent is not a closing condition to the Bayswater PSA and, in the event that such consent is not obtained or is challenged, the Bayswater PSA does not provide that the purchase price will be negatively adjusted. Moreover, our recourse against Bayswater may be limited under these circumstances. Consequently, we may not realize certain of the benefits of such working interests that are intended to be transferred to us as part of the Bayswater Acquisition and those benefits would be significant. The inability to transfer these working interests to us or failure to receive the economic benefits of such working interests, would have a significant adverse effect on our business, financial condition, results of operations and stock price.

If we are successful in completing the Bayswater Acquisition, our level of indebtedness could adversely affect our business and financial condition and prevent us from fulfilling our debt obligations.

As of January 31, 2025, $34.0 million of revolving borrowings and no letters of credit were outstanding under the Existing Credit Agreement. As of January 31, 2025, after giving pro forma effect to the Financing Transactions and the Bayswater Acquisition, we would have had $349.0 million of revolving borrowings and no letters of credit outstanding under the New Credit Agreement, leaving $126.0 million of available capacity thereunder for future borrowings and letters of credit. In addition, as of January 31, 2025, we had $3.9 million outstanding in aggregate principal amount relating to the Convertible Promissory Note and $3.2 million outstanding in aggregate principal amount relating to a Subordinated Promissory Note, and we had cash and cash equivalents of approximately $3.0 million. Our Existing Credit Agreement contains, and we expect our New Credit Agreement will contain, certain covenants limiting our ability to pay dividends, incur indebtedness, grant liens, make acquisitions, make investments or dispositions, engage in transactions with affiliates and enter into hedging and derivative arrangements, as well as covenants requiring us to maintain certain financial ratios and tests. In addition, the borrowing base under these agreements is, and we expect will continue to be, subject to periodic review by our lenders. Difficulties in the credit markets may cause the banks to be more restrictive when redetermining the borrowing base.

Our indebtedness could adversely affect our business, financial condition, results of operations and cash flows, including, without limitation, impairing our ability to obtain additional financing for our drilling and development program, potential acquisitions, working capital, capital expenditures, debt service requirements or other general corporate purposes. In addition, we will have to use a substantial portion of our cash flow to pay principal, premium (if any) and interest on our indebtedness when due which will reduce the funds available to us for other purposes. Our level of indebtedness will also make us more vulnerable to economic downturns and adverse industry conditions, and may compromise our ability to capitalize on business opportunities and to react to competitive pressures as compared to our competitors.

In connection with our New Credit Agreement, we are required to enter into hedging arrangements with respect to our production, and therefore, we will be exposed to fluctuations in the price of oil, natural gas and NGLs and will be affected by continuing and prolonged declines in such prices. These hedging arrangements, along with any future hedging activities we may engage in, may result in financial losses or could reduce our income.

Oil, natural gas, and NGLs prices are volatile. We are required pursuant to our New Credit Agreement to hedge a significant portion of our oil and natural gas production in order to reduce our exposure to adverse fluctuations in these prices within 10 days after the closing. The production associated with the Bayswater Assets is not currently hedged by us and therefore we are exposed to price volatility for our oil, natural gas and NGLs production and may be subject to significant reduction in prices, which would have a material negative impact on our results of operations. In connection with our New Credit Agreement and the Bayswater Acquisition, we intend to enter into derivative arrangements for a portion of our oil, natural gas, and NGLs production, including swaps, collars and other instruments. Derivative arrangements would expose us to the risk of financial loss in some circumstances, including when: (i) production is less than the volume covered by the derivative instruments; (ii) the counterparty to the derivative instrument defaults on its contract obligations; or (iii) there is an increase in the differential between the underlying price in the derivative instrument and actual prices received. These types of derivative arrangements may limit the benefit we would receive from increases in the prices for oil, natural gas and NGLs and may expose us to cash margin requirements. If oil, natural gas and NGLs prices upon settlement of derivative swap contracts exceed the price at which commodities have been hedged, we will be obligated to make cash payments to counterparties, which could, in certain circumstances, be significant.

We cannot assure you that our diligence review of the Bayswater Acquisition has identified all material risks associated with the transaction. Additionally, following the consummation of the Bayswater Acquisition, if certain risks arise, we may be required to take write-downs or write-offs, restructuring and impairment or other charges that could have a significant negative effect on our financial condition, results of operations and stock price, which could cause you to lose some or all of your investment.

Before entering into the Bayswater PSA, we performed a due diligence review of Bayswater and the Bayswater Assets, which we believe to be generally consistent with industry practices. However, we cannot assure you that our due diligence review identified all material issues and our assessments of the Bayswater Assets and our estimates are inherently uncertain. As a result, we may be forced to later write-down or write-off assets, restructure our operations or incur impairment or other charges that could result in losses. Even if our due diligence successfully identified certain risks, unexpected risks may arise and previously known risks may materialize in a manner that is inconsistent with our preliminary risk analysis. These risks that may not have arisen in the scope of our due diligence review of the Bayswater Assets, include, but are not limited to, title, production, environmental or other problems. Even though these charges may be non-cash items and may not have an immediate impact on our liquidity, the fact that we report charges of this nature could contribute to negative market perceptions about us following the completion of the Bayswater Acquisition or our Common Stock. In addition, charges of this nature may impair our ability to obtain future financing on favorable terms or at all. Moreover, we may have limited recourse against Bayswater for certain risks or liabilities incurred after the consummation of the Bayswater Acquisition. Accordingly, our stockholders following the Bayswater Acquisition could suffer a reduction in the value of their shares of Common Stock, and such stockholders are unlikely to have a remedy for such reduction in value.

