Recently, the FHLB of San Francisco announced that it was suspending dividend payments and suspending capital repurchases due to the deterioration in the market value of their mortgage-backed securities portfolio. While the FHLB of San Francisco has announced it does not anticipate that additional capital is immediately necessary, nor does it believe that its capital level is inadequate to support realized losses in the future, the FHLB of San Francisco could require its members, including the Bank, to contribute additional capital in order to return the FHLB of San Francisco to compliance with capital guidelines.

At December 31, 2008, we held $4.4 million of common stock in the FHLB of San Francisco. Should the FHLB of San Francisco fail, we anticipate that our investment in the FHLB’s common stock would be “other than temporarily” impaired and may have no value.

At December 31, 2008, we maintained a line of credit with the FHLB of San Francisco equal to 30% of total assets to the extent the Bank provides qualifying collateral and holds sufficient FHLB stock. At December 31, 2008, we were in compliance with collateral requirements. We are highly dependent on the FHLB of San Francisco to provide the primary source of wholesale funding for immediate liquidity and borrowing needs. The failure of the FHLB of San Francisco or the FHLB System in general, may materially impair our ability to meet our growth plans or to meet short and long term liquidity demands.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

FNB Bancorp does not own any real property. Since its incorporation on February 28, 2001, FNB Bancorp has conducted its operations at the administrative offices of First National Bank, located at 975 El Camino Real, South San Francisco, California 94080.

First National Bank owns the land and building at 975 El Camino Real, South San Francisco, California 94080. The premises consist of a modern, three-story building of approximately 15,000 square feet and off-street parking for employees and customers of approximately 45 vehicles. The Buri Buri Branch Office of First National Bank is located on the ground floor of this three-story building and administrative offices, including the offices of senior management, occupy the second and third floors.

First National Bank owns the land and two-story building occupied by the Daly City Branch Office (6600 Mission Street, Daly City, CA 94014); the land and two-story building occupied by the Colma Branch Office (1300 El Camino Real, Colma, CA 94014); the land and two-story building occupied by the South San Francisco Branch Office (211 Airport Boulevard, South San Francisco, CA 94080); the land and two-story building occupied by the Redwood City Branch Office (700 El Camino Real, Redwood City, CA 94063); the land and two-story building occupied by the Millbrae Branch Office (1551 El Camino Real, Millbrae, CA 94030); the land and single-story building occupied by the Half Moon Bay Branch Office (756 Main Street, Half Moon Bay, CA 94019); and the land and two-story building occupied by the Pescadero Branch Office (239 Stage Road, Pescadero, CA 94060). All properties include adequate vehicle parking for customers and employees.

First National Bank leases premises at 1450 Linda Mar Shopping Center, Pacifica, California 94044, for its Linda Mar Branch Office. This ground floor space of approximately 4,100 square feet is leased from Fifty Associates and Demartini/Linda Mar, LLC. The lease term is 10 years and expires on September 1, 2009.

First National Bank leases premises at 210 Eureka Square, Pacifica, California 94044, for its Eureka Square Branch Office. This ground floor space of approximately 3,000 square feet is leased from Joseph A. Sorci and Eldiva Sorci. The lease term is for 5 years, commencing January 1, 1995, with two 5-year options to extend the lease term, the second of which has been exercised and expires on December 31, 2009.

First National Bank leases premises at 65 Post Street, San Francisco, CA 94104, for its Financial District Office. The current lease term expires April 30, 2013, with one 5-year option to extend the lease remaining. The location consists of approximately 2,826 square feet of street level, 1,322 square feet of basement, and 1,077 square feet of mezzanine space.

31

First National Bank leases premises at 6599 Portola Drive, San Francisco, CA 94127, for its Portola Office. The current lease expires June 30, 2009, and has a remaining 5-year option to extend the lease. The location consists of approximately 1,325 square feet of street level space.

First National Bank leases premises at 150 East Third Avenue, San Mateo, CA 94401, for its San Mateo Branch Office. The current lease term, expires July 31, 2013. It has one remaining five-year option to extend the lease. The location consists of approximately 4,000 square feet of ground floor usable commercial space.

First National Bank leases a warehouse facility at 450 Cabot Road, South San Francisco, CA 94080. The lease term is for 5 years and one half month, and will expire February 28, 2011. The facility consists of approximately 7,600 square feet of office/warehouse space.

The foregoing summary descriptions of leased premises are qualified in their entirety by reference to the full text of the lease agreements listed as exhibits to this report.

ITEM 3. LEGAL PROCEEDINGS

There are no material legal proceedings adverse to the Company or First National Bank to which any director, officer, affiliate of the Company, or 5% shareholder of the Company, or any associate of any such director, officer, affiliate or 5% shareholder of the Company are a party, and none of the foregoing persons has a material interest adverse to the Company or First National Bank.

From time to time, the Company and/or First National Bank are a party to claims and legal proceedings arising in the ordinary course of business. The Company’s management is not aware of any material pending legal proceedings to which either it or First National Bank may be a party or has recently been a party, which will have a material adverse effect on the financial condition or results of operations of the Company and First National Bank, taken as a whole.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

None in the fourth quarter.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Since March 18, 2002, the common stock of the Company has been quoted on the OTC Bulletin Board under the trading symbol, “FNBG.OB.” There has been limited trading in the shares of common stock of the Company. On February 28, 2009, the Company had approximately 700 shareholders of common stock of record.

32

The following table summarizes sales of the Common Stock of FNB Bancorp during the periods indicated of which management of the Bank has knowledge, including the approximate high and low bid prices during such periods and the per share cash dividends declared for the periods indicated. All information has been adjusted to reflect 5% stock dividends effected on December 14, 2007 and on December 15, 2008. The prices indicated below reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

| | | | | | | | | | |

| | Bid Price of FNB Bancorp

Common Stock | | Cash

Dividends

Declared (1) | |

| | High | | Low | | |

| | | | | | | |

2007 | | | | | | | | | | |

First Quarter | | $ | 35.3351 | | $ | 33.3506 | | $ | 0.15 | |

Second Quarter | | | 34.7288 | | | 33.5160 | | | 0.15 | |

Third Quarter | | | 33.6263 | | | 30.6495 | | | 0.15 | |

Fourth Quarter | | | 30.5025 | | | 25.7250 | | | 0.15 | |

| | | | | | | | | | |

2008 | | | | | | | | | | |

First Quarter | | $ | 24.4650 | | $ | 21.5250 | | $ | 0.15 | |

Second Quarter | | | 23.1000 | | | 16.2750 | | | 0.15 | |

Third Quarter | | | 16.9050 | | | 11.5500 | | | 0.15 | |

Fourth Quarter | | | 13.0000 | | | 10.1500 | | | 0.15 | |

| |

(1) | See Item 1, “Limitations on Dividends,” above, for a description of the limitations applicable to the payment of dividends by FNB Bancorp. |

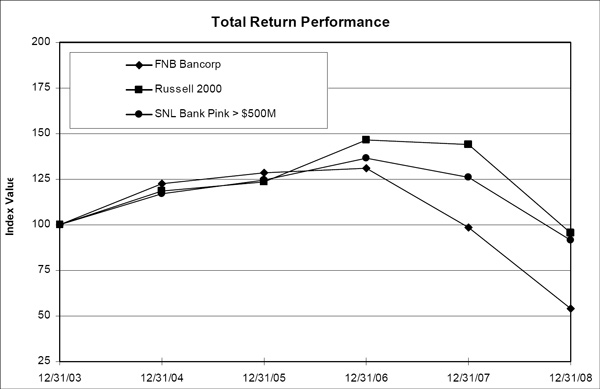

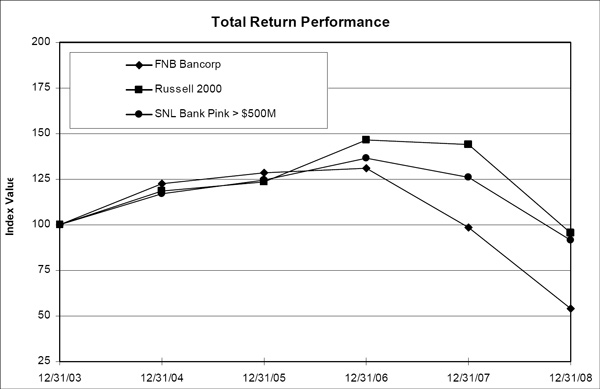

STOCK PERFORMANCE GRAPH

Set forth below is a line graph comparing the annual percentage change in the cumulative total return on FNB Bancorp Common Stock with the cumulative total return of the SNL Securities Index of Pink Banks (asset size of over $500 million) and the Russell 2000 Index as of the end of each of the last five fiscal years.

The graph assumes that $100.00 was invested on December 31, 2003 in FNB Bancorp Common Stock and each index, and that all dividends were reinvested. Returns have been adjusted for any stock dividends and stock splits declared by FNB Bancorp. Shareholder returns over the indicated period should not be considered indicative of future shareholder returns.

33

| | | | | | | | | | | | | | | | | | | |

| | Period Ending | |

| | | |

Index | | 12/31/03 | | 12/31/04 | | 12/31/05 | | 12/31/06 | | 12/31/07 | | 12/31/08 | |

| | | | | | | | | | | | | | |

FNB Bancorp | | | 100.00 | | | 122.27 | | | 128.50 | | | 131.20 | | | 98.73 | | | 53.86 | |

Russell 2000 | | | 100.00 | | | 118.33 | | | 123.72 | | | 146.44 | | | 144.15 | | | 95.44 | |

SNL Bank Pink > $500M Index | | | 100.00 | | | 116.97 | | | 124.48 | | | 136.58 | | | 125.85 | | | 91.32 | |

ISSUER PURCHASES OF EQUITY SECURITIES

On August 24, 2007, the Board of Directors of the Company authorized a stock repurchase program which calls for the repurchase of up to five percent (5%) of the Company’s then outstanding 2,863,635 shares of Common Stock, or 143,182 shares. There were no repurchases during the quarter ended December 31, 2008. There were 10,457 shares remaining that may be purchased under this Plan as of December 31, 2008. Effective February 27, 2009, based on the Purchase Agreement with the U. S. Treasury, the Company may not repurchase Company common stock so long as the Treasury’s Preferred Stock investment is outstanding.

34

ITEM 6 - SELECTED FINANCIAL DATA

The following table presents a summary of selected financial information that should be read in conjunction with the Company’s consolidated financial statements and notes thereto included under item 8 - “FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.”

| | | | | | | | | | | | | | | | |

| | At and for the years ended December 31, | |

| | | |

Dollar amounts in thousands, except

per share amounts and ratios | | 2008 | | 2007 | | 2006 | | 2005 | | 2004 | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

STATEMENT OF INCOME DATA | | | | | | | | | | | | | | | | |

Total interest income | | $ | 39,427 | | $ | 42,290 | | $ | 37,196 | | $ | 30,732 | | $ | 24,046 | |

Total interest expense | | | 11,507 | | | 13,657 | | | 9,821 | | | 5,533 | | | 2,533 | |

| | | | | | | | | | | | | | | | |

Net interest income | | | 27,920 | | | 28,633 | | | 27,375 | | | 25,199 | | | 21,513 | |

Provision for loan losses | | | 3,045 | | | 690 | | | 683 | | | 628 | | | 408 | |

| | | | | | | | | | | | | | | | |

Net interest income after provision for loan losses | | | 24,875 | | | 27,943 | | | 26,692 | | | 24,571 | | | 21,105 | |

Total noninterest income | | | 5,043 | | | 4,300 | | | 6,259 | | | 3,841 | | | 3,787 | |

Total noninterest expenses | | | 25,344 | | | 23,182 | | | 21,760 | | | 20,255 | | | 18,627 | |

| | | | | | | | | | | | | | | | |

Earnings before taxes | | | 4,574 | | | 9,061 | | | 11,191 | | | 8,157 | | | 6,265 | |

Income tax expense | | | 611 | | | 2,382 | | | 3,609 | | | 2,429 | | | 1,577 | |

| | | | | | | | | | | | | | | | |

Net earnings | | $ | 3,963 | | $ | 6,679 | | $ | 7,582 | | $ | 5,728 | | $ | 4,688 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

PER SHARE DATA - see note (1) | | | | | | | | | | | | | | | | |

Net earnings per share: | | | | | | | | | | | | | | | | |

Basic | | $ | 1.29 | | $ | 2.13 | | $ | 2.42 | | $ | 1.83 | | $ | 1.48 | |

Diluted | | $ | 1.28 | | $ | 2.10 | | $ | 2.37 | | $ | 1.80 | | $ | 1.45 | |

Cash dividends per share | | $ | 0.60 | | $ | 0.60 | | $ | 0.60 | | $ | 0.60 | | $ | 0.60 | |

Weighted average shares outstanding: | | | | | | | | | | | | | | | | |

Basic | | | 3,077,000 | | | 3,139,000 | | | 3,133,000 | | | 3,122,000 | | | 3,171,000 | |

Diluted | | | 3,099,000 | | | 3,173,000 | | | 3,203,000 | | | 3,181,000 | | | 3,222,000 | |

Shares outstanding at period end | | | 3,030,000 | | | 2,965,000 | | | 2,853,000 | | | 2,700,000 | | | 2,586,000 | |

Book value per share | | $ | 22.49 | | $ | 22.44 | | $ | 21.75 | | $ | 20.46 | | $ | 20.35 | |

|

BALANCE SHEET DATA | | | | | | | | | | | | | | | | |

Investment securities | | | 99,221 | | | 94,432 | | | 94,945 | | | 113,463 | | | 102,823 | |

Net loans | | | 497,984 | | | 489,574 | | | 419,437 | | | 380,224 | | | 341,107 | |

Allowance for loan losses | | | 7,075 | | | 5,638 | | | 5,002 | | | 4,374 | | | 3,133 | |

Total assets | | | 660,957 | | | 644,465 | | | 581,270 | | | 569,314 | | | 490,255 | |

Total deposits | | | 500,910 | | | 499,255 | | | 481,567 | | | 507,544 | | | 413,253 | |

Shareholders’ equity | | | 68,149 | | | 66,545 | | | 62,063 | | | 55,243 | | | 52,629 | |

| | | | | | | | | | | | | | | | |

SELECTED PERFORMANCE DATA | | | | | | | | | | | | | | | | |

Return on average assets | | | 0.60 | % | | 1.07 | % | | 1.32 | % | | 1.08 | % | | 1.02 | % |

Return on average equity | | | 5.87 | % | | 10.39 | % | | 12.86 | % | | 10.75 | % | | 8.94 | % |

Net interest margin | | | 4.75 | % | | 5.05 | % | | 5.26 | % | | 5.27 | % | | 5.14 | % |

Average loans as a percentage of average deposits | | | 97.93 | % | | 91.74 | % | | 78.92 | % | | 77.80 | % | | 79.98 | % |

Average total stockholders’ equity as a percentage of average total assets | | | 10.25 | % | | 10.31 | % | | 10.25 | % | | 10.06 | % | | 11.37 | % |

Dividend payout ratio | | | 44.71 | % | | 25.69 | % | | 21.43 | % | | 26.92 | % | | 32.55 | % |

SELECTED ASSET QUALITY RATIOS | | | | | | | | | | | | | | | | |

Net loan charge-offs to average loans | | | 0.32 | % | | 0.01 | % | | 0.01 | % | | 0.02 | % | | 0.13 | % |

Allowance for loan losses/Total Loans | | | 1.40 | % | | 1.14 | % | | 1.18 | % | | 1.14 | % | | 0.91 | % |

CAPITAL RATIOS | | | | | | | | | | | | | | | | |

Total risk-based capital | | | 11.86 | % | | 11.47 | % | | 12.00 | % | | 11.59 | % | | 13.50 | % |

Tier 1 risk-based capital | | | 10.67 | % | | 10.52 | % | | 11.05 | % | | 10.67 | % | | 12.69 | % |

Tier 1 leverage capital | | | 9.70 | % | | 9.89 | % | | 10.08 | % | | 9.50 | % | | 10.72 | % |

(1) per share data has been adjusted for stock dividends.

35

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS OF FNB BANCORP AND SUBSIDIARY

Critical Accounting Policies And Estimates

Management’s discussion and analysis of its financial condition and results of operations are based upon the Company’s financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of these financial statements requires the Company to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. On an on-going basis, the Company evaluates its estimates, including those related to its loans and allowance for loan losses. The Company bases its estimates on current market conditions, historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions. All adjustments that, in the opinion of management, are necessary for a fair presentation for the periods presented have been reflected as required by Regulation S-X, Rule 10-01. The Company believes the following critical accounting policy requires significant judgments and estimates used in the preparation of the consolidated financial statements.

Allowance for Loan Losses

The allowance for loan losses is periodically evaluated for adequacy by management. Factors considered include the Company’s loan loss experience, known and inherent risks in the portfolio, current economic conditions, known adverse situations that may affect the borrower’s ability to repay, regulatory policies, and the estimated value of underlying collateral. The evaluation of the adequacy of the allowance is based on the above factors along with prevailing and anticipated economic conditions that may impact borrowers’ ability to repay loans. Determination of the allowance is part objective and part a subjective judgment by management given the information it currently has in its possession. Adverse changes in any of these factors or the discovery of new adverse information could result in higher charge-offs and loan loss provisions.

Goodwill

Goodwill arises from the Company’s purchase price exceeding the fair value of the net assets of an acquired business. Goodwill represents the value attributable to intangible elements acquired. The value of goodwill is supported ultimately by profit from the acquired business. A decline in earnings could lead to impairment, which would be recorded as a write-down in the Company’s consolidated statements of income. Events that may indicate goodwill impairment include significant or adverse changes in results of operations of the acquired business or asset, economic or political climate; an adverse action or assessment by a regulator; unanticipated competition; and a more-likely-than-not expectation that a reporting unit will be sold or disposed of at a loss.

36

Other Than Temporary Impairment

The decline in the fair value of any security in the Company’s investment portfolio that is considered other than temporarily impaired is written down with a charge to noninterest income in the period in which the impairment occurs in an amount that equals the book value less the fair value of the security. There are many factors that are considered before an other than temporary impairment is recorded. These factors include the length of time and the extent to which market value has been less than cost, reasons for decline in market price – whether an industry issue or issuer specific, changes in the general market condition of the area or issuer’s industry, the issuer’s financial condition, capital strength, ability to make timely future payments and any changes in agencies ratings that drop the security’s rating below investment grade and any potential legal actions.

Provision for Income Taxes

The Company is subject to income tax laws of the United States, its states, and municipalities in which it operates. The Company considers its income tax provision methodology to be critical, as the determination of current and deferred taxes based on complex analyses of many factors including interpretation of federal and state laws, the difference between tax and financial reporting bases of assets and liabilities (temporary differences), estimates of amounts due or owed, the timing of reversals of temporary differences and current financial standards. Actual results could differ significantly from the estimates due to tax law interpretations used in determining the current and deferred income tax liabilities. Additionally, there can be no assurances that estimates and interpretations used in determining income tax liabilities may not be challenged by federal and state taxing authorities.

Recent Accounting Pronouncements

In December 2007, the Financial Accounting Standards Board (“FASB”) announced that it had revised Statement 141, Business Combinations, with 141(R). The revised Statement No. 141 was written to improve the relevance, representational faithfulness and comparability of the information that a reporting entity provides in its financial reports about a business combination and its effects. This Statement establishes principles and requirements for how the acquirer:

| | |

| a. | Recognizes and measures in its financial statements the identifiable assets acquired, the liabilities assumed, and any noncontrolling interest in the acquiree |

| | |

| b. | Recognizes and measures the goodwill acquired in the business combination or a gain from a bargain purchase |

| | |

| c. | Determines what information to disclose to enable users of the financial statements to evaluate the nature and financial effects of the business combination |

This Statement applies prospectively to business combinations for which the acquisition date is on or after the beginning of the first annual reporting period beginning on or after December 15, 2008. The Company does not expect this Standard to have a material effect on the Company’s financial statements.

37

In December 2007, the Financial Accounting Standards Board (“FASB”) issued Statement No. 160, “Noncontrolling Interest in Consolidated Financial Statements – an amendment of ARB No. 51.” Statement No. 160 clarifies reporting and disclosure requirements related to noncontrolling interest included in an entity’s consolidated financial statements. This Statement clarifies that noncontrolling interests are to be reported in the noncontrolling section of the balance sheet and requires net income to include amounts from both the parent and the noncontrolling interest. This Statement also requires the parent company to recognize a gain or loss in net income when a subsidiary is deconsolidated. This Statement is effective for fiscal years (and interim periods within those years), beginning on or after December 15, 2008. The Company will apply this Statement prospectively and does not expect the Statement to have a material impact on the Company’s financial statements.

In March, 2008, the Financial Accounting Standards Board (“FASB”) issued Statement No. 161 “Disclosures About Derivative Instruments and Hedging Activities – an amendment of FASB Statement No. 133.” Statement No. 161 changes the disclosure requirements for derivative instruments and hedging activities by requiring enhanced disclosures about (a) how and why an entity uses derivative instruments, (b) how derivative instruments and related hedged items are accounted for, and (c) how derivative instruments and related hedged items affect an entity’s financial position, financial performance and cash flows. This statement is effective for fiscal years and interim periods beginning after November 15, 2008. The Company does not expect this Standard to have a material impact on the Company’s financial statements.

In May, 2008 the Financial Accounting Standards Board (“FASB”) issued Statement No. 162 “The Hierarchy of Generally Accepted Accounting Principles.” This new standard is intended to improve financial reporting by identifying a consistent framework, or hierarchy, for selecting accounting principles to be used in preparing financial statements that are presented in conformity with U. S. generally accepted accounting principles (GAAP) for nongovernmental entities. This Statement becomes effective 60 days following the SEC’s approval of the Public Company Oversight Board amendments to AU Section 411,The Meaning of Present Fairly in Conformity With Generally Accepted Accounting Principles. The Company does not expect this Standard to have a material impact on the Company’s financial statements.

Earnings Analysis

Net earnings in 2008 were $3,963,000, a $2,716,000 or a 40.7% decrease from 2007 earnings of $6,679,000. Earnings for the year 2007 decreased $903,000 or 11.9% from year 2006 earnings of $7,582,000. The principal source of earnings is interest income on loans. The Federal Open Market Committee made a series of significant reductions in the intended federal funds rate in 2008, with a 4.25% rate on January 1, 2008, ending with a target rate of 0% to 0.25% on December 16, 2008.

Basic earnings per share were $1.29 in 2008, $2.13 in 2007 and $2.42 in 2006. Diluted earnings per share were $1.28 in 2008; $2.10 in 2007; and $2.37 in 2006.

38

Net interest income for 2008 was $27,920,000, a decrease of $713,000 or 2.5% from 2007. In 2007 it was $28,633,000, an increase of $1,258,000 or 4.6% from 2006. Interest income was $39,531,000 in 2008, a decrease of $2,759,000 or 6.5% from 2007. Interest income was $42,290,000 in 2007, an increase of $5,094,000 or 13.7% over 2006. The decrease in net interest income was caused by a decrease in the interest rate on earning assets which exceed the decrease in the interest rate on interest bearing liabilities, reflecting the actions of the Federal Open Market Committee, mentioned above. Most of the interest earning assets are tied to the prime lending rate, which adjusts immediately, whereas most of the interest-bearing liabilities adjust on a lagged basis, particularly in the case of time deposits, which change only at maturity. An increase in the volume of loans in nonaccrual status of $2,637,000 during 2008 also contributed to the decline. Average interest earnings assets in 2008 were $598,399,000, an increase of $31,154,000 or 5.5% over 2007. Average interest earning assets in 2007 were $567,245,000, an increase of $46,315,000 or 8.9% over 2006. The yield on interest earning assets decreased 79 basis points in 2008 compared to 2007. The yield on interest earning assets increased 32 basis points in 2007 compared to 2006. The principal earning assets were loans, and average loans outstanding increased $30,100,000 in 2008 versus 2007, and $80,269,000 in 2007 versus 2006, while their yield decreased 100 basis points in 2008 versus 2007, and decreased 10 basis points in 2007 versus 2006.

Interest expense for 2008 was $11,507,000 compared to $13,657,000 for 2007, a decrease of $2,150,000 or 15.7%. It increased by $3,836,000 in 2007 over 2006, or 39.1%. The decrease in interest expense during 2008 and 2007 was caused by rate decreases on deposits, as rates followed the declines in prevailing short term market interest rates. The Federal Open Market Committee intended federal funds rate was 4.25% on December 31, 2007. By December 31, 2008, that rate had been reduced to a target of 0% to 0.25%. No new branches or significant product lines were added during 2008. Average interest bearing liabilities were $463,546,000 in 2008, $426,354,000 in 2007 and $386,254,000 in 2006. This represented an increase of $37,192,000 in 2008 over 2007, or 8.7%, and an increase of $40,100,000 or 10.4% in 2007 compared to 2006. The cost of these liabilities decreased 72 basis points in 2008 compared to 2007, and increased 66 basis points in 2007 compared to 2006. The principal cost was in time deposits, which decreased 113 basis points in 2008 compared to 2007, and increased 78 basis points in 2007 compared to 2006.

Net Interest Income

Net interest income is the difference between interest yield generated by earning assets and the interest expense associated with the funding of those assets. Net interest income is affected by the interest rate earned or paid and by volume changes in loans, investment securities, deposits and borrowed funds.

39

TABLE 1

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Net Interest Income and Average Balances | |

| | | |

| | Year ended December 31 | |

| | 2008 | | 2007 | | 2006 | |

| | | | | | | |

(Dollar amounts in thousands) | | Average

Balance | | Interest

Income

(Expense) | | Average

Yield

(Cost) | | Average

Balance | | Interest

Income

(Expense) | | Average

Yield

(Cost) | | Average

Balance | | Interest

Income

(Expense) | | Average

Yield

(Cost) | |

| | | | | | | | | | | | | | | | | | | |

INTEREST EARNING ASSETS | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Loans, gross (1) (2) | | $ | 497,532 | | $ | 35,515 | | | 7.14 | % | $ | 467,432 | | $ | 38,035 | | | 8.14 | % | $ | 387,163 | | $ | 31,898 | | | 8.24 | % |

Taxable securities (3) | | | 53,328 | | | 2,248 | | | 4.22 | % | | 34,323 | | | 1,733 | | | 5.05 | % | | 62,354 | | | 2,595 | | | 4.16 | % |

Nontaxable securities (3) | | | 42,809 | | | 2,044 | | | 4.77 | % | | 56,080 | | | 2,643 | | | 4.71 | % | | 57,580 | | | 2,664 | | | 4.63 | % |

Federal funds sold | | | 4,730 | | | 106 | | | 2.24 | % | | 9,410 | | | 487 | | | 5.18 | % | | 13,833 | | | 683 | | | 4.94 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total interest earning assets | | $ | 598,399 | | $ | 39,913 | | | 6.67 | % | $ | 567,245 | | $ | 42,898 | | | 7.56 | % | $ | 520,930 | | $ | 37,840 | | | 7.26 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

NONINTEREST EARNING ASSETS: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cash and due from banks | | $ | 17,155 | | | | | | | | $ | 17,487 | | | | | | | | $ | 19,384 | | | | | | | |

Premises and equipment | | | 13,648 | | | | | | | | | 13,735 | | | | | | | | | 12,875 | | | | | | | |

Other assets | | $ | 28,906 | | | | | | | | | 24,924 | | | | | | | | | 21,927 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total noninterest earning assets | | $ | 59,709 | | | | | | | | $ | 56,146 | | | | | | | | $ | 54,186 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

TOTAL ASSETS | | $ | 658,108 | | | | | | | | $ | 623,391 | | | | | | | | $ | 575,116 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

INTEREST BEARING LIABILITIES: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Deposits: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Demand, interest bearing | | $ | 59,472 | | $ | 329 | | | 0.55 | % | $ | 59,491 | | $ | 416 | | | 0.70 | % | $ | 62,382 | | $ | 338 | | | 0.54 | % |

Money market | | | 140,177 | | | 3,259 | | | 2.32 | % | | 136,672 | | | 4,656 | | | 3.41 | % | | 119,779 | | | 3,423 | | | 2.86 | % |

Savings | | | 46,695 | | | 127 | | | 0.27 | % | | 48,633 | | | 247 | | | 0.51 | % | | 53,965 | | | 264 | | | 0.49 | % |

Time deposits | | | 142,895 | | | 4,689 | | | 3.28 | % | | 140,934 | | | 6,210 | | | 4.41 | % | | 132,497 | | | 4,814 | | | 3.63 | % |

Fed Home Loan Bank advances | | | 73,777 | | | 3,084 | | | 4.18 | % | | 39,482 | | | 2,070 | | | 5.24 | % | | 15,863 | | | 880 | | | 5.55 | % |

Fed funds purchased | | | 530 | | | 19 | | | 3.58 | % | | 1,142 | | | 58 | | | 5.08 | % | | 1,768 | | | 102 | | | 5.77 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total interest bearing liabilities | | $ | 463,546 | | $ | 11,507 | | | 2.48 | % | $ | 426,354 | | $ | 13,657 | | | 3.20 | % | $ | 386,254 | | $ | 9,821 | | | 2.54 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

NONINTEREST BEARING LIABILITIES: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Demand deposits | | | 118,784 | | | | | | | | | 123,766 | | | | | | | | | 121,957 | | | | | | | |

Other liabilities | | | 8,290 | | | | | | | | | 8,977 | | | | | | | | | 7,944 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total noninterest bearing liabilities | | $ | 127,074 | | | | | | | | $ | 132,743 | | | | | | | | $ | 129,901 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total liabilities | | $ | 590,620 | | | | | | | | $ | 559,097 | | | | | | | | $ | 516,155 | | | | | | | |

Stockholders’ equity | | $ | 67,488 | | | | | | | | $ | 64,294 | | | | | | | | $ | 58,961 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | | $ | 658,108 | | | | | | | | $ | 623,391 | | | | | | | | $ | 575,116 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

NET INTEREST INCOME AND MARGIN ON TOTAL EARNING ASSETS (4) | | | | | $ | 28,406 | | | 4.75 | % | | | | $ | 29,241 | | | 5.15 | % | | | | $ | 28,019 | | | 5.38 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(1) Interest on non-accrual loans is recognized into income on a cash received basis.

(2) Amounts of interest earned included loan fees of $1,425,000, $1,593,000 and $1,445,000 for the years ended December 31, 2008, 2007 and 2006, respectively.

(3) Tax equivalent adjustments recorded at the statutory rate of 34% that are included in the nontaxable securities portfolio are $481,000, $608,000 and $625,000 for the years ended December 31, 2008, 2007 and 2006, respectively, and were derived from nontaxable municipal interest income. Tax equivalent adjustments recorded at the statutory rate of 34% that are included in taxable securities portfolio were created by a dividends received deduction of $5,000, $0 and $19,000 in the years ended December 31, 2008, 2007 and 2006, respectively.

(4) Net interest margin is computed by dividing net interest income by total average interest earning assets.

40

The following table analyzes the dollar amount of change in interest income and expense and the changes in dollar amounts attributable to (a) changes in volume (changes in volume at the current year rate), (b) changes in rate (changes in rate times the prior year’s volume) and (c) changes in rate/volume (changes in rate times changes in volume). In this table, the dollar change in rate/volume is prorated to volume and rate proportionately.

TABLE 2

| | | | | | | | | | | | | | | | | | | |

| | Rate/Volume Variance Analysis | |

| | | |

| | Year Ended December 31 | |

| | | |

| | 2008 compared to 2007

Increase (decrease) | | 2007 compared to 2006

Increase (decrease) | |

| | Interest

Income/

Expense | | Variance

Attributable To | | Interest

Income/

Expense | | Variance

Attributable To | |

(Dollar amounts in thousands) | | Variance | | Rate | | Volume | | Variance | | Rate | | Volume | |

INTEREST EARNING ASSETS: | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Loans | | ($ | 2,520 | ) | ($ | 4,669 | ) | $ | 2,149 | | $ | 6,137 | | ($ | 394 | ) | $ | 6,531 | |

| | | | | | | | | | | | | | | | | | | |

Taxable securities | | | 515 | | | (444 | ) | | 959 | | | (862 | ) | | 305 | | | (1,167 | ) |

| | | | | | | | | | | | | | | | | | | |

Nontaxable securities | | | (599 | ) | | 27 | | | (626 | ) | | (21 | ) | | 48 | | | (69 | ) |

| | | | | | | | | | | | | | | | | | | |

Federal funds sold | | | (381 | ) | | (276 | ) | | (105 | ) | | (196 | ) | | 33 | | | (229 | ) |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Total | | ($ | 2,985 | ) | ($ | 5,362 | ) | $ | 2,377 | | $ | 5,058 | | -$ | 8 | | $ | 5,066 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

INTEREST BEARING LIABILITIES: | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Demand deposits | | ($ | 87 | ) | ($ | 87 | ) | $ | — | | $ | 78 | | $ | 94 | | ($ | 16 | ) |

| | | | | | | | | | | | | | | | | | | |

Money market | | | (1,397 | ) | | (1,478 | ) | | 81 | | | 1,233 | | | 658 | | | 575 | |

| | | | | | | | | | | | | | | | | | | |

Savings deposits | | | (120 | ) | | (115 | ) | | (5 | ) | | (17 | ) | | 10 | | | (27 | ) |

| | | | | | | | | | | | | | | | | | | |

Time deposits | | | (1,521 | ) | | (1,607 | ) | | 86 | | | 1,396 | | | 1,089 | | | 307 | |

| | | | | | | | | | | | | | | | | | | |

Federal Home Loan Bank advances | | | 1,014 | | | (420 | ) | | 1,434 | | | 1,190 | | | (48 | ) | | 1,238 | |

| | | | | | | | | | | | | | | | | | | |

Federal funds purchased | | | (39 | ) | | (17 | ) | | (22 | ) | | (44 | ) | | (12 | ) | | (32 | ) |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Total | | ($ | 2,150 | ) | ($ | 3,724 | ) | $ | 1,574 | | $ | 3,836 | | $ | 1,791 | | $ | 2,045 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

NET INTEREST INCOME | | ($ | 835 | ) | ($ | 1,638 | ) | $ | 803 | | $ | 1,222 | | ($ | 1,799 | ) | $ | 3,021 | |

| | | | | | | | | | | | | | | | | | | |

41

In 2008, net interest income represented 84.70% of net revenue (net interest income plus noninterest income) compared to 86.94% in 2007 and 81.39% in 2006. The net interest margin on average earning assets was 4.75% in 2008 compared to 5.05% in 2007 and 5.26% in 2006. The average rate earned on interest earning assets was 6.67% in 2008, up from 7.46% in 2007, and 7.14% in 2006. The average cost for interest-bearing liabilities was 2.48% in 2008 compared to 3.20% in 2007 and 2.54% in 2006.

As mentioned above under the heading “Earnings Analysis”, there were increases in the prime lending rate during 2006, followed by decreases from 8.25% at the end of 2006 to 7.25% at the end of 2007, and 3.25% at the end of 2008, as a result of action by the Federal Open Market Committee of the Federal Reserve, which affected interest-bearing assets and interest-bearing liabilities.

Yield on average loans was 7.14% in 2008, 8.14% in 2007 and 8.24% in 2006. Interest on average taxable securities was 4.22% in 2008, 5.05% in 2007, and 4.13% in 2006. Interest on average nontaxable securities was 4.77% in 2008, 3.63% in 2007 and 3.54% in 2006. Interest on average federal funds sold was 2.24% in 2008, 5.18% in 2007 and 4.94% in 2006. Interest on average total interest earning assets was 6.67% in 2008, 7.46% in 2007 and 7.14% in 2006. On the expense side, interest on average interest bearing demand deposits was 0.55% in 2008, 0.70% in 2007 and 0.54% in 2006. Interest on average money market accounts was 2.32% in 2008, 3.41% in 2007 and 2.86% in 2006. Interest on average savings accounts was 0.27% in 2008, 0.51% in 2007 and 0.49% in 2006. Interest on average time deposits was 3.28% in 2008, 4.41% in 2007 and 3.63% in 2006. Interest on average Federal Home Loan Bank advances was 4.18% in 2008, 5.24% in 2007 and 5.55% in 2006. Interest on federal funds purchased was 3.58% in 2008, 5.08% in 2007 and 5.77% in 2006. Interest on average total interest bearing liabilities was 2.48% in 2008, 3.20% in 2007 and 2.54% in 2006.

Allowance For Loan Losses

The Bank has the responsibility of assessing the overall risks in its loan portfolio, assessing the specific loss expectancy, and determining the adequacy of the loan loss reserve. The level of reserves is determined by internally generating credit quality ratings, reviewing economic conditions in the Bank’s market area, and considering the Bank’s historical loan loss experience. The Bank is committed to maintaining adequate reserves, identifying credit weaknesses by consistent review of loans, and maintaining the risk ratings and changing those risk ratings in a timely manner as circumstances change.

During 2006, the Bank transferred a portion of the allowance for loan losses to establish a reserve for unfunded loan commitments in a separate account in Other Liabilities. The Allowance for Loan Losses in Table 3 has been reclassified for prior years to agree with the current year presentation.

42

Real estate loans outstanding increased by $961,000 in 2008 compared to 2007. They increased by $33,395,000 in 2007 compared to 2006. The proportion of the Allowance for Loan Losses attributable to real estate loans was $4,712,000 in 2008 compared to $3,669,000 in 2007, and $3,864,000 in 2006. Real estate loans in 2008 remained nearly the same as in 2007, reflecting tighter underwriting standards that were imposed during 2008 coupled with the fact that there were fewer loans available that met those standards. We priced our loans competitively, but did not discount our loans in order to attract new business. The real estate loan growth in 2007 and 2006 was primarily the result of increased market penetration within our existing market area. The perceived risk in the Real Estate loan portfolio had decreased slightly in 2006 and 2007. The reserve allocated to these loans was increased in 2008, to mitigate the risk involved in the current markets. We experienced increased loan charge-offs and non accrual loans during 2008. The credit quality of our underlying collateral also deteriorated during 2008, necessitating an increased provision for loan losses.

The allowance for loan losses totaled $7,075,000, $5,638,000 and $5,002,000 at December 31, 2008, 2007, and 2006, respectively. This represented 1.40%, 1.14% and 1.18% of total loans outstanding on those dates. These balances reflect amounts that, in management’s judgment, are adequate to provide for probable loan losses based on the considerations listed above. During 2008, the provision for loan losses was $3,045,000, and the charge-offs were $1,788,000. During 2007, the provision for loan losses was $690,000, and the charge-offs were $80,000. In 2006, the provision for loan losses was $683,000, while charge-offs were $59,000.

TABLE 3

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Allocation of the Allowance for Loan Losses | |

| | | |

| | (Dollar amounts in thousands) | |

| | | | 2008 | | | | 2007 | | | | 2006 | | | | 2005 | | | | 2004 | |

| | | | | | | | | | | | | | | | | | | | | |

| | Amount | | Percent

of loans

in each

category

to total

Loans | | Amount | | Percent

of loans

in each

category

to total

Loans | | Amount | | Percent

of loans

in each

category

to total

Loans | | Amount | | Percent

of loans

in each

category

to total

Loans | | Amount | | Percent

of loans

in each

category

to total

Loans | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Real Estate | | $ | 4,712 | | | 69.9 | % | $ | 3,669 | | | 71.1 | % | $ | 3,864 | | | 74.9 | % | $ | 3,373 | | | 78.5 | % | $ | 1,940 | | | 73.9 | % |

Construction | | | 1,388 | | | 13.0 | % | | 1,576 | | | 11.6 | % | | 539 | | | 8.7 | % | | 365 | | | 6.8 | % | | 755 | | | 8.4 | % |

Commercial | | | 932 | | | 16.5 | % | | 370 | | | 16.6 | % | | 582 | | | 15.6 | % | | 611 | | | 13.8 | % | | 415 | | | 17.0 | % |

Consumer | | | 43 | | | 0.6 | % | | 23 | | | 0.7 | % | | 17 | | | 0.8 | % | | 25 | | | 0.9 | % | | 23 | | | 0.7 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | $ | 7,075 | | | 100.0 | % | $ | 5,638 | | | 100.0 | % | $ | 5,002 | | | 100.0 | % | $ | 4,374 | | | 100.0 | % | $ | 3,133 | | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

43

Table 4 summarizes transactions in the allowance for loan losses and details the charge-offs, recoveries and net loan losses by loan category for each of the last five fiscal years ended December 31, 2008. The amount added to the provision and charged to operating expenses for each period is based on the risk profile of the loan portfolio.

TABLE 4

| | | | | | | | | | | | | | | | |

| | Allowance for Loan Losses

Historical Analysis | |

| | | |

| | For the year ended December 31, | |

(Dollar amounts in thousands) | | 2008 | | 2007 | | 2006 | | 2005 | | 2004 | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Balance at Beginning of Period | | $ | 5,638 | | $ | 5,002 | | $ | 4,374 | | $ | 3,133 | | $ | 3,155 | |

Provision for Loan Losses | | | 3,045 | | | 690 | | | 683 | | | 628 | | | 408 | |

| | | | | | | | | | | | | | | | |

Charge-offs: | | | | | | | | | | | | | | | | |

Real Estate | | | (493 | ) | | (48 | ) | | 0 | | | (70 | ) | | (383 | ) |

Commercial | | | (1,284 | ) | | (19 | ) | | (49 | ) | | (34 | ) | | (31 | ) |

Consumer | | | (11 | ) | | (13 | ) | | (10 | ) | | (6 | ) | | (17 | ) |

| | | | | | | | | | | | | | | | |

Total | | | (1,788 | ) | | (80 | ) | | (59 | ) | | (110 | ) | | (431 | ) |

| | | | | | | | | | | | | | | | |

Recoveries: | | | | | | | | | | | | | | | | |

Real Estate | | | 36 | | | 15 | | | — | | | — | | | — | |

Commercial | | | 144 | | | 10 | | | 3 | | | 22 | | | — | |

Consumer | | | — | | | 1 | | | 1 | | | 1 | | | 1 | |

| | | | | | | | | | | | | | | | |

Total | | | 180 | | | 26 | | | 4 | | | 23 | | | 1 | |

Net Charge-offs | | | (1,608 | ) | | (54 | ) | | (55 | ) | | (87 | ) | | (430 | ) |

| | | | | | | | | | | | | | | | |

Allowance acquired in business combination | | | — | | | — | | | — | | | 700 | | | — | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Balance at End of Period | | $ | 7,075 | | $ | 5,638 | | $ | 5,002 | | $ | 4,374 | | $ | 3,133 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Percentages | | | | | | | | | | | | | | | | |

Allowance for loan losses/total loans | | | 1.40 | % | | 1.14 | % | | 1.18 | % | | 1.14 | % | | 0.92 | % |

Net charge-offs/real estate loans | | | 0.14 | % | | 0.01 | % | | 0.00 | % | | 0.02 | % | | 0.15 | % |

Net charge-offs/commercial loans | | | 1.37 | % | | 0.01 | % | | 0.07 | % | | 0.02 | % | | #VALUE! | |

Net charge-offs/consumer loans | | | #VALUE! | | | 0.33 | % | | 0.27 | % | | 0.15 | % | | 0.62 | % |

Net charge-offs/total loans | | | 0.32 | % | | 0.01 | % | | 0.01 | % | | 0.02 | % | | 0.13 | % |

Allowance for loan losses/non-performing loans | | | 50.17 | % | | 49.18 | % | | 190.33 | % | | 25729.41 | % | | 111.97 | % |

The increase in charge-offs during 2008 is primarily related to problems related to specific borrowers rather than problems with a specific segment of the loan portfolio. In particular, borrowers who had exposure to real estate projects outside of San Mateo and San Francisco counties were identified as having a relatively higher risk profile than those operating solely in these two counties. If real estate values continue to decline in the future, an increase in our allowance for loan losses may be warranted.

44

Non-performing Assets.

Non-performing assets consist of nonaccrual loans, foreclosed assets, and loans that are 90 days or more past due but are still accruing interest. The accrual of interest on non-accrual loans is discontinued when, in management’s opinion, the borrower may be unable to meet payments as they become due. For the years ended December 31, 2008, 2007 and 2006, had non-accrual loans performed as agreed, approximately $692,000, $547,000, and $70,000, respectively, would have accrued in additional interest.

Table 5 provides a summary of contractually past due loans for the most recent five years. Nonperforming loans were 1.8% of total loans at December 31, 2008 compared to 2.4% of total loans at December 31, 2007. Nonperforming loans were 2.4% of total loans at December 31, 2007 compared to 0.6% of total loans at December 31, 2006. Management believes the current list of past due loans are collectible and does not anticipate significant losses. Nonperforming loans at December 31, 2008 include five Real Estate loans compared to four Real Estate loans at December 31, 2007. The one nonperforming Real Estate loan at the end of 2006 has since paid off.

TABLE 5

| | | | | | | | | | | | | | | | |

| | Analysis of Nonperforming Assets | |

| | | |

| | | | | | | | | | | | | | | | |

| | Year ended December 31 | |

| | | |

(Dollar amounts in thousands) | | 2008 | | 2007 | | 2006 | | 2005 | | 2004 | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Accruing loans 90 days or more | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | |

Nonaccrual loans | | | 14,102 | | | 11,465 | | | 2,628 | | | 17 | | | 2,798 | |

Other real estate owned | | | 3,557 | | | 440 | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | |

Total | | $ | 17,659 | | $ | 11,905 | | $ | 2,628 | | $ | 17 | | $ | 2,798 | |

| | | | | | | | | | | | | | | | |

There was no commitment to lend additional funds to any customer whose loan was classified as nonperforming at December 31, 2008, 2007 or 2006.

Nonaccrual loans at December 31, 2008 consist of several single family residence loans and commercial loans as well as some commercial real estate loans. The Bank is working with our borrowers to develop strategies that can give the borrowers time to work through their financial difficulties. The other real estate owned consists of two single family residences and a land development parcel. The Bank is actively marketing these properties. However, given current market conditions, there can be no assurance that these properties can be sold in the near future.

45

Noninterest Income

The following table sets forth the principal components of noninterest income:

TABLE 6

| | | | | | | | | | | | | | | | | | | | | | |

| | Noninterest Income | | | | | |

| | | Variance | | Variance | |

| | Years ended December 31, | | 2008 vs. 2007 | | 2007 vs. 2006 | |

(Dollar amounts in thousands) | | 2008 | | 2007 | | 2006 | | Amount | | Percent | | Amount | | Percent | |

| | | | | | | | | | | | | | | |

Service charges | | $ | 2,888 | | $ | 2,580 | | $ | 2,463 | | $ | 308 | | | 11.9 | % | $ | 117 | | | 4.8 | % |

Death benefit bank owned life insurance policy | | | 760 | | | — | | | — | | | 760 | | | — | | | — | | | — | |

Credit card fees | | | 749 | | | 778 | | | 839 | | | (29 | ) | | -3.7 | % | | (61 | ) | | -7.3 | % |

Gain on sale of other equity securities | | | — | | | — | | | 1,352 | | | — | | | — | | | (1,352 | ) | | -100.0 | % |

Gain on sale of other real estate owned | | | (2 | ) | | — | | | 756 | | | — | | | — | | | (756 | ) | | -100.0 | % |

Gain (loss) on sale or impairment of securities AFS | | | (290 | ) | | 4 | | | (11 | ) | | (294 | ) | | 7350.0 | % | | 15 | | | 136.4 | % |

Other income | | | 938 | | | 938 | | | 860 | | | 0 | | | 0.0 | % | | 78 | | | 9.1 | % |

| | | | | | | | | | | | | | | | | | | | | | |

Total noninterest income | | $ | 5,043 | | $ | 4,300 | | $ | 6,259 | | $ | 745 | | | 17.3 | % | ($ | 1,959 | ) | | -31.3 | % |

| | | | | | | | | | | | | | | | | | | | | | |

Total noninterest income consists mainly of service charges on deposits. The increase in service charges on deposits in 2008 over 2007 is primarily attributable to an increase in non-sufficient-funds fees and ATM surcharge fees. The increased non-sufficient-funds fees are the result of increased liquidity problems that some of our deposit customers are facing, stemming from the current economic downturn. The increase in ATM surcharge fees is a function of increased demand for cash from our ATM machines by those who do not have a deposit relationship with the Bank. Noninterest income in 2008 included proceeds from a life insurance contract related to death benefits received from a policy that was placed on the life of an executive who is no longer working at the Bank. Noninterest income in 2006 included a gain on sale of other equity securities of $1,352,000 related to the sale of Pacific Coast Banker’s Bank stock and a gain of $756,000 on sale of other real estate owned in 2006. The principal source of Other Income was policy dividends on Officers’ Life Insurance, which was $404,000, $364,000, and $304,000 in the years 2008, 2007 and 2006, respectively, which reflected an increased investment in these policies.

46

Noninterest Expenses

The following table sets forth the various components of noninterest expense:

TABLE 7

| | | | | | | | | | | | | | | | | | | | | | |

| | Noninterest Expenses | | | | | |

| | | Variance | | Variance | |

| | Years ended December 31, | | 2008 vs. 2007 | | 2007 vs. 2006 | |

(Dollar amounts in thousands) | | 2008 | | 2007 | | 2006 | | Amount | | Percent | | Amount | | Percent | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

Salaries and employee benefits | | $ | 14,335 | | $ | 12,778 | | $ | 12,300 | | $ | 1,557 | | | 12.2 | % | | 478 | | | 3.9 | % |

Occupancy expense | | | 2,081 | | | 1,975 | | | 1,728 | | | 106 | | | 5.4 | % | | 247 | | | 14.3 | % |

Equipment expense | | | 1,930 | | | 1,620 | | | 1,665 | | | 310 | | | 19.1 | % | | (45 | ) | | -2.7 | % |

Professional fees | | | 1,149 | | | 1,303 | | | 1,278 | | | (154 | ) | | -11.8 | % | | 25 | | | 2.0 | % |

Telephone, postage, supplies | | | 1,029 | | | 1,017 | | | 1,056 | | | 12 | | | 1.2 | % | | (39 | ) | | -3.7 | % |

Advertising expense | | | 686 | | | 942 | | | 770 | | | (256 | ) | | -27.2 | % | | 172 | | | 22.3 | % |

Bankcard expenses | | | 697 | | | 708 | | | 797 | | | (11 | ) | | -1.6 | % | | (89 | ) | | -11.2 | % |

Data processing expense | | | 495 | | | 503 | | | 452 | | | (8 | ) | | -1.6 | % | | 51 | | | 11.3 | % |

Surety insurance | | | 842 | | | 502 | | | 479 | | | 340 | | | 67.7 | % | | 23 | | | 4.8 | % |

Director expense | | | 180 | | | 195 | | | 207 | | | (15 | ) | | -7.7 | % | | (12 | ) | | -5.8 | % |

Other | | | 1,920 | | | 1,639 | | | 1,028 | | | 281 | | | 17.1 | % | | 611 | | | 59.4 | % |

| | | | | | | | | | | | | | | | | | | | | | |

Total noninterest expense | | $ | 25,344 | | $ | 23,182 | | $ | 21,760 | | $ | 2,162 | | | 9.3 | % | $ | 1,422 | | | 6.5 | % |

| | | | | | | | | | | | | | | | | | | | | | |

Total noninterest expenses for the year ended December 31, 2008 were $25,344,000 compared to $23,182,000 and $21,760,000 for the years ended December 31, 2007 and 2006. Salaries and employee benefits were $14,335,000 in 2008, $12,778,000 in 2007, and $12,300,000 in 2006. Salaries and employee benefits represent over 50% of noninterest expense. They increased by 12.2% in 2008 over 2007 and 3.9% in 2007 over 2006. During the third quarter of 2008, a Call Center was established; there were also support staff increases in the loan area during 2008. In an effort to stem the increasing salaries and employee benefits costs, the company instituted a downsizing program, whereby eight staff positions were eliminated in the fourth quarter. In a further effort to reduce expenses, advertising expense decreased by $256,000 in 2008 compared to 2007. Within this category, efficiencies were achieved by decreasing advertising in the media, community and through advertising agencies, which decreased $185,000. Surety insurance increased $340,000 in 2008 over 2007. The principal item in this expense is FDIC insurance, which increased by $378,000, while the remaining items (Office of the Comptroller of the Currency assessment, Local Agency assessment and regular insurance) declined $38,000 net in the same period. Other expense, which includes numerous smaller accounts, increased $281,000 in 2008 over 2007. The principal increase was an Other Real Estate Owned write-down of $218,000. which is primarily related to a single family residence in San Jose, while the remaining thirty-seven expense categories increased a net $63,000. Other expense increased $611,000 in 2007 over 2006, due primarily to Low Income Housing investment expenses of $219,000. The remaining thirty-seven expense categories increased a net $392,000.

Balance Sheet Analysis

Total assets of the Company were $660,957,000, an increase of 2.6% over 2007. Total assets were $644,465,000 at December 31, 2007, an increase of 10.9% over 2006. Assets averaged $658.1 million in 2008, compared to $623.4 million in 2007 and $575.1 million in 2006. Average earning assets increased from $520.9 million in 2006 to $567.2 in 2007 and $598.4 million in 2008. Average earning assets represented 90.6% of total average assets in 2006, 91.0% in 2007 and 90.9% in 2008. Average interest-bearing liabilities were $386.3 million in 2006, $426.4 million in 2007 and $463.5 million in 2008.

47

Loans

The loan portfolio is the principal earning asset of the Bank. Loans outstanding at December 31, 2008 increased by $9.8 million or 2.0% over December 31, 2007. December 31, 2007 increased by $70.8 million or 16.7% over December 31, 2006.

Real estate loans increased by $1.0 million or 0.3% in 2008 compared to 2007, and they increased by $33.4 million or 10.5% in 2007 compared to 2006. Construction loans increased by $8.3 million or 14.4% in 2008 compared to 2007, and they increased by $20.3 million or 54.6% in 2007 compared to 2006. This increase occurred despite a tightening in our underwriting standards. Commercial loans increased by $1.2 million in 2008 or 1.5% compared to 2007, and increased by $16.1 million in 2007 or 24.3% compared to 2006. Consumer loans represent a nominal portion of total loans. They decreased by $0.5 million in 2008 or 13.6% compared to 2007, and they increased $0.4 million in 2007 or 10.9% compared to 2006.

Table 8 presents a detailed analysis of loans outstanding at December 31, 2004 through December 31, 2008.

TABLE 8

| | | | | | | | | | | | | | | | |

| | Loan Portfolio | |

| | | |

| | December 31 | |

| | | |

(Dollar amounts in thousands) | | 2008 | | 2007 | | 2006 | | 2005 | | 2004 | |

| | | | | | | | | | | |

Real Estate loans | | $ | 353,011 | | $ | 352,050 | | $ | 318,655 | | $ | 302,813 | | $ | 255,433 | |

Construction loans | | | 65,647 | | | 57,362 | | | 37,094 | | | 26,243 | | | 28,997 | |

Commercial loans | | | 83,442 | | | 82,228 | | | 66,139 | | | 53,070 | | | 58,849 | |

Consumer loans | | | 3,136 | | | 3,636 | | | 3,279 | | | 3,420 | | | 2,589 | |

| | | | | | | | | | | | | | | | |

Sub total | | | 505,236 | | | 495,276 | | | 425,167 | | | 385,546 | | | 345,868 | |

Net deferred loan fees | | | (177 | ) | | (64 | ) | | (728 | ) | | (948 | ) | | (1,628 | ) |

| | | | | | | | | | | | | | | | |

Total | | $ | 505,059 | | $ | 495,212 | | $ | 424,439 | | $ | 384,598 | | $ | 344,240 | |

| | | | | | | | | | | | | | | | |

The following table shows the Bank’s loan maturities and sensitivities to changes in interest rates as of December 31, 2008.

TABLE 9

| | | | | | | | | | | | | |

(Dollar amounts in thousands) | | Maturing

Within One

Year | | Maturing

After One

But Within

Five Years | | Maturing

After Five

Years | | Total | |

| | | | | | | | | |

Real Estate loans | | $ | 184,190 | | | 114,207 | | | 54,614 | | $ | 353,011 | |

Construction loans | | | 34,252 | | | 21,239 | | | 10,156 | | | 65,647 | |

Commercial loans | | | 43,538 | | | 26,995 | | | 12,909 | | | 83,442 | |

Consumer loans | | | 1,636 | | | 1,015 | | | 485 | | | 3,136 | |

| | | | | | | | | | | | | |

Sub total | | | 263,616 | | | 163,456 | | | 78,164 | | | 505,236 | |

Net deferred loan fees | | | (92 | ) | | (58 | ) | | (27 | ) | | (177 | ) |

| | | | | | | | | | | | | |

Total | | $ | 263,524 | | $ | 163,398 | | $ | 78,137 | | $ | 505,059 | |

| | | | | | | | | | | | | |

48

Investment Portfolio

Investments at December 31, 2008 were $99,221,000, an increase of $4,789,000 or 5.1% over December 31, 2007. At December 31, 2007, they were $94,432,000, a decrease of $513,000 or 0.5% from 2006.

Available funds are first used to fund Loans, purchase investments, pay down borrowings, or sold as Federal Funds. The Company’s primary source of funds is the deposit base. If more funds are needed, investment maturities, calls and sales from the Investment Portfolio may be used, which accounts for the volume variances in Investments year over year. The Bank’s investment portfolio is concentrated in debt securities of U. S. Government Agencies and in obligations of States and their political subdivisions. The Bank believes this provides for an appropriate liquidity level.

The following table sets forth the maturity distribution and interest rate sensitivity of investment securities at December 31, 2008:

TABLE 10

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(Dollar amounts

in thousands) | | Due

In One

Year

Or Less | | Yield | | After

One

Year

Through

Five

Years | | Yield | | After

Five

Years

Through

Ten

Years | | Yield | | Due

After

Ten

Years | | Yield | | Fair

Value | | Maturity

In

Years | | Average

Yield | |

| | | | | | | | | | | | | | | | | | | | | | | |

U. S. Government Agencies | | $ | 7,723 | | | 3.08% | | $ | 37,589 | | | 3.56% | | | 1,878 | | | 4.46% | | $ | 12,252 | | | 5.57% | | $ | 59,442 | | | 2.46 | | | 3.94% | |

States & Political Subdivisions | | | 3,817 | | | 3.85% | | | 23,934 | | | 3.76% | | | 12,028 | | | 3.81% | | | — | | | — | | | 39,779 | | | 4.23 | | | 3.78% | |

Total | | $ | 11,540 | | | 3.34% | | $ | 61,523 | | | 3.64% | | $ | 13,906 | | | 3.89% | | $ | 12,252 | | | 5.57% | | $ | 99,221 | | | 5.31 | | | 3.88% | |

The following table shows the securities portfolio mix at December 31, 2008, 2007 and 2006.

| | | | | | | | | | | | | | | | | | | |

| | | |

| | 2008 | | | | 2007 | | | | 2006 | | | |

| | | |

(Dollar amounts in thousands) | | Amortized

Cost | | Fair

Value | | Amortized

Cost | | Fair

Value | | Amortized

Cost | | Fair

Value | |

| | | | | | | | | | | | | |

U.S. Government Agencies | | $ | 57,995 | | | 59,442 | | | 38,370 | | | 38,672 | | | 29,197 | | | 29,132 | |

States & Political Subdivisions | | | 38,918 | | | 39,779 | | | 52,357 | | | 52,760 | | | 59,693 | | | 59,761 | |

Corporate Debt | | | — | | | — | | | 2,999 | | | 3,000 | | | 3,984 | | | 3,974 | |

Other Securities | | | — | | | — | | | — | | | — | | | 2,078 | | | 2,078 | |

| | | | | | | | | | | | | |

Total | | $ | 96,913 | | | 99,221 | | | 93,726 | | | 94,432 | | | 94,952 | | | 94,945 | |

| | | | | | | | | | | | | |

49

Deposits

The increase in average earning assets in 2008 was funded by increases in average deposits and from increased Federal Home Loan Bank advances. During 2008, average deposits were $508,023,000, a decrease of $1,473,000, or 0.3% over 2007. During 2007, average deposits were $509,496,000, an increase of $18,916,000, or 3.9% over 2006. In 2008, average interest-bearing deposits were $389,239,000, an increase of $3,509,000, or 0.9% over 2007. In 2007, average interest-bearing deposits were $385,730,000, an increase of $17,107,000, or 4.6% over 2006. The prime lending rate rose from 5.25% at the beginning of 2005 to 7.25% at the end of 2005 and 8.25% at the end of 2006. The rate did not change again until September 18, 2007, when it dropped to 7.75%, followed by a decrease to 7.50% on October 31, 2007 and 7.25% on December 11, 2007. Time deposits lagged the prime rate changes because their rates changed only as certificates matured or new certificates were issued. Thus, interest-bearing demand costs averaged 0.3% in 2005, 0.5% in 2006 and 0.7% in 2007. Money market deposit costs averaged 2.9% in 2006, 3.4% in 2007 and 2.3% in 2008. Savings rates averaged 0.5% in 2006 and 2007 and 0.3% in 2008. Finally, average interest on time certificates of deposit of $100,000 or more was 4.0% in 2006, 4.9% in 2007 and 3.6% in 2008. On certificates under $100,000, average rates were 3.1% in 2006, 3.7% in 2007 and 2.8% in 2008.

The following table summarizes the distribution of average deposits and the average rates paid for them in the periods indicated:

TABLE 12

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Average Deposits and Average Rates paid for the period ending December 31, | |

| | 2008 | | 2007 | | 2006 | |

| | | | | | | |

(Dollar amounts in thousands) | | Average

Balance | | Average

Rate | | % of total

Deposits | | Average

Balance | | Average

Rate | | % of total

Deposits | | Average

Balance | | Average

Rate | | % of total

Deposits | |

| | | | | | | |

Deposits: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest-bearing demand | | $ | 59,472 | | | 0.6 | % | | 11.7 | % | $ | 59,491 | | | 0.7 | % | | 11.7 | % | $ | 62,382 | | | 0.5 | % | | 12.2 | % |

Money market | | | 140,177 | | | 2.3 | % | | 27.6 | | | 136,672 | | | 3.4 | % | | 26.8 | | | 119,779 | | | 2.9 | % | | 23.5 | |

Savings | | | 46,695 | | | 0.3 | % | | 9.2 | | | 48,633 | | | 0.5 | % | | 9.5 | | | 53,965 | | | 0.5 | % | | 10.6 | |

Time deposits $100,000 or more | | | 89,705 | | | 3.6 | % | | 17.7 | | | 85,115 | | | 4.9 | % | | 16.7 | | | 73,061 | | | 4.0 | % | | 14.3 | |

Time deposits under $100,000 | | | 53,190 | | | 2.8 | % | | 10.5 | | | 55,819 | | | 3.7 | % | | 11.0 | | | 59,436 | | | 3.1 | % | | 11.7 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total interest bearing deposits | | $ | 389,239 | | | 2.2 | % | | 76.6 | | $ | 385,730 | | | 3.0 | % | | 75.7 | | $ | 368,623 | | | 2.4 | % | | 72.4 | |

The following table indicates the maturity schedule of time deposits of $100,000 or more:

TABLE 13

| | | | | | | | | | | | | |

| | Analysis of Time Deposits $100,000 or more at December 31, 2008 | |

| | | |

(Dollar amounts in thousands) | | | | Over Three | | Over Six | | Over | |

Total Deposits | | Three Months | | To Six | | To Twelve | | Twelve | |

$100,000 or more | | Or Less | | Months | | Months | | Months | |

| | | | | | | | | | |

90,176 | | | 50,932 | | | 16,686 | | | 15,891 | | | 6,667 | |

Capital

At December 31, 2008, shareholders’ equity of the Company was $68,149,000 an increase of $1,604,000 or 2.4% over 2007; at December 31, 2007, shareholders’ equity of the Company was $66,545,000, an increase of $4,482,000 or 7.2% over 2006. The increases were primarily attributable to retention of net income after payment of cash dividends of $1,772,000 in 2008, $1,720,000 in 2007 and, $1,633,000 in 2006.

50

In 1989, the Federal Deposit Insurance Corporation (FDIC) established risk-based capital guidelines requiring banks to maintain certain ratios of “qualifying capital” to “risk-weighted assets”. Under the guidelines, qualifying capital is classified into two tiers, referred to as Tier 1 (core) and Tier 2 (supplementary) capital. Currently, the Company’s Tier 1 capital consists of common shareholders’ equity, though other instruments such as certain types of preferred stock can also be included in Tier 1 capital. Tier 2 capital consists of eligible reserves for possible loan losses and qualifying subordinated notes and debentures. Total capital is the sum of Tier 1 plus Tier 2 capital. Risk-weighted assets are calculated by applying risk percentages specified by the FDIC to categories of both balance sheet assets and off-balance sheet obligations. At year-end 1990, the FDIC also adopted a leverage ratio requirement. This ratio supplements the risk-based capital ratios and is defined as Tier 1 capital divided by quarterly average assets during the reporting period. This requirement established a minimum leverage ratio of 3.0% for the highest rated banks and ratios of 100 to 200 basis points higher for most other banks. Furthermore, in 1993, the FDIC began assessing risk-based deposit insurance assessments based on financial institutions’ capital resources and “management strength”, as mandated by the FDIC Improvement Act of 1991. To qualify for the lowest insurance premiums as indicated in the following table, “well-capitalized” financial institutions must maintain risk-based Tier 1 and total capital ratios of at least 6.0% and 10.0% respectively. “Well-capitalized” financial institutions must also maintain a leverage ratio equal to or exceeding 5.0%.

The following table shows the risk-based capital ratios and the leverage ratios at December 31, 2008, 2007 and 2006 for the Bank.

TABLE 14

| | | | | | | | | | | | | | | | |

Risk-Based Capital Ratios | | 2008 | | 2007 | | 2006 | | | | | Minimum

“Well Capitalized”

Requirements | |

| | | | | | | | | | | | | |

|

Total Capital | | 11.84 | % | | 11.42 | % | | 11.98 | % | | | ≥ | | 10.00 | % | |

Tier 1 Capital | | 10.65 | % | | 10.47 | % | | 11.03 | % | | | ≥ | | 6.00 | % | |

Leverage ratios | | 9.68 | % | | 9.84 | % | | 10.06 | % | | | ≥ | | 5.00 | % | |

Subsequent to December 31, 2008, the Company accepted a $12 million dollar investment in Preferred Shares issue to the U. S. Department of the Treasury. The funds were subsequently contributed to the Bank. If this capital investment had been received on December 31, 2008, the Bank’s risk-based capital ratios would have been as follows:

| | | | |

Risk-Based Capital Ratios | | Pro Forma at

December 31, 2008 | |

| | | | |

Total Capital | | 13.78 | % | |

Tier 1 Capital | | 12.59 | % | |

Leverage ratio | | 11.29 | % | |

Liquidity

The Company’s primary source of liquidity on a stand-alone basis is dividends from the Bank. The payment of dividends by the Bank is subject to regulatory restrictions. Liquidity is a measure of the Company’s ability to convert assets into cash. Liquidity consists of cash and due from other banks accounts, including time deposits, federal funds sold, and Securities Available-for-Sale. The Company’s policy is to maintain a liquidity ratio of 5% or greater of total assets. As of December 31, 2008, the Company’s primary liquidity was 17.26%, compared to 17.10% in 2007 and 20.98% in 2006. Total Liquid Assets were $114,086,000 in 2008, $110,182,000 in 2007 and $121,967,000 in 2006. The objective of liquidity management is to ensure that the Company has funds available to meet all present and future financial obligations and to take advantage of business opportunities as they occur. Financial obligations arise from withdrawals of deposits, repayment on maturity of purchased funds, extension of loans or other forms of credit, payment of operating expenses and payments of dividends.

51

Core deposits, which consist of all deposits other than time deposits, have provided the Company with a sizable source of relatively stable low-cost funds. The Company’s average core deposits represented 61.8% of average total liabilities of $590,620,000 for the year ended December 31, 2008, 65.9% of average total liabilities of $559,097,000 for the year ended December 31, 2007 and 69.4% of average total liabilities of $516,155,000 for the year ended December 31, 2006.

As of December 31, 2008, the Company had contractual obligations and other commercial commitments totaling approximately $205,553,000. The following table sets forth the Company’s contractual obligations and other commercial commitments as of December 31, 2008. These obligations and commitments will be funded primarily by loan repayments and the Company’s liquidity sources, such as cash and due from other banks, federal funds sold, securities available for sale, as well as time deposits.

TABLE 15

| | | | | | | | | | | | | | | | |

| | Payments Due by Period

| |

(Dollar amounts in thousands)

Contractual Obligations | | Total | | 1 year

or less | | Over 1 to

3 years | | Over 3 to

5 years | | Over

5 years | |

| | | | | | | | | | | | |

|

Federal Home Loan Bank Advances | | $ | 86,100 | | $ | 81,100 | | $ | 5,000 | | | — | | | — | |

Operating Leases | | | 1,798 | | | 566 | | | 740 | | | 492 | | | — | |

Salary Continuation Agreements | | | 1,834 | | | 418 | | | 260 | | | 260 | | $ | 896 | |

| | | | | | | | | | | | | | | | |

Total Contractual Cash Obligations | | $ | 89,732 | | $ | 82,084 | | $ | 6,000 | | $ | 752 | | $ | 896 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | Amount of Commitment Expirations Per Period | |

(Dollar amounts in thousands)

Other Commercial Commitments | | Total

Amounts

Committed | | 1 year

or less | | Over 1 to

3 years | | Over 3 to

5 years | | Over

5 years | |

| | | | | | | | | | | | |

Lines of Credit | | $ | 73,735 | | $ | 60,486 | | $ | 6,666 | | $ | 4,320 | | $ | 2,263 | |

Standby Letters of Credit | | | 2,743 | | | 2,643 | | | — | | | 100 | | | — | |

Guarantees | | | — | | | — | | | — | | | — | | | — | |

Other Commercial Commitments | | | 39,343 | | | 29,948 | | | 7,895 | | | 1,500 | | | — | |

| | | | | | | | | | | | | | | | |

Total Commercial Commitments | | $ | 115,821 | | $ | 93,077 | | $ | 14,561 | | $ | 5,920 | | $ | 2,263 | |

| | | | | | | | | | | | | | | | |

The largest component of the Company’s earnings is net interest income, which can fluctuate widely when significant interest rate movements occur. The prime lending rate rose from 5.25% at the beginning of 2005 to 7.25% at the end of 2005 and 8.25% at the end of 2006. The rate decreased to 7.25% at the end of 2007, and to 3.25% at the end of 2008. The Company’s management is responsible for minimizing the Bank’s exposure to interest rate risk and assuring an adequate level of liquidity. This is accomplished by developing objectives, goals and strategies designed to enhance profitability and performance.

52

Ongoing management of the Company’s interest rate sensitivity in order to keep interest rate risk levels within acceptable limits. Management can adjust the Bank’s interest rate by controlling the mix and maturity of assets and liabilities. Management regularly reviews the Company’s position and evaluates alternative sources and uses of funds as well as changes in external factors. Various methods are used to achieve and maintain the desired rate sensitivity position including the sale or purchase of assets and product pricing.

In order to ensure that sufficient funds are available for loan growth and deposit withdrawals, as well as to provide for general needs, the Company must maintain an adequate level of liquidity. Asset liquidity comes from the Company’s ability to convert short-term investments into cash and from the maturity and repayment of loans and investment securities. Liability liquidity is provided by the Company’s ability to attract deposits and obtain short term credit through established borrowing lines. The primary source of liability liquidity is the Bank’s customer base, which provides core deposit growth. The overall liquidity position of the Company is closely monitored and evaluated regularly. The Company has federal fund borrowing facilities for a total of $40,000,000, a Federal Home Loan Bank line of credit of up to 30% of total assets, and a Federal Reserve Bank borrowing facility. Management believes the Company’s liquidity sources at December 31, 2008 are adequate to meet its operating needs in 2009 and into the foreseeable future. Subsequent to December 31, 2008, the Company received a $12,000,000 investment in Company Preferred Stock from the U. S. Department of the Treasury. This investment was then contributed to the Bank as an additional capital contribution. These funds are intended to fund loan workout programs and to bolster lending activity of the Bank.

Effect of Changing Prices

The results of operations and financial conditions presented in this report are based on historical cost information and are not adjusted for the effects of inflation.

Since the assets and liabilities of banks are primarily monetary in nature (payable in fixed, determinable amounts), the performance of the Company is affected more by changes in interest rates than by inflation. Interest rates generally increase as the rate of inflation increases, but the magnitude of the change in rates may not be the same.

The effect of inflation on banks is normally not as significant as its influence on those businesses that have large investments in plant and inventories. During periods of high inflation, there are normally corresponding increases in the money supply, and banks will normally experience above average growth in assets, loans and deposits. Also, increases in the price of goods and services will result in increased operating expenses.

53

The following table includes key ratios, including returns on average assets and equity.

TABLE 16

| | | | | | | | | | |

| | Return on Equity and Assets

(Key financial ratios are computed on average balances)

| |

| | Year Ended December 31, | |

| | 2008 | | 2007 | | 2006 | |

| | | | | | | |

Return on average assets | | 0.60 | % | | 1.07 | % | | 1.32 | % | |

Return on average equity | | 5.87 | % | | 10.39 | % | | 12.86 | % | |

Dividend payout ratio | | 44.71 | % | | 25.69 | % | | 21.43 | % | |

Average equity to assets ratio | | 10.25 | % | | 10.31 | % | | 10.25 | % | |

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Interest Rate Risk