Misrepresentations made to us by Bayswater in the Bayswater PSA could cause us to incur substantial financial obligations and harm our business.

If we were to discover that there were misrepresentations made to us by Bayswater in the Bayswater PSA regarding the Bayswater Assets, we would explore all possible legal remedies to compensate us for any loss, including our rights to indemnification under the Bayswater PSA. However, there is no assurance that legal remedies would be available or collectible. If such unknown liabilities exist and we are not fully indemnified for any loss that we incur as a result thereof, we could incur substantial financial obligations, which could materially adversely affect our financial condition and harm our business.

As a result of the Bayswater Acquisition and the NR Acquisition, we anticipate that the scope and size of our assets, operations and business will substantially change. We cannot provide assurance that our expansion in size and integration and operation of the Bayswater Assets and Central Weld Assets will be successful.

We anticipate that the Bayswater Acquisition and the NR Acquisition will substantially expand the scope and size of our business by adding substantial upstream oil, natural gas and NGLs assets and operations to our existing assets and operations. Prior to the Bayswater Acquisition and NR Acquisition, our assets and operations primarily consisted of the Genesis Assets, which includes approximately 18,000 net mineral acres in, on and under approximately 38,300 gross undeveloped acres, with 72 fully permitted undeveloped drilling locations and situated in a rural area of northern Weld County, Colorado. Our recently acquired Central Weld Assets include approximately 5,400 net leasehold acres, 63 approved well permits and 26 operated horizontal wells and the Bayswater Assets we expect to acquire in the Bayswater Acquisition include approximately 24,000 net mineral acres in, on and under, approximately 27,800 gross acres and 22 fully permitted proven undeveloped drilling locations. Although we, Bayswater and Nickel Road operate in many of the same regions of the DJ Basin, Bayswater and Nickel Road’s operations focus more heavily on drilling and production of oil, natural gas and NGLs which require different operating strategies and managerial expertise than our current operations and are subject to additional or different regulatory requirements. Consequently, we may not be able to successfully integrate the Bayswater Assets and Central Weld Assets into our existing operations, successfully manage these assets or to realize the expected economic benefits of the Bayswater Acquisition and NR Acquisition, which may have a material adverse effect on our business, financial condition and results of operations.

We may not achieve the perceived benefits of the Bayswater Acquisition and the market price of our Common Stock following such transaction may decline.

The market price of our Common Stock may decline as a result of the Bayswater Acquisition for a number of reasons, including if investors react negatively to the prospects of the Company’s business; the effect of the Bayswater Acquisition on our business and prospects is inconsistent with the expectations of our management or of financial or industry analysts; or we do not achieve the perceived benefits of the Bayswater Acquisition as rapidly or to the extent anticipated by our management or financial or industry analysts.

The reserve, production and other data and estimates with respect to the Bayswater Assets are based primarily on information provided by Bayswater. We have not yet verified these data and estimates and cannot assure you that actual results will not differ materially.

Bayswater has represented that the Bayswater Assets contain a specified number of net mineral and gross acres, gross and net wells as well as net horizontal well locations. Pro Forma production is approximately 27,500 Boe/d and we expect production to increase to approximately 29,000 - 31,000 Boe/d for full year 2025 based on only current proved developed reserves, drilled uncompleted wells, permits, and our expected development plan, which assumes the completion of the Bayswater Acquisition.

However, none of the above information about Bayswater has been verified by us or our independent reserve engineers and could prove to be inaccurate, and in some instances materially so. We have limited recourse against Bayswater should any of these estimates or other data prove to be inaccurate. Likewise, we may not be able to achieve our 2025 production estimates. We cannot assure you that we will achieve the results estimated by us with respect to the Bayswater Assets.

The unaudited pro forma condensed combined financial information and pro forma combined proved reserves and production data incorporated by reference into this prospectus may not be representative of our future results or operations.

The unaudited pro forma information incorporated by reference into this prospectus is constructed from our consolidated historical financial statements and operating results and the financial statements and operating results of the Company, Bayswater and Nickel Road and adjusted to reflect the impact of the Financing Transactions, the Bayswater Acquisition, the NR Acquisition and the other transactions and subsequent events described therein. Such unaudited pro forma information does not purport to be indicative of our future results of operations following such transactions. Therefore, such unaudited pro forma information may not be representative of our future results or operations. The unaudited pro forma information incorporated by reference in this prospectus is also based in part on certain assumptions that we believe are reasonable. We cannot assure you, however, that our assumptions will prove to be accurate. Accordingly, the pro forma information included in this prospectus may not be indicative of what our results of operations and financial condition would have been had the applicable events occurred during the periods presented, or what our results of operations and financial conditions will be in the future.

We expect to incur significant transaction costs in connection with the Bayswater Acquisition, which may be in excess of those currently anticipated